In continuation with past efforts, several initiatives in the arena of, inter-alia, human resource development, research and data dissemination, ERM, international relations and promotion of Rajbhasha marked the year 2015-16. As part of the drive to spread knowledge on financial, monetary and economic matters, a national level competition (RBI Policy Challenge) targeted at under/post graduate students was launched during the year. The Bank continued with flagship publications, research articles and conferences; the scope of data dissemination was also expanded considerably during 2015-16. The Reserve Bank’s innovative process for preparing the risk registers was adjudged as an international best practice. In the international arena, India took a leadership role which got reflected in the BRICS contingent reserve arrangement (CRA) and SAARCFINANCE Symposium. Several special programmes were organized during 2015-16 as part of the celebration of the Rajbhasha Golden Jubilee Year. X.1 This chapter summarises the achievements of a number of departments during 2015-16, and sets priorities/agendas for 2016-17. It takes note of the changes in the organisational structure, governance developments and strengthening of human resources in terms of new recruitments and updating the skills and knowledge of existing staff members using several innovative channels. Further, with a view to disseminating knowledge regarding financial, monetary and economic matters amongst students, the Reserve Bank launched several national-level competitions such as quizzes, essay writing and problem solving in interesting formats. X.2 In the international arena, the year was marked by India’s leadership role among the emerging market economies (EMEs), which was reflected in the work related to BRICS contingent reserve arrangement (CRA); hosting of the SAARCFINANCE Governors’ Symposium; being an important voice in the international financial architecture, global financial regulatory issues and green finance; and the structural reform agenda under the Chinese presidency of the G20. In addition, pivotal standards were achieved in statutory publications, policy based research, seminars, data management, surveys and data dissemination standards using state-of-the-art technology in reporting systems. The communication policy also crossed all previous benchmarks, with connectivity to social media sites, Banking Hall events, awareness campaigns and outreach programmes. X.3 With a view to developing an integrated assessment of risk, a 3-phase Enterprise-wide Risk Management (ERM) framework was pursued during 2015-16. Internal audit exercises were also undertaken in the Reserve Bank for risk assessment and assurance. Two departments focused on achieving cost and operational efficiency during the year, including the initiation of the Darpan (EDMS) project. Besides compliance with statutory provisions of the Official Language Act, the Rajbhasha Department also organised several trainings, conferences and seminars while the Premises Department continued with its endeavours of creating, maintaining and upgrading the Reserve Bank’s infrastructure. Several legal landmarks were also achieved during the year. GOVERNANCE STRUCTURE X.4 The Central Board of Directors, with the Governor in the Chair, is the apex body in the governance structure of the Reserve Bank. It comprises of the Governor and Deputy Governors of the Reserve Bank, government nominees and independent directors. There are four Local Boards for the northern, southern, eastern and western areas of the country which take care of local interests. The Government of India (GoI) appoints/nominates directors to the Central Board and Members to the Local Boards in accordance with the Reserve Bank of India Act, 1934. The Central Board is assisted by three committees – the Committee of the Central Board (CCB), the Board for Financial Supervision (BFS) and the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS). These committees are headed by the Governor. In addition, the Central Board also has four sub-committees – the Audit and Risk Management Sub-Committee (ARMS), the Human Resource Management Sub-Committee (HRM-SC), the Building Sub- Committee (BSC) and the Information Technology Sub-Committee (IT-SC). These sub-committees are typically headed by an independent Director. Meetings of the Central Board and CCB X.5 The Central Board held six meetings during 2015-16 in Chennai, Mumbai (two meetings), Aizawl, Kolkata and New Delhi. The Finance Minister of India addressed the post- Budget meeting held in New Delhi on March 12, 2016. The Governor interacted with the Governor of Mizoram and the Chief Minister of Mizoram in Aizawl on October 15, 2015. The meeting focused on financial inclusion and credit delivery in the state. X.6 CCB held 47 meetings during the year, 22 of which were held through electronic mode. CCB attended to the current business of the Reserve Bank, including approval of its Weekly Statement of Affairs. External directors were invited to the CCB meetings by rotation. X.7 The Standing Committee of the Central Board set up in 2014-15 to look into important concerns pertaining to a region where Local Boards are not able to function, held meetings in each of the four regions (four meetings in all) to discuss region-specific issues and concerns. Attendance of Directors X.8 The details of participation of the directors in the meetings of the Central Board, its committees and sub-committees are annexed. Central Board/ Local Boards – Changes X.9 Dr. Urjit R. Patel was re-appointed Deputy Governor for a further period of three years with effect from January 11, 2016. Shri Harun R. Khan relinquished charge as Deputy Governor in the forenoon of July 04, 2016 on completion of his tenure. Shri N.S. Vishwanathan was appointed Deputy Governor for a period of three years from July 04, 2016 vice Shri Khan. X.10 Ms Anjuly Chib Duggal, Secretary, Department of Financial Services, Ministry of Finance, GoI and Shri Shaktikanta Das, Secretary, Department of Economic Affairs, Ministry of Finance, GoI were nominated as directors on the Central Board under Section 8(1)(d) of the Reserve Bank of India Act, 1934 with effect from September 03, 2015 and October 30, 2015 vice Dr. Hasmukh Adhia and Shri Ajay Tyagi respectively. X.11 Shri Natarajan Chandrasekaran, Shri Bharat Narotam Doshi and Shri Sudhir Mankad were nominated as directors on the Central Board of Directors of the Reserve Bank under Section 8(1)(c) of the Reserve Bank of India Act, 1934 for a period of four years with effect from March 04, 2016. X.12 Shri Dipankar Gupta, Shri G.M. Rao, Smt Ela Bhatt, Professor Indira Rajaraman and Shri Y.H. Malegam, directors on the Central Board nominated under Section 8(1)(c) of the Reserve Bank of India Act, 1934 ceased to be members of the Board on the expiry of their terms. X.13 Shri Kiran Karnik and Dr. Anil Kakodkar ceased to be members of the western and northern area Local Boards respectively on the expiry of their terms on September 22, 2015. Consequently and concurrently, they also ceased to be members of the Central Board. Smt Anila Kumari and Shri Sharif Uz-zaman Laskar ceased to be members of the eastern area Local Board on the expiry of their terms. Shri A. Naveen Bhandari ceased to be a member of the northern area Local Board on the expiry of his term. Shri K. Selvaraj and Shri Kiran Pandurang ceased to be members of the southern area Local Board on the expiry of their terms. Executive Directors - Changes X.14 Shri Jasbir Singh and Shri P. Vijaya Bhaskar, Executive Directors retired on October 31, 2015 and February 29, 2016, respectively. Shri Deepak Singhal and Shri B.P. Kanungo were promoted as Executive Directors effective November 01, 2015 and March 01, 2016, respectively. Shri Sudarshan Sen was promoted as Executive Director effective July 04, 2016. Obituary X.15 Shri S. S. Tarapore, Deputy Governor of the Reserve Bank of India (January 30, 1992 to September 30, 1996) passed away in Mumbai on February 02, 2016. Agenda for 2016-17 X.16 E-meetings for the Committee of the Central Board (CCB) were introduced in 2014. These meetings are held in alternate weeks as an effort to optimise executives’ time and cost of governance. As this system stabilises, the frequency of e-meetings from July 2016 will be increased, while having at least one faceto- face meeting every month. Further, as an environment friendly initiative, agenda notes for various meetings of the Central Board and its committees/sub-committees are proposed to be provided to the participants in soft form. Work of art will also be acquired for display in the Reserve Bank’s properties with a view to recognising and encouraging budding artists. An art acquisition policy has been framed for this purpose. COMMUNICATION PROCESSES X.17 The Reserve Bank continues to uphold its goal of having a dynamic communication policy to enable swift responses to domestic and international developments. Within this overall goal, the Department of Communication strives to build and nurture a fruitful and beneficial partnership between the Reserve Bank and the public through a two-way communication. It not only disseminates policy and its rationale to various stakeholders in a transparent, timely and credible manner but also strives to obtain continuous feedback on the policy. Agenda for 2015-16: Implementation Status The Website X.18 The refurbished website of the Reserve Bank was launched in April 2015 strengthening the department’s communication tools. With technological up-gradation, the website is now rendered in a more user-friendly manner. The website is also integrated with two social media sites, Twitter and YouTube. While all important releases get tweeted automatically as soon as they are published on the website, YouTube publishes speeches, media interviews and press conferences of the top management. The Governor’s post-policy conferences on the bi-monthly statements on monetary policy along with his interviews to television channels were disseminated through YouTube along with live streaming on the Reserve Bank's website. The channel also shows financial education films produced by the Reserve Bank. This process is being taken forward this year to add Facebook and LinkedIn to showcase the Reserve Bank as a more attractive and accessible institution to the youth. Review of the Communication Policy X.19 A committee was set up to review the Reserve Bank’s communication policy under the chairmanship of the Executive Director, Dr. M. D. Patra. The committee held