During 2016-17, the Indian banking sector had to cope with the concerns about deteriorating asset quality, on

the one hand, and a sharp decline in credit growth, on the other, while supporting the government in its initiatives

to further reach out to the public and in promoting digitalisation of the modes of payments in the economy. The

branch authorisation policy was revised to harmonise the treatment of different forms of bank presence for the

purpose of opening banking outlets in under-served areas. Empowered by requisite legislative provisions put in

place by the government, the Reserve Bank focused on strengthening the institutional framework to address asset

quality concerns by improving the recovery process and the early response mechanism. Having gained experience

with the licensing of small finance and payments banks, the Reserve Bank explored the scope of introducing more

differentiated banks such as ‘wholesale and long-term finance banks’ and also examined the regulatory challenges

posed by innovations by Fin Tech entities in the financial landscape. Apart from focusing on the supervision of

financial conglomerates and early response to asset quality deterioration, the Reserve Bank formalised a framework

for taking enforcement action against banks for non-compliance with guidelines and instructions issued by it. For

ensuring timely and effective redressal of customer grievances in non-banking financial companies (NBFCs), the

Reserve Bank proposes to formulate an appropriate Ombudsman Scheme for NBFCs.

VI.1 The banking sector continued to grapple

with the challenge of rising non-performing

assets (NPAs) during 2016-17. In view of the

mounting stress on asset quality, the banking

sector’s performance in terms of profitability and

return on assets came under pressure in 2016-

17. To deal with stressed assets, the existing

regulations were revised in consultation with the

stakeholders. Subsequent to promulgation of the

Banking Regulation (Amendment) Ordinance,

the Reserve Bank has taken several steps to

expedite the process of resolution of certain large

value stressed accounts. The market perception

of this Ordinance seems to be positive for banks

with relatively high level of non-performing assets

(NPAs) and for firms with greater capacity to meet

their interest obligations (Box VI.1). Further, in

order to bring in greater transparency, banks were

mandated to make suitable disclosures in the

Notes to Accounts to Annual Financial Statements

for 2016-17 and onward with regard to divergences in asset classification and provisioning from the

Reserve Bank’s supervisory assessment.

VI.2 Keeping in view the entry of differentiated

banks and their role in financial inclusion, the branch

authorisation policy was revised to harmonise the

treatment of different forms of a bank’s presence

for the purpose of opening banking outlets in

under-served areas. Licenses were issued to

more players in the banking sector and some small

finance banks (SFBs) and payments banks (PBs)

began operations during the year. The Reserve

Bank also explored the scope for operations of

other types of differentiated banks to cater to the

sector-specific financing needs of the economy.

Box VI.1

Market Reaction to the NPA Ordinance*

The President approved the Banking Regulation

(Amendment) Ordinance, 2017, on May 5, 2017. This

ordinance empowers the Reserve Bank to direct banking

companies to initiate insolvency proceedings in respect

of corporate borrowers in default, under the provisions of

the Insolvency and Bankruptcy Code, 2016 (IBC). It also

enables the Reserve Bank to constitute committees to

advise banking companies on resolution of stressed assets.

Following this, the Reserve Bank released a detailed

action plan to implement the Ordinance on May 22, 2017.

An Internal Advisory Committee (IAC) constituted by the

Reserve Bank held its first meeting on June 12, 2017. The

IAC recommended that all accounts with an outstanding

amount greater than ₹50 billion, and with more than 60 per

cent classified as non-performing by banks as on March 31,

2016 be resolved using the new IBC. Using these criteria, 12

accounts aggregating to around 25 per cent of the current

gross NPAs were referred to the National Company Law

Tribunal (NCLT), a statutory body responsible for judging

insolvency proceedings under the new IBC law1.

Against this backdrop, the following two events are

analysed viz., (i) the manner in which the market perceived

the passage of the Ordinance empowering the Reserve

Bank, and (ii) the reaction of stakeholders to the news of

identification of default accounts.

With regard to the first event, the event date is defined as

the date on which the Ordinance was approved (May 5,

2017). The event window around which the market response

is analysed starts nine trading days before the event date

and ends nine trading days after the event date. However,

one week prior to the approval of Ordinance, the Finance

Minister hinted at empowering the Reserve Bank to address

the problem of non-performing assets (NPAs) in the Indian

banking system. Since, it was likely that the stock market

might have reacted prior to the actual event date, hence the

principal empirical analysis here is based on the response

of the stock market from five trading days prior to the event

till the event date.

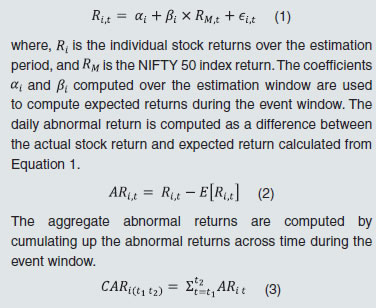

The response of the market is analysed by computing

abnormal returns (ARs), which are defined as the difference

between realised returns and expected returns. Expected

returns are estimated by using the market model wherein

for each company or bank, its stock returns are regressed

on market returns separately over the estimation window

starting 250 days prior to the event window and ending 30

days before the announcement date. The equation used for

estimation is given below.

The analysis focuses on the 36 scheduled commercial

banks for which stock market data are available. Those

banks that have a non-performing asset to advances ratio

(NPAR) above the sample median value for NPAR for all

banks in 2015-16 are classified as stressed banks. The

remaining are classified as non-stressed banks.2 While a

greater proportion of public sector banks are classified as

stressed, almost all private sector banks are classified as

non-stressed banks. The firm sample is divided into three

sets on the basis of interest coverage ratio (ICR) in 2015-16:

(i) low quality (ICR < 1), (ii) intermediate quality (1 ≤ ICR ≤ 2), and (iii) high quality (ICR ≥ 2).3

The event study analysis for all firms and associated

banks is structured as follows: (i) comparison of stressed banks and non-stressed banks, (ii) comparison of low

quality, intermediate quality, and high quality firms, and

(iii) comparison of low and high quality firms, segregated

on whether their lead banks are stressed or non-stressed

banks.4

The second event study uses June 12, 2017 - the date of

the IAC’s first meeting - as the event date. It examines stock

price reactions of the twelve firms that were referred to NCLT

for resolution, and the lead banks of these firms. To study the

relative market perception of these firms, all exchange listed

firms in the same industry as the defaulter firms are used as

control firms.5 For the bank analysis, the thirty-six banks in

the sample are divided into those that are the lead banks of

any of these twelve defaulter firms and the remaining banks.

Results and Inference

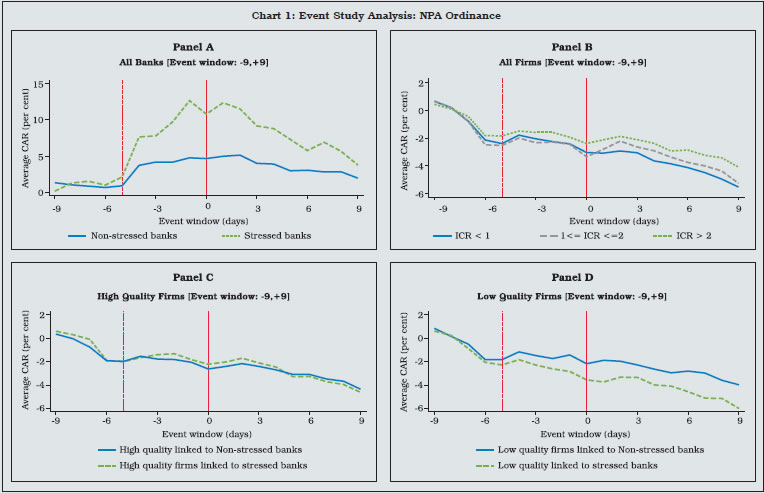

Figure 1 displays the market response to the President's

approval of the Banking Amendment Ordinance. Abnormal

returns of stressed banks increased sharply following the Finance Minister’s announcement (dashed red line at -5

in Chart 1, Panel A). This pattern continues till the event

date which is the passage of the Ordinance. In contrast,

non-stressed banks witnessed a more modest increase

in abnormal returns. Strikingly, abnormal returns between

stressed and non-stressed banks widened to almost 5 per

cent indicating that markets perceived the amendment

would help stressed banks in resolving their NPA problem.

