Signature of the Members of the Household Finance Committee Sd/-

Dr. Pawan Gopalakrishnan

Member

RBI | Sd/-

Mr. Suresh Mathur

Member

IRDAI | | | | Sd/-

Mr. Prabhas Rath

Member

SEBI | Sd/-

Dr. Alpana Vats

Member

PFRDA | Sd/-

Prof. Tarun Ramadorai

Chairman

Imperial College, London | Members of the Committee on Household Finance | Name | Organization | | | Prof. Tarun Ramadorai | Imperial College, London | Chairman | | Dr. Pawan Gopalakrishnan | Reserve Bank of India | | | Mr. Suresh Mathur | Insurance Regulatory and Development Authority | | | Mr. Prabhas Rath | Securities and Exchange Board of India | | | Dr. Alpana Vats | Pension Fund Regulatory and Development Authority | | Members of the Research Subcommittee | Prof. Tarun Ramadorai | Imperial College, London | Chairman | | Dr. Cristian Badarinza | National University of Singapore | | | Dr. Vimal Balasubramaniam | University of Oxford | | | Dr. Pawan Gopalakrishnan | Reserve Bank of India | | | Ms. Manuela Kristin Gunther | CAFRAL, ODI Fellow | | Members of the Technology Subcommittee | Prof. Tarun Ramadorai | Imperial College, London | Chairman | | Ms. Smita Aggarwal | Omidyar Network | | | Dr. Pawan Bakshi | BMGF | | | Mr. Gautam Bharadwaj | pinBox Solutions | | | Mr. Sanjay Jain | ekSTEP and iSPIRT Foundation | | | Dr. Rajiv Lall | IDFC Bank | | | Mr. Rahul Matthan | Trilegal | | | Mr. Varad Pande | Dalberg | | Members of the Pensions and Insurance Subcommittee | Mr. Suresh Mathur | Insurance Regulatory and Development Authority | Co-Chair | | Dr. Alpana Vats | Pension Fund Regulatory and Development Authority | Co-Chair | | Mr. Antony Jacob | Apollo Munich Health Insurance | | | Mr. M.R. Kumar | Life Insurance Corporation of India | | | Mr. Anand Pejawar | SBI Life Insurance Co. Ltd. | | | Ms. Neera Saxena | The New India Assurance Co. Ltd. | | | Mr. Tapan Singhel | Bajaj Allianz General Insurance | | Members of the Legal Advisory Subcommittee | Mr. Rahul Matthan | Trilegal | | Mr. Rohan Shah | Rohan Shah's Chambers | | Mr. Somasekhar Sundaresan | SS Chambers | | Mr. Anu Tiwari | AZB Partners |

ACKNOWLEDGEMENTS The Committee on Household Finance (henceforth “the committee”) was given a daunting task. The first few items in the terms of reference (ToR) direct us to compare Indian household financial markets to those in other major world markets, and to identify areas in which Indian household allocations deviate from what we might consider to be desirable allocations. The remaining items then direct us to propose solutions to these problems. The brief, therefore, is both diagnostic and surgical, both positive and normative. This is a difficult act to pull off – but we have been fortunate to have enormous help and support to attempt this ambitious exercise. The committee met on six separate occasions, and each such meeting was roughly a day long. These meetings were spent listening to evidence and engaging in debates with a range of highly knowledgeable and thoughtful individuals and firms from across the spectrum of Indian household finance. We are most grateful to these individuals and groups who gave of their time so generously to present both data and opinions to the committee, and we list them all at the end of this report.1 We would also like to thank Satish Chander, R. R. Nerurkar, Mayank Saxena, and Latha Vishwanath from the Department of Banking Regulation at the RBI for their help in coordinating these meetings. In the run up to each of these meetings of the committee, there were a number of subcommittee meetings, averaging roughly four sub-committee meetings for each meeting of the committee. During these meetings, members of the sub-committees worked tirelessly to produce the material that constitutes this report. We briefly outline their contributions below. Our research subcommittee has generated genuinely new and insightful research on household finance in India, exploiting multiple waves of nationally representative datasets (such as the All India Debt and Investment Survey in India, as well as counter-part micro-surveys from Australia, Germany, the UK, the US, Thailand, and China), as well as more specialized surveys (such as the Finscope survey, the Financial Inclusion Insights Survey, and the ICE 360 degree survey) that focus on particular aspects of financial market participation in India. They have also collated work from authoritative and informative secondary sources on these topics, and have interacted extensively with world-renowned experts in these areas to pull in relevant content. A special mention is owed to Cristian Badarinza and Vimal Balasubramaniam for serving as an informal “drafting committee” for this report. Without their efforts, this report would simply never have come to fruition. Our technology subcommittee, populated with experts in various aspects of finance, technology, and indeed, financial technology, thoroughly debated the complex issues surrounding the promise and peril of technological solutions in household finance. They have contributed to forward-thinking policy solutions to remove obstacles for the supply side to make progress in helping to address problems which simultaneously require customisation and scale. Our pensions and insurance subcommittee has provided very useful suggestions from the industry perspective which have fed into many of our new product recommendations and innovations, and our legal subcommittee, aided by talented and hardworking staff, has helped with detailed and thoughtful opinions about the feasibility of our policy recommendations. In addition to these contributions from individuals directly affiliated with the committee, or invited to present at committee meetings, we have greatly benefited from help, enlightening conversations, and detailed comments from a number of individuals that are contributors to this important area of finance. We also list these individuals at the end of this report, and are hugely grateful for their generous contributions. It is worth noting that for many, working in household finance is not merely an occupation, but rather, a vocation, and the levels of passion and enthusiasm we have witnessed have been quite extraordinary. The Chairman would like to thank Imperial College Business School and the Brevan Howard Centre and its director, Prof. Franklin Allen, for support, as well as the staff of the Centre especially Jaswinder Gill. Finally, we thank Jo Leask for excellent administrative support. Overall, we have been lucky to be able to assemble such a distinguished and thoughtful group of contributors to the report, and the quality of the final product will, we hope, do justice to their contributions.

