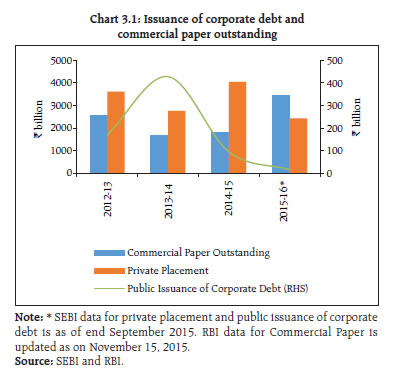

While global financial sector regulatory reform agenda is being implemented steadily, given the structurally different economies with varying national priorities, there is a need for better appreciation of the cost-benefit matrix of these reforms across jurisdictions. With the emergence of newer and more disruptive technologies the main risk drivers will perhaps have moved to different areas where most of the changes are taking place at a pace that will continuously challenge the regulators’ acumen. While steps taken for developing corporate debt markets in India are showing some results, the dependence on bank finance continues even as banks, especially public sector banks face challenges on asset quality, profitability and capital. Regulation of Indian capital markets has kept pace with the requirements of the changing business environment by, among other things, creating a special platform for enabling start-up companies to access the capital market. The domestic institutional investors are providing a stabilising support against possible volatility due to foreign portfolio investment flows. The insurance and pension sectors have also helped in providing stability to the capital market as significant steps are being taken for further development of these sectors. International regulatory reform agenda Progress of implementation and some dilemmas 3.1 While the design stage of G-20 reform measures is almost complete, debates still persist around the challenges in ensuring uniformity in their implementation and efficacy, as also some unintended consequences of some of the regulatory measures. A report1 of Financial Stability Board (FSB) also observes that the progress of implementation across the breadth of reforms has been steady but uneven. As was emphasised in the previous issues of the Financial Stability Report (FSR), given the structurally different economies with varying national priorities, there is a need for better appreciation of the cost-benefit matrix of these reforms across jurisdictions. In this context the excessive focus on complex capital regulations and their applicability to jurisdictions having less complex financial systems continue to be a debatable issue. If the evolving capital regulations are more guided by the fact that financial institutions in certain jurisdictions expanded their domain into risky areas along with leverage with ex-ante insufficient capital, then the application of such stringent capital regulations may not have a net positive impact in jurisdictions which are much less complex and where the penetration of basic financial services is relatively low. There is a view that the situation may lead to a ‘fallacy of composition’ impacting systemic stability and efficacy even as individual entities appear to be more resilient2. 3.2 Financial markets being complex systems and given the autocatalytic effects of the non-linear processes involved therein, even small triggers could lead to potentially wide and deep adverse effects. In an increasingly interconnected financial system, with newer and more disruptive technologies, the main risk drivers perhaps will have moved to different areas where most of the changes are taking place at a pace that is continuously challenging the regulators’ reach and acumen. Box 3.1: Implications of ‘disruptions’ – ‘Blockchain’ technology3 The initial concerns over the emergence of virtual currency schemes (digital currencies like Bitcoin) had been about larger issues related to the underlying design and incentive-structures of such privately-owned, internet-enabled alternative currency systems and their implications for the traditional monetary system. Even as opinions diverged on their merits, episodes of excessive volatility in their value and the failure of some virtual currency exchanges proved to be a dampener to their take-off. On the other hand, their anonymous nature that goes against global money laundering rules rendered their very existence questionable. While these issues along with challenges for consumer protection and taxation related aspects are being debated, the key technical concept of ‘blockchain’ which underpins such crypto-currency systems, is drawing more attention now. With its potential to fight counterfeiting, the ‘blockchain’ is likely to bring about a major transformation in the functioning of financial markets, collateral identification (land records for instance) and payments system. The traditional (and presently used) system works on the basis of ‘trust’ and the ‘regulatory’ and ‘controlling’ power of ‘central’ entities / counter parties. As against this, the ‘blockchain’ technology is based on a shared, secured and public ledger system, which is not controlled by any single (‘central’) user and is maintained collectively by all the users / participants in the system based on a set of generally agreed and strictly applied rules. Thus, the ‘blockchain’ technology facilitates transactions / collaborations among participants / entities which have no information about or confidence in each other, without necessarily having to resort to a neutral and trusted ‘central’ counterparty4. While the notion of shared and technologically secured public ledgers raises the prospects of revolutionising financial systems, the full potential as also implications of its applications are still not known. At the same time, regulators and authorities need to keep pace with developments as many of the world’s largest banks are said to be supporting a joint effort for setting up of ‘private blockchain’ and building an industry-wide platform for standardising the use of the technology, which has the potential to transform the functioning of the back offices of banks, increase the speed and cost efficiency in payment systems and trade finance. 3.3 The previous FSRs also emphasised on the need for preparedness on the part of regulators and policy-makers to respond to challenges posed by technology-enabled innovations like ‘virtual currency schemes’ and ‘peer-to-peer-lending’, to the established framework of institutions and market mechanisms. While questions regarding the implications of some such innovations on the effectiveness of monetary and macro-prudential policies are still being debated, there is a need for understanding the potential of technologies underlying such innovations for remodelling the business and service delivery models for reducing costs, increasing efficiency and promoting financial inclusion (Box 3.1). Need for a broader perspective for operational risks 3.4 During and in its immediate aftermath, the global financial crisis was branded as a credit and liquidity risk crisis. However, it has now been established that many sources of systemic risks were triggered or at least precipitated and propagated by factors related to operational risks5. Some of these could be categorised as the inherent ‘conflict of interest’ in the functions performed, adverse selection, inadequate due diligence, falsification of the documentation process, insufficient product and risk awareness and understanding, moral hazard, weaknesses in corporate governance mechanisms and weak management information systems (MIS). The magnitude of the crisis has highlighted the inadequacies of the then prevailing risk management frameworks and has led to a rethinking on how financial institutions should manage their risks. 3.5 Many of the emerging risks like technology risks, cyber risks, risk of frauds, risks related to people and governance, business and control processes, legal risks etc. are covered under the ambit of operational risks which pervade every aspect of the functioning of a financial institution. The identification, measurement and management of operational risks remain among the biggest challenges for financial institutions and regulatory authorities. 3.6 Reports of manipulation of market mechanisms and legal proceedings involving role and conduct of big global banks in advanced economies resulting in heavy penalties and settlement amounts in some cases have raised the issue related to the importance of ‘ethical’ conduct for smooth functioning of financial systems. At the same time addressing these issues, both at the individual institutions as well as at system levels6, has become even more challenging for regulators. 3.7 From another perspective, the regulatory apparatus may need to be more discerning since the regulatory stances themselves could be flawed, backward looking, susceptible to what may be called the “Eastland Syndrome”7 and/or inconsistent both inherently and across regulatory turfs, thus themselves becoming drivers of operational risks. 3.8 It is imperative to underscore the importance of operational risks as these can amplify system wide risks and have the potential to manifest themselves in catastrophic events, given the increased size, interconnectedness and complexity of financial institutions. Thus, the approach to operational risk issues and their systemic significance needs to go beyond the challenges of measuring capital charge for operational risk. Domestic financial system Banking sector Continued importance of bank credit for economic growth 3.9 The decline in bank credit growth, especially in sectors where asset quality stress is comparatively higher (Chart 2.1 and 2.2, Chapter 2), is indicative, among other factors, of banks’ current focus on ‘cleaning up’ of their balance sheets. In view of this, developing the corporate bond market has assumed added urgency given the need of the economy for long term financing. The flow of credit to the commercial sector through corporate bond markets has increased during the year 2015-16 as seen by trends in private placement of corporate bonds and outstanding amount of commercial paper (Chart 3.1). However, with the public issuance of corporate bonds remaining subdued, the overall corporate bond market trends may not yet indicate a firm and significant shift in the dependence of the corporate sector, especially the needs of the infrastructure sector (long-term finance) away from the banking sector.

