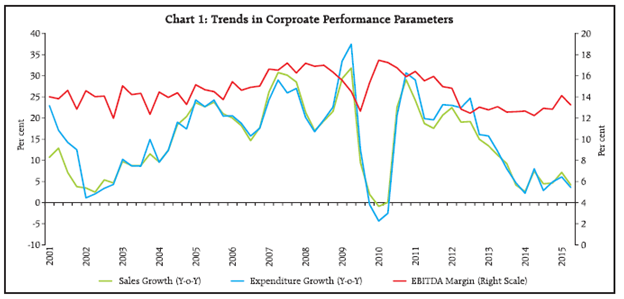

The aggregated sales growth of the private (non-financial)

corporate business sector improved marginally during

H1:2014-15 with a combination of improved sales growth

during Q1 followed by a deceleration in Q2 of 2014-15.

This is primarily due to a sluggish sales growth in the

manufacturing sector and moderation for the services

including IT sectors. EBITDA margins improved despite

moderation in sales to a level earlier observed in H1:2011-

12. Profit growth and profit margins (EBITDA and Net

profit) witnessed improvement across all size groups. Sales

growth increased in major industries except in textiles and

construction during H2:2013-14 and H1:2014-15.

Performance of the private (non-financial) corporate

business sector over the quarters revealed that sales

growth(Y-o-Y) decelerated in the second quarter of 2014-

15 as compared to the previous quarter and an upturn noticed earlier in Q2:2013-14 and then in Q1:2014-15

could not be sustained. Net Profit margin was maintained

at similar levels during the first two quarters.

The article analyses the performance of the private

(non-financial) corporate business sector during the

first half (April- September) of 2014-15, based on

earnings results of 2,965 listed companies. Besides

analysing the aggregate performance, it provides a brief

analysis by size and major industry groups. It also

captures the trend in sales, expenditure and profit

margins of the private corporate sector over a longer

horizon. Detailed quarterly data has been made

available periodically in the website of the Reserve Bank

of India (Q2:2014-15 data released on 24th December

2014).

1. Upsurge in Net Profit at the aggregate level

1.1. Sales growth (Y-o-Y) of 2,965 listed companies

of the private corporate sector improved marginally

during H1:2014-15. Aggregate sales growth decelerated

for previous three half-years. Though total expenditure

showed downward trend since H1:2011-12, cost of raw materials witnessed higher growth in H1:2014-15

(Table 1). In contrast, staff cost declined from

H1:2013-14 level and recorded lowest growth since

H1:2010-11. Likewise interest expenses growth

declined considerably during current half-year. But

interest expenses as a proportion to sales and overall

expenditure remained at the level of H1:2013-14.

| Table 1: Performance of the Listed Non-Government Non-Financial Companies |

| No. of companies |

H1: 2014-15 |

H2: 2013-14 |

H1: 2013-14* |

| Items |

Amount

(` billion) |

Y-o-Y Growth @

in Per cent |

| 2,965 |

2,864 |

2,731 |

| 1 |

2 |

3 |

4 |

| Sales |

16,038 |

5.8 |

4.7 |

5.4 |

| Value of Production |

16,133 |

6.0 |

4.4 |

4.8 |

| Expenditure |

13,940 |

5.0 |

4.8 |

5.6 |

| CRM ** |

7,394 |

7.0 |

3.1 |

2.4 |

| Staff Cost |

1,271 |

8.2 |

9.5 |

13.1 |

| Power & fuel |

595 |

8.7 |

4.0 |

-0.8 |

| Operating Profits (EBITDA) |

2,193 |

12.6 |

1.6 |

-0.8 |

| Other Income@@ |

485 |

14.0 |

18.1 |

14.9 |

| Depreciation |

592 |

6.4 |

7.9 |

10.1 |

| Gross Profits (EBIT) |

2,086 |

14.8 |

2.9 |

-0.8 |

| Interest |

642 |

1.4 |

9.3 |

15.0 |

| Earnings before tax (EBT)^ |

1,499 |

31.1 |

-2.9 |

-10.0 |

| Tax provision |

404 |

27.2 |

3.0 |

3.7 |

| Net Profits^ |

1,095 |

32.6 |

-4.9 |

-14.9 |

| Paid-up Capital |

1,277 |

2.3 |

4.2 |

5.7 |

* : Published in February 2014 issue of the RBI Bulletin.

@ : Growth rates calculated on the basis of common set of companies

during any period.

