During the year, a major challenge in the aftermath of COVID-19 pandemic was the management of debt both for the central and state governments. In this milieu, the Reserve Bank took conventional and unconventional measures in order to maintain the orderly market conditions along with ensuring that the financial needs of the governments are met, while keeping in mind the major objectives of cost minimisation, risk mitigation and market development. Supported by these measures, the weighted average cost of government borrowings through primary issuances of central government dated securities during 2020-21 was at 17-year low of 5.79 per cent despite a 141.2 per cent jump in net market borrowings of the central government. VII.1 The Internal Debt Management Department (IDMD) of the Reserve Bank is entrusted with the responsibility of managing the domestic debt of the central government by statute vide Sections 20 and 21 of the RBI Act, 1934, and of 28 state governments and two union territories (UTs) in accordance with bilateral agreements as provided in Section 21A of the said Act. Further, short-term credit is provided up to three months to both central and state governments/UTs in the form of Ways and Means Advances (WMA) to bridge temporary mismatch in their cash flows, as laid down in terms of Section 17(5) of the RBI Act, 1934. VII.2 The remainder of the chapter is arranged in three sections. Section 2 presents the implementation status in respect of the agenda for 2020-21. Section 3 covers major initiatives to be undertaken in 2021-22, followed by a summary in last section. 2. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 VII.3 The Department had set out the following goals for 2020-21: -

Consolidation of debt through calendar-driven, auction-based switches and buyback operations along with reissuances of securities to augment liquidity in Government of India (GoI) securities (G-sec) market and facilitate fresh issuance (Para VII.5 - VII.7); -

Ease of doing business in the G-sec market – hiving off servicing of compensation bonds issued in physical forms to state treasuries (Utkarsh) [Para VII.8]; -

Complete the process of mirroring of gilt account in e-Kuber; examine the feasibility of marking lien by banks for loans against G-sec in the Reserve Bank’s e-Kuber portal; and review guidelines on subsidiary general ledger (SGL)/constituent subsidiary general ledger account (CSGL) [Para VII.9]; -

Introduction of Separate Trading of Registered Interest and Principal Securities (STRIPS) in State Development Loans (SDLs) (Utkarsh) [Para VII.10]; -

Explore the possibilities for optimising the market borrowings; develop the methodology for building up of liquidity buffer for better cash management; and consolidation of public debt data (including data on market borrowings, valuations and special securities) in the Reserve Bank’s data warehouse (Para VII.11); -

Undertake best practices in data reporting to improve quality and veracity of data (Para VII.12); and -