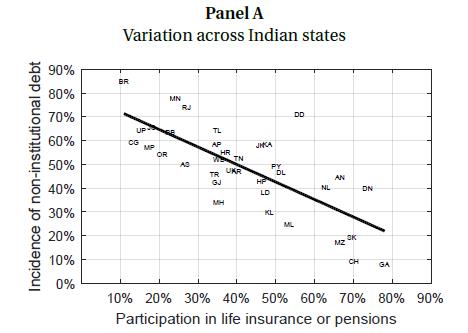

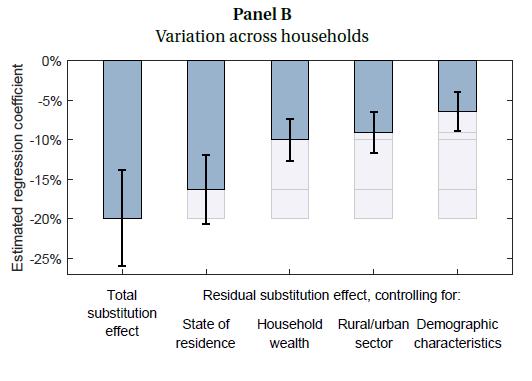

EXECUTIVE SUMMARY In the first part of this report, we provide our responses to points i) and ii) on the ToR. We describe the results of an international benchmarking exercise, in which we document how Indian households allocate assets and take on liabilities both along the lifecycle and across the wealth distribution, and compare these patterns to those evident in micro-data on households in a range of advanced and emerging economies. We find several attributes of Indian households that are exceptional in the international context. Importantly, these distinctive features of Indian household balance sheets cannot be explained by differences in the demographic characteristics, wealth, or income of Indian households relative to their counterparts in other countries. We also find that these properties of Indian balance sheets are difficult to explain using a standard lifecycle portfolio choice model, which we calibrate using estimated data on the income dynamics of Indian households. Taken together, it appears that these patterns are likely driven by unique aspects of Indian households’ financial decision-making. The distinctive features of Indian household balance sheets are: 1. A large fraction of the wealth of Indian households is in the form of physical assets (in particular, gold and real estate). This is unusual in the international context, and especially unusual for younger households, and for households in the bottom 40% of the wealth distribution, i.e., those with the lowest amounts of gross assets. 2. Despite the high holdings of real estate, mortgage penetration is low early in life, and subsequently rises as households age. This is also at variance with Indian households’ counterparts in other countries, where debt has a characteristically hump-shaped pattern over the lifecycle. Indian households tend to borrow later in life and are more likely to reach retirement age with positive debt balances, which is a source of risk given that they are no longer earning income during these years. a) We note that 1. and 2. above are clearly connected. Social arrangements in which households bequest housing wealth to future generations and in turn receive support during retirement are an underlying determinant of these patterns. Such traditional approaches to household financial management have likely evolved over time as a rational response to prevailing economic conditions. We note, however, that these traditional structures are increasingly under pressure from shifting demographic patterns, social norms, and changing economic conditions, introducing risks to economic well-being especially as households age. 3. The Indian household finance landscape is distinctive through the near total absence of pension wealth. Pension accounts and investment-linked life insurance products exist, but they are only used frequently by households located in a small group of states, while in most other states, the contribution of pensions wealth to household wealth is negligible. 4. We document high levels of unsecured debt, and perhaps more importantly, debt taken from non-institutional sources such as moneylenders. Such debt generates high costs for Indian households, and as we document later in the report, is likely to lead to households becoming trapped in a long cycle of interest repayments. We note that this phenomenon has been well-documented over the decades, but nevertheless remains stubbornly persistent. 5. There are low levels of insurance penetration (life and non-life) despite numerous sources of risk such as rainfall (leading to income shocks in largely agrarian segments of the population), health shocks, and catastrophes such as floods or cyclones. 6. There is a strong negative correlation between participation in insurance and the incidence of non-institutional source debt, suggesting that households are dealing with risks through high-cost borrowing ex-post as opposed to insuring against such risks ex-ante. We find that this is a costly approach for households, as high interest payments on informal debt impose substantially greater costs on Indian households relative to the (counterfactual) policy of purchasing actuarially fair insurance. -

This is an important observation, since it suggests that efforts to reduce informal lending will likely fail in an environment in which households are not sufficiently well-insured against risks. -

We note that some of these risks could be mitigated through strengthening the public provision of health and social welfare services. We also observe that this finding could arise from tight constraints on household budgets which do not permit them to take on insurance ex-ante; or as a consequence of adverse selection, moral hazard, or other issues causing premiums in the insurance market to become unaffordable for households. Next, we attempt to evaluate the implications of these features of Indian household balance sheets in response to point ii) on the ToR. We also attempt to evaluate the size of any gains from counterfactual policies that households might pursue, and conclude (in this partial equilibrium exercise) that Indian households can potentially realise significant benefits from several changes to their balance sheets. In particular, we find that: -

If the current patterns of allocation are maintained, demographic projections indicate that there will be significant additional pressure on the demand for assets such as gold and real estate in the coming decades. -

Over the coming decade and a half, the elderly cohort is expected to grow by 75 percent. Only a small fraction of this cohort has saved in private pension plans. Moreover, a large segment of the population of households in all age cohorts has not actively taken steps to insure adequate financial coverage during retirement. The need to finance adequate consumption during retirement is therefore a looming issue, and when combined with the low penetration of insurance, households appear particularly vulnerable to adverse shocks later in life. -

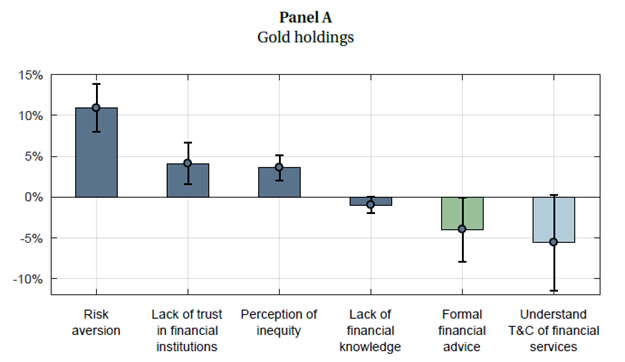

Indian households can benefit greatly by re-allocating assets towards financial markets and away from gold. If households in the middle third of the gold holdings distribution re-allocated a quarter of their existing gold holdings to financial assets, on average, they could earn an amount equivalent to 0.8% of their annual income per year (on an ongoing flow basis). Expressed differently, the wealth gain in real present value terms accruing from this shift would be sufficient to move these households roughly 1 percentage point (pp) up the current Indian wealth distribution. For households that hold more substantial amounts of gold, i.e., those in the top third of the cross-sectional distribution, the ongoing annual income gain from re-allocating a quarter of their gold holdings to financial assets is 3.4%, which when capitalised, translates into a upwards movement of roughly 5 pp along the Indian wealth distribution. These projected gains are almost always above zero, even when we account for volatility which may lead to different realisations of returns on gold and financial assets. -

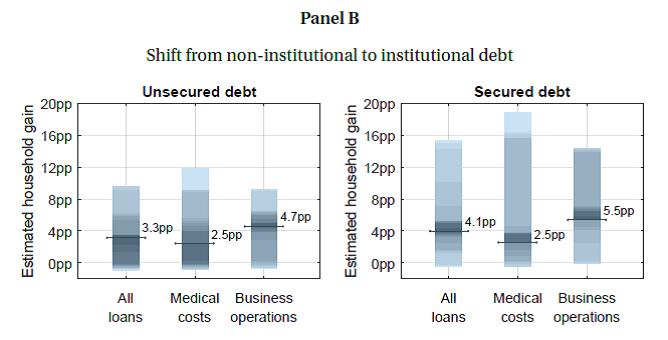

For the median Indian household, shifting from non-institutional debt to institutional debt can lead to gains equivalent to between 1.9%–4.2% of annual income on an ongoing basis, or equivalently when capitalised, to upward moves along the current Indian wealth distribution of 2.5 pp–5.5 pp. These gains are almost always above zero in the cross-section of all households, regardless of the reason that the debt was incurred (medical costs, or financing business operations), and regardless of whether the debt is secured by collateral or unsecured. We also note that these numbers are quite conservative, as we accept self-reported “friends and family” interest rates as zero, despite the fact that there is likely significant non-monetary compensation demanded for the provision of such informal credit. -

By avoiding the interest burden of emergency credit associated with medical costs, the median Indian household can gain 0.4%–1.2% of annual income on an ongoing basis, or equivalently, move up the Indian wealth distribution between 0.4 pp–1.6 pp. Households could avoid such costs if they were able to access strengthened public health services or if they were able to purchase actuarially fair insurance ex-ante that exactly covered the ex-post debt principal incurred in order to finance future emergency (such as health) expenditure. Having documented that the expected gains from these changes to Indian households’ balance sheets are high, we turn to point iii) on the ToR. Here, we uncover significant evidence for the underlying causes of the deviations between Indian household financial allocations and what might be considered to be more desirable financial allocation and behaviour. In particular, we find that the following causes are important: 1. High transactions costs and bureaucratic impediments to efficient participation create a high “nuisance factor” for households hoping to engage in formal financial markets. For example, we find from the empirical analysis of several household surveys that Indian households strongly associate formal banking institutions with large administrative burdens and complicated paperwork. 2. Trust issues that households face in their participation in formal financial markets. We find that these arise from households’ often negative perceptions of formal providers, which are exacerbated by occasional poor experiences with unscrupulous providers. These trust issues appear to correlate highly with the income level of the household, and low income households often report their belief that access to financial products is the prerogative of elite groups in society. This lack of trust in financial institutions helps to explain the tendency of households to eschew financial products and to invest in instruments such as gold instead. It also helps to explain the continuing reliance of Indian households on traditional systems of provision of financial services. 3. The use of non-institutional debt is related to the type of expenditure for which the liability is incurred, and the urgency of the financial need. This points once again to non-institutional debt serving as a high-cost, imperfect form of insurance. 4. Behavioural factors such as a lack of self-confidence in engaging with formal financial systems. For example, we find that the lack of participation in the market for life insurance products appears to be related to the self-perceived financial management skills of the household head. As in many other parts of the world, we also find that cognitive issues such as present bias are widely prevalent, and can lead to issues such as low pensions take-up. 5. The high complexity of Indian households’ financial needs: -

We note that there are significant differences across households located in different states even after controlling for households’ demographic characteristics (for example, there is a particularly high demand for gold in southern Indian states). This is further evidence that traditional and cultural factors are strong determinants of observed allocations. Effective policies in Indian household finance should attempt to complement, or at least recognise, such longstanding traditional approaches to financial management in order to be effective. -

