By Dr. Raghuram G. Rajan, Governor Part A: Monetary Policy Monetary and Liquidity Measures On the basis of an assessment of the current and evolving macroeconomic situation, it has been decided to: -

reduce the policy repo rate under the liquidity adjustment facility (LAF) by 50 basis points from 7.25 per cent to 6.75 per cent with immediate effect; -

keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4.0 per cent of net demand and time liability (NDTL); -

continue to provide liquidity under overnight repos at 0.25 per cent of bank-wise NDTL at the LAF repo rate and liquidity under 14-day term repos as well as longer term repos of up to 0.75 per cent of NDTL of the banking system through auctions; and -

continue with daily variable rate repos and reverse repos to smooth liquidity. Consequently, the reverse repo rate under the LAF stands adjusted to 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 7.75 per cent. Assessment 2. Since the third bi-monthly statement of August 2015, global growth has moderated, especially in emerging market economies (EMEs), global trade has deteriorated further and downside risks to growth have increased. In the United States, industrial production slowed as capital spending in the energy sector was cut back and exports contracted, weighed down by the strength of the US dollar. Consumer spending stayed buoyant, however, amidst steadily improving labour market conditions. In the Euro area, a fragile recovery strengthened, supported by domestic consumption, less slack in the labour market and improving financial conditions engendered by ultra-accommodative monetary policy. Economic activity in Japan, however, is faltering under the weight of weak private consumption and exports, with both business and consumer confidence subdued. EMEs are caught in a vortex of slowing global trade volumes, depressed commodity prices, weakening currencies and capital outflows, which is accentuating country-specific domestic constraints. China’s intended rebalancing from investment towards consumption is being hit by the stock market meltdown, slower industrial production and weaker exports. The devaluation of the renminbi on August 11, while mild, has unsettled financial markets across the world. Brazil and Russia are grappling with recession and runaway inflation, while South Africa is facing tightening structural constraints which threaten to tip it into a downturn. 3. Since the Chinese devaluation, equity prices, commodities and currencies have fallen sharply. Capital flight from EMEs into mature bond markets has pushed down developed market yields, and risk spreads across asset classes have widened. Although volatility ebbed in early September and capital flows returned cautiously to some EMEs, sentiment in financial markets remains fragile. The September 17 decision of the Federal Open Market Committee to stay on hold in response to global conditions and weak domestic inflation lifted financial markets briefly, but overall financial conditions are yet to stabilise. 4. In India, a tentative economic recovery is underway, but is still far from robust. In agriculture, sown area has expanded modestly from a year ago, reflecting the timely and robust onset of the monsoon in June, but the southwest monsoon is currently deficient by 14 per cent – with production-weighted rainfall deficiency at 20 per cent. Nevertheless, the first advance estimates indicate that food grain production is expected to be higher than last year, reflecting actions taken to contain the adverse effects of rain deficiency through timely advisories and regular monitoring of seed and fertiliser availability. Allied farm activities, which are more insulated from the monsoon, remain resilient and could partly offset the effects of adverse weather on crop production. Rural demand, however, remains subdued as reflected in still shrinking tractor and two-wheeler sales. 5. Manufacturing has exhibited uneven growth in April-July, with industrial activity slowing sequentially in July, although it has been in expansionary mode for the ninth month in succession. Industries such as apparel, furniture and motor vehicles have experienced acceleration. Furthermore, the resumption of growth in production of consumer durables in recent months, after a protracted period of contraction over the last two years, is indicative of some pick-up in consumption demand, primarily in urban areas. Since our last review, however, external demand conditions have turned weaker, suggesting a more persistent drag from lower exports and cheaper imports due to global overcapacity. This contributes to continuing domestic capacity under-utilisation, decelerating new orders and a rising ratio of finished goods inventories to sales. 6. As a result of still tepid aggregate demand, output price growth is weak, but input material costs have fallen further, leading to an increase in margins for most producers. Weak aggregate demand appears to have more than offset the effect of higher margins to hold back new investment intentions. The expansion in capital goods production, therefore, likely relates more to the revival of stalled projects than to a build-up of the green field pipeline. Survey-based business sentiment has been falling in recent quarters. The manufacturing purchasing managers’ index (PMI) nevertheless remained in expansion territory in August, although it slowed from July due to weak domestic and export order books. 7. In the services sector, construction activity is weakening as reflected in low demand for cement and the large inventory of unsold residential houses in some localities. Rising public expenditure on roads, ports and eventually railways could, however, provide some boost to construction going forward. Lead indicators relating to freight and passenger traffic are mixed. In August, the services PMI remained in expansion for the second consecutive month on improving new business, but business expectations remain subdued. 8. Headline consumer price index (CPI) inflation reached its lowest level in August since November 2014. The ebbing of inflation in the year so far is due to a combination of low month-on-month increases in prices and favourable base effects. Overall year-on-year food inflation dropped sharply, led by vegetables and sugar. Cereal inflation moderated steadily during April-August, but price pressures in respect of pulses and onions remained elevated. 