The Reserve Bank continued with its agenda for furthering financial inclusion in the country as envisaged under the National Strategy for Financial Inclusion (NSFI). Steps were taken for scaling up the Centre for Financial Literacy (CFL) project to cover the entire country by end-March 2024. The Reserve Bank conducted all-India quiz on financial literacy for students of classes VIII to X for enhancing financial literacy. IV.1 During 2023-24, the Reserve Bank continued with initiatives to deepen financial inclusion and improve credit delivery to agriculture, micro, small and medium enterprises (MSMEs), and other identified priority sectors. The composite financial inclusion index (FI-Index), a comprehensive indicator of financial inclusion across the country, registered a year-on-year (y-o-y) growth of 6.6 per cent to 60.1 in March 2023, with expansion across all the sub-indices. A Financial Inclusion Dashboard - ANTARDRISHTI - was launched in June 2023 to strengthen policy insights for assessing and monitoring the progress of financial inclusion by capturing broad parameters under the three dimensions of financial inclusion, viz., Access, Usage and Quality. To provide further impetus to financial literacy, the CFL project was scaled up to 2,421 CFLs covering 7,225 blocks as at end-March 2024. The Reserve Bank also conducted all-India quiz on financial literacy for students of government and municipal schools across the country. IV.2 Against this backdrop, the rest of the chapter is structured into three sections. The implementation status of the agenda for 2023-24 along with the performance of credit flow to priority sectors and developments with respect to financial inclusion and financial literacy are presented in section 2. The agenda for 2024-25 is provided in section 3 with concluding observations in section 4. 2. Agenda for 2023-24 IV.3 The Department had set the following goals for 2023-24: -

Setting up CFLs in the remaining blocks so as to cover the entire country (Utkarsh 2.0) [Paragraph IV.4]; and -

Working towards the deliverables of G20 Global Partnership for Financial Inclusion (GPFI) [Paragraph IV.5]. Implementation Status IV.4 The pilot CFL project, initiated in 2017 with the objective of exploring innovative and participatory approaches to financial literacy at the block level, has been scaled up based on experiences gained since its implementation. As a part of the National Strategy for Financial Inclusion (NSFI), it was envisaged to expand the reach of CFLs to cover the entire country by March 31, 2024. In consonance with this milestone, the CFL project was rolled out in three phases across the country. Starting with 80 CFLs, initially covering an equal number of blocks in the pilot phase, the project has expanded to 2,421 CFLs catering to 7,225 blocks, as on March 31, 2024. Funding support for the project is provided by the Depositor Education Awareness Fund (DEAF), the Financial Inclusion Fund (FIF) of the National Bank for Agriculture and Rural Development (NABARD) and the sponsor banks. The financial literacy camps conducted by these CFLs aim to further financial literacy at the grass root level and achieve certain end-outcomes such as accounts opening/reactivation, pension and insurance linkages and awareness on grievance redressal. IV.5 During India’s G20 Presidency, the GPFI Working Group (WG), as part of the Presidency priority delivered a report on “G20 Policy Recommendations for Advancing Financial Inclusion and Productivity Gains through Digital Public Infrastructure (DPI)”. The Reserve Bank contributed substantially to the report and other deliverables of the GPFI during the period. Major Developments Credit Delivery Priority Sector IV.6 Scheduled commercial banks’ (SCBs’) priority sector lending (PSL) as on March 31, 2024 stood at 45.1 per cent1 of adjusted net bank credit (ANBC). Each of the bank groups achieved the prescribed 40 per cent overall PSL target during 2023-24 (Table IV.1). | Table IV.1: Achievement of Priority Sector Lending Targets | | (Amount in ₹ lakh crore) | | Financial Year | Public Sector Banks | Private Sector Banks | Foreign Banks | SCBs | | 1 | 2 | 3 | 4 | 5 | | 2022-23 | 28.4 | 19.5 | 2.3 | 50.2 | | | (43.7) | (45.3) | (42.8) | (44.2) | | 2023-24* | 32.2 | 24.7 | 2.3 | 59.1 | | | (43.4) | (48.1) | (41.5) | (45.1) | *: Data are provisional.

Note: Figures in parentheses are percentage to adjusted net bank credit (ANBC) or credit equivalent of off-balance sheet exposure (CEOBE), whichever is higher.

