During the year, the Reserve Bank unveiled its Communication Policy 2.0, continuing with its endeavour to reach out to a wide spectrum of audience through multiple channels including social media and public awareness campaigns, while adhering to the principles of relevance, transparency, clarity, comprehensiveness, and timeliness in its communication. Economic and statistical policy analysis and research were sharpened, and information management systems were strengthened. International relations were deepened under the BRICS Chair of India in 2021 with achievement of several milestones. The Reserve Bank also joined the Network for Greening of the Financial System (NGFS) with its commitment to support greening India’s financial system. Efforts were also made for effective cash management on behalf of the government and sound management of foreign exchange reserves. Legislative initiatives/amendments were also pursued during the year to ensure a robust legal framework necessary for a sound and efficient financial system in the economy. X.1 The Reserve Bank released its Communication Policy 2.0 on July 16, 2021. Transparent communication, unambiguous interpretation and precise articulation of the multifarious objectives of the Reserve Bank are the goals of its communication policy. The economic and financial relations with international organisations and multilateral bodies were further strengthened during the year. In pandemic-induced environment, concerted efforts were made to provide effective cash management services to the government by integrating its system with that of e-Kuber. In the uncertain global macroeconomic scenario, safety, liquidity and return in that order continued to be the guiding principles for managing foreign exchange reserves (FER). During the year, several research studies were undertaken on a wide range of contemporary issues, besides providing research inputs for policy formulation and timely release of the flagship publications. Information management system was further strengthened through development of the next generation data warehouse [viz., centralised information management system (CIMS)] and several other initiatives such as use of non-traditional data sources and advanced statistical and artificial intelligence (AI)/machine learning (ML) techniques. The year also witnessed a number of amendments/introduction of legislations pertaining to the financial sector. X.2 Against this backdrop, the rest of the chapter is structured into eight sections. The next section presents major initiatives of the Reserve Bank with regard to its communication strategy and processes. Section 3 discusses the Reserve Bank’s international relations, including interactions with international organisations and multilateral bodies. Section 4 dwells on the activities of the Reserve Bank as a banker to governments and banks. Section 5 reviews the conduct of foreign exchange reserves management. Section 6 sets out research activities, including statutory reports and frontline research publications. Section 7 profiles the activities of the Department of Statistics and Information Management (DSIM), whereas Section 8 presents the activities of the Legal Department. Concluding observations are given in the last section. 2. COMMUNICATION PROCESSES X.3 In recent years, central bank communication has become a key guiding factor in making the central bank policies effective and transparent. Communication of central banks is now targeted to cover a wide spectrum of the audience while ensuring clarity and accuracy. Central banks are now judged not only on what information they communicate, but how it is communicated to a diverse audience. X.4 The Communication Policy 2.0 of theReserve Bank1 was released on July 16, 2021. The Reserve Bank’s communication policy follows the guiding principles of relevance, transparency, clarity, comprehensiveness and timeliness; it strives to continuously improve public understanding of developments in the multiple domains under its ambit. The Reserve Bank’s approach is to communicate its policy stance and its assessment of the evolving situation by providing rationale as well as supporting information and analyses to all stakeholders. Transparent communication, unambiguous interpretation and precise articulation of the multifarious objectives of the Reserve Bank are thegoals2 of its communication policy. The composite mandate necessitates open, clear and structured communication for its effective functioning as well as for supporting the expanding boundaries of its policy instruments. X.5 The Communication Policy 2.0, which distinctly sets out the purpose and principles of communication, is aligned with medium-term strategy (Utkarsh) of the Reserve Bank and recognises social media as another channel of communication with emphasis on monetary policy communication [particularly, post Monetary Policy Committee (MPC) deliberations], financial stability communication and communication during crisis time, alongside communication by the central board members. Further, the Communication Policy 2.0 embraces technological advancements, changes in modes of communication and other developments in the aspects of central bank communication over the years. X.6 The Reserve Bank disseminates customised communication depending on thetarget audience3 through public awareness initiatives and microsite on its website in 11 major regional languages apart from Hindi and English. The Reserve Bank reaches out to academicians, researchers, financial market participants, bankers, financial journalists and other financially informed communities and also maintains deeper engagement with the general public through traditional and non-traditional channels (Box X.I). Box X.1

Central Bank Outreach and Public Awareness In line with one of the broad goals of the Reserve Bank’s Communication Policy 2.0 to disseminate customised communication depending on the target audience, the Reserve Bank reaches out to such audience through multiple channels such as the Reserve Bank’s website, media interface, informal workshops, and social media, besides public awareness campaigns to reach out to the general public. Further, target-specific communication of public interest has also been released through social media and placed under the ‘RBI Kehta Hai’ page of the Reserve Bank’s website and YouTube channel - a multi-media and multi-lingual flagship public awareness initiative launched to educate the public about banking regulations and practices. Virtual modes of awareness campaigns also became crucial for spreading financial literacy among masses, particularly during the COVID-19 pandemic. New Initiatives In 2021, the Reserve Bank launched a few key initiatives to reach out to the general public by: -

Spreading awareness through a rap song which encourages people to transact digitally, while protecting themselves against cybercrimes like identity theft. -

Associating with Olympic gold medallist Neeraj Chopra, bronze medallist Bajrang Punia and Bhavani Devi through a sports broadcasting channel for warning people against digital banking frauds. The timing of the broadcast was synchronised with the Olympics sports events to maximise the impact. -

The Financial Literacy Week 2021 saw a creative change when the Reserve Bank animated its mascot for financial literacy named ‘Money Kumar’. -

Spreading awareness on the need to be cautious while transacting digitally through an animated dance video and song with its mascot ‘Money Kumar’, which was broadcast on TV channels and its social media handles. -

Associating with a popular kids’ dance show to spread the message “how to stay cyber secure”. -

Use of popular television programmes like Kaun Banega Crorepati in multiple languages, to convey financial awareness messages. Apart from these public awareness campaigns, the Reserve Bank constantly monitors its social media presence and envisages structured two-way communication and engagement over social media. Source: RBI. | Agenda for 2021-22 X.7 Last year, the Department had set out the following goals under Utkarsh: -

To open for public a new section of 'The RBI Museum', which will be dedicated to the functions and working of the Reserve Bank (Paragraph X.8); -

To revamp the Reserve Bank’s website with improved information architecture (Paragraph X.9); -

To continue to conduct virtual/physical workshops/sessions for the regional media on important regulatory and banking related issues (Paragraph X.10); and -

