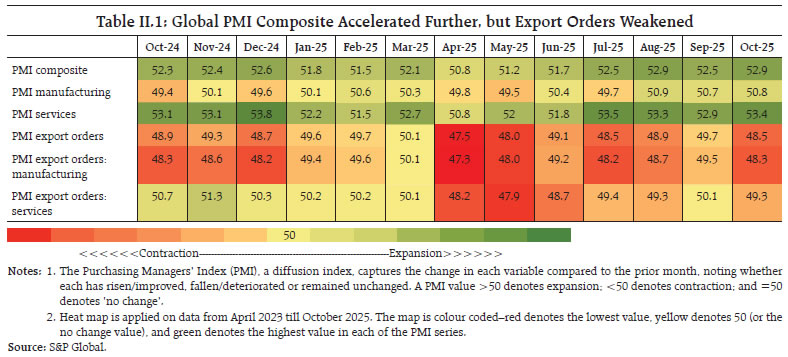

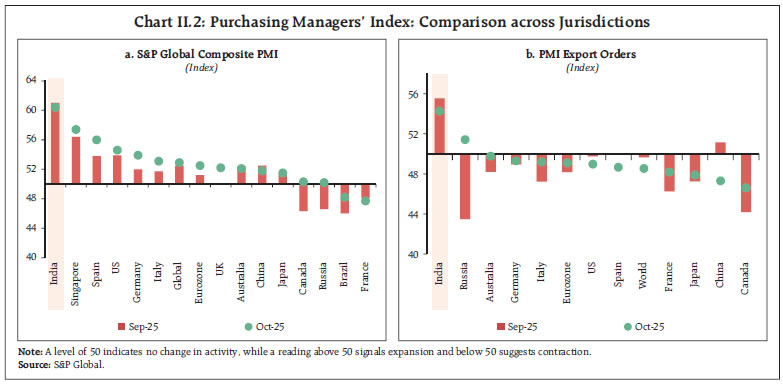

Global uncertainty remains elevated, although October witnessed a slight pullback after more than a year of continuous increase. Concerns persist about the heightened exuberance in global equity markets, raising questions about its sustainability and its implications for financial stability. The Indian economy showed signs of a further pick up in momentum, despite continuing global headwinds. Available high-frequency indicators for October suggest a robust expansion in both manufacturing and services activities, supported by festive season demand and the ongoing positive impact of the GST reforms. Inflation has moderated to a historic low and remained well below the target rate. Financial conditions remained benign, and the flow of financial resources to the commercial sector increased significantly from a year ago. Introduction Global uncertainty remains elevated, although October witnessed a slight pullback after more than a year of continuous increase. World trade and policy uncertainties also retreated. Financial market volatility, which had moderated in October, resurged in November due to concerns over stretched valuations in AI stocks. In this context, concerns persist about the heightened exuberance in global equity markets, raising questions about its sustainability and the financial stability implications of any sharp correction. The global PMI composite indicated an expansion in business activity, supported by strong growth in services and resilient manufacturing. Reflecting the stifling effect of trade policy uncertainty, most of the major economies continued to witness a contraction in new export orders in October. Global commodity prices remained subdued on lower food and crude oil prices. Prices of industrial metals rose on fears of a supply shortage and higher imports by China. Gold prices saw a correction from a record high in mid-October in the second half due to reduced safe haven buying and a stronger dollar. Headline inflation eased in October across most advanced economies (AEs) and emerging market and developing economies (EMDEs). However, it remains elevated in AEs amidst persistent services inflation. Central banks, in November so far, by and large maintained status quo on policy rates, awaiting further clarity on the evolving macroeconomic situation. The Indian economy showed signs of a further pick up in momentum, despite lingering external sector headwinds. Demand conditions exhibited signs of improvement with the revival of urban demand and continued strength in rural demand. High-frequency indicators of overall economic activity remained robust in October, supported by Goods and Services Tax (GST) rate reductions and a pick up in festive spending. GST collections improved over the previous month, indicating a strong pick up in consumer demand. Sowing of all rabi crops is progressing well following the harvesting of kharif crops. High-frequency indicators for October suggest further broadening of manufacturing activity and continued robust expansion in the services sector. Merchandise trade deficit widened to an all-time high in October 2025. While exports contracted after remaining in expansion for three months, reflecting the adverse impact from global headwinds, imports surged on account of higher gold and silver imports, catering to the festive demand. To mitigate the impact of trade disruptions on exports arising on account of global headwinds, the Reserve Bank implemented various trade relief measures for exporters with immediate effect.1 Tariff exemptions on some agricultural products by the US on November 14, 2025 will help Indian exports.2 Headline consumer price index (CPI) inflation declined by 1.2 percentage points in October to touch an all-time low in the current (2012=100 base year) series. The fall in inflation was driven by a decline in food prices and the GST rate cut on goods and services prices, besides favourable base effects. The deepening of deflation in CPI food in October took it to its lowest point in the current series. Core inflation (CPI excluding food and fuel) moderated marginally. However, excluding the impact of high gold and silver prices, the decline in core inflation was steeper, falling to an all-time low. Financial conditions remained benign with system liquidity largely in surplus during the second half of October and November. The weighted average call rate – the operating target of monetary policy – was aligned with the policy repo rate. Yields on three-month commercial papers averaged around the same level. At the same time, interest rates on certificates of deposit edged up slightly while that on treasury bills moderated. In the fixed income segment, the yield curve shifted slightly upwards especially at the longer end. During April-October 2025-26, the flow of financial resources to the commercial sector increased significantly compared to the same period a year ago. Non-bank sources, primarily corporate bond issuances, credit by non-banking financial companies and foreign direct investment to India, were the key drivers, even as bank credit growth remained steady. Indian equity markets gained in October-November amidst positive cues on India-US trade deal and healthy corporate earnings for Q2:2025-26. Primary market mobilisation also recorded a significant increase in October over the previous month. The initial public offerings (IPOs) mobilisation during April-October 2025 was markedly higher than last year, with strong participation from both FPIs and DIIs. In the midst of continuing uncertainty on global trade policies and concerns about their domestic impact, Indian economy continues to be resilient to external sector shocks, backed by strong services exports, robust remittance receipts, and benign oil prices. Foreign exchange reserves remain adequate to cushion adverse external shocks. External debt as a proportion of GDP remains low and stable. Further, the share of short-term debt in total external debt remains low. Set against this backdrop, the remainder of the article is structured into four sections. Section II covers the rapidly evolving developments in the global economy. Section III provides an assessment of domestic macroeconomic conditions. Section IV encapsulates financial conditions in India, while Section V presents the concluding observations. II. Global Setting Global uncertainty remained elevated in October, although there was a slight pullback, a decline for the first time in over a year. Both world trade and policy uncertainties retreated. Financial market volatility, which had moderated in October, resurged in November due to concerns over stretched valuations in AI stocks (Charts II.1a and II.1b). The global PMI composite for October indicated an expansion in business activity, supported by strong growth in services and resilient manufacturing. New export orders for both services and manufacturing contracted signalling continuing weakness in global demand (Table II.1). Business activity, as indicated by PMI indices, expanded at a faster pace across major AEs, including the US, the UK, Japan, and Eurozone, whereas it continued to contract in France. Among major EMDEs, business activity expanded in India, China and Russia while it contracted in Brazil (Chart II.2a). Major economies continued to witness a contraction in new export orders in October, but India and Russia recorded an expansion (Chart II.2b).