** : CRM : Consumption of Raw Materials.

@@ : Includes forex gain while forex losses are included in Expenditure.

^ : Adjusted for non-operating surplus/deficit |

1.2. Earnings before Interest, Tax, Depreciation and

Amortisation (EBITDA or operating profits) and earnings

before interest and tax (EBIT) have grown considerably

during current half-year against a contraction in the

corresponding period in 2013-14. Earnings before tax

(EBT) witnessed a buoyant growth owing to lower

growth in interest expenses. Growth rate in net profits before adjusting non-operating income jumped steeply

from -11.4 percent in H1:2013-14 to 20.1 percent in

H1:2014-15. Net profits after adjusting non-operating

income increased further to 32.6 per cent indicating a

significant addition to income other than the normal

operations of business. EBITDA and net profit margins

witnessed improvement in H1:2014-15.

| Table 2: Important Performance Parameters |

| Period |

No. of

Companies |

Sales Growth

(Y-o-Y) |

Expenditure

Growth (Y-o-Y) |

EBITDA Growth

(Y-o-Y) |

Net Profit

Growth

( Y-o-Y) |

EBITDA Margin

(Per cent) |

Net Profit Margin

(Per cent) |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

| H1:2011-12 |

2,643 |

20.8 |

22.8 |

5.7 |

-4.9 |

13.8 |

6.7 |

| H2:2011-12 |

2,861 |

17.6 |

20.6 |

-2.1 |

-11.9 |

12.8 |

6.2 |

| H1:2012-13 |

2,832 |

12.3 |

13.6 |

4.9 |

4.3 |

13.1 |

6.4 |

| H2:2012-13 |

2,912 |

6.8 |

5.8 |

8.0 |

11.9 |

13.2 |

6.5 |

| H1:2013-14 |

2,731 |

5.4 |

5.6 |

-0.8 |

-14.9 |

12.5 |

5.2 |

| H2:2013-14 |

2,864 |

4.7 |

4.8 |

1.6 |

-4.9 |

12.3 |

5.1 |

| H1:2014-15 |

2,965 |

5.8 |

5.0 |

12.6 |

32.6 |

13.7 |

6.8 |

2. Large Companies performance improved

2.1. Large companies (annualised sales more than

`10 billion) witnessed modest increase in sales growth

after moderation since 2012-13. Sales growth of the

medium sized companies (annualised sales between

`1 billion to `10 billion), after slight improvement in

H1:2013-14, again decelerated during 2014-15. Sales of

small companies (annualised sales up to `1 billion)

continued to contract during H1:2014-15 (Table 3).

2.2. Companies across all size groups witnessed

improvement in EBITDA growth with a remarkable

recovery for the small companies for the first time after

successive contractions since H2:2010-11, particularly

for the pharmaceutical industry. Net profit growth

sharply increased for medium and large sized

companies whereas small sized companies witnessed

reduction in losses.

