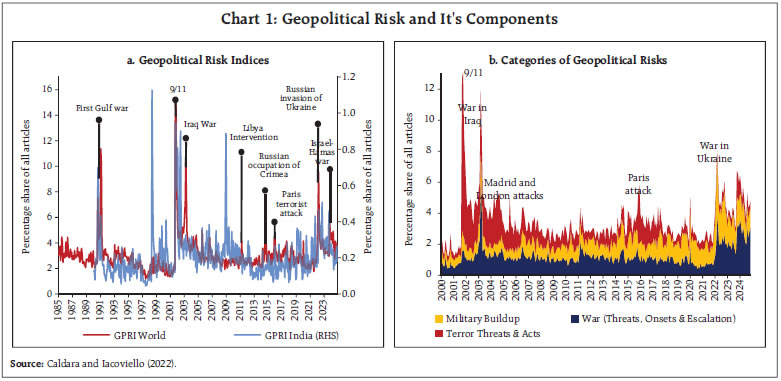

by Shesadri Banerjee, Harendra Kumar Behera, Harshita Keshan and Michael Debabrata Patra^ In an era of intensifying global tensions, understanding the economic implications of geopolitical risk (GPR) is critical. Our estimates of the impact of GPR on the Indian economy using multivariate time series models indicate that it is transmitted through adjustment of terms of trade and the exchange rate, contracting trade and capital flows by 1.0 and 0.3 percentage points, respectively. Given the relative predominance of the trade channel over the financial channel and consequent pressures on the exchange rate, strategic responses are warranted to bolster resilience against GPR shocks. Introduction Geopolitical risks have become the preeminent threat to global stability, reshaping the world’s economic landscape and international relations.1 From the war in Ukraine, the conflict in the Middle East, logistics and shipping disruptions to political spillovers from at least 64 countries going to the polls lately, these crises have dislocated energy markets, shattered supply chains, and imperilled food security, fuelling inflation and accentuating global vulnerabilities. Their pervasive and unpredictable nature has shrouded the trajectory of global growth and stability with heightened uncertainty. Thus, understanding the wider economic implications of geopolitical risk (GPR) assumes importance in the context of interconnectedness between economies propagating and amplifying ripple effects from these exogenous and unpredictable shocks. India has been no exception to the pervasive influence of GPR. Indian CEOs rank geopolitical factors among the most significant threats to business growth over the next three years (KPMG, 2023). The complexity of policy formulation because of geopolitical factors has also been highlighted (Das, 2023).2 Yet, interest in India-specific implications of GPR has been sparse, with a broad preference for considering India within a broader panel focusing on BRICS economies and Asian emerging markets economies, often with a specific emphasis on stock market performance (Balcilar et al., 2018; Kannadhasan and Das, 2020; and Hoque and Zaidi, 2020).3 Our study aims to bridge this gap in the literature by drawing new evidence on the dynamic effects of shocks to the Geopolitical Risk Index (GPRI) on trade and capital flows in respect of the Indian economy4 by using various multivariate time series models. The estimation results show that the propagation of the shocks to GPRI for India and the world are dissimilar, both qualitatively and quantitatively, depending on whether the shock to GPRI operates through the trade channel or the financial channel. A one standard deviation shock to the GPRI for India causes a decline in the trade to GDP ratio by 0.9 percentage points and net capital flows by 0.2 percentage points whereas a similar shock to the GPRI for the world contracts trade and capital flows by 1.0 percentage points and 0.3 percentage points, respectively, with a marked difference in the timing of the peak effects. In Section 2, we present stylised facts that motivate the analysis. Section 3 provides the details of data and sources, model properties and shock identifications. In Section 4, we discuss the results of our analysis, Section 5 concludes the article with some policy perspectives. II. Stylised Facts Geopolitics implies a broad realm in international relations, encompassing political instability, tensions and military conflicts between countries, terrorist threats and/or geographical events that can have regional or global impacts (Caldara and Iacoviello 2022). GPR impacts through two channels: the real economy channel, and the financial channel (Gupta et al., 2019; Soltani et al., 2021; Hou et al., 2024; Dieckelmann et al., 2024; and Hodula et al., 2024). The real economy channel includes disruptions to trade, investment, and consumption, often exacerbated by supply chain interruptions while the financial channel operates through heightened uncertainty and increasing risk aversion, causing shifts in investment portfolios and cross-border capital flows exemplifying a “flight home” effect (Feng et al., 2023) and a shift toward safer assets, or “flight to quality” (Agoraki et al., 2024). The GPRI captures global risks by analysing