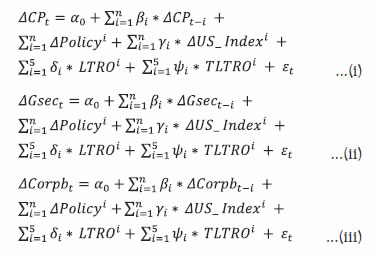

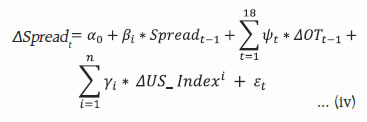

Unconventional monetary policy tools (UMPTs) significantly differ from conventional instruments in terms of the nature of policy actions, their rationale, the channels through which they work and the scale of operations. The Reserve Bank undertook several unconventional measures in the wake of COVID-19; specifically, long term repo operations (LTROs) were introduced to facilitate monetary transmission and support credit offtake while targeted long-term repo operations (TLTROs) provided liquidity to specific sectors and entities experiencing liquidity stress. Special OMOs (Operation Twists) were conducted to compress the term premium while explicit forward guidance complemented other UMPTs in restoring normalcy, easing financial conditions while maintaining financial stability. Overall, these measures have laid the foundations for economic revival, going ahead. Introduction Since the beginning of the 1990s and the advent of inflation targeting, central banks in advanced economies (AEs) have typically used a short-term interest rate as their principal monetary policy instrument. In response to the global financial crisis (GFC), many AE central banks lowered their policy interest rates to near-zero levels. The persistence of such low rates, however, rendered conventional policy tools impotent, which impaired the monetary transmission mechanism. In this milieu, some central banks introduced ‘unconventional’ monetary policy tools (UMPTs) to stimulate economic activity.1 UMPTs, which provided greater leeway to central banks during the GFC, were redeployed after the outbreak of COVID-19 to mitigate its deleterious impact on financial conditions and economic activity. The public health concern posed by the pandemic quickly transformed into a macroeconomic and financial crisis. As the lockdowns and social distancing measures were enforced across the globe, it led to a near collapse of economic and financial market activity presenting unprecedented challenges for life and livelihood. Following the declaration of COVID-19 as a pandemic2, financial market conditions tightened while volatility across key market segments amplified across the globe. In this background, central banks worldwide deployed several conventional and unconventional measures to safeguard economic and financial stability and prevent adverse macro-financial feedback loops (BIS, 2020). This article presents an assessment of the Indian experience on UMPTs and is organised in the following manner. Section II presents a synoptic view of various UMPTs and their rationale. The deployment of UMPTs by authorities in the light of COVID-19 is discussed in Section III while measures taken in the Indian context are presented in Section IV. An empirical assessment of specific measures and their efficacy is undertaken in Section V while Section VI concludes. II. Unconventional Monetary Policy Tools (UMPTs) – A Primer UMPTs significantly differ from conventional instruments in terms of the nature of policy actions, their rationale, the channels through which they work and the scale of operations. Broadly, UMPTs include (i) negative interest rate policies; (ii) extended lending or term funding facilities; (iii) asset purchase programmes; and (iv) forward guidance. Apart from negative interest rates3, these tools have always been in the arsenal of most central banks and have been used sparingly in the past to ensure the smooth functioning of financial markets. What has been unconventional is the use of UMPTs in recent years as the principal mechanism for achieving the goals of monetary policy (BIS, 2019). (i) Negative Interest Rate Policies (NIRPs): Negative interest rates are truly unconventional as it is difficult to justify that depositors would be taxed for placing funds with banks. Conventional wisdom suggested that there was a ‘zero lower bound’ (ZLB) to policy rates, implying that interest rates could never be negative.4 The ZLB, however, was not a constraint as some AE central banks viz., in Denmark, Sweden, Switzerland and the Euro Area decided to implement NIRPs immediately after the GFC.5 Commercial banks, however, eschewed negative rates by setting a floor of zero on retail deposit rates. Nonetheless, there is still likely to be a lower bound on deposit rates below which depositors will withdraw money and hold cash. As a result, central banks began to discuss an ‘effective lower bound’ (ELB) for policy interest rates. Overall, this strategy was effective as long term yields adjusted downwards and provided the desired expansionary stimulus. Although it resulted in compression of bank interest margins, it has not posed a major problem for banking stability in AEs till date (BIS, 2019). In emerging market economies (EMEs), however, NIRPs can cause large cross-border spillovers in the form of a deluge of capital inflows in search of yields, thereby posing enormous monetary policy and financial stability challenges. (ii) Extended Lending or Term-Funding Operations (ELO/TFO): Following the GFC and again more recently after the pandemic, many central banks provided low-cost long-term funding to financial institutions at concessional rates which enables them to pass on the benefits to businesses and households. Although such facilities supported credit flows to the private sector, they also occasionally resulted in inefficient credit allocation by compromising loan quality and acted as a disincentive to reducing excessive leverage. Nevertheless, these measures eased liquidity strains in highly stressed bank funding markets and helped restore monetary transmission channels (Lowe, 2019). (iii) Asset Purchase Programmes (APPs): APPs