several meetings to deliberate on various issues of relevance and submitted its report to the Deputy Governor in charge of communication. Monetary Policy Communication X.20 Intensive communication activities were carried out to disseminate each bi-monthly monetary policy announcement. Apart from press conferences and teleconferences with researchers and analysts, interviews of the Governor with media were also conducted in English and Hindi. Banking Hall Events X.21 During 2015-16, in an attempt to improve internal communication, the department organised Banking Hall events for the Governor to interact with staff members in its various offices. During the year six Banking Hall events were organised (in Chennai, Mumbai, Thiruvananthapuram, Jammu, Bhopal and Bhubaneswar). Awareness Campaigns and Advertisements Fictitious Emails X.22 A public awareness campaign on fictitious emails offering money titled – ‘Don’t get cheated by emails/SMSs/calls/fake credit cards promising you money’ was released on FM channels including Prasar Bharti, All India Radio and other private channels in November and December 2015. Sovereign Gold Bonds X.23 Public awareness campaigns on the Sovereign Gold Bond scheme (SGB), 2015 were aired on November 18 and 19, 2015 on FM channels. Two rounds of the public awareness campaign on the SGB scheme, 2015 were released in newspapers in January and March 2016 in English, Hindi and 11 vernacular languages. Additional Security Features of Bank Notes X.24 To highlight the three additional features of bank notes introduced in 2015-16, the Reserve Bank, jointly with the Department of Consumer Affairs, Ministry of Consumer Affairs conducted an awareness campaign on currency in September 2015 under its ‘जागो ग्राहक जागो’ campaign. The campaign was undertaken in 13 languages in three different design sets in 1,055 newspapers all over the country. Advertisements X.25 On behalf of various departments, 127 regular advertisements were published in English, Hindi and vernacular newspapers during July 2015 and June 2016. These advertisements comprised notices for tenders, recruitment, request for proposals and expressions of interest. Workshops for the Media X.26 Since the media is the main interlocutor for the Reserve Bank, the department endeavours to respond to media queries and suggestions in a time-bound fashion. The Reserve Bank organises informal briefings/workshops for the media to enhance its understanding and also the reach of major policy announcements made by the Reserve Bank as well as its publications, such as, the Annual Report and the Financial Stability Report. As in the past, the department arranged an annual workshop on the Reserve Bank’s role and functions for the media. During 2015- 16, the department also organised workshop for mediapersons from Nepal on a request from the Nepal Rastra Bank. Agenda for 2016-17 X.27 The Department of Communication will continue its engagement with stakeholders by conducting workshops/sessions for the media on important regulatory and banking related issues. New consumer awareness programmes will be carried out in coordination with concerned departments. In addition, the department will also continue educating citizens through advertisements and radio/TV campaigns. This will be undertaken as per the needs of the Reserve Bank’s departments. Websites for the common man and financial education will be integrated with the Reserve Bank’s main website. Engagements with stakeholders will also be carried out through Facebook and LinkedIn. HUMAN RESOURCE INITIATIVES X.28 The Human Resource Management Department (HRMD) operates on a broad-based framework, facilitating the Reserve Bank’s central banking activities by enhancing efficiency, drawing out the best from staff members and creating an atmosphere of trust. Regulatory/Other Developments Training X.29 The Reserve Bank strives to impart necessary knowledge and skill up-gradation for developing the technical and behavioural skills of its human resources. It also helps employees in attaining personal growth and improving their effectiveness at work. The six training establishments of the Reserve Bank – the Reserve Bank Staff College (RBSC), Chennai; College of Agricultural Banking (CAB), Pune; and four Zonal Training Centres (ZTCs) in Mumbai, New Delhi, Kolkata and Chennai – cater to its training requirements (Table X.1). | Table X.1: Reserve Bank Training Establishments - Programmes Conducted (July-June) | | Training Establishment | 2013-14 | 2014-15 | 2015-16 | | Number of Programmes | Number of Participants | Number of Programmes | Number of Participants | Number of Programmes | Number of Participants | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | RBSC, Chennai | 105 | 2,560 | 141 | 2,626* | 125 | 2,741* | | CAB, Pune | 127 | 3,909 | 215 | 7,183* | 198** | 7,580* | | ZTCs (Class I) | 99 | 2,222 | 105 | 2,241 | 97 | 2,055 | | ZTCs (Class III) | 70 | 1,510 | 98 | 2,036 | 102 | 2,247 | | ZTCs (Class IV) | 37 | 725 | 53 | 1,041 | 38 | 807 | Note * : Includes foreign participants.

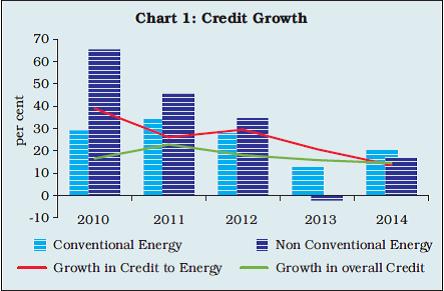

** : Includes National Mission for Capacity Building of Bankers for Financing MSME Sector (NAMCABS) programmes held offsite. | Training at External Institutions X.30 During 2015-16, 470 officers were deputed by the Reserve Bank to participate in training programmes, seminars and conferences organised by external management/banking institutions in India. The Reserve Bank also deputed 599 officers to attend various training courses, seminars, conferences and workshops conducted by banking and financial institutions and multilateral institutions in more than 55 countries (Table X.2). Golden Jubilee Scholarship and Study Leave Schemes X.31 The Golden Jubilee Scholarship scheme was reviewed in 2015. The number of officers to be selected for studying abroad was increased from six to eight and the upper age limit increased from 45 to 48 years. In 2015, eight officers were awarded this scholarship. Ten officers of the Reserve Bank availed of different schemes for pursuing higher studies other than the Golden Jubilee scheme during the year. Further, 325 employees pursued select part-time/distance education courses under the Reserve Bank’s incentive scheme. Grants and Endowments X.32 Towards promoting research, training and consultancy in the banking and financial sector, the Reserve Bank provided financial support of ₹260 million to the Indira Gandhi Institute of Development Research (IGIDR), Mumbai; ₹60 million to the Centre for Advanced Financial Research and Learning (CAFRAL), Mumbai; ₹15.4 million to the National Institute of Bank Management (NIBM), Pune; ₹3.7 million to the Indian Institute of Bank Management (IIBM), Guwahati; and ₹9.7 million to the London School of Economics (LSE) India observatory and the I.G. Patel Chair, London. | Table X.2: Number of Officers Trained in External Training Institutions in India and Abroad | | Year | Trained in India | Trained abroad | | 1 | 2 | 3 | | 2013 - 14 | 798 | 530 | | 2014 - 15 | 906 | 562 | | 2015 - 16 | 470 | 599 | Industrial Relations X.33 Industrial relations in the Reserve Bank by and large remained peaceful during the year. The Reserve Bank continued to hold periodic meetings with recognised associations/federations of officers and employees/workmen on various matters related to service conditions and welfare measures for employees. The Reserve Bank also revised its employees pay and allowances during the year. Superannuation Benefits X.34 A demand from pensioners/retirees relating to improvements in pension conditions remained unresolved and the Reserve Bank is still engaged in discussions with the Government of India for its early resolution. Recruitments and Staff Strength X.35 During 2015 (January-December), the Reserve Bank recruited 723 employees. Of this, 96 belonged to Scheduled Castes (SCs) and 54 to Scheduled Tribes (STs), constituting 20.75 per cent of the total recruitments (Table X.3). X.36 The changes introduced in the recruitment process have led to a reduction in the recruitment cycle for Grade ‘B’ (Direct Recruit) officers from more than 14 months in 2012-13 to about 6 months in 2015-16. X.37 The total staff strength of the Reserve Bank as on December 31, 2015 was 15,854 as compared to 16,794 a year ago. Of the total staff strength, 19.55 per cent belonged to SCs and 6.63 per cent belonged to STs (Table X.4). | Table X.3: Recruitment by the Reserve Bank in 2015* | | Category of recruitment | Category-wise strength | | Total | of which | Per cent of total | | SC | ST | SC | ST | | 1 | 2 | 3 | 4 | 5 | 6 | | Class I | 128 | 10 | 8 | 7.81 | 6.25 | | Class III | 553 | 83 | 42 | 15.01 | 7.59 | | Class IV | | | | | | | (a) Maintenance Attendant | - | - | - | - | - | | (b) Others | 42 | 3 | 4 | 7.14 | 9.52 | | Total | 723 | 96 | 54 | 13.28 | 7.47 | | * January-December | X.38 The number of full-time employees in theReserve Bank stood at 15,693 as on June 30,2016. Of these, 6,932 were in Class I, 4,119 inClass III and 4,642 in Class IV categories. X.39 During 2015 (January-December), four meetings of the management and representatives of the All India Reserve Bank Scheduled Castes/ Scheduled Tribes and the Buddhist Federation were held to discuss issues relating to the implementation of the Reserve Bank’s reservation policy. In accordance with the central government’s policy, the Reserve Bank is providing reservation to Other Backward Classes (OBCs), effective September 08, 1993. The number of OBCs (recruited after September 1993) in the Reserve Bank as on December 31, 2015 was 1,923. Of these, 560 were in Class I, 729 in Class III and 634 in Class IV categories. X.40 The total strength of ex-servicemen in the Reserve Bank as on December 31, 2015 stood at 991. Of these, 187 were in Class I, 169 in Class III and 635 in Class IV categories. There were 215, 85 and 91 physically challenged employees in Class I, Class III and Class IV cadres respectively as on December 31, 2015. Prevention of Sexual Harassment of Women at the Workplace X.41 The formal grievance redressal mechanism for prevention of sexual harassment of women at the workplace, in place since 1998, was further strengthened with the issue of a new set of comprehensive guidelines in 2014- 15 in accordance with the Sexual Harassment of Women at the Workplace (Prohibition, Prevention and Redressal) Act and Rules, 2013. No complaint of sexual harassment was received in 2015. | Table X.4: Staff Strength of the Reserve Bank* | | Category | Category-wise strength | Per cent to total strength | | Total Strength | SC | ST | SC | ST | | 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | 2015 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | Class I | 7,565 | 7,233 | 1,128 | 1,062 | 479 | 434 | 14.7 | 6.0 | | Class III | 3,573 | 3,756 | 499 | 552 | 193 | 212 | 14.7 | 5.6 | | Class IV | 5,656 | 4,865 | 1,740 | 1,486 | 446 | 405 | 30.5 | 8.3 | | Total | 16,794 | 15,854 | 3,367 | 3,100 | 1,118 | 1,051 | 19.6 | 6.6 | | *: End December | X.42 During the year, a number of awareness programmes were organised at various Regional Offices on the mechanisms in place in the Reserve Bank. Besides, the Reserve Bank’s training college in Chennai also conducted a gender sensitisation programme for members of the Complaints Committee. Further, an all-India seminar on the theme ‘Prohibition, prevention and redressal of sexual harassment of women at the workplace – implementation & way forward’ was organised during March 03-05, 2016 in which representatives from the Complaints Committees in all the Regional Offices participated. Right to Information (RTI) X.43 The Reserve Bank received 11,758 requests for information and 1,477 first appeals under the RTI Act during 2015-16, all of which were responded to. Six training programmes on the RTI Act were conducted for employees at the Reserve Bank’s training centres. Samadhan and Other Initiatives X.44 Samadhan, a human resource (HR) transformation project, was taken up by the Reserve Bank in 2014-15 to deliver uniform and rule-based HR services to its employees. The first phase of its implementation is nearing completion. The project has gone live with salary and benefits modules and a few advances. The portal has been made available to all users of the Reserve Bank. Once the first phase is complete, the implementation of the second phase will be initiated. Senior Management Retreat X.45 The Reserve Bank’s Senior Management Retreat for 2015 was held in October 2015 on the broad theme, ‘Public oversight and internal governance: The optimal mix and how to achieve it.’ RBIQ and The RBI Policy Challenge X.46 The RBI quiz, which was introduced by the Reserve Bank in 2012, was conducted in 62 locations across the country during 2015. It drew an enthusiastic response from school students. Zonal and national finals were conducted in Mumbai and telecast on Doordarshan’s National Channel. X.47 To spread knowledge on financial monetary and economic matters among students, the Bank launched a national level competition, 'The RBI Policy Challenge', in January, 2016 (Box X.1). Box X.1 The RBI Policy Challenge: A National Level Competition for Students Building on the success of RBIQ which covers school students and with a view to further spreading knowledge on financial, monetary and economic matters amongst the student community, the Reserve Bank launched a national level competition titled, ‘The RBI Policy Challenge’ in January 2016. Targeted at under-graduate and post-graduate students, it tested essay writing, problem solving and presentation skills of the participants. The competition had three rounds: regional, zonal and national. More than 260 reputed institutions from across the country participated in the competition and four teams eventually made it to the final which was conducted at the Reserve Bank’s Central Office in Mumbai on April 05, 2016. A monetary policy related topic was assigned to the teams in the forenoon and each team made a 15-minute presentation in the afternoon before a select panel headed by the Governor. This was followed by a ‘question & answer’ session in which the participants responded to queries posed by the panellists, members of the press and the audience. Teams from the Indian Institute of Foreign Trade (IIFT), Delhi and the Indian Institute of Management (IIM), Raipur emerged as the joint winners of the inaugural edition of this annual event. Besides a trophy and a cash prize of ₹1 lakh per team, members of both teams also won an offer to intern with the Reserve Bank for up to three months in a department of their choice. Agenda for 2015-16: Implementation Status RBI Academy X.48 The RBI Academy is visualised as an apex institution for central banking studies in the Southeast Asian region. This institution is based in Mumbai and fully funded by the Reserve Bank. The Academy will address knowledge gaps and training needs of officers of the Reserve Bank. Eventually, the training programmes, especially programmes like MBA in Central Banking, will be offered and opened up to officers of central banks of other countries. Initially the Academy is expected to cover courses on risk management, macroeconomics, monetary economics and strategic and human resource management. It is expected that subject experts from renowned academic institutions will form a part of the faculty administering the courses. It is also envisaged that over a period of time, the Academy will cater to the training needs of bankers, government officials and other financial institutions. Competency based HR Framework X.49 A competency framework comprising the required core behavioural, operational and leadership competencies for various roles in the Reserve Bank was envisaged to integrate and align all its major HR policies including placement, performance management/development, skill gap analyses and training. Competency mapping exercise for two departments (the Department of External Investments & Operations and the Department of Banking Regulation) is being taken up on a pilot basis through empanelled consultants. Based on the experience gained, the exercise will be extended to the entire Reserve Bank in due course. A Steering Committee has been formed to monitor the pilot project. HR Units X.50 HR units have been set up in the Reserve Bank’s Central Office departments and Regional Offices to strengthen the HR developmental functions of the Reserve Bank. Structured e-learning X.51 The Reserve Bank will introduce structured e-learning with courses targeted at larger groups of staff members. The development of the first few modules is expected to commence shortly. This will be an on-going process with newer modules being prepared and hosted on Samadhan’s Learning Management System module. Common Cadre Recruitment X.52 The Reserve Bank has introduced the concept of common cadre recruitments. Under the revised recruitment process, the officers recruited will have common seniority instead of separate cadre seniority for economists, statisticians and the general cadre. Agenda for 2016-17 X.53 A manpower planning exercise has been undertaken to evaluate and firm up the Reserve Bank’s manpower requirements in the next five years. This will form the cornerstone for the Reserve Bank’s HR policies during this period. ENTERPRISE-WIDE RISK MANAGEMENT IN THE RESERVE BANK X.54 With a view to developing an integrated assessment and management of the risks faced by the Reserve Bank in conformity with its articulated risk policies, an enterprise-wide risk management (ERM) framework was adopted in February 2012, marking a move from a ‘silo-based’ approach to a ‘whole-of-business’ perspective to risk management in the Reserve Bank. During 2015-16, this process was taken forward by the Risk Monitoring Department. Three-phase Rollout Plan X.55 The first phase of the 3-phase ERM rollout plan was completed with the creation of a Risk Governance Structure1 (RGS) and a 3-tier Risk Management Structure2, laying down ERM policies, methodologies for risk ratings, framework for risk reporting by Business Areas (BAs) and preparation of risk registers (RRs) to create a risk profile of each BA. The second phase envisages articulation of the Reserve Bank’s risk appetite and tolerance limits by RGS while also attempting a quantification of operational risks. In the final stage of ERM implementation, the need and scope for shifting the Middle Office functions in the Reserve Bank to its Risk Monitoring Department (RMD) and greater involvement of the department in evaluating policy risks will be considered. Agenda for 2015-16: Implementation Status X.56 During 2015-16, RRs of 13 BAs were completed and approved by RGS, while for the remaining 19 departments, RRs are in advanced stages of completion. Further, a mechanism for a periodic review of risk events (based on incident reports submitted by BAs) has been put in place and monitoring of high-risk events up to their eventual closure from the risk perspective has started. X.57 A risk awareness campaign for strengthening the risk culture in the Reserve Bank, initiated in 2014-15, was continued during 2015-16 through risk seminars for senior officers, classroom discussions in the Reserve Bank’s Training Establishments (TEs) and through developing case studies based on actual/unique incidents which offered scope for learning and enhancing risk awareness. Besides, risk awareness programmes were conducted for Regional Directors/Chief General Managers/ Officers-in-Charge as part of a top-down approach for strengthening a risk culture. Risk surveys of the Reserve Bank’s senior officers were conducted to identify emerging risks for the Reserve Bank. RGS reviewed the survey responses and directed initiation of appropriate risk mitigation measures. Risk conferences were also conducted in 2015- 16 for the Senior Risk Officers and Risk Officers identified in each BA. X.58 Being a relatively new function in central banks the world over, ERM offers considerable scope for peer-to-peer learning with regard to evolving ERM practices and processes. In this direction, having joined the International Operational Risk Working Group3 (IORWG) in 2014, the Reserve Bank has been regularly participating in its endeavours. In order to assess and improve its Incident Reporting System, the Reserve Bank surveyed practices in other member central banks. The survey findings provided valuable inputs for strengthening the Reserve Bank’s incident reporting framework. Besides, the Reserve Bank has also been responding to surveys conducted by other central banks and by the IORWG. Based on its responses to such surveys, one of the elements of the process for preparing RRs adopted in the Reserve Bank has been adjudged as an international best practice for emulation by other central banks. Details of IORWG’s process of compiling best practices are given in Box X.2. Box X.2 IORWG Survey: RBI’s Process Adjudged as an International Best Practice The International Operational Risk Working Group (IORWG) acts as a centre of competence in operational risk management (ORM) for central banks (CBs) with a view to ensuring