Panel B shows that low and intermediate quality firms

performed worse than high quality firms. Overall, these

results indicate that the recent amendment to the existing

Banking Regulation Act is perceived by the market as being

more positive for stressed banks, but negative for low and

intermediate quality firms.

The remaining panels in Chart 1 further explore which firms

are driving these results, based on whether the firm’s lead

bank is classified as stressed or non-stressed. Panel C

and Panel D examine the market reaction of low and high

quality firms, separating firms that are related to stressed banks vis-à-vis non-stressed banks. Low quality firms linked

to stressed banks performed worse than low quality firms

linked to non-stressed banks. In contrast, high quality firms

linked to stressed banks performed better than high quality

firms linked to non-stressed banks at least in the days

immediately following the event date. It appears that the

market lost confidence in low quality firms linked to stressed

banks but high quality firms linked to stressed banks are

seen in a positive light. One possible explanation is that high

quality firms linked to stressed banks benefit from a balance

sheet clean-up of stressed banks. The market may also be

reflecting long term benefits to high quality firms possibly

through the reallocation of resources away from low quality

firms (Hsieh and Klenow, 2009 and Kulkarni, 2017).

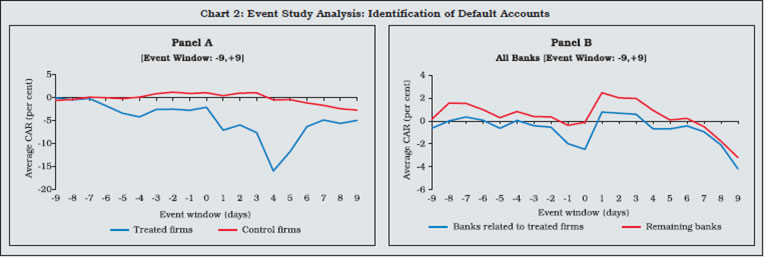

The second event study focuses on the date of the IAC’s

first meeting on June 12, 2017 when defaulter accounts

were identified. Chart 2 displays the response of the market

to the announcement in reference to defaulter accounts.

Panel A shows that defaulter firms realised a decline in

abnormal stock returns relative to other firms belonging to

the same industry as the defaulter firm. The identification

of these firms by the Reserve Bank was a clear indication of their poor financial health, and it is evident that market

stakeholders lost confidence in these firms. Panel B displays

how the market responded to the lead banks of defaulter

firms relative to other banks. In general, the abnormal

returns increased for both the sets of banks immediately

after the event.

In summary, both event studies point to a positive market

reaction for banks but a negative market reaction for

distressed firms. Thus, based on the market reaction, the

Ordinance is good news for stressed banks as well as high

quality borrowers. It has the potential to increase efficiency

of capital allocation in the Indian economy with significant

positive spillover effects on healthy firms and to rejuvenate

the banking sector.

References:

1. Hsieh, C. and Klenow, P. (2009). “Misallocation and

manufacturing TFP in China and India.” The Quarterly

Journal of Economics, 1124(4), 1403-1448.

2. Kulkarni N. (2017). “Creditor rights and allocative

distortions: Evidence from India.” CAFRAL Working

Paper. |

VI.3 The Reserve Bank continued the process

of harmonising the regulatory framework for

cooperative banks and NBFCs with that of

commercial banks. Apart from strengthening

cooperative banks through mergers and licensing,

there was also a move towards reducing the tiers in the cooperative structure with a view to bringing

down the cost of borrowings for final borrowers.

Keeping in view the greater role envisaged

for asset reconstruction companies (ARCs) in

resolving stressed assets, regulatory norms for

them were revised.

VI.4 With the entry of new forms of differentiated

banks, the Reserve Bank began the process of developing a suitable framework for supervising

payment banks and small finance banks. The

Reserve Bank also identified a revised set of 11

financial conglomerates (FCs) for monitoring

purposes. The Reserve Bank formalised a

framework for taking enforcement action against

banks for non-compliance with guidelines and

instructions issued by it.

FINANCIAL STABILITY UNIT (FSU)

VI.5 FSU is responsible for analysing the risks

to financial stability, undertaking macro-prudential

surveillance through systemic stress tests and

other tools, and disseminating information relating

to the status of and challenges to financial

stability through the bi-annual Financial Stability

Report (FSR). FSU also acts as secretariat to

the sub-committee of the Financial Stability and

Development Council (FSDC), a coordination

council of regulators for maintaining financial

stability and monitoring macro-prudential

regulation in the country.

Agenda for 2016-17: Implementation Status

VI.6 As planned, FSR was published in

December 2016 along with the Report on Trend

and Progress of Banking in India (RTP) and in June

2017. Towards strengthening the stress testing

framework, a methodology for estimating sectoral

probability of defaults to model the dynamics of

risk weighted assets was developed and its output

is being assessed.

VI.7 FSU is coordinating the macro-level stress

testing exercise of all commercial banks as part

of the Financial Sector Assessment Programme

(FSAP) conducted jointly by the International

Monetary Fund (IMF) and the World Bank.

The Unit carried out stress tests based on the

scenarios agreed upon under FSAP so as to

broaden the scenario-based stress test analysis.

The key emerging sectoral vulnerabilities of banks

have also been analysed.

VI.8 The FSDC sub-committee held two

meetings in 2016-17 and reviewed various issues

including establishing a statutory financial data

management centre, developing corporate bond

market, minimum assured return scheme under

the National Pension System (NPS), regulation of

spot exchanges, setting up of computer emergency response team for the financial sector (CERT-Fin),

roadmap for the National Centre for Financial

Education, single pension regulator for the

pension sector in India, extant macro-prudential

framework in India, and framework for identification

of systemically important financial institutions

(SIFIs). The status of the recommendations of

the financial stability board (FSB) peer review of

India and the progress of FSAP 2017 were also

discussed by the sub-committee.

VI.9 Inter-Regulatory Technical Group (IRTG),

a sub-group of the FSDC sub-committee held

one meeting during the year and discussed the

implementation of the recommendations of Legal

Entity Identifier (LEI) working group.

Agenda for 2017-18

VI.10 In the year ahead, FSU will continue to

conduct macro-prudential surveillance, publish the

bi-annual FSR and conduct meetings of the FSDC

sub-committee. The feasibility of expanding the

contagion (network) analysis to urban cooperative

banks will also be examined.

REGULATION OF FINANCIAL

INTERMEDIARIES

Commercial Banks: Department of Banking

Regulation (DBR)

VI.11 DBR is the nodal department for regulation

of commercial banks. The regulatory measures

focus on ensuring a healthy and competitive

banking system in the country to promote financial

stability, and cost effective and inclusive banking

services.

Agenda for 2016-17: Implementation Status

Financial Stress and Reinforcements

VI.12 During 2016-17, the Reserve Bank further

strengthened the regulatory framework for dealing

with stressed assets, inter alia, by revising its guidelines on the resolution of stressed assets;

viz., the strategic debt restructuring (SDR) scheme,

the scheme for sustainable structuring of stressed

assets (S4A), flexible structuring of existing long

term project loans to infrastructure and core

industries; and guidelines for projects under

implementation. Keeping in view the critical role of

the bankruptcy and insolvency regime in shaping

the business environment as well as resolution of

debtors in distress, the government enacted the

Insolvency and Bankruptcy Code, 2016 in May

2016. This single law will override multiple and

overlapping laws and adjudicating forums dealing

with financial failures and insolvency of companies

and individuals in India (Box VI.2).