| Table 3: Size class* – wise important performance parameters |

| Size Classes |

Large |

Medium |

Small |

| Annualised sales more than `10 billion |

Annualised sales between `1 billion and `10 billion |

Annualised sales less than `1 billion |

| Period |

Growth Rate (Y-o-Y) (%) |

Margins (%) |

Growth Rate (Y-o-Y) (%) |

Margins (%) |

Growth Rate (Y-o-Y) (%) |

Margins (%) |

| Sales |

EBITDA |

Net Profit |

EBITDA |

Net Profit |

Sales |

EBITDA |

Net Profit |

EBITDA |

Net Profit |

Sales |

EBITDA |

Net Profit |

EBITDA |

Net Profit |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

| H1:2011-12 |

22.9 |

8.2 |

-0.3 |

14.4 |

7.4 |

12.8 |

-6.6 |

-32.7 |

11.1 |

3.7 |

-7.0 |

-41.7 |

$ |

6.1 |

-0.8 |

| H2:2011-12 |

20.8 |

0.5 |

-12.7 |

13.5 |

6.7 |

3.6 |

-13.8 |

-38.0 |

10.9 |

3.2 |

-18.9 |

-41.9 |

$ |

2.6 |

-3.4 |

| H1:2012-13 |

14.6 |

5.9 |

7.8 |

13.4 |

7.0 |

3.8 |

0.6 |

-27.1 |

11.9 |

3.5 |

-21.5 |

-19.1 |

$ |

6.9 |

-4.0 |

| H2:2012-13 |

9.2 |

10.9 |

22.9 |

13.9 |

7.8 |

-2.7 |

-10.5 |

-86.6 |

10.2 |

0.5 |

-24.3 |

-119.3 |

$ |

-0.3 |

-15.0 |

| H1:2013-14 |

6.6 |

1.6 |

-11.4 |

13.0 |

5.9 |

1.1 |

-14.1 |

-40.8 |

10.2 |

2.1 |

-19.3 |

-56.9 |

$ |

4.2 |

-7.7 |

| H2:2013-14 |

6.4 |

7.4 |

4.1 |

13.4 |

6.7 |

-1.7 |

-38.5 |

$ |

6.3 |

-2.6 |

-25.8 |

$ |

$ |

-5.9 |

-25.0 |

| H1:2014-15 |

7.5 |

13.2 |

31.4 |

14.4 |

7.9 |

-0.8 |

5.6 |

52.1 |

9.5 |

1.0 |

-24.3 |

33.1 |

$ |

4.9 |

-12.2 |

| *: Classification is done based on the data for the latest reporting period. |

2.3. EBITDA and net profit margins have improved

for medium and large sized companies. In case of small

sized companies, EBITDA margin improved slightly over

corresponding period of the previous year.

2.4. Interest coverage ratio (EBIT/Interest Expenses)

was in range of 3.5 to 4.0 for large companies during

the period of H2:2011-12 to H1:2014-15. For medium and small companies it worsened continuously since

2009-10 and recorded a minor improvement for small

companies in H1:2014-15.

2.5. The increase in EBITDA growth and better

interest coverage for the small sized companies did not

mitigate the deteriorating liquidity and solvency of

these companies. Debt repayment capacity if measured as a ratio of total borrowings to EBITDA for small

companies declined in H1:2014-15 as compared to

H1:2013-14. Quick and current ratio contracted while

leverage ratio increased whereas the overall and the

manufacturing sector leverage showed downward

movement in H1:2014-15.

| Table 4: Sector- wise important performance parameters |

| Sector |

Manufacturing |

Services (other than IT) |

IT |

| Period |

Growth Rate (Y-o-Y) (%) |

Margins (%) |

Growth Rate (Y-o-Y) (%) |

Margins (%) |

Growth Rate (Y-o-Y) (%) |

Margins (%) |

| Sales |

EBITDA |

Net

Profit |

EBITDA |

Net

Profit |

Sales |

EBITDA |

Net

Profit |

EBITDA |

Net

Profit |

Sales |

EBITDA |

Net

Profit |

EBITDA |

Net

Profit |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

| H1:2011-12 |

22.7 |

5.5 |

-3.7 |

12.5 |

6.0 |

14.3 |

1.3 |

-41.5 |

15.8 |

3.9 |

18.1 |

13.4 |

21.8 |

21.1 |

17.1 |

| H2:2011-12 |

17.6 |

-3.4 |

-20.4 |

11.5 |

5.1 |

12.9 |

-2.8 |

-34.1 |

15.7 |

4.1 |

17.8 |

13.8 |

23.9 |

21.6 |

17.7 |

| H1:2012-13 |

12.2 |

3.0 |

3.0 |

11.5 |

5.7 |

11.4 |

10.1 |

43.4 |

16.2 |

4.7 |

16.9 |

25.6 |

18.6 |

22.7 |

17.1 |

| H2:2012-13 |

6.5 |

6.5 |

8.4 |

11.4 |

5.2 |

13.3 |

2.9 |

-44.3 |

16.4 |

2.9 |

6.0 |

8.7 |

-6.3 |

22.0 |

15.8 |

| H1:2013-14 |

4.5 |

-3.6 |

-16.3 |

10.6 |

4.5 |

9.2 |

-3.6 |

-31.2 |

16.0 |

3.8 |

15.1 |

20.5 |

14.0 |

24.8 |

17.9 |

| H2:2013-14 |

5.4 |

1.7 |

-5.7 |

10.8 |

4.6 |

0.7 |

-19.9 |

-88.2 |

12.9 |

0.4 |

17.2 |

33.3 |

33.8 |

25.4 |

18.9 |

| H1:2014-15 |

6.2 |

13.5 |

36.9 |

11.5 |

5.5 |

2.9 |

17.2 |

99.5 |

18.4 |

7.9 |

9.4 |

11.9 |

26.3 |

25.3 |

20.7 |

3. Sales growth for IT sector declined; Margins

maintained across sectors

3.1. The manufacturing sector has shown a gradual

improvement in the sales during H2:2013-14 and

H1:2014-15. The sales growth of the non-IT services

sector declined successively from a level of 13.3 per

cent observed in the second half of 2012-13 till second

half of 2013-14 and showed only a minor improvement

in H1:2014-15.