Source: Priority sector returns submitted by SCBs. | Flow of Credit to Agriculture IV.7 The Kisan Credit Card (KCC) is a single window facility for providing working capital as well as investment credit to farmers for cultivation, animal husbandry and fisheries (Table IV.2). The number of operative KCC cards rose by 5.4 per cent at end-March 2024 over the previous year, while the outstanding amount increased by 10.9 per cent. | Table IV.2: Kisan Credit Card (KCC) Scheme | | (Number in lakh, Amount in ₹ crore) | | Financial Year | Number of Operative KCCs # | Outstanding Crop Loan | Outstanding Term Loan | Outstanding Loan for Animal Husbandry and Fisheries | Total | | 1 | 2 | 3 | 4 | 5 | 6 | | 2022-23 | 282.96 | 4,61,391 | 37,551 | 19,694 | 5,18,636 | | 2023-24* | 298.14 | 4,93,362 | 46,332 | 35,279 | 5,74,973 | *: Data are provisional.

#: The number of operative KCC accounts does not include non-performing asset (NPA) accounts.

Source: Public sector banks, private sector banks and small finance banks (excluding RRBs). | Bank Credit to the MSME Sector IV.8 Increasing the flow of credit to the MSMEs has been a policy priority of the Reserve Bank and the Government of India. On a y-o-y basis, the outstanding credit to the MSMEs by SCBs expanded by 20.9 per cent during 2023-24 (up to end-December 2023) [Table IV.3]. Measures for the MSME Sector IV.9 In terms of extant regulatory guidelines, lenders are required to obtain ‘Udyam Registration Certificate (URC)’ for classification of entities as MSMEs. To facilitate formalisation of informal micro enterprises (IMEs), which were not able to register on the ‘Udyam Registration Portal’ due to lack of mandatory documents, the Ministry of MSME, Government of India, has launched an ‘Udyam Assist Platform’ (UAP). The Reserve Bank has advised its regulated entities that the certificate issued on the UAP shall be treated on par with the URC, thus facilitating, for the purpose of PSL classification, the recognition of IMEs as micro enterprises under MSME. National Mission for Capacity Building of Bankers for Financing MSME Sector IV.10 A special capacity building programme ‘National Mission for Capacity Building of Bankers for Financing MSME Sector (NAMCABS)’ has been in place since 2015 to familiarise bankers with the entire gamut of credit related issues of the MSME sector and developing entrepreneurial sensitivity amongst them. The programme structure has been revamped to incorporate new developments in the MSME sector focusing on emerging thrust areas. During 2023-24, a total of 3,950 bank officials participated in NAMCABS programme conducted by the regional offices of the Reserve Bank. Financial Inclusion Assignment of Lead Bank Responsibility IV.11 The assignment of lead bank responsibility to a designated bank in every district is undertaken by the Reserve Bank. As on March 31, 2024, 12 public sector banks and two private sector banks (Jammu & Kashmir Bank and ICICI Bank) have been assigned lead bank responsibility, covering 779 districts across the country. | Table IV.3: Bank Credit to MSMEs | | (Number in lakh, Amount in ₹ lakh crore) | | Financial Year | Micro Enterprises | Small Enterprises | Medium Enterprises | MSMEs | | Number of Accounts | Amount Outstanding | Number of Accounts | Amount Outstanding | Number of Accounts | Amount Outstanding | Number of Accounts | Amount Outstanding | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 2021-22 | 239.6 | 8.8 | 21.9 | 7.2 | 3.2 | 4.1 | 264.7 | 20.1 | | 2022-23 | 194.4 | 10.5 | 15.7 | 7.5 | 3.2 | 4.6 | 213.3 | 22.6 | | 2022-23 (As at end-December 2022) | 193.6 | 9.8 | 16.8 | 7.3 | 3.2 | 4.4 | 213.6 | 21.5 | | 2023-24* (As at end-December 2023) | 242.6 | 12.6 | 15.6 | 8.3 | 3.5 | 5.0 | 261.7 | 26.0 | *: Data are provisional.