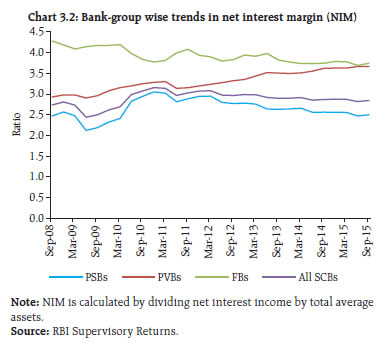

Urgency for resolution of stressed assets along with capital infusion 3.10 The pressure on asset quality continues to be the biggest impediment in improving the performance of banks, especially the public sector banks (PSBs), which needs to be tackled head-on to ensure that bank credit growth is not allowed to settle at a level lower than what is considered optimum. Previous FSRs have discussed in detail different dimensions of the challenges on the asset quality front along with significant regulatory measures taken in recent years for addressing them (Box 3.2). While the fresh policy measures with respect to some of the stressed sectors are expected to help ease the pressure to some extent, the results may take time to manifest themselves fully. 3.11 Apart from additional capital requirements on account of regulatory prescriptions (with the phasing in of Basel III capital requirements), banks need further capital cushion to tide over the current situation due to the impact of asset quality stress. However, as the path of ‘distance to default’ is not linear and since a marginal deterioration in asset quality accelerates the ‘default probability’, devising appropriate strategies for resolution of bad assets is of crucial importance to derive the benefits from any additional capital infusion. This has a behavioural dimension too, as both- the lenders and borrowers tend to be drawn towards taking extreme positions between ‘total risk aversion’ and ‘the temptation to take bigger gambles’, in the face of mounting potential losses. An early clearance of the proposed Insolvency and Bankruptcy Bill, which aims at a time-bound and predictable insolvency resolution process along with the establishment of a resolution corporation for the financial sector, will also play an important role in this context. Box 3.2: Recent regulatory initiatives on asset quality The Reserve Bank has taken a number of regulatory initiatives to further strengthen the credit risk management at banks, like withdrawal of the special asset classification benefit on restructuring of advances with effect from April 1, 2015, increasing the quantum of provisioning on ‘standard’ restructured assets to 5 per cent and enhancing promoters’ contribution to restructured assets. These measures are in line with the international best practices and were meant to dis-incentivise ever greening of loans in the guise of restructuring. A comprehensive framework for revitalising distressed assets in the economy was initiated in January 2014 which outlined setting up a Central Repository of Information on Large Credits (CRILC) to collect, store, and disseminate credit data to lenders. Other measures included setting up of Joint Lenders’ Forum (JLF), early identification of problem accounts by banks, timely restructuring of accounts which are considered to be viable, and encouraging banks to take prompt action for recovery of loans. The concept of non-cooperative borrowers was also introduced, providing for higher provisioning norms for such borrowers. In order to ensure high level of representation from banks in JLFs and approval of Corrective Action Plans (CAPs) by a high level body having impartial views, Reserve Bank has recently introduced JLF-Empowered Groups (JLF-EG), constituting Executive Director level representations from top lending and non-lending banks to the specific borrower under a JLF. The Reserve Bank’s strategic debt restructuring (SDR) scheme provides that the lenders under the JLF have the option to convert their existing loans into equity under a revised pricing formula of the Securities and Exchange Board of India (SEBI) in order to collectively become majority shareholders of a borrower company which fails to meet the milestones set up under a restructuring package. This pricing formula minimises the conversion loss to banks, which are also given moderate asset classification benefit for 18 months. In order to provide flexibility to banks’ in effecting a change in ownership of borrowing entities, which are under stress primarily due to operational/ managerial inefficiencies despite substantial sacrifices made by the lending banks, the Reserve Bank has allowed banks to upgrade the credit facilities extended to borrowing entities whose ownership has been changed outside SDR (for instance by invocation of pledge and subsequent sale of shares, issue of new shares to a new promoter and acquisition of the borrower company by a new promoter), to ‘standard’ category upon such change in ownership subject to certain conditions. 3.12 As banks face constraints in raising capital in an environment of slowing credit growth, there may be an increased tendency to reduce the provisioning levels, to protect the profitability. To the extent ‘provisions’ are not adequate and capital augmentation is not forthcoming as a buffer for the ‘expected’ and ‘unexpected’ losses, banks may be forced to aim for higher net interest margins (NIMs) - which is considered by the banking industry in some jurisdictions as an alternative to regulatory capital. The NIMs of SCBs, especially PSBs and foreign banks, have been showing a declining trend in recent quarters (Chart 3.2). Challenges in achieving a quick resolution of stressed assets 3.13 Banks need to free up their resources tied up with the stressed assets, which also increase the burden on account of higher provisioning. One of the ways of achieving this is by sale of such assets to the asset reconstruction companies (ARCs). Globally, entities tackling bad assets are formed as a response to a systemic crisis to protect commercial banks by creating one ‘bad bank’ that takes over the stressed loans of the entire system. Typically, governments provide legal, regulatory, fiscal and administrative support to such institutions. The aim of creating such an entity is to protect the capital of the banking system as banks need to set aside money for bad assets and this erodes their capital.

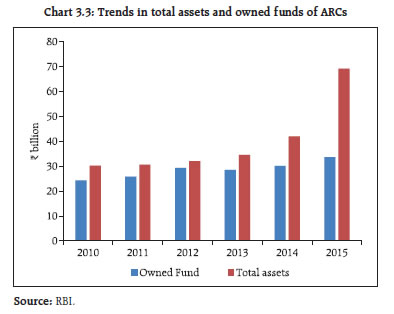

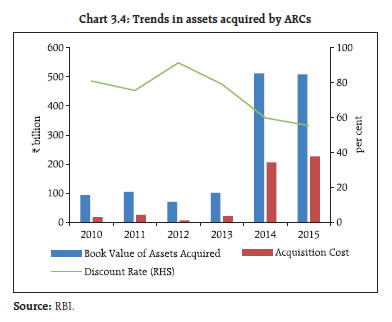

3.14 The Indian ARC model, however, does not envisage any fiscal support or tax forbearance from the government. It also does not call for mandatory transfer of bad assets of the banking system. It is a market-driven model that allows banks to take their own decisions to sell bad loans to ARCs, based on bilateral negotiations and/or auctions. ARCs are set up as non-government vehicles and function on the basis of ongoing business models. A ‘sunset’ clause for ARCs has not been envisaged in the Indian system. 3.15 The market for stressed assets is not adequately developed in India and ARCs are facing capital constraints (Chart 3.3). Also, currently, with steep discounts (Chart 3.4) there is no meeting point between the price expectations of banks/financial institutions (FIs) and bid prices by ARCs, which is also evident from the low success rate of auctions.

