RBI/DOR/2025-26/345

DOR.CAP.REC.264/21-01-002/2025-26 November 28, 2025 Reserve Bank of India (Non-Banking Financial Companies – Prudential Norms

on Capital Adequacy) Directions, 2025 In exercise of the powers conferred under Sections 45L of the Reserve Bank of India Act, 1934 and Section 3 read with Section 31A and Section 6 of the Factoring Regulation Act, 2011, the Reserve Bank, being satisfied that it is necessary and expedient in the public interest so to do, hereby, issues the Directions hereinafter specified. Chapter I

Preliminary A. Short title and commencement 1. These Directions shall be called the Reserve Bank of India (Non-Banking Financial Companies – Prudential Norms on Capital Adequacy) Directions, 2025. 2. These Directions shall come into effect immediately upon issuance. B. Applicability 3. These Directions shall be applicable to the following Non-Banking Financial Companies (hereinafter collectively referred to as ‘NBFCs’ and individually as an ‘NBFC’), subject to layer-wise applicability, unless specified otherwise: (i) Deposit taking NBFC (NBFC - D) registered with the RBI under the provisions of the RBI Act, 1934; (ii) NBFC - Investment and Credit Company (NBFC – ICC) registered with the RBI under the provisions of the RBI Act, 1934; (iii) NBFC - Factor registered with the RBI under the provisions of the Factoring Regulation Act, 2011; (iv) NBFC - Infrastructure Finance Company (NBFC – IFC) registered with the RBI under the provisions of the RBI Act, 1934; (v) Infrastructure Debt Fund - NBFC (IDF-NBFC) registered with the RBI under the provisions of the RBI Act, 1934; and (vi) NBFC - Micro Finance Institution (NBFC - MFI) registered with the RBI under the provisions of the RBI Act, 1934. Provided that paragraphs 6(1), 6(2), and 17 shall not apply to an NBFC-MFI. (2) The provisions contained in paragraphs 6(4), 7, 8, 11, 15, 16, 18(2)(iv), 18(3) to 18(11), and paragraphs 19 to 54, shall apply to a Housing Finance Company (HFC) registered with the RBI under the provisions of the National Housing Bank Act, 1987, as per layer-wise applicability. (3) The provisions contained in paragraphs 6(4), 7, 8, 11, 15, 16, and 54 shall apply to Mortgage Guarantee Company (MGC) registered with RBI under the Scheme of Registration of Mortgage Guarantee Companies, as per layer-wise applicability. (4) The provisions contained in paragraph 15, 16, and 54 shall apply to Core Investment Company (CIC) registered with the RBI under the provisions of the RBI Act, 1934, as per layer-wise applicability. (5) The provisions contained in paragraph 16, and 54 shall apply to every Standalone Primary Dealer (SPD) registered with the RBI as an NBFC under the provisions of the RBI Act, 1934. (6) These Directions are not applicable to the following: (i) NBFC - Peer to Peer Lending Platform (NBFC - P2P), registered with the RBI under the provisions of the RBI Act, 1934; (ii) NBFC - Account Aggregator (NBFC - AA) registered with the RBI under the provisions of the RBI Act, 1934; (iii) Non - Operative Financial Holding Company (NOFHC) registered with the RBI as NBFC under the provisions of the RBI Act, 1934; (iv) ‘NBFC not availing public funds and not having any customer interface’; and (v) ‘NBFC - Base Layer (NBFC – BL) having customer interface but not availing public funds’. Note - The applicability under these Directions is in line with the regulatory structure for NBFCs as set out in Reserve Bank of India (Non-Banking Financial Companies – Registration, Exemptions and Framework for Scale Based Regulation) Directions, 2025. C. Definitions 4. In these Directions, unless the context states otherwise, the terms herein shall bear the meanings assigned to them below: (1) ‘Central Counterparty (CCP)’ is a clearing house that interposes itself between counterparties to contracts traded in one or more financial markets, becoming the buyer to every seller and the seller to every buyer and thereby ensuring the future performance of open contracts. A CCP becomes counterparty to trades with market participants through novation, an open offer system, or another legally binding arrangement. For the purposes of the capital framework, a CCP is a financial institution; (2) ‘Companies in the same group’, shall mean an arrangement involving two or more entities related to each other through any of the following relationships: subsidiary - parent, joint venture, associate, promoter - promotee [as provided in the SEBI (Acquisition of Shares and Takeover) Regulations, 1997] for listed companies, a related party, common brand name, and investment in equity shares of 20 