Conduct capacity building programmes for sensitising the state governments about the prudent measures of cash and debt management (Para VII.13). Implementation Status of Goals VII.4 During 2020-21, the market borrowing programme was conducted following the debt management strategy of minimising cost, risk mitigation and market development. Amidst heightened uncertainty created by the COVID-19 pandemic and its effects on domestic and global economy and the financial markets, the Reserve Bank successfully managed the combined gross market borrowings of the central and the state governments, which increased by 61.3 per cent to ₹21,69,140 crore during the year. VII.5 The Reserve Bank continued its policy of passive consolidation by way of reissuances and active consolidation through buyback/switches. During 2020-21, 162 out of 178 issuances of G-sec were re-issuances (91.0 per cent) as compared with 185 re-issuances out of 194 issuances (95.4 per cent) in the previous year. VII.6 The active form of fiscal consolidation through switching of short-term G-sec with long-term is generally conducted on third Monday of every month. Accordingly, 95.9 per cent of the switches budgeted for the fiscal 2020-21, amounting to ₹1,53,418 crore, were completed during 2020-21, as against ₹1,64,803 crore in the previous year. VII.7 During the year 2020-21, new securities ranging from 2 to 40 year tenors were issued with the objective of catering to different investor needs. Floating Rate Bonds (FRBs) were also issued during the year in order to broaden the investor base. The share of FRBs in total issuances during 2020-21 was 6.51 per cent as against 8.5 per cent a year ago. VII.8 A review has been undertaken to hive off servicing of compensation bonds (CBs) to state treasuries. VII.9 In continuation of efforts to facilitate interoperability of government securities depositories, the Reserve Bank had decided to modify its government securities registry (the PDO-NDS system) to include constituent details in the Constituent Subsidiary General Ledger (CSGL) accounts. Accordingly, an upgrade in e-Kuber system to capture the G-sec holding details of constituents (entities maintaining securities accounts with CSGL holders), facilitate settlement of G-sec transactions directly in the constituent accounts and also enable lien-marking for constituent accounts in e-Kuber, is under process. VII.10 As announced in the Reserve Bank’s Monetary Policy Statement on Developmental and Regulatory Policies on August 7, 2019 to introduce STRIPS/reconstitution facility in SDLs, Financial Benchmark India Pvt. Ltd. (FBIL) was advised to work on a methodology for constructing zero coupon yield curve for SDLs for implementing STRIPS in SDLs, for which the work is underway. VII.11 The study on optimisation of market borrowings and developing methodology for building up of liquidity buffer for better cash management is completed. The consolidation of public debt data is currently going on under the Reserve Bank’s revamped data warehouse project. VII.12 The reports relating to public debt are being linked to source data, and data inconsistency, if any, across various reports is being addressed. VII.13 Capacity building programmes for sensitising state governments about the prudent measures of cash and debt management were conducted for five states, viz., Chhattisgarh, Goa, Himachal Pradesh, Manipur, and Nagaland. Other Initiative VII.14 As announced in the Reserve Bank’s Monetary Policy Statement on Developmental and Regulatory Policies on February 5, 2021, to increase retail participation in government securities market, it is planned to provide retail investors with the facility to open their gilt securities account directly with the Reserve Bank (‘Retail Direct’) and provide online access to the government securities market for managing their government securities portfolio. The user-friendly online ‘Retail Direct’ portal will have facilities for participation in primary auction under the non-competitive segment as well in the secondary market on NDS-OM. It is expected that the initiative will encourage greater retail participation in government securities market through improvement in ease of access to the market. Debt Management of the Central Government VII.15 During 2020-21, the gross market borrowing2 through dated G-sec was higher by 93.0 per cent as compared with the previous year. The planned market borrowing of GoI increased initially by ₹4.20 lakh crore, which was further increased twice during the year, i.e., first, ₹1.10 lakh crore under the special window given to states and UTs towards shortfall in goods and services tax (GST) compensation cess, and second, ₹80,000 crore during the announcement of the Union Budget for the year 2021-22. Net market borrowings through dated G-sec increased by 141.2 per cent as compared with previous year. Net market borrowings through dated G-sec financed 61.8 per cent of the centre’s budgeted gross fiscal deficit (GFD) as against 50.8 per cent in the previous year. The net market borrowings through dated securities and Treasury Bills (T-Bills) taken together also increased in 2020-21 (Table VII.1). Debt Management Operations VII.16 Notwithstanding the volatility in the bond market, the weighted average yield (WAY) of G-sec issuances during the year declined by 106 basis points (bps) as compared to the WAY of the previous year, thus falling to its lowest since 2004-05. The weighted average coupon on the entire outstanding debt stock also decreased by 44 bps. The weighted average maturity (WAM) of primary issuances (excludes issuances under switch auction) was 14.49 years as compared with 16.15 years in previous year. The weighted average maturity (WAM) of the outstanding debt increased from 10.72 years to 11.31 years primarily due to issuances of longer tenor security in the switch auctions in 2020-21 (Table VII.2). | Table VII.1: Net Market Borrowings of the Central Government | | (Amount in ₹ crore) | | Item | 2017-18 | 2018-19 | 2019-20 | 2020-21 | | 1 | 2 | 3 | 4 | 5 | | Net Borrowings (i to iv) | 4,98,891 | 4,58,337 | 5,11,500 | 13,75,654 | | (i) Dated Securities@ | 4,48,410 | 4,22,737 | 4,73,972 | 11,43,114 | | (ii) 91-day T-Bills | 31,886 | -46,542 | -9,600 | 10,713 | | (iii) 182-day T-Bills | 1,436 | 32,931 | 38,354 | -18,743 | | (iv) 364-day T-Bills | 17,159 | 49,211 | 8,774 | 2,40,570 | @: Without adjusting for buyback and switches. After adjusting for buyback and switches, net borrowings during 2020-21 stood at ₹11,46,739 crore, ₹4,73,990 crore in 2019-20, ₹4,23,269 crore in 2018-19 and ₹4,10,260 crore in 2017-18.

