Letter of Transmittal March 1, 2015 Dr. Raghuram G. Rajan

Governor

Reserve Bank of India

Central Office

Mumbai 400 001 Sir Report of the Internal Working Group (IWG) to Revisit the Existing Priority Sector Lending Guidelines We hereby submit the Report of the Internal Working Group constituted to revisit the existing priority sector lending guidelines and suggest revised guidelines in alignment with the national priorities as well as financial inclusion goals of the country. On behalf of members of the Working Group as well as on my own behalf, we sincerely thank you for entrusting this important responsibility to us as well as for all the guidance and support we have received from you at all stages. With kind regards Yours sincerely, Sd/-

(Lily Vadera) | | | | | | | Sd/-

(R.N. Dash) | Sd/-

(Reena Banerjee) | Sd/-

(R.K. Moolchandani) | | | | | Sd/-

(Abhiman Das) | Sd/-

(P. Manoj) | Sd/-

(Pallavi Chavan) |

Acknowledgements The Working Group expresses its gratitude for the guidance it received from the Hon’ble Governor Dr. Raghuram G. Rajan who evinced a keen interest and deep insight on the subject. It also expresses its gratitude to Deputy Governors, Shri Harun R. Khan, Dr Urjit R. Patel, Shri R. Gandhi and Shri S.S. Mundra, for sharing their rich perspective and understanding of the subject as also Executive Directors, Shri B. Mahapatra (since retired) and Dr. Deepali Pant Joshi under whose auspices the Group worked. The Working Group benefited from the inputs provided by Shri A. Udgata, PCGM, FIDD, Smt. Madhavi Sharma, CGM, FIDD, RBI; Shri H. R. Dave, DMD, NABARD; Shri S. K. Bansal, CGM, NABARD and his team; Prof. M.S. Sriram, IIM, Bangalore; Dr. N. R. Prabhala, CAFRAL; Dr. K. Subramanian, ISB; Shri N. Srinivasan, Retd. CGM, NABARD and Shri Vinay Baijal, Retd. CGM, RBI. The Working Group also acknowledges the suggestions and contributions of the various banks with whom discussions were held. The Working Group thanks Smt. Ranjeeta Choudhary, Shri Vinay Jain, Smt. Sabeeta Badkar and Shri Subhash Kaspale, Department of Banking Regulation, for the administrative and logistical support provided.