percent and above. The terms parent, subsidiary, joint venture, associate, and related party shall be as defined / described in applicable Accounting Standards; (3) ‘Credit event payment’ is the amount which is payable by the credit protection seller to the credit protection buyer, under the terms of the credit derivative contract, following the occurrence of a credit event. The payment shall be only in the form of physical settlement (payment of par in exchange for physical delivery of a deliverable obligation); (4) ‘Current exposure’, in context of bilateral netting, is the larger of zero, or the market value of a transaction or portfolio of transactions within a netting set with a counterparty that would be lost upon the default of the counterparty, assuming no recovery on the value of those transactions in bankruptcy. Current exposure is also called Replacement Cost (RC); (5) ‘Deliverable asset/ obligation’ means any obligation of the reference entity which shall be delivered, under the terms of the contract, if a credit event occurs. (Assets under this clause will rank at least pari-passu or junior to the underlying obligation); (6) ‘Hybrid Debt’ means a capital instrument which possesses certain characteristics of equity as well as of debt; (7) ‘Leverage Ratio’ means the total outside liabilities divided by owned fund; (8) ‘NBFC primarily engaged in lending against gold jewellery’ means an NBFC in which such loans comprise 50 percent or more of its financial assets; (9) ‘Netting Set’ is a group of transactions with a single counterparty that are subject to a legally enforceable bilateral netting arrangement and for which netting is recognised for regulatory capital purposes. Each transaction that is not subject to a legally enforceable bilateral netting arrangement that is recognised for regulatory capital purposes shall be interpreted as its own netting set for the purpose of these rules; (10) ‘Qualifying Central Counterparty (QCCP)’ is an entity that is licensed to operate as a CCP (including a license granted by way of confirming an exemption) and is permitted by the appropriate regulator / overseer to operate as such with respect to the products offered. This is subject to the provision that the CCP is based and prudentially supervised in a jurisdiction where the relevant regulator / overseer has established, and publicly indicated that it applies to the CCP on an ongoing basis, domestic rules and regulations that are consistent with the CPSS-IOSCO Principles for Financial Market Infrastructures; (11) ‘Reference obligation’ means the obligation used to calculate the amount payable when a credit event occurs under the terms of a credit derivative contract. [A reference obligation is relevant for obligations that are to be cash settled (on a par-less-recovery basis)]; (12) ‘Subordinated Debt’ means an instrument, which is fully paid up, unsecured, subordinated to the claims of other creditors, free from restrictive clauses, and is not redeemable at the instance of the holder or without the consent of the supervisory authority of the NBFC; (13) ‘Tranche’ means a contractually established segment of the credit risk associated with an exposure or a pool of exposures, where a position in the segment entails a risk of credit loss greater than or less than a position of the same amount in another segment, without taking account of credit protection provided by third parties directly to the holders of positions in the segment or in other segments. Explanation - Securitisation notes issued by the SPE and credit enhancement facilities available shall be treated as tranches; (14) ‘Tranche maturity’ means the tranche’s effective maturity in years and is measured as prescribed in paragraphs 38 to 40; (15) ‘Tranche thickness’ means the measure calculated as detachment point (D) minus attachment point (A), where D and A are calculated in accordance with paragraphs 33 to 37; and (16) ‘Underlying asset/obligation’ means the asset which a protection buyer is seeking to hedge. The terms appearing in paragraphs 19 to 51 on ‘Securitisation Exposures’ shall bear the meanings assigned to them under Reserve Bank of India (Non-Banking Financial Companies – Securitisation Transactions) Directions, 2025, unless stated otherwise herein. 5. All other expressions unless defined herein shall have the same meaning as have been assigned to them under the Reserve Bank of India Act, 1934 or Companies Act, 2013 and rules / regulations made thereunder, or any statutory modification or re-enactment thereto or as used in commercial parlance, as the case may be. Chapter II

