| I. Macroeconomic Outlook The inflation outlook for 2016-17 has improved, but beyond, close vigilance is required to achieve the prospects of reaching 4 per cent i.e., the centre of the target band. Robust consumption brightens the outlook for real gross value added (GVA) in 2016-17, but muted private investment and weak global demand may restrain the pace of growth in 2017-18. Amendments to the Reserve Bank of India (RBI) Act, which came into force on June 27, 2016 will empower the conduct of monetary policy in India. For the first time in its history, the RBI has been explicitly provided the legislative mandate to operate the monetary policy framework of the country. The primary objective of monetary policy has also been defined explicitly for the first time – “to maintain price stability while keeping in mind the objective of growth.” The amendments also provide for the constitution of a monetary policy committee (MPC) that shall determine the policy rate required to achieve the Inflation target, another landmark in India’s monetary history. The composition of the MPC, terms of appointment, information flows and other procedural requirements such as implementation of and publication of its decisions, and failure to maintain the Inflation target as well as remedial actions have been specified and subsequently gazetted. On August 5, 2016 the Government set out the Inflation target as four per cent with upper and lower tolerance levels of six per cent and two per cent, respectively. The Government and the RBI have constituted the six member MPC. All conditions are, therefore, in place for the MPC to take its first decision on October 4 under the Reserve Bank’s fourth bi-monthly monetary policy review for 2016-17. The amended RBI Act establishes the procedures for MPC meetings. It specifically lays down that the Bank shall organise at least four meetings of the MPC in a year (Section 45ZI). The cross-country experience in this regard is varied, both in terms of the number of meetings and the press conferences that usually follow the meetings in order to explain the stance of monetary policy for the benefit of the public. A survey of country practices suggests a central tendency among major central banks to hold four press conferences a year, although the number of MPC meetings may be higher (Table I.1). | Table I.1: Monetary Policy Meetings and Press Conferences | | Name of the Central Bank/ Monetary Authority | Number of Monetary Policy Meetings in a Year | Number of Press Conferences in a Year | | Bank of England | 8 | 4 (a) | | US Federal Reserve | 8 | 4 | | Bank of Canada | 8 | 4 | | Reserve Bank of New Zealand | 7 | 4 | | Bank of Israel | 12 | 4 | | | (8 from 2017) | | | Bank of Russia | 8 | 4 | | Central Bank of the Republic of Turkey | 12 | 4 (b) | | Bank Indonesia | 12 | 4 | | Banco Central Do Brasil | 8 | 4 (c) | | European Central Bank | 8 | 8 | | Norges Bank | 6 | 6 | | Bank of Japan | 8 | 8 | | Bank of Korea | 12 | 12 | | South African Reserve Bank | 6 | 6 | | Czech National Bank | 8 | 8 | Notes:

(a) : Inflation Report press conference.

(b) : Governor’s speech/presentation at the briefing on the Inflation Report.

(c) : Presentation by central bank director at the quarterly Inflation Report.

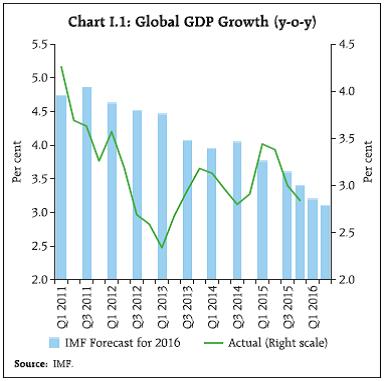

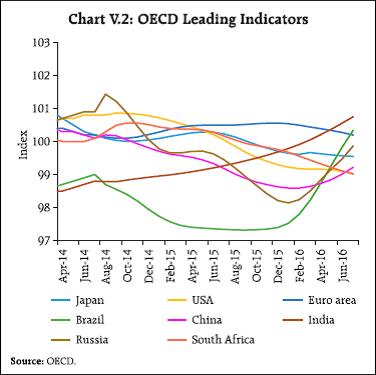

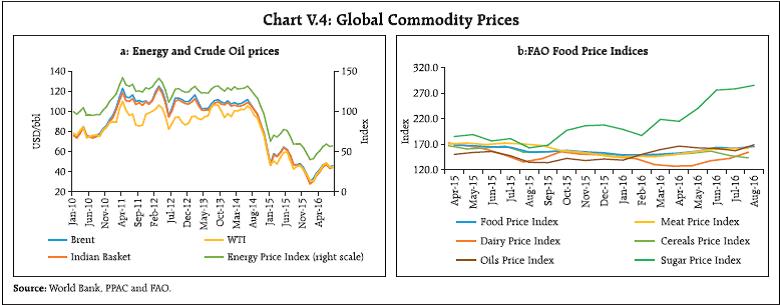

Source: Central Bank websites. | Chapters II and III compare Inflation and growth outcomes with the April 2016 forecasts and drill down into factors underlying deviations. Turning to the outlook, the April 2016 monetary policy report (MPR) presaged the continuing weakening of global growth and external demand. At the September G20 Summit in Hangzhou, the International Monetary Fund (IMF) warned about an even more modest pace of global growth this year, with the balance of risks remaining skewed to the downside (Chart I.1). This will necessitate an adjustment to assumptions on initial conditions for the projections given in this MPR. Furthermore, international crude oil prices, which fell to a recent trough in early April, have been edging up in ensuing months and the slightly firmer note in these prices observed since July will need to be factored into the assumptions (Table 1.2).

| Table I.2: Baseline Assumptions for Near-Term Projections | | Variable | April 2016 MPR | Current (October 2016) MPR | | Crude Oil (Indian Basket)* | US$ 40 per barrel during FY 2016-17 | US$ 46 per barrel during 2016-17:H2 | | Exchange rate ** | ₹68.5 per US$ | Current level | | Monsoon | Normal for 2016 | Normal for 2016 | | Global growth *** | 3.4 per cent in 2016 | 3.1 per cent in 2016 | | 3.6 per cent in 2017 | 3.4 per cent in 2017 | | Fiscal deficit | To remain within BE 2016-17 (3.5 per cent) | To remain within BE 2016-17 (3.5 per cent) | | Domestic macroeconomic/ structural policies during the forecast period | No major change | No major change | Notes:

* Represents a derived basket comprising sour grade (Oman and Dubai average) and sweet grade (Brent) crude oil processed in Indian refineries in the ratio of 71:29.

** The exchange rate path assumed here is for the purpose of generating staff’s baseline growth and inflation projections and does not indicate any ‘view’ on the level of the exchange rate. The Reserve Bank is guided by the need to contain volatility in the foreign exchange market and not by any specific level/ band around the exchange rate.

