As the debt manager to the central and state governments, the Reserve Bank manages the government market borrowing programme in a non-disruptive manner while adhering to the broad objectives of cost optimisation, risk mitigation and market development. During 2023-24, while the government securities (G-secs) yields softened, the weighted average coupon on the entire outstanding debt stock increased marginally. The weighted average maturity of primary issuances increased as compared to the previous year. An ultra-long 50-year G-sec was introduced to cater to the demand from long-term investors. Issuances of sovereign green bonds also continued during the year. VII.1 The Internal Debt Management Department (IDMD) of the Reserve Bank is entrusted with the responsibility of managing the domestic debt of the central government by statute vide Sections 20 and 21 of the Reserve Bank of India (RBI) Act, 1934, and of 28 state governments and two union territories (UTs) in accordance with respective bilateral agreements as provided in Section 21A of the RBI Act. In terms of Section 17(5) of the RBI Act, 1934, short-term credit up to three months is provided to both the central and state governments in the form of ways and means advances (WMA) to bridge temporary mismatches in their cash flows. VII.2 The gross fiscal deficit (per cent to GDP) of the central government in 2023-24 was budgeted lower than the previous year. Market borrowings by the central and state governments remained elevated due to increase in their financing requirements. Notwithstanding global headwinds and tighter domestic financial conditions, the Reserve Bank ensured completion of the market borrowing programme for both central and state governments in a non-disruptive manner, keeping in mind the three broad objectives of cost optimisation, risk mitigation and market development. The weighted average yield of market borrowing for central government softened by 8 basis points (bps) during the year. The maturity profile of outstanding dated securities was elongated to contain the rollover risk. The Reserve Bank in consultation with the central government issued sovereign green bonds (SGrBs) for an amount aggregating to ₹20,000 crore during 2023-24. VII.3 The remainder of the chapter is arranged under three sections. Section 2 presents the implementation status in respect of the agenda for 2023-24 along with major developments during the year in the areas of debt management for both central and state governments. Section 3 covers major initiatives to be undertaken in 2024-25, followed by a summary in the last section. 2. Agenda for 2023-24 VII.4 The Department had set out the following goals for 2023-24: -

Consolidation of debt through calendar driven, auction-based switch operations along with reissuance of securities to augment liquidity in the G-sec market and facilitate fresh issuances (Paragraph VII.5-VII.6); -

Development of a mobile application for improving the ease of access for retail investors under the ‘RBI Retail Direct Scheme’ (Paragraph VII.7); -

Taking appropriate measures for enhancing retail investor awareness about the ‘RBI Retail Direct Scheme’ (Paragraph VII.7); -

Implementation of Society for Worldwide Interbank Financial Telecommunications (SWIFT) module for putting through transactions of foreign central banks (FCBs) [Paragraph VII.8]; -

Expansion of the coverage of government debt statistics in RBI’s data warehouse system (Paragraph VII.9); and -