Box VI.2

The Insolvency and Bankruptcy Code, 2016

The Insolvency and Bankruptcy Code (IBC), 2016

consolidates and amends the laws relating to reorganisation

and insolvency resolution of corporate persons (excluding

financial service providers), partnership firms and individuals

in a time bound manner for maximising the value of assets

of such entities. Some of the key aspects of the IBC are set

out below.

1. IBC lays down a resolution process that is time bound

(180 days) and is undertaken by professionals. It

creates an institutional mechanism for the insolvency

resolution process for businesses either by coming up

with a viable survival mechanism or by ensuring their

prompt liquidation.

2. IBC’s institutional infrastructure comprises four pillars,

viz., insolvency professionals, information utilities,

adjudicating authorities and the Insolvency and

Bankruptcy Board of India (IBBI).

3. While insolvency resolution for companies will be

adjudicated by the National Company Law Tribunal

(NCLT), the same for firms and individuals will be

adjudicated by the Debt Recovery Tribunals (DRTs).

The IBBI is the apex body for promoting transparency

and governance in IBC’s administration.

4. Where a corporate debtor has defaulted in paying

a debt, the corporate insolvency resolution process may be initiated by a financial creditor, an operational

creditor or the corporate debtor itself.

5. A default-based test for entry into the insolvency

resolution process permits early intervention when the

corporate debtor shows early signs of financial distress.

6. On the distribution of proceeds from the sale of assets,

first priority is accorded to the costs of insolvency

resolution and liquidation, and second to the secured

debt together with workmen’s dues for the preceding

24 months. Central and state governments' dues are

ranked lower in priority.

By providing an effective legal framework for timely

resolution of insolvency and bankruptcy, IBC will support

the development of credit and corporate bond markets,

strengthen debt recovery, encourage entrepreneurship,

improve ease of doing business and facilitate more

investments. The code proposes a paradigm shift from

the existing ‘debtor in possession’ to a ‘creditor in control’

regime. Moreover, the priority accorded to secured creditors

is advantageous for entities such as banks.

IBC’s success hinges to a great extent on the efficient

functioning of information utilities. An adequate number of

insolvency professionals will also be needed to handle the

large number of cases. More benches of NCLT may also

have to be set up as the volume of references increases. |

VI.13 With a view to further strengthening banks’

ability to resolve their stressed assets effectively

and to enhance transparency in the entire

process, the Reserve Bank issued guidelines on

sale of stressed assets by banks on September

1, 2016. The guidelines require banks to identify

and list internally, at least once a year, the

specific financial assets identified for sale to other

institutions, including securitisation companies

(SCs)/reconstruction companies (RCs).

Branch Authorisation Policy

VI.14 The Reserve Bank issued final guidelines

on May 18, 2017, clarifying on what constitutes a

‘banking outlet’ and harmonising the treatment of

different forms of bank presence for the purpose of opening banking outlets in under-served areas

(Box VI.3).

Box VI.3

Rationalisation of Branch Authorisation

The first bi-monthly monetary policy statement 2016-17

announced on April 5, 2016 proposed to redefine branches

and permissible methods of outreach, keeping in mind the

various attributes of banks and the types of services that

are sought to be provided. Accordingly, based on the report

of an internal working group and public comments on the

report, final guidelines clarifying what is a ‘banking outlet’

and harmonising the treatment of different forms of bank

presence for the purpose of opening outlets in under-served

areas were issued on May 18, 2017 as under:

Banking outlet: A banking outlet includes a branch as well

as business correspondent (BC) outlet, among others.

For a domestic scheduled commercial bank (DSCB), a

small finance bank (SFB) and a payment bank (PB), it is

a fixed point service delivery unit, manned by either bank’s

staff or its BC where services of acceptance of deposits,

encashment of cheques/ cash withdrawal or lending of

money are provided for a minimum of four hours per day

for at least five days a week. If it provides services for less

number of hours per day and days in a week, it is considered

a part-time banking outlet.

Unbanked rural centre (URC): It is a rural (Tier 5 and 6)

centre that does not have a core banking solution (CBS)

enabled banking outlet of an SCB, a PB, an SFB or an RRB

nor a branch of a local area bank or a licensed co-operative

bank for carrying out customer based banking transactions.

Thus, the role of technological advances in banking services

is recognised as against the earlier definition based on a

brick and mortar structure.

Conditions for opening banking outlets: At least 25 per cent

of banking outlets opened during a financial year must be

opened in unbanked rural centres. Pro-rata benefit for part-time

banking outlets will also be extended. The opening of a

banking outlet/part-time banking outlet in a Tier 3 to 6 centre

of north-eastern states, Sikkim and left wing extremism

affected districts, notified by the Government of India, will be

considered as equivalent to opening a banking outlet/part-time

banking outlet in a URC. A bank opening a brick and

mortar branch in a rural (Tier 5 and 6) centre which – owing to

the presence of a BC outlet of another bank – is not defined

as a URC, will also be eligible for the same incentive. Similar

treatment will be given for opening a banking outlet in a rural

centre which is served only by a banking outlet of a PB.

Micro Finance Institution (MFI) structure of SFBs: Towards

preserving the advantages of the MFI/NBFC structure of

SFBs to promote financial inclusion, they have been allowed

three years from the commencement date, to align their

banking network with the extant guidelines. Till such time, the

existing structure may continue and the existing branches

will be treated as banking outlets though not immediately

reckoning for the 25 per cent norm. Nevertheless, during this

period of three years, the 25 per cent norm will be applicable

for all the banking outlets opened or converted from the

existing MFI branches in a year.

Role of board of directors: Financial inclusion being the

overarching objective of the revised framework and given the

operational flexibility being provided to banks, the boards of

banks have been accorded overall responsibility to ensure

that all the guidelines are complied with, in letter and spirit. |

Diversification of Lending Base

VI.15 Towards aligning the exposure norms for

Indian banks with the Basel Committee of Banking

Supervision (BCBS) standards and to further

diversify the banks’ lending base, on December 1,

2016, the Reserve Bank issued final guidelines on

large exposures framework (LEF), effective April

1, 2019. The exposure limits will consider a bank’s

exposure to all its counterparties and groups of

connected counterparties.

VI.16 To encourage funding from sources other

than bank credit for the corporate sector, the

Reserve Bank, in August 2016, issued guidelines

on enhancing credit supply for large borrowers

through market mechanism, effective April 1, 2017.

VI.17 Scheduled commercial banks (SCBs) were

advised that housing finance companies (HFCs)

will be risk weighted in a manner similar to that of

corporates to bring uniformity in the application of

risk weights among banks on their exposures.

VI.18 Banks were allowed to invest in Real Estate

Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) within the overall ceiling

of 20 per cent of net worth for direct investment

in convertible bonds/ debentures, units of equity-oriented

mutual funds and exposures to venture

capital funds.

Capital and Risk Management

VI.19 With a view to developing the market

for rupee-denominated bonds overseas and

providing an additional avenue for raising capital,

banks were permitted to issue rupee-denominated

perpetual debt instruments (PDI) overseas as part

of additional tier (AT)-1 capital and debt capital

instruments as part of Tier 2 capital.

VI.20 The guidelines on capital requirements

for banks’ exposures to central counterparties,

issued on November 10, 2016 and effective from

April 1, 2018, specified the credit risk treatment

for exposures to central counterparties arising from over the counter derivatives transactions,

exchange traded derivatives transactions,

securities financing transactions and long

settlement transactions. The Reserve Bank also

issued guidelines for computing exposure for

counterparty credit risk arising from derivatives

transactions.

VI.21 In line with the revised BCBS framework on

interest rate risk in the banking book, the Reserve

Bank issued draft guidelines on governance,

measurement and management of interest rate

risk in banking book on February 2, 2017 for

feedback/comments.

VI.22 In April 2015, the Reserve Bank had

formulated a scheme for setting up of IFSC banking

units (IBUs) by banks in International Financial

Services Centres (IFSCs). The instructions under

the scheme were modified in light of the feedback

from stakeholders (Box VI.4).

