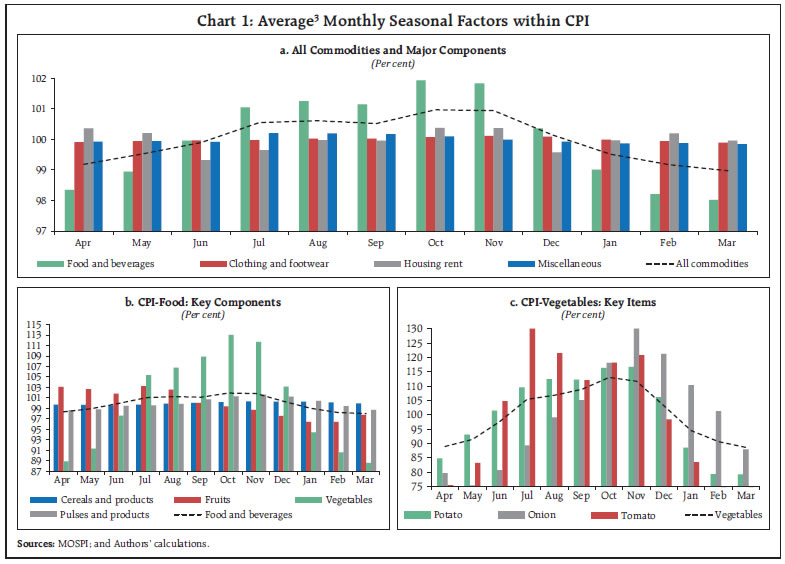

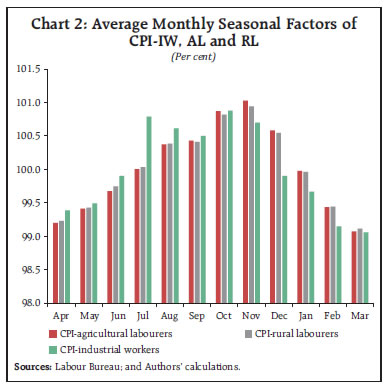

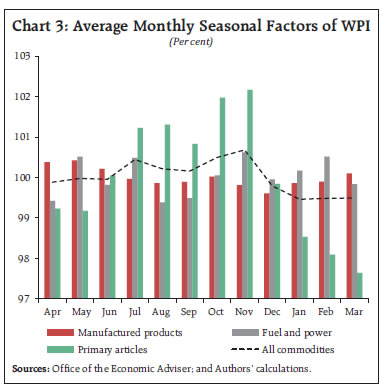

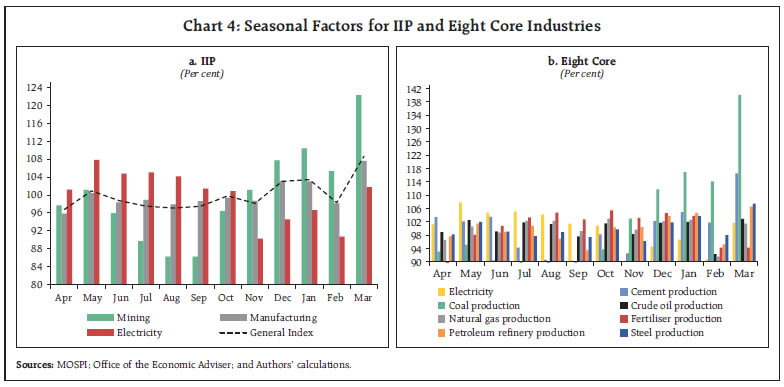

by Souvik Ghosh, Shivangee Misra, Anirban Sanyal and Sanjay Singh^ This article unveils the seasonal patterns in key economic indicators for India, analysing 78 monthly indicators across six major sectors—monetary and banking, payment systems, prices, industrial production, merchandise trade and services along with 25 quarterly indicators spanning national accounts, balance of payments, capacity utilisation of Indian manufacturing companies and forward looking enterprise surveys. Large seasonal fluctuations were noted in various economic indicators, including cash balances with RBI, demand deposits, vegetable prices, production across sectors and merchandise exports. The quarterly data reveal increased seasonality in real GDP, influenced by government expenditure. Among supply side components, GVA agriculture demonstrated the highest seasonal variations. Lastly, capacity utilisation and services exports also experienced high seasonal variation. Introduction Seasonality in macroeconomic indicators refers to recurring, predictable patterns that occur within a year. It is a fundamental component of the data generating process, alongside trend, cyclical variation and random fluctuations. Various factors, such as weather conditions, production cycles, the nature of economic activity, holidays and vacation periods influence the seasonal pattern of economic indicators. Seasonal adjustment involves removing these recurring patterns and calendar effects from time series data to better identify underlying long-term trend, cyclical movements and temporary changes, thereby providing a clearer picture of economic conditions. Since 1980, the Reserve Bank has been publishing monthly seasonal factors for key macroeconomic indicators.1 This article presents the estimates of seasonal patterns in key economic indicators for India. Economic activity came to a halt in 2020 due to the disruptions caused by the COVID-19 pandemic, followed by a gradual return to normalcy. This entire episode induced severe volatility in major macroeconomic variables, characterised by shortlived inter-temporal changes. In light of this, the analysis of seasonal factors accounts for possible changes in the temporary disruptions of these economic series before teasing out the seasonal patterns. To ensure the robustness of the findings, the stability of seasonal patterns is also cross-validated using pre-pandemic data. The rest of the article is organised as follows: Section II describes the data and methodology. Section III illustrates seasonal factor estimates and discusses seasonal variations in the selected economic series. The article concludes by summarising the findings in Section IV. II. Data and Methodology The article covers the seasonality analysis of major economic indicators at monthly and quarterly frequency. The quarterly variables were included for the first time in the analysis since the last release of this article in November 2024. The monthly variables span six key thematic areas: monetary and banking statistics, price indices, industrial production, services sector indicators, merchandise trade and payment systems. A comprehensive list of the 78 indicators under these categories is provided in Table A1-M1 (Annex I). The quarterly series includes data on national accounts, capacity utilisation (CU) and new orders from the order books, inventories and capacity utilisation survey (OBICUS), business assessment and expectations indices, component series from the industrial outlook survey (IOS) and external trade in services from the balance of payments (BoP) statistics. A full list of the 25 quarterly series used in the seasonality analysis is available in Table A2-Q1 (Annex II). Seasonal factors are estimated using a multiplicative time series model with the X13-ARIMA-SEATS software developed by the U.S. Census Bureau, adapted to Indian conditions by incorporating adjustments for Diwali and Indian trading day effects. The pandemic-infused volatility in the economic series and temporary changes in their data generating process are adjusted using an automatic outlier detection mechanism through three types of outliers, namely additive outliers (AO), temporary changes (TC) and level shifts (LS), which are checked subsequently to justify the economic interpretation. The seasonal factor estimates are provided in terms of last 10 years average, last year estimates, range of seasonal variations defined by the difference between the maximum and minimum of seasonal factors and model diagnostics. Recognising that the lack of longer time series data for the post-pandemic period may influence outlier detection and thereby, influence seasonal factor estimates, robustness checks are carried out by comparing the seasonal factor estimates of the pre-COVID sample (Technical Annex)2. III. Seasonality in Major Economic Variables in India III.1. Seasonality in Monthly Series Most of the economic variables examined in the study display stable seasonal patterns. Among the 14 selected monetary and banking indicators, 11 show seasonal peaks in either March or April, while 5 exhibit troughs in August. Reserve money, narrow money and bank credit typically peak in March, whereas broad money and aggregate deposits of scheduled commercial banks (SCBs) reach their seasonal high in April. Within aggregate deposits, demand deposits show a seasonal surge in March, while time deposits peak in April. Loans, cash credits and overdrafts by SCBs and non-food credit follow a similar seasonal peak in March. Seasonal trough occurs in February for aggregate deposits and in August for bank credit. SCBs’ investments tend to be higher in September and decline in March. Currency in circulation increases seasonally in April and tapers off in September (Table A1-M2, Annex I). Among the monetary and banking indicators, seasonal variations, measured by the range of the seasonal factors, are high in demand deposits, SCBs’ cash in hand and balances with RBI and narrow money. Seasonal variations in demand deposits remained steadfast at 5.5 percentage points in 2024-25, is lower than its last ten years’ average. On the other hand, the range of seasonal variations in the SCBs’ cash in hand and balances with RBI gradually increased over time and touched the highest value of 8.0 percentage points during 2024-25 (Table A1-M3, Annex I). Seasonal pattern in consumer price index-combined (CPI-C) shows that headline CPI typically attains seasonal peak in October and touches seasonal lowest by March, largely driven by the food and beverage component. Within food items, vegetables exhibit the most pronounced seasonal price fluctuations, with tomatoes, potatoes, and onions (TOP) contributing significantly to overall variation. Potato and onion prices rise in November, with seasonal pressures easing by March and May, respectively, while tomato prices increase in July and moderate by March (Chart 1 and Table A1-M2). Protein items such as meat, fish and eggs also display notable seasonality. In contrast, other major groups like clothing and footwear, housing and miscellaneous items experience relatively lower seasonal variation (Table A1-M3). Among the other major price indices, the consumer price index for industrial workers (CPI-IW) reaches its seasonal peak in October, whereas the consumer price indices for agricultural labourers (AL) and rural labourers (RL) peak in November. All three indices show seasonal easing in March. However, the seasonal fluctuations in CPI-IW, AL and RL were milder as compared to headline CPI-C during 2024-25 (Chart 2 and Tables A1-M2, A1-M3). Seasonal peak in wholesale prices generally happen in November, while easing is in January (Chart 3). The wholesale price index (WPI) for primary articles showed a seasonal variation of 4.6 percentage points in 2024-25, remaining close to last year’s level of 4.4 percentage points. While seasonal variations in WPI food articles have gradually increased, those for WPI fuel and manufactured products have remained stable within a narrow range (Table A1-M3). Industrial output, as measured by the index of industrial production (IIP), typically rises in March and moderates in April, largely due to seasonal patterns in the manufacturing sector. Mining activity also peaks in March, with a seasonal low in August. Electricity generation reaches its seasonal high in May and declines in November. Within manufacturing, seasonal peaks and troughs vary across subsectors. Food product manufacturing sees a peak in December, while beverage production reaches its seasonal high in May. The lowest production levels for food and beverages occur in June and November, respectively.   Under the use-based classification of IIP, production of consumer durables peaks in October, driven by major Indian festivals, while non-durable goods production reaches its seasonal high in December. Most other major categories, including capital goods and infrastructure goods, experience peak production in March. Seasonal troughs occur in April for capital goods and consumer goods. Seasonal trough of consumer durables and non-durables happen during April and June, respectively. Primary goods and intermediate goods show seasonal moderation in September and February, respectively, while infrastructure goods production softens in November. Among the eight core industries, most record seasonal peaks in March, with the exceptions of fertilisers and natural gas, which reach their seasonal highs in October (Chart 4 and Table A1-M2).  Among the major sectors of the IIP, mining exhibited the highest seasonal fluctuation, followed by electricity. Within the use-based classification, capital goods showed the most pronounced seasonal variation, followed by consumer non-durables in 2024-25. Among the eight core industries, coal production recorded the widest range of seasonal factors, while crude oil showed the least seasonal variation (Table A1-M3). Among high-frequency services sector indicators, passenger vehicle sales (wholesale) reach a seasonal peak in October, driven by increased demand during the festive season. Cargo and railway traffic typically rise in March, while domestic air passenger traffic peaks in December and international air travel sees the highest seasonal volume in January (Chart 5a and Table A1-M2). Most of these indicators experience seasonal troughs in September, except for passenger vehicle sales, which decline seasonally in December. In terms of the magnitude of seasonal variation, passenger vehicle sales showed the widest range of seasonal factors in 2024–25, at 27 percentage points. Railway and cargo traffic also exhibited greater seasonal fluctuations compared to air passenger traffic over the past financial year (Table A1-M3).  Merchandise trade typically peaks in March, with both exports and imports reaching seasonal highs. Exports experience a seasonal low in November, while imports moderate in February. Non-oil, non-gold, and non-silver imports show a seasonal peak in December and a decline in February (Chart 5b and Table A1-M2). Seasonal fluctuations are more pronounced in merchandise exports than in imports (Table A1-M3). Payment system indicators generally reach their seasonal peak in March, with the exception of card payments. Real Time Gross Settlement (RTGS) transactions show a seasonal dip in February, while paper clearing hits its seasonal low in September. Retail electronic payments (REC) decline in November and card payments experience seasonal moderation in February (Chart 6 and Table A1-M2). Among the payment indicators selected for this study, REC exhibited the highest seasonal variation, with seasonal factor range of 31.7 percentage points in 2024–25, followed by RTGS payments (range 30.1 percentage points) (Table A1-M3).