Conduct of capacity building programmes for sensitising the state governments about prudent practices in cash and debt management (Paragraph VII.10). Implementation Status VII.5 The Reserve Bank successfully completed the combined gross market borrowings of the central and state governments to the tune of ₹25.5 lakh crore, which was 17.0 per cent higher than the previous year. The Reserve Bank continued with its policy of passive consolidation by way of reissuances and active consolidation through switches. During 2023-24, there were 135 re-issuances out of 149 issuances of G-secs (90.6 per cent) as compared with 161 re-issuances out of 177 issuances (91 per cent) in the previous year. The active debt consolidation through switching of government securities maturing in the near-term with the long-dated government securities was generally conducted once in a month. Accordingly, switches amounting to ₹1.03 lakh crore were completed during 2023-24 as against the budgeted amount of ₹1 lakh crore. VII.6 During 2023-24, securities ranging from 3 to 50 years tenor (original maturity) were issued with the objective of catering to the requirement of various investors with appetite for securities of different maturity buckets. A new 3-year benchmark security was introduced as part of government market borrowing programme during H1:2023-24. Another dated security of 50-year maturity was introduced in H2:2023-24 in response to market demand for ultra-long duration securities. The total issuance of SGrBs during 2023-24 was ₹20,000 crore, with issuances in 5-year (₹5,000 crore) and 10-year (₹5,000 crore) tenors in addition to the maiden issuance of SGrBs in 30 years (₹10,000 crore) tenor. VII.7 To further improve the ease of access for retail investors in the ‘RBI Retail Direct’ portal, development of mobile application is under final stages and is expected to be rolled out in early 2024-25. During the year, the Reserve Bank continued its efforts aimed at improving the overall reach of ‘RBI Retail Direct Scheme’ through investor awareness programmes. In order to ease the registration process and to make the portal more user friendly, various technological upgrades have been undertaken. The basket of products offered through the ‘Retail Direct’ portal has also been expanded to include floating rate savings bond (FRSB), 2020 (Taxable). The national automated clearing house (NACH) payment functionality has also been enabled on the portal, enabling the investors to register one-time mandate and use the same for funding bids placed under primary auction. VII.8 The Department carries out investments on behalf of FCBs and other multilateral financial institutions (MFls) under the scheme of Rupee investment by FCBs. The SWIFT module has been operationalised that enables messaging using SWIFT network for back-office activities related to the transactions carried out under the scheme. VII.9 Government debt statistics are disseminated through the Reserve Bank’s website and data warehouse system. During the year, time series information was migrated to the Reserve Bank’s next-generation data warehouse system, i.e., centralised information management system (CIMS). VII.10 Capacity building programmes (CBPs) for sensitising state governments about prudent cash and debt management practices were conducted for some states. In addition, a two-day CBP on cash and debt management was conducted in the Reserve Bank’s College of Agricultural Banking (CAB), Pune, in December 2023 which witnessed participation from 11 state governments and the UT of Puducherry. Major Developments Debt Management of the Central Government VII.11 During 2023-24, both gross and net market borrowings of Government of India (GoI) through dated G-secs were higher by 8.6 per cent and 6.5 per cent, respectively, as compared to the previous year. Net market borrowings through dated securities and T-Bills taken together were higher by 4.6 per cent as compared with the previous year (Table VII.1). Debt Management Operations VII.12 The weighted average yield (WAY) of G-secs issued during the year decreased by 8 bps as compared to the previous year, while the weighted average coupon on the entire debt stock increased by 3 bps. The weighted average maturity (WAM) of primary issuances and the outstanding debt as at end-March 2024 increased as compared to the previous year (Table VII.2). VII.13 There was no devolvement on Primary Dealers (PDs) during 2023-24 as compared to eight instances, amounting to ₹23,053 crore in 2022-23. There was no instance of non-acceptance of bids in 2023-24 as compared to four instances for a total notified amount of ₹16,000 crore in the previous year. | Table VII.1: Market Borrowings of Central Government | | (₹ crore) | | Item | 2020-21 | 2021-22 | 2022-23 | 2023-24 | | 1 | 2 | 3 | 4 | 5 | | Gross Market Borrowings through Dated Securities | 13,70,324 | 11,27,382 | 14,21,000 | 15,43,000 | | | (6.90) | (4.78) | (5.27) | (5.25) | | Net Market Borrowings (i to iv) | 13,75,654 | 9,29,351 | 11,74,375 | 12,28,805 | | | (6.93) | (3.94) | (4.36) | (4.18) | | i) Dated Securities@ | 11,43,114 | 8,63,103 | 11,08,261 | 11,80,456 | | ii) 91-day T-Bills | 10,713 | 45,439 | -23,798 | 20,164 | | iii) 182-day T-Bills | -18,743 | 71,252 | 52,426 | 15,982 | | iv) 364-day T-Bills | 2,40,570 | -50,444 | 37,487 | 12,203 | @: Without adjusting for buyback/switches. After adjusting for switches, net market borrowings during 2023-24 stood at ₹12,26,101 crore, ₹11,71,951 crore in 2022-23, ₹9,29,060 crore in 2021-22, and ₹11,46,739 crore in 2020-21.

Note: Figures in parentheses are per cent to GDP.

Source: RBI and MoSPI. |

| Table VII.2: Market Loans of Central Government - A Profile* | | (Yield in Per cent/Maturity in Years) | | Years | Range of Cut Off Yield in Primary Issues | Issued during the Year^ | Outstanding Stock# | | Under 5 Years | 5-10 Years | Over 10 Years | Weighted Average Yield | Range of Maturities@ | Weighted Average Maturity | Weighted Average Maturity | Weighted Average Coupon | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 2017-18 | 7.23-7.27 | 6.42-7.48 | 6.68-7.67 | 6.97 | 5-38 | 14.13 | 10.62 | 7.76 | | 2018-19 | 6.56-8.12 | 6.84-8.28 | 7.26-8.41 | 7.77 | 1-37 | 14.73 | 10.40 | 7.81 | | 2019-20 | 5.56-7.38 | 6.18-7.44 | 5.96-7.77 | 6.85 | 1-40 | 16.15 | 10.72 | 7.71 | | 2020-21 | 3.79-5.87 | 5.15-6.53 | 4.46-7.19 | 5.79 | 1-40 | 14.49 | 11.31 | 7.27 | | 2021-22 | 4.07-5.10 | 4.04-6.78 | 4.44-7.44 | 6.28 | 1-40 | 16.99 | 11.71 | 7.11 | | 2022-23 | 5.43-7.45 | 5.21-7.52 | 5.65-7.90 | 7.32 | 1-40 | 16.05 | 11.94 | 7.26 | | 2023-24 | 6.89-7.39 | 6.98-7.40 | 7.07-7.57 | 7.24 | 3-50 | 18.09 | 12.54 | 7.29 | @: Residual maturity of issuance and figures are rounded off.