3.2. A closer look at the components of expenditure

as a proportion to sales for the manufacturing sector

indicated a steady decline in the cost of raw materials

to sales ratio for large companies and also the sector as

a whole. However, the ratio increased for the small

sized companies within the manufacturing sector. Staff

cost to sales went up in H1:2014-15, though it remained

higher for the small sized companies. Interest to sales

ratio remained flat for large and medium sized companies in manufacturing and the non-IT services

sectors, while that of the small companies showed an

increasing trend till H2:2013-14 and thereafter declined

in H1:2014-15, remaining distinctly higher than the

manufacturing sector as a whole.

3.3. The trend in EBITDA margin for the

manufacturing sector closely followed that of the ratio

of raw-materials to sales while it remained close to an

average of 11.4 per cent during the seven consecutive

half-years. Both EBITDA and net profit growth rates for

the non-IT services sector shot up in H1:2014-15, to

pull up the sunken margins above the average for the

seven half-years.

3.4. In H1:2014-15 the manufacturing sector

witnessed a rise in the non-operating surplus. This

additional surplus accounted for 12.6 per cent of net

profits in H1:2014-15, which is maximum in the period

of seven half-years considered for the study and also

remained higher than the levels observed for the

services (IT and non-IT) sectors.

3.5. The IT sector, after recovering from its lowest

sales growth of 6 per cent in the second half of 2012-13,

was the only sector to report a moderation in sales

growth in H1:2014-15. The Y-o-Y growth rates for

EBITDA and net profits declined significantly in

H1:2014-15. However, EBITDA margin was maintained at similar levels as H2:2013-14, while net profit margin

improved.