geopolitical-related content in 10 major newspapers5 from automated text-search results of electronic archives. This media-based approach ensures that the GPR index remains exogenous to the model and captures all the major geopolitical events (Caldara and Iacoviello, 2022) (Chart 1a). Additionally, the dataset includes country-specific indices, representing the percentage of articles meeting the search criteria for 43 economies. For this study, we utilise the GPR Index specific to India and the global benchmark GPR index. The GPRI registered its first notable surge during the Iraq invasion of Kuwait and the Gulf War, followed by a sharp rise in early 1993 amidst escalating tensions between the United States and Iraq (Chart 1a). After a period of decline, it spiked again in the wake of the 9/11 attacks and the 2003 Iraq invasion. Subsequent peaks are observed during the 2011 military intervention in Libya, the 2014 annexation of Crimea by Russia, the 2015 Paris terrorist attacks, the 2017–2018 North Korean crisis, and the onset of the US-China trade war in 2018. More recently, the GPR index has soared following Russia’s invasion of Ukraine and the intensification of conflict in the Middle East with the Israel-Hamas war.  The India-specific GPRI spiked independently of the global GPRI with notable instances including 1990 when the insurgency in Kashmir escalated tensions with Pakistan; in 1999 during the Kargil War between India and Pakistan; in 2002 with communal violence in Gujarat; and in 2008 during the devastating Mumbai terrorist attacks. Since 2014, however, co-movement between India’s GPR and global GPR has increased, reflecting India’s deeper integration into global geopolitics and the amplified interplay between domestic and international factors. Analysing various components of the GPRI that are consolidated into three overarching categories - military buildups; war (encompassing threats, onsets, and escalations); and terror-related threats and acts (Gopinath, 2024) – shows that the recent surge in the GPRI can be attributed primarily to war, with a nearly equal contribution from military buildups (Chart 1b). During episodes of heightened geopolitical risk (shaded in red in Chart 2), total capital inflows to India, whether gross or net, decrease relative to the trend, pointing to flight home effects (a la Feng et al., 2023).6 Moreover, shocks to the GPRI may trigger a flight to quality in which investors shift toward safer assets, including US equities and bonds, during heightened uncertainty (Wang et al., 2023; Agoraki et al., 2024). Different types of capital flows to India exhibit varying sensitivities to global GPRI, with foreign portfolio investment (FPI) generally more volatile than foreign direct investment (FDI) (Chart 3). This characteristic aligns with flight to safety effects. To examine the relationship between trade and GPR, we plot their trends. This reveals a decline in India’s trade-to-GDP ratio during periods associated with GPR spikes (Chart 4a). GPR significantly contributes to rising trade costs (Hou et al., 2024), as evidenced by the sharp increases in all major shipping cost indicators—the Global Supply Chain Pressure Index (GSCPI), the Baltic Dry Index, and the Drewry World Container Index—in 2022 (Chart 4b). This surge aligns with the onset of the Russia-Ukraine war, as indicated by the shaded red region.

Based on simple correlation analysis for the period 2004Q1 to 2024Q2, several relationships emerge (Table 1). The India-specific GPRI shows a negative correlation with the net capital flow-to-GDP ratio, indicating that higher domestic geopolitical risks may discourage foreign capital inflows due to increased risk aversion. The global GPRI also exhibits a negative correlation with the net capital flow-to-GDP ratio, suggesting that global geopolitical tensions could lead to capital outflows from India as a broader global risk-off sentiment takes hold. A positive and significant relationship between the global GPRI and terms of trade (TOT) highlights how global supply chain disruptions stemming from geopolitical events can affect India’s trade dynamics. Additionally, the significant correlation between global GPR and India-specific GPR emphasises the interconnectedness of geopolitical risks, where international events often reverberate within India.