To use public awareness programmes, social media presence and other channels of communication to further deepen engagement with the society (Paragraph X.11-X.13). Implementation Status Second Phase of 'The RBI Museum' X.8 Preparation of the visualisation and exhibits for the second phase of 'The RBI Museum' located at Kolkata (West Bengal) is currently underway. It will display exhibits pertaining to major functions of the Reserve Bank, such as currency management, banker to banks, banker to the government, financial markets, monetary policy, regulation and supervision, foreign exchange and the Reserve Bank’s role in the Indian financial system. Revamping of Reserve Bank’s Website X.9 The work of revamping and redesigning the Reserve Bank’s website was awarded after following an open and competitive selection process. The revamped and redesigned website of the Reserve Bank is expected to be rolled out in 2022-23. Workshops for Regional Media Persons X.10 The Reserve Bank conducts regular workshops and interactions with the regional media to familiarise the media persons with major functional areas of the Reserve Bank. This promotes a clear understanding of the Reserve Bank’s role and functions and in turn fosters better informed reporting on its regulations, policy actions and decisions. A workshop for the regional media was conducted at Hyderabad in September 2021. Social Media Command Centre X.11 Department has set up a social media command centre for monitoring the Reserve Bank related communication on social and digital media on a near real time basis. Specific reports on media monitoring are generated, analysed and suitable measures are taken, if required. The Reserve Bank constantly monitors its social media presence and going forward envisages structured two-way communication and engagement with social media (Table X.1). Public Awareness Campaigns X.12 The Reserve Bank continued to conduct 360-degree mass media public awareness campaigns through media channels, viz., print, television, radio, digital, hoardings and SMS. Campaigns through cinema halls were kept on hold, following the COVID-19 protocols. The Reserve Bank also participated in high-impact unique programmes on television, viz., Indian Premier League (IPL), Kaun Banega Crorepati (KBC), Euro Cup, Olympics, Kon Honar Crorepati (Marathi version of KBC), Evaru Meelo Koteeswaralu (Telegu version of KBC), and year-long campaign on Doordarshan and All India Radio. In 2021, the Reserve Bank also launched some new initiatives to reach out to the wider public as alluded to earlier in Box X.1. Table X.1: Social Media Following

(as on March 31, 2022) | | Platform | Name of Social Media Handle/Page | Launched in | Number of Followers/Subscribers | | 1 | 2 | 3 | 4 | | Twitter | i.@RBI | January 2012 | 15.70 lakh | | | ii.@RBIsays | August 2019 | 1.13 lakh | | YouTube | Reserve Bank of India | August 2013 | 1.11 lakh | | Facebook | i.@RBIsays | August 2019 | 5,526 | | | ii.@therbimuseum | February 2020 | 1,127 | | Instagram | @reservebankofindia | January 2022 | 9,381 | | Source: RBI. | X.13 The Reserve Bank also spreads public awareness through social media such as Facebook, Instagram, Twitter, and YouTube. Other Initiatives Communication Seminars X.14 During the year, three communication seminars were conducted for senior and top management of the Reserve Bank. The objectives of the communication seminars were: (i) to engage with senior management on nuances of external communication; (ii) to aid Regional Directors, Banking Ombudsmen and Officers-in-Charge in communicating with the stakeholders, including media on various issues pertaining to their functional or geographical jurisdiction; and (iii) to equip senior management with strategies and techniques in communication during times of crisis. X.15 A communication seminar for Executive Directors was organised on August 7, 2021 at Kashid, Maharashtra, and two communication seminars for Regional Directors/Chief General Managers/Officers-in-Charge and Ombudsmen were organised on July 30 and December 20, 2021 at Bengaluru and Amritsar, respectively. Informal Media Interactions X.16 Apart from the structured post monetary policy press conferences on the days that monetary policy announcement is scheduled at bi-monthly intervals, the Reserve Bank conducts semi-structured media interactions in an informal set-up a few days after every monetary policy announcement, or as and when such an engagement is felt necessary. 16 such interactions were held during 2021-22 to explain the rationale behind major policy decisions, seek feedback from media persons and clarify their doubts and concerns on the domain. RBI Website X.17 During the year, a new FinTech microsite was made live in co-ordination with FinTech Department and Reserve Bank Information Technology Pvt. Ltd. (ReBIT). X.18 During 2021-22, the Department released 1,953 press releases, 200 notifications/circulars, 16 master directions and uploaded 37 interviews/speeches of the top management, six RBI reports, 10 working papers, 1,026 tenders and 97 recruitment related advertisements. Agenda for 2022-23 X.19 During 2022-23, the Reserve Bank’s communication channels would be further strengthened, and efforts will be made to: -

Revamp the Reserve Bank’s website with improved information architecture (Utkarsh); -

Greater engagement with general public through additional social media platforms, such as Instagram and enhance two-way communication efforts through active social media listening (Utkarsh); -

Layering of public awareness messages for last-mile connectivity by adding illustrations, animations and infographics for interactive campaigns; -

Targeted media monitoring at the level of regional offices of the Reserve Bank; -

Revisiting the style and usage in written communication as a step towards simplifying the Reserve Bank’s internal and external communication content; and -

Conducting impact assessment of the Reserve Bank’s public awareness campaigns to gauge the effectiveness. 3. INTERNATIONAL RELATIONS X.20 During 2021-22, the Reserve Bank further strengthened economic and financial relations with international organisations and multilateral bodies through its International Department. Agenda for 2021-22 X.21 The Department had set out the following goals: -

Follow up on the issues relating to the International Financial Architecture Working Group (IFA WG) of the G20 (Utkarsh) [Paragraph X.22-X.23]; -

Successful completion of the IMF Article IV surveillance by the IMF Mission to India (Utkarsh) [Paragraph X.24]; -

Continue to deliver under various initiatives including the BRICS (Utkarsh) [Paragraph X.25-X.28]; -

Continue to support the South Asian Association for Regional Cooperation (SAARC) countries (Utkarsh) [Paragraph X.29-X.30]; and -

