With rapid advancement of technology and advent of new developments and innovations in the payments ecosystem, the Reserve Bank enhanced its focus on safety and security of payment systems. In addition, the Reserve Bank continued its efforts to nurture efficiency, innovation, competition, customer protection and financial inclusion. Implementation of round-the-clock RTGS within a short timeline was a momentous milestone in this journey. Going ahead, the Reserve Bank’s endeavour would be to promote innovation in the financial sector by leveraging on technology for a sustainable Information and Communication Technology (ICT) infrastructure designed for operational excellence with focus on resilience, reliability, security, integrity and cost efficiency. IX.1 During the year, the Department of Payment and Settlement Systems (DPSS) continued to work towards the planned development of payment systems as guided by the Reserve Bank’s Payment and Settlement Systems Vision 2019-2021 document. The Reserve Bank’s primary focus was to (i) facilitate digital penetration; (ii) introduce innovative payment options; (iii) ensure smooth operations notwithstanding the disruptions caused by the COVID-19 pandemic; and (iv) organise consumer awareness campaigns on digital payments, which are the building blocks to achieve the objective of a “less-cash” society. The Department of Information Technology (DIT), in its swift response to unprecedented challenges due to COVID-19 pandemic and to keep pace with the fast-changing technology landscape, adopted a proactive approach by leveraging on technology. The Reserve Bank continued its efforts to graduate its ICT infrastructure to next generation applications with an inbuilt architecture for operational excellence, resilience, scalability and security. IX.2 Against this backdrop, the following section covers developments in the sphere of payment and settlement systems during the year and also takes stock of the implementation status of the agenda for 2020-21. Section 3 provides various measures undertaken by the DIT during the year vis-à-vis the agenda set for 2020-21. These departments have also set out an agenda for 2021-22. The chapter has been summarised at the end. 2. DEPARTMENT OF PAYMENT AND SETTLEMENT SYSTEMS (DPSS) IX.3 Guided by the Reserve Bank’s Payment and Settlement Systems Vision 2019-2021 document, various initiatives were undertaken by the department during the year in the payments ecosystem with continued emphasis on safety, security, efficiency, innovation, competition, customer protection and financial inclusion. The focus was to facilitate digital penetration by enhancing acceptance infrastructure across the country and introducing innovative payment options to deepen the reach of payment systems. Efforts were also directed towards ensuring smooth functioning of all the payment systems notwithstanding disruptions in movement of resources and access to infrastructure caused by the COVID-19 lockdown with varying intensity and duration across various locations in the country. A few initiatives were customised keeping in view social distancing and minimal-contact requirements of the pandemic while making digital payments. The Reserve Bank undertook focused campaigns to improve consumer awareness on digital payments and put in place measures to ensure that the consumer grievances are addressed seamlessly in a timebound manner. The journey towards “less-cash” continued during the year with a rapid growth in digital payments observed with the gradual relaxation in lockdown imposed due to COVID-19. Payment Systems IX.4 The payment systems recorded a robust growth of 26.2 per cent in terms of volume during 2020-21 on top of the expansion of 44.2 per cent in the previous year. In terms of value, the contractionary trend which started in the previous year (-1.2 per cent) got further amplified and witnessed a drop of 13.4 per cent, mainly due to lower growth observed in the large value payment system, viz., Real Time Gross Settlement (RTGS) system and decrease in transactions of paper-based instruments. The decline in value of transactions in RTGS is largely attributable to the subdued economic activity. The share of digital transactions in the total volume of non-cash retail payments increased to 98.5 per cent during 2020- 21, up from 97.0 per cent in the previous year (Table IX.1). | Table IX.1: Payment System Indicators – Annual Turnover (April-March) | | Item | Volume (Lakh) | Value (₹ Crore) | | 2018-19 | 2019-20 | 2020-21 | 2018-19 | 2019-20 | 2020-21 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | A. Settlement Systems | | | | | | | | CCIL Operated Systems | 36 | 36 | 28 | 11,65,51,038 | 13,41,50,192 | 16,19,43,141 | | B. Payment Systems | | | | | | | | 1. Large Value Credit Transfers – RTGS | 1,366 | 1,507 | 1,592 | 13,56,88,187 | 13,11,56,475 | 10,55,99,849 | | Retail Segment | | | | | | | | 2. Credit Transfers | 1,18,481 | 2,06,506 | 3,17,852 | 2,60,90,471 | 2,85,62,857 | 3,35,22,150 | | 2.1 AePS (Fund Transfers) | 11 | 10 | 11 | 501 | 469 | 623 | | 2.2 APBS | 14,949 | 16,766 | 14,373 | 86,226 | 99,179 | 1,12,747 | | 2.3 ECS Cr | 54 | 18 | 0 | 13,235 | 5,145 | 0 | | 2.4 IMPS | 17,529 | 25,792 | 32,783 | 15,90,257 | 23,37,541 | 29,41,500 | | 2.5 NACH Cr | 8,834 | 11,290 | 16,450 | 7,29,673 | 10,43,212 | 12,32,714 | | 2.6 NEFT | 23,189 | 27,445 | 30,928 | 2,27,93,608 | 2,29,45,580 | 2,51,30,910 | | 2.7 UPI | 53,915 | 1,25,186 | 2,23,307 | 8,76,971 | 21,31,730 | 41,03,658 | | 3. Debit Transfers and Direct Debits | 4,914 | 7,525 | 10,456 | 5,24,556 | 7,19,708 | 8,72,552 | | 3.1 BHIM Aadhaar Pay | 68 | 91 | 161 | 815 | 1,303 | 2,580 | | 3.2 ECS Dr | 9 | 1 | 0 | 1,260 | 39 | 0 | | 3.3 NACH Dr | 4,830 | 7,340 | 9,630 | 5,22,461 | 7,18,166 | 8,68,906 | | 3.4 NETC (Linked to Bank Account) | 6 | 93 | 650 | 20 | 200 | 913 | | 4. Card Payments | 61,769 | 72,384 | 57,841 | 11,96,888 | 14,34,814 | 12,93,822 | | 4.1 Credit Cards | 17,626 | 21,773 | 17,641 | 6,03,413 | 7,30,895 | 6,30,414 | | 4.2 Debit Cards | 44,143 | 50,611 | 40,200 | 5,93,475 | 7,03,920 | 6,62,667 | | 5. Prepaid Payment Instruments | 46,072 | 53,318 | 49,392 | 2,13,323 | 2,15,558 | 1,97,695 | | 6. Paper-based Instruments | 11,238 | 10,414 | 6,704 | 82,46,065 | 78,24,822 | 56,27,189 | | Total – Retail Payments (2+3+4+5+6) | 2,42,473 | 3,50,147 | 4,42,229 | 3,62,71,303 | 3,87,57,759 | 4,15,12,514 | | Total Payments (1+2+3+4+5+6) | 2,43,839 | 3,51,654 | 4,43,821 | 17,19,59,490 | 16,99,14,234 | 1471,12,363 | | Total Digital Payments (1+2+3+4+5) | 2,32,602 | 3,41,240 | 4,37,118 | 16,37,13,425 | 16,20,89,413 | 14,14,85,173 | Note: 1. RTGS system includes customer and inter-bank transactions only.