| Table 5 : CRM, Staff Cost and Interest Expenditure as percentage to sales |

| Period |

CRM |

Staff Cost |

Interest |

CRM |

Staff Cost |

Interest |

CRM |

Staff Cost |

Interest |

CRM |

Staff Cost |

Interest |

| Large |

Medium |

Small |

All Companies |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

| Manufacturing |

| H1:2011-12 |

59.9 |

3.9 |

2.2 |

54.8 |

6.6 |

4.0 |

51.1 |

9.9 |

4.8 |

59.0 |

4.4 |

2.5 |

| H2:2011-12 |

63.3 |

3.7 |

2.7 |

57.6 |

6.5 |

4.4 |

52.4 |

9.6 |

7.1 |

62.3 |

4.2 |

3.0 |

| H1:2012-13 |

62.0 |

4.0 |

2.7 |

54.4 |

6.8 |

4.5 |

52.7 |

9.5 |

8.6 |

60.8 |

4.5 |

3.0 |

| H2:2012-13 |

61.3 |

4.0 |

2.7 |

56.7 |

7.5 |

4.8 |

52.7 |

10.1 |

8.9 |

60.6 |

4.5 |

3.1 |

| H1:2013-14 |

60.0 |

4.4 |

2.9 |

55.1 |

7.0 |

4.4 |

49.6 |

9.9 |

9.3 |

59.3 |

4.8 |

3.1 |

| H2-2013-14 |

59.9 |

4.1 |

2.7 |

58.3 |

7.1 |

4.9 |

51.1 |

9.6 |

11.3 |

59.6 |

4.5 |

3.1 |

| H1-2014-15 |

58.9 |

4.5 |

2.7 |

53.5 |

7.3 |

5.4 |

51.7 |

10.3 |

9.9 |

58.1 |

4.9 |

3.2 |

| Services (Other than IT) |

| H1:2011-12 |

18.3 |

5.1 |

5.5 |

10.6 |

11.8 |

9.5 |

18.3 |

12.2 |

8.6 |

17.1 |

6.3 |

6.2 |

| H2:2011-12 |

6.6 |

4.9 |

5.1 |

8.2 |

9.8 |

11.3 |

16.8 |

11.3 |

6.4 |

7.2 |

6.0 |

6.3 |

| H1:2012-13 |

6.2 |

4.7 |

5.4 |

8.8 |

10.8 |

11.5 |

15.5 |

13.1 |

8.3 |

6.9 |

6.0 |

6.6 |

| H2:2012-13 |

7.2 |

4.4 |

4.5 |

10.4 |

9.8 |

11.3 |

23.4 |

10.1 |

6.4 |

8.1 |

5.5 |

5.8 |

| H1:2013-14 |

3.1 |

5.0 |

5.3 |

9.5 |

11.1 |

12.3 |

15.8 |

12.6 |

13.4 |

4.3 |

6.1 |

6.6 |

| H2-2013-14 |

4.8 |

5.3 |

4.0 |

9.9 |

11.8 |

11.6 |

17.9 |

11.8 |

16.7 |

6.0 |

6.6 |

5.6 |

| H1-2014-15 |

3.9 |

5.6 |

4.8 |

8.2 |

12.5 |

11.1 |

18.9 |

12.2 |

13.0 |

5.0 |

6.9 |

6.0 |

| IT |

| H1:2011-12 |

3.4 |

35.7 |

1.1 |

3.8 |

40.4 |

3.0 |

15.0 |

31.6 |

8.0 |

3.6 |

36.1 |

1.4 |

| H2:2011-12 |

3.4 |

36.3 |

1.2 |

4.6 |

31.4 |

4.3 |

10.7 |

33.0 |

10.6 |

3.7 |

35.7 |

1.7 |

| H1:2012-13 |

2.6 |

38.1 |

0.9 |

8.3 |

34.8 |

5.8 |

11.3 |

35.5 |

10.9 |

3.3 |

37.8 |

1.5 |

| H2:2012-13 |

1.3 |

40.5 |

0.8 |

7.6 |

35.4 |

5.9 |

10.1 |

32.2 |

13.5 |

2.0 |

39.9 |

1.5 |

| H1:2013-14 |

1.6 |

39.6 |

0.6 |

2.3 |

39.1 |

7.2 |

22.4 |

31.3 |

19.0 |

1.9 |

39.5 |

1.3 |

| H2-2013-14 |

1.7 |

37.5 |

0.5 |

1.8 |

41.3 |

6.4 |

10.3 |

29.6 |

19.4 |

1.8 |

37.8 |

1.3 |

| H1-2014-15 |

1.3 |

38.9 |

0.5 |

1.6 |

40.2 |

7.3 |

11.5 |

30.3 |

10.3 |

1.4 |

38.9 |

1.0 |

| Aggregate |

| H1:2011-12 |

47.5 |

7.2 |

3.1 |

47.9 |

6.8 |

2.7 |

45.8 |

9.0 |

4.7 |

42.7 |

11.9 |

6.2 |

| H2:2011-12 |

49.0 |

6.7 |

3.6 |

49.4 |

6.3 |

3.2 |

47.2 |

8.3 |

5.5 |

41.4 |

12.2 |

8.0 |

| H1:2012-13 |

48.3 |

7.3 |

3.7 |

49.0 |

7.0 |

3.3 |

44.5 |

8.9 |

5.8 |

41.5 |

12.4 |

9.2 |

| H2:2012-13 |

47.7 |

7.2 |

3.7 |

47.9 |

6.8 |

3.3 |

46.9 |

9.2 |

6.0 |

43.2 |

12.0 |

9.1 |

| H1:2013-14 |

46.5 |

7.8 |

4.0 |

46.7 |

7.5 |

3.6 |

45.7 |

9.1 |

6.0 |

40.5 |

12.3 |

11.4 |

| H2-2013-14 |

47.5 |

7.3 |

3.7 |

47.6 |

6.9 |

3.2 |

48.2 |

9.3 |

6.3 |

40.0 |

11.9 |

13.3 |

| H1-2014-15 |

46.1 |

7.9 |

4.0 |

46.4 |

7.7 |

3.5 |

44.8 |

9.2 |

6.9 |

41.0 |

12.5 |

10.9 |

4. Sales growth showed upward turn in major

industries except in textiles and construction

4.1. In the basic goods sector, sales growth of iron

& steel and cement industries went up at noticeable rate in H2:2013-14 and H1:2014-15, which was declining

from H2:2011-12 to H1:2013-14. EBITDA margin also

grew successively for two half-years after H1:2013-14.

Size wise analysis shows a mixed picture indicating

considerable growth of large and medium companies,

while no improvement is observed in small companies

(Table 6).