involve the outright purchase of assets (mainly government bonds) by central banks and have long been a feature of their liquidity management operations; however, these have been used more extensively after the GFC and especially in response to COVID-19, leading to large expansion of central bank balance sheets. Moreover, some central banks have broadened the spectrum of asset purchases beyond risk-free securities. Typically, a central bank can either set (i) a target for the quantity of assets it will purchase (at any price); or (ii) a target for the asset price (purchasing any quantity that would achieve the targeted price). While a quantity target is commonly referred to as quantitative easing (QE), a price target is known as yield curve control (YCC). Under QE, large-scale purchases reduce yields thereby lowering longer-term rates and easing financial conditions. In case of YCC, the target price becomes the market price once the bond markets internalise the central bank’s commitment to buy any amount (BIS, 2019). While the US Federal Reserve (US Fed) undertook large-scale QE after the GFC, the BoJ introduced YCC in 2016 to peg yields on 10-year Japanese Government Bonds (JGBs) around zero per cent to combat persistent deflation risks.6 In March 2020, the Reserve Bank of Australia (RBA) introduced YCC for 3-year bonds with a target of around 0.25 per cent which was subsequently reduced to 0.1 per cent in November. Operation Twist (OT) is a variant of QE used by the Fed in 2012.7 The “twist” in the operation occurs whenever the Fed uses sale proceeds of short-term Treasury bills to buy long-term Treasury notes, which lowers longer-term interest rates thereby reducing the term premium (Bernanke, 2020). Lower long-term rates, in turn, allow businesses to expand thereby stimulating economic activity. The precise goal of asset purchases varied across countries although lowering interest rates on risk-free assets has been a common feature. APPs also reinforce the central bank’s forward guidance that policy interest rates will remain low for a long period, which sustains the downward pressure on yields (Lowe, 2019). APPs were also country-specific: while the US Fed purchased government-backed agency securities to support mortgage markets, the Bank of England (BoE) purchased commercial papers (CPs) to ease stress in corporate credit markets during the GFC. (iv) Forward Guidance (FG): FG – both implicit and explicit – pertains to central bank communication on the ‘stance’ of monetary policy going ahead, i.e., the future path of the policy interest rate. Forward guidance can be (a) time-based; or (b) state-based. Under ‘time-based guidance’, the central bank commits to a stance of monetary policy until a specific point in time. In contrast, ‘state-based guidance’ pertains to a stance until an explicit set of economic conditions are met. In a period of heighted uncertainty about the economic outlook, FG played an indispensable role in clarifying central banks’ intent while they remained committed to price stability. FG also complimented other UMPTs in achieving the policymakers’ desired outcome. During the GFC and COVID-19, central banks were active in providing FG to (i) reinforce their commitment to low interest rates; and (ii) communicate their strategy in uncertain times. From this perspective, FG was quite effective in reducing uncertainty about the economic and financial outlook.8 A key challenge with FG in exceptional circumstances has been the balancing of trade-offs between clarity of communication, credibility of follow-up actions and flexibility of future policy response to changing financial conditions (BIS, 2019). In addition to the above-mentioned UMPTs, many central banks made significant adjustments in their market operations to deal with financial market stress in the aftermath of the GFC and COVID-19. These adjustments included (i) injecting unprecedentedly large liquidity; (ii) expanding the range of collaterals; and (iii) widening the range of ‘eligible counterparties’. These refinements sought to address market seizure and illiquidity as financial entities increasingly became unsure about their liquidity access, which can precipitate a severe ‘credit crunch’ and trigger economic contraction. By assuring financial institutions about uninterrupted liquidity access, central banks were able to ensure the smooth functioning of markets. Empirical evidence on the macroeconomic and financial market impact of UMPTs provides useful insights. Based on monthly data of eight AEs9 for the period January 2008 - June 2011, an exogenous increase in central bank balance sheets at the ZLB was found to temporarily increase economic activity and consumer prices, although the price impact was weaker and less persistent. Individual country-specific results suggested that despite the heterogeneity of the measures undertaken across countries, there were no major differences in their macroeconomic impact (Gambacorta et al., 2014). An event-study (ES) analysis of 24 COVID-19 QE announcements made by 21 central banks found that the average developed market QE announcement had a statistically significant 1-day impact of -0.14 per cent on their local 10-year government bond yields, while the impact of such announcements in EMEs was significantly higher at -0.28 per cent. Cumulatively, the overall average 1-day impact was -0.23 per cent (Hartley and Rebucci, 2020). III. UMPTs during Covid-19: Cross-country Practices Guided by the urgent need to restore normalcy in financial markets and minimise the loss of economic activity, central banks have swiftly designed and implemented various UMP measures post COVID-19, based on their GFC experience. In EMEs constrained by