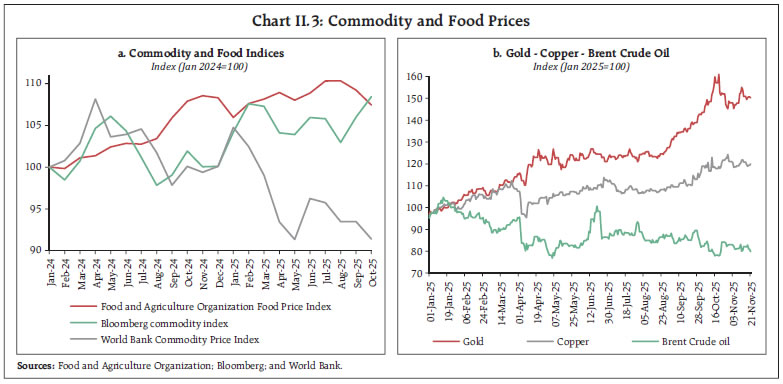

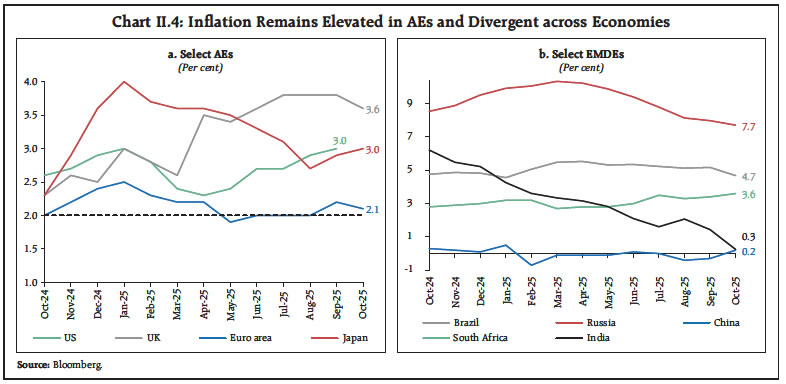

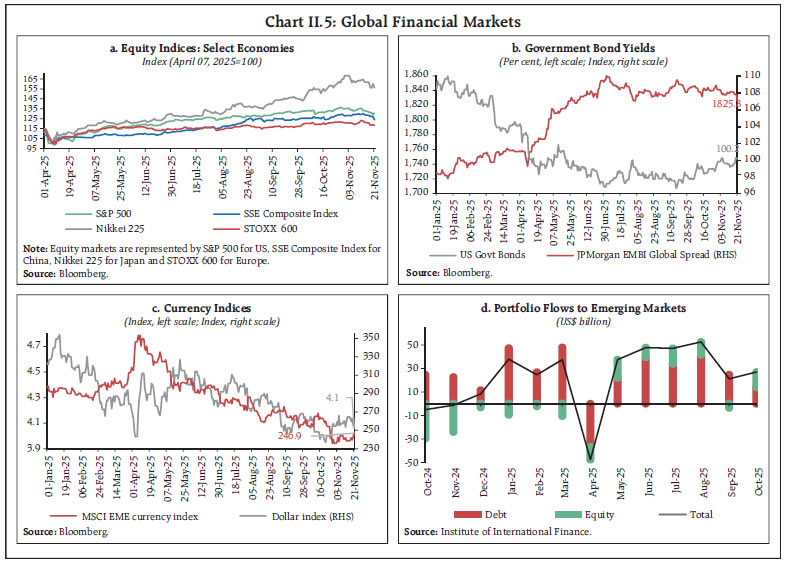

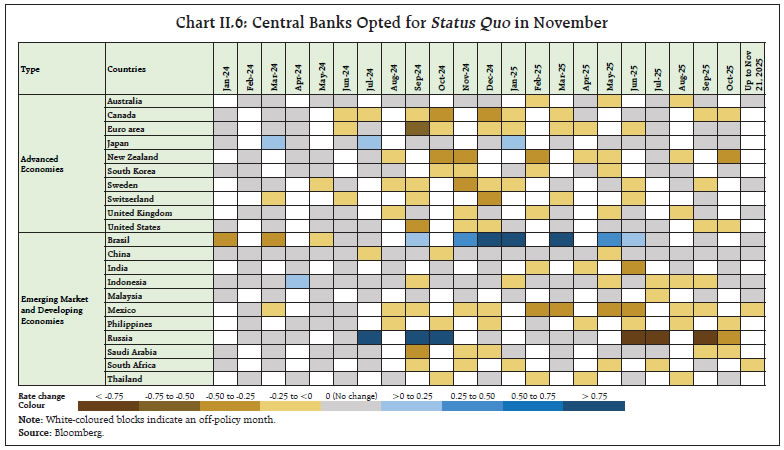

Global commodity prices, barring gold and silver, remained subdued. In October, the World Bank Commodity Price Index softened on lower food and crude oil prices. The Food and Agriculture Organization’s benchmark for world food commodity prices eased, marking its second consecutive monthly decline, with food prices barring vegetable oils registering a decline (Chart II.3a). Crude oil prices edged up in end-October following US sanctions on Russian oil firms. Thereafter, prices stabilised in November on sluggish demand and the forecast of excess supply conditions3. Copper prices edged up on fears of a supply shortage in major producing countries. While gold prices strengthened in the first half of October on safe-haven demand, it showed some decline since the latter half, in the wake of softening in safe-haven demand flowing from the US China trade truce and a strengthening US dollar. However, gold prices exhibited bi-directional movements in November on varying expectations of a Fed rate cut in December (Charts II.3a and II.3b).  Headline inflation eased in October across most AEs and EMDEs. However, it remains elevated in AEs amidst persistent services inflation. In the Euro area, headline inflation eased slightly in October and continued to hover around the ECB’s target. Inflation in the UK eased for the first time in five months (Chart II.4a). Among major EMDEs, inflation in Brazil declined to its lowest level since January while it continued to moderate in Russia. Deflationary pressures in China eased with inflation turning positive reversing a two-month decline (Chart II.4b). Equity markets in major economies rallied in October. In the US, renewed investor confidence stemming from a temporary let-up in trade tension with China, strong corporate earnings, the AI-driven rally, and the Federal Reserve’s rate cut boosted market exuberance, lifting valuations up. European equities also strengthened on the back of strong corporate earnings. Japan’s equity market reached record highs as investors anticipated expansionary fiscal and monetary policies under the newly elected prime minister. China’s markets also gained as easing trade tensions improved sentiment. In November, concerns on stretched valuations have triggered some correction in equity markets (Chart II.5a). In bond markets, US Treasury yields declined until the third week of October on safe-haven demand, a prolonged government shutdown, and Fed rate cut expectations. Yields, however, edged higher from the end of October on Fed Chair’s comments tempering further rate cut expectations. The JP Morgan Emerging Markets Bond Index (EMBI) spread narrowed in October, reflecting reduced risk-off pressures and lower risk premia amid improving emerging market fundamentals and easing trade tensions (Chart II.5b). The US dollar broadly strengthened till early November on increased safe-haven demand amidst the US government shutdown, and lower expectations of Fed rate cut in the December meeting. However, it fell thereafter as markets awaited official data releases post US government reopening. Emerging market currencies remained volatile, in tune with developments in US-China trade negotiations and varying expectations regarding Fed monetary policy (Chart II.5c). Even as debt flows moderated, portfolio flows to major emerging markets improved in October driven by a surge in equity flows on strong macroeconomic fundamentals and elevated expectations of US rate cut (Chart II.5d).  Central bank monetary policy rate actions across AEs and EMDEs presented a mixed picture in October, conditional on the evolving domestic growth inflation balance.4 In November so far, most of the central banks surveyed held their key policy rates. Among AEs, while the US, Canada, and New Zealand reduced benchmark rates in October due to concerns about a weakening labour market, the European Central Bank, the Bank of Japan, and the Bank of Korea held benchmark interest rates steady, adopting a cautious, data-driven approach amidst ongoing external challenges. Amongst the EMDEs, Philippines, Saudi Arabia and Russia cut their policy rates citing a combination of inflation and deteriorating growth outlook. China, Thailand and Indonesia held the benchmark rates steady, adopting a cautious approach to monitor the impact of previous rate cuts amidst significant downside risks to growth. In November so far, the UK, Sweden and Australia from the AEs and Brazil, Indonesia and China from the EMDEs kept the interest rates steady. Malaysia kept the policy rate unchanged over steady economic growth. Central banks of Mexico and South Africa, however, cut rates on growth concerns (Chart II.6).