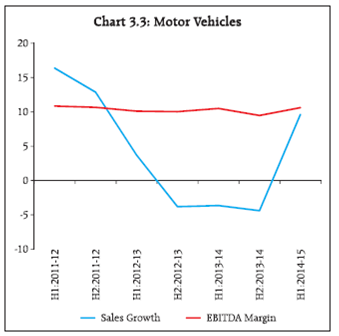

4.2. In the consumer goods sector, textile industry

suffered steady decline in sales growth with moderation

since H2:2012-13, while motor vehicle industry

witnessed sharp rise in sales growth during the period,

after a contraction in previous three half-years

(Chart 3.5). In pharmaceutical industry, sales growth declined in H1:2014-15 after showing a good growth in

H2:2013-14. EBITDA margin went up in all industries

including textiles even with declining sales growth. Net

Profit margin increased further in pharmaceutical

industry only showing good results for large companies.

However, the pharmaceutical industry added a considerable amount of non-operating surplus

accounting for total 37 per cent of such income for the

entire manufacturing.

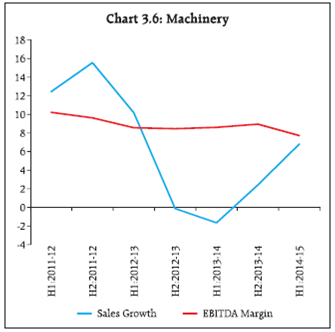

4.3. In capital goods sector, machinery industry

maintained the momentum in sales growth in H2:2013-

14 and H1:2014-15, which was falling sharply since

H2:2011-12. EBIDTA margin and net profit margin

declined in H1:2014-15 after showing a marginal

recovery in H2:2013-14 (Chart 3.6).

4.4. Construction industry showed continuous

contraction in sales growth in H2:2013-14 and H1:2014-

15. It had started declining from H1:2013-14. While net

profit margin improved initially in H2:2013-14 but

declined in H1:2014-15, EBITDA margin declined in

H2:2013-14 and improved in H1:2014-15 (Table 6). In

electricity generation & supply industry, sales growth

showed steep contraction in H2:2013-14 but

improvement was seen in H1:2014-15. EBITDA margin

maintained its level in both the half-years, while net profit margin increased in H2:2013-14 noticeably and

then declined in H1:2014-15. Large companies of this

industry witnessed improvement in the three

parameters- sales, EBITDA margin and profit margin

(Table 6).