Regulatory capital A. Limits and minima 6. An NBFC shall meet the following minimum capital requirements on an ongoing basis: (1) An NBFC primarily engaged in lending against gold jewellery shall maintain a minimum Tier 1 capital and Capital to Risk-weighted Asset Ratio (CRAR) of 12 per cent and 15 per cent respectively of the aggregate Risk Weighted Assets (RWAs). The Tier 2 capital of the NBFC, at any point of time, shall not exceed 100 per cent of Tier 1 capital. Explanation - (2) An NBFC - Middle Layer (NBFC – ML) and above shall maintain a minimum Tier 1 capital of 10 per cent of the aggregate RWAs. Explanation - For paragraph 6(1) and 6(2) above: (3) An NBFC – ML and above shall maintain a minimum CRAR of 15 per cent of the aggregate RWAs. The Tier 2 capital of the NBFC, at any point of time, shall not exceed 100 per cent of Tier 1 capital. (4) An NBFC – Upper Layer (NBFC – UL) shall also maintain a minimum Common Equity Tier 1 (CET1) capital of 9 per cent of the aggregate RWAs. Explanation - (5) An NBFC falling in the Top Layer of the regulatory structure shall, inter alia, be subject to higher capital charge. Such higher requirements shall be specifically communicated to the NBFC at the time of its classification in the Top Layer. B. Elements of Common Equity Tier 1 (CET1) capital 7. CET1 capital shall comprise the following: (i) Paid-up equity share capital issued by the NBFC; (ii) Share premium resulting from the issue of equity shares; (iii) Capital reserves representing surplus arising out of sale proceeds of assets; (iv) Statutory reserves; (v) Revaluation Reserves arising out of change in the carrying amount of an NBFC’s property consequent upon its revaluation in accordance with the applicable Accounting Standards may, at the discretion of the NBFC, be reckoned as CET1 capital (instead of as Tier 2 capital) at a discount of 55 per cent under extant regulations, subject to meeting the following conditions: (a) the property is held for own use by the NBFC; (b) the NBFC is able to sell the property readily at its own will and there is no legal impediment in selling the property; (c) the revaluation reserves are presented / disclosed separately in the financial statements of the NBFC; (d) revaluations are realistic, in accordance with applicable Accounting Standards; (e) valuations are obtained from two independent valuers at least once in every three years; (f) where the value of the property has been substantially impaired by any event, it shall be immediately revalued and appropriately factored into capital adequacy computations; and (g) the external auditors of the NBFC have not expressed a qualified opinion on the revaluation of the property; (vi) Other disclosed free reserves, if any; (vii) Balance in Statement of Profit and Loss Account after allocations and appropriations i.e., retained earnings at the end of the previous financial year. Accumulated losses shall be reduced from CET1; (viii) Profits in current financial year may be included on a quarterly basis if it has been audited or subject to limited review by the statutory auditors of the NBFC. Further, such profits shall be reduced by average dividend paid in the last three years and the amount which can be reckoned would be arrived at as under: EPt=NPt -0.25 *D*t Where: EPt=Eligible profit up to quarter ‘t’ of the current financial year, t varies from 1 to 4; NPt=Net profit up to quarter ‘t’; D=average dividend paid during the last three years. Losses in the current year shall be fully deducted from CET1; and (ix) Less: Regulatory adjustments / deductions applied in the calculation of CET1 capital [i.e., to be deducted from the sum of items (i) to (viii)] as per paragraph 8 below. 8. The following regulatory adjustments / deductions shall be made from CET1 capital: (1) Goodwill and other intangible assets (i) Goodwill and all other intangible assets shall be deducted from CET1 capital. (ii) The full amount of the intangible assets may be deducted net of any associated deferred tax liabilities (DTL) which would be extinguished if the intangible assets become impaired or derecognised under the relevant Accounting Standards. For this purpose, the definition of intangible assets shall be in accordance with the applicable Accounting Standards. Losses in the current period and those brought forward from previous periods shall also be deducted from CET1 capital, if not already deducted. (iii) An NBFC shall not be required to deduct a Right-of-Use (ROU) asset (created in terms of Ind AS 116 - Leases) from CET1 capital, provided the underlying asset being taken on lease is a tangible asset; (2) Deferred Tax Assets (DTAs) The following DTAs shall be deducted in full from CET1 capital: (i) DTAs associated with accumulated losses; and (ii) DTAs (excluding DTAs associated with accumulated losses) net of DTL. Where the DTL is in excess of the DTA (excluding DTA associated with accumulated losses), the excess shall neither be adjusted against item (i) nor added to CET1 capital. DTAs may be netted with associated DTLs only if the DTAs and DTLs relate to taxes levied by the same taxation authority and offsetting is permitted by the relevant taxation authority. The DTLs permitted to be netted against DTAs shall exclude amounts that have been netted against the deduction of goodwill, intangibles, and defined benefit pension assets; (3) Investment in shares of other NBFCs and in shares, debentures, bonds, outstanding loans and advances including hire purchase and lease finance made to and deposits with subsidiaries and companies in the same group exceeding, in aggregate, ten per cent of the owned fund of the NBFC. Notes - (i) The lower of acquisition cost or fair value of investments / advances shall be used to arrive at the amount of