The Reserve Bank successfully completed the borrowing programme of the Government of India and the state

governments during 2014-15 despite several challenges, such as scaling up of the size of borrowing and elevated

yields in the first half of the year. It continued the strategy of elongating the maturity, consolidating the debt

portfolio and imparting more liquidity to the secondary market. In pursuance of the objective of minimising the

rollover risk, the maturity profile of the debt portfolio was elongated during the year with a resultant marginal

increase in weighted cost. Leveraging on increased appetite for longer maturity debt, the Reserve Bank announced

issuance of 40-year security during 2015-16 to extend the yield curve beyond 30 years. A medium term debt

management strategy in line with sound international practices, regular quarterly calendar for state borrowings,

review of the WMA scheme for the states, an efficient market infrastructure to aid a deeper and wider government

debt market and expanding the investors’ base, are some of the important agenda items slated for 2015-16.

VII.1 In terms of Sections 20 and 21 of the

Reserve Bank of India Act, 1934, the Reserve Bank

has the obligation and right to transact Central

Government business in India and manage its

public debt. Similarly, the Reserve Bank is the debt

manager for all the 29 state governments and the

union territory of Puducherry as also a banker to

them except the Government of Sikkim in terms of

their agreement with the Reserve Bank under

Section 21A of the RBI Act, 1934. Further, the

Reserve Bank makes advances to the Central and

state governments to tide over temporary mismatch

in the cash flows. Such advances are termed as

‘ways and means advances’ (WMA), which are

repayable in each case not later than three months

from the date of making the advances in terms of

Section 17 (5) of the RBI Act.

VII.2 The Reserve Bank has set for itself a

medium-term agenda of transforming the financial

sector into a stronger, deeper, more efficient and

inclusive system. Within this broader agenda, the

approach for debt management as entrusted to the

Internal Debt Management Department (IDMD)

encompasses: a comprehensive debt management

strategy in alignment with sound international practices, minimising the borrowing cost, extending

maturities to cater to the requirements of diverse

investors, consolidation of public debt and reduction

in the rollover risk through active switch/buyback

operations.

Agenda and Implementation Status in 2014-15

VII.3 In 2014-15, the debt management strategy

aimed to:

i. conduct debt management operations in an

orderly manner and successfully meet the

market borrowing programmes in a smooth

and non-disruptive manner while minimising

the cost of borrowing;

ii. ensure reasonable distribution in issuances

over the first half and the second half with

issuance of new bonds coupled with bonds of

non-standard maturity to avoid concentration

of redemptions in the first half of the year;

iii. smoothen the maturity profile of GoI securities

to reduce redemption pressures in 2014-15

through buybacks/switches;

iv. ensure quicker and wider dissemination of

auction related information to market

participants and other stakeholders;

v. promote liquidity in government securities

(G-secs) through a scheme for market making

by PDs in semi-liquid and illiquid G-secs; and

vi. improve efficiency of cash management and

ensure reasonable returns on the CSF/GRF

(consolidated sinking fund/guarantee

redemption fund) of the states.

DEBT MANAGEMENT OF THE CENTRAL

GOVERNMENT

VII.4 The gross market borrowings of ₹5,920

billion (BE ₹6,000 billion) and net market borrowings

of ₹4,532 billion, which funded 90.3 per cent of the

gross fiscal deficit (GFD), were successfully raised

in 2014-15 (Table VII.1). With relatively comfortable

liquidity and stable market conditions during 2014-

15, there was lower devolvement of ₹53 billion on

primary dealers (PDs) on three occasions as

compared with 26 instances amounting to ₹175

billion in 2013-14.

| Table VII.1: Gross and Net Market Borrowings of the Central Government# |

| (₹ billion) |

| Item |

2004-05 |

2012-13 |

2013-14 |

2014-15 |

2015-16* |

| 1 |

2 |

3 |

4 |

5 |

6 |

| Net Borrowings |

460 |

4,674 |

4,686 |

4,532 |

1,757 |

| |

|

|

|

|

(4,564) |

| Gross Borrowings |

803 |

5,580 |

5,636 |

5,920 |

2,670 |

| |

|

|

|

|

(6,000) |

Note: 1. Figures in brackets are budget estimates.

