Macroeconomic risks arising from domestic weakness and global uncertainty came to the fore during 2013-14

following the US Fed’s indication that it would taper its large-scale asset purchase programme. The Reserve Bank

responded through several policy actions to mitigate the risks to macro-financial stability. It aimed at containing

exchange rate volatility, compressing the current account deficit (CAD) and rebuilding buffers. It also accorded

primacy to containing inflation, the persistence of which over the years had caused several macroeconomic

imbalances. Though these measures helped in stabilising the economy, keeping it on a disinflationary path, the

slowdown continues to pose policy challenges into 2014-15. The economy requires policies that address growth

through increased productivity, as well as greater investment and use of labour.

II.1 THE REAL ECONOMY

Growth slows to sub-5 per cent for the second

consecutive year, but growth may increase from

here

II.1.1 Real GDP growth improved marginally to

4.7 per cent in 2013-14 from 4.5 per cent in 2012-

13, recording a sub-5 per cent growth for the second

consecutive year (Chart II.1). In the absence of a

clear legal and regulatory framework in key areas

such as natural resources, especially mining

activity, environmental clearances and land

acquisition, business confidence dipped and

affected investments in the economy. Consumption

also decelerated on the back of the growth

slowdown. However, growth may increase from

here, with a moderate-paced recovery likely in 2014-15. Recovery in growth would essentially

come from an improvement in the investment

climate through better governance, transparent,

effective and efficient regulatory and legal regimes,

gains in technical efficiency, institutional

improvements, improved labour mobility and other

reforms. Better business sentiment, anticipating

such improvements following the elections, is a

welcome development.

II.1.2 In 2013-14, the agriculture sector’s rebound

to an above trend growth rate on the back of a

normal monsoon, supported overall growth. The

industrial sector contracted, while services sector

growth remained unchanged at the previous year’s

level. Structural impediments, high inflation and

domestic policy uncertainties continued to weigh

down growth prospects.

Continued deceleration in consumption and

sluggish investment

II.1.3 The growth in real GDP at market prices

increased modestly to 5 per cent during 2013-14

led by a pickup in exports coupled with a decline

in imports (Chart II.2a). The contribution of net

exports to overall growth increased significantly in

2013-14 (Chart II.2b). In contrast, there was a

slowdown in the pace of growth of the private final

consumption expenditure (PFCE) mainly due to

the persistence of inflation and slackening of disposable incomes, notwithstanding higher

growth in agriculture.

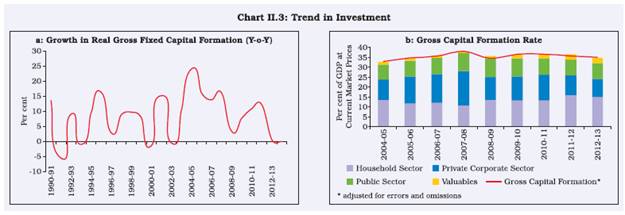

II.1.4 Real fixed investment growth decelerated

for the second consecutive year and turned

negative in 2013-14 (Chart II.3a). Statistical

measures indicate that while the trend growth rate

of real fixed investment had peaked in mid-2005-06,

it declined markedly thereafter largely on account

of the structural bottlenecks that choked investments.

The cyclical component also showed a substantial

downturn in recent years (Box II.1).

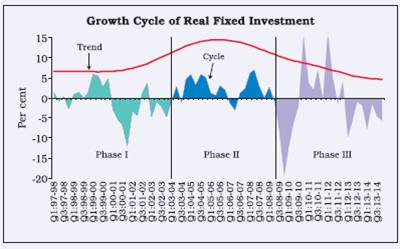

Box II.1

Investment Cycles in India and the Recent Downturn

Empirical evidence suggests that both structural and cyclical

factors have caused investment to slow down in recent years.

Moreover, these two factors have reinforced each other. The

trend component has declined since mid-2005-06, largely

reflecting the impact of structural impediments. The empirical

analysis based on quarterly data over the past fourteen

years also reveals that fiscal imbalances, fuel inflation, world

growth (as a proxy for external demand) and the monetary

policy stance impact the cyclical component of real fixed

investment growth.

The trend component of real investment in India was

estimated using the Hodrick-Prescott (HP) filter on the

deseasonalised series of real gross fixed capital formation

(GFCF) adopting a growth cycle approach. The cyclical

component of investment was extracted by subtracting the

estimated trend growth from its actual growth over the period

1997-98:Q1 to 2013-14:Q4. The series of the growth cycle and trend growth of real fixed investment is shown in the

chart below. The time period was divided into three phases,

based on the generally evolving path of real GDP growth,

i.e., Phase I (1997-98:Q1 to 2002-03:Q4), Phase II (2003-

04:Q1 to 2008-09:Q2) and Phase III (2008-09:Q3 to 2013-

14:Q4).

The trend growth in GFCF declined significantly from 14.5

per cent in H2 of 2005-06 to below 5 per cent in 2013-14.

In Phase I, the rate of investment growth alternated,

exceeding and remaining below trend for nearly the same

number of quarters. On the other hand, the investment

growth generally remained above trend in Phase II but

dipped below trend for the larger part in Phase III. The

cyclical component of real investment growth dipped and

turned negative especially since Q1 of 2012-13. The

cyclical component of real investment growth and real GDP

growth showed fairly strong co-movement (statistically

significant correlation of +0.62), implying that falling investment growth and GDP growth, as evident in the recent

period, are related.

In line with the observation on following trend growth in

investment a recent study by Anand and Tulin (2014) also

highlights the importance of economic policy uncertainity

and deteriorating business confidence in the recent

investment slowdown. Interest rates appears to explain a

smaller portion of investment slowdown.

Further work will be necessary to examine the contribution

of specific factors, like delays in land acquisition and

environment clearances, reduction in the marginal

productivity of capital despite lower real interest rates, weak

business confidence and policy uncertainty that may have

adversely impacted the growth rate of real investment.

Reference

Anand Rahul and Tulin Volodymyr (2014), ‘Disentangling

India’s Investment Slowdown’, IMF working paper WP/1447.

II.1.5 The rate of gross capital formation

(investment rate) declined for the second consecutive

year to 34.8 per cent in 2012-13 as compared to

35.5 per cent in 2011-12 and 36.5 per cent in

2010-11(Chart II.3b). The sectoral composition of

fixed investment shows that the private corporate

sector accounted for most of the reduction in the

overall investment rate in recent years particularly

in ‘machinery and equipment’ (Table II.1). On the

other hand, fixed investments of the public and

household sectors which are concentrated in

‘construction’ remained somewhat less volatile.

Productivity changes may have had a significant

impact on growth

II.1.6 Over the previous decade, productivity

changes may have had a significant impact on the

growth rate for the Indian economy. India KLEMS

(Capital, Labour, Energy, Material and Services)

project study has shown significant productivity

improvements in the previous decade up to 2008-09

(Box II.2). Much of this period overlapped the high

growth phase in the Indian economy. Though

estimates are not available for the subsequent years, the increase in capital-output ratios during

2011-12 to 2013-14 suggests that productivity

improvements have not continued at the same pace

over the last three years.

Table II.1: Gross Fixed Capital Formation |

(as percentage of GDP at current market prices) |

Year |

Public Sector |

Private Corporate Sector |

Household Sector |

Construction |

Machinery & equipment |

Total |

Construction |

Machinery & equipment |

Total |

Construction |

Machinery & equipment |

Total |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

2008-09 |

5.6 |

2.9 |

8.5 |

2.2 |

8.1 |

10.3 |

10.3 |

3.1 |

13.5 |

2009-10 |

5.5 |

2.9 |

8.4 |

2.5 |

7.7 |

10.2 |

9.8 |

3.3 |

13.2 |

2010-11 |

5.1 |

2.7 |

7.8 |

2.9 |

7.5 |

10.4 |

9.1 |

3.5 |

12.7 |

2011-12 |

4.7 |

2.4 |

7.1 |

2.7 |

6.8 |

9.4 |

10.4 |

4.9 |

15.2 |

2012-13 |

5.4 |

2.4 |

7.8 |

2.4 |

6.0 |

8.5 |

9.7 |

4.4 |

14.1 |

| Source: Central Statistics Office. |

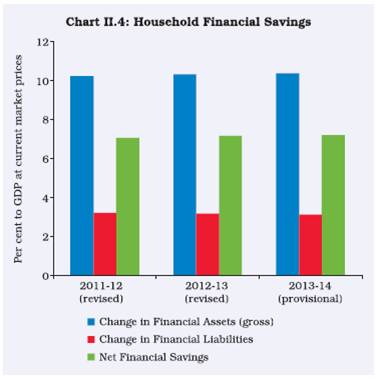

Household financial saving rate stays low in

2013-14

II.1.7 The Reserve Bank’s preliminary estimates

showed that the household financial saving rate remained low during 2013-14, increasing only

marginally to 7.2 per cent of GDP in 2013-14 from

7.1 per cent of GDP in 2012-13 and 7.0 per cent of

GDP in 2011-12 (Chart II.4). During 2013-14, households increased their saving in deposits

(especially with commercial banks) and small

savings, while that in currency and mutual funds

declined (Table II.2).