Preparedness for transition to IFRS converged accounting standards 3.16 While the banks are intensely focussed on consolidating their balance sheets, the Reserve Bank is taking a comprehensive review of the banks’ assessment of stress in their asset portfolios and associated provisioning requirements. This will help banks in preparing for the implementation of the International Financial Reporting Standards (IFRS) converged Indian Accounting Standards (Ind AS) for accounting periods commencing on or after April 1, 2018. Ind AS, especially Ind AS 109 (IFRS 9), represents a paradigm shift from the current accounting framework followed by banks which is based on a mélange of accounting standards and regulatory guidelines, especially in certain key areas such as, classification and measurement of financial instruments, including inter alia, recognition of gains and losses on marking to market and impairment of financial assets. This transition is expected to have a significant impact on the financial and operational results of Indian banks and calls for careful preparation and examination of major implications for all stakeholders. While it may not be possible to precisely quantify the impact of implementation of Ind AS at this stage, banks and other stakeholders need to take cognisance of some of the major implications (Box 3.3).

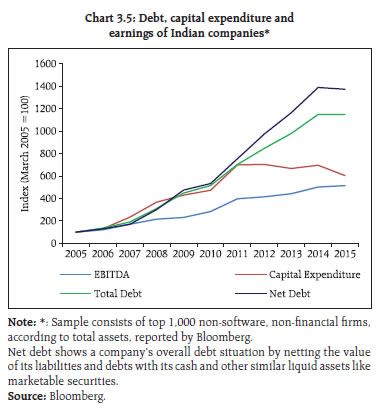

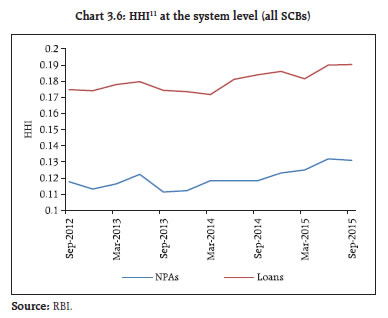

Box 3.3: Some key implications of implementation of Ind AS 109 by Indian Banks The Reserve Bank has recommended to the Government of India, the implementation of IFRS converged Indian Accounting Standards (Ind AS) by SCBs for accounting periods commencing on or after April 1, 2018. Expected credit loss (ECL) impairment model: Ind AS 109 entails a forward looking impairment model based on expected losses. The standard requires entities to make an ongoing assessment of expected credit losses and requires earlier recognition of credit losses. It is anticipated that the implementation of the ECL model will result in significantly higher impairment provisions, which could also impact capital adequacy. Classification and measurement of financial assets: The classification and measurement of financial assets under Ind AS 109, will be based on an entity’s business model and the contractual cash flow characteristics of the assets and will thus be a departure from the current accounting framework followed by banks which is based on regulatory guidelines in this regard. Ind AS 109 requires the recognition of fair value gains in the profit and loss account in respect of assets classified under Fair Value through Profit and Loss (FVTPL). This will result in banks recognising unrealised gains which was not permitted so far. Other comprehensive income (OCI): The current Indian GAAP framework does not encourage direct adjustment to reserves. However, under Ind AS, several items, notably fair value changes on certain financial instruments (FVOCI) and re-measurements of net defined benefit obligations, can be directly adjusted through OCI. Effective interest rate: The interest income under Ind AS will be recognised on the basis of effective interest rate (EIR) method leading to amortisation of certain items such as processing fees and, incremental and directly attributable loan origination costs. Disclosures: Ind AS provides for extensive disclosures, notably with regard to financial instruments and their attendant risks (Ind AS 107), fair value measurement (Ind AS 113) and requirements relating to consolidation (Ind AS 110, 111 and 112). Banks need to have systems in place and make significant efforts to meet the extensive requirements in this regard. Greater subjectivity and management discretion: Ind AS is a ‘principle based’ framework allowing for greater management judgement as compared to the largely ‘rules based’ framework that is currently followed by Indian banks. Consequently, the role of the auditors becomes even more critical in ensuring that financial statements reflect a true and fair view of the state of affairs of a bank. Skilling of human resources: Banks not only prepare but are also the users of financial statements and hence will need to ensure that a large proportion of their staff are adequately equipped to operate in an Ind AS environment. Large scale modifications to IT systems: Banks will need to invest in updating their IT systems to provide for Ind AS requirements. Ind AS 109 in particular also requires historical, current and forward looking information and will therefore require robust data management systems. Issues related to bank lending to corporate sector 3.17 As discussed earlier, bank credit to the industrial sector accounts for a major share of their overall credit portfolio as well as stressed loans. This aspect of asset quality is related to the issue of increasing leverage of Indian corporates. While capital expenditure (capex) in the private sector is a desirable proposition for a fast growing economy like India, it is observed that the capex which had gone up sharply has been coming down despite rising debt (Chart 3.5). During this period, profitability and as a consequence, the debt-servicing capacity of companies has, seen a decline (refer Chart 1.208, Chapter 1). These trends may be indicative of halted projects, rising debt levels per unit of capex, overall rise in debt burden with poor recoveries on resources employed. This phenomenon, related to a rapid growth in the stressed assets of banks, is leading to a rise in ‘external finance premium’9 which may be impeding the transmission of softened monetary policy stance. The travails of the “industrial” sector may also be exerting a demonstration effect inhibiting new investments. 3.18 While adverse economic conditions and other factors related to certain specific sectors played a key role in asset quality deterioration, one of the possible inferences from the observations in this context could be that banks extended disproportionately high levels of credit to corporate entities / promoters who had much less ‘skin in the game’ during the boom period. Trends in sector-wise concentration of loans vis-à-vis that in non-performing advances (NPAs) of banks indicate that the deterioration in asset quality10 was observed across sectors (Chart 3.6).

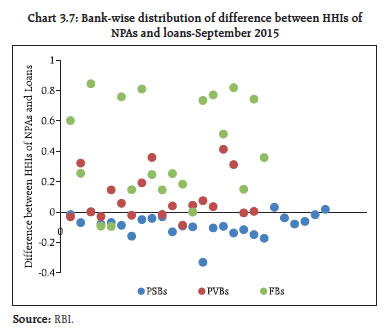

3.19 The bank-wise trends in the sector-wise concentration of loans and NPAs provides more insight about the possible role of weak systems of credit appraisal and monitoring in the case of the PSBs in their asset quality deterioration (Chart 3.7). 3.20 The implicit subsidy to the bank debtors acted as a significant friction making one of the propositions of Modigliani-Miller’s irrelevance theorem, that is, a firm’s leverage should not have any effect on the weighted average cost of capital – irrelevant in the Indian context. It could be said that the debt levels under the framework of limited liability have been somewhat overstretched to corroborate the dangers of limited liability. On the other hand, the benefits of mere asset-liability matching at the banks’ end could have been negated by a maturity transformation carried out by the borrower through a possible diversion of short-term funds to long-term uses or non-core businesses, indicating lapses in credit monitoring. Long term project finance by banks 3.21 With the conversion of the development financial institutions (DFIs) into universal banks, banks have been playing a major role in project financing, especially during the early stages of planning and implementation. However, the inherent risks and problems associated with project financing are also borne by the banking sector. This is also reflected by the fact that a significant part of stress in banks’ asset quality is related to long-term project financing. Given that banks are dependent on deposit liabilities and depositors enjoy deposit insurance albeit with limits, banks need to be risk-light on their asset side. Requirements of asset -liabilities matching through liquidity ratios further constrains banks’ ability for ‘maturity transformation’.

