During the year, the Reserve Bank continued its endeavour to increase efficiency, improve customer convenience, expand outreach and ensure safety and security of payment systems, in line with the Payment Systems Vision 2021. Though the focus remained on cyber resilience in a COVID-19 induced pandemic environment and for ensuring round the clock availability of the Information and Communication Technology (ICT) infrastructure in the Reserve Bank, the efforts also continued towards upgrading IT infrastructure and stabilising newly introduced applications. IX.1 During the year, the Department of Payment and Settlement Systems (DPSS) continued its efforts towards the planned development of the payment systems as guided by the Reserve Bank’s Payment and Settlement Systems Vision 2021 document, viz., enhance experience of consumers, empower payment system operators and service providers, enable the ecosystem and infrastructure and put in place forward looking regulation supported by risk focused supervision. Keeping in view the global focus on enhancing cross-border payment arrangements, the Reserve Bank also explored the possibility of linking India’s fast payment system - Unified Payments Interface (UPI) with similar systems in other jurisdictions, and actively participated in the discussions of the Committee on Payments & Market Infrastructures (CPMI) and Financial Stability Board (FSB) on implementation of the G20 endorsed cross-border payments roadmap. The focus of the Department of Information Technology (DIT) remained on ensuring an uninterrupted functioning of the ICT infrastructure in the Reserve Bank in the COVID-19 induced pandemic environment. Further, the major milestones achieved during the year included enhancing resilience of Real Time Gross Settlement (RTGS) and Structured Financial Messaging System (SFMS), upgradation of non-IT physical infrastructure at data centres and stabilisation of Sarthi application (i.e., electronic document management system for internal use in the Reserve Bank). IX.2 Against this backdrop, the following section covers developments in the sphere of payment and settlement systems during the year and also takes stock of the implementation status of the agenda for 2021-22. Section 3 provides various measures undertaken by the DIT during the year vis-à-vis the agenda set for 2021-22. These departments have also set out an agenda for 2022-23. The chapter has been summarised at the end. 2. DEPARTMENT OF PAYMENT AND SETTLEMENT SYSTEMS (DPSS) IX.3 The Reserve Bank continued its endeavour to enhance competition, ensure optimal cost for consumers, improve customer convenience and increase confidence in payment systems, in line with the outcomes identified in the Payment Systems Vision 2021. The Reserve Bank expanded access to centralised payment systems to include non-bank payment system providers. Leveraging on the 24x7x365 availability of RTGS, additional settlements were introduced in UPI, Immediate Payment Service (IMPS), Aadhaar enabled Payment System (AePS), National Electronic Toll Collection (NeTC), and National Financial Switch (NFS), and National Automated Clearing House (NACH) was operationalised on all days of the week. In order to enhance cross-border payment arrangements, the Reserve Bank explored the possibility of linking India’s fast (retail) payment system, UPI, with similar system in other jurisdictions. The India (UPI) Singapore (PayNow) interlinking is underway (Box IX.1). Box IX.1