Executive Summary 1. In the past, the objective of priority sector lending (PSL) has been to ensure that vulnerable sections of society get access to credit and there is adequate flow of resources to those segments of the economy which have higher employment potential and help in making an impact on poverty alleviation. Thus, the sectors that impact large sections of the population, the weaker sections and the sectors which are employment-intensive such as agriculture and micro and small enterprises were included in priority sector. India in her quest for inclusive growth has experimented with a variety of policy mix since gaining independence in 1947. Policymaking, however, evolves based on experience gained in success and failure of past measures, and reflects changing priorities over time. The Indian economy has not only undergone a structural transformation but has also been increasingly integrated into the global economy. The national priorities have changed over the last four decades, as India has moved up to middle income level status. The emphasis now, over and above lending to vulnerable sections, is to increase employability, create basic infrastructure and improve competitiveness of the economy, thus creating more jobs. 2. Hence, there is a need to ensure adequate allocation of credit to emerging priority sectors. The issue regarding the need for continuance of priority sector prescriptions was discussed with a representative section of bankers and some of the other stakeholders to get a wider perspective. A general perception that emerged was that if the prescriptions under PSL had not been there, the identified sectors would not have benefited to the extent they have and hence, there is a need to continue with priority sector prescriptions. However, the composition of the priority sector needs a re-look and review to re-align it with the national priorities and financial inclusion goals of the country. 3. The Working Group, therefore, felt that while revisiting the extant guidelines on priority sector, the focus will be on giving a thrust to areas of national priority as well as inclusive growth. In this backdrop, the Working Group has looked at the following sectors for priority sector status viz., agriculture, Micro, Small and Medium Enterprises (MSMEs), exports, social infrastructure, renewable energy, educational loans and housing. Overall Priority Sector Target 4. In view of the continued need for making credit available to various priority sectors on grounds of growth and equity, the Working Group recommends that the target for lending to the redefined priority sector may be retained at 40 per cent of ANBC or Credit Equivalent of Off-Balance Sheet Exposure (CEOBE), whichever is higher, for all scheduled commercial banks uniformly. All foreign banks (irrespective of number of branches they have) may be brought on par with domestic banks and the same target/ sub-targets may be made applicable to them. Foreign banks with 20 and above branches may be given time up to March 2018 in terms of extant guidelines and submit their revised action plans. Other foreign banks i.e. with less than 20 branches, may be given time up to March 2020 to comply with the revised targets as per action plans submitted by them and approved by Reserve Bank. 5. In view of the need for efficiency in priority sector lending, the Working Group has made certain recommendations which include introduction of Priority Sector Lending Certificates (PSLCs). These instruments would provide a mechanism for banks to specialize in certain segments of priority sector and leverage on their comparative advantage. Agriculture 6. The Working Group has attempted to focus on ‘credit for agriculture’ rather than ‘credit in agriculture’. While the Working Group recommends retaining the agriculture target of 18 per cent, the approach and thrust has been re-defined to include (i) Farm Credit (which will include short-term crop loans and medium/long-term investment credit to farmers) (ii) Agriculture Infrastructure and (iii) Ancillary Activities and on-lending as defined in Chapter 4. 7. Considering the significant share of landholdings of small and marginal farmers and their contribution to the agriculture sector, the Working Group recommends a sub-target of 8 per cent of ANBC for lending to them, which is to be achieved in a phased manner within a period of two years i.e., achieve 7 per cent by March 2016 and 8 per cent by March 2017. The remaining 10 per cent may be given to other farmers, agri-infrastructure and ancillary activities. Perceiving the huge need to create rural infrastructure and processing capabilities, the Working Group decided not to put any caps on the loan limits for lending for agri-infrastructure and agri-processing. 8. The Working Group has designed a framework for a periodic reset of the agricultural targets. It has recommended that while the agriculture lending target should be retained at 18 per cent of ANBC, the designed framework can be followed for resetting of this target every three years depending on the function of three variables viz., contribution of agriculture to GDP, employment and number of credit accounts. Micro, Small and Medium Enterprises 9. Presently, credit extended to micro and small enterprises counts for priority sector. The Working Group recommends extending PSL status to Medium Enterprises (MEs) in addition to the Micro and Small Enterprises (MSEs). While all MEs (Manufacturing) may be included under PSL, MEs (Service) with credit limit up to Rs.10 crore may be eligible to qualify for PSL. 10. To ensure that the smallest segment within the MSME sector i.e. micro enterprises, is not crowded out with the inclusion of the medium enterprises, the Working Group recommends a target of 7.5 per cent of ANBC for lending to micro enterprises to be achieved in stages i.e. achieve 7 per cent by March 2016 and 7.5 per cent by March 2017. 11. Further as the MSMED Act 2006 does not provide for any sub-categorisation within the definition of micro enterprise and a separate sub-target for micro enterprises has been suggested, the Working Group recommends that the extant provisions of further bifurcating micro enterprises may be dispensed with. 12. To ensure that MSMEs do not remain small and medium units merely to be eligible for priority sector status, the Working Group recommends that the priority sector lending status may stay with them for up to three years after they grow out of the category of MSMEs. 13. It was announced in the Union Budget 2014-15 that the definition of MSME will be reviewed to provide for a higher capital ceiling. In the light of the Budget announcement, the Working Group recommends that the matter may be pursued with the Government. Any change in definition will automatically apply to PSL norms from the date it is notified. Exports 14. Given the importance of exports in the economy and to give focused attention to export finance within the priority sector lending, the Working Group recommends carving out a separate category of export credit under priority sector. The Working Group recommends that incremental export credit from a base date (i.e. the outstanding export credit as on the date of reckoning minus outstanding export credit as on the base date) to units having turnover of upto Rs.100 crore having sanctioned credit limit of upto Rs.25 crore from the banking system may be included in priority sector. The export credit under priority sector may have a ceiling of 2 percent of ANBC in order to ensure that other segments are not crowded out. Education 15. The Working Group endorses the need for continuation of including education loans, including loans for vocational courses, under priority sector. The recent trends in education loans, however, suggested a concentration of educational loans in the size class of up to Rs. 5 lakh, notwithstanding the extant ceilings of Rs.10/20 lakh. Taking this into account, the Working Group recommends that an amount of Rs.10 lakh for education loans per borrower, irrespective of the sanctioned limit be considered eligible under priority sector. As the extant guidelines provide for loans upto Rs.20 lakh for study abroad, all such existing loans may continue under priority sector till the date of maturity. Housing 16. With a view to ensure that the credit flows to needy persons for affordable housing, it is recommended that the overall cost of the dwelling unit in the metropolitan centre and at other centres should not exceed Rs.35 lakh and Rs. 25 lakh respectively. Further, with a view to align it with guidelines on Loan to Value Ratio (presently 80% for loans above Rs.20 lakh) prescribed by the Reserve Bank, it recommends that priority sector limits be modified and fixed at Rs. 28 lakh in metropolitan centres and Rs. 20 lakh in other centres. 17. The recent guidelines allow exemption from ANBC for long-term bonds for lending to housing loans with loan up to Rs.50 lakh. As the inclusion of priority sector housing loans which are backed by the long term bonds, would result in ‘double counting’ on account of exemption from ANBC, the Working Group recommends that banks should either include housing loans to individuals up to the prescribed ceiling under priority sector or take benefit from exemption from ANBC, but not both. All other existing guidelines regarding housing loans may be continued. Weaker Sections 18. So that, vulnerable sections of the society get a reasonable share of bank credit, the Working Group, recommends that existing categories and the target of 10 per cent of ANBC for loans to weaker sections may continue as per extant guidelines with some enhancement in the existing loan limits. Social Infrastructure 19. Given the importance of social infrastructure for development and its impact on ultimate credit absorption in rural and urban areas, the Working Group recommends that financing for building infrastructure for certain activities viz., schools and health care facilities; drinking water facilities and sanitation facilities in Tier II to Tier VI centres, with population less than 1 lakh, may be treated as a separate category under priority sector, subject to a ceiling of Rs.5 crore per borrower. Renewable Energy 20. The Working Group recommends that bank loans up to Rs. 10 crore to borrowers other than households, for purposes like solar-based power generators, biomass-based power generators, wind mills and micro-hide plants and for purposes like non-conventional energy-based public utilities viz., street lighting systems, remote village electrification, etc. be included under priority sector. For household sector, the loan limit may be Rs. 5 lakh. Review of Limits 21. The Working Group recommends that the various loan limits recommended should be reviewed once in three years. In addition, based on the experience gained, the targets and sub-targets recommended may also be revisited. Monitoring and Reporting 22. Presently, PSL compliance is monitored on the last day of March each year. The Working Group recommends that more frequent monitoring of PSL compliance by banks may be done. To start with, it may be done on ‘quarterly’ basis. The Working Group recommends that PSL shortfall should be worked out based on the average shortfall for the four quarters during the financial year. The base for determining the target achievement for each quarter end i.e. ANBC should be as of the corresponding date of the previous year so that banks get sufficient time for planning and achieving the targets, and seasonalities are taken care of. 23. The reporting format for PSL may be modified to capture the achievement of banks on the PSL targets /sub- targets recommended by the Working Group. While monitoring the lending to small and marginal farmers, it may have to be ensured that the format captures lending to small and marginal farmers directly as well as through SHGs/JLGs, farmer producer organizations, etc. To ensure accurate reporting to the Reserve Bank, banks would have to ensure that they build a robust database on PSL. Priority Sector Lending Certificates (PSLCs) 24. The Working Group recommends introduction of PSLCs to enable banks to meet their PSL requirements and allow leveraging of their comparative advantage. The model on PSLCs envisages that banks will issue PSLCs that can be purchased at a market determined fee on an electronic platform. This purchase will give the buyer a right to undershoot his PSL achievement for the stated amount of PSLC. PSLCs would count specifically towards PSL achievement and thus would be sector/ sub-sector specific where particular targets have been mandated. It would not be necessary for an issuer to have underlying assets on his books at the time of issue of PSLC or for the buyer to have a shortfall in obligation of that amount. The issuer could assess possible credit achievement during the year and issue PSLCs of the estimated surplus. However, as the PSLCs could be issued without an underlying, there is a risk that the issuing bank may overestimate its achievement and fall short on reporting date, thereby subjecting itself to penalties. Therefore, no bank can issue PSLCs of more than 50 percent of last year’s PSL achievement or excess over the last year’s PSL achievement, whichever is higher. However, there would be no limit on the amount of PSLCs that could be purchased for achievement of various targets. 25. The buyer could also estimate possible credit shortfall without the need for waiting till the time of such shortfall or he could also buy PSLCs with a view to trading it when premiums are higher. This would add to efficiency in meeting targets and create a deep and liquid forward market. PSLCs envisage the separation of transferring priority sector obligations from the credit risk transfer and refinancing aspects. While the PSLCs will be sold, the loans would continue to be on the books of the original lender. If the loans default, for example, no loss would be borne by the certificate buyer. As stated in the Report of the Committee on Financial Sector Reforms, the merit of a scheme of this nature is that it would allow the most efficient lender to provide access to the poor, while finding a way for banks to fulfil their norms at a lower cost. Essentially, the PSLCs will be a market-driven interest subsidy to those who make priority sector loans. 26. In the future, the Reserve Bank may intervene in the market for PSLCs to encourage further lending to a particular sector. Non-Achievement of Targets 27. With the inclusion of new sectors and introduction of PSLCs, banks would be better placed to achieve the targets and sub-targets. However, in case of shortfall, the prevailing penal provisions would continue. The need for more stringent measures such as imposition of monetary penalties could be considered either independently or in combination with the existing provisions after a period of three years of operationalisation of the PSLC market and based on the performance of banks in achievement of targets. Improving the credit culture 28. The Working Group observed that it would also be necessary to look at the credit delivery mechanism to ensure that credit reaches the intended beneficiaries and misuse in the form of availing of credit from multiple institutions does not take place. The Working Group, therefore, recommends that, to be eligible for PSL status, any borrowal account, including that to individual members of SHGs and JLGs, should be reported to one of the credit bureaus. The information should also capture the borrower’s Aadhaar number which will help in identification of the borrower. The deadline for this may be linked to that of UIDAI deadline for completion of Aadhaar enrolment. A system of information sharing may be put in place between the credit bureaus.

