[Under Section 45ZL of the Reserve Bank of India Act, 1934] The ninth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the amended Reserve Bank of India Act, 1934, was held on February 6 and 7, 2018 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the amended Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:– - the resolution adopted at the meeting of the Monetary Policy Committee;

- the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and

- the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting.

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to: - keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.0 per cent.

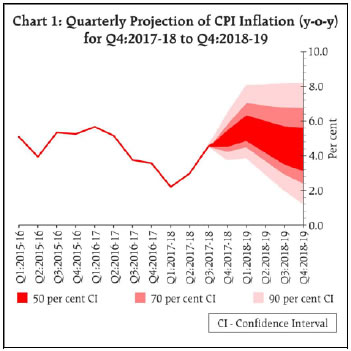

Consequently, the reverse repo rate under the LAF remains at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.25 per cent. The decision of the MPC is consistent with the neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 6. Since the MPC’s last meeting in December 2017, global economic activity has gained further pace with growth impulses becoming more synchronised across regions. Among advanced economies (AEs), the Euro area expanded at a robust pace, supported by consumption and investment. Economic optimism alongside falling unemployment and low interest rates are supporting the recovery. The US economy lost some momentum with growth slowing down in Q4 of 2017 even as manufacturing activity touched a multi-month high in December. The Japanese economy continued to grow as manufacturing activity gathered pace in January on strong external demand, providing fillip to the already bullish business confidence. 7. Economic activity accelerated in emerging market economies (EMEs) in the final quarter of 2017. The Chinese economy grew above the official target, driven by strong domestic consumption and robust exports. However, some downside risks to growth remain, especially from easing fixed asset investment and surging debt levels. In Russia, strong private consumption, rising oil prices and high exports are supporting economic activity, although weak investment and economic sanctions are weighing on its growth prospects. In Brazil, data on household spending and unemployment were positive in Q4. However, recovery remains vulnerable to political uncertainty, which has dampened consumer confidence. South Africa continues to face challenges on both domestic and external fronts, including high unemployment and declining factory activity. 8. Global trade continued to expand, underpinned by strong investment and robust manufacturing activity. Crude oil prices touched a three-year high as production cuts by the OPEC coupled with falling inventories weighed on the global demand-supply balance. Bullion prices touched a multi-month high on a weak US dollar. Inflation remained contained in most AEs, barring the UK, on subdued wage pressures. Inflation was divergent in key EMEs due to country-specific factors. 9. Financial markets have become volatile in recent days due to uncertainty over the pace of normalisation of the US Fed monetary policy in view of January payrolls data showing rapidly accelerating wage growth and better than expected employment. The volatility index (VIX) has climbed to its highest level since Brexit. Equity markets have witnessed a sharp correction, both in AEs and EMEs. Bond yields in the US have hardened sharply, adding to the upward pressures seen during January, with concomitant rise in bond yields in other AEs and EMEs. Forex markets have become volatile as well. Until this episode of recent volatility, global financial markets were buoyed by investor appetite for risk, corporate tax cuts by the US, and stable economic conditions. Equity markets had gained significantly in January, driven by robust Chinese growth, uptick in commodity prices, and positive corporate sentiment in general. In currency markets, the US dollar had touched a multi-month low on February 1 on fiscal risks and improving growth prospects in other AEs. 10. On the domestic front, the real gross value added (GVA) growth as per the first advance estimates (FAE) released by the Central Statistics Office (CSO) is estimated to decelerate to 6.1 per cent in 2017-18 from 7.1 per cent in 2016-17 due mainly to slowdown in agriculture and allied activities, mining and quarrying, manufacturing, and public administration and defence (PADO) services. 11. Information available after the release of FAE by the CSO has, however, been generally positive. Manufacturing output boosted the growth of index of industrial production (IIP) in November. After a period of prolonged weakness, cement production registered robust growth in November-December, which along with continuing healthy growth in steel production led to acceleration of infrastructure goods production in November. The manufacturing purchasing managers’ index (PMI) expanded for the sixth consecutive month in January led by new orders. Assessment of overall business sentiment in the Indian manufacturing sector improved in Q3 as reflected in the Reserve Bank’s Industrial Outlook Survey (IOS). However, core sector growth decelerated in December due to contraction/deceleration in production of coal, crude oil, steel and electricity. Acreage in the case of wheat, oilseeds and coarse cereals was lower than last year. As a result, the shortfall in area sown for rabi crops increased to (-) 1.5 per cent as on February 2 as compared with (-) 1.0 per cent on December 29, 2017. 