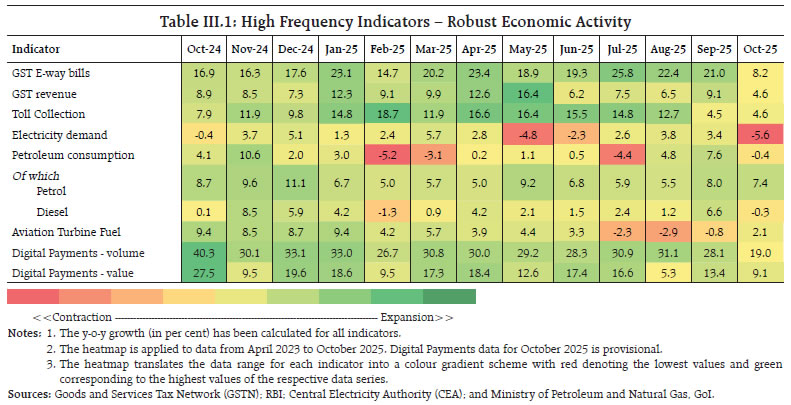

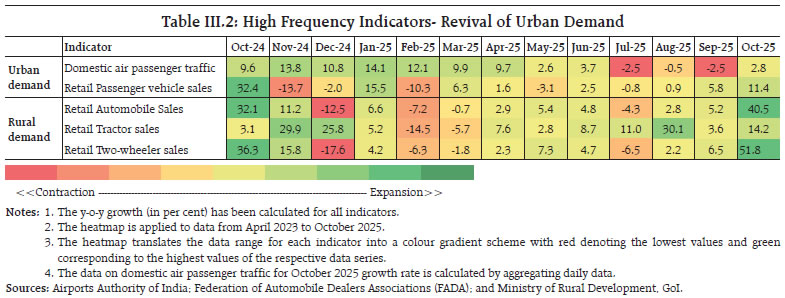

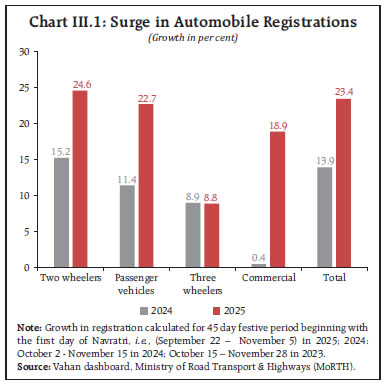

III. Domestic Developments The Indian economy showed signs of a further pick up in momentum, despite continuing global headwinds. Quarterly results of listed private companies in manufacturing and services show an uptick in sales growth. Available high-frequency indicators for October suggest a robust expansion in both manufacturing and services activities, supported by festive season demand and the ongoing positive impact of the Goods and Services Tax (GST) reforms. Inflation has moderated to a historic low and remained well below the target rate. Aggregate Demand The high-frequency indicators of overall economic activity remained robust in October, supported by Goods and Services Tax (GST) rate reductions and a pickup in festive spending. Despite a reduction in rates, GST collections registered a positive growth, albeit at a slower pace than the previous month. Digital payments registered a moderation in growth, in both volume and value, during October 2025 (Table III.1). Recent data on digital transactions also indicate a rising adoption and usage of digital payments across regions and merchant categories, including groceries and supermarkets, and gold purchases.5 Electricity demand declined due to unseasonal rainfall and the early onset of the winter season. Fuel demand presented a mixed picture, with petrol consumption rising due to increased mobility and travel during the festive season, while diesel consumption showed a marginal decline.6  During October, overall demand conditions showed signs of improvement. Rural demand steered overall demand, supported by favourable monsoon conditions, strong agricultural activity, GST rate reductions, and increased festive season spending. Rural demand for two-wheelers and automobiles registered a sharp pick up, as sales recorded the highest growth rate for both series. Urban demand also gained momentum, with passenger vehicle sales recording their highest growth in the past nine months (Table III.2). Vehicle registrations recorded strong growth across all major segments compared with the corresponding festive period last year7, reflecting strong consumer sentiment and the positive impact of GST rate cuts (Chart III.1).