2. Figures excluding buyback/ switches.

#: Issuance through dated securities;

* : upto August 14, 2015. |

VII.5 Debt management operations faced several

challenges during 2014-15. First, the combined

market borrowings of the Centre and the states

increased over the level in the preceding year in

both gross and net terms (that is, net of repayments)

resulting in a sizeable scaling up of debt issuances

in the primary market, particularly for the states.

The Reserve Bank held auctions of government

securities (including T-bills and SDLs or state

development loans) on 118 days, leading to a total of 548 issuances and 41 underwriting auctions.

Second, elevated level of yields in the first half of

the year when the borrowing programme was frontloaded

posed challenges for the cost of borrowing.

Under these testing conditions, the efficacy of debt

management can be gauged from the modest 12

bps increase in the weighted average yield of dated

securities issued by the Centre during the year to

8.51 per cent (Table VII.2) despite a lengthening of

maturity. Third, the Reserve Bank continued debt

consolidation through reissuances and eased

redemption pressures through buybacks/switches

during the year and also elongated the maturity

profile of government debt, thereby mitigating

rollover risks.

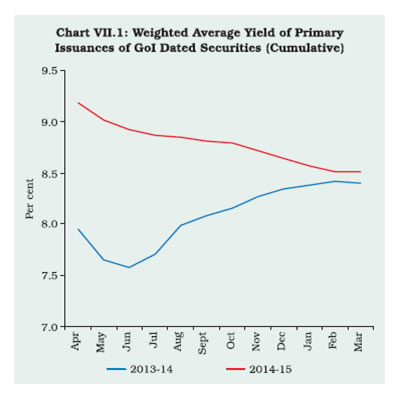

VII.6 Although yields on government dated

securities gradually declined during the course of

the year from relatively higher levels in the early

months (Chart VII.1), the weighted average yield

of dated securities issued during 2014-15 was

somewhat higher than in the previous year. Higher

issuances of long dated securities lengthened the

average maturity of outstanding debt (Table VII.3).

VII.7 As part of the consolidation of Government

debt, 95 per cent of the securities were reissued.

Buybacks/switches were conducted to smoothen

the maturity profile of GoI securities and reduce

redemption pressures. Buyback of short-term

securities amounting to ₹188 billion from the market

was completed through reverse auctions in September 2014 and switches of ₹88 billion were

conducted in February 2015. A conversion

operation of securities from the Reserve Bank’s

portfolio amounting to ₹302 billion was conducted

in March 2015. By these measures, the Reserve

Bank ensured the elongation of maturity of the

outstanding debt while containing the rollover risk

for GoI.

VII.8 Commercial banks remained predominant

investors in dated government securities, holding

around 43 per cent at end-March 2015, followed

by insurance companies and provident funds at

around 21 and 8 per cent, respectively. The share

of the Reserve Bank’s holding declined to 14 per

cent from a high of 16 per cent in the previous two

years. The share of foreign portfolio investors

(FPIs), which have emerged as active market

players in the recent period, more than doubled to

3.7 per cent from a year ago.

VII.9 Net market borrowings of the Centre

through treasury bills and dated securities stood at

₹4,779 billion in 2014-15, 6 per cent lower than

those in 2013-14. Yields on treasury bills also

softened at the shorter end in 2014-15 reflecting

comfortable liquidity conditions. Continuing its

pursuit of the market development strategy, the

Reserve Bank ensured quicker and wider

dissemination of auction related information among

market participants and other stakeholders. The

system of displaying primary auction results of

treasury bills, SDLs and GoI dated securities in

e-Kuber and NDS-OM along with publication of the results on the Reserve Bank’s website has been

implemented.