India and Singapore to Link their Fast Payment Systems - UPI and PayNow The Reserve Bank of India and the Monetary Authority of Singapore (MAS) have announced a project to link their fast payment systems, UPI and PayNow. The linkage will enable users of the two systems to make instant fund transfers (remittances) without the need to get onboarded onto the other system. In other words, a user of UPI does not require to be a part of PayNow system to be able to transfer funds to a PayNow user in Singapore and vice versa. The linkage builds upon the earlier efforts of NPCI International Payments Limited (NIPL, a subsidiary of NPCI) and Network for Electronic Transfers (NETS of Singapore) to facilitate QR code-based payments through UPI in Singapore. The initiative is in line with the Reserve Bank’s vision of reviewing inbound remittance corridors between India and other countries. The UPI-PayNow linkage can foster cross-border interoperability of payments and further anchor trade, travel and remittance flows between the two countries. Singapore has a large number of Indian workers and students, resulting in substantial (more than USD 1 billion) in-bound and out-bound remittances every year. The UPI-PayNow linkage is expected to be a significant milestone in the development of infrastructure for cross-border payments between India and Singapore, and aligns with the G20’s financial inclusion priority of enabling faster, cheaper and more transparent cross-border payments. It can also contribute towards fulfilling United Nation’s (UN) Sustainable Development Goals (SDG 10.c)1 by reducing cost of remittances. The linkage is expected to be operationalised in the second half of 2022. Source: RBI. | Payment Systems IX.4 The payment systems2 recorded a robust growth of 63.6 per cent in terms of volume during 2021-22 on top of the expansion of 26.7 per cent in the previous year. In value terms, the growth was 23.1 per cent as against a decline of 13.4 per cent in the previous year, mainly due to robust growth observed in the large value payment system, viz., RTGS. The share of digital transactions in the total volume of non-cash retail payments increased to 99.3 per cent during 2021-22, up from 98.8 per cent in the previous year (Table IX.1). Digital Payments IX.5 Among the digital modes of payments, the number of transactions using RTGS increased by 30.5 per cent during 2021-22 (Table IX.1). In terms of value, RTGS transactions registered an increase of 21.8 per cent; transactions through the National Electronic Funds Transfer (NEFT) system also witnessed an increase of 30.6 per cent and 14.3 per cent in volume and value, respectively, reflective of the increase in large value corporate transactions, in line with rising economic activity. As at end March 2022, RTGS services were available through 1,56,740 IFSCs3 of 239 members, while NEFT services were available through 1,60,428 IFSCs of 227 member banks. IX.6 During 2021-22, payment transactions carried out through credit cards increased by 27.0 per cent and 54.3 per cent in terms of volume and value, respectively (Table IX.1). Transactions through debit cards decreased by 1.9 per cent in terms of volume, though in terms of value, it increased by 10.4 per cent. Prepaid Payment Instruments (PPIs) recorded an increase in volume and value terms by 32.3 per cent and 48.5 per cent, respectively. The growth in digital payments can be attributed to increased availability of acceptance infrastructure, which witnessed substantial growth during the year benefitting from the operationalisation of the Payments Infrastructure Development Fund (PIDF). The number of Points of Sale (PoS) terminals increased by 28.6 per cent to 60.7 lakh during the year, while the number of Bharat Quick Response (BQR) codes deployed increased by 39.3 per cent to 49.7 lakh during the same period. Further, the number of Automated Teller Machines (ATMs) also increased to 2.48 lakh in 2021-22 from 2.39 lakh in the previous year. | Table IX.1: Payment System Indicators - Annual Turnover (April-March) | | Item | Volume (lakh) | Value (₹ lakh crore) | | 2019-20 | 2020-21 | 2021-22 | 2019-20 | 2020-21 | 2021-22 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | A. Settlement Systems | | | | | | | | CCIL Operated Systems | 36 | 28 | 33 | 1,341.50 | 1,619.43 | 2,068.73 | | B. Payment Systems | | | | | | | | 1. Large Value Credit Transfers – RTGS | 1,507 | 1,592 | 2,078 | 1,311.56 | 1,056.00 | 1,286.58 | | Retail Segment | | | | | | | | 2. Credit Transfers | 2,06,297 | 3,17,868 | 5,77,632 | 285.57 | 335.04 | 427.23 | | 2.1 AePS (Fund Transfers) | 10 | 11 | 10 | 0.005 | 0.01 | 0.01 | | 2.2 APBS | 16,747 | 14,373 | 12,298 | 0.99 | 1.11 | 1.33 | | 2.3 ECS Cr | 18 | 0 | 0 | 0.05 | 0 | 0 | | 2.4 IMPS | 25,792 | 32,783 | 46,625 | 23.38 | 29.41 | 41.71 | | 2.5 NACH Cr | 11,100 | 16,465 | 18,730 | 10.37 | 12.17 | 12.77 | | 2.6 NEFT | 27,445 | 30,928 | 40,407 | 229.46 | 251.31 | 287.25 | | 2.7 UPI | 1,25,186 | 2,23,307 | 4,59,561 | 21.32 | 41.04 | 84.16 | | 3. Debit Transfers and Direct Debits | 6,027 | 10,457 | 12,222 | 6.06 | 8.66 | 10.38 | | 3.1 BHIM Aadhaar Pay | 91 | 161 | 228 | 0.01 | 0.03 | 0.06 | | 3.2 ECS Dr | 1 | 0 | 0 | 0 | 0 | 0 | | 3.3 NACH Dr | 5,842 | 9,646 | 10,788 | 6.04 | 8.62 | 10.31 | | 3.4 NETC (Linked to Bank Account) | 93 | 650 | 1,207 | 0.002 | 0.01 | 0.02 | | 4. Card Payments | 72,384 | 57,787 | 61,786 | 14.35 | 12.92 | 17.02 | | 4.1 Credit Cards | 21,773 | 17,641 | 22,399 | 7.31 | 6.30 | 9.72 | | 4.2 Debit Cards | 50,611 | 40,146 | 39,387 | 7.04 | 6.61 | 7.30 | | 5. Prepaid Payment Instruments | 53,811 | 49,743 | 65,812 | 2.16 | 1.98 | 2.94 | | 6. Paper-based Instruments | 10,414 | 6,704 | 6,999 | 78.25 | 56.27 | 66.50 | | Total - Retail Payments (2+3+4+5+6) | 3,48,933 | 4,42,557 | 7,24,451 | 386.38 | 414.86 | 524.07 | | Total Payments (1+2+3+4+5+6) | 3,50,440 | 4,44,149 | 7,26,530 | 1,697.94 | 1,470.86 | 1,810.65 | | Total Digital Payments (1+2+3+4+5) | 3,40,026 | 4,37,445 | 7,19,531 | 1,619.69 | 1,414.59 | 1,744.14 | APBS: Aadhaar Payment Bridge System. ECS: Electronic Clearing Service.

Note: 1. RTGS system includes customer and inter-bank transactions only.

2. Settlements of government securities and forex transactions are through the Clearing Corporation of India Ltd. (CCIL). Government Securities include outright trades and both legs of repo transactions and triparty repo transactions.