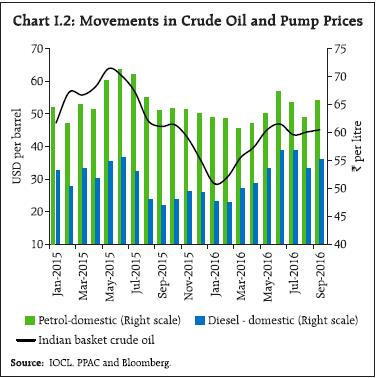

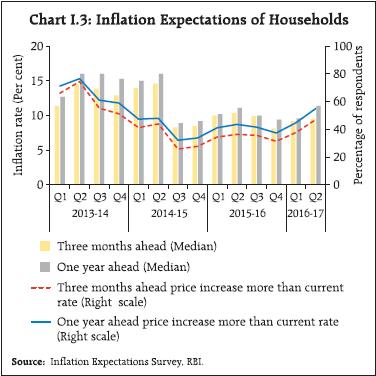

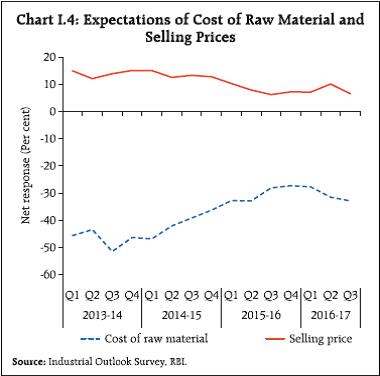

*** Based on projections from January 2016 and July 2016 Updates of the IMF’s World Economic Outlook. | International petroleum product price benchmarks used by domestic oil marketing companies (OMCs) to set domestic pump prices of petrol and diesel at fortnightly intervals tend to be highly correlated with international crude prices (0.9). On the other hand, domestic pump prices and international petroleum product prices diverge on account of refinery/maintenance/inventory costs and domestic tax structures, with this wedge having increased significantly since November 2014 in view of excise duty increases. Of every one per cent change in international product prices (lagged by a fortnight to simulate pump price revisions in India), only 0.31 per cent is reflected in domestic pump prices of petrol, the pass-through increasing to 0.42 per cent during episodes of international price increases and falling to 0.28 per cent during international price declines (Chart I.2; see also Chapter II). In 2016 so far, however, a substantially higher degree of pass-through is being observed.  I.1 The Outlook for Inflation Daily price collections of sensitive items under pulses, fruits, vegetables and cereals suggest that the seasonal surge in food prices may have peaked in July. Subdued momentum in food Inflation in Q3 and the usual seasonal softening of food prices in early Q4, notwithstanding a reversal of base effects in March 2017, improves the near-term outlook for Inflation considerably. Commodity prices are expected to remain quiescent over the rest of the year. These anticipated developments feed into Inflation expectations and, in turn, influence wage and price conditions, going forward. Among various economic agents, households tend to be the most adaptive in their expectations formation. Accordingly, food price increases of May-July appear to have remained entrenched in their Inflation expectations. The September round of the Reserve Bank’s survey of urban households indicates a pick-up in their current perceptions and expectations of Inflation farther out, as in the June round of the survey, with an increase in the proportion of respondents expecting prices to rise by more than the current rate1 (Chart I.3). In the September round, in fact, Inflation is expected to be 9.5 per cent three months ahead and 11.4 per cent one year ahead.  By contrast, producers’ Inflation expectations appear to be more forward-looking. The July-September round of the Reserve Bank’s industrial outlook survey2 reveals an increase in the proportion of respondents expecting higher input prices in Q3. The survey also indicates a decline in their expectations of higher selling prices (Chart I.4). Expectations of improvement in demand conditions should be comfortably absorbed by the presence of spare capacity. Manufacturing purchasing managers polled in Nikkei’s survey for September 2016 indicate that, despite some uptick, both input and output price indices were lower than their long-term averages. Increases in staff costs in the organised sector as well as nominal rural wage growth – especially with the deceleration in July – are expected to remain moderate in Q3.  The September round of the Reserve Bank’s survey of professional forecasters indicates a greater degree of anchoring of their Inflation expectations, relative to other agents, around the Reserve Bank’s Inflation targets (Chart I.5). They expect Inflation to ease to 4.7 per cent by Q4 of 2016-17 and to 4.4 per cent by Q2 of 2017-18, both lying within the Reserve Bank’s Inflation target band. While their medium-term Inflation expectations (five years ahead) have remained unchanged at 5 per cent, their longer-term expectations (10 years ahead) have moved down to 4.5 per cent from 4.8 per cent polled in the immediately preceding round of the survey. These expectations reflect the stubborn persistence that may be encountered in moving below current levels of Inflation.  Staff’s baseline model forecasts, taking into account the revisions in assumptions on initial conditions and augmented by information yielded by these forward-looking surveys of various classes of economic agents as well as from lead indicators, set a trajectory that takes consumer price index (CPI) Inflation down from 5.7 per cent in Q1 of 2016-17 to 5.0 per cent in Q3 before it firms up moderately to 5.3 per cent in Q4 (the 70 per cent confidence interval lies in a range of 3.9-7.0 per cent) (Chart I.6). These projections incorporate the 7th pay commission’s award relating to salaries and pensions which will work through aggregate demand and expectations effects to add around 10 basis points (bps) to the baseline path from Q4 of 2016-17. Furthermore, the projections also factor in cost-push effects of the proposed increase in minimum wages which would add 5 bps to baseline Inflation within two months of implementation3. Taking into account these shocks to the baseline and given the initial conditions in Table I.2, staff projects Inflation to ease modestly through 2017-18 and reach 4.5 per cent by Q4 of 2017-18 (2.1 per cent to 7.7 per cent defining the 70 per cent confidence interval). By current reckoning, the pass-through of the goods and services tax (GST) will likely commence from April 2017 and last for about 12-18 months, going by the cross-country experience. While the impact of the GST on CPI Inflation would largely depend on the standard rate decided by the GST Council, almost 50 per cent of the CPI is expected to be exempt. Cross-country experience indicates that the GST implementation might have one-off effects, which tend to dissipate after a year of its implementation (see Chapter II). It is in the context of unanticipated shocks to the future evolution of Inflation that the rationale of setting India’s Inflation target at 4 per cent with a tolerance band of +/- 2 per cent can be appreciated. Globally too, the subject of the appropriate level of the Inflation target is being intensely debated. For advanced economies, the wide-spread practice of a 2 per cent Inflation target has come under considerable scrutiny in the aftermath of the global financial crisis. The crisis showed that large adverse shocks can and do happen and when they do, policymakers need room for monetary policy to react to them, especially when the longer-term prospects of the economy are jeopardised. Accordingly, a view has been expressed that they should aim for a higher Inflation target of say 4 per cent since the costs of Inflation at 4 per cent and/or of anchoring expectations at 4 per cent are judged to be lower than the benefits of headroom made available to monetary policy to stabilise the economy in the face of recession risks. More recently, the potential benefits of a higher Inflation target have been cited in the context of the secular decline in the natural/neutral rate of interest (Williams, 20164)5. I.2 The Outlook for Growth The April 2016 MPR had outlined the key downside risks that could impinge upon the path of growth in 2016-17 – the depressed private investment climate amidst subdued capacity utilisation and corporate balance sheet deleveraging; depressed global output and trade growth dragging down net exports. It also highlighted several positive factors that could potentially lift growth, including the government’s “start-up” and other initiatives, the boost to household consumption demand from the 7th Central Pay Commission (CPC) award, still benign cost conditions, measures announced in the Union Budget 2016- 17 to transform the rural sector, upbeat consumer confidence and the expected recovery in agriculture and allied activities. Since then, some of these assumptions have materialised. Accordingly, the spatially and temporally satisfactory south-west monsoon during the 2016 season, and the implementation of the 7th CPC award are expected to provide a boost to consumption spending, both rural and urban. The Reserve Bank’s survey conducted in August-September 2016 found consumer optimism on the general economic outlook, but somewhat less confidence on future income and employment6 (Chart I.7). While private investment activity remains sluggish, corporate business expectations remain upbeat in the Reserve Bank’s industrial outlook survey on improving prospects for production, capacity utilisation, employment and the availability of finance (Chart I.8). This positive sentiment was also reflected in business confidence surveys conducted by other institutions (Table I.3).

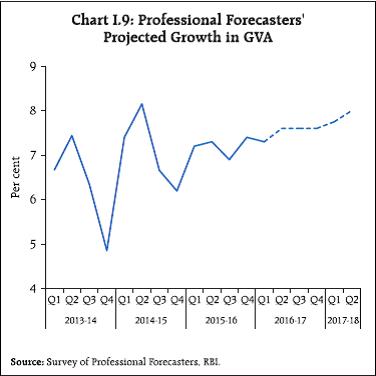

| Table I.3: Business Expectations Surveys | | Item | NCAER Business Confidence Index | FICCI Overall Business Confidence Index | Dun and Bradstreet Composite Business Optimism Index | CII Business Confidence Index | | Q1: 2016-17 | June 2016 | Q3: 2016 | Q1: 2016-17 | | Current level of the index | 124.3 | 64.3 | 83.2 | 57.2 | | Index as per previous Survey | 121.6 | 56.7 | 81.1 | 54.1 | | % change (q-o-q) sequential | 2.2 | 13.4 | 2.6 | 5.7 | | % change (y-o-y) | 2.1 | -3.0* | 6.7 | 5.1 | | *: Variation over August 2015 survey. | Over the medium-term, the implementation of the GST should boost business confidence and investment, brightening the environment for an acceleration of growth. Other initiatives such as steps to attract foreign direct investment in defence, civil aviation, pharmaceuticals and broadcasting, measures to improve infrastructure, and the enactment of the Insolvency and Bankruptcy Code and the Real Estate (Regulation and Development) Act should also contribute to unlocking entrepreneurial energies and growth impulses. Professional forecasters surveyed during September 2016 expected real GVA growth to improve from 7.3 per cent in 2016-17:Q1 to 7.6 per cent each in the remaining three quarters of 2016-17 on account of better agricultural prospects (Chart I.9 and Table I.4).

| Table I.4: Reserve Bank's Baseline and Professional Forecasters' Median Projections | | (Per cent) | | | 2016-17 | 2017-18 | | Reserve Bank’s Baseline Projections | | Inflation, Q4 (y-o-y) | 5.3 | 4.5 | | Real Gross Value Added (GVA) Growth | 7.6 | 7.9 | | Assessment of Survey of Professional Forecasters@ | | GVA Growth | 7.6 | 7.8 | | Agriculture and Allied Activities | 3.5 | 3.0 | | Industry | 7.5 | 7.9 | | Services | 8.8 | 9.2 | | Inflation, Q4 (y-o-y) | 4.7 | 4.4 # | | Gross Domestic Saving (per cent of GNDI) | 31.6 | 32.1 | | Gross Fixed Capital Formation (per cent of GDP) | 29.5 | 29.8 | | Money Supply (M3) Growth | 11.5 | 12.3 | | Credit Growth of Scheduled Commercial Banks | 11.5 | 13.0 | | Combined Gross Fiscal Deficit (per cent of GDP) | 6.5 | 6.0 | | Central Government Gross Fiscal Deficit (per cent of GDP) | 3.5 | 3.3 | | Repo Rate (end period) | 6.25 | 6.25 | | CRR (end period) | 4.00 | 4.00 | | Yield of 91-Days Treasury Bills (end period) | 6.4 | 6.4 | | Yield of 10-years Central Government Securities (end period) | 6.8 | 6.8 | | Overall Balance of Payments (US$ bn.) | 24.7 | 34.0 | | Merchandise Exports Growth | 1.2 | 6.1 | | Merchandise Imports Growth | -1.1 | 9.2 | | Merchandise Trade Balance (per cent of GDP) | -6.0 | -5.6 | | Current Account Balance (per cent of GDP) | -1.0 | -1.2 | | Capital Account Balance (per cent of GDP) | 2.0 | 2.9 | @: Median forecasts. #: Q2: 2017-18

GNDI: Gross National Disposable Income.

Source: Survey of Professional Forecasters (September 2016). | Taking into account these developments in conjunction with signals from various surveys and indicators and updated model forecasts, staff retains the projection of real GVA growth at 7.6 per cent for 2016-17, with a range of 7.6-7.7 per cent in Q2-Q4 (Chart I.10). For 2017-18, assuming a normal monsoon, fiscal consolidation in line with the announced trajectory and no major exogenous/policy shock(s), structural model estimates and off-model adjustments (Box I.1), real GVA growth of 7.9 per cent indicated in April is retained, but with downside risks mainly due to lower global demand vis-à-vis the April MPR. Box I.1: Nowcasting Economic Activity It is widely accepted that monetary policy needs to be forward-looking and should respond to expectations, since it affects Inflation and output with varying lags. Moreover, lags in data releases challenge the assessment of underlying economic conditions. Illustratively, the latest data on GDP, which became available on August 31, 2016 pertain to April-June 2016; GDP data for the quarter July-September 2016 – the quarter that is most relevant to this MPR as a starting point – will be released at the end of November 2016. Therefore, timely and accurate projections of these key goal variables are important. As noted in the MPR of September 2015, the Reserve Bank deploys a host of modelling approaches for generating forecasts. It also scans a host of incoming data to “nowcast” the current state of the economy. The “nowcasting” process involves analysing a number of leading and concurrent indicators of economic activity through a dynamic factor model (DFM) to estimate GVA growth for the relevant quarter, as well as the immediately preceding and following quarters. With an initial input of around 47 variables, the DFM exploits the co-movement among the series to select a relatively few salient ‘factors’. Given that data releases are scattered over the course of a month, the nowcast is updated as soon as new information comes in, thus providing an assessment of the economy almost in real time. The nowcasting of India’s GVA employs not only coincident and lead indicators but also survey results. Chart A presents nowcasts at the end of the relevant quarter - for example, the nowcast for the quarter January-March 2016 is based on information up to end-March. Chart B evaluates nowcasting performance over alternative horizons (from 2 months before the end of the reference quarter to one month after the reference quarter), and indicates an improvement in model performance as more information becomes available. The model performs better than a benchmark random walk (RW) model. Nonetheless, there are formidable challenges to nowcasting performance from the data – the persisting wide wedge between growth in industrial production and the growth in GVA in the manufacturing sector necessitates off-model adjustments to the results.