Self-reported financial goals of households are often driven by “life events,” such as marriage, which disproportionately affect the household budgets of the poor because of the high fixed costs of such events. This highlights the importance of traditional social insurance in driving household financial decisions. Notably, such life events appear to be more important to households than goals such as financing education. -

There are the usual lifecycle and wealth considerations leading to different demands by households. As added complications in the Indian context, informal labour market arrangements are widely prevalent, and income derived from agrarian sources generates significant variation in the timing and frequency of income that households receive. Such complications can make the often rigid contractual terms in standard financial products undesirable for such households. -

Decisions concerning homeownership, savings product choice, insurance, pensions, mortgages, and emergency credit are inter-dependent and inter-related, increasing the total complexity burden on household decisions. 6. There is no unified framework or guidelines for the provision of high quality and low cost financial advice to Indian households. The diagnosis of these problems naturally leads to a set of policy responses, which we are directed to provide in points iv) and v) of the ToR. To set the context for our recommendations, we make several observations about promising solutions in Indian household finance: -

Indian households require customised financial products that account for their unique economic conditions, longstanding traditions, idiosyncratic life goals, and the complexity of their financial circumstances. -

Such customised financial products are required at low marginal costs of servicing additional households. That is, they need to be scalable. -

These products need to be relevant to households, in the sense that they should be delivered in a manner that is free from incentive problems, at a price that is fair, and dispensed alongside financial advice that is in the best interests of households. -

Complicated paperwork and bureaucratic impediments can exacerbate feelings of embarrassment and shame for low income and poorly educated households in their initial engagement with financial markets. Financial product terms and conditions should therefore be explained to households in a manner that is both intuitive and salient. -

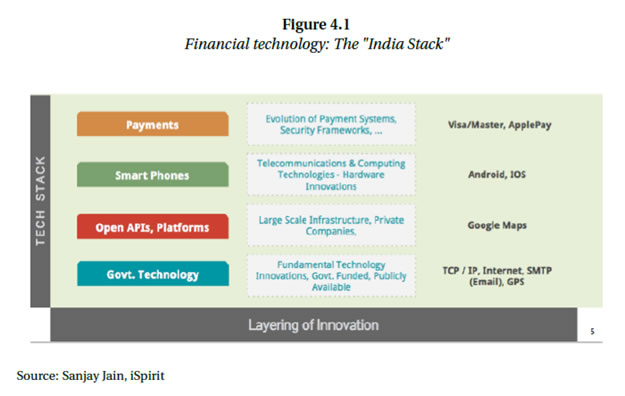

Technological solutions hold significant promise for providing customisation and scalability simultaneously, and technological interfaces can help in depersonalising potentially embarrassing face-to-face interactions when households are making financial decisions. -

Given the cognitive/behavioural issues that we uncover, “nudge” solutions, where sensible default options are provided to households also appear appealing to improve Indian household finance outcomes. These observations lead us in turn to our recommendations, which we view as complementary to those in previous important committee reports in this space. These recommendations are listed in order of how quickly we believe they can be implemented: 1. We propose a set of sector-specific recommendations to improve the functioning of mortgage, collateralised lending, insurance, pensions, and gold markets. We believe that these “old fashioned” recommendations are potentially helpful in fixing obvious gaps in Indian household financial markets, and are an important complement to the technology-based solutions which we also propose. We also propose improvements to official survey data on Indian household finance, in an effort to spur more detailed analysis and research of these issues in the future, and to assist in the implementation of evidence-based policy. 2. At present, financial advice regulations are product-specific and vary across regulators. We make proposals about the current structure of financial advice in India. We suggest a set of standardised norms across regulators for financial advice to be implemented in a phased and unified manner, supported with a fiduciary standard for financial advisors. We propose that the provision of financial advice be clearly separated from the distribution of financial products, and provided in a manner that avoids conflicts of interest. We also discuss the promise of robo-advice, which appears to offer both scale and customisation, which, as discussed earlier, are twin imperatives for Indian household finance. 3. We propose a number of measures to streamline the delivery of and access to financial products that are relevant for Indian households, to eliminate or reduce informal transactions costs, such as filling in forms, bureaucratic impediments such as certification and verification costs, and costs arising from any uncertainty in knowing when approvals will happen. In particular, we propose that the total time and effort taken to engage in the financial market be substantially reduced through a combination of digital end-to-end distribution networks and the movement of know-your-customer (KYC) requirements into purely paperless form (i.e., eKYC). We also propose that regulators and service providers strive to enable quick, cost-effective, and seamless switching between financial service providers. 4. We suggest improvements to the electronic collateralised lending registry (CERSAI) to aid the development of this important market, as well as improvements to the RBI’s recent policies on account aggregation to help households form a comprehensive and integrated view of their financial situation. 5. We describe a minimum set of financial products which Indian households should have in order to effectively harness the benefits of formal financial markets. Many of these products already exist, and indeed, are being delivered to households via government programmes such as PMJDY. Nevertheless, we believe that it is useful to provide this list for several reasons. -

To serve as a checklist that can be used to evaluate progress on participation and use of household financial markets in India. -

Where this is not already the case, products on the list could be made readily available to households, either seeded automatically at the point of PMJDY account opening (or added later to PMJDY accounts as a default but “opt-out” option), or by automatically pre-qualifying households to access all of these products at the point of e-KYC for any single product. -

While households will have access to the essential minimum kit of assets by default, we propose requiring (either or both of) explicit opt-ins and mandatory education before households access more complex products. This is not to inhibit households from portfolio optimization, but rather, to permit an opportunity for households to reflect on whether the added complexity will appropriately serve their needs. -

We recommend additional design features which could simplify access to, or improve the use of, several of the simple products which are currently out in the market. 6. We recognise that technological solutions to household finance problems often rely on households sharing personal data with financial product providers. This raises obvious issues of privacy. While this is not the principal focus of our recommendations, we do provide thinking about a sensible framework for data privacy in Indian household finance, and suggest the adoption of a rights-based privacy framework in contrast with the more common consent-based privacy framework. 7. Finally, we stress the need for flexible regulatory processes to further encourage financial innovation that will benefit households. Towards this aim, we propose the creation of a regulatory sandbox to allow regulators to facilitate small-scale tests by financial technology firms. In such a carefully controlled environment, certain regulations may be temporarily relaxed, and households can be allowed to participate in new products. The goal is to collect empirical evidence which can ultimately lead to better policy solutions, whilst simultaneously evaluating the risk of any new product or technology. Such an institution can provide a structured avenue for regulators to engage with the financial supply-side, develop innovation-enabling regulations, and holds promise to facilitate the delivery of relevant, customised, and low-cost financial products to Indian households.

CHAPTER 1

INDIAN HOUSEHOLD FINANCE: AN INTERNATIONAL COMPARATIVE ANALYSIS The average Indian household holds 84% of its wealth in real estate and other physical goods, 11% in gold and the residual 5% in financial assets. Retirement accounts play a very limited role in household balance sheets, even at the top of the wealth distribution. Indian households continue to accumulate debt as they approach retirement age, and most debt is unsecured (56%), reflecting an unusually high reliance on non-institutional sources such moneylenders. We compare these patterns to those of households in a range of developed and developing countries, using detailed micro-level data from representative national surveys. Households in advanced economies hold substantially more financial assets than their Indian counterparts, are much more likely to finance home purchasing with a mortgage, and allocate a sizeable fraction of their wealth to retirement savings over the course of their lifetime. The variation in household demographic characteristics and wealth explains only a negligible fraction of the difference between India and the rest of the world. The remainder can be attributed to differences in household behaviour, which is partly determined by exposure to the Indian institutional context. Using a calibrated portfolio choice life cycle model, we can only rationalise the large holdings of physical assets at young ages and during retirement by creating another puzzle, which is the lack of significant secured debt take-up and collateralization of household asset holdings. The model also cannot explain the observed prominence of physical assets in middle-age, exactly when the potential for the accumulation of financial wealth would be largest, and the low mortgage loan take-up during young age, when most households expect an upwards-sloping labour income profile. The first item of the terms of reference (ToR) of the committee calls for a benchmarking exercise, where the current depth of household financial markets in India are to be compared to those in other major world markets. To conduct this first analysis, we adopt methodology from Badarinza, Campbell, and Ramadorai (2016), Campbell (2016), and Badarinza, Balasubramaniam, and Ramadorai (2017), and employ multiple waves of the nationally representative All-India Debt and Investment Survey to document the allocation of assets and liabilities of Indian households along the life cycle (i.e., the age distribution) and across the wealth distribution.1 Throughout, we compare these patterns to those of households in a range of developed and developing countries (Australia, China, Germany, Thailand, the U.K., and the U.S.) using detailed micro-data from household surveys in these countries. We find several attributes of Indian households that are distinct in the international context. Our work on the first few points on the ToR can be viewed as providing a rigorous evidence-base and foundation for our ultimate policy recommendations. 1.1 Cross-country comparison: Broad trends HIGHLIGHTS Indian household balance sheets exhibit a set of features that is unusual in the international context: -