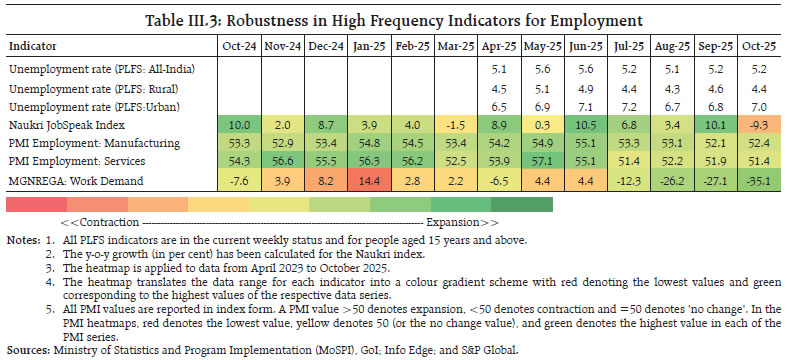

As per the Quarterly Bulletin of the Periodic Labour Force Survey (released on November 10, 2025), all India unemployment rate (among persons of age 15 years and above) declined to 5.2 per cent in Q2 from 5.4 per cent in Q1 with divergent trends across rural and urban areas. The unemployment rate in rural areas declined while that in urban areas increased slightly8. In October, based on the Monthly Bulletin, the all-India unemployment rate remained unchanged at 5.2 per cent, with a marginal decline in rural areas, while the urban unemployment rate increased. Labour force participation rate and worker population ratio increased to their highest level since May, driven by gains in rural areas. The PMI employment indices for both manufacturing and services remained within the expansionary zone. The Naukri JobSpeak Index experienced contraction in October, reflecting subdued momentum in white-collar hiring activity, partly due to the clustering of major festive holidays in the month. Meanwhile, the continuation of contraction in work demand under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) suggests improving rural labour market conditions (Table III.3).  During H1:2025-26 (April-September 2025), the gross fiscal deficit (GFD) of the union government was higher than the corresponding period of the previous year (Chart III.2).9 This was due to higher growth of capital expenditure10 accompanied by a contraction in the net tax receipts11. The growth in revenue expenditure, on the other hand, decelerated12. The decline in net tax receipts reflected a deceleration in growth for both direct and indirect taxes13. The slowdown in net tax collections during the period was partially offset by robust growth in non-tax revenue and non-debt capital receipts. The key deficit indicators of states during H1:2025-26 were higher than last year (Chart III.2b). This was largely on account of subdued revenue growth. While the collection of state goods and services tax and sales tax/VAT moderated, state excise and non-tax revenue registered robust growth. There was also a contraction in grants-in-aid from the centre. On the expenditure front, revenue expenditure growth was moderate, while capital expenditure rebounded sharply. During the year so far (April-October), the merchandise trade deficit was higher than last year, primarily driven by the gold as well as the non-oil non-gold deficit. India’s merchandise exports witnessed a marginal expansion supported by electronic goods, even as imports surged.14 In October, the merchandise trade deficit widened to an all-time high15 in (Chart III.3a)16. While exports contracted after remaining in expansion for three months, reflecting the adverse impact from global headwinds, imports surged on account of higher gold and silver imports catering to the festive demand (Chart III.3b)17. Net services exports growth accelerated in September18 with services exports growing faster and imports emerging out of contraction19. Services exports were driven by business services and software services exports (Chart III.4). Aggregate Supply Agriculture The final estimates for agricultural production in 2024–25 indicate a record output of foodgrains, led by higher production of rice, wheat, maize and moong. Oilseeds output also increased, supported by gains in groundnut and soybean.20 Excess rainfall conditions were witnessed in the post-monsoon period this year owing to cyclone Montha and depression in the Arabian sea, which is in sharp contrast to the shortfall witnessed last year (Chart III.5a). Consequently, the average storage level in major reservoirs in the country has reached a historic high compared to the corresponding period in the previous years, which augurs well for the ongoing rabi season sowing (Chart III.5b).21

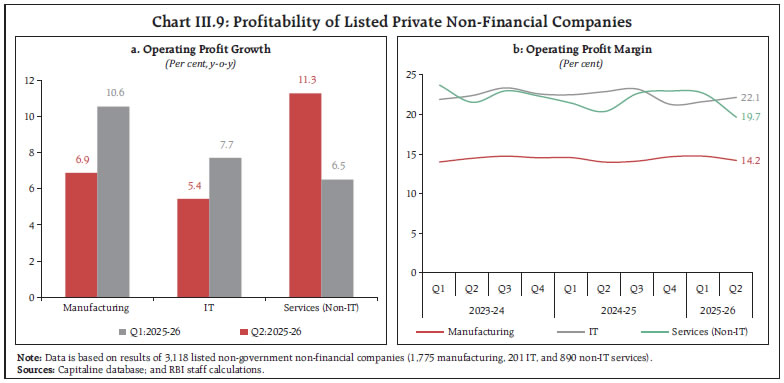

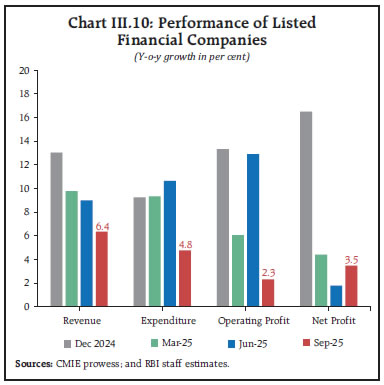

Rabi season sowing is progressing well across crops with wheat, rice, pulses, oilseeds and coarse cereals recording higher sowing so far (Chart III.6).22 Aided by higher production and lower market price, procurement of rice during the kharif marketing year 2025-26 so far (September 10 to November 21, 2025) has surpassed last year’s level.23 Consequently, the stock of rice with the Food Corporation of India has reached its highest level in recent years.24 The stock of wheat also remains comfortable at 1.5 times the buffer requirement (Chart III.7). Industry and Services Quarterly results of listed non-government non-financial25 companies for Q2:2025-26 show an uptick.26 Sales growth of listed private manufacturing companies inched up despite a contraction in the petroleum industry.27 Sales growth of IT companies and non-IT services companies also inched up (Chart III.8). Operating profit and operating profit margin of manufacturing companies have risen on a year-on-year basis during Q2:2025-26. However, operating profit margin moderated from the previous quarter. Within the services sector, operating profit and operating profit margin of IT companies expanded sequentially, aided by cost rationalisation, but they moderated for non-IT services companies (Chart III.9). During Q2:2025-26, revenue growth for listed Indian banking and financial sector companies moderated, while net profit growth increased (Chart III.10). 0  On the investment front, the total cost of capex projects sanctioned by banks and financial institutions (FIs) during Q2:2025-26 surged over the previous quarter pointing to improved investment optimism among private corporates. Power, construction, roads and bridges constituted the majority of the intended investment. Funds raised for capex through external commercial borrowings (ECBs) and initial public offerings (IPOs) also increased compared to the preceding quarter (Chart III.11). Monthly Indicators of Industrial Activity In September, growth in industrial activity, as measured by the year-on-year change in the Index of Industrial Production (IIP), was more or less steady. While electricity continued to expand, mining activity contracted after strong growth in the previous month. Growth in manufacturing activity picked up. Infrastructure/construction goods and consumer durables were the best performers with double-digit growth. In October, the combined index of eight core industries remained unchanged, as growth in steel, cement, fertilisers and refinery products was offset by contractions in coal, electricity, natural gas and crude oil.  The available high-frequency indicators for October point to sustained strength in manufacturing activity. The manufacturing Purchasing Managers’ Index (PMI) accelerated during the month, supported by a sharp expansion in output and new orders, underpinned by resilient domestic demand and the continued positive effects of Goods and Services Tax (GST) reforms. Steel output grew strongly, reflecting continued momentum in infrastructure and construction activity. Automobile production showed mixed signals as passenger vehicle segment and three wheelers recorded robust growth while production of two-wheeler declined (Table III.4). Green energy loans are gaining traction in India as bank credit to the renewable energy sector showed a triple digit growth in September (y-o-y) driven by consistent policy support as well as growing investor and consumer demand (Chart III.12). According to the International Energy Agency (IEA)28, India’s clean energy expansion is on track with its renewables market expected to emerge as the world’s second largest by 2030.29