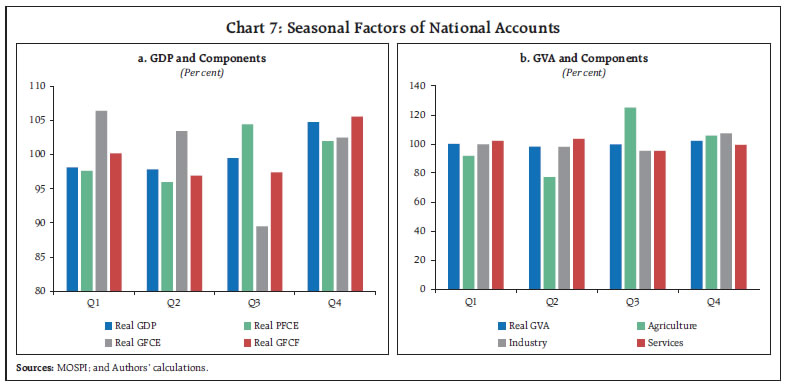

III.2. Seasonality in Quarterly Series4 Quarterly estimates of gross domestic product (GDP) and gross value added (GVA) typically show seasonal peaks in January to March quarter (Q4) and troughs in July to September (Q2). Among GDP components, Government final consumption expenditure (GFCE) rises seasonally in April to June (Q1) and eases in October to December (Q3). Gross fixed capital formation (GFCF) peaks in Q4 and dips in Q2, aligning with the monsoon season. Private final consumption expenditure (PFCE) tends to increase in Q3, driven by major festivals, following a seasonal slowdown in Q2. On the supply side, agricultural output (value added) shows a seasonal dip in Q2 during the main kharif sowing period and peaks in Q3 (i.e., harvest time). Industrial output records a seasonal high in Q4 and a low in Q3. In contrast, services activity strengthens in Q2 but moderates in Q3 (Chart 7 and Table A2-Q2). The extent of seasonal variations, measured by the range of seasonal factors, is higher in GDP than GVA, possibly on account of the variations in net taxes, which influence market prices. GFCE exhibits the highest seasonal variations among the expenditure-side components of GDP. Seasonal fluctuations in GFCF and PFCE are approximately closer to each other. Seasonal fluctuations in GVA were higher in 2024-25 than the last 10 years’ average. Among the supply side components, seasonal variations are highest in agriculture (Table A2-Q3).  CU of manufacturing companies, as measured by the OBICUS, typically peaks in Q4 and dips in Q1. Seasonal variation in CU has remained relatively stable over the past decade, with an average range of 3.7 percentage points. The Business Assessment Index (BAI) and Business Expectation Index (BEI), derived from the IOS, show seasonal peaks in Q4 and Q3, respectively, while their troughs occur in Q2 and Q1. Order book assessments and expectations both peak in Q4. However, order book assessments bottom out in Q2, while expectations decline in Q1. Manufacturers’ assessment of CU reaches its seasonal high in Q4, while expectations peak in Q3. Regarding pricing outlook, selling price assessments are higher in Q1 and moderate in Q2, whereas expectations rise in Q1 but ease in Q4. Profitability assessments are strongest in Q4, while expectations for future profitability typically peak in Q2 (Chart 8 and Table A2-Q2). BAI and BEI indices exhibit relatively mild seasonal fluctuations, with seasonal factors averaging between 1.8 and 2.3 percentage points in 2024-25. In contrast, assessments related to production, capacity utilisation and selling prices display more pronounced seasonal variation (Table A2-Q3).

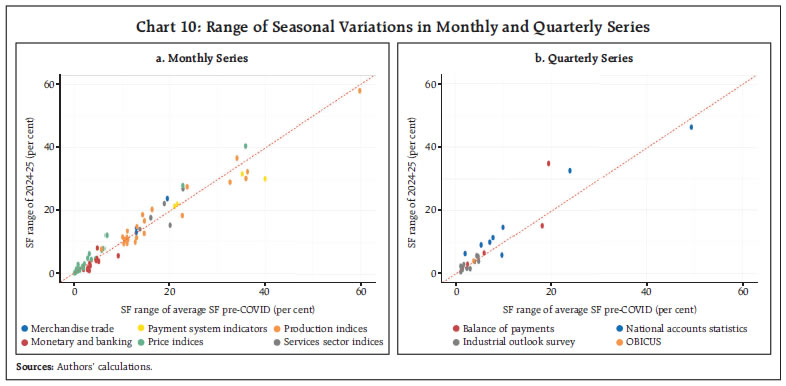

Overall services exports reach their seasonal peak in Q4 and hit a trough in Q1. Within services exports, computer software and information technology enabled services (ITES) exports are seasonally strong in Q3, while travel services exports peak in Q4. On the import side, travel services see a seasonal high in Q1 (Chart 9 and Table A2-Q2). Services exports exhibit notable seasonal variation, with a ten-year average range of 6.1 percentage points. Overall, travel services exports and imports display the most significant seasonal fluctuations within services trade (Table A2-Q3). III.3. Stability of Seasonality The stability of seasonal variations is assessed using both parametric and non-parametric tests, with the diagnostic results presented in Tables A1-M4 and A2-Q4. Additionally, the consistency of seasonal factor estimates is evaluated by comparing the range of seasonal factors for 2024-25 against their five-year averages from the pre-COVID period for both monthly and quarterly series. Scatter plots indicate that seasonal variations during 2024-25 closely align with pre-pandemic averages across most monthly series (Chart 10a). A similar trend is observed in quarterly series, except for one series in national accounts statistics (GFCE) and one series in balance of payments (travel exports), which have shown increased seasonal variation recently (Chart 10b). IV. Conclusion This article presents updated estimates of seasonal factors for key economic indicators, revealing that while overall seasonal patterns remain largely stable, several indicators—such as cash in hand and balances with the RBI, demand deposits, prices of major vegetables, industrial production, passenger vehicle sales, merchandise exports and RTGS transactions—have experienced more pronounced seasonal fluctuations. Additionally, some indices and banking and monetary aggregates have seen shifts in their peak and trough months.  Banking indicators like bank credit, non-food credit and demand deposits typically reach their year-end peak in March. CPI experiences seasonal pressure from July to November, primarily due to rising vegetable prices during the monsoon, while fruit prices tend to peak in the summer. In industrial production, most items hit their highest levels in March, except consumer durables, which peak in October during the festive season. Both exports and imports also reach their seasonal highs in March, with exports showing more pronounced seasonal fluctuations than imports. Among the quarterly series, real GDP and GVA consistently peak in Q4, with seasonal variations in national account aggregates having increased since the pandemic began, even after adjusting for pandemic-related volatility as detailed in the technical annex. Both GDP and GVA reach their seasonal trough in Q2. Among the expenditure-side components, PFCE and GFCF trough in Q2, whereas GFCE experiences seasonal low in Q3. Within supply side, GVA agriculture experiences the highest seasonal variations. In IOS, manufacturers’ current assessment peaks during Q4 and expectations scales seasonal maximum in Q3. Services exports peak in Q4, while exports of telecommunications, computer and information services are strongest in Q3. The pandemic caused major disruptions in economic activity, resulting in atypical data patterns. Due to the limited post-pandemic data availability, estimates of stochastic seasonality using the seasonal ARIMA model may be affected. With this limited data, it is difficult to definitively identify changes in the underlying data-generating process. The seasonal factor estimates presented in this article have been derived with appropriate precautions and robustness checks; however, these estimates may further evolve as more post-pandemic data become available. References: Shiskin, J., Young, A. H., and Musgrave, J. C. (1967). The X-11 variant of the census method II seasonal adjustment program. U.S. Department of Commerce, Bureau of the Census. Gómez, Victor and Maravall, Agustin (1996). Programs TRAMO and SEATS, Instruction for User (Beta Version: September 1996). Working Papers, Banco de España.

Technical Annex Seasonal patterns in economic data are systematic fluctuations that recur at specific times each year, driven by factors such as weather, holidays and cultural events. The X13-ARIMA-SEATS programme, developed by the US Census Bureau, is a widely used tool for seasonal adjustment and trend extraction in time series analysis. This programme integrates two methodologies: RegARIMA modeling, which forecasts and models the underlying time series, and SEATS (Signal Extraction in ARIMA Time Series), which decomposes the series into seasonal, trend and irregular components. The decomposition process involves the iterative application of centered moving average filters, progressively refining the separation of components. Various filters and moving averages are employed throughout to accurately isolate the different elements of the time series. The X-13 ARIMA-SEATS program incorporates two distinct seasonal adjustment modules. The first module employs the X-11 seasonal adjustment methodology, as originally described by Shiskin, Young and Musgrave (1967). This module retains all the seasonal adjustment features found in the earlier X-11 and X-11-ARIMA programmes, including the use of traditional seasonal and trend moving averages as well as calendar and holiday adjustment procedures. The second module utilises the ARIMA model-based seasonal adjustment approach from the SEATS programme, developed by Victor Gomez and Agustin Maravall at the Bank of Spain. This version of X-13 ARIMA-SEATS fully integrates SEATS capabilities, providing stability and spectral diagnostics comparable to those available for X-11 adjustments. For the purposes of this article, the X-11-based seasonal adjustment module was employed to extract seasonal factors. X-13 ARIMA-SEATS provides four other types of regression variables to deal with abrupt changes in the level of a series of a temporary or permanent nature: additive outliers (AOs), level shifts (LSs), temporary changes (TCs) and ramps. AOs affect only one observation in the whole series and hence, this effect is removed by a dummy variable, which takes ‘0’ at break and ‘1’ for other period. LSs increases or decreases all observations from a certain time point onward by some constant amount, this LS effect is removed by introducing a dummy variable which takes value ‘-1’ for all the time point up-to the break point and ‘0’ for all the time points afterwards. TCs allow for an abrupt increase or decrease in the level of the series that returns to its previous level exponentially, this effect is captured by a variable which takes value ‘0’ for all observation before the change point and αt (0<α<1) thereafter. Ramps allow for a linear increase or decrease in the level of the series over a specified time interval (say t0 - t1). Ramps are smoothed out by introducing a variable which take three values, ‘-1’ for time t0, (t-t0)/((t1- t0)–1) for t0 < t 1, and ‘0’ after the time point t > t1. X-13 ARIMA employs Seasonal Autoregressive Integrated Moving Average (SARIMA) models to identify and estimate the seasonal patterns within economic time series. The selection of the SARIMA model order is guided by in-sample goodness-of-fit measures, with the optimal model chosen based on established information criteria. Consequently, the selected model provides a representation of the underlying data-generating process through averaged parameter estimates. However, the onset of the COVID-19 pandemic introduced significant challenges to this modeling approach, complicating the identification and stability of seasonal components. The COVID-19 pandemic may have fundamentally transformed the economic data-generating process across numerous sectors. This shift has introduced increased uncertainty and volatility into the data, necessitating more adaptive and flexible analytical approaches. The changes that occurred during the COVID period and the subsequent post-pandemic normalisation may have influenced seasonal patterns. However, the limited availability of data from the past two to three years is insufficient to fully capture these shifts using SARIMA models. To address potential alterations in seasonality since COVID, the stability of seasonal adjustments is maintained through outlier adjustments, comparisons with pre-pandemic estimates and annual updates of seasonal factors for the most recent periods. In the X-13 ARIMA model, outlier adjustments for the COVID period are implemented using three types of outliers: AO, TC and LS. These outliers are automatically identified according to guidelines established by the US Census Bureau, and their significance is validated by correlating them with economic events in India. To ensure the stability of seasonal patterns, the range of seasonal factors from the most recent period is compared with the average range observed during the pre-pandemic period.

| Annex - I | | Table A1-M1: Time Period Used for Estimating Monthly Seasonal Factors | | Name of Sectors/Variables | Time Period | Name of Sectors/Variables | Time Period | | Monetary and Banking Indicators (14 series) | Index of Industrial Production (23 series) | A.1.1 Broad Money (M3)

A.1.1.1 Net Bank Credit to Government

A.1.1.2 Bank Credit to Commercial Sector

A.1.2 Narrow Money (M1)

A.1.3 Reserve Money (RM)

A.1.3.1 Currency in Circulation

A.2.1 Aggregate Deposits (SCBs)

A.2.1.1 Demand Deposits (SCBs)

A.2.1.2 Time Deposits (SCBs)

A.3.1 Cash in Hand and Balances with RBI (SCBs)

A.3.2 Bank Credit (SCBs)

A.3.2.1 Loans, Cash Credits and Overdrafts (SCBs)

A.3.2.2 Non-Food Credit (SCBs)

A.3.3 Investments (SCBs) | April 1994 to March 2025 | E. IIP (Base 2011-12 = 100) General Index | April 1994 to March 2025 | E.1.1 IIP - Primary goods (34.05%)

E.1.2 IIP - Capital goods (8.22%)

E.1.3 IIP - Intermediate goods (17.22%)

E.1.4 IIP - Infrastructure/ construction goods (12.34%)

E.1.5 IIP - Consumer goods (28.17%)

E.1.5.1 IIP - Consumer durables (12.84%)

E.1.5.2 IIP - Consumer non-durables (15.33%) | April 2012 to March 2025 | E.2.1 IIP - Mining (14.37%)

E.2.2 IIP – Manufacturing (77.63%) | April 1994 to March 2025 | E.2.2.1 IIP - Manufacture of food products (5.30%)

E.2.2.2 IIP - Manufacture of beverages (1.04%)

E.2.2.3 IIP - Manufacture of textiles (3.29%)

E.2.2.4 IIP - Manufacture of chemicals and chemical products (7.87%)

E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers (4.86%) | April 2012 to March 2025 | | Price Indices [CPI: 21 series and WPI: 8 series] | B. CPI (Base: 2012 = 100) All Commodities

B.1 CPI - Food and beverages (45.86%)

B.1.1 CPI - Cereals and products (9.67%)

B.1.2 CPI - Meat and fish (3.61%)

B.1.3 CPI – Egg (0.43%)

B.1.4 CPI - Milk and products (6.61%)

B.1.5 CPI – Fruits (2.89%)

B.1.6 CPI – Vegetables (6.04%)

B.1.6.1 CPI – Potato (0.98%)

B.1.6.2 CPI – Onion (0.64%)

B.1.6.3 CPI – Tomato (0.57%)

B.1.7 CPI - Pulses and products (2.38%)

B.1.8 CPI – Spices (2.50%)

B.1.9 CPI - Non-alcoholic beverages (1.26%)