Source: Priority sector returns submitted by SCBs. | Universal Access to Financial Services in Every Village IV.12 Providing banking access to every village within a 5 km radius/hamlet of 500 households in hilly areas is one of the key objectives of the NSFI: 2019-24. The milestone has been fully achieved in 27 states and 8 union territories (UTs) as on March 31, 2024; 99.99 per cent of the identified villages/hamlets across the country have been covered. Efforts are on to achieve the target for the remaining few villages/hamlets. Expanding and Deepening of Digital Payments Ecosystem IV.13 For expanding and deepening the digital payments ecosystem in the country, all State Level Bankers’ Committees (SLBCs)/Union Territory Level Bankers’ Committees (UTLBCs) were advised to identify district(s) in their respective states/UTs and allot the same to a bank having significant footprint, which would endeavour to make the district 100 per cent digitally enabled in order to facilitate every individual in the district to make/receive payments digitally in a safe, secure, quick, affordable, and convenient manner. As on March 31, 2024, all districts across the country (except two districts from UT of Andaman and Nicobar Islands) have been identified for the purpose; as reported by the Regional Offices of the Reserve Bank,179 districts were 100 per cent digitally enabled. Financial Inclusion Plan IV.14 The progress made by the banks in the financial inclusion sphere under the financial inclusion plan (FIP) as at end-December 2023 is set out in Table IV.4. The total amount under Basic Savings Bank Deposit Accounts (BSBDA) rose by 13.2 per cent (y-o-y) in December 2023. | Table IV.4: Financial Inclusion Plan: A Progress Report | | Particulars | March 2010 | December 2022 | December 2023$ | | 1 | 2 | 3 | 4 | | Banking Outlets in Villages – Branches | 33,378 | 53,159 | 53,893 | | Banking Outlets in Villages > 2000*– BCs | 8,390 | 13,83,569 | 13,15,004 | | Banking Outlets in Villages < 2000*– BCs | 25,784 | 2,95,657 | 2,77,594 | | Total Banking Outlets in Villages – BCs | 34,174 | 16,79,226 | 15,92,598 | | Banking Outlets in Villages – Other Modes | 142 | 2,273 | 2,289 | | Banking Outlets in Villages – Total | 67,694 | 17,34,658 | 16,48,780 | | Urban Locations Covered Through BCs | 447 | 4,38,333 | 3,58,167 | | BSBDA – Through Branches (Number in lakh) | 600 | 2,704 | 2,780 | | BSBDA – Through Branches (Amount in crore) | 4,400 | 1,23,653 | 1,35,628 | | BSBDA – Through BCs (Number in lakh) | 130 | 4,082 | 4,274 | | BSBDA – Through BCs (Amount in crore) | 1,100 | 1,16,777 | 1,36,558 | | BSBDA – Total (Number in lakh) | 735 | 6,786 | 7,053 | | BSBDA – Total (Amount in crore) | 5,500 | 2,40,430 | 2,72,186 | | OD Facility Availed in BSBDAs (Number in lakh) | 2 | 89 | 53 | | OD Facility Availed in BSBDAs (Amount in crore) | 10 | 546 | 579 | | KCC – Total (Number in lakh) | 240 | 499 | 507 | | KCC – Total (Amount in crore) | 1,24,000 | 7,66,694 | 8,11,906 | | GCC – Total (Number in lakh) | 10 | 67 | 55 | | GCC – Total (Amount in crore) | 3,500 | 1,85,915 | 53,690 | | ICT-A/Cs-BC-Total Transactions (Number in lakh) # | 270 | 25,434 | 27,294 | | ICT-A/Cs-BC-Total Transactions (Amount in crore)# | 700 | 8,15,598 | 9,86,236 | BCs: Business Correspondents. BSBDAs: Basic Savings Bank Deposit Accounts.

OD: Overdraft. KCC: Kisan Credit Card. GCCs: General Credit Cards.

ICT: Information and Communication Technology.

$: Data are provisional.

*: Village population.

#: Transactions during the financial year.

Source: FIP returns submitted by public sector banks, private sector banks and regional rural banks. |

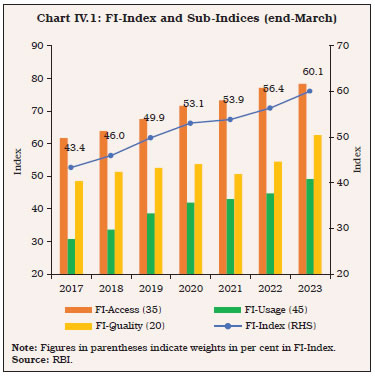

Financial Inclusion Index (FI-Index) IV.15 To achieve the financial inclusion goals and objectives, the measurement and evaluation of financial inclusion assumes importance. Towards this direction, a composite FI-Index was constructed and published by the Reserve Bank in August 20212. The FI-Index comprises of three broad sub-indices (weights in parentheses), viz., Access (35 per cent), Usage (45 per cent), and Quality (20 per cent) with each of these consisting of various dimensions, in turn, based on a number of indicators. The FI-Index for March 2023 rose to 60.1 from 56.4 in March 2022, with growth witnessed across all the sub-indices (Chart IV.1). Financial Inclusion Dashboard - ANTARDRISHTI IV.16 To assess and monitor the progress of financial inclusion and to gauge the extent of financial exclusion, a Financial Inclusion Dashboard - ANTARDRISHTI - was launched in June 2023 (Box IV.1). National Strategy for Financial Inclusion (NSFI) 2019-24 IV.17 The objective of NSFI is to deepen and sustain financial inclusion efforts at the national level with the coordination of all the stakeholders. The NSFI lays down action plans and milestones and suggests broad recommendations to be completed within the period of the strategy. Five recommendations earmarked to be implemented during 2023-24, focused on leveraging developments in FinTech space, moving towards an increasingly digital and consent-based architecture for customer onboarding, strengthening process literacy, expanding the reach of CFLs, and articulation/monitoring of responsibilities of stakeholders. Box IV.1