Box II.2

Productivity Growth in India

Productivity improvement remains an important contributory

factor in the overall growth process. Empirical studies relating

to productivity growth in India largely relate to the 1980s and

1990s. While these studies differ in terms of the methodology

used, some of the studies based on the growth accounting

framework, reveal that there was a sharp acceleration in the

rate of total factor productivity (TFP) growth in the Indian

economy after 1980. Further, the rate of growth in TFP in the

post-reform period is found to be even higher than that in

the 1980s, mainly due to improved productivity performance

of the services sector.

Recent estimates on TFP growth for 26 industries and at

the aggregate level have been prepared for the period 1980-

81 to 2008-09 under the aegis of India KLEMS research

project (RBI, 2014) which indicate that the TFP increased

significantly in the 2000s (up to 2008-09) as compared to the

previous two decades. The increase in TFP at the economy

level in the 2000s was primarily due to manufacturing,

electricity and services sectors. In agriculture and mining

sectors, however, the rate of TFP growth decelerated in

the 2000s. In the case of construction, the steep fall in TFP

growth during 1980-99 was largely arrested in the 2000s.

Looking at the reasons for productivity growth, the opening

up of the economy post-1991 has been identified as an

important factor which resulted in a significant jump in services

sector productivity which continued during the 2000s. The

electricity sector is found to have economised on the use of

energy and services input in 2000s raising the value added

per kilowatt hour of production. The manufacturing sector

has seen a more broad-based phenomenon of productivity

growth with 8 out of 14 industries showing faster productivity

growth during 2000-08. The liberal market reforms in the

1990s seem to have helped in the accumulation of capital

in some segments of manufacturing immediately after the

reforms, while opening up to foreign technology and import

of capital goods might have translated into better productivity

gains in the latter period (2000s) (Das, 2014). In some other

studies, increase in manufacturing productivity in 2000s

has been attributed to factors, such as, removal of trade

barriers and increasing openness. Infrastructure facilities as

well as labour market conditions also exerted a significant

influence on technical efficiency and productivity growth of

manufacturing industries in India.

As productivity might have been adversely impacted over

the last 3 years, going forward, removing infrastructure

bottlenecks and labour market rigidities holds the key to

improving output growth vis-à-vis factor accumulation.

Continuing relocation of labour out of low productivity

sectors to high productivity sectors is also akin to increase in

productivity. In India, although there is some migration from

agriculture, there is a need to create further employment

opportunities in industrial and services sectors to ensure

gainful employment of migrated labour and for enhancing

overall productivity level.

Period wise trend growth rate of Total Factor Productivity

by broad sector

(using labour input and capital service) |

Sector |

1980-2008 |

1980-1999 |

2000-2008 |

1 |

2 |

3 |

4 |

Agriculture, Hunting, Forestry, Fishing |

1.52 |

1.78 |

0.71 |

| Mining and Quarrying |

-0.24 |

0.22 |

-1.59 |

Manufacturing |

0.73 |

0.04 |

2.76 |

Electricity, Gas and Water Supply |

2.96 |

1.14 |

6.93 |

Construction |

-3.31 |

-4.19 |

-0.69 |

Services |

1.84 |

1.74 |

2.14 |

Total Economy |

1.40 |

1.11 |

2.26 |

| Source: KLEMS database available at www.rbi.org.in |

The recent thrust to infrastructure spending is expected

to boost productivity along with employment. Further, the

opening up of various sectors to FDI will promote greater

competition and productivity.

References

Das Deb Kusum (2014), ‘Productivity Growth in India under

Different Policy Regimes 1980-2012’, Presentation at Third

World KLEMS Conference, Tokyo, Japan, June.

Reserve Bank of India (2014), ‘Estimates of Productivity

Growth for Indian Economy’, KLEMS project report,

http://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/EPGIKLEMS110614, June 11, 2014.

Table II.2 : Financial Saving of the Household Sector |

Item |

Per cent to Gross Financial Saving |

` billion |

2010-11 |

2011-12

(R) |

2012-13

(R) |

2013-14

(P) |

2010-11 |

2011-12

(R) |

2012-13

(R) |

2013-14

(P) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

A. Change in Financial Assets (Gross Financial Saving) |

100.0 |

100.0 |

100.0 |

100.0 |

10,518 |

9,215 |

10,437 |

11,741 |

a. Currency |

13.0 |

11.5 |

10.7 |

8.7 |

1,371 |

1,062 |

1,116 |

1,018 |

b. Deposits |

49.9 |

59.1 |

56.6 |

58.8 |

5,248 |

5,445 |

5,906 |

6,908 |

i) With Commercial Banks |

46.5 |

53.4 |

51.1 |

53.1 |

4,886 |

4,923 |

5,338 |

6,233 |

ii) With Cooperative Banks and Societies |

3.0 |

3.6 |

3.9 |

4.2 |

311 |

336 |

412 |

489 |

iii) With Non-banking Companies |

0.5 |

2.0 |

1.5 |

1.6 |

51 |

186 |

157 |

185 |

iv) Trade Debt (Net) |

0.6 |

0.5 |

0.3 |

0.4 |

68 |

45 |

32 |

48 |

c. Shares and Debentures |

-0.4 |

-0.3 |

4.1 |

2.9 |

-43 |

-28 |

430 |

337 |

of which : |

|

|

|

|

|

|

|

|

i) Private Corporate Business |

0.6 |

0.4 |

0.4 |

0.3 |

68 |

41 |

44 |

31 |

ii) Banks |

0.1 |

0.0 |

0.1 |

0.0 |

8 |

1 |

7 |

5 |

iii) Bonds of Public Sector Undertakings |

0.1 |

0.0 |

0.0 |

0.8 |

8 |

1 |

2 |

92 |

iv) Mutual Funds (including UTI) |

-1.1 |

-1.2 |

3.4 |

1.8 |

-116 |

-106 |

350 |

210 |

d. Claims on Government |

2.7 |

-2.4 |

-0.8 |

0.4 |

287 |

-219 |

-83 |

46 |

i) Investment in Government securities |

0.0 |

0.1 |

0.0 |

0.0 |

3 |

5 |

5 |

4 |

ii) Investment in Small Savings, etc. |

3.4 |

-2.4 |

-0.7 |

0.6 |

361 |

-218 |

-73 |

75 |

e. Life Insurance Funds |

20.0 |

21.3 |

17.3 |

17.0 |

2,101 |

1,958 |

1,803 |

1,996 |

of which : |

|

|

|

|

|

|

|

|

i) Life Funds of LIC and private insurance companies |

19.9 |

21.2 |

17.2 |

16.6 |

2,095 |

1,955 |

1,800 |

1,943 |

f. Provident and Pension Funds |

13.4 |

10.3 |

11.7 |

11.6 |

1,410 |

949 |

1,223 |

1,359 |

B. Change in Financial Liabilities |

|

|

|

|

2,804 |

2,870 |

3,213 |

3,555 |

C. Net Financial Saving of Household Sector (A-B) |

|

|

|

|

7,713 |

6,345 |

7,224 |

8,186 |

R: Revised Estimates. P: Preliminary Estimates.

Note : Components may not add up to the totals due to rounding off.

|

Gross domestic saving rate declines further in

2012-13

II.1.8 The gross domestic saving rate as per

Central Statistics Office’s (CSO’s) estimates

declined to 30.1 per cent in 2012-13 from 31.3 per cent in 2011-12, mainly on account of a decline in

the rate of household physical savings (Table II.3).

The saving rate dipped to the lowest in the past 9

years and has accentuated macroeconomic

imbalances. The household saving rate had

generally hovered around 23 per cent since 2003-

04. Following a one-off sharp increase to 25.2 per

cent in 2009-10, it declined to 21.9 per cent in

2012-13. This decline was led by a reduction in the

household financial saving rate that dipped sharply

from 12 per cent in 2009-10 to 7.1 per cent in

2012-13.

Agricultural sector rebounds in 2013-14

II.1.9 After a subdued performance in 2012-13,

agriculture emerged as the driver of growth

during 2013-14. The south-west monsoon was

6 per cent above the long period average (LPA) and

the north-east monsoon was 18 per cent above

LPA. As per the Fourth Advance Estimates,

foodgrains production during 2013-14 is placed at

264.8 million tonnes, 3.0 per cent higher than in

2012-13 (Table II.4).