B.1.10 CPI - Prepared meals, snacks, sweets etc. (5.55%)

B.2 CPI - Clothing and footwear (6.53%)

B.3 CPI – Housing (10.07%)

B.4 CPI – Miscellaneous (28.32%) | January 2011 to March 2025 | E.2.3 IIP - Electricity (7.99%) | April 1994 to March 2025 | E.3 Cement Production (2.16%)

E.4 Steel Production (7.22%)

E.5 Coal Production (4.16%)

E.6 Crude Oil Production (3.62%)

E.7 Petroleum Refinery Production (11.29%)

E.8 Fertiliser Production (1.06%)

E.9 Natural Gas Production (2.77%) | April 2004 to March 2025 | | Service Sector Indicators (5 series) | F.1 Cargo handled at Major Ports

F.2 Railway Freight Traffic

F.3 Passenger flown (Km) - Domestic

F.4 Passenger flown (Km) - International | April 1994 to March 2025 | | F.5 Passenger Vehicle Sales (wholesale) | April 2004 to March 2025 | | Merchandise Trade (3 series) | G.1 Exports

G.2 Imports

G.3 Non-Oil, Non-Gold and Non-Silver Imports | April 1994 to March 2025 | C.1 Consumer Price Index for Industrial Workers (Base: 2016=100)

C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100)

C.3 Consumer Price Index for Rural Labourers (Base: 1986- 87=100) | January 2000 to March 2025 | Payment System Indicators (4 Series) | | H.1 Real Time Gross Settlement | April 2004 to March 2025 | | H.2 Paper Clearing | April 2005 to March 2025 | D. WPI (Base: 2011-12=100) All Commodities

D.1 WPI - Primary Articles (22.62%)

D.1.1 WPI - Food Articles (15.26%)

D.2 WPI - Fuel & Power (13.15%)

D.3 WPI – Manufactured Products (64.23%)

D.3.1 WPI - Manufacture of Food Products (9.12%)

D.3.2 WPI - Manufacture of Chemicals & Chemical Products (6.47%)

D.3.3 WPI - Manufacture of Basic Metals (9.65%) | April 1994 to March 2025 | H.3 Retail Electronic Clearing (REC)

H.4 Cards | April 2004 to March 2025 | | | | | April 2012 to March 2025 | | Note: The figures in brackets represent weights for groups, sub-groups and items under the respective general index. |

| Table A1-M2: Average* Monthly Seasonal Factors of Select Economic Time Series (Per cent) | | SERIES NAME | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | Monetary and Banking Indicators (14 series) | | A.1.1 Broad Money (M3) | 101.0 | 100.6 | 100.3 | 100.3 | 99.9 | 99.7 | 99.7 | 99.3 | 99.4 | 99.5 | 99.7 | 100.5 | | A.1.1.1 Net Bank Credit to Government | 101.0 | 100.4 | 100.0 | 101.3 | 101.2 | 99.7 | 99.5 | 100.2 | 98.4 | 99.3 | 99.7 | 99.5 | | A.1.1.2 Bank Credit to Commercial Sector | 100.8 | 100.1 | 99.9 | 99.5 | 99.0 | 99.4 | 99.4 | 99.5 | 100.2 | 100.2 | 100.3 | 101.6 | | A.1.2 Narrow Money (M1) | 101.8 | 101.3 | 101.1 | 99.7 | 99.0 | 99.0 | 98.6 | 98.3 | 98.9 | 99.0 | 100.1 | 103.2 | | A.1.3 Reserve Money (RM) | 101.4 | 101.9 | 101.6 | 100.4 | 99.1 | 98.4 | 98.3 | 98.9 | 99.1 | 99.1 | 99.0 | 102.7 | | A.1.3.1 Currency in Circulation | 102.6 | 102.5 | 101.9 | 100.2 | 99.1 | 98.0 | 98.1 | 98.6 | 98.7 | 99.3 | 100.0 | 100.8 | | A.2.1 Aggregate Deposits (SCBs) | 100.6 | 100.2 | 100.0 | 100.1 | 99.9 | 100.3 | 99.9 | 99.6 | 99.8 | 99.7 | 99.5 | 100.4 | | A.2.1.1 Demand Deposits (SCBs) | 100.8 | 98.7 | 99.9 | 98.4 | 97.7 | 102.9 | 98.8 | 98.9 | 100.4 | 98.6 | 98.8 | 106.0 | | A.2.1.2 Time Deposits (SCBs) | 100.5 | 100.3 | 100.0 | 100.3 | 100.0 | 100.1 | 100.1 | 99.8 | 99.8 | 99.8 | 99.6 | 99.7 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 101.2 | 100.0 | 102.0 | 100.4 | 100.5 | 101.1 | 100.0 | 100.4 | 101.6 | 97.8 | 96.4 | 98.2 | | A.3.2 Bank Credit (SCBs) | 100.6 | 100.0 | 99.9 | 99.4 | 99.0 | 99.9 | 99.6 | 99.6 | 100.3 | 100.1 | 100.1 | 101.4 | | A.3.2.1 Loans, Cash Credits and Overdrafts (SCBs) | 100.5 | 100.0 | 99.9 | 99.4 | 99.0 | 99.9 | 99.7 | 99.7 | 100.3 | 100.2 | 100.1 | 101.3 | | A.3.2.2 Non-Food Credit (SCBs) | 100.6 | 100.0 | 99.9 | 99.4 | 99.1 | 99.9 | 99.7 | 99.4 | 100.2 | 100.0 | 100.1 | 101.6 | | A.3.3 Investments (SCBs) | 99.4 | 100.1 | 100.3 | 101.1 | 101.2 | 101.3 | 100.9 | 100.0 | 99.1 | 98.9 | 99.2 | 98.5 | | Price Indices [ CPI: 21 series and WPI: 8 series] | | B. CPI (Base: 2012 = 100) All Commodities | 99.2 | 99.5 | 99.9 | 100.6 | 100.6 | 100.5 | 101.0 | 100.9 | 100.1 | 99.5 | 99.2 | 99.0 | | B.1 CPI - Food and beverages | 98.3 | 98.9 | 100.0 | 101.0 | 101.3 | 101.2 | 101.9 | 101.8 | 100.4 | 99.0 | 98.2 | 98.0 | | B.1.1 CPI - Cereals and products | 99.7 | 99.7 | 99.6 | 99.7 | 99.9 | 100.0 | 100.2 | 100.4 | 100.3 | 100.3 | 100.2 | 100.0 | | B.1.2 CPI - Meat and fish | 99.5 | 101.2 | 103.0 | 102.1 | 100.1 | 99.9 | 99.8 | 99.2 | 98.7 | 99.1 | 98.7 | 98.7 | | B.1.3 CPI - Egg | 96.3 | 96.6 | 99.0 | 100.4 | 98.5 | 98.4 | 99.4 | 101.9 | 104.2 | 104.8 | 102.1 | 98.7 | | B.1.4 CPI - Milk and products | 99.8 | 100.0 | 100.0 | 100.1 | 100.1 | 100.1 | 100.1 | 100.1 | 100.0 | 99.9 | 99.9 | 99.8 | | B.1.5 CPI - Fruits | 103.1 | 102.7 | 101.8 | 103.2 | 102.6 | 100.1 | 99.4 | 98.7 | 97.6 | 96.4 | 96.4 | 97.8 | | B.1.6 CPI - Vegetables | 88.9 | 91.4 | 97.6 | 105.4 | 106.8 | 108.9 | 113.0 | 111.7 | 103.2 | 94.4 | 90.6 | 88.6 | | B.1.6.1 CPI - Potato | 84.8 | 93.1 | 101.5 | 109.5 | 112.4 | 112.3 | 116.4 | 116.7 | 106.2 | 88.5 | 79.3 | 79.2 | | B.1.6.2 CPI - Onion | 79.6 | 75.3 | 80.7 | 89.3 | 99.1 | 105.1 | 118.1 | 133.0 | 121.2 | 110.4 | 101.2 | 87.9 | | B.1.6.3 CPI - Tomato | 75.4 | 83.2 | 104.7 | 136.5 | 121.5 | 112.1 | 118.2 | 120.8 | 98.4 | 83.5 | 74.4 | 71.8 | | B.1.7 CPI - Pulses and products | 98.7 | 98.8 | 99.5 | 99.6 | 99.9 | 100.7 | 101.3 | 101.6 | 101.3 | 100.4 | 99.4 | 98.7 | | B.1.8 CPI - Spices | 99.4 | 99.4 | 99.4 | 99.9 | 100.1 | 100.3 | 100.5 | 100.7 | 100.6 | 100.4 | 99.9 | 99.5 | | B.1.9 CPI - Non-alcoholic beverages | 99.9 | 99.9 | 99.9 | 100.0 | 100.0 | 100.0 | 100.0 | 100.1 | 100.1 | 100.1 | 100.1 | 99.9 | | B.1.10 CPI - Prepared meals, snacks, sweets etc. | 99.9 | 99.9 | 99.9 | 100.0 | 100.1 | 100.0 | 100.0 | 100.1 | 100.0 | 100.0 | 100.0 | 100.0 | | B.2 CPI - Clothing and footwear | 99.9 | 99.9 | 100.0 | 100.0 | 100.0 | 100.0 | 100.1 | 100.1 | 100.1 | 100.0 | 99.9 | 99.9 | | B.3 CPI - Housing | 100.4 | 100.2 | 99.3 | 99.6 | 100.0 | 100.0 | 100.4 | 100.4 | 99.6 | 100.0 | 100.2 | 100.0 | | B.4 CPI - Miscellaneous | 99.9 | 99.9 | 99.9 | 100.2 | 100.2 | 100.2 | 100.1 | 100.0 | 99.9 | 99.9 | 99.9 | 99.8 | | C.1 Consumer Price Index for Industrial Workers (Base: 2016=100) | 99.4 | 99.5 | 99.9 | 100.8 | 100.6 | 100.5 | 100.9 | 100.7 | 99.9 | 99.7 | 99.1 | 99.1 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 99.2 | 99.4 | 99.7 | 100.0 | 100.4 | 100.4 | 100.9 | 101.0 | 100.6 | 100.0 | 99.4 | 99.1 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 99.2 | 99.4 | 99.7 | 100.0 | 100.4 | 100.4 | 100.8 | 100.9 | 100.5 | 100.0 | 99.4 | 99.1 | | D. WPI (Base: 2011-12=100) All Commodities | 99.9 | 100.0 | 100.0 | 100.4 | 100.2 | 100.2 | 100.5 | 100.7 | 99.8 | 99.5 | 99.5 | 99.5 | | D.1 WPI – Primary Articles | 99.2 | 99.2 | 100.1 | 101.2 | 101.3 | 100.8 | 102.0 | 102.2 | 99.8 | 98.5 | 98.1 | 97.6 | | D.1.1 WPI - Food Articles | 98.6 | 98.8 | 100.2 | 101.6 | 101.4 | 101.5 | 103.1 | 103.0 | 99.7 | 98.1 | 97.1 | 96.7 | | D.2 WPI – Fuel & Power | 99.4 | 100.5 | 99.8 | 100.5 | 99.4 | 99.5 | 100.1 | 100.6 | 99.9 | 100.2 | 100.5 | 99.8 | | D.3 WPI – Manufactured Products | 100.4 | 100.4 | 100.2 | 100.0 | 99.9 | 99.9 | 100.0 | 99.8 | 99.6 | 99.9 | 99.9 | 100.1 | | D.3.1 WPI - Manufacture of Food Products | 100.3 | 100.1 | 100.2 | 100.0 | 100.4 | 100.4 | 100.1 | 100.1 | 99.8 | 99.7 | 99.4 | 99.6 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 100.3 | 100.5 | 100.3 | 100.1 | 100.0 | 99.8 | 99.9 | 99.8 | 99.6 | 99.7 | 99.9 | 100.2 | | D.3.3 WPI - Manufacture of Basic Metals | 101.1 | 101.6 | 100.8 | 99.4 | 99.0 | 99.5 | 99.8 | 99.1 | 98.9 | 99.8 | 100.2 | 100.7 |