A disproportionately high share of wealth allocated to physical (i.e. non-financial) assets, such as gold. -

Under-investment in long-term insurance and pension products. -

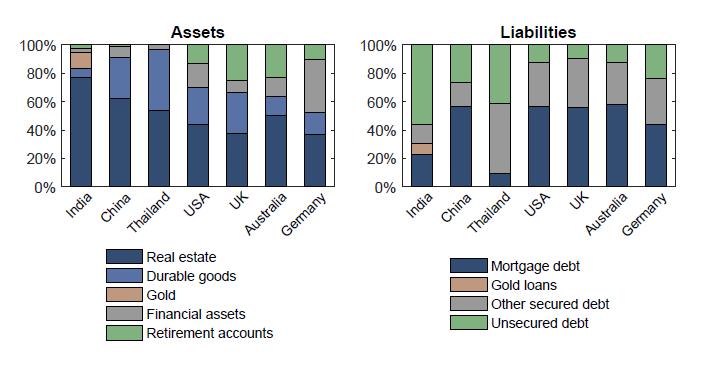

A disproportionally large reliance on unsecured debt, mostly from non-institutional sources (e.g. moneylenders). We begin by comparing the average allocations of household assets across different countries in Figure 1.1. In India, the average household holds 77% of its total assets in real estate (which includes residential buildings, buildings used for farm and non-farm activities, constructions such as recreational facilities, and rural and urban land), 7% in other durable goods (such as transportation vehicles, livestock and poultry, agricultural machinery and non-farm business equipment), 11% in gold and the residual 5% in financial assets (such as deposits and savings accounts, publicly traded shares, mutual funds, life insurance and retirement accounts). Taken together, non-financial assets therefore account for 95% of the household balance sheet, which is identical with the 95% for Thai households, and only slightly higher than the corresponding 91% for Chinese households. However, the average Chinese household has a relatively lower share of real estate wealth (62%), a higher share of durable assets (28%), and negligible amounts of gold (0.4%). Furthermore, household allocation choices are very different in India, Thailand and China when compared with more advanced economies. On average, holdings of real estate account for low fractions of wealth in countries such as the US (44%), and particularly Germany (37%). Households in advanced economies hold substantially more financial assets than their Indian counterparts. In addition, households in these economies allocate a sizeable fraction of their wealth to retirement savings over the course of their lifetimes, for example, retirement assets account for relatively large shares of wealth in Australia (23%), and the UK (25%). The two trends are related, in the sense that state-sponsored schemes appear to act as a substitute for private savings in retirement accounts, but potentially as a complement to private savings in non-retirement financial assets. The German case illustrates this effect particularly well. Since the German retirement system is mostly based on state-sponsored defined-benefit pensions, households in Germany only save small amounts in private retirement accounts, and invest larger amounts in financial assets such as sight deposits, government bonds, publicly traded shares, and mutual funds. The liabilities of Indian households also exhibit distinct patterns relative to other countries. Figure 1.1 reports the average allocation of liabilities across all households that carry a positive amount of debt at the date of the survey. Mirroring the dominance of real estate as the dominant component of wealth, we find that mortgage loans are households’ largest liability in China, the US, the UK, and Australia. In these countries, the average household’s mortgage holdings account for close to 60% of their total debt exposure. Germany is an exception to this rule (the share of mortgage debt is 44%), which is not surprising given the low homeownership rate and the relative preference for renting over owning in the German population. However in India, despite the prominent role of non-financial assets in the household balance sheet, mortgage loans account for only a small part of total liabilities (23%) and the role of other secured debt (such as vehicle loans and instalment credit for durable goods) is well below the levels observed in other countries, particularly Thailand. The high average level of home equity held by Indian households is important, and suggests a strong investment motivation for real estate purchases in addition to the usual consumption motivation. Of course, the consumption motivation may also be high in an environment of poor contract enforcement, and suggests that measures to improve the private rental market may have a non-negligible impact on the physical asset share. Instead of secured debt, most Indian household debt is unsecured (56%), which as we will see, also reflects an unusually high reliance of Indian households on informal, non-institutional sources of lending such as moneylenders and intra-family loans. We also document a non-negligible role for gold loans (7.6%), which are a unique feature of the Indian market, and absent from other countries, suggesting that gold plays a dual role as an investment asset as well as a store of collateral value for Indian households. These conclusions are also apparent when averages are computed by wealth-weighting across households rather than equally-weighting across households. This suggests that for India (and China) unsecured debt (including gold loans, for India) also matter in the aggregate. Quantitatively, unsecured loans account for 23% of total debt in China and 39% in India, while they play a negligible role in the financial systems of developed countries (with the exception of the US, where households rely relatively more on short-term debt for both daily expenses and for purchases of durable consumer goods). These aggregate patterns are interesting, but there is also significant variation in allocations along Indian households’ life cycles, and across the wealth distribution. We describe how these patterns make the distinct features of the aggregate allocations in India a potential cause for concern, as they suggest that Indian households may face significant constraints which impede them from participating optimally in financial asset and liability markets. 1.2 Participation in financial markets HIGHLIGHTS -

Indian households are exceptional in the international context, as there is no reduction in their holdings of physical assets as they pass retirement age - unlike in countries such as the UK, Australia, Germany, and China. -

The participation rate of Indian households in financial assets is well below the one observed in developed countries. This pattern has been recognised and there has been a sustained drive to spread banking to the unbanked. -

The important distinction between access and use needs to be considered carefully when formulating policy – simply extending access to banking services is unlikely to be sufficiently effective on its own. The overall allocations described in the previous section mask important patterns evident along the lifecycle of Indian households and across the wealth distribution. Uncovering these patterns is important for two reasons. First, India is an extraordinarily diverse country along many dimensions, and so we need to be able to coherently capture the diversity of household experiences. Moreover, different household finance problems may manifest themselves at a) different points in the wealth distribution, and b) at different ages. For an example of the former, we find that poorer households in India have significantly lower allocations to any form of retirement savings than their counterparts overseas, which further highlights the need for some mechanism to address these needs. An example of the latter is that we detect a rising pattern of indebtedness with age in both secured and unsecured loans in India, which is unusual both from the perspective of theoretical optimization as well as from the cross-country comparison. In other countries, there is a more natural hump-shaped pattern of indebtedness as households borrow presumably to smooth consumption over their lifetimes. Figure 1.2 illustrates these and other patterns across the age distribution of Indian households. Only 65% of Indian households in which the household head is younger than 35 years of age hold any financial assets. This participation rate increases to 77% for more mature households, but remains well below the rate of financial asset market participation observed in developed countries, where close to all households own at least one bank account and use formal financial products as the preferred means of savings.2 While the drive to bank the unbanked in India holds great promise, it is worth noting the massive popularity of physical assets. In both China and India, the rate of participation in land and housing assets is 78% for the lowest age cohort and increasing to roughly 95% for households that are close to retirement. However, Indian households are exceptional in the international context, as there is seemingly no reduction in their holdings of real estate as they pass retirement age, unlike in countries such as the UK, Australia, Germany, and China. This is probably the consequence of “joint family” households in which multiple-generations co-exist, in which land and residential properties constitute a significant share of bequests and inter-generational wealth transfers. The patterns in the assets of Indian households are also distinct across the wealth distribution. In terms of participation, only 55% of the poorest households hold any financial assets (see Figure 1.3). This number rises to 90% for the richest population group, but is still well below the fraction participating in developed countries. Turning to non-financial asset holdings, one particular finding stands out. At the very bottom end of the wealth distribution, 60% of Indian and Chinese households have ownership over land or buildings, while in Germany, the UK and Australia, this number is less than 1%. At least part of this observation can be attributed to the very different nature of what is considered and recorded as ownership of real estate across these countries. The average value of the main residence in the bottom quintile group of Indian households is equal to ₹ 22,000, which is significantly lower than the lowest percentile of the value of the main residence in Germany (₹ 15 lakh) or the US (₹ 3.7 lakh). In India and China, the urbanisation rate is much lower, rental markets are virtually absent, and agricultural work is widely prevalent. We explore these issues using a number of alternative datasets, as we describe later in this report. Turning to the liabilities of Indian households in Figure 1.4, mortgage indebtedness is particularly low across the age distribution in India in comparison with other countries except Thailand. Especially during peak earnings years, very few households take mortgage loans in the international comparative context throughout the lifecycle. However, surprisingly, the participation rate of older households and retirees is comparable to that in Australia and the UK. This suggests that Indian households take on relatively higher financial burdens towards the end of life, probably reflecting intergenerational transfers. This under-penetration of mortgages despite high reliance on real estate is an important issue, and we explore it in greater detail in other chapter of this report. Part of the issue is that Indian households are extremely debt-averse, but there are also frictions in mortgage markets impeding easy access to this important source of borrowing, which allows smoothing of consumption across the lifecycle. In response to point iii) in the ToR, the report will go on to investigate whether and to what extent Indian household balance sheets reflect deviations from optimal financial allocations, or indeed signal the presence of behavioural anomalies. To some extent, these patterns may also reflect underlying constraints of households, and in response to points iv) and v), we consider the extent to which specific types of financial products can improve the observed allocations of Indian households. However, we first turn to a brief description of the pattern of household assets and liabilities, conditional on participating in these markets. 1.3 Allocation of wealth HIGHLIGHTS -