12. In the services sector, some of the high frequency indicators improved. Commercial vehicle sales growth touched an eight-year high in December. Cargo carried by sea, rail and air also registered higher growth in November, but showed mixed performance in December. Other indicators such as domestic and international air passenger traffic and foreign tourist arrivals grew at a fast pace in November-December. The services PMI expanded sequentially in December and January on the back of higher business activity. 13. Retail inflation, measured by the year-on-year change in the consumer price index (CPI), increased for the sixth consecutive month in December on account of a strong unfavourable base effect. After rising abruptly in November, food prices reversed partly in December, reflecting mainly the seasonal moderation, albeit muted, in prices of vegetables along with continuing decline in prices of pulses. Cereals inflation moderated with prices remaining steady in December. However, inflation in some components of food – eggs; meat and fish; oils and fats; and milk – increased. Fuel and light group inflation, which showed a sharp increase in November, softened somewhat in December, driven by moderation in electricity, LPG and kerosene inflation. 14. CPI inflation excluding food and fuel increased further in November and December, largely on account of increase in housing inflation following the implementation of higher house rent allowances (HRA) for government employees under the 7th central pay commission (CPC) award. Inflation also picked up in health and personal care and effects. Reflecting incomplete pass-through to domestic petroleum product prices, inflation in transport and communication remained muted in December. Inflation also slowed down in clothing and footwear, household goods and services, recreation, and education. 15. Households’ inflation expectations, measured by the Reserve Bank’s survey of households, remained elevated for both three-month ahead and one-year ahead horizons even as inflation expectation for one-year ahead horizon moderated marginally. Firms responding to the Reserve Bank’s Industrial Outlook Survey (IOS) continued to report input price pressures and increase in selling prices in Q3. This is also confirmed by manufacturing and services firms polled by PMI. Organised sector wage growth remained firm, while the rural wage growth decelerated. 16. The liquidity in the system continues to be in surplus mode, but it is moving steadily towards neutrality. The weighted average call rate (WACR) traded 12 basis points (bps) below the repo rate during December-January as against 15 bps below the repo rate in November. On some days in December and January, the system turned into deficit due to slow down in government spending and large tax collections, which necessitated injection of liquidity by the Reserve Bank. During the two weeks beginning December 16, 2017, the Reserve Bank injected average daily net liquidity of ₹ 388 billion into the system. For December as a whole, however, the Reserve Bank absorbed ₹ 316 billion (on a net daily average basis). As the system turned into deficit again in the fourth week of January, the Reserve Bank injected average net liquidity of ₹ 145 billion. For January, on the whole, the Reserve Bank absorbed ₹ 353 billion (on a net daily average basis). 17. Merchandise exports bounced back in November and December. While petroleum products, engineering goods and chemicals accounted for three-fourths of this growth, exports of readymade garments contracted. During the same period, merchandise import growth accelerated sequentially with over one-third of the growth emanating from petroleum (crude and products) due largely to high international prices. Gold imports increased – both in value and volume terms – in December, after declining in the preceding three months. Pearls and precious stones, electronic goods and coal were major contributors to non-oil non-gold import growth. With import growth exceeding export growth, the trade deficit for December was US$ 14.9 billion. 