3. The figures for cards are for payment transactions at point of sale (POS) terminals and online.

4. Figures in the columns might not add up to the total due to rounding off of numbers.

Source: RBI. | IX.7 There is global evidence of a pandemic-induced shift in digital payment habits owing to social distancing norms (Alber and Dabour, 2020; Jonker et al., 2020) and relief measures by governments (Toh and Tran, 2020) to mitigate the negative impacts of the pandemic on household consumption spending (Liu et al. 2020). In the Indian context also, the COVID-19 induced lockdown was an inflection point for digital onboarding of new users (Box IX.2). Box IX.2

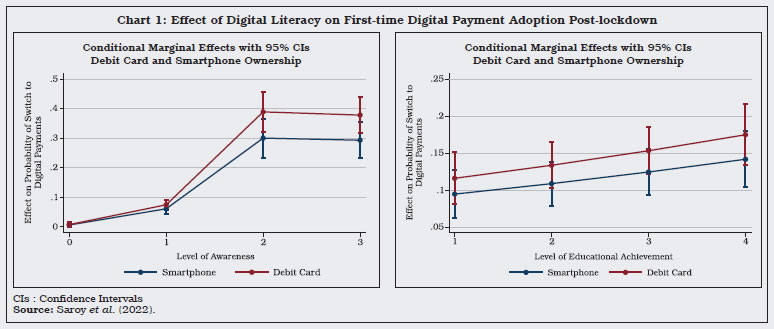

Household Choice of Digital Payments amidst COVID-19 Pandemic An empirical analysis of primary survey data from the National Payments Corporation of India (NPCI, 2020) brings to the fore useful perspectives about households’ choice of digital payments during the pandemic (Table 1). Around one-third of surveyed households transacted digitally for the first time during the lockdown. Households that had prior experience with digital payments but had abandoned them for reasons such as difficulty in use, lack of internet access, fraud, overspending, etc., were most likely to re-adopt them during the pandemic. General awareness about payment modes as well as the level of formal educational attainment contributed to first-time adoption, notably even at low levels. The former has a stronger effect than the latter, indicating that familiarity and occasional use are sufficient to encourage the switch. Long-term beneficiaries of welfare support were more likely to go digital to access their entitlements in a timely manner. Debit card and smartphone ownership were key enablers, while access to bank mitras and mobile banking apps played a relatively smaller role. Actual use of smartphones for digital payments may be effectively boosted by enhancing digital literacy and awareness (Chart 1). Most new users were from the middle-aged and the old age segment, indicating that the pandemic may have “force-bridged” the generation gap in digital payments. While respondents over the age of 60 preferred cards, UPI and mobile wallets were highly popular amongst the younger and middle-aged population. Heads of households who didn’t personally own a smartphone were also likely to switch if they had a family member with a smartphone. There is evidence of such digitally empowered household members substituting for bank mitras in enabling digital payment adoption. The pandemic induced ‘switch to digital’ is likely to be permanent if there are significant changes in the underlying enablers such as enhancement in the payment infrastructure, more merchant on-boarding, reduction in frauds, greater customer trust in digital payments and enhanced ease of use of such payment modes. This would ensure that the recent shift in preferences towards digital is not just a temporary spike but a permanent behavioural shift. Table 1: Summarised Logistic Regression Results (Dependent Variable:

“Did you use digital methods for the first time after the lockdown?”) | | Variables | Logit Coefficients | Marginal Effect at Means | | Used Digital Payments earlier but discontinued later | 2.826*** (0.192) | 0.458*** (0.0484) | | Level of Awareness= 1 (Low) | 2.357*** (0.615) | 0.0334*** (0.00544) | | Level of Awareness= 2 (Medium) | 4.676*** (0.619) | 0.277*** (0.0293) | | Level of Awareness = 3 (High) | 4.608*** (0.615) | 0.264*** (0.0228) | | Level of Education | 0.169** (0.0695) | 0.0121** (0.00519) | | Received DBT based government aid both before and after lockdown | 2.601*** (0.324) | | | Access to Smartphone | 1.436*** (0.193) | 0.0860*** (0.0122) | | Access to Debit Card | 2.171*** (0.285) | 0.106*** (0.0128) | | Access to Bank Mitra | 0.474*** (0.113) | 0.0327*** (0.00852) | | Access to Mobile Banking App | 0.407*** (0.115) | 0.0314*** (0.0101) | | Constant | -9.609*** (0.794) | | | McFadden’s Adjusted R2 | 0.481 | | | Observations | 4,061 | 4,061 | ***: Significant at 1 per cent level. **: Significant at 5 per cent level.

Note: 1. Values in the parentheses indicate standard errors.

2. Levels of Awareness are: 0 (Not Aware - base case), 1 (Low), 2 (Medium) and 3 (High).

3. Levels of Education are on the scale: 1 (Illiterate), 2 (Primary School), 3 (High School), and 4 (Graduates and above).

4. The Marginal Effect at Means (MEM) is the marginal effect of a particular regressor with other regressors held at their mean values.

5. To ascertain the predictive accuracy of the baseline model, the data was split into training and testing set (80:20). The classification accuracy of the model stands at 87 per cent, sensitivity at 89 per cent and specificity at 82 per cent. Based on Cook’s distance, there is no evidence of influential outliers.