that their current risk management approaches are commensurate with the level and nature of their operational risk exposures. In pursuance of its objectives, the group shares best practices for addressing various aspects in the current risk management framework, methods used, implementation challenges and the lessons learnt from past operational failures with its members. IORWG and its members conduct surveys of member CBs, analyse the data and share the final outcomes of the surveys, which are useful for self-assessing the CBs’ standing in operational risk monitoring. In 2016, the IORWG, inter alia, conducted a survey to identify the best practices adopted by CBs in ORM. As part of the survey, IORWG studied the methodology used by the Reserve Bank for preparing its RRs. The use of domain experts in this process was adjudged as an international best practice, fit for emulation by other member central banks. IORWG’s compilation of best practices noted: ‘In the Reserve Bank Risk Unit adopted an innovative approach by including Domain Experts for vetting the RRs. These Domain Experts are officers of the Central Bank who have worked as resource person/s in the BA in the recent past but are presently not posted in the concerned BA. This approach has helped in imparting objectivity and granularity in the process of finalising of the RR and enhanced its quality. The identified Domain Experts were provided exposure by the Risk Unit (through workshop/training programme/ interactions) on the risk management concepts and methodology for vetting the RR. Thus, the Domain Experts acted as extensions of the Central Risk Unit and helped in ensuring that the coverage in the RRs was exhaustive and the risk ratings were objective and in consonance with the approved risk assessment methodology.’ Financial Risk Management X.59 In line with international best practices, the Reserve Bank prepared a draft economic capital/provisioning framework to assess its risk-buffer requirements in a structured and systematic manner. It is envisaged that this framework will also be used for determining the surplus transferable each year by the Reserve Bank to the Government of India. Based on this framework, a risk-reporting mechanism has been implemented for the Reserve Bank to periodically report on the balance sheet and other risks faced by it to RGS. Agenda for 2016-17 X.60 The remaining 19 RRs will be finalised during 2016-17. Risk profiles and heat maps for each BA and of the Reserve Bank as a whole will be generated to facilitate an enterprise-wide review of risks by the RGS. Measures to enhance reporting of incidents, including expanding the universe of eligible reporters of incidents and strengthening the risk culture in the Reserve Bank will also be pursued. The patterns and causes of risk events as reflected in incident reports will continue to be analysed on an on-going basis with a view to preventing their recurrence. Risk surveys will be conducted to monitor emerging risks and also for reviewing the top risks faced by the Reserve Bank. Vigorous efforts for fostering risk awareness at all levels and across all locations in the Reserve Bank will be persevered with a view to deepening its risk culture. The risk reporting software, developed in-house in 2014-15, will be revamped and made web-enabled to facilitate closer oversight as well as management of risks in the Reserve Bank. X.61 During the year, the focus will also be on the rollout of a Risk Appetite Framework (RAF) in the Reserve Bank. On the finalisation of the Risk Tolerance Statement (RTS), the next step will entail a comprehensive review of the extant Risk Tolerance Limits (RTLs) in various BAs. X.62 The Reserve Bank is slated to host the 12th edition of the Central Bank Risk Managers’ Conference (CBRMC)4 in November 2016, with ‘Economic Capital Frameworks of Central Banks’ as its theme. INTERNAL AUDIT/INSPECTION IN THE RESERVE BANK X.63 Internal audit exercises undertaken by the Inspection Department provide risk assurance to the top management. The inspections are conducted under the Risk Based Internal Audit (RBIA) framework and include an information system audit carried out by specialist empanelled officers. Agenda for 2015-16: Implementation Status X.64 The focus of inspection is shifting from a transaction-based approach to a risk-based methodology. The departments of the Central Office are in the process of preparing risk registers (RRs) in consonance with RMD and getting them approved by the Risk Monitoring Committee. The scope of the Audit Management System (AMS) has been enlarged to incorporate risk monitoring functions; it has also been rechristened as the Audit Management and Risk Monitoring System (AMRMS). The work for system requirement specifications is under process. With regard to Vulnerability Assessment and Penetration Testing (VA-PT), the empanelment process for external audit firms in terms of the Technical Advisory Group’s (TAG) recommendations has been completed and the VA-PT of certain critical applications has been undertaken. In December 2015, the department issued detailed guidelines on the revised methodology for appointing concurrent auditors, delineating a 2-stage process of technical and financial biddings. Draft guidelines for project audit are under finalisation. Agenda for 2016-17 X.65 An information security (IS) audit as part of the RBIA is undertaken with reference to the IS policy of the Reserve Bank. In this context, the Inspection Department will put in place a standard operating procedure or checklist for IS auditors. During the year, the focus will be on implementing AMRMS by providing end-to-end solutions for automating the process from inspection planning to final closure of inspection reports. The process of preparing RFP/scope of VA-PT for select critical IT applications is underway. The modalities for conducting a technology audit/VA-PT of select critical IT applications will also be worked out. INTERNATIONAL RELATIONS X.66 Given its mandate to act as a nodal unit for international financial diplomacy to further national interests, the International Department continued its efforts towards promoting international macroeconomic policy coordination, driving global policy agenda and contributing to global regulatory standard-setting. Agenda 2015-16: Implementation Status X.67 India was the leading voice from EMEs in finalising common international standards on the Total Loss Absorbing Capacity (TLAC) for global systemically important banks (G-SIBs). In collaboration with other concerned departments, the International Department made detailed presentations to help articulate India’s position on key regulatory issues of TLAC, Liquidity Coverage Ratio (LCR), capital requirements for sovereign assets, leverage ratio and reforms in the OTC derivatives market as per G20 commitments. Central bank liquidity to central counterparties and recovery and resolution regime were the other aspects covered by the department. X.68 Work relating to the BRICS Contingent Reserve Arrangement (CRA) was completed, consequent to which BRICS central banks opened local currency denominated swap accounts in their books in favour of one another, making CRA operational. X.69 The International Department hosted a 2-day SAARCFINANCE Governors’ Symposium on the ‘Impact of Chinese Slowdown on SAARC Region and Policy Options’ during May 26-27, 2016 in Mumbai. The symposium was attended by governors/deputy governors of central banks, senior officials from the ministries of finance of SAARC countries, experts from IMF, BIS and several other dignitaries. The SAARCFINANCE database, which is one of the major areas of cooperation among the SAARCFINANCE Group, has been developed by the Reserve Bank in collaboration with other SAARC central banks. This was launched for the general public to promote research activities in the SAARC region. X.70 India holding the co-chair of the G20 Framework Working Group (FWG), the International Department worked in close collaboration with the Government of India for shaping India’s growth strategy for the G20 Antalya Action Plan in 2015. During 2016, the International Department also played a key role in deciding the nine priority areas of structural reforms, a set of principles guiding them and a set of indicators to help monitor and assess the progress of structural reforms in G20 jurisdictions. X.71 India was peer reviewed by the Financial Stability Board (FSB) in two major areas - the macro-prudential policy framework and regulation and supervision of non-banking financial companies (NBFCs). The department has been contributing to and coordinating various thematic reviews undertaken by FSB such as shadow banking, OTC market reforms and resolution regimes. The department also played an effective role in furthering country position on a range of international financial architecture issues in the G20 Working Group. Some of the important regulatory issues currently under discussion included fin tech and credit intermediation, the CCP work plan and PFMI implementation, and resolution framework. The department also coordinated the IMF’s Article IV consultations in coordination with the Government of India. X.72 The department joined hands with the International Monetary Fund’s Institute for Capacity Development (ICD) and the College of Agricultural Banking (CAB), Pune to organise an intensive one-week course on ‘Early Warning Exercise’ in February 2016 at CAB, Pune. Given the importance of a comprehensive and comparable database, a seminar on the SAARCFINANCE database was organised for the officials of SAARC member countries for making available time series data on select macroeconomic indicators during December 8-9, 2015 at the Reserve Bank, Mumbai. During 2015-16, the department also organised 40 exposure visits by leading global universities, officials from central banks and international standard setting bodies. Agenda for 2016-17 X.73 The International Department will continue to be active in driving the global agenda from the Indian perspective at the G20, BIS, FSB and IMF. The department will continue to work along with the Government to shape the national growth strategy for the G20 Hangzhou Action Plan and provide analytical inputs on issues currently under discussion at various international fora. The department will also play an active role in discussions on green finance (Box X.3). The department will work closely with the Government of India towards 15th IMF's General Review of Quotas, including a new quota formula. Besides, the department