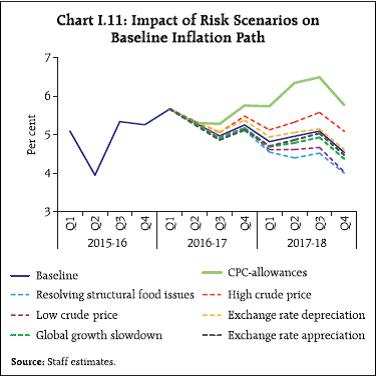

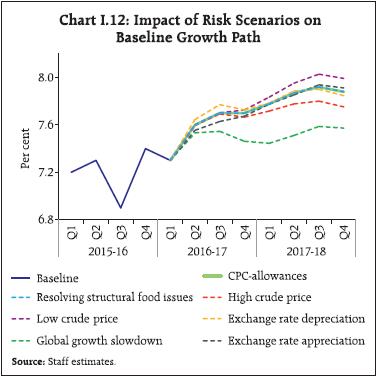

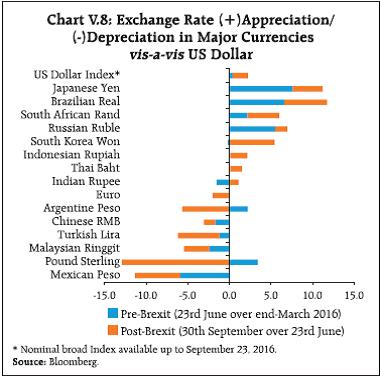

Reference: Giannone, Domenico, Lucrezia Reichlin and David Small (2008), “Nowcasting: The Real-time Informational Content of Macroeconomic Data”, Journal of Monetary Economics, Vol. 55, pp.665-676. I.3 Balance of Risks (i) Implementation of the 7th Central Pay Commission Award on Allowances While the second round impact of the 7th CPC award in the form of salaries and pensions is incorporated in the baseline forecasts, the effect of house rent allowances (HRA) is not, since its implementation was deferred, pending a review. As and when the revised allowances are awarded, they will have a direct impact on headline CPI Inflation through an increase in housing Inflation (house rents have a weight of 9.5 per cent in the CPI). In addition, indirect effects could arise through Inflation expectations. Assuming that (a) the revised allowances are implemented from early 2017, (b) the increase proposed by the 7th CPC is retained7, and (c) state governments implement a similar order of increase in allowances with a lag of one quarter, headline CPI Inflation in 2017-18 could be 100-150 bps above the baseline. The impact on Inflation is expected to persist for 6-8 quarters, with the peak effect occurring at around 3-4 quarters following the implementation (Chart I.11). While for policy purposes, the statistical direct effects of the increase in HRA should be looked through since they do not constitute an increase in true Inflation, model simulations indicate that indirect effects arising out of aggregate demand effects and rise in Inflation expectations may require a tightening of the monetary policy stance to ensure that Inflationary pressures from this factor do not get generalised and entrenched into expectations.  (ii) Moderation in Pulses Inflation A striking characteristic of food Inflation in recent years has been its persistence in certain groups such as pulses. In turn, this characteristic imparts stickiness to overall Inflation formation. Pulses, which have a weight of just 2.4 per cent in the CPI, have accounted for around 12-20 per cent of overall Inflation since mid-2015, manifesting structural demand supply imbalances rather than transient mismatches. Several initiatives have been undertaken over the past year to augment supply and bring down pulses Inflation (see Chapter II). If these efforts are able to bring down the prices of pulses on a sustained basis, food Inflation could ebb by around 35 bps by 2016-17:Q4 and around 100 bps by 2017-18:Q4 and, through a process of relative price adjustments, overall Inflation could moderate by 15 bps in 2016-17:Q4 and 50 bps by 2017-18:Q4. (iii) Exchange Rate Movements Uncertainty prevailing about the pace of US monetary policy normalisation tends to get amplified by every incoming data. The outcome of the US presidential election also adds to uncertainty. Consequently, spillovers purvey volatility to global and domestic financial markets, especially in the foreign exchange, equity and debt segments, with implications for domestic Inflation and growth. A five per cent depreciation of the Indian rupee vis-à-vis the US dollar could increase Inflation by 10-15 bps and real GVA growth by 5-10 bps above the baseline through effects on net exports (Charts I.11 and I.12). Model simulations that incorporate the resulting rise in headline Inflation above the baseline path and a faster closing of the output gap could indicate monetary policy tightening.  On the other hand, India could become a preferred destination of capital flows, as is the case currently, in view of relatively stronger macroeconomic fundamentals. This may cause the rupee to appreciate. An appreciation of the rupee by 5 per cent could moderate Inflation by around 10-15 bps and real GVA growth by 10 bps below the baseline. (iv) International Crude Oil Prices International crude oil prices have remained volatile in recent months. The price of the Indian basket increased from around US$ 36 per barrel in March 2016 to US$ 47 in July before softening again to around US$ 44 in August-September. Consequently, the baseline assumption in Table I.2 could be subject to variations on either side. If crude oil prices increase to US$ 70 per barrel by the end of 2017-18 (higher by around 40 per cent than the baseline assumption), Inflation could be higher by about 40-60 bps, while real GVA growth could weaken by around 20 bps relative to baseline paths by March 2018. Returning the goal variables to their baseline trajectories would require monetary policy tightening. On the other hand, crude prices could also soften below the baseline assumption in an event of weaker than expected global demand, and/or excess supply of crude in global markets. If crude oil prices fall to around US$ 35 per barrel and this softening is passed on to pump prices of petroleum products in India, Inflation may be about 30-50 bps below its baseline, while real GVA growth could be around 15 bps above its baseline. (v) Global Demand Stagnation Global growth has been muted so far and projections by various agencies for this year and the next are expected to downgrade the outlook for global growth even further. The uncertainty associated with the “Brexit”, the US presidential election and the still nebulous effects of US monetary policy normalisation and Chinese re-balancing, could undermine global economic activity even more. Should global growth be one percentage point below the assumed baseline, domestic real GVA growth and Inflation could be 20-40 bps and 10-20 bps below their respective baseline forecasts. The near-term outlook for the Indian economy is characterised by a continuing slow recovery, underpinned by consumption spending and by public investment at the margin. As regards Inflation, the outlook has improved for 2016-17, but beyond, the prospects of reaching 4 per cent i.e., the centre of the target band requires close monitoring. Recent initiatives and reforms by the government such as ‘Make in India’, measures to improve the infrastructure, the scheduled introduction of the GST, improvements in food supply management and steps to enhance domestic production of fertilisers as well as a reduction in prices of non-urea fertilisers are expected to help disinflate in the medium-term. Even as the urgency of safeguarding near-term growth and stability has increased, the policy challenge is to bolster medium-term growth prospects through structural reforms that step up new investment in the economy on a sustained basis, renew skills and job creation, and broaden the swathe of the growth process to include the widest sections of society in its benefits. Globally, the danger of secular stagnation and an entrenchment of lastingly impaired potential output have become more tangible than before. Besides the main priority of lifting both actual and potential output, keeping financial stability risks in check, containing external vulnerabilities, and building resilience is essential if an adjustment to diminished growth prospects globally becomes inevitable.

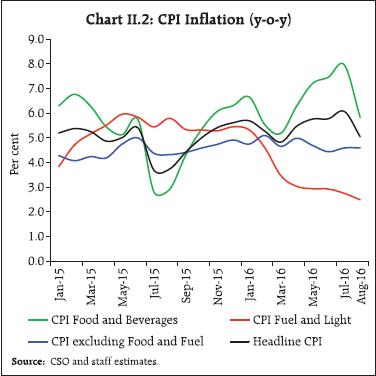

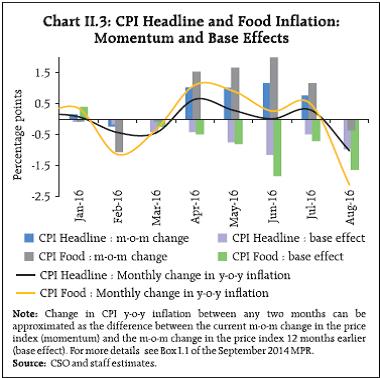

II. Prices and Costs Consumer price inflation was pushed up by a surge in the momentum of food inflation during April-July 2016 before a sharp correction set in during August. Input costs firmed up moderately for both farm and non-farm sectors alongside corporate staff costs. Drawing on a modest softening of households’ and professional forecasters’ Inflation expectations, still muted corporate pricing power and model forecasts, the April 2016 MPR envisaged a trajectory on which headline CPI Inflation1 would edge down from 5.4 per cent in Q4 of 2015-16 to 5.3 per cent in Q1 of 2016-17 and to 5.1 per cent in Q2. In the event, the momentum of the seasonal firming up of food prices that usually sets in from April was much stronger than anticipated, especially in vegetables prices. Moreover, occurring as it did on top of highly elevated prices of pulses, it imparted an unusual upside to Inflation that lasted right up to July. In addition, international crude prices rose from a recent trough in April to US$ 44 per barrel by September. Crude prices averaged US$ 44 per barrel during April-September as against US$ 40 per barrel in the assumptions on initial conditions in the April 2016 MPR. Consequently, headline CPI Inflation averaged higher at 5.7 per cent in Q1 of 2016-17, deviating from the forecast of 5.3 per cent (Chart II.1). With the rapid waning of these transient price pressures in August, Inflation momentum collapsed. Inflation appears to be returning to the April 2016 forecast path, albeit from some elevation. A one percentage point deviation of food Inflation from its trajectory projected in the April MPR leads to 47 basis points increase in headline Inflation in terms of the direct effect alone and this perturbation could cause headline Inflation to diverge from its projected path for upto four to six months, based on impulse responses in an unrestricted vector autoregression (VAR) framework. This imparts a modest potential upside to the balance of risks around the target of 5 per cent for Q4 of 2016-17. II.1 Consumer Prices The April 2016 projections were predicated on the presence of favourable base effects arising from high Inflation a year ago, with the base effects for food Inflation stronger than those pulling down the headline. Even while the downside base effects were significant up to June-July, they were overwhelmed by a surge in the month-on-month (m-o-m) momentum – especially of food prices – which peaked in July. As surprisingly as it took hold, the momentum of headline CPI dissipated completely in August, with the momentum of food prices turning negative. With this unexpected reversal, sizable base effects in that month came into full play and pulled down overall Inflation to 5.05 per cent, an intra-year low, in August (Charts II.2 and II.3).

The transient upsurge in Inflation momentum in April-July was induced by two main drivers – pulses and vegetables – as evident in the strong positive skew of the distribution of Inflation (Chart II.4). This is corroborated by a significant fall in the diffusion index of price changes in CPI during the first half of 2016-17, which suggests that Inflationary impulses were confined to a few food items (Chart II.5).