*: Excluding special securities. ^: Excluding switch auction. #: Including switch auction.

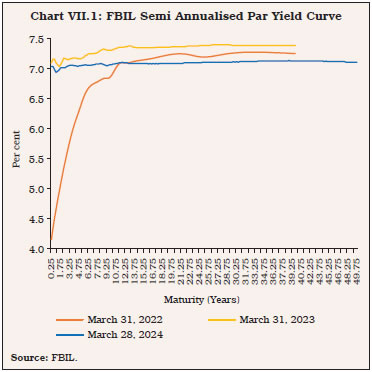

Source: RBI. | VII.14 G-sec yields softened during the year mainly driven by easing of inflationary pressures, expectations of a possible end to the monetary policy tightening cycle across major economies and surge in foreign portfolio investment (FPI) inflows. The yields declined sharply in April and May on the back of unchanged repo rate and lower than expected domestic consumer price index (CPI) prints for March and April. Though 10-year yield hardened slightly in June, overall, it softened by 21 bps in Q1 to close at 7.10 per cent as at end-June 2023. During Q2:2023-24, the yields rose tracking US treasury yields, higher crude oil prices, and higher than expected domestic CPI prints for July. The 10-year yield hardened by 12 bps in Q2 to close at 7.22 per cent as at end-September 2023. In Q3:2023-24, the yields initially rose but softened thereafter on account of decline in crude oil prices, lower than expected domestic CPI prints for October and November and news about possible inclusion of Indian government bonds (IGBs) in a major global emerging market index. The 10-year yield declined by 2 bps in Q3 to close at 7.20 per cent as at end-December 2023. The yields declined further during Q4:2023-24 on lower than expected CPI and reduced market borrowing and budgeted fiscal deficit for 2024-25. The 10-year yield softened by 13 bps in Q4 to close at 7.07 per cent as on March 28, 2024 (Chart VII.1).

| Table VII.3: Issuance of Government of India Dated Securities – Maturity Pattern | | (Amount in ₹ lakh crore) | | Residual Maturity | 2021-22 | 2022-23 | 2023-24 | | Amount Raised | Percentage to Total | Amount Raised | Percentage to Total | Amount Raised | Percentage to Total | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | Less than 5 Years | 2.3 | 20.3 | 2.7 | 19.0 | 2.5 | 16.5 | | 5 - 9.99 Years | 2.4 | 21.5 | 4.6 | 32.1 | 4.8 | 31.4 | | 10 -14.99 Years | 3.2 | 28.4 | 2.9 | 20.1 | 2.8 | 17.8 | | 15 Years and Above | 3.4 | 29.8 | 4.1 | 28.8 | 5.3 | 34.3 | | Total | 11.3 | 100.0 | 14.2 | 100.0 | 15.4 | 100.0 | Note: Figures in the columns might not add up to the total due to rounding off of numbers.