Source: Saroy et al., (2022). |

References: 1. Alber, N., and M. Dabour (2020), ‘The Dynamic Relationship Between FinTech and Social’, International Journal of Economics and Finance, 12(11), 109-109. 2. Jonker, N., C. van der Cruijsen, M. Bijlsma, and W. Bolt (2020), ‘Pandemic Payment Patterns’, DNB Working Papers 701, Research Department, Netherlands Central Bank. 3. Liu, T., B. Pan, and Z.Yin (2020), ‘Pandemic, Mobile Payment, and Household Consumption: Micro Evidence from China’, Emerging Markets Finance and Trade, 56(10), 2378-2389. 4. National Payments Corporation of India (2020), ‘Digital Payments Adoption in India, 2020’, NPCI-PRICE Report. 5. Saroy, R., S. Awasthy, N. K. Singh, S. Adki, and S. Dhal (2022), ‘Impact of COVID-19 on Digital Payment Habits of Indian Households’, Bulletin of Monetary Economics and Banking, Vol 25, Special Issue. 6. Toh, Y. L., and T. Tran (2020), ‘How the COVID-19 Pandemic May Reshape the Digital Payments Landscape’, Payments System Research Briefing, 1-10, Federal Reserve Bank of Kansas City. | Authorisation of Payment Systems IX.8 Payment System Operators (PSOs) comprise PPI issuers, cross-border Money Transfer Service Schemes (MTSS), White Label ATM (WLA) operators, Trade Receivables Discounting Systems (TReDS), ATM networks, Instant Money Transfer Service Providers, Card Payment Networks and Bharat Bill Payment Operating Units (BBPOUs), besides Clearing Corporation of India Ltd. (CCIL) and National Payments Corporation of India (NPCI) [Table IX.2]. Agenda for 2021-22 IX.9 Last year, the Department had set out the following goals: Encouraging Healthy Competition | Table IX.2: Authorisation of Payment System Operators (as at end-March) | | (Number) | | Entities | 2021 | 2022 | | 1 | 2 | 3 | | A. Non-Banks – Authorised | | | | PPI Issuers | 36 | 37 | | WLA Operators | 4 | 4 | | Instant Money Transfer Service Providers | 1 | 1 | | BBPOUs | 8 | 9 | | TReDS Platform Operators | 3 | 3 | | MTSS Operators | 9 | 9 | | Card Networks | 5 | 5 | | ATM Networks | 2 | 2 | | B. Banks – Approved | | | | PPI Issuers | 56 | 57 | | BBPOUs | 42 | 43 | | Mobile Banking Providers | 566 | 648 | | ATM Networks | 3 | 3 | | Source: RBI. | Improving Consumer Convenience -

The Reserve Bank had announced that pilot schemes for offline payment solutions would be conducted till March 31, 2021. Based on the experience gained through these pilot schemes, the Reserve Bank shall decide on implementing offline payment solutions in the country (Paragraph IX.12); and -

The Reserve Bank shall explore the possibility of facilitating settlement of card transactions processed by various card payment networks through the accounts of card payment networks maintained with the Reserve Bank. Settlement of card transactions in Reserve Bank books shall increase confidence in card transactions (Paragraph IX.13). Ensuring Affordable Cost Increasing Customer Confidence -

The Reserve Bank has established a framework to capture the location and business details of commercial bank branches, ATMs and business correspondents (BCs). It is envisaged to extend a similar framework to capture and maintain information about PoS terminals and other payment system touch points as well (Paragraph IX.15); and -