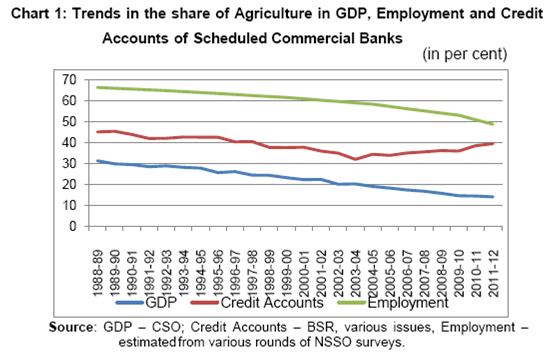

Chapter 1 Introduction 1.1 The concept of using directed credit to channelise resources to areas whose development was seen as national priority originated at a meeting of the National Credit Council held in July 1968, and was further formalised into the priority sector concept in 1972. Since then, directed credit through the priority sector dispensation has continued as a major public policy intervention to finance areas which might otherwise be financially underserved as also to achieve Plan targets. 1.2 In the decades since the vision of priority sector first took shape, the structure of the Indian economy and the contribution by various sectors to GDP and the demographic profile has changed significantly. These emerging realities have also shaped our perception of national priority and these must reflect in any definition of priority sector. Going forward, the country’s vision of equitable growth and development will require investment in areas such as infrastructure, exports, micro small and medium enterprises, non- conventional energy, education, health, etc. 1.3 In view of the above, an Internal Working Group, to revisit the existing priority sector lending guidelines and suggest revised guidelines in alignment with the national priorities as well as financial inclusion goals of the country, was set up vide Governor’s orders dated July 02, 2014. The Terms of Reference of the Working Group are as under: -

To revisit the priority sector lending targets/classification; whether the purpose of the priority sector has been achieved by way of inclusion and access needs of the weak and vulnerable sections of the population and the neglected sectors of the economy; -

Whether the priority sector lending should encompass certain areas of national priorities, while at the same time examine the need to continue with all the existing items under PSL; -

To examine whether there is a need for having sub-limits within the prescribed overall PSL limit. To devise criteria for fixing the targets under priority sector lending; -

To suggest ways on how to achieve the priority sector targets in the most effective way; and -

To suggest better measures to be taken in case of under achievement of the priority sector targets. 1.4 The members of the Working Group are: -

Smt. Lily Vadera, Chief General Manager, DBR, Central Office -

Shri R.N.Dash, General Manager, FIDD, Hyderabad Office -

Smt. Reena Banerjee, General Manager, DBR, Central Office -

Shri R. K. Moolchandani, General Manager, FIDD, Central Office -

Dr. Abhiman Das, Director, DSIM -

Shri P. Manoj, Deputy General Manager, FIDD, Central Office -

Dr. Pallavi Chavan, Assistant Adviser, DEPR 1.5 The progress of the Working Group was monitored by Executive Directors Shri B Mahapatra (since retired on August 31, 2014) and Dr. Deepali Pant Joshi. 1.6 The Report is structured as follows: Chapter 2 discusses the approach of the Working Group and delineates the broad contours and framework within which the Group shaped its recommendations. Chapter 3 analyses the impact of priority sector lending on inclusion/serving the vulnerable/neglected sectors of the economy. Chapter 4 details the recommended future approach for priority sector lending including targets/sub-targets keeping in mind national priorities as well as non-achievement of targets. Chapter 5 discusses the concept of Priority Sector Lending Certificates (PSLCs) as an alternative and efficient method of achievement of targets.