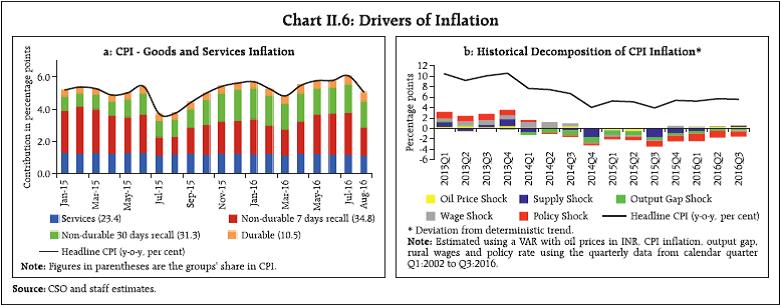

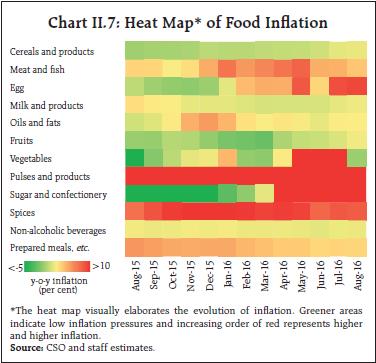

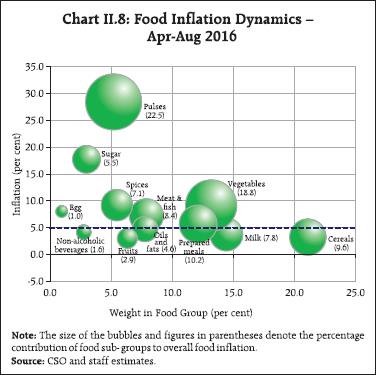

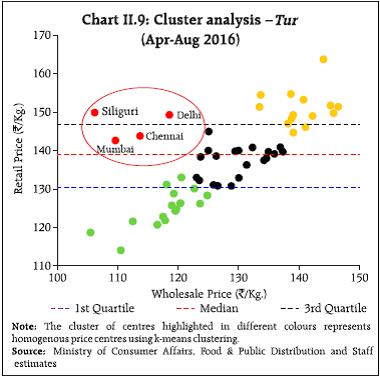

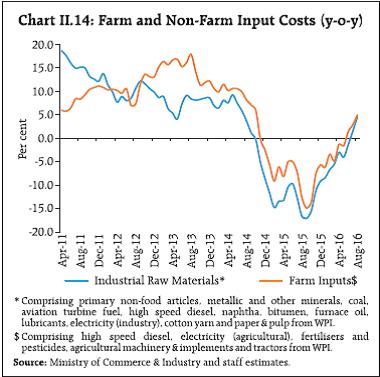

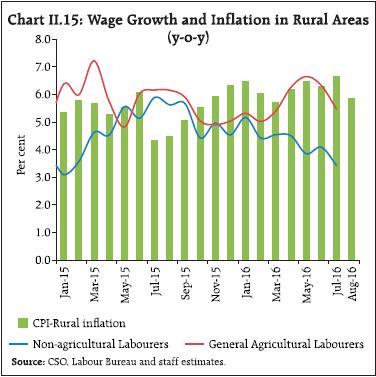

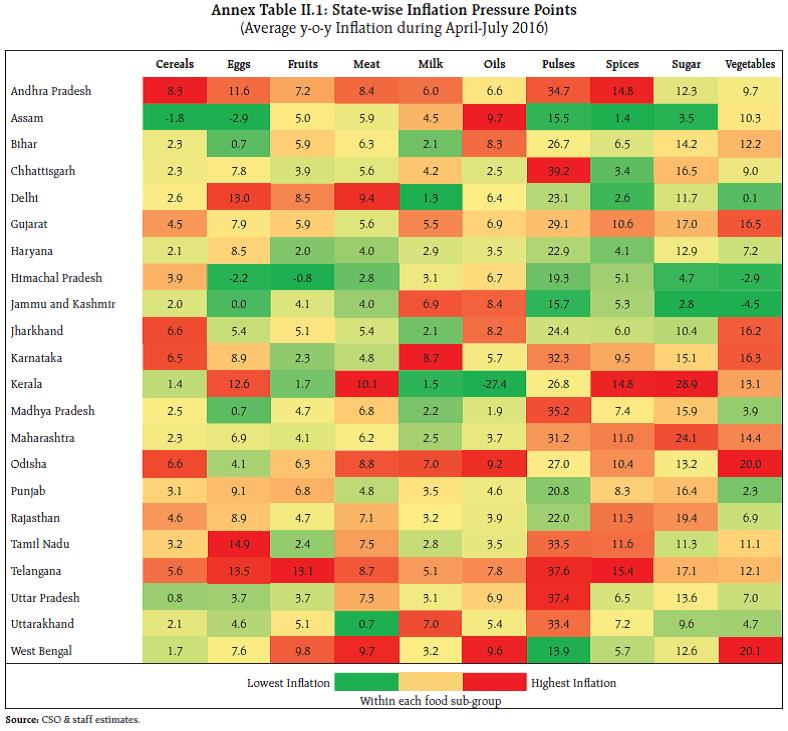

II.2 Drivers of Inflation In a forward-looking perspective, Inflation developments are likely to be influenced by three domestic drivers which, in themselves, embed upside risks to the Inflation target, namely (a) spatial distribution of food Inflation pressures; (b) the implementation of the 7th CPC award, especially house rent allowances and subsequently, implementation by states; and (c) the 42 per cent increase in minimum wages across the board for the central sphere2. Accordingly, the narrative in the rest of this chapter, albeit backward-looking, will be tilted towards a sharper focus on these elements under their respective categories in the CPI. This assumes relevance in view of the presence of considerable slack in the economy, resulting in demand-push factors remaining muted as evident in the relatively stable contribution of services to overall Inflation. By contrast, there has been a predominance of supply side factors – non-durable items that are largely food related – in the unravelling of recent Inflation developments (Chart II.6a).  A historical decomposition of Inflation shocks also shows that in the April-July episode, it was the positive contribution of domestic supply shocks along with that of firmer international crude oil prices that resulted in the uptick in Inflation. Aggregate demand – embodied in the still negative output gap – along with continuing pass-through of past monetary policy tightening worked towards tempering Inflation pressures (Chart II.6b). In the food and beverages sub-group – the dominant category in the CPI with a weight of 46 per cent – Inflation rose steadily through April-July. The sharp, though delayed, correction in August was triggered by the compression in the contribution of vegetables. The food group contributed 59 per cent to average headline CPI Inflation during April-August, with price pressures mainly emanating from pulses, sugar and vegetables (Chart II.7).  Pulses have been the major source of food Inflation consistently since Q2 of 2015-16 (Chart II.8). Reeling under two consecutive droughts, the production of pulses declined from 19.3 million tonnes in 2013-14 to 16.5 million tonnes in 2015-16 and the widening of the demand-supply imbalances elevated pulse prices unconscionably. As a consequence, pulses accounted for 22 per cent of food Inflation and 13 per cent of overall Inflation during April-August, despite a relatively low weight of 2.4 per cent in CPI. Excluding pulses, average food Inflation would have been lower by 1.2 percentage points and average headline Inflation by 0.6 percentage points during this period. In order to augment the supply of pulses, the Government undertook a number of measures, including higher imports at zero import duty, raising the buffer stock of pulses as well as minimum support prices (MSP). Although initially hamstrung by delayed arrival of imports, procurement at a time of high market prices and low offtake by States; the combined effects of these measures are increasingly visible in softening price pressures in pulses. Sugar emerged as the second major driver of food Inflation during first half of 2016-17 (Chart II.8). Despite adequate availability of stocks and reasonably good production, Inflation in this component rose sharply and remained in double digits from April, suggesting possible illicit stocking. Some moderation in sugar prices is expected by October 2016 as the cane-crushing season begins and fresh output is released in the market, although policy interventions may be warranted to ensure this outcome. A number of price control measures have been undertaken by the Government, including imposition of stock holding limits, extension of production subsidy, withdrawal of the mandatory export quota as well as extending financial assistance to the sugar mills through soft loan scheme.  Food Inflation was also pushed up by a sharp uptick in prices of vegetables, especially tomatoes. Upside impulses started to manifest in April in a typical pre-monsoon sequence; however, pressures accentuated during June-July 2016 on account of the delayed onset of the south west monsoon. Food supply management strategies need to be informed by the spatial dynamics of Inflation. Empirical scrutiny of the stronger than anticipated firming of food price pressures during April to July 2016 in an analysis of variance (ANOVA) framework that tests inter alia for the equality of mean Inflation across states reveals significant spatial variations. Inter-state price differences turn out to be statistically significant for all sub-groups of food. Cereal prices show up pockets of high Inflation in Andhra Pradesh, Jharkhand and Odisha. Vegetables Inflation was highest in the eastern states of Odisha and West Bengal, and least in the hilly states of Himachal Pradesh and Jammu and Kashmir. Pulses Inflation, which averaged 30 per cent across the country, was relatively low at around 13 per cent in Assam and West Bengal (Annex Table II.1). These wide variations across states appear to be complemented by rising inter-state divergence in the case of commodities such as eggs, oils and fats, spices and sugar. This calls for integrating fragmented agricultural markets in the country, if food supply management policies have to be effective. Cluster analysis by sifting centre-level daily data from mandis3 points to strong regional variation in mark-ups from wholesale to retail prices for pulses, especially in the case of tur. In centres like Mumbai, Chennai, Delhi and Siliguri, the mark-ups for tur have been strikingly higher than in the rest of the country (Chart II.9). Thus, the sharp increase in retail prices in pulses, for example, is due to a combination of increases in wholesale prices and unduly large retail margins.  In the fuel and light sub-group, Inflation softened steadily through April-August. Electricity demand underwent a sustained moderation in an environment of subdued offtake from the manufacturing sector as well as from stress-laden distribution companies (DISCOMs). With the resulting compression in the demand supply gap, spot electricity prices fell below the average price in the power purchase agreement (PPA) contracts. LPG prices also declined sharply, largely influenced by the softening of international gas prices. International kerosene prices have hardened during the financial year so far, driving a wedge between the administered kerosene price which has been increased by ₹0.25 per litre per month beginning July 2016; under-recoveries on account of kerosene prices rose to ₹10.5 per litre effective October 1, 2016 from ₹6.5 per litre for March 2016. Inflation in respect of fuel items has diverged significantly between rural and urban areas with the latter, in fact, going into deflation in August. Items of fuel consumption in rural areas like firewood and dung cake reveal stickiness; on the other hand, fuel items in urban consumption are increasingly getting indexed to international prices (Chart II.10). CPI Inflation excluding food and fuel eased unevenly through April-August from 5.0 per cent in April to 4.6 per cent in August, with most of the sub-groups imbibing this halting moderation. Housing, clothing and footwear, and health were the main drivers (with a combined weight of 48 per cent in CPI excluding food and fuel), contributing 54 per cent of Inflation in this category (Chart II.11). Included in this sub-group under transportation, however, are petrol and diesel4; if they are excluded, Inflation excluding food and fuel (and petrol and diesel) would have moved down by less – from 5.3 per cent in April to 5.0 per cent in August (Chart II.12a). As alluded to in Chapter I, the implementation of the 7th CPC award starting August 2016 is expected to have a significant and drawn out impact on the CPI Inflation trajectory through both direct and indirect channels. These effects will be magnified as implementation spreads at the state level, as the experience with the 5th and 6th CPC awards have shown (Box II.1 of the April 2016 MPR provides a comprehensive assessment), playing out over a period of two years. These developments will have to be carefully monitored on account of the risks of getting generalised. Other Measures of Inflation Since outliers like vegetables and pulses impart a strong positive skew, trimming the Inflation distribution by removing specific portions of upper and lower tails of the distribution is widely used to understand underlying Inflation movements5, with the weighted median being a specific case of trimming. Trimmed means, the weighted median and exclusion-based measures of CPI Inflation reveal a central tendency at around 5 per cent during April-August 2016 (Chart II.12b). Inflation measured by other sectoral CPIs broadly tracked the movements in headline CPI. The wholesale price index (WPI), which had been in negative territory for 17 successive months, registered Inflation of 1.4 per cent in Q1 of 2016-17 that rose to 3.7 per cent in August 2016. As a result, the divergence between CPI and WPI Inflation, which was at 7.4 percentage points in 2015-16, narrowed down to 1.3 percentage points in August 2016. This reflected the bottoming out of the prolonged downturn in international commodity prices. Given the stickiness observed in services Inflation in the CPI, and the impending HRA effects of the 7th CPC award, it is unlikely that the divergence would reduce further. GDP and GVA deflators, which had been in the negative zone for two consecutive quarters, also started rising since Q4 of 2015-16 (Chart II.13). II.3 Costs Domestic farm and non-farm input costs embedded in the WPI have risen sequentially beginning October 2015, although the rates of increase are still benign (Chart II.14). In the farm sector, price rises in respect of high speed diesel, pesticides, tractors, fodder and cattle feed have contributed to the hardening of costs. Interventions such as ‘Make in India’ and the Government’s initiative to bring down prices of fertilisers by (a) reduction in non-urea prices for the first time in the last 15 years; and (b) increasing domestic production of fertilisers will have positive effects on the farm sector.  In the case of industrial inputs, sequential price increases in respect of mineral oil, metallic minerals and non-food articles – especially fibre and oil seeds – have started imposing cost pressures. The 75th round of the Reserve Bank’s industrial outlook survey (IOS) pertaining to July-September 2016 suggests that input price pressures are building up, with the rise in raw materials costs expected to continue into Q3. On the other hand, surveys of purchasing managers in manufacturing and services – that provide contemporaneous information – suggest that input and output price pressures still remain weak by histrocial standards. Rural wage growth exhibited divergent movements in its constituents. Rural non-agricultural wage growth has ebbed in recent months, possibly reflecting an increase in supply of non-agricultural labourers in rural areas due to weak construction activity attracting less labour migration to urban areas. In contrast, agricultural labour wage growth rose on the back of demand as sowing conditions improved. At the state level, agricultural wages increased, especially in foodgrain producing states such as Karnataka and Andhra Pradesh (Chart II.15).  The proposed revision in basic minimum wages of the central sphere for different categories of employees (unskilled, semi-skilled, skilled, highly skilled and clerical)6 would support rural incomes that have been depressed by drought conditions for two successive years (2014-16). At the same time, however, it would push up headline CPI Inflation, as analysed in Chapter I. The expected increase in rural wages is also likely to bring on second round effects on Inflation. The Commission for Agricultural Costs and Prices (CACP) recommends MSP for agricultural commodities, including cereals and pulses, based inter alia on costs of production, labour and other inputs, with labour cost accounting for more than half of the total cost of production. While increases in MSPs for cereals have been moderate in the recent period – partly owing to the subdued growth in farm labour wages – the MSPs of pulses have been raised substantially on top of the sizable hike last year and are set to be raised even higher in the period ahead, with implications for the Inflation outlook. Wages in the organised sector reflected in staff costs per employee remained firm in Q1 of 2016-17 for both the manufacturing and the services sectors. On the other hand, unit labour cost measured by the ratio of staff cost to value of production, continued to rise for firms engaged in both sectors, notwithstanding some moderation in the case of manufacturing companies (Chart II.16). Looking ahead, Inflation developments are likelyto be shaped by the implementation of the GST.While the creation of a unified goods and servicesmarket in the country would reduce supply chainrigidities, cut down on transportation costs and alsobring down costs in general through improvementsin productivity, it could also produce a short-livedpass-through to the Inflation trajectory. The cross-countryexperience suggests that, controlling forcountry-specific characteristics, one-off effects tend todissipate after a year of its implementation (Box II.1). Box II.I: Inflation Impact of GST – Cross Country Evidence Internationally, 160 countries have some form of value added tax (World Bank, 2015). The experiences of the United Kingdom, Canada, New Zealand and Malaysia suggest that Inflation did increase in the period when GST was introduced (Table 1). Eventually, the Inflation impact moderated over a year, except in the case of United Kingdom where it remained elevated, due mainly to the oil crisis in 1973. Estimates of passthrough of changes in the VAT rate to consumer prices for 17 Euro zone countries for the period 1999-2013 show that, on average, the pass-through is much less than full and is highly sensitive to the type of VAT change. For changes in the standard rate, for instance, the final pass-through is about 100 per cent; for reduced rates, however, it is significantly less at around 30 per cent. The short-term effects on Inflation depend upon a host of factors, including the tax rate at which GST is implemented, the tax base and efficiency of the administrative machinery. | Table 1: Inflation Before and After GST Implementation (per cent) | | | t-1 | t | t+1 | t+2 | t+3 | t+4 | United Kingdom