Box VI.4

Modifications in Permissible Activities of IFSC Banking Units (IBUs)

The scheme for setting up of IFSC banking units aims at

enabling banks to undertake activities largely akin to those

carried out by overseas branches of Indian banks. Certain

activities are, however, not allowed in view of the fact that

IBUs are functioning from the Indian soil and the legal and

regulatory framework is still governed by domestic laws

and there is no separate financial sector regulator for IFSC.

Nevertheless, IBUs were allowed progressively to undertake

more activities as recently as in April 2017 as summarised

below:

1. IBUs may undertake derivative transactions including

structured products that the banks operating in India

have been allowed. However, IBUs shall obtain the

Reserve Bank’s prior approval for offering any other

derivatives products.

2. Fixed deposits accepted by IBUs from non-banks

cannot be repaid prematurely within the first year.

However, fixed deposits accepted as collateral from

non-banks for availing credit facilities from IBUs or

deposited as margin in favour of an exchange, can be

adjusted prematurely in the event of a margin call or a

default in repayment.

3. An IBU can be a trading member of an exchange in

the IFSC for trading in the interest rate and currency

derivatives segments that banks operating in India have

been allowed to undertake.

4. An IBU can become a professional clearing member of

the exchange in the IFSC for clearing and settlement in

any derivatives segment.

5. IBUs are allowed to extend the facilities of bank

guarantees and short term loans to IFSC stock broking/

commodity broking entities.

6. Any financial institution or a branch of a financial

institution including an IBU operating in IFSC can

maintain special non-resident rupee (SNRR) accounts

with a bank (authorised dealer) in the domestic sector

for meeting its administrative expenses in Indian

rupee. These accounts must be funded only by foreign

currency remittances through a channel appropriate for

international remittances which will be subject to extant

FEMA regulations.

A Task Force (Chairman: Minister of State for Finance) is

monitoring the progress in the development of IFSCs. The

Reserve Bank is a member of the task force. |

VI.23 After a review of the criteria for determining

customer liability in unauthorised electronic

banking transactions, the final guidelines on

customer protection – limiting liabilities of

customers – have been issued.

VI.24 A regulatory framework making elements

of Basel III standards selectively applicable to the

All India Financial Institutions (AIFIs) is being put

in place.

VI.25 An Aadhaar enabled one time pin (OTP)

based e-KYC process was allowed in December

2016 for on-boarding of customers subject

to certain conditions. The Reserve Bank also

prescribed a customer due diligence procedure

for opening accounts of judicial persons such as

the government or its departments, societies, universities and local bodies like village

panchayats.

VI.26 The Reserve Bank issued directions to

scheduled commercial banks (excluding RRBs)

to comply with Indian Accounting Standards (Ind

AS) for financial statements beginning April 1,

2018 onwards, with comparatives for the periods

ending March 31, 2018 or thereafter. Banks were

also advised to submit proforma Ind AS financial

statements for the half year ended September

30, 2016. The Reserve Bank is in the process of

finalising the draft guidelines on key aspects of

expected credit loss (ECL) under Ind AS to ensure

minimum standards as also consistency in the

application of the standards to the extent possible

(Box VI.5).

Box VI.5

Implementation of Ind AS - Guidance on the Expected Credit Loss Framework

The implementation of Ind AS will mark a major shift from

the current accounting framework followed by banks in India

which is based on a melange of accounting standards and

regulatory guidelines, especially in certain key areas such

as classification and measurement of financial instruments,

and impairment of financial assets.

Recent developments in the banking system underscore

the continued importance of adequate provisioning,

commensurate with the increase in credit risk. Applying

an incurred loss provisioning framework can result in

impairments that are recognised after the loss event has

occurred, when the probability of default is close to 100

per cent. Provisions are not made as credit risk increases

significantly (although short of default) even where bank

management has information about stress/future likely

losses.

Ind AS 109 expresses the view that delinquency is a lagging

indicator of significant increase in credit risk. Banks are,

therefore, expected to have credit risk assessment and

measurement processes in place to ensure that credit risk

increases are detected ahead of exposures becoming past

due or delinquent, for timely transfer to lifetime expected credit losses. The standard differentiates between the three

stages of credit risk:

-

The financial assets in Stage 1 are those with no

significant increase in credit risk since initial recognition,

or financial instruments that have low credit risk at the

reporting date. For these assets, 12-month expected

credit losses (ECLs) are recognised in profit or loss.

-

The financial instruments in Stage 2 are those which

have experienced a significant increase in credit risk

since initial recognition, but with no objective evidence

of impairment. For such assets, lifetime ECLs are

recognised. This accounting treatment is based on

the rationale that an economic loss arises when ECLs

significantly exceed initial expectations. By recognising

lifetime ECLs following a significant increase in credit

risk, this economic loss is reflected in the financial

statements.

The financial instruments in Stage 3 comprise those for

which objective evidence indicates impairment at the

reporting date. These are typically non-performing loans

where the bank considers that the borrower is unlikely to pay the existing debt. Lifetime ECLs are recognised

for these exposures.

The estimated overall impact of Ind AS on regulatory

capital is likely to be adverse mainly due to the impairment

requirements under it. In view of the capital constraints

already faced by many banks, particularly public sector

banks, the Reserve Bank believes that it may be appropriate

to introduce transitional arrangements for the impact of

accounting changes on regulatory capital. The primary

objective of a transitional arrangement is to avoid a 'capital shock’, by giving banks time to rebuild their capital resources

following a potentially significant negative impact arising

from the introduction of ECL accounting.

The Reserve Bank is also considering the introduction of

‘regulatory floor’ for provisioning in the regulatory capital

calculation, i.e., when a bank makes lower accounting

provisions than the standardised regulatory floor amounts,

the shortfall would be deducted from the bank’s common

equity tier (CET)1 capital, which would incentivise robust

provisioning. |

VI.27 A discussion paper on wholesale and long-term

finance banks was released in April 2017.

It explores the scope of setting up more such

differentiated banks in a backdrop of in-principle

approvals and licenses issued to set up payments

banks and small finance banks (Box VI.6).

VI.28 Considering payments banks and small

finance banks’ differentiated nature of business

and their focus on financial inclusion, separate operating guidelines for these banks were issued

in October 2016. The guidelines elaborate

upon the areas of prudential regulations, risk

management, ownership and control regulations,

corporate governance, and banking operations to

be adhered to by these banks.

Box VI.6

Discussion Paper on Wholesale and Long-Term Finance Banks

The proposed differentiated banks – wholesale and long-term

finance (WLTF) banks – are expected to focus primarily

on lending to infrastructure sector and small, medium

and corporate businesses. They can mobilise liquidity for

banks and financial institutions directly originating priority

sector assets, through the securitisation of such assets

and actively dealing in them as market makers. They may

also act as market-makers in securities such as corporate

bonds, credit derivatives, warehouse receipts and take-out

financing. These banks can provide refinance to lending

institutions and may be present in capital markets in the

form of aggregators. The primary sources of funds for these

banks could be a combination of wholesale and long term

deposits (above a large threshold), debt/equity capital raised

from primary market issues or private placement, and term

borrowings from banks and other financial institutions.

Financial structures in some countries support banks

concentrating on wholesale and long-term financing. Some

of these institutions in the public sector, which began as part of the government-backed development policy, have begun

their transition towards privatisation.

The stipulations for WLTF banks, expected to be different

from universal banks, are mooted as: (i) higher initial

minimum capital of ₹10 billion, (ii) negligible lending

exposure to the retail sector, no savings accounts, and a

higher threshold for term deposits of above ₹100 million, (iii)

exemption from Statutory Liquidity Ratio (SLR) requirements

and some relaxation in the prudential norms on liquidity risk,

and (iv) exemption from a mandatory rural presence and

priority sector lending requirements.