| Table 1: Key Cross-correlations | | Variables | Trade to GDP ratio | Net Capital Flow to GDP ratio | Exchange rate | Terms of Trade | GPRI India | GPRI World | | Trade to GDP ratio | 1.00 | | | | | | | Net Capital Flow to GDP ratio | 0.06 | 1.00 | | | | | | Exchange rate | 0.39*** | -0.49*** | 1.00 | | | | | Terms of Trade | 0.06 | 0.05 | -0.03 | 1.00 | | | | GPRI India | 0.05 | -0.22* | 0.16 | -0.01 | 1.00 | | | GPRI World | -0.15 | -0.20* | -0.16 | 0.23** | 0.29*** | 1.00 | Note: The symbols ‘*’, ‘**’, and ‘***’ indicate the statistical significance of correlation coefficients at the level of 10 per cent, 5 per cent and 1 per cent, respectively.

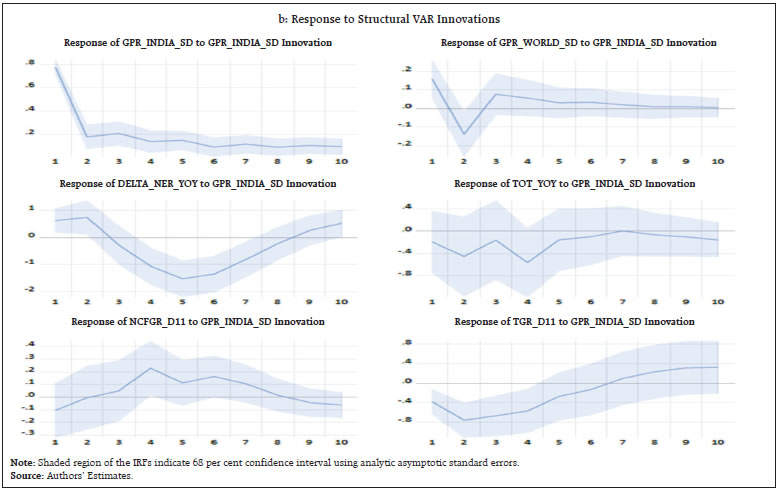

Source: Authors’ estimates. | The exchange rate shows an intriguing offsetting relationship with the trade-to-GDP ratio and the net capital flow-to-GDP ratio. Its positive relationship with the trade-to-GDP ratio suggests that higher imports as compared to exports results in a rise in the trade to GDP ratio which leads to currency depreciation while rise in capital inflows could result in appreciation. Building on the insights gained from this correlation analysis, we proceed to more robust statistical methods to identify how shocks to the GPRI impacts its relationships with key economic variables. III. Methodology As stated in the introductory section, we use a suite of multivariate time series models to identify the shocks to GPRI for India and the world - an unrestricted Vector Autoregression (VAR) model; a structural VAR (SVAR) model with short-run restrictions; and a structural VAR model with sign-restrictions (SRVAR). In the system of equations, each variable is considered to be driven by its own lagged values, the lagged values of all other variables in the system, and an error term. All the models capture the dynamic relationships among multiple variables and their responsiveness to exogenous shocks from the GPRI. The data matrix includes six variables: (i) seasonally adjusted trade volume (i.e. sum of exports and imports of goods and services to GDP ratio) (TGR_ D11), (ii) seasonally adjusted net capital flows to GDP ratio (NCFGR_D11), (iii) year on year (y-o-y) changes in the nominal exchange rate (DELTA_NER_YOY),7 (iv) y-o-y change in terms of trade (TOT_YOY),8 (v) standardised series of GPRI for India (GPR_INDIA_SD) and (vi) standardised series of GPRI for the world (GPR_WORLD_SD). First, we consider a positive shock to the GPRI for India and its impact on the rest of the variables i.e., the case of the country-specific shock. Next, we evaluate the shock to the global GPRI. Impulse response functions (IRFs) — play a central role for analysing the impact of GPR shocks. All the model specifications include that three quarter lags best capture temporal variations in the responsiveness of the relevant variables and satisfy the stability condition.9 The properties of the IRFs are examined in alternative models and identification schemes which are premised on the methods of generalised impulse responses, short-run identification restrictions and sign-restricted structural identification. Alternative specifications and identification schemes provide a battery of tests for the IRFs of the shocks of our interest. The starting point is an unrestricted VAR with generalised IRFs which is an ordering-invariant approach (Pesaran and Shin, 1998; Koop et al., 1996).10 The SVAR model has short-run restrictions in the recursive factorisation. In the SRVAR model, we impose a positive sign restriction on the impulse response of the relevant GPRI for one quarter to identify a rise in geopolitical risks. In