The largest fraction of the wealth of young households in India is in the form of durable goods and gold. The largest share of wealth as Indian households approach retirement is held in land and housing. -

Financial assets and pensions account for a very low portion of the total balance sheet even for the rich. -

Unsecured debt accounts for two-thirds of total liabilities for the very poor, and one-third for the rich. In the previous section, we considered the extent to which Indian households participate in particular types of assets and liabilities. This is admittedly an important question, and improvements along this dimension are clearly a government priority, as can be seen from PMJDY. However, it is equally important, and perhaps even more relevant for households’ well-being that when they do participate in financial markets, that they do so efficiently. This is because the benefits of participation can quickly turn into costs if participation is inefficient (see, for example, Campbell, 2006). This is essentially the distinction between access and use of financial instruments. We find four broad patterns here. First, the exposures of Indian households to the real estate sector are higher in all population sub-groups. The difference from other countries is particularly striking for poorer cohorts. Second, we find that households continue to accumulate mortgage debt as they approach retirement age, which can potentially lead to larger inter-generational transfers of liabilities. Third, we find that retirement assets play a very limited role, even for households at the top of the wealth distribution. Fourth, the prevalence of non-institutional debt is high for poorer households, but it decreases for relatively richer segments of the population, although even wealthier households who take on debt hold high fractions of unsecured liabilities. This tendency to take on unsecured liabilities at the bottom end of the wealth distribution is primarily associated with loans for productivity/working capital purposes, but worryingly, is highly likely to be from high-cost non-institutional sources. In Figure 1.5, we can see that the patterns of participation on the assets side of the balance sheet are mirrored in the allocations conditional on participation. In contrast with the advanced economies, a large fraction of the wealth of young households in India and China is in the form of durable goods and gold, and most of their wealth as they approach retirement comprises land and housing. It is notable that financial assets and pensions account for a very low portion of the total balance sheet even for the rich (3.7%). Instead, we observe a pronounced substitution effect between durable goods, gold, and real estate. Poor households own more of the former two assets, and richer households move away from these assets and towards real estate, but in a manner that leaves the total share of assets in physical form relatively fixed. This is somewhat unusual - in the UK, and the US for example, wealthier households hold larger shares of financial assets, but this pattern is not seen in India, suggesting that there are important factors impeding financial market participation even for the wealthy. On the liabilities side, we note that India is the only country in which mortgages account for an increasing share of total liabilities as people approach retirement age, suggesting a relatively large debt exposure beyond retirement age. For households in developed countries, the share of mortgage debt relative to total liabilities follows a hump-shaped pattern along the life cycle (see Figure 1.2), which implies that the financial burden of home-ownership is shifted towards the period in the life cycle when it is easiest to bear, and in keeping with standard consumption-smoothing motivations. In addition, the overall relative share of mortgage debt in total liabilities remains lower in India than in China across all parts of the population, with the gap narrowing only at the very top. Moreover, unlike in developed countries, where secured debt backed by vehicles and consumer goods seems to be the preferred alternative to mortgage debt, in India unsecured debt accounts for close to two-thirds of total liabilities for the very poor and one-third for the rich. The picture that emerges is one in which Indian households are relatively less indebted than their foreign counterparts, but those that take on debt are more likely to have no collateral to secure it, which leaves them exposed to repayment risk even in old age. While the cross-country and cross-state statistics that we have generated suggest that there are indeed significant deviations from desirable allocation and behaviour, we attempt to more rigorously answer question iii) on the ToR. 1.4 Understanding international allocation differences HIGHLIGHTS -

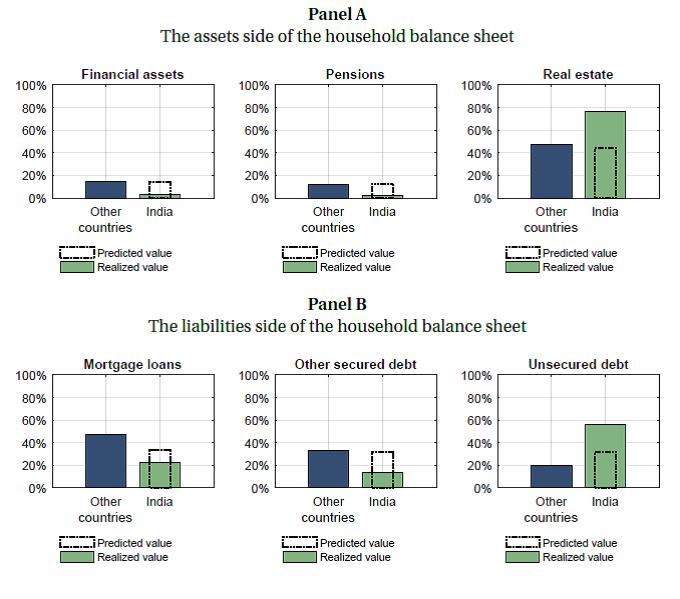

Indian household demographic characteristics and wealth levels explain a negligible fraction of the differences between Indian household portfolios and those observed in the rest of the world. The remainder can be attributed to differences in Indian household financial behaviour, partly determined by exposure to the Indian institutional context. -

Demographic characteristics and wealth levels explain a large part of the differences between Indian household credit product choices and those observed in the rest of the world. This suggests that economic development will correct at least some of the imbalances noted on the liabilities side of the Indian households’ balance sheets. To understand the role of the demographic profiles and wealth levels in explaining why Indian households’ allocations differ from the international comparator countries, we decompose the observed average shares of assets and liabilities into a component that is explained by household characteristics, and the residual component, which we broadly attribute to differences in the behaviour of Indian households relative to their counterparts in other countries. We calculate counter-factual values of shares of assets and liabilities under the assumption that Indian households behave exactly like their counterparts from other countries, using a four-step procedure. We start by expressing the wealth levels of households from other countries in 2012 equivalent Indian rupees. For example, to calculate the equivalent rupee value of the wealth of a US household surveyed in 2010, we multiply the observed US dollar value with the total gross US inflation rate between 2010 and 2012, and with the average bilateral exchange rate between Indian rupees and US dollars in 2012. We then attach equal weights for all countries, but carefully preserve the population weighting structure within each country. We then construct within-country quintile categorical variables, which capture the positions of households in their own country’s distributions of ages and wealth levels, and across-country quintile categorical variables, which capture the positions of households in the world distributions of ages and wealth levels. For each asset and debt share, we run two identical analyses for India and for the ’rest of the world’, with both within- and across age and wealth quintile categorical variables as explanatory variables. To obtain counter-factual ’predicted’ values for India, we multiply the explanatory variables obtained for India with the estimated coefficients from the ’rest of the world’. The results of this decomposition, reported in Figure 1.6, show that when looking at the asset side of the balance sheet, the variation in household demographic characteristics and households’ wealth explains only a negligible fraction of the difference between India and the rest of the world. The remainder can be safely attributed to differences in behaviour, which is also determined by households’ exposure to the Indian institutional context. To the contrary, when turning to the liabilities side, we find that demographic and economic characteristics explain 50% of the difference between the mortgage share in India and the other countries in our sample, and 32.5% of the difference in the share of unsecured debt. As the Indian economy grows, and household wealth (in absolute terms) approaches that observed in other countries, the mortgage share will likely increase, and the share of unsecured debt can be expected to decrease. Nevertheless, a large part of the difference between the asset portfolio allocation and mortgage indebtedness of Indian households, relative to their counterparts from other countries, still remains unexplained. To explore whether the allocation of household wealth and liabilities can be rationalised in the context of the particular institutional framework in India, we build a life cycle model of optimal household decisions in the next section. 1.5 Theory: Optimal decisions along the life cycle HIGHLIGHTS -