Source: RBI. | VII.15 During 2023-24, about 52.1 per cent of the market borrowing was raised through issuance of dated securities, with a residual maturity of 10 years and above as compared with 48.9 per cent in the previous year (Table VII.3). Treasury Bills VII.16 Short-term cash requirements of the central government are met through issuance of T-Bills. The net short-term market borrowing of the government through T-Bills (91, 182 and 364 days) declined to ₹48,349 crore during 2023-24 from ₹66,114 crore in the previous year. Ownership of Securities VII.17 Commercial banks remained the largest holders of government securities [including T-Bills and State Government Securities (SGSs)] accounting for 37.6 per cent as at end-March 2024, followed by insurance companies (25.0 per cent), provident funds (10.1 per cent) and the Reserve Bank (7.9 per cent). The share of FPIs was 1.5 per cent. The other holders of government securities (including T-Bills and SGSs) include mutual funds, state governments, financial institutions, and corporates. Primary Dealers (PDs) VII.18 The number of PDs stood at 21 [14 Bank-PDs and 7 standalone PDs (SPDs)]. The PDs have the mandate to underwrite primary auctions of dated G-secs with targets of achieving bidding commitment and success ratio in respect of primary auctions of T-Bills/cash management bills (CMBs). The PDs achieved an average success ratio of 59.3 per cent in H1:2023-24 and 62.2 per cent in H2:2023-24. The share of PDs in auctions of T-Bills was 69.4 per cent during 2023-24 as compared with 68.9 per cent in the previous year. The commission paid to PDs, including GST, for underwriting primary auctions of dated G-secs during 2023-24 was ₹48.5 crore as compared to ₹107.5 crore during 2022-23. Sovereign Gold Bond (SGB) Scheme VII.19 The Reserve Bank, in consultation with the GoI, announced a calendar comprising four tranches of SGBs to be issued during 2023-24. The aggregate sum raised during 2023-24 amounted to ₹27,031 crore (44.34 tonne). Since the inception of the SGB scheme in November 2015, a total of ₹72,274 crore (146.96 tonne) has been raised through 67 tranches. Floating Rate Savings Bond, 2020 (Taxable) Scheme VII.20 During the year, ₹7,063 crore was raised through issuance of the floating rate savings bond (FRSB), 2020 (Taxable). As part of its continuing efforts towards increasing retail participation in government securities, the Reserve Bank, in consultation with the central government has also enabled subscription to FRSB, 2020 (Taxable) through the Reserve Bank’s ‘Retail Direct’ portal Cash Management of the Central Government VII.21 The WMA limit of the central government was fixed at ₹1.5 lakh crore and ₹0.5 lakh crore for H1 and H2 of 2023-24, respectively. The central government resorted to WMA/overdraft (OD) for 24 days during 2023-24 vis-à-vis 9 days in the previous year. The cash balance of the central government remained in surplus during most part of the year (Chart VII.2). Investments under Foreign Central Bank (FCB) Scheme VII.22 Under the FCB scheme, the Reserve Bank invests in Indian G-secs on behalf of select FCBs and multilateral development institutions in the secondary G-sec market. Total volume transacted on behalf of these institutions stood at ₹920 crore (face value) during 2023-24 as compared to ₹4,805 crore (face value) in the previous year. Debt Management of State Governments VII.23 Following the recommendations of the 14th Finance Commission to exclude most of the states from the National Small Savings Fund (NSSF) financing facility, market borrowings of states have been increasing over the last few years. The share of market borrowings in financing the gross fiscal deficit of states rose to 76.1 per cent in 2023-24 (BE) from 72.4 per cent in 2022-23 (RE). VII.24 The gross market borrowings of states in 2023-24 stood at 93 per cent of the amount indicated in the quarterly indicative calendar for market borrowings by the state governments. There were 782 issuances in 2023-24, of which 49 were re-issuances (605 issuances in 2022-23, of which 45 were re-issuances) [Table VII.4]. VII.25 The weighted average cut-off yield (WAY) of SGSs issuances during 2023-24 was lower at 7.52 per cent than 7.71 per cent in the previous year. The weighted average spread (WAS) of SGSs issuances over comparable maturity of central government securities was 31 bps in 2023-24, the same as in the previous year. In 2023-24, 23 states and two UTs issued dated securities of tenors other than 10 year, ranging from 2 to 40 years. The average inter-state spread on securities of 10-year tenor (fresh issuances) was 3 bps in 2023-24, the same as in 2022-23. VII.26 During 2023-24, 15 states/UTs availed Special Drawing Facility (SDF), 14 states/UTs resorted to WMA and 11 states/UTs availed OD. VII.27 Keeping in view the risks associated with contingent liabilities, it was decided during the 32nd Conference of the State Finance Secretaries held on July 7, 2022 to set up a Working Group on State Government Guarantees, comprising members drawn from the Ministry of Finance, GoI; Comptroller and Auditor General of India and state governments. The Working Group submitted its final report to the Reserve Bank on September 16, 2023 (Box VII.1). | Table VII.4: Market Borrowings of States through SGSs | | (Amount in ₹ lakh crore) | | Item | 2020-21 | 2021-22 | 2022-23 | 2023-24 | | 1 | 2 | 3 | 4 | 5 | | Maturities during the Year | 1.5 | 2.1 | 2.4 | 2.9 | | Gross Sanctions under Article 293(3) | 9.7 | 9.0 | 8.8 | 11.3 | | Gross Amount Raised during the Year | 8.0 | 7.0 | 7.6 | 10.1 | | Net Amount Raised during the Year | 6.5 | 4.9 | 5.2 | 7.2 | | Amount Raised during the Year to Total Sanctions (per cent) | 82.4 | 78.4 | 86.1 | 89.2 | | Outstanding Liabilities (at the end of period) # | 39.3 | 44.3 | 49.3 | 56.4 | #: Including Ujjwal DISCOM Assurance Yojana (UDAY) and other special securities.