The Reserve Bank shall examine the need for a separate regulatory framework for outsourcing arrangements by non-bank payment service providers, given the current trend of outsourcing arrangements and the need for security control and clarity of roles and responsibilities of the regulated entities (Paragraph IX.16). Implementation Status IX.10 In the ‘Payment and Settlement Systems in India: Vision 2019-2021’, DPSS had identified four goal-posts, viz., competition, cost, convenience, and confidence, for achieving its vision. Encouraging Healthy Competition Review of Membership to Centralised Payment Systems (CPS) IX.11 The Reserve Bank expanded access to CPS (RTGS and NEFT) and permitted authorised non-bank PSOs, viz., PPI issuers, card networks and WLA operators, to participate in CPS as direct members. The non-bank PSOs were also allowed to open current accounts with the central bank. Guidelines were issued in July 2021 stipulating eligibility criteria, membership type and nature of transactions, along with frequently asked questions (FAQs) for operational and user convenience. Direct access is expected to minimise the overall risk in the payments ecosystem and also benefit non-banks by lowering cost and time for effecting/receiving payments, reducing dependence on banks and eliminating uncertainty in finality of payments as settlement will be carried out in central bank money. Improving Customer Convenience Offline Payment Solutions IX.12 To encourage technological innovations that enable offline digital transactions, authorised PSOs were permitted in August 2020 to conduct pilots for proximity payments using cards, wallets or mobile devices. Based on the experience gained, the framework for facilitating small value digital payments in offline mode was issued on January 3, 2022. Accordingly, the authorised PSOs and Payment System Participants (both acquirer and issuers – banks and non-banks) were permitted to enable small value digital payments in offline mode using any channel or instrument like cards, wallets, mobile devices, etc., subject to specified conditions. The initiative is expected to give a push to digital transactions in areas with poor or weak internet or telecom connectivity, particularly in semi-urban and rural areas. National Settlement Services for Card Schemes IX.13 A circular on ‘Access for Non-Banks to CPS’ was issued on July 28, 2021, amending Master Directions on Access Criteria for Payment Systems dated January 17, 2017 and permitting direct access to non-bank PSPs including card networks. This will facilitate settlement of card transactions in the Reserve Bank. Ensuring Affordable Costs Review of Corridors and Charges for Inbound Cross-border Remittances IX.14 The Reserve Bank is working on use of UPI for cross-border remittances across jurisdictions. While the efforts with various countries are at various stages, the interlinking of UPI with PayNow has been formally announced and is expected to be operationalised in the second half of 2022. The interlinking will further anchor trade, travel and remittance flows between the two countries and lower the cost of cross-border remittances. It would also serve as an example of interlinking of respective fast payment systems to achieve instant remittances in a cost-effective manner. Increasing Confidence Geo-tagging of Payment System Touch Points IX.15 As announced in the Statement on Developmental and Regulatory Policies of October 8, 2021, the Reserve Bank prescribed a framework for geo-tagging of payment acceptance infrastructure deployed by banks and non-bank PSOs. Geo-tagging is expected to provide insights on regional penetration of digital payments by monitoring infrastructure density across different locations. This will help initiate policy interventions to deploy additional payment touch points and facilitate undertaking focused digital literacy programmes. Third Party Risk Management and System-wide Security IX.16 The Reserve Bank issued a circular dated August 3, 2021 on “Framework for Outsourcing of Payment and Settlement-related Activities by Payment System Operators”. The framework provides minimum standards to manage risks in outsourcing of payment and/or settlement-related activities (including other incidental activities like on-boarding customers, IT based services, etc.). Major Developments Improving Customer Convenience Enhancements in PPIs IX.17 Mandating interoperability, permitting cash withdrawal from full-KYC4 PPIs and increasing maximum balance in full-KYC PPIs to ₹2 lakh were enhancements permitted to PPIs in May 2021. Bharat Bill Payment System (BBPS) - Addition of Biller Category IX.18 In July 2021, mobile prepaid recharges were permitted as a biller category in BBPS. As part of BBPS, the mobile prepaid customers will benefit from standardised bill payment experience, centralised customer grievance redressal mechanism, transparent customer convenience fee and availability of a bouquet of anytime, anywhere digital payment options. Enhancements to Indo-Nepal Remittance Facility Scheme IX.19 Enhancements were made to the Indo Nepal Remittance Facility Scheme in October 2021 by way of increasing the ceiling per transaction to ₹2 lakh and removing the annual cap of 12 remittances. These enhancements are expected to boost trade payments between the two countries and also ease pension payments to the ex-servicemen settled/relocated in Nepal. Availability of NACH on All Days IX.20 Leveraging on the availability of RTGS 24x7x365, NACH system was made operational on all days of the week, including weekends, effective August 1, 2021. NACH has emerged as a popular and prominent digital mode of direct benefit transfer (DBT) to large number of beneficiaries and has helped transfer of government subsidies during the COVID-19 pandemic in a timely and transparent manner. 24x7 Helpline for Digital Payments – DigiSaathi IX.21 Under the guidance of the Reserve Bank, NPCI in association with the payments industry set-up a centralised industry-wide 24x7 helpline for digital payments christened – DigiSaathi. The 24x7 helpline provides a channel to obtain help on the entire gamut of digital payments. Automated responses on information related to digital payment products and services are available in Hindi and English through multiple options like – (a) toll-free number (1800-891-3333), (b) a short code (14431), (c) website – www.digisaathi.info, and chatbots. DigiSaathi will assist users with their queries on digital payments via website and chatbot facility and through toll-free calls where user can dial or call out the options/products for which the information is required. UPI for Feature Phones – UPI123Pay IX.22 UPI123Pay was launched by the Reserve Bank to empower 40+ crore feature phone subscribers to get onboarded to the domain of digital payments by enabling them to transact digitally and avail UPI features. UPI123Pay provides four distinct options to feature phone users to effect digital payments, viz., (a) Interactive Voice Response (IVR), (b) missed call, (c) app