Benchmark theoretical models predict high participation rates in financial assets throughout the life cycle, a relatively larger prevalence of debt for younger cohorts, and a reduction of both assets and liabilities as people approach retirement. These implications are difficult to reconcile with the observed empirical patterns of behaviour for Indian households. -

We construct a life-cycle model of household behaviour and calibrate it to Indian data. -

Rational portfolio optimization cannot explain Indian households financial allocations. While it is difficult to capture the diversity of preferences, constraints and institutional arrangements that households face in a single theoretical framework, there are some relatively universal implications delivered by all benchmark models in the field of household finance about optimal decisions along the life cycle. (i) All households should participate in financial markets, saving a strictly positive amount in risky assets such as publicly traded stocks, (ii) The portfolio exposure to risky assets should be largest in young age and drop off substantially as people approach retirement, (iii) Most debts should be incurred during the first years of activity in the labour market, (iv) Mortgages are generally the largest household liabilities, and (v) Savings of both financial and non-financial assets should substantially reduce as people age. To some degree, all of these predictions are different from the observed patterns of behaviour for Indian households. One possible reason is that the parameters that have been previously used to calibrate theoretical models do not adequately capture the institutional situation in India. Our theoretical analysis therefore begins with a calibration exercise which uses Indian data to estimate conditional survival probabilities along the life cycle, the dynamics of expected income, and the profiles of financial market risk and return (see Figure 1.7). We have constructed and calibrated a lifecycle portfolio choice model of household financial decisions, which we are using to explore whether the observed empirical patterns can be reconciled with theoretically optimal predictions. We note that the model is selected to have a useful role for durable goods, thus giving it the best possible chance of models in this class to rationalise the patterns we detect in Indian household data. The model economy is assumed to be comprised of agents that live up to a maximum of T = 100 years. For each age group, the remaining life span is uncertain, and given by the conditional probability of survival. In each period, the household head receives labour income, which is randomly shocked using draws from a probability distribution. We assume the household is exposed to two types of such labour income shocks: temporary shocks, e.g. minor health issues, or a financial bonus, have only a transitory effect on the financial situation of the household, limited to just a few months; permanent shocks, such as an accident, physical disability, a significant promotion or a shift in occupational status, have a much more pronounced long-term impact. We choose to distinguish between education groups because this type of variation is measured without noise and we need a parsimonious specification to discuss the heterogeneity of household finance decisions across the Indian population. Of course, the heterogeneity across education groups also captures variation across occupation categories, regions of residence, and employment sectors. Households are risk-averse and choose to save some of the income they receive, and to consume the rest. They derive consumption utility from pure consumption goods such as food, but also durable goods such as residential real estate, vehicles, mobile phones and gold. For their savings in the form of financial assets, households earn a risk-free return. The value of durable goods depreciates at a constant rate in each period. Households can take on unsecured debt, i.e. credit contracts simply backed by their future labour income, and also secured debt, where their stock of durable goods serves as collateral for a loan. Importantly, we assume that durable goods are also illiquid, and households pay an adjustment cost whenever purchasing or selling them. In each period, a strict collateralization constraint guarantees full repayment, i.e. we assume that agents do not default on their payments, but they can roll over any debt indefinitely. Figure 1.8 illustrates the optimal decisions of Indian households, as implied by the life cycle model. The two panels report the average levels of net financial assets (i.e. the difference between investments and debt) and physical assets (i.e. real estate, vehicles and gold), for different age groups. In the early years of household formation, the accumulation of financial assets is slow, and most households are indebted, to be able to afford investments in real estate and other durables. More wealth is accumulated towards the middle age, a large part of which continues to be in physical form. In the top panel of Figure 1.9, we calculate the allocation profiles of wealth for the average household explicitly. The profiles are similar across all education groups. First, the relative share of physical assets is larger at the beginning of life. The first ten years in the labour market, when the income profile is generally expected to be upwards-sloping, is a period in which it makes sense to invest in durable goods, and to enjoy the utility associated with them for long periods of time thereafter (e.g. an apartment, a transportation vehicle, or gold jewellery). Second, in middle age, the share of physical goods is gradually decreasing, allowing for the accumulation of financial wealth. Finally, after retirement, financial wealth is drawn down more rapidly than physical wealth, which increases the relative allocation towards physical wealth. The bottom panel reports the optimal share of the population that participates in the debt market. Consistent with the significant role of physical assets at the beginning of life, we find that this is the period when most households incur substantial liabilities. Importantly, our results suggest that later in life, and especially during retirement, it is optimal to use products that resemble a reverse mortgage arrangement. The property or physical asset is still retained in the possession of the household, but it is used as collateral for loans, to insure a steady stream of consumption utility. In retirement, uneducated households should be the primary beneficiaries of reverse mortgage-type of products, because they did not have the chance to accumulate high levels of financial wealth that can be easily liquidated. Put differently, the model uncovers that the puzzle can be shifted elsewhere. Even if Indian households rationally choose to hold high levels of physical assets, they are foregoing consumption smoothing opportunities by not collateralising those assets and extracting liquidity, especially later in life. This calls into question why the reverse mortgage market isn’t functioning at far higher rates of utilization in the country than we observe. Figure 1.9 also compares the optimal allocations described above with the actual ones, observed in survey data. We can rationalise the predominant role of physical assets below 35 years and during retirement, but the model implies a much larger exposure to financial assets during middle age. Similarly, we find that more households should hold positive amounts of debt during their first years in the labour market, compared to what we currently observe in the Indian economy. In Figure 1.10, we analyze the counter-factual case in which the return on financial assets is perceived to be very low (1% per year). This leads to a high share of physical goods for all education groups and at all ages. However, the additional implication is that virtually the entire Indian population should participate in the credit market, continuously ‘financializing’ or ‘liquidating’ at least part of the high holdings of physical wealth, to better smooth consumption along the life cycle. This is in striking contradiction to what is currently observed in the market. Overall, we are able to rationalise the large holdings of physical assets at young ages and during retirement, but only by shifting the puzzle. Households should substantially decrease their overall wealth levels after retirement, de-cumulating financial wealth and entering into credit contracts of the reverse mortgage type. Instead, what we observe in the data is that both financial assets and especially physical assets continue to be accumulated as people age. Second, it remains difficult to rationalise the observed prominence of physical assets in middle-age, exactly when the potential for the accumulation of financial wealth would be largest. Third, this part of the analysis suggests the presence of very significant market frictions that prevent mortgage loan take-up during young age, when most households expect an upwards-sloping labour income profile. Instead, most debt in India tends to be unsecured, especially during the early years of labour market activity. In the next chapter, we show that the problem is actually worse. A large part of the unsecured debt that Indian households hold is sourced from non-institutional sources, and that the motive for borrowing has a lot to do with unexpected household events such as loss of crops and livestock, medical emergencies, and the effects of natural disasters. We start by discussing the heterogeneity of these patterns across states and population sub-groups and proceed to estimate potential household gains that are associated with a re-allocation of assets and liabilities within the household portfolio. Figure 1.1