this method, we follow the penalty function approach (Uhlig, 2005).11 IV. Results In this section, we analyse the results of the qualitative features of the IRFs and the quantitative impact of the shocks (Chart 5 and 6). Effects of a Rise in GPRI for India: The qualitative patterns of the IRFs in response to the positive shock to the GPRI indicate the presence of trade and financial channels and their interplay. A shock to the GPRI for India causes (i) a rise in the index itself and in the global GPRI; (ii) a decline in India’s terms of trade; (iii) depreciation of the Indian rupee (INR) on impact; (iv) a drop in capital flows; and (v) contraction in trade flows. Intuitively, a rise in the GPRI increases trading costs with a rise in prices of exports. Trade restrictions such as sanctions or tariffs can reduce export opportunities for India, force the exporters to reroute their trade, cause inefficiency in resource allocation and increase costs of exporting. The INR also depreciates as foreign investors shift their funds from INR-denominated investments to foreign currency-denominated investments (i.e. USD) to reduce country risk and/or currency risk in their investment portfolio.12 The effects of the financial channel via the exchange rate, however, is transient and may not influence capital flows lastingly.13

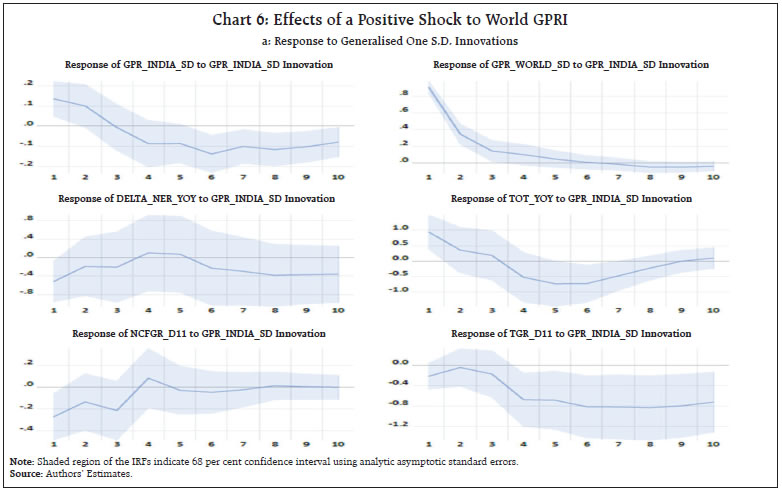

The IRFs obtained from the shock to the GPRI for India show that the trade channel is more predominant relative to the financial channel. Capital flows respond sharply, while trade flows contract gradually and recover over a period of 6-7 quarters. These qualitative features remain robust across the alternative identification methods. Considering the mean impulse responses from all three models, it is found that at the peak, a one standard deviation shock to the GPRI for India causes a decline in trade volume by 0.9 percentage points and capital flows by 0.2 percentage points. The peak effect of contraction appears on impact for the shock to the financial channel, and with a lag of 2 quarters for the trade channel. The timing of contraction is robust irrespective of the models and shock identification strategies. Effects of a Rise in GPRI for the World The estimated IRFs obtained from the positive shock to GPRI for the world also indicate the presence of trade and financial channel along with offsetting effects on the exchange rate across modelling strategies. The role of the financial channel turns out to be prominent in the shocks resulting from the GPRI of the world. Comparing peak effects, it is observed that the shock to global GPRI has more pronounced effects than its Indian counterpart. A positive shock to GPRI at the global level entails (i) spillovers to India; (ii) worsens the terms of trade; (iii) capital outflows and sluggish but prolonged contraction in trade flows. At the peak, a one standard deviation shock leads to contraction of trade volume and capital flows of the magnitudes of 1.0 percentage points and 0.3 percentage points, respectively. The peak effects of the contraction appear with a 6 to 8 quarters lag for the trade to GDP ratio, and on impact for capital flows. V. Conclusion Shocks to geopolitical risk are distinct from ordinary shocks, as they are neither transient nor inherently mean-reverting. Instead, they are exogenous in nature, marked by strong persistence and a pronounced hysteretic effects. Moreover, they exert differentiated impacts across nations, contingent on factors such as geographical proximity to the epicentre of the event, political configurations, and economic dependencies. Consequently, each