based functionality, and (d) proximity sound-based payments. Enhancing Transaction Limit for IMPS IX.23 IMPS is an important payment system providing 24x7 instant domestic funds transfer facility and is accessible through various channels like internet banking, mobile banking apps, bank branches, ATMs, SMS and Interactive Voice Response System (IVRS). Keeping in view the importance of IMPS in processing of domestic payment transactions, the per-transaction limit was enhanced from ₹2 lakh to ₹5 lakh for all channels other than SMS and IVRS (₹5 thousand). This will lead to further increase in digital payments and will provide an additional facility to customers for making digital payments beyond ₹2 lakh. Increase in UPI Transaction Limit for Specified Categories IX.24 To facilitate greater participation of retail customers in financial markets, e.g., investment in the G-secs segment through the Retail Direct Scheme, and for payment towards subscription of Initial Public Offerings (IPOs); the transaction limit in UPI system was enhanced from ₹2 lakh to ₹5 lakh for these categories. Ensuring Affordable Costs Usage of Automated Teller Machines/Cash Recycler Machines - Review of Interchange Fee and Customer Charges IX.25 The interchange fee and customer charges for transactions at ATMs and cash recycler machines were reviewed in June 2021 after examining the recommendations of the committee set-up by the Reserve Bank under the Chairmanship of the Chief Executive, Indian Banks’ Association (IBA). Accordingly, a marginal increase in interchange fees per transaction from ₹15 to ₹17 for financial transactions and from ₹5 to ₹6 for non-financial transactions in all centres was effected from August 1, 2021. Consequently, the ceiling on customer charge per transaction, beyond the free transactions, was also increased slightly from ₹20 to ₹21, effective January 1, 2022. Discussion Paper on Charges in Payment Systems IX.26 To take a comprehensive view of the charges payable by merchants and consumers for receiving/making digital payments, it was announced in the Statement on Developmental and Regulatory Policies of December 8, 2021 that a discussion paper covering all aspects related to charges (including convenience fee and surcharging) involved in various channels of digital payments will be issued shortly. Increasing Confidence Investment in Entities from FATF Non-compliant Jurisdictions IX.27 Guidelines were issued in June 2021 on investment in PSOs from Financial Action Task Force (FATF) non-compliant jurisdictions to ensure consistency with similar instructions for investment in non-banking financial companies (NBFCs) from such jurisdictions. Tokenisation - Card Transactions IX.28 The framework on device-based card tokenisation was extended in August 2021 to include laptops, desktops, wearables (wrist watches and bands) and Internet of Things (IoT) devices. Further, in September 2021, card networks and card issuers were permitted to offer Card-on-File Tokenisation (CoFT) services. It was also advised that from July 1, 2022 no entity in the card transaction/payment chain, other than the card issuers and/or card networks, shall store the actual card data, and any such data stored previously shall be purged. Other Initiatives CPFIR - Payment Fraud Reporting (Utkarsh) IX.29 The reporting of payment frauds to the Central Payments Fraud Information Registry (CPFIR) maintained by the Reserve Bank was further streamlined with inclusion of more scheduled commercial banks and non-bank PPI issuers as reporting entities. Payments Infrastructure Development Fund (PIDF) [Utkarsh] IX.30 The PIDF scheme was operationalised fully during the year, and as at end-March 2022, the contribution to the scheme was ₹798.94 crore. Also, as at end-March 2022, 94.77 lakh payment acceptance devices were deployed under the PIDF. The Advisory Council chaired by the Reserve Bank’s Deputy Governor (Shri T. Rabi Sankar) provided overall guidance and also approved inclusion of eligible street vendors of the Prime Minister Street Vendor’s AatmaNirbhar Nidhi (PM SVANidhi) Scheme in Tier-1 and 2 centres as beneficiaries of the PIDF Scheme. Inspection of NPCI IX.31 Inspection of NPCI was conducted in November 2021. The scope of the inspection, driven by the Principles for Financial Market Infrastructures (PFMIs), was confined to functional assessment of various retail payment systems operated by NPCI, risk assessment and management framework, governance and oversight, business impact analysis, compliance audit, information and cyber security audit, compliance status of previous Inspection Report and compliance of the terms and conditions of the Certificate of Authorisation. Inspection of CCIL IX.32 The Reserve Bank conducted the onsite inspection of CCIL under Section 16 of the Payment and Settlement Systems (PSS) Act, 2007. CCIL was assessed against the 24 PFMIs formulated by the Committee on Payments and Market Infrastructures-International Organisation of Securities Commissions (CPMI-IOSCO). As Central Counterparty (CCP), CCIL was rated ‘Observed’ for 17 principles and ‘Broadly Observed’ for three, while four were ‘Not Applicable’ to it. As Trade Repository (TR), CCIL was rated ‘Observed’ for 11 principles, while 13 were ‘Not Applicable’. Developments in CCIL IX.33 During the year, CCIL was able to manage its operations smoothly notwithstanding the challenges from the COVID-19 pandemic. CCIL enhanced its risk management process by increasing margin period of risk (MPOR) to 5 days in various segments, calibrating the floor for 1-day value at risk (VaR) for securities in a tenor bucket to 95th percentile and improving the methodology for intra-month revision of default fund. IX.34 Leveraging on RTGS 24x7, CCIL extended the cut-off time for clearing and settlement in forex segments. CCIL settlement data was included in daily data on payment systems published on the Reserve Bank’s website from May 3, 2021. Submission of returns/statements by CCIL was further rationalised. CCIL also assumed responsibility as the aggregator and receiving office for the RBI Retail Direct Scheme, which facilitates investment in government securities by individual investors. The issuances of Legal Entity Identifier (LEI) by CCIL’s subsidiary Legal Entity Identifier India Ltd. (LEIL) crossed 45,000 in March 2022. e-BAAT Programmes IX.35 The Reserve Bank has been conducting electronic Banking Awareness and Training (e-BAAT) programmes regularly for the benefit of customers/bankers/students/public. The aim is to create awareness and clear doubts on use of various payment systems and products. During the year, 367 e-BAAT programmes were conducted by the regional offices of Reserve Bank. Inspection of PSOs IX.36 Under Section 16 of the PSS Act, inspection of 46 retail entities, viz., 30 PPI issuers, 4 WLA operators, 8 BBPOUs, 3 TReDS platform operators and one ATM Network was carried out by the Reserve Bank during the year. Agenda for 2022-23 IX.37 In 2022-23, the Department will focus on the following goals: -