[t =Q2:1973] | 7.9 | 9.3 | 9.2 | 10.3 | 12.9 | 15.9 | Canada

[t = Q1:1991] | 5.0 | 6.4 | 6.2 | 5.8 | 4.1 | 1.6 | New Zealand

[t = Q4:1986] | 10.7 | 18.7 | 18.6 | 18.9 | 16.6 | 8.6 | Australia

[t = Q3:2000] | 3.1 | 6.1 | 5.8 | 6.0 | 6.1 | 2.5 | Malaysia

[t = Q2: 2015] | 0.7 | 2.2 | 3.0 | 2.6 | 3.4 | 1.9 | | Source: OECD.Stat, Reserve Bank of Australia, Reserve Bank of New Zealand and Bank Negara Malaysia. | References: Benedek, Dora, Ruud De Mooij, Michael Keen and Philippe Wingender (2015), “Estimating VAT Pass-Through”, IMF Working Paper Series, WP/15/214, September. Government of India (2015), “Report on the Revenue Neutral Rate and Structure of Rates for the Goods and Services Tax”, Ministry of Finance, December 4. World Bank (2015), “Fiscal Policy for Equitable Growth,” India Development Report. The impact of the implementation of GST on CPI Inflation in India would largely depend on the standard rate that would be decided by the GST Council. The dual rate GST structure with a standard rate of 18 per cent and a low rate of 12 per cent (consistent with a revenue neutral rate (RNR) of about 15-15.5 per cent) is expected to have a minimal impact on Inflation (GoI, 2015)7. If the standard rate is increased to 22 per cent8 (consistent with an RNR of 17-18 per cent), the impact on aggregate Inflation would be in the range of 0.3-0.7 per cent, concentrated in select groups like healthcare (excluding medicines). As the standard rate increases from 22 per cent to 26 per cent and 30 per cent, the impact on CPI would increase from 0.6- 1.3 per cent and to 1.0-1.9 per cent (with input tax credit), respectively7. The general consensus is that the impact on consumer price Inflation is likely to be moderate if the standard GST rate is at 18 per cent – in fact, overall price levels may go down due to more efficient allocation of factors of production (NCAER, 2009)9.

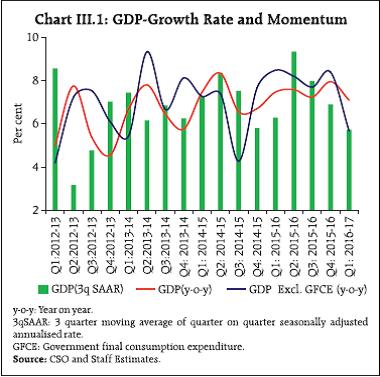

III. Demand and Output Aggregate demand slowed down in the first quarter of 2016-17, restrained by weak investment, but consumption spending is gradually improving. Aggregate supply conditions are poised to receive a strong boost from a reinvigoration of agriculture with some support from services, but industrial activity remains subdued. Economic activity lost some pace in the first half of 2016-17, relative to the preceding six months and a year ago. A deeper moderation has been cushioned by robust public spending. A retrenchment of investment has been underlying the slowdown; although public investment has been stepped up, crowding-in effects on private investment are not yet discernible. Private consumption spending has moderated somewhat, but a revival of agricultural activity and incomes and a sizable upward revision in wages and salaries in the public sector are set to boost it and regenerate growth impulses across the economy in the rest of 2016-17 and in the next year. While the weakness in domestic demand has sent imports into a prolonged contraction, the weakening global economy and financial market turbulence constitute the biggest risks to net exports and to overall economic activity, going forward. III.1. Aggregate Demand Measured by year-on-year (y-o-y) changes in real gross domestic product (GDP) at market prices, aggregate demand decelerated to a five-quarter low in Q1 of 2016-17, unable to sustain the strength of the upturn in the immediately preceding quarter (Table III.1). | Table III.1: Real GDP Growth (2011-12 Prices) | | (Per cent) | | Item | 2014-15 | 2015-16 | Weighted contribution 2015-16 * | 2014-15 | 2015-16 | 2016- 17 | | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | | I. Private Final Consumption Expenditure | 6.2 | 7.4 | 4.1 | 8.2 | 9.2 | 1.5 | 6.6 | 6.9 | 6.3 | 8.2 | 8.3 | 6.7 | | II. Government Final Consumption Expenditure | 12.8 | 2.2 | 0.2 | 9.0 | 15.4 | 33.2 | -3.3 | -0.2 | 3.3 | 3.0 | 2.9 | 18.8 | | III. Gross Fixed Capital Formation | 4.9 | 3.9 | 1.3 | 8.3 | 2.2 | 3.7 | 5.4 | 7.1 | 9.7 | 1.2 | -1.9 | -3.1 | | IV. Net Exports | 11.7 | -36.6 | -0.5 | 62.8 | -72.5 | -111.0 | -6.6 | -47.6 | -41.3 | -29.0 | -11.0 | 93.5 | | (i) Exports | 1.7 | -5.2 | -1.2 | 11.6 | 1.1 | 2.0 | -6.3 | -5.7 | -4.3 | -8.9 | -1.9 | 3.2 | | (ii) Imports | 0.8 | -2.8 | -0.7 | -0.6 | 4.6 | 5.7 | -6.1 | -2.4 | -0.6 | -6.4 | -1.6 | -5.8 | | GDP at Market Prices | 7.2 | 7.6 | 7.6 | 7.5 | 8.3 | 6.6 | 6.7 | 7.5 | 7.6 | 7.2 | 7.9 | 7.1 | *: In percentage points. Component-wise contributions do not add up to GDP growth because change in stocks, valuables and discrepancies are not included here.