Table II.3: Gross Domestic Savings: Sector-wise |

(As percentage to GDP at current market prices) |

|

Average (2005-06 to 2007-08) |

2008-09 |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Gross domestic saving (1+2+3) |

35.0 |

32.0 |

33.7 |

33.7 |

31.3 |

30.1 |

1. Household sector (i+ii) |

23.0 |

23.6 |

25.2 |

23.1 |

22.8 |

21.9 |

(i) Financial saving (Net) |

11.6 |

10.1 |

12.0 |

9.9 |

7.0 |

7.1 |

(ii) Saving in physical assets (Gross) |

11.4 |

13.5 |

13.2 |

13.2 |

15.8 |

14.8 |

2. Private corporate sector (i+ii) |

8.3 |

7.4 |

8.4 |

8.0 |

7.3 |

7.1 |

(i) Joint Stock Companies |

7.8 |

7.0 |

7.9 |

7.6 |

6.9 |

6.7 |

(ii) Cooperative Banks and Societies |

0.5 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

3. Public sector |

3.7 |

1.0 |

0.2 |

2.6 |

1.2 |

1.2 |

Of which: |

|

|

|

|

|

|

a) Government administration (including quasi govt. bodies) |

-0.9 |

-2.8 |

-3.1 |

-0.5 |

-2.0 |

-1.9 |

b) Non-departmental enterprises |

4.0 |

3.3 |

2.8 |

2.8 |

2.9 |

2.8 |

Note : Household financial saving is arrived at by netting out of household’s financial liabilities from their gross investment in financial assets.

Household physical saving is shown in gross terms i.e. inclusive of depreciation.

Source: Central Statistics Office.

|

Table II.4 : Agricultural Production 2013-14 |

(in million tonnes) |

Crop |

2012-13 |

2013-14* |

Percentage Change |

1 |

2 |

3 |

4 |

Foodgrains |

257.1 |

264.8 |

3.0 |

Rice |

105.2 |

106.5 |

1.2 |

Wheat |

93.5 |

95.9 |

2.6 |

Coarse Cereals |

40.0 |

43.1 |

7.8 |

Pulses |

18.3 |

19.3 |

5.5 |

Oilseeds |

30.9 |

32.9 |

6.5 |

Groundnut |

4.7 |

9.7 |

106.4 |

Rapeseed & Mustard |

8.0 |

8.0 |

0.0 |

Soyabean |

14.7 |

12.0 |

-18.4 |

Cotton # |

34.2 |

36.6 |

7.0 |

Jute & Mesta ## |

10.9 |

11.6 |

6.4 |

Sugarcane (Cane) |

341.2 |

350.0 |

2.6 |

*: Fourth Advance Estimates as on August 14, 2014.

#: Million bales of 170 kgs. each.

## : Million bales of 180 kgs. each.

Source: Ministry of Agriculture, GoI.

|

Food security management assumes importance

in the face of a sub-normal monsoon

II.1.10 Though it is still early to assess the

quantum, 2014-15 may not be as favourable for

agriculture growth as last year (see also Box I.1 in

Chapter 1). If managed well, the current stocks of

rice and wheat (63.8 million tonnes at end-July

2014) are adequate to meet food security and buffer

requirements despite a sub-normal monsoon

(Chart II.5). However, it may prove a challenge to

bring down price pressure for perishable food items,

in particular, vegetables and fruits. Further reforms

are necessary covering the entire gamut of food

management. This could cover the unbundling of

functions of the Food Corporation of India (FCI)

and the removal of perishable items from the ambit

of the agricultural produce marketing committee

(APMC) Act, with adequate safeguards to farmers.

The latter will be a significant step towards instilling

competition and price discovery.

Industrial sector contracted in 2013-14

II.1.11 Industrial sector declined during 2013-14.

This was only the third instance since 1951-52,

when the Indian industry recorded contraction, the

previous instances being 1979-80 (during the

second international oil crisis) and 1991-92 (fallout

of the Gulf war and the external payments crisis).

Moderation in demand, both domestic and global,

and rising input costs adversely affected industrial

performance during 2013-14. The contraction in the

industrial sector was reflected in mining and

manufacturing sectors and more than offset strong

growth in the electricity sector. Including 2013-14,

mining sector has contracted for 3 consecutive

years. Contraction in the manufacturing sector

reflected poor investment demand and weakness

in consumer spending.

II.1.12 As per the use-based classification, the

production of capital goods and consumer durables

declined, reflecting subdued investment and

consumption demand (Table II.5). However, the

performance of intermediate goods and consumer

non-durable goods segment improved during the

year.

Table II.5: Index of Industrial Production (IIP) |

(Per cent) |

|

Weight |

2005-06 |

2006-07 |

2007-08 |

2008-09 |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

Apr-Jun 2014 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

Overall IIP |

100.0 |

8.6 |

12.9 |

15.5 |

2.5 |

5.3 |

8.2 |

2.9 |

1.1 |

-0.1 |

3.9 |

Sectoral Classification |

|

|

|

|

|

|

|

|

|

|

|

Mining |

14.2 |

2.3 |

5.2 |

4.6 |

2.6 |

7.9 |

5.2 |

-2.0 |

-2.3 |

-0.6 |

3.2 |

Manufacturing |

75.5 |

10.3 |

15.0 |

18.4 |

2.5 |

4.8 |

8.9 |

3.0 |

1.3 |

-0.8 |

3.1 |

Electricity |

10.3 |

5.2 |

7.3 |

6.3 |

2.7 |

6.1 |

5.5 |

8.2 |

4.0 |

6.1 |

11.3 |

Use-Based Classification |

|

|

|

|

|

|

|

|

|

|

|

Basic goods |

45.7 |

6.1 |

8.9 |

8.9 |

1.7 |

4.7 |

6.0 |

5.5 |

2.5 |

2.1 |

7.6 |

Capital goods |

8.8 |

18.1 |

23.3 |

48.5 |

11.3 |

1.0 |

14.8 |

-4.0 |

-6.0 |

-3.6 |

13.9 |

Intermediate goods |

15.7 |

6.6 |

11.5 |

7.3 |

0.0 |

6.0 |

7.4 |

-0.6 |

1.6 |

3.1 |

3.1 |

Consumer goods |

29.8 |

10.7 |

16.1 |

17.6 |

0.9 |

7.7 |

8.5 |

4.4 |

2.4 |

-2.8 |

-3.6 |

Consumer durables |

8.5 |

16.2 |

25.3 |

33.1 |

11.1 |

17.0 |

14.2 |

2.6 |

2.0 |

-12.2 |

-9.6 |

Consumer non-durables |

21.3 |

8.6 |

12.3 |

10.2 |

-5.0 |

1.4 |

4.2 |

5.9 |

2.8 |

4.8 |

0.7 |

| Source: Central Statistics Office. |

II.1.13 Industrial output data for Q1 of 2014-15

shows an improvement over the corresponding

period last year. Growth of Index of Industrial

Production (IIP) during Q1 of 2014-15 at 3.9 per

cent is the highest in last 11 quarters. Further, the

acceleration in exports growth is expected to

provide a boost to industrial recovery.

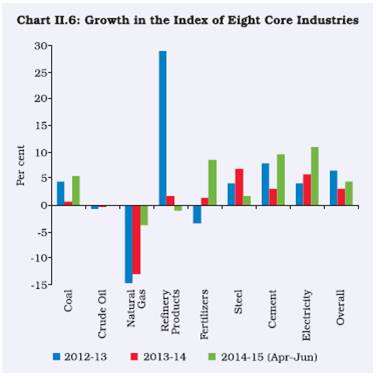

II.1.14 Growth in the eight core industries

decelerated to 3.1 per cent during 2013-14,

compared to 6.5 per cent in the previous year

(Chart II.6). Three consecutive years of contraction

in natural gas production from the KG-D6 block

from 56 mcm/d in 2010-11 to 14 mcm/d in 2013-14

has adversely affected capacity utilisation of gas

based thermal power plants while crude oil

production continued to suffer from ageing oil fields

and delay in the execution of new oil-field projects.

However, electricity generation accelerated during

the year driven mainly by hydel power. Thermal

power generation decelerated during 2013-14.

II.1.15 Growth in the eight core industries growth,

however, improved during Q1 of 2014-15 to 4.6 per

cent from 3.7 per cent in the corresponding period

in the previous year. The turnaround was caused by growth acceleration in the production of coal,

fertilisers, cement and electricity, as also markedly

lower contraction in natural gas output. Growth in

steel and refinery products decelerated.