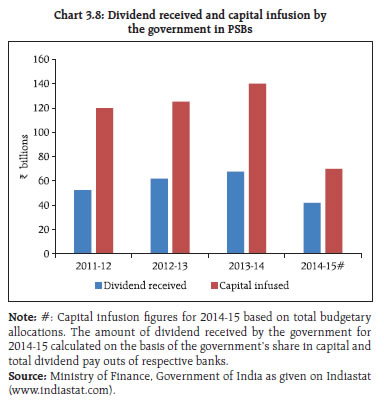

3.22 While loans for projects under implementation whose asset quality is linked to their attainment of date of commencement of commercial operation (DCCO) have been a major area of concern, the Reserve Bank has allowed certain concessions regarding attaining DCCO for project loans, in view of complexities in project implementation as also numerous exogenous factors affecting the DCCO of a project. Under the structured financing of project loans, banks are allowed to extend structured long-term project loans with the amortisation schedule linked to their economic life, and to provide periodic refinancing option to projects in the infrastructure and core industries sector. Banks are also allowed to refinance their existing infrastructure and other project loans by way of take-out financing even without a pre-determined agreement with other banks / financial institutions. 3.23 While such regulatory steps along with those related to ‘take-out financing’, and enabling regulations for raising long-term bonds by banks for financing their project loans seek to address some of the concerns, in view of the riskiness on account of the tenor of the loan, the banks’ processes and business models may not yet be adequately prepared to make, monitor and manage long-term project loans. Therefore, entities with long term investible resources such as pension funds and insurance companies need to be encouraged in this space (refer to para 3.45).12 Addressing the challenges being faced by PSBs 3.24 As discussed in previous FSRs, while the PSBs continue to play a vital role in Indian economy and financial system, they have been lagging their private sector counterparts on performance and efficiency indicators. Presently the PSBs with a predominantly high share in infrastructure financing are observed to be facing the highest amount of stress in their asset quality and profitability. Despite their developmental objectives, PSBs as financial intermediaries, need to operate on commercial considerations, to remain viable. Reforms under ‘Indradhanush’ initiative of government 3.25 In August 2015, government rolled out a seven pronged plan (named ‘Indradhanush’13) aimed at improving the performance of PSBs. The initiatives under this revamp plan cover aspects such as (i) appointments with separation of the post of managing director and non-executive chairman in some large PSBs, (ii) proposal for a ‘bank board bureau’ (BBB), (iii) plan for capitalisation (₹700 billion from budgetary allocations for four years up to financial year 2018- 1914), (iv) plan for de-stressing banks’ books, (v) empowerment of PSBs by encouraging them to take the business decision independently – without interference from government, (vi) a new framework for accountability based on ‘key performance indicators’ (KPI) and (vii) better governance through continuous engagement with banks. As envisaged under these reforms, they are expected to work as ‘private’ entities in terms of their business strategies, operations, controls and financial targets. Therefore, the business models of PSBs, their capital structures and dividend policies need a review. Directed lending and financial inclusion effort 3.26 Directed lending involves implicit and explicit subsidies and such costs should ideally be borne by the state so as not to compromise with the best banking practices and loan discipline. Loans to public utilities (for instance ‘discoms’) ultimately turn out to have quasi fiscal implications and it is important to inculcate the habit of paying user charges while dealing with subsidies separately without any impact on established lending norms. On the other hand, while there is a need to promote financial inclusion, it needs to be executed in a manner that is not detrimental to established commercial banking practices. If the implementation of financial inclusion is pushed beyond a point, it may have negative costs to the system. As progress on the governance and operational reforms takes hold, the gap between the culture and performance of PSBs vis-à-vis the performance of private sector banks is expected to narrow down. If the inherent strengths of PSBs, in terms of their reach and experience in delivering banking services to a larger geographical and demographical domain are to be used, their efforts should be suitably compensated on commercial considerations. Capital infusion and dividend decision at PSBs 3.27 It is observed that PSBs pay out significant amounts as dividend to the government (Chart 3.8) and other shareholders which have no relevance to their balance sheet strengths and capital planning. This also reveals a cross-subsidisation by better banks (given their relatively higher pay outs but a disproportionately higher capital infusion into weaker banks by the government). This pattern of dividend pay outs is not consistent with the dividend irrelevance theory.15 Thus, it is imperative that PSBs approach their dividend decisions as strategic business decisions which are in keeping with their objective of shareholder wealth maximisation.

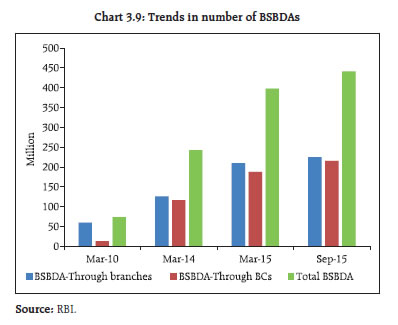

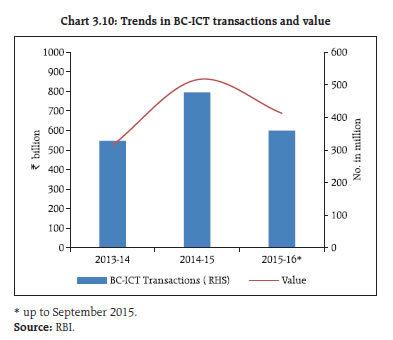

Financial inclusion Financial inclusion plans: Progress made during April - September 2015 3.28 Financial inclusion plans (FIPs) submitted by banks which are duly approved by their boards form a part of the business strategies of the banks. The comprehensive FIPs capture data relating to progress based on various parameters including basic savings bank deposit accounts (BSBDAs), small credits and business correspondent-information and communication technology (BC-ICT) transactions. There was a considerable increase in the opening of BSBDAs during the year because of the government’s initiative under the Pradhan Mantri Jan Dhan Yojana (PMJDY). BSBDAs reached 441 million as at end September 2015 as against 398 million as at end March 2015 (Chart 3.9). 3.29 The total number of banking outlets went up from 553,713 as at end March 2015 to 567,530 as at end September 2015 (517,328 branchless modes and 50,202 branches). BC-ICT transactions in BSBDAs showed steady progress with 359 million transactions during April -September 2015, as against 477 million transactions recorded for the year ended March 2015. In value terms, the BC-ICT transactions increased from ₹524 billion during 2013-14 to ₹859 billion during 2014-15. During the first half of year 2015-16 value of BC-ICT was ₹688 billion (Chart 3.10). Small farm sector entrepreneurial credits totalling 42 million accounts were outstanding with a balance of ₹4,860 billion. Small credit towards non-farm sector entrepreneurial activities totalling 11 million accounts was outstanding with a balance of ₹1,390 billion. New entrants in the banking sector – Push for financial inclusion 3.30 The Reserve Bank has granted ‘in-principle’ approval for setting up 11 payments banks and 10 small finance banks.16 These 21 applicants include seven pre-paid payment instrument (PPI) issuers, nine non-banking financial companies (NBFCs) and one local area bank (LAB) (Box 3.4). While the entry of these new types of banking institutions is expected to bring about far-reaching changes in the landscape of the Indian banking sector and increase the competition in the banking industry, the primary objective of these differentiated banks is furthering financial inclusion. Further, to work out a medium-term (five-year) measureable action plan for financial inclusion, the Reserve Bank has constituted a committee on Medium-term Path on Financial Inclusion.17