| Table VII.2: Central Government’s Market Loans-A Profile# |

| (yield in per cent / maturity in years) |

| Year |

Range of YTMs at Primary Issues |

Issued during the year |

Outstanding Stock

(As at end-March) |

| under 5 years |

5-10 years |

Over 10

years |

Weighted

average

yield |

Tenor of

securities

(range) |

Weighted

average

maturity |

Weighted

average

maturity |

Weighted

average

coupon |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

| 2008-09 |

7.71-8.42 |

7.69-8.77 |

7.77-8.81 |

7.69 |

6-30 |

13.80 |

10.45 |

8.23 |

| 2009-10 |

6.09-7.25 |

6.07-7.77 |

6.85-8.43 |

7.23 |

5-15 |

11.16 |

9.82 |

7.89 |

| 2010-11 |

5.98-8.67 |

7.17-8.19 |

7.64-8.63 |

7.92 |

5-30 |

11.62 |

9.78 |

7.81 |

| 2011-12 |

8.21-8.49 |

7.80-10.01 |

8.25-9.28 |

8.52 |

5-30 |

12.66 |

9.60 |

7.88 |

| 2012-13 |

8.82-8.21 |

7.86-8.76 |

7.91-8.06 |

8.36 |

5-30 |

13.50 |

9.67 |

7.97 |

| 2013-14* |

7.22-9.00 |

7.16-9.40 |

7.36-9.40 |

8.39 |

6-30 |

14.22 |

10.00 |

7.99 |

| 2014-15* |

- |

7.66-9.28 |

7.65-9.42 |

8.51 |

6-30 |

14.67 |

10.23 |

8.08 |

#: Excludes issuances under market stabilisation scheme;

YTM: Yield to maturity;

*: Excluding inflation linked bonds and buyback/switch in GoI securities. |

| Table VII.3: Issuance of the Central Government Dated Securities - Maturity Pattern |

| (Amount in ₹ billion) |

| |

2012-13 |

2013-14 |

2014-15 |

| Amount

raised |

Percentage

to total |

Amount

raised |

Percentage

to total |

Amount

raised |

Percentage

to total |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

| Less than 5 years |

470 |

8.42 |

110 |

1.95 |

- |

- |

| 5 -9.99 years |

1,910 |

34.23 |

2,305 |

40.91 |

2,350 |

39.69 |

| 10-14.99 years |

1,730 |

31.00 |

1,340 |

23.78 |

1,510 |

25.51 |

| 15 -19.99 years |

270 |

4.84 |

930 |

16.50 |

960 |

16.22 |

| 20 years & above |

1,200 |

21.51 |

950 |

16.86 |

1,100 |

18.58 |

| Total |

5,580 |

100.00 |

5,635 |

100.00 |

5,920 |

100.00 |

Cash Management

VII.10 The Government started the fiscal year with

a cash build-up of ₹1,284 billion and the cash

position remained comfortable until the third week

of May 2014 (Chart VII.2). Following spending by

the Government, cash balance declined and the

Government intermittently availed WMA for 61 days

altogether vis-à-vis 42 days during the previous

year. It also issued cash management bills (CMBs)

for ₹100 billion in November 2014.

VII.11 From December 16, 2014 onwards, the

Government’s cash balance held with the Reserve

Bank is being reckoned for auction through variable

rate repo as part of the Reserve Bank’s revised

liquidity management framework. The Government

ended the fiscal year with a cash balance of ₹1,573

billion.

VII.12 WMA limits for the first half (April-September)

and the second half (October-March) of 2014-15

were fixed at ₹350 billion and ₹200 billion,

respectively, for the Central Government. The WMA

limit for the first half of 2015-16 was raised to ₹450

billion.

DEBT MANAGEMENT OF STATE GOVERNMENTS

Market Borrowings

VII.13 The Reserve Bank entered into an

agreement with the Government of Telangana for

carrying out its cash and debt management

operations effective June 2, 2014, under Section

21A of the Reserve Bank of India Act, 1934.With

this, the Reserve Bank is now the debt manager

for all the 29 states and for the union territory (UT)

of Puducherry. All of them participated in market

borrowing programme in 2014-15, with the net

borrowing rising by 26 per cent (Table VII.4).

VII.14 Despite higher market borrowings, the

weighted average yeild of state government

securities issued during the year stood lower at 8.58 per cent as compared to 9.18 per cent last

year. Alongside, the weighted average spread came

down significantly to 38 bps over GoI securities of

comparable maturities from 75 bps in the previous

year (Table VII.4).