Slowdown seen in planned corporate investment

amid economic slowdown

II.1.16 Fixed investment plans of the corporate

sector slowed down during 2013-14. The Reserve Bank’s data on the time phasing details of the major

projects, which were sanctioned financial assistance

by banks and other financial institutions or raised

funds through external commercial borrowings

(ECBs)/ foreign currency convertible bonds

(FCCBs) or domestic equity issuances, indicated

that investment intentions of 1,065 companies were

to the tune of `2.5 trillion in 2013-14. This was lower

by 17.9 per cent than the revised estimate for 2012-

13. Investment in 2013-14 was mainly envisaged

in ‘power’, ‘metal & metal products’, ‘textiles’,

‘cement’ and ‘construction’ industries.

II.1.17 Based on the investment plans up to 2013-

14, the capital expenditure envisaged in 2014-15

aggregated `1.2 trillion, which implies that for

improving the level of aggregate capital expenditure

in 2014-15 from that of 2013-14, a capital

expenditure of more than `1.2 trillion will need to

come from new investment intentions of the private

corporate sector in 2014-15. This could be realised

as forward looking surveys and economic indicators

along with rising business confidence provide hope

that the decline in private corporate investment

could be arrested in 2014-15.

Services sector stayed weak in 2013-14

II.1.18 Growth of services sector during 2013-14

was mainly driven by the sub-sector ‘financing,

insurance, real estate & business services’ which

grew in double digits followed by ‘community, social

& personal services’ (Chart II.7). However, the

construction sector suffered a major setback in the

last 2 years on account of the economic slowdown

(Appendix Table 2). A recovery in domestic services

such as transport, trade and logistics is contingent

upon the recovery of the domestic economy.

II.1.19 Various lead indicators of the services

sector for 2014-15 signal improvement in most

segments except steel consumption and commercial

vehicle sales. Trade and transport related indicators

like cargo handled at ports, foreign tourist arrivals

and civil aviation show improved prospects. However, moderation in steel consumption indicates

a sluggish outlook for the construction sector. Weak

consumer spending on the back of elevated inflation

and interest rates has affected the automobile

sector. However, there has been some pickup in

passenger car sales during May-July of 2014-15.

Persistent efforts to address infrastructural

constraints, though revival remains modest

II.1.20 In the last few years, infrastructure sector

has been experiencing sluggish growth mainly due

to macro economic factors and policy gridlock

coupled with sector specific bottlenecks. However,

over the last one year, the government attempted

several reforms aimed at reviving the sector viz.,

streamlining approvals through the Cabinet

Committee on Investments (CCI), increasing

domestic availability of coal supply through fuel

supply agreements and coal imports at a cost-plus

basis, streamlining coal block auctioning, financial

restructuring of state electricity distribution

companies and gas pricing guidelines. These

supply-side measures have yielded some benefits,

though more efforts will be needed to turnaround

the investment in the sector. Along with supply side constraints, of late, the power sector is also facing

demand side pressures, associated with both slow

growth as well as the financial weaknesses of most

of the state and privately owned electricity

distribution companies, which has made them

reluctant to buy power. This has led to many power

producers operating at sub-optimal capacities. Plant

load factor (PLF) of thermal power plants declined

to 65.6 per cent during 2013-14 from 70.3 per cent

recorded in the previous year, putting pressure on

the profitability of power producers. In addition,

several power projects have been stuck due to

issues such as environment clearances and land

acquisition.

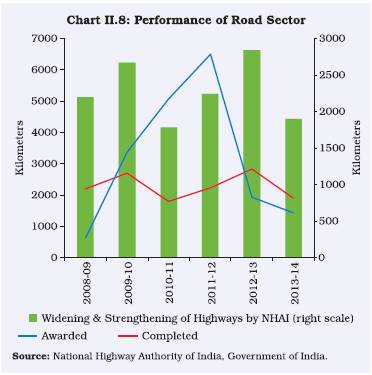

II.1.21 For the last 2 years, the road sector seems

to be experiencing stagnancy. Notwithstanding

several sector-specific measures, the road subsector

failed to attract private investment during

2013-14, partly due to increased leverage of many

construction firms operating in this area and partly

due to difficulties in land acquisition, obtaining

environmental clearances and concerns about the

financial viability of the projects. There were only

few takers for public private partnership (PPP)

projects for roads in 2013-14; less than 1,500 km

was awarded under the engineering, procurement

and construction (EPC) mode. During 2013-14, the

National Highways Authority of India (NHAI)

recorded a growth that was 33.2 per cent lower than

that during the same period in the previous year

with regard to the strengthening/widening of

national highways (Chart II.8). During the current

financial year, the new government has set a target

of 8,500 km of national highway construction; with

the majority to be awarded through the EPC route.

II.1.22 A series of governmental initiatives were

taken in 2013-14 to boost infrastructure investment.

These included establishment of the CCI and the

Project Monitoring Group (PMG) to expedite the

clearance of key mega infra projects, enactment of

new legislation for land acquisition, rehabilitation

and resettlement, treating debts due to the lenders as ‘secured’ loan in the case of PPP projects,

relaxation of external commercial borrowing (ECB)

norms for infrastructure finance companies and

facilitation of infrastructure debt funds (IDFs).

However, these initiatives yielded limited benefits.

Since its inception PMG has undertaken the

resolution of issues pertaining to projects worth

`5.8 trillion. A majority of the projects resolved by

PMG were in the power sector followed by coal

projects and related mainly to fuel supply

agreements. However, as on May 1, 2014, of the

727 central sector infrastructure projects (worth

`1.5 billion and above) monitored by the Ministry

of Statistics and Programme Implementation

(MoSPI), about 39 per cent of the projects were

reported to be delayed and 41 per cent were without

any specific date of commissioning. The cost

overruns of these projects continue to remain high

at 20 per cent.

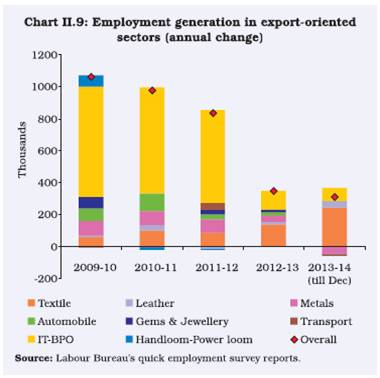

Employment generation during 2013-14 showed

mixed trends

II.1.23 India being a highly populated developing

economy, employment generation serves as an

important indicator of inclusive and sustainable growth. The quarterly employment surveys

conducted by the Labour Bureau for select exportoriented

sectors reveal that there was a significant

moderation in the rate of employment generation

in 2012-13, though some improvement was seen

in 2013-14. Employment generation in the IT-BPO

sector has been declining over the years while the

textile sector saw an increase, especially in 2013-14

(till December) (Chart II.9). Some private data

sources of employment in the organised sector also

present a mixed picture during 2013-14. The third

Annual Employment-Unemployment Survey for

2012-13 conducted by Labour Bureau showed that

the unemployment rate was 4.0 per cent on UPSS1.

Unemployment rate in urban areas at 5.3 per cent

was higher than 3.5 per cent in rural areas. The

latest Annual Survey of Industries’ (ASI) results

pertaining to 2011-12 indicated that there was a

fall in the growth rate of organised sector employment

in 2011-12 over the previous year.

Real activity set to improve in 2014-15

II.1.24 Stronger business sentiments, improved

consumer confidence and increased capital inflows

in the recent quarters appears to indicate a start to

a modest recovery in the growth of the economy.

The key priority is to enhance the growth rate of

the economy by addressing structural impediments

that are constraining investment activity in the

economy.

II.2 PRICE SITUATION

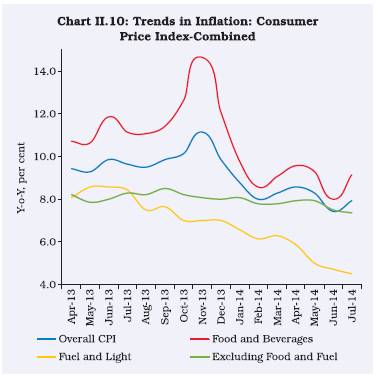

Headline CPI inflation moderated during 2013-14

but remains high with pressure from food prices

and other second round effects

II.2.1 Inflation in terms of consumer price index

(CPI) eased during the period December 2013 to

February 2014, declining to 8.0 per cent after

remaining above 9 per cent for 22 successive

months and touching a high of 11.2 per cent in

November 2013. The moderation in consumer price

inflation resulted from a sharp correction in food

prices. However, the disinflationary momentum has

not gathered strength as decline in food prices was

temporary and second round effects from high food

inflation continue to exert pressures on the general

price level. CPI excluding food and fuel inflation

showed considerable persistence at an elevated

level during H1 of 2013-14, followed by a fall from

8.5 per cent in September 2013 to 7.8 per cent in

March 2014 and further to 7.4 per cent in July 2014

(Chart II.10). This decline in a component that has

exhibited stickiness was supported by a tight

monetary policy stance. Going forward, while

growth revival on a sustainable basis will remain

an objective, inflation risks will need to be factored

in. Given the unsatisfactory progress of south-west monsoon so far and its impact on food prices, as

also risks emanating from potential crude oil price

shocks, upside risks persist to the disinflationary

glide path set out by the Expert Committee to revise

and strengthen the monetary policy framework

(Chairman: Dr. Urjit Patel) (to 8.0 per cent by

January 2015 and 6.0 per cent by January 2016).

