| IX.1 In

view of the fast changing external environment brought about by the growing deregulation,

liberalisation and opening up ofthe Indian economy, human resources management

has assumed high significance. The Reserve Bank, therefore, continued with its

endeavour of upgrading the skills of its human resources. The focus was on facilitating

the transition to a learning environment that lays stress on developing functional,

inter-personal and leadership skills, creativity and communication capabilities

as well as the ability to work in a cross-cultural work environment and with cross-functional

teams. Efforts to benchmark the work processes in the Reserve Bank to the international

best practices were carried forward during 2006-07. With a view to reaching out

to the common person in the country, the Reserve Bank has also been suitably designing

and developing communication strategies for disseminating information on its policies.

Speeches by Top Management (Annex 1), reports of the various Working Groups (Annex

II), and regular publications, an important part of the communication policy,

are all placed on the Reserve Bank’s website.

IX.2 This Chapter

details the various initiatives undertaken by the Reserve Bank for upgrading the

human resources skills through appropriate training facilities at its own as well

as external training institutes in areas of relevance to its working and operations.

It also covers various measures taken for improving the customer service in the

areas of banking, currency, foreign exchange and clearing mechanism including

evaluation of customer satisfaction, financial inclusion and financial education.

A Customer Service Department was set up in July 2006 by bringing in various customer

service activities handled by different departments of the bank under a single

roof for improving the quality of services to the members of public, banks, Central

and State Governments and financial institutions. IX. 3 The

Reserve Bank’s research departments continued to provide analytical research

on various aspects of the Indian economy in the conduct and formulation of its

monetary and financial policies. In order to explain the rationale and the analytics

of its policy initiatives to the public, the Reserve Bank disseminated wide ranging

information through press releases, notifications, master circulars, publications,

speeches, frequently asked questions and advertisements. IX.4 Finally, the

Chapter presents an overview of the meetings of the Central Board and its Committees.

Seven meetings of the Central Board were held during the year ended June 30, 2007

wherein there were discussions on the areas of currency management, banking regulation

and supervision, monetary and credit policy, accounting policy, and internal debt

management policy. The deliberations of the Board also focused on the critical

issue of ensuring the benefits of growth to the poorer sections of

society and increasing the flow of credit to agriculture and rural areas.

HUMAN RESOURCE INITIATIVES

Training and Skills

Enhancement

IX.5 Three training colleges of the Reserve Bank,

viz., the Bankers’ Training College (BTC), Mumbai, the Reserve

Bank Staff College (RBSC), Chennai and the College of Agricultural Banking (CAB),

Pune continued to cater to the training needs of the officers of the Reserve Bank

and the banking industry. The four Zonal Training Centres (ZTCs) focused on training

of Class III and IV staff of the Reserve Bank (Table 9.1). Banker’

Training College/Centre for Advanced Financial Learning, Mumbai

IX.6 The Bankers’ Training College (BTC) was established to train the personnel

of commercial banks and other financial institutions in India. Recognising the

many changes that have taken place in the financial sector and to provide a broad-based

intellectual platform for research, training and discussion for senior executives

and professionals in the financial sector, both Indian and foreign, the Bankers’

Training College was relaunched as “Centre for Advanced Financial Learning”

by the Honourable Prime Minister of India in 2006. The Centre conducted two high-end

programmes on Advanced Derivatives and Financial Risk Management by outside experts

for senior officers of the Reserve Bank. It also conducted 12 programmes in areas

such as asset liability management, risk management, human resources development,

customer services and emerging issues in banking (Table 9.2).

Table

9.1: Training Establishments of the Reserve Bank – Programmes Conducted

| Training | 2002-03 | 2003-04 | 2004-05 | 2005-06

| 2006-07 |

Establishment | (July-June) | (July-June) | (July-June) | (July-June)

| (July-June) |

| Number

of | Number

of | Number

of | Number

of | Number

of | Number

of | Number

of | Number

of | Number

of | Number

of | | | Progra

mmes | Partici

pants | Progra

mmes | Partici

pants | Progra

mmes | Partici

pants | Progra

mmes | Partici

pants | Progra

mmes | Partici

pants | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

BTC, Mumbai | 160 | 3,735 | 171 | 3,204 | 153 | 3,287 | 85 | 1,908 | 89 | 2,148 |

RBSC, Chennai | 139 | 3,013 | 144 | 2,874 | 133 | 2,895 | 127 | 2,633 | 138 | 2,941 |

CAB, Pune | 173 | 3,461 | 147

* | 3,138 * | 146 | 3,364 | 152

# | 3,812 # | 146 | 4,279 |

ZTCs (Class III) | 153 | 2,991 | 187 | 3,652 | 245 | 5,442 | 230 | 4,710 | 215 | 4,069 |

ZTCs (Class IV) | 31 | 535 | 56 | 958 | 40 | 1,295 | 76 | 1,592 | 78 | 1,605 |

* : Includes 10 outstation

programmes conducted at the initiative of Regional Offices involving 384 participants.

# : Includes 13 offsite programmes involving 437 participants.

BTC : Bankers’

Training College.

RBSC : Reserve Bank Staff College.

CAB : College of

Agricultural Banking.

ZTC : Zonal Training Centre. | Reserve

Bank Staff College, Chennai

IX.7 The Reserve Bank Staff College (RBSC),

established to impart training to the Reserve Bank’s own officers in junior

and middle management cadres and specialised development of officers in the senior

management cadre, continues to contribute to the upgradation of skills of all

the cadres of the officers. In line with the changing environment, it has been

consistently endeavouring to modernise the

| Table

9.2: New Programmes/Seminar/Workshops Conducted by Training Colleges during 2006-07

| Bankers

Training College (BTC)/Centre for Advanced Financial Learning (CAFL) | Reserve

Bank Staff

College (RBSC) | College

of Agricultural

Banking (CAB) | 1 | 2

| 3 |

1. | Credit,

Forex and Risk

Management (for Canara Bank) | 1. | Credit

Management and Quantitative Techniques | 1. | National

Symposium on Farm Credit for Inclusive Growth | 2. | Executive

Development Programme for Promotees

to Executive Cadre (for Canara Bank) | 2. | Rainwater

Harvesting and Energy Conservation | 2. | National

Workshop on ICT for Rural Financial Services | 3. | Human

Resource Development Challenges for Indian Banks | 3. | Organisational

Culture Building | 3. | National

Seminar on Micro Finance

(in Hindi) | 4. | Disaster

Recovery Management | 4. | Financial

Crimes and Market Intelligence | 4. | National

Seminar on Organic Agriculture | 5. | Seminar

on Issues in Customer Service in Banks | 5. | International

Seminar on Basel II Implementation Issues | 5. | Workshop

on Commodities Futures and Agricultural Produce Marketing | 6. | Asset

Liability Management with Duration

Gap Analysis Framework | 6. | Programme

for Police Officials

from National Police Academy,

Hyderabad | 6. | Management

Development Programmes

for the Chief Executive Officers of the

Urban Cooperative

Banks and Micro

Finance Institutions | 7. | Seminar

on Credit Delivery, Culture and Pricing | | | 7. | International

Programme

on

Restructuring and Strengthening

Agricultural / Rural

Financial Institutions | 8. | Compliance

Risk Management | | | 8. | Customised

Programmes on Micro Finance Delivery Systems

For Participants from Sri Lanka. |

9. | Internal

Credit Risk Modelling under Basel II | | | | |

10. | Seminar

on Emerging Issues in Banking | | | | |

11. | Advanced

Derivatives Programme | | | | |

12. | Financial

Risk Management | | | | |

techniques of training as well as the coverage of inputs.

Ethical issues, communication techniques as well as human values are being included

in most of the programmes.

IX.8 Four e-learning modules have been prepared

and kept on the website of the RBSC for perusal, while two are under preparation.

A number of topical programmes relating to Basel II, credit management, rain water

harvesting, organisational culture building and financial crimes were organised

in the College during the year (see Table 9.2). The College

conducted off-site programmes at various centres. In order to provide an intellectual

platform on financial and central banking issues for the Afro-Asian region, the

College conducted “International Seminar on Basel II-Implementation Issues”.