| SERIES NAME | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | Index of Industrial Production (23 series) | | E. IIP (Base 2011-12 = 100) General Index | 96.8 | 100.9 | 98.8 | 97.5 | 97.1 | 97.5 | 99.8 | 98.1 | 103.0 | 103.4 | 98.3 | 108.6 | | E.1.1 IIP - Primary goods | 98.4 | 103.5 | 100.5 | 98.7 | 96.4 | 94.1 | 97.9 | 97.2 | 102.1 | 103.8 | 97.0 | 110.2 | | E.1.2 IIP - Capital goods | 89.3 | 97.4 | 100.8 | 96.5 | 96.3 | 102.6 | 98.7 | 96.5 | 100.4 | 100.8 | 100.9 | 119.3 | | E.1.3 IIP - Intermediate goods | 97.6 | 100.4 | 98.3 | 101.3 | 99.7 | 98.4 | 99.1 | 97.5 | 102.3 | 102.2 | 96.6 | 106.5 | | E.1.4 IIP - Infrastructure/ construction goods | 99.2 | 102.2 | 100.2 | 97.5 | 97.4 | 96.0 | 99.5 | 94.4 | 102.0 | 104.0 | 99.7 | 108.6 | | E.1.5 IIP - Consumer goods | 95.2 | 98.8 | 95.4 | 98.5 | 97.5 | 100.9 | 99.5 | 101.4 | 105.1 | 103.5 | 99.2 | 105.0 | | E.1.5.1 IIP - Consumer durables | 95.7 | 100.0 | 98.3 | 101.0 | 99.9 | 105.8 | 106.6 | 97.8 | 96.5 | 98.1 | 95.8 | 104.1 | | E.1.5.2 IIP - Consumer non-durables | 95.2 | 97.6 | 94.7 | 96.9 | 95.6 | 96.8 | 97.1 | 103.3 | 110.2 | 106.7 | 100.9 | 104.8 | | E.2.1 IIP - Mining | 97.7 | 101.1 | 96.0 | 89.7 | 86.2 | 86.3 | 96.4 | 101.1 | 107.7 | 110.4 | 105.3 | 122.3 | | E.2.2 IIP - Manufacturing | 95.8 | 100.4 | 98.3 | 98.9 | 97.9 | 98.6 | 99.4 | 98.7 | 103.1 | 103.0 | 98.1 | 107.6 | | E.2.2.1 IIP - Manufacture of food products | 95.7 | 89.0 | 86.6 | 90.6 | 90.0 | 89.4 | 93.9 | 105.8 | 121.0 | 118.7 | 110.6 | 108.1 | | E.2.2.2 IIP - Manufacture of beverages | 111.1 | 120.4 | 107.4 | 93.6 | 89.2 | 91.2 | 89.9 | 88.8 | 93.0 | 98.2 | 100.9 | 117.1 | | E.2.2.3 IIP - Manufacture of textiles | 98.3 | 99.1 | 97.4 | 100.1 | 100.6 | 100.6 | 101.1 | 99.3 | 103.2 | 101.7 | 96.7 | 102.0 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 95.5 | 101.3 | 100.2 | 104.0 | 101.4 | 100.7 | 100.7 | 97.1 | 100.9 | 101.0 | 93.8 | 103.1 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 98.0 | 100.6 | 97.2 | 100.9 | 98.5 | 100.2 | 102.8 | 99.5 | 93.5 | 101.6 | 100.3 | 106.9 | | E.2.3 IIP - Electricity | 101.2 | 107.8 | 104.8 | 105.0 | 104.2 | 101.4 | 100.8 | 90.3 | 94.6 | 96.6 | 90.7 | 101.7 | | E.3 Cement Production | 103.4 | 102.1 | 103.5 | 94.3 | 90.6 | 90.4 | 98.2 | 92.5 | 102.2 | 104.9 | 101.8 | 116.5 | | E.4 Steel Production | 98.2 | 102.0 | 99.1 | 97.7 | 98.9 | 97.4 | 99.7 | 96.2 | 101.9 | 103.7 | 98.0 | 107.4 | | E.5 Coal Production | 93.1 | 95.1 | 90.4 | 82.4 | 79.2 | 80.0 | 93.7 | 102.9 | 111.7 | 116.9 | 114.2 | 140.1 | | E.6 Crude Oil Production | 98.9 | 102.5 | 99.1 | 101.8 | 101.3 | 97.7 | 101.5 | 98.3 | 101.7 | 102.0 | 92.3 | 102.9 | | E.7 Petroleum Refinery Production | 97.7 | 101.5 | 99.0 | 100.8 | 97.0 | 93.4 | 100.3 | 100.4 | 103.7 | 104.7 | 95.2 | 106.6 | | E.8 Fertiliser Production | 84.0 | 98.1 | 100.8 | 103.3 | 104.8 | 102.7 | 105.5 | 103.2 | 104.6 | 103.8 | 94.2 | 94.3 | | E.9 Natural Gas Production | 96.6 | 100.6 | 98.8 | 102.3 | 102.3 | 99.2 | 102.9 | 99.6 | 102.1 | 102.6 | 91.6 | 101.4 | | Service Sector Indicators (5 series) | F.1 Cargo handled at Major Ports | 100.4 | 102.7 | 97.9 | 98.9 | 97.0 | 92.9 | 98.1 | 98.6 | 103.0 | 104.7 | 96.4 | 109.9 | F.2 Railway Freight Traffic | 97.6 | 102.1 | 98.5 | 97.3 | 95.4 | 93.2 | 97.7 | 98.0 | 103.4 | 105.5 | 97.6 | 113.4 | F.3 Passenger flown (Km) - Domestic | 99.7 | 106.0 | 98.3 | 96.0 | 96.1 | 93.5 | 99.4 | 101.1 | 107.2 | 103.9 | 98.2 | 101.0 | F.4 Passenger flown (Km) - International | 94.1 | 98.5 | 98.1 | 102.2 | 101.9 | 93.2 | 95.4 | 98.1 | 108.3 | 110.7 | 97.0 | 102.6 | F.5 Passenger Vehicle Sales (wholesale) | 96.4 | 93.7 | 90.6 | 99.4 | 98.5 | 105.0 | 114.0 | 100.1 | 89.7 | 105.0 | 101.4 | 106.0 | Merchandise Trade (3 series) | G.1 Exports | 98.1 | 102.7 | 97.7 | 97.9 | 96.6 | 98.8 | 95.4 | 94.7 | 103.7 | 98.2 | 99.8 | 116.5 | G.2 Imports | 95.1 | 102.5 | 98.3 | 100.1 | 101.5 | 98.9 | 103.2 | 99.9 | 104.1 | 97.7 | 93.5 | 105.2 | G.3 Non-Oil, Non-Gold and Non-Silver Imports | 96.0 | 99.7 | 101.6 | 103.5 | 100.4 | 102.9 | 101.3 | 97.5 | 104.1 | 99.1 | 91.3 | 102.6 | Payment System Indicators (4 series) | H.1 RTGS | 93.9 | 95.9 | 103.0 | 98.0 | 93.5 | 101.8 | 96.7 | 93.1 | 107.6 | 98.9 | 91.7 | 126.0 | H.2 Paper Clearing | 107.8 | 102.0 | 95.3 | 100.5 | 94.8 | 94.4 | 100.0 | 94.6 | 101.5 | 97.8 | 95.6 | 115.5 | H.3 REC | 96.5 | 96.4 | 100.3 | 98.5 | 96.4 | 98.7 | 101.0 | 92.8 | 103.2 | 97.3 | 93.0 | 126.7 | H.4 Cards | 99.5 | 103.2 | 99.3 | 103.1 | 101.3 | 95.8 | 109.8 | 98.1 | 102.0 | 99.9 | 88.3 | 100.1 | *: Average of last ten years’ monthly seasonal factors, in general. Here, the average monthly seasonal factors have been computed on the basis of last 10 years (i.e., April 2015 to March 2025). Numbers marked in ‘bold’ are peaks and troughs of respective series. |

| Table A1-M3: Range (Difference Between Peak and Trough) of Monthly Seasonal Factors | | (Percentage points) | | SERIES \ YEAR | 2015- 16 | 2016- 17 | 2017- 18 | 2018- 19 | 2019- 20 | 2020- 21 | 2021- 22 | 2022- 23 | 2023- 24 | 2024- 25 | Average Range | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | Monetary and Banking Indicators (14 series) | | A.1.1 Broad Money (M3) | 2.0 | 2.1 | 2.2 | 2.1 | 1.9 | 1.8 | 1.6 | 1.5 | 1.3 | 1.3 | 1.7 | | A.1.1.1 Net Bank Credit to Government | 3.6 | 3.6 | 3.5 | 3.4 | 3.1 | 2.7 | 2.5 | 2.6 | 3.1 | 3.2 | 2.9 | | A.1.1.2 Bank Credit to Commercial Sector | 2.9 | 3.1 | 3.2 | 3.2 | 3.0 | 2.8 | 2.4 | 2.1 | 1.8 | 1.7 | 2.6 | | A.1.2 Narrow Money (M1) | 4.5 | 5.3 | 5.9 | 6.2 | 6.0 | 5.4 | 4.7 | 4.2 | 3.9 | 3.7 | 4.9 | | A.1.3 Reserve Money (RM) | 4.7 | 4.8 | 4.7 | 4.7 | 4.6 | 4.5 | 4.3 | 4.1 | 4.0 | 3.9 | 4.4 | | A.1.3.1 Currency in Circulation | 5.0 | 5.1 | 5.1 | 5.0 | 4.6 | 4.3 | 4.3 | 4.5 | 4.6 | 4.7 | 4.6 | | A.2.1 Aggregate Deposits (SCBs) | 1.1 | 1.4 | 1.7 | 1.7 | 1.5 | 1.2 | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | | A.2.1.1 Demand Deposits (SCBs) | 7.4 | 9.5 | 11.5 | 12.2 | 11.3 | 9.4 | 7.4 | 5.9 | 5.1 | 5.5 | 8.4 | | A.2.1.2 Time Deposits (SCBs) | 1.1 | 1.0 | 1.0 | 1.0 | 1.1 | 1.2 | 1.1 | 1.1 | 1.1 | 1.0 | 1.0 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 4.9 | 5.4 | 5.6 | 6.2 | 7.1 | 7.4 | 7.1 | 6.7 | 7.1 | 8.0 | 5.6 | | A.3.2 Bank Credit (SCBs) | 2.8 | 3.2 | 3.4 | 3.5 | 3.2 | 2.7 | 2.0 | 1.5 | 1.2 | 1.1 | 2.4 | | A.3.2.1 Loans, Cash Credits and Overdrafts (SCBs) | 2.7 | 3.0 | 3.2 | 3.3 | 3.0 | 2.5 | 1.9 | 1.4 | 1.2 | 1.1 | 2.3 | | A.3.2.2 Non-Food Credit (SCBs) | 3.0 | 3.5 | 3.8 | 3.9 | 3.5 | 2.8 | 2.1 | 1.3 | 0.9 | 0.9 | 2.5 | | A.3.3 Investments (SCBs) | 3.7 | 3.6 | 3.5 | 3.3 | 3.2 | 3.1 | 3.0 | 2.9 | 2.6 | 2.4 | 2.8 | | Price Indices [ CPI: 21 series and WPI: 8 series] | | B. CPI (Base: 2012 = 100) All Commodities | 1.9 | 1.9 | 1.8 | 1.9 | 2.0 | 2.0 | 2.1 | 2.1 | 2.2 | 2.2 | 2.0 | | B.1 CPI - Food and beverages | 3.8 | 3.7 | 3.6 | 3.7 | 3.8 | 4.0 | 4.0 | 4.2 | 4.3 | 4.4 | 3.9 | | B.1.1 CPI - Cereals and products | 0.7 | 0.7 | 0.6 | 0.6 | 0.6 | 0.7 | 0.8 | 1.0 | 1.2 | 1.3 | 0.8 | | B.1.2 CPI - Meat and fish | 3.2 | 3.2 | 3.4 | 3.7 | 4.1 | 4.5 | 5.0 | 5.5 | 5.9 | 6.1 | 4.3 | | B.1.3 CPI - Egg | 7.0 | 6.8 | 6.6 | 6.7 | 7.1 | 7.9 | 9.1 | 10.3 | 11.3 | 12.0 | 8.5 | | B.1.4 CPI - Milk and products | 0.6 | 0.5 | 0.4 | 0.3 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.3 | | B.1.5 CPI - Fruits | 6.2 | 6.1 | 6.2 | 6.5 | 6.7 | 7.2 | 7.4 | 7.6 | 7.7 | 7.8 | 6.8 | | B.1.6 CPI - Vegetables | 22.5 | 22.1 | 21.9 | 22.7 | 23.8 | 24.8 | 26.0 | 26.8 | 27.6 | 27.9 | 24.4 | | B.1.6.1 CPI - Potato | 36.5 | 35.3 | 34.7 | 35.6 | 37.5 | 38.7 | 40.6 | 41.1 | 41.3 | 40.5 | 37.4 | | B.1.6.2 CPI - Onion | 40.4 | 43.0 | 48.6 | 55.9 | 62.6 | 66.4 | 67.8 | 66.2 | 64.1 | 62.2 | 57.7 | | B.1.6.3 CPI - Tomato | 61.9 | 60.9 | 61.0 | 61.4 | 63.3 | 65.2 | 66.6 | 67.2 | 68.9 | 71.4 | 64.7 | | B.1.7 CPI - Pulses and products | 3.4 | 3.4 | 3.1 | 2.7 | 2.3 | 2.2 | 2.8 | 3.6 | 4.3 | 4.7 | 3.0 | | B.1.8 CPI - Spices | 1.1 | 1.1 | 1.0 | 0.9 | 0.7 | 0.9 | 1.3 | 1.8 | 2.4 | 2.8 | 1.3 | | B.1.9 CPI - Non-alcoholic beverages | 0.3 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | | B.1.10 CPI - Prepared meals, snacks, sweets etc. | 0.5 | 0.4 | 0.4 | 0.3 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.2 | | B.2 CPI - Clothing and footwear | 0.5 | 0.4 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.1 | 0.1 | 0.2 | 0.2 | | B.3 CPI - Housing | 1.1 | 1.1 | 1.2 | 1.2 | 1.1 | 1.1 | 1.1 | 1.0 | 1.0 | 1.0 | 1.1 | | B.4 CPI - Miscellaneous | 0.5 | 0.5 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.3 | 0.4 | | C.1 Consumer Price Index for Industrial Workers (Base: 2016=100) | 2.3 | 2.2 | 2.0 | 1.8 | 1.6 | 1.7 | 1.8 | 1.8 | 1.9 | 1.9 | 1.8 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 2.4 | 2.2 | 2.0 | 1.9 | 1.9 | 1.8 | 1.8 | 1.9 | 1.8 | 1.9 | 2.0 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 2.2 | 2.0 | 1.9 | 1.8 | 1.7 | 1.7 | 1.7 | 1.8 | 1.7 | 1.7 | 1.8 | | D. WPI (Base: 2011-12=100) All Commodities | 1.5 | 1.4 | 1.3 | 1.2 | 1.2 | 1.3 | 1.3 | 1.3 | 1.3 | 1.3 | 1.2 | | D.1 WPI – Primary Articles | 5.0 | 4.8 | 4.7 | 4.8 | 4.8 | 4.7 | 4.5 | 4.4 | 4.4 | 4.6 | 4.5 | | D.1.1 WPI - Food Articles | 5.6 | 5.5 | 5.8 | 6.4 | 6.7 | 7.0 | 7.1 | 7.2 | 7.3 | 7.3 | 6.5 | | D.2 WPI – Fuel & Power | 3.0 | 2.6 | 2.0 | 1.6 | 1.2 | 1.5 | 1.8 | 1.9 | 2.0 | 2.1 | 1.2 | | D.3 WPI – Manufactured Products | 0.7 | 0.6 | 0.6 | 0.6 | 0.7 | 0.9 | 1.0 | 1.1 | 1.0 | 1.0 | 0.8 | | D.3.1 WPI - Manufacture of Food Products | 1.5 | 1.3 | 1.2 | 1.1 | 1.1 | 1.1 | 1.2 | 1.3 | 1.2 | 1.1 | 1.0 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 0.8 | 0.8 | 0.9 | 0.9 | 1.0 | 1.1 | 1.2 | 1.1 | 0.9 | 0.7 | 0.9 | | D.3.3 WPI - Manufacture of Basic Metals | 1.8 | 2.1 | 2.3 | 2.6 | 2.8 | 3.1 | 3.3 | 3.3 | 3.2 | 3.0 | 2.7 |