Strengthen engagement with the G20 in the run-up to taking over the Presidency in 2023 (Paragraph X.31). Implementation Status IMF and IFA Related Issues X.22 The Department participated in the meetings of the G20 IFA WG and provided inputs on issues relating to volatility in capital flows, adequacy of global financial safety net (GFSN), and the new general allocation of the Special Drawing Rights (SDRs) by the IMF. X.23 The Department provided inputs for participation in the biannual meetings of the International Monetary and Financial Committee (IMFC) held virtually in April and October 2021. A new Note Purchase Agreement (NPA) 2020 was signed between the Reserve Bank of India (RBI) and the IMF. The NPA 2020 amounting to USD 3.9 billion is effective from September 24, 2021. X.24 In view of the pandemic, the Article IV engagement with the IMF was held in a virtual format in July 2021. The Department regularly participated in various surveys of the IMF such as Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER), the Macroprudential Policy Survey, and surveys on climate risks and cyber risks. The Department also participated in the IMF’s Independent Evaluation Office (IEO) Survey for assessment of the IMF’s capacity development. X.25 The Department firmed up the Reserve Bank’s stance and provided inputs to the Ministry of Finance (MoF), Government of India (GoI) on various international policy issues. The Department also worked closely with the Ministry of Commerce and Industry and provided inputs for various bilateral, plurilateral and multilateral trade negotiations relating to the World Trade Organisation (WTO). X.26 The Department provided inputs for the World Bank’s India Development Update 2021, participated in the Organisation for Economic Co-operation and Development’s (OECD) Advisory Task Force on the Codes (ATFC) meetings and coordinated the completion of the Asian Development Bank’s Asia Small and Medium-Sized Enterprise Monitor (ASM) 2021. BRICS, SAARC and Bilateral Cooperation X.27 As the BRICS Chair in 2021, the Reserve Bank led the BRICS central bank workstream in 2021 (Box X.2), which led up to the BRICS Leaders’ New Delhi Declaration in the XIII BRICS Summit held on September 9, 2021. X.28 The Reserve Bank conducted the maiden Contingent Reserve Arrangement (CRA) test run of the IMF-linked portion in 2021 and initiated discussions to establish a framework for coordination between the CRA and the IMF. X.29 The Reserve Bank extended currency swap support aggregating USD 1.05 billion to three SAARC central banks. Under the SAARCFINANCE Scholarship Scheme for the academic year 2022-23, the Reserve Bank selected four candidates, two from the Bangladesh Bank and one each from the Royal Monetary Authority of Bhutan and the Nepal Rastra Bank (NRB) for pursuing higher studies in recognised Indian Universities/institutions. Box X.2

BRICS Chair 2021 – RBI Achievements In 2021, the Reserve Bank achieved the following milestones under BRICS Chair of India: -

Several BRICS high-level meetings of Finance Ministers and Central Bank Governors (FMCBG), Finance and Central Bank Deputies (FCBD), CRA Governing Council (GC), CRA Standing Committee (SC) and CRA technical and research groups were conducted during the year. -

The BRICS Economic Bulletin 2021 with the theme “Navigating the Ongoing Pandemic: The BRICS Experience of Resilience and Recovery” was published under the aegis of the CRA Research Group. -

BRICS deepened its cooperation in 2021 by exchange of information on cyber threats and sharing of experience in countering cyber-attacks in the financial sphere. -

BRICS e-Booklet on “Information Security Regulations in Finance”, “Compendium of BRICS Best Practices on Information Security Risks: Supervision and Control”, and “BRICS Digital Financial Inclusion Report” were the important publications during 2021. -

BRICS Seminar on “Information Security and Consumer Protection” was organised on December 15, 2021. -

The Reserve Bank has undertaken several initiatives, including the BRICS Collaborative Study on “COVID-19: Headwinds and Tailwinds for BoP of the BRICS ” and a dialogue with the IMF under the CRA. -

The BRICS Payments Task Force (BPTF) has taken various measures in 2021 to strengthen cooperation amongst BRICS countries on payments systems. The BPTF Annual Report 2021 and the CRA Evaluation Report were produced during the year. Source: RBI. | X.30 The fourth Joint Technical Coordination Committee (JTCC) meeting, hosted by the NRB, was held virtually on September 6, 2021. The meeting covered discussions on issues raised by the NRB relating to currency management, non-competitive bidding in T-bills, and other issues relating to foreign trade, balance of payments and foreign direct investment. G20 and its Working Groups X.31 The Department provided research briefs/inputs for the agenda issues under the Italian and Indonesian Presidencies. India has entered the G20 Troika from December 2021, ahead of the Indian Presidency in 2023. Other Initiatives Engagement with BIS X.32 The Department provided analytical support that shaped RBI’s stance on issues discussed in various meetings of the Bank for International Settlements (BIS), including the Committee on the Global Financial System (CGFS). X.33 The Department contributed to various BIS surveys including on mandate of the central bank beyond price stability, post-pandemic modes of working and opinion surveys to gauge public awareness and perception of central banks. It also coordinated the Reserve Bank’s participation in the CGFS workshop on non-bank financial institutions (NBFIs) and the functioning of government bond markets. In addition, the Department also provided support and inputs for activities related to the BIS Board and its Administrative Committee. FSB Initiatives on Global Financial Regulation X.34 The Department prepared inputs for presenting India’s stance in various Committees and Working Groups of the Financial Stability Board (FSB). X.35 With India as the co-chair of FSB’s Regional Consultative Group, Asia (RCG-Asia), the Department organised two meetings of the RCGA in virtual mode. Contributions were made to the FSB’s annual monitoring exercise to assess global trends and risks from the NBFIs. The Department also provided inputs for varioussurveys4 conducted by the FSB. X.36 The Reserve Bank joined the Network forGreening of the Financial System5 (NGFS) on April 23, 2021 and the Department spearheaded the effort for this outcome. The Reserve Bank, as a member central bank, has been contributing to the work of NGFS (Box X.3). X.37 The Department is the nodal point for bilateral dialogues/meetings with other countries and for various other bilateral issues. Other Activities X.38 The Reserve Bank continued its active engagement with the South Asia Regional Training and Technical Assistance Centre (SARTTAC) and the South East Asian Central Banks (SEACEN) Centre. A mid-term evaluation of IMF’s SARTTAC operations by external agencies was facilitated by the Department. X.39 The third Senior Level Dialogue (SLD) between the Reserve Bank and Bank of Japan (BoJ) was organised and hosted on November 29, 2021 in a virtual format. The SLD is organised every year to deepen relations, strengthen the exchange of information and reinforce cooperation in the field of central banking between the two central banks. Box X.3