2. Settlements of CBLO, government securities and forex transactions are through the Clearing Corporation of India Ltd. (CCIL). Government Securities include outright trades and both legs of repo transactions and triparty repo transactions. With effect from November 5, 2018, CCIL discontinued CBLO and operationalised triparty repo under securities segment.

3. The figures for cards are for payment transactions at point of sale (PoS) terminals and online.

4. Figures in the columns might not add up to the total due to rounding off of numbers.

Source: RBI. |

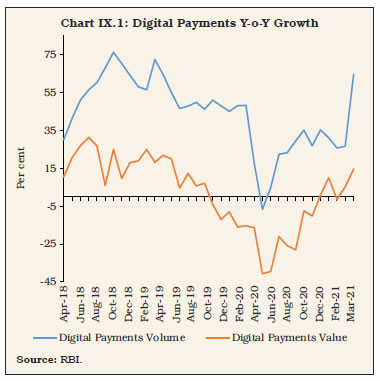

IX.5 The nationwide lockdown due to COVID-19 pandemic resulted in decline in payments during its initial phase. However, the value and volume of payments subsequently picked up with the gradual relaxations in lockdown (Chart IX.1). Digital Payments IX.6 Amongst the electronic modes of payments, the number of transactions undertaken using RTGS increased by 5.7 per cent during the year, with value amounting to ₹1,056 lakh crore, resulting in a decline in value by 19.5 per cent from the previous year, mainly on account of reduction in large value transactions of corporates in line with slowdown in economic activity. At the end of March 2021, the RTGS facility was available through 1,75,947 branches of 227 banks. Transactions through National Electronic Funds Transfer (NEFT) system rose by 12.7 per cent during the year. At the end of March 2021, the NEFT facility was available through 1,75,283 branches of 225 banks. IX.7 During 2020-21, the number of card payment transactions carried out through credit cards and debit cards decreased by 19.0 per cent and 20.6 per cent, respectively. This resulted in a decrease in value of credit card transactions by 13.7 per cent and debit card transactions by 5.9 per cent during the same period. Prepaid Payment Instruments (PPIs) recorded contraction in volume by 7.4 per cent during the year as against a growth of 15.7 per cent a year ago, while the transaction value at 1.97 lakh crore was lower by 8.3 per cent vis-à-vis last year. The number of Points of Sale (PoS) terminals increased by 6.5 per cent to 47.20 lakh and the number of Bharat Quick Response (BQR) codes deployed increased by 76.0 per cent to 35.70 lakh as at end-March 2021. Further, the number of ATMs marginally increased by 2.0 per cent from 2.34 lakh at end-March 2020 to 2.38 lakh at end-March 2021. Authorisation of Payment Systems IX.8 Payments System Operators (PSOs) comprise PPI issuers, Cross-border Money Transfer Service Scheme operators, White Label ATM (WLA) operators, Trade Receivables Discounting System (TReDS) platform operators, ATM networks, Instant Money Transfer Service providers, Card Payment Networks and Bharat Bill Payment Operating Units (BBPOUs), besides Clearing Corporation of India Ltd. (CCIL) and National Payments Corporation of India (NPCI) [Table IX.2.] | Table IX.2: Authorisation of Payment System Operators (as at end-March) | | (Number) | | Entities | 2020 | 2021 | | 1 | 2 | 3 | | A. Non-Banks – Authorised | | | | PPI Issuers | 43 | 36 | | WLA Operators | 8 | 4 | | Instant Money Transfer Service Providers | 1 | 1 | | BBPOUs | 9 | 8 | | TReDS Platform Operators | 3 | 3 | | Cross-border Money Transfer Service Scheme | 9 | 9 | | Operators | | | | Card Networks | 5 | 5 | | ATM Networks | 2 | 2 | | B. Banks – Approved | | | | PPI Issuers | 62 | 56 | | BBPOUs | 39 | 42 | | Mobile Banking Providers | 540 | 566 | | ATM Networks | 3 | 3 | Note: Validity period of Certificate of Authorisation (CoA) granted to three non-bank PPI issuers was not extended. One PPI issuer voluntarily surrendered while three non-bank PPI issuers are under the process of voluntarily surrendering their CoA. The CoAs of two WLAOs were revoked, one WLAO ceased operation and one WLAO is under the process of voluntarily surrendering the CoA along with one BBPOU. Consequent upon amalgamation of six public sector banks, the number of bank PPIs have reduced.