| SERIES \ YEAR | 2015- 16 | 2016- 17 | 2017- 18 | 2018- 19 | 2019- 20 | 2020- 21 | 2021- 22 | 2022- 23 | 2023- 24 | 2024- 25 | Average Range | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | Index of Industrial Production (23 series) | | E. IIP (Base 2011-12 = 100) General Index | 12.8 | 13.0 | 13.2 | 13.1 | 12.8 | 12.0 | 11.5 | 11.2 | 11.2 | 11.2 | 11.9 | | E.1.1 IIP - Primary goods | 13.8 | 14.2 | 15.1 | 16.0 | 16.7 | 17.1 | 17.4 | 17.3 | 17.1 | 16.8 | 16.2 | | E.1.2 IIP - Capital goods | 34.5 | 32.4 | 31.0 | 29.8 | 29.2 | 28.7 | 28.4 | 28.4 | 28.6 | 29.0 | 30.0 | | E.1.3 IIP - Intermediate goods | 10.7 | 10.7 | 10.4 | 10.4 | 10.3 | 10.0 | 9.7 | 9.5 | 9.4 | 9.3 | 10.0 | | E.1.4 IIP - Infrastructure/ construction goods | 12.8 | 13.4 | 13.8 | 14.2 | 14.2 | 14.4 | 14.6 | 14.8 | 14.9 | 15.0 | 14.2 | | E.1.5 IIP - Consumer goods | 10.5 | 10.0 | 9.9 | 10.5 | 11.1 | 11.0 | 11.3 | 11.3 | 11.0 | 10.7 | 9.9 | | E.1.5.1 IIP - Consumer durables | 12.7 | 11.7 | 10.9 | 11.1 | 11.2 | 11.0 | 10.8 | 10.7 | 10.9 | 10.7 | 10.9 | | E.1.5.2 IIP - Consumer non-durables | 13.1 | 13.6 | 14.3 | 14.9 | 15.5 | 16.2 | 16.8 | 17.3 | 18.1 | 18.7 | 15.5 | | E.2.1 IIP - Mining | 32.0 | 33.0 | 34.8 | 36.4 | 37.8 | 38.3 | 38.3 | 38.0 | 37.3 | 36.6 | 36.1 | | E.2.2 IIP - Manufacturing | 12.6 | 12.6 | 12.8 | 12.8 | 12.6 | 12.1 | 11.4 | 10.7 | 10.1 | 9.8 | 11.7 | | E.2.2.1 IIP - Manufacture of food products | 36.1 | 36.6 | 36.8 | 36.4 | 35.4 | 34.6 | 33.1 | 32.2 | 31.6 | 32.3 | 34.5 | | E.2.2.2 IIP - Manufacture of beverages | 46.0 | 39.6 | 34.8 | 31.3 | 29.2 | 28.8 | 27.4 | 27.2 | 28.4 | 30.1 | 31.6 | | E.2.2.3 IIP - Manufacture of textiles | 6.4 | 5.3 | 5.3 | 5.8 | 6.6 | 7.1 | 7.3 | 7.5 | 7.6 | 7.6 | 6.5 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 10.8 | 11.4 | 11.7 | 11.4 | 10.6 | 10.8 | 10.5 | 10.2 | 9.8 | 9.4 | 10.2 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 14.8 | 15.2 | 15.3 | 14.6 | 13.7 | 12.5 | 12.0 | 11.7 | 11.8 | 12.6 | 13.4 | | E.2.3 IIP - Electricity | 14.6 | 15.8 | 16.9 | 17.8 | 18.3 | 19.6 | 20.6 | 20.8 | 20.7 | 20.4 | 17.5 | | E.3 Cement Production | 22.4 | 23.0 | 24.3 | 26.1 | 27.8 | 28.9 | 29.0 | 28.6 | 27.9 | 27.5 | 26.1 | | E.4 Steel Production | 9.4 | 9.9 | 10.7 | 11.6 | 12.0 | 12.0 | 11.9 | 11.8 | 11.6 | 11.4 | 11.2 | | E.5 Coal Production | 56.3 | 58.7 | 61.8 | 64.0 | 64.7 | 64.0 | 62.5 | 60.4 | 58.9 | 58.0 | 60.9 | | E.6 Crude Oil Production | 10.5 | 10.6 | 10.7 | 10.6 | 10.6 | 10.7 | 10.7 | 10.7 | 10.6 | 10.4 | 10.6 | | E.7 Petroleum Refinery Production | 9.8 | 10.1 | 11.0 | 12.6 | 14.1 | 15.4 | 15.8 | 15.2 | 14.2 | 13.4 | 13.1 | | E.8 Fertiliser Production | 24.5 | 22.7 | 22.0 | 21.8 | 22.1 | 22.2 | 21.5 | 20.7 | 19.2 | 18.5 | 21.4 | | E.9 Natural Gas Production | 10.8 | 10.9 | 11.0 | 11.2 | 11.6 | 11.9 | 11.9 | 11.9 | 11.6 | 11.3 | 11.4 | | Service Sector Indicators (5 series) | | F.1 Cargo handled at Major Ports | 15.5 | 15.8 | 16.3 | 16.9 | 17.3 | 17.4 | 17.6 | 17.8 | 17.8 | 17.8 | 17.0 | | F.2 Railway Freight Traffic | 18.1 | 18.3 | 19.1 | 19.7 | 20.1 | 20.4 | 20.9 | 21.4 | 21.9 | 22.3 | 20.2 | | F.3 Passenger flown (Km) - Domestic | 16.7 | 14.7 | 13.1 | 12.7 | 13.5 | 14.2 | 14.6 | 14.6 | 14.4 | 14.0 | 13.8 | | F.4 Passenger flown (Km) - International | 20.0 | 20.2 | 20.7 | 20.3 | 19.5 | 18.4 | 17.6 | 16.5 | 15.6 | 15.5 | 17.6 | | F.5 Passenger Vehicle Sales (wholesale) | 19.3 | 20.9 | 22.4 | 25.1 | 26.8 | 27.3 | 26.4 | 26.1 | 26.7 | 27.0 | 24.3 | | Merchandise Trade (3 series) | | G.1 Exports | 18.6 | 18.8 | 20.3 | 21.7 | 22.7 | 22.8 | 23.2 | 23.1 | 23.4 | 23.9 | 21.8 | | G.2 Imports | 13.4 | 13.3 | 13.0 | 12.6 | 12.7 | 11.9 | 11.1 | 11.2 | 13.3 | 14.4 | 11.7 | | G.3 Non-Oil, Non-Gold and Non-Silver Imports | 13.2 | 13.4 | 13.3 | 13.1 | 13.0 | 12.9 | 12.6 | 12.3 | 12.3 | 12.9 | 12.8 | | Payment System Indicators (4 series) | | H.1 RTGS | 42.5 | 40.2 | 38.1 | 36.2 | 34.2 | 32.0 | 31.3 | 30.8 | 30.2 | 30.1 | 34.3 | | H.2 Paper Clearing | 21.8 | 21.2 | 21.3 | 21.4 | 21.2 | 21.5 | 21.9 | 21.8 | 21.8 | 22.1 | 21.1 | | H.3 REC | 35.0 | 35.4 | 35.6 | 35.5 | 35.3 | 34.7 | 33.6 | 32.7 | 32.0 | 31.7 | 33.9 | | H.4 Cards | 20.1 | 20.4 | 21.1 | 21.6 | 22.3 | 22.4 | 22.4 | 22.1 | 21.7 | 21.4 | 21.5 | | Note: Average seasonal factor range is the range of average seasonal factors for last ten years; range is calculated as the difference between maximum and minimum of monthly seasonal factors. |

| Table A1-M4: Major Diagnostics of all the Monthly Indicators | | Name of variable | Seasonality in Original Series | Residual Seasonality | Quality diagnostics | | F test p-value | KW test p-value | F test p-value | F test 3 yr p-value | M7 | Q | | A.1.1 Broad Money (M3) | 0.00 | 0.00 | 1.00 | 0.93 | 0.31 | 0.26 | | A.1.1.1 Net Bank Credit to Government | 0.00 | 0.00 | 0.97 | 0.40 | 0.39 | 0.36 | | A.1.1.2 Bank Credit to Commercial Sector | 0.00 | 0.00 | 1.00 | 0.39 | 0.35 | 0.27 | | A.1.2 Narrow Money (M1) | 0.00 | 0.00 | 0.96 | 0.64 | 0.28 | 0.27 | | A.1.3 Reserve Money (RM) | 0.00 | 0.00 | 0.46 | 0.91 | 0.28 | 0.22 | | A.1.3.1 Currency in Circulation | 0.00 | 0.00 | 0.50 | 0.29 | 0.20 | 0.30 | | A.2.1 Aggregate Deposits (SCBs) | 0.00 | 0.00 | 1.00 | 0.96 | 0.55 | 0.41 | | A.2.1.1 Demand Deposits (SCBs) | 0.00 | 0.00 | 0.84 | 0.62 | 0.50 | 0.60 | | A.2.1.2 Time Deposits (SCBs) | 0.00 | 0.00 | 1.00 | 0.95 | 0.57 | 0.32 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 0.00 | 0.00 | 0.97 | 0.67 | 1.31 | 0.92 | | A.3.2 Bank Credit (SCBs) | 0.00 | 0.00 | 1.00 | 0.97 | 0.47 | 0.31 | | A.3.2.1 Loans, Cash Credits and Overdrafts (SCBs) | 0.00 | 0.00 | 1.00 | 0.96 | 0.46 | 0.32 | | A.3.2.2 Non-Food Credit (SCBs) | 0.00 | 0.00 | 1.00 | 0.97 | 0.72 | 0.45 | | A.3.3 Investments (SCBs) | 0.00 | 0.00 | 0.88 | 0.99 | 0.44 | 0.31 | | B. CPI (Base: 2012 = 100) All Commodities | 0.00 | 0.00 | 1.00 | 0.88 | 0.27 | 0.31 | | B.1 CPI - Food and beverages | 0.00 | 0.00 | 1.00 | 0.80 | 0.23 | 0.32 | | B.1.1 CPI - Cereals and products | 0.00 | 0.00 | 1.00 | 0.60 | 0.93 | 0.62 | | B.1.2 CPI - Meat and fish | 0.00 | 0.00 | 0.94 | 0.82 | 0.43 | 0.44 | | B.1.3 CPI - Egg | 0.00 | 0.00 | 1.00 | 0.62 | 0.39 | 0.35 | | B.1.4 CPI - Milk and products | 0.00 | 0.00 | 0.97 | 1.00 | 1.27 | 0.57 | | B.1.5 CPI - Fruits | 0.00 | 0.00 | 0.99 | 0.98 | 0.25 | 0.27 | | B.1.6 CPI - Vegetables | 0.00 | 0.00 | 0.99 | 0.66 | 0.24 | 0.29 | | B.1.6.1 CPI - Potato | 0.00 | 0.00 | 1.00 | 0.93 | 0.22 | 0.32 | | B.1.6.2 CPI - Onion | 0.00 | 0.00 | 0.90 | 0.97 | 0.41 | 0.40 | | B.1.6.3 CPI - Tomato | 0.00 | 0.00 | 0.93 | 0.88 | 0.36 | 0.68 | | B.1.7 CPI - Pulses and products | 0.00 | 0.00 | 0.98 | 0.92 | 0.67 | 0.53 | | B.1.8 CPI - Spices | 0.00 | 0.00 | 1.00 | 1.00 | 1.25 | 0.83 | | B.1.9 CPI - Non-alcoholic beverages | 0.00 | 0.00 | 1.00 | 1.00 | 1.08 | 0.53 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | 0.00 | 0.00 | 0.97 | 1.00 | 1.56 | 0.69 | | B.2 CPI - Clothing and footwear | 0.00 | 0.00 | 0.97 | 1.00 | 1.34 | 0.67 | | B.3 CPI - Housing | 0.00 | 0.00 | 0.94 | 1.00 | 0.38 | 0.42 | | B.4 CPI - Miscellaneous | 0.00 | 0.00 | 1.00 | 0.97 | 0.99 | 0.47 | | C.1 Consumer Price Index for Industrial Workers (Base: 2016=100) | 0.00 | 0.00 | 1.00 | 0.96 | 0.26 | 0.29 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 0.00 | 0.00 | 1.00 | 0.99 | 0.25 | 0.29 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 0.00 | 0.00 | 1.00 | 0.99 | 0.26 | 0.26 | | D. WPI (Base: 2011-12=100) All Commodities | 0.00 | 0.00 | 1.00 | 0.93 | 0.46 | 0.42 | | D.1 WPI – Primary Articles | 0.00 | 0.00 | 0.99 | 0.48 | 0.31 | 0.37 | | D.1.1 WPI - Food Articles | 0.00 | 0.00 | 0.86 | 0.52 | 0.28 | 0.31 | | D.2 WPI – Fuel & Power | 0.00 | 0.00 | 1.00 | 1.00 | 1.62 | 0.77 | | D.3 WPI – Manufactured Products | 0.00 | 0.00 | 1.00 | 0.97 | 0.67 | 0.49 | | D.3.1 WPI - Manufacture of Food Products | 0.00 | 0.00 | 1.00 | 0.99 | 0.98 | 0.65 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 0.00 | 0.00 | 1.00 | 1.00 | 1.39 | 0.65 | | D.3.3 WPI - Manufacture of Basic Metals | 0.00 | 0.00 | 1.00 | 0.82 | 0.87 | 0.61 | | D.3.4 WPI - Manufacture of Machinery and Equipment | 0.02 | 0.01 | 1.00 | 0.98 | 1.72 | 0.80 |