Chapter 2 Approach of the Working Group 2.1 The Priority Sector Lending (PSL) programme of India is one among the longest serving directed lending programmes in the world. The origin of the PSL programme can be traced back to the Credit Policy for 1967-68, when public sector banks were advised to increase their involvement in financing of certain sectors identified as priority sectors viz., agriculture and small-scale industries in line with the national economic policy. Priority sector lending in its present form was introduced in 1980, when it was also made applicable to private sector banks and a sub-target was stipulated for lending to the “weaker” sections of the society within the priority sector. Over time, there have been changes in overall definition of PSL as newer sectors were added to the list with an attempt to realign PSL with the changing economic realities. There were also attempts to redefine the contours of many of the identified sectors. 2.2 The Committee that in many ways offered the blue print for economic reforms in India in the early 1990s, namely the Committee on Financial Sector Reforms of 1991 [Chairman: Shri M. Narasimham (popularly known as Narasimham Committee I)] had recommended reduction followed by phasing out of PSL requirements. Notwithstanding this recommendation, the PSL dispensation continued due to various economic and social considerations, as noted in the Committee on Banking Sector Reforms of 1998 [Chairman: Shri M Narasimham (Narasimham Committee II)]. However, the recommendation made by Narasimham Committee I and later upheld by Narasimhmam Committee II, of having a focus on various employment generating sectors as part of PSL has influenced the PSL policy in the later years. The Report of the Internal Working Group on Priority Sector Lending (2005) too emphasised the need to include those sectors as part of PSL that, inter alia, had a bearing on employment generation in the economy. 2.3 The Committee to Re-examine the Existing Classification and Suggest Revised Guidelines with regard to Priority Sector Lending Classification and Related Issues (Chairman: Shri M. V. Nair) in 2012 recommended several changes in the definition and targets under the PSL policy. The underlying emphasis of the Committee on employment generating sectors, however, could not be missed. 2.4 The insights offered by many of these committees along with the deliberations with other stakeholders including banks, NABARD and other individual experts have been useful inputs for the Working Group while examining the PSL policy. Further, the Working Group has also relied on Plan and Union Budget documents in order to identify the various sectors of national priority and understand their credit needs. The Group has attempted an empirical assessment of the impact of sectoral credit on output to determine the efficacy of the PSL policy. It has also designed a framework for a periodic reset of the agricultural targets under PSL. Finally, banks’ achievements under the PSL programme in recent decades have also been a guiding factor for the Group while recommending revisions in the overall and sectoral targets. 2.5 While examining the broad superstructure of the PSL policy, the approach of the Working Group has been to give emphasis on sectors that (a) have greater potential for employment generation, (b) address the considerations of social and economic equity, and (c) create a conducive infrastructure for improving the absorptive capacity of credit. Accordingly, while the existing sectors of agriculture and allied activities, MSEs, exports and socio-economically weaker sections have been considered for continuation by the Working Group, several newer sectors/segments, including agricultural and social infrastructure, medium enterprises, and renewable energy have also been recommended for addition to the existing sectors. The Working Group has given emphasis on a targeted lending for small and marginal farmers and micro enterprises within the PSL policy. 2.6 One of the outcomes of the Group’s interactions with banks was the unequivocal need for targets to ensure the flow to credit to priority sectors. Coupled with the need for targets, however, the Group has also laid emphasis on improving the efficiency of achievements of these targets. The process by which the mandates are implemented has been revisited to emphasize on efficiency and better compliance. Towards this end, the Group has examined the possibility of introducing the Priority Sector Lending Certificates (PSLCs) to allow a more efficient implementation of the priority sector lending mandate. Accordingly, the targets set may be viewed as floors rather than ceilings to ensure that banks are incentivised to lend more to priority sectors. 2.7 Finally, apart from revisiting the sectors and targets, the Working Group has recommended bringing in uniformity in priority sector lending requirements for all banks - domestic and foreign - in the interest of equitable treatment, and given the magnitude of need to provide credit to underserved segments. Accordingly, domestic and foreign banks irrespective of the branch network would be equal stakeholders in the PSL policy. The introduction of PSLCs will provide a mechanism to cover the priority sector shortfall and help banks specialize in certain sectors of the priority sector. Bringing all banks on par would also help in releasing greater resources towards the priority sectors. 2.8 In sum, the approach of the Working Group has been to align the priority sectors with the existing and emerging economic realities as also to improve the means to achieve the targeted credit flow to these sectors.