Formulation and Release of Payment System Vision 2025 Document: With the achievement of the intended outcomes and completion of identified actions in Vision 2021, the Reserve Bank shall come out with its Vision for the payments ecosystem in the coming years to ensure continuous development of the payments landscape; -

Publication of Payments Dashboard: To enhance consumer experience and provide greater insights into payment trends, the Reserve Bank shall publish a payments dashboard with pictorial representation of trends in payment systems; and -

Implementation of Framework of Geo-tagging of Payment Acceptance Infrastructure: As announced in the Statement on Developmental and Regulatory Policies of October 8, 2021, the Reserve Bank has prescribed a framework for geo-tagging payment touch points and will initiate the process to implement the framework. 3. DEPARTMENT OF INFORMATION TECHNOLOGY (DIT) IX.38 The focus of the Department of Information Technology during the year remained on ensuring an uninterrupted functioning of the ICT infrastructure in the Reserve Bank in the COVID-19 induced pandemic environment. The Bio-bubble created by the Department, right at the beginning of the COVID-19 pandemic, was sustained through the successive waves of the pandemic ensuring smooth functioning of the country’s payment systems, financial market operations, internal ICT facilities in the Reserve Bank, among others. IX.39 During the year, though the focus remained on cyber resilience in a COVID-19 induced pandemic environment for ensuring round the clock availability of the ICT infrastructure in the Reserve Bank, the Department also continued its efforts towards upgrading infrastructure and also stabilising newly introduced applications. The major milestones achieved during the year included enhancing resilience of RTGS and SFMS, upgradation of non-IT physical infrastructure at data centres and stabilisation of Sarthi application. Major Initiatives Improving Resilience of RTGS IX.40 As an incremental strategy to continuously improve India’s payment systems, upgrades have been carried out in underlying infrastructure hosting RTGS, which smoothens the message flow, its reconciliation and replication across sites. This coupled with ongoing improvements in RTGS system would help in reducing the system Recovery Time Objective (RTO) and further improving the resilience. New Advanced Firewall and Network Data Flow Monitoring IX.41 The new advanced firewall solution, which is being implemented across the Reserve Bank, provides advanced features equipped to cater to the security requirements of the growing needs of Reserve Bank’s IT infrastructure. The content disarm and reconstruction feature provides dedicated file scanning for the network traffic. IX.42 The network data flow monitoring solution provides protection against both internal and external threats with higher visibility and security, through analytics on encrypted traffic for malware. The security analytics of the solution helps to identify security compliance gaps, aids in forensic investigation, threat alarms and incident response. Upgradation of Non-IT Physical Infrastructure at Data Centres IX.43 The Reserve Bank rejuvenated non-IT infrastructure of its existing data centres during the COVID-19 induced lockdown. All non-IT infrastructure was replaced/upgraded in live running environment of 24x365 critical operations. The work has been completed at two data centres and is in advanced stage of completion at third data centre. The major driving factor for the project was optimal capacity planning and energy efficiency which includes upgrading of non-IT infrastructure at data centres. This measure is expected to increase the operational efficiency of data centres. Enhancing Resilience/Efficiency of SFMS IX.44 SFMS, the messaging system used for both NEFT and RTGS, is being upgraded in phased manner in the Reserve Bank and 200+ member banks to enhance its capability to support functions in automated manner. Features such as reconciliation, enhanced reconciliation and dual certificate support are already implemented. The upgraded SFMS will take care of the futuristic requirements, viz., high availability, scalability, enhanced security, performance, and resilience. Reserve Bank as Aggregator for Tax Information Network (TIN 2.0) IX.45 The initiative is to integrate Reserve Bank’s e-Kuber system with Tax Information Network (TIN 2.0) of Central Board of Direct Taxes (CBDT) and the Public Financial Management System (PFMS) of Controller General of Accounts (CGA) for implementation of Pratyaksh Kar Lekhankan Pranali (PRAKALP). The development in e-Kuber has been completed and is ready for implementation. Stabilisation of Sarthi Application IX.46 Sarthi, the less-paper solution for the Reserve Bank’s internal processes was launched on January 1, 2021, and continuous efforts were made during the year to customise new workflow processes and enhance the features and functionalities of the application as well as ensuring better user experience. Further, extensive users’ training programmes were conducted covering all central office departments (CODs), regional offices (ROs) and training establishments (TEs) for better adoption of the application. Additionally, application utilisation is being continuously monitored and application security measures are being regularly reviewed to ensure robustness of the application. Hybrid Payment System IX.47 An efficient payment system is the lifeline of the economy. The Reserve Bank has been focusing on developing the payment systems in the country for the past four decades. Today, India can boast of having a vibrant, efficient and secured payment ecosystem. Availability of NEFT and RTGS around the clock has further strengthened the payment ecosystem in the country. Currently, the payment systems are either based on gross settlement or net settlement, so, the possibility of having an integrated system capable of both gross and net settlements may be explored. Agenda for 2021-22 IX.48 Last year, the Department had set out the following goals under Utkarsh: -

Next Generation Data Centre: Examination of the feasibility of next generation data centre and preparation of detailed prototype plan to cater to the Reserve Bank’s ICT roadmap for coming years (Paragraph IX.49 - IX.50); -