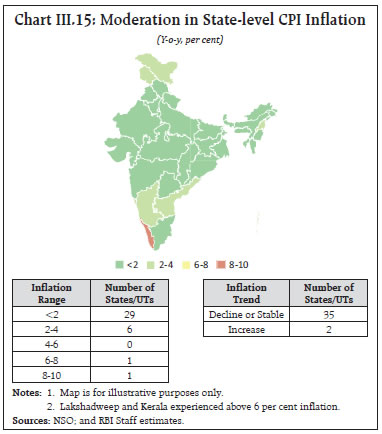

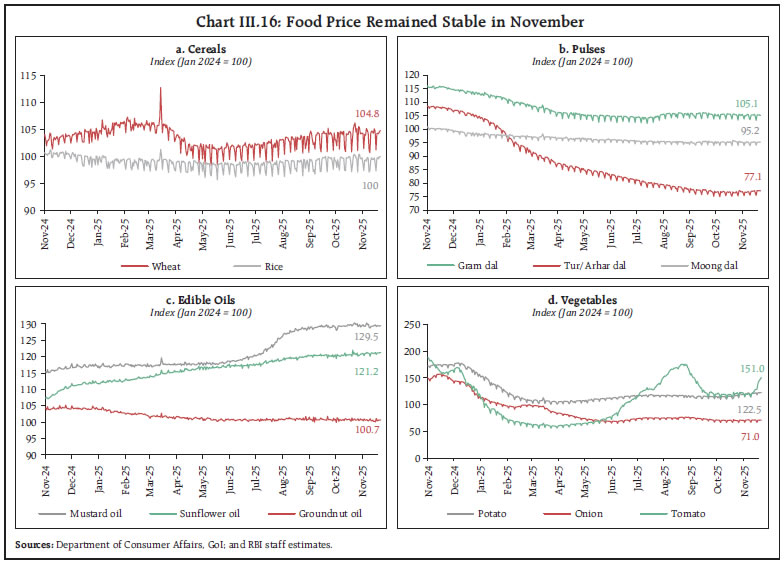

Electric vehicles industry has been showcasing impressive growth with the total EV registrations reaching an all-time high in October. Within the EV segment, electric two-wheeler category crossed the milestone of one million sales during 2025 so far reflecting a transformative shift towards green mobility. Monthly Indicators of Services Activity India’s services sector demonstrated sustained expansionary momentum, supported by robust festive demand and GST relief. However, unseasonal rains led to some sequential softening in activity in October. Sales of retail commercial vehicles rose to near three-year high. Growth in port traffic accelerated, led by an uptick in petroleum, oil & lubricants and containerised cargo. Growth in cement production improved, while steel consumption moderated (Table III.5). Inflation Headline CPI inflation declined in October to touch an all-time low in the current (2012=100 base year) series. Headline CPI inflation, moderated to 0.3 per cent in October 2025 from 1.4 per cent in September.30 The fall in inflation was driven by the deepening of deflation in food prices and impact of the GST rate cut on goods and services prices, amid large favourable base effects (Chart III.13).31 The deflation in the food group deepened on account of a decline in the prices of vegetables, pulses and spices.32 Inflation in sub-groups such as cereals, meat and fish, milk and products, eggs, oils and fats, fruits, prepared meals, and non-alcoholic beverages moderated (Chart III.14). Fuel and light inflation remained at 2.0 per cent in October, the same as in September. Inflation continued to remain elevated for LPG while it remained low and steady in electricity. Core (i.e., CPI excluding food and fuel) inflation moderated to 4.3 per cent in October 2025 from 4.4 per cent in September driven by clothing and footwear, health, recreation and amusement, and transport and communication subgroups. Education, pan, tobacco and intoxicants, and personal care and effects subgroups recorded an increase in inflation. Excluding precious metals, the core component recorded a decline of 0.1 per cent from the previous month, reflecting the impact of GST rate cuts. Inflation in both rural and urban areas eased in October with the former registering deflation of 0.3 per cent while the latter recording inflation of 0.9 per cent. While inflation ranged from (–) 2.9 per cent to 8.6 per cent across states/UTs, majority of states recorded inflation below 2 per cent. Overall, a broad-based moderation in state-level inflation was observed, as it declined or remained stable in 35 out of 37 states/UTs (Chart III.15). High-frequency food price data for November so far (up to 21st) point towards a moderation in cereal prices. Among pulses, prices moderated for gram and moong dal while it increased marginally for tur/arhar dal. Within edible oils, sunflower oil prices increased, groundnut oil prices eased, and mustard oil prices stayed stable. Prices of key vegetables (tomato, onion, and potato) hardened (Chart III.16).

| Table III.6: Petroleum Products Prices | | Item | Unit | Domestic Prices | Month-over-month

(per cent) | | Nov-24 | Oct-25 | Nov-25^ | Oct-25 | Nov-25^ | | Petrol | ₹/litre | 100.99 | 101.1 | 101.1 | 0.0 | 0.0 | | Diesel | ₹/litre | 90.45 | 90.5 | 90.5 | 0.0 | 0.0 | | Kerosene (subsidised) | ₹/litre | 43.4 | 45.4 | 45.4 | 3.4 | 0.0 | | LPG (non-subsidised) | ₹/cylinder | 813.3 | 863.3 | 863.3 | 0.0 | 0.0 | ^: For the period November 1-21, 2025.

Note: Other than kerosene, prices represent the average Indian Oil Corporation Limited (IOCL) prices in four major metros (Delhi, Kolkata, Mumbai and Chennai). For kerosene, prices denote the average of subsidised prices in Kolkata, Mumbai and Chennai.

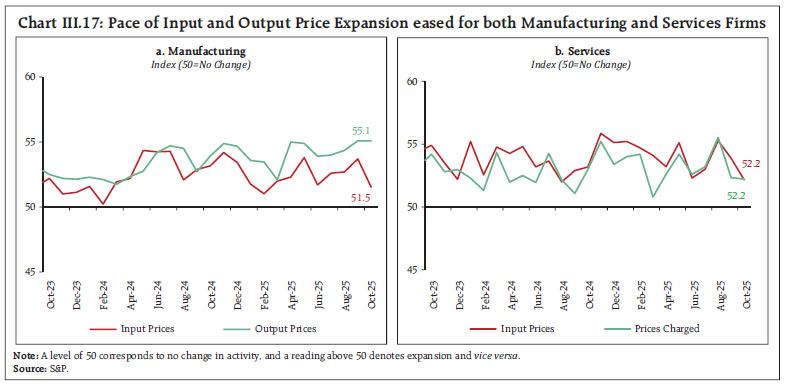

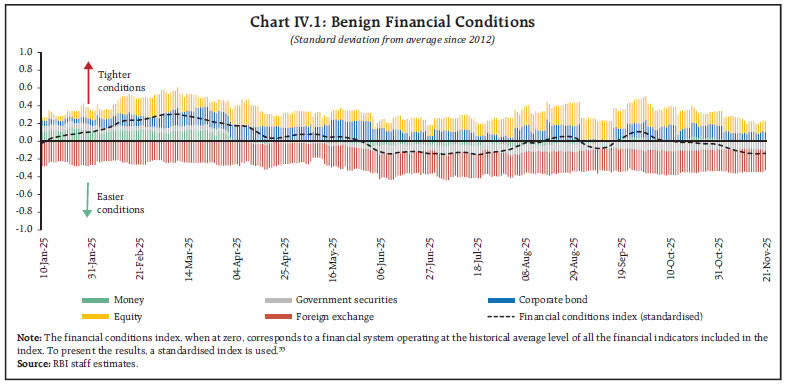

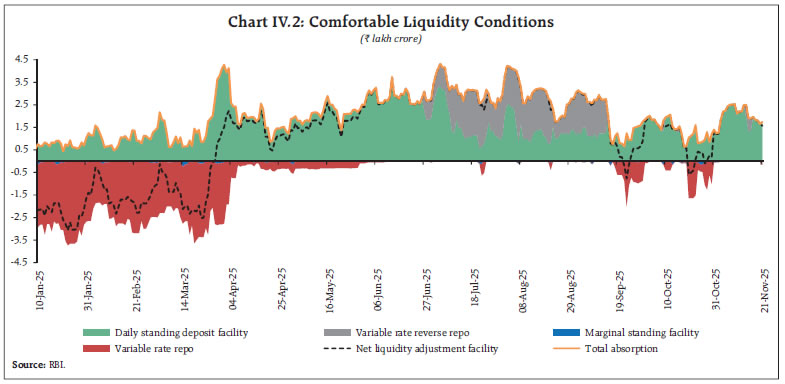

Sources: IOCL; Petroleum Planning and Analysis Cell (PPAC); and RBI staff estimates. | Retail selling prices of petrol, diesel, kerosene and LPG remained unchanged in November (up to 21st) [Table III.6]. In October, the PMIs for manufacturing recorded a moderation in the rate of expansion of both input and output prices with a sharper fall in the former. For services, deceleration was seen in both input prices and selling prices due to GST reforms (Chart III.17). IV. Financial Conditions Overall financial conditions remained benign in October and November (up to 21st), primarily due to easing in the equity and corporate bond markets (Chart IV.1). System liquidity remained in surplus during the second half of October and November (up to 21st), though temporary increases in government cash balances and a rise in currency-in-circulation due to festival-related demand led to some episodes of liquidity deficit in the second half of October. Overall, average net absorption under the liquidity adjustment facility increased marginally to ₹1.3 lakh crore during October 16 to November 21, from ₹1.0 lakh crore in the preceding one-month period, supported by CRR cuts (Chart IV.2). To offset the transient liquidity tightness during this period, the Reserve Bank conducted 11 variable rate repo auctions (overnight to 7-day maturity). With an improvement in overall liquidity conditions, a 3-day VRRR was conducted on November 14 which absorbed surplus liquidity of around ₹0.57 lakh crore against the notified amount of ₹1.0 lakh crore. Average balances under the standing deposit facility remained marginally higher, and banks’ recourse to the marginal standing facility remained unchanged.34