Source: RBI. | Agenda for 2020-21: Implementation Status Goals Set for 2020-21 IX.9 Last year, the Department had set out the following goals: • Encouraging Healthy Competition o Offline Payment Systems: Offline payments through mobile devices and stored value component on cards will be made available to boost digital payment modes, and a pilot scheme will be tested to gain experience for a fuller roll-out of the scheme (Para IX.11). • Improving Customer Convenience o Online Dispute Resolution (ODR): A phased approach to implementing an ODR system across various payment systems is proposed to be undertaken, beginning with implementation for failed transactions for all authorised payment systems (Utkarsh) [Para IX.16]; o Self-Regulatory Organisation: A framework for creation of a Self- Regulatory Organisation (SRO) for engaging with the regulator/ supervisor and also responsible for setting and enforcing rules for the PSOs as announced in the Reserve Bank’s Statement on Developmental and Regulatory Policies of February 6, 2020, will be formalised (Para IX.17); and o Pan-India Cheque Truncation System: All Express Cheque Clearing System (ECCS) centres will be merged with the Cheque Truncation System (CTS) grids to facilitate cheque collection services by banks (Para IX.18). • Ensuring Affordable Cost o Legal Entity Identifier (LEI): The use of LEI to identify payment system participants, agents and distributors in respect of cross-border services, particularly for large value payments, including expanding the implementation across all the identified segments will be explored (Para IX.23). • Increasing Confidence o Digital Payments Index: The Reserve Bank in its Statement on Developmental and Regulatory Policies of February 6, 2020 announced that the Reserve Bank would construct and periodically publish a composite “Digital Payments Index (DPI)” [Para IX.25]. Implementation Status of Goals IX.10 In the ‘Payment and Settlement Systems in India: Vision 2019-2021’, DPSS had identified four goal-posts, viz., competition, cost, convenience, and confidence, for achieving its vision. Encouraging Healthy Competition Offline Payment Systems IX.11 The Reserve Bank allowed authorised PSOs – banks and non-banks – to conduct a pilot scheme for offline payment solutions using cards, wallets or mobile devices for remote or proximity payments to encourage technological innovations that enable offline digital transactions. The availability of such options to make offline payments is expected to boost the use of digital payments, which are constrained by the absence of, or erratic, internet connectivity, especially in remote areas. Post completion of the pilot scheme, the Reserve Bank shall decide on implementing offline payment systems based on the experience gained. Framework for Authorisation of Pan-India Umbrella Entity for Retail Payments IX.12 The Reserve Bank released a framework, stipulating eligibility criteria, scope and governance structure for entities interested in setting up a pan-India umbrella entity for retail payments. The applications for authorisation were required to be submitted till February 26, 2021, which was extended by a month till March 31, 2021. Enabling Posting of Settlement Files of Payment Systems on All Days of the Week IX.13 With the operationalisation of RTGS on 24x7 basis, the Reserve Bank permitted NPCI to post additional settlement files of payment systems operated by them for settlement on weekends as well as holidays with effect from January 3, 2021. This measure helped to reduce build-up of settlement and default risks in ancillary payment systems and enabled better management of funds by member banks, which in turn enhanced the overall efficiency of the payments ecosystem. Maintenance of Escrow Account with Scheduled Commercial Banks IX.14 The Reserve Bank permitted authorised non-bank PPI issuers and Payment Aggregators (PA) to maintain an additional escrow account in a different scheduled commercial bank. This measure has helped diversify risk and address business continuity concerns. Inter-Regulatory and Intra-Regulatory Co-ordination IX.15 The Reserve Bank set up two separate committees, i.e., (i) Inter-Regulatory Committee comprising sectoral regulatory authorities, viz., Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), Telecom Regulatory Authority of India (TRAI), Ministry of Electronics and Information Technology (MeitY) and Department of Telecommunications (DoT); and (ii) Intra- Regulatory Committee comprising various regulatory and supervisory departments of the Reserve Bank. The committees are expected to ensure co-ordinated approach to regulation, remove frictions and ease system operator/ customer comfort. Improving Customer’s Convenience Online Dispute Resolution (ODR) IX.16 The Reserve Bank advised authorised PSOs to implement an ODR system for disputes and grievances related to failed transactions in their respective payment systems by January 1, 2021. The ODR system was conceptualised as a rule-based technology-driven customer-friendly mechanism for resolving customer grievances and disputes with zero or minimal manual intervention. This will provide a quick, affordable and accessible dispute resolution system for customers. With the possibility of customer grievances increasing in line with the manifold increase in digital transactions, the ODR system will eliminate the requirement of additional manpower at PSOs to handle disputes / grievances. Self-Regulatory Organisation (SRO) IX.17 The Reserve Bank released a framework for recognition of SRO for PSOs on October 22, 2020. SRO shall set and enforce rules and standards relating to the conduct of member entities in the industry, with the aim of protecting the customer and promoting ethical and professional standards, including addressing larger concerns, such as protecting customers, furthering training and education and striving for development of members, the industry and the ecosystem as a whole. Pan-India Cheque Truncation System (CTS) IX.18 In its Statement on Developmental and Regulatory Policies of February 6, 2020, the Reserve Bank announced that a pan-India CTS would be made operational. Accordingly, all 1,219 ECCS clearing houses across the country closed their cheque clearing operations voluntarily in terms of Regulation 25 of the Uniform Regulations and Rules for Bankers Clearing Houses (URRBCH) and migrated to CTS grids. Further, to leverage the availability of CTS and provide uniform customer experience irrespective of location of bank branch, banks were advised to ensure that all their branches participate in image-based CTS by September 30, 2021. 24x7 Availability of RTGS System IX.19 The Reserve Bank made available the RTGS system 24x7 on all days of the year from 00:30 hours on December 14, 2020. India has become one of the few countries across the world where RTGS system operates round the clock throughout the year. Round the clock availability of RTGS has provided extended flexibility to businesses for effecting payments and enabled introduction of additional settlement cycles in ancillary payment systems. Digital Payment Transactions – Streamlining QR Code Infrastructure IX.20 The Reserve Bank mandated that existing proprietary QR codes shall migrate to interoperable QR codes by March 31, 2022 and there shall not be further issuance of proprietary QR codes. These measures are expected to strengthen the acceptance infrastructure and enhance customer convenience due to interoperability and augment system efficiency. Card Transactions in Contactless Mode – Relaxation in Requirement of Additional Factor of Authentication (AFA) IX.21 The Reserve Bank enhanced the per transaction limit permitted for contactless transactions (also known as tap and pay transactions) using Near Field Communication enabled EMV chip cards without the need for AFA from ₹2,000 to ₹5,000. The COVID-19 pandemic had underlined the benefits of contactless transactions and the limits were enhanced keeping in mind the sufficient protection available to consumers. The enhanced limits were effective from January 1, 2021. Processing of e-Mandates for Recurring Transactions IX.22 The Reserve Bank advised that processing of recurring transactions (domestic and cross-border) using cards/PPIs/UPI under arrangements/practices not compliant with the extant framework for such transactions shall not be continued beyond September 30, 2021. Ensuring Affordable Costs Legal Entity Identifier (LEI) IX.23 LEI number facilitates unique identification of the parties involved in financial transactions worldwide, thereby, improving quality and accuracy of financial data systems and ensuring better risk management post the global financial crisis. In India, LEI is being rolled out in a phased manner for participants in the over the counter (OTC) derivative and non-derivative markets as also for large corporate borrowers. The Reserve Bank decided to introduce the LEI number for all payment transactions of value ₹50 crore and above, undertaken by entities (non-individuals) using centralised payment systems, viz., RTGS and NEFT. Operationalisation of PIDF IX.24 The Reserve Bank operationalised PIDF in January 2021 to encourage acquirers to deploy payment acceptance infrastructure in tier-3 to tier-6 centres and north eastern states. The Reserve Bank contributed ₹250 crore to the initial corpus of PIDF and the card networks and card issuing banks have contributed around ₹200 crore. Further, recurring contribution on half yearly basis would be made by card networks and card issuing banks based on the outstanding cards. The scheme envisages creation of 30 lakh new touch points every year for digital payments across the country during 2021-23. An Advisory Council under the chairmanship of Deputy Governor-in-Charge of DPSS, consisting of representatives from card networks, card payment industry, IBA and NABARD, was set up to manage and govern the PIDF. Increasing Customer Confidence Digital Payments Index (DPI) IX.25 The Reserve Bank constructed and published a composite DPI to effectively capture the extent of digitisation of payments across the country (Box IX.1). Positive Pay System for CTS IX.26 In order to augment customer safety in cheque payments and reduce instances of fraud occurring on account of tampering of cheque leaves, the Reserve Bank announced a concept of Positive Pay Mechanism for all cheques of value ₹50,000 and above. Under this mechanism, cheques are processed for payment by the drawee bank based on information passed on by its customer at the time of issuance of cheque. Positive Pay System was implemented from January 1, 2021. Perpetual Validity for CoA Issued to PSO IX.27 The Reserve Bank decided to grant authorisation for all PSOs (both new and existing) on a perpetual basis, subject to the usual conditions. For existing authorised PSOs, grant of perpetual validity shall be examined as and when the CoA becomes due for renewal subject to their adherence to specified conditions. While allowing the perpetual authorisation, the Reserve Bank has relied on the robust system for monitoring performance of regulated entities through onsite inspection and offsite surveillance and monitoring mechanism. The measure shall reduce licensing uncertainties and enable PSOs to focus on their business as also to optimise utilisation of regulatory resources. Box IX.1