deduction mentioned above; and (ii) For the above deduction, margin money placed with a subsidiary or company in the same group shall be considered as deposits; (4) Impairment Reserve shall not be recognised in CET1 capital; (5) Securitisation Transactions: An NBFC shall be guided by the provisions of paragraphs 19 to 51; (6) Defined benefit pension fund assets and liabilities: Defined benefit pension fund liabilities, as included on the balance sheet, shall be fully recognised in the calculation of CET1 capital (i.e., CET1 capital cannot be increased through derecognising these liabilities). For each defined benefit pension fund that is an asset on the balance sheet, the asset shall be deducted in the calculation of CET1 capital; and (7) Investments in own shares (Treasury stock): Investment in an NBFC’s own shares is tantamount to repayment of capital and therefore, such investments, whether held directly or indirectly, shall be deducted from CET1 capital. This deduction shall remove the double counting of equity capital which arises from direct holdings, indirect holdings via index funds and potential future holdings as a result of contractual obligations to purchase own shares. Note - Section 67 of the Companies Act, 2013, restricts the purchase by a company or giving loans by it for purchase of its shares. C. Elements of owned fund 9. ‘Owned Fund’ means aggregate of: (i) paid up equity capital; (ii) preference shares which are compulsorily convertible into equity; (iii) free reserves; (iv) balance in share premium account; and (v) capital reserves representing surplus arising out of sale proceeds of asset, excluding reserves created by revaluation of asset. as reduced by: (vi) accumulated loss balance; (vii) book value of intangible assets; and (viii) deferred revenue expenditure, if any. Note - An NBFC shall not be required to deduct an ROU asset (created in terms of Ind AS 116 - Leases) from owned fund, provided the underlying asset being taken on lease is a tangible asset. D. Elements of Tier 1 capital 10. Tier 1 capital of an NBFC – BL primarily engaged in lending against gold jewellery and an NBFC - ML shall comprise the following: (i) Owned fund as reduced by followings investments exceeding, in aggregate, 10 per cent of the owned fund: (a) investment in shares of other NBFCs; and (b) investment in shares, debentures, bonds, outstanding loans, and advances including hire purchase and lease finance made to and deposits with subsidiaries and companies in the same group. (ii) Perpetual Debt Instruments (PDI) issued by a non-deposit taking NBFC that meets conditions specified in paragraph 12, to the extent it does not exceed 15 per cent of its aggregate Tier 1 capital as on March 31 of the previous financial year. Note - An NBFC-BL shall not include PDI in its Tier 1 capital. 11. Tier 1 capital of an NBFC-UL shall comprise the following: (i) CET1 capital as defined under paragraph 7 above; (ii) Preference shares which are compulsorily convertible into equity; and (iii) PDI issued by a non-deposit taking NBFC that meets conditions specified in paragraph 12, to the extent it does not exceed 15 per cent of its aggregate Tier 1 capital as on March 31 of the previous financial year. Terms and conditions applicable to Perpetual Debt Instrument (PDI) for being eligible for inclusion in regulatory capital 12. The PDI shall be issued as bonds or debentures by a non-deposit taking NBFC on the following terms and conditions to qualify for inclusion as Tier 1 capital or Tier 2 capital, as the case may be, for capital adequacy purposes: (1) Currency of issue PDIs shall be issued in Indian rupees only; (2) Amount The aggregate amount to be raised by issue of such instruments shall be within the overall limits of Tier 1 and Tier 2 as explained in paragraph 12(3) below. It may be raised in tranches. However, the minimum investment by single investor in each such issue / tranche shall be ₹5 lakh; (3) Limits PDI shall be eligible to be treated as Tier 1 capital up to 15 per cent of total Tier 1 capital as on March 31 of previous year after deduction of goodwill and other intangible assets but before the deduction of investments. The amount of PDI in excess of amount admissible as Tier 1 shall qualify as Tier 2 capital subject to provisions contained in these Directions; (4) Maturity period The PDI shall be perpetual; (5) Rate of interest The interest payable to the investors may be either at a fixed rate or at a floating rate referenced to a market determined rupee interest benchmark rate; (6) Options A non-deposit taking NBFC shall issue PDI as plain vanilla instruments only. However, it may issue PDI with a 'call option' subject to strict compliance with each of the following conditions: (i) the instrument has run for a minimum period of ten years from the date of issue; and (ii) call option shall be exercised only with the prior approval of the Reserve Bank. While considering the proposals received from such an NBFC for exercising the call option, the Reserve Bank shall, among other things, take into consideration its CRAR position both at the time of exercise of the call option and after the exercise of the call option; (7) Step-up option The issuing non-deposit taking NBFC may have a step-up option for increasing the rate of interest payable on PDIs. Such option can be exercised only once during the whole life of the instrument after the lapse of ten years from the date of issue. The step-up shall not be more than 100 bps in reference to interest rate advertised in terms of offer document under paragraph 12(5) above. The limits on step-up apply to the all-in cost of the debt to the issuing NBFC; (8) Lock-in clause (i) PDI shall be subject to a lock-in clause in terms of which the issuing non-deposit