II.2.2 Food and beverages group in CPI, with a

weight of 47.6 per cent contributed more than half

to headline inflation during 2012-13 and 2013-14.

The main contributors to food inflation, however,

changed over time as cereals prices dominated

during 2012-13, whereas it was the spike in

vegetable prices that kept food inflation high during

2013-14. Notwithstanding the pressure from the

food group, the contribution of CPI excluding food

and fuel inflation remained persistent. Monetary

policy response during the second half of 2013-14

was aimed at anchoring inflation expectations and

containing second round impact in the wake of such

persistence. The Reserve Bank increased the repo

rate under Liquidity Adjustment Facility (LAF) by a

total of 75 basis points to 8.0 per cent during

September 2013 to January 2014.

Insights into disinflation momentum since December

2013 suggest more is required to tame inflation

II.2.3 CPI inflation moderated during December

2013-February 2014, driven largely by seasonal

moderation in vegetable prices. CPI-Combined

inflation remained above 8 per cent till May 2014

but declined to 7.5 per cent in June 2014 on account

of favourable base effect. It, however, rebounded

to 8.0 per cent in July 2014 as vegetable prices

went up by 16.9 per cent over the month. Though

some moderation in CPI excluding food and fuel

inflation is visible in recent months, the extent of

moderation warranted by the significant growth

slowdown is yet to manifest in CPI. Such rigidity in

the core component of inflation points to the inertial

nature of inflation feeding into the elevated inflation

expectations, which would necessitate credible

anti-inflationary monetary policy to provide a

nominal anchor and break the inflation persistence.

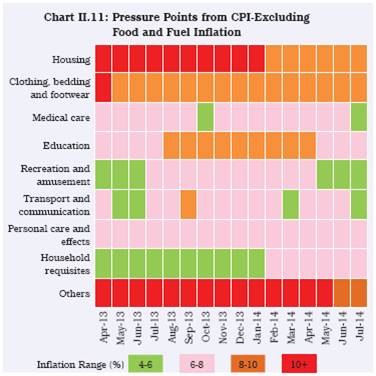

Services led components drive CPI excluding food

and fuel inflation

II.2.4 The stickiness in CPI inflation excluding food

and fuel emanated from the pressures from

housing, transport and communication and services

led components such as medical care, education

and stationery, household requisites and ‘others’

sub-category, which includes charges paid to

barbers, beauticians, washer-men, tailors and ironmen.

High inflation in the services constituents

reflected the role of wage pressures and other

second round effects. The disaggregated data in

this respect suggest that prices of most of the items

grew in a band of 6-8 per cent, while the ‘others’

sub-category grew at more than 10 per cent during

2013-14 (Chart II.11). Inflation in the housing subgroup

declined to 8.9 per cent in July 2014 after

remaining in double digits during 2012 and 2013.

Services inflation starts to taper

II.2.5 Given that more than 60 per cent of India’s

GDP emanates from services, understanding movements in services prices is critical to gauge

the growth-inflation dynamics. Also, much of the

services are labour intensive and, therefore, the

second round effects from wage-price spiral could

be much stronger in services inflation. The CPICombined

data do not have a separate services

category. However, the miscellaneous sub-category

that largely represents services has shown

considerable inflation persistence. Using the

disaggregated information on 32 individual price

series for services available from CPI-Industrial

Workers (IW), a composite service price index was

constructed to assess the trends in services

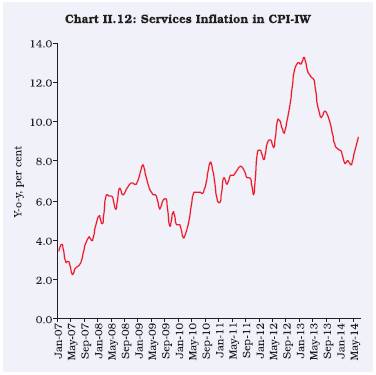

inflation. Inflation trends available from this index

indicate moderation in services inflation beginning

March 2013, though its level continues to remain

high at over 8 per cent (Chart II.12).

II.2.6 One key indicator of inflation persistence is

inflation expectations. As highlighted in the report

of the Expert Committee to revise and strengthen

the monetary policy framework (Chairman: Dr. Urjit

Patel), the elevated and entrenched nature of

inflation expectations in India – as measured by the

RBI’s households’ surveys – is likely a key reason why elevated inflation currently co-exists with

negative output gaps. The results of the Inflation

Expectations Survey of Households (IESH) indicate

that household inflation expectations continued to

remain elevated at double digit level during 2013-

14. As per the latest IESH Round 36 (i.e., April –

June 2014), the short-term inflation expectations

in terms of median for next three months moved up

marginally whereas the one-year ahead median

inflation expectations of households decreased

fractionally as compared with the previous quarter.

Also, about 72 per cent (75 per cent in the last

round) and 74 per cent (77 per cent in the last

round) of the respondents expected double digit

inflation rates for three-month ahead and one-year

ahead period, respectively (Box II.3).

Volatility in inflation pointed to supply side

rigidities

II.2.7 Volatility in prices, especially of select food

items continues to pose a major challenge to

managing inflation. It is observed that since January

2012 both inflation and volatility in vegetable prices

has been the highest across the food items

(Chart II.13). Inflation in the case of cereals, milk, egg, fish and meat remained, on an average, at

double digit level and exhibited low volatility

indicating that the pressures in these commodities

were persistent.

Box II.3

Trends in Inflation Expectations: Evidence from Survey Based Measures in India

Forward looking monetary policy attaches a lot of importance

to inflation expectations as inflation expectations of economic

agents significantly influence their inter-temporal as well as

current economic choices. High inflation expectations could

lead workers to bargain for higher wages, thereby putting cost

pressure on prices leading to high actual inflation resulting in

a wage-price spiral. Monetary policy, by committing to a

credible anti-inflationary stance, endeavours to influence

inflation expectations so that they remain anchored at levels

close to the target/medium term objective (Mohanty, 2012).

Well-anchored inflation expectations imply that inflation

expectations are relatively insensitive to incoming data, i.e.,

the long-run expectation of inflation of public changes little,

in a period witnessing inflation that is higher than their longrun

expectation (Bernanke, 2007). Central banks in most

advanced as well as emerging economies, especially those

which operate with an inflation targeting framework, place

emphasis on assessment and outlook for inflation expectations

in their monetary policy communication.

Unlike the economic variables, inflation expectations are not

directly observable, and therefore would have to be either

derived from other indicators or measured using survey based

methods. From the financial market data, the differential yields

between ordinary and inflation-indexed government bonds of

similar maturity as well as the shape of the yield curve throws

light on the expected rate of inflation. The survey based

approach for measuring inflation expectations could be in the

form of direct survey of households, survey of producers’

outlook on input and output prices or survey of professional

forecasters.

In India, the absence of time series data on inflation indexed

bonds limits the source of information on inflation expectations.

The yield spreads, on the other hand, are influenced by the

outlook relating to government borrowing programme,

statutory g-sec holding requirements on banks and inflation

expectations. Therefore, a lot of emphasis has been placed

on survey based measures of inflation expectations. In the

recent period, the Reserve Bank has been conducting

qualitative and quantitative surveys at quarterly frequency to

assess the inflation expectations for India. These surveys

cover households, producers and professional forecasters.

The Inflation Expectations Survey of Households (IESH)

initiated in September 2005 elicits qualitative and quantitative

responses for three-month ahead and one-year ahead period

on expected price changes. The Technical Advisory

Committee on Surveys constituted in 2009 by the Reserve

Bank regularly deliberates on the concept, methodology and

data quality and suggests methodological improvements in

the survey. It is recognised that inflation expectations of

households are subjective and are based on individual

consumption baskets and hence may differ from the official

inflation numbers released periodically by the government. The households’ expectations are generally observed to be

higher than the official inflation estimates (Chart 1). The nearterm,

i.e., three-month ahead inflation expectations of the

households are believed to be a better indicator of consumer

expectations as compared with one-year ahead expectations,

which have wider variations.

The Reserve Bank has been conducting the survey of

professional forecasters (SPF) since September 2007. The

forecasters provide medium-term (5-year ahead) and longterm

(10-year ahead) quantitative forecasts of inflation. As

the professional forecasters consider all the available

information, both past and future, their expectations could be

considered more rational than that of households.