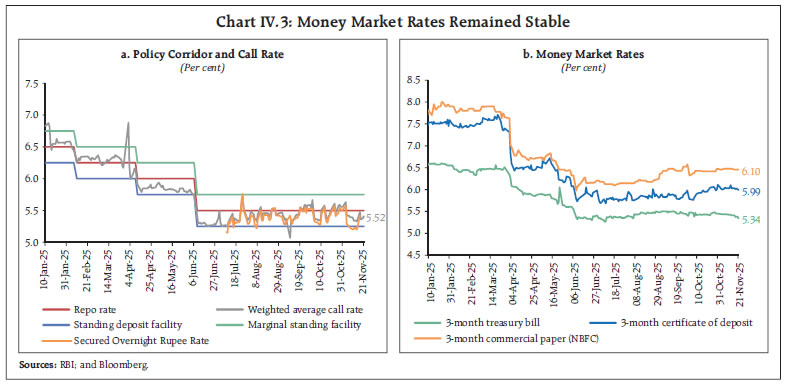

Money Market The weighted average call rate (WACR) remained broadly aligned with the policy repo rate in October and November, despite some temporary liquidity squeezes in the second half of October. The WACR hovered within the policy corridor as liquidity conditions improved since the beginning of November. Overall, the WACR remained unchanged on an average at 5.5 per cent during October 16 to November 21, 2025, compared with the preceding one-month period (Chart IV.3a). Overnight rates in the collateralised segments – as measured by the benchmark secured overnight rupee rate – moved in tandem with the uncollateralised rate. Yields on three-month commercial papers issued by non-banking financial companies averaged around the same level. At the same time, interest rates on certificates of deposit edged up slightly on account of rising credit-deposit ratio, while that on treasury bills moderated (Chart IV.3b).35 The average risk premium in the money market (the spread between the yields on 3-month commercial paper and 91-day treasury bill) recorded a mild uptick.36

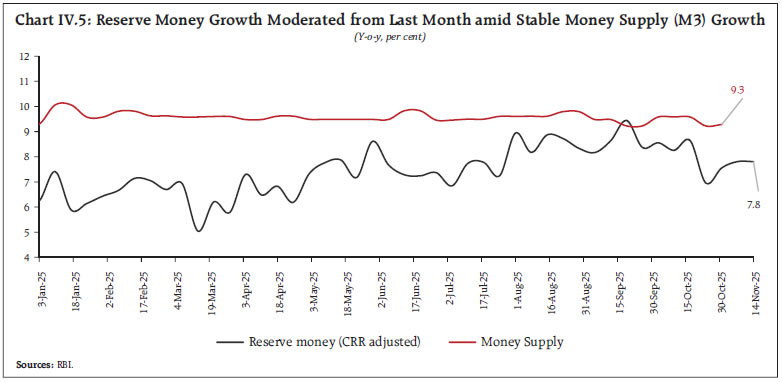

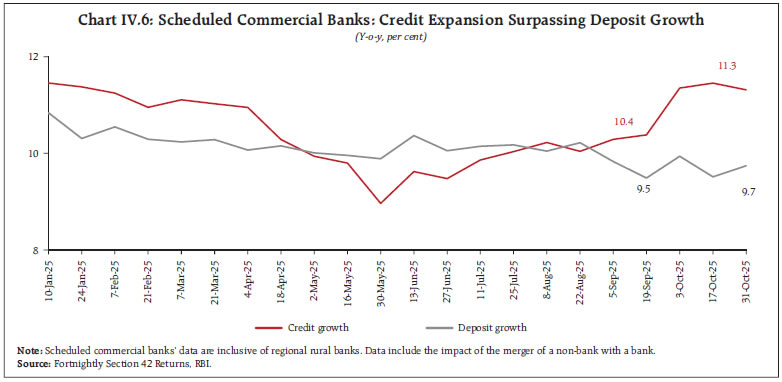

Government Securities (G-Sec) Market In the fixed income segment, the yield curve slightly shifted upwards especially at the longer end, during the second half of October and into November (up to 21st).37 The average term spread (the difference between the yields of 10-year G-sec and 91-day treasury bill) inched up marginally during the period (Charts IV.4a and IV.4b).38 Corporate Bond Market Corporate bond yields generally softened across tenors and rating spectrum (Table IV.1). New corporate bond issuances increased in September compared to August. On a cumulative basis, too, total issuances were marginally higher in the current financial year compared to the previous year.39 Money and Credit During November so far (up to 14th), reserve money growth declined, tracking the movements in currency in circulation.40 The moderation of growth in currency in circulation was primarily due to the waning of festive demand. The growth in money supply (M3) remained steady (Chart IV.5).41 Credit growth of scheduled commercial banks (SCBs) picked up further in October. Deposit growth, on the other hand, remained steady. With the pace of credit expansion outpacing deposit growth, the wedge between credit and deposit growth widened to 160 bps from 90 bps in last month (Chart IV.6).42,43 | Table IV.1: Corporate Bonds - Yields and Spreads | | Instrument | Interest Rates

(Per cent) | Spread (bps) | | (Over Corresponding Risk-free Rate) | | September 16, 2025 – October 15, 2025 | October 16, 2025 – November 20, 2025 | Variation | September 16, 2025 – October 15, 2025 | October 16, 2025 – November 20, 2025 | Variation | | 1 | 2 | 3 | (4 = 3-2) | 5 | 6 | (7 = 6-5) | | (i) AAA (1-year) | 6.69 | 6.72 | 3 | 104 | 108 | 4 | | (ii) AAA (3-year) | 7.05 | 7.01 | -4 | 108 | 103 | -5 | | (iii) AAA (5-year) | 7.21 | 7.20 | -1 | 92 | 85 | -7 | | (iv) AA (3-year) | 8.18 | 8.08 | -10 | 221 | 208 | -13 | | (v) BBB- (3-year) | 11.86 | 11.76 | -10 | 590 | 572 | -18 | Note: Yields and spreads are computed as averages for the respective periods.