9. CPI inflation excluding food and fuel eased in August for the second consecutive month, primarily due to the decline in petrol and diesel prices pulling down inflation in transportation. Fares other than for air transport have, however, remained inflexible downwards. Inflation in house rentals increased, but was more than offset by some moderation in the heterogeneous category of services, including education, personal care and effects, and health. Inflation expectations of households remained elevated in double digits likely in response to recent month-on-month increases in the prices of vegetables and pulses. Professional forecasters’ inflation expectations eased as credibility built around the January 2016 inflation target. Rural wage growth remains subdued and corporate staff costs decelerated. 10. Liquidity conditions eased considerably during August to mid-September. In addition to structural factors such as deposit mobilisation in excess of credit flow, lower currency demand and pick-up in spending by the government contributed to the surplus liquidity. In response, the Reserve Bank conducted variable rate reverse repos of overnight and longer tenors ranging from 2 to 20 days. As a result, the average net daily liquidity absorption by the Reserve Bank increased from ₹120 billion in July to ₹261 billion in August and further to ₹544 billion in September (up to September 15). Money market rates generally remained below the repo rate. As quarterly tax collections went out of the system from mid-September, deficit conditions returned and the Reserve Bank engaged in average net injections of the order of ₹544 billion (September 16 to 27), keeping the call money rate close to the repo rate. Some forms of bank credit such as personal loans grew strongly as did non-bank financing flows through commercial paper, public equity issues and housing finance. 11. With the weakening of growth prospects in EMEs and world trade volume growth falling below world GDP growth, India’s merchandise exports continued to decline in the first two months of Q2. Imports values also declined, but the sharp fall in international crude oil and gold prices was offset by rising import volumes. Non-oil non-gold imports went back into contraction after recording a marginal pick-up in the previous quarter, although there were higher imports of fertilisers, electronics and pulses. With services exports moderating, the widening of the merchandise trade deficit could lead to a modest increase in the current account deficit (CAD) during Q2. Net capital inflows were buoyed by sustained foreign direct investment and accretion to non-resident deposits, and reduced by portfolio outflows, mainly from equity markets. Foreign exchange reserves rose by US $ 10.4 billion during the first half of 2015-16. Policy Stance and Rationale 12. In the bi-monthly policy statement of August, the Reserve Bank indicated that further monetary policy accommodation will be conditioned by the abating of recent inflationary pressures, the full monsoon outturn, possible Federal Reserve actions and greater transmission of its front-loaded past actions. Since then, inflation has dropped to a nine-month low, as projected. Despite the monsoon deficiency and its uneven spatial and temporal distribution, food inflation pressures have been contained by resolute actions by the government to manage supply. The disinflation has been broad-based and inflation excluding food and fuel has also come off its recent peak in June. The Federal Reserve has postponed policy normalisation. Markets have transmitted the Reserve Bank’s past policy actions via commercial paper and corporate bonds, but banks have done so only to a limited extent. The median base lending rates of banks have fallen by only about 30 basis points despite extremely easy liquidity conditions. This is a fraction of the 75 basis points of the policy rate reduction during January-June, even after a passage of eight months since the first rate action by the Reserve Bank. Bank deposit rates have, however, been reduced significantly, suggesting that further transmission is possible. 13. Looking forward, inflation is likely to go up from September for a few months as favourable base effects reverse. The outlook for food inflation could improve if the increase in sown area translates into higher production. Moderate increases in minimum support prices should keep cereal inflation muted, while subdued international food price inflation should continue to put downward pressure on the prices of sugar and edible oil, and food inflation more generally. It is important that pro-active supply-side management by the government be in place to head off any food price pressures should they materialise, especially in respect of onion and pulses. The pass-through of the recent depreciation of the rupee will have to be carefully monitored, although benign crude prices should have an offsetting effect. Taking all this into consideration, inflation is expected to reach 5.8 per cent in January 2016, a shade lower than the August projection (Chart 1).  14. The modest pick-up in the growth momentum in the first half of 2015-16 benefited from soft commodity prices, disinflation, comfortable liquidity conditions, some de-clogging of stalled projects, and higher capital expenditure by the central government. Underlying economic activity, however, remains weak on account of the sustained decline in exports, rainfall deficiency and weaker than expected momentum in industrial production and investment activity. With global growth and trade slower than initial expectations, a continuing lack of appetite for new investment in the private sector, the constraint imposed by stressed assets on bank lending and waning business confidence, output growth projected for 2015-16 is marked down slightly to 7.4 per cent from 7.6 per cent earlier (Chart 2). Concurrent indicators also suggest that the new GDP series shows higher growth than would the old series, which necessitates recalibrating old measures of potential output and the output gap to the new series.  