Cash Management of State Governments

VII.15 The Reserve Bank has been extending

WMA to state governments since 1937 under the

provisions of Section 17(5) of the RBI Act with the

objective of covering temporary mismatches in their

cash flows. There are two types of WMA: (i) normal

WMA or clean advances, and (ii) special WMA

(SWMA) or secured advances (the nomenclature

of SWMA was changed in June 2014 as ‘special

drawing facility’ (SDF) by amending the agreement

with state governments). An overdraft (OD) occurs

whenever the Reserve Bank’s credit to a state

government exceeds the SDF and WMA limits.

| Table VII.4: States' Market Borrowings |

| (₹ billion) |

| Item |

2012-13 |

2013-14 |

2014-15 |

2015-16@ |

| 1 |

2 |

3 |

4 |

5 |

| Net Allocation |

1,881 |

2,185 |

2,365 |

NA |

| Gross Allocation |

2,187 |

2,506 |

2,564 |

NA |

| Gross Amount |

1,772 |

1,967 |

2,408 |

824 |

| Raised during the Year |

|

|

|

|

| Net Amount Raised during the Year |

1,467 |

1,646 |

2,075 |

720 |

| Weighted Average Yield (%) |

8.84 |

9.18 |

8.58 |

8.22 |

| Weighted Average Spread (bps) |

71 |

75 |

38 |

34 |

| SDLs outstanding (at the end period) |

9,291 |

10,619 |

12,755 |

13,474 |

| @: as on August 12, 2015. |

VII.16 The aggregate WMA limit for the states,

including the Government of the Union Territory of

Puducherry was raised by 50 per cent to ₹154

billion in November 2013 and the same limit was

continued in 2014-15. The monthly average

utilisation of WMA and OD by the states was higher

in 2014-15 even as the number of states resorting

to WMA remained unchanged at 12. Fourteen

states resorted to SDF, up from 12 in 2013-14. Ten

states availed of OD in 2014-15 as against eight

states in 2013-14.

VII.17 The Reserve Bank’s recent initiatives in the

government banking business are expected to

enhance efficiency in the cash management of

state governments (Box VII.1).

Investments in the Consolidated Sinking Fund

(CSF)/Guarantee Redemption Fund (GRF)

VII.18 As the fund manager of state governments,

the Reserve Bank has been managing their

consolidated sinking funds (CSF) and guarantee redemption funds (GRF). In addition to dated

government securities, the Reserve Bank has

started investing in SDLs and other high yielding

securities (for example, treasury bills) as per the

mandate given by the respective state governments.

The outstanding investment in CSF and GRF stood

at ₹703 billion at end-March 2015, a rise of 14.8

per cent over the previous year. In its endeavour to

create awareness among Finance Department

officials of state governments, capacity building

programmes were organised by the Reserve Bank

in a number of states including Tripura, Mizoram,

Jharkhand, Odisha and Uttarakhand.

Agenda for 2015-16

VII.19 Union Budget, 2015-16 has projected a

marginal increase in the Centre’s net market

borrowings in 2015-16. With signs of improvement

in macroeconomic conditions and moderation in

inflationary pressures, the governments’ market

borrowing programmes are likely to be completed

in an orderly manner, while minimising the cost of

borrowing.

VII.20 A medium term debt management strategy,

in consultation with GoI, in line with best international practices will be placed in the public domain during

2015-16. In order to manage GoI’s maturity profile

and also to reduce the rollover risk, it is planned

that buybacks and switches will be part of the regular calendar of issuance from the second half

of 2015-16. To cater to the demand from long term

investors like insurance companies and pension

funds, a 40-year security is proposed to be issued during 2015-16, taking in view a relatively flat yield

curve.

Box VII.1

New Initiatives in Government Banking

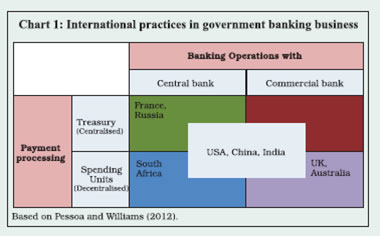

Internationally, arrangements for the government banking

business vary across countries. For instance, it is performed

by the central banks in France and Russia while in the UK

and Australia it is performed by commercial banks. The

payment processing is centralised in France and Russia but

decentralised in South Africa. Larger countries, such as the

US, China and India have adopted a mixed approach,

depending on the nature and type of transactions (Chart 1).