Source: RBI. |

| Table VII.2: Market Loans of Central Government - A Profile* | | (Yield in Per cent/Maturity in Years) | | Years | Range of Cut Off Yield in Primary Issues^ | Issued during the Year^ | Outstanding Stock# | | Under 5 years | 5-10 years | Over 10 years | Weighted Average Yield | Range of Maturities @ | Weighted Average Maturity | Weighted Average Maturity | Weighted Average Coupon | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 2014-15 | - | 7.66-9.28 | 7.65-9.42 | 8.50 | 6-30 | 14.66 | 10.23 | 8.08 | | 2015-16 | - | 7.54-8.10 | 7.59-8.27 | 7.88 | 6-40 | 16.03 | 10.50 | 8.08 | | 2016-17 | 6.85-7.46 | 6.13-7.61 | 6.46-7.87 | 7.15 | 5-38 | 14.76 | 10.65 | 7.99 | | 2017-18 | 7.23-7.27 | 6.42-7.48 | 6.68-7.67 | 6.97 | 5-38 | 14.13 | 10.62 | 7.76 | | 2018-19 | 6.56-8.12 | 6.84-8.28 | 7.26-8.41 | 7.77 | 1-37 | 14.73 | 10.40 | 7.81 | | 2019-20 | 5.56-7.38 | 6.18-7.44 | 5.96-7.77 | 6.85 | 1-40 | 16.15 | 10.72 | 7.71 | | 2020-21 | 3.79-5.87 | 5.15-6.53 | 4.46-7.19 | 5.79 | 1-40 | 14.49 | 11.31 | 7.27 | -: Not applicable. @: Residual maturity of issuances and figures are rounded off.

*: Excluding special securities. ^: Excluding switch auction. #: Including switch auction.