The professional forecasters survey suggests a fall in the

inflation expectations and the medium-term CPI inflation has

been trending down in the recent period. The 5-year and 10-

year ahead median CPI inflation expectations in the latest

survey round released in July 2014 have fallen to 7.0 per cent

and 6.0 per cent, from 7.75 per cent and 7.0 per cent,

respectively, in the survey round released in January 2014.

Such a fall in long-term inflation expectations augurs well for

the economy at a time when the central bank seeks to build

its credibility in aiming to lower inflation further.

References:

Bernanke, B. (2007). Inflation Expectations and Inflation

Forecasting, Speech delivered at the Monetary Economics

Workshop of the National Bureau of Economic Research

Summer Institute, Cambridge, Massachusetts, July 10, 2007.

Mohanty, D. (2012). The Importance of Inflation Expectations,

Reserve Bank of India Monthly Bulletin, December 2012,

2295- 2303.

Reserve Bank of India (2009). Report of the Technical

Advisory Committee on Inflation Expectations Survey of

Households, Reserve Bank of India Monthly Bulletin, May

2010, 1161- 1226.

II.2.8 Apart from the large volatility, there is also

significant variation in inflation across the states in

the country (Chart II.14). Empirical results suggest

that although over time prices tend to converge

across regions in India, inflation spikes are usually

associated with increase in variability in inflation

across regions pointing to region-specific factors

playing a role (Box II.4).

Box II.4

Regional Inflation Dynamics in India

Given large differences in economic structure in a diverse

country like India, there could be a number of region specific

factors that influence inflation dynamics. Economic literature

has identified several reasons for inflation differentials

among regions within a common currency area (Hendrikx

and Chapple, 2002). Following a food price shock, it is likely

that inflation pressure is more severe in areas where the

share of food in total consumption is high and also in areas

which depend on imports from rest of the country for

consumption. Disparities in the product and labour market

structures could also lead to inflation differentials across

regions. If a country is experiencing a phase of economic

integration between regions within the country, the Balassa-

Samuelson effect could result in inflation differentials as the

productivity differentials between tradable and non-tradable

sectors in a region will lead to inflation pressures. Variation

in transport costs could be another source of inflation

differentials.

Monetary policy is primarily focused on price stability at the

aggregate level, but heterogeneous price movements at the

regional level and inflation differentials could have a

significant impact on monetary policy efficacy. Large inflation

differences can create real interest rate deviations across

regions with uniform nominal interest rate across the country.

If inflation is manifested by demand pressures, this would

imply that the regions with high aggregate demand may

further fuel inflation due to prevailing lower real rate of

interest (Cecchetti et al, 2002). Therefore, regional

dispersion of inflation is an important input that may be useful

in designing the appropriate policy response.

The trends in regional dispersion are analysed using the

data for Consumer Price Index for Industrial Workers (CPIIW),

which give detailed information on price movements

across 78 centres in the country. A plot of the inflation trends in CPI-IW and the regional dispersion in inflation as

measured by the standard deviation indicates that there is

considerable co-movement between the two and most of

the inflation spikes are also associated with increase in

regional inflation dispersion (Chart 1). This shows that region

specific supply and demand factors play a crucial role in

shocks to inflation.

Notwithstanding the disproportionate impact of supply-side

shocks on inflation across regions, an important issue is whether, over the long-run, price levels across regions within

the country converge. The law of one price and product and

factor mobility, over time, should lead to price equalisation

between regions. Empirical evidence in the case of euro

area supports the law of one price. Applying panel unit root

tests on monthly CPI-IW data for India from April 1990 to

January 2014, it is found that the price level deviations from

national average do not have a common unit root. This shows

that, following a deviation from the national average, price

level in a particular region reverts. This implies that the law

of one price holds for India as well and the role of aggregate

demand management policies like monetary policy remains

significant in controlling inflation.

References

Hendrikx, Maarten and Bryan Chapple (2002). “Regional

Inflation Divergence in the Context of EMU,” MEB Series

2002-19, Netherlands Central Bank, Monetary and

Economic Policy Department.

Cecchetti, Stephen G., Nelson C. Mark and Robert J. Sonora

(2002). “Price Index Convergence among United States

Cities”, International Economic Review, Vol. 43, No. 4.

WPI Inflation too showed moderation during

2013-14

II.2.9 Average wholesale price index (WPI)

inflation during 2013-14 at 6.0 per cent was

significantly lower than 7.4 per cent during the

previous year (Chart II.15 and Appendix Table 3).

Whereas inflation in food articles picked up,

inflation in the fuel group remained persistent. The

decline in overall inflation in terms of the WPI was

largely driven by the fall in average inflation in

non-food manufactured products, reflecting weak

pricing power of the Indian corporate. Softer global

commodity prices, especially of metals played a

significant role in keeping inflation low in this

segment. However, on a year-on-year basis, nonfood

manufactured product inflation steadily

edged up from 2.2 per cent in July 2013 to 4.0 per

cent in March 2014 reflecting input cost pressures. Subsequently, it declined to 3.6 per

cent in July 2014.

Administered fuel price revisions reduced

suppressed inflation, but the process remains

incomplete

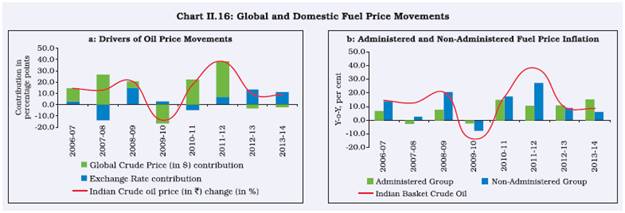

II.2.10 Although international crude prices (Indian

basket) declined by about 2 per cent in dollar terms

in 2013-14 over the previous year, sharp rupee

depreciation since May 2013 and an increase in

international crude oil prices resulted in a rebound

in WPI fuel inflation to double digit level during

2013-14 (Chart II.16). Administered prices were

adjusted in a staggered manner during the course

of the year, especially for diesel. The hike in

electricity prices in August and December 2013

exerted further pressure on the fuel group inflation.

The revision in administered petroleum prices has

caused some reduction in the extent of underrecoveries

of the Oil Marketing Companies (OMCs).

The estimated under-recovery of the OMCs during

2013-14 was high at `1.4 trillion, of which 45 per

cent was on account of diesel. Currently, the OMCs

are incurring daily under recovery of `2.26 billion

(effective August 1, 2014) on the sale of diesel,

PDS kerosene and domestic LPG. Geopolitical

developments in the Middle East and Ukraine

remain an upside risk to global crude prices with

significant implications for inflation and underrecoveries. These will need to be managed by

greater flexibility in domestic prices and adequate

budgetary provisions.

Global inflation remained diverse among advanced

and emerging economies

II.2.11 Globally, inflation pressures vary across

advanced and the emerging economies. In

advanced economies, inflation remained low aided

by range-bound commodity price movements,

large spare capacity and high unemployment

during 2013-14. Emerging market and developing

economies (EMDEs), on the other hand, witnessed

inflationary pressures driven by a weaker exchange

rate and domestic supply side factors. Many central

banks in EMDEs were faced with the trade-off

arising from a combination of slowing economic

growth and stubborn inflationary pressures. In view

of high inflation and exchange rate depreciation,

many central banks in the EMDEs including Turkey,

Ukraine, Russia, Indonesia and Brazil hiked policy

rates. In the case of advanced economies, the US

Fed began tapering in a calibrated manner in view

of a strengthening economic recovery. The

European Central Bank (ECB) introduced negative

deposit rate to encourage bank lending for

business activity.

Global commodity prices remained range-bound

but exchange rate depreciation during H1 of

2013-14 led to some pass-through effects

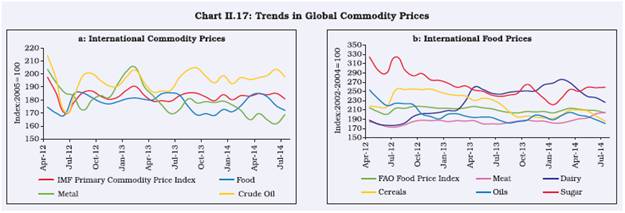

II.2.12 Global commodity prices continued to

soften amid improved supply and weak demand

conditions in 2013-14 (Chart II.17). Global crude

oil prices witnessed some uptick during H1 of

2013-14 driven by supply outages but declined in

H2 of 2013-14 on account of easing supply

concerns and tepid demand conditions. Metal

prices edged down in 2013-14 aided by surplus

supplies and slowing demand in emerging

economies, particularly in China and India. The

Food and Agriculture Organisation (FAO) food price

index declined by 1.6 per cent in 2013 as large

supplies pushed down the international prices of

commodities such as cereals, oils and sugar.