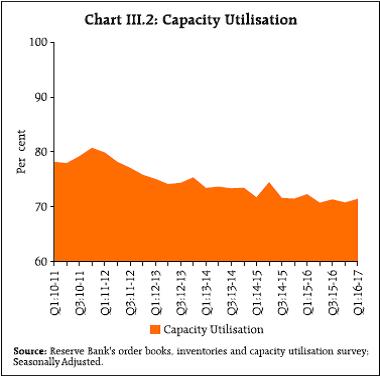

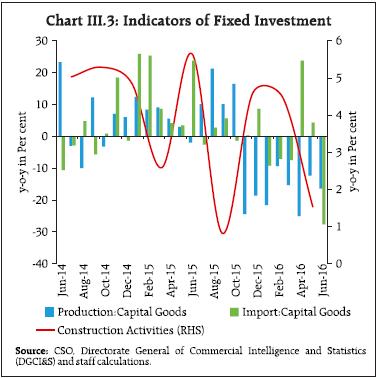

Source: Central Statistics Office (CSO). | The weakening of momentum was evident even on a seasonally adjusted basis (Chart III.1). In fact, aggregate demand was propped up by the front-loading of plan revenue expenditure; excluding the support from government final consumption expenditure, real GDP growth would have slumped to 5.7 per cent in Q1 of 2016-17, the lowest since Q4 of 2014-15 (Chart III.1). Demand conditions were undermined by a deepening of the contraction in gross fixed capital formation that set in from Q4 of 2015-16, besides a slowdown in private final consumption expenditure after two consecutive quarters of relatively robust growth. Weak domestic demand was also reflected in a sizable shrinking of imports, which enabled a positive contribution of net exports to aggregate demand after negative contributions for seven consecutive quarters.  Investment demand has been muted through the first half of 2016-17, juxtaposing the absolute decline in gross fixed capital formation in Q1 of 2016-17 with more recent higher frequency indicators. Capex spending remains moribund even as industry is operating marginally below the long-term average of capacity utilisation on a seasonally adjusted basis (Chart III.2). Still significant financial stress in large brown field projects, especially in sectors such as iron and steel, construction, textiles and power continues to inhibit bank credit flows. Depressed construction activity and lacklustre demand for plant and machinery more generally is being mirrored in the coincident decline in production and imports of capital goods (Chart III.3).

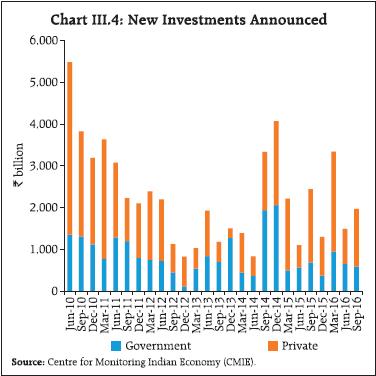

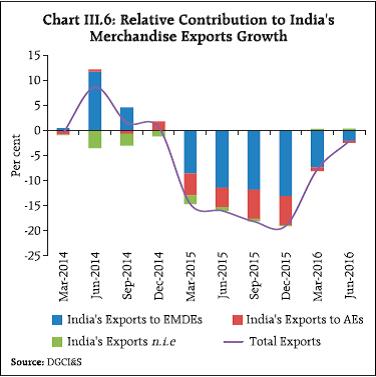

reflecting the lacklustre investment climate, new investment intentions have slowed down by 19 per cent on y-o-y basis in Q2 of 2016-17 (Chart III.4). It needs to be noted, however, that the Project Monitoring Group is striving to galvanise new investments; it cleared 65 large projects in 2016-17 (up to September, 2016) worth ₹3.05 trillion (as compared with 89 projects worth ₹2.7 trillion in April- September, 2015-16). When these clearances fructify, these will increase the value of investment, with the majority of these projects in the roads, power, coal and petroleum sectors. While the stock of stalled projects declined by 44 per cent in Q1 and 28 per cent in Q2 of 2016-17 on a sequential basis – propelled by faster clearances, particularly in respect of non-environmental permissions – on-streaming of investment spending in these projects is yet to materialise, largely due to unfavourable market conditions. Meanwhile, sales of non-government non-financial companies have contracted, and both foreign direct investment and external commercial borrowings have slowed down in relation to their levels a year ago.  Even though private final consumption expenditure (PFCE) growth decelerated in Q1 in relation to immediately preceding quarters in tandem with the production of consumer goods, it continued to anchor the evolution of aggregate demand in the economy, contributing 52.3 per cent of real GDP growth. For the first half of the year cumulatively, a modest improvement in consumption spending may be taking root. Overall, consumer goods production slowed in July, but remained in positive territory for the third consecutive month on an improvement in the production of durables – reflective of the underlying resilience of urban consumption. Sales of passenger vehicles – another indicator of urban consumption demand – posted double-digit growth in July-August. Urban spending is poised to pick up with the implementation of the 7th CPC award on wages, salaries and pensions from August as well as from the ongoing preference of banks for relatively less risky retail and personal lending. Manufacturing purchasing managers index continued to point to modest expansion in employment since July 2016. Rural incomes and consumption spending should also receive a strong boost from the satisfactory spread and intensity of the south west monsoon, with the robust improvement in foodgrains production and acceleration in sales of tractors (excluding exports) and two-wheelers in August providing lead indications. While rural wage growth in April-July was slightly slower than a year ago, the implementation of the increase in minimum wages in the central sphere (see Chapter II) should improve rural incomes, going forward. Turning to government final consumption expenditure (GFCE) which provided strong support to aggregate demand in Q1, information gleaned from central government finances during Q2 so far (July-August, 2016) indicates this was sustained by a growth of 19.3 per cent in Plan revenue expenditure, largely in the form of spending on social and physical infrastructure1. Consequently, plan revenue expenditure in April- August rose as a proportion to budget estimates (BE) and on a year-on-year basis. Non-plan revenue expenditure was somewhat lower than a year ago in relation to BE for the first five months of 2016-17, with the expenditure on major subsidies and interest payments going through contractions in July-August 2016. Overall capital expenditure, however, increased in July-August, both on the plan and non-plan account, even as capital expenditure fell back marginally in relation to BE in April-August (Table III.2). | Table III.2: Key Fiscal Indicators – Central Government Finances (April-August) | | Indicator | Actual as per cent of BE | | 2015-16 | 2016-17 | | 1. Revenue Receipts | 30.3 | 28.0 | | a. Tax Revenue (Net) | 22.8 | 26.6 | | b. Non-Tax Revenue | 61.5 | 32.5 | | 2. Total Non-Debt Receipts | 29.7 | 27.3 | | 3. Non-Plan expenditure | 41.6 | 39.6 | | a. On Revenue Account | 42.0 | 39.9 | | b. On Capital Account | 37.0 | 35.3 | | 4. Plan expenditure | 40.1 | 43.0 | | a. On Revenue Account | 40.6 | 44.8 | | b. On Capital Account | 38.9 | 38.1 | | 5. Total Expenditure | 41.2 | 40.5 | | 6. Fiscal Deficit | 66.5 | 76.4 | | 7. Revenue Deficit | 74.7 | 91.8 | | 8. Primary Deficit | 206.9 | 565.9 | | Source: Controller General of Accounts (CGA), GoI. | Gross tax revenue recorded significant growth during April-August, led by buoyant income tax and excise duty collections (Chart III.5). The sharp growth in income tax collections in April-August reflected the change in advance tax payment requirements for individuals2, lower refunds by the Government than in the previous year and increase in surcharge3 on high net worth individuals. Within indirect taxes, while union excise duty collections were buoyed by higher consumption of petroleum products, the growth in the service tax receipts was significantly higher than a year ago due to the imposition of Krishi Kalyan cess at 0.5 per cent with effect from June 1, 2016. Non-tax revenue was, however, lower than last year as disinvestment failed to pick up despite conducive stock market conditions. In view of these developments, there was deterioration in the gross fiscal deficit (GFD) as a proportion to BE during April-August, mainly on account of a sharp increase in the revenue deficit. The Medium Term Expenditure Framework (MTEF) statement indicates that in order to absorb the complete impact of pay revisions in 2016-17, the provision for salary payments made in the Union Budget will require some enhancement in the revised estimates. The first batch of supplementary demands for grants for 2016-17 announced in August entails a net cash outgo of ₹209 billion over and above the BE. Therefore, fiscal spending may have to be restrained going forward in order to adhere to the target. The secondary impact of additional pay-out due to the Pay Commission recommendations on aggregate demand is likely to be muted as the revenue expenditure multiplier is found to be less than one in the Indian context4, partly reflecting the dampening impact of leakages through direct and indirect taxes. Moreover, as disbursements under the Pay Commission are undertaken without compromising the ongoing fiscal consolidation process, the growth enhancing impact will be moderate unlike the 5th and 6th Pay Commission awards. Taking into account the surge in Q1, net exports contributed to the increase in aggregate demand in the first quarter of 2016-17 through a large saving on account of cutbacks in major merchandise imports such as petroleum, oil and lubricants (POL), gold, iron and steel, and fertilisers. This was also reflected in the current account deficit narrowing to near-balance (0.1 per cent of GDP in Q1 from 1.2 per cent a year ago). Merchandise exports declined by 3 per cent in April- August in an environment of subdued global trade and output, and net terms of trade gains were eroded by the firming up of commodity prices. Emerging market economies (EMEs), which account for more than half of India’s export receipts, have suffered a persistent decline in their import volume (Chart III.6).  Gold import volume declined in April-August to almost a third of its level a year ago due to destocking of gold purchased earlier, subdued rural demand due to two consecutive poor monsoons and possibility of some supply through informal channels. The fall in non-oil non-gold imports in the year so far, particularly in the capital goods segment, reflects the weak domestic investment climate. Consequently, the merchandise trade deficit shrank sharply to US$ 34.7 billion in the first five months of 2016-17 from US$ 58.4 billion a year ago. Net services exports declined by over 10 per cent (April-July) as all major segments, except software services, were in contractionary mode. The prospects of private transfers, which had declined by about US$ 2 billion (a y-o-y decline of 11 per cent) in Q1, are uncertain as the prolonged softness in crude prices takes its toll on remittances from the Middle East. Disconcerting evidence has been forming for some time now that the engine of trade liberalisation that powered global output and trade since the 1980s in a rapidly integrating world marketplace is stalling. The ratio of world trade to GDP has been languishing since 2012, the longest phase of stagnation in the post-World War II period. The volume of world trade has plateaued since the beginning of 2015, even as underlying financial flows are coming off their pre-global crisis peaks. More recent evidence is pointing to a sharp drop in the demand for EME exports from AEs, particularly from the US, notwithstanding the recovery in US demand and the strength of the US dollar. While the biggest contraction of US demand is in respect of imports from China, imports from India have also fallen in value terms during 2016 so far. According to the International Monetary Fund (IMF), US imports from EMEs excluding China have been in contraction since 2015. This is being regarded as confirmation of the weakening of US manufacturing spreading to EMEs through the channel of trade5. Imports from EMEs by the European Union have also been contracting since 2015. Trade as a driver of world growth is on the wane, and instead a steady rise in protectionism is turning the tide of globalisation, possibly reversing it. India’s trade sector has also faced considerable protectionism in major partner economies. According to the Global Trade Alert database, Indian exports have been mainly impacted directly or indirectly through various types of measures, both tariff and non-tariff, in partner countries. III.2 Aggregate Supply Output measured by gross value added (GVA) at basic prices moderated marginally in Q1 of 2016-17 on a sequential y-o-y basis, although it was still a little above the average quarterly GVA growth recorded in 2015-16 (Table III.3). Seasonally adjusted q-o-q annualised growth indicates, however, a strengthening of momentum in Q1 relative to the immediately preceding quarter (Chart III.7a)6. | Table III.3: Sector-wise Growth in GVA | | (Per cent) | | Item | 2014-15 | 2015-16 | 2015-16 | 2014-15 | 2015-16 | 2016-17 | | Growth | Share | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | | I. Agriculture, Forestry and Fishing | -0.2 | 1.2 | 15.4 | 2.3 | 2.8 | -2.4 | -1.7 | 2.6 | 2.0 | -1.0 | 2.3 | 1.8 | | II. Industry | 6.5 | 8.8 | 22.7 | 9.2 | 6.2 | 3.4 | 6.9 | 7.1 | 8.5 | 10.3 | 9.2 | 7.7 | | (i) Mining & quarrying | 10.8 | 7.4 | 3.1 | 16.5 | 7.0 | 9.1 | 10.1 | 8.5 | 5.0 | 7.1 | 8.6 | -0.4 | | (ii) Manufacturing | 5.5 | 9.3 | 17.5 | 7.9 | 5.8 | 1.7 | 6.6 | 7.3 | 9.2 | 11.5 | 9.3 | 9.1 | | (iii) Electricity, gas, water supply & other utilities | 8.0 | 6.6 | 2.2 | 10.2 | 8.8 | 8.8 | 4.4 | 4.0 | 7.5 | 5.6 | 9.3 | 9.4 | | III. Services | 9.4 | 8.2 | 61.9 | 8.0 | 9.9 | 11.7 | 8.3 | 8.3 | 7.9 | 8.5 | 8.1 | 8.4 | | (i) Construction | 4.4 | 3.9 | 8.5 | 5.0 | 5.3 | 4.9 | 2.6 | 5.6 | 0.8 | 4.6 | 4.5 | 1.5 | | (ii) Trade, hotel, transport, communication and services | 9.8 | 9.0 | 19.2 | 11.6 | 8.4 | 6.2 | 13.1 | 10.0 | 6.7 | 9.2 | 9.9 | 8.1 | | (iii) Financial, real estate & professional services | 10.6 | 10.3 | 21.6 | 8.5 | 12.7 | 12.1 | 9.0 | 9.3 | 11.9 | 10.5 | 9.1 | 9.4 | | (iv) Public administration, defence and other services | 10.7 | 6.6 | 12.6 | 4.2 | 10.3 | 25.3 | 4.1 | 5.9 | 6.9 | 7.2 | 6.4 | 12.3 | | IV. GVA at basic prices | 7.1 | 7.2 | 100.0 | 7.4 | 8.1 | 6.7 | 6.2 | 7.2 | 7.3 | 6.9 | 7.4 | 7.3 | | Source: CSO. |