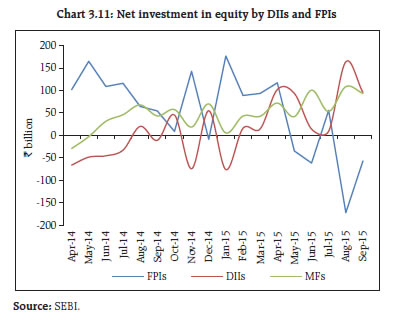

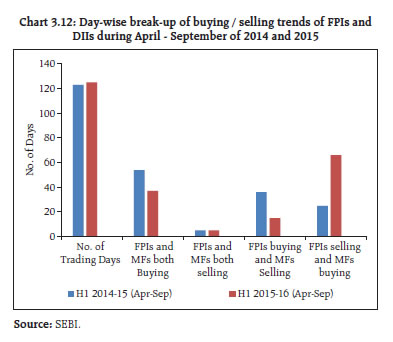

Box 3.4: Payment banks and small finance banks Payment banks have the primary objective of financial inclusion through providing small savings accounts and payment/remittance services to the migrant labour workforce, low income households, small businesses, other unorganised sector entities and other users, by enabling high volume-low value transactions in deposits and payment / remittance services in a secured technology-driven environment. Payment banks are not allowed to undertake lending activities and will be restricted to holding a maximum balance of ₹100,000 per individual customer initially. Apart from amounts maintained as CRR with the Reserve Bank on outside demand and time liabilities, these banks will be required to invest minimum 75 per cent of their ‘demand deposit balances’ in government securities/treasury bills and in other securities with maturity up to one year that are recognised by the Reserve Bank as eligible securities for maintaining SLR and hold maximum 25 per cent in current and time/ fixed deposits with other SCBs for operational purposes and liquidity management. The 11 applicants who have received in-principle approval for setting up payment banks propose to bring fresh capital of ₹ 16.22 billion to the banking system and an addition of 1,140 bank branches in their first year of operation. The objective of setting up of small finance banks (SFBs) is furthering financial inclusion by (i) providing savings vehicles primarily to unserved and underserved sections of the population, and (ii) supplying credit to small business units, small and marginal farmers, micro and small industries, and other unorganised sector entities, through high technology-low cost operations. SFBs have a priority sector lending target of 75 per cent of adjusted net bank credit (ANBC) and at least 50 per cent of the loan portfolio should comprise of loans and advances of up to ₹2.5 million. The 10 applicants who have received in-principle approval for setting up SFBs propose to bring fresh capital of ₹57.34 billion to the banking system and an addition of 2,444 bank branches in the first year of operation. A working group has been formed to examine and finalise the regulatory and supervisory framework for payment banks and small finance banks. The group is currently examining the various issues that need to be addressed considering the size and scope of these banks. Securities market Domestic institutional investors vis-à-vis foreign portfolio investors 3.31 While foreign portfolio investment (FPI) flows have helped in improving the liquidity and depth of the Indian equity markets, these flows often lead to concerns over emergence of herd behaviour and spells of excessive volatility driven by exogenous factors. The first half of the year 2014-15 saw a robust trend in net investments by FPIs in Indian equity market - with net FPI investment in equity at ₹610 billion, whereas domestic institutional investors (DIIs) were net sellers to the tune of ₹126.10 billion. The mutual funds (MFs) were an exception among DIIs as they had a net investment of ₹156.25 billion, while other major DIIs such as banks, insurance companies, and domestic financial institutions (DFIs) were net sellers during this period. However, during the first half of the year 2015-16, DIIs have invested over ₹600 billion in equities, of which over ₹450 billion has been invested by MFs. This strong purchasing streak of DIIs appears to have provided resistance to the sharp fluctuations in index values in a market where FPIs in equities have witnessed net outflows to the tune of ₹152 billion in the same period. 3.32 During 2014-15, the monthly trend of DII investments in equities was largely negative and for 8 out of the 12 months, the trends were countervailing the trading strategies of FPIs. MFs, however, have shown consistent net investments in equities, starting from June 2014. The first half of financial year 2015- 16 witnessed substantial investments by DIIs, mainly on account of net investments by MFs and outflows on account of FPIs, in 4 out of 6 months, (Chart 3.11). 3.33 A day-wise analysis of the data on equity investments for the two comparative periods (first half of 2014-15 and 2015-16) reveals that DIIs have stepped up their buying and the number of days on which they have been net buyers even when FPIs were net sellers has increased quite significantly. More importantly, from amongst the DIIs, MFs, with their larger investments in equities, have acted as the major countervailing force to the net selling positions of FPIs in Indian equities often becoming net buyers during the referred periods (Chart 3.12). Mutual funds’ investment in corporate bonds 3.34 The recent episodes involving rating downgrades of some corporate bonds and consequent imposition of certain restrictions on redemptions by some MFs have brought to the forefront, the concerns related to the extent of exposure of MFs in corporate bonds. Apart from the credit risk, other related aspects like liquidity risks, concentration risks and investors’ awareness levels are also in focus. The Global Financial Stability Report (GFSR) October 2015, has also discussed the impact of changes in market structures on liquidity and concentration risks in respect of larger holdings of corporate bonds by MFs and other institutional investments, along with the possible adverse impact of proliferation of small bond issuances on liquidity in the bond market. 3.35 The analysis of the exposure of MFs to corporate bonds in India and more particularly to corporate bonds which have been downgraded in last six months shows that assets under management (AUM) of ‘debt oriented schemes’ constitutes close to 64 per cent of the total AUM of mutual fund industry – of which 39 per cent is invested in corporate bonds. However, the proportion of such MFs having more than the average level of exposure to corporate bonds is small (Table 3.1).

3.36 In the context of Indian debt oriented MFs, the AUM of debt oriented schemes exposed to corporate bonds downgraded during last six months formed only about 1.6 per cent of their total AUM as on September 30, 2015. The highest level of proportion of exposure to downgraded bond is about 9 per cent for one asset management company (AMC) and for the rest of the AMCs the exposure of their debt oriented funds to downgraded bonds was in the range of 1 to 3 per cent. Thus, such exposure levels are not expected to assume systemic proportions, unless the rate of credit downgrades or corporate defaults increase unexpectedly. Product labelling in mutual funds 3.37 SEBI’s framework on ‘product labelling’ is meant to address the issues of mis-selling and provide investors an easy understanding of the kind of product/scheme they are investing in and its suitability to them. Accordingly, MFs are required to ‘label’ their schemes on the parameters such as nature and objective of scheme (wealth creation / regular income, debt / equity or hybrid) and indicative time horizon (short/ medium/ long term). The level of risk was required to be depicted by colour code boxes (blue where principal is at low risk, yellow for medium risk and brown for high risk). In order to further strengthen the framework for product labeling by MFs, SEBI in April 2015 increased the risk categories for labeling of mutual fund schemes to five, adding ‘moderately low’ and ‘moderately high’ labels. Further, with effect from July 01, 2015, the depiction of risk using colour codes have been replaced by pictorial meter named “Riskometer” as the visual indicator of risk can be more effective in conveying the message and it is also simple and self-explanatory which investors can easily comprehend18. | Table 3.1: Exposure of MFs to corporate bonds during April – September 2015 | | (Amount in ₹ Billion) | | Assets under management (AUM) of Mutual Funds | 12331.97 | | Assets under management (AUM) of Debt Oriented Schemes | 7929.10 | | Percentage of AUM of Debt oriented scheme /Total AUM | 64 | | Total Exposure of Debt oriented schemed to Corporate Bonds | 3124.82 | Percentage of Exposure of Debt oriented schemes to Corporate bonds

/ AUM of Debt oriented schemes | 39 | Exposure of Debt Oriented Funds to Downgraded Corporate Bonds