Reserve Bank of India – Digital Payments Index (RBI-DPI) In the recent past, the payments ecosystem in India has witnessed many developments, resulting in a bouquet of payment systems and platforms, payment products and services, which are available for consumers for undertaking digital payments, be they individuals, firms, corporates, governments or other economic agents. To ensure continued progress and also understand the impediments and areas that require focused attention, the Reserve Bank delineates its Payment System Vision at triannual intervals, releases periodic data/statistics relating to payment systems performance and undertakes surveys, apart from participating in discussions/meetings of global standard setting bodies like Financial Stability Board (FSB) and Committee on Payments & Market Infrastructures (CPMI). In this continuum, it is imperative to measure and track digital payments growth and impact over time by constructing a composite index covering the entire gamut of the payment ecosystem in the country. Accordingly, the DPI has been conceived, by adopting scientific tools based on statistical and empirical data for its construction. Theoretically, index score is a technique of measuring changes in a variable or group of related variables with respect to time, geographical location or other characteristics. It measures the relative changes in a variable or group of variables over a previous period known as the base period. The DPI constructed by the Reserve Bank (RBI-DPI), is a first-of-its kind index and is envisaged as a score to measure the diffusion and deepening of digital payments across the country. To capture this, the RBI-DPI has five broad parameters, which, in turn have sub-parameters and indicators, with appropriate weights for each of them to signify their relative importance in the digital payments ecosystem as shown below (Table 1). | Table 1: Broad Parameters under RBI-DPI | | Parameters | Weight