The issues for discussion posed by the discussion paper

are: (i) whether there is a need for licensing WLTF banks

when their proposed activities are currently allowed for

universal banks, (ii) whether the time is opportune for

this, (iii) what will be the net impact of such players on the

financial system, and (iv) whether the proposed regulatory

framework is appropriate. |

VI.29 As part of the efforts to promote financial

inclusion through a greater focus on small credit

and payment/remittance facilities, the Reserve Bank issued licenses to eight SFBs and six PBs

during the year taking the number of licensees to

10 in case of SFBs and seven in case of PBs. Eight

SFBs and four PBs have commenced operations.

VI.30 The Depositors' Education and Awareness

(DEA) Fund, started in February 2014, had

accumulated a corpus of ₹124 billion at end-

March, 2017, and a total of 2,145 banks were

registered for transfer of unclaimed amounts to

the DEA Fund.

VI.31 The fields of specialisation for the directors

on the boards of commercial banks (excluding

RRBs) were broadened in May 2017 to include

(i) information technology, (ii) payment and

settlement systems, (iii) human resources, (iv) risk

management, and (v) business management to

bring in persons with professional knowledge and

experience in these fields to the banks’ boards.

VI.32 An inter-regulatory working group

(Chairman: Shri Sudarshan Sen, Executive

Director) was set up in July 2016 with members

drawn from the Reserve Bank, SEBI, IRDA,

PFRDA, IDRBT, select banks and rating agencies

to examine the granular aspects of Fin Tech,

particularly from the perspective of reorienting the

regulatory framework. The report of the working

group was submitted to the Reserve Bank in

February 2017 for consideration.

Agenda for 2017-18

VI.33 The Reserve Bank will continue to focus

on improving the institutional framework for a

sound banking system in the country, particularly

addressing asset quality issues. Implementation

of Ind AS and the Basel III framework will be the

areas of focus during 2017-18.

VI.34 In the context of Ind AS implementation,

the Bank will issue guidelines on regulatory floors

for asset provisioning. Guidelines on mechanics

of the transitional arrangements will also be

issued.

VI.35 The Reserve Bank will analyse the Ind

AS financial statements submitted by banks for

the quarter ended June 30, 2017 as part of the

regulatory reporting. It will review other extant

instructions in the light of Ind AS implementation.

VI.36 A discussion paper on margin requirements

for non-centrally cleared derivatives was issued

in May 2016. The final guidelines on margin

requirements for non-centrally cleared derivatives

will be issued, after a review of the developments

globally, as also the availability of infrastructure

required for exchange of such margins in India.

VI.37 The revised framework for securitisation,

the minimum capital for market risk and the

guidelines on corporate governance as per Basel

standards shall also be issued.

VI.38 The Basel III norms prescribe two minimum

standards for banks – the liquidity coverage ratio

(LCR) and the net stable funding ratio (NSFR) –

for promoting short-term resilience of banks to

potential liquidity disruptions and resilience over

a longer-term time horizon, respectively. The LCR

guidelines are effective in India since January 1,

2015. The draft guidelines on NSFR were issued

in May 2015. The final guidelines will be issued

during 2017-18.

VI.39 The revised regulatory framework for the

AIFIs, including extension of various elements of

Basel III standards relevant to these institutions,

will be issued after due consultations with

stakeholders.

Cooperative Banks: Department of

Cooperative Bank Regulation (DCBR)

VI.40 The Reserve Bank continues to play

a key role in the revival and strengthening of

the cooperative banking sector by fortifying the

regulatory and supervisory framework. In this

context, DCBR, in charge of prudential regulations

of cooperative banks, took the following initiatives

in 2016-17.

Agenda for 2016-17: Implementation Status

Harmonisation of Regulatory Policies

VI.41 Taking the process of harmonisation of

regulations forward, cooperative banks fulfilling

certain criteria were allowed to issue/ redeem

long term (subordinated) deposits (LTDs) without

the prior approval of the Reserve Bank provided

mandatory disclosure requirements were made.

The guidelines on non-SLR investments by rural

cooperative banks were aligned with those for

urban cooperative banks (UCBs). Guidelines

were issued for deployment of point of sale (POS) terminals and issuance of prepaid instruments by

all cooperative banks.

Revival and Licensing of Unlicensed DCCBs

VI.42 The government launched a scheme for

revival of 23 unlicensed DCCBs (Uttar Pradesh

-16, Maharashtra - 3, Jammu and Kashmir -

3 and West Bengal - 1) in November 2014.

Accordingly, a tripartite agreement in the form

of a memorandum of understanding was signed

between the central government, the concerned

state government and NABARD. With the release

of funds by the government, the concerned state

government and NABARD, banking licenses were

issued to the unlicensed DCCBs in Uttar Pradesh,

Maharashtra and West Bengal, bringing down

the number of unlicensed DCCBs to three by

September 30, 2016. Licensing of the remaining

DCCBs has been taken up with the state of

Jammu & Kashmir. There is also a move towards

reducing the tiers in the cooperative structure

with a view to reducing the cost of borrowings for

final borrowers (Box VI.7).

Box VI.7

Two-tier Rural Cooperative Structure in Jharkhand

The short term cooperative credit structure (STCCS) of

the country primarily meets the crop and working capital

requirements of farmers and rural artisans. The pyramid of

STCCS is primarily 3-tier and is federal in nature within a

state. The apex level is the state cooperative bank (StCB),

at the district level there are district central cooperative

banks (DCCBs) and at the village level, there are primary

agricultural credit societies (PACS). Across India, there are

more than 93,000 PACS having a membership base of 120

million. The structure of STCCS is not uniform across the

states with a 3-tier structure in 16 states and 2-tier structure

in 13 smaller states and union territories where PACS are

directly affiliated to StCBs. There is a mixed structure in

three states – 2-tier in some districts and 3-tier in others.

Notwithstanding the phenomenal outreach and volume

of operations, the financial health of STCCS has been a matter of concern. In a 3-tier credit structure, each tier

adds to cost and margins leading to an escalation in the

cost of borrowings for the ultimate borrowers. The interest

rate structure also varies from one state to another. Since

STCCS deals with relatively larger number of small value

loan accounts as compared with commercial banks and

RRBs, the transaction cost also tends to be high.

The relevance of the three-tier credit structure has been

examined by several committees in the past (notably, those

headed by Professor V. S. Vyas, Shri Jagdish Capoor,

Professor Vaidyanathan and Dr. Prakash Bakshi). The Vyas

Committee argued for the elimination of one of the tiers to

bring down costs for ultimate borrowers. The NABARD Act,

1981 was amended in 2003 to provide for direct refinance

to DCCBs but no concrete action has been initiated towards

reducing tiers in STCCS.

In 2013, the Jharkhand State Cooperative Bank (JStCB)

took a path breaking initiative and approached the Reserve

Bank to approve establishment of a 2-tier rural cooperative

structure in the state to replace the age-old 3-tier structure.

The state proposed to merge all the DCCBs with JStCB.

Considering the merits of the request, ‘in-principle’ approval

was given for the amalgamation of all eight DCCBs with

JStCB in October 2013. However, since the Dhanbad DCCB

went to court against the state’s decision of amalgamation,

the state came up with a revised proposal to amalgamate

seven DCCBs with JStCB. The Reserve Bank accorded

‘in-principle’ approval to the revised proposal in November

2014.

NABARD carried out a snap scrutiny of the amalgamated

entity in March 2017 following an infusion of a ₹500 million

grant by the state that enabled JStCB to achieve CRAR of

more than 9 per cent. It was observed that the amalgamation

of STCCS entailed a stronger structure in terms of

improvements in operational, managerial and governance

efficiency. Consequently, the Reserve Bank conveyed its

final approval to the amalgamation proposal on March 30,

2017 and the state government issued a notification for

amalgamation of seven DCCBs with JStCB on March 31,

2017. The new entity started functioning from April 1, 2017,

ushering an era of 2-tier cooperative credit structure in the

state, barring the pending court case of the Dhanbad DCCB. |

Scheduling, Licensing, Mergers and Voluntary

Conversions

VI.43 During the year, one state cooperative

bank – the Telangana State Cooperative Apex

Bank Ltd. – was included in the second schedule

to the RBI Act, 1934. Five merger proposals

received from UCBs were approved, out of which

two proposals were implemented, two proposals

are under process while one proposal was

withdrawn by the target bank. Further, three UCBs

voluntarily converted themselves into non-banking

institutions under Section 36A (2) of the Banking

Regulation Act, 1949.