Chapter 3 Impact of Priority Sector Lending 3.1 Since the early 1970s, Priority Sector Lending (PSL) programme has been an integral part of the banking policy in India. It is a major public policy intervention through which credit is directed to the sectors of national priorities critical for both employment and equity. This chapter examines the efficacy of the PSL programme by analysing the growth and distribution of credit to various sectors and sections covered by this programme. As a background to this analysis, it provides a discussion on the major lessons emerging from the literature on the PSL programme in India and also similar directed lending programmes in other countries. I. Directed Lending Programmes – An International Perspective 3.2 Like India, several advanced and emerging economies have experimented with Directed Lending Programmes (DLPs) of various types since the Second World War. Although there were considerable differences across countries in the design of such programmes, the broad objective was to provide credit-based support for the development of the deserving sectors/sections that had been under-served by the mainstream banking institutions by way of public intervention in the financial markets. 3.3 Given the dynamic nature of the economic and financial structures, DLPs in many countries have evolved over time. Further, the international thinking about directed lending has also influenced the perception about these programmes. While the economic theory after the 1950s bore the influence of Keynesian economics, the period after 1980s was a period of economic liberalism. During the 2000s, the concept of “financial inclusion” gained global currency through its link with the achievement of the Millennium Development Goals (MDGs) set by the United Nations (UN).1 In addition, the global financial crisis of 2008 brought to the fore the informational asymmetries, credit rationing, prevalence of complex products in financial markets requiring regulatory intervention to protect the interests of small customers.2 In response to many of these developments, some countries either liberalised or even discontinued their DLPs, while some others have continued/redefined and even strengthened them in order to deal with a financial/economic crisis. 3.4 The DLPs across countries have taken various forms: Form 1: Sectoral lending programmes – These are public programmes designed to lend to a particular sector/section of the population. These programmes can be implemented through a governmental agency or in collaboration with public/private banking institutions. These may involve sectoral targets, as is the case with the priority sector lending programme in India. Form 2: Administered interest rate programmes – These programmes carry an element of interest subsidy while lending to the targeted sectors/sections. Form 3: Refinance programmes – These programmes involve refinance from apex financing institutions towards lending to the targeted sectors/sections. Form 4: Development financial institutions (DFI)/Public sector banks – Certain institutions are created in the public sector or private banks are nationalised to lend to either exclusively or primarily to the targeted sectors/sections. Form 5: Credit guarantee programmes – These programmes involve credit guarantee with respect to loans advanced to the targeted sectors/sections. 3.5 The existing DLPs in some of the advanced and emerging economies are presented in Table 3.1. 3.6 The review of the existing DLPs indicates: -

Agriculture and micro/small/medium enterprises have been the major sectors targeted by DLPs in most of the reviewed economies primarily owing to their employment potential. -

Credit guarantee (often described as a default subsidy in the literature) is the most commonly used instrument of intervention. However, interest subsidies and sectoral targets too are used as instruments by some of the countries. -

Except in the US, where the Government departments are directly involved, DLPs in other countries are implemented through either public banking institutions or through a mix of public and private banking institutions/cooperatives. -

At present, DLPs can be commonly seen in emerging economies, which have longstanding experience with such programmes. The advanced economies have either narrowed the scope of DLPs over time or have phased them out completely. However, some of the advanced economies from the European Union, which had discontinued these programmes, have re-introduced them to deal with the economic slowdown after 2008. 3.7 Various studies have attempted to ascertain the impact of some of the past and present DLPs on income, private savings, employment, production, productivity and other social outcomes across countries. The evidence from these studies on the impact of DLPs is mixed: -

Directed credit had a desired impact on the access to formal finance, growth of a given sector, private investment and income poverty in many countries.3 -

However, there were problems of targeting the beneficiaries under many of these programmes leading to a misallocation of resources to non-priority sectors.4 -

There were signs of financial stress resulting from directed lending in some of the countries. This stress was on account of either the usage of directed funds by beneficiaries for less productive purposes or deliberate defaults by beneficiaries exploiting the priority sector status.5 However, there were also notable exceptions among the development financial institutions that showed a consistently sound financial performance.6 -

Governments in many countries could not scale down or discontinue the DLPs in order to avoid further misuse of these programmes given the pressures exerted by a given constituency that benefitted from these programmes.7 However, there were also cases where the government discontinued these programmes, particularly the longstanding ones, leading to a serious contraction in credit availability, growth and employment.8 3.8 In sum, the available evidence on DLPs from various countries suggests positive social and economic outcomes from these programmes. In certain cases, however, it raised concerns about the benefits from these programmes, not reaching the targeted sections and resulting in financial stress for the lenders. | Table 3.1: Existing DLPs in select advanced and emerging economies | | Country | Sectors/activities under focus | Implementing agency | | US | Small businesses, students/education,

Low income groups in rural areas/for creation of electricity, waste disposal facilities

Low income groups, elderly and handicapped/housing

(involves credit guarantee in lending to some of these sectors) | US Government Departments (either independently, or in collaboration with private investment companies) | | EU (Denmark and Ireland)9 | Micro enterprises,

Small and Medium Enterprises

(involves sectoral targets, credit guarantee) | Private banking institutions | | Brazil | Industry including SME sector/long-term investment credit,

Rural housing,

Agriculture,

Micro credit (involves credit guarantee, interest subsidy and sectoral targets for some of these sectors) | Public banking institutions (either directly or through local commercial banks) | | People’s Republic of China | Agriculture,

Micro and Small Enterprises

(involves sectoral growth targets, credit guarantee, interest rate subsidy) | Public banking institutions | | Pakistan | Agriculture,

Exports

(involves indicative targets and interest rate subsidy) | Public and private banking institutions | | Russian Federation | Agriculture and agro-based industries,

Rural infrastructure

(involves interest subsidies) | Public banking institutions | | Philippines | Agriculture

(involves credit guarantee) | Public and private banking institutions/cooperatives | | India | Agriculture,