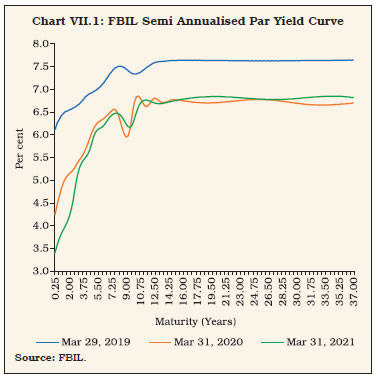

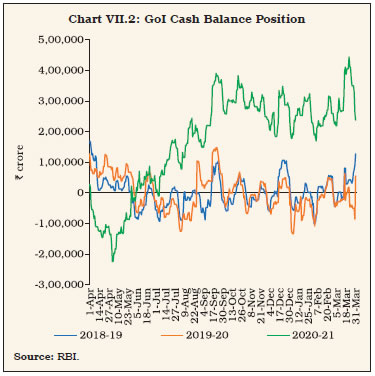

Source: RBI. | VII.17 Partial devolvement on Primary Dealers (PDs) took place on fifteen instances amounting to ₹1,30,562 crore during 2020-21 as compared with two instances for ₹3,606 crore in 2019-20. No bid was accepted on four instances due to the market conditions prevailing then, for a total notified amount of ₹ 39,000 crore. VII.18 The yields on G-sec declined during the year with the 10-year yield softening by 37 bps mainly due to the monetary and liquidity measures taken by the Reserve Bank to tackle the stress induced by the COVID-19 pandemic. Yields declined sharply in Q1:2020-21 as the Reserve Bank cut the policy repo rate by 40 bps and undertook various liquidity augmenting measures in the wake of the pandemic. Decline in US treasury yields and fall in crude oil prices also aided in easing of yields. The 10-year yield softened by 81 bps in Q1. In Q2:2020-21, the G-sec yields hardened mainly due to the rise in crude oil prices and higher CPI inflation figures for June and July. Certain policy measures announced by the Reserve Bank towards end of August, viz., hike in held-to-maturity (HTM) limit for banks, term repo operations and special OMOs, helped in easing of the yields. The 10-year yield rose by 14 bps in Q2. The Q3:2020-21 saw softening of the yields with the 10-year yield easing by 15 bps aided by certain policy measures, viz., introduction of on-tap TLTROs, extended dispensation of enhanced HTM limit for banks, OMOs, and MPC’s forward guidance suggesting continuance of accommodative monetary policy stance. During Q4:2020-21, yields spiked following the Union Budget announcement of larger than expected government borrowings and tracking the sharp rise in US treasury yields and higher crude oil prices. However, the cancellation of the last scheduled G-sec auction for 2020-21 resulted in some easing of the yields towards the end of March 2021. The 10-year yield rose by 45 bps in Q4 to end the year at 6.34 per cent (Chart VII.1).  VII.19 During 2020-21, about 49.0 per cent of the market borrowings were raised through issuance of dated securities with a residual maturity of 10 years and above, as compared with 54.2 per cent in the previous year. Further, the 30-year and 40-year tenor securities were issued/reissued during the year with the objective of catering to the demand from long-term investors such as insurance companies and pension funds (Table VII.3). Treasury Bills VII.20 Short-term cash requirements of the central government are met through issuance of T-Bills. The net short-term market borrowing of the government through T-Bills (91, 182 and 364 days) increased to ₹2,32,540 crore during 2020-21 from ₹37,528 crore in the previous year. Ownership of Securities VII.21 Commercial banks remained the largest holders of government securities (including T-Bills and SDLs) accounting for 37.3 per cent as at end-March 2021, followed by insurance companies (25.7 per cent), the Reserve Bank (10.4 per cent) and provident funds (9.8 per cent). The share of the foreign portfolio investors (FPIs) was 1.2 per cent. The other holders of government securities (including T-Bills and SDLs) include mutual funds, state governments, financial institutions (FIs) and corporates. Primary Dealers VII.22 The number of primary dealers (PDs) stood at 21 [14 Bank-PDs and 7 Standalone PDs (SPDs)] at end-March 2021. The PDs have the mandate to underwrite primary auctions of dated G-sec while they have a target of achieving bidding commitment and success ratio in respect of primary auctions of Treasury Bills (T-Bills)/cash management bills (CMBs). The PDs individually achieved the stipulated minimum success ratio of 40 per cent in primary auctions of T-Bills with an average success ratio of 57.10 per cent in H1: 2020-21(April-September 2020) and 60.13 per cent in H2:2020-21 (October 2020-March 2021). The share of PDs in auctions of T-Bills/CMBs was 68.89 per cent during 2020-21 as compared with 71.67 per cent in the previous year. The commission paid to PDs, excluding GST, for underwriting primary auctions of dated G-sec during 2020-21 was ₹454.64 crore as compared with ₹41.04 crore in the previous year. | Table VII.3: Issuance of Government of India Dated Securities – Maturity Pattern | | (Amount in ₹ crore) | | Residual Maturity | 2018-19 | 2019-20 | 2020-21 | | Amount Raised | Percentage to Total | Amount Raised | Percentage to Total | Amount Raised | Percentage to Total | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | Less than 5 Years | 1,08,899 | 19.1 | 1,46,000 | 20.6 | 3,91,990 | 28.6 | | 5-9.99 Years | 1,57,000 | 27.5 | 1,79,000 | 25.2 | 3,07,405 | 22.4 | | 10-14.99 Years | 98,000 | 17.2 | 1,37,000 | 19.3 | 3,76,766 | 27.5 | | 15-19.99 Years | 71,101 | 12.5 | 15,000 | 2.1 | - | - | | 20 Years & Above | 1,36,000 | 23.8 | 2,33,000 | 32.8 | 2,94,162 | 21.5 | | Total | 5,71,000 | 100.0 | 7,10,000 | 100.0 | 13,70,324 | 100.0 | -: Nil.