Source: FIMMDA. |

During 2025-26 so far (up to October 31), total flow of financial resources to commercial sector increased to ₹20.1 lakh crore from ₹16.2 lakh crore a year ago. Non-bank sources − corporate bond issuances, credit by non-banking financial companies and foreign direct investment to India − showed a marked increase in the year so far (Table IV.2). As on October 31, the total outstanding credit to commercial sector rose by 13.0 per cent from 12.0 per cent last year, with non-bank sources registering a growth of 17.2 per cent compared to 12.4 per cent a year ago (Table IV.3).44.

| Table IV.2: Flow of Financial Resources to Commercial Sector in India | | (₹ crore) | | Source | April-March | Up to October 31 | | 2023-24 | 2024-25 | 2024-25 | 2025-26 P | | A. Non-Food Bank Credit | 21,40,243 | 17,98,321 | 9,80,394 | 11,12,687 | | B. Non-Bank Sources (B1+B2) | 12,63,721 | 17,10,459 | 6,43,105 | 8,95,813 | | B1. Domestic Sources | 10,20,302 | 13,85,609 | 5,04,612 | 6,70,531 | | B2. Foreign Sources | 2,43,419 | 3,24,850 | 1,38,493 | 2,25,282 | | C. Total Flow of Resources (A+B) | 34,03,964 | 35,08,780 | 16,23,499 | 20,08,500 | P: Provisional.

Note: For detailed notes, please refer to Current Statistics Table No: 18(a).

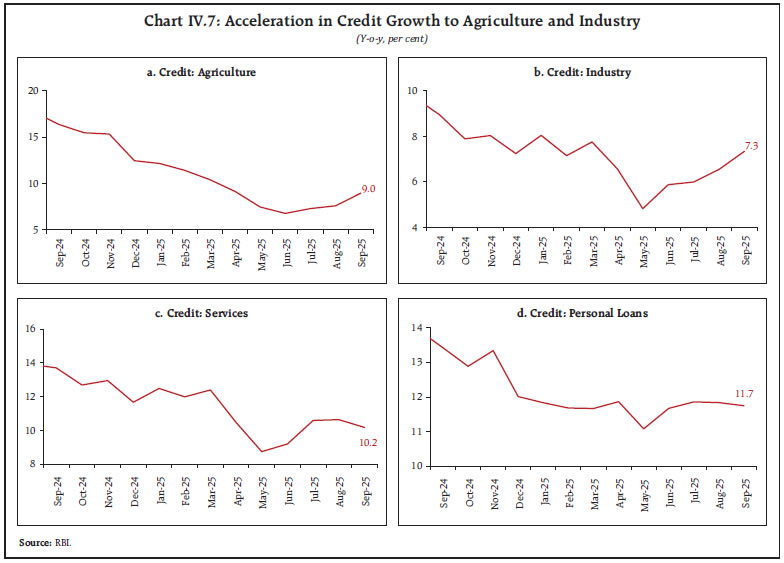

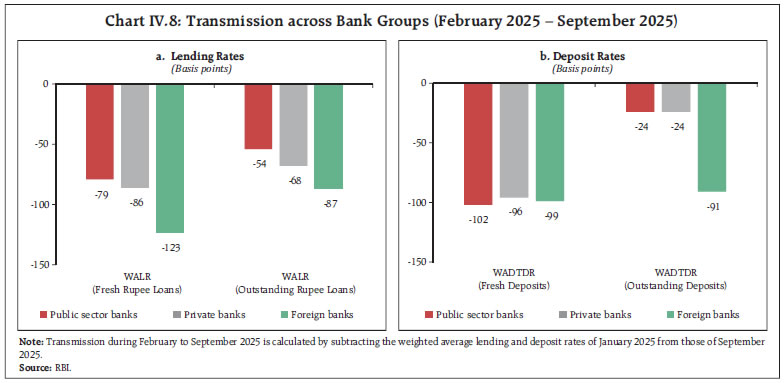

Sources: RBI; SEBI; and AIFIs; and RBI staff estimates. | Across key sectors, bank credit continued to exhibit steady growth in September, led by personal loans, services, and industry (Chart IV.7).45,46 Personal loans sustained double-digit growth, with housing credit registering a modest increase, even as growth in vehicle and gold loans moderated. Credit to the services sector witnessed a marginal deceleration in growth. Non-banking financial companies (NBFCs) – the largest recipients of services sector credit – and commercial real estate, however, recorded improvements. Within the industrial sector, infrastructure and engineering segments observed a rise in credit growth. The credit to the micro, small, and medium enterprises (MSMEs) segment accelerated further, and it continued to be the key driver of industrial credit growth. The agriculture sector also witnessed an improvement in credit flow. Deposit and Lending Rates In response to the cumulative 100 basis points reduction in the policy repo rate since February 2025, the one-year marginal cost of funds-based lending rate of scheduled commercial banks declined by 45 basis points during February-October 2025. The weighted average lending rates on both fresh and outstanding rupee loans also registered a decline during February-September 2025. On the deposit side, banks reduced rates on fresh term deposits. However, given the relatively longer maturity profile of term deposits, the outstanding deposits have moderated, although to a lesser extent (Table IV.4).

| Table IV.3: Outstanding Credit to Commercial Sector in India | | (₹ crore; Figures in parentheses are y-o-y percentage changes) | | Source | At End-March | As on October 31 | | 2024 | 2025 | 2024 | 2025 P | | A. Non-Food Bank Credit | 1,64,09,083 | 1,82,07,441 | 1,73,89,477 | 1,93,20,128 | | | (20.2) | (11.0) | (11.7) | (11.1) | | B. Non-Bank Sources (B1+B2) | 77,56,314 | 88,85,434 | 81,00,470 | 94,90,483 | | | (4.2) | (14.6) | (12.4) | (17.2) | | B1. Domestic Sources | 56,59,037 | 66,37,411 | 59,73,684 | 71,54,605 | | | (4.9) | (17.3) | (15.8) | (19.8) | | B2. Foreign Sources | 20,97,277 | 22,48,023 | 21,26,786 | 23,35,877 | | | (2.4) | (7.2) | (3.8) | (9.8) | | C. Total Credit (A+B) | 2,41,65,397 | 2,70,92,875 | 2,54,89,947 | 2,88,10,611 | | | (14.5) | (12.1) | (12.0) | (13.0) | P: Provisional.

Notes: For detailed notes, please refer to Current Statistics Table No: 18(b).

Sources: RBI; SEBI; and AIFIs; and RBI staff estimates. |

| Table IV.4: Monetary Transmission to Banks’ Deposit and Lending Rates | | (Variation in basis points) | | | | Term Deposit Rates | Lending Rates | | Period | Repo Rate | WADTDR- Fresh Deposits | WADTDR- Outstanding Deposits | EBLR | 1-Year MCLR

(Median) | WALR - Fresh Rupee Loans | WALR- Outstanding Rupee Loans | | Overall | Interest Rate Effect # | | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | | Tightening Period | | | | | | | | | | May 2022 to Jan 2025 | +250 | 259 | 206 | 250 | 175 | 182 | 191 | 115 | | Easing Phase | | | | | | | | | | Feb 2025 to Sep* 2025 | -100 | -102 | -27 | -100 | -45 | -83 | -73 | -61 | Note: 1. Data on EBLR pertain to 32 domestic banks.

2. *Data on MCLR as in October 2025. #: At constant weight.

WALR: Weighted average lending rate; WADTDR; Weighted average domestic term deposit rate.