Micro and small enterprises,

Education,

Housing,

Socio-economically weaker sections

(involves aggregate targets and sectoral targets for some sectors, credit guarantees and interest subsidy for some sectors) | Public and private banking institutions | | Source: Circulars at <www.va.gov>, <www.sba.gov>, <www.bndes.gov.br>, China Banking Regulatory Commission – Annual Report 2011, <www.sbp.org.pk>, <www.oecd.org>, <www.rbi.org.in>. | II. Priority Sector Programme in India: An Analysis 3.9 There is a large body of literature examining the impact of financial intermediation on economic growth. Empirical findings broadly support the view that financial development has strong influence on economic growth and financial market imperfections have an impact on investment and growth.10 However, despite being one of the largest and longest public policy intervention programmes in the world, empirical evidence of the efficacy of PSL meeting its final objectives has been limited. It turns out to be a relatively tricky issue, and even referred to as “a gaping hole in the entrepreneurship development literature”.11 3.10 In the case of agriculture credit, when the farmer faces a credit constraint, additional credit supply can raise input use, investment, and hence output. This is the liquidity effect of credit. But credit has another important role. In most developing countries where agriculture still remains a risky activity, better credit facilities can help farmers smooth out consumption and, therefore, increase the willingness of risk-averse farmers to take risks and make agricultural investments. This is the consumption smoothing effect of credit. 3.11 In the case of India, early evidence based on detailed district level data suggest that in agriculture, the output effect of expanded rural finance is not large, despite the fact that credit to agriculture has strongly increased fertilizer use and private investment in machines and livestock. This means that the additional capital investment has been more important in substituting for agricultural labour than in increasing crop output. However, the impact of rural credit and the expansion of the rural financial system on rural wages have been positive, as the creation of non-farm employment has added more to total employment than has apparently been subtracted by the substitution of capital for labour in agriculture.12 Relatively recent evidence suggests that directed lending may have a consumption smoothing effect. However, evidence also suggests that it has contributed towards increased consumption inequality in rural India.13 3.12 Taking a sectoral approach, the Working Group attempted the quantification of the impact of PSL to agriculture and observed positive elasticity of credit to output based on district-level data for four States viz., Maharashtra, Andhra Pradesh, West Bengal and Punjab for the period 2004 to 2009.14 These findings broadly match with those in the literature that bring out a positive role played by agricultural credit in supporting the purchase of inputs and aiding growth in the agricultural sector.15 3.13 Further analysis based on the total credit to agriculture, and then separately for direct and indirect credit to agriculture suggests that the intervention through direct agriculture credit has a positive impact on agriculture output. This effect, however, was not statistically significant for indirect credit reflecting its limited role.16 Finally, the Working Group also examined how changes in growth of agricultural credit affected the growth of gross value added from agriculture based on a SVAR framework.17 The estimated impulse response showed that the increase in growth of agriculture credit positively affects the growth of agricultural value added. 1. Growth and distribution of credit to major priority sectors 1.1 Agriculture 3.14 Agriculture has figured prominently in the list of sectors included under PSL for commercial banks in India right from the inception of this programme. Even though there has been a decline in the contribution of agriculture to India’s domestic product, its share in total employment has remained high. 3.15 Over the last two decades of economic reforms, the share of agricultural credit to total bank credit has shown variations but has broadly remained within the band of 10 to 12 per cent (Chart 3.1). The pattern was broadly of a decline over a major part of the 1990s followed by a revival over the 2000s (Table 3.2). During the 2000s, a notable increase in this share could be seen during the first half of the decade, which was a period when the Comprehensive Credit Policy was initiated by the Central Government for reviving the growth of agricultural credit. The 1990s was a period of slower growth in bank credit to agriculture, which picked up in 2000s marginally exceeding even the overall growth in bank credit during this decade. 3.16 Two noteworthy features of bank credit to agriculture since the early 1990s have been the following: First, there has been a rise in share of indirect agricultural credit in total agricultural credit. This could be gauged from the widening gap between the shares of total and direct credit. | Table 3.2: Rate of growth in agricultural credit, in per cent per annum | | Period | Credit to agriculture | Total bank credit | | 1991-2001 | 4.3 | 4.9 | | 2001-2011 | 15.6 | 15.2 | Source: Calculated using data from Handbook of Statistics on Indian Economy, various issues; Statistical Tables relating to Banks in India, various issues

Notes: 1. Figures refer to compound annual rates of growth.