will continue to work on a host of global financial/regulatory issues. X.74 During 2016, India assumed the Chair of BRICS. The department will continue to work with the Government of India in driving BRICS agenda in her capacity as the Chair. X.75 The department will continue to play a key role in spearheading the SAARCFINANCE roadmap including the database initiative, capacity building and a Joint Technical Coordination Committee with Nepal. India will undergo the Financial Stability Assessment Programme (FSAP) by the Fund-Bank during 2017, which will be coordinated by the department. Box X.3 Green Finance: An Analysis With the objective of exploring ways and sharing knowledge on the modalities for mobilising more private capital for green investments, either directly or via financial intermediaries, a Green Finance Study Group (GFSG) was set up post G20 Finance and Central Bank Deputies meeting at Sanya in China in December 2015. GFSG submitted its report, ‘G20 Green Finance Synthesis Report’ in July 2016. The report outlines voluntary options for enhancing the ability of the financial system to mobilise private capital for green investments. In particular, the report highlights the need for supporting the development of local green bond markets, facilitating cross-border investments in green bonds, facilitating knowledge sharing on environmental risks, and improving the measurement of green finance activities. To effectively manage environmental risks, banks can reduce lending to polluting sectors and enhance their preference for green lending and help improve the resilience of the financial system. Notwithstanding a growing interest in green finance, many banks have yet to fully incorporate environmental and social factors in their business models, governance frameworks and cultures. The BSR data show that bank lending to renewable energy has been uneven. It grew at a rate higher than the overall credit growth during 2009 to 2014, leading to an increase in its share in overall credit (Chart 1). However, the share remains low, with a bulk of it being accounted for by nationalised banks (Table 1). In line with the empirical literature available in the Indian context (Rajput 2013), the relationship between renewable energy credit and return on assets (RoA) for India seems inconclusive (Chart 2). Adoption of green policies by banks during 2007-09 and inclusion of renewable energy in the priority sector lending in 2012 have been instrumental in giving a push to green bank lending. The priority sector reporting system was revised in June 2015 to enable reporting on credit under this sector as a separate head. This shows an average growth of about 21.8 per cent in bank credit to renewable energy during 2015-16, though its share in overall credit remains miniscule.

| Table 1: Share of Bank Groups in Renewable Energy Lending (per cent) | | | 2009 | 2011 | 2013 | 2014 | | 1 | 2 | 3 | 4 | 5 | | Foreign Banks | 8.5 | 1.1 | 3.7 | 2.3 | | Nationalised Banks | 54.1 | 72.7 | 62.7 | 70.4 | | Private Sector Banks | 9.9 | 7.9 | 15.9 | 15.3 | | SBI and its associates | 27.4 | 18.4 | 17.7 | 11.9 |

In 2015, SEBI brought out a concept paper for issuance of green bonds. After considering the feedback received, it is in the process of finalising the guidelines for issuing such bonds. India has already entered the green bond market with bonds issued by a handful of pioneer issuers. The guidelines for such bonds are expected to facilitate investment decisions by investors who have a mandate to focus on green investments, and to provide uniformity in disclosure standards. In the Indian context, while the Government and the regulators have been addressing the impact of climate change, there are broader issues that may need careful consideration. They include definition of green activities, areas of green financing, aspects of intellectual property rights (IPRs) in development and transfer of green technology from developed countries, and modalities for environmental risk assessment by banks. References: Rajput. N, S. Arora, A. Khanna (2013), ‘‘An Empirical Study of Impact of Environmental Performance on Financial Performance in Indian Banking Sector”, International Journal of Business and Management Invention, Volume 2 Issue 9, September. GOVERNMENT AND BANK ACCOUNTS X.76 The Department of Government and Bank Accounts (DGBA) formulates internal accounting policies and policies pertaining to conduct of government business by agency banks. It oversees activities undertaken by the Regional Offices as a banker to banks and central and state governments. In the area of accounts and their presentation, the Reserve Bank has been constantly moving towards greater transparency through improved presentation of its financial statements and disclosures. In the area of ‘banker to banks’ and ‘banker to government’, the Reserve Bank has been leveraging IT solutions to provide better and more efficient services. Agenda for 2015-16: Implementation Status X.77 Based on the recommendations of the Technical Committee formed to review the presentation of the balance sheet and profit and loss account of the Reserve Bank, rupee securities are being carried at fair value and appreciation or depreciation on re-valuation is being transferred to ‘Investment Revaluation Account-Rupee Securities’ with effect from July 2015. In addition, rupee securities are being amortised on a daily basis from July 2015. X.78 A Working Group constituted in February 2015 to review the system of inspecting government business in agency banks, submitted its report in December 2015. Recommendations of the group relating to onsite inspections of agency banks have been implemented. The Reserve Bank is in the process of putting in place a system of offsite monitoring of government business. A Working Group on Business Process Reengineering (BPR) of government business, which was set up in March 2015, comprising of members from the Reserve Bank, various government agencies and a few select agency banks, is expected to submit its report shortly. Agenda for 2016-17 X.79 Once the Working Group on BPR submits its report, it will be examined for implementation. Efforts will be directed at further integrating electronic receipts and payments of more state and central government systems with the Reserve Bank’s CBS (e-Kuber) for better efficiency and customer service. Other items on the agenda for implementation include standardising the process of imposing penalties on agency banks and rationalisation of agency commission rates. X.80 DGBA was involved in finalising the recommendations of the technical group that examined the banking arrangements for implementing GST. The Reserve Bank will be actively involved in the process of implementation as an aggregator with the transactions being integrated with the Reserve Bank’s CBS. MANAGING FOREIGN EXCHANGE RESERVES X.81 The Department of External Investments and Operations (DEIO) manages the country’s foreign exchange reserves. The increasing volume of foreign exchange reserves warrants strengthening the reserves management structure in terms of valuation methods, risk management practices, accounting framework and IT infrastructure including disaster management. Agenda for 2015-16: Implementation Status X.82 Diversification of India’s foreign currency assets (FCA) continued during 2015-16 by way of investments in new markets and asset classes within the framework of safety, liquidity and returns. A hotstandby set-up was operationalised at a different location to mitigate the impact of disaster induced disruptions. The computation of value at risk (VaR) was extended to all the FCA and gold. Credit stress testing of FCA also commenced during the year. Agenda for 2016-17 X.83 Further diversification of FCA, active management of the gold portfolio, strengthening of the risk management framework relating to portfolio management and IT systems and a further build-up of staff capacities are on the agenda for 2016-17. ECONOMIC AND POLICY RESEARCH X.84 Research activity has significant importance for policymaking in central banks. In the Reserve Bank, the Department of Economic and Policy Research (DEPR) is entrusted with the task of providing research inputs and management information system (MIS) services on economic and policy related issues. The department is envisaged to establish itself as a premier knowledge centre in policy-oriented research on macroeconomic and monetary policy issues. DEPR contributes in several ways including regular publication of reports, data dissemination and policy oriented research. Agenda for 2015-16: Implementation Status Publications X.85 As in the past, the department brought out the flagship publications of the Reserve Bank during 2015-16 − the Annual Report, Study on State Finances and the Reserve Bank of India Monthly Bulletin. Three outreach seminars were held in coordination with the Department of Communication at various centres, mostly universities, during the year to disseminate the main messages of the Reserve Bank’s Annual Report 2014-15 among students and researchers. This exercise was well received. The department also compiled and disseminated primary statistics on monetary aggregates, balance of payments, external debt, household financial savings and flow of funds during the year. The department unveiled the Handbook of Statistics on Indian States, the first of its kind, providing state-wise statistical tables on a wide range of variables including social and demographic indicators, state domestic product, agriculture, industry, infrastructure, banking and fiscal indicators. Research X.86 During 2015-16, 32 research papers were completed, of which 10 were published in domestic and foreign journals. Eleven working papers were brought out during the year. The research papers covered multiple areas of interest: monetary policy transmission and challenges, effectiveness of forex interventions, global spillovers, SME financing, issues relating to private placements and financing of NBFCs. Several initiatives were undertaken in collaboration with external experts to promote research. One DRG study and a DRG project were completed during 2015-16. Other Activities X.87 The department organised various events during the year including a seminar on ‘Understanding inflation in India’ by Professor Laurence M. Ball, a talk by Professor V.V. Chari on ‘Lessons from economic theory for monetary policy in India’ and a talk by Mr José Viñals, Financial Counsellor, IMF on ‘Global financial stability - where do we stand?’