Upgradation of Non-IT Physical Infrastructure at Data Centres: The rejuvenating of non-IT infrastructure at its existing data centres is underway. Optimal capacity planning and energy efficiency is a major driving factor for the project, which includes invigorating non-IT infrastructure at data centres (Paragraph IX.51); and -

Implementation of Next-Generation e-Kuber: e-Kuber is performing key financial services and operations of the Reserve Bank with/for various stakeholders such as government, banks and other market participants. The system is being revived to improve the functionalities by leveraging on technological developments and will facilitate enhanced automation of processes, flexibility of integration with external and internal systems, ease of change management, enhanced modularity, reporting with comprehensive real time dashboards, front end improvements for enhancing productivity and robust controls (Paragraph IX.52). Implementation Status Next Generation Data Centre IX.49 The Reserve Bank will be constructing a new state-of-the-art greenfield data centre to address capacity expansion constraints to meet the ever-increasing IT landscape need, avoid region specific risk and house critical data centre manpower. The new data centre will also host ‘Enterprise Computing and Cybersecurity Training Centre’ to cater to the advanced training needs of the Reserve Bank’s staff and also the banking sector. IX.50 Land acquisition for the new data centre has been completed. The Reserve Bank is in the process of identifying the project implementation agencies. Upgradation of Non-IT Physical Infrastructure at Data Centres IX.51 The work has been completed at two data centres, and is in advanced stage of completion at the remaining data centre. Implementation of Next-Generation e-Kuber IX.52 The process of upgradation of e-Kuber system which facilitates key financial services and operations of the Reserve Bank with/for various stakeholders, is in progress. Agenda for 2022-23 IX.53 The Department’s goals for 2022-23 are set out below: -

Robotic Process Automation (RPA) Solution for Automation of Routine and Repetitive Tasks: RPA is envisioned for automation of repetitive and manual tasks such as software installation, report generation, reconciliation issues and fault remediation activities by bots without the support of IT engineers thereby resulting in better utilisation of their services in other critical functions. This shall help in reducing human errors and bring in more efficiency and productivity in day-to-day operations across the Reserve Bank; -

Better Interface for Internal Applications to Enhance User Experience and Adoption: The Department will be enhancing the user interface of the internal applications by adopting the latest best practices and global standards to improve the user experience and adoption of the applications. Special focus will be on user-centric design and continuous accessibility in safe and secure manner; -

Next Generation e-Kuber: The e-Kuber will be upgraded to the next generation based on newer technologies with wider flexibility and stability. The upgraded system will have functionalities like reporting with comprehensive real time dashboards, enhanced user experience, scalability, resilient, easier process orchestration, ease of integration with external and internal systems, front end improvements for enhancing productivity, robust controls, and integrated security architecture platform; -

Making NEFT Compliant to Global Messaging Standards: Payment industry has evolved over a period and various business drivers like richness of data, standardisation across payment nodes, compliance, deeper reporting, and related requirements have been constantly driving the need for change. ISO 20022 is a global and open standard for payment messaging. The RTGS system is already based on ISO 20022. The Reserve Bank will strive to make its NEFT system also compliant to this global messaging standard. Adoption of ISO 20022 will provide structured and granular data, improved analytics, end-to-end automation, and better global harmonisation. It will also pave way for interoperability between RTGS and NEFT (Utkarsh); -

Continuous Upgrading of IT and Cyber Security: The Reserve Bank strives to continuously assess and upgrade its IT security infrastructure to enhance its efficiency and effectiveness of tackling the emergent threats and protect its IT infrastructure that caters to critical payment infrastructure. In this endeavour, the Reserve Bank will upgrade Security Operation Centre (SOC) technologies with innovative capabilities and additional advancements like security orchestration, automation and response, user entity behaviour analytics, extended detection and response; and -

Enterprise Data Centre and Enterprise Computing and Cybersecurity Training Centre: The Reserve Bank plans to commence work on a new state-of-the-art greenfield data centre during 2022-23 for which necessary land has been obtained. The data centre will cater largely to internal needs of the Reserve Bank, and will also host an enterprise computing and cybersecurity training centre which will cater to the needs of the banking and financial sector of the country. 4. CONCLUSION IX.54 The Reserve Bank continued its efforts to develop state-of-the-art payment and settlement systems in the country for building less cash society, along with a focus on increasing efficiency, improving customer convenience, expanding outreach and ensuring safety and security of payment systems as envisaged in the Reserve Bank’s Payment and Settlement Systems Vision 2021 document. Keeping in view the global focus on enhancing cross-border payment arrangements, the Reserve Bank also explored the possibility of linking India’s fast payment system UPI with PayNow of Singapore. Further, the major milestones achieved during the year included enhancing resilience of RTGS and SFMS, upgradation of non-IT physical infrastructure at data centres and stabilisation of Sarthi application. Going ahead, release of Payment System Vision Document 2025; implementation of framework of geo-tagging of payment acceptance infrastructure; making NEFT compliant to global messaging standards; strengthening IT and cyber security; setting up enterprise data centre and enterprise computing and cybersecurity training centre will be the major focus areas of the Reserve Bank.

|