(for Debt Oriented Funds value of assets invested in corporate

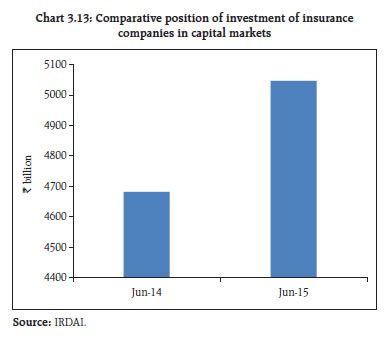

Bonds which have been downgraded during the period) | 128.17 | | Percentage of Downgraded corporate bonds to Total AUM of Debt oriented schemes | 1.62 | | Source: SEBI. | Risk management framework for national commodity derivatives exchanges 3.38 The commodity derivatives market has seen a rapid growth in India since 2003, when electronic trading platforms were introduced in the forms of modern de-mutualised exchanges. The last FSR covered some of the issues and challenges in strengthening the commodity markets in India, given the fragmentation in the ‘spot’ markets and other legal and tax related aspects. Pursuant to the announcement in the Union Budget 2015-16, the Forward Markets Commission (FMC), the erstwhile regulator of commodity derivatives in India, has been merged with SEBI on September 28, 2015. Subsequent to this merger, SEBI has issued guidelines on the comprehensive risk management framework19 to align and streamline the risk management framework across national commodity derivatives exchanges in India. This framework will be operationalised latest by January 01, 2016. SEBI has also prescribed risk management norms for regional commodity derivatives exchanges20 which are to be implemented latest by April 01, 2016. SEBI framework for fund raising by start-ups 3.39 India has witnessed a rapid growth in setting up of technology based ‘start-up’ companies in recent years and is among the top ranking countries in the globalised start-up ecosystems. Most of these start-ups have innovative business models and need huge risk capital in the initial years. As their valuation models vary depending upon the technology and types of service involved, they are analysed by the specialised institutional investors and the risk-return profiles may not be generally understood by common investors. Given their limitations in raising funds, these companies tend to tap foreign capital markets. Therefore, it is a challenge to provide the right incentives, including a simplified regulatory regime, for start-ups to raise funds from domestic sources even while shielding the small investor from the potentially higher risk of failures, as compared to companies which have already grown larger and have a reasonably long track record to refer to. 3.40 Accordingly, SEBI has simplified the framework for capital raising by technological start-ups and other companies on the Institutional Trading Platform (ITP) with effect from August 15, 2015. The framework stipulates eligibility criteria, composition of capital, disclosure, allocation of funds to institutional investors and discretionary allotment (Box 3.5). Stress testing of liquid fund and money market mutual fund schemes 3.41 Liquid /Money Market Mutual Funds (MMMFs) are generally exposed to various risks like short term interest rate risk, liquidity risk and credit risk. As on September 30, 2015, the AUM of liquid / MMMFs stood at ₹1,785 billion which is approximately 15 per cent of the total AUM. The International Organization of Securities Commissions (IOSCO), in its report on Policy Recommendations for Money Market Funds, made 15 key policy recommendations relating to eight reform areas. For effective liquidity management, periodical stress tests of MMMF scheme’s portfolio has been recommended based on various scenarios. Box 3.5: SEBI Framework for fund raising by start-ups The Institutional Trading Platform (ITP) is accessible to companies which are intensive in their use of information technology, intellectual property, data analytics, bio-technology, nano-technology to provide products, services or business platforms with substantial value addition and with at least 25 per cent of the pre-issue capital being held by Qualified Institutional Buyers (QIBs), or any other company in which at least 50 per cent of the pre-issue capital is held by QIBs. Further, no person (individually or collectively with persons acting in concert) in such a company shall hold 25 per cent or more of the post-issue share capital. Only two categories of investors, i.e. (i) Institutional Investors (QIBs along with family trusts, systematically important NBFCs registered with RBI and intermediaries registered with SEBI, all with net-worth of more than ₹5 billion) and (ii) Non-Institutional Investors (NIIs) other than retail individual investors can access ITP. The disclosure by the companies may contain only broad objectives of the issue and there shall be no cap on amount raised for ‘General Corporate Purposes’. As the standard valuation parameters such as P/E, EPS etc., may not be relevant in case of many such companies, the basis of such issue price may include other disclosures, except projections, as deemed fit by the issuers. In case of public offer, allotment to institutional investors may be on a discretionary basis whereas to NIIs it shall be on proportionate basis. Allocation between these two categories shall be in the ratio of 75 per cent and 25 per cent respectively. In case of discretionary allotment to institutional investors, no institutional investor shall be allotted more than 10 per cent of the issue size. All shares allotted on discretionary basis shall be locked-in, in line with requirements for lock-in by anchor investors i.e. 30 days at present. The minimum application size in case of such issues and the minimum trading lot is ₹1 million. The number of allottees in case of a public offer must be more than 200. The company is given the option to migrate to main board after 3 years subject to compliance with eligibility requirements of the stock exchanges. 3.42 In line with the global developments and to strengthen the risk management practices, SEBI had issued guidelines in April 2015 requiring the AMCs to have stress testing policy in place which mandates them to conduct stress test on all liquid funds and MMMF Schemes in terms of risk parameters deemed necessary by the AMC, including interest rate risk, credit risk and liquidity/redemption risk so as to evaluate their impact on the scheme and its Net Asset Value (NAV). Such stress tests should be carried out internally at least on a monthly basis, and if the market conditions require so, AMC should conduct more frequent stress tests. 3.43 In the event of stress tests revealing any vulnerability or early warning signal, the AMC would be required to bring it to the notice of the ‘trustees’ and take corrective action as deemed necessary, to reinforce their robustness. Each AMC should also have documented guidelines, to deal with the adverse situation effectively. The stress-testing policy shall be reviewed by the Board of AMC and ‘trustees’, at least on an annual basis, in the light of the evolving market scenarios and trustees shall be required to report compliance of the guidelines and steps taken to deal with adverse situations faced, if any, in the half yearly trustee report submitted to SEBI. This framework will allow fund managers to continually monitor and adjust their portfolios depending on existing and anticipated market conditions and construct portfolios to withstand severe stress and ensure financial stability. 3.44 Mutual Funds have stress testing policy and conduct stress tests on their liquid / MMMF schemes at least on a monthly basis, as per guidelines laid down by SEBI. Stress tests conducted by MFs in past did not reveal any vulnerability in case of most MFs, except in case of one MF, wherein, based on the vulnerability revealed by a specific stress test scenario, corrective action was taken by the concerned MF. Insurance sector Insurance companies’ role as source of financial stability 3.45 The insurance business model encompassing both insurers and reinsurers has specific features that differentiate it from the banking system and make it a source of stability in the financial system. Insurance is funded by upfront premium, giving insurers strong operating cash flows. Further, insurance policies especially in life insurance are generally long-term in tenor, with controlled outflows. Thus with an ‘inverted cycle of production’ and self-funding through premium inflows the sector acts as a long-term source of capital and contributes to a positive liquidity cycle. Insurers aim to match the duration of assets and liabilities and consequently hold long-term assets against longer term liabilities, and they do not generally leverage their asset bases by incurring short-term liabilities (see para 3.23). 3.46 The risks that the insurance companies and banks face differ fundamentally. Insurance risk is idiosyncratic and, for the most part, independent of the economic cycle. Further, large insurers are typically well diversified both geographically and across lines of business. In contrast, bank specific risks tend to be highly correlated with the economic cycle. Asset-liability management is the core activity for insurance companies. Insurers hold large amounts of assets that they match against their liabilities. Insurers’ investment functions therefore differ from ‘third party’ asset management entities which are managing against a market benchmark. Also, insurers’ highly regulated balance sheets serve to limit the proportion of assets at risk. Insurance sector’s approach to capital market investment 3.47 The role of the insurance function in the financial crisis has had a stabilising influence on the capital market as a whole, especially in the Indian context (Chart 3.13). Insurance companies are large investors and they (especially life insurers) typically have longer-term investment horizons. They may not have the compulsion to sell in a falling market and instead can be contrarians with the falling capital market providing an opportunity to go ‘long’. Investment risks and regulations for the insurance sector 3.48 In the case of insurance companies, the pattern of investments is prescribed in the regulations, which provide sector based, group based and entity based exposure limits. The exposure to immovable property is restricted to 5 per cent of the total investable assets/ total fund value. In addition, valuation norms of investments have been specified in accounting regulations, which predominantly provide for valuation of the assets on amortised cost except in case of equity where insurers are allowed to value them at fair value. However, the difference in fair value and the purchase value is not available for computation of solvency / declaration of bonus. Foreign reinsurance companies – Risk mitigation 3.49 The recent Insurance Laws (Amendment) Act, 2015 allows a foreign reinsurer to set up a branch in India to transact the business of reinsurance. These insurers may have exposure to non-traditional and non-insurance products which may entail systemic risks. The recent regulations21 from the Insurance Regulatory and Development Authority of India (IRDAI) are aimed at providing adequate safeguards to mitigate possible systemic risks.