Financial Inclusion Dashboard – ANTARDRISHTI The Financial Inclusion Dashboard - ANTARDRISHTI - aims to monitor the progress on relevant parameters at the national level with drill-down facility for regional, state and district level information. Some of the parameters captured by the dashboard include credit to deposit (CD) ratio, credit linkage of farmers and self-help groups (SHGs), credit disbursement to priority sectors and progress in financial literacy programmes. The dashboard has facilities in the form of colour-coded heat maps, quick tickers and trend charts to assess regional disparities in the availability of banking facilities and flow of credit in multiple dimensions so as to address factors leading to financial exclusion. The dashboard, therefore, serves as an effective management information tool, besides providing insights to front-line functionaries. Source: RBI. | IV.18 During 2023-24, significant headway was made towards the implementation of the recommendations through various initiatives, viz., linking of RuPay credit card with unified payments interface (UPI) and launch of UPI Lite. Further, initiatives such as payment infrastructure development fund (PIDF), expanding and deepening of digital payments ecosystem (EDDPE) along with BharatNet Project of Government of India continue to provide impetus for advancing digital financial inclusion. Financial Literacy Implementation of Milestones Under the National Strategy for Financial Education (NSFE): 2020-25 IV.19 The NSFE has laid out a ‘5Cs’ approach for dissemination of financial education through emphasis on developing Content, developing Capacity among intermediaries, leveraging Community led model, adopting appropriate Communication strategy, and enhancing Collaboration. Towards these objectives, the National Centre for Financial Education (NCFE)3 conducts various financial literacy initiatives, viz., Financial Education Programme for Adults (FEPA), Financial Education Training Programme (FETP) for school teachers, Money Smart School Programme (MSSP)4 for students, and Financial Awareness and Consumer Training (FACT) for young graduates and post-graduates. Further, the various milestones under NSFE are also being monitored by the Technical Group on Financial Inclusion and Financial Literacy (TGFIFL) under the aegis of Financial Stability Development Council Sub-Committee (FSDC-SC). The 22nd meeting of TGFIFL was held on December 14, 2023. Observing Financial Literacy Week 2024 IV.20 The Financial Literacy Week (FLW) is an initiative of the Reserve Bank to spread awareness among the masses/various sections of the population on key topics through a focused campaign every year. The FLW 2024 was observed from February 26 - March 1, 2024 on the theme ‘Make a Right Start: Become Financially Smart’ targeting students and young adults. The sub-themes on which awareness campaigns focused were ‘Saving and Power of Compounding’, ‘Banking Essentials for Students’ and ‘Digital and Cyber Hygiene’. All-India Quiz on Financial Literacy for Students IV.21 As a part of initiatives towards financial literacy and to give impetus to financial education at grass root level in a participatory manner, the Reserve Bank conducted all-India Quiz on financial literacy for students of classes VIII to X of government and municipal schools across the country. The multi-level quiz was initiated at the block level from April 2023 onwards. The quiz witnessed participation of 1,03,388 students from 51,694 schools across the country. The national level final competition of the quiz was held at Mumbai on September 14, 2023. It generated tremendous enthusiasm amongst the students in the area of financial literacy/awareness. 3. Agenda for 2024-25 IV.22 The Department has set the following goals for 2024-25: -

Formulation of the next iteration of the National Strategy for Financial Inclusion (NSFI) for the period 2025-30 (Utkarsh 2.0); -

Review of priority sector lending guidelines (Utkarsh 2.0); -

Achieving 100 per cent coverage in 50 per cent districts across the country by March 2025, under expanding and deepening of digital payments ecosystem (EDDPE) [providing every eligible individual in the identified district at least one mode of digital payments, viz., debit/RuPay cards, net banking, mobile banking, UPI, unstructured supplementary service data (USSD), Aadhaar enabled payment system (AePS), etc.]; -

Enhancing the effectiveness of Lead Bank Scheme (LBS) for greater financial inclusion; and -

Strengthen the regulatory framework to bolster credit availability for MSMEs. 4. Conclusion IV.23 The Reserve Bank continued with its focus on ensuring availability of banking services to all sections of society across the country and strengthening the credit delivery system to cater to the needs of productive sectors of the economy, particularly agriculture, and micro and small enterprises. The Reserve Bank launched Financial Inclusion Dashboard - ANTARDRISHTI - during 2023-24 in pursuance of its efforts to further deepen financial inclusion in the country. Going forward, the Reserve Bank would review the priority sector lending guidelines and work towards formulation of the next iteration of the NSFI for the period 2025-30, among others.

Index |