18. Even though the current account deficit narrowed sharply in Q2 of 2017-18 on a sequential basis, it was higher than its level a year ago, mainly due to widening of the trade deficit. While net foreign direct investment (FDI) inflows moderated in April-October 2017 from their level a year ago, net foreign portfolio investment (FPI) inflows were buoyant in 2017-18 (up to February 1). India’s foreign exchange reserves were at US$ 421.9 billion on February 2, 2018. Outlook 19. The December bi-monthly resolution projected inflation in the range of 4.3-4.7 per cent in the second half of 2017-18, including the impact of increase in HRA. In terms of actual outcomes, headline inflation averaged 4.6 per cent in Q3, driven primarily by an unusual pick-up in food prices in November. Though prices eased in December, the winter seasonal food price moderation was less than usual. Domestic pump prices of petrol and diesel rose sharply in January, reflecting lagged pass-through of the past increases in international crude oil prices. Considering these factors, inflation is now estimated at 5.1 per cent in Q4, including the HRA impact. 20. The inflation outlook beyond the current year is likely to be shaped by several factors. First, international crude oil prices have firmed up sharply since August 2017, driven by both demand and supply side factors. Second, non-oil industrial raw material prices have also witnessed a global uptick. Firms polled in the Reserve Bank’s IOS expect input prices to harden in Q4. In a scenario of improving economic activity, rising input costs are likely to be passed on to consumers. Third, the inflation outlook will depend on the monsoon, which is assumed to be normal. Taking these factors into consideration, CPI inflation for 2018-19 is estimated in the range of 5.1-5.6 per cent in H1, including diminishing statistical HRA impact of central government employees, and 4.5-4.6 per cent in H2, with risks tilted to the upside (Chart 1). The projected moderation in inflation in the second half is on account of strong favourable base effects, including unwinding of the 7th CPC’s HRA impact, and a softer food inflation forecast, given the assumption of normal monsoon and effective supply management by the Government. 21. Turning to the growth outlook, GVA growth for 2017-18 is projected at 6.6 per cent. Beyond the current year, the growth outlook will be influenced by several factors. First, GST implementation is stabilising, which augurs well for economic activity. Second, there are early signs of revival in investment activity as reflected in improving credit offtake, large resource mobilisation from the primary capital market, and improving capital goods production and imports. Third, the process of recapitalisation of public sector banks has got underway. Large distressed borrowers are being referenced for resolution under the Insolvency and Bankruptcy Code (IBC). This should improve credit flows further and create demand for fresh investment. Fourth, although export growth is expected to improve further on account of improving global demand, elevated commodity prices, especially of oil, may act as a drag on aggregate demand. Taking into consideration the above factors, GVA growth for 2018-19 is projected at 7.2 per cent overall – in the range of 7.3-7.4 per cent in H1 and 7.1-7.2 per cent in H2 – with risks evenly balanced (Chart 2).

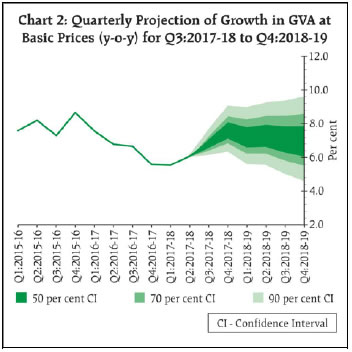

22. The MPC notes that the inflation outlook is clouded by several uncertainties on the upside. First, the staggered impact of HRA increases by various state governments may push up headline inflation further over the baseline in 2018-19, and potentially induce second-round effects. Second, a pick-up in global growth may exert further pressure on crude oil and commodity prices with implications for domestic inflation. Third, the Union Budget 2018-19 has proposed revised guidelines for arriving at the minimum support prices (MSPs) for kharif crops, although the exact magnitude of its impact on inflation cannot be fully assessed at this stage. Fourth, the Union Budget has also proposed an increase in customs duty on a number of items. Fifth, fiscal slippage as indicated in the Union Budget could impinge on the inflation outlook. Apart from the direct impact on inflation, fiscal slippage has broader macro-financial implications, notably on economy-wide costs of borrowing which have already started to rise. This may feed into inflation. Sixth, the confluence of domestic fiscal developments and normalisation of monetary policy by major advanced economies could further adversely impact financing conditions and undermine the confidence of external investors. There is, therefore, need for vigilance around the evolving inflation scenario in the coming months. 23. There are also mitigating factors. First, capacity utilisation remains subdued. Second, oil prices have moved both ways in the recent period and can potentially soften from current levels based on production response. Third, rural real wage growth is moderate. 24. Accordingly, the MPC decided to keep the policy repo rate on hold and continue with the neutral stance. The MPC reiterates its commitment to keep headline inflation close to 4 per cent on a durable basis. 