NGFS’ Glasgow Declaration and Reserve Bank’s Commitment As part of contribution to the COP26, the NGFS released the “NGFS Glasgow Declaration: Committed to Action”, in which it set forth future plans to improve the resilience of the financial system to climate-related and environmental risks, and for supporting the transition towards a sustainable economy. Alongside, the Reserve Bank also published its Commitment to Support Greening India’s Financial System on November 3, 2021. The Reserve Bank broadly supports the NGFS declaration. Specifically, keeping in view the national commitments, priorities and complexity of India’s financial system, a commitment has been made to explore how climate scenario exercises can be used to identify vulnerabilities in the Reserve Bank supervised entities’ balance sheets and business models. Also, the Reserve Bank shall work to integrate climate-related risks into financial stability monitoring and shall also build awareness about climate-related risks among regulated financial institutions. References: 1. NGFS Glasgow Declaration: Committed to Action, Glasgow, November 3, 2021. 2. RBI, Statement of Commitment to Support Greening India’s Financial System - NGFS, November 3, 2021. | Agenda for 2022-23 X.40 In the year 2022-23, the Department will focus on attaining the following milestones: -

Deepening engagement with multilateral institutions including on issues under IFA WG of the G20; -

Participation in Advisory Group for G20 Finance Track Agenda set up by the MoF, GoI to ideate on priorities, suggest outcomes/ deliverables and provide expert guidance on the finance track agenda under the 2023 Indian Presidency of the G20; -

India will take over the G20 Presidency on December 1, 2022 and several high-level and working group meetings will be organised in collaboration with the Government of India; -

Increasing exposure visits and capacity building support for SAARC and other countries through formal MoUs or otherwise; and -

Strengthening BRICS central banks’ cooperation through various channels of engagement. 4. GOVERNMENT AND BANK ACCOUNTS X.41 The Department of Government and Bank Accounts (DGBA) oversees the functions of the Reserve Bank as banker to banks and banker to governments, besides maintenance of internal accounts and formulation of accounting policies of the Reserve Bank. Agenda for 2021-22 X.42 Last year, the Department had set out the following goals under Utkarsh: -

Pursuing the on-going agenda of integration of central and state government systems with e-Kuber for e-payments and e-receipts (Paragraph X.43); and -

Providing dashboard facility to governments for self-monitoring of e-receipts and e-payments transactions (Paragraph X.44). Implementation Status Pursuing the on-going Agenda of Integration of Central and State Government Systems with e-Kuber for e-Payments and e-Receipts X.43 During the year, the Treasury Single Account (TSA) system for central government autonomous bodies has been extended for universal application in coordination with Office of Controller General of Accounts, Ministry of Finance. One Union Territory (UT) has been on-boarded for e-payments and two state governments have completed testing and are expected to be on-boarded soon. Two other state governments are in the process of carrying out changes to their internal systems for integration with e-Kuber. Providing Dashboard Facility to Governments for Self-monitoring of e-Receipts and e-Payments Transactions X.44 The facility is in advanced stages of design/development and fine-tuning to meet the requirements of governments. Major Initiatives Induction of Scheduled Private Sector Banks as Agency Bank X.45 After the lifting of embargo placed on private sector banks to undertake fresh or additional government business by Department of Financial Services, Ministry of Finance, Government of India, revised guidelines have been issued by the Reserve Bank for authorising scheduled private sector banks as its agency banks for conduct of government business. As on March 31, 2022, there are 31 agency banks comprising all 12 public-sector banks (post amalgamation) and 19 scheduled private sector banks which are undertaking government business on behalf of the Reserve Bank. Extension of online Memorandum of Error (MoE) Process in GST Framework to All State Governments X.46 During the year, the online MoE process was extended to seven more state governments and one UT for reconciliation of GST transactions. As on March 31, 2022, 14 state governments and two UTs have been successfully onboarded on the online MoE platform. Moreover, one state government has completed the testing and is expected to go live shortly, nine more state governments are in various stages of testing. Integration of Express Cargo Clearing System (ECCS) with E-Payment Gateway of ICEGATE X.47 E-Kuber of the Reserve Bank is integrated with Indian Customs Electronic Gateway (ICEGATE) system of the Central Board of Indirect Taxes and Customs (CBIC) since July 1, 2019 for payment of central excise, service tax and special economic zone (SEZ) custom duty. During the year, ECCS was also integrated with e-Kuber through ICEGATE payment gateway from August 2021 thus enabling payment of requisite duties by taxpayers directly into the accounts of CBIC maintained at the Reserve Bank using NEFT/RTGS payment option. Universalisation of Treasury Single Account (TSA) X.48 As announced in the Union Budget speech in February 2021, and as per the office memorandum dated February 22, 2021 issued by the Department of Economic Affairs, Ministry of Finance, the TSA system is being extended for universal application in coordination with Office of Controller General of Accounts, Ministry of Finance. Other Developments X.49 The facility of account validation through National Payments Corporation of India (NPCI) was rolled out during the year and three state governments have been on-boarded. X.50 Facility of direct benefit transfer (DBT) payment using Aadhaar Payment Bridge System (APBS) for governments through e-Kuber has been enabled and one state government has been on-boarded during the year. X.51 Facility for dissemination of changes in Indian Financial System Code (IFSC) through XML based notification to government systems integrated with e-Kuber for e-payments is under testing. X.52 Facility for providing Application Programming Interface (API) web-based reconciliation system is being implemented in consultation with Office of Controller General of Accounts, Ministry of Finance, GoI. X.53 Office of Controller General of Defence Accounts (CGDA) is in the process of enabling defence pension payments to Nepal-domiciled pensioners under the Indo-Nepal Remittance Facility through e-Kuber integration with CGDA’s SPARSH [System for Pension Administration (Raksha)]. Agenda for 2022-23 X.54 For 2022-23, the Department proposes the following agenda in line with Utkarsh: -

Enhancing the payments (non-pension) by Central Civil Ministries through integration between e-Kuber and Public Fund Management System, including Inter-Government Adjustment Advice; -

Enhancing the e-payment transactions (non-pension) of state governments who are already integrated with e-Kuber ; -

Integration of state governments with e-Kuber for e-receipts for direct NEFT/RTGS based receipts and agency bank reporting; -

Integrating remaining state governments in North-East region with e-Kuber ; and -