the ELB, UMPTs help create monetary policy space to cushion the impact of the COVID-19 crisis and support the recovery (Hofman and Kamber, 2020). (i) Negative Interest Rate Policy: Many AE central banks continued with negative interest rates adopted during GFC. The Swiss National Bank (SNB) maintained its policy rate at -0.75 per cent while the European Central Bank (ECB)’s standing deposit facility rate is currently at -0.50 per cent. Though the BoE and the US Fed have not introduced negative interest rates, the former pared its main rate to a record low of 0.1 per cent while the latter made an emergency move by dropping its benchmark interest rate to 0-0.25 per cent in March 2020. The Swedish Riksbank also reduced its lending rate for overnight loans in phases to 0.1 per cent. (ii) Liquidity support through new instruments: Most central banks have lowered reserve requirements, eased collateral norms and increased the scale and tenor of repo operations. The BoE (a) introduced a new Term Funding Scheme with additional incentives for lending to small and medium enterprises (SMEs); and (b) activated a Contingent Term Repo Facility to complement the existing sterling liquidity facilities. The Fed expanded overnight / term repo operations and introduced several new facilities to support the flow of credit. These facilities are: (a) commercial paper funding facility (CPFF) for companies and municipal issuers; (b) primary dealer credit facility (PDCF) for financing primary dealers; (c) money market mutual fund liquidity facility (MMLF) to provide loans to depository institutions for asset purchases; (d) primary market corporate credit facility (PMCCF) to purchase new bonds and loans from companies; (e) Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds; (f) term asset-backed securities loan facility (TABSLF) for issuance of asset-backed securities; (g) paycheck protection program liquidity facility (PPPLF) for financial institutions which incentivises small businesses to keep workers on their payroll; (h) main street lending program (MSLP) to purchase new or expanded loans to small and mid-sized businesses; and (i) municipal liquidity facility (MLF) to purchase short term securities directly from state and eligible local governments. The ECB conducted additional auctions of (a) the full-allotment, fixed rate temporary liquidity facility at the deposit facility rate and (b) existing targeted longer-term refinancing operations (TLTRO-III) with interest rates even 50 bps below the average deposit facility rate. More recently, the ECB introduced a series of non-targeted pandemic emergency longer-term refinancing operations (PELTRO). In Japan, the special funds-supplying operations have widened the range of eligible counterparties and collateral to private debt. In May 2020, the BoJ introduced a new fund-provisioning measure to support financing of SMEs. Among EMEs, the Bank of Indonesia increased the maximum duration of repo and reverse repo operations (up to 12 months) while introducing daily auctions. The Reserve Bank of South Africa (RBSA) provided loans to financial institutions by accepting corporate bonds as collateral. Measures undertaken by the Bank of Thailand (BoT) included cheaper loans to financial institutions for on-lending to SMEs and a special facility to provide liquidity to mutual funds through banks. (iii) Asset Purchases: Central banks also expanded their APPs to meet additional demand for bank reserves arising from pandemic-induced elevated uncertainty and facilitate lower long-term interest rates. The BoE expanded its holding of UK government bonds and non-financial investment grade corporate bonds by £300 billion while the US Fed committed to purchase any amount of Treasury and agency securities. In March, the ECB introduced the pandemic emergency purchase program (PEPP) which was increased in phases to €1.85 trillion and its duration was extended to end-March 2022. In March, the BoJ increased the size and frequency of JGB purchases along with targeted purchases of CPs and corporate bonds. Subsequently, the BoJ decided to purchase JGBs without any limit. Several EME central banks viz., Indonesia, South Africa, Philippines and Thailand also launched bond purchase programmes, with Indonesia and Philippines monetising debt by purchasing bonds directly from the government (Annex Table 1). Mexico and Brazil conducted operation twist. (iv) Forward Guidance: The Fed indicated that rates will remain low until the economy has weathered recent events and was on track to achieve its maximum employment and price stability goals. The ECB expected rates to remain at their present or lower levels until the inflation outlook converges close to, but below, 2 per cent within its projection horizon. In addition, many central banks have resorted to regulatory and supervisory measures including (a) reduction in counter-cyclical capital buffers; (b) relaxation in liquidity coverage ratio (LCR); (c) suspension of dividend and buyback; (d) relaxation in debt restructuring and loss provisioning; (e) slackening of prudential norms and (f) regulatory forbearance in reporting and compliance. Supervisors are encouraging banks to (1) renegotiate loan terms prudently for those struggling to service their debts; (2) use existing capital and liquidity buffers; and (3) use their regulatory and accounting frameworks flexibly to absorb losses (BIS, 2020). Reflecting the above measures, funding markets, although experiencing intermittent bouts of volatility, have remained functional while investor sentiment has improved and financial market spreads have narrowed with the improvement in liquidity conditions. Market reactions suggest that these measures have been successful