Source: RBI. | VII.28 The outstanding investments of states in intermediate treasury bills (ITBs) and auction treasury bills (ATBs) increased during 2023-24 (Table VII.5). Box VII.1 Working Group on State Government Guarantees Guarantee is a potential liability that is contingent on the occurrence of an unforeseen future event. If these liabilities get crystallised without adequate buffer, it may lead to increase in expenditure, fiscal deficit, and debt levels for the state government. If the guarantee invoked is not honoured, it may cause reputational damage and legal costs to the guarantor. A related concern is the increasing bank finance to government owned entities backed by their guarantees. It is, therefore, important to assess, monitor and be prudent while issuing guarantees, especially, when such guarantees are issued by a state government. The major recommendations of the Working Group are as under: -

There should not be any distinction between conditional/unconditional, financial/performance guarantees; -

The word ‘Guarantee’ should be used in a broader sense and may include instruments, by whatever name they were called, if these create obligation on the state government; -

Government guarantees should not be used to obtain finance through state owned entities, which substitutes budgetary resources of the state government; -

States should classify the projects/activities as high, medium and low-risk and assign appropriate risk weights before extending guarantee for them; -

There should be a ceiling for incremental guarantees issued during a year at 5 per cent of revenue receipts or 0.5 per cent of gross state domestic product (GSDP), whichever is less. States should conservatively keep the lowest slab of risk weight at 100 per cent; -

A minimum of 0.25 per cent per annum may be considered as the base or minimum guarantee fee and additional risk premium, based on risk assessment by the state government, may be charged to each risk category of issuances; -

States should build a buffer of five per cent of their total outstanding guarantees over a period of five years from the date of constitution of guarantee redemption fund (GRF); -

The borrowing state enterprises should set up escrow accounts with periodic contributions from project earnings for repayments before resorting to state government guarantees; and -

States should publish/disclose data relating to guarantees as per the Indian Government Accounting Standards (IGAS). Source: RBI. |

| Table VII.5: Investments in ITBs and ATBs by State Governments/UTs | | (₹ crore) | | Item | Outstanding as on March 31 | | 2020 | 2021 | 2022 | 2023 | 2024 | | 1 | 2 | 3 | 4 | 5 | 6 | | 14-Day (ITBs) | 1,54,757 | 2,05,230 | 2,16,272 | 2,12,758 | 2,66,805 | | ATBs | 33,504 | 41,293 | 87,400 | 58,913 | 51,258 | | Total | 1,88,261 | 2,46,523 | 3,03,672 | 2,71,671 | 3,18,063 | | Source: RBI. | Investments in Consolidated Sinking Fund (CSF)/GRF VII.29 The Reserve Bank manages two reserve fund schemes on behalf of states - the CSF and the GRF. Currently, 24 states and one UT have set up CSF while 20 states are members of the GRF. Outstanding investments by member states in the CSF and GRF as at end-March 2024 stood at ₹2,06,441 crore and ₹12,259 crore, respectively, as against ₹1,84,029 crore and ₹10,839 crore, respectively, as at end-March 2023. 3. Agenda for 2024-25 VII.30 During 2024-25, the market borrowing programme is proposed to be conducted with the following strategic milestones to achieve the overall goals of debt management: -

Consolidation of debt through calendar driven, auction-based switch operations along with reissuance of securities to augment liquidity in the G-sec market; -

Development of an application programming interface (API) to facilitate value free transfer (VFT) of government securities by the depositories in a seamless manner; -

Review of operational guidelines for floating rate saving bonds and sovereign gold bond scheme; and -

Further improving the user interface of the RBI ‘Retail Direct’ portal by providing additional payment options. 4. Conclusion VII.31 During the year, the market borrowings of the central and state governments were successfully conducted amidst challenges emanating from volatility in global financial markets and geopolitical tensions. The market borrowing programme for 2024-25 would be rolled out in an orderly manner keeping in view the size of the budgeted fiscal deficit of the government and evolving market conditions. The Reserve Bank would continue to ensure smooth conduct of the market borrowing programme based on the guiding principles of debt management while ensuring a stable debt structure.

Index |