Extraordinary measures taken by central banks and other regulators to mitigate the impact of the pandemic have anchored financial stability and cushioned the deleterious effects of COVID-19 on economic activity. International standard setting bodies have also responded pro-actively to this evolving landscape. On the domestic front, financial sector regulators have maintained accommodative policies while being alert to the risks to financial stability. The Financial Stability and Development Council (FSDC) and its Sub-Committee remained alert to emerging challenges and coordinated initiatives by various regulators to strengthen financial sector resilience and stability. Introduction 3.1 The COVID-19 pandemic continues to impose tremendous human and economic costs. Public institutions and authorities have maintained unprecedented measures to manage the fallout of the pandemic. Despite positive news on the development of its vaccine offsetting to some extent the gloom overshadowing global economic prospects on account of the second wave, high uncertainty prevails on the outlook for the global economic and financial system and its constituents. 3.2 The rest of this chapter begins by addressing recent regulatory and other measures taken globally in Section III.1. Measures taken by India’s financial sector regulators in their domains are described in Sections III.2 to III.4. The final section concludes with some perspectives on the outlook. III.1 Global Developments 3.3 Strong policy interventions by central banks to reduce interest rates, provide ample liquidity and ensure credit to the commercial sector have so far contained financial market volatility and reduced the likelihood of adverse macro-financial feedback loops in response to the pandemic. In aggregate, the U.S. Federal Reserve, Bank of England (BoE) , Bank of Japan (BoJ) and the European Central Bank (ECB) have grown their balance sheets by US$ 5.6 trillion this year alone (till end-November) through quantitative easing. They have been emboldened by inflation indicators continuing to be subdued, although there are some concerns that the overhang of liquidity has the potential for overpricing of financial assets. The ECB has recently decided to enhance the pandemic emergency purchase programme (PEPP) by 500 billion to a total of 1,850 billion, extend the horizon for net purchases under the PEPP to at least the end of March 2022 and to extend the reinvestment of principal payments from maturing securities purchased under the PEPP until at least the end of 2023. 3.4 The liquidity phase of the crisis is now giving way to the solvency phase as the impact of economic disruptions on the banking sector unfolds, especially in those sectors where the pandemic’s impact has been the most destructive. This is visible from banks stepping up precautionary provisioning for loan losses even as surveys indicate tightening of lending standards in various parts of the world. In this context, the steps taken by major standard setting authorities in respect of regulatory treatment of direct relevance to banks’ balance sheets, viz., Capital, Liquidity and Expected Credit Loss (ECL) provisioning, are outlined below. III.1.1 Capital 3.5 The Basel Committee on Banking Supervision (BCBS) announced that banks could use their capital buffers during the crisis to absorb financial shocks and to support the real economy by lending to creditworthy households and businesses. It also encouraged supervisors to allow banks sufficient time to restore buffers, taking account of economic and market conditions as well as bank-specific circumstances. The Financial Stability Board (FSB) has supported the BCBSs’ policy stance and approach. III.1.2 Liquidity 3.6 The BCBS signaled that it was acceptable for banks to draw down their buffers of High-quality Liquid Asset (HQLA) securities to meet unforeseen liquidity demands, adding that supervisors may provide sufficient lead time before the buffers are restored. Some of the major regimes have introduced sunset clauses towards utilisation of such buffers. Illustratively, the ECB committed to allow banks to operate below the Liquidity Coverage Ratio (LCR) until at least end-2021 without automatically triggering supervisory actions. The US Federal Reserve (Fed) announced temporary measures extended upto March 31, 2021 to help increase the availability of intraday credit by suspending uncollateralised intra-day credit limits and permitting a streamlined procedure for secondary credit institutions to request collateralised intraday credit. III.1.3 Expected Credit Loss (ECL) provisioning 3.7 The International Accounting Standards Board (IASB) issued a clarificatory statement1 on application of International Financial Reporting Standards - 9 (IFRS-9) for accounting of expected credit losses in order to manage the economic uncertainty resulting from the pandemic. While IFRS-9 requires that lifetime ECLs be recognised when there is a significant increase in credit risk (SICR) on a financial instrument, the IASB cited the example of not automatically treating the extension of payment holidays to all borrowers in particular classes of financial instruments as cases involving SICR, emphasising that entities should not apply their existing ECL methodology mechanically. The IASB also opined that in the current stressed environment, IFRS-9 and the associated disclosures can provide much needed transparency to users of financial statements. III.1.4 Operational Risk in Banks 3.8 The pandemic has purveyed heightened uncertainty and amplified operational risks in banks affecting personnel, processes, information systems and business continuity. Recognising the need for heightened operational resilience, the BCBS published a consultative document2 on proposed principles for operational resilience and revision to its ‘Principles for the Sound Management of Operational Risk’ (PSMOR) which focuses on aspects such as business continuity planning, cyber security, and third-party risk management. 3.9 The Financial Action Task Force (FATF) issued a paper3 discussing money laundering (ML) and/or terrorist financing (TF) risks arising from COVID-19. It posits that increased use of online services may result in on-boarding customers without sufficient customer due diligence (CDD) screening, thereby facilitating undetected movement of virtual assets and concealing of illicit funds. Such risks are incipiently magnified as financial institutions remain preoccupied with maintaining business continuity, allowing lags in identification and reporting suspicious transactions. To manage these potential vulnerabilities, the paper recommends that AML/ combating the financing of terrorism (CFT) policy responses should include (i) a domestic assessment of the impact of COVID-19 on AML/CFT risks and systems; (ii) strengthening communication with the private sector; (iii) encouraging the full use of a risk-based approach to due diligence; (iv) encouraging use of responsible digital identities while conducting transactions; and (v) pragmatic, risk-based AML/CFT supervision. III.1.5 COVID-19 and the Insurance Sector 3.10 The International Association of Insurance Supervisors (IAIS) published a statement highlighting the impact of COVID-19 on the global insurance sector, emphasising the importance of effective policyholder protection and fair customer treatment during the crisis. It also cautioned against insurers being required to cover COVID-19 related losses retrospectively, drawing attention to the adverse impact this could have on solvency, capability to meet other types of claims, and on financial stability at large. The statement also noted that the crisis has served to highlight the limits on the protection that the insurance sector by itself can be expected to provide. III.1.6 Other International Regulatory Developments in the Banking Sector 3.11 In July 2020, BCBS published the final revised standard4 for Credit Valuation Adjustment (CVA) risk viz., the risk faced by banks of incurring mark-to-market losses because of the deterioration in the creditworthiness of their counterparties in derivatives or securities financing transactions. The revision will result in reduced risk weights for CVA in both Standardised Approaches (SA) and Basic Approaches to CVA in respect of certain classes of counterparties. The revised market risk framework also introduced new ‘index buckets’ under which banks could, under certain conditions, calculate capital requirements by using credit and equity indices directly instead of looking through to the underlying constituents. The Committee has also agreed to adjust the scope of portfolios subject to CVA risk capital requirements by excluding some securities financing transactions (SFTs). The targeted revision has also revised overall calibration of the CVA risk framework, leading to a reduced value of the aggregate multiplier for banks using the SA-CVA approach. 3.12 The FSB and the BCBS published a report5 on the findings of surveys on LIBOR transition undertaken by them. The report highlights the need for sustained efforts by both financial and non-financial institutions across jurisdictions to prepare for and facilitate the transition, noting that financial institutions in LIBOR jurisdictions have shown better progress in transitioning than those in non-LIBOR jurisdictions. The report recommends a three-pronged effort by authorities to support the transition involving (i) engaging with trade associations and periodically taking stock of LIBOR exposure of financial institutions; (ii) establishing a formal transition strategy and enhancing supervisory action in case of banks exhibiting tardiness in preparation; and (iii) promoting industry-wide coordination and exchange of information on best practices and challenges. III.1.7 Holistic Review of the Market Turmoil in March 2020 3.13 The FSB published its review6 of the unprecedented financial market turmoil in March 2020, which highlighted the fundamental repricing of risk and the heightened demand for safe assets as well as large and persistent imbalances in the demand for and supply of liquidity needed to support intermediation. The review identified three main areas of focus going forward: (i) work to examine and address specific risk factors and markets that contributed to amplification shock; (ii) enhancing understanding of systemic risks in the non-banking financial intermediation (NBFI) space and the financial system as a whole, including interactions between banks and non-banks and cross-border spill-overs; and (iii) assessing policies to address systemic risks in the NBFI space. III.1.8 Global Monitoring Report on Non-bank Financial Intermediation 3.14 The Financial Stability Board (FSB), in its recent report7 on non-bank financial intermediation (NBFI), noted that the NBFI sector comprising mainly pension funds, insurance corporations and other financial intermediaries (OFIs)8 grew at a faster pace than the banking sector and accounted for 49.5 per cent of the global financial system in 2019. The expansion of collective investment vehicles (CIVs), which are inherently susceptible to runs, drove much of the growth. In EMEs, both the pace of growth of the NBFI sector itself and credit expansion by non-bank entities dependent on short-term funding, were faster as compared to AEs. III.1.9 Climate Change Risk 3.15 The FSB in its recent report9 on climate-related risk has noted that the value of financial assets/ liabilities could be affected either by continuation in climate change (physical risks), or by an adjustment towards a low-carbon economy (transition risks). The manifestation of physical risks could lead to a sharp fall in asset prices and increase in uncertainty. A disorderly transition to a low carbon economy could also have a destabilising effect on the financial system. Climate-related risks may also give rise to abrupt increases in risk premia across a wide range of assets amplifying credit, liquidity and counterparty risks. Such changes could lead to a self-reinforcing reduction in bank lending and insurance provision. The report also observes that the efficacy of actions taken by financial firms to mitigate climate-related risks may be hampered by lack of data with which to assess clients’ exposures to climate-related risks or the magnitude of climate-related effects. III.1.10 Risks from Outsourcing and Third-party Relationships 3.16 The FSB published a discussion paper10 identifying the regulatory and supervisory issues relating to outsourcing and third-party relationships. One of the key concerns highlighted is the possibility of systemic risk arising from concentration in the provision of some outsourced and third-party services to financial institutions (FIs) wherein an outage or failure at a single third party could create a single point of failure with potential adverse consequences for financial stability. III.1.11 Development of Capital Markets in Emerging Markets 3.17 The International Organization of Securities Commissions (IOSCO) published its final report11 examining the challenges and opportunities that emerging market (EMs) jurisdictions face in developing their capital markets. Some challenges identified by the IOSCO include weak institutional and legal frameworks, low levels of economic development, and high levels of financial and social risk. In addition, abusive related-party transactions, disclosure failures, corruption scandals, and undue political interference act as disincentives for investors. While recognising that there is no one-size-fits-all approach to capital markets development, the report sets out the following five key recommendations: (i) preparing a holistic strategy for development of capital markets; (ii) ensuring that capital markets are fair and efficient for capital raising by increasing institutional investor participation, providing diversified investment options, and ensuring market confidence; (iii) ensuring adequate resources, power and capacity to securities regulators; (iv) establishing strong national and international cooperation; and (v) developing and implementing an efficient workplan for investor education and guidance. III.2 Domestic Developments 3.18 The Financial Stability and Development Council (FSDC) and its Sub Committee (FSDC-SC) continued to monitor evolving conditions in the financial system through formal and informal interactions. In its 23rd meeting on December 15, 2020 chaired by the Finance Minister, the Council reviewed major global and domestic macroeconomic developments and financial stability issues with special reference to vulnerability related issues and noted that the policy measures taken by the Government of India and the financial sector regulatory authorities have ensured a faster economic recovery in India relative to initial expectations, as reflected in the reduced contraction of GDP in Q2 of 2020-21. The economy has gained momentum and the path to recovery will be faster than what was predicted earlier. Discussions were held on further measures which may be required to be taken to ensure consistent support to the financial sector, while continuing to maintain financial stability. Challenges involved in smooth transition of London Interbank Offered Rate (LIBOR) based contracts to alternative benchmarks were discussed. It noted that a multipronged strategy involving relevant stakeholder institutions and departments is required in this regard. 3.19 At its 25th meeting held on August 31, 2020, the FSDC-SC reviewed global and domestic developments and the state of financial markets that impinge on financial stability. It discussed issues relating to inter-regulatory coordination and the working of its inter-regulatory technical groups. It also reviewed the initiatives and activities of National Centre for Financial Education (NCFE) and the functioning of State Level Coordination Committees (SLCCs) in various states/UTs. Regulators reaffirmed their commitment to continue coordinating on various initiatives and measures to strengthen the financial sector in these extraordinarily challenging times. III.3 Initiatives from Regulators/Authorities 3.20 The Reserve Bank and other financial sector regulators have kept up their multidimensional efforts to maintain financial stability and to mitigate the impact of COVID-19. These measures are essentially directed at continuing and complementing the earlier liquidity and regulatory support to ease constraints posed by the pandemic for maintaining market integrity and resilience. III.3.1 Credit Related Measures 3.21 The Reserve Bank announced a resolution framework to mitigate the impact of the pandemic-induced stress on borrowers and to facilitate revival of real sector activity in August 2020. It provides a window under the prudential framework to enable lenders to implement a resolution plan in respect of eligible corporate exposures without change in ownership, while classifying them as ‘standard’ but subject to specified conditions and also includes personal loans. Subsequently, broadly accepting the recommendations of the Expert Committee (Chairman: Shri K V Kamath) the Reserve Bank notified the financial parameters and the sector-specific thresholds to be considered while finalising resolution plans for exposures other than personal loans under the resolution framework. 3.22 Continuing its support to the micro, small and medium enterprises (MSME) sector, the Reserve Bank extended the existing restructuring framework for MSMEs upto March 31, 2021 covering borrowers whose aggregate exposure, including non-fund exposures, does not exceed ₹25 crore and which are classified as ‘standard’ as on March 1,2020, without a downgrade in the asset classification, subject to certain conditions. 3.23 The Government of India as part of its ‘Atma Nirbhar Bharat Abhiyan’ (self-reliance) package extended the Emergency Credit Line Guarantee Scheme (ECLGS 1.0) upto March 31, 2021 and raised the loan size eligibility ceiling. The Government also launched a second version of the Scheme (ECLGS 2.0) offering credit guarantee for loans by banks and NBFCs to identified stressed sectors. The Reserve Bank permitted lending institutions to assign zero risk weight to the credit facilities extended under the scheme to the extent of guarantee coverage. III.3.2 Support for the NBFC sector 3.24 NBFCs were adversely impacted by COVID-related stress due to their underlying business models. On the supply side, the sources of funds dried up, more so for the small and mid-sized NBFCs, on account of reduced risk appetite of banks for low rated and unrated exposures. The situation was worsened by the unprecedented redemption pressure overshadowing the mutual fund industry, resulting in a spike in spreads. On the demand side, it became difficult for NBFCs to find creditworthy projects and borrowers to lend to as a result of the pandemic induced stress. 3.25 A key measure taken by the Reserve Bank and Government of India during H1:2020-21 to ameliorate the liquidity constraints faced by NBFCs, was to set up a Special Purpose Vehicle (SPV) to purchase short-term papers from eligible NBFCs/HFCs, which could then utilise the proceeds to extinguish their existing liabilities. The special securities issued by the SPV were guaranteed by the Government of India and would be purchased by the Reserve Bank. Additionally, the scope of the Government scheme on partial credit guarantee (PCG) was expanded to cover the borrowings of lower-rated NBFCs, HFCs and MFIs. III.3.3 Insurance Sector 3.26 In view of the multifarious risks arising in the wake of the COVID-19 pandemic, the Insurance Regulatory and Development Authority of India (IRDAI) constituted a Working Group to explore the possibility of addressing these risks through the mechanism of a “Pandemic Risk Pool”. The Group has proposed a Government backstop of about ₹75,000 crore in the initial stages, investment of pool premium collected in Government securities or specifically designed Government bonds and mandatory participation for the sectors which are covered. III.3.4 Customer Protection 3.27 In the context of the pandemic, the use of digital modes for conducting transactions gathered substantial traction. Pari passu, the risks of new users falling prey to various forms of online frauds also increased. In this regard, the Reserve Bank intensified its multi-lingual awareness campaigns on safe digital banking, instructions on limited liability of customers in fraudulent electronic transactions and the Ombudsman scheme, over different media platforms. The Reserve Bank also issued instructions12 requiring authorised payment system operators and participants (banks as well as non-banks) to undertake targeted multi-lingual campaigns to educate their users on safe and secure use of digital payments. III.3.5 Resolution and Recovery 3.28 Recent developments have necessitated calibration of the insolvency framework to prevent otherwise viable enterprises from being forced into insolvency proceedings on account of the financial stress induced by the pandemic. Towards this end, the Government of India, by notification, has raised the threshold amount of default required to initiate an insolvency proceeding from ₹1 lakh to ₹1 crore and has also inserted Section 10A in the IBC for suspension of initiation of the corporate insolvency resolution process (CIRP) of a corporate debtor for any default arising on or after March 25, 2020 for a period of six months, which was further extended by six months in two tranches of three months each i.e., up to March 24, 2021. III.4 Other Regulatory Developments 3.29 In addition to taking targeted measures to address COVID-related dislocations, financial sector regulators kept up their efforts to strengthen the resilience of regulated entities, support robustness of market infrastructure and promote the ease of operations for market participants (Annex 3). Some of these initiatives are highlighted below. III.4.1 Bilateral Netting of Contracts 3.30 In a major step towards promoting financial sector stability and development, the Bilateral Netting of Qualified Financial Contracts Act, 2020 came into effect from October 01, 2020. It recognises bilateral netting for all qualified financial contracts entered into between qualified financial market participants, and also ensures the enforceability of collateral associated with the contract. In its absence, when one of the counterparties to a set of financial contracts went into bankruptcy, there was uncertainty on enforceability of collateral and the other counterparty would have to continue to make the payment as per the financial contracts, though there would be uncertainty on receiving the payment from the counterparty who has gone into bankruptcy. The new legislation carries substantial benefits for the financial sector in terms of conserving capital for banks, encouraging market participants to use derivatives including credit default swaps (CDS) for risk hedging and risk mitigation. It will also help in deepening of the bond market by facilitating corporate bonds issuance by low rated issuers. It will also enable market participants to exchange margins for non-centrally cleared OTC derivatives (NCCDs) on a net basis. Payment and Settlement Systems III.4.2 Launch of RTGS 24x7 3.31 The Reserve Bank’s Payment Systems Vision 2021 aspires to ensure efficient and uninterrupted availability of safe, secure, accessible and affordable payment systems. In pursuance of this vision, and to expand flexibility for businesses for effecting payments, the Reserve Bank made the Real Time Gross Settlement (RTGS) system available round the clock on all days of the year from December 14, 2020. India has become one of the few countries in the world to achieve this milestone. The RTGS 24x7x365 was implemented on the back of operationalising round the clock National Electronic Fund Transfer (NEFT) system a year ago. The RTGS presently handles around 6 lakh transactions daily for a value of around ₹4 lakh crore across 237 participant banks with the average ticket size of ₹57.96 lakh (November 2020). III.4.3 Remittances through Indian Payment Systems 3.32 The payment and settlement systems vision of the Reserve Bank envisages the scope for enhancing the global outreach of India’s payment systems, including remittance services, through active participation and co-operation in international and regional fora by collaborating and contributing to standard-setting. In order to bestow undivided attention towards this goal, the National Payments Corporation of India (NPCI) was encouraged to incorporate a wholly owned subsidiary for international business, viz., NPCI International Payments Limited. Work is being undertaken to strengthen the international presence of RuPay cards and build inter-regional partnerships to enhance foreign inward remittances to India using the Unified Payments Interface (UPI). III.4.4 Digital Transactions – Streamlining Quick Response (QR) Code Infrastructure 3.33 Based on a review of the existing system of Quick Response (QR) Codes in India, measures were taken to reinforce the acceptance infrastructure and provide better user convenience through interoperability and enhanced system efficiency. The measures include (i) continuation of the existing interoperable QR codes viz., UPI QR and Bharat QR; (ii) migration by payment system operators using proprietary QR codes to one or more interoperable QR codes by March 2022; and (iii) continuation of the consultative process by the Reserve Bank to standardise and improve interoperable QR codes to enable beneficial features. III.4.5 Oversight Framework for Financial Market Infrastructures (FMIs) and Retail Payment Systems (RPS) 3.34 With the changing payments and settlements ecosystem, the oversight framework for financial market infrastructures (FMIs) and retail payment systems (RPSs) has been modified by the Reserve Bank to incorporate the supervisory framework for payment system operators as well as supervisory considerations that have arisen in the intervening period. The framework details the oversight objectives and supervisory processes as well as the assessment methodology of FMIs and system-wide important payment systems under the IOSCO’s Principles for financial market infrastructures (PFMIs). The Reserve Bank has laid down the point of arrival (PoA) and performance metrics (PM) to assess and monitor payment systems and participants. III.4.6 LIBOR Transition in the Indian Context 3.35 The Reserve Bank has been monitoring international and domestic developments and sensitising banks about the need to be prepared for LIBOR cessation. The Indian Banks Association (IBA) has been tasked with working out the step-by-step transition plan. 3.36 In the domestic market, LIBOR linked exposures are spread across loan contracts (e.g., external commercial borrowings [ECBs]), floating rate deposits, derivatives linked to LIBOR or to MIFOR (i.e., Mumbai Interbank Forward Offer Rate, which is a domestic benchmark based on LIBOR) and sovereign loans raised from multilateral institutions which are referenced to LIBOR (Table 3.1). Also, there are trade contracts referenced to LIBOR, but these are short term in nature. | Table 3.1 : LIBOR Linked Exposures of Various Financial Contracts in India | | Financial Contract | Exposure | | External Commercial Borrowing (ECB)* | $74 billion | | FCNR (B) Deposit* | $24 billion | | Cross Currency Swap$ | $83 billion | | FCY Interest Rate Swap$ | $260 billion | | MIFOR Interest Rate Swap$ | $91 billion | Note : *As on March 31, 2020; $ As on August 31,2020.

Source : Bloomberg and RBI staff calculations. | 3.37 The key steps to be taken to ensure a smooth transition in the Indian context include: (i) development of alternate methodologies to replace MIFOR; (ii) development of fallback clauses that are customised to the Indian market but based on practices adopted globally; (iii) promoting stakeholder awareness to deal with issues around the contract renegotiation; and (iv) notifying a cut-off date closer to the LIBOR cessation date beyond which institutions should cease to enter into new contracts that make reference to LIBOR. This is also dependent on the evolution of the global adoption of financial contracts that reference alternative reference rates (ARRs). III.4.7 Cyber Security 3.38 The Indian Computer Emergency Response Team (CERT-In) has undertaken several measures to strengthen cyber resilience of financial entities in the country. These include: (i) cyber security exercises/ drills; (ii) operating Cyber Swachhta Kendra (Botnet Cleaning and Malware Analysis Centre); (iii) disseminating cyber threat intelligence in real time; (iv) sharing tailored advisories with the CISO community in the financial sector; (v) releasing the report of the Secure Digital Payments working group for Asia Pacific CERT members to address security threats and evolve best practices to secure digital payments; (vi) developing a toolkit (as a member of the Financial Stability Board) on Cyber Incident Response and Recovery for enhancing cyber resilience; and (vii) establishment of Financial Sector Computer Security Incident Response Team (CSIRT-Fin) under the umbrella of CERT-In since mid-May 2020. 3.39 The Reserve Bank has been placing emphasis on digital banking, which has a massive customer base now. There is a need for all financial entities to invest adequately in secure, robust, scalable and fault-tolerant IT infrastructure so that they remain competitive, expansion plan is well supported and public confidence is maintained. Inability to manage the operational risk/s, particularly, controlling the incidence of frauds, both cyber-related and otherwise, is another visible area of concern in the arena of fraud risk management. The Reserve Bank takes appropriate supervisory action on case-to-case basis depending on concerns / deficiencies. 3.40 With an aim to strengthen the cyber resilience of the primary (urban) co-operative banks (UCBs) against the evolving IT and cyber threat environment, the Reserve Bank released the ‘Technology Vision for Cyber Security: 2020-2023’ for UCBs, based on inputs from various stakeholders. It envisages a five-pillared strategic approach covering (i) governance oversight; (ii) Utile technology investment; (iii) appropriate regulation and supervision; (iv) robust collaboration; and (v) developing necessary IT and cyber security skills sets. It aspires to (a) involve more oversight by banks’ Board over cyber security; (b) enable UCBs to better secure their IT assets; (c) implement an offsite supervisory mechanism framework for UCBs on cyber security related controls; (d) develop a forum where UCBs can share best practices and discuss practical issues and challenges; and (e) implement a framework for providing awareness/ training for effective management of the associated risks by UCBs. III.4.8 Risk Mitigation Measures 3.41 In the context of the use of multiple operating accounts by large borrowers, the Reserve Bank issued revised instructions aimed at improving credit discipline on opening current accounts for customers who have availed cash credit (CC) / overdraft (OD) facilities from the banking system. The formats of the Long Form Audit Report to be used by Statutory Auditors were reviewed and revised. All authorised payment systems operators and participants were advised to undertake targeted multi-lingual campaigns by way of short message services (SMSs) and advertisements in print and visual media, to educate their users on safe and secure use of digital payments. In addition, instructions on reporting of frauds to law enforcement agencies, early warning signal (EWS) mechanisms, red-flagged accounts and commissioning of forensic audit are being reviewed. The Institute of Chartered Accountants of India (ICAI) is in the process of developing forensic accounting and investigation standards (FAIS) aimed at standardising the work undertaken by its members in this area. III.4.9 Deposit Insurance 3.42 With the limit of deposit insurance in India raised to ₹5 lakh, insured deposits stood at ₹68,71,500 crore in March 2020 constituting 50.9 per cent of total assessable deposits at ₹1,34,88,900 crore. Fully protected accounts constituted 98.3 per cent of the total number of accounts. Of the total premium of ₹13,234 crore collected from member banks during 2019-20, commercial banks contributed 93 per cent and co-operative banks accounted for the remaining seven per cent. The premium received during H1: 2020-21 was ₹8,540 crore. The Deposit Insurance and Credit Guarantee Corporation (DICGC) sanctioned aggregate claims of ₹80.7 crore in respect of 10 co-operative banks during 2019-20. | Table 3.2 : Insured Deposits of Cooperative Banks | | (₹ crore) | | Quarter ended | STCBs/ DCCBs Under Direction | UCBs Under Direction | Weak UCBs except (3) | Total (2+3+4) | | (1) | (2) | (3) | (4) | (5) | | June 2020 | 4,945 | 11,697 | 5,151 | 21,793 | | September 2020 | 4,945 | 11,688 | 5,151 | 21,784 | | Source: DICGC. | 3.43 In case of observations of serious irregularities observed during inspections, the Reserve Bank issues directions to co-operative banks to protect the interests of depositors and in public interest. As at end-September 2020, insured deposits of banks under direction and weak banks constituted about 0.3 per cent of the total insured deposits of commercial and co-operative banks, and 18.2 per cent of the deposit insurance fund (Table 3.2). III.4.10 Corporate Insolvency Resolution Process (CIRP) 3.44 As at the end of Q2:2020, the number of CIRPs admitted since the inception of the Insolvency and Bankruptcy Code (IBC) stood at 4008, with the manufacturing sector accounting for the largest share (Table 3.3 and 3.4).There was a sharp decline in the number of CIRPs during Q1 and Q2:2020 as compared to previous quarters, owing to temporary suspension of the process, in the wake of the pandemic situation. | Table 3.3 : Corporate Insolvency Resolution Process | | (Number) | | Quarter | CIRPs at the beginning of the Period | Admitted | Closure by | CIRPs at the end of the Period | | Appeal/ Review/ Settled | Withdrawal under Section 12A | Approval of Resolution Plan | Commencement of Liquidation | | 2016-17 | 0 | 37 | 1 | 0 | 0 | 0 | 36 | | 2017-18 | 36 | 705 | 90 | 0 | 20 | 90 | 541 | | 2018-19 | 541 | 1152 | 141 | 95 | 80 | 306 | 1071 | | Q1:2019-20 | 1071 | 301 | 45 | 31 | 26 | 96 | 1174 | | Q2:2019-20 | 1174 | 588 | 46 | 43 | 33 | 155 | 1485 | | Q3:2019-20 | 1485 | 623 | 71 | 43 | 40 | 150 | 1804 | | Q4:2019-20 | 1804 | 441 | 62 | 46 | 36 | 135 | 1966 | | Q1:2020-21 | 1966 | 81 | 7 | 21 | 20 | 25 | 1974 | | Q2:2020-21 | 1974 | 80 | 10 | 12 | 22 | 68 | 1942 | | Total | NA | 4008 | 473 | 291 | 277 | 1025 | 1942 | These CIRPs are in respect of 3936 corporate debtors.

This excludes one corporate debtor, which has moved directly from BIFR to resolution.

Source: Compilation from website of the NCLT and filing by Insolvency Professionals. |

| Table 3.4 : Sectoral Distribution of CIRPs as on September 30, 2020 | | Sector | No. of CIRPs | | Admitted | Closure by | Ongoing | | Appeal/ Review/ Settled | Withdrawal under Section 12 A | Approval of Resolution Plan | Commencement of Liquidation | Total | | Manufacturing | 1639 | 163 | 118 | 140 | 449 | 870 | 769 | | Food, Beverages & Tobacco Products | 208 | 17 | 10 | 15 | 58 | 100 | 108 | | Chemicals & Chemical Products | 164 | 16 | 15 | 19 | 38 | 88 | 76 | | Electrical Machinery & Apparatus | 118 | 14 | 4 | 5 | 45 | 68 | 50 | | Fabricated Metal Products | 92 | 8 | 11 | 4 | 28 | 51 | 41 | | Machinery & Equipment | 183 | 25 | 20 | 10 | 45 | 100 | 83 | | Textiles, Leather & Apparel Products | 279 | 27 | 18 | 19 | 98 | 162 | 117 | | Wood, Rubber, Plastic & Paper Products | 195 | 17 | 18 | 20 | 38 | 93 | 102 | | Basic Metals | 286 | 26 | 11 | 35 | 73 | 145 | 141 | | Others | 114 | 13 | 11 | 13 | 26 | 63 | 51 | | Real Estate, Renting & Business Activities | 793 | 123 | 75 | 34 | 166 | 398 | 395 | | Real Estate Activities | 188 | 36 | 16 | 5 | 18 | 75 | 113 | | Computer and related activities | 115 | 15 | 12 | 1 | 29 | 57 | 58 | | Research and Development | 5 | 1 | 1 | 1 | 0 | 3 | 2 | | Other Business Activities | 485 | 71 | 46 | 27 | 119 | 263 | 222 | | Construction | 428 | 70 | 36 | 26 | 76 | 208 | 220 | | Wholesale & Retail Trade | 398 | 39 | 22 | 16 | 127 | 204 | 194 | | Hotels & Restaurants | 93 | 15 | 9 | 10 | 20 | 54 | 39 | | Electricity & Others | 124 | 11 | 3 | 10 | 22 | 46 | 78 | | Transport, Storage &Communications | 119 | 15 | 7 | 9 | 40 | 71 | 48 | | Others | 414 | 37 | 21 | 32 | 125 | 215 | 199 | | Total | 4008 | 473 | 291 | 277 | 1025 | 2066 | 1942 | Note: The distribution is based on the CIN of corporate debtors and as per National Industrial Classification (NIC 2004).

Source: Insolvency and Bankruptcy Board of India (IBBI). | 3.45 Of the CIRPs initiated, 277 ended in resolutions up to end-September 2020. Realisation by creditors under resolution plans in comparison to liquidation value stood at 185.2 per cent, while the realisation was 43.6 per cent in comparison to their claims (Table 3.5). Significantly, out of the above 277 resolutions, 91 corporate debtors were under Board for Industrial and Financial Reconstruction (BIFR) processes or defunct. The CIRPs which yielded resolution plans by the end of September 2020 took an average of 384 days (after excluding the time excluded by the Adjudicating Authority) for conclusion of the process. | Table 3.5 : Outcome of CIRPs initiated Stakeholder-wise, as on September 30, 2020 | | Outcome | Description | Financial Creditor | Operational Creditor | Corporate Debtor | Total | | Status of CIRPs | Closure by Appeal/Review/Settled | 124 | 343 | 6 | 473 | | Closure by Withdrawal u/s 12A | 88 | 198 | 5 | 291 | | Closure by Approval of Resolution Plan | 157 | 80 | 40 | 277 | | Closure by Commencement of Liquidation | 444 | 438 | 143 | 1025 | | Ongoing | 917 | 958 | 67 | 1942 | | Total | 1730 | 2017 | 261 | 4008 | | CIRPs yielding Resolution Plans | Realisation by FCs (% of Liquidation Value) | 192.09 | 112.40 | 142.77 | 185.15 | | Realisation by FCs as % of their Claims | 46.84 | 21.80 | 25.30 | 43.56 | | Average time taken for Closure of CIRP | 444 | 406 | 443 | 433 | | CIRPs yielding Liquidations | Liquidation Value as % of Claims | 6.35 | 9.19 | 9.89 | 7.20 | | Average time taken for Closure of CIRP | 336 | 304 | 306 | 318 | | Source: IBBI. | 3.46 Out of the CIRPs closed, nearly half yielded orders for liquidation. In 73.5 per cent of these cases (751 out of 1022 for which data is available), the corporate debtors were earlier with BIFR and / or defunct (Table 3.6) and the economic value in most cases had already eroded before they were admitted into CIRP. These corporate debtors had assets, on average, valued at less than five per cent of the outstanding debt amount. III.4.11 Mutual Funds 3.47 During the first half of 2020-21, net inflow of ₹1.5 lakh crore into mutual fund schemes was much higher than that of ₹0.6 lakh crore during the same period in the previous year. Income/debt-oriented schemes attracted the major share of the inflows (₹1.2 lakh crore) whereas growth/equity-oriented schemes accounted for a relatively meagre amount (₹2,496 crore). All other schemes together recorded inflows of ₹0.3 lakh crore. | Table 3.6 : CIRPs Ending with Orders for Liquidation till September 30, 2020 | | State of Corporate Debt-or at the Commencement of CIRP | No. of CIRPs initiated by | | Financial creditor | Operational Creditor | Corporate Debtor | Total | | Either in BIFR or Non-functional or both | 304 | 337 | 110 | 751 | | Resolution Value > Liquidation Value | 67 | 35 | 26 | 128 | | Resolution Value < Liquidation Value* | 374 | 404 | 116 | 894 | *: Includes cases where no resolution plans were received and cases where liquidation value is zero or not estimated.

Note: 1. There were 57 CIRPs, where corporate debtors were in BIFR or non-functional but had resolution value higher than liquidation value.

2. Data of 3 CIRPs is awaited.

Source: IBBI. | 3.48 The mutual fund industry’s assets under management (AUM) increased by 10.9 per cent (y-o-y) at the end of November 2020 (Chart 3.1). 3.49 Systematic investment plans (SIPs) continued to remain a favoured choice for investors. During April–September 2020, the number of folios of SIPs increased by 22 lakh (Table 3.7).

| Table 3.7: SIPs in 2020-21 (April 01, 2020 to September 30, 2020) | | Existing at the beginning of the period (excluding STP) | Registered during the period | Matured during the period | Terminated prematurely during the period | Closing no. of SIPs at end of period | SIP AUM at the beginning of the period | SIP AUM at the end of the period | | (Number in lakhs) | (in ₹ crore) | | 315 | 72 | 15 | 35 | 337 | 2,38,821 | 3,75,968 | | Source: SEBI. | III.4.12 Capital Mobilisation - Equity and Corporate Bonds 3.50 Despite the pandemic, fund mobilisation from the primary market during the first half of 2020-21 was 14.1 per cent higher than in the corresponding period in 2019-20. This was owing to an increase of 24.9 per cent in funds raised through debt placements (through public issue and private placement). Fund mobilisation through equity declined by 6.6 per cent during the period (Chart 3.2). 3.51 During the first half of 2020-21, funds raised through QIPs went up by 152 per cent over the same period in the previous year, while those raised through preferential allotment fell by 78.3 per cent. Funds mobilised through public issues almost doubled during this period. In case of debt, private placement of debt increased by 27.7 per cent during H1 of 2020-21 compared to the same period in the previous year (Chart 3.3). III.4.13 Credit Ratings 3.52 On an aggregate basis, there was an increase in the share of downgraded/ suspended companies in total outstanding ratings during the quarter ending June 2020, as compared with the prior two quarters.

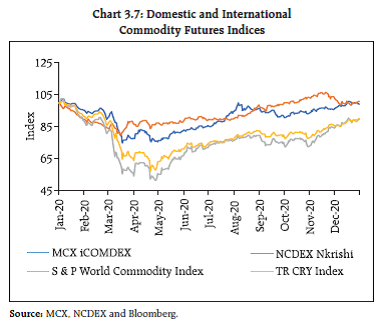

This share went down significantly, however, during the quarter ending September 2020 (Chart 3.4). 3.53 The rating downgrades during H1:2020-21 spanned various sectors; however, the proportion of downgrades relating to the NBFC and HFC sector as well as banks and financial services went down significantly during the September 2020 quarter as compared to the preceding quarter (Chart 3.5). III.4.14 Commodity Derivatives Market 3.54 The impact of the COVID-19 pandemic on global commodity prices has been mixed, with the energy sector bearing the brunt and metals and agriculture prices falling less steeply in comparison (Chart 3.6). Precious metal prices continued to rise during the pandemic on safe haven demand. Of late, commodity prices have reverted from their lows in March/April 2020, boosted by a rebound in economic activity. The metal price surge has been led by the industrial upturn and surge in consumption by China. Domestic Commodity Derivatives Market 3.55 Favourable monsoons enabled a robust kharif crop and raised expectations of softening food prices as the lockdown related supply disruptions eased. Reflecting this, the benchmark commodity derivative indices, MCX iCOMDEX composite and Nkrishi index gained 27.2 per cent and 15.3 per cent, respectively, during the financial year so far (up to December 31, 2020) (Chart 3.7).

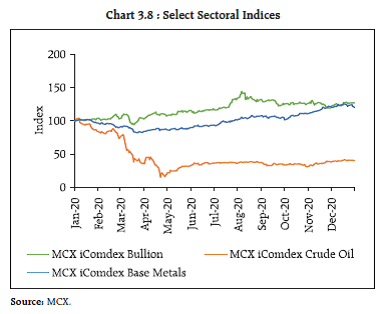

3.56 The recovery in the indices was more pronounced post July 2020 and the iCOMDEX Bullion index climbed by 23.7 per cent during the current financial year, as the safe haven demand for precious metals, especially gold, led to a historic rally in prices. The iComdex Crude oil index recovered from its record low in April 2020 rising by 10.1 per cent. The iComdex base metal index showed the most robust movement, with an increase of 42.9 per cent during 2020-21 so far (up to December 31, 2020) (Chart 3.8). Trading Activity in the Commodity Derivatives Market 3.57 Despite an across-the-board decline of turnover in all segments except bullion, which increased by 93 per cent, the aggregate turnover in the commodity derivatives market, showed a marginal uptick of 3.2 per cent during 2020-21 (up to November 2020) as compared with the corresponding period last year (Chart 3.9 and Table 3.8). While the turnover of futures contracts declined by 2.8 per cent, that of the options segment increased by 227.6 per cent, driven by introduction of commodity options at BSE and NSE since June 2020. In contrast to the uptrend witnessed in turnover, the total traded contracts at NCDEX and MCX declined (y-o-y) by 31.2 per cent and 34.5 per cent, respectively, during the current year so far (up to November 2020). Traded volumes (in tonnes) in the metal and energy segments at MCX and the agri segment at NCDEX fell by almost 50 per cent.

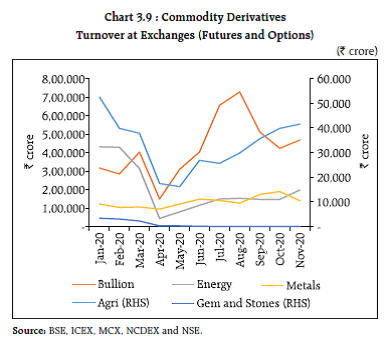

| Table 3.8: Segment-wise Turnover in Commodity Derivatives (Futures and Options) | | (₹ crore) | | Period/Turnover | Agri | Bullion | Energy | Metals | Gems and Stones | Total Turnover | | 2020-21 (April-November) | 2,33,199 | 36,51,498 | 10,32,070 | 11,34,603 | 554 | 60,51,924 | | 2019-20 (April-November) | 4,05,549 | 18,85,570 | 24,23,082 | 11,33,187 | 16,728 | 58,64,116 | | y-o-y change (per cent) | -42.5 | 93.7 | -57.4 | 0.1 | -96.7 | 3.2 | | Share in Total Turnover (per cent; Nov,20) | 4 | 60 | 17 | 19 | 0 | 100 | | Source: BSE, ICEX, MCX, NCDEX and NSE. | 3.58 Notwithstanding the overall challenging milieu, new products such as options in goods contracts in the agri segment and trading of index futures products like Agridex futures, Bulldex futures and Metaldex futures were introduced. The Index futures segment at MCX recorded a total turnover of ₹19,529 crore and that at NCDEX was ₹295 crore during this period. III.4.15 Insurance 3.59 The impact of COVID-19 on new business premiums pertaining to life insurance was discernible in the negative double-digit growth rates registered beginning March 2020 and continuing up to June 2020 (Chart 3.10). This contraction was, however, completely offset in the subsequent months. New business premiums increased by 3 per cent on an y-o-y basis as at the end of October 2020. During the period, customers showed an increased preference for non-linked Insurance products that offer explicitly guaranteed benefits as compared with unit-linked insurance products. 3.60 The impact of COVID-19 on the premium collection figures of non-life insurers was mixed. “Pull” products like fire and health insurance performed well, but regulatorily mandated insurance products dependent on economic factors (e.g., marine, motor and crop insurance) did not fare well. Marine insurance contracted due to the fall in cargo movement. Crop insurance declined as some states opted out of the Pradhan Mantri Fasal Bima Yojana. While new motor insurance premium collections improved on account of higher vehicle sales post-lockdown, premium collections from vehicle owners impacted by the work-from-home model were lower. 3.61 Regulatory initiatives taken by the Insurance Regulatory and Development Authority of India (IRDAI) had a positive impact on the growth of premiums in the health insurance business (Table 3.9). 3.62 Insurance premiums collected under various COVID-19 specific policies stood at around ₹865 crore for an insured sum of ₹13 lakh crore up to end-September 2020. Senior citizens (above 60 years in age) accounted for about seven per cent of the lives covered under ‘Corona Kavach’ policy and four per cent of lives covered under ‘Corona Rakshak’ and other COVID-19 specific products (Table 3.10). 3.63 From April to November 2020, the life insurance industry has received 12753 claims (where death was due to COVID-19 and related complications) worth ₹990 crore. In terms of value they constitute 0.3 per cent of total premium income in the same period. 11,464 death claims amounting to ₹687 crore have been settled and 1259 claims amounting to ₹303 crore are under process. This has no significant impact on the financials of the life insurers, so far. The claim paid ratio on the basis of number of claims is 92.76 per cent with respect to individual claims and 95.44 per cent in Group for the period April-September 2020 in comparison to 90.09 per cent and 96.47 per cent for the corresponding period last year. Thus, there is no significant impact of COVID-19 overall on death claim settlement. III.4.16 Pension Funds 3.64 Enrolment as well as Assets under Management (AUM) of the National Pension System (NPS) and Atal Pension Yojana (APY) increased on a y-o-y basis (Table 3.11). In the effort towards financial inclusion of the unorganised sector and the low-income groups, 391 banks were registered under APY with the aim of expanding the coverage of citizens under the pension net. | Table 3.9: Growth in Health Insurance sector* | | Type of Business | Q1:2020-21 | Q1:2019-20 | % Change | H1:2020-21 | H1:2019-20 | % Change | | Government Business | 631 | 961 | -34.4 | 1,843 | 2,567 | -28.2 | | Group Business | 7,776 | 7,180 | 8.3 | 14,929 | 12,908 | 15.7 | | Individual Business | 4,990 | 4,025 | 24.0 | 11,927 | 8,879 | 34.3 | | Total | 13,397 | 12,166 | 10.1 | 28,699 | 24,354 | 17.8 | Note *: Excluding Personnel Accident and Travel Insurance

Source: General Insurance Council. |

Table 3.10 : Business in COVID specific Insurance Products

(April 1, 2020 to September 30, 2020) | | Type of business / Units | No. of Policies | Lives covered | Total Sum Insured | Gross Premium | | Number | ₹ Crore | | Corona Kavach | 19,58,677 | 32,86,692 | 1,12,253 | 469.66 | | Corona Rakshak | 3,80,270 | 4,42,812 | 7,481 | 57.03 | | Other COVID Specific products | 36,954 | 73,39,399 | 11,70,851 | 338.12 | | Total | 23,75,901 | 1,10,68,903 | 12,90,585 | 864.81 | | Source: IRDAI. | III.4.17 International Financial Services Centres Authority (IFSCA) 3.65 The International Financial Services Centres Authority13 (IFSCA) was set up in April 2020 to develop a strong global connect and focus on the needs of the Indian economy as well as to serve as an international financial platform for the entire region and the global economy as a whole. Specifically, the Authority is aiming to develop GIFT-IFSC as a destination for fund-raising by both Indian and foreign issuers, fintech start-ups and innovations, sustainable and green financing, bullion trading, aircraft leasing and financing, global in-house centres, fund management, international banking and reinsurance. It introduced frameworks for Regulatory Sandbox, Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) in IFSC and listing of depository receipts in IFSC, among others. Summary and Outlook 3.66 Overall, the authorities’ initial response to the COVID-19 pandemic was massive given the enormity of the problem. Prompt measures across monetary, liquidity, fiscal and financial regulatory domains kept the financial system well-lubricated and smoothly functioning. These early measures contained volatility and imbued confidence to the financial markets. In the medium run, the pandemic support packages have to be unwound in a calibrated manner with minimal disruption to restore the prudential norms to pre-pandemic levels. | Table 3.11 : Subscribers and AUM: NPS and APY | | Sector | Subscribers (in lakhs) | AUM (₹ crore) | | September 2019 | September 2020 | September 2019 | September 2020 | | Central Government | 20.26 | 21.30 | 1,24,703 | 1,60,606 | | State Government | 45.51 | 48.97 | 1,86,849 | 2,50,260 | | Corporate | 8.77 | 10.46 | 36,340 | 50,730 | | All Citizen Model | 10.24 | 13.58 | 11,127 | 16,224 | | NPS Lite | 43.40 | 43.17 | 3,631 | 4,068 | | APY | 178.21 | 236.85 | 8,743 | 13,042 | | Total | 306.39 | 374.32 | 3,71,393 | 4,94,930 | | Source: PFRDA. | 3.67 Unrelated to the pandemic, the focus continues on other developmental and risk mitigation measures, including cyber security and the payments system, which would consolidate past gains and ensure the robust functioning of financial markets, underpinning financial stability enduringly.

|