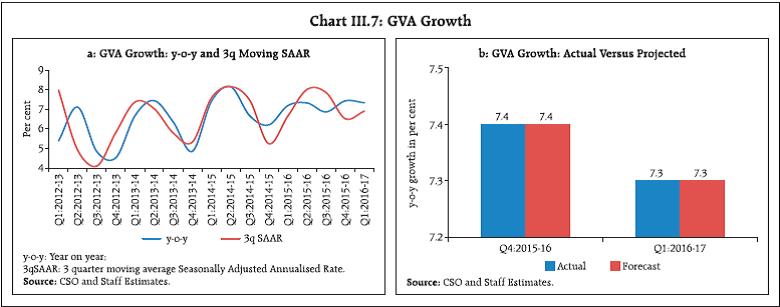

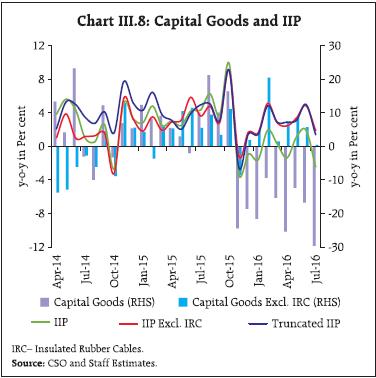

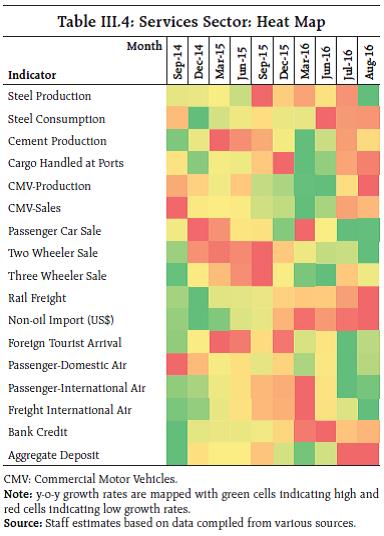

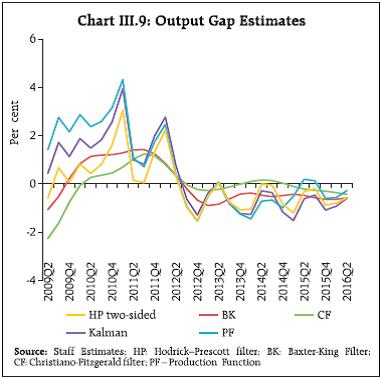

The April 2016 MPR had projected a gradual improvement in GVA growth from 7.3 per cent in Q1 to 7.7 per cent in Q2. With most of the initial assumptions underlying these projections materialising, the actual outcome for Q1 has matched the projection (Chart III.7b) (see Chapter I).Turning to Q2, the deceleration in value added in agriculture and allied activities in Q1 is well-positioned to reverse, although the upturn could undershoot the April 2016 projection slightly. The south-west monsoon commenced with a delay but soon gathered momentum and by mid-July, it had covered 89 per cent of the country’s meteorological sub-divisional area with excess/normal rainfall. From the second week of August, it waned in intensity and by end-September, precipitation was 3 per cent below the long period average (LPA) and was excess /normal across 85 per cent of the country’s meteorological sub-divisional area7. reflecting the initial delay in the monsoon’s onset, kharif sowing started on a low note, lagging behind last year’s acreage till first week of July. It picked up vigorously thereafter and by the end of September, it was 3.5 per cent higher than last year’s sown area, most notably under pulses (29.2 per cent), but also with respect to rice, coarse cereals and oilseeds. This has brightened the prospects of kharif crops production. According to the first advance estimates, the production of kharif foodgrains during 2016-17 at 135.0 million tonnes was 8.9 per cent higher than last year. The production of kharif pulses was a record high at 8.7 million tonnes. Among commercial crops, the production of oilseeds and cotton increased by 41.0 per cent and 6.6 per cent, respectively, over last year, even as that of sugarcane contracted. The satisfactory performance of the south west monsoon augurs well for the prospects of the rabi crops. The significant improvement in reservoir levels, especially in the Central and Western region, which accounts for around 64 per cent of irrigated area from these reservoirs, and the improvement in soil moisture conditions should enable the achievement of the rabi foodgrains target of 137.4 million tonnes (higher than that of 128.2 million tonnes last year). Growth of value added in the industrial sector in Q1 was pulled down by a contraction in mining and quarrying caused inter alia by a deceleration in the production of coal and absolute declines in the output of crude petroleum and natural gas. Turning to Q2, industrial production contracted in July, though a caveat is in order. Since the second half of 2015-16, movements in the index of industrial production (IIP) have been unduly influenced by a sharp contraction in the lumpy and large order-driven output of insulated rubber cables (IRC). It has produced strong and overwhelming effects on the headline index as well as on capital goods of which it is a component. Trimmed of IRC, industrial production would have risen by 3.2 per cent during April-July 2016 instead of contracting by 0.2 per cent. This is corroborated by the movements in a truncated IIP8 (Chart III.8). Manufacturing output contracted in July, although excluding IRC, it would have posted an expansion of 2.1 per cent. Nonetheless, manufacturing performance continues to face headwinds from the subdued business and investment environment. Illustratively, while sales of non-government manufacturing companies contracted in Q1 of 2016-17, profitability was shored up by other income and still soft input costs rather than a durable strengthening of output, with some indications of improvement in Q2. The corporate sector is challenged by high levels of leverage, relative to debt servicing capacity and concentration of risks. In this context, the vulnerability of the corporate sector to external debt has been amplified by low debt servicing capacity.  As regards other components of the IIP, electricity generation dipped in July after growing at a healthy pace in preceding months. It has fallen further in August due to contraction in thermal power generation – the first time in 16 months – with the plant load factor falling to a low of 52 per cent. Electricity demand has also been experiencing a sustained moderation in an environment of subdued offtake from the manufacturing sector as well as from stress-laden distribution companies (DISCOMs). The demand-supply gap narrowed to 0.5 per cent of total demand from 2.5 per cent a year ago. Consequently, suppliers sold electricity in the spot exchange – volumes reached a record high of 3,580 million units in July before dipping to 3,445 million units in August – bringing down exchange-traded spot prices to ₹2.20 per kilowatt hour (kWh), lower than prices under long-term power purchase agreements (PPAs). In terms of use-based activity, consumer nondurables slipped back into negative territory in July – a nine-month long slump had been interrupted by tentative positive growth in June – indicating that rural consumption is still weak. On the other hand, consumer durables have been supported by the abiding strength of urban consumption. While, basic goods decelerated, capital goods excluding IRC rose by barely 0.5 per cent in July, reflecting subdued investment demand. The recent momentum in core industries was sustained by a sharp pick-up in steel production in August 2016 reflecting inter alia low base and imposition of minimum import price, anti-dumping and safeguard duties. This, in consonance with the positive trend in cement production, augurs well for construction sector – even though the output of core industries as a whole was constrained by a decline in the production of coal, crude oil and natural gas, and deceleration in refinery products and electricity generation. The environment for industrial activity should improve with recent policy initiatives like liberalisation of foreign direct investment (FDI) policy in defence, civil aviation, pharmaceutical and broadcasting. This is being reflected in the manufacturing purchasing managers index which has remained in the expansionary zone since January 2016 mainly driven by new and export orders. Value added in the services sector, which constitutes around 63 per cent of total GVA, accelerated in Q1 on the back of stronger growth in public administration, defence and other services, supported by financial, real estate and professional services. On the other hand, activity in the construction sector slowed down and GVA growth in trade, hotels, transport and communication slowed sequentially. In Q2, public administration and defence services would have been boosted by the implementation of the 7th CPC award and one rank one pension (OROP) from August. The robust improvement in sales of two wheelers, passenger cars and tractors in recent months suggests that GVA in the transportation sub-sector is picking up (Table III.4).  Construction activity remained subdued on account of stalled projects in the sector and onset of monsoon. As monsoon winds up, the construction sector is set for a turnaround on the package of measures approved by the Cabinet Committee on Economic Affairs (CCEA) to revive stalled projects, and especially the unclogging of cash flows. Available information shows that the construction of highways and capital expenditure under Railways are picking up and there are similar signs in respect of the sales of commercial properties in main cities. Though backed by low base, the consumption of steel accelerated in August after two months of contraction. Port cargo continues to decelerate, mostly on account of slowdown in imports of coal as domestic production picked up, and also due to contraction in tonnage of iron ore and fertilisers. Railway freight contracted due to low haulage of coal, and foodgrains, but it is expected to turn around once kharif procurement of foodgrains starts. Growth of foreign tourist arrivals accelerated on account of the e-visa facility. Accordingly, the services PMI improved further, driven by new business and improved business expectations in Q2. III.3 Output Gap The above assessments of the formation of aggregate demand and aggregate supply provide insights into the state of the economy vis-a-vis the underlying business cycle and, in turn, the trade-off between growth and Inflation confronting the setting of monetary policy. In this context, measurement of the potential level of output i.e., the sustainable level of output in which the intensity of resource use is non-Inflationary, becomes crucial. Bearing in mind that potential output is unobservable, that it has to be estimated and that these estimations are highly sensitive to the choice of period and methodology and the availability of data, staff has been employing the pragmatic approach. It combines a battery of methodologies, including different univariate filters - Hodrick–Prescott (HP); Baxter-King (BK); Christiano- Fitzgerald(CF); multivariate Kalman filter – with estimates of the production function approach in a principal components framework to derive a proximate view of potential output, while cautioning about the limitations with which these estimates have to be used (see MPRs of September 2015 and April 2016). The non-availability of a historical profile of GVA/GDP under the new series is also a major handicap to the accuracy of these estimates. Given these caveats, updated estimates of potential output suggest that the output gap – the deviation of actual output from its potential level and expressed as a percentage of potential output – remains negative, as it has been since 2015-16, but is slowly closing (Chart III.9). This is corroborated by the latest round of the Reserve Bank’s order books, inventory and capacity utilisation survey which shows capacity utilisation plateauing, after declining from 2011-12 (Chart III.2).  Economic activity is evolving in close alignment with staff’s projections, still below its underlying potential. Persisting slack in the economy has restrained a fuller expression of aggregate demand, which remains essentially consumption-driven. The continuing weakness in investment poses a risk not only to the prospects of the recovery gaining momentum on a durable basis but also to potential output itself. There is also some evidence, anecdotal and estimation-based, that productivity is getting impaired. Key to breaking out of this low-level trap is a revival of investment, especially private, in a conducive environment of reforms in product and factor supplies that unlock productivity and competitiveness, and raise the economy’s potential itself. This acquires urgency in view of the prolonged weakening of the global economy and the sense that global potential output may have become lastingly debilitated.