. DEPR in collaboration with the Centre for Advanced Financial Research and Learning (CAFRAL) organised an international conference titled, ‘Monetary policy challenges in open emerging economies’ in which international and national researchers participated. The Annual Research Conference of the department was organised in Goa in June 2016. It included special sessions by eminent economists and external experts. The DEPR Study Circle, an in-house forum of researchers organised 12 presentations on diverse themes by internal researchers. Six seminars were also organised under the same banner with presentations by external experts. A professor of repute from abroad visited the department for two weeks and guided research and forecasting exercises undertaken by the DEPR and the Monetary Policy Department (MPD). Agenda for 2016-17 X.88 Going forward, the research areas envisaged to be covered during 2016-17 include the equilibrium exchange rate, exchange rate pass-through to domestic inflation, credit and production linkages in agriculture, availability of clean notes, the impact of MGNREGA and credit potential in special category states. The department proposes to organise a number of seminars/lectures during 2016-17 and a Southeast Asian Central Banks (SEACEN) course on ‘financial cycles and crises’ in December 2016. The drafting of Volume V of the ‘History of the Reserve Bank’ covering the period from 1997 to 2008 is underway in the History Cell of the department. The department has formed a group on Food inflation Research and Measurement (FIRM) in coordination with MPD and the Department of Statistics and Information Management (DSIM), which will bring out a comprehensive report decoding food inflation in India. STATISTICS AND INFORMATION MANAGEMENT X.89 The Department of Statistics and Information Management (DSIM) disseminates macro-financial statistics to the public and provides statistical support and analytical inputs for meeting the policy and operational needs of the Reserve Bank. DSIM maintains comprehensive statistical systems related to banks, corporate and external sectors; undertakes structured surveys, manages the Reserve Bank’s data warehouse and provides statistical analyses and forecasts. Agenda for 2015-16: Implementation Status Data Management, Dissemination and Publications X.90 During 2015-16, DSIM released statistics related to banks, corporate and external sector as per schedule and with reduced time-lags wherever possible. Banks started submitting International Banking Statistics (IBS) data in the revised reporting system for implementation of Stage-2 enhancements as per the recommendations of the Committee on the Global Financial System (CGFS). The department has developed a methodology for compiling the Index of Service Production for the Banking (ISPB) sector in India, which will be finalised in consultation with the Government. Classification of bank branches in various population groups is being updated based on the 2011 population Census. The scope of banking data dissemination has been expanded by releasing new statistics on types of deposits at a quarterly frequency and the number of branches opened during a quarter/year. Further, the department is actively involved in the validation of market risk models, in addition to developing a rating model for banks. X.91 During the year, the performance of the corporate sector was analysed, using a much larger dataset of the Ministry of Corporate Affairs (MCA). Further, gross value added of the private corporate sector was compiled in line with the revised National Accounts Statistics. The quarterly international investment position was disseminated as per the SDDS time schedule coupled with a reduced time-lag for all the surveys on the external sector. X.92 A secure web-portal based reporting framework was implemented under the Foreign Exchange Transactions Electronic Reporting System (FETERS) forming the core of the balance of payments (BoP) compilation. The Central Fraud Registry Portal has been developed based on XBRL system in consultation with the Department of Banking Supervision (DBS) as a centralised database displaying information on frauds involving an amount of ₹0.1 million and above, reported by banks/FIs with search facility, user management and audit trail. X.93 Phase-II of the XBRL based reporting system was completed during 2015-16 and 97 returns were brought under XBRL. Phase-III of the XBRL project has been initiated with 95 returns covering different areas. During the year, XBRL International, the global custodian of XBRL standards, presented the ‘XBRL International Award for Excellence’ to the Reserve Bank in recognition of its efforts in ‘Innovation and Continuous Pursuit of Improvement in Regulatory Reporting’. An inter-departmental Return Governance Group (RGG) has been formed to vet the process of introducing new returns/ modifications to existing returns in the Reserve Bank. X.94 The department developed the SAARCFINANCE database (SFDB). The dedicated SFDB website was opened to the public during the SAARCFINANCE Governors’ Symposium in May 2016. X.95 Under the integrated database and the National Factsheet of the Indian Economy, an automated interface mechanism has been developed to meet the regular requirements of the Ministry of Communications and Information Technology. Surveys and Research X.96 During the year, issues relating to statistical surveys required for monetary policy were referred to the Technical Advisory Committee on Surveys (TACS), which functions under the chairmanship of the Deputy Governor in charge of the department, drawing members from reputed institutions in the field. Research collaboration with the Indian Statistical Institute, Kolkata to improve technical aspects of various surveys undertaken has been extended for one more year. Several research studies were contributed to the Reserve Bank’s Working Paper Series/other publications/ academic conferences. Agenda for 2016-17 X.97 The department will continue pursuing work related to the harmonisation of data with the aim of providing definitions of all major items which can then be used by banks to report data. Further, under the aegis of the RGG, banks will be persuaded to streamline their automated data flow (ADF) systems. The process of taking 95 returns under the XBRL Phase-III will be taken forward. During the year, the department will also augment the SAARCFINANCE database coverage in consultation with partner countries. The existing system of collecting and storing information on banking entities will be upgraded in order to enhance the scope and efficiency of the system. The department will also consider rationalisation of certain banking returns in order to reduce the reporting burden on banks. X.98 Corporate finance studies in areas of risk and vulnerability, capital structure and investment behaviour will also be taken up during 2016-17. In addition, short-term forecasting of corporate sales and profitability using nowcasting techniques will be attempted. The department will also take up rationalisation of existing surveys under the guidance of the TACS. LEGAL ISSUES X.99 The Legal Department is an advisory department established for examining and advising on legal issues and for facilitating the management of litigation on behalf of the Reserve Bank. It vets the circulars, directions, regulations and agreements for various departments of the Reserve Bank with a view to ensuring that the decisions of the Reserve Bank are legally sound. Legal Department is also extending its support and advice to DICGC and other RBI owned institutions on legal issues, litigation and court matters. Agenda for 2015-16: Implementation Status X.100 The provisions of the Negotiable Instruments Act, 1881 were amended in December 2015. Accordingly, a complaint for bouncing of cheques can only be filed before the court having jurisdiction over (i) the place where the payee delivers the cheque for payment through his account viz. the bank branch of the payee or (ii) the place where he presents the cheque for payment viz. the branch of the drawee bank, is situated. X.101 The Supreme Court vide its judgment dated July 01, 2015 passed in the case of DICGC vs Raghupati Raghavan & Others settled the question of law on the priority of DICGC’s claims in cases of liquidation of insured banks. X.102 The Reserve Bank filed petitions against certain orders of the Central Information Commission under the Right to Information Act, 2005 directing it to provide copies of inspection reports and related information. The Supreme Court declined to interfere with the orders passed by the Commission. Agenda for 2016-17 X.103 In 2016-17, the department will continue to advise various departments on legal matters and furnish specific legal opinions whenever sought. It will also continue its efforts at managing litigation on behalf of the Reserve Bank and function as a secretariat to the Appellate Authority under the Right to Information Act. Amendments to various Acts administered by the Reserve Bank will be pursued during the year in order to meet international commitments and standards and for clarifying relevant provisions. CORPORATE STRATEGY AND BUDGET MANAGEMENT X.104 The Corporate Strategy and Budget Department (CSBD) formulates the budget of the Reserve Bank by allocating resources optimally towards strategic priorities of the Bank. Agenda for 2015-16: Implementation Status X.105 The department prepared a medium-term strategy and action plan framework for the Reserve Bank during the year. Granular action plans of all the Central Office departments (CODs) were aggregated into broad strategies and linked to the Reserve Bank’s core purpose, values and vision statement. The department apprises the top management on a quarterly basis on the status of implementation of the agendas that different departments of the Reserve Bank have set for themselves. Their plans for the following quarters in terms of clear timelines, milestones, impediments and corrective measures were taken on board with the intention of plugging the gap between the goals envisaged and their achievement. X.106 The department also prepared a draft Business Continuity Management (BCM) policy. A BCM diagnostic was conducted to review the status of BCM in the Reserve Bank and to identify existing gaps. This was followed by appointing a consultant to help implement a robust integrated BCM across the entire Reserve Bank. A business impact analysis (BIA) is being carried out at all CODs and select Regional Offices (ROs)/training