| Name of variable | Seasonality in Original Series | Residual Seasonality | Quality diagnostics | | F test p-value | KW test p-value | F test p-value | F test 3 yr p-value | M7 | Q | | E. IIP (Base 2011-12 = 100) General Index | 0.00 | 0.00 | 0.21 | 0.68 | 0.16 | 0.23 | | E.1.1 IIP - Primary goods | 0.00 | 0.00 | 0.21 | 0.79 | 0.26 | 0.74 | | E.1.2 IIP - Capital goods | 0.00 | 0.00 | 0.27 | 0.92 | 0.29 | 0.48 | | E.1.3 IIP - Intermediate goods | 0.00 | 0.00 | 0.33 | 0.24 | 0.34 | 0.39 | | E.1.4 IIP - Infrastructure/ construction goods | 0.00 | 0.00 | 0.28 | 0.99 | 0.39 | 0.46 | | E.1.5 IIP - Consumer goods | 0.00 | 0.00 | 0.40 | 0.18 | 0.46 | 0.60 | | E.1.5.1 IIP - Consumer durables | 0.00 | 0.00 | 0.13 | 0.57 | 0.38 | 0.43 | | E.1.5.2 IIP - Consumer non-durables | 0.00 | 0.00 | 0.39 | 0.19 | 0.38 | 0.77 | | E.2.1 IIP - Mining | 0.00 | 0.00 | 0.87 | 0.33 | 0.23 | 0.36 | | E.2.2 IIP - Manufacturing | 0.00 | 0.00 | 0.14 | 0.55 | 0.22 | 0.27 | | E.2.2.1 IIP - Manufacture of food products | 0.00 | 0.00 | 1.00 | 0.98 | 0.17 | 0.47 | | E.2.2.2 IIP - Manufacture of beverages | 0.00 | 0.00 | 0.43 | 0.64 | 0.49 | 0.43 | | E.2.2.3 IIP - Manufacture of textiles | 0.00 | 0.00 | 0.34 | 0.99 | 0.58 | 0.61 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 0.00 | 0.00 | 0.49 | 0.79 | 0.49 | 0.79 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 0.00 | 0.00 | 0.30 | 0.34 | 0.57 | 0.62 | | E.2.3 IIP - Electricity | 0.00 | 0.00 | 0.47 | 0.99 | 0.52 | 0.53 | | E.3 Cement Production | 0.00 | 0.00 | 0.40 | 0.83 | 0.22 | 0.31 | | E.4 Steel Production | 0.00 | 0.00 | 0.52 | 0.87 | 0.47 | 0.63 | | E.5 Coal Production | 0.00 | 0.00 | 0.62 | 0.76 | 0.12 | 0.32 | | E.6 Crude Oil Production | 0.00 | 0.00 | 0.89 | 1.00 | 0.19 | 0.32 | | E.7 Petroleum Refinery Production | 0.00 | 0.00 | 0.97 | 0.29 | 0.44 | 0.68 | | E.8 Fertiliser Production | 0.00 | 0.00 | 0.75 | 0.11 | 0.29 | 0.61 | | E.9 Natural Gas Production | 0.00 | 0.00 | 0.82 | 0.94 | 0.23 | 0.27 | | F.1 Cargo handled at Major Ports | 0.00 | 0.00 | 0.94 | 0.99 | 0.29 | 0.50 | | F.2 Railway Freight Traffic | 0.00 | 0.00 | 0.29 | 0.95 | 0.13 | 0.33 | | F.3 Passenger flown (Km) - Domestic | 0.00 | 0.00 | 0.36 | 0.41 | 0.29 | 0.32 | | F.4 Passenger flown (Km) - International | 0.00 | 0.00 | 0.70 | 0.23 | 0.37 | 0.50 | | F.5 Passenger Vehicle Sales (wholesale) | 0.00 | 0.00 | 0.77 | 0.07 | 0.39 | 0.41 | | G.1 Exports | 0.00 | 0.00 | 0.56 | 0.88 | 0.36 | 0.54 | | G.2 Imports | 0.00 | 0.00 | 0.99 | 0.86 | 0.80 | 0.81 | | G.3 Non-Oil, Non-Gold and Non-Silver Imports | 0.00 | 0.00 | 1.00 | 0.24 | 0.56 | 0.70 | | H.1 RTGS | 0.00 | 0.00 | 0.40 | 0.52 | 0.42 | 0.46 | | H.2 Paper Clearing | 0.00 | 0.00 | 0.14 | 0.76 | 0.27 | 0.70 | | H.3. REC | 0.00 | 0.00 | 0.10 | 0.83 | 0.39 | 0.29 | | H.4 Cards | 0.00 | 0.00 | 0.04 | 0.95 | 0.36 | 0.37 | Notes: 1. Test for seasonality in original series: F-test for the presence of seasonality assuming stability and Kruskall and Wallis test (a nonparametric test for stable seasonality).

2. Test for seasonality in seasonally adjusted series: F-test for the presence of seasonality assuming stability for full sample and for latest 3 years.

3. M7 corresponds to the amount of moving seasonality present relative to the amount of stable seasonality (acceptable range is between 0 and 1). However, M Diagnostics are aggregated in a single quality control indicator - Q, which gives the overall assessment of the adjustment (acceptable range is between 0 and 1). |

| Table A1-M5: Monthly Seasonal Factors of Select Economic Time Series for 2024-25 (Per cent) | | SERIES NAME | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | Monetary and Banking Indicators (14 series) | | A.1.1 Broad Money (M3) | 100.7 | 100.6 | 100.5 | 100.4 | 99.8 | 99.4 | 99.7 | 99.5 | 100.0 | 99.6 | 99.7 | 100.1 | | A.1.1.1 Net Bank Credit to Government | 101.8 | 99.6 | 99.5 | 100.6 | 100.5 | 99.2 | 99.6 | 101.2 | 98.6 | 98.6 | 99.9 | 101.0 | | A.1.1.2 Bank Credit to Commercial Sector | 100.7 | 100.1 | 100.0 | 99.4 | 99.2 | 99.3 | 99.5 | 99.8 | 100.5 | 100.3 | 100.2 | 100.8 | | A.1.2 Narrow Money (M1) | 101.6 | 101.4 | 101.8 | 99.7 | 98.6 | 98.3 | 98.4 | 98.8 | 100.0 | 99.4 | 99.9 | 102.0 | | A.1.3 Reserve Money (RM) | 101.1 | 102.3 | 101.8 | 100.7 | 99.2 | 98.4 | 98.3 | 98.9 | 98.9 | 99.1 | 99.4 | 101.9 | | A.1.3.1 Currency in Circulation | 102.5 | 102.4 | 101.8 | 100.3 | 99.2 | 98.2 | 97.9 | 98.6 | 98.5 | 99.3 | 100.1 | 101.2 | | A.2.1 Aggregate Deposits (SCBs) | 100.5 | 100.3 | 100.2 | 100.1 | 100.2 | 100.5 | 99.8 | 99.7 | 100.0 | 99.7 | 99.6 | 99.4 | | A.2.1.1 Demand Deposits (SCBs) | 101.5 | 99.1 | 100.4 | 98.6 | 97.3 | 102.8 | 99.1 | 99.2 | 101.0 | 99.3 | 99.4 | 101.9 | | A.2.1.2 Time Deposits (SCBs) | 100.3 | 100.3 | 100.2 | 100.3 | 100.2 | 100.3 | 100.0 | 99.8 | 100.1 | 99.7 | 99.6 | 99.3 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 102.1 | 99.5 | 101.0 | 101.2 | 101.6 | 103.1 | 101.5 | 101.4 | 99.8 | 97.9 | 96.0 | 95.1 | | A.3.2 Bank Credit (SCBs) | 100.3 | 99.9 | 99.7 | 99.6 | 99.4 | 100.1 | 99.9 | 100.0 | 100.5 | 100.2 | 100.1 | 100.2 | | A.3.2.1 Loans, Cash Credits and Overdrafts (SCBs) | 100.2 | 99.8 | 99.7 | 99.5 | 99.4 | 100.1 | 99.9 | 100.1 | 100.5 | 100.3 | 100.1 | 100.2 | | A.3.2.2 Non-Food Credit (SCBs) | 100.1 | 100.0 | 100.0 | 99.6 | 99.5 | 100.1 | 100.0 | 99.9 | 100.3 | 100.4 | 100.1 | 100.1 | | A.3.3 Investments (SCBs) | 99.6 | 99.7 | 100.0 | 101.2 | 100.9 | 101.4 | 100.8 | 99.7 | 99.3 | 99.0 | 99.4 | 99.3 | | Price Indices [ CPI: 21 series and WPI: 8 series] | | B. CPI (Base: 2012 = 100) All Commodities | 99.1 | 99.5 | 100.0 | 100.7 | 100.5 | 100.5 | 101.0 | 101.0 | 100.2 | 99.6 | 99.1 | 98.9 | | B.1 CPI - Food and beverages | 98.2 | 98.7 | 100.0 | 100.9 | 101.0 | 101.0 | 102.2 | 102.0 | 100.7 | 99.2 | 98.3 | 97.9 | | B.1.1 CPI - Cereals and products | 99.6 | 99.6 | 99.3 | 99.4 | 99.7 | 99.9 | 100.2 | 100.5 | 100.6 | 100.6 | 100.5 | 100.2 | | B.1 2 CPI - Meat and fish | 99.8 | 101.9 | 104.1 | 102.0 | 99.4 | 100.0 | 100.2 | 99.0 | 98.0 | 98.7 | 98.3 | 98.5 | | B.1.3 CPI - Egg | 94.7 | 95.7 | 99.3 | 100.2 | 97.2 | 97.9 | 99.7 | 102.5 | 105.5 | 106.7 | 102.6 | 98.5 | | B.1.4 CPI - Milk and products | 99.9 | 100.1 | 100.1 | 100.0 | 100.1 | 100.1 | 100.1 | 100.0 | 100.0 | 99.9 | 99.9 | 99.9 | | B.1.5 CPI - Fruits | 103.7 | 102.2 | 101.2 | 103.5 | 102.8 | 100.5 | 100.0 | 98.8 | 97.2 | 96.0 | 96.3 | 97.9 | | B.1.6 CPI - Vegetables | 87.5 | 90.3 | 98.7 | 105.8 | 106.4 | 108.7 | 115.3 | 111.9 | 104.1 | 94.0 | 89.2 | 87.4 | | B.1.6.1 CPI - Potato | 82.7 | 93.3 | 102.4 | 113.6 | 116.0 | 114.4 | 116.3 | 115.4 | 105.0 | 87.5 | 75.8 | 76.7 | | B.1.6.2 CPI - Onion | 77.4 | 74.0 | 81.3 | 93.2 | 100.5 | 107.1 | 120.7 | 136.2 | 122.0 | 104.8 | 96.3 | 83.9 | | B.1.6.3 CPI - Tomato | 71.3 | 77.2 | 104.8 | 140.5 | 119.8 | 115.9 | 122.5 | 122.2 | 100.5 | 81.9 | 73.3 | 69.1 | | B.1.7 CPI - Pulses and products | 98.6 | 98.1 | 99.0 | 99.5 | 99.8 | 101.3 | 102.1 | 102.5 | 101.9 | 100.6 | 99.0 | 97.7 | | B.1.8 CPI - Spices | 98.8 | 98.7 | 98.7 | 99.5 | 100.1 | 100.9 | 101.3 | 101.6 | 101.3 | 100.7 | 99.7 | 98.9 | | B.1.9 CPI - Non-alcoholic beverages | 99.9 | 99.9 | 100.0 | 99.9 | 100.0 | 100.0 | 100.0 | 100.1 | 100.1 | 100.1 | 100.0 | 100.0 | | B.1.10 CPI - Prepared meals, snacks, sweets etc. | 99.9 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.1 | 100.0 | | B.2 CPI - Clothing and footwear | 100.0 | 99.9 | 100.0 | 100.0 | 100.0 | 99.9 | 100.0 | 100.1 | 100.1 | 100.1 | 100.0 | 100.0 | | B.3 CPI - Housing | 100.5 | 100.3 | 99.5 | 99.7 | 100.1 | 99.8 | 100.5 | 100.4 | 99.5 | 99.8 | 100.1 | 99.8 | | B.4 CPI - Miscellaneous | 100.0 | 100.0 | 100.0 | 100.2 | 100.1 | 100.1 | 100.1 | 100.0 | 99.9 | 99.9 | 99.9 | 99.9 | | C.1 Consumer Price Index for Industrial Workers (Base: 2016=100) | 99.4 | 99.4 | 100.0 | 100.7 | 100.5 | 100.5 | 100.9 | 100.7 | 100.0 | 99.7 | 99.2 | 99.0 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 99.2 | 99.3 | 99.6 | 99.9 | 100.2 | 100.3 | 100.8 | 101.0 | 100.7 | 100.2 | 99.6 | 99.2 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 99.2 | 99.3 | 99.7 | 100.0 | 100.2 | 100.3 | 100.7 | 100.9 | 100.6 | 100.1 | 99.6 | 99.2 | | D. WPI (Base: 2011-12=100) All Commodities | 100.1 | 99.8 | 100.1 | 100.5 | 100.1 | 100.0 | 100.7 | 100.7 | 99.8 | 99.5 | 99.4 | 99.4 | | D.1 WPI – Primary Articles | 99.4 | 99.2 | 100.2 | 101.1 | 101.1 | 100.4 | 102.3 | 102.1 | 100.0 | 98.6 | 97.8 | 97.7 | | D.1.1 WPI - Food Articles | 98.7 | 98.9 | 100.6 | 102.3 | 101.2 | 101.4 | 103.7 | 102.7 | 99.5 | 97.6 | 96.6 | 96.4 | | D.2 WPI – Fuel & Power | 100.0 | 99.9 | 99.0 | 99.6 | 99.1 | 99.1 | 99.9 | 100.9 | 100.8 | 100.5 | 101.1 | 100.4 | | D.3 WPI – Manufactured Products | 100.6 | 100.6 | 100.2 | 99.9 | 99.8 | 99.8 | 100.0 | 99.8 | 99.6 | 99.7 | 99.9 | 100.0 | | D.3.1 WPI - Manufacture of Food Products | 100.5 | 100.1 | 100.1 | 99.7 | 100.2 | 100.1 | 100.0 | 100.6 | 100.0 | 99.7 | 99.5 | 99.7 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 100.3 | 100.4 | 100.2 | 100.1 | 99.9 | 99.8 | 100.0 | 99.8 | 99.7 | 99.8 | 99.9 | 100.1 | | D.3.3 WPI - Manufacture of Basic Metals | 101.3 | 101.9 | 100.8 | 99.6 | 99.3 | 99.3 | 99.9 | 99.2 | 99.0 | 99.3 | 99.8 | 100.3 |