Other Developments

VI.44 A scheme of financial assistance to UCBs

for implementing the core banking solution (CBS)

was announced on April 13, 2016 in consultation

with IDRBT/Indian Financial Technology and Allied

Services (IFTAS) (a subsidiary of IDRBT). Under

the scheme, the initial setup cost of ₹0.4 million

is paid by the Reserve Bank to IFTAS. During

the year, 23 UCBs implemented CBS under the

scheme taking the number of CBS-compliant

UCBs to 1,301 out of a total of 1,561 UCBs.

Agenda for 2017-18

VI.45 Further harmonisation of the guidelines for

rural and urban cooperative banks will continue to

be an agenda for 2017-18. The Reserve Bank will

pursue the process of recapitalisation and licensing

of the remaining three DCCBs in Jammu & Kashmir

under the rehabilitation scheme approved by the

government to create an environment where only

licensed rural cooperative banks operate in the

banking space. The supervisory action framework

for UCBs, framed in 2014, will be reviewed with a

view to engaging with the concerned banks at an

early stage for corrective action. Implementation

of CBS under the scheme of financial assistance

to UCBs will be taken forward during the year. The

Reserve Bank will formulate certain standards

and benchmarks for CBS in UCBs in consultation

with IDRBT in order to make it more robust.

Non-Banking Financial Companies (NBFCs):

Department of Non-Banking Regulation

(DNBR)

VI.46 NBFCs play a vital role in providing credit

by complementing commercial banks and also

cater to some niche sectors. DNBR is entrusted with the regulation of the NBFC sector with a

view to providing a conducive environment for

orderly growth of the sector as also protecting the

interests of depositors and customers.

Agenda for 2016-17: Implementation Status

VI.47 During the year, the Reserve Bank issued

guidelines on NBFC-account aggregators (NBFCAAs).

Subsequently, the process of registering

NBFC-AAs has been initiated. The guidelines

to banks for relief measures in areas affected

by natural calamities, were extended mutatis

mutandis to NBFCs.

VI.48 The guidelines on pricing of credit were

issued for NBFC-microfinance institutions (NBFCMFIs)

to ensure that the average interest rate on

loans sanctioned during a quarter does not exceed

the average borrowing cost during the preceding

quarter plus the margin, within the prescribed cap.

Guidelines in respect of disbursal of loans in cash

by NBFCs were amended to align these with the

requirements under the Income Tax Act, 1961.

VI.49 Keeping in view the role of asset

reconstruction companies (ARCs) in resolving

stressed assets as also the recent regulatory

changes governing the sale of stressed assets

by banks to ARCs, the minimum net owned fund

requirement for ARCs was fixed at ₹1 billion

on an on-going basis, effective April 28, 2017

(Box VI.8). In terms of Section 30A, 30B and

30C of the SARFAESI Act, 2002, the Reserve

Bank has designated Adjudicating Authority for

imposing penalty on ARCs for non-compliance

of any direction issued by the Reserve Bank.

Further, the Reserve Bank has designated the

Appellate Authority for deciding on an appeal

filed by the aggrieved party. These guidelines will

come into force after its notification by the central

government.

Box VI.8

Asset Reconstruction Companies: Progress and the Way Forward

During the late 1990s, in view of the rising level of bank

NPAs, the Narasimham Committee II and Andhyarujina

Committee were constituted to examine the scope for

banking sector reforms and the need for changes in the

legal system to resolve NPAs. These committees suggested

a new legislation for securitisation, empowering banks

and financial institutions (FIs) to take possession of the

securities and sell them without the intervention of the court.

Accordingly, the SARFAESI Act (the Act) was enacted in 2002

to provide an enabling environment for resolution of NPAs

and for strengthening the financial sector. It provides three

alternative methods for recovery of NPAs – securitisation,

asset reconstruction and enforcement of security interests. It

envisaged the formation of asset reconstruction companies

(ARCs) under Section 3 of the Act.

ARC’s primary goal is to acquire, manage and recover the

financial assets which have been classified as NPAs by the

banks/FIs. Presently, there are 24 ARCs in the country. The

Reserve Bank has been assigned powers under the Act to regulate and supervise ARCs. An ARC can acquire and

keep the financial asset – NPAs – in its own balance sheet or

transfer it to one or more trust(s) (set up under Section 7 of

the Act) at a price at which the asset was acquired from the

originator (secured lender). Most of the deals are structured

with a 15 per cent upfront payment to the seller banks/

FIs and issue of security receipts (SRs) for the remaining

amount with a defined cash-flow waterfall. Management

fee, a primary source of income for ARCs, has priority

(after netting the expenses) over redemption of SRs. The

trusteeship of such trusts vests with the ARC.

The net owned fund requirement for ARCs was raised from

₹20 million to ₹1 billion effective April 28, 2017 with a view

to attract serious players to the business. Other recent

measures for encouraging the sector include 100 per cent

foreign direct investment (FDI) under the automatic route,

removal of the limit on shareholding by a sponsor, and

inclusion of additional qualified buyers for investments in

SRs. |

VI.50 The NBFC sector has evolved over a

period of time resulting in a variety of categories of

NBFCs. The different categories were envisaged

to promote specific sector/ asset classes and hence different sets of regulatory prescriptions

were put in place. There are NBFCs catering

to asset financing, infrastructure financing,

microfinance, lending, etc. At present, there are

eleven categories of NBFCs – Asset Finance

Company (AFC), Loan Company (LC), Investment

Company (IC), Core Investment Company (CIC),

NBFC-Factor, IDF-NBFC, Infrastructure Finance

Company (IFC), NBFC-MFI, NOFHC, NBFC-AA

and Mortgage Guarantee Company (MGC). In

line with the Reserve Bank’s medium term goal

of moving toward activity-based regulation rather

than entity-based regulation, the rationalisation of

multiple categories of NBFCs into fewer categories

is under way.

Agenda for 2017-18

VI.51 Going forward, the Reserve Bank will

rationalise the NBFCs into fewer categories. The

Bank will oversee the time-bound implementation

of Ind AS, converged with IFRS, by NBFCs.

SUPERVISION OF FINANCIAL

INTERMEDIARIES

Commercial Bank: Department of Banking

Supervision (DBS)

VI.52 DBS supervises all SCBs (excluding

RRBs), local area banks (LABs), payment

banks, small finance banks and AIFIs within the existing legal and regulatory framework, based

on supervisory inputs received through off-site

monitoring and on-site inspections.

Agenda for 2016-17: Implementation Status

VI.53 During 2016-17, all SCBs operating in India

(excluding RRBs and LABs) were brought under

risk based supervision – Supervisory Programme

for Assessment of Risk and Capital (SPARC).

The Reserve Bank also started the process of

developing a suitable framework for supervising

PBs and SFBs. The supervisory process is

being strengthened by incorporating elements

of continuous supervision in off-site monitoring

(Box VI.9).

VI.54 The inter-regulatory forum for monitoring

financial conglomerates (IRF-FC) identified a

revised set of 11 FCs in the Indian financial

sector including five bank-led FCs, four insurance

company-led FCs and two securities company-led

FCs, based on their significant presence in two or

more segments of the financial sector.

Box VI.9

Asset Quality Review (AQR) in Perspective – Lessons Learnt

The Asset Quality Review (AQR), undertaken in 2015-

16 for all major banks together, was aimed at making

banks recognise their asset quality realistically. It provided

valuable insights on asset quality at the individual bank/

system level and ensured uniformity in identification of

non-performing assets (NPAs) at the system level. Further,

the early finalisation and communication of divergences

in provisioning gave banks more time for effecting the

additional provisioning over subsequent quarters. AQR was extensively based on off-site data from the Central

Repository for Information on Large Credits (CRILC).