II.2.13 Global commodity prices, especially of

crude oil have remained volatile in 2014-15 so far

on account of factors including supply disruptions

from Libya, the Ukraine crisis and political

developments in Iraq. Brent crude oil spot prices

averaged US$111.9/barrel in June 2014 but

improved supply prospects in Libya led to

subsequent correction in Brent crude oil prices to

below US$104 per barrel in early-August 2014.

Further, sustained softer prices of non-oil

commodities, especially metals offset some of the

inflation risks. Weather-related concerns and

increased geopolitical tensions have caused global

prices of some cereals, especially wheat, maize

and barley to firm up during February-April 2014.

Inflation expected to be range-bound during

2014-15 but risks remain

II.2.14 The pick-up in CPI inflation after significant

moderation during December 2013-February 2014,

especially in July 2014 driven by shocks to food

prices indicates that the concerns on inflation are

far from over. The unsatisfactory progress of southwest

monsoon so far could further exacerbate

pressures on food prices as is evident from the

spikes witnessed in prices of certain vegetables

such as tomato. Such pressures could drive inflation

expectations up, necessitating policy actions to

contain inflation and mute the second round effects

unless supply side actions mitigate price pressures.

Global commodity prices may remain range-bound,

but pressure on crude oil prices from geopolitical

tensions, especially in Iraq could be a major upside

risk. With the marked reduction in external sector

risks that have imparted stability to the rupee

exchange rate, the likelihood of exchange rate

pass-through pressures on domestic inflation have

receded. However, administered price revisions,

particularly in the case of fuel will need to continue

in order to reduce the fiscal burden, which will also

add some upside pressures on prices in the nearterm.

Over the medium term, however this will help

lower inflation and inflation expectations. The

persistence of negative output gap despite a fall in

potential output growth should support the

disinflation momentum going forward.

II.3 MONEY AND CREDIT

Tapering signal posed challenges to conduct of

monetary policy in H1 of 2013-14

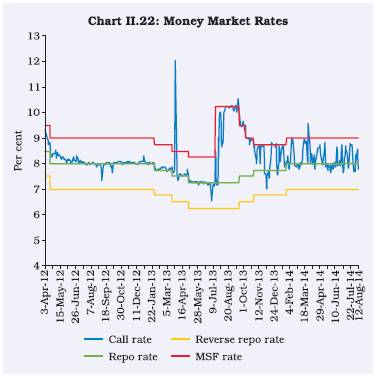

II.3.1 The monetary policymaking during 2013-14

can be demarcated into three distinct phases. The

easing cycle that began in January 2012 was

followed by a 125 basis points (bps) reduction in

the repo rate during April 2012 to May 2013. This

phase was interrupted by large and sudden capital

outflows. The trigger for such huge volumes of

outflows emanated from the May 2013

communication by the US Fed regarding the

possible tapering of its quantitative easing (QE) in

the following months. Uncertainty about the timing

and quantum of the tapering led to large capital

outflows from emerging market and developing

economies (EMDEs), particularly those with high

current account deficits (CAD) and high inflation,

including India.

II.3.2 EMDEs had to actively tighten their

monetary policy stance so as to stem capital

outflows and also rely on foreign exchange

interventions. The anticipated impact of QE

tapering on global liquidity, withdrawal of crossborder

capital flows and their effect on asset prices

put downward pressure on the rupee, especially

in the presence of a large and unsustainable CAD.

Monetary policy challenges from spillovers were

not unique to India; significant contagion felt across

EMDEs

II.3.3 The monetary policy of central banks in

large advanced economies (AEs) spilling over to

emerging markets were evident from the

developments during 2013-14. The experience of

such spillovers provides a rationale for greater

policy coordination in this arena (Box II.5).

II.3.4 Facing risks of currency turmoil that could

spill over to various forms of macro-financial stability and endanger growth over the medium

term, the Reserve Bank gave priority to stabilisation

of the rupee. In this the second phase, it effected

a 200 bps hike in the Marginal Standing Facility

(MSF) rate in July 2013 among other measures

(see Box III.2, Chapter 3 for chronology of events),

thereby increasing the spread between the repo

and the MSF rates to 300 bps. With the MSF rate

acting as the effective policy rate, the cost of money market funds in the economy increased significantly.

Caps on access to the LAF window and an

increased average daily CRR requirement (initially

to 99 per cent from 70 per cent, and thereafter to

95 per cent) contributed to the tightening domestic

liquidity situation and increasing the cost of

speculation (Chart II.18a). Increasing domestic

interest rates was important to prevent narrowing

of the spread that could have accelerated debt outflows given that FII debt flows are found to be

particularly sensitive to monetary policy variables

(see Box II.6).

Box II.5

The risks from exiting unconventional monetary policies for emerging markets

Spillovers from the unwinding of unconventional monetary

policies of the US Fed to the emerging markets economies

(EMEs) occurred in significant intensity during 2013-14.

Empirical evidence from the in-house research work in the

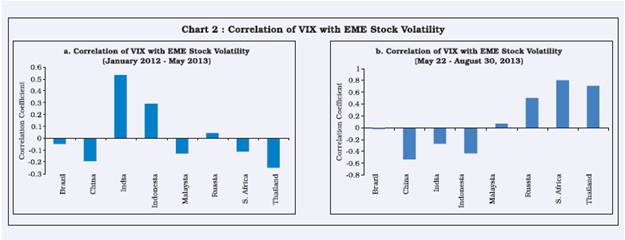

Reserve Bank suggests a clear relationship between the US

VIX and the volatility in various financial markets in EMEs,

including India. US VIX is a widely tracked measure of volatility

in the US equity markets.

Unconventional monetary policy generally refers to nonstandard

monetary measures. These measures include

large-scale asset purchase programmes (LSAPs) also

known as quantitative easing (QE) that change the size and

composition of a central bank’s balance sheet, such as

through purchasing less credit worthy, illiquid private sector

securities. It also includes forward guidance provided by the

central banks to move expectations on long-term interest

rates. For all practical purposes, even the policy rates at or

near zero lower bound (ZLB) of nominal interest rates

constitute unconventional measures. The Bank of Japan has

resorted to QE since 2001. Since 2008, it has been joined

by the US Fed and the Bank of England in resorting to a

significant dose of unconventional monetary policy

measures.

In 2013-14, a mere indication by the Fed on tapering of the

QE resulted in stronger spillovers to EMEs. The response to

the actual tapering under which the US Fed has reduced its

QE asset purchases from US$85 billion a month to US$25

billion so far (up to August 2014) was relatively muted.

However, risks of further spillovers remains if the US monetary

policy tightening cycle takes an uncertain turn or significant

tightening occurs in a relatively short span. In the past, several

but not all of these tightening cycles have witnessed a

significant impact on bond yields, currencies and equities in

global financial markets.

In February 1994, when the Federal Open Market Committee

(FOMC) indicated the start of the tightening, Federal funds

rate rose by 300 bps in a year. There was a severe negative

reaction in bonds in both AEs and EMEs, though in the case

of equities it were essentially the EMEs equities that got

battered. The spillovers also resulted in the occurrence of the

Mexican peso crisis of 1994-95. The EMEs bond market

spreads over US treasuries reached a high, up to 1500 bps

in some cases at that stage. Regarding the spillovers from

the tapering in 2013, Eichengreen and Gupta (2013) indicated

that the largest impacts of the tapering were felt by countries that allowed exchange rates to run up in the earlier period in

expectation of continuous Federal Reserve’s easing.

Countries with larger markets experienced more depreciation

pressures and macroeconomic fundamentals like budget

deficit, public debt, level of reserves and GDP growth rates

which provided little insulation to countries that came under

depreciation pressure during the summer of May 2013.

Besides currency depreciation pressures, financial market

volatilities resulting from the QE taper have been a major

concern in the policy arena especially for emerging market

economies (EMEs). Following literature on clustering of

financial markets volatility, an augmented GARCH(1,1) model

was used to model the daily volatility of stock market returns,

percentage change in the exchange rate (USD as the base

currency) and changes in benchmark (10-years) yield for

BRICS and a set of Asian emerging markets.

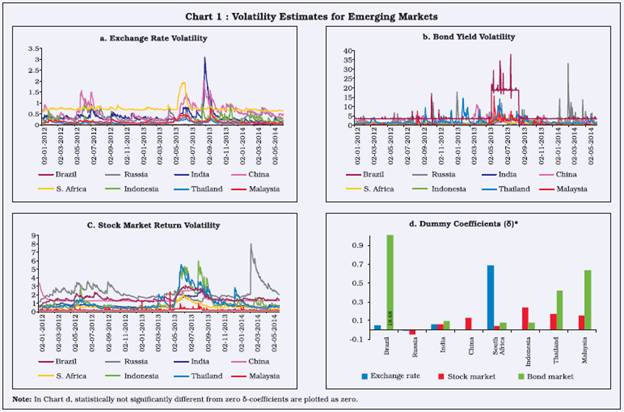

These estimations use daily data from January 2012 to May

2014. A dummy variable that takes value one for Fed’s

tapering talk, that is, May 22, 2013 to August 2013 otherwise

zero was introduced in the volatility equation. The estimated

conditional variance series are given in Chart 1.