MCLR: Marginal cost of funds-based lending rate; EBLR: External benchmark-based lending rate. |

The decline in the weighted average lending rate on fresh and outstanding rupee loans was higher in the case of private banks relative to public sector banks (Chart IV.8). On the deposit side, transmission was higher for public sector banks compared to private banks. Equity Markets Indian equity markets gained in October-November as optimism surrounding India-US trade deal and corporate earnings for Q2:2025-26 offset the drag from uncertainty surrounding US-China trade negotiations. Domestic equity markets were also supported by a moderation in crude oil prices and a policy rate cut by the US Federal Reserve. Realty, oil and gas, and telecom emerged as the top-performing sectors during October. In equity markets, domestic institutional investors (DIIs) continued to be net buyers, while foreign portfolio investors (FPIs) turned net buyers in October after a phase of three consecutive months (Chart IV.9). Fund mobilisation through Initial Public Offers (IPOs) in the primary market remained strong in the current financial year, reflecting greater investor participation. Consistent with this trend, both FPIs and DIIs recorded positive cumulative flows in the primary market (Chart IV.10a).47 In contrast, in the secondary market, FPIs remained net sellers, while DIIs continued to register strong net purchases (Chart IV.10b).

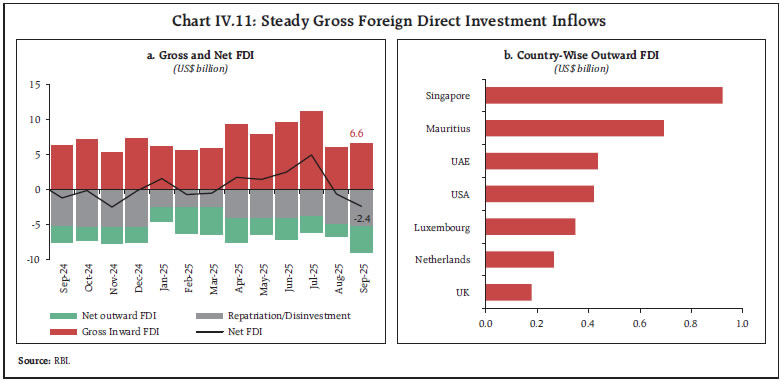

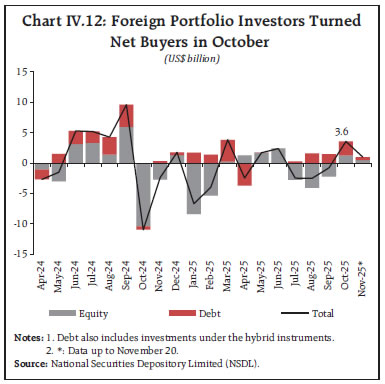

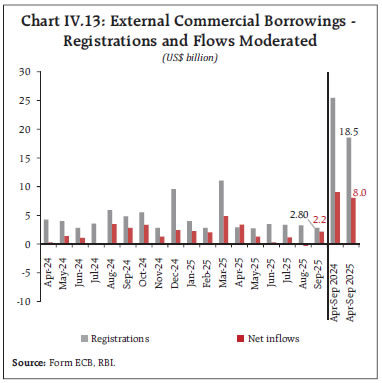

External Sources of Finance During April-September 2025, FDI was higher than the same period last year on both gross and net basis.48 Gross inward FDI remained robust in September, with Singapore, Mauritius, the UAE, Luxembourg, and Qatar together accounting for about 78 per cent of total inflows (Chart IV.11a). The major recipient sectors were manufacturing, retail & wholesale trade, communication services, financial services and computer services. However, net FDI turned negative for the second consecutive month due to a rise in outward FDI and repatriation.49 For outward FDI, the key destinations were Singapore, Mauritius, the UAE and the US, while major sectors included financial services, insurance & business services, agriculture & mining and manufacturing (Chart IV.11b).  During 2025–26 so far (up to November 20), net FPI registered inflows driven largely by the debt segment while equity registered net outflows.50 The debt segment continued to witness net inflows, supported by expectations of a US Fed rate cut and favourable yield differentials. In October, net FPI flows turned positive after three consecutive months of outflows, supported by robust quarterly earnings, improved valuations, and IPO issuances (Chart IV.12). In November so far (up to 20th), net FPI flows remained positive supported by both equity and debt segment. The registrations of external commercial borrowings (ECBs) moderated during April - September 2025. Despite this slowdown, inflows continued to outpace outflows resulting in net inflows of US$ 8.0 billion (Chart IV.13). Notably, 45 per cent of the total ECBs registered during this period were raised for capital expenditure.  Amidst global trade policy uncertainties and external sector headwinds, India’s economy is turning out to be more resilient to external shocks over time, backed by strong services exports, remittances receipts and oil prices becoming less detrimental to the current account sustainability. The increasing share of renewables in India’s energy mix is adding further resilience. Key external vulnerability indicators improved as of end-June from their levels at end-March 2025 (Table IV.5). The current account deficit to GDP ratio remained modest in Q1:2025-26. The external debt to GDP ratio also stayed at a comfortable level and the ratio of short-term debt to total external debt, and to total reserves remained low.51 In addition, the ratio of volatile capital flows (comprising cumulative portfolio inflows and outstanding short-term debt) to foreign exchange reserves has also declined.52 India’s foreign exchange reserves remain adequate to cushion the impact of any external shocks to the balance of payments (Chart IV.14).53

| Table IV.5: External Vulnerability Indicators | | Item | End-March 2013

(Pre-Taper Talk) | End-March 2024 | End-March 2025 | End-June 2025 | | Current account balance (per cent of GDP) | -4.8 | -0.7 | -0.6 | -0.2 | | External Debt (per cent of GDP) | 22.4 | 18.5 | 19.1 | 18.9 | | Short-term Debt (per cent of Reserves) | 59.0 | 44.9 | 45.4 | 43.6 | | International Investment Position (per cent of GDP) | -17.8 | -10.1 | -8.6 | -8.0 | | Reserve cover for imports (in months) | 7.0 | 11.3 | 11.0 | 11.4 | | Reserve to External Debt (per cent) | 71.3 | 96.7 | 90.8 | 93.4 | | Volatile capital flow (per cent of Reserves) | 96.1 | 69.8 | 69.0 | 66.6 | Note: The import cover data is based on annualised merchandise imports as per the balance of payments statistics.

Source: RBI. | Foreign Exchange Market The Indian rupee (INR) depreciated slightly against the US dollar in October, reflecting the impact of a stronger US dollar following the US Fed’s policy announcement around the end of the month. In mid-October, however, the INR registered a brief but sharp appreciation, supported by optimism over India-US trade talks and renewed net FPI inflows (Chart IV.15). Consequently, rupee volatility increased marginally during the month, although it remained relatively contained compared with most major currencies. In November so far (up to 21st), the INR appreciated slightly by 0.1 per cent over its end-October level. In real effective terms, the Indian rupee appreciated marginally in October mainly driven by appreciation in nominal effective exchange rate (Chart IV.16). V. Conclusion The month of October has seen a further pick up in demand conditions pointing towards a resilient growth outlook. Headline inflation has fallen to a historic low in October, significantly helped by favourable supply-side factors, including the prospects of a good kharif season and the reduction of GST rates. The external sector’s capacity to absorb shocks has also improved over time, building resilience amid global trade policy uncertainties. The World Bank’s Financial Sector Assessment (FSA) report of October 2025 highlighted a financial system growing in resilience and strength. Improved macroeconomic frameworks and outcomes have not only enhanced the ability of financial institutions to support the macroeconomy but also allowed the Reserve Bank to better calibrate regulatory measures, to improve the efficiency of financial intermediation and augment the flow of credit to the broader economy. The fiscal, monetary, and regulatory measures undertaken so far this year should pave the way for a virtuous cycle of higher private investment, productivity, and growth, leading to long-term economic resilience.

|