Country comparison: Allocation of household assets and liabilities As documented in Badarinza, Balasubramaniam and Ramadorai (2016b), we compare the average allocations of household assets across countries. The data sources are the All India Investment and Debt Survey (2012 wave), the Chinese Household Finance Survey (CHFS, 2012 wave), the Townsend Thai Survey (TTS, 2012), the US Survey of Consumer Finances (SCF, 2010 wave), the UK Wealth and Assets Survey (WAS, 2012 wave), the Australian Household, Income and Labour Dynamics Survey (HILDA, 2010 wave), and the Eurosystem Household Finance and Consumption Survey (HFCS). Real estate includes land, buildings and other constructions owned by the household, for residential, commercial or vacation purposes. Durable goods include vehicles and other transport equipment, valuables, works of art and carpets, livestock and poultry, agricultural machinery, and other farm and non-farm equipment. Gold includes jewellery, bullion, ornaments and coins. Financial assets include bank deposits, publicly traded shares and government securities, mutual funds, managed accounts, and loans receivable by the household. Retirement accounts include private pension accounts, provident funds, annuity certificates, and life insurance accounts. Mortgage debt includes loans using land or real estate as collateral. Other secured debt includes loans secured by a third party, and loans using crops, shares of companies, government securities, or insurance policies as collateral. Gold loans use bullion and ornaments as collateral. Unsecured debt includes all loans classified as personal security, which are not backed up by any collateral, such as unsecured loans from money lenders, loans from family and friends, credit cards, and overdraft facilities. We compute weighted population averages across households using representative population weights, as indicated in each survey.  Figure 1.2

Participation in financial markets along the life cycle As documented in Badarinza, Balasubramaniam and Ramadorai (2016b), this figure reports the shares of the population that hold positive amounts of different assets and debt classes. The data sources are the All India Investment and Debt Survey (2012 wave), the Chinese Household Finance Survey (CHFS, 2012 wave), the Townsend Thai Survey (TTS, 2012), the US Survey of Consumer Finances (SCF, 2010 wave), the UK Wealth and Assets Survey (WAS, 2012 wave), the Australian Household, Income and Labour Dynamics Survey (HILDA, 2010 wave), and the Eurosystem Household Finance and Consumption Survey (HFCS). We compute weighted population averages across households using representative population weights, as indicated in each survey. Figure 1.3

Balance sheet allocation of household assets As documented in Badarinza, Balasubramaniam and Ramadorai (2016b), this figure reports the average shares of different asset classes, relative to total household wealth. The data sources are the All India Investment and Debt Survey (2012 wave), the Chinese Household Finance Survey (CHFS, 2012 wave), the Townsend Thai Survey (TTS, 2012), the US Survey of Consumer Finances (SCF, 2010 wave), the UK Wealth and Assets Survey (WAS, 2012 wave), the Australian Household, Income and Labour Dynamics Survey (HILDA, 2010 wave), and the Eurosystem Household Finance and Consumption Survey (HFCS). We compute weighted population averages across households using representative population weights, as indicated in each survey. Figure 1.4

Participation in financial markets across the wealth distribution As documented in Badarinza, Balasubramaniam and Ramadorai (2016b), this figure reports the shares of the population that hold positive amounts of different assets and debt classes. The data sources are the All India Investment and Debt Survey (2012 wave), the Chinese Household Finance Survey (CHFS, 2012 wave), the Townsend Thai Survey (TTS, 2012), the US Survey of Consumer Finances (SCF, 2010 wave), the UK Wealth and Assets Survey (WAS, 2012 wave), the Australian Household, Income and Labour Dynamics Survey (HILDA, 2010 wave), and the Eurosystem Household Finance and Consumption Survey (HFCS). We compute weighted population averages across households using representative population weights, as indicated in each survey. Figure 1.5

Balance sheet allocation of household liabilities As documented in Badarinza, Balasubramaniam and Ramadorai (2016b), this figure reports the average shares of different debt classes, relative to total household liabilities. The data sources are the All India Investment and Debt Survey (2012 wave), the Chinese Household Finance Survey (CHFS, 2012 wave), the Townsend Thai Survey (TTS, 2012), the US Survey of Consumer Finances (SCF, 2010 wave), the UK Wealth and Assets Survey (WAS, 2012 wave), the Australian Household, Income and Labour Dynamics Survey (HILDA, 2010 wave), and the Eurosystem Household Finance and Consumption Survey (HFCS). We compute weighted population averages across households using representative population weights, as indicated in each survey. Figure 1.6

Cross-country comparison: Blinder-Oaxaca decomposition This figure reports predicted values for the average shares of assets and liabilities of Indian households, under the assumption that Indian households behave like their counterparts in other countries. We first express the wealth levels of the surveyed households from China, Thailand, USA, UK, Australia and Germany in 2012 equivalent Indian Rupees, using bilateral exchange rates and inflation levels in respective countries and years. We then construct within-country quintile dummies, which capture the positions of households in their own country’s distributions of ages and wealth levels, and across-country quintile dummies, which capture the positions of households in the world distributions of ages and wealth levels. For each asset and debt share, we run two identical regressions for India and for the ’rest of the world’. We include within-country age and wealth level quintile dummies, and across-country age and wealth level quintile dummies as explanatory variables. To obtain counter-factual ’predicted’ values for India, we multiply the values of the explanatory variables for Indian households with the estimated coefficients from the ’rest of the world’. We compute weighted population averages across households using representative population weights, as indicated in each survey.  Figure 1.7

Model calibration parameters This figure reports the life cycle profiles of the parameters used to calibrate the household portfolio choice model for India. Panel A shows the evolution of survival probabilities for each age years, conditional on survival until the previous age year. Panel B shows the evolution of average family income profiles by education groups. The profiles are constructed by fitting a third-degree polynomial through the coefficients on the age dummies in a cross-sectional regression of family income on ages. Income after 70 is the median income of households whose heads are over 70. The profiles are smoothed through linear interpolation to insure continuity of the model functions. For easier interpretation, we normalize the absolute values by dividing through the average yearly income level in the population. The data comes from the second wave of the India Human Development Survey, 2015.

Figure 1.8

Model-implied life cycle profile for Indian households We construct and solve a portfolio choice life cycle model of optimal household behaviour. In each period, households receive labour income and decide optimally on how to allocate their available resources across a set of consumption goods, financial assets and durable goods, such as houses and gold. We calibrate the model with income life cycle profiles for the Indian economy, for three education groups (below primary school, primary or secondary school degree, and college degree), survival probabilities, and market parameters characterizing the constraints and market conditions that Indian households face. We simulate N=50,000 life cycle profiles. In the figure below, we report average holdings of financial assets and durable goods, for each age-education group. For easier interpretation, we normalize the absolute values by dividing through with the average yearly income level in the population. Figure 1.9

Model implications vs. observed household behaviour The top panel of this figure compares the allocations of household wealth that are implied by the portfolio choice life cycle model, with the observed allocations of Indian households. The source of the empirical data is the 2012 wave of the All India Debt and Investment Survey (AIDIS), which is representative for the entire country. In the data, the physical assets share is calculated as the sum of real estate wealth, durable goods and gold, normalized by the total household wealth level. The bottom panel reports the model-implied and the actually observed participation rate in the debt market. Both in the model and in the data, total household debt includes both secured and unsecured credit products. We compute weighted population averages across households using representative population weights, as indicated in the survey. Figure 1.10

Counter-factual scenario: Low return on financial assets The top panel of this figure compares the allocations of household wealth that are implied by the portfolio choice life cycle model with the observed allocations of Indian households. We calibrate the model assuming a counter-factual return on financial assets equal to r = 1%. The source of the empirical data is the 2012 wave of the All India Debt and Investment Survey (AIDIS), which is representative for the entire country. In the data, the physical assets share is calculated as the sum of real estate wealth, durable goods and gold, normalized by the total household wealth level. The bottom panel reports the model-implied and the actually observed participation rate in the debt market. Both in the model and in the data, total household debt includes both secured and unsecured credit products. We compute weighted population averages across households using representative population weights, as indicated in the survey.