taking NBFC shall defer the payment of interest, if: (a) Its CRAR is below the minimum regulatory requirement prescribed by the Reserve Bank; or (b) The impact of such payment results in the NBFC’s CRAR falling below or remaining below the minimum regulatory requirement prescribed by the Reserve Bank. (ii) However, a non-deposit taking NBFC may pay interest with the prior approval of the Reserve Bank when the impact of such payment may result in net loss or increase the net loss, provided the CRAR remains above the regulatory norm. (iii) The interest shall not be cumulative except in cases as in paragraph 8(i) above. (iv) All instances of invocation of the lock-in clause shall be notified by the issuing NBFC to the Regional Office of Department of Supervision of the Reserve Bank in whose jurisdiction it is registered; (9) Seniority of claim The claims of the investors in PDI shall be: (i) Superior to the claims of investors in equity shares; and (ii) Subordinated to the claims of all other creditors; (10) Discount The PDI instruments shall not be subject to a progressive discount for capital adequacy purposes since these are perpetual; (11) Other conditions (i) PDI shall be fully paid-up, unsecured, free of any restrictive clauses, and the issue of PDI and the terms and conditions applicable thereto shall be compliant with the provisions of Companies Act, 2013, and all other laws for the time being in force including the rules, regulations, directions, and guidelines issued by the applicable regulatory authorities. (ii) Subject to compliance with the extant Foreign Exchange Management Act (FEMA), 1999, an NBFC shall obtain prior approval of the Reserve Bank, on a case-by-case basis, for investment by Foreign Institutional Investors (FIIs) in PDI to be raised by a non-deposit taking NBFC in Indian rupees. (iii) Non-deposit taking NBFC issuing PDI, shall comply with the terms and conditions, if any, stipulated by the Securities and Exchange Board of India (SEBI) / other regulatory authorities in regard to issue of the instruments; (12) Reporting requirements A non-deposit taking NBFC issuing PDI shall submit a report to the Regional Office of Department of Supervision of the Reserve Bank under whose jurisdiction it is registered giving details of the debt raised, including the terms of issue together with a copy of the offer document soon after the issue is completed; (13) Investment in PDI issued by other NBFC An NBFC investing in PDI issued by other NBFC and financial institutions shall be subject to the definition of NOF as defined in Section 45-IA of the RBI Act, 1934 and shall attract risk weight as prescribed by the Reserve Bank; (14) Grant of advances against PDI A non-deposit taking NBFC issuing PDI shall not grant advances against the security of its PDI; (15) Disclosure requirement (i) A non-deposit taking NBFC issuing PDI shall make suitable disclosures in its Annual Report about: (a) Amount of funds raised through PDI during the year and outstanding at the close of the financial year; (b) Percentage of the amount of PDI of the amount of its Tier 1 capital; and (c) Mention the financial year in which interest on PDI has not been paid in accordance with paragraph 12(8) above. (ii) While framing policy as regards PDI, the Board of Directors of the non-deposit taking NBFC shall ensure that sufficient disclosures are made to the investor which clarify the type of the instrument, the risks associated, and its uninsured nature so as to enable the investor to make informed investment decision. The offer document shall contain a clause that investors shall make investment decision on the basis of their own analysis and the Reserve Bank does not accept any responsibility about repayment of such investment. The policy evolved by such NBFC shall also include provision as regards factors to be taken into account by it to demonstrate that it can meet extra load in case the company decides to step up the rate of interest under paragraph 12(7) above. The Board of Directors shall ensure strict compliance with all the terms and conditions set forth above. E. Elements of Tier 2 capital 13. Tier 2 capital of an NBFC shall comprise the following: (i) Preference shares other than those which are compulsorily convertible into equity; (ii) Revaluation Reserves at a discounted rate of 55 per cent; (iii) General provisions (including that for Standard Assets) and loss reserves to the extent these are not attributable to actual diminution in value or identifiable potential loss in any specific asset and are available to meet unexpected losses, to the extent of 1.25 per cent of RWAs; (iv) Hybrid debt capital instruments; (v) Subordinated debt; Provided that book value of subordinated debt shall be subject to discounting as provided under: | Remaining Maturity of the instruments | Rate of discount | | Up to one year | 100% | | More than one year but up to two years | 80% | | More than two years but up to three years | 60% | | More than three years but up to four years | 40% | | More than four years but up to five years | 20% | to the extent such discounted value does not exceed fifty percent of Tier 1 capital; and (vi) PDI issued by a non-deposit taking NBFC, which is in excess of what qualifies for Tier 1 capital; Note – An NBFC-BL is not eligible to include PDI in its Tier 2 capital. F. Treatment of Deferred Tax Asset (DTA) and Deferred Tax Liability (DTL) for regulatory capital 14. The following regulatory treatment shall be provided to DTA and DTL: (1) DTA shall be treated as an intangible asset by an NBFC; (2) DTA associated with accumulated losses shall be deducted from Tier 1 capital; (3) DTA (excluding DTA associated with accumulated losses) net of DTL shall be deducted from Tier 1 capital; (4) Where