The GARCH volatility estimates in most of the emerging

market countries indicate a spillover in currency, bond and

equity markets of the Fed’s tapering talk during May to August

2013. Uncertainty about the magnitude of the taper and fears

of future rate hikes led to the withdrawal of capital flows from

emerging markets in this period. The estimated dummy

variable coefficients were mostly significant and positive,

indicating that the increase in volatility in the EMEs was due

to the uncertainty surrounding the possibility and magnitude

of QE withdrawal.

Rey (2013) in her Jackson Hole paper emphasised the role

of a global financial cycle in capital flows, asset prices and

credit growth, which co-moves with the VIX. Her central

argument is the existence of the ‘irreconcilable duo’ rather

than the ‘impossible trinity’, implying that independent

monetary policies are only possible with managed capital

accounts. The paper adds that one of the policy options to

cope with the dilemma is to act on the policies of a large

source country that generates these cycles (such as that from

QE). However, these source countries are unlikely to agree

to this. To further examine Rey’s proposition during the tapering of QE, an analysis of the US-VIX and the estimated

GARCH volatility for the 8 emerging stock markets (including

BRICS) indicate changes in the correlations during the taper

announcement period. Chart 2 plots the changes in magnitude

and signs of stock market volatility correlation during the Fed

tapering talk (May-August 2013) indicating the impact of

tapering on emerging stock markets.

Rajan (2014) has pointed out that the current ‘non-system’ in

international monetary policy as a source of substantial risk,

and argued for more consideration by source countries to the

effect that their policies will have on other countries. The

adverse effect of such a feedback loop might be minimised

by greater coordination among systemically important central

banks, multilateral arrangements for liquidity provision, better

micro-prudential measures, or independent assessors who

could analyse such policies and come to a judgement on

whether they follow the rule of the game. These measures

could minimise the snowballing of adverse feedback spillovers

of QE-withdrawal taking the locus towards a globally optimal

monetary policy framework. While international monetary policy coordination where AE central banks prepare the

markets and allow gradual adjustments remains the first best

policy choice, EMEs domestic policy responses will need to

gear up to convince markets on stable inflation, smooth

exchange rate adjustments and effective micro and macroprudential

policies.

References:

Eichengreen, Barry and Poonam Gupta (2014), ‘Tapering talk:

the impact of expectations of reduced federal reserve security

purchases on emerging markets’, Policy Research Working

Paper Series 6754, The World Bank.

Rajan, Raghuram G. (2014), ‘Competitive monetary easing:

is it yesterday once more?’, RBI Monthly Bulletin, 1-12,

available at: http://www.rbi.org.in/scripts/BS_SpeechesView.aspx?Id=886

Rey, Helen (2013), ‘Dilemma not Trilemma: The global

financial cycle and monetary policy independence’, Paper

presented at the 25th Jackson Hole symposium, Wyoming,

August.

Monetary and liquidity conditions re-calibrated to

address rising inflation challenges in H2 of 2013-14

II.3.5 While the pressures on the exchange

market were effectively managed by timely

measures including the forex swap facility for banks

and oil companies, their gradual withdrawal and

the calibrated normalisation of the interest rate

corridor helped restore stability to the financial

markets. However, increasing inflationary pressures

and the possible impact on the long term valuation

of the rupee, warranted a shift in the policy stance

beginning October 2013. In view of the upturn in

inflation and elevated inflation expectations and in

order to avert the adverse impact of low real rates

on financial savings, the Reserve Bank raised the

repo rate by 50 bps during September-October

2013 even as the MSF rate was lowered so as to

restore the interest rate corridor spread to 100 bps.

II.3.6 In order to rebuild buffers in the face of

uncertainty regarding the global interest rate cycle

and financial conditions, the Reserve Bank offered

a forex swap window (September 4-November 30,

2013) for banks’ overseas borrowing and nonresident

deposit (FCNR(B)) funds, resulting in

capital inflows in excess of US$ 34 billion through the swap facility. These facilities not only proved to

be timely in strengthening external resilience but

also helped in easing domestic liquidity significantly,

which was reflected in under-utilisation of limits by

the banks under overnight LAF repo and export

credit refinance (ECR), a steady decline in access

to MSF and the parking of excess liquidity with the

Reserve Bank through reverse repos.

II.3.7 In order to prevent liquidity tightening

measures from adversely impacting financing

conditions and with a view to keeping a check on

the long-term interest rates in the system, the

Reserve Bank conducted OMO purchase auctions

that led to net liquidity injection to the tune of about

`520 billion during the year in addition to injection

under LAF and MSF. Although access to overnight

liquidity through LAF was restricted, variable rate

term repos were introduced with 7 and 14 day

tenors.

II.3.8 However, the build up of large surplus cash

balances of the government with the Reserve Bank

up until the interim budget (February 2014) caused

the liquidity situation to tighten again. Despite the

subsequent spending by the government, the yearend

pressures on liquidity on account of annual

closure of bank accounts caused the net recourse

to LAF (including term repo and MSF) to shoot up

to around `2 trillion at the end of the year

(Chart II.18b). During 2014-15 so far, liquidity conditions have remained broadly stable barring

intermittent tightening of liquidity conditions on

account of build up of government cash balances

maintained with the Reserve Bank.

Enhanced liquidity injection, revaluation gains lead

to more balanced net domestic assets (NDA)-net

foreign assets (NFA) led expansion in monetary

aggregates

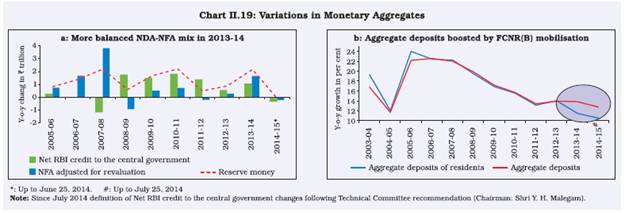

II.3.9 Following inflows under swap facilities, the

increase in reserve money during 2013-14 was

supported by a more balanced NDA-NFA mix as

compared with the skewed trend in recent years

on the sources side (Chart II.19a).

II.3.10 The broad money growth remained largely

in line with the indicative trajectory of 13 per cent

for 2013-14. However, netting out the impact of the

flows into FCNR(B) deposits through the forex

swap facility, the growth in aggregate deposits of

residents was lower at around 11 per cent and the

corresponding resident money growth (NM3) was

also lower. Near static deposit rates have also

dampened the pace of deposit mobilisation

(Chart II.19b).

II.3.11 Scheduled commercial banks (SCBs’)

credit off-take and deposit growth at around 14 per

cent in 2013-14 remained comparable to that in

2012-13. The closing of the gap between credit

and deposit helped reduce the pressure on liquidity.

Uncertainty, slowdown and banking sector asset

quality remain a drag on credit off-take

II.3.12 In line with the cyclical downturn, the

banking sector has been passing through a

challenging phase with deterioration in asset

quality, increased provisioning requirements and

decelerating profitability indicators. These factors

have contributed to increased risk aversion,

affecting credit off-take adversely. Although the

gross NPAs to the gross advances ratio has

increased y-o-y, especially in public sector banks,

the pace of growth in NPAs has moderated recently,

though it is too early to be confident that the worst

is over (See Table VI.2 for banking asset quality

indicators).

Non-food credit growth led by services, personal

loans

II.3.13 The y-o-y credit growth to the industrial

sector moderated during 2013-14 to 13.1 per cent

as compared to 15.1 per cent in the previous year.

Deceleration in credit growth was observed

particularly in mining, chemicals, cement and

textiles. However, credit flow was higher in

construction, rubber and plastic, leather and paper.

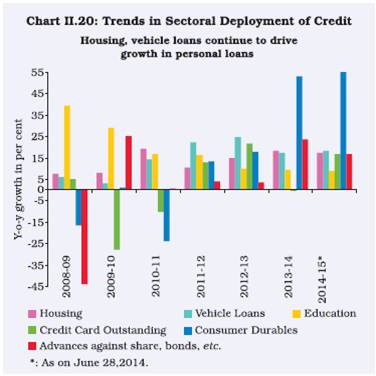

II.3.14 The y-o-y credit growth in services and

personal loans was at around 16 per cent. While

personal loans continued to be led by housing and

vehicles there was a significant pick-up in consumer durables and advances to individuals against

shares and bonds (Chart II.20).

II.3.15 Monetary and liquidity policies in 2013-14

were shaped by twin risks emanating from external

vulnerability and domestic inflation pressures amid

downward sticky inflation expectations. While the

monetary policy measures along with external

sector measures helped in containing external