2. Growth rates have been worked out after deflating the credit figures by GDP deflator. |

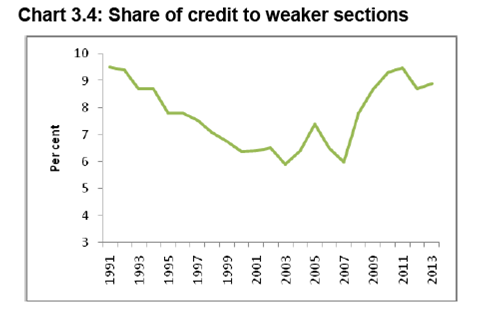

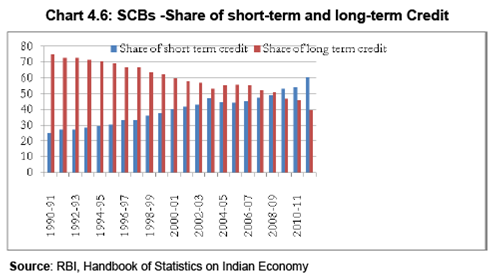

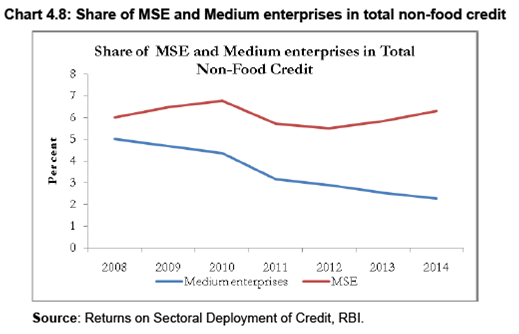

3.17 Secondly, small and marginal cultivators (operating less than 5 acres of land) have not received their due share in the distribution of agricultural credit despite the fact they account for more than 80 per cent of total cultivators in India.18 The increase in the share of small and marginal farmers is, in part, attributable to the subdivision of land given the high land-man ratio. However, given their major contribution to overall agricultural production, food security and diversification within agriculture in India, they remain legitimate claimants for an increased allocation of agricultural credit (Chart 3.2).19 1.2 MSE sector 3.18 Over the last two decades, the share of credit to MSEs showed a broadly similar trend as that of agricultural credit, first posting a decline and then showing some signs of revival with the broadening of the definition of the MSE sector after 2006-07 (Chart 3.3). Further, similar to agriculture, the 1990s was a period of relatively slow growth in credit to SSI sector, a trend that was reversed over the 2000s, particularly after 2006-07 (Table 3.3). | Table 3.3: Rate of growth in credit to MSE sector, in per cent per annum | | Period | Credit to MSE sector | Total bank credit | | 1991-2001 | 4.1 | 4.9 | | 2001-2007 | 7.2 | 16.4 | | 2008-2012 | 12.7 | 8.5 | Source: Calculated using data from Handbook of Statistics on Indian Economy, various issues.

Notes: 1. The periodisation in the 2000s is based on the year of definitional change in the MSE sector.

2. Figures refer to compound annual rates of growth.

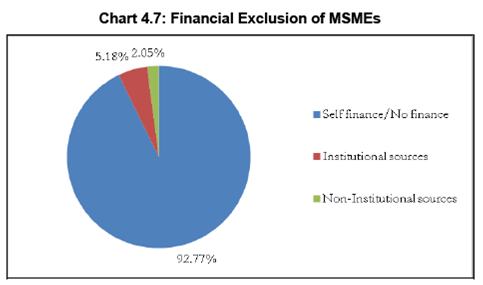

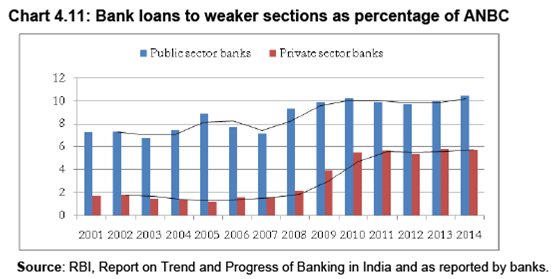

3. Growth rates have been worked out after deflating the credit figures by GDP deflator. | 3.19 Notwithstanding the pick up, concerns about a gap in credit allocation to MSE sector have remained. As per the available estimates, the supply of credit to the sector in 2012-13 has been short of the total demand by about 59 per cent.20 The average gap for the entire plan period of the 12th Five Year Plan has been of about 52 per cent. 1.3 “Weaker” Sections 3.20 The category of “weaker” sections as defined under PSL encompasses various socially and economically underprivileged sections. The share of credit to these sections followed a pattern that was similar to agriculture and MSE sectors. There was a steady decline in the share of credit to weaker sections over the 1990s followed by a revival that took the share of credit to these sections back to the level seen in the early 1990s (Chart 3.4). 3.21 Another way of looking at the credit distribution to the underprivileged sections could be to segregate the loan accounts with relatively small credit limits. For this purpose, the accounts with a credit limit of up to Rs.0.2 million (referred to as small borrowal account (SBAs), were separately analysed. The share of such accounts in total number of accounts was 79.7 per cent in 2013 reflecting the predominance of small-sized loans in the Indian banking system. However, these accounts together accounted for only 9.3 per cent of the total credit outstanding. The flip side of this observation was that only 20 per cent of the loan accounts accounted for more than 90 per cent of the total bank credit. More importantly, both in terms of the number of accounts and amount, the share of small accounts were on a steady decline over the last two decades (Table 3.4).  3.22 Inflation could be one of the obvious reasons for this decline. However, even when the cut-off of Rs.0.2 million for 1998 was adjusted using the price levels of 2013 and compared the shares of small accounts for these two years, the decline was evident (Table 3.4).21 The share of small borrowers in total accounts declined from 93.2 per cent in 1998 to 79.7 per cent in 2013. The decline could also be seen in the share of SBAs in the amount of bank credit. On an average, these shares shrank by more than one per cent every year. III. Concluding Observations 3.23 This chapter analysed the impact, growth and distribution of credit to various priority sectors broadly during the period of economic reforms. The analysis suggests while there has been a growth of credit to these sectors, there have been concerns about the distribution of credit and a persistent credit gap in these sectors having national priority. Hence, there is a need to ensure a further increase in the allocation of credit to these sectors and also to design the PSL in a manner such that the allocated credit reaches the desired sections. Towards this end, it is important (a) to undertake a review of the PSL definitions and targets (b) to examine innovative means to incentivize banks to meet these targets. The following chapters of the Report look into these issues. | Table 3.4 : Share of credit to weaker sections | | | Small Borrowal Accounts | All Accounts | Per cent share of SBA in all accounts | | End March | No. of accts. | Amt. Outstanding | Average amt. (SBA) | No. of accts. | Amt. Outstanding | Average amt. (ALL) | No. of accts. (%) | Amt. outstanding (%) | | 1998 | 49,932 | 521.67 | 10.4 | 53,583 | 3299.44 | 61.6 | 93.2 | 15.8 | | Cut-off limit: Rs.200,000 | | 1999 | 50,997 | 882.82 | 17.3 | 52,305 | 3824.25 | 73.1 | 97.5 | 23.1 | | 2000 | 52,856 | 1027.45 | 19.4 | 54,370 | 4600.81 | 84.6 | 97.2 | 22.3 | | 2001 | 50,456 | 1062.94 | 21.1 | 52,364 | 5384.34 | 102.8 | 96.4 | 19.7 | | 2002 | 54,130 | 1256.49 | 23.2 | 56,388 | 6559.93 | 116.3 | 96.0 | 19.2 | | 2003 | 56,527 | 1450.57 | 25.7 | 59,491 | 7559.69 | 127.1 | 95.0 | 19.2 | | 2004 | 61,900 | 1627.00 | 26.3 | 66,390 | 8803.12 | 132.6 | 93.2 | 18.5 | | 2005 | 71,106 | 1998.80 | 28.1 | 77,151 | 11524.68 | 149.4 | 92.2 | 17.3 | | 2006 | 77,122 | 2484.98 | 32.2 | 85,435 | 15138.42 | 177.2 | 90.3 | 16.4 | | 2007 | 84,347 | 2788.95 | 33.1 | 94,442 | 19471.00 | 206.2 | 89.3 | 14.3 | | 2008 | 94,554 | 3310.22 | 35.0 | 106,990 | 24170.07 | 225.9 | 88.4 | 13.7 | | 2009 | 95,801 | 3498.65 | 36.5 | 110,056 | 28477.13 | 258.8 | 87.0 | 12.3 | | 2010 | 102,632 | 3607.45 | 35.1 | 118,648 | 33451.69 | 281.9 | 86.5 | 10.8 | | 2011 | 102,155 | 3838.88 | 37.6 | 120,724 | 40756.47 | 337.6 | 84.6 | 9.4 | | 2012 | 109,111 | 4566.21 | 41.8 | 130,881 | 48032.67 | 367.0 | 83.4 | 9.5 | | 2013 | 102,305 | 5148.33 | 50.3 | 128,286 | 55253.17 | 430.7 | 79.7 | 9.3 | | Source: RBI, Survey of Small Borrowal Accounts, various issues. |