DTL is in excess of the DTA (excluding DTA associated with accumulated losses), the excess DTL shall neither be adjusted against item (2) nor added to Tier 1 capital; (5) The balance of DTL account shall not be included either in Tier 1 or Tier 2 capital for capital adequacy purpose; (6) DTA created by credit to opening balance of Revenue Reserves or to Profit and Loss account for the current year shall be included under item 'others' of ‘Other Assets’; and (7) DTL created by debit to opening balance of Revenue Reserves or to Profit and Loss Account for the current year shall be included under 'others' of ‘Other Liabilities and Provisions’. G. Other adjustments to be made from regulatory capital 15. The following adjustments shall be made from regulatory capital: (1) In terms of Reserve Bank of India (Non-Banking Financial Companies – Undertaking of Financial Services) Directions, 2025, if an NBFC’s contribution is in the form of subordinated units of any Alternative Investment Fund (AIF) scheme, it shall deduct the entire investment from its capital funds – proportionately from both Tier 1 and Tier 2 capital (wherever applicable); (2) In terms of Reserve Bank of India (Non-Banking Financial Companies – Transfer and Distribution of Credit Risk) Directions, 2025, an NBFC shall adhere to the applicable Accounting Standards while booking of unrealised profit under Co-lending Arrangements, if applicable. However, such profits shall be deducted from CET1 capital or Net Owned Funds for meeting regulatory capital adequacy requirement till the maturity of such loans. Further, for the prudential treatment of unrealised profits arising because of transfer of loan exposures and Security Receipts guaranteed by the Government of India, an NBFC shall be guided by the Directions ibid; and (3) In terms of Reserve Bank of India (Non-Banking Financial Companies – Credit Facilities) Directions, 2025, if an NBFC is the Default Loss Guarantee (DLG) provider, it shall deduct the full amount of DLG, which is outstanding, from its capital. 16. An NBFC, covered by Rule 4 of the Companies (Indian Accounting Standards) Rules, 2015 [i.e., an NBFC that has implemented Indian Accounting Standards (Ind AS)], shall be guided by the following while determining ‘owned fund’, ‘CET1 capital’, ‘Tier 1 capital’, and ‘regulatory capital’: (1) Any net unrealised gains arising on fair valuation of financial instruments, including such gains arising on transition to Ind AS, shall not be included in owned fund and CET1 capital whereas all such net losses shall be considered. In determining the net unrealised gains for reduction from owned fund and CET1 capital, the NBFC shall categorise financial assets measured at fair value into following two categories: (i) Investments in shares of other NBFCs and in shares, debentures, bonds, etc., in Group companies that are required to be reduced while determining CET1 / Tier 1 capital as defined in paragraphs 8 and 10 of these Directions; and (ii) Others. While netting may be done within the aforementioned categories, net gains from one category shall not offset against losses in the other category. Unrealised gains / losses shall be considered net of the effect of taxation; (2) As unrealised gains on category (i) in proviso to paragraph 16(1) above have been excluded in computation of owned fund, an NBFC shall reduce the lower of acquisition cost or fair value of investments / advances in subsidiaries / other group companies and other NBFCs while determining Tier 1 capital. Further, net unrealised gains on category (ii) in proviso to paragraph 16(1) above (i.e., ‘Others’), to the extent they have been excluded in regulatory capital, shall also be reduced from RWAs; (3) Any unrealised gains or losses recognised in equity due to (i) own credit risk, and (ii) cash flow hedge reserve shall be derecognised while determining owned fund and CET1 capital; (4) The unrealised gain / loss on a derivative transaction undertaken for hedging may be offset against the unrealised loss / gain recognised in the capital (either through Profit or Loss or through Other Comprehensive Income) on the corresponding underlying hedged instrument. If after such offset and netting with unrealised gains / losses on other financial instruments, there are still net unrealised gains, the same shall be excluded from regulatory capital. These unrealised gains / losses shall be considered net of the effect of taxation; (5) Where an NBFC uses fair value as deemed cost at the date of transition with respect to Property, Plant and Equipment (PPE) in terms of Ind AS 101, and the difference between the deemed cost and the current carrying cost is adjusted directly in retained earnings, any fair value gains upon such transition shall be reckoned as Tier 2 capital for an NBFC at a discount of 55 per cent; (6) 12 month expected credit loss (ECL) allowances for financial instruments, i.e., where the credit risk has not increased significantly since initial recognition, shall be included under general provisions and loss reserves in Tier 2 capital within the limits specified by extant regulations. Lifetime ECL shall not be reckoned for regulatory capital (numerator) while it shall be reduced from the RWAs; (7) Securitised assets not qualifying for de-recognition under Ind AS due to credit enhancement given by an originating NBFC on such assets shall be risk weighted at zero per cent. However, the NBFC shall reduce 50 per cent of the amount of credit enhancement given from Tier 1 capital and the balance from Tier 2 capital; and (8) The balance in the ‘Impairment Reserve’ shall not be reckoned for regulatory capital. H. Leverage Ratio 17. The leverage ratio of an NBFC - BL shall not be more than seven at any point of time. Chapter III