(Per cent) | Indicators | | 1 | 2 | 3 | | 1. Payment Enablers | 25 | Internet users, mobile users, Aadhaar numbers, bank accounts, digital payment facilitators, and payment system members. | | 2. Payment Infrastructure - Demand-side Factors | 10 | Payment and other instruments issued, customer registrations for mobile and internet banking, and FASTags. | | 3. Payment Infrastructure - Supply-side Factors | 15 | Physical and digital payment acceptance points, and payment intermediaries. | | 4. Payment Performance | 45 | Volume and value of various payment systems, unique users in such systems, cheque transactions, cash withdrawals using cards, and cash estimates. | | 5. Consumer Centricity | 5 | Consumer awareness and education initiatives, declines, complaints, frauds, and system downtime. | | Source: RBI. | Keeping in mind the significant developments in the payments landscape in recent times (period post demonetisation and payment systems vision 2021), March 2018 has been taken as the base period (i.e., RBI-DPI score for March 2018 is set as 100). The DPI for March 2019 and March 2020 worked out to 153.47 and 207.84, respectively, indicating appreciable growth. Going forward, the RBI-DPI shall be published on semi-annual basis from March 2021 onwards with a lag of 4 months. | Authorisation of Entities for Operating a Payment System – Introduction of Cooling Period IX.28 The Reserve Bank introduced the concept of cooling period in certain situations like revocation or non-renewal, voluntary surrender, and rejection of application submitted for grant of CoA. This concept will also be applicable to any new entity, which is set-up by promoters involved in any of the above categories. This measure shall inculcate discipline and encourage submission of applications by serious players as also ensure effective utilisation of regulatory resources. It was decided that the cooling period shall be for one year from the date of revocation/non-renewal/ acceptance of voluntary surrender/rejection of application, as applicable and during this period entities shall be prohibited from submission of applications for operating any payment system under the Payment and Settlement Systems (PSS) Act. Guidelines on Regulation of Payment Aggregators (PAs) and Payment Gateways (PGs) IX.29 In terms of extant instructions issued by the Reserve Bank on regulation of PAs and PGs, PAs cannot store customer card credentials within their database or the server [i.e. Card-on-File (COF)]. Similarly, their on-boarded merchants cannot store the payment data of their customers. As a one-time measure, the Reserve Bank extended the timeline by six months till December 31, 2021 for implementing the aforesaid instructions by non-bank PAs. Other Developments UPI/RuPay International Outreach Initiatives IX.30 The Reserve Bank continued its efforts towards global outreach of its payment systems, including remittance services. In view of the potential of UPI to provide for stronger bilateral business and economic partnership with other jurisdictions, the Reserve Bank had written to other central banks highlighting the features of UPI as an efficient and secure system, which can be used to transform retail payment mechanisms globally and at the same time promote financial inclusion. The Reserve Bank also participated in regional outreach programmes organised by the Bank for International Settlements (BIS), where the possibility of leveraging UPI system to facilitate cross-border transactions was presented to participants. Supervision of Payment Systems IX.31 During 2020-21, onsite inspection/off-site assessments of 32 entities, viz., CCIL, 26 PPI issuers, one ATM Network, one WLA operator, and three TReDS platform operators was carried out by the Reserve Bank under Section 16 of the PSS Act. Inspection of CCIL IX.32 The Reserve Bank conducted the onsite inspection of CCIL under Section 16 of the PSS Act. CCIL was assessed against the 24 Principles for Financial Market Infrastructures (PFMIs) formulated by the Committee on Payments and Market Infrastructures-International Organisation of Securities Commissions (CPMI-IOSCO). As Central Counterparty (CCP), CCIL was rated ‘Observed’ for 17 principles and ‘Broadly Observed’ for three, while four were ‘Not Applicable’ to it. As Trade Repository (TR), CCIL was rated ‘Observed’ for 10 principles, ‘Broadly Observed’ for one, while 13 were ‘Not Applicable’. Developments in CCIL IX.33 During the year, despite facing challenges due to the COVID-19 pandemic, CCIL managed its operations smoothly. There was no disruption in operations even during the power outage in Mumbai on October 12, 2020. CCIL finalised implementation of extended clearing membership structure in rupee derivatives and forex forward segments and revised intra-month additional contribution to default fund when stress loss exceeds specific threshold of pre-funded resources. CCIL improved risk management further by fixing lower limits based on internal rating and stepping up haircut rates for weaker entities; and also extended the FX-Retail platform by introducing booking and cancelling facility for forward contracts for bank customers besides operationalising ‘Request for Quote’ (RFQ) module on negotiated dealing system (order matching). e-Baat Programmes and Awareness Campaigns IX.34 The Reserve Bank has been conducting electronic banking awareness and training (e-BAAT) programmes regularly for the benefit of cross-section of customers/bankers/students/ public. The aim of these programmes was to educate the masses to move their focus of payments from physical presence of money to electronic money payments through various forms. During July 2020-March 2021, 178 e-BAAT programmes were conducted by the regional offices, in which financial literacy on electronic payment systems, their benefits and issues related to cyber security were explained to the participants consisting of bank staff, customers, students and the common man. IX.35 The Reserve Bank advised all authorised PSOs and their participants to undertake targeted multilingual campaigns by way of SMSs and advertisements in print and visual media to educate their users on safe and secure use of digital payments. IX.36 Aarogya Setu is a mobile application developed by the Government of India to connect essential health services with the people of India in the fight against COVID-19 pandemic. In order to spread awareness about the Aarogya Setu app to the general public, the Reserve Bank advised all authorised PSOs to display a banner on it on their website and app, to encourage maximum downloads. Payment Systems Booklet IX.37 The Reserve Bank released a Booklet on Payment Systems covering the journey of payment and settlement systems in India during the second decade of the millennium, viz., from the beginning of 2010 till the end of 2020. The booklet captures the transformation of India in the sphere of payment and settlement systems and describes, inter-alia, the legal and regulatory environment underpinning the digital payments systems, various enablers, payment options available to consumers and extent of adoption. FinTech-related Activities IX.38 The Indian FinTech industry as it stands today is the result of unique concoction of India’s technological enablers, regulatory interventions, business opportunities as well as certain other unique characteristics, which have led to the establishment of the third largest start-up ecosystem in the world1. As the COVID-19 pandemic continued to create uncertainty, stress has emerged for some FinTechs, while some others gained from new business opportunities the pandemic provided. However, as the broader economy shifts from “respond” to “recover”, new employment opportunities may be created by some FinTechs (Box IX.2). Reserve Bank Innovation Hub IX.39 The Reserve Bank in its Statement on Developmental and Regulatory Policies of August 6, 2020, announced that Reserve Bank Innovation Hub (RBIH) will be set up to promote innovation across the financial sector by leveraging on technology and creating an environment which would facilitate and foster innovation. Accordingly, RBIH has been incorporated as a Section 8 company under the Companies Act, 2013, with registered office at Hyderabad. In order to guide and manage RBIH, the Reserve Bank had set up a Governing Council (GC) with Shri Senapathy (Kris) Gopalakrishnan, co-founder and former co-chairman of Infosys as the first Chairperson and other members comprising of industry stalwarts and from academia. The setting up of the RBIH is a continuation of the efforts of the Reserve Bank to keep up with technological evolution in the finance space, with a more active involvement and intention of shaping an organised evolution rather than passively adapting to random changes. The RBIH is expected to create an eco-system for idea generation and development, through collaboration with tech innovators, as well as the academia. Box IX.2

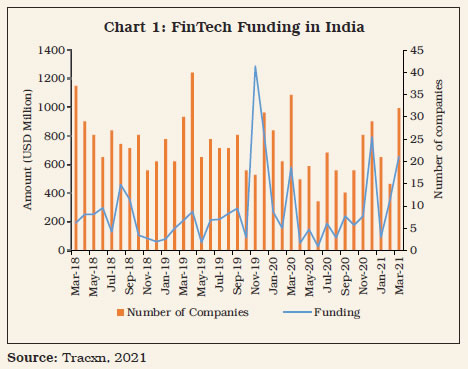

FinTech Activity in India: Funding and Employment Trends during COVID-19 Over the past year, COVID-19 pandemic has brought to fore the crucial role of technology amidst widespread adoption of social distancing and work-from-home culture. While many economic and financial indicators continued to slide into negative territory throughout 2020, the enthusiasm towards start-ups did not wane drastically. Many in fact believe that this Black Swan event would lead to a creative disruption, with a reorientation of investment towards new ideas. Data from Tracxn show that despite the global economic slowdown, US$ 56.1 billion were invested into the FinTech sector globally during 2020-21 (April-March), as compared with US$ 84.8 billion in 2019 and US$ 77.8 billion in 2018. The US and Canada continued as the leading geographies for new companies, followed by Europe. In 2020-21, nearly US$ 3 billion was invested in Indian FinTech (approximately US$ 4.5 billion last year), indicating a tempering of investor sentiment due to the economic slowdown [Chart 1, (Tracxn, 2021)]. Nevertheless, monthly trends indicate a revival of investor sentiment as the economic shock of the pandemic wears off. Besides promoting financial inclusion, FinTech can also provide impetus to growth and employment (Phillippon, 2017, Sahay et al., 2020). Empirical analysis of employment trends in Indian FinTech using random-effect panel data model provides some interesting perspectives (Table 1). With appropriate controls for company scale and funding stage, it is seen that the amount of funds raised is an important determinant of employee count. Also, more mature firms in later funding stages are more likely to have higher employment strength. An assessment of the operational domains indicates that online insurance providers are more probable to have higher employee count (due to the need for on-ground staff of surveyors), while highly specialised FinTechs such as those in the accounting technology domain are more likely to operate with very few highly skilled employees.

| Table 1: Panel Data Estimation Results | | Dependent Variable: Employee Count | Model 1 Coefficient