The exercise clearly brought out the importance of

data analysis for effective supervision. In particular, it

emphasised the importance of collecting relevant data,

ensuring robust data quality and integrity and the use of IT

infrastructure for carrying out an incisive off-site analysis

which, in conjunction with on-site assessment, ensures an

effectively continuous supervisory assessment. |

VI.55 A revised prompt corrective action

(PCA) framework for banks was rolled out for

implementation from 2017-18 based on the

financials of banks for the year ended March 31,

2017. The PCA matrix notified under the revised

framework specifies indicators and risk thresholds under four areas – capital (breach of either CRAR

or common equity tier (CET) 1 ratio), asset quality,

profitability and leverage (Box VI.10).

Box VI.10

Revised Prompt Corrective Action Framework for Banks

The prompt corrective action (PCA) framework for banks

was introduced by the Reserve Bank in December 2002 as

an early intervention mechanism. The sub-committee of the

Financial Stability and Development Council (FSDC-SC) in

its meeting held in December 2014 decided to introduce the

PCA framework for all regulated entities. Subsequently, the

Reserve Bank reviewed the existing PCA framework keeping

in view the recommendations of the working group on

resolution regimes for financial institutions in India (January

2014), the Financial Sector Legislative Reforms Commission

(FSLRC, March 2013) and international best practices. The

Board for Financial Supervision (BFS) decided to implement the provisions of the revised PCA framework with effect from

April 1, 2017, based on the financials for March 31, 2017.

Capital, asset quality and profitability continue to be the

key areas for monitoring under the revised framework.

However, common equity Tier-1(CET 1) ratio will constitute

an additional trigger and leverage will also be monitored.

The revised PCA defines certain risk thresholds, breach of

which would lead to invocation of PCA and invite certain

mandatory and discretionary actions. The PCA framework

will apply to all banks operating in India including small

banks and foreign banks operating through branches or

subsidiaries. |

VI.56 In line with BCBS principles on cross-border

supervisory cooperation, the Reserve

Bank has set up supervisory colleges for Indian

banks with considerable overseas presence,

viz., State Bank of India (SBI), ICICI Bank Ltd.,

Bank of Baroda, Bank of India, Punjab National

Bank and Axis Bank Ltd. The major objectives of

supervisory colleges are to enhance information

exchange and cooperation among supervisors to

improve understanding of the risk profile of the

banking group, thereby facilitating more effective

supervision of the internationally active banks. The

Reserve Bank held meetings of all the supervisory

colleges during 2016-17.

VI.57 With a view to assessing banks’ cyber

security preparedness, the Reserve Bank

mandated a baseline cyber security and

resilience framework and conducted IT/cyber

security examinations/ vulnerability assessments

to evaluate their responses to cyber security

incidents. It also conducted targeted inspections in the wake of certain cyber security incidents of

significant concern. The Reserve Bank conducted

trainings on cyber security with hands-on sessions

for its IT examiners to build skills in cyber security

assessment.

VI.58 In order to improve data quality, a

working group was set up with members from

major public sector, private and foreign banks

to rationalise existing off-site returns. The group

submitted its report in September 2016. The

various recommendations of the group, after

due consideration and approval, are being

implemented in a phased manner.

VI.59 Towards enhancing supervisory focus, the

department conducted some thematic studies

during the year relating to derivatives portfolio

and custodial services offered by foreign banks;

non-credit related facilities and trade finance; and

real estate exposure/housing finance. The studies

were shared with the concerned departments for

policy action.

VI.60 Migration of supervisory returns, other

than off-site monitoring and surveillance

(OSMOS) returns, to the eXtensible business

reporting language (XBRL) reporting platform is under progress. Returns relating to fraud reporting

and monitoring have been migrated to the XBRL

reporting platform.

VI.61 Taking the process of cross-border

supervisory cooperation and exchange of

supervisory information further, the Reserve

Bank signed memoranda of understanding

(MoUs) with seven overseas banking supervisory

authorities during the year, viz., the Central

Bank of Myanmar, the Banking Regulation

and Supervision Agency of Turkey, the Central

Bank of Nigeria, the Bank of Zambia, the Bank

of Guyana, the Bank of Thailand and the Royal

Monetary Authority of Bhutan. Further, a letter

of cooperation was executed with the Czech

National Bank. With this, the Reserve Bank has

signed 40 MoUs, two letters of cooperation and

one statement of cooperation.

VI.62 The Reserve Bank launched a Central

Fraud Registry (CFR), a web-based online

searchable database in January 2016. However,

usage of CFR by banks, especially PSBs, is yet to

pick up on expected lines.

Agenda for 2017-18

VI.63 A joint working group of regulators

constituted by IRF-FC will develop a format and

structure for a data template for capturing systemic

risks arising out of FC activities.

VI.64 As part of capacity building on SPARC, the

Reserve Bank will continue to conduct focused

workshops and orientation sessions for internal and

external stakeholders. Further, specific sessions

for board members and top managements of the

banks as also for other external stakeholders will

be on the agenda for 2017-18.

VI.65 A suitable supervisory framework for

small finance banks and payment banks will be

developed and implemented. Further, in view of

the implementation of Ind AS by banks, its impact

on their quantitative and qualitative reporting

will be reviewed, aligned and integrated with the

supervisory framework.

VI.66 Taking into account concerns arising from

examination of IT risks in banks, thematic studies

and assessments will be undertaken on specific

domains for appropriate policy and supervisory

interventions (Box VI.11). Based on the off-site assessment of the key risk indicators in cyber

security, IT examinations with a risk based

approach will be conducted in 2017-18. The

findings will be factored in the overall assessment

of risks in banks. Assessment of IT risks in other

regulated entities such as major urban cooperative

banks will be covered in a phased manner. A

back office support system (BOSS) has been

established for this. With a view to enabling a more

efficient supervisory assessment of banks, BOSS

will develop standard data templates on major

concern areas under various risk categories.

Box VI.11

Standing Committee on Cyber Security

In the wake of exponential growth of digitalisation in banks,

cyber risks have emerged as a major area of concern.

Conscious of the rising threats to the cyber infrastructure

in its regulated entities, the Reserve Bank has taken a

number of measures, particularly over the last two years.

Based on the recommendations of the Expert Panel on

Cyber Security and Information Technology Examination

(Chairperson: Smt. Meena Hemchandra), guidelines were

issued to banks in June 2016, mandating cyber security

preparedness. Banks’ progress in strengthening their cyber

resilience and response is being monitored. Recognising

the increasing frequency and complexity of cyber security

incidents, the monetary policy statement of February 8, 2017

announced that an Inter-disciplinary Standing Committee will be set up to conduct an ongoing review of the cyber

security landscape and emerging threats.

The remit of the committee, inter alia, includes reviewing the

threats inherent in existing/emerging technology; studying

adoption of various security standards/protocols; interfacing

with stakeholders; and suggesting appropriate policy

interventions to strengthen cyber security and resilience.

The committee was constituted on February 28, 2017

(Chairperson: Smt. Meena Hemchandra, Executive Director).

Members of the committee include experts on cyber security

in the Reserve Bank as well as from outside. The committee

is meeting regularly and, as per its recommendations, sub-groups

have been formed on certain focus areas for an in-depth

examination. |

Cooperative Banks: Department of

Cooperative Bank Supervision (DCBS)

VI.67 DCBS is entrusted with the supervisory

responsibility of primary (urban) cooperative

banks (UCBs) to ensure a safe and well managed

cooperative banking sector. The department

undertakes supervision of these banks on an on-going

basis through periodic on-site inspections

and continuous off-site monitoring.