As part of its initiatives to improve efficiency in government

banking services, the Reserve Bank constituted a Working

Group to Bring in Uniformity and Standardisation in

Procedures/Data Structure of e-Receipt/e-Transactions of

State Governments. The group submitted its report in April

2014. Its recommendations focus on migrating to a broadly

uniform model for receipts and payments for all the states

and integration with e-Kuber, the core banking solution of the

Reserve Bank. As discussed in the State Finance Secretaries

Conference organised by the Reserve Bank in May 2015, it

was decided to implement the recommendations of the report

on a pan-India basis. Accordingly, a task force has been

constituted for monitoring the implementation process. Till

date, 15 states have started this process and are at various

stages of implementation. Efforts are on to bring the remaining

states on board.

E-receipt and e-payment functions have been developed in

e-Kuber to provide enhanced operational efficiency and

facilitate better fund management of governments.The

e-receipts system envisages revenue collection through

agency banks, flow of information to the Reserve Bank and final transfer of funds to the respective state government’s

accounts. The system is designed for faster processing

without giving rise to any reconciliation issues. The agency

banks participating in the revenue collection of a state are

required to prepare details of daily receipts in a standardised

ISO 20022 format file and upload it on the e-Kuber portal

which is used by banks for their interface with the Reserve

Bank. After processing the files, e-scrolls with all relevant

information are transmitted electronically to the state

governments in a straight-through-processing (STP) manner.

The interface of e-Kuber with the public finance management

system (PFMS) of the Central Government has been scaled

up to serve all central ministries for effecting inter-government

transactions on a STP basis.

For e-payments, wherever a state has a centralised treasury

system, integration of its IT system with e-Kuber will be done

and the details of payments to be effected by the government

will be directly received, processed and transmitted to the

National Electronic Funds Transfer (NEFT) system for

effecting payments, with no manual intervention. Transactionwise

e-scrolls will be sent on the same day, duly indicating

status of payments (whether successful, or returned). This

will ensure that all payments are processed efficiently and

beneficiaries receive the payments without delay

With a view to maximising benefits from technological

developments, a Working Group on Business Process Reengineering

with participation from government agencies,

banks and the Reserve Bank has been set up. The group will

examine the workflows, systems and processes for handling

government business, related institutional infrastructure and

reporting structures. The group is expected to submit its report

by October 2015. With these initiatives, banking arrangements

of the governments including their cash management are set

to witness significant efficiencies in the years to come.

References:

Pessoa, M. and M. Williams (2012), ‘Government Cash

Management: Relationship between the Treasury and the

Central Government’, International Monetary Fund.

Pattanayak, S. and I. Fainboim (2011), ‘Treasury Single

Account: An Essential Tool for Government Cash

Management’, International Monetary Fund.

VII.21 Market borrowings of state governments

have been budgeted higher for 2015-16 than the

previous year. To improve predictability of market

borrowings, all the states will be encouraged to

move over to a quarterly calendar of issuances with

effect from 2015-16 and the first of this calendar

has been announced for the second quarter of

2015-16. The states have also been advised to

actively engage with investors within their states to

diversify the investor base.

VII.22 The report of the Advisory Committee on

Ways and Means Advance to State Governments

(Chairman: Sumit Bose) is expected to be finalised

and will be taken up for implementation.

VII.23 The Reserve Bank will continue with the

agenda of enabling easier and increased access

to retail investors. As part of this, a web-based

solution on the e-Kuber platform for participation of

all mid-segment/retail investors having gilt accounts is being implemented. To develop a more liquid

government securities market, a scheme of market

making in select semi-liquid securities by PDs will

be implemented. The non-competitive bidding

facility available to retail investors is currently

applicable only to auctions of dated securities. It is

proposed to allow the non-competitive bidding

facility in treasury bills to individuals as well. The

Reserve Bank in consultation with all stakeholders

will enable seamless movement of securities from

the subsidiary general ledger (SGL) form to demat

form and vice versa to promote trading of G-secs

on stock exchanges. The Reserve Bank will work

to put in place a more predictable framework on

the size and scope of investments in G-secs by

foreign portfolio in vestors taking into account the

risks and benefits associated with such flows into

the debt market.

VII.24 The Reserve Bank will closely work with the

Government of India in the preparatory arrangements

for the establishment of the Public Debt Management

Agency (PDMA). |