(Std. Error) | Model 2 Coefficient

(Std. Error) | | 1 | 2 | 3 | | Funds Raised | 0.00000741*** | 0.00000715*** | | (Current Quarter) | (0.00000124) | (0.00000124) | | Funding Round Stage | | | | Seed | -90.8 (131.2) | -90.7 (131.2) | | Series A | -164.1 (140.3) | -149.7 (140.6) | | Series B | -217.1 (154.4) | -199.5 (154.7) | | Series C | -45.5 (174.6) | -36.7 (174.9) | | Series D | -206.6 (217.9) | -198.4 (218.5) | | Series E | 596.5 (425.5) | 857.2** (409.9) | | Series F | 6199.6 *** (506.3) | 6277.2*** (501.4) | | Series G | -3832.0*** (1354.5) | -3491.7*** (1343.7) | | Annual Revenue | 0.00000142 | 0.00000179* | | | (0.000000917) | (0.000000924) | | Sector - Insurance | | 200.0* (105.9) | | Sector - Finance and Accounting | -251.8*** (122.7) | | | Constant | 433.2 (385.4) | 166.9 (367.5) | | No. of observations | 158 | 158 | | Wald chisq. (p-value) | 794.5 (0.000) | 802.3 (0.000) | Note: 1. Sample Period: 2018Q4 - 2020Q3.

2. Both specifications control for the start-ups' highest stage of funding reached.

3. Hausman test and Breusch-Pagan LM test support the Random Effects specification.

4. *, **, ***: indicate the statistical significance at 1 per cent, 5 per cent and 10 per cent, respectively.

5. Start-ups tend to raise equity in successive pitches or rounds (Seed, Series A, B, C and so on), which broadly follow the growth/scale of the business, and serve the needs of the business in that stage. Early rounds may be used to establish a foothold in the market, while later rounds can be used for expansion.

Source: RBI staff estimates. | With start-ups expected to create jobs for a burgeoning and aspirational youth segment, these results provide two policy takeaways. First, while it is important to freely channelise productive investment into the start-ups, preferential policies may help in the growth of sub-sectors that have potential for low and semi-skilled job creation. Second, it is important not only to have an ecosystem that promotes new entrepreneurial ventures, but also one that helps in capacity building of domestic start-ups and handholds/nudges them to scale up. While FinTech firms initially suspended operations during the lockdown due to the uncertain impact of COVID-19 on their risk and business models, the stress started to diminish later in the year and considerable optimism remains about the sector. Their operations do not directly depend on movement of goods and people, and they are more suited for work-from-home culture. The pandemic has also presented an opportunity to expand operations, as the general public is expected to emerge out of the crisis more comfortable with using new technology (NPCI, 2021). References: 1 NPCI (2021), ‘Digital Payments Adoption in India, 2020’, January 14. 2 Phillippon, T. (2017), ‘The FinTech Opportunity’, BIS Working Paper No. 655, August. 3 Sahay, R., von Allmen, U., Lahreche, A., Khera, P., Ogawa, S., Bazarbash, M., and Beaton, K. (2020), ‘The Promise of Fintech: Financial Inclusion in the Post COVID-19 Era’, Monetary and Capital Markets Departmental Paper Series No. 20/09, IMF. 4 Tracxn (2021), Database accessed on May 5, 2021. | Regulatory Sandbox (RS) – Cohorts – Test Phase IX.40 The Enabling Framework for Regulatory Sandbox (RS) was placed on the website on August 13, 2019, followed by the announcement of ‘Retail Payments’ as the theme of the first cohort. The testing of the products of six entities selected under the first cohort commenced from November 16, 2020. Four of the entities have completed the ‘Test Phase’, and the final assessment of the results of the testing process is being undertaken quantitatively and qualitatively based on the mutually agreed test scenarios and expected outcomes and adherence to the conditions stipulated for testing. The remaining two entities are still testing their products. The delay in completion of the test phase for these entities was on account of technical glitches, operations issues, disruptions, and inconveniences due to COVID-19 pandemic. IX.41 To encourage innovation and broaden the eligibility criteria for the applicants to participate in RS, the modified ‘Enabling Framework’ was published on December 16, 2020. The net worth requirement was reduced from the existing ₹25 lakh to ₹10 lakh. Partnership Firms and Limited Liability Partnerships were also permitted to participate in the RS. IX.42 To foster innovations capable of recasting the cross-border payments landscape, the second cohort under the RS with ‘Cross Border Payments’ as its theme was announced on December 16, 2020. A total of 27 applications was received under the second cohort. These applications are being scrutinised as per the approved standard operating procedure. Further, it was also decided that the theme for next cohort shall be ‘MSME Lending’ in order to foster innovation in lending to MSMEs. RegTech Solutions for Effective and Focused Regulations IX.43 The Reserve Bank has entered into Cooperation Agreement (CoA) on FinTech with International Finance Corporation (IFC) –- a member of the World Bank Group (WBG). Under the scope of CoA, among others, IFC will provide knowledge/advisory support on RegTech/ SupTech initiatives. Further, an exploratory survey was conducted among a few Regulated Entities (REs) in order to assess the level and extent of RegTech adoption as well as to understand existing/potential use of RegTech by REs, risks and challenges faced and the expectations of REs from the regulators. The survey has given fair insight into the level of adoption of RegTech in the country. IX.44 The Reserve Bank has joined the Global Financial Innovation Network (GFIN), a network of over 50 organisations committed to support financial innovation. GFIN has three work streams, namely (i) “Collaboration”, which focuses on how to help regulators in collaborating and sharing of experiences of innovation, (ii) “Cross-Border Testing”, which focuses on running cross-border testing of innovative products and services, and (iii) “RegTech and Lessons Learned”, which focuses on sharing RegTech knowledge, collaborating on areas of mutual interest such as potential cross jurisdictional efficiency. Participation in any of the above three work streams of GFIN will help in enhancing the FinTech related activities in India. Inter - Regulatory Technical Group on FinTech IX.45 An Inter-Regulatory Technical Group on FinTech (IRTG on FinTech) has been constituted under the aegis of Sub-Committee of the Financial Stability and Development Council (FSDC-SC). The Group is chaired by Chief General Manager (CGM) of DPSS with representatives at the level of the CGM from other financial sector regulators, viz., SEBI, IRDAI, International Financial Services Centres Authority (IFSCA) and Pension Fund Regulatory and Development Authority (PFRDA) and one representative each from the Ministry of Finance and MeitY. During its first meeting held in March 2021, it was decided that financial sector regulators shall co-ordinate and share information among members on their innovation initiatives. Further, members also agreed to suggest models on Inter-Operable RS mechanism for hybrid products/services to facilitate framing of standard operating procedure (SOP). Agenda for 2021-22 IX.46 The proposed action items under the goal-posts identified in the ‘Payment and Settlement Systems in India: Vision 2019-21’ are set out below: Encouraging Healthy Competition - Review of Membership to Centralised Payment Systems: The Reserve Bank shall initiate discussion to develop a framework for settlement risk management with increased participation of non-banks in centralised payment systems.