The seminar attended by 24 central bankers from 14 countries deliberated on various

issues and options based on individual country experiences. College

of Agricultural Banking, Pune

IX.9 The College of Agricultural Banking

(CAB), originally set up with a focus on training the senior and middle level

officers of rural and co-operative credit sectors, has, in recent years, diversified

into areas relating to non-banking financial companies, human resource management

and information technology (IT). Keeping in view the emerging training needs,

the College organised 45 new programmes such as farm credit for inclusive growth,

IT for rural financial services, micro finance, commodities futures and management

development (see Table 9.2). The College also organised four

international programmes, viz., the International Programme on Restructuring

and Strengthening of Agricultural/Rural Financial Institutions (sponsored by the

Centre for Co-operative Training in Agriculture and Banking) and three customised

programmes on Micro Finance Delivery Systems for participants from Sri Lanka.

The College conducted 31 customised programmes for the Central Bank of Sri Lanka,

Dena Bank, Union Bank of India, Corporation Bank, Canara Bank, Indian Overseas

Bank, National Housing Bank, and Indian Banks’ Association. The Planning

Commission/ United Nations Development Programme (UNDP) sponsored programme for

the senior State/Central Government officials was also organised. Furthermore,

19 off-campus programmes were organised at various centres. 128 participants from

Sri Lanka, Nepal and Bangladesh attended training programmes conducted by the

College during the year. The College continued to provide faculty support to a

number of other institutions. IX.10 The College also undertook a study on

‘Costs and Margins of Micro Finance Institutions’ in association with

some regional offices. The College has been regularly bringing out a quarterly

journal “CAB Calling”, focused on developmental banking. Two out of

the three issues of the magazine published during 2006-07 focused on “SME

Financing” and “Organic Agriculture”. The College has initiated

the process of obtaining ISO certification in a time-bound manner to improve the

quality management systems in its academic activities. Deputation of

Officers for Training in India and Abroad

IX.11 In order to upgrade

the skills of its human resources, the Reserve Bank also deputes its officers

to various external training institutes, conferences, seminars and workshops,

both in India and abroad. During 2006-07, 871 officers were deputed for various

programmes in India while 352 officers were sent abroad. The areas covered in

such programmes included banking supervision, derivatives, risk management, financial

programming and policies, central bank accounting, monetary policy and operations,

macroeconomic management, debt management, reserve management, finance for agriculture,

rural development, micro finance, human resources, international banking, foreign

trade and labour laws (Table 9.3).

IX.12 With a view

to enhancing the level of knowledge and sharpening executive skills, the Reserve

Bank has decided to depute Senior Officers in Grade ‘F’ for advanced

management programmes of about two to three weeks’ duration at leading business

schools abroad. Four Senior Officers in Grade ‘F’ have been chosen

for deputation to pursue such courses in 2007 at internationally renowned business

schools such as the Harvard Business School, the Columbia Business School and

the London Business School.

Table

9.3: Number of Officers Trained in External | Training

Institutions in India and Abroad | Year | Number

of officers | Number

of officers | | trained

in India | trained

abroad | 1 | 2 | 3 |

2001-02 | 355 | 137 |

2002-03 | 452 | 208 |

2003-04 | 433 | 242 |

2004-05 | 521 | 171 |

2005-06 | 625 | 273 |

2006-07 | 871 | 352 |

IX.13 In order to hone the technical and management skills of the Reserve

Bank’s officers, a need was felt for greater coordination with leading central

banks as well as other key regulatory and supranational agencies. With this objective,

an inter-institutional exchange of human resources in the form of a Short-term

Secondment Scheme has been put in place; under the first such exchange, one officer

has taken up a secondment with the Financial Stability Division at the Bank of

England effective April 2007. Discussions are on with the Banque de France

on designing a similar shor t-term Secondment Scheme.

IX.14 A scheme

of sponsoring officers in Grades A and B below the age of 35 years for pursuing

PostGraduate Programme in Banking & Finance (PGPBF) conducted by the National

Institute of Bank Management (NIBM), Pune has been instituted and one officer

has been selected to pursue the course during the academic year 2007-08.

IX.15 Four officers were selected during 2006-07 under the Reserve Bank’s

Golden Jubilee Scholarship Scheme for higher studies abroad. In all, 87 officers

have been selected under this scheme since its inception in 1986.

IX.16

Ten officers were allowed to pursue higher studies during the year. Besides, one

officer completed research under the Bank for International Settlements (BIS)

Visiting Fellowship Programme. One officer has been deputed for the post of India

Analyst in a project being jointly run by Bank of Tokyo and Waseda University,

Japan. Zonal Training Centres

IX.17 Zonal Training Centres

(ZTCs) of the Reserve Bank conducted programmes on functional areas, information

technology and behavioural areas for employees in the Class III and IV cadres

of the Reserve Bank. Apart from regular programmes at their premises, the ZTCs

also conducted offsite programmes. Four pre-Integrated Officer Development Programme

(IODP) courses were conducted at ZTC, Kolkata. Pre-examination trainings for Assistant

Managers (for SC/ST and physically handicapped candidates) and Managers as well

as preparatory training programmes for promotion of Class IV to Class III were

also conducted at ZTCs.

IX.18 ZTC, Belapur conducted an exclusive training

programme on Inventory Management and Accounts for the employees of the Royal

Monetary Authority of Bhutan. The National Bank for Agriculture and Rural Development

(NABARD) has been deputing its Class III and IV employees for investment and retirement

planning programme conducted by ZTCs on a cost basis.

Deputation

of Class III and IV Staff to External Institutions in India

IX.19

Under the scheme for deputation of Class III and IV staff for training in external

institutions in India in human resource development, 182 Class III and 21 Class

IV employees were deputed during the calendar year 2006. Four in-company programmes

for Class III employees and for Class IV employees were conducted at external

training institutions, viz., V. V. Giri National Labour Institute, Noida

and National Productivity Council, New Delhi, respectively, during the year 2006-07.

Training in Computer Technology

IX.20 During 2006-07, 130

officers were deputed for advanced training programmes in computers and information

technology to leading training institutions such as the National Institute of

Bank Management (NIBM), Pune and the Institute for Development and Research in

Banking Technology (IDRBT), Hyderabad. The Reserve Bank contributed Rs.9 crore

towards training fees and membership subscriptions of various institutions.

Other Initiatives

IX.21 During July-June 2007, 555 employees

availed benefits under the incentive scheme for pursuing part time and distance

education courses. The major areas of the study were management, information technology,

financial analyst and postgraduation in commerce and economics.

IX.22

In order to provide its staff an additional avenue of skill enhancement, the Reserve

Bank has obtained an e-learning module designed by the Indian Institute of Banking

and Finance (an affiliate of the Indian Institute of Bankers) exclusively for

its employees covering different facets of central banking such as treasury

and risk management, and international banking and foreign exchange.

IX.23 FSI-Connect, an innovative web-based information resource and learning tool

for bank supervision introduced by Financial Stability Institute of Bank for International

Settlement has been subscribed by the Reserve Bank since 2005. The Reserve Bank

is the largest subscriber having 1,213 connections. This e-learning facility contains

modules like Capital and Basel II, Market Risk, Credit Risk, Operational Risk

and Payment Systems. IX.24 At the Reserve Bank’s Regional

Directors’ Conference for the year 2006 held in informal settings at Mumbai

from November 23 to 26, 2006, Governor/ Deputy Governors shared their vision on

the way forward for the Reserve Bank and set out the broad goals for the organisation.

At this annual forum, organisational strategies were also discussed with the heads

of the Regional Offices and Central Office departments with a view to enhancing

efficiency through internal re-engineering. Deliberations also laid emphasis on

outcomes as against processes, given the changes in the external environment.

In order to provide the Regional Directors a first-hand idea of the issues engaging

the Reserve Bank, presentations were made by heads of the various Central Office

departments. Presentations were also made by the Regional Directors on notable

initiatives taken by the offices under their jurisdictions. An interactive Strategy

Conversation Session discussed internal issues such as HR ownership, execution

and delivery and leadership building. A galaxy of eminent guest speakers also

addressed the Conference on a range of interesting and evolving issues.

IX.25 With a view to imparting more transparency and objectivity in the Performance

Rating System, a new Performance Appraisal Reporting (PAR) System for the members

of staff in the Class III cadre was introduced during 2006-07. The revised arrangement

replacing the erstwhile Annual Confidential Reporting (ACR) System incorporates

self-assessment by the employees and has been received favourably as a step forward

towards a fairer and more objective system of employee appraisal.