25. The MPC notes that the economy is on a recovery path, including early signs of a revival of investment activity. Global demand is improving, which should help strengthen domestic investment activity. The focus of the Union Budget on the rural and infrastructure sectors is also a welcome development as it would support rural incomes and investment, and in turn provide a further push to aggregate demand and economic activity. On the downside, the deterioration in public finances risks crowding out of private financing and investment. The Committee is of the view that the nascent recovery needs to be carefully nurtured and growth put on a sustainably higher path through conducive and stable macro-financial management. 26. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of the monetary policy decision. Dr. Michael Debabrata Patra voted for an increase in the policy rate of 25 basis points. The minutes of the MPC’s meeting will be published by February 21, 2018. 27. The next meeting of the MPC is scheduled on April 4 and 5, 2018. Voting on the Resolution to keep the policy repo rate unchanged at 6.0 per cent | Dr. Chetan Ghate | Yes | | Dr. Pami Dua | Yes | | Dr. Ravindra H. Dholakia | Yes | | Dr. Michael Debabrata Patra | No | | Dr. Viral V. Acharya | Yes | | Dr. Urjit R. Patel | Yes | Statement by Dr. Chetan Ghate 28. Since the last review, there has been a sharp increase in headline inflation (November, 4.9%; December, 5.2%). The latest reading is, worryingly, led by rising inflation in all major groups. Both food and fuel inflation have also increased, with the usual seasonal easing in food inflation getting delayed till December. Global demand – with world GDP projected to grow at approximately 3.9% in 2018 – could push oil prices higher. All measures of inflation have converged above 5%. Adverse supply side shocks could push the Phillips curve of the economy upward posing a strong risk to the medium-term inflation target of 4%. 29. Inflation, excluding food and fuel (December, 5.2%) is up although this is primarily due to the statistical boost from Centre’s HRA. Pricing decisions by firms may possibly be responding more to the recent increases in input costs, driven by a reversal of the international commodity cycle, rather than staff costs, driven by a tightening of the labour market, or higher capacity utilisation. This suggests that inflation excluding food and fuel may be increasing more because of cost-push factors, which will worsen the growth-inflation trade-off. 30. There are fewer mitigating factors to rising inflation compared to two months ago. Rural wage growth continues to be moderate but with an uptick, possibly reflecting a rise in construction activity. The deflation in pulses continues but could reverse with the new procurement policy announced in the Union Budget of 2018-2019. At the current juncture though, stripped of cereals and vegetables (volatile items), the increase in inflation net of volatile items, from its trough in June 2017, is less pronounced. Both 3-month and 1-year ahead inflationary expectations are also stable. 31. In my last review, I had flagged how increases in MSP by the government could lead to generalized inflation, and worsen monetary transmission, based on research (with co-authors). While details on the exact procurement policy are awaited, the enactment of a more elaborate procurement policy in the 2018-2019 Union Budget will put stress on state finances as well. Fiscal slippages in India are inflationary! 32. With respect to economic growth, data trends have largely been positive in the last few months, as suggested by many high frequency indicators. My main concern in the last few reviews was whether animal spirits in the economy will sustain GDP growth beyond the base effect induced increases in Q3 and Q4 2017-2018. This looks increasingly likely. 33. Profit margins in the manufacturing sector are improving, with sales being higher in real terms. The PMI in services increased in December and January. The RBI enterprise surveys also suggest a substantial improvement in demand conditions. Several high frequency activity indicators have picked up suggesting that the growth deceleration has troughed. The flow of financial resources by banks and non-banks is also picking up. It is highly possible however that current growth trends will make the economy accelerate into an inflationary phase. This needs to be watched with laser-like precision. 34. Ultimately, any durable increase in growth in GDP however will depend on investment demand. The figure below, using the KLEMS database, plots growth in output per worker against growth in capital stock per worker between 1980 and 2011. While the figure is merely suggestive, it does indicate that output per worker has tracked capital per worker fairly closely during this period, suggesting dynamics in output per worker in India in the medium term are described reasonably well by a Solow-Swan style model. Any durable increase in output per worker will only come about by increases in capital per worker. To that extent, the recent uptick in investment/GDP ratio is encouraging. 