Onboarding of agency banks for collection of customs duty receipts through ICEGATE portal of the Central Board of Indirect Taxes and Customs (CBIC). 5. MANAGING FOREIGN EXCHANGE RESERVES X.55 The Russia-Ukraine conflict has roiled financial markets and injected a fresh dose of uncertainty in the global economy, which was already struggling to recover from the pandemic-driven shock. The initial indications suggest that the conflict could impact the global macroeconomy primarily through the inflation channel, though growth is also likely to take a hit as the conflict prolongs. In this milieu of dynamic global macroeconomic environment and increasing geo-political uncertainties, safety, liquidity and return in that order continued to guide the Department of External Investments and Operations (DEIO) as investment objectives for managing foreign exchange reserves (FER). On a year-on-year basis, FER increased by 5.3 per cent during 2021-22 as compared with 20.8 per cent in the previous year. X.56 Gold has traditionally offered reserve managers many benefits, such as the absence of default risk, diversification of portfolio, low correlation with other asset classes and safe haven investment during different phases of financial cycles (Box X.4). Box X.4

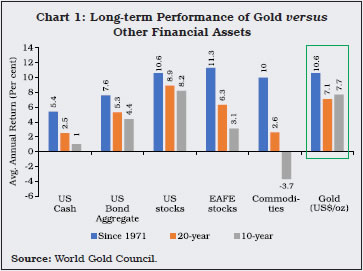

Gold as a Financial Asset in Different Phases of Financial Cycles Gold is a unique asset with attributes of financial assets. Gold acts as a diversifier and is a vehicle to mitigate losses in times of market stress. Gold has delivered positive returns over the long run, often outperforming other major asset classes (Chart 1). In the context of a negative relationship between the US dollar and the price of gold, as observed by many analysts and researchers, Pukthuanthong and Roll (2011) showed that price of gold in terms of US dollar increases while the US dollar depreciates against other currencies. They further showed that the fall in price of gold in USD terms can be associated with currency depreciation in every country. The financial cycle may be constructed based on economic fluctuations that originate in the financial system. It typically manifests itself as a co-movement between credit aggregates and asset prices. The Global Financial Crisis (GFC) reinvigorated the interest in studying financial cycles. Stremmel (2015) identified the key ingredients for European financial cycles by constructing techniques and contrasting different financial indicators such as credit aggregates, asset prices and banking sector variables. More recently, Potjagailo and Wolters (2020) have used a time-varying dynamic factor model to analyse co-movement in credit, house prices, equity prices, and interest rates across 17 advanced economies over 130 years. They observe global co-movement across financial variables as well as variable-specific global cycles of different lengths and amplitudes. Global cycles have gained relevance over time. For equity prices, they now constitute the main driver of fluctuations in most countries. Global cycles in credit and housing have become much more pronounced and protracted since the 1980s, but their relevance increased for a sub-group of financially open and developed economies only.  The performance of gold as a financial asset during different phases of financial cycles has been examined using a combination of Baxter-King filter and the Harding and Pagan’s cycle dating algorithm. This is used to determine the financial cycles from the credit-to-GDP and GDP weighted equity indices. To determine the property cycle, the periods with negative and positive year-on-year GDP weighted percentage changes in prices were segregated. The objective behind using above methodologies is to construct meaningful cycles for the study. This helps to understand the relation between gold returns and explanatory variables in the different phases of financial cycles. As per earlier studies and empirical findings, gold’s price is driven by the performance of USD. The filtered credit, equity and property cycles have unique characteristics in terms of amplitude and duration which is well expected from the financial markets. In a sample of 21 years, both cycles peaked before the two international financial events (2001 market crash and 2008 global financial crisis). However, it was observed that the equity cycle reaches peak before the credit cycle. This can be explained due to the nature of credit and equity markets as credit build-up and wind down takes a longer time than changes in the equity indices. Both the cycles witness highest peaks before the global financial crisis. This observation is supported by Claessens, Kose and Terrones (2011) that recoveries coinciding with booms in credit and housing markets are stronger. The observations across the various phases of the different financial cycles imply that in addition to providing a greater risk hedge to USD, gold’s performance as a safe asset among other asset classes has also improved in the recent phases of financial cycles. References: -

Claessens, Kose and Terrones (2011), ‘How Do Business and Financial Cycles Interact?’, IMF working paper, IMF. -

Pukthuanthong, K. and Roll, R. (2011), ‘Gold and the Dollar (and the Euro, Pound and Yen)’, Journal of Banking and Finance, 35(8), 2070-2083. -

Potjagailo and Wolters (2020), ‘Global Financial Cycles since 1880’, Staff Working Paper, No. 867, Bank of England. -

Ranjan, Aniket and Naveen Kumar (2022), ‘Performance of Gold as a Financial Asset During Different Phases of Financial Cycles’, Social Science Research Network (SSRN), March. -

Stremmel, H. (2015), ‘Capturing the Financial Cycle in Europe’, Working Paper Series, European Central Bank. | X.57 The 49th Board of Directors’ Meeting of the Asian Clearing Union (ACU) held virtually on May 24, 2021 (Chair: Reserve Bank of India) deliberated on various issues such as resuming the use of Euro in the ACU mechanism, ways in which the ACU platform can be expanded and strengthened, issues faced by the exporters and importers in using the ACU mechanism, among others. X.58 As part of diversification strategy, the Reserve Bank continued to purchase gold during the year. The Department also continued in its endeavour to ensure effective diversification of reserves by exploring new asset classes/jurisdictions for deployment of foreign currency assets (FCA), while adhering to the primary objectives of safety and liquidity. The process of scaling up of newly introduced products such as forex swaps and repos also continued during the year. Agenda for 2021-22 X.59 Last year, the Department had set out the following goals: -

Continue to explore new asset classes, new jurisdictions/markets for deployment of FCA for portfolio diversification and in the process tap advice from external experts, if required (Paragraph X.60); -

Leverage IT in the form of contemporary treasury management solution for FER management (Utkarsh) [Paragraph X.61]; and -

Roll-out system based daily computation of weighted average cost for assets (Paragraph X.62). Implementation Status X.60 The Department continued in its endeavour to ensure effective diversification of reserves by exploring new asset classes/jurisdictions for deployment of FCA, while adhering to the primary objectives of safety and liquidity. The process of scaling up of newly introduced products continued during the year. X.61 The Department has initiated the process of implementing a new treasury application which is targeted to go live during 2022-23. X.62 During the year, the system-based daily computation of weighted average cost for foreign currency assets was developed and implemented effective April 1, 2022. Agenda for 2022-23 X.63 For 2022-23, the Department will focus on the following goal: 6. ECONOMIC AND POLICY RESEARCH X.64 As the knowledge centre of the Reserve Bank with a focus on issues relating to the economy and the financial system, the Department of Economic and Policy Research (DEPR) provides research-based inputs and management information system (MIS) services for policy formulation by the Reserve Bank. The Department generates primary national level data on various economic heads, prepares the statutory reports of the Reserve Bank, brings out several research publications, provides technical support to various operational departments and to technical groups/committees constituted by the Reserve Bank from time to time, and promotes collaborative policy-oriented research with external experts. The Department is also the key repository and disseminator of secondary data on various heads relating to the Indian economy. X.65 While fully adhering to COVID-19 protocols and safety measures, the Department provided all information and analytical inputs required for policy measures on time. Research and analysis related work continued without much disruption, and all research-related publications were also released on time. The Central Library facilitated uninterrupted remote access to various databases and other reference resources required for undertaking research. The Department also hosted a number of knowledge sharing sessions both on the online and offline platforms. Agenda for 2021-22 X.66 Last year, the Department had set out the following goals: -