Note: Figures in the columns might not add up to the total due to rounding off of numbers.

Source: RBI. | Sovereign Gold Bond (SGB) Scheme VII.23 The Reserve Bank in consultation with the GoI issued twelve tranches of SGB for an aggregate amount of ₹16,049 crores (32.35 tonnes) during 2020-21. A total of ₹25,702 crore (63.32 tonnes) has been raised through the scheme since its inception in November 2015. Cash Management of the Central Government VII.24 The central government started the year 2020-21 with a cash balance of ₹55,573 crore. In the beginning of the financial year, the WMA limit of the centre was fixed at ₹1,25,000 crore for the first half of 2020-21. In the wake of the evolving macroeconomic conditions, and to tide over the stress situation arisen due to the outbreak of the COVID-19 pandemic, the Reserve Bank, in consultation with the GoI, increased the limit for WMA to ₹2,00,000 crore for the remaining part of the first half of the financial year. Further, the WMA limit for the second half was set at ₹1,25,000 crore. The central government resorted to WMA for 63 days during 2020-21 vis-à-vis 189 days in the previous year and went into overdraft (OD) for 9 days vis-à-vis 52 days during the same period previous year. The highest amount of WMA/OD resorted to by the central government was ₹2,24,078 crore on May 3, 2020. The central government issued CMBs of ₹80,000 crore of 84-days tenor to tide over short-term mismatches in cash flows during 2020-21. Despite COVID-19 pandemic situation, the cash balance of the centre was comfortable throughout the year (Chart VII.2).  Investments under Foreign Central Bank Scheme VII.25 Under the Foreign Central Bank (FCB) scheme, the Department invests in Indian G-sec on behalf of select FCBs and multilateral development institutions in the secondary G-sec market. Total volumes transacted on behalf of these institutions stood at ₹3,120 crore (face value) during 2020-21 as compared with ₹4,500 crore in the previous year. Debt Management of State Governments VII.26 Following the recommendation of the 14th Finance Commission (FC) to exclude states from the National Small Savings Fund (NSSF) financing facility (barring Delhi, Madhya Pradesh, Kerala and Arunachal Pradesh), market borrowings of states have been increasing over the last few years. The share of market borrowings in financing gross fiscal deficit (GFD) of states consequently rose to 89.5 per cent in 2020-21 (BE) from 74.9 per cent in 2019-20 (RE). VII.27 The gross and net market borrowings of states were higher than the previous year owing to the COVID-19 induced macroeconomic conditions. The gross market borrowings of states stood at 97.5 per cent of the amount indicated in the quarterly indicative calendar for market borrowings by the state governments. There were 742 issuances in 2020-21, of which 56 were re-issuances (636 issuances in 2019-20, of which 114 were re-issuances) [Table VII.4]. VII.28 The weighted average cut-off yield (WAY) of SDL issuances during 2020-21 was lower at 6.55 per cent than 7.24 per cent in the previous year. The weighted average spread (WAS) of SDL issuances over comparable central government securities was 52.72 bps in 2020-21 as compared with 55.02 bps in the previous year. In 2020-21, twenty one states and two union territories issued dated securities of tenors other than 10 year, ranging from 1.5 to 35 year. Eight states rejected all the bids in one or more of the auctions. Following the policy of passive consolidation, four states (viz., Maharashtra, Tamil Nadu, Punjab and Madhya Pradesh) undertook re-issuances during 2020-21. The average inter-state yield spread on 10 year fresh issuances was 10 bps in 2020-21 as compared with 6 bps in the previous year. Cash Management of State Governments VII.29 The recommendations of the Advisory Committee on WMA scheme for state governments (Chairman: Shri Sumit Bose) set WMA limit at ₹32,225 crore for all states/UTs together until the next review in 2020-21. In order to provide greater comfort to state governments in undertaking COVID-19 containment and mitigation measures, and to enable states to plan their market borrowings, as an interim measure, the Reserve Bank had announced an increase in WMA limit of the states/UTs by 60 per cent over and above the level as on March 31, 2020, which remained valid till March 31, 2021. The Advisory Committee on WMA to state governments (Chairman: Shri Sudhir Shrivastava) has submitted its report in March 2021. Based on the recommendations of the Committee, the Reserve Bank has decided to retain the interim limit of WMA (at ₹51,560 crore for all States/UTs) till September 30, 2021. Relaxation in the overdraft (OD) scheme has been given by the Reserve Bank to state governments/UTs to tide over mismatches in cash flows by increasing the number of days for which a state/UT can be in OD continuously to 21 working days from 14 working days, and in a quarter to 50 working days from 36 working days, effective from April 7, 2020, till March 31, 2021. Eighteen states/UTs availed the Special Drawing Facility (SDF), fifteen states/UTs resorted to WMA and eight states/UTs availed OD in 2020-21. | Table VII.4: Market Borrowings of States through SDLs | | (Amount in ₹ crore) | | Item | 2017-18 | 2018-19 | 2019-20 | 2020-21 | | 1 | 2 | 3 | 4 | 5 | | Maturities during the Year | 78,819 | 1,29,680 | 1,47,067 | 1,47,039 | | Gross Sanction under Article 293(3) | 4,82,475 | 5,50,071 | 7,12,744 | 9,69,525 | | Gross Amount Raised during the Year | 4,19,100 | 4,78,323 | 6,34,521 | 7,98,816 | | Net Amount Raised during the Year | 3,40,281 | 3,48,643 | 4,87,454 | 6,51,777 | | Amount Raised during the Year to Total Sanctions (per cent) | 86.9 | 87.0 | 89.0 | 82.4 | | Outstanding Liabilities (at the end of period) # | 24,29,892 | 27,78,536 | 32,65,989 | 39,25,555 | #:Including Ujwal DISCOM Assurance Yojana (UDAY) and other special securities.