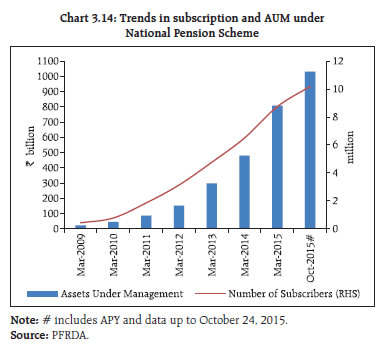

Pension sector Growing importance with changing demography 3.50 The socio-economic implications of nurturing the pension sector can be derived from the fact that the government is presently spending about 2.2 per cent of the GDP on pension payments which, according to one estimate may reach 4.1 per cent of GDP by 2030. The Pension Fund Regulatory and Development Authority (PFRDA), therefore seeks to ensure that benefits of a sustainable pension system reach out beyond the currently served target groups without unduly straining the fiscal discipline of the government and simultaneously providing long-term investment funds for the economy. 3.51 Moreover, the workforce in the unorganised sector has limited access to formal channels of old age economic support. Hence, creating a viable old age security system has become an imperative to counter the fast dwindling demographic dividend. Tenuous labour market attachments, intermittent incomes and poor access to social security make unorganised sector workers highly vulnerable to economic shocks during their productive years and without access to some kind of retirement incomes or benefits they are also likely to face old age poverty. National pension system and progress under Atal Pension Yojana 3.52 The national pension system (NPS) is showing a steady increase in the number of subscribers and AUM (Chart 3.14). The Atal Pension Yojana (APY) launched in June 2015 aims to provide an assured income level and sustainable retirement solution to the unorganised sector with flexibility and ease of operations that may be able to cover the challenges of seasonality of employment and indebtedness in the old age. APY added more than 825,000 subscribers with ₹1.43 billion during the period from June 2015 till October 24, 2015. The existing points of presence (PoP) and aggregators under the ‘Swavalamban’ scheme are being used for enrolling subscribers through the architecture of NPS and the amount collected under APY is managed by pension funds appointed by APY as per the investment pattern specified by the government. Revision of investment guidelines 3.53 The investment guidelines applicable to NPS schemes are revisited and revised periodically to ensure that the returns that a subscriber gets are maximised and also to provide fillip to financial flows and economic development. Under NPS, rated infrastructure debt funds (IDFs) and infrastructure bonds are considered eligible for investment under the debt category of all the NPS schemes, provided the investment is made in instruments having an investment grade rating from at least two credit rating agencies. Choice of pension funds and schemes for government sector employees 3.54 The PFRDA Act, 2013,22 states that there shall be a choice of multiple pension funds and multiple pension schemes for subscribers. Hence, subsequent to the notification of the PFRDA Act, there is a need to align the investment framework for government employees. The choice of pension funds and investment patterns should rest with an individual employee. There is a need for shifting the risk from the employer to the employee wherein the onus of ‘funding’ old age income security moves from the employer to the individual employee, through his/ her individual retirement accounts. Parity with other subscribers through harmonisation of investment patterns for both government as well as private sector subscribers ensures that government subscribers can also enjoy a choice in the selection of a pension fund manager (both public and private sector PF) as well as the choice to allocate funds amongst the three asset classes (equity, corporate debt and government securities) with only one ceiling applicable - relating to the maximum 50 per cent of funds to be allocated to equity.