in improving bond market activity, pushing down yields and shoring up confidence (BIS, 2020). IV. UMPTs – The Indian Experience10 The Reserve Bank undertook several conventional and unconventional measures in the wake of COVID-19. While conventional measures included reduction in the policy repo rate by 115 bps and cash reserve ratio (CRR) by 100 bps, unconventional measures featured (i) extended lending or term-funding operations including liquidity support through refinance; (ii) asset purchase programmes including operation twists (OTs); and (iii) forward guidance, the broad contours of which are discussed below. (i) Liquidity Support Operations (a) Extended lending/term-funding: Akin to the ECB after the GFC, the Reserve Bank introduced long term repo operations (LTROs) in February 2020 to facilitate monetary policy transmission and support credit offtake. Under the scheme, the Reserve Bank provided long-term liquidity to banks at the erstwhile policy repo rate (5.15 per cent) – a rate lower than the prevailing market rates as well as banks’ own deposit cost – to lower their cost of funds. During February-March 2020, five LTRO auctions (each amounting to ₹25,000 crore with one of 1-year and four of 3-years tenor) were conducted, which augmented system liquidity by ₹1,25,117 crore. In September 2020, however, banks repaid ₹1,23,572 crore (about 98.8 per cent of the funds availed) to reduce their cost of funds11 by exercising an option of prepayment before maturity. An event study (ES) analysis around announcement days indicated that LTROs had a significant impact on G-sec yields of some maturities (Das et al., 2020; RBI, 2020a). The outbreak of COVID-19 ignited sell-off pressures in financial markets as large global spillovers triggered flight to safety. Consequently, financial conditions tightened as sharp spikes in risk premium on corporate bonds, CPs and debentures dried up trading activity resulting in market illiquidity. Accordingly, targeted long-term repo operations (TLTROs) were introduced to provide liquidity to specific sectors and entities experiencing liquidity stress. Four TLTRO auctions (₹25,000 crore each of three years tenor) were conducted during March-April 2020 providing ₹1,00,050 crore to banks for deployment in investment grade corporate bonds, CPs, and non-convertible debentures. Banks were required to acquire up to fifty per cent of their incremental holdings of eligible instruments from the primary market and the remaining from the secondary market, including from mutual funds (MFs) and non-banking finance companies (NBFCs). Since the deployment of TLTRO funds was largely confined to primary issuances of public sector entities and large corporates, TLTRO 2.0 was introduced to provide relief to the small and mid-sized corporates, including NBFCs and micro finance institutions (MFIs). Banks were required to invest in investment grade bonds, CPs, and non-convertible debentures of NBFCs, with at least 50 per cent of the total amount availed going to small and mid-sized NBFCs and MFIs. The demand, however, was lukewarm at ₹12,850 crore reflecting lack of market appetite for additional liquidity. In November 2020, banks returned ₹37,348 crore of TLTRO funds (33.1 per cent of the availed amount) under a scheme similar to the prepayment of LTROs. As liquidity measures concentrated on reviving specific sectors that have multiplier effects on growth, ‘On Tap TLTRO’ was introduced in October 2020 for a total amount of up to ₹1,00,000 crore with tenors of up to three years at a floating rate linked to the policy repo rate. Funds availed are to be deployed in corporate bonds, CPs, and non-convertible debentures issued by the entities in five specific sectors; additionally, it can also be used to extend bank loans and advances to these sectors. Subsequently, 26 stressed sectors identified by the Kamath Committee (2020) were brought within the ambit of this scheme in December which was further expanded to include bank lending to NBFCs in February 2021. (b) Liquidity support: In view of tightening financial conditions, all India financial institutions (AIFIs) were facing difficulties in raising resources. To alleviate their liquidity stress and meet sectoral credit needs, special refinance facilities were provided at the policy repo rate for a total amount of ₹60,000 crore to National Bank for Agriculture and Rural Development (NABARD), Small Industries Development Bank of India (SIDBI) and National Housing Bank (NHB).12 The inter se allocation comprised ₹30,000 crore to NABARD for refinancing regional rural banks (RRBs), cooperative banks and MFIs; ₹15,000 crore to SIDBI for on-lending/refinancing; and ₹15,000 crore to NHB for supporting Housing Finance Companies (HFCs). A line of credit of ₹15,000 crore was extended to the EXIM Bank for a period of 90 days (with maximum rollover up to one year) to avail a US dollar swap facility to meet its foreign exchange requirements. Thus, total refinance support to AIFIs amounted to ₹75,000 crore. In order to ease redemption pressures on Mutual Funds (MFs) emanating from closure of some debt MFs and minimise their potential contagious effects, a special liquidity facility for mutual funds (SLF-MF) of ₹50,000 crore was introduced in April 2020 although its utilisation was a meagre ₹2,430 crore. The Reserve Bank had earlier extended a similar facility to MFs in 2008 during the GFC and later in 2013 following the taper tantrum. (ii) Asset Purchase Programme (APP): Unlike many central banks, the Reserve Bank’s purchases have been confined to the secondary market and solely in government securities. An innovation has been the inclusion of state government securities in October 2020 – commonly known as state