establishments (TEs) to identify time-sensitive critical business processes in a scientific manner. X.107 The Reserve Bank’s budget was formulated by the department based on action plans finalised by each unit (RO/COD/TE) and its utilisation was monitored on a quarterly basis. X.108 The department is also responsible for the management of various superannuation funds and provision of budgetary support to training/research institutions such as NIBM, IGIDR, CAFRAL and IIBM. X.109 Tier III offices at Aizawl and Imphal were opened on October 15 and 17, 2015 respectively. In this regard, the department has prepared a list containing aspects and issues to be kept in mind for newly opened offices, facilitating the functioning of such offices and the personnel posted there. Agenda for 2016-17 X.110 The department’s agenda for the coming year includes implementing BCM in an integrated manner throughout the Reserve Bank by framing a robust BCM policy, issuing guidelines, conducting a business impact analysis (BIA), putting in place a crisis management framework, creating awareness amongst all stakeholders and reviewing the business continuity plans (BCP) of each unit. Monitoring the implementation of the strategic plan of the Reserve Bank is an important on-going agenda. The department will further fine-tune the process of budget formulation and its review so as to rationalise expenditure. The department also plans to establish state government (SG) cells, DNBS/DCBS cells and/or other departments in select Tier III offices based on emerging requirements. CORPORATE SERVICES X.111 The Department of Corporate Services (DCS) was established as part of the institutional re-organisation undertaken in November 2014 with the objective of coordinating and facilitating delivery of internal corporate services catering to the needs of the various departments of the Reserve Bank. Agenda for 2015-16: Implementation Status X.112 The department focused on providing efficient corporate support services by way of management/providing services related to events/ meetings/hospitality/protocol services to the top management and promoted receipt of payments for sales of the Reserve Bank’s publications through e-mode. The department also delineated guidelines for award of rate contracts and event management. The department made arrangements for centralised procurement of stationery, printing of Reserve Bank publications at a centralised place, empanelling printers and providing centralised courier services. Agenda for 2016-17 X.113 During 2016-17, the department envisages to initiate actions on policy formulations for records management and workflow processes. Awareness programmes on the Electronic Documents Management System (EDMS) will be conducted with enhanced focus and coverage (Box X.4). Handbooks/manuals on functions related to procurements/rate contracts and protocol and event management will be prepared. An impact analysis will be carried out to assess the benefits of the common/centralised rate contracts of various stationery items. RAJBHASHA X.114 During 2015-16, the Reserve Bank continued its efforts to ensure compliance with the statutory provisions of the Official Language Act with a view to promoting use of Hindi in its working. The Rajbhasha Department of the Reserve Bank is entrusted with this responsibility. Box X.4 Electronic Documents Management System (EDMS)-Darpan The Reserve Bank has initiated a project to implement the Electronic Document Management System (EDMS). Using a collection of technologies, this system will enable users in the Reserve Bank to initiate and manage documents and records throughout the document’s life-cycle, from its creation to disposition. The objectives of the project are creating a platform for initiating workflows; automating the Reserve Bank’s business processes; establishing a channel for collaboration and communication; building a centralised repository of records for the organisation; and aiding the Reserve Bank in its pursuit of becoming a knowledge organisation by enabling sharing of documents. One of the major benefits of EDMS is that it will provide an integrated content repository for most of the records with intelligent library services enabling users to sieve through millions of documents to get to the right content at the right time. For an organisation spread over multiple locations, the workflow management module of this system will allow instant access to documents that normally requires time to be transferred from one location to the other either via mail, fax or post. Unlike paper-based processes, the status of a document within an electronic workflow can be easily queried and determined giving pan-organisational control over documents. This will provide opportunities for reviewing the workflow processes and facilitate business process improvements. Substantial time spent on retrieving a paper file, performing an action with it and then re-archiving the file and expenditure on paper, ink, file folders, filing cabinets, filing staff and other requirements can be saved, thus reducing substantial time and costs for the Reserve Bank. Also, with efficient scanning and indexing capabilities, EDMS will almost guarantee that files will be current and up-to-date and will have document and record version control. The security in EDMS will be much more flexible than that associated with paper-based environments. It will provide access to groups and individuals based on the access control policy of the Reserve Bank and maintain audit trails that will show who accessed and updated documents. The electronic repository can be replicated at several locations and complete recovery from a major disaster such as a fire, can be a matter of days with proper disaster recovery infrastructure and procedures in place. Logging records of the system can be used for auditing purposes. Further, the system can be configured and business practices adjusted to ensure regulatory compliances regarding storage, access and retention of documents. Agenda for 2015-16: Implementation Status X.115 The Reserve Bank celebrated 2015-16 as the Rajbhasha Golden Jubilee Year. In order to sensitise regional directors and heads of Central Office departments on the requirements of the Official Language Policy, a workshop was conducted at Lonavala on July 10, 2015. Subsequently, four zonal seminars on different aspects of the Rajbhasha policy were organised at Hyderabad, Patna, Nagpur and Jammu. Four programmes, viz., Hindi Diwas, Anuwad Diwas, Vishwa Hindi Diwas and Matribhasha Diwas were organised in the offices/departments of the Reserve Bank; these were followed by an all-India seminar in Lucknow in February 2016. The closing ceremony of the Rajbhasha Golden Jubilee Year was organised on May 24, 2016 in which, in addition to a souvenir, eight other publications were released. Besides statutory publications, other publications were also brought out in bilingual form during the year. Visit of Parliamentary Committee X.116 The Committee of Parliament on Official Language visited the Reserve Bank’s offices in Delhi, Kolkata and Ahmedabad and reviewed the status of implementation of the Rajbhasha policy. The Drafting and Evidence Sub-Committee of the Committee visited the Bhubaneswar, Bengaluru and Kolkata offices. The sub-committee has suggested various corrective actions for promoting the use of Hindi in the Reserve Bank. Agenda for 2016-17 X.117 An annual work plan for 2016-17 has been prepared keeping in view the requirements of the annual programme published by the Government and the concerns expressed by the Committee of Parliament on Official Language. In addition to a one-day programme on the official language for senior officers, conducting a seminar on use of technology for progressive use of Rajbhasha is the agenda for 2016-17. PREMISES DEPARTMENT X.118 The remit of the Premises Department covers creating, maintaining and upgrading the Reserve Bank’s physical infrastructure. In 2015- 16, significant progress was made in this direction. Land for office building in Imphal was acquired. Construction of hostel buildings for RBSC, Chennai and IGIDR, Mumbai, as also senior officers’ flats along with four executive visiting officers’ flats (VOFs) and an amenities block at Ameerpet, Hyderabad was completed during the year. Construction of officers’ flats at Anna Nagar, Chennai and Dadar-Parel in Mumbai is in advanced stages of completion. Construction of infrastructural facilities for CAFRAL in Mumbai is set to commence shortly. Efforts were also made to consolidate and optimally utilise office space in Mumbai with the vacation of Garment House, leading to huge cost efficiency and substantial annual savings. X.119 For upgrading the security infrastructure, an internet protocol based CCTV (IPCCTV) system was operationalised in 19 offices during 2015-16. Installation of an Integrated Security System for the Central Office Building of the Reserve Bank has commenced for ensuring greater and integrated security. X.120 The Reserve Bank has taken steps to harness solar energy through grid interactive solar installations with a cumulative capacity of 336 Kilowatt peak (kWp) in various premises. Installation of energy efficient and eco-friendly AC plants was completed in all the offices. Organic waste converters were installed in residential colonies at eight locations. Rain water harvesting has been put in place in many office and residential premises. Agenda for 2016-17 X.121 Construction of office buildings at Naya Raipur and Dehradun will commence during 2016-17. Land acquisition formalities for office buildings are presently underway at Shillong, Agartala and Ranchi. Construction of residential colonies in Jammu and Dehradun is in advanced stages of planning. Residential colonies in Delhi (Hauz Khas), Mumbai (Chembur, Andheri and Malad), Jaipur (Malviya Nagar), Chandigarh and Ahmedabad (Vasna) are also being planned. Steps are also being initiated for constructing a holiday home in Lonavala. X.122 As part of its green initiatives, a cumulative target of 800 kWp grid interactive solar power is set for 2016-17. Concrete steps for water and electricity conservation across all the premises of the Reserve Bank are also envisaged to be taken up. X.123 With a view to further enhancing transparency in procurement, e-tendering is being implemented for procurement beyond the threshold limit of ₹ 1 million and sale of goods/ scrap, etc. beyond ₹ 0.5 million. All offices have been advised to pay attention to the upkeep and maintenance of their premises.