country must prepare differently, tailoring its policy responses to its specific vulnerabilities rather than relying exclusively on multinational strategies and/or multilateral agencies. Our results show that geopolitical risk is playing an increasingly pervasive role in shaping India’s trade and financial dynamics. Distinguishing between India-specific and global GPR shocks, the analysis provides a nuanced understanding of the transmission mechanisms. The results show that the propagation of the shocks to GPRI for India and GPRI for the world are different, both qualitatively and quantitatively, on account of the relative roles of the trade and financial channels. While domestic shocks primarily travel through disruptions in supply chains and export competitiveness, global shocks are propagated through both trade and capital flows, reflecting heightened global risk aversion, trade restrictions and capital reallocation. Comparing peak effects, it is observed that the shock to global GPRI has more pronounced effects than its Indian counterpart. Given the relative predominance of the trade channel over the financial channel and their countervailing pressures on the exchange rate, policymakers can envisage strategic responses with a suite of targeted interventions to neutralise these shocks than relying on broad-brush instruments like policy rate adjustments. On the trade front, measures could include diversifying trade sources and participating in larger trade agreements, such as free trade areas (FTAs) and global trade blocs, to bolster resilience. Investments in infrastructure, particularly in enhancing port logistics and connectivity, would position India as an international shipping hub. From the financial channel perspective, building strategic buffers, forging bilateral swap agreements, and engaging with multilateral institutions to bring GPR mitigation strategies are imperative to resolve GPR-induced disruptions. These strategies, combined with a robust safety net, can equip the Indian economy to navigate the complexities of persistent geopolitical risks effectively. References Agoraki, M. E. K., Wu, H., Xu, T., & Yang, M. (2024). Money never sleeps: Capital flows under global risk and uncertainty. Journal of International Money and Finance, 141, 103013. Balcilar, M., Bonato, M., Demirer, R., & Gupta, R. (2018). Geopolitical risks and stock market dynamics of the BRICS. Economic Systems, 42(2), 295-306. Będowska-Sójka, B., Demir, E., & Zaremba, A. (2022). Hedging geopolitical risks with different asset classes: a focus on the Russian invasion of Ukraine. Finance Research Letters, 50, 103192. Boyd, J. H., Levine, R., & Smith, B. D. (2001). The impact of inflation on financial sector performance. Journal of monetary Economics, 47(2), 221-248. Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. American Economic Review, 112(4), 1194-1225. Cantelmo, A., & Melina, G. (2018). Monetary policy and the relative price of durable goods. Journal of Economic Dynamics and Control, 86, 1-48. Cheung, Y. W., Lai, K. S., & Bergman, M. (2004). Dissecting the PPP puzzle: the unconventional roles of nominal exchange rate and price adjustments. Journal of International Economics, 64(1), 135-150. Das, S. (2023, December 20). Winning in uncertain times: The Indian experience [Speech]. Reserve Bank of India. https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=22251 Dedola, L., & Neri, S. (2007). What does a technology shock do? A VAR analysis with model-based sign restrictions. Journal of Monetary Economics, 54(2), 512-549. Dieckelmann, D., Kaufmann, C., Larkou, C., McQuade, P., Negri, C., Pancaro, C., & Rößler, D. (2024). Turbulent