Source: RBI. | VII.30 Over the years, states have been accumulating a sizeable cash surplus in the form of intermediate treasury bills (ITBs), which, however, entail a negative carry cost of 520 bps, difference between the average borrowing cost of states (6.55 per cent) and the average rate of return on ITBs (1.35 per cent), as on March 31, 2021. The outstanding investments of states in ITBs and auction treasury bills (ATBs) increased during the year 2020-21 (Table VII.5). Investments in Consolidated Sinking Fund (CSF) / Guarantee Redemption Fund (GRF) VII.31 The Reserve Bank manages two reserve fund schemes on behalf of state governments - the consolidated sinking fund (CSF) and the guarantee redemption fund (GRF). So far, twenty four states and one UT, i.e., Puducherry have set up the CSF. Currently, eighteen states are members of the GRF. States are permitted to avail of a special drawing facility (SDF) at a discounted rate from the Reserve Bank against their incremental annual investment in CSF and GRF. Outstanding investment by states in the CSF and GRF as on March 31, 2021 was ₹1,27,208 crore and ₹8,405 crore, respectively, as against ₹1,30,431 crore and ₹7,486 crore at end-March 2020. Total investment and disinvestment in CSF/GRF during 2020-21 were ₹17,900 crore and ₹18,264 crore, respectively. A review of the CSF/GRF schemes is underway to make it more attractive for states. | Table VII.5: Investments in ITBs and ATBs by State Governments/UT | | (Amount in ₹ crore) | | Item | Outstanding as on March 31 | | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | | 1 | 2 | 3 | 4 | 5 | 6 | | 14-Day(ITBs) | 1,56,050 | 1,50,871 | 1,22,084 | 1,54,757 | 2,05,230 | | ATBs | 36,603 | 62,108 | 73,927 | 33,504 | 41,293 | | Total | 1,92,653 | 2,12,979 | 1,96,011 | 1,88,261 | 2,46,523 | | Source: RBI. | 3. Agenda for 2021-22 VII.32 In the Union Budget 2021-22, the gross market borrowings through dated securities for the year 2020-21 was revised upward from ₹7,80,000 crore (BE) to ₹12,80,000 crore (RE), however, actual gross borrowings for the year 2020-21 stood at ₹12,60,324 crore. This is in addition to ₹1.10 lakh crore borrowed under the special window for states and UTs towards GST compensation cess shortfall. Gross market borrowings for 2021-22 through dated securities are projected at ₹12,05,500 crore, about 12.0 per cent lower than ₹13,70,324 crore in 2020-21. Net market borrowings (including short-term debt and repayment of Post Office Life Insurance Fund) are budgeted at ₹9,67,708 crore, financing 64.2 per cent of GFD in 2021-22. VII.33 During the year 2021-22, the market borrowing programme is proposed to be conducted with the following strategic milestones so as to achieve the overall goals of debt management: -