Increase in the number of research studies for publication in the Reserve Bank of India Occasional Papers and Working Papers (Utkarsh) [Paragraph X.67]; -

Forward-looking agricultural commodity price sentiment analysis, based on newspaper coverage, through big data applications (Utkarsh) [Paragraph X.68]; -

Development of an in-house expertise for data compilation under the KLEMS [capital (K), labour (L), energy (E), material (M) and services (S)] project (Paragraph X.69); and -

Conduct of an Itinerant Archives Exhibition on the first floor of the Reserve Bank Museum at Kolkata (Paragraph X.70). Implementation Status X.67 During 2021-22, the Department published 67 research papers/articles, of which 20 were published in external international and domestic journals. In addition, 10 RBI Working Papers and eight papers in the RBI Occasional Papers were published during the year. The published papers covered a wide range of issues, such as leverage and investment dynamics of Indian corporate sector; macroeconomic implications of bank capital regulations; education loan NPAs; forecasting core inflation; long-run saving-investment relationship; measuring demand supply mismatch index to forecast inflation; the non-deliverable forwards (NDF) market; climate change; determinants of India’s external commercial borrowings; policy responses for banks facing loan defaults; performance of inflation forecasting models; and monetary policy transmission through the lens of Monetary Conditions Index. X.68 Based on the news coverage on agricultural commodities in nine leading English dailies, commodity-wise price sentiment indices were constructed using text mining techniques for three vegetables, namely tomatoes, onions and potatoes (TOP), as the volatility in the prices of these three vegetables has substantial bearing on the headline inflation. The results confirmed the usefulness of news-based sentiment in providing forward-looking information on price movements of TOP in the Consumer Price Index (CPI). X.69 The Department created a new KLEMS Division for an in-house compilation of the KLEMS estimates. KLEMS database provides time-series estimates on total factor productivity and factor inputs [Capital (K), Labour (L), Energy (E), Material (M), and Services (S)] for the Indian economy and 27 subsectors. The knowledge transition from the external experts at the Delhi School of Economics to the KLEMS Division was completed during the year. The Division successfully completed a parallel estimate of KLEMS for 2018-19, following which the KLEMS data were posted on the Reserve Bank’s website. X.70 The RBI Archives identified the relevant archival documents and prepared a story line for the Itinerant RBI Archives Exhibition. Other Initiatives X.71 The Department employed a new approach to forecast GDP growth, involving the use of innovative machine learning algorithms. GDP nowcasting using a dynamic factor model was augmented with most relevant sets of indicators and the model is now being used to nowcast GDP of recent quarters. X.72 In view of the pandemic, the Department also undertook research on certain pandemic-related issues, including the impact of the global supply chain disruptions on real GDP growth. Furthermore, research on various topical issues, including the role of systemic liquidity and gross NPA (GNPA) on bank credit offtake during a downcycle and the efficacy of the quality and quantum of government spending on growth was undertaken. X.73 Apart from regular compilation of the annual estimates of household financial savings, the data on quarterly household financial savings and household debt to GDP ratio were also compiled and were released up to the third quarter of 2020-21. X.74 During India’s BRICS Presidency 2021, the Department along with the Department of Statistics and Information Management hosted two workshops on Services Trade Statistics as part of the BRICS Contact Group on Economic and Trade Issues. X.75 The Department initiated its survey on India’s inward remittances in 2021-22 to capture various aspects relating to remittances in 2020-21, including the source, destination, purpose of inward remittances, size, prevalent mode of transmission, and receivers’/senders’ cost of remittances. X.76 Apart from completing the various goals set for 2021-22, the Department also released all its flagship publications, viz., the Annual Report, Report on Trend and Progress of Banking in India, and State Finances: A Study of Budgets of 2021-22 in a timely manner. The Report on Currency and Finance 2021-22, with the theme ‘Revive and Reconstruct’, was released in the public domain on April 29, 2022. The History of the Reserve Bank, Volume-5 for the period spanning 1997 to 2008 is expected to be released in 2022. X.77 Furthermore, the compilation and dissemination of primary statistics on monetary aggregates, balance of payments, external debt, effective exchange rates, combined government finances, household financial savings and flow of funds on established timelines and quality standards engaged the Department during the year. X.78 The DEPR Study Circle, an in-house discussion forum, organised 26 online seminars/presentations during the year on diverse research themes. The Department also organised a DEPR Colloquium on Productivity, Competitiveness and Inflation on June 28, 2021 and an expert talk on “Tapering Then and Now” delivered by Dr. Poonam Gupta, Director General, National Council for Applied Economic Research on November 16, 2021. X.79 The Reserve Bank Information Technology Pvt. Ltd. (ReBIT) has been assigned the work of developing the document management software (DMS). The functional module of the DMS software has been completed and overall security aspects of the application are in progress. The testing of the DMS was taken up in April 2022. By August 2022, the user acceptance test is expected to be completed after which the DMS can be operationalised. The RBI Archives (RBIA) had also conducted about 16 online customised programmes on record management for central office departments, regional offices and training establishments during 2021-22. The tender for digitisation of 5 lakh pages of archival records (kept in RBIA) per year has been awarded based on the e-tendering process. It is proposed to complete the digitisation of 15 lakh pages up to March 31, 2024. The scientific preservation of paper records has also been outsourced by the RBIA. Agenda for 2022-23 X.80 The Department’s agenda for 2022-23 will focus on the following goals: -

Publishing a minimum of 100 research papers every year and to improve quality of analysis and research with broader coverage of emerging issues (Utkarsh); -

Making Municipal Finance Report timely and improving the coverage of the report (Utkarsh); -

Annual compilation of the KLEMS dataset and manual by the Department (Utkarsh); -

Application of new machine learning techniques for assessing macro-economic outlook; and -