CHAPTER 2

UNDERSTANDING INDIAN HOUSEHOLD FINANCIAL DECISIONS This chapter documents the trade-offs and frictions that affect the financial decisions of Indian households, and the ways in which they can lead households to sub-optimal behaviour. First, we observe substantial heterogeneity in the allocation patterns of assets and liabilities in balance sheets across Indian states. Second, we find that households simply shift gold holdings towards real estate, and do not increase their wealth allocation to either financial assets or retirement accounts, even as they move towards the top of the wealth distribution. Third, we document a strong link between the insufficient take-up of insurance products and the reliance on non-institutional sources of unsecured credit. Finally, we document significant financial vulnerabilities implied by an ageing population, and demonstrate the potential for financial gains from changes in household behaviour. We estimate financial gains for three scenarios: a shift of resources of 25% of gold holdings to financial assets, a full replacement of non-institutional with institutional debt, and a shift to full coverage of medical costs through health insurance. For the median household, such changes in behaviour can lead to financial gains equivalent to an upwards movement of 3.5 pp, 3.8 pp, and 0.9 pp along the wealth distribution, over a period of 10 years. 2.1 Heterogeneity across Indian states HIGHLIGHTS -

The availability of resources and the sources of debt are very different across Indian states. -

Some states (e.g., Maharashtra, Karnataka and Tamil Nadu) have high levels of life insurance participation, while in others (e.g. Madhya Pradesh and Chattisgarh) participation is very low. -

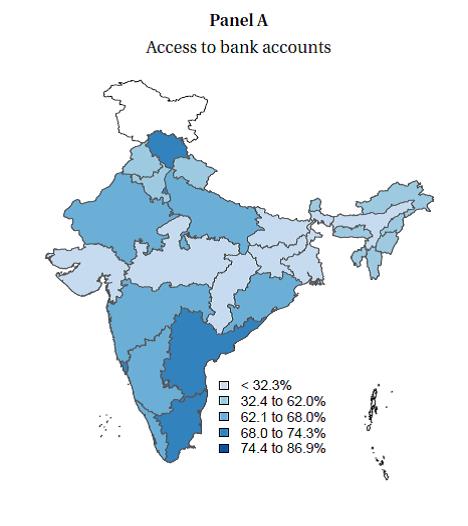

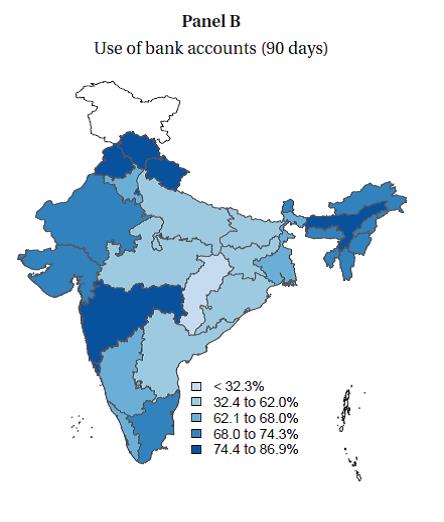

In states such as Tamil Nadu, households store a high fraction of their wealth in gold, and also have more than 40% of their total debt in the form of gold loans. India has enormous heterogeneity in a number of dimensions: geographical, linguistic, and cultural. We explore the extent to which Indian household balance sheets also vary across states of India, and find that there are significant differences across households located in different states, even after controlling for households’ demographic characteristics. In both participation and allocation, we observe substantial heterogeneity in the patterns of assets and liabilities in household balance sheets across Indian states (see Table 2.1). For example, a (relatively poor) state like Bihar has households with barely no financial assets, while cities/union territories such as Chandigarh have the highest levels of financialization of the household balance sheet. Another important example is that in Tamil Nadu, households hold relatively large amounts of gold, followed closely by Andhra Pradesh. These high gold holdings in Southern Indian states suggest that strong cultural factors may also be at play in these cross-state patterns. Large differences can also be observed in patterns of debt allocation. While poor states such as Bihar have nearly all of their loans as unsecured debt and almost all of it originated from non-institutional sources, states such as Goa have only small amounts of unsecured loans, as well as low fractions originated from non-institutional sources. Moreover, in states such as Tamil Nadu, where households store a high fraction of their wealth in gold, they also have more than 40% of their total debt in the form of gold loans – further suggesting that gold plays multiple roles in household balance sheets, and that solutions to sub-optimally high gold holdings will need to consider these different dimensions of its use. Even in the prevalence of simple bank accounts, we see wide dispersion across states. Figure 2.1 shows data from a nationally representative survey (Financial Inclusion Insights Survey, 2015), and documents substantial heterogeneity by states in terms of the participation rates in access and use of bank accounts. The correlation between access and use of bank accounts in India is 0.59, which is not particularly high, suggesting that while the drive to provide bank accounts to the unbanked is a promising policy, it needs to be supplemented with policies to promote effective use of finance amongst Indian households.1 One of the most striking observations from the previous chapter is the predominance of physical assets in the portfolio of household wealth, and a very limited role for financial assets. Of course, this pattern has been recognised by the Indian government, and there has been an important drive in India to spread banking to the unbanked. The recent policy push for universal coverage of bank accounts through the Pradhan Mantri Jan Dhan Yojna (PMJDY) has had a significant impact on households in India. Figure 2.3 presents trends in coverage and use of PMJDY accounts obtained from a submission to the committee by the largest scheduled commercial bank, the State Bank of India (SBI). The rapid decline in the fraction of accounts with non-zero balances do not necessarily mean that these accounts are being transacted in frequently. Around 33% of the PMJDY accounts were second accounts opened for individuals, and hence about 28% of these accounts lay dormant. Agarwal, Alok, Ghosh, Ghosh, Piskorski and Seru (2017) show that about 77% of the bank accounts (as of November 2016) maintain a positive balance and usage increases over time with inward and outward remittances being the most common type of transaction conducted with bank accounts. Importantly, they present evidence that is consistent with learning by individuals – lendings (and defaults on new loans) increase in regions with low ex-ante access to banking services, which suggests that supplying Indian households with bank accounts has created new demand for formal banking credit from households that were previously unbanked. In related work, Chopra, Prabhala and Tantri (2017) show that the extent of transactions using bank accounts increases as accounts age and that they converge or exceed levels in non-PMJDY accounts of similar vintage.2 The objective of universal access to banking services driven by a state-led initiative has enabled two important possibilities for households in India. It allows for households to create formal credit histories, which in turn increases their potential for future access to debt at lower rates of interest. Some evidence for such supply creating future demand for financial services has been documented in Chopra, Prabhala and Tantri (2017). Second, it allows households to learn and build experience with the formal financial system. Some evidence of this is also documented in Agarwal, Alok, Ghosh, Ghosh, Piskorski and Seru (2017). These findings suggest that some form of product push does hold promise, especially for low income households to benefit from accessing the formal financial system. However, as we will document later, there is an important distinction between access and use that needs to be considered carefully when formulating policy in this area. Figure 2.2 turns to another important financial instrument which households also use, and shows that there is substantial geographic heterogeneity in the uptake of life and non-life insurance products in India. While some states of India (e.g., Maharashtra, Karnataka and Tamil Nadu) have higher levels of life insurance participation, states such as Madhya Pradesh and Chattisgarh have very poor penetration rates for life insurance. Similarly, non-life insurance products that hedge against common shocks such as accidents and poor rainfall have literally no take-up in states where we ex ante believe that they will be most relevant – for example, despite historical levels of drought in Andhra Pradesh, non-life insurance levels are abysmally low. However, solutions are not completely straightforward. The appropriate use of financial services, in contrast with access, may be far more challenging than simply endowing every individual in the country with a suite of financial assets. 2.2 Household behaviour: a detailed analysis HIGHLIGHTS -

As they become richer, households trade off gold holdings for real estate. They do not increase their wealth allocation to either financial assets or retirement accounts. -

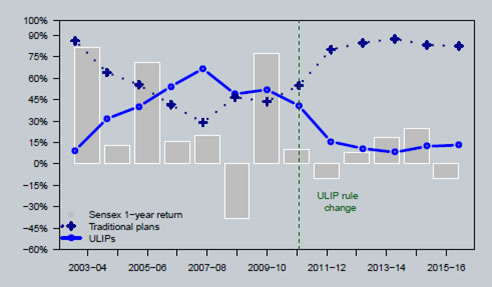

Formal bank loans are almost irrelevant as a means to cope with unexpected emergencies. Instead, we document a trade-off between the take-up of insurance products and the reliance on non-institutional sources of unsecured credit. -