Risk Weight Assets (RWAs) A. Risk Weight Assets (RWAs) 18. An NBFC shall follow following guidelines for computation of RWAs. (1) Risk-weights, representing degree of credit risk, to be applied to on balance sheet items are as provided in the table below. The value of each on balance sheet asset / item shall be multiplied with applicable risk weights to arrive at risk-adjusted value of on balance sheet assets / items. The aggregate of risk-adjusted value of on balance sheet assets shall be taken into account for reckoning the minimum capital ratio. | Sr. No. | On-balance sheet items | Percentage weight | | (1) | | Cash and bank balances including fixed deposits and certificates of deposits with banks | 0 | | (2) | | Investments | | | | (a) | Approved securities [Except at (c) below] | 0 | | | (b) | Bonds of public sector banks | 20 | | | (c) | Fixed deposits / certificates of deposits / bonds of public financial institutions | 100 | | | (d) | Shares of all companies and debentures / bonds / commercial papers of all companies and units of all mutual fund | 100 | | | (e) | All assets covering PPP and post commercial operations date (COD) infrastructure projects in existence over a year of commercial operation. | 50 | | (3) | | Current assets / Other financial assets | | | | (a) | Stock on hire (net book value) | 100 | | | (b) | Inter corporate loans / deposits | 100 | | | (c) | Loans and advances fully secured against deposits held | 0 | | | (d) | Loans to staff | 0 | | | (e) | Other secured loans and advances considered good [Except at (6) below] | 100 | | | (e)(i) | Consumer credit exposure categorised as retail loans, excluding housing loans, educational loans, vehicle loans, loans against gold jewellery and microfinance / SHG loans | 125 | | | (e)(ii) | Credit card receivables | 125 | | | (f) | Bills purchased / discounted | 100 | | | (g) | Others (To be specified) | 100 | | (4) | | Fixed assets (net of depreciation) | | | | (a) | Assets leased out (net book value) | 100 | | | (b) | Premises | 100 | | | (c) | Furniture and fixtures | 100 | | (5) | | Other assets | | | | (a) | Income tax deducted at source (net of provision) | 0 | | | (b) | Advance tax paid (net of provision) | 0 | | | (c) | Interest due on Government securities | 0 | | | (d) | Others (to be specified) (including ROU assets) | 100 | | (6) | | Domestic sovereign | | | | (a) | Fund-based claims on the Central Government | 0 | | | (b) | Direct loan / credit / overdraft exposure and investment in State Government securities | 0 | | | (c) | Central Government guaranteed claims | 0 | | | (d) | State Government guaranteed claims, which have not remained in default / which are in default for a period not more than 90 days | 20 | | | (e) | State Government guaranteed claims, which have remained in default for a period of more than 90 days | 100 | (2) While calculating risk-weighted value of on-balance sheet items following shall also be considered: (i) Netting shall be done only in respect of assets where provisions for depreciation or for bad and doubtful debts have been made. (ii) An asset that has been deducted, from owned fund shall have a risk-weight of ‘zero’ percentage. (iii) While calculating the aggregate of funded exposure of a borrower for the purpose of assignment of risk weight, an NBFC shall net off the amount of cash margin / caution money / security deposits (against which right to set-off is available) held as collateral against the advances out of the total outstanding exposure of the borrower. (iv) An NBFC may apply zero per cent risk weights in respect of exposures guaranteed under any existing or future schemes launched by Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), Credit Risk Guarantee Fund Trust for Low Income Housing (CRGFTLIH), and individual schemes under National Credit Guarantee Trustee Company Ltd (NCGTC) provided they satisfy the following conditions: (a) Prudential Aspects: The guarantees provided under the respective schemes shall comply with the requirements for credit risk mitigation, as applicable for scheduled commercial banks in terms of paragraphs 167 to 176 of the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025, which, inter alia, requires such guarantees to be direct, explicit, irrevocable and unconditional. (b) Restrictions on permissible claims: Where the terms of the guarantee schemes restrict the maximum permissible claims through features like specified extent of guarantee coverage, clause on first loss absorption by member lending institutions (MLI), payout cap, etc., the zero percent risk weight shall be restricted to the maximum permissible claim and the residual exposure shall be subjected to risk weight as applicable to the counterparty in terms of extant regulations. (c) In case of a portfolio-level guarantee, effective from April 1, 2023, the extent of exposure subjected to first loss absorption by the MLI, if any, shall be subjected to full capital deduction and the residual exposure shall be subjected to risk weight as applicable to the counterparty in terms of extant regulations, on a pro rata basis. The maximum capital charge shall be capped at a notional level arrived at by treating the entire exposure as unguaranteed. (d) Further, subject to the aforementioned prescriptions at paragraph 18 (2)(iv), any future scheme launched under any of the aforementioned trust funds, in order to be eligible for zero percent risk weight, shall provide for settlement of the eligible guaranteed claims within thirty days from the date of lodgement, and the lodgement shall be permitted within sixty days from the date of default. (e) Illustrative examples of risk weights applicable on claims guaranteed under specific existing schemes are as under. | Scheme name | Guarantee cover | Risk weight (RW) | | 1. Credit Guarantee Fund Scheme for Factoring (CGFSF) | The first loss of 10% of the amount in default to be borne by Factors. The remaining 90% (i.e., second loss) of the amount in default will be borne by NCGTC and Factors in the ratio of 2:1 respectively. | • First loss of 10% amount in default – Full capital deduction