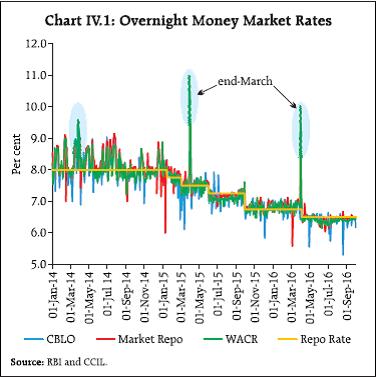

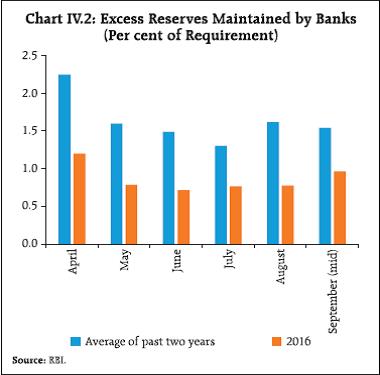

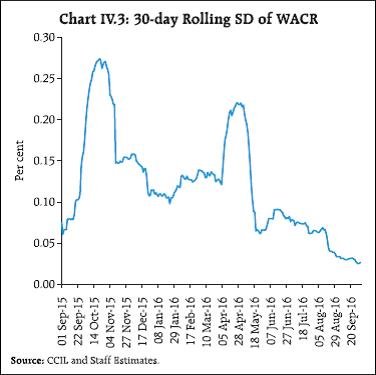

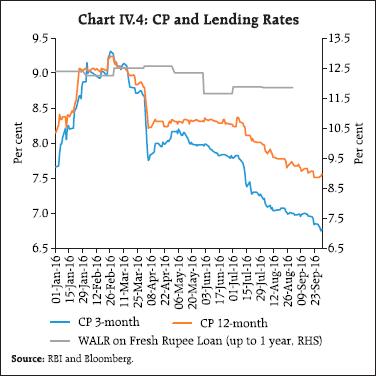

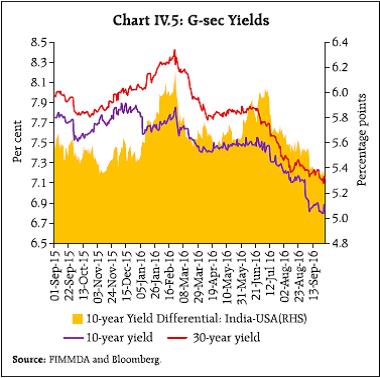

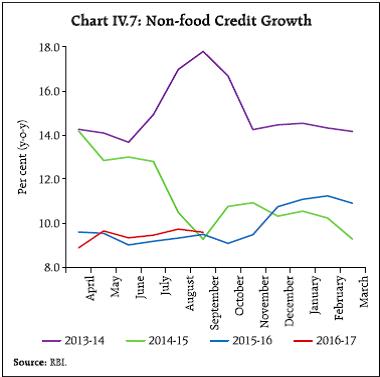

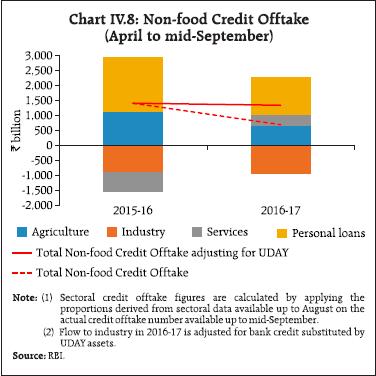

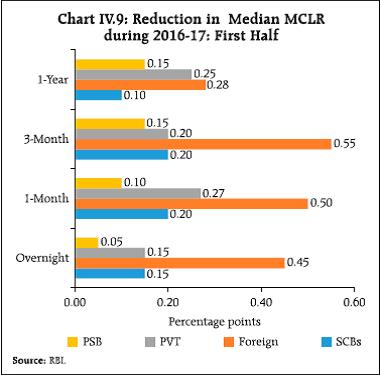

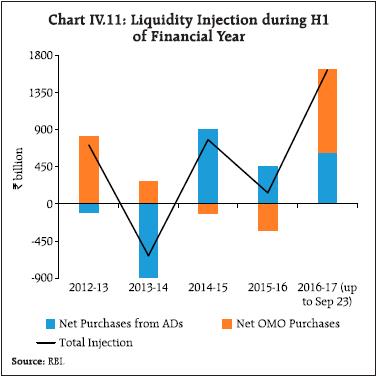

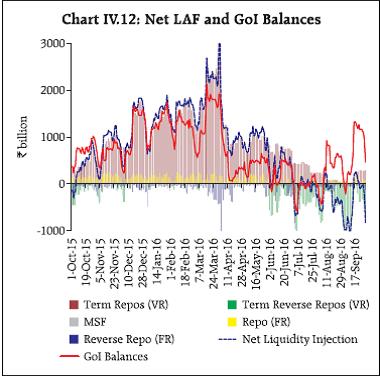

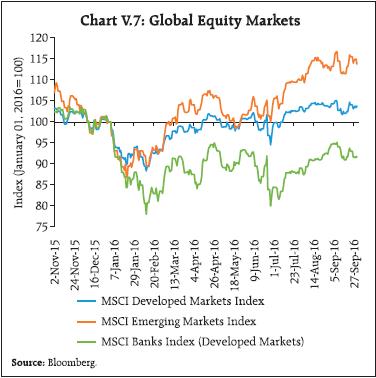

IV. Financial Markets and Liquidity Conditions Liquidity conditions have eased significantly, consistent with the accommodative stance of monetary policy. Bond yields touched multi-year lows. Commercial paper (CP) and corporate bond markets witnessed stronger transmission of monetary policy relative to the credit market, with issuances of CPs and corporate bonds increasing. Bank credit growth remains sluggish, albeit consistent with the nominal GDP growth outturn. Spells of turbulence have kept global financial markets unsettled since the April MPR, mainly sparked by worries about weakening global growth and diminishing confidence in the ability of central banks to nurture a sustainable recovery. In Q1 of 2016-17, equity, bond and commodity markets traded on a subdued note, with higher volatility and investor differentiation having widened credit spreads on EME and corporate assets. The universe of negative yields expanded rapidly in this risk-averse environment. The Brexit vote of June 23, however, took markets by surprise, causing equity, currencies and bonds to plunge across the globe. Yet, recovery too was surprisingly quick, especially in the context of a black swan type event. In Q2, volatility has subsided, commodity prices have firmed up, credit spreads have narrowed, equity markets have rallied to new highs and portfolio flows to EMEs have resumed. Although uncertainty around the Fed’s decision of September 21 did push up bond yields, other market segments maintained poise and risk appetite has intensified. Domestic financial markets have been resilient to these global developments and have, in fact, shown greater sensitivity to domestic cues. Even in the equity and foreign exchange segments, which are most vulnerable to global spillovers, the impact of international events has been transient. The Indian rupee turned out to be among the most stable currencies, notwithstanding fears about FCNR(B) redemptions commencing in September. In the money markets, interest rates have eased in the first half of 2016-17 propelled by comfortable liquidity conditions, and volatility has fallen. Bond yields touched multi-year lows, responding to abundant liquidity and expectations of falling Inflation cheered by a satisfactory monsoon. By contrast, credit markets have remained isolated in this generalised softening, with lending rate movements reportedly inhibited by asset quality concerns and balance sheet repair. Although deposit rates have also imbibed these rigidities, they have declined more than lending rates in recent months. IV.1 Financial Markets Q1 commenced with money markets fully transmitting the 25 bps cut in the repo rate of April 5. Liquidity conditions were influenced by restraint in government expenditure and a sustained elevation in currency demand entailing a leakage from the banking system during rabi procurement period of April and May. Open market purchases and term repos of varying tenors, in addition to the Reserve Bank’s normal liquidity operations, assuaged liquidity pressures. Consequently, the weighted average call money rate (WACR) and collateralised overnight rates traded tightly around the repo rate with a slight softening bias (Chart IV.1). The return of currency to the system towards the end of May and a pick-up in government expenditure in June helped to ease liquidity conditions.  Two developments are noteworthy in the evolution of money market in this period. First, with the relaxation in reserve maintenance norms (to a daily minimum of 90 per cent from 95 per cent earlier) as part of the refinements in the liquidity management framework in April (see section IV.2), there was a moderation in banks’ holdings of excess reserves (Chart IV.2). Secondly, the market response to the narrowing of the policy rate corridor to +/-50 bps on April 5 was reflected in a compression of money market spreads vis-à-vis the repo rate and a decline in volatility (Chart IV.3).