Improving Customer Convenience -

On Offline Payment Solutions: The Reserve Bank had announced that pilot schemes for Offline payment solutions would be conducted till March 31, 2021. Based on the experience gained through these pilot schemes, the Reserve Bank shall decide on implementing Offline payment solutions in the country; -

National Settlement Services for Card Schemes: The Reserve Bank shall explore the possibility of facilitating settlement of card transactions processed by various card payment networks through the accounts of card payment networks maintained with the Reserve Bank. Settlement of card transactions in Reserve Bank books shall increase confidence in card transactions; Ensuring Affordable Cost - Review of Corridors and Charges for Inbound Cross-Border Remittances: The Reserve Bank will examine the role that the payment services providers (PSPs) can play to ensure friction free remittances at lower cost.

Increasing Confidence -

Geo-tagging of Payment System Touch Points: The Reserve Bank has established a framework to capture the location and business details of commercial bank branches, ATMs and business correspondents (BCs). It is envisaged to extend a similar framework to capture and maintain information about PoS terminals and other payment system touch points as well; -

Third Party Risk Management and System-wide Security: The Reserve Bank shall examine the need for a separate regulatory framework for outsourcing arrangements by non-bank payment service providers, given the current trend of outsourcing arrangements and the need for security control and clarity of roles and responsibilities of the regulated entities. 3. DEPARTMENT OF INFORMATION TECHNOLOGY (DIT) IX.47 The Department of Information Technology (DIT), in its swift response to unprecedented challenges due to COVID-19 pandemic and to keep pace with the fast-changing technology landscape, adopted a proactive approach by leveraging on technology. Its effects were felt in business continuity under pandemic as well as in efficiency upgradation of normal business processes within as well outside the Reserve Bank. The Reserve Bank lined up a slew of measures and implemented environmentally sustainable products and practices, which make the workplaces paperless, collaborative and energy-efficient. A sustainable Information and Communication Technology (ICT) infrastructure, which is adaptive to changing technologies, was driven by the need for operational excellence through focus on resilience, reliability, security, integrity and cost efficiency. IX.48 The Reserve Bank continued its efforts to graduate its ICT systems to next generation applications with an inbuilt architecture for high-availability, scalability, enhanced security and performance. The security and privacy, which are embedded into the design and architecture of IT systems and practices, are the guiding principles. IX.49 The uninterrupted functioning of the ICT infrastructure of the Reserve Bank during the pandemic time including the critical payment applications NEFT and RTGS; core banking solution e-Kuber; treasury operations for money and forex market; and debt management for the governments (centre and states) indicates the resilience and buoyancy of the Department. The major milestones achieved during the year included support in rapid digitisation of financial services through facilitation of RTGS 24x365; disbursement of domestic defence pension payments through e-Kuber; and implementation of paperless office with recently launched “Sarthi” (i.e., Electronic Document Management System) application. Major Initiatives RTGS 24x365 IX.50 The RTGS system operated by the Reserve Bank of India went live on 24x365 basis at the stroke of midnight of December 14, 2020 (Box IX.3). While India is already recognised as the leader in retail payment systems, the launch of 24x365 RTGS makes India a leader in the large value payment systems across the world. With this development, the country is now ready to be a part of the world, where financial systems are integrated and not dependent on time zones. Treasury Single Account (TSA) system IX.51 Following the recommendation of Expenditure Management Commission (EMC) for curtailing the cost of government borrowings and enhancing efficiency of fund flows to Autonomous Bodies (ABs)/Sub-Autonomous Bodies (Sub-ABs), Treasury Single Account (TSA) was implemented with phase wise expansion since August 1, 2020. The Reserve Bank functions as the primary banker in TSA. The assignment accounts of ABs and Sub-ABs are opened in e-Kuber to receive different categories of grants-in-aid and incurred expenditure against the assigned limit. TSA facilitates just-in-time fund release to ABs/Sub- ABs and operates on straight through process (STP) with integration between e-Kuber and Public Financial Management System (PFMS) of Controller General of Accounts (CGA). Box IX.3

RTGS 24x365, Including Lessons from the Country Experience RTGS system, a large value electronic fund transfer system, enables transfer of funds between any two RTGS enabled bank accounts on real time basis. RTGS, which began its operations on March 26, 2004 with a soft launch involving four banks, now has membership of 242 participants. Since its inception in 2004, RTGS has undergone many changes with a significant one being adoption of ISO 20022 messaging standards in 2013. RTGS operational timings were increased at regular intervals with the last extension implemented on August 26, 2019 by making the RTGS system available between 7:00 AM and 7:45 PM. Before commencing round the clock operations, RTGS system was handling 6.35 lakh transactions daily for a value of ₹4.17 lakh crore. After successful launch of NEFT on 24x365 basis in December 2019 and smooth operation since then, it was felt that, to support the ongoing efforts aimed at global integration of Indian financial markets, facilitate India’s efforts to develop international financial centres and provide wider payment flexibility to domestic corporates and institutions, RTGS system should also be available round the clock. Accordingly, Reserve Bank announced in its Statement on Developmental and Regulatory Policies of October 9, 2020, that the RTGS will be available round the clock on all days of the year. All this culminated with the launch of RTGS 24x365 from December 14, 2020. After the launch, there was slight increase in average daily volume on week days. On March 30, 2021, RTGS system handled all time high of 11.40 lakh customer and inter-bank transactions. RTGS system is at present available on all days including Saturdays, Sundays and National Holidays and at all times except for the time taken to complete the end-of-day activity around midnight. Lessons from the Country Experience India is one of the very few countries offering RTGS on 24x365 basis. Two other countries having near 24x365 service are Mexico and South Africa. RTGS system of South Africa known as South African Multiple Option Settlement (SAMOS) system was designed for large-value interbank transactions, which was developed to bring domestic interbank settlement practices. The SAMOS system has been operating 24x365 since its inception on March 9, 1998. It moved to same-day settlement in August, 2004. The system closes at midnight and moves to the next business day, while instructions are received throughout the day. On public holidays and Sundays, the system allows for retail batch settlements. In order to enable banks to manage the final liquidity position for each day, a window of 25 minutes is allocated between 16:30 and 16:55. Mexico operates Interbanking Electronic Payment System (SPEI), a large-value funds transfer system in which participants can make transfers among themselves or their customers. The system began operating on August 13, 2004. Participants are not allowed to incur overdrafts of their accounts. The central bank administers the accounts of Mexican financial agents through Account Holders Service System (SIAC), which is used to provide liquidity to participants. Only banks registered in Mexico can avail collateralised intraday overdrafts in the SIAC system. The SPEI system operates between 19:00 hours to 17:35 hours. Source: RBI, BIS and Banco de México (Central Bank of Mexico). | Pension Disbursement for Defence Pensioners IX.52 The Reserve Bank integrated Comprehensive Pension Package (CPP) of defence pensioners with e-Kuber from September 7, 2020 and facilitated automatic credit of monthly pension through the enhanced e-Payment module in e-Kuber. Implementation of Advanced Mail Gateway and Exchange Scan Solutions IX.53 An advanced mail gateway solution that provides protection for the Mail Messaging System (MMS) against traditional and targeted attacks from outside through correlated intelligence was implemented. Further, an exchange specific security solution to protect against targeted phishing and ransomware attacks by using predictive machine learning, document exploit detection, custom sandbox analysis of suspicious files and Uniform Resource Locators (URLs) was also implemented. Sarthi - Electronic Document Management System (EDMS) IX.54 During the year, the Reserve Bank introduced its Electronic Document Management System, named as Sarthi, to facilitate and automate the various facets of document processing and management in a safe and secure manner. The implementation is expected to bring enhanced productivity, efficient record management and a less-paper environment. The application is accessible from anywhere through a secure remote access tool, which facilitated remote working during the COVID-19 pandemic time. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 IX.55 Last year, the Department had set out the following goals: -

