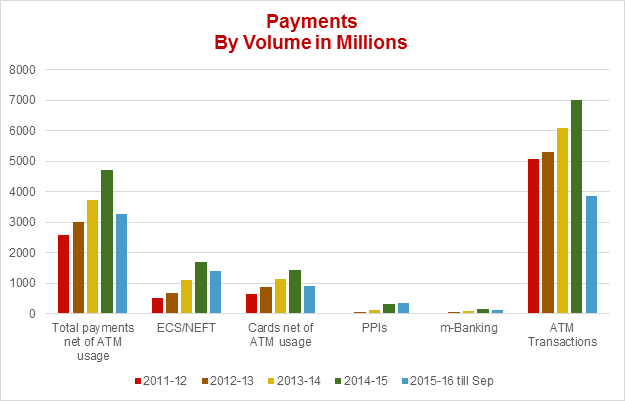

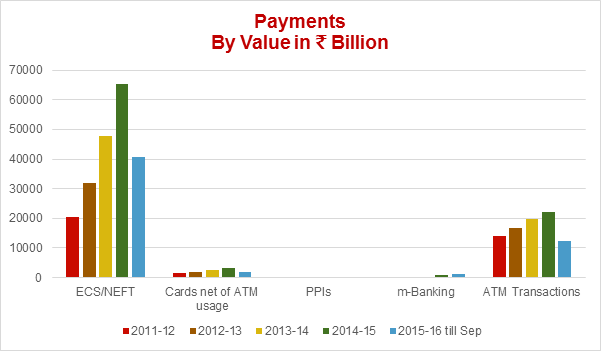

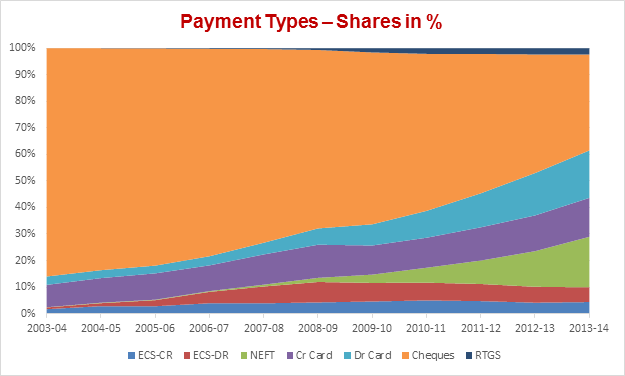

It was in the Reserve Bank’s Payment Systems Vision 2005-08 document, which I was fortunate enough to draft, it was indicated that the focus would be on setting up of a new institution for all retail payment systems and operationalizing a national settlement system. This new institution would be a limited company, owned and operated by banks and act as an umbrella organization for all retail clearing operations, both paper based and electronic. I am very glad that the National Payments Corporation of India (NPCI) established in 2009 footed the bill in perfect unison and has now emerged as the prime engine chugging ahead in the retail payment systems. NPCI is working closely with the banking community and payments technology industry at large and is at the forefront of digitizing the payments while also providing for interoperability. The industry has also been privy to the new initiatives taken by NPCI which are impacting the payments system positively. As it is, NPCI is completing six years now and in its six years existence, it has successfully launched six products viz., grid-wise operations of the CTS, Interoperability on NACH, IMPS, NFS and the RuPay card scheme. I am sure that NPCI has and will have much more successful rabbits under its hat. I understand NPCI is in an advanced stage of offering Touch & Go cards and is discussing the modalities for introducing interoperability for ETC Tags. My hearty congratulations to the Team NPCI headed by Shri A P Hota, a longtime friend. 2. We have been focusing our attention on developing the payment systems in the country for the past thirty five years, starting from the computerization of clearing houses way back in early 1980s. Thanks to all these years’ efforts, today we have a vibrant, innovating, efficient and secured payment eco system in the country. The share of electronic payments is continuously on the increase, both in volume and value terms. Several payment channels viz., cards (including credit, debit and prepaid varieties), near field and cardless, electronic, internet and mobile based, are growing in big proportions. ATMs and POS machines have proliferated.

3. However, the country is very big, spread over 3.288 million sq km area, with 1.2 billion citizens, and 650,000 plus villages. The growth recorded so far, though gratifying, is nowhere near our fellow emerging markets, leave alone developed west or east. Therefore, we need to be pressing ahead with our efforts in this area. The Reserve Bank is working on the next Payment Systems Vision document. In this context, it is also imperative that market participants also continue to take serious interest in developing the payment systems. That will need quite a catalytic efforts from common interest groups. One of such efforts is to recognize performance and it is heartening to note that NPCI has constituted the ‘National Payments Excellence Awards’ to identify and reward the member banks for their performance on the network. The awards are in several categories, separate for big players and not so big players. My hearty congratulations to the awardee banks and their staff. I am sure that other banks will redouble their efforts to win over these awards in the coming years. Emerging Payment Revolution 4. According to a research report of Goldman Sachs, one of the three emerging trends in the financial world is the payment revolution. It says that the drivers that are changing the way we pay are the technology, the regulations, the demography and international factors. Innovations in network technology, cryptography and telecom technology, the regulations relating to Consumer protection, Anti-Money Laundering and Anti-Terrorist Funding, directions on transaction fees and interchange fees, the Financial inclusion initiatives, the B2C, C2C, B2B type of payments, the Cryptocurrencies and the tech-savvy-Gen-Next are all bringing forth that revolution. 5. The Payments Landscape in India is also changing and is changing fast; the key elements are the regulatory focus on creating robust payments infrastructure, technology enabling solutions to be available in millions of hand held devices, the number literate populace, the evolving payments marketplace with new players and existing players riding the enhanced culture of innovation in the country to create solutions that are Make In India and Made for India. 6. To reach out to all segments of the society, Interoperability is the key and a critical ingredient to evolving larger payment ecosystems. NPCI today provides the largest interoperable domestic network for multiple services and caters interoperability as the core service to the community. The retail payments in the next 3-5 years are likely to be driven essentially through Mobile payments. This is to ride on over 1 billion mobile connections in the country and the Financial Inclusion drive. 7. In order to participate in the ensuing Payment Revolution and to take advantage thereof, we need to be taking certain strategic actions. These are as follows: a) Expanding the acceptance ecosystem: The proliferation of digital channels is evident mostly in the Tier I & Tier II centres of the country. In order to promote digital channels, it is incumbent on the ecosystem which includes the banks, Network partners and others. To ensure that there is adequate availability of digital channels and enablers such as Debit Cards, Internet Banking registrations, etc. in Tier III to Tier VI centres as well. It is of critical importance that the population in over 6 lakh villages in the country is exposed to the alternate delivery channels. Some estimates indicate that to reach the average levels of BRIC countries, India will need 20 million POS terminals as against the current 1.2 million. This is a tall order. b) Government initiatives: There have been attempts to move the government direct benefit transfers onto electronic channels. I believe that with over 946 million Aadhaar numbers having been issued, Electronic benefit transfer is a clear strategy to promote efficient payment systems. c) Interoperability: Interoperability of the digital channels as I mentioned earlier is a key driver to promote digital channels. The digital channels by definition should be available anywhere & anytime. d) Simplicity and Standardization: End customers need to have simple ways of accessing the digital channels. This can be brought about through seamless processes driven by the ecosystem partners. And for this, standardization of the processes, right from registration to delivery and post delivery services is an imperative. e) Security: No Electronic payment mechanism can undermine the role of security and risk mitigation in promoting digital channels. There has to be continuous and concerted efforts to ensure that the digital channels are safe & secure. The confidence of customers shall be a key to deepening the usage of digital channels. 8. With these steps, and in association with the key stakeholders like the Reserve Bank, the Government, the banks, the payment system participants and the catalysts like NPCI, the Reserve Bank is quite sanguine that India will reap the advantages of the Payment Revolution. 9. I wish NPCI and payments community all the very best to shape the banking of future and future of banking.

|