Consolidation of debt through calendar driven, auction-based switch operations along with reissuance of securities to augment liquidity in the G-sec market and facilitate fresh issuances; -

Improve overall liquidity in G-sec market by enhancing role of PDs in market making (Utkarsh); -

Permit retail investors to open gilt securities account directly with the Reserve Bank under the ‘Retail Direct’ scheme in order to encourage greater retail participation through improvement in ease of access to the government securities market; -

Developing a module in e-Kuber for capturing gilt level data to improve the existing market infrastructure for the government securities market besides enabling primary and secondary market settlement directly at the gilt account level for facilitating effective monitoring and surveillance of the market (Utkarsh); -

Review of the SGL/CGSL guidelines for gilt module development and gilt account settlement; -

Review of value free transfer guidelines; -

Review of operational guidelines on GoI savings bond in order to account for online subscriptions as well as incorporating better system of risk management; -

Continuing efforts to enhance quality of data and consolidating data on public debt; -

Automating monitoring of GoI’s consent to states for open market borrowings (OMBs) – developing a centralised system in e-Kuber to record these consents for better control, monitoring and management information system (MIS) purposes; -

Implementation of STRIPS/reconstitution facility in SDLs (Utkarsh); -

Hiving-off of servicing of compensation bonds issued in physical forms to state treasuries (Utkarsh); -

Operationalisation of Society for Worldwide Interbank Financial Telecommunication (SWIFT) module for transactions with FCBs to smoothen the investment and disinvestment instructions from FCBs in a secured manner (Utkarsh); and -

Conduct capacity building programmes for sensitising the state governments about prudent practices in cash and debt management. 4. Conclusion VII.34 Overall, during 2020-21, combined gross market borrowings of centre and states were conducted successfully in line with the guiding principles of debt management. The Reserve Bank also announced a number of measures to manage the stress on the finances of both central and state governments in the wake of the COVID-19 pandemic. Going ahead, smooth completion of the government borrowing programme for the year 2021-22 and consolidation of government debt will be the key areas of focus of the Reserve Bank.

|