times: geopolitical risk and its impact on euro area financial stability. Financial Stability Review, 1. Feng, C., Han, L., Vigne, S., & Xu, Y. (2023). Geopolitical risk and the dynamics of international capital flows. Journal of International Financial Markets, Institutions and Money, 82, 101693. Giannetti, M., & Laeven, L. (2012). The flight home effect: Evidence from the syndicated loan market during financial crises. Journal of Financial Economics, 104(1), 23-43. Gopinath, G. (2024, May 7). Geopolitics and its impact on global trade and the dollar [Speech]. Series on the Future of the International Monetary System, Stanford Institute for Economic Policy Research. International Monetary Fund. https://www.imf.org/en/News/Articles/2024/05/07/sp-geopolitics-impact-global-trade-and-dollar-gita-gopinath Gupta, R., Gozgor, G., Kaya, H., & Demir, E. (2019). Effects of geopolitical risks on trade flows: Evidence from the gravity model. Eurasian Economic Review, 9, 515-530. Hodula, M., Janků, J., Malovaná, S., & Ngo, N. A. (2024). Geopolitical risks and their impact on global macro-financial stability: Literature and measurements (No. 9/2024). BOFIT Discussion Papers. Hoque, M. E., & Zaidi, M. A. S. (2020). Global and country-specific geopolitical risk uncertainty and stock return of fragile emerging economies. Borsa Istanbul Review, 20(3), 197-213. Hou, Y., Xue, W., & Zhang, X. (2024). The Impact of Geopolitical Risk on Trade Costs. Global Economic Review, 53(1), 1-24. Huang, Y., Neftci, S. N., & Guo, F. (2008). Swap curve dynamics across markets: Case of US dollar versus HK dollar. Journal of International Financial Markets, Institutions and Money, 18(1), 79-93. International Monetary Fund. Global Financial Stability Report, April 2023: Safeguarding Financial Stability amid High Inflation and Geopolitical Risks. Jordà, Ò. (2005). Estimation and inference of impulse responses by local projections. American economic review, 95(1), 161-182. Kannadhasan, M., & Das, D. (2020). Do Asian emerging stock markets react to international economic policy uncertainty and geopolitical risk alike? A quantile regression approach. Finance Research Letters, 34, 101276. KPMG. (2023). India CEO outlook 2023. KPMG. https://kpmg.com/in/en/insights/2023/10/kpmg-2023-india-ceo-outlook.html Kumar, S., & Rao, A. (2024). Assessing And Mitigating The Impact Of Geopolitical Risk Uncertainty On The Indian Financial Sector: A Policy Perspective. Bulletin of Monetary Economics and Banking, 27(3), 483-526. Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of econometrics, 74(1), 119-147. Mountford, A., & Uhlig, H. (2009). What are the effects of fiscal policy shocks?. Journal of applied econometrics, 24(6), 960-992. Pappa, E. (2009). The effects of fiscal shocks on employment and the real wage. International Economic Review, 50(1), 217-244. Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics letters, 58(1), 17-29. Portes, R., Rey, H., & Oh, Y. (2001). Information and capital flows: The determinants of transactions in financial assets. European economic review, 45(4-6), 783-796. Soltani, H., Triki, M. B., Ghandri, M., & Abderzag, F. T. (2021). Does geopolitical risk and financial development matter for economic growth in MENA countries?. Journal of International Studies (2071-8330), 14(1). Uhlig, H. (2005). What are the effects of monetary policy on output? Results from an agnostic identification procedure. Journal of Monetary Economics, 52(2), 381-419. Wang, X., Wu, Y., Xu, W., 2023. Geopolitical risk and investment. Journal of Money, Credit and Banking, forthcoming.

|