Annex | Table 1: Attendance in the Meeting of the Central Board of Directors during July 01, 2015-June 30, 2016 | | Name of the Member | Appointed/Nominated under RBI Act, 1934 | No. of Meetings Held | No. of Meetings Attended | | 1 | 2 | 3 | 4 | | Raghuram G. Rajan | 8 (1) (a) | 6 | 6 | | Harun R. Khan | 8 (1) (a) | 6 | 6 | | Urjit R. Patel | 8 (1) (a) | 6 | 6 | | R. Gandhi | 8 (1) (a) | 6 | 6 | | S. S. Mundra | 8 (1) (a) | 6 | 6 | | Nachiket M. Mor | 8 (1) (b) | 6 | 6 | | Y. C. Deveshwar | 8 (1) (c) | 6 | 4 | | Damodar Acharya | 8 (1) (c) | 6 | 5 | | Natarajan Chandrasekaran | 8 (1) (c) | 2 | 2 | | Bharat N. Doshi | 8 (1) (c) | 2 | 2 | | Sudhir Mankad | 8 (1) (c) | 2 | 1 | | Anil Kakodkar | 8 (1) (c) | 2 | 2 | | Kiran S. Karnik | 8 (1) (c) | 2 | 2 | | Y. H. Malegam | 8 (1) (c) | 2 | 2 | | Dipankar Gupta | 8 (1) (c) | 2 | 1 | | G. M. Rao | 8 (1) (c) | 2 | 1 | | Ela Bhatt | 8 (1) (c) | 2 | 1 | | Indira Rajaraman | 8 (1) (c) | 2 | 2 | | Hasmukh Adhia | 8 (1) (d) | 2 | 1 | | Ajay Tyagi | 8 (1) (d) | 3 | 3 | | Anjuly Chib Duggal | 8 (1) (d) | 4 | 1 | | Shaktikanta Das | 8 (1) (d) | 3 | 2 |

| Table 2: Committees of the Central Board | | Name of the Member | Appointed/Nominated under RBI Act, 1934 | No. of Meetings Held | No. of Meetings Attended | | I. Committee of the Central Board (CCB) | | Raghuram G. Rajan | 8 (1) (a) | 47 | 31 | | Harun R. Khan | 8 (1) (a) | 47 | 35 | | Urjit R. Patel | 8 (1) (a) | 47 | 20 | | R. Gandhi | 8 (1) (a) | 47 | 29 | | S. S. Mundra | 8 (1) (a) | 47 | 20 | | Anil Kakodkar | 8 (1) (b) | 10 | 02 | | Kiran S. Karnik | 8 (1) (b) | 06 | 06 | | Nachiket M. Mor | 8 (1) (b) | 38 | 27 | | Y. H. Malegam | 8 (1) (c) | 11 | 11 | | Dipankar Gupta | 8 (1) (c) | 05 | 04 | | G. M. Rao | 8 (1) (c) | 04 | 04 | | Ela Bhatt | 8 (1) (c) | 03 | 02 | | Indira Rajaraman | 8 (1) (c) | 04 | 04 | | Y. C. Deveshwar | 8 (1) (c) | 38 | 00 | | Damodar Acharya | 8 (1) (c) | 39 | 36 | | N. Chandrasekaran | 8 (1) (c) | 04 | 03 | | Bharat N. Doshi | 8 (1) (c) | 07 | 06 | | Sudhir Mankad | 8 (1) (c) | 06 | 03 | | II. Board for Financial Supervision (BFS) | | Raghuram G. Rajan | Chairman | 10 | 9 | | Harun R. Khan | Member | 10 | 8 | | Urjit R. Patel | Member | 10 | 8 | | R. Gandhi | Member | 10 | 8 | | S. S. Mundra | Vice-Chairman | 10 | 9 | | Nachiket M. Mor | Member | 10 | 10 | | Y. H. Malegam | Member | 3 | 3 | | Ela Bhatt | Member | 2 | 1 | | Bharat N. Doshi | Member | 3 | 3 | | Sudhir Mankad | Member | 3 | 1 | | III. Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) | | Raghuram G. Rajan | Chairman | 4 | 4 | | Harun R. Khan | Vice-Chairman | 4 | 3 | | Urjit R. Patel | Member | 4 | 3 | | R. Gandhi | Member | 4 | 2 | | S. S. Mundra | Member | 4 | 4 | | Anil Kakodkar | Member | 1 | 1 | | Kiran S. Karnik | Member | 1 | 1 | | Damodar Acharya | Member | 3 | 3 | | N. Chandrasekaran | Member | 1 | 0 | | Bharat N. Doshi | Member | 1 | 1 |

| Table 3: Sub-Committees of the Board | | Name of the Member | Appointed/Nominated under RBI Act, 1934 | No. of Meetings Held | No. of Meetings Attended | | I. Audit & Risk Management Sub-Committee (ARMS) | | Y. H. Malegam# | Chairman | 2 | 2 | | Dipankar Gupta | Member | 2 | 2 | | Indira Rajaraman | Member | 2 | 2 | | Y. C. Deveshwar | Member | 2 | 0 | | Harun R. Khan | Invitee | 5 | 4 | | Urjit R. Patel | Invitee | 5 | 2 | | R. Gandhi | Member | 5 | 5 | | S. S. Mundra | Invitee | 5 | 2 | | Nachiket M. Mor | Member | 3 | 2 | | Bharat N. Doshi | Chairman | 3 | 3 | | Sudhir Mankad | Member | 3 | 1 | | #: Up to October 6, 2015 | | | | | II. Building Sub-Committee (BSC) | | G. M. Rao@ | Chairman | 1 | 1 | | Sudhir Mankad | Chairman | 1 | 1 | | Y. C. Deveshwar | Member | 1 | 0 | | Anil Kakodkar | Member | 1 | 0 | | Harun R. Khan | Member | 2 | 2 | | @: Up to September 22, 2015 | | | | | III. Human Resource Management Sub-Committee (HRM-SC) | | Damodar Acharya | Chairman | 4 | 4 | | Kiran S. Karnik | Member | 2 | 2 | | S. S. Mundra | Member | 4 | 4 | | IV. Information Technology Sub-Committee (IT-SC) | | Kiran S. Karnik | Chairman | 1 | 1 | | Damodar Acharya | Member | 1 | 1 | | Harun R. Khan | Member | 1 | 1 |

|