Next Generation Structured Financial Messaging System (NGSFMS): The proposed NGSFMS will revamp the existing Structured Financial Messaging System (SFMS) platform and simplify the architecture, bringing in scalability and flexibility and at the same time promoting enterprise framework of message communication among internal applications such as RTGS, core banking solution (CBS) of banks and NEFT (Utkarsh) [Para IX.56]; -

Augmentation and Modernisation of Infrastructure Security Layer: Consolidation, augmentation and automation of security layers, comprising internal and perimeter firewalls and intrusion management solution [i.e., governance, risk management and compliance (GRC)] will be undertaken to enhance cyber resilience and strengthen security of the Reserve Bank (Para IX.57); -

Next Generation Wireless Technology Wifi-6 Across the Reserve Bank: The adoption of new emerging technology Wifi-6 will be initiated across the Reserve Bank for upgradation of the Wi-fi infrastructure wherein new access points (available with next generation wireless technology, i.e., Wifi-6) will be deployed (Para IX.58); and -

Reserve Bank as Aggregator for Tax Information Network (TIN2.0): The Central Board of Direct Taxes (CBDT) is implementing a new payment system, i.e., Tax Information Network (TIN2.0), while subsuming the erstwhile Online Tax Accounting System (OLTAS) in the new system. The new system in e-Kuber will facilitate the Reserve Bank’s functions both as the collecting bank and as an aggregator for amounts received by the authorised agency banks (Para IX.59). Implementation Status of Goals Next Generation Structured Financial Messaging System (NGSFMS) IX.56 The Reserve Bank of India upgraded the Structured Financial Messaging System (SFMS) in August 2020. SFMS is the messaging system used for both NEFT and RTGS managed by the Reserve Bank. The upgraded SFMS version offers simplified architecture, best industry practices in application framework, modular approach for much needed flexibility for any future changes, and enhanced security features, to name a few. Augmentation and Modernisation of Infrastructure Security Layer IX.57 Security Controls were augmented by implementing secure remote access capability to access the Reserve Bank’s applications from outside of office premises. The solution offers security checks at multiple levels through user multifactor authentication, endpoint authentication and health check, and secure access tunnel through a secure network gateway. Further, next generation antivirus solution with predictive machine learning and behaviour analysis has also been implemented during the year to enhance endpoint and email security controls of the Reserve Bank. Next Generation Wireless Technology Across the Reserve Bank IX.58 The Betaar Sanchar Seva (BSS) Sanchar project was successfully implemented during the COVID-19 induced lockdown at Central office Building (COB) and other selected office locations (including four metros) of the Reserve Bank. This has improved the overall operational efficiency, visibility and reliability of internet service across offices. The platform also provides an alternate channel to meet day-to-day business requirements and acts as a backup for the wired internet network in case of any exigencies. Reserve Bank as Aggregator for Tax Information Network IX.59 The Reserve Bank is in the process of integration of e-Kuber system with Tax Information Network (TIN 2.0) of Central Board of Direct Taxes (CBDT) and the Public Financial Management System (PFMS) of Controller General of Accounts (CGA) for implementation of Pratayaksh Kar Lekhankan Pranali (PRAKALP). The new system in e-Kuber will facilitate the Reserve Bank to function both as the collecting bank through over-the-counter (OTC) as well as NEFT/RTGS modes and as an aggregator for amounts received by the authorised agency banks. Agenda for 2021-22 IX.60 The Department’s goals for 2021-22 under Utkarsh are set out below: Next Generation Data Centre: Examination of the feasibility of next generation data centre and preparation of detailed prototype plan to cater to the Reserve Bank’s ICT roadmap for coming years; -

Upgradation of Non-IT Physical Infrastructure at Data Centres: The rejuvenating non-IT infrastructure of its existing data centres is underway. Optimal capacity planning and energy efficiency is a major driving factor for the project, which includes invigorating non-IT infrastructure at data centres; and -

Implementation of Next-Generation e-Kuber: e-Kuber is performing key financial services and operations of the Reserve Bank with/for various stakeholders such as government, banks and other market participants. The system is being refreshed to improve the functionalities by leveraging on technological developments and will facilitate enhanced automation of processes, flexibility of integration with external and internal systems, ease of change management, enhanced modularity, reporting with comprehensive real time dashboards, front end improvements for enhancing productivity and robust controls. 4. CONCLUSION IX.61 In sum, the Reserve Bank continued its efforts to develop state-of-the-art payment and settlement systems in the country and enhance the digital payment experience of the consumers, while ensuring adequate security measures. These initiatives have facilitated smooth transition towards a less cash society with improved transaction efficiency and a delightful digital experience. Amidst difficulties arising from the COVID-19 pandemic, efforts were also made for the smooth functioning of the payment system. Further, the Reserve Bank focused on enhancements in the IT infrastructure for internal users also contributing to improved efficiency. It also helped expand coverage for government transactions using digital technologies. Going ahead, strengthening the payments ecosystem, enhancing awareness, and ensuring facilitation of digital payments across the length and breadth of the country will be the key areas of focus of the Reserve Bank.

|