| Table 6: Important Performance Parameters of Select Industries |

| Industry |

Period |

Large |

Medium |

Small |

All Companies |

| Sales |

EBITDA |

Net

Profit |

Sales |

EBITDA |

Net

Profit |

Sales |

EBITDA |

Net

Profit |

Sales |

EBITDA |

Net

Profit |

Growth

(Y-o-Y) |

Margin

(Per cent) |

Margin

(Per cent) |

Growth

(Y-o-Y) |

Margin

(Per cent) |

Margin

(Per cent) |

Growth

(Y-o-Y) |

Margin

(Per cent) |

Margin

(Per cent) |

Growth

(Y-o-Y) |

Margin

(Per cent) |

Margin

(Per cent) |

| |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

| Cement |

H1:2013-14 |

-1.4 |

15.2 |

6.8 |

-9.9 |

6.7 |

-0.7 |

-15.0 |

5.2 |

-8.0 |

-2.5 |

14.1 |

5.9 |

| H2:2013-14 |

2.5 |

15.2 |

8.6 |

0.5 |

5.9 |

-0.3 |

1.2 |

13.6 |

2.6 |

2.3 |

14.2 |

7.6 |

| H1:2014-15 |

14.3 |

15.8 |

7.4 |

16.4 |

9.8 |

8.1 |

0.5 |

7.3 |

-5.6 |

14.4 |

15.2 |

7.4 |

| Iron & Steel |

H1:2013-14 |

-2.3 |

16.4 |

3.2 |

-9.3 |

4.8 |

-3.2 |

-43.3 |

-3.2 |

-47.7 |

-4.0 |

14.5 |

1.8 |

| H2:2013-14 |

11.8 |

17.9 |

4.8 |

-10.3 |

0.1 |

-5.2 |

-13.1 |

2.4 |

-34.7 |

8.6 |

15.8 |

3.5 |

| H1:2014-15 |

11.0 |

18.3 |

5.4 |

1.2 |

6.0 |

-2.7 |

-41.0 |

-8.1 |

-37.4 |

9.3 |

16.8 |

4.2 |

| Motor Vehicles |

H1:2013-14 |

-3.4 |

10.9 |

5.7 |

-5.0 |

7.6 |

2.0 |

-24.6 |

5.2 |

3.9 |

-3.7 |

10.5 |

5.3 |

| H2:2013-14 |

-4.3 |

9.8 |

6.8 |

-4.8 |

7.8 |

3.0 |

-12.7 |

-18.2 |

-54.5 |

-4.4 |

9.5 |

6.2 |

| H1:2014-15 |

10.7 |

10.8 |

4.8 |

4.5 |

9.3 |

0.6 |

-43.9 |

-4.2 |

-2.3 |

9.6 |

10.6 |

4.4 |

| Pharmaceuticals |

H1:2013-14 |

8.1 |

17.9 |

9.7 |

8.3 |

15.9 |

7.7 |

-16.7 |

2.8 |

-22.9 |

7.6 |

17.2 |

8.8 |

| H2:2013-14 |

14.8 |

21.7 |

15.8 |

5.5 |

11.7 |

2.6 |

-12.2 |

-57.5 |

-34.1 |

12.4 |

18.5 |

12.5 |

| H1:2014-15 |

14.1 |

23.2 |

21.9 |

-1.2 |

12.5 |

9.2 |

-6.1 |

7.5 |

-17.8 |

10.6 |

21.0 |

18.9 |

| Textiles |

H1:2013-14 |

10.6 |

13.9 |

2.9 |

10.8 |

9.1 |

0.3 |

-12.8 |

2.5 |

-15.1 |

9.9 |

12.2 |

1.7 |

| H2:2013-14 |

3.5 |

13.0 |

3.4 |

8.5 |

6.2 |

-2.9 |

-0.9 |

1.3 |

-14.1 |

5.0 |

10.5 |

0.9 |

| H1:2014-15 |

5.8 |

13.5 |

3.5 |

-1.4 |

6.9 |

-1.5 |

-10.8 |

4.2 |

-9.8 |

2.9 |

11.2 |

1.5 |

| Machinery* |

H1:2013-14 |

-1.2 |

8.8 |

3.6 |

-0.2 |

7.8 |

2.7 |

-29.2 |

6.1 |

4.8 |

-1.7 |

8.6 |

3.5 |

| H2:2013-14 |

4.6 |

9.0 |

5.3 |

-5.4 |

8.2 |

0.8 |

-13.2 |

6.5 |

-4.1 |

2.4 |

8.9 |

4.4 |

| H1:2014-15 |

8.2 |

9.1 |

4.7 |

1.1 |

7.9 |

-0.2 |

-2.5 |

7.1 |

-6.6 |

6.8 |

7.7 |

3.8 |

| Construction |

H1:2013-14 |

4.0 |

11.5 |

2.5 |

-12.3 |

14.0 |

0.5 |

-10.7 |

12.3 |

2.3 |

2.3 |

11.7 |

2.3 |

| H2:2013-14 |

-0.3 |

11.4 |

2.8 |

-12.5 |

6.2 |

0.3 |

-25.8 |

12.2 |

5.7 |

-1.6 |

11.0 |

2.7 |

| H1:2014-15 |

-1.9 |

12.6 |

1.8 |

-11.7 |

9.7 |

-5.7 |

-24.3 |

15.9 |

6.1 |

-3.5 |

12.3 |

0.9 |

| Electricity Generation & Supply |

H1:2013-14 |

2.4 |

23.8 |

1.6 |

20.5 |

7.7 |

1.3 |

8.6 |

3.7 |

49.8 |

2.7 |

23.4 |

1.7 |

| H2:2013-14 |

-12.4 |

25.7 |

9.0 |

0.9 |

14.1 |

5.2 |

-15.0 |

11.6 |

-162.1 |

-12.0 |

25.3 |

8.3 |

| H1:2014-15 |

6.3 |

26.0 |

6.9 |

32.2 |

14.5 |

-9.2 |

-17.0 |

38.6 |

-66.2 |

7.0 |

25.6 |

6.2 |

| *: Includes Machinery & Machine Tools and Electrical Machinery and Apparatus. |

5. On a quarterly basis, sales growth decelerated,

profit margin improved.