Annex 1 Dynamic Panel (Arellano-Bond) regression coefficients with total agri. credit

(Dependent Variable: Lagged - per capita output) | | Variables | Coef. | Robust SE | z | P>z | 95% Conf.[Interval] | | Lagged - per capita output | 0.512 | 0.124 | 4.140 | 0.000 | 0.270 | 0.755 | | Per capita credit amount | 0.040 | 0.023 | 1.760 | 0.079 | -0.005 | 0.084 | | Per capita number of credit accounts | 0.015 | 0.011 | 1.380 | 0.167 | -0.006 | 0.037 | | Per capita agri. Area | 0.069 | 0.031 | 2.220 | 0.026 | 0.008 | 0.130 | | Rainfall | -0.013 | 0.009 | -1.420 | 0.156 | -0.031 | 0.005 | | Intercept | 0.444 | 0.473 | 0.940 | 0.348 | -0.483 | 1.370 | Number of obs. = 434; Wald chi2(5) = 141.59; Prob> chi2 = 0.0000

Arellano-Bond test that average autocovariance in residuals of order 1 is 0: H0: no autocorrelation z = -2.829 Pr > z = 0.0047

Arellano-Bond test that average autocovariance in residuals of order 2 is 0: H0: no autocorrelation z = -1.39 Pr > z = 0.1632

Sargan test of over-identifying restrictions: chi2(46) = 75.7419 Prob> chi2 = 0.4543 |

| Dynamic Panel (Arellano-Bond) regression coefficients with direct agri. Credit | | Variables | Coef. | Robust SE | Z | P>z | 95% Conf.[Interval] | | Lagged - per capita output | 0.468 | 0.119 | 3.930 | 0.000 | 0.235 | 0.701 | | Per capita direct credit amount | 0.073 | 0.030 | 2.450 | 0.014 | 0.015 | 0.132 | | Per capita number of direct credit accounts | 0.005 | 0.012 | 0.430 | 0.668 | -0.019 | 0.030 | | Per capita agri. Area | 0.068 | 0.030 | 2.240 | 0.025 | 0.009 | 0.127 | | Rainfall | -0.012 | 0.009 | -1.330 | 0.184 | -0.031 | 0.006 | | Intercept | 0.506 | 0.472 | 1.070 | 0.284 | -0.420 | 1.431 | Number of obs. = 434; Wald chi2(5) = 142.90 Prob> chi2 = 0.0000

Arellano-Bond test that average autocovariance in residuals of order 1 is 0: H0: no autocorrelation z = -2.833 Pr > z = 0.0048

Arellano-Bond test that average autocovariance in residuals of order 2 is 0: H0: no autocorrelation z = -1.3005 Pr > z = 0.1934

Sargan test of over-identifying restrictions: chi2(46) = 77.3377 Prob> chi2 = 0.4039 |

| Dynamic Panel (Arellano-Bond) regression coefficients with indirect agri. Credit | | Variables | Coef. | Robust SE | Z | P>z | 95% Conf.[Interval] | | Lagged - per capita output | 0.572 | 0.125 | 4.560 | 0.000 | 0.326 | 0.818 | | Per capita indirect credit amount | 0.028 | 0.030 | 0.930 | 0.351 | -0.031 | 0.086 | | Per capita number of indirect credit accounts | 0.526 | 0.273 | 1.930 | 0.054 | -0.009 | 1.062 | | Per capita agri. Area | 0.093 | 0.033 | 2.800 | 0.005 | 0.028 | 0.159 | | Rainfall | -0.008 | 0.010 | -0.790 | 0.429 | -0.029 | 0.012 | | Intercept | 0.815 | 0.376 | 2.160 | 0.030 | 0.077 | 1.552 | Number of obs. = 434; Wald chi2(5) = 157.05; Prob> chi2 = 0.0000

Arellano-Bond test that average autocovariance in residuals of order 1 is 0: H0: no autocorrelation z = -2.777 Pr > z = 0.0055

Arellano-Bond test that average autocovariance in residuals of order 2 is 0: H0: no autocorrelation z = -1.5919 Pr > z = 0.1114

Sargan test of over-identifying restrictions: chi2(46) = 77.3322 Prob> chi2 = 0.4041 |