Agenda for 2016-17: Implementation Status

VI.68 The Reserve Bank began focused

attention on select weak UCBs by way of intensive

hand-holding and periodic training in the identified

areas of weakness. It organised a conference on

‘Building Banks Co-operatively - Professionalise

and Progress’ in Ahmedabad inviting participation

from the state government, other stakeholders and

the top management of the Reserve Bank. During

the year, several training programmes for capacity

building were conducted by regional offices for

CEOs/directors/officials of UCBs and auditors of

UCBs.

Agenda for 2017-18

VI.69 The department will continue to identify

select UCBs for hand-holding and impart focused

training to them for all round improvement in their functioning. In addition, the Department will take

initiatives for capacity building for both supervisors

and supervised entities – UCBs – in the coming

year. In this direction, conferences on cooperative

banking as organised last year will be conducted.

As the development of software package for DCBS

returns has been completed under XBRL-based

reporting platform, the Department will focus on

stabilising the package and ensuring submission

of timely and reliable data through the platform by

all UCBs.

NBFCs: Department of Non-Banking

Supervision (DNBS)

VI.70 DNBS supervises the NBFC sector in

the country, which is a fast growing sector with

significant diversity in terms of size and operational

dimensions. The department supervises more

than 11,500 NBFCs of which 222 are non-deposit

taking systemically important ones.

Agenda for 2016-17: Implementation Status

VI.71 The role of statutory auditors in the

certification process was enhanced by enabling

on-line filing of statutory auditors certificate (SAC).

Further, the Institute of Chartered Accountants of

India (ICAI) agreed to digitally authenticate the

returns of small NBFCs on the XBRL platform,

which will be operationalised soon. The Reserve

Bank focused on improving adherence to the fair

practices code by NBFCs through levy of penalties.

The Bank is in the final stages of incorporating

risk factors in the existing CAMELS model of

inspection of NBFCs. The project for automation

of all regulatory approvals of NBFCs has been

initiated and this will be operationalised in 2017-

18. The Reserve Bank also operationalised a

formal PCA framework for NBFCs.

Agenda for 2017-18

VI.72 The department will put in place a

supervisory rating system for ARCs. The Sachet portal on NBFCs will be refurbished by improving

readability and functionalities (Box VI.12). A

detailed standard operating procedure for noncompliant

and/or inactive small NBFCs will also

be operationalised.

Box VI.12

Sachet Portal

The Reserve Bank launched a mobile friendly portal

Sachet (sachet.rbi.org.in) on August 4, 2016 to help the

public as well as regulators to ensure that only regulated

entities accept deposits from the public. The portal can be

used by the public to share information including through

uploading photographs of advertisements/publicity material,

raise queries on any fund raising/investment schemes that

they come across and lodge and track complaints. The

portal has links to all regulators and the public can easily

access information on lists of regulated entities. The portal

has a section for a closed user group – the state level

coordination committees (SLCCs), inter-regulatory forums

for exchange of information and coordinated action on unauthorised deposit collection and financial activities. It will

help in enhancing coordination among regulators and state

government agencies and will serve as a useful source of

information for early detection and curbing of unauthorised

acceptance of deposits. The portal is designed to place the

entire proceedings of SLCCs on an IT platform. It facilitates

comprehensive MIS with respect to complaints received,

referred to regulators / law enforcement agencies and for

monitoring the progress in redressal of such complaints.

Complaints relating to unauthorised deposit collection and

financial activities that have been lodged in Sachet have

been taken up expeditiously with respective regulators for

resolution. |

Enforcement Department (EFD)

VI.73 Taking note of the changes in the global

and domestic financial sector environment, with a

view to separate the function of identification of

contravention of respective statutes/guidelines

and directives by the regulated entities from

imposition of punitive action and to make this

process endogenous, formal and structured, a

separate Enforcement Department was created within the Reserve Bank with effect from April 3,

2017 (Box VI.13).

Box VI.13

Supervisory Enforcement Framework

An effective system of banking supervision, inter alia,

depends on effective enforcement of supervisory policies

which, in turn, needs a unified and well-articulated

supervisory enforcement policy and institutional

framework. Taking cognisance of such a need, the

Board for Financial Supervision approved a Supervisory

Enforcement Framework for action against non-compliant

banks. Following a subsequent announcement in the 6th bi-monthly monetary policy statement of February 2017, a

separate Enforcement Department was established in April

2017.

Over time, the framework is expected to make the Reserve

Bank’s enforcement actions more transparent, predictable,

standardised, consistent and timely, leading to improvement

in the banks’ overall compliance with the regulatory

framework. |

VI.74 The core function of the department is to

enforce regulations with the objective of ensuring

financial system stability and promoting public

interest and consumer protection. The department

will, inter alia, (i) develop a sound policy framework

for enforcement consistent with international best

practices; (ii) identify actionable violations on

the basis of inspections/supervisory reports and

market intelligence reports received/generated

by it, conduct further investigations/verifications,

if required, on the actionable violations thus

identified and enforce them in an objective, consistent and non-partisan manner; (iii) deal

with the complaints referred to it by the Bank's top

management for possible enforcement action, and

(iv) act as a secretariat to the Executive Directors’

Committee constituted for adjudication.

VI.75 To begin with, the department will focus

on the enforcement of penalty provisions under

the Banking Regulation Act. In the medium-term,

the entire enforcement function of the Reserve

Bank will be migrated to EFD. In 2017-18, the

department will develop a policy framework for

enforcement; put in place detailed protocols for

information sharing with other regulatory and

supervisory departments of the Reserve Bank,

other regulators and the government; create

channels for generating actionable market

intelligence; and initiate enforcement action.

CONSUMER EDUCATION AND PROTECTION

Consumer Education and Protection

Department (CEPD)

VI.76 The Reserve Bank has always recognised

protection of consumers’ interests as a key area

and has accorded high priority to providing safe

and efficient services to the customers of banks.

CEPD is the nodal department in the Bank for

monitoring the function of protection of consumer

interests.

Agenda for 2016-17: Implementation Status

VI.77 The Reserve Bank operationalised the

Charter of Customer Rights in 2014-15 for

strengthening customer protection in banks.

During the year, the Reserve Bank advised the

banks to furnish a certificate in the specified

proforma under the signature of the MD or CEO

certifying that their customer service policy was

fine-tuned to incorporate the principles of the

Charter of Customer Rights. All the banks have

submitted the certificate.

VI.78 The Reserve Bank's Banking Ombudsman

(BO) Scheme – a dispute redressal mechanism

notified under Section 35(A) of the Banking

Regulation Act, 1949 – has been in existence

since 1995. The scheme has been reviewed

periodically and its latest comprehensive

review was undertaken in 2015-16 covering

pecuniary jurisdiction of the BO, compensation

and grounds of complaint and rationalisation of

certain clauses of the scheme. The scheme was

amended accordingly. The government, during the

year, conveyed its concurrence to the amended

Banking Ombudsman Scheme. The amended

scheme came into effect from July 1, 2017. The

Reserve Bank also opened and operationalised

five new offices of the BO in Dehradun, Jammu,

Ranchi, Raipur and an additional office in New

Delhi. At present, the total number of BO offices

has reached 20.

VI.79 The Reserve Bank in consultation with

the Indian Banks' Association (IBA) reviewed the

forms commonly used by customers in banks

and suggested standardisation of these forms.

Accordingly, IBA released modified and user

friendly specimens of ten commonly used forms

during the year to banks for implementation.

VI.80 Aspects and modalities of setting up

of an Ombudsman Scheme (OBS) for NBFCs

were examined and discussed with concerned

regulatory and supervisory departments

(Box VI.14).

Box VI.14

The Ombudsman Scheme for Non-Banking Financial Companies

A pressing need has been felt for setting up a cost effective,

expeditious and easily accessible alternative dispute

resolution mechanism in the form of the ombudsman

scheme (OBS) for customers of NBFCs.

As compared to banks, the NBFCs are relatively larger in

number and vary substantially in terms of their activities and

size. These aspects need to be weighed carefully before

setting up an OBS for the NBFCs.