15. Since our last review, the bulk of our conditions for further accommodation have been met. The January 2016 target of 6 per cent inflation is likely to be achieved. In the monetary policy statement of April 2015, the Reserve Bank said that it would strive to reach the mid-point of the inflation band by the end of fiscal 2017-18. Therefore, the focus should now shift to bringing inflation to around 5 per cent by the end of fiscal 2016-17. In this context, the weakening of global activity since our last review suggests that commodity prices will remain contained for a while. Still-low industrial capacity utilisation indicates more domestic demand is needed to substitute for weakening global demand in order that the domestic investment cycle picks up. The coming Pay Commission Report could add substantial fiscal stimulus to domestic demand, but the government has reaffirmed its desire to respect its fiscal targets and improve the quality of its spending. Under these circumstances, monetary policy has to be accommodative to the extent possible, given its inflation goals, while recognizing that continuing policy implementation, structural reforms and corporate actions leading to higher productivity will be the primary impetus for sustainable growth. Furthermore, investment is likely to respond more strongly if there is more certainty about the extent of monetary stimulus in the pipeline, even if transmission is slow. Therefore, the Reserve Bank has front-loaded policy action by a reduction in the policy rate by 50 basis points. Given our year-ahead projections of inflation, this ensures one year expected Treasury bill real interest rates of about 1.5-2.0 per cent, which are appropriate for this stage of the recovery. 16. While the Reserve Bank’s stance will continue to be accommodative, the focus of monetary action for the near term will shift to working with the Government to ensure that impediments to banks passing on the bulk of the cumulative 125 basis points cut in the policy rate are removed. The Reserve Bank will continue to be vigilant for signs that monetary policy adjustments are needed to keep the economy on the target disinflationary path. 17. The fifth bi-monthly monetary policy statement will be announced on December 1, 2015. Part B: Developmental and Regulatory Policies 18. This part of the Statement reviews the Reserve Bank’s measures to strengthen the monetary policy framework, make banking structure and practices more efficient, broaden and deepen financial markets, deal with stress in corporate and financial assets, and extend the reach of financial services to all. I. Monetary Policy Framework 19. Discussions on monetary policy and its institutional and operating framework are set out in Part A of this Statement and the Monetary Policy Report issued along with this Statement. II. Banking Structure 20. The Reserve Bank has put out for comment draft guidelines for banks on the computation of base rate, based on their marginal cost of funds. Guidelines will be issued by end-November 2015. 21. In March 2015, the Reserve Bank issued a Discussion Paper titled “Large Exposures Framework and Enhancing Credit Supply through Market Mechanism” for stakeholders’ comments. The Discussion Paper focused on the need to encourage alternative sources of funding to bank credit for the corporate sector to finance growth. This would also de-risk the balance sheets of banks. Specifically, the paper proposed ways to encourage large corporates with borrowings from the banking system above a cut-off level to tap the market for their working capital and term loan needs. Based on suggestions received from stakeholders, the Reserve Bank will issue a draft circular by end-December 2015. 22. As a part of its supervisory process, the Reserve Bank assesses compliance by banks with extant prudential norms on income recognition, asset classification and provisioning (IRACP). There have been divergences between banks and the supervisor as regards asset classification and provisioning. In order to bring in greater transparency, better discipline with respect to compliance with IRACP norms as well as to involve other stakeholders, the Reserve Bank will mandate disclosures in the notes to accounts to the financial statements of banks where such divergences exceed a specified threshold. Instructions in this regard are being issued separately. 23. The Union Budget for 2014-15 emphasised the urgent need for convergence of the current Indian accounting standards (IND AS) with International Financial Reporting Standards (IFRS). The Reserve Bank has recommended to the Ministry of Corporate Affairs a roadmap for the implementation of IND AS by banks and non-banking financial companies from 2018-19 onwards. The Reserve Bank constituted a Working Group (Chairman: Shri Sudarshan Sen) for its implementation. The Report of the Working Group will be placed on the Reserve Bank’s website by end-October 2015 for public comments. 24. At present, the minimum risk weight applicable on individual housing loans is 50 per cent. With a view to improving “affordability of low cost housing” for economically weaker sections and low income groups and giving a fillip to “Housing for All”, while being cognisant of prudential concerns, it is proposed to reduce the risk weights applicable to lower value but well collateralised individual housing loans. Detailed guidelines are being issued separately. 25. Banks are permitted to hold investments under the HTM category in excess of the limit of 25 per cent of their total investments, provided the excess comprises only SLR securities and the total SLR securities held under the HTM category are not more than 22 per cent of NDTL. The SLR has been reduced to 21.50 per cent of NDTL with effect from February 7, 2015. To align them, it has been decided to bring down the ceiling on SLR securities under HTM from 22 per cent to 21.50 per cent with effect from the fortnight beginning January 9, 2016. Thereafter, both the SLR and the HTM ceiling will be brought down by 0.25 per cent every quarter till March 31, 2017. 26. The Depositor Education and Awareness Fund Scheme, 2014 has been established by transfer of bank deposits and other credit balances that have remained unclaimed for more than 10 years. It envisages grant of financial assistance to applicants selected on the basis of proposals intended to promote depositors’ interests. In response to the press release issued on January 9, 2015, the Reserve Bank received 90 applications for financial assistance. The names of successful applicants will be announced by October 1, 2015. The window for inviting applications for availing financial assistance from the fund shall be re-opened. 27. The report of the High Powered Committee (HPC) on UCBs (Chairman: Shri R. Gandhi) to examine and recommend permissible business lines, appropriate size, conversion of UCBs into commercial banks and licensing of new UCBs was placed on the Reserve Bank’s website on August 20, 2015 for comments and suