S. S. Mundra

Deputy Governor & Appellate Authority FOREWORD As I write this foreword the number of complaints received under the Banking Ombudsman Scheme (BOS) has increased from 4994 in the year 1999-2000 to 102894 during the year under review and surpassed the figure of one lakh for the first time since inception of the Scheme. It brings to the fore the significant responsibility of addressing the mounting challenges placed before Reserve Bank of India (RBI) and the banking industry at large on consumer protection. In such a scenario of increase in the number of complaints, Reserve Bank of India (RBI) places great deal of importance on appropriate services being provided to customers of banks and also is committed to ensure protection to consumers of banking products and services. In this endeavour, RBI as the banking regulator has been proactive in gauging the customer service rendered by banks and has been persistently persuading the banks operating in the country to embrace more customer-friendly approach and customer-centric practices. Though the primary thrust of RBI in the sphere of Consumer Protection is geared to empower the individual customer’s rights, the measures taken for strengthening the Internal Grievance Redressal Mechanism of the banks cannot be overemphasized, as the ultimate endeavour of RBI is to ensure that the major part of customer-service delivery aspects are effectively addressed internally by the banks. 2. The BO Scheme operated and fully funded by RBI is an Alternate Disputes Redressal (ADR) Mechanism that provides a cost-free, easily accessible and expeditious redressal on various service related issues faced by bank customers. The supplementary initiatives of RBI in furthering the consumer protection framework besides the ADR mechanism such as Charter of Customer Rights, which has been adopted by the banks in the form of a Customer Rights Policy and appointment of Internal Ombudsman by all Public Sector Banks, select Private Sector and Foreign Banks are noteworthy. The banks have since implemented the Charter in the form of a Customer Rights Policy and its full-fledged implementation is being monitored by RBI. 3. The establishment of Internal Ombudsman Mechanism is expected to improve the efficacy of the internal grievance redressal system of banks and thus enable banks to retain goodwill of their customers. The Internal Ombudsmen are senior retired executives from other banks inter alia mandated to examine all the complaints which are rejected or partially accepted by the bank. Though the challenges on consumer protection are being addressed proactively by RBI with the aforesaid initiatives, the challenges emerging in the consumer education sphere needs further impetus. The BO Scheme report reveals that consumer education in general and awareness about Banking Ombudsman Scheme in particular is sub-optimal. This fact has been reiterated in the year under review too, as 73% of complaints have been received from Metro and Urban centres and 50 % of the complaints are non-maintainable under the Scheme. These challenges are steadily being addressed by RBI. I would like to mention at this juncture that the review of Banking Ombudsman Scheme is in the final stages and some more Offices of Banking Ombudsman would be opened soon by RBI to address these continued challenges. 4. It is heartening to note that the Offices of Banking Ombudsman have been rendering admirable and outstanding service over the years in redressing customer grievances in an efficient, impartial and effective manner. As Appellate Authority I noticed that though the number of complaints has increased significantly during the year 2015-16, the number of Appeals preferred by the banks and customers are considerably lower than last year. But the distinctive feature is that many Appeals preferred by customers are specific, well-founded and convincing. This trend rebuilds confidence amongst the stake holders, reassures us about the increasing awareness amongst the customers about the Scheme and effectiveness of the mediation and conciliation process undertaken by the Banking Ombudsmen in resolving the customer grievances. I am confident that the Offices of Banking Ombudsman will continue to play a critical, constructive and pivotal role in grievance redressal and also help in creating a more customer-centric culture in banks. Sd/-

(S S Mundra) Vision and Goals of the

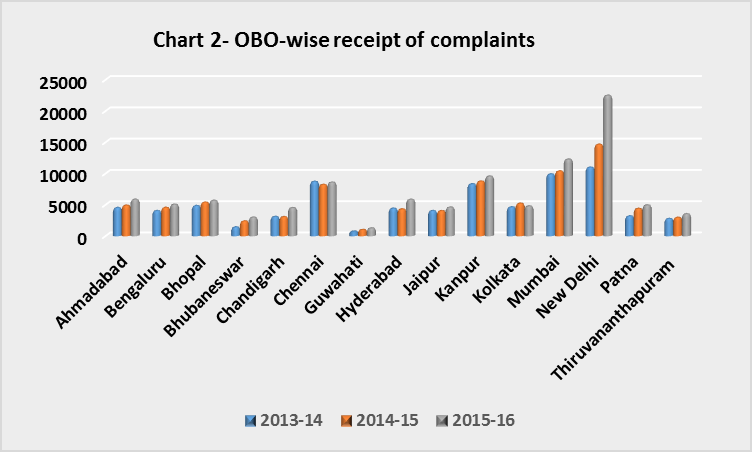

Banking Ombudsman Offices Vision • To act as a visible and credible dispute resolution agency for common persons utilizing banking services. Goals • To ensure redress of grievances of users of banking services in an inexpensive, expeditious and fair manner that provides impetus to improve customer services in the banking sector on a continuous basis. • To provide policy feedback/suggestions to Reserve Bank of India towards framing appropriate and timely guidelines for banks to improve the level of customer service and to strengthen their internal grievance redress systems • To enhance awareness of the Banking Ombudsman Scheme. • To facilitate quick and fair (non-discriminatory) redress of grievances through use of IT systems, comprehensive and easily accessible database and enhanced capabilities of staff through capacity building. EXECUTIVE SUMMARY Reserve Bank of India introduced the Banking Ombudsman Scheme in the year 1995 as the apex level grievance redressal mechanism akin to the Alternate Dispute Resolution Mechanism primarily focusing the small and vulnerable class of bank customers for whom other avenues for redressal of grievance are cost prohibitive. The Scheme was notified under Section 35 A of the Banking Regulation Act, 1949. The aim and objective of the Scheme is to provide a quick and cost free resolution mechanism for complaints relating to deficiency of banking services. The Scheme is applicable to Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks and the Regional Rural Banks. The Scheme has been revised four times since inception to keep it update with the changes in banking field. Presently, the Banking Ombudsman Scheme 2006, as amended up to February 3, 2009, is in operation. Presently the Scheme is administered by RBI through 15 offices of Banking Ombudsmen with specific State-wise jurisdiction covering all 29 States and 7 Union Territories. The cost of running the Scheme is fully borne by the RBI. 2. Brief review of operations of the BO Scheme in 2015-16 • 102894 complaints were received by 15 Offices of the Banking Ombudsmen during the year. • Complaints increased by 21% compared to the previous year. • Offices of Banking Ombudsmen maintained a disposal rate of 95%. • 18 Awards were issued by the Banking Ombudsmen during the year. • 34 appeals were received by the Appellate Authority during the year against the Awards/decisions of Banking Ombudsmen. • Complaints pertaining to failure to meet commitments, non-observance of fair practices code, BCSBI Codes taken together constituted the largest category of complaints with 33.9% of complaints received. • ATM/Debit card complaints comprised 12.71% of complaints received • Credit card complaints comprised 8.49% of complaints received • Complaints in the category of Pension (6.2%), Levy of charges without prior notice (5.5%), Loans and Advances (5.3%), Deposit Accounts (4.9%), Remittances (2.4%) were other areas of complaints. • 330 complaints were received by the Offices of Banking Ombudsman through the Government of India CPGRAMS portal. • 616 applications under Right to Information Act were received during the year. • Average cost of handling a complaint was ₹ 4396 • Offices of Banking Ombudsman organized awareness campaigns/outreach activities, Town Hall events, advertisement campaigns to spread awareness about the Scheme primarily covering the rural and semi-urban areas of their respective jurisdictions. 1. The Banking Ombudsman Scheme 2006 The RBI notified the Banking Ombudsman Scheme in the year 1995 under Section 35 of the Banking Regulation Act 1949. The Scheme is a cost free Alternate Dispute Redressal mechanism. It has completed two decades of its operations and is well established. The volume of complaints received by the OBOs is witnessing an increasing trend in the last three years. Several factors such as expansion in the customer base of banks due to financial inclusion efforts of Government of India and RBI, introduction of various technology based banking products and services, etc. are the drivers responsible for the increase in complaints over the years. Technology has brought the grievance redressal mechanism to the doorsteps of customers. Young and new generation bank customers are well aware of their rights and how to exert them. Being techno-savy, this generation is extensively using electronic modes of lodging complaints. During the year under review, 49% of the complaints received in the OBOs were lodged through electronic mode. This brings to the fore that the redressal mechanism of banks is required to match the pace and realign the resolution process extensively through automation. As compared to last year there was 21% increase in complaints received in the OBOs. The absolute figure of complaints received crossed one lakh mark this year. Despite this increase, OBOs could dispose 95% of the complaints as on June 30, 2016. Technology and automation has helped in a great way to achieve this. The processes in the OBOs are automated to a large extent which helps in drastically cutting down the time lag in seeking and receiving the information required to resolve the complaint. The analysis of complaints received in the OBOs over the years clearly shows that the Scheme is deeply rooted in urban and metro areas. During the year 2015-16, 73% of the complaints received were from these areas. Ease of access, level of awareness, level of education and concentration of branch network are some of the factors that can be attributed to high visibility of the Scheme in Urban and Metro areas. The penetration of the Scheme in Rural and Semi-Urban areas has continued to be low despite the efforts of RBI and OBOs concentrating awareness initiatives in these areas. Reluctance to exercise their rights as customer among rural population, low literacy level, fear to complain and difficulty in accessing proper redressal mechanism are some of the reasons for low visibility of the Scheme in these areas. To improve accessibility, RBI is exploring a possibility of opening more OBOs. The RBI periodically amends the Scheme to keep it update with the changes in the banking scenario. The Scheme was last amended in the year 2009. Since then the banking scenario has undergone a drastic change. New areas of complaints have emerged needing suitable changes in the Scheme to include additional grounds of complaints and streamline the operations. Presently, review of the Scheme has been undertaken and the revised Scheme will be notified on receipt of concurrence from the Government of India. During the year 2015-16, the 15 offices of Banking Ombudsmen received 102894 complaints. A detailed analysis of the complaints handled by the offices of Banking Ombudsmen during the year is given in the ensuing chapters. | Profile of customer complaints handled by OBOs | | Particulars | 2013-14 | 2014-15 | 2015-16 | | Complaints brought forward from previous year | 5479 | 3307 | 3778 | | Complaints received | 76573 | 85131 | 102894 | | Total No of complaints handled | 82052 | 88438 | 106672 | | Complaints disposed | 78745 | 84660 | 101148 | | Complaints pending at the end of the year | 3307

(4%) | 3778

(4%) | 5524

(5%) | | Complaints Pending for less than one month | 2432

(3%) | 2375

(2.55%) | 3136

(2.9%) | | Complaints Pending for one to two months | 838

(1%) | 1207

(1.23%) | 1675

(1.5%) | | Complaints Pending for two to three months | 36

(0.04%) | 105

(0.12%) | 481

(0.4%) | | Complaints Pending for more than three months | 1

(0.001%) | 91

(0.1%) | 232

(0.2%) | | Appeals pending at beginning of the year | 0 | 30 | 15 | | Appeals received | 107 | 73 | 34 | | Total no. of Appeals handled | 107 | 103 | 49 | | Appeals Disposed | 77 | 88 | 46 | | Appeals pending at the end of the year | 30 | 15 | 3 | | Representations to review the decision of BOs | 531 | 810 | 855 | 2. Receipt of Complaints 2.1 During the year 2015-16, 15 OBOs covering 29 States and 7 Union Territories, received 102894 complaints. Comparative position of complaints received during the last three years in given in Table 1, Chart 1. | Table 1 - Number of complaints received by OBOs | | | 2013-14 | 2014-15 | 2015-16 | | No. of OBOs | 15 | 15 | 15 | | Complaints received during the year | 76573 | 85131 | 102894 | Compared to previous year there was 21 % increase in the complaints received in the OBOs during the year 2015-16. This gives an indication about increasing awareness amongst bank customers about their rights and how to exert them. This also shows that the consistent and concerted efforts of RBI and OBOs of spreading awareness about the BOS are yielding the desired results. OBO-wise receipt of complaints 2.2 OBO-wise comparative position of complaints received during the last three years is given in Table 2 and Chart 2. | Table 2- OBO-wise receipt of complaints | | OBO | No. of complaints received during | % change in 2015-16 over 2014-15 | % to total complaints | | 2013-14 | 2014-15 | 2015-16 | | Ahmadabad | 4588 | 4965 | 5909 | 19.01% | 5.74% | | Bengaluru | 4101 | 4610 | 5119 | 11.04% | 4.98% | | Bhopal | 4907 | 5451 | 5748 | 5.45% | 5.59% | | Bhubaneswar | 1498 | 2448 | 3050 | 24.59% | 2.96% | | Chandigarh | 3162 | 3131 | 4571 | 45.99% | 4.44% | | Chennai | 8775 | 8285 | 8645 | 4.35% | 8.40% | | Guwahati | 770 | 1054 | 1328 | 26.00% | 1.29% | | Hyderabad | 4477 | 4366 | 5910 | 35.36% | 5.74% | | Jaipur | 4104 | 4088 | 4664 | 14.09% | 4.53% | | Kanpur | 8389 | 8818 | 9621 | 9.11% | 9.35% | | Kolkata | 4698 | 5277 | 4846 | -8.17% | 4.71% | | Mumbai | 9965 | 10446 | 12333 | 18.06% | 11.99% | | New Delhi | 11045 | 14712 | 22554 | 53.30% | 21.92% | | Patna | 3253 | 4456 | 5003 | 12.28% | 4.86% | | Thiruvananthapuram | 2841 | 3024 | 3593 | 18.82% | 3.49% | | Total | 76573 | 85131 | 102894 | 20.87% | |

OBO New Delhi received the highest number of complaints (22554) with 22% of the total complaints received. Four metro centres OBOs viz. New Delhi, Chennai, Kolkata, Mumbai and two non-metro centres viz. OBO Kanpur and Bhopal put together, accounted for 62 % of the total complaints received. The complaints received at OBO New Delhi increased by 53% during the year 2015-16 vis-s-vis previous year 2014-15. RBI has conducted a comprehensive study to ascertain the reasons for the spurt in complaints from the jurisdiction of OBO New Delhi. The major findings of the study are given in Box I. Zone-wise distribution of complaints 2.3. Zone-wise distribution of complaints is shown in Table 3 and Chart 3. | Table 3 - Zone-wise distribution of complaints | | EASTERN ZONE | 2014-15 | 2015-16 | % change | | Bhubaneswar | 2448 | 3050 | 24.59% | | Guwahati | 1054 | 1328 | 26.00% | | Kolkata | 5277 | 4846 | -8.17% | | Patna | 4456 | 5003 | 12.28% | | | 13235 | 14227 | 7.50% | | NORTHERN ZONE | | Chandigarh | 3131 | 4571 | 45.99% | | Jaipur | 4088 | 4664 | 14.09% | | Kanpur | 8818 | 9621 | 9.11% | | New Delhi | 14712 | 22554 | 53.30% | | 30749 | 41410 | 34.67% | | SOUTHERN ZONE | | Bengaluru | 4610 | 5119 | 11.04% | | Chennai | 8285 | 8645 | 4.35% | | Hyderabad | 4366 | 5910 | 35.36% | | Thiruvananthapuram | 3024 | 3593 | 18.82% | | 20285 | 23267 | 14.70% | | WESTERN ZONE | | Ahmedabad | 4965 | 5909 | 19.01% | | Bhopal | 5451 | 5748 | 5.45% | | Mumbai | 10446 | 12333 | 18.06% | | | 20862 | 23990 | 14.99% |

Northern Zone accounted for 40% of the complaints received in all zones. Western and Southern Zones accounted for 23% each respectively, whereas, Eastern Zone accounted 14% of the total complaints received. Compared to last year there was 34.67% increase in complaints received in Northern Zone followed by 14.99% in Western, 14.70% in Southern and 7.50% in Eastern Zone. Box I: A study on Spurt in complaints at the Office of Banking Ombudsman, New Delhi A very high proportion of complaints received in the OBO, New Delhi compared to other OBOs, prompted RBI to conduct a study to ascertain the reasons/specific areas leading to exponential increase in complaints. The analysis carried out including interactions with stakeholders, sample survey with complainants, discussions with bankers has revealed the following: Major findings of the Study: -

The major area i.e. National Capital Region (NCR) falling under the jurisdiction of OBO, New Delhi witnessed rapid growth led by construction boom, growth of IT and ITES sector as well as education and health sectors, leading to migration from nearby areas. -

The region also witnessed high growth in banking penetration, as measured by number of villages/towns having bank branches, number of branches and ATMs as also banking business. -

Also, the literacy rates in Delhi and Haryana are also relatively high. Thus, it is presumed that there was ‘greater awareness’ among the bank customers in the region. -

Ease of filing complaints through e-mail and online mode against the backdrop of fast internet growth in Delhi during last 5 years. -

Card related complaints accounted for over one-fifth of all complaints at all-India level. However, this category contributed much higher and increasing share of 33-40 per cent in the area under jurisdiction of OBO, New Delhi. Survey of the complainants of past three years revealed the following: -

Younger population (22-29 years) are filing more complaints -

Less educated (illiterates, up to middle and higher secondary) customers also started filing of complaints and their proportion are significant over the years. -

Employed/Self-employed persons and persons with college degree or higher education accounted for over 80 per cent complaints. -

Persons with 5-10 years relationship with their banks had high share in the total complaints. -

Banks failing to meet enhanced expectations of customers. -

Awareness of the grievance redressal systems was very high and increasing. -

Lack of courtesy and delayed/non-response to customer complaints by the bank. -

Confidence/Faith in the BO system was also a reason for rising number of complaints. -

OBO as a definite channel of redressal in a non-pensive and expeditious manner -

More than half the respondents rated their experience with OBO as either ‘very good’’ or ‘good’, and 75-80% cent of all respondents indicated that they have recommended/ will recommend approaching OBO for redressal of their grievance to family/friends. The bankers expressed the following as possible reasons for spurt in the complaints: -

Diversity and Socio-cultural differences in the population -

Speedy development, particular in peripheral areas -

Low technological and other awareness level in certain segments of the population -

Non registration of complaints involving small amount by law enforcing agencies -

Lack of proper co-operation in the dispute resolution (like, sharing ATM footage, etc.) -

Growth in business disproportionate to growth in human resource at banks -

Higher propensity of fraudulent transaction (particularly on ATMs) in border/ peripheral areas and in less developed/ lower Socio economic localities of the area) -

Groups with vested interest enticing the people to make frivolous/non-material complaints, at times with ulterior motives. Population group-wise distribution of complaints 2.4 Population group-wise distribution of complaints during the last three years is given in Table 4 and Chart 4. | Table 4 - Population group-wise distribution of complaints | | Population Group | No of complaints received during | % increase decrease

(Year-on-year) | | 2013-14 | 2014-15 | 2015-16 | | Rural | 9927

(13%) | 11484

(13%) | 12420

(12%) | 8.2% | | Semi Urban | 12314

(16%) | 13363

(16%) | 15048

(15%) | 12.6% | | Urban | 25448

(33%) | 30710

(36%) | 42994

(42%) | 40% | | Metropolitan | 28884

(38%) | 29574

(35%) | 32432

(31%) | 9.7% | | Total | 76573 | 85131 | 102894 | | | (Figures in bracket indicate %age to total complaints of respective year) | The trend of urban centric receipt of complaints continue to remain the same. Urban and Metropolitan population are the major group of complainants under the BOS with 73% complaints from this strata. Year-on-year basis, Urban population group recorded phenomenal increase of 40% in complaints received. Complaints from Rural and Semi-urban population groups increased by 8.2% and 12.6% respectively, whereas in Metropolitan population group, complaints increased by 9.7%. Receipt of complaints - Mode-wise 2.5 A complaint can be lodged with the OBO by hand delivery, post, courier, fax or e-mail. It can also be lodged online from the complaint form placed on the website of RBI. Comparative position of complaints received through various modes during the last three years is indicated in Table 5 and Chart 5. | Table 5 – Receipt of complaints - Mode-wise | | Mode of Receipt | No. of Complaints received during | % change

(Year-on-year) | | 2013-14 | 2014-15 | 2015-16 | | Email | 15181

(20%) | 19508

(23%) | 35169

(34%) | 80.3% | | On line | 9785

(13%) | 11634

(14%) | 15378

(15%) | 32.2% | | Post/Fax/Courier/hand delivery | 51607

(67%) | 53989

(63%) | 52347

(51%) | -3.04% | | Total | 76573 | 85131 | 102894 | | | (*Figures in bracket indicate %age to total complaints of respective years.) |

Though for lodging complaints with OBOs, the physical mode (Post/Fax/Courier/hand delivery) remained the dominant mode, it may be seen that over the years the share of physical mode in lodging of complaints is witnessing a downward trend. From 67% in 2013-14 it has come down to 51% in 2015-16. On year-on year basis, the proportion of complaints lodged through electronic mode (Email and Online) has increased by 62%. This is one of the major factors for increase in number of complaints received during 2015-16. Complainant group-wise classification 2.6 The main target group of the BOS is individual bank customers. During the year 93.06% complaints were received from individual customers including senior citizens. Break-up of complaints received from various segments of society is given in Table 6 and Chart 6. | Table 6 – Complainant group-wise classification | | | Complaints Received | | 2013-14 | 2014-15 | 2015-16 | | Individual | 70913

(92.6%) | 78353

(92%) | 94186

(91.54%) | | Individual- Business | 2163

(2.87%) | 2566

(3%) | 3312

(3.22%) | | Proprietorship/Partnership | 151

(0.2%) | 255

(0.3%) | 310

(0.3%) | | Limited Company | 510

(0.7%) | 699

(0.8%) | 936

(0.91%) | | Trust | 184

(0.2%) | 224

(0.3%) | 288

(0.28%) | | Association | 297

(0.4%) | 281

(0.3%) | 316

(0.31%) | | Government Department | 287

(0.4%) | 376

(0.4%) | 561

(0.54%) | | PSU | 266

(0.3%) | 234

(0.3%) | 524

(0.51%) | | Senior Citizen | 1229

(1.6%) | 1318

(1.55%) | 1569

(1.52%) | | Others | 573

(0.73%) | 825

(0.97%) | 892

(0.87%) | | Total | 76573 | 85131 | 102894 | | (*Figures in bracket indicate %age to total complaints of respective years.) |

Bank group-wise classification 2.7 Classification of complaints received by OBOs based on bank group is indicated in Table 7 and Chart 7. | Table 7 - Bank group-wise classification | | Bank Group | No of Complaints Received During | % change

(Year-on-year) | | 2013-14 | 2014-15 | 2015-16 | | Nationalized Banks | 24391

(32%) | 28891

(34%) | 35447

(35%) | 22.7% | | SBI & Associates | 24367

(32%) | 26529

(31%) | 29585

(29%) | 11.5% | | Private Sector Banks | 17030

(22%) | 19773

(23%) | 26931

(26%) | 36.2% | | Foreign Banks | 5016

(6.5%) | 3406

(4%) | 3413

(3%) | 0.2% | | RRBs/ Scheduled Primary Urban Co-op. Banks | 1590

(2%) | 1966

(2%) | 2293

(2%) | 16.6% | | Others | 4179

(5.5%) | 4566

(6%) | 5225

(5%) | 14.5% | | Total | 76573 | 85131 | 102894 | |

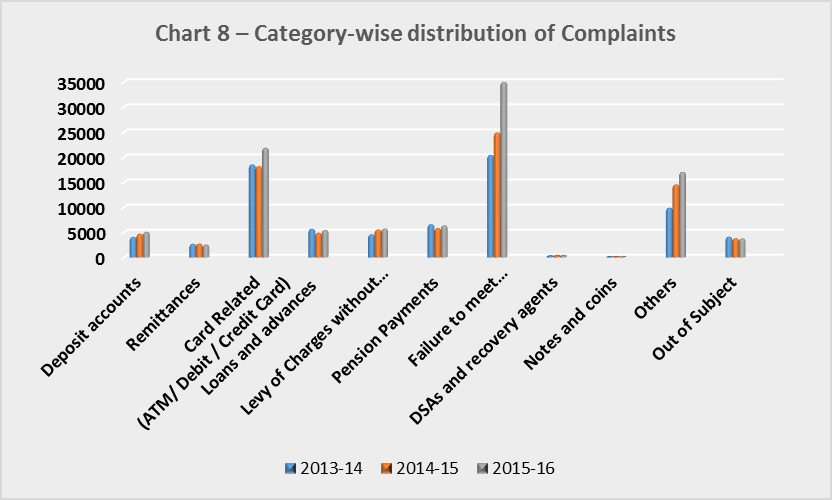

Public Sector Banks accounted for 64% of the total complaints out of which 29% complaints were against SBI & Associates group. Private Sector Banks accounted for 26% whereas Foreign Banks accounted for 3% of total complaints received. Regional Rural Banks and Scheduled Urban Co-operative Banks accounted for 2% of the complaints received. 5% of the complaints were received against other non-bank entities not covered under the BOS. Year-on-year basis, compared to last year, complaints against Public Sector banks increased by 17% and against Private Sector banks by 36%. There was a marginal increase of 0.2% in complaints against Foreign banks. The detailed bank-wise (Scheduled Commercial Banks) and complaint category-wise break-up of complaints received during the year 2015-16 is given at Annex V. 3. Nature of Complaints Handled 3.1 The BOS provides 27 grounds of complaints on which complaints can be lodged with the OBO. Complaints received under these grounds are clubbed into broad categories under the heads indicated in the table below. The Table 8 and Chart 8 indicate the proportion of complaints received under these major categories to the total complaints received during the last three years. Table 8 – Category-wise distribution of complaints

(Figures in bracket indicate %age to total complaints of respective years) | | | No of complaints received | | 2013-14 | 2014-15 | 2015-16 | | Deposit accounts | 4032

(5.3%) | 4661

(5.5%) | 5046

(4.9%) | | Remittances | 2659

(3.5%) | 2700

(3.2%) | 2494

(2.4%) | | ATM/ Debit Cards | 10714

(14%) | 10651

(12.5%) | 13081

(12.7%) | | Credit Cards | 7760

(10%) | 7472

(8.7%) | 8740

8.5%) | | Loans and advances | 5655

(7.4%) | 4846

(5.7%) | 5399

(5.3%) | | Levy of Charges without prior notice | 4547

(5.9%) | 5510

(6.5%) | 5705

(5.5%) | | Pension Payments | 6555

(8.5%) | 5777

(6.8%) | 6342

(6.2%) | | Failure to meet commitments /Non observance of Fair Practice Code/BCSBI Codes | 20368

(26.6%) | 24850

(29.2%) | 34928

(33.9%) | | DSAs and recovery agents | 295

(0.4%) | 347

(0.4%) | 357

(0.3%) | | Notes and coins | 63

(0.1%) | 61

(0.1%) | 63

(0.1%) | | Others | 9861

(12.9%) | 14482

(17%) | 16988

(16.5%) | | Out of Subject | 4064

(5.3%) | 3774

(4.4%) | 3751

(3.7%) | | Total | 76573 | 85131 | 102894 |

3.2 Failure to meet commitments /Non observance of fair practices code/BCSBI Codes with 33.9% of total complaints continued to remain the major category of complaints received in the year 2015-16. Banks need to give adequate attention on meeting the commitments made to customers and also impart appropriate training to their frontline staff on understanding Fair Practices Code and BCSBI Codes. 3.3 Card related complaints constituted 21.2% of the total complaints and was the second largest category of complaints. In percentage terms proportion of card related complaints to total complaints remained the same as that of last year but in absolute terms there was an increase of 3698 complaints during 2015-16. Out of a total of 21821 card related complaints, 13081 complaints were pertaining to ATM/Debit Cards (12.7% of complaints received). Of these, 8259 complaints were regarding failed ATM withdrawal transactions involving short dispensation/non-dispensation of cash, including alleged fraudulent withdrawals from ATMs. Whereas, 8740 complaints were pertaining to credit cards operations (8.5% of complaints received). The main causes for credit card complaints were issue of unsolicited cards, sale of unsolicited insurance policies and recovery of premium along with card charges, charging of annual fees in spite of being offered as 'free' card, authorization of loans over phone, wrong billing, settlement offers conveyed telephonically, non-settlement of insurance claims after the demise of the card holder, exorbitant charges, inappropriate practices by recovery agents, wrong reporting of credit information by banks to Credit Information Companies etc. 3.4 5.3 % of the total complaints were pertaining to ‘loans and advances’. The major issues for these complaints are non-sanction/delay in sanction of loans, charging of excessive rate of interest, non-return of title deeds, non-issuance of no due certificate, education loans, wrong/delayed reporting to CIBIL etc. 3.5 Complaints received on pension related issues constituted 6.2% of the total complaints. Major reasons for these complaints were delayed payments, errors in calculations, difficulties in converting the pension to family pension on demise of pensioner, non cooperation to the pensioners by the bank, etc. 3.6 'Levy of charges without prior notice' continued to be one of the major subsets of complaints. 5.5% Complaints were in this category. These were mainly regarding charges for non-maintenance of minimum balance, processing fees, pre-payment penalties, cheque collection charges, etc. 3.7 Complaints in the category of ‘Deposit Accounts’ constituted 4.9 % of complaints received. Delays in credit, non-credit of proceeds to parties accounts, non-payment of deposit or non-observance of the RBI directives, if any, applicable to rate of interest on deposits in savings, current or other account maintained with a bank, etc., were the major reasons for complaints in this category. 3.8 Non-payment or delay in payment of inward remittances, Non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc. were the major reasons for 2.4% complaints received under the category of ‘Remittances’ 3.9 Complaints in ‘Others’ category comprised of complaints on grounds other than those mentioned in foregoing paragraphs. These were non-adherence to prescribed working hours, delay in providing banking facilities, refusal/delay in accepting payment towards taxes as required by RBI/Government, refusal/delay in issuing/servicing or redemption of government securities, non-adherence to RBI directives, etc. These complaints constituted 16.5% of the total complaints. 3.10 Complaints under the category ‘Out of Subject’ are complaints, which are not relating to the grounds of complaints specified in BOS. 3.7% of the complaints received during the year were in this category. Lack of awareness among the public about applicability of the BOS is the primary reason for such complaints. 4. Disposal of Complaints 4.1 During the year OBOs handled 106672, including 3778 pending complaints pertaining to last year. This is the highest number of complaints handled by the OBOs since introduction of the BOS. Number of complaints received also crossed 1 lakh for first time under the BO Scheme. Despite the significant increase in receipt of complaints, OBOs disposed 101148 (95%) of the complaints as on June 30, 2016. Table 9 and Chart 9 below indicate a comparative position of disposal of complaints by OBOs. | Table 9- Comparative position of disposal of complaints by OBOs | | Number of complaints | Year | | 2013-14 | 2014-15 | 2015-16 | | Received during the year | 76573 | 85131 | 102894 | | Brought forward from previous year | 5479 | 3307 | 3778 | | Handled during the year | 82052 | 88438 | 106672 | | Disposed of during the year | 78745 | 84660 | 101148 | | Rate of Disposal (%) | 96% | 96% | 95% | | Carried forward to the next year | 3307 | 3778 | 5524 |

OBO-wise position of complaints disposed during the year 2015-16 is indicated in Table 10 below: | Table 10 - OBO-wise position of complaints disposed during 2015-16 | | OBO | Complaints pending at the beginning of the Year | Complaints Received during the Year | Complaints handled | Complaints Disposed | Pending at the end of the year | Rate of Disposal (%) | | Ahmedabad | 0 | 5909 | 5909 | 5909 | 0 | 100.00% | | Bengaluru | 174 | 5119 | 5293 | 5162 | 131 | 97.53% | | Bhopal | 1078 | 5748 | 6826 | 6610 | 216 | 96.84% | | Bhubaneswar | 6 | 3050 | 3056 | 3048 | 8 | 99.74% | | Chandigarh | 63 | 4571 | 4634 | 4593 | 41 | 99.12% | | Chennai | 87 | 8645 | 8732 | 8616 | 116 | 98.67% | | Guwahati | 16 | 1328 | 1344 | 1307 | 37 | 97.25% | | Hyderabad | 122 | 5910 | 6032 | 5695 | 337 | 94.41% | | Jaipur | 5 | 4664 | 4669 | 4437 | 232 | 95.03% | | Kanpur | 589 | 9621 | 10210 | 8753 | 1457 | 85.73% | | Kolkata | 71 | 4846 | 4917 | 4639 | 278 | 94.35% | | Mumbai | 402 | 12333 | 12735 | 11848 | 887 | 93.03% | | New Delhi | 932 | 22554 | 23486 | 21902 | 1584 | 93.26% | | Patna | 125 | 5003 | 5128 | 5035 | 93 | 98.19% | | Thiruvananthapuram | 108 | 3593 | 3701 | 3594 | 107 | 97.11% | | Total | 3778 | 102894 | 106672 | 101148 | 5524 | 95% | Disposal of complaints - Maintainable / Non-Maintainable 4.2 The complaints received in the OBOs are classified in two categories viz. Maintainable and Non-Maintainable. The complaints which do not fall under the grounds of complaint specified in Clause 8 of the BOS and those complaints, where procedure for filing the complaint is not adhered to as laid down in Clause 9 of the BOS, are classified as ‘Non-Maintainable’ complaints. All other complaints are classified as ‘Maintainable’ complaints and are dealt in accordance with the provisions of the BOS 2006. Non-Maintainable complaints are returned to the complainants stating the reason and requesting them to resubmit after following the procedure if these are within the specified grounds of complaints under Clause 8 of the BOS. One of the reasons for high proportion of Non-Maintainable complaints received in OBOs is the high level of confidence exists amongst the common bank customers in the Scheme coupled with lack of awareness about provisions of the Scheme. General feeling among the informed public is that by sending a complaint to the bank with a copy marked to Banking Ombudsman, helps in quick resolution of complaint. This factor contributes to the receipt of a large number of First Resort Complaints in OBOs i.e. the complaints sent directly to the OBO without first approaching the bank-branch for resolution. A study undertaken by RBI in the jurisdiction of OBO, New Delhi to ascertain the reasons for sudden spurt in the number of complaints has corroborated the fact that the people repose confidence in the BO Scheme. (Please see Box I - A study on spurt in complaints at the Office of Banking Ombudsman, New Delhi). Table 11 and Chart 10 indicate the number of Maintainable and Non-Maintainable complaints disposed by all the OBOs during the last three years. Out of the total 101148 complaints disposed during the year, 50% complaints were Maintainable. | Table-11 Maintainable / Non-maintainable complaints | | | 2013-14 | 2014-15 | 2015-16 | | Complaints Disposed | 78745 | 84660 | 101148 | | Maintainable | 44822

(57%) | 43035

(51%) | 50187

(50%) | | Non-maintainable | 33923

(43%) | 41625

(49%) | 50961

(50%) | | (* Figures in brackets indicate percentage to Complaints Disposed) |

Mode of disposal of Maintainable complaints 4.3 The objective of the BOS is to facilitate amicable settlement of dispute by conciliation and mediation so that the relationship between the customer and the banker is maintained. The Scheme follows a non-disruptive mode of resolution of complaints to the extent possible. This results in less number of Awards issued by the Banking Ombudsman. In terms of Clause 7(2) of the BOS the BO shall facilitate resolution of complaints by settlement, by agreement or through conciliation and mediation between the bank and the aggrieved parties or by passing an Award in accordance with the Scheme. BO gives a decision or passes an Award when the mediation and conciliation efforts fail to arrive at resolution. Table 12 and Chart 11 below indicate the mode of disposal of Maintainable complaints. | Table 12 - Mode of disposal of Maintainable complaints | | Disposal of Maintainable Complaints | 2013-14 | 2014-15 | 2015-16 | | By Mutual Settlement/agreement | 19469

(43.5%) | 16893

(39.3%) | 18031

(35.93%) | | Disposal by Award | 207

(0.5%) | 87

(0.2%) | 18

(0.04%) | | Maintainable Complaints Rejected | 24960

(55.6%) | 25976

(60.3%) | 31946

(63.65%) | | Maintainable Complaints Withdrawn | 186

(0.4%) | 79

(0.2%) | 192

(0.38%) | | Total Maintainable complaints disposed | 44822 | 43035 | 50187 | | (* Figures in brackets indicate percentage to Maintainable Complaints) |

35.93% of the Maintainable complaints received during the year were resolved by mutual settlement. Awards were passed in less than 0.1% of the cases. 63.65% complaints were rejected whereas 0.38% complaints were withdrawn by the complainants. Grounds for rejection of Maintainable complaints 4.4 The grounds for rejection of Maintainable complaints and their proportion to total complaints received during the year are indicated in the Table 13 and Chart 12. | Table 13 - Grounds for rejection of Maintainable complaints | | Sr. No. | Ground for Rejection | No of complaints rejected | % to Rejected Complaints | % to

Total Complaints | | 1 | Not in accordance with provisions of Sub-Clause (3) of clause 9 of the Scheme | 26929 | 84.30% | 26.17% | | 2 | Beyond the pecuniary jurisdiction of the BO - Clause 12 (5) & (6) | 135 | 0.42% | 0.13% | | 3 | Requiring elaborate documentary and oral evidence- Clause 13 (c) | 4501 | 14.09% | 4.37% | | 4 | Complaints without sufficient cause - Clause 13(d) | 136 | 0.42% | 0.13% | | 5 | Not pursued by the complainants | 219 | 0.69% | 0.21% | | 6 | No loss/damage/inconvenience to the complainants – Clause 13 (f) | 26 | 0.08% | 0.03% | | 7 | Total | 31946 | | | | (* Figures in brackets indicate percentage to Maintainable Complaints-Rejected) |

Non-Maintainable complaints 4.5 Reasons for Non-Maintainable complaints and their proportion to total complaints received during the year are given in Table 14. | Table 14 – Non-Maintainable complaints | | Sr. No. | Reasons | No of Complaints | % to Non-Maintainable complaints | % to

Total complaints | | 1 | Complaints out of ambit of Clause 8 | 6360 | 12.48% | 6.18% | | 2 | Complaints out of territorial jurisdiction of the BO as defined under Clause 7(1) and Clause 9 (1) | 6459 | 12.67% | 6.28% | | 3 | Complaints against entities other than banks as defined under Clause 3 (5) | 1712 | 3.36% | 1.66% | | 4 | Complaints not represented properly as indicated under Clause 9(2) | 11430 | 22.43% | 11.11% | | 5 | Complaints where the complainant did not approach the bank first for redressal (First Resort Complaints) as required under Clause 9 (3) (a) | 13571 | 26.63% | 13.19% | | 6 | Time barred complaints - Clause 9 (3) (b) | 450 | 0.88% | 0.44% | | 7 | Complaints in respect of the same cause of action which was settled or dealt earlier- Clause 9 (3) (c) | 8155 | 16.00% | 7.93% | | 8 | Complaints pertaining to same cause of action for which proceedings before any court, tribunal or arbitrator or any other forum is pending – Clause 9 (3) (d) | 1125 | 2.21% | 1.09% | | 9 | Frivolous / vexatious complaints | 26 | 0.05% | 0.03% | | 10 | Complaints where the period of limitation prescribed under the Indian Limitation Act, 1963 is expired – Clause 9 (3) (f) | 198 | 0.39% | 0.19% | | 11 | Others - pertaining to policy and other miscellaneous issues not within the ambit of the BOS forwarded to regulatory departments of RBI/other regulators/institutions. | 1475 | 2.89% | 1.43% | | | Total | 50961 | | | 4.6. First resort complaints: In terms of Clause 9 (3) (a) of the BOS, the complainant should first approach the concerned bank-branch for redress of his/her grievance. If the bank does not reply within a month or the complainant is not satisfied with bank's reply, then he/she can approach the BO. When the complainant directly approaches the BO without approaching the bank, the complaint is treated as First Resort Complaint (FRC) and rejected by the BO. Such complaints are invariably sent by the OBO to concerned bank for suitable resolution. During the year, 13% of the complaints received were FRCs. FRCs received through online BO complaint form placed on the website of RBI are forwarded online to the bank concerned. During the year, 12312 FRCs received through this mode were forwarded to the banks concerned. OBOs also use this online module to forward FRCs received in physical form to concerned banks. During the year OBOs forwarded 3140 FRCs to concerned banks through this module. Maintainable and Non Maintainable Complaints - Bank wise 4.7 Table 15 below shows bank-wise distribution of Maintainable and Non-Maintainable complaints. | Table 15 – Maintainable and Non-Maintainable complaints - Bank wise | | Bank Name | Total Disposed | Maintainable | Non-Maintainable | | STATE BANK OF INDIA | 25638 | 14598 | 11040 | | STATE BANK OF BIKANER AND JAIPUR | 1197 | 852 | 345 | | STATE BANK OF HYDERABAD | 744 | 555 | 189 | | STATE BANK OF MYSORE | 361 | 237 | 124 | | STATE BANK OF PATIALA | 767 | 425 | 342 | | STATE BANK OF TRAVANCORE | 837 | 479 | 358 | | ALLAHABAD BANK | 1168 | 541 | 627 | | ANDHRA BANK | 1023 | 645 | 378 | | BANK OF BARODA | 3701 | 1710 | 1991 | | BANK OF INDIA | 3127 | 1644 | 1483 | | BANK OF MAHARASHTRA | 647 | 334 | 313 | | CANARA BANK | 3738 | 2060 | 1678 | | CENTRAL BANK OF INDIA | 2262 | 1194 | 1068 | | CORPORATION BANK | 790 | 400 | 390 | | DENA BANK | 774 | 382 | 392 | | INDIAN BANK | 1346 | 959 | 387 | | INDIAN OVERSEAS BANK | 2313 | 1518 | 795 | | ORIENTAL BANK OF COMMERCE | 1039 | 488 | 551 | | PUNJAB AND SIND BANK | 539 | 228 | 311 | | PUNJAB NATIONAL BANK | 4578 | 2232 | 2346 | | SYNDICATE BANK | 1193 | 612 | 581 | | UCO BANK | 1370 | 761 | 609 | | UNION BANK OF INDIA | 2249 | 1141 | 1108 | | UNITED BANK OF INDIA | 701 | 428 | 273 | | VIJAYA BANK | 481 | 259 | 222 | | BHARATIYA MAHILA BANK LTD. | 9 | 8 | 1 | | IDBI BANK LIMITED | 1410 | 746 | 664 | | CATHOLIC SYRIAN BANK LTD | 78 | 46 | 32 | | CITY UNION BANK LIMITED | 120 | 87 | 33 | | FEDERAL BANK LTD | 376 | 232 | 144 | | JAMMU AND KASHMIR BANK LTD | 168 | 43 | 125 | | KARNATAKA BANK LTD | 145 | 74 | 71 | | KARUR VYSYA BANK LTD | 238 | 165 | 73 | | LAKSHMI VILAS BANK LTD | 167 | 112 | 55 | | NAINITAL BANK LTD | 45 | 15 | 30 | | RATNAKAR BANK LTD | 219 | 86 | 133 | | SOUTH INDIAN BANK LTD | 191 | 115 | 76 | | TAMILNAD MERCANTILE BANK LTD | 118 | 76 | 42 | | THE DHANALAKSHMI BANK LTD | 72 | 38 | 34 | | AXIS BANK LIMITED | 4861 | 2495 | 2366 | | BANDHAN BANK LIMITED | 23 | 8 | 15 | | DCB BANK LIMITED | 252 | 85 | 167 | | HDFC BANK LTD. | 7547 | 3024 | 4523 | | ICICI BANK LIMITED | 7708 | 3578 | 4130 | | IDFC BANK LIMITED | 1 | 0 | 1 | | INDUSIND BANK LTD | 1189 | 595 | 594 | | KOTAK MAHINDRA BANK LTD. | 2287 | 1066 | 1221 | | YES BANK LTD. | 481 | 205 | 276 | | AB BANK LIMITED | 1 | 0 | 1 | | ABU DHABI COMMERCIAL BANK LTD | 3 | 2 | 1 | | AMERICAN EXPRESS BANKING CORP. | 155 | 63 | 92 | | ANTWERP DIAMOND BANK NV | 2 | 0 | 2 | | A N Z BANKING GROUP LIMITED | 2 | 1 | 1 | | BANK OF AMERICA N.T. AND S.A. | 4 | 0 | 4 | | BANK OF NOVA SCOTIA | 2 | 1 | 1 | | BARCLAYS BANK PLC | 96 | 38 | 58 | | BNP PARIBAS | 3 | 1 | 2 | | CALYON BANK | 2 | 0 | 2 | | CITIBANK N.A | 881 | 404 | 477 | | DBS BANK LTD. | 11 | 4 | 7 | | DEUTSCHE BANK(ASIA) | 89 | 36 | 53 | | HONGKONG & SHANGHAI BKG CORPN. LTD. | 383 | 170 | 213 | | HSBC BANK OMAN S.A.O.G. | 2 | 1 | 1 | | MASHREQ BANK PSC | 2 | 0 | 2 | | ROYAL BANK OF SCOTLAND | 175 | 52 | 123 | | SBERBANK | 1 | 0 | 1 | | SONALI BANK | 2 | 0 | 2 | | STANDARD CHARTERED BANK | 1557 | 726 | 831 | | STATE BANK OF MAURITIUS LTD | 2 | 1 | 1 | | THE BANK OF TOKYO-MITSUBISHI UFJ LTD | 2 | 1 | 1 | | REGIONAL RURAL BANKS | 1765 | 841 | 924 | | SCHEDULED CO-OP BANKS | 470 | 254 | 216 | | OTHERS | 5248 | 10 | 5238 | | TOTAL | 101148 | 50187 | 50961 | Maintainable and Non Maintainable Complaints - OBO wise 4.8 Table 16 below shows OBO-wise distribution of Maintainable and Non-Maintainable complaints. | Table 16 - Maintainable and Non Maintainable Complaints - OBO wise | | OBO | Total Disposed | Maintainable | Non-Maintainable | | AHMEDABAD | 5909 | 2057 | 3852 | | BENGALURU | 5165 | 3226 | 1939 | | BHOPAL | 6611 | 4094 | 2517 | | BHUBANESWAR | 3048 | 1159 | 1889 | | CHANDIGARH | 4593 | 2682 | 1911 | | CHENNAI | 8616 | 6430 | 2186 | | GUWAHATI | 1308 | 924 | 384 | | HYDERABAD | 5696 | 4522 | 1174 | | JAIPUR | 4437 | 3228 | 1209 | | KANPUR | 8753 | 3066 | 5687 | | KOLKATA | 4640 | 2837 | 1803 | | MUMBAI | 11845 | 5796 | 6049 | | NEW DELHI | 21897 | 5290 | 16607 | | PATNA | 5035 | 2815 | 2220 | | THIRUVANANTHAPURAM | 3595 | 2061 | 1534 | | Total | 101148 | 50187 | 50961 | Awards Issued 4.9 During the year 18 Awards were issued by the OBOs against the banks. Out of these, ten Awards were implemented by the banks. In seven cases the banks have filed appeal before the Appellate Authority. One Award remained unimplemented as on June 30, 2016 as it was issued during the month of June 2016 and the time for implementation was not over. OBO-wise position of Awards issued during the year 2015-16 is indicated in Table 17. | Table 17 - OBO wise position of Awards issued during the year 2015-16 | | OBO | Awards Issued | | Ahmedabad | 1 | | Bengaluru | 1 | | Bhopal | 0 | | Bhubaneswar | 0 | | Chandigarh | 2 | | Chennai | 0 | | Guwahati | 1 | | Hyderabad | 0 | | Jaipur | 0 | | Kanpur | 6 | | Kolkata | 1 | | Mumbai | 3 | | New Delhi | 1 | | Patna | 2 | | Thiruvananthapuram | 0 | | Total | 18 | Age –wise classification of pending complaints 4.10 Table 18 and Chart 13 below indicate age-wise classification of pending complaints. | Table 18- Age-wise classification of pending complaints | | Pending up to | June 30, 2014 | June 30, 2015 | June 30,2016 | | 1 Month | 2432

(3%) | 2375

(2.69%) | 3136

(2.94%) | | 1-2 Months | 838

(1%) | 1207

(1.36%) | 1675

(1.57%) | | 2-3 Months | 36

(0.04%) | 105

(0.12%) | 481

(0.45%) | | More than 3 Months | 1

(0.001%) | 91

(0.1%) | 232

(0.22%) | | Total Pending | 3307

(4%) | 3778

(4%) | 5524

(5%) | | Complaints handled | 82052 | 88438 | 106672 | | (Figures in bracket indicate %age to complaints handled during respective years) |

OBOs disposed of 95% of the complaints handled during the year. At the end of the year, 5524 (5%) complaints were pending at all OBOs. Out of these, 2.94% complaints were pending for less than one month, 1.57% complaints were pending between one to two months, 0.45% complaints were pending between two to three months and only 0.2% complaints were pending beyond three months. Compared to last year, there was 21% increase in complaints received during the year. First time since introduction of the BOS, the complaints figure crossed 1 lakh mark. Despite the significant increase in the volume of complaints received by OBOs, with concerted efforts OBOs disposed of 95% of the complaints. Complaints per officer 4.11 During the year 2015-16 there were 134 desk officers handling the complaints received in all OBOs. On an average proportion of complaints per officer worked out to 768. Table 19 and Chart 14 below indicate complaints 'per officer' in respective OBOs. | Table 19 – Complaints per officer | | Office | 2013-14 | 2014-15 | 2015-16 | | No. of complaints received | No. of officers | No. of complaints per officer | No.of complaints received | No. of officers | No. of complaints per officer | No. of complaints received | No. of officers | No. of complaints per officer | | Ahmedabad | 4588 | 13 | 353 | 4965 | 10 | 497 | 5909 | 8 | 739 | | Bengaluru | 4101 | 11 | 372 | 4610 | 10 | 461 | 5119 | 6 | 853 | | Bhopal | 4907 | 7 | 701 | 5451 | 6 | 909 | 5748 | 6 | 958 | | Bhubaneswar | 1498 | 4 | 374 | 2448 | 6 | 408 | 3050 | 4 | 763 | | Chandigarh | 3162 | 8 | 395 | 3131 | 8 | 391 | 4571 | 7 | 653 | | Chennai | 8775 | 13 | 675 | 8285 | 11 | 753 | 8645 | 9 | 961 | | Guwahati | 770 | 2 | 385 | 1054 | 2 | 527 | 1328 | 2 | 664 | | Hyderabad | 4477 | 9 | 497 | 4366 | 9 | 485 | 5910 | 8 | 739 | | Jaipur | 4104 | 9 | 456 | 4088 | 6 | 681 | 4664 | 7 | 666 | | Kanpur | 8389 | 20 | 419 | 8818 | 13 | 678 | 9621 | 12 | 802 | | Kolkata | 4698 | 18 | 261 | 5277 | 15 | 352 | 4846 | 12 | 404 | | Mumbai | 9965 | 19 | 524 | 10446 | 18 | 580 | 12333 | 18 | 685 | | New Delhi | 11045 | 22 | 502 | 14712 | 24 | 613 | 22554 | 23 | 981 | | Patna | 3253 | 4 | 813 | 4456 | 3 | 1485 | 5003 | 4 | 1251 | | Thiruvananthapuram | 2841 | 8 | 355 | 3024 | 8 | 378 | 3593 | 8 | 449 | | All India | 76573 | 167 | 459 | 85131 | 149 | 571 | 102894 | 134 | 768 |

5. Cost of Running the Scheme 5.1 The expenditure incurred on running the BOS is fully borne by the RBI from the year 2006. This includes revenue expenditure and capital expenditure incurred on administration of the BOS. The revenue expenditure includes establishment items like salary and allowances of the staff attached to OBOs and non-establishment items such as rent, taxes, insurance, law charges, postage and telegram charges, printing and stationery expenses, publicity expenses, depreciation and other miscellaneous items. The capital expenditure items include furniture, electrical installations, computers/related equipment, telecommunication equipment and motor vehicle. 5.2 Average cost incurred for handling a complaint under the BOS 2006 is indicated in Table 20 and Chart 15. | Table 20 - Cost of handling a complaint | | | 2013-14 | 2014-15 | 2015-16 | | Total Cost (₹ Million) | 369 | 387 | 452 | | Complaints Received | 76573 | 85131 | 102894 | | Average Cost of handling a Complaint (₹) | 4824 | 4541 | 4396 | The aggregate cost of running the BOS has increased from ₹ 369 million in 2013-14 to ₹ 452 million in 2015-16. Though the volume of complaints increased by 34% during this period, the average cost of handling a complaint has witnessed a decline from ₹ 4824/- to ₹ 4396/-. BO Office wise 'Per-Complaint Cost’ for the year 2015-16 is given in Table 21 | Table 21 - OBO wise 'Per-Complaint Cost’ for the year 2015-16 | | OBO | Per Complaint Cost (₹) | | Ahmedabad | 5481 | | Bengaluru | 4610 | | Bhopal | 4567 | | Bhubaneswar | 6000 | | Chandigarh | 6355 | | Chennai | 4354 | | Guwahati | 7441 | | Hyderabad | 4907 | | Jaipur | 5879 | | Kanpur | 4052 | | Kolkata | 7911 | | Mumbai | 3923 | | New Delhi | 2070 | | Patna | 3666 | | Thiruvananthapuram | 7810 | 6. Appeals against the Decisions of the BOs 6.1 The BOS provides an option of appeal to both the parties in terms of Clause 14 of the BOS 2006. Any party aggrieved by an Award issued by the BO under clause 12 or rejection of a complaint for the reasons referred to in sub clauses (d) to (f) of clause 13, can prefer an appeal before the Appellate Authority designated under the Scheme within 30 days of the date of receipt of communication of Award or rejection of complaint. The Deputy Governor-in-Charge of the department of RBI administering the Scheme (Consumer Education and Protection Department) is the designated Appellate Authority. The secretarial assistance to the Appellate Authority is provided by the Consumer Education and Protection Department. Position of appeal handled by the Appellate Authority during the year 2015-16 is given in Table 22 below. | Table 22 - Position of appeals | | Particulars | No of Appeals | | Appeals pending at the beginning | 15 | | Appeals received during the year from Complainants | 25 | | Appeals received during the year from Banks | 9 | | Total appeals handled during the year | 49 | | Appeal disposed during the year | 46 | | Pending at the end of the year | 3 | | Mode of Disposal | | Appeals remanded to the BO for review | 0 | | Appeals withdrawn / settled | 5 | | Appeals rejected | 29 | | Appeals allowed | 12 | | Appeals Disposed during the year | | In favour of customers | 15 | | In favour of banks | 29 | 6.2 During the year 34 appeals were received against the decisions of BOs. Including 15 appeals pending at the beginning of the year, the Appellate Authority handled 49 appeals during the year. The Appellate Authority disposed 46 appeals. In 15 cases the Appellate Authority’s decision was in favour of customers whereas in 29 cases it was in favour of banks. Five appeals were withdrawn. The OBO wise position of appeals received during the year 2015-16 is given in Table 23. | Table 23 - OBO wise position of appeals received during the year 2015-16 | | OBO | No of Appeals | | Ahmedabad | 0 | | Bengaluru | 2 | | Bhopal | 0 | | Bhubaneswar | 0 | | Chandigarh | 3 | | Chennai | 0 | | Guwahati | 2 | | Hyderabad | 0 | | Jaipur | 0 | | Kanpur | 0 | | Kolkata | 0 | | Mumbai | 25 | | New Delhi | 1 | | Patna | 0 | | Thiruvananthapuram | 1 | | Total | 34 | Representations to review the complaints closed under non-appealable clauses of the BOS 2006 6.3 In terms of Clause 14 (1) of BOS 2006 complaints rejected by the BO under Clause 13 (a), (b) & (c) of the Scheme are non-appealable. Still, representations from the complainants to reopen complaints rejected under these non-appealable Clauses of the Scheme are being received in the Consumer Education and Protection Department, the Secretariat of the Appellate Authority. During the year 855 representations were received and disposed. 7. Complaints received through Centralised Public Grievance Redress and Monitoring System (CPGRAMS) CPGRAMS is a web based application developed by the Department of Administrative Reforms and Public Grievances of Government of India empowering the citizens to lodge their complaints online and also enabling redress action within a prescribed time limit. Government Departments, banks are sub-ordinate offices under this system to receive and redress complaints forwarded through this portal. The Consumer Education and Protection Department, RBI is the Nodal Office for RBI. Fifteen OBOs are sub-ordinate offices. Comparative position of complaints handled by OBOs through this portal is given in Table 24 below. | Table 24 - Complaints received through CPGRAMS | | OBO | 2013-14 | 2014-15 | 2015-16 | | Ahmedabad | 12 | 07 | 19 | | Bengaluru | 14 | 06 | 16 | | Bhopal | 5 | 02 | 17 | | Bhubaneswar | 3 | 04 | 7 | | Chandigarh | 9 | 14 | 6 | | Chennai | 29 | 23 | 52 | | Guwahati | 2 | 03 | 7 | | Hyderabad | 13 | 07 | 11 | | Jaipur | 2 | 01 | 9 | | Kanpur | 24 | 23 | 31 | | Kolkata | 22 | 13 | 14 | | Mumbai | 40 | 21 | 37 | | New Delhi | 72 | 48 | 79 | | Patna | 8 | 05 | 6 | | Thiruvananthapuram | 6 | 01 | 19 | | Total | 261 | 178 | 330 | 8. Applications received under Right to Information Act, 2005 The Banking Ombudsmen have been designated as the Central Public Information Officers under the Right to Information Act 2005 to receive applications and furnish information relating to complaints handled by the OBOs. During the year 15 OBOs received 616 applications under RTI Act. Comparative position of RTI applications handled by OBOs is indicated in the Table 25. | Table 25 - Applications received by OBOs under RTI Act | | OBO | 2013-14 | 2014-15 | 2015-16 | | Ahmedabad | 11 | 10 | 9 | | Bengaluru | 11 | 11 | 19 | | Bhopal | 13 | 11 | 34 | | Bhubaneswar | 4 | 5 | 5 | | Chandigarh | 21 | 22 | 31 | | Chennai | 81 | 50 | 55 | | Guwahati | 9 | 1 | 9 | | Hyderabad | 40 | 22 | 20 | | Jaipur | 51 | 52 | 51 | | Kanpur | 131 | 112 | 137 | | Kolkata | 28 | 19 | 14 | | Mumbai | 62 | 32 | 59 | | New Delhi | 90 | 60 | 94 | | Patna | 31 | 35 | 63 | | Thiruvananthapuram | 13 | 12 | 16 | | Total | 596 | 454 | 616 | 9. Other Important Developments 9.1. Annual Conference of Banking Ombudsmen 2016 9.1(i) The Annual Conference of Banking Ombudsmen was held at Thiruvananthapuram on February 15 and 16, 2016. Dr. Raghuram G. Rajan, Governor, RBI inaugurated the Conference. The Conference was attended by Managing Directors and Senior Executives of major Commercial Banks, Indian Banks’ Association, Banking Codes and Standards Board of India, Banking Ombudsmen and heads of concerned regulatory and supervisory departments of the Reserve Bank. 9.1(ii) The Governor urged the banks to provide customers with comfortable environment when they access banking services so that they get a feeling that they are not 'excluded' from the banking fold. He also dwelt on the suitability aspects and the importance of educating the customers while selling Third Party Products so that they do not make sub-optimal choices and cautioned the banks that the Reserve Bank might even consider regulatory action against banks if they continue the mis-selling of products. The Governor urged the banks and Banking Ombudsmen that when in doubt they should tilt the balance of power in favour of customers. The Governor suggested that the banks may use of their product publicity campaigns to disseminate the cautionary messages of common interests such as fictitious offers of money, security aspects of card payments, internet banking, features of genuine currency notes etc. 9.1 (iii) Shri S.S. Mundra, Deputy Governor, RBI in his address explained the four basic principles of bank regulation as creating diversified environment, enhancing customer choice, financial inclusion and banking that is ethically right. He mentioned that today, with rapid developments in technology, account number portability could be within the realms of possibility which could hugely empower a bank customer to move away from a bank if he/she was dissatisfied with the quality of its services. Shri Mundra also pointed out that the Reserve Bank was reviewing its Banking Ombudsman Scheme to enlarge the areas covered by it and to reduce the urban bias. 9.1 (iv) Shri U. S. Paliwal, Executive Director in his welcome address stressed upon the need for a root cause analysis of complaints by banks so as to initiate prompt corrective action. 9.2 Principal Nodal Officers Conference 9.2 (i) The Conference of Principal Nodal Officers of banks of Scheduled Commercial Banks for the half year ended June 2015 was convened on three days. On September 08, 09 and 10, 2015 at RBI Mumbai. Principal Nodal Officers of major Scheduled Commercial Banks, representatives from IBA, BCSBI, heads of regulatory and supervisory departments of RBI and Banking Ombudsmen of Mumbai, New Delhi, Chennai, Kanpur participated in the Conference. 9.2 (ii) In his keynote address Shri U. S. Paliwal, Executive Director, RBI highlighted the importance given by RBI to consumer protection and stressed upon various important aspects viz. the appointment of CCSO (Internal Ombudsman) in banks and the possible impact on the volume of complaints handled by OBOs, timely submission by banks of the information called for by OBOs to ensure expeditious resolution of complaints, training of frontline staff, consumer education and awareness, root cause analysis of complaints, special attention to complaints of senior citizens, pensioners, widows, ATM operations and security issues associated with it. 9.2 (iii) Crucial customer service issues discussed during the deliberations in the meetings were relating to credit/debit cards, accessibility of ATMs to person with disabilities, levy of charges for sending SMS alerts on actual usage basis, switchover charges for home loans, mis-selling of third party investment products, non-sanction/delay in sanction of loans especially education loan, safe deposit lockers, KYC compliance, settlement of claims of deceased deposit accounts, nomination of accounts. 9.3 Annual Conference of International Network of Financial Services Ombudsman Schemes (INFO) 2015 : The International Network of Financial Services Ombudsman Schemes (the INFO Network) is a worldwide association of 56 financial services dispute resolution schemes from 36 jurisdictions. India is represented by the Banking Ombudsman Scheme on INFO. Every year, INFO organizes the Conference of its member Schemes. The conference provides an excellent opportunity to exchange expertise in financial services and opportunities for professional development and networking. This year, the INFO 2015 was organized in Helsinki from the 13th to 16th of September 2015. The theme of the conference was ‘Solving problems – building trust’. The topics covered were Guidelines to Manage Crises, How to Navigate Potentially Tricky Stakeholder Relationships, Cross Border Issues and New Inventions and Advances in Digital Technology. 9.4 Regional Conferences of Banking Ombudsmen Regional Conferences of Banking Ombudsmen of respective zones were organized by nodal OBOs during the year. Important systemic issues were discussed at these conferences. Meetings with the Controllers and Nodal Officers of major banks of the region were also organized on this occasion where various customer service issues of topical interests were discussed and regulatory concerns were flagged for action by banks. 9.5 Awareness and Consumer Education The OBOs continued their efforts to reach out to the members of public within their jurisdiction to increase awareness about the Banking Ombudsman Scheme, 2006. This was done through advertisements in electronic media as also direct interaction with members of public in outreach programmes, awareness campaigns, Town Hall Events etc. Advertisement campaigns were undertaken in local, Hindi and English languages and designed to reach the maximum number of people, especially in rural areas. Major initiatives taken by the OBOs are given below. • Ahmedabad: Town Hall Events were organized at Surat and Rajkot which was attended by customers, including pensioners and senior citizens where the participants were briefed on Banking Ombudsman Scheme, grounds and procedure of filing complaint, jurisdiction and powers of BO, customer service aspects relating to deposit accounts, loan accounts, nomination facilities; reporting of credit information to CIBIL etc. The participants were advised to be extra vigilant / alert while using their credit/debit cards for transactions at ATMs as also during online transactions. The office also conducted Customer Awareness Programmes at Bhuj and Gandhidham in Kutch District. A recorded interview in the form of question–answer session was telecast on Doordarshan wherein salient features of BOS, 2006 were explained by Banking Ombudsman. Similar programme was broadcasted on All India Radio. One-liner message in Gujarati about the Scheme was scrolled at 33 Doordarshan Relay Centres of Gujarat for 40 days. An audio clip in Hindi on the Scheme was broadcasted on AIR / FM Radio stations in Gujarat for 97 days. • Bengaluru: Three outreach programmes were conducted at Sakleshpur and Belur in Hassan District, and at Chikkaballapur, in Chikkaballapur District. These programmes were well attended and received by customers of banks and members of public. Local media was involved in publicity efforts, prior to the event and subsequently as well. Besides, explaining the salient features of Banking Ombudsman Scheme to the customers, on-the-spot redressal of complaints and distribution of pamphlets were also done. • Bhopal: One grievance redressal awareness programme on Banking Ombudsman Scheme was held each at Indore and Raipur respectively. The participants were briefed about the salient features of the Banking Ombudsman Scheme and also initiatives taken by the Reserve Bank of India for improving customer service. Publicity material of the Banking Ombudsman Scheme was distributed. Advertisements on Banking Ombudsman Scheme were published in leading local newspapers of MP and Chhattisgarh. ‘Jingles’ on the Banking Ombudsman Scheme, were broadcast on All India Radio (AIR) in M.P. and Chhattisgarh. AIR aired an interview with the Banking Ombudsman on the implementation of Banking Ombudsman Scheme • Bhubaneswar: Advertisements for popularizing the Banking Ombudsman Scheme were published in the press and were telecast on DD Oria channel in Oria language during the live broadcast of Rath Yatra. Public awareness camps were organized at different rural/ semi-urban areas at sub-district level in the State to spread awareness about the Banking Ombudsman Scheme. The OBO also participated in a Town Hall Meeting organized by a nationalized bank at Bhubaneswar. • Chandigarh: During the year the OBO organised four Town Hall events, five outreach programmes and six awareness programmes. Advertisement of the Banking Ombudsman Scheme was broadcast on All India Radio. The Banking Ombudsman participated in a program “Radio Jingle” broadcast by the All India Radio, where the objectives of Banking Ombudsman Scheme and the role of Banking Ombudsman were explained. The Banking Ombudsman attended an outreach programme at Ropar, Punjab and answered a number of queries regarding pensions, changing of rate of interest on loans, non- release of title deed papers after repayment of loans, ATM frauds, poor customer service, etc. • Chennai: The OBO organised six awareness programmes at Gudiyatam, Andaman, Kodumudi, Kovilpatti, Mayiladuthurai and Kothagiri in co-ordination with the lead banks of the respective districts. In these programmes, the animation CD on Banking Ombudsman Scheme was displayed to the audience and pamphlets on salient features of the Banking Ombudsman Scheme were distributed. Various queries raised regarding banking services were clarified. The OBO utilized the services of Post Offices who have a wide reach in these areas and bilingual pamphlets containing the details of Banking Ombudsman Scheme were delivered to individual households in these areas through Department of Post and also through Meghdoot Post Cards, where a snapshot of the Banking Ombudsman Scheme was printed in the post cards and sold through the Sub-Post Offices in these areas. The effect of distribution of these cards has created awareness among the public resulting in the increase of complaints. The OBO actively participated in Chennai Trade Fair / outreach activities carried out by RBI. • Guwahati: The OBO issued advertisements about the Banking Ombudsman Scheme and its functioning in English, Hindi, Bengali, Assamese and local languages in National level, State level and Local newspapers in all the seven States under its jurisdiction. A Weekly published a detailed interview of the Banking Ombudsman. A live phone in programme with Banking Ombudsman, Guwahati was aired on All India Radio. Many queries from listeners were answered during the programme. A spot advertisement on Banking Ombudsman Scheme was telecast on TV on DD1 and DD13 Northeast. OBO conducted awareness programmes on Banking Ombudsman Scheme in all the 7 States under its territorial jurisdiction: • Hyderabad: RBI Hyderabad set up a pavilion ‘Numaish 2016’ in 77th annual industrial exhibition of twin cities of Hyderabad and Secunderabad. Officers from OBO handled queries from public and distributed literature on Banking Ombudsman Scheme. Office took an active part in outreach initiatives launched by RBI Hyderabad. A Town Hall event was organized at Warangal. • Jaipur: Town Hall events were organised at Chittorgarh, Nimbahera, village Nikumb, Amthala and Oria for spreading awareness about the Banking Ombudsman Scheme amongst the general public. Many grievances were redressed on the spot while in some other instances, the process of redressal was initiated. The precautions to be taken with regard to ATM transactions and lottery promises were also explained. • Kanpur: OBO organized a Town Hall Event at Mughalsarai aiming to create awareness among the public about BOS, security aspects of banking especially use of ATM /Debit card, net banking, fund transfers, avenues available to bank customers for redressal of grievances, education loans security features of currency notes, etc. The event was conducted in Hindi which is the local language. OBO organized customer education/awareness campaigns in different areas of Uttar Pradesh and Uttarakhand. A large number of villagers, school, college students, bank customers, bank officials of public and private sector banks, representatives from Pensioners’ Association, Depositors’ Association, etc. were involved in these programmes. These events were arranged mainly in rural and semi urban areas. BO also conducted on-site resolution of complaints during these campaigns. • Kolkata: The OBO organised various programmes for spreading and enhancing customer awareness about the BOS among the members of public. The OBO sensitised the bank customers about the Dos and Don’ts on the various financial products (Credit Card, Business loan, Personal loan, Insurance policies) and services like internet banking, ATM services, mobile banking, Loans & Advances, Term Deposits, pension, etc. The outreach programmes were generally conducted in rural, urban and semi-urban areas in close co-ordination with the stake holders, including the Banks, Bank customers and members of general public who attended these programmes, shared their experiences, and received clarifications to their queries. On-the-spot redressal of grievances wherever possible was also done in these programmes. Advertisements about the Scheme were published in major newspapers in Bengali, Hindi and English. • Mumbai: Awareness Programmes were organized at Panaji-Goa and Palghar-Maharashtra. Local bankers, customers and senior citizens’ associations participated in these programmes. A meeting was also held with the local bankers wherein the Banking Ombudsman impressed upon them the need to provide good customer service The Banking Ombudsman arranged for spot resolution of complaints during these programmes. A Town Hall event was organized at Kolhapur which was attended by about 800 customers and the local representatives of several banks. • New Delhi: The OBO organised three outreach programmes in the state of Jammu and Kashmir. Banks were advised to take steps to educate their customers on an ongoing basis about their financial products, use of ATM/internet banking etc., and various precautions to be taken while using their products with a view to reduce/minimize generation of complaints. In addition to the above, the office participated in town hall / outreach events/ customer meets conducted by various other departments of the RBI. • Patna: The OBO organized seven awareness programmes on BOS including one Town Hall Event at Hazaribagh (Jharkhand), Jagdishpur (Ara-Bihar), Ratu (Ranchi-Jharkhand), Rampura Village (Darbhanga-Bihar), Danapur Cantt (Patna-Bihar), Ramgarh (Jharkhand) and Darbhanga (Bihar). Apart from explaining the features of the Banking Ombudsman Scheme, the participants were encouraged to share their experiences in the use of banking products. Office also ensured that most of the queries and complaints/problems raised during such programmes were addressed satisfactorily on the spot. OBO participated in the financial literacy and awareness programme conducted by RBI, Patna during Rajgir Mahotsav at Rajgir where information regarding BOS was disseminated amongst the public through distribution, displays & posters. The office also participated in Sonepur Mela to spread awareness about the Banking Ombudsmen Scheme. • Thiruvananthapuram: A Town Hall event and outreach/awareness programmes were held at Erattayar, Kanthalloor-Marayoor in Idukki District, Ambalapuzha Taluk in Alappuzha District, Perumkadavila in Thiruvananthapuram District. The highlights of the BOS, customer protection, customer awareness and counselling were effectively conveyed and queries from audience were replied in these programmes. 'On the spot' redressal of complaints was also done by the BO. Town Hall event was organised at Haripad, Alappuzha District. The Heads of major banks in Haripad Taluk, customers of various banks, Defense personnel, Pensioners and general public participated in large number. The BO participated in a live awareness programme on Doordarshan and answered questions raised by the viewers in the phone-in programme. The BO undertook incognito visits to some bank branches. Banks were advised to rectify the deficiencies observed during these visits. OBO participated in customer service meetings conducted by branches of various banks at different locations of Kerala with the objective of gauging the customer service rendered by banks to its customers. 9.6 Press Meetings The OBOs arranged meetings with local media and shared the information on number and nature of complaints handled / resolved and significant / exemplary cases handled during the year. 9.7 Meetings with Nodal Officers of Banks OBOs conducted periodical meetings with Nodal Officers of the banks under their jurisdiction and discussed the systemic issues and corrective measures to be taken. Information on various developments in consumer protection and initiatives of RBI was shared with the bankers. 9.8 Skill building In their endeavour to keep the staff update with latest developments in banking in addition to In-house training workshops, OBOs arranged training programmes for their staff in coordination with external institutions like IDRBT, NPCI, etc. OBOs also deputed their staff to the training programmes conducted by the Zonal Training Centre, RBI, New Delhi and Reserve Bank Staff College, Chennai. 10. Consumer Protection and Awareness

Initiatives by Reserve Bank of India 10.1 On account of fast increasing customer base in banks predominantly by new and vulnerable class of the society and introduction of technology based banking products, consumer protection and awareness has assumed crucial role for the RBI. Over the years through policy interventions and oversight, RBI has ensured that the interests of the customers are safeguarded. With increasing instances of common public falling prey to fictitious offers of money, RBI has focused on spreading awareness about such offers of money among members of public. Some of the important initiatives taken by RBI during the year are given in the following paras. 10.2 Sale of third party products by banks - Incognito visits to assess customer service In view of the increasing complaints of mis-selling / forced selling of insurance products / mutual fund products by banks, RBI through its regional offices carried out incognito visits to bank branches involved in selling of such products. These visits were specifically undertaken to branches in semi-urban and rural areas across the country to assess the issues relating to mis-selling prevalent in those areas. Following are some of the major findings of these visits: -

No due diligence about the needs and capabilities of customers -

Overlooking suitability and appropriateness of the product to the customers -

Targets and incentives driven sales -

Debiting insurance premium to the loan account of the customer without consent. -

Not conveying the availability of other products to customers. -

Cross sale of TPP made mandatory as a part of the product terms and conditions -

Not giving their customers the option to avail products from other agencies. 10.3 Review of the Banking Ombudsman Scheme 10.3(i) A comprehensive review of the Banking Ombudsman Scheme 2006 was undertaken by RBI during the year. The aspects considered in this review of are: -

Increasing pecuniary jurisdiction of the award passed by the BO -

Increasing the ceiling on the amount of an Award -

Compensation for loss of time, expenses, harassment and mental anguish (as applicable in Credit Card Complaints) -

Inclusion of a few additional grounds of complaint under the Scheme -

Rationalization of the clauses provided for rejection of complaint by BO and enlarging the scope of appealable clauses under the Scheme -