Embedding climate risk in the traditional macro-modelling framework and analysing its impact on macroeconomic aggregates. 7. STATISTICS AND INFORMATION MANAGEMENT X.81 In keeping with its core mandate, the Department of Statistics and Information Management (DSIM) engaged in compilation, analysis and dissemination of macro-financial statistics and also provided statistical support and analytical inputs through data management, applied statistical research, and forward-looking surveys across various functions of the Reserve Bank. In this endeavour, it maintains centralised information system of the Reserve Bank, manages electronic submission of returns by regulated entities, and compiles statistical indicators in the area of banking, corporate and external sectors. To further enhance the efficiency and effectiveness of these functions, the next generation data warehouse [viz., centralised information management system (CIMS)] is at an advanced stage of development. Initiatives have been taken to use non-traditional data sources and advanced statistical and artificial intelligence (AI)/machine learning (ML) techniques. Agenda for 2021-22 X.82 Last year, the Department had set out the following goals: -

Work towards making CIMS fully operational and migrate all databases to the new centralised system (Utkarsh) [Paragraph X.83]; -

Follow Statistical Data and Metadata eXchange (SDMX) standards for metadata-driven maintenance and dissemination system (Utkarsh) [Paragraph X.84]; -

Implement a scalable end-to-end system for public credit registry (PCR) in a phased manner, starting with scheduled commercial banks (SCBs) (Utkarsh) [Paragraph X.85]; -

Revise the reporting system for international banking statistics (IBS) as per the revised guidelines of the Bank for International Settlements (BIS) [Paragraph X.86]; -

Expand the scope of data collection mechanism and analytical work in the domain of Big data for providing supplementary information relevant to the Reserve Bank (Paragraph X.87); and -

Put in place a system to collect monthly data on economic classification of international credit/debit card transactions (Paragraph X.88). Implementation Status X.83 All infrastructure installations (i.e., hardware and standard softwares) for CIMS were completed, despite delays caused by containment measures in the wake of successive waves of the pandemic. The new software application is under user acceptance test (UAT). All existing data are migrated and are under third party audit. All SCBs (excluding regional rural banks) and 14 major cooperative banks are in the process of onboarding. A majority of the returns have been deployed under the Reserve Bank’s test environment, with an aim to complete all returns by September 2022. X.84 Data elements / dimensions / measures / attributes have been finalised in 245 returns for SDMX standards for metadata-driven maintenance and dissemination systems. X.85 Hardware and software set-up installations have been completed at the data centre and disaster recovery (DR) sites of the Indian Financial Technologies and Allied Services (IFTAS). The system requirement study (SRS) has been done, and system design and development of a comprehensive credit information repository is in progress. X.86 The reporting system for IBS is undergoing modifications to implement the revised guidelines within the deadline given by the BIS. X.87 The analytical activities in the domain of Big data covered under Utkarsh 2022 were completed and the compilation of price indices (food and housing) is being carried out on a regular basis to complement existing statistical efforts. Remote sensing based climatic factors and crop vegetation indicators have been used for modelling mandi arrivals and food price projections (Box X.5). Box X.5

Satellite Images and Remote Sensing Data for Assessment of Agricultural Commodities The constellation of artificial satellites whirling around the earth collects massive amount of data, which provide useful information for understanding natural resources, monitoring of weather, crop coverage, estimation of biomass density and crop yields, and efficient use of groundwater and fertilisers in agriculture. Accordingly, a better understanding of the Indian agro-economy can be obtained by juxtaposing satellite-based information on (a) wholesale prices of diverse set of agricultural commodities collected from mandis across the nation, (b) modal prices, price ranges, mandi profile and daily arrivals available on the agricultural marketing portal (www.agmarknet.gov.in) of the Ministry of Agriculture & Farmers Welfare, Government of India, and (c) spatial and temporal rainfall. In this box, price dynamics of the two widely used price sensitive agro-commodities in the Indian consumer basket, viz., tur (or arhar) dal and onion are presented. Tur Dal Daily arrival data from mandis are juxtaposed with the normalised difference vegetation index (NDVI) at taluk/tehsil level for three major production states (viz., Karnataka, Maharashtra and Madhya Pradesh), with an average share of 63 per cent in total production during the five-year period from 2015-16 to 2019-20. Due consideration is given to temporal signatures, since crop-specific phenology changes (i.e., development of crop during its life cycle from sowing to harvesting) as the crop season progresses. Vegetation growth is derived by suitable seasonal filtering and temporal aggregation of NDVI. Arrival growth has been modelled as a function of vegetation growth over fortnights during the growing season. The impact of vegetation growth on mandi arrivals is estimated dynamically and the coefficients are presented in Chart 1. Onion Mandi prices from Lasalgaon, Nashik district, Maharashtra, which is considered to be the biggest onion market in Asia, has been used along with weather parameters as an initial use case to determine the association between high price (rise of 25 per cent and above) events and dew temperature at two meters above the earth’s surface (Chart 2). The bin height in the chart corresponds to the proportion of high price events in the respective dew temperature bucket. Higher event rates are found to be associated with higher dew temperature and fortnightly onion price growth shows close co-movements with wind speed at 50 meters above the earth’s surface (Chart 3).