| SERIES NAME | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | Index of Industrial Production (23 series) | | E. IIP (Base 2011-12 = 100) General Index | 97.7 | 100.9 | 99.6 | 98.3 | 96.4 | 96.8 | 99.4 | 97.6 | 103.4 | 104.0 | 98.1 | 107.6 | | E.1.1 IIP - Primary goods | 99.5 | 104.7 | 101.3 | 98.2 | 95.6 | 93.1 | 97.2 | 96.0 | 102.0 | 104.2 | 98.1 | 109.9 | | E.1.2 IIP - Capital goods | 88.6 | 96.9 | 102.4 | 98.1 | 96.8 | 104.1 | 99.8 | 95.4 | 98.8 | 101.9 | 99.7 | 117.6 | | E.1.3 IIP - Intermediate goods | 98.0 | 100.9 | 98.5 | 101.0 | 99.7 | 98.1 | 99.6 | 97.3 | 102.4 | 103.1 | 96.0 | 105.3 | | E.1.4 IIP - Infrastructure/ construction goods | 99.4 | 101.0 | 99.0 | 97.3 | 98.0 | 97.1 | 99.2 | 93.8 | 102.2 | 104.6 | 99.2 | 108.8 | | E.1.5 IIP - Consumer goods | 96.0 | 98.5 | 96.6 | 99.2 | 97.3 | 99.7 | 98.0 | 101.7 | 106.6 | 104.2 | 97.9 | 103.7 | | E.1.5.1 IIP - Consumer durables | 95.4 | 100.2 | 100.3 | 101.3 | 100.0 | 105.4 | 106.0 | 96.9 | 95.7 | 97.9 | 96.1 | 105.0 | | E.1.5.2 IIP - Consumer non-durables | 97.8 | 97.3 | 95.1 | 97.7 | 94.5 | 94.8 | 97.1 | 105.3 | 113.2 | 107.8 | 98.0 | 101.0 | | E.2.1 IIP - Mining | 98.4 | 102.1 | 96.6 | 88.4 | 85.4 | 84.8 | 96.8 | 100.9 | 107.5 | 111.3 | 106.2 | 121.4 | | E.2.2 IIP - Manufacturing | 96.9 | 100.2 | 98.7 | 99.3 | 97.4 | 98.1 | 98.6 | 98.4 | 104.0 | 103.8 | 97.7 | 106.7 | | E.2.2.1 IIP - Manufacture of food products | 96.6 | 89.7 | 87.3 | 89.9 | 91.2 | 88.3 | 93.2 | 106.8 | 119.3 | 119.7 | 111.3 | 107.0 | | E.2.2.2 IIP - Manufacture of beverages | 107.7 | 118.1 | 110.6 | 98.7 | 89.6 | 90.1 | 88.8 | 87.9 | 90.8 | 100.3 | 102.3 | 115.5 | | E.2.2.3 IIP - Manufacture of textiles | 98.4 | 99.0 | 97.9 | 99.8 | 99.5 | 99.7 | 102.1 | 98.8 | 104.0 | 102.3 | 96.4 | 102.0 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 97.1 | 103.1 | 102.0 | 104.0 | 100.8 | 99.7 | 101.0 | 96.0 | 100.3 | 100.2 | 94.5 | 101.1 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 96.2 | 100.9 | 98.1 | 101.9 | 98.3 | 99.9 | 103.5 | 99.8 | 92.1 | 104.7 | 100.4 | 104.1 | | E.2.3 IIP - Electricity | 102.4 | 108.4 | 106.9 | 105.3 | 104.3 | 101.3 | 100.5 | 88.0 | 93.0 | 96.7 | 91.4 | 101.5 | | E.3 Cement Production | 103.3 | 101.3 | 104.4 | 92.7 | 91.1 | 90.2 | 97.9 | 90.0 | 103.4 | 104.9 | 102.9 | 117.5 | | E.4 Steel Production | 99.4 | 100.4 | 97.5 | 97.3 | 98.5 | 97.5 | 99.7 | 96.1 | 102.2 | 105.3 | 98.4 | 107.5 | | E.5 Coal Production | 93.3 | 96.6 | 92.0 | 84.6 | 78.9 | 79.7 | 93.8 | 102.1 | 111.0 | 118.1 | 112.9 | 136.8 | | E.6 Crude Oil Production | 99.3 | 102.7 | 99.0 | 101.8 | 100.9 | 97.3 | 101.1 | 98.3 | 101.9 | 102.5 | 92.4 | 102.8 | | E.7 Petroleum Refinery Production | 99.3 | 102.5 | 98.2 | 100.1 | 96.1 | 93.5 | 96.5 | 99.4 | 105.6 | 105.4 | 96.3 | 106.8 | | E.8 Fertiliser Production | 86.3 | 101.3 | 100.9 | 103.5 | 103.8 | 101.6 | 104.5 | 103.1 | 104.8 | 103.9 | 94.1 | 91.7 | | E.9 Natural Gas Production | 96.2 | 100.6 | 98.4 | 102.3 | 102.2 | 99.6 | 103.3 | 99.5 | 102.2 | 102.4 | 91.9 | 101.6 | | Service Sector Indicators (5 series) | | F.1 Cargo handled at Major Ports | 99.9 | 102.8 | 98.2 | 98.3 | 96.9 | 92.3 | 97.9 | 97.7 | 102.5 | 105.3 | 97.8 | 110.2 | | F.2 Railway Freight Traffic | 98.4 | 103.4 | 99.1 | 96.6 | 95.0 | 92.3 | 97.0 | 96.9 | 103.8 | 105.5 | 97.6 | 114.6 | | F.3 Passenger flown (Km) - Domestic | 100.4 | 104.7 | 98.2 | 94.7 | 95.9 | 93.6 | 99.0 | 101.5 | 107.7 | 103.1 | 98.6 | 102.4 | | F.4 Passenger flown (Km) - International | 93.0 | 100.0 | 100.1 | 102.8 | 101.6 | 94.9 | 96.1 | 97.4 | 106.0 | 108.5 | 97.7 | 101.5 | | F.5 Passenger Vehicle Sales (wholesale) | 94.4 | 95.6 | 93.5 | 99.3 | 100.1 | 104.0 | 113.5 | 97.5 | 86.5 | 108.5 | 103.3 | 103.4 | | Merchandise Trade (3 series) | | G.1 Exports | 98.9 | 102.2 | 98.3 | 98.1 | 95.6 | 96.1 | 94.6 | 92.9 | 105.1 | 99.9 | 102.1 | 116.7 | | G.2 Imports | 93.0 | 101.8 | 96.7 | 99.9 | 105.9 | 99.6 | 107.4 | 100.1 | 101.5 | 95.4 | 94.2 | 103.7 | | G.3 Non-Oil, Non-Gold and Non-Silver Imports | 93.6 | 99.2 | 101.2 | 103.9 | 101.2 | 101.7 | 104.7 | 97.0 | 103.9 | 99.2 | 91.8 | 102.5 | | Payment System Indicators (4 series) | | H.1 RTGS | 91.5 | 93.7 | 102.1 | 96.9 | 94.2 | 103.7 | 100.2 | 94.4 | 111.7 | 97.6 | 92.2 | 121.6 | | H.2 Paper Clearing | 109.1 | 101.6 | 95.5 | 100.4 | 94.4 | 95.1 | 99.7 | 93.8 | 101.7 | 97.2 | 95.4 | 115.9 | | H.3 REC | 93.8 | 96.7 | 97.3 | 99.3 | 96.0 | 98.0 | 102.9 | 94.2 | 103.2 | 99.2 | 94.2 | 125.4 | | H.4 Cards | 98.2 | 101.5 | 97.3 | 102.9 | 100.5 | 97.9 | 111.2 | 96.7 | 102.6 | 100.1 | 89.8 | 102.2 |

| Annex - II | | Table A2-Q1: Time Period Used for Estimating Quarterly Seasonal Factors | | Quarterly Series | Industrial Outlook Survey (12 series) | | National Accounts Statistics (8 series) | L.1 Production Assessment

L.2 Production Expectation

L.3 Order Books Assessment

L.4 Order Books Expectation

L.5 Capacity Utilisation Assessment

L.6 Capacity Utilisation Expectation

L.7 Selling Price Assessment

L.8 Selling Price Expectation

L.9 Profit Margin Assessment

L.10 Profit Margin Expectation

L.11 Business Assessment Index

L.12 Business Expectation Index | Q1:2000-01 to Q4:2024-2025 | I.1 Real Gross Domestic Product (GDP)

I.2 Real Gross Value Added (GVA)

I.3 Real PFCE

I.4 Real GFCE

I.5 Real GFCF

I.6 GVA of Agriculture

I.7 GVA of Industry

I.8 GVA of Services | Q1:2011-12 to Q4:2024-2025 | | Balance of Payments (4 series) | | J.1 Exports of Services

J.2 Exports in Travel

J.3 Exports in Telecommunications, Computer and Information Services

J.4 Imports in Travel | Q1:2011-12 to Q4:2024-2025 | | OBICUS (1 series) | | K.1 Capacity Utilisation of manufacturing companies | Q1:2008-09 to Q4:2024-2025 |

| Table A2-Q2: Average* Quarterly Seasonal Factors of Select Economic Time Series | | (Per cent) | | SERIES NAME | Q1 | Q2 | Q3 | Q4 | | 1 | 2 | 3 | 4 | 5 | | National Accounts Statistics (8 series) | | I.1 Real Gross Domestic Product (GDP) | 98.1 | 97.8 | 99.5 | 104.7 | | I.2 Real Gross Value Added (GVA) | 100.1 | 98.3 | 99.7 | 102.1 | | I.3 Real PFCE | 97.6 | 96.0 | 104.4 | 102.0 | | I.4 Real GFCE | 106.4 | 103.4 | 89.5 | 102.5 | | I.5 Real GFCF | 100.2 | 96.9 | 97.4 | 105.5 | | I.6 GVA of Agriculture | 91.8 | 77.3 | 125.1 | 105.9 | | I.7 GVA of Industry | 99.7 | 98.0 | 95.3 | 107.3 | | I.8 GVA of Services | 102.1 | 103.5 | 95.2 | 99.3 | | Balance of Payments (4 series) | | J.1 Exports of Services | 96.5 | 98.5 | 102.4 | 102.6 | | J.2 Exports in Travel | 85.9 | 95.2 | 109.1 | 110.2 | | J.3 Exports in Telecommunications, Computer and Information Services | 99.0 | 100.7 | 101.3 | 99.1 | | J.4 Imports in Travel | 108.2 | 107.2 | 92.3 | 92.4 | | OBICUS (1 series) | | K.1 Capacity Utilisation of manufacturing companies | 98.3 | 99.5 | 100.1 | 102.0 | | Industrial Outlook Survey (12 series) | | L.1 Production Assessment | 99.2 | 97.9 | 99.9 | 103.0 | | L.2 Production Expectation | 98.9 | 100.7 | 100.8 | 99.5 | | L.3 Order Books Assessment | 100.5 | 98.4 | 99.0 | 102.1 | | L.4 Order Books Expectation | 99.3 | 100.2 | 100.1 | 100.4 | | L.5 Capacity Utilisation Assessment | 99.4 | 98.4 | 99.0 | 103.3 | | L.6 Capacity Utilisation Expectation | 99.5 | 99.2 | 100.9 | 100.2 | | L.7 Selling Price Assessment | 102.8 | 97.9 | 98.5 | 100.8 | | L.8 Selling Price Expectation | 100.4 | 100.1 | 100.0 | 99.5 | | L.9 Profit Margin Assessment | 100.3 | 99.5 | 98.7 | 101.5 | | L.10 Profit Margin Expectation | 100.5 | 100.5 | 99.7 | 99.3 | | L.11 Business Assessment Index | 100.0 | 99.2 | 99.6 | 101.2 | | L.12 Business Expectation Index | 99.2 | 99.3 | 101.0 | 100.4 | | Note: *: Average of last ten years’ quarterly seasonal factors, in general. Here, the average quarterly seasonal factors have been computed on the basis of last 10 years (i.e., Q1: 2015-16 to Q4: 2024-25). Numbers marked in ‘bold’ are peaks and troughs of respective series. |