5.1. An analysis of the performance of listed nonfinancial private corporates over the quarters reveal

that the upturn in the aggregate sales growth

(Y-o-Y) observed during Q2:2013-14 and Q1:2014-15

could not be sustained and a considerable decline was

observed during Q2:2014-15 as compared to Q1:2014-15 (Table 7). Y-o-Y growth in interest expenses contracted

in Q2:2014-15 against a sharp increase of 19.9 per cent

observed in Q2:2013-14. Interest coverage ratio (EBIT/

interest expenses) was higher than the levels observed

in Q2:2013-14, however this was only a marginal

improvement. EBITDA growth was also distinctly higher

in Q2:2014-15 than the levels observed in Q2:2013-14,

though it was at about half, when compared with Q1:2014-15. Without being affected by decelerating

sales growth, net profit growth improved on a Y-o-Y basis and net profit margins also improved from the

levels observed in Q2:2013-14.

| Table 7: Performance of Select Companies over the Quarters |

| Indicator |

2013-14 |

2014-15 |

| Q1 |

Q2 |

Q1 |

Q2 |

| 1 |

2 |

3 |

4 |

| No. of Companies |

2,768 |

2,708 |

2,755 |

2,863 |

| Sales |

2.6 |

7.4 |

7.1 |

4.2 |

| Expenditure |

2.2 |

8.0 |

6.1 |

3.6 |

| Operating Profits (EBITDA) |

1.1 |

-1.3 |

16.5 |

8.3 |

| Other Income |

28.0 |

-0.2 |

-2.8 |

26.1 |

| Depreciation |

9.4 |

11.6 |

8.0 |

3.5 |

| Gross Profits (EBIT) |

3.9 |

-4.6 |

14.7 |

14.1 |

| Interest |

12.1 |

19.9 |

1.4 |

-0.6 |

| Net Profits |

-10.9 |

-20.5 |

27.3 |

25.6 |

| EBITDA to Sales |

12.7 |

12.2 |

14.1 |

13.2 |

| EBIT to Sales |

11.8 |

11.3 |

12.9 |

13.0 |

| Net Profit to Sales |

5.2 |

5.1 |

6.7 |

6.6 |

| Interest to Sales |

4.2 |

3.9 |

3.8 |

4.0 |

| Interest Burden |

35.3 |

34.8 |

29.2 |

31.0 |

| Interest Coverage(times) |

2.8 |

2.9 |

3.4 |

3.2 |

Annex

Explanatory Notes

1. To compute the growth rates in any period, a

common set of companies for the current and

previous period is considered.

2. The classification of industries and sectors

broadly follows the National Industrial

Classification (NIC).

3. The manufacturing sector consists of industries

like Iron & Steel, Cement & Cement products,

Machinery & Machine Tools, Motor Vehicles,

Rubber, Paper, Food products etc. This does not

include ‘Tea Plantations’ and ‘Mining &

Quarrying’ industries. The services (other than

IT) sector includes Real Estate, Wholesale &

Retail Trade, Hotel & Restaurants, Transport,

Storage and Communication industries. This

does not include Construction and Electricity

Generation and Supply Industries.

4. FOREX gain and loss are reported on net basis

by companies and included in the net profit calculation. While net FOREX loss is considered

as a part of the expenditure and thus included

in EBITDA, net FOREX gain is considered as a

part of other income and included in EBIT.

5. Other income includes various regular incomes

like rents, dividends, royalties etc. and does not

include extra-ordinary income/expenses.

6. Extra-ordinary income/expenses are included in

EBT and net profit. As the name suggests, these

income/expenses can be very large for some of

the companies in a particular quarter.

7. Some companies report interest on net basis.

However, some companies include the interest

expenses on gross basis, where, interest received

is reported in other income.

8. The ratio/growth rate for which denominator is

negative or negligible is not calculated, and is

indicated as ‘$’.

Glossary of Terms

| EBITDA |

- |

Operating Profits/Earnings before Interest, Tax, Depreciation & Amortisation |

- |

Sales + Change in Stock – Expenditure |

| EBIT |

- |

Gross Profits/Earnings before Interest & Tax |

- |

EBITDA+ Other Income – Depreciation & Amortisation |

| EBT |

- |

Earnings before Tax |

- |

EBIT – Interest Payment + Extra-ordinary income/expenses |

| Net Profit |

- |

|

- |

EBT – Tax |

| Interest Burden |

- |

|

- |

Interest Payment/EBIT*100 |

| Interest Coverage |

- |

|

- |

EBIT/Interest Payment |

|