IX.26

As part of its capacity building and knowledge management initiatives, the Reserve

Bank signed a Memorandum of Understanding with the London School of Economics

and Political Science (LSE) for creating a LSE India Observatory and IG Patel

Chair to be based at the Asia Research Centre at the LSE. The LSE India Observatory

will co-ordinate India-related research, policy development and teaching at the

LSE and is expected to emerge as a hub for academic collaboration with academic

institutions in India, government agencies and corporate bodies. The IG Patel

Chair, which is being set up in honour of the late Dr. I.G. Patel, a former Governor

of the Reserve Bank, who also later held the post of Director at the LSE, will

be a fully endowed permanent professorship and its holder will lead the LSE India

Observatory. The LSE proposes to invite an eminent scholar with an established

reputation in development economics, political economy or a closely related field

to hold this post. The Reserve Bank, as part of a sponsor consortium, will provide

a funding of £100,000 per annum to the LSE for a period of ten years beginning

January 2007. The Memorandum of Understanding in this regard was signed on December

7, 2006 in New Delhi in the presence of the Honourable Prime Minister of India.

IX.27 With a view to positioning India as a global training provider in the

field of banking and finance, the Joint India-International Monetary Fund (IMF)

Training Programme (ITP) has been established at the National Institute of Bank

Management (NIBM) campus in Pune. This is the seventh such facility of the IMF

Institute in the world. The ITP will impart policy-oriented training to nominees

of Governments and central banks of the participating SAARC and East African countries,

apart from India, in areas such as macroeconomic management and policies, financial

programming, monetary policy, bank supervision, financial sector issues, public

finance, exchange rate policy and foreign exchange operations and statistics.

The ITP will also include seminars on topical issues for high-level officials.

Faculty support for these courses will be provided by the IMF Institute, Washington.

The inaugural course at the ITP was held from July 24 to August 4, 2006. In all,

six courses were held at the ITP during 2006-07 (July-June).

IX.28 The

Reserve Bank organised an interface on the broad theme of “Capacity

Building in Central Banks : Creating Synergies” with the Heads of the Human

Resource Depar tment(s)/Training Establishments of central banks ofthe countries

participating in the courses run at the ITP Centre at Pune. The interface, aimed

at building up the synergy with other key central banks on human resource issues,

afforded an opportunity to learn from cross-country experiences in aligning human

resource management with the strategic objectives. The event coincided with the

formal inauguration of the Joint India-IMF training facility in Pune.

IX.29 Twelve officials from the central banks of Zambia, Tanzania and Nigeria

were provided study attachments at the Reserve Bank’s Central Office departments

during 2006-07. Interface sessions were held for students of Pace University,

University of Texas at Austin, and University of Manchester; such sessions were

also held for senior civil servants of Singapore, par ticipants from Higher Defence

Management Course, Secunderabad, and College of Naval Warfare.

Summer

Placement

IX.30 The Reserve Bank has in place a

Summer Placement scheme which affords an opportunity to domestic and foreign students

to expose themselves to an actual managerial environment and apply their knowledge

to operational issues in the central bank while doing their internship. During

the year 2006-07, 30 students selected under the scheme from management institutes/colleges

of India undertook their internship in the Reserve Bank. Furthermore, 13 students

pursuing higher studies abroad have also been selected to undertake internship

with the Reserve Bank during the year 2006-07.

Industrial Relations

IX.31 Industrial relations in the Reserve Bank remained, by and large, peaceful

during 2006-07. Periodical meetings were held with the recognised Associations/Federations

of workmen employees/ officers on various matters related to service conditions

and welfare measures in the Reserve Bank.

Recruitment

IX.32 During 2006 (January-December), the Reserve Bank recruited 360 employees.

Of this, 105 belonged to Scheduled Castes (SCs) and Scheduled Tribes (STs) categories,

constituting 29.1 per cent of total recruitment (Table 9.4).

Staff Strength

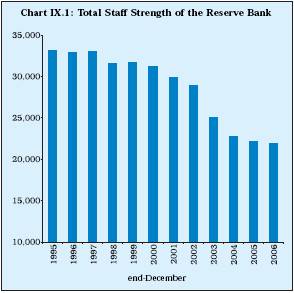

IX.33 The total staff strength as on December

31, 2006 was 21,910 as compared with 22,192 a year

Table

9.4: Recruitment by the Reserve Bank – 2006* |

Category | Total | of

which | Percentage |

| Recruitment | SC | ST | SC | ST |

1 | 2 | 3 | 4 | 5 | 6 |

Class I | 140 | 33 | 15 | 23.6 | 10.7 |

Class III | 8 | – | – | – | – |

Class IV | | | | | |

(a) Maintenance | | | | | |

Attendants | 187 | 31 | 23 | 16.6 | 12.3 |

(b) Others | 25 | 3 | – | 12.0 | – |

Total | 360 | 67 | 38 | 18.6 | 10.5 |

* : January-December. | | | | | |

SC : Scheduled Castes.

ST : Scheduled Tribes. | ago. Of the total staff,

21.2 per cent belonged to Scheduled Castes and 8.9 per cent belonged to Scheduled

Tribes as on December 31, 2006 (Table 9.5 and Chart

IX.1).

IX.34 During 2006 (January-December), the Reserve Bank’s

Liaison Officer for Scheduled Caste/ Scheduled Tribe employees conducted inspection

of reservation rosters maintained at six offices, viz., Guwahati, Thiruvananthapuram,

Kochi, Jaipur, Jammu and Hyderabad. Meetings between the management and

the representatives of the All India Reserve Bank Scheduled Castes/Scheduled Tribes

and the Buddhist Federation were held on four occasions during the year to discuss

issues relating to the implementation of reservation policy in the Reserve Bank.

In accordance with the Central Government’s policy, the Reserve Bank has

provided reservation to Other Backward Classes (OBCs) effective September 8, 1993.

The representation of the OBCs (recruited after September 1993) in the Reserve

Bank as on December 31, 2006 was 820. Of these, 217 were in Class I, 110 in Class

III and 493 in Class IV. Two meetings were held with the All India Reserve

Bank OBC Employees’ Welfare

Table

9.5: Staff Strength of the Reserve Bank | Category | Category-wise

Strength | Per

cent to Total Strength | | Total

Strength | SC | ST | SC | ST |

| December | December | December | December | December | December | December |

| 31,

2005 | 31,

2006 | 31,

2005 | 31,

2006 | 31,

2005 | 31,

2006 | 31,

2006 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

Class I | 5,885 | 6,819 | 870 | 993 | 367 | 458 | 14.6 | 6.7 |

Class III | 8,773 | 7,522 | 1,341 | 1,183 | 845 | 744 | 15.7 | 9.9 |

Class IV | 7,534 | 7,569 | 2,459 | 2,465 | 731 | 752 | 32.6 | 9.9 |

Total | 22,192 | 21,910 | 4,670 | 4,641 | 1,943 | 1,954 | 21.2 | 8.9 |

SC : Scheduled Castes.

ST : Scheduled Tribes. |

Association

to discuss issues relating to implementation of the reservation policy in the

Reserve Bank.

IX.35 The total strength of ex-servicemen in the Reserve

Bank at end-December 2006 was 1,273 comprising 165 in Class I, 288 in Class III

and 820 in Class IV. The number of physically handicapped employees in Class I,

Class III and Class IV cadres was 113, 218 and 133, respectively, at end-December

2006.

IX.36 Of the total staff, 31.1 per cent was in Class I, 34.3 per

cent in Class III and the remaining 34.6 per cent in Class IV (Table

9.6).

IX.37 Almost one-four th of the total staff is involved in

the work related to currency management (Table 9.7).

IX.38 Mumbai (including the Central Office Departments) continued to have the

maximum number of staff – 29 per cent of total staff strength –followed

by Kolkata (10 per cent), Chennai and Delhi (7 per cent each) (Table 9.8).

Contract Appointments

IX.39 In view of the ongoing innovations,

new developments and wor k processes getting increasingly technology-driven, induction

of appropriate technical manpower in the Reserve Bank was considered imperative.

Accordingly, during the year, the Reserve Bank took Information Technology (IT)

resources personnel on a contract appointment basis.

Table

9.6: Category-wise Actual Staff Strength | (As

on December 31, 2006) | Class

| Actual

Strength | 1

| 2 |

Class I | 6,819 |

1. | Senior

Officers in Grade F | 89 |

2. | Senior

Officers in Grade E | 231 |

3. | Senior

Officers in Grade D | 359 |

4. | Officers

in Grade C | 856 |

5. | Officers

in Grade B | 1,476 |

6. | Officers

in Grade A | 3,482 |

7. | Treasurers | 19 |

8. | Deputy

Treasurers | 60 |

9. | Assistant

Treasurers | 247 |

Class III | 7,522 |

1. | Clerks

Grade I | 2,494 |

2. | Clerks

Grade II | 3,201 |

3. | Stenographers | 229 |

4. | Typists | 538 |

5. | Tellers | 459 |

6. | Others | 601 |

Class IV | 7,569 |

1. | Peons | 1,505 |

2. | Mazdoors | 1,796 |

3. | Others | 4,268 |

Total Strength in the

Reserve Bank | 21,910 |

Opening of New Offices/Departments

IX.40 The

Reserve Bank opened sub-offices at Dehradun and Raipur on June 30, 2006 and January

2, 2007 for the States of Uttaranchal (since renamed as Uttarakhand) and Chhattisgarh,

respectively. The sub-offices will focus on issues relating to rural credit and

co-operative banks in the respective States. The sub-offices will initially have

two departments, namely, the Rural Planning and Credit Department (RPCD) and the

Urban Banks Department (UBD).

IX.41 In July 2006, a new department called

‘Customer Service Department’ was set up in order to bring together

all activities relating to customer service in the Reserve Bank under one roof

(see Box V.5). IX.42 In October 2006, the Lucknow

Sub-office was granted the status of an independent office of the Reserve Bank

with the creation of an independent jurisdiction of the Issue Circle at Lucknow

and clear demarcation of functional jurisdiction between Kanpur and Lucknow offices.

Table

9.7: Reserve Bank’s Department-wise Strength of Staff as on December 31,

2006 | Sr. | Department/Office | Class

I | Class

III | Class

IV | Grand |

No. | | C.O | R.O | Total | C.O | R.O | Total | C.O | R.O | Total | Total |

1. | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

1. | Department

of Administration and | | | | | | | | | | |

| Personnel

Management (DAPM) | 88 | 764 | 852 | 83 | 1,007 | 1,090 | 47 | 2,691 | 2,738 | 4,680 |

2. | Department

of Banking Operations and | | | | | | | | | | |

| Development

(DBOD) | 143 | 5 | 148 | 90 | 4 | 94 | 84 | 4 | 88 | 330 |

3. | Department

of Banking Supervision (DBS) | 120 | 571 | 691 | 25 | 193 | 218 | 18 | 110 | 128 | 1,037 |

4. | Department

of Currency Management (DCM) | 35 | 1,075 | 1,110 | 24 | 2,068 | 2,092 | 17 | 2,059 | 2,076 | 5,278 |

5. | Department

of Economic Analysis and Policy (DEAP) | 195 | 38 | 233 | 152 | 35 | 187 | 71 | 22 | 93 | 513 |

6. | Department

of Expenditure and | | | | | | | | | | |

| Budgetary

Control (DEBC) | 63 | 302 | 365 | 86 | 499 | 585 | 31 | 135 | 166 | 1,116 |

7. | Department

of External Investment and | | | | | | | | | | |

| Operations

(DEIO) | 54 | – | 54 | 27 | – | 27 | 11 | – | 11 | 92 |

8. | Department

of Statistical Analysis and Computer | | | | | | | | | | |

| Services

(DESACS) | 172 | 19 | 191 | 119 | 35 | 154 | 80 | 13 | 93 | 438 |

9. | Department

of Government and Bank Accounts (DGBA) | 59 | 816 | 875 | 56 | 1,466 | 1

,522 | 19 | 528 | 547 | 2,944 |

10. | Department

of Information Technology (DIT) | 76 | 49 | 125 | 11 | 16 | 27 | 14 | 2 | 16 | 168 |

11. | Department

of Non-Banking Supervision (DNBS) | 45 | 227 | 272 | 10 | 101 | 111 | 7 | 66 | 73 | 456 |

12. | Foreign

Exchange Department (FED) | 77 | 189 | 266 | 101 | 312 | 413 | 50 | 177 | 227 | 906 |

13. | Financial

Markets Department (FMD) | 21 | – | 21 | 4 | – | 4 | 3 | – | 3 | 28 |

14. | Human

Resources Development Department (HRDD) | 50 | 5 | 55 | 46 | 5 | 51 | 27 | 1 | 28 | 134 |

14A. | Bankers’

Training College, Mumbai | 0 | 37 | 37 | – | 30 | 30 | – | 86 | 86 | 153 |

14B. | Reserve

Bank Staff College, Chennai | 0 | 38 | 38 | – | 21 | 21 | – | 37 | 37 | 96 |

14C. | Zonal

Training Colleges | 0 | 17 | 17 | – | 9 | 9 | – | 5 | 5 | 31 |

14D. | College

of Agricultural Banking, Pune | 0 | 55 | 55 | – | 35 | 35 | – | 91 | 91 | 181 |

15. | Internal

Debt Management Department (IDMD) | 26 | – | 26 | 11 | – | 11 | 7 | – | 7 | 44 |

16. | Inspection

Department (ID) | 48 | – | 48 | 16 | – | 16 | 11 | – | 11 | 75 |

17. | Legal

Department (LD) | 34 | 9 | 43 | 14 | 7 | 21 | 13 | 3 | 16 | 80 |

18. | Press

Relations Division (PRD) | 8 | – | 8 | 6 | – | 6 | 6 | – | 6 | 20 |

19. | Premises

Department (PD) | 44 | 248 | 292 | 39 | 300 | 339 | 45 | 667 | 712 | 1,343 |

20. | Rural

Planning and Credit Department (RPCD) | 108 | 330 | 438 | 34 | 141 | 175 | 37 | 101 | 138 | 751 |

21. | Secretary’s

Department | 39 | 0 | 39 | 19 | – | 19 | 38 | – | 38 | 96 |

22. | Urban

Banks Department (UBD) | 71 | 364 | 435 | 27 | 152 | 179 | 37 | 57 | 94 | 708 |

23. | Rajbhasha

Department | – | 27 | 27 | – | 37 | 37 | – | 9 | 9 | 73 |

24. | Deposit

Insurance and Credit Guarantee | | | | | | | | | | |

| Corporation

(DICGC) | – | 46 | 46 | – | 37 | 37 | – | 25 | 25 | 108 |

25. | Reserve

Bank Services Board (RBSB) | 12 | – | 12 | 12 | – | 12 | 7 | – | 7 | 31 |

| Total

1,588 | 5,231 | 6,819 | 1,012 | 6,510 | 7,522 | 680 | 6,889 | 7,569 | 21,910 |

Note :

1. C.O : Central Office. R.O : Regional Office.

2. The staff in Monetary Policy

Department (MPD) are not shown separately since the staff are drawn from five

other Departments, viz.,

DEAP, DESACS, DBOD, RPCD and DAPM. The staff

strength of MPD in different categories as on December 31, 2006 was 37 in

Class I, 17 in Class III and 16 in Class IV.

3. The Department of Payment

and Settlement Systems (DPSS) is not shown separately as their staff forms a part

of staff strength of DIT.

4. The Banking Codes and Standard Board of India

(BCSBI) and Customer Service Department (CSD) have not been shown separately

as their staff forms part of RPCD.

5. The staff shown against DCM is inclusive

of staff employed in Issue Department.

6. The staff shown against DGBA is

inclusive of staff employed in Banking Department, Public Accounts Department

and Public

Debt Offices. |

Table

9.8: Office-wise Strength of Staff | (As

on December 31, 2006) | | Office | Class

I | Class

III | Class

IV | Total |

| 1 | 2 | 3 | 4 | 5 |

1. | Ahmedabad | 316 | 334 | 310 | 960 |

2. | Bangalore

| 385 | 349 | 315 | 1,049 |

3. | Belapur | 88 | 180 | 236 | 504 |

4. | Bhopal

# | 145 | 51 | 100 | 296 |

5. | Bhubaneswar

| 141 | 161 | 221 | 523 |

6. | Chandigarh

| 187 | 57 | 115 | 359 |

7. | Chennai | 416 | 599 | 597 | 1,612 |

8. | Guwahati | 163 | 262 | 218 | 643 |

9. | Hyderabad

| 279 | 277 | 331 | 887 |

10. | Jaipur | 225 | 246 | 258 | 729 |

11. | Jammu

| 81 | 18 | 56 | 155 |

12. | Kanpur

* | 188 | 406 | 432 | 1,026 |

13. | Kochi

| 21 | 68 | 49 | 138 |

14. | Kolkata | 561 | 857 | 797 | 2,215 |

15. | Lucknow

| 145 | 157 | 123 | 425 |

16. | Mumbai | 746 | 966 | 1,373 | 3,085 |

17. | Nagpur

| 204 | 428 | 314 | 946 |

18. | New

Delhi | 453 | 632 | 481 | 1,566 |

19. | Panaji,

Goa | 6 | 6 | 2 | 14 |

20. | Patna

| 246 | 252 | 288 | 786 |

21. | Pune

(CAB and CRDC) | 54 | 33 | 89 | 176 |

22. | Thiruvananthapuram | 181 | 171 | 184 | 536 |

A. | Total

(1 to 22) | 5,231 | 6,510 | 6,889 | 18,630 |

B. | Mumbai

Central Office | | | | |

| Departments | 1,588 | 1,012 | 680 | 3,280 |

Grand Total

(A+B) | 6,819 | 7,522 | 7,569 | 21,910 |

# : Includes staff

of the sub-office opened at Raipur on January 2, 2007.

* : Includes staff

of the sub-office opened at Dehradun on June 30, 2006.

CRDC : Central Records

and Documentation Centre. | Promotion of Hindi

IX.43 During the year 2006-07, the Reserve Bank persevered with its efforts

to promote the use of Hindi in its working. In fulfilling the statutory requirements

of Rajbhasha Policy, involving implementation of the provisions of the Official

Languages Act, 1963, the Official Language Rules, 1976 and the Annual Programme

issued by the Government of India, Hindi training programmes and other promotional

activities such as shield competitions, inter-bank Hindi essay competitions and

inter-bank/financial institutions Hindi/ bilingual house journal competitions

were conducted. Many programmes were conducted at the time of Hindi fortnight

observed from September 14, 2006.

IX.44 In order to promote Hindi, the

Reserve Bank continued to bring out its various publications in bilingual form,

i.e., both in Hindi and English. The Reserve Bank’s Central office

publishes a bilingual house journal ‘Without Reserve’. The publication

‘Banking Glossary’ has been revised with the cooperation of the representatives

of the public sector banks to enhance its usefulness. The Reserve Bank through

its Rajbhasha Depar tment fur ther strengthened the use of Hindi in computerisation.

The Reserve Bank’s training colleges bring out books in Hindi which featured

useful articles on current topics on banking and other related topics. The Bankers’

Training College continued its prestigious Hindi publication named ‘Banking

Chintan Anuchintan’ which is quite popular in the banking sector in

India. The regional offices also made attempts to publish regular magazines in

Hindi during the year.

IX.45 The Reserve Bank has prepared a 3-year action

plan for effective use of Hindi. The action plan includes computer bilingualisation,

translation, training in Hindi medium, dissemination of information related to

Rajbhasha and initiatives to motivate the Reserve Bank’s staff for the use

of Hindi. The Reserve Bank’s main website has been linked with the Hindi

section. The intranet site of Rajbhasha Department is in Hindi only. The intranet

sites of various offices/ departments are also provided with Hindi section; the

intranet site of Department of Economic Analysis and Policy is fully bilingual.

An ‘Expert Group on Bilingualisation of Computers’ has been set up

in order to ensure bilingualisation. A translation workshop was conducted for

Rajbhasha officers from the Reserve Bank as well as from public sector banks so

as to encourage the assimilation of translation work. To make the translation

work easy, simple and perceptible, a ‘Translation Review Committee’

has been constituted. Guidelines regarding the use of Hindi in Banking Ombudsman

offices were issued in November 2006. Training programmes ‘Intensive Course

in Hindi Correspondence in Networking Environment’ for officers and ‘Entire

Work in Hindi through MS Office’ for staff members are conducted regularly

to enable them to work in Hindi on computers. A special training programme for

senior officers was also conducted during 2006-07.

IX.46 The Committee

of Parliament for Official Language visited Thiruvananthapuram Regional Office

on January 17, 2007 and expressed satisfaction with progress on the use of Hindi

in the Office.

Customer Service and Grievance Redressal System

in the Reserve Bank

IX.47 The Reserve Bank renders services

to members of public, banks, Central and State Governments and financial institutions

in areas covering currency management, Government receipts and payments including

tax collections, public debt management, clearing and remittance of funds and

foreign exchange. In order to further improve the delivery of customer services,

a Customer Service Department was set up in July 2006 by bringing in various customer

service activities handled by different departments of the bank under a single

roof. Customer Ser vice Depar tment oversees the functioning of the Complaints

Redressal Cells (CRCs) functioning in Regional Offices. CRCs cover all service-oriented

departments of the Reserve Bank such as the Banking Departments [Public Accounts

Department (PAD), Deposit Accounts Department (DAD), and Public Debt Office (PDO)],

Foreign Exchange Department and Issue Department. In order to achieve optimum

awareness and improvement of customer service in the Reserve Bank, the CRC uses

a variety of tools like release of advertisements, Citizens’ Charter, branch

level meetings, status reports and reviews by the Local Board. All the full-fledged

Reserve Bank offices issue advertisements on the first Sunday of January and July

every year, giving wide publicity about the functioning of the CRCs at various

centers and also at the Central Office. The advertisement also gives the names

and contact details of the Grievance Redressal Officers at the Regional Office

and Central Office. The Citizens’ Charter specifies the timeframe for each

of the customer related activity of the Banking Department. The Citizens’

Charter is prominently displayed in the Banking Departments for the benefit of

the members of the public visiting the Bank’s premises for availing various

kinds of services. As per the recommendations of the Committee on Procedures and

Performance Audit on Public Services (CPPAPS), the Regional Offices assess the

level of their customer service every quarter. The shor tcomings/exceptions observed

during this process are rectified in consultation with the Central Office departments.

Incognito visits are conducted by the Chief General Managers on their visits

to Regional Offices to assess the level of customer service at the ground level.

The issues relating to the customer service and redressal of complaints are discussed

in the monthly meetings of the Branch Level Management Committees. The status

of receipt/ redressal of complaints is reviewed in the quarterly meetings of the

Local Boards of the Reserve Bank. During 2006-07 (July-March), 157 complaints

were received against the Reserve Bank of which, 111 pertained to Issue/Cash Department.

The largest number of complaints was received at Mumbai and Bhopal offices. IX.48

During 2006-07, various innovative measures were taken for improving customer

service in the areas of banking, currency, foreign exchange and clearing mechanism.

These included evaluation of customer satisfaction, financial inclusion and financial

education. Training programmes/workshops/meetings were conducted to educate officials

of various banking and non-banking organisations, such as, State and Central Government

undertakings, authorised foreign exchange dealers, rural and urban money lenders,

representatives of major NGOs, professors and farmers’ organisations. The

Regional Offices held informal meetings with controlling heads of banks and impressed

upon them the need to take effective steps for financial inclusion. Bhubaneswar

and Lucknow offices achieved 100 per cent financial inclusion in select districts

in their States with the help of banks, district magistrates, chief development

officers and NABARD. Officers of some Regional Offices made incognito

visits to bank branches to assess, inter alia, the level of customer

service, foreign exchange business conducted, exchange of defective notes, display

of service charges, interest rates on deposits and cheque drop box facility. The

deficiencies found were taken up with the controlling offices for corrective action. IX.49

As part of its efforts to spread awareness about electronic clearing products,

Thiruvananthapuram office invited a large number of users – corporates,

college students, State and Central Government undertakings – for a detailed

presentation on various electronic funds transfer products, viz., electronic

clearing service (ECS), national electronic funds transfer (NEFT) and real time

gross settlement (RTGS). A pamphlet prepared on the ECS was released on the occasion. IX.50

Chennai office set up a pavilion in the 33rd India Tourism and Industrial Fair

2007 to create awareness among the public on issues such as the Reserve Bank’s

role as a central bank, Clean Note Policy, security features of new series notes,

and Star series notes. Banners and posters on detection of forged notes, foreign

exchange facilities for residents, guidance on investment in NBFCs and key features

of the new Banking Ombudsman Scheme, 2006 were displayed in the pavilion. Hyderabad

Office participated in the “Hyderabad Coins and Notes Fair – 2007”

organised by the Philatelic and Hobbies Society, Secunderabad in which the officers

interacted with visitors. The features of genuine banknotes and ways to identify

forged notes were explained with the aid of posters, power point presentations,

film shows, and pamphlets. Patna office set up a ‘Help Desk’

at the venue of the “Global Meet for a Resurgent Bihar” and also distributed

FAQs on various foreign exchange matters among the delegates.

Complaints

Redressal Mechanism – Prevention of Sexual Harassment of Women at Workplace

IX.51 Pursuant to the guidelines laid down in the Supreme Court Judgment

[Vishaka and Others vs. State of Rajasthan (1997) SCC 241], a Complaints

Redressal Mechanism for prevention of incidence of sexual harassment of women

at workplaces was put in place in the Reserve Bank in 1998. Under the system,

a Central Complaints Committee (CCC) headed by a lady officer in Grade ‘F’

is functional at the Central Office level. In order to provide an easy access

to the complaints redressal mechanism for the lady staff working in offices located

at various other places, additional Complaints Committees have been formed at

six locations in the Reserve Bank’s offices at Mumbai and 20 Regional Offices.

These Committees are also headed by senior woman officers. The CCC and the Regional

Complaints Committees (RCCs), besides having a NGO member each, have more than

50 per cent women members. The CCC acts as the focal point for all the Complaints

Committees constituted at 20 centres of the Reserve Bank as well as for the six

Committees formed in various premises of the Reserve Bank in Mumbai. During 2006-07

(July-May), four complaints of the alleged harassment were received by the Complaints

Committees from aggrieved women employees. Of these, one complaint did not fall

under the purview of the Committee and in another case, no sexual harassment,

as alleged, was involved; the third complaint is being investigated, whereas in

the fourth case, the CCC has submitted its report for further action. IX.52

A survey conducted in the Reserve Bank to ascertain the level of awareness among

the lady staff members about the Supreme Court guidelines and the remedies available

in the system found that (i) a majority of women staff – three out of four

surveyed – believed that the complaints committees could settle the issues

of sexual harassment; (ii) 94.5 per cent of the surveyed lady staff felt

that the working environment in the Reserve Bank was healthy/ conducive; (iii)

a majority of the respondents felt that it was the responsibility of both men

and women employees to keep work environment healthy in the Reserve Bank; and

(iv) 10.5 per cent of women employees reported having faced some form of sexual

harassment in the office; however, they did not report the instances and preferred

to remain quiet or handle the situation themselves and some expressed having undergone

extreme anguish under such circumstances.

IX.53 A two day seminar was

arranged on September 6 and 7, 2006 at Zonal Training Centre, Kharghar to impart

training to the Chairpersons of the RCCs on the issues relating to prevention

and redressal of sexual harassment of women at workplaces. The seminar,

inaugurated by Smt. Shyamala Gopinath, Deputy Governor was conducted by Dr. H.

S. Rana, Additional Director, National Institute of Public Administration, Bangalore.

In all, 23 Chairpersons/members of complaints committees participated in the seminar.

The seminar covered topics such as Supreme Court guidelines, facts and figures

of sexual harassment, constitutional safeguards and sexual harassment, constitution

of complaints committees, preventive measures, redressal mechanism, and background

of the latest guidelines. This was the first occasion when all the Chairpersons

could meet, interact and exchange their views on the subject after the formation

of the RCCs.

Premises Department

IX.54 In order

to provide better all-around ambience at work and residential colonies, the Premises

Department focused on ensuring better services and maintenance standards at the

Reserve Bank’s offices and residential premises. Older electrical/ electromechanical

installations are being upgraded to ensure energy efficiency and environmental

protection. A special thrust is also being given to upgrading the residential

premises owned by the Reserve Bank. Efforts were made during the year to decentralise

and simplify procedures to increase the level of outsourcing of activities and

to improve overall efficiency in delivery of services.

IX.55 As a result

of business planning and property strategies and rationalisation/consolidation

of work-space and living space, in the context of changes in the functions and

manpower requirements of the Reserve Bank, three surplus proper ties were identified

and disposed off during 2006-07. A documented policy for disposal of surplus property,

duly approved by the Central Board of the Reserve Bank, is in place. The

Reserve Bank is making efforts towards further consolidation of its properties

across the country.

Inspection of Offices/Departments in the

Reserve Bank

IX.56 In order to enhance the effectiveness of

the internal inspection/audit process, Management Audit & Systems Inspection

(MA&SI), Information Systems Audit (ISA), Concurrent Audit (CA) and Control

Self-Assessment Audit (CSAA) of the offices/departments of the Reserve Bank are

undertaken at prescribed intervals. The focus of the MA&SI is on three ‘E’s,

i.e., efficiency, economy and effectiveness of the system. The MA&SI

evaluates the adequacy and reliability of existing systems and procedures to ensure

that laws, regulations, internal policy guidelines and instructions are meticulously

followed. Apart from conducting systems inspection, the inspection teams also

conduct the management audit under which aspects relating to organisational goals,

delegation of power, customer service in the department/office and management

efficacy are also looked into. During 2006-07, systems inspections, including

information systems audits of 15 Regional Offices (ROs), 10 Central Office departments

and two training establishments were completed. In addition, six special scrutinies

were carried out. Compliance Audit of PDO-NDS was also completed during this period.

The compliance position in respect of major findings of MA&SI reports is monitored

by the Executive Directors’ Committee under the overall supervision and

guidance of the Inspection and Audit Sub-Committee (IASC) of the Central Board.

During 2006-07, four meetings of the IASC, three meetings of the Executive Directors’

Committee and twelve meetings of CGMs’ Committee were held.

IX.57

During 2006-07, snap audits of 16 Regional Offices, 24 Central Office departments

and three training establishment were conducted. The functions relating to monitoring

and guidance of CA and CSAA for ensuring comprehensive coverage of work areas/activities

were undertaken under Audit Monitoring Arrangement. The functioning of the system

of CA and CSAA was reviewed and measures to improve upon areas found deficient

were advised to the auditee departments/offices concer ned. The Inspection Depar

tment also extended faculty support for conducting training programmes/workshops

on CSAA.

IX.58 In keeping with the recommendations of the Committee on

Procedures and Performance Audit on Public Services (CPPAPS), it was decided to

take up the ISO 9001-2000 Certification process in phases. ISO 9001-2000 is a

generic management standard providing an internationally accepted framework for

establishing quality management systems with customer focus and continual improvement

as the key elements. During the first phase, the ISO 9001-2000 certification was

obtained for Depar tment of Government and Bank Accounts (DGBA) and Department

of Currency Management (DCM) at the Central Office and Issue and Banking Departments

at Hyderabad and Kolkata offices. In the second phase, Issue and Banking Departments

at New Delhi, Jaipur, Chennai and Bangalore offices were taken up for ISO 9001-2000

implementation and are in readiness to achieve Certification shortly. In the third

phase, the process of implementing the Standards at Issue and Banking Departments

at Ahmedabad, Nagpur, Bhopal and Thiruvananthapuram offices has been initiated.

Furthermore, action has also been initiated to cover Department of Administration

and Personnel Management (DAPM), Human Resource Development Department (HRDD)

and Department of Economic Analysis and Policy (DEAP) under such Certification.

IX.59 As a part of the Reserve Bank’s continuing initiatives to adopt

and adhere to international best practices and standards, BS7799 certification

(Information Security Management System Certification) was obtained for two of

its important work areas, viz., internal debt management and external

investments and operations handled by Internal Debt Management Department (IDMD)

and Department of External Investments and Operations (DEIO), respectively. The

BS7799 certification at IDMD and DEIO has been upgraded to ISO27001 –a new

Standard having more clauses/features vis-à-vis BS 7799. The ISO27001

standards are internationally recognised information security management standards,

which define the desired methods of controlling the confidentiality, integrity

and availability of information. The certification under these standards implies

establishment/existence of requisite policies for information security management,

their effective implementation and suitable mechanism for improvement in the domain,

in tandem with the functional information security requirements. In the second

phase of certification, two more departments, viz., Department of Banking

Supervision (DBS) and Department of Banking Operations and Development (DBOD)

have been taken up for ISO 27001 Certification. Department of Expenditure

and Budgetary Control

IX.60 The Depar tment of Expenditure and

Budgetary Control (DEBC) prepares the Reserve Bank’s Annual Budget and also

provides services to the Reserve Bank’s own staff. As regards the Annual

Budget, initiatives were taken during 2006-07 to improve/simplify the budgetary

process. These included permitting (i) interchangeability between subheads (ii)

deviations in seasonal expenditures like Leave Fare Concession (LFC) in the quarterly

reports, and (iii) overall budget utilisation within the range of 5 per cent of

the budgeted amount.

Dissemination Policy

IX.61

In order to explain the rationale and the analytics of its policies to the public,

the Reserve Bank disseminates a wide range of information through press releases,

notifications, master circulars, publications, speeches, frequently asked questions

and advertisements. During the year ended June 30, 2007, the Reserve Bank issued

1,826 press releases, 79 master circulars and 447 notifications. It organised

meetings, workshops and seminars to interact with special audiences. The e-mail

helpdesks continued to furnish replies to the queries raised by the general public.

Members of the public continued to send their queries relating to various services

provided by the Reserve Bank through e-mail/telephone/fax to the helpdesks set

up in various departments and Regional Offices. These queries are over and above

the queries received under the Right to Information Act.

IX.62 With accent

on transparency and accountability the Reserve Bank has been making increasing

use of its website (URL: http://ww.rbi.org.in)

in communicating with external audiences. As against adding an average 10 MB material

in a year, the material added to the site now is close to 2.5 GB. The total size

of the website in about 10 years has increased to 13.5 GBs. In keeping with its

two-way communication policy, the Reserve Bank also uses the site to seek feedback

on draft reports and recommendations of expert groups. During 2006-07, three draft

reports and 10 draft guidelines were placed on the website for feedback.

Having revamped its English website in 2005 with the intention of making it more

attractive and customer-friendly, the Reserve Bank undertook a similar task for

its Hindi website. The number of users registering themselves for receiving information

available on the Reserve Bank’s website through email went up to 7,399 during

the year from 5,630 during 2005-06. IX.63 Making use of the available technology,

the Reserve Bank extended its communication relating to monetary policy to six

of its Regional Offices -Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata and

New Delhi, apart from Mumbai. This was enabled through the video conferencing

facility. It gave an opportunity to the regional press to interact with the Governor.

The webcast of the Governor’s press conferences on monetary policy has fur

ther strengthened the communication framework of the Reserve Bank. The webcast

of the press conference held at the time of the Mid-term Review on October 31,

2006 was accessed by 465 persons while that of the Annual Policy Statement on

April 24, 2007 was accessed by 1,803 persons.

IX.64 The Reserve Bank

arranges, from time to time, interactive seminars for press persons with the objective

of familiarising them with the basic concepts in banking/finance/central banking.

Such seminars have now become a part of the Reserve Bank’s media outreach

programme. Five such seminars were held during the year. A first-ever interactive

seminar for senior journalists was also arranged in May 2007 with the objective

of facilitating interaction between the top executives of the Reserve Bank and

senior presspersons on relevant issues under the Reserve Bank’s purview.

IX.65 To give an insight into its role and functions, the Reserve Bank, in

2006, embarked on a programme of encouraging school/college students and other

interest groups of the public to visit the Reserve Bank. The programme includes

interactive session between students and the Reserve Bank officials on issues

relating to central banking and economy, a tour of the Monetary Museum and a visit

to the National Clearing Cell where cheques are processed. During the year,

496 visitors from 10 schools and others organisations visited

the Reserve Bank under this arrangement.

IX.66 Given the current focus

of the Reserve Bank on financial education and literacy, a massive effort for

preparing material on subjects of interest to the common person has been

under taken. As a precursor to this effort, a multi-lingual website was

released in June 2007. Aimed at giving information to the common person

that he can use in his own language the site has instructions issued by the Reserve

Bank on banking matters, customer grievance redressal mechanism and the

Right to Information Act. The site also has a section explaining the role and

functions of the Reserve Bank, interesting aspects about currency and the Reserve

Bank’s history. The site is available in 11 regional languages apart

from Hindi and English.

The Right to Information Act, 2005

IX.67 The Government of India enacted the Right to Information Act, 2005

on June 15, 2005. The Act, which came into effect from October 12, 2005, aims

at providing the right to information to citizens in order to promote transparency

and accountability in the working of every public authority. The Reserve Bank,

as a public authority, as defined in the Right to Information Act, 2005 is obliged

to provide information to the members of public. Central Assistant Public Information

Officers (CAPIOs) have been designated to receive the applications for information

or appeals under the Act at all Regional Offices and Central Office depar tments.

The Reserve Bank has designated Shri V.S. Das, Executive Director, as the Chief

Public Information Officer (CPIO) and Shri H.N. Prasad, Principal Chief General

Manager as the Alternate CPIO in the absence of regular CPIO. Dr. Rakesh

Mohan, Deputy Governor, has been designated as the Appellate Authority (AA) and

Shri V. Leeladhar, Deputy Governor, as the Alternate AA in the absence of regular

AA. IX.68 Increased awareness of the Act resulted in a rise in the number

of requests for information received from 796 (October 2005 to June 2006) to 2,163

(July 2006 to June 2007). Almost 95 per cent of the requests received during

the period were resolved. Furthermore, 393 appeals against non-disclosure of information

were received by the Bank’s Appellate Authority. In 53 such cases, the appellants

approached the Central Information Commission(CIC) (Table 9.9).

Some of the major decisions of the Central Information Commission are in Box

IX.1.

Risk Management

IX.69 The Reserve

Bank performs several functions of a diverse nature. These functions expose

the Reserve Bank to various risks such as market risk, credit risk, liquidity

risk and operational risk. Market risk is one of the critical sources of

risk faced by the Reserve Bank which arises from revaluation of its financial

assets due to exchange rate and interest rate changes both in India and abroad.

The balance sheet of the Reser ve Bank has become very sensitive to exchange rate

changes due to increase in the share of foreign currency assets in its balance

sheet in recent years. Since foreign currency assets are invested in fixed

income instruments, they are also subject to interest rate changes. Deployment

of foreign currency assets and gold in deposits and debt instruments, lending

or refinancing operations of the Reserve Bank expose it to credit risk.

Liquidity risk arises when foreign currency assets are to be converted into cash

for intervening in the markets or meeting any other cash obligations. The

Reserve Bank is also exposed to operational risk which may result in direct or

indirect loss on account of inadequate or failed internal process, people and

systems or from external events.

IX.70 These risks are managed in line

with the laid down policy. Market risk is periodically monitored.

Credit risk is managed by placing limits for counterparties and entering into

transactions through delivery versus payment systems. Liquidity

risk is effectively managed by deploying a considerable proportion of foreign

currency assets in highly liquid assets.

IX.71 Adequate measures have

also been taken to mitigate operational risk by ensuring sound internal control

systems/inspection/audit arrangements and well laid down procedures and policies,

business continuity plan for systems, insurance and physical safety of assets,

process control and validation checks for data integrity. For managing the

operational risk, increased emphasis is being placed on promoting human integrity

and alertness. Since operational risk is unquantifiable, the Reserve Bank

has also initiated measures for developing a database of past losses/operational

risks to analyse and control the same.

Table

9.9: Right to Information Act – Requests | Received

and Resolved | Item

| 2006-07 |

| (July

to June) | 1

| 2 |

A. | i) | Requests

Received | 2,163 |

| ii) | Requests

Resolved | 2,050 |

| of

which: | |

| | a) | Requests

met fully | 1,062 |

| | b) | Requests

met partly | 329 |

| | c) | Requests

declined | 270 |

| | d) | Resolved

in other manner | 389 |

| iii) | Under

Consideration | 113 |

B. | Appeals

received by the Bank’s | |

| Appellate

Authority (AA) | 393 |

| of

which: | |

| i) | Appeals

under consideration | 96 |

| ii) | Number

of appeals disposed of | 297 |

| | a) | Number

of appeals allowed/partially | |

| | | allowed

by AA with direction to furnish | |

| | | additional

information | 118 |

| | b) | Appeals

where CPIO’s decisions were | |

| | | upheld | 179 |

C. | Appeals

Referred to Central Information | |

| Commission | 53 |

| of

which: | |

| i) | Orders

issued | 24 |

| | a) | Appeals

partially allowed | 7 |

| | b) | Appeals

where CPIO/AA’s decisions | |

| | | were

upheld | 17 |

| ii) | Under

Consideration | 29 |

Box IX.1

Major

Decisions of Central Information Commission (CIC) 1) Inspection

Reports of the Reserve Bank: The Central Information Commission, while

examining the validity of the exemption claim made by the Reserve Bank in relation

to its Inspection Reports, granted absolute discretion to the Reserve Bank to

assess the desirability of disclosure of Inspection Report in individual cases.

The Full Bench of the CIC observed as under: “…the RBI is entitled

to claim exemption from disclosure under section 8(1) (a) of the Act if it is

satisfied that the disclosure of such report would adversely affect the economic

interests of the State. The RBI is an expert body appointed to oversee this matter

and we may therefore rely on its assessment. The issue is decided accordingly.”

Decision of the CIC in Shri Ravin Ranchchodlal Patel and Shri Madhav

Balwant Karmarkar vs. Reserve Bank of India (December 7, 2006).

2) File notings on the basis of information received in a fiduciary capacity

exempt from disclosure: On a complaint filed before the Chief Public

Information Officer (CPIO) of the Reserve Bank on the issue

of unauthorised withdrawal of money from an account

in the Gurgaon Gramin Bank (GGB), the CPIO furnished

copies of the correspondence between the Reserve Bank and GGB and advised the

appellant the action taken on her complaint. On the basis of office notings, replies

obtained from the GGB were furnished to the appellant. However, a

copy of the office notings was denied, since these were confidential

and privileged documents containing information furnished by the bank

in fiduciary capacity, claiming exemption from disclosure under section 8(1) (e)

and (j) of the RTI Act. The appellate authority upheld the decision of the CPIO

and the CIC ruled: “there is as such no question of denial of information

from RBI as all the information asked for

has already been provided to the appellant except

copies of the notings from the concerned file of the Bank. In the instant case,

file notings in possession of RBI are furnished by the Gramin Bank (third party)

in fiduciary capacity. Therefore, the exemption under section 8(1) (e) has been

correctly applied by the public authority”.

Decision of the

CIC in Mrs. Sunita vs. Reserve Bank of India (June 19, 2006).

3) Only citizens entitled for information: “An Association

or a Company is not and cannot be treated as a citizen even though it may have

been registered or incorporated in the country. A natural born person can only

be a citizen of India under the provisions of Part II of the Constitution. Section

3 of the Right to Information Act, 2005 gives the right to information to all

citizens. Thus, it is quite clear that a person who is not a citizen cannot claim

this right.” Decision of the CIC in D.N. Sahu vs. Ministry of Urban

Development (May 9, 2006).

4) RTI Act cannot be used for

redressal of grievances:

“The RTI Act cannot be confused

with an instrument for grievance redress albeit the information obtained

through it can be so used with telling effect.” Decision of the CIC

in Pratap Singh Gandas vs. Delhi Electricity Regulatory Commission (January 11,

2006). 5) RTI application cannot be used to enquire into why,

how and in what manner a decision was taken: “In terms of the provisions

of the RTI Act, the mandate for the CIC is to make available to a citizen, the

information in possession of a public authority, by giving appropriate directions.

It has no powers to either enquire into why, how and in what manner a decision

was taken or to direct how and in what manner the affairs of a public authority

are to be conducted.” Decision of the CIC in Ms. Nita Arya, UDC, Department

of Health and Family Welfare vs. Ministry of Health and Family Welfare (June 19,

2006).

6) Details of annual immovable property returns of

an officer exempt from disclosure: “The information requested for

is in the nature of personal information, the disclosure of which may cause unwarranted

invasion of privacy of an individual officer. The exemption from disclosure of

information under Section 8(1)(j) of the Act has therefore been correctly applied

by the appellate authority.” Decision of the CIC in Mukesh Kumar vs.

Department of Revenue, Ministry of Finance (February 22, 2006).

7) PAN/TAN are personal information: “PAN is a statutory

number, which functions as a unique identification for each tax payers. Making

PAN public can result in misuse of this information by other persons to quote

wrong PAN while entering into financial transactions and also could compromise

the privacy of the personal financial transactions linked with PAN. This also

holds true for TAN. Information relating to PAN and TAN, including the date of

issue of these numbers, are composite and confidential in nature under Section

138 of the Income Tax Act.” Decision of the CIC in Arun Verma vs. Director

General of Income Tax (Systems), New Delhi (March 3, 2006). IX.72 As

a part of its traditional central banking function, the Reserve Bank has been

acting as a banker to the Central Government as also to the State Governments.

Over the years, commercial banks have also been involved as agents of the Reserve

Bank to carry out such functions. Government business carried out by the

Reserve Bank and by agency banks is subject to many operational and reputational

risks. In order to better manage these risks, the Reserve Bank has taken

a number of measures such as ensuring multiple banking arrangements, nominating

alternate clearing banks and putting in place back-up arrangements. Furthermore,

with a view to controlling and mitigating the operational risk in general and

human risk in particular, the Reserve Bank undertakes periodic reviews and revisions

of operational manuals and work procedure.

IX.73 The Reserve Bank has

taken up the task of introducing Risk-based Internal Inspection across the Bank.

An internal Task Force was constituted in the Inspection Department with the objective

of evolving a framework for a Risk-based Internal Inspection by profiling activities

undertaken, as per inherent perceived risk, in the various offices/departments,

training establishments and subsidiaries. The Reserve Bank has also consulted

the Institute of Internal Auditors (IIA), Mumbai and M/s Ernst & Young in

the matter. A ‘pilot’ on risk assessment has been undertaken by the

Inspection Department with assistance from M/s Ernst & Young at Chandigarh,

Kolkata and Mumbai Regional Offices of the Bank, besides Urban Banks Department

(MRO).

IX.74 The Reserve Bank as the central bank manages the payment

and settlement systems of the country, which also entail counterparty and operational

risks. In the recent past several measures have been taken to manage the

risks in the payment and settlement systems. The Reserve Bank has introduced

the real time gross settlement (RTGS) system, under which processing of payment

instructions or messages is required to be undertaken on a real time basis separately

for individual transactions. Thus, the counterparty risk in the RTGS is

obviated. The attendant problem of excess liquidity requirement under the

RTGS is also effectively managed through liquidity saving features such as queuing,

prioritisation, gridlock resolution mechanism and intra-day liquidity support

from the Reserve Bank. The RTGS is now the core payment system in India

and recognising its risk mitigating features, the netting based inter-bank clearings

(where the settlement of payables and receivables of participants in clearing

is done on a net basis) have almost been closed down. IX.75 All other payment

systems (other than RTGS) function on a deferred net settlement systems (DNS)

basis. This comprises both large-value payment systems [inter-bank government

securities clearing system, inter-bank foreign exchange clearing system and collateralised

borrowing and lending operations (CBLO)] and retail payment systems [paper-based

MICR and non-MICR clearing systems and high value clearing system; and electronic

systems such as electronic clearing service (ECS-credit and debit), electronic

funds transfer (EFT) system and national electronic fund transfer system (NEFT)].

These are operated by the Reserve Bank, State Bank of India and other public sector

banks. For large value netting systems, clearing is now settled on a central

counterparty arrangement basis, where Clearing Corporation of India Limited (CCIL)

acts as a counterparty. The central counterparty arrangement has since stabilised

and has enabled better management of risks. In respect of cheque clearing

and other low value electronic clearing systems, India has a modified version

of 'unwind' (the system of excluding the defaulting participant and reworking

the settlement as if it never participated in the clearing on that particular

day) which is known as 'partial unwind'. Under this system, in the case

of a default by one or more participants in a DNS system, the instruments drawn

on the defaulter and presented to it are taken back by other participants, while

the value of instruments drawn on other participants and presented by the defaulter

are put in a suspense account. IX.76 One of the key driving factors in all

the IT initiatives is the need to ensure business continuity in the event of a

contingency. Therefore, in all the systems implemented, particularly the critical

payment system application systems (such as the RTGS, CFMS, Public Debt Office-Negotiated