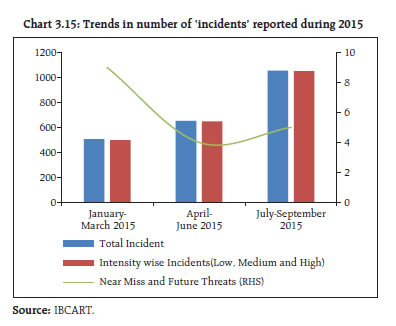

Investments in corporate bonds – Risks for pension funds 3.55 The existing investment guidelines prescribed by PFRDA permit pension funds to invest up to 45 per cent of the subscriber’s contribution in corporate bonds. Historically, the limit has been effectively used by pension funds for better asset quality and returns, and at present 33.95 per cent of the NPS portfolio is invested in corporate bonds. PFRDA has also prescribed limits related to sub-categories of different instruments, concentration risks and group and industry exposure norms for safeguarding the interests of subscribers. 3.56 The economic down cycle and sluggish growth in corporate earnings have severely impacted the performance of the corporate sector in India in recent years. Therefore, in addition to regulatory prescriptions, there is a need for appropriate risk management frameworks and information systems in pension funds to prevent contagion risks from a sudden and large-scale deterioration in the credit quality of corporate bonds. Along with the maturing and deepening of corporate bond markets in India, flexibility and efficiency in asset allocations between government securities and corporate bonds will also help in improving the effectiveness of pension funds. Deepening of the annuity market 3.57 Currently, at the time of vesting, a minimum 40 per cent of the pension wealth of a subscriber has to be annuitised and up to 60 per cent of the pension wealth may be withdrawn as lump-sum. Though annuitisation enables a subscriber to have a regular stream of income in his old age, this may not be providing the optimal outcomes in terms of returns. Therefore, deferred annuity and other post retirement products which ensure optimal post-retirement returns to subscribers should be developed. Further, steps are also required to boost the annuity market to deepen and widen the pension sector. Financial safety nets: Deposit insurance Differential premium system for deposit insurance 3.58 While most deposit insurance systems initially adopt an ex-ante flat-rate premium system because they are relatively simple to design, implement and administer, there has been an increasing recognition among deposit insurance agencies globally about the need for a differential premium system (DPS) based on the risk profile of banks, also often referred to as risk-based premium (RBP). The Federal Deposit Insurance Corporation (FDIC), US, made a beginning in 1993 by introducing RBP. Since then, 26 of the 79 member jurisdictions of the International Association of Deposit Insurers (IADI) had adopted RBP as on December 31, 2013. 3.59 In India, various committees constituted by the Government of India, the Reserve Bank of India and Deposit Insurance and Credit Guarantee Corporation (DICGC) in the past have made recommendations for the introduction of risk-based premium for banks. However, the implementation of risk-based premium has not been operationalised due to various reasons. On the other hand, there has been a persistent demand from stakeholders and public representatives in the recent past for a hike in deposit insurance cover from the current level of ₹ 0.1 million. A hike in cover without calibrating premium rates to the risk profiles of insured banks may exacerbate moral hazards. Report of the committee on differential premium system for banks in India 3.60 In this context, a Committee on Differential Premium System for Banks in India23 was constituted in March 2015 to make recommendations for the introduction of risk based premium in India. The committee submitted its report on September 30, 2015 which was simultaneously placed on the websites of the Reserve Bank of India and DICGC for feedback from stakeholders. The major recommendations of the committee, inter alia, cover aspects like number of categories for assigning premium rates, institution of DICGC’s management information system (MIS) for member banks in order to collect model related information mainly based on audited balance sheet data, information on key characteristics of the rating model in the public domain, a periodic review of the rating system and premium collection. Financial market infrastructure Stress testing by clearing corporations in the capital market 3.61 The clearing corporation is required to maintain a Settlement Guarantee Fund (SGF) for each segment of the recognised stock exchange so as to guarantee the settlement of trades executed in the respective segment of the stock exchange. Towards this end, in order to ensure that the SGF maintained by the clearing corporation is sufficient, the clearing corporations are required to carry out daily stress testing for credit risk using at least the standardised stress testing methodology prescribed for each segment viz., equity, equity derivatives and currency derivatives. The worst case loss numbers arrived through the stress testing scenarios are used to determine the quantum of the minimum required corpus (MRC) for SGF for each segment. 3.62 The SGF, Stress Test and Default Waterfall guidelines came into effect from December 2014. As per the data obtained from the three clearing corporations - Indian Clearing Corporation Limited (ICCL), National Securities Clearing Corporation Limited (NSCCL) and Metropolitan Clearing Corporation of India Ltd (MCCIL), it is observed that the total MRC for SGF of all the segments, for the month of November 2015 are - ICCL: ₹1.73 billion, NSCCL : ₹9.42 billion and MCCIL: ₹0.42 billion. Over the period of December 2014 - November 2015, the requirement of the MRC for SGF has gone up considerably as a result of the stress tests, which has been suitably funded by the clearing corporation and the stock exchange. 3.63 In addition to the stress testing, the clearing corporations also carry out liquidity stress test and reverse stress tests so as to determine the sufficiency of the financial resources available with the clearing corporation. Further, the clearing corporations also carry out back testing of margins in order to assess the appropriateness of the margin models. Cyber security framework of equity market FMIs 3.64 In line with the global developments, SEBI has adopted the Principles for Financial Market Infrastructures (PFMIs) laid down by the Committee on Payments and Market Infrastructures (CPMI) and IOSCO and has issued guidance for implementation of the principles in the securities market. Principle 17 of PFMI relates to management and mitigation of ‘operational risk’ at systemically important market infrastructure institutions. Accordingly, SEBI in consultation with the stakeholders, has laid down the framework that FMIs in securities market (like stock exchanges, depositories and clearing corporations) would be required to comply with regard to cyber security and cyber resilience. Stock exchanges, depositories and clearing corporations have been mandated to ‘identify’ critical IT assets and risks associated with such assets; ‘protect’ assets by deploying suitable controls, tools and measures; ‘detect’ incidents, anomalies and attacks through appropriate monitoring tools / processes; ‘respond’ by taking immediate steps after identification of the incident, anomaly or attack and ‘recover’ from incident through incident management, disaster recovery as well as business continuity framework. The framework covers areas such as governance, identification of critical assets and cyber risks (threats and vulnerabilities), access controls, physical security, network security management, security of data, hardening of hardware and software, application security and testing, patch management, disposal of systems and storage devices, vulnerability assessment and penetration testing (VAPT), monitoring and detection, response and recovery, sharing of information, training, and periodic audit. Strengthening of the central counterparty in key financial markets 3.65 As presented in previous issues of FSR, the Reserve Bank has been taking initiatives towards strengthening the regulatory framework for the Clearing Corporation of India Ltd. (CCIL). Accordingly, in order to mitigate the Herstatt risk24 in the USD-INR segment, the payment versus payment (PvP) settlement mode has been implemented with effect from April 2015 and the IRS dealing system, that is, anonymous system for trading in rupee OTC interest rate derivatives (ASTROID) was launched in August 2015. CCIL has been carrying out portfolio compression in the IRS segment. While CCIL has carried out a self-assessment against PFMIs published by the CPMI and IOSCO, the Reserve Bank has also inspected CCIL to assess its compliance with PFMIs. CCIL has also made disclosures on its compliance to PFMIs25 as per the disclosure framework published by the CPMI-IOSCO. CCIL has been advised to prepare a recovery and resolution plan in consultation with the regulator (Reserve Bank of India). Legal entity identifier (LEI)26 system for India 3.66 The local operating units (LOU), are the local implementers of the LEI system and provide the primary interface for entities wishing to register for LEI. CCIL was identified and designated as the pre- LOU in India. CCIL has also been registered as a pre- LOU by the Regulatory Oversight Committee (ROC) and it commenced the service of LEI issuance27 by issuing LEIs to itself and to ICCL. As of now, it has issued 13 LEIs to various entities. CCIL’s new subsidiary Legal Entity Identifier India Limited (LEIL) has been registered by Ministry of Corporate Affairs (MCA). Testing the resilience of information technology based systems at banks 3.67 The Reserve Bank requires banks in India to conduct regular, periodic business continuity (BC)/ disaster recovery (DR) drills, for ensuring high levels of resilience of information technology (IT) based systems like core banking systems (CBS). The banks have been undertaking the BC/DR drills periodically, suggesting a high level of resilience of their CBS in particular and IT systems in general. 3.68 There have been two major initiatives in the area of strengthening the information system on cyber security for the Indian banking community – the Indian Banks’ Centre for Analysis of Risks and Threats (IB-CART) and the Computer Emergency Response Team- India (CERT-In). IB-CART of the Institute for Development and Research in Banking Technology (IDRBT) is a centralised platform that facilitates the reporting of security related events. The CERT-In, set up under the Ministry of Communications and Information Technology, Government of India, is a nodal agency to deal with cyber security threats like hacking and phishing. It strengthens security-related defence of the Indian internet domain. As per the reports received by IB-CART, there were 2,214 security related incidents, of which 2,196 were actual incidents while the remaining were attempts which did not fructify (Chart 3.15). Payment systems 3.69 The Reserve Bank is managing and operating critical payment systems - Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT), E-Kuber Core Banking System and electronic government transactions such as e-receipts and e-payments. The overall activity of payment systems has increased significantly mainly due to rapid developments in the area of information technology. A business continuity plan (BCP) document has been prepared and it is subject to periodical reviews. One of the key technological aspects of BCP is disaster recovery planning, which covers the immediate and temporary restoration of computing and network operations within defined timeframes. Financial stability and development council 3.70 The financial stability and development council (FSDC) and its Sub Committee held two meetings each in 2015. Some of the important issues taken up for discussions during the year included: asset quality in the banking industry and corporate sector balance sheet stress; development of corporate bond market; collective investment schemes international financial services centre (IFSC); central ‘know your customer’ (KYC) registry; deposit raising by multi-state co-operative societies; inter-regulatory co-ordination for reporting under foreign account tax compliance act (FATCA); orderly growth of pension sector in India; functioning of state level coordination committees (SLCCs) and standards and protocol for setting up account aggregation for financial assets,

|