35. Taking these considerations into account, I vote for a pause in the policy repo rate at today’s meeting of the Monetary Policy Committee. Statement by Dr. Pami Dua 36. CPI inflation continued its upward trajectory in November and December 2017, climbing to a 17 month high of 5.2% in December, partly due to an unfavourable base effect. This increase was also driven by an increase in food prices, along with inflation in fuel due to a rise in global crude prices. CPI inflation excluding food and fuel also increased in December, partly due to housing inflation driven by the effects of house rent allowance for government employees under the 7th central pay commission. 37. Going forward, several upside risks to inflation remain. These include the possibility of an increase in global commodity prices and higher crude oil prices. Fiscal deficit slippage and the slower than expected fiscal consolidation as well as the staggered impact of house rent allowance by state governments may also exert pressure on inflation. The proposal in the Budget to link the minimum support prices (MSPs) for kharif crops with 1.5 times the cost of production, may also drive inflation up, although its impact cannot be ascertained as yet. The Union Budget has also proposed an increase in customs duty on several items. Further, the Industrial Outlook Survey (IOS) of the RBI suggests hardening of input prices which may be passed on to the consumers and lead to higher CPI inflation. Households’ inflation expectations, as per RBI’s survey of households, remain high for both three-month-ahead and one-year-ahead forecast horizons. Meanwhile, the Indian Future Inflation Gauge, a harbinger of inflation (constructed by the Economic Cycle Research Institute (ECRI), New York, with which the author is affiliated), has increased in recent months, indicating an uptick in inflation pressures. 38. At the same time, positive signs of economic growth are visible. To begin with, the implementation of the GST is stabilising. Other positive factors include the recapitalisation of public sector banks and steps towards NPA resolution under the insolvency and bankruptcy code. Credit growth has also increased in December. Steps have also been taken in the Union Budget to revive economic activity, with a focus on rural and infrastructure sectors. 39. However, growth in ECRI’s Indian Leading Index, a predictor of future economic activity, has eased lately, indicating fading economic growth prospects, Also, ECRI’s international leading indexes suggest that global growth will ease this year. Moreover, with growth in ECRI’s Indian Leading Exports Index, which anticipates the direction of exports growth, staying subdued, the Indian export growth outlook remains restrained. 40. There is also concern about global financial market volatility against the backdrop of rising global bond yields and uncertainty regarding the normalisation of monetary policy by major advanced economies. 41. Thus, with upside risks to inflation and lacklustre growth prospects, a wait and watch strategy with status quo in policy interest rate and a neutral stance is currently recommended. Statement by Dr. Ravindra H. Dholakia 42. Developments on inflation and growth fronts since the last meeting of MPC in December 2017 have been more or less on expected lines. Although the headline inflation was expected to rise in November and December 2017, the extent of increase was higher than I expected. However, it is likely to decline during the next 3-4 months on account of favourable base effect and seasonal factors. The expectation about recovery in the growth of GVA remained subdued in the Economic Survey 2017-18 in line with what I had anticipated in my statement in the last meeting of MPC. Capacity utilisation continues to be stubborn at around 72 per cent reflecting continued presence of excess capacity in manufacturing sectors. As I have been arguing, the output gap continues to be negative and expanding. Inflation expectations of households 12 months ahead show marginal decline over the previous round in spite of the headline inflation sharply picking up during the survey period. The latest Business Inflation Expectation Survey (BIES) conducted by the Indian Institute of Management Ahmedabad (IIMA) with more than 2500 respondents finds that their expectation about costs 12 months ahead has risen by 40 basis points but still remains at 3.7 per cent. Even the RBI’s forecast of the headline inflation 12 months ahead is around 4.5-4.6 per cent. 43. However, inflation trends need to be watched carefully. Although the base effects are going to be favorable over the next 3-4 months, the oil price movements can create uncertainties and serious upside risks. The fiscal space to accommodate future higher oil price shocks seems to be absent given the slippage in the Union budget for 2018-19. Impact of the increase in customs duty and MSP proposed in the budget on the headline inflation is again uncertain. Although there is substantial fiscal slippage by the Centre, the fiscal performance of major states needs to be watched. Their revenues are now more certain and the Centre has provided for an increased transfer of tax revenues to states by 0.2 percentage points of GDP in the budget. As a result, the fiscal discipline by states is a critical factor to watch – whether it compounds or compensates for the fiscal indiscipline of the Centre. Moreover, the implementation of the HRA revisions by states and other bodies like universities and its likely impact on the headline inflation is again uncertain though its primary effect is only statistical. 