Given the complex non-linear interactions between weather parameters and price dynamics, the analysis revealed that machine learning techniques (e.g., random forests) may have more predictive capabilities than traditional statistical methods. References: 1. Navalgund, R.R., and Ray, S.S. (2019), ‘Application of Space Technology in Agriculture: An Overview’, Smart Agripost, 6(6), 6-11. 2. Ray, S.S. (2016), ‘Crop Assessment using Space, Agro-Meteorology & Land Based Observations: Indian Experience’, International Seminar on Approaches & Methodologies for Crop Monitoring & Production Forecasting (pp. 25-26). | X.88 A new system called “Foreign Exchange Transactions Electronic Reporting System – Cards (FETERS-Cards)” under the Balance of Payments (BoP) portal was implemented for collecting economic activity wise monthly data on international credit / debit cards and unified payment instrument (UPI) transactions. All Authorised Dealer (AD) banks have been reporting such transactions since April 2021. Other Initiatives X.89 Despite the operational challenges posed by the outbreak of the pandemic, the Department adhered to the timelines on forward looking bimonthly/quarterly surveys of enterprises, households and professional forecasters. Several ad hoc surveys were also conducted at short notice by the central and regional offices. In addition, methodological improvements were also carried out for improving the robustness of estimates, coverage and for aligning codes in the regular monetary policy surveys under the guidance of the Reserve Bank’s Technical Advisory Committee on Surveys (TACS) [e.g., product/industry codes in the industrial outlook survey (IOS), and nature of business/activity codes in the services and infrastructure outlook survey (SIOS) to industry standard classifications, estimation under the order books, inventories and capacity utilisation survey (OBICUS)]. X.90 The Department also reduced the time lag in releasing the results of external sector census/surveys [viz., annual census on foreign liabilities and assets (FLA) of Indian direct investment entities, FLA survey of mutual fund companies, survey on exports of computer software and information technology-enabled services (ITES), and biennial survey on foreign collaboration in Indian industry]. X.91 All regular data publications were released, and updated time series data were made available through the Database on Indian Economy (DBIE) portal of the Reserve Bank in a timely manner despite COVID-19-induced operational challenges. The Department regularly submitted around 175 data series of various periodicities (viz., daily, weekly, monthly, quarterly and annual) to BIS databank as per the schedule. X.92 Electronic data submission portal (EDSP) has been extended to the (i) payments frauds register; (ii) natural calamity return; (iii) unit-level data for inflation expectations survey of households (IESH); and (iv) residential asset price monitoring survey (RAPMS). Offsite monitoring returns relating to NBFCs have been automated and the return submission process has been strengthened. Data management and extraction facility has been enhanced by providing additional monitoring facility for user departments during the COVID-19 pandemic. Agenda for 2022-23 X.93 Going ahead, the Department will focus on the following goals: -

Completion of all integration in the advanced analytics environment and automate publication workflow of all regular data publications in the next generation data warehouse (Utkarsh); -

Populating of the comprehensive credit information repository in a phased manner starting with SCBs (Utkarsh); -

Implementation of the new data governance framework through flexible element-based repository (EBR) with the facility to convert from return-based repository (RBR) by carrying out forward and reverse engineering to ensure completeness; -

Maintaining of a ‘Regulatory Reporting’ link on the Reserve Bank’s website giving all resources and validation rules to aid banks and other reporting entities for further improving the quality of data reporting to the Reserve Bank; -

Further refinement of the estimation procedures for monetary policy surveys under the guidance of the TACS; and -

Exploring alternate sources of data including satellite data in the areas relevant to the Reserve Bank and use of advanced statistical tools, including Big data and ML techniques. 8. LEGAL ISSUES X.94 The Legal Department is an advisory department established for examining and advising on legal issues, and for facilitating the management of litigation on behalf of the Reserve Bank. The Department vets circulars, directions, regulations, and agreements for various departments of the Reserve Bank with a view to ensuring that the decisions of the Reserve Bank are legally sound. The Department also functions as the secretariat to the First Appellate Authority under the Right to Information Act, 2005 and represents the Reserve Bank in the hearing of cases before the Central Information Commission, with the assistance of operational departments. The Department also extends legal support and advice to the Deposit Insurance and Credit Guarantee Corporation (DICGC), the Centre for Advanced Financial Research and Learning (CAFRAL), and other RBI-owned institutions on legal issues, litigation and court matters. Agenda for 2021-22 X.95 Last year, the Department had set out the following goals: -

Proactively perform its functions in close coordination with the operational departments of the Reserve Bank (Paragraph X.96); and -

Take efforts to automate its workflow process and function, keeping in view the importance of use of technology in legal operations, particularly, in a situation like COVID-19 pandemic (Paragraph X.97). Implementation Status X.96 Several important legislations/regulations concerning the financial sector were brought in/amended during the year as set out below: -

The National Bank for Financing Infrastructure and Development Act, 2021 received the assent of the President on March 28, 2021. As stated in the Preamble to the Act, it establishes the National Bank for Financing Infrastructure and Development as the principal development financial institution to support infrastructure financing in India. -

The Factoring Regulation (Amendment) Act, 2021, which received the assent of the President on August 7, 2021 and came into force with effect from August 23, 2021, amends the Factoring Regulation Act, 2011. The Amendment Act simplifies the definition of ‘receivables’ and adds the definition of “Trade Receivables Discounting System” as a payment system authorised by the Reserve Bank under section 7 of the Payment and Settlement Systems Act, 2007 for the purpose of facilitating financing of trade receivables. -

The Insolvency and Bankruptcy Code (Amendment) Act, 2021 received the assent of the President on August 11, 2021 and came into force with effect from April 4, 2021. It amends the Insolvency and Bankruptcy Code, 2016 and makes provision for an alternative process of insolvency resolution for micro, small, and medium enterprises (MSMEs), called the pre-packaged insolvency resolution process (PIRP). -

The Deposit Insurance and Credit Guarantee Corporation (Amendment) Act, 2021 received the assent of the President on August 13, 2021. The Act was notified in the Gazette of India on August 27, 2021 and came into force with effect from September 1, 2021 for banks insured under the DICGC Act, 1961. The said Act amends certain provisions of the Deposit Insurance and Credit Guarantee Corporation Act, 1961 and inserts a new Section 18A in the Act. X.97 The work relating to the development of a software package for automating the activities of the Department has been entrusted to the Reserve Bank Information Technology Private Ltd. (ReBIT). Development of the software in this regard is in the advanced stages and the software shall soon be integrated with the activities of the Department. Agenda for 2022-23 X.98 In 2022-23, the Department will continue to focus on the following goals: -

Completion of the implementation of the workflow automation process application (Utkarsh); -

Merging the existing opinion database management system and the litigation management system (Utkarsh); and -

Digitisation of available/existing legal records and providing their access to the users. 9. CONCLUSION X.99 The Reserve Bank continued with its endeavour to reach out to a wide spectrum of audience through multiple channels, including social media and public awareness campaigns during the year. The international economic and financial relations with the international organisations and multilateral bodies were deepened and strengthened. The Reserve Bank joined the NGFS with its commitment to support greening India’s financial system. Going ahead, the major focus of the Reserve Bank in the functional areas covered in the chapter would be aimed at ensuring: greater engagement with general public through additional social media platform such as Instagram; further strengthening economic and financial international relations; integration of state governments with e-Kuber for e-receipts for direct NEFT/RTGS based receipts and agency bank reporting; continuing to explore portfolio diversification through new asset classes/markets for forex reserve management; sharpening economic and statistical policy analysis and research; exploring alternate sources of data including satellite data in the areas relevant to the Reserve Bank and use of advanced statistical tools, including AI, Big data and ML techniques, in analytical studies.

|