development loans (SDLs) – as a special case for 2020-21. Net OMO purchases amounted to ₹3,04,754 crore (including SDLs worth ₹30,000 crore) during 2020-21 (up to February 26). In the backdrop of the Fed’s experience on OTs, the Reserve Bank announced special OMOs (OTs) involving the simultaneous purchase of long-term and sale of short-term securities in December 2019, predating the COVID-19 outbreak in India. These operations were aimed at compressing the term premium and reducing the steepness of the yield curve. Moderation in long term risk-free (g-sec) rates, in turn, gets reflected in other financial market instruments that are priced of the g-sec rate, thereby improving monetary transmission. Up to end-February 2021, the Reserve Bank conducted 20 such operations of ₹10,000 crore each (Annex - Table 2).13 The success of OTs combined with liquidity injection through outright OMOs moderated yields and reduced the cost of borrowing for the Government in 2020-2114. Going ahead, outright OMOs in combination with OTs would continue to be a potent tool in the Reserve Bank’s arsenal. (iii) Forward Guidance (FG): In the aftermath of the pandemic, FG gained prominence in the Reserve Bank’s communication strategy to support the accommodative stance of the monetary policy committee (MPC). The MPC’s reiteration that the policy stance would remain accommodative till the revival of growth epitomises explicit time-contingent and state-contingent FG. For instance, the MPC noted in October 2020 “…. decided to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward” (RBI, 2020b). Moreover, the Governor assured financial markets that the Reserve Bank will maintain comfortable liquidity conditions in sync with the monetary policy stance and highlighted the need for cooperative solutions by emphasising that financial market stability and the orderly evolution of the yield curve are public goods (RBI, 2020c). The commitment to ensure congenial financial conditions for sustaining the recovery dispelled illiquidity fears and bolstered market sentiment. The Reserve Bank’s liquidity management operations in support of the stance convinced market participants to respond synchronously and cooperatively, which bears testimony to the effectiveness of FG in monetary policy communication. Thus, FG complimented other UMPT measures in the post-COVID environment. In response to UMPTs as well as policy rate cuts, yields declined and corporate bond spreads narrowed considerably across the maturity spectrum and rating categories (Annex - Table 3). In fact, corporate bond spreads have reached pre-COVID levels. Induced by the lower rates, corporate bond issuance reached a record level of ₹6.4 lakh crore during 2020-21 (April-January) as compared with ₹5.3 lakh crore during the corresponding period of 2019-20 (an increase of 20.2 per cent) with issuers in the lowest investment category (BBB-) – who hitherto had no market access – being able to raise resources (Annex - Table 4). V. Empirical Assessment The empirical assessment on the efficacy of UMPTs is undertaken in two parts. First, the impact of LTRO and TLTRO auctions on specific segments of the money and bond markets is estimated from daily data. The second exercise involves evaluating the announcement effect of operation twist on the term premium in the g-sec market. (i) Auction Impact on Money and Bond Markets Measures undertaken by the Reserve Bank to augment system-level liquidity (LTRO) and targeted liquidity (TLTRO) produced differential responses in terms of varying intensity of appetite for funds, as reflected in their bid-cover ratio (Annex - Chart 1). While the first and third LTRO auction evoked much interest, response to the fifth LTRO and TLTRO (2.0) auctions was lukewarm. The instantaneous impact of the LTRO and TLTRO auctions on money and bond markets is examined in an ES framework adapting from the recent literature (Hartley and Rebucci, 2020). Daily data on interest rates of 3-month CPs, yields on 10-year government securities and 10-year AAA corporate bonds spanning the period December 2019-September 2020 used for estimation are stationary in first difference (Annex - Table 5). Specifically, daily changes in 3-month CP rates and 10-year bond yields (G-sec as well as corporate bonds separately) are regressed on LTRO and TLTRO auction dates (as dummies) with controls for other key variables that can impact daily rates/ yields, viz., changes in the policy repo rate; and changes in the US economic policy uncertainty15 (as a proxy for international oil prices and US yield movements), with the following specifications:  The estimates indicate that the cumulative impact of LTRO and TLTRO auctions was more on the money market than in bond markets (Annex - Table 6). Specifically, the cumulative impact eased CP rates by 259 bps while yields on 10-year G-secs and on 10-year corporate bonds softened by around 32 bps and 46 bps, respectively16. Individually, however, LTRO and TLTRO had a differential impact. For instance, while LTROs reduced CP rates by 307 bps, the impact of TLTROs was not significant. On the other hand, while the impact of LTROs on g-sec yields at 8 bps was muted in comparison to 22 bps on corporate bonds, TLTROs had a significant easing impact of 23-24 bps on both segments. The reduction in the policy rate (from 5.15 per cent to 4.0 per cent over the period) is estimated to have softened CPs rates by 92 bps while those on G-sec and corporate bonds moderated by 5-9 bps. Overall, the measures undertaken by the Reserve Bank had a sobering impact on yields and risk spreads, which helped in easing market stress and softening financing conditions. (ii) Operation Twist As mentioned earlier, OTs were conducted to