44. Under all these uncertainties and conflicting trends, prudence lies in following the policy of wait and watch and allow clearer picture to emerge. Hence, I vote for maintaining the status quo on both the policy rate and neutral stance. Statement by Dr. Michael Debabrata Patra 45. In April last year, I expressed a preference for a pre-emptive policy rate increase, sensing that inflation is rising out of the demonetisation trough. I voted, however, for holding the rate unchanged through the June and August meetings to allow transitory effects to fully pass. My vote for status quo was maintained in August even though the Committee by majority decision reduced the policy rate by 25 basis points in that meeting. 46. By the October meeting, my stance had been vindicated. Looking ahead, I saw inflation stripped of house rent allowance effects exceeding the target by the end of the year. Worrying that a vicious spiral could be developing – input costs; domestic prices of petroleum products; inflation expectations – as the slowdown in growth troughed and geared to pick up in the second half of the year, I provided specific forward guidance. 47. My vote for status quo was conditioned to inflation staying within the target, with a readiness to raise the policy rate if inflation drivers strengthen. By the December meeting, the time had come to take guard, bringing to critical mass my stance articulated since April. 48. Circling back to the present, several drivers of inflation are firing at the same time – upward adjustments of domestic POL prices in response to the hardening of international crude prices, including catching up with withheld pass-through; imminent MSP increases; fiscal slippage; customs duty increases. Various measures of underlying inflation are converging to the headline at above 5 per cent. Expectations are elevated and volatile. Fixed income markets are telling us that we have fallen behind the curve. 49. In the near term outlook (up to mid-2018), inflation is likely to drift well above target. It is important to recognise that the expected easing of inflation in the outer months of the forecast horizon – between July 2018 and March 2019 – is largely statistical as the HRA effect wanes. The target is in danger of getting out of reach and over the next few months, the upper tolerance band is under threat. This could seriously dent the credibility of the Committee’s commitment to the target. 50. Turning to the state of the economy, a turnaround has likely begun in the third quarter of 2017-18 – sales are accelerating even as inventories are being drawn down; the capex cycle is starting up; and pricing power is returning. External demand is providing support as exports grow at ASEAN rates. Accelerating growth in non oil non bullion imports is reflecting domestic demand, including substitution effects, impatient with the sluggishness in the supply response. 51. The output gap is starting to turn up from a persistently negative state. If the professional forecasters’ consensus around 7 per cent plus growth for 2018-19 materialises, the output gap is expected to close going forward. 52. If the statistical reversal of the HRA effect is looked through, the real policy rate is below 1 per cent and could fall further absent policy action. This is completely misaligned with underlying fundamentals and the economy's prospects at a time when activity is picking up. In view of the prolonged period of status quo, a series of rate increases may be warranted to remove excessive accommodation. The time to begin is upon us. 53. I vote for an increase of 25 basis points in the policy rate to commence the withdrawal of accommodation. Statement by Dr. Viral V. Acharya 54. Headline inflation prints since last policy have been significantly above the target. While a part of this is statistical due to the Centre's HRA implementation, there has also been a rise in inflation sans HRA. A major concern has been the steep rise in oil prices coincidentally with (i) global rates and commodity cycles having turned up; and (ii) our fiscal deficit having overshot for this year and likely to do so next year too. Hence, even without factoring in the States’ staggered HRA implementation and MSP rises announced in the Union Budget, risks to inflation seem clearly tilted on the upside. Indeed, RBI's projections at 12-14 months in future put headline inflation by more than 50 basis points above the target (by then the statistical effect of Centre’s HRA implementation would have completely waned). 