• 60% amount in default borne by NCGTC- 0% RW.

• Balance 30% amount in default Counterparty / Regulatory Retail Portfolio (RRP) RW as applicable.

Note - The maximum capital charge shall be capped at a notional level arrived by treating the entire exposure as unguaranteed. | | 2. Credit Guarantee Fund Scheme for Skill Development (CGFSD) | 75% of the amount in default.

100% of the guaranteed claims shall be paid by the Trust after all avenues for recovery have been exhausted and there is no scope for recovering the default amount. | • Entire amount in default - Counterparty / Regulatory Retail Portfolio (RRP) RW as applicable. | | 3. Credit Guarantee Fund for Micro Units (CGFMU) | Micro Loans

The first loss to the extent of 3% of amount in default.

Out of the balance, guarantee will be to a maximum extent of 75% of the amount in default in the crystallized portfolio | • First loss of 3% amount in default – Full capital deduction

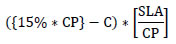

• 72.75% of the amount in default - 0% RW, subject to maximum of

Where-

o CP = Crystallized Portfolio (sanctioned amount)

o C = Claims received in previous years, if any, in the crystallized portfolio

o SLA = Sanctioned limit of each account in the crystallized portfolio

o 15 per cent represents the payout cap • Balance amount in default - Counterparty / RRP RW as applicable.

Note - The maximum capital charge shall be capped at a notional level arrived by treating the entire exposure as unguaranteed. | | 4. CGTMSE guarantee coverage for Micro-Enterprises | up to ₹5 lakh

85% of the amount in default subject to a maximum of ₹4.25 lakh

Above ₹5 lakh and up to ₹50 lakh

75% of the amount in default subject to a maximum of ₹37.50 lakh

Above ₹50 lakh & up to ₹200 lakh

75% of the amount in default subject to a maximum of ₹150 lakh | • Guaranteed amount in default – 0% RW*