| Table A2-Q3: Range (Difference Between Peak and Trough) of Quarterly Seasonal Factors | | (Percentage points) | | SERIES \ YEAR | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | Average Range | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | National Accounts Statistics (8 series) | | I.1 Real Gross Domestic Product (GDP) | 5.1 | 5.1 | 5.5 | 6.0 | 6.6 | 7.0 | 7.6 | 8.2 | 8.7 | 9.1 | 6.9 | | I.2 Real Gross Value Added (GVA) | 1.7 | 1.7 | 2.0 | 2.6 | 3.2 | 4.1 | 4.9 | 5.6 | 6.1 | 6.4 | 3.8 | | I.3 Real PFCE | 7.2 | 6.8 | 6.8 | 7.4 | 8.0 | 8.7 | 9.4 | 9.9 | 10.1 | 10.0 | 8.4 | | I.4 Real GFCE | 30.8 | 29.6 | 25.4 | 18.2 | 19.1 | 20.8 | 27.0 | 32.5 | 33.6 | 32.6 | 16.9 | | I.5 Real GFCF | 6.5 | 6.8 | 7.6 | 8.7 | 9.6 | 10.1 | 10.2 | 10.8 | 11.4 | 11.5 | 8.6 | | I.6 GVA of Agriculture | 52.2 | 50.3 | 48.8 | 48.0 | 47.3 | 46.8 | 46.2 | 46.0 | 46.1 | 46.4 | 47.8 | | I.7 GVA of Industry | 10.0 | 10.3 | 10.5 | 10.6 | 11.1 | 11.8 | 12.7 | 13.7 | 14.4 | 14.8 | 12.0 | | I.8 GVA of Services | 10.4 | 10.2 | 9.8 | 9.4 | 8.9 | 8.3 | 7.5 | 6.8 | 6.2 | 5.9 | 8.3 | | Balance of Payments (4 series) | | J.1 Exports of Services | 5.5 | 5.6 | 5.8 | 6.1 | 6.5 | 6.7 | 6.7 | 6.6 | 6.6 | 6.6 | 6.1 | | J.2 Exports in Travel | 20.9 | 18.7 | 17.5 | 18.5 | 21.7 | 26.4 | 30.1 | 31.2 | 33.7 | 34.8 | 24.3 | | J.3 Exports in Telecommunications, Computer and Information Services | 3.0 | 2.9 | 2.5 | 2.2 | 2.0 | 2.0 | 2.0 | 2.4 | 2.8 | 3.1 | 2.4 | | J.4 Imports in Travel | 18.4 | 18.9 | 18.1 | 17.6 | 16.4 | 15.7 | 15.1 | 14.9 | 14.9 | 15.2 | 15.9 | | OBICUS (1 series) | | K.1 Capacity Utilisation of manufacturing companies | 4.3 | 3.8 | 3.3 | 3.1 | 3.1 | 3.3 | 3.7 | 3.9 | 4.0 | 4.1 | 3.7 | | Industrial Outlook Survey (12 series) | | L.1 Production Assessment | 4.6 | 4.6 | 4.8 | 4.9 | 4.9 | 5.0 | 5.3 | 5.3 | 5.5 | 5.6 | 5.0 | | L.2 Production Expectation | 3.3 | 2.8 | 2.5 | 2.1 | 2.0 | 2.6 | 2.8 | 2.5 | 1.9 | 1.8 | 2.0 | | L.3 Order Books Assessment | 4.2 | 4.0 | 3.8 | 3.7 | 3.6 | 3.5 | 3.6 | 3.8 | 3.8 | 3.9 | 3.7 | | L.4 Order Books Expectation | 1.5 | 0.9 | 0.9 | 1.0 | 0.9 | 0.8 | 1.2 | 1.9 | 2.3 | 2.4 | 1.1 | | L.5 Capacity Utilisation Assessment | 4.6 | 4.5 | 4.4 | 4.5 | 4.6 | 4.8 | 5.0 | 5.3 | 5.5 | 5.7 | 4.9 | | L.6 Capacity Utilisation Expectation | 3.0 | 2.1 | 1.5 | 1.4 | 1.6 | 1.9 | 2.1 | 2.3 | 2.7 | 3.0 | 1.7 | | L.7 Selling Price Assessment | 3.6 | 4.4 | 5.2 | 5.7 | 5.9 | 5.9 | 5.7 | 5.0 | 4.4 | 4.0 | 5.0 | | L.8 Selling Price Expectation | 1.3 | 1.4 | 1.6 | 1.9 | 2.0 | 1.6 | 1.4 | 1.3 | 1.3 | 1.4 | 0.9 | | L.9 Profit Margin Assessment | 3.6 | 3.5 | 3.4 | 3.2 | 2.9 | 2.7 | 2.7 | 2.5 | 2.2 | 1.6 | 2.8 | | L.10 Profit Margin Expectation | 1.3 | 1.2 | 1.4 | 1.9 | 2.4 | 2.6 | 2.3 | 1.7 | 1.0 | 0.7 | 1.2 | | L.11 Business Assessment Index | 2.5 | 2.4 | 2.3 | 2.2 | 2.0 | 1.7 | 1.6 | 1.5 | 1.6 | 1.8 | 2.0 | | L.12 Business Expectation Index | 1.5 | 1.5 | 1.6 | 1.7 | 1.8 | 1.8 | 1.9 | 2.0 | 2.2 | 2.3 | 1.8 | | Note: Average seasonal factor range is the range of average seasonal factors for last ten years; range is calculated as the difference between maximum and minimum of quarterly seasonal factors. |

| Table A2-Q4: Major Diagnostics of all the Quarterly Indicators | | Name of variable | Seasonality in Original Series | Residual Seasonality | Quality Diagnostics | | F test p-value | KW test p-value | F test p-value | F test 3 yr p-value | M7 | Q | | I.1 Real Gross Domestic Product (GDP) | 0.00 | 0.00 | 0.06 | 0.42 | 0.23 | 0.27 | | I.2 Real Gross Value Added (GVA) | 0.00 | 0.00 | 0.02 | 0.10 | 0.46 | 0.46 | | I.3 Real PFCE | 0.00 | 0.00 | 0.04 | 0.45 | 0.19 | 0.52 | | I.4 Real GFCE | 0.00 | 0.00 | 0.33 | 0.62 | 0.71 | 1.00 | | I.5 Real GFCF | 0.00 | 0.00 | 0.15 | 0.36 | 0.32 | 0.67 | | I.6 GVA of Agriculture | 0.00 | 0.00 | 0.74 | 0.66 | 0.07 | 0.13 | | I.7 GVA of Industry | 0.00 | 0.00 | 0.16 | 0.80 | 0.23 | 0.38 | | I.8 GVA of Services | 0.00 | 0.00 | 0.02 | 0.14 | 0.27 | 0.32 | | J.1 Exports of Services | 0.00 | 0.00 | 0.43 | 0.52 | 0.30 | 0.36 | | J.2 Exports in Travel | 0.00 | 0.00 | 0.94 | 0.54 | 0.42 | 0.47 | | J.3 Exports in Telecommunications, Computer and Information Services | 0.00 | 0.00 | 0.09 | 0.65 | 0.49 | 0.48 | | J.4 Imports of Services | 0.04 | 0.01 | 0.91 | 0.86 | 1.19 | 1.00 | | J.5 Imports in Travel | 0.00 | 0.00 | 0.44 | 0.98 | 0.32 | 0.29 | | J.6 Imports in Telecommunications, Computer and Information Services | 0.02 | 0.04 | 0.82 | 0.63 | 1.20 | 1.47 | | K.1 Capacity Utilisation of manufacturing companies | 0.00 | 0.00 | 0.18 | 0.54 | 0.29 | 0.55 | | L.1 Production Assessment | 0.00 | 0.00 | 0.16 | 0.85 | 0.31 | 0.45 | | L.2 Production Expectation | 0.00 | 0.00 | 0.77 | 0.64 | 0.57 | 0.63 | | L.3 Order Books Assessment | 0.00 | 0.00 | 0.13 | 0.69 | 0.56 | 0.71 | | L.4 Order Books Expectation | 0.00 | 0.00 | 0.36 | 0.95 | 0.82 | 0.95 | | L.5 Employment Assessment | 0.24 | 0.02 | 0.30 | 0.98 | 2.03 | 1.07 | | L.6 Employment Expectation | 0.09 | 0.03 | 0.64 | 0.69 | 1.57 | 1.09 | | L.7 Capacity Utilisation Assessment | 0.00 | 0.00 | 0.08 | 0.94 | 0.25 | 0.44 | | L.8 Capacity Utilisation Expectation | 0.00 | 0.00 | 0.92 | 0.93 | 0.74 | 0.98 | | L.9 Selling Price Assessment | 0.00 | 0.00 | 0.40 | 0.74 | 0.49 | 0.82 | | L.10 Selling Price Expectation | 0.03 | 0.00 | 0.52 | 0.70 | 1.27 | 1.22 | | L.11 Cost of External Finance Assessment | 0.64 | 0.57 | 0.27 | 0.99 | 2.71 | 1.32 | | L.12 Cost of External Finance Expectation | 0.02 | 0.01 | 0.33 | 0.96 | 1.41 | 0.84 | | L.13 Profit Margin Assessment | 0.00 | 0.00 | 0.16 | 0.95 | 0.76 | 1.05 | | L.14 Profit Margin Expectation | 0.31 | 0.12 | 0.70 | 0.45 | 2.13 | 1.19 | | L.15 Business Assessment Index | 0.00 | 0.00 | 0.30 | 0.94 | 0.51 | 0.75 | | L.16 Business Expectation Index | 0.00 | 0.00 | 0.97 | 0.90 | 0.56 | 0.86 | | Note: Please see notes to Table A1-M4. |

| Table A2-Q5: Quarterly Seasonal Factors of Select Economic Time Series for 2024-25 | | (Per cent) | | SERIES NAME | Q1 | Q2 | Q3 | Q4 | | 1 | 2 | 3 | 4 | 5 | | National Accounts Statistics (8 series) | | I.1 Real Gross Domestic Product (GDP) | 97.3 | 97.0 | 99.7 | 106.1 | | I.2 Real Gross Value Added (GVA) | 99.2 | 97.4 | 99.7 | 103.8 | | I.3 Real PFCE | 97.2 | 95.8 | 105.8 | 101.1 | | I.4 Real GFCE | 100.6 | 93.1 | 87.0 | 119.5 | | I.5 Real GFCF | 99.6 | 98.4 | 95.2 | 106.6 | | I.6 GVA of Agriculture | 91.1 | 77.5 | 123.9 | 107.6 | | I.7 GVA of Industry | 98.8 | 97.6 | 94.4 | 109.2 | | I.8 GVA of Services | 101.1 | 102.0 | 96.0 | 101.1 | | Balance of Payments (4 series) | | J.1 Exports of Services | 96.2 | 98.9 | 102.8 | 102.0 | | J.2 Exports in Travel | 82.7 | 88.8 | 117.4 | 110.7 | | J.3 Exports in Telecommunications, Computer and Information Services | 98.7 | 100.0 | 101.7 | 99.6 | | J.4 Imports in Travel | 107.8 | 106.0 | 92.6 | 93.4 | | OBICUS (1 series) | | K.1 Capacity Utilisation of manufacturing companies | 98.5 | 99.1 | 99.9 | 102.5 | | Industrial Outlook Survey (12 series) | | L.1 Production Assessment | 99.2 | 97.6 | 100.0 | 103.2 | | L.2 Production Expectation | 99.0 | 100.8 | 100.7 | 99.7 | | L.3 Order Books Assessment | 100.4 | 98.1 | 99.5 | 102.1 | | L.4 Order Books Expectation | 98.4 | 100.7 | 100.8 | 100.1 | | L.5 Capacity Utilisation Assessment | 98.8 | 97.9 | 99.8 | 103.6 | | L.6 Capacity Utilisation Expectation | 100.0 | 98.5 | 101.5 | 100.0 | | L.7 Selling Price Assessment | 102.4 | 98.3 | 99.1 | 100.2 | | L.8 Selling Price Expectation | 99.2 | 100.6 | 100.4 | 100.0 | | L.9 Profit Margin Assessment | 99.4 | 100.6 | 99.2 | 100.8 | | L.10 Profit Margin Expectation | 100.0 | 100.1 | 99.8 | 100.4 | | L.11 Business Assessment Index | 99.7 | 99.5 | 99.6 | 101.2 | | L.12 Business Expectation Index | 99.0 | 99.4 | 101.3 | 100.4 |

|