55. Such an inflation scenario would imply a raise in policy rates by a pure inflation-targeting central bank, in turn, implying a change in stance from "neutral" to "withdrawal of accommodation." However, two reasons induced me to pause. 56. First, an important factor determining inflation going forward is likely to be the shale gas production response to rising oil prices; while this response has been somewhat muted, its trigger out of dormancy could dampen oil prices swiftly. I would like to see whether this downside risk plays out in next few months to have a firmer grip on the medium-term inflation trajectory. 57. Second, for a flexible inflation targeting framework, the growth trajectory relative to potential output has to be considered too. 58. On this front, the output gap remains somewhat negative though it has been steadily closing. Structurally, the improving balance sheets of the banking system post recapitalisation package and the ongoing resolution of large stressed accounts have made the recent pick up in credit growth more sustainable. Real economic activity indicators also suggest a broad-based growth revival. While RBI growth projections for next year are in line with this buoyant activity of late, the recovery is nevertheless nascent and worthy of some support in the short run. 59. Given these trade-offs, I vote for a pause with no change in the neutral stance. The next few months of inflation and growth data will be key to determining the evolution of policy rates. If growth remains robust and inflation prints continue to project headline inflation a year ahead well above the target, then a change in stance from "neutral" to "withdrawal of accommodation" might have to be considered. 60. In the meantime, it would be good to focus on (i) pushing forward the work we have undertaken in improving the transmission of policy rate changes to the real sector; and (ii) taking the resolution framework for stressed assets to its logical conclusion. Statement by Dr. Urjit R. Patel 61. CPI inflation rose for the sixth consecutive month in December. Food inflation increased further even as pulses continued to deflate. Fuel group inflation rose sharply in November and remained elevated thereafter. With rising input prices, inflation is getting increasingly generalised. Inflation expectations have remained elevated. 62. Looking forward, inflation in the baseline scenario is projected to remain above the target of 4 per cent throughout 2018-19. There are several upside risks to inflation, especially from the staggered impact of HRA increases by various state governments (the direct effect on the CPI of the pure statistical adjustment has to be looked through, but not the second round effects driven by, say, expectations); policy for arriving at the minimum support prices for Kharif crops; and the fiscal slippage as indicated in the Union Budget, which also has attendant “crowding-out” implications with regard to the cost of private domestic credit. The evolving global macro backdrop is a concern. Tighter monetary policy by systemically important central banks, viz., the US Federal Reserve, combined with a looser US fiscal policy stance has the potential to imbue financial turbulence with concomitant consequences, especially for emerging markets. International crude oil prices increased significantly between December and early February, which is worrisome. However, oil prices could moderate if there is a strong supply response. Effective supply management by the government, as in the recent past, could help in keeping food inflation under check. Further, overall capacity utilisation in industry, according to surveys, is restrained. 63. Domestic economic growth impulses are strengthening. Manufacturing activity has picked up. The manufacturing purchasing managers’ index (PMI) expanded for the sixth consecutive month in January, led by new orders. There are also early signs of revival of investment activity. Many service sector indicators have shown robust growth such as commercial vehicle sales, domestic & international air passenger traffic, and foreign tourist arrivals. The services PMI expanded sequentially in December and January, supported by higher business activity. Credit growth is picking up and is also becoming broad-based. GVA growth in 2018-19 is forecast at 7.2 per cent, which will be a significant improvement over the current year. 64. Although inflation risks have increased in recent months, incoming data should provide greater clarity about the persistence of inflationary pressures. The economic recovery is also at a nascent stage and calls for a cautious approach at this juncture. I, therefore, vote for keeping the policy repo rate on hold while maintaining a neutral stance. Jose J. Kattoor

Chief General Manager Press Release: 2017-2018/2263 |