reduce the term premia. For this purpose, the spread between 10-year and 1-year g-sec rates are calculated based on daily data for the period December 2019-January 2021,17 which witnessed eighteen OT announcements. Since all these announcements came after the closure of business hours, the difference in yield between the closing rate on the announcement day and the opening rate next day is separately taken for 10-year and 1-year government paper. The consequent difference in spreads (between the announcement day and the next day) is taken as the dependent variable in the model and is regressed on the explanatory variables, viz., lagged spread, OT announcement dates (as dummies) and changes in the US economic policy uncertainty index, with the following specification:  The estimates indicate that the cumulative announcement impact of all OTs reduced the term spread by 29 bps, thereby flattening the yield curve (Annex - Table 7). It is, however, noted that on six announcement dates (viz., January 2, April 23, November 12, December 11, 24 and 31, 2020), the spread increased because of market-specific events. These were: (i) concerns of fiscal slippage on January 2, 2020; (ii) redemption pressures faced by mutual funds on April 23; (iii) anticipation of higher inflation print for October on November 12; (iv) underbidding in auctions for dated securities on December 11; (v) market discomfort at high yields on long term rates after the Reserve Bank rejected bids for 5.85% GS 2030 on December 24; and (vi) traders uncertainty about OMO announcement ahead of large weekly sale of government debt. Overall, the findings bear testimony to the efficacy of OTs in reducing the steepness of the yield curve, which helped in easing financing conditions. VI. Conclusion Drawing lessons from the international experience, the Reserve Bank unveiled a gamut of unconventional measures supported by conventional, regulatory and prudential policies in response to the pandemic. Given the enormity of the international spillovers that overwhelmed domestic markets in March 2020, the need of the hour was for innovative and comprehensive measures targeted at not only augmenting systemic liquidity but also addressing the concerns of specific segments. From that perspective, the LTRO and TLTRO schemes complemented the regular OMOs in easing financial conditions by softening yields and moderating spreads, which instilled confidence among market participants. In league with the size and scale of liquidity injections through OMOs, the OTs significantly moderated the G-sec term spreads and reduced the cost of borrowing for the government which was particularly important, given the large funding requirement to design and implement a comprehensive fiscal response to the pandemic. Moderation of long term rates, in turn, softened interest rates across the spectrum of instruments and issuer category, which rekindled market activity and restored normalcy while maintaining financial stability. Specific measures such as refinance facilities and liquidity support to mutual funds alleviated sector-specific liquidity stress and eased redemption pressures. Finally, explicit time-contingent and state-contingent forward guidance became a noticeable feature of monetary policy communication during COVID-19. Its innovative use reinforced and complemented other measures in reviving markets and, given its success, would continue to be an important instrument in the Reserve Bank’s policy toolkit. Overall, the proactive measures undertaken during the pandemic have laid the foundations for economic recovery to gain momentum, going ahead. References Baker, S. R. Bloom, N. and S. J. Davis (2016): Measuring Economic Policy Uncertainty, The Quarterly Journal of Economics, Vol 131:4, pp. 1593-1636. Bank for International Settlements (2019): Unconventional monetary policy tools: a cross-country analysis, CGFS Papers No. 63, October. Bank for International Settlements (2020): BIS Annual Economic Report, June. Bernanke, B. S., (2020): The New Tools of Monetary Policy, American Economic Association Presidential Address, January 4. Das, S., Ghosh, S., and V Kamate (2020): Monetary Policy and Financial Markets: Twist and Tango, RBI Bulletin, August. Gambacorta, L., Hoffman, B. and G. Peersman (2014): The Effectiveness of Unconventional Monetary Policy at the Zero Lower Bound: A Cross-Country Analysis, Journal of Money, Credit and Banking, Vol. 46, No. 4 (June). Hartley, J. S. and A. Rebucci (2020): An Event Study of COVID-19 Central Bank Quantitative Easing in Advanced and Emerging Economies, NBER Working Paper No. 27339, June. Hofman, D and G. Kamber (2020): Unconventional Monetary Policy in Emerging Market and Developing Economies, Special Series on COVID-19, Monetary and Capital Markets, International Monetary Fund, September 23. Kuroda, H. (2016): The Practice and Theory of Unconventional Monetary Policy, in J. E. Stiglitz and M. Guzman (eds.), Contemporary Issues in Macroeconomics, Palgrave Macmillan. Lowe, P. (2019): Unconventional Monetary Policy: Some Lessons From Overseas, Address to Australian Business Economists Dinner, November 26. Reserve Bank of Australia (2020): Unconventional Monetary Policy, Education. Reserve Bank of India (2014): Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: Dr Urjit R. Patel), January. Reserve Bank of India (2020): Expert Committee on Resolution Framework for COVID-19 related Stress (Chairman: Shri K. V. Kamath), September 7. Reserve Bank of India (2020a): Financial Markets and Liquidity Conditions, Monetary Policy Report, October 9. Reserve Bank of India (2020b): Resolution of the Monetary Policy Committee, October 9. Reserve Bank of India (2020c): Governor’s Statement, October 9.

ANNEX

| Table 1: Central Bank Measures during COVID-19 | | Country | Asset Purchase | Lending/Liquidity | FX Swap / Intervention | Prudential Regulations | | Govt. Bond | Commercial Paper | Corporate Bond | General Liquidity facility | Specialised Lending | USD Swap Line | FX intervention | | AEs | Australia | √ | | | √ | √ | √ | | √ | | Euro Area | √ | √ | √ | √ | √ | √ | | √ | | Japan | √ | √ | √ | √ | √ | √ | | √ | | New Zealand | √ | | | √ | √ | √ | | | | Sweden | √ | | √ | | √ | √ | | √ | | Switzerland | | | | | √ | √ | √ | √ | | United Kingdom | √ | √ | √ | √ | √ | √ | | √ | | United States | √ | √ | √ | √ | √ | | | √ | | EMEs | Argentina | | √ | | | √ | | | | | Brazil | | | | √ | √ | √ | √ | √ | | India | √ | | | √ | √ | | √ | √ | | Indonesia | √ | | | √ | | | | √ | | Malaysia | | | | √ | √ | | | | | Mexico | | | | √ | √ | √ | √ | √ | | Philippines | √ | | | | √ | | | | | Russia | | | | √ | √ | | √ | √ | | Singapore | | | | √ | √ | √ | | | | South Africa | √ | | | √ | | | | √ | | Korea | | | | √ | √ | √ | | √ | | Thailand | √ | | | | √ | | √ | | | Source: BIS Annual Economic Report, 2020: IMF and respective central bank websites. |

| Table 2: Special OMOs (Operation Twist) | | Date | OMO Purchases

(₹ crore) | OMO Sales

(₹ crore) | Net OMO Purchases (+) / Sales (-)

(₹ crore) | | Announcement | Auction | Settlement | Amount notified | Amount accepted | Amount notified | Amount accepted | | 19-12-2019 | 23-12-2019 | 24-12-2019 | 10,000 | 10,000 | 10,000 | 6,825 | 3,175 | | 26-12-2019 | 30-12-2019 | 31-12-2019 | 10,000 | 10,000 | 10,000 | 8,501 | 1,499 | | 02-01-2020 | 06-01-2020 | 07-01-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 16-01-2020 | 23-01-2020 | 24-01-2020 | 10,000 | 10,000 | 10,000 | 2,950 | 7,050 | | 23-04-2020 | 27-04-2020 | 28-04-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 29-06-2020 | 02-07-2020 | 03-07-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 25-08-2020 | 27-08-2020 | 28-08-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 31-08-2020 | 03-09-2020 | 04-09-2020 | 10,000 | 7,132 | 10,000 | 10,000 | -2,868 | | 07-09-2020 | 10-09-2020 | 11-09-2020 | 10,000 | 10,000 | 10,000 | 9,900 | 100 | | 14-09-2020 | 17-09-2020 | 18-09-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 24-09-2020 | 01-10-2020 | 05-10-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 05-11-2020 | 12-11-2020 | 13-11-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 12-11-2020 | 19-11-2020 | 20-11-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 19-11-2020 | 26-11-2020 | 27-11-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 11-12-2020 | 17-12-2020 | 18-12-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 24-12-2020 | 30-12-2020 | 31-12-2020 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 31-12-2020 | 07-01-2021 | 08-01-2021 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 07-01-2021 | 14-01-2021 | 15-01-2021 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 15-02-2021 | 25-02-2021 | 26-02-2021 | 10,000 | 10,000 | 10,000 | 10,000 | 0 | | 24-02-2021 | 04-03-2021 | 05-03-2021 | 15,000 | 15,000 | 15,000 | 15,000 | 0 | | Source: RBI. |

| Table 3: Financial Markets - Rates and Spread | | Instrument | Interest Rates

(per cent) | Spread (bps)

(over corresponding risk-free rate) | | As on March 26, 2020 | As on February 26, 2021 | Variation

(in bps) | As on March 26, 2020 | As on February 26, 2021 | Variation | | 1 | 2 | 3 | (4 = 3-2) | 5 | 6 | (7 = 6-5) | | CP (3-month) | 6.74 | 4.25# | -249 | 170 | 105 | -65 | | Corporate Bonds | | | | | | | | (i) AAA (1-yr) | 7.76 | 4.33 | -343 | 246 | 22 | -224 | | (ii) AAA (3-yr) | 8.47 | 5.60 | -287 | 276 | 37 | -239 | | (iii) AAA (5-yr) | 7.84 | 6.35 | -149 | 141 | -3 | -144 | | (iv) AA (3-yr) | 9.15 | 6.40 | -275 | 344 | 97 | -247 | | (iv) BBB-minus (3-yr) | 12.29 | 10.23 | -206 | 658 | 412 | -246 | | 10-yr G-sec | 6.22 | 6.23 | 1 | - | - | - | #: CP-NBFC rate.

Sources: CCIL: F-TRAC; FIMMDA; and Bloomberg. |

| Table 4: Corporate Bond Issuances | | Month | 2019-20 | 2020-21 | Variation

(Per cent) | | (₹ crore) | | April | 72,255 | 54,741 | -24.2 | | May | 44,626 | 84,871 | 90.2 | | June | 50,008 | 70,536 | 41.0 | | July | 46,082 | 48,122 | 4.4 | | August | 43,431 | 58,419 | 34.5 | | September | 49,124 | 64,538 | 31.4 | | October | 48,291 | 65,028 | 34.7 | | November | 49,192 | 45,688 | -7.1 | | December | 58,677 | 88,130 | 50.2 | | January | 71,712 | 60,871 | -15.1 | | April-January | 5,33,398 | 6,40,943 | 20.2 | | Source: Securities and Exchange Board of India (SEBI). |

Table 5: ADF Unit Root Tests

(2019:12 – 2020:9) | | Variable | Level | First Difference | | G-Sec | -1.484 | -14.899*** | | Corporate Bond | -1.364 | -14.855*** | | CP | -2.574* | -12.344*** | | Note: *, ** and *** implies significance at 10%, 5% and 1%, respectively. |

| Table 6: LTRO and TLTRO Impact on Money and Bond Markets | | Variables | ΔCP rates | ΔG-sec yields | ΔCorp. bond yields | | ΣLag(-1 to -2) | -0.62*** | -0.23 | 0.00 | | ΔPolicy rate | 0.80** | 0.04*** | 0.08*** | | ΔUS policy uncertainty (-1) | 0.00 | 0.00 | 0.00 | | ΣLTRO1(0 to -1) | 0.71*** | -0.90*** | -0.04*** | | ΣLTRO2(0 to -1) | -0.09 | 0.00 | -0.11*** | | ΣLTRO3(0 to -1) | 0.73** | -0.03*** | -0.14*** | | ΣLTRO4(0 to -1) | -4.78*** | -0.09*** | -0.04 | | ΣLTRO5(0 to -1) | 0.36** | 0.13*** | 0.11 | | ΣLTRO | -3.07*** | -0.08* | -0.22*** | | ΣTLTRO1(0 to -1) | 2.34*** | -0.06 | 0.04** | | ΣTLTRO3(0 to -1) | 0.18 | 0.08*** | 0.03 | | ΣTLTRO4(0 to -1) | -0.83*** | -0.26*** | -0.26*** | | ΣTLTRO5(0 to -1) | -1.21*** | -0.06*** | -0.08*** | | ΣTLTRO | 0.49 | -0.24*** | -0.23*** | | ΣLTRO + ΣTLTRO | -2.59** | -0.32*** | -0.46*** | | Diagnostics (p - value) | | ARCH LM test for conditional heteroscedasticity | 0.92 | 0.51 | 0.96 | | Portmanteau test for white noise of residuals | 0.42 | 0.43 | 0.06 | *,** and *** implies significance at 10%, 5% and 1%, respectively.

Source: Authors estimates. |

| Table 7: Announcement Impact of OT on Term Spread | | Variable | Spread | | Lag (-1) | -0.06 | | ΔUS uncertainty (-1) | 0.00 | | OT1(-1) | -0.12*** | | OT2(-1) | -0.98*** | | OT3(-1) | -0.01 | | OT4(-1) | -0.03*** | | OT5(-1) | 0.05*** | | OT6(-1) | -0.04*** | | OT7(-1) | -0.02*** | | OT8(-1) | -0.12*** | | OT9(-1) | -0.05*** | | OT10(-1) | -0.08** | | OT11(-1) | -0.02*** | | OT12(-1) | -0.01*** | | OT13(-1) | 0.09*** | | OT14(-1) | -0.02** | | OT15(-1) | -0.00 | | OT16(-1) | 0.09*** | | OT17(-1) | 0.03*** | | OT18(-1) | -0.01*** | | Σ OT | -0.29*** | | Diagnostics (p - value) | | Breusch-Godfrey LM test | 0.06 | | ARCH LM test for conditional heteroscedasticity | 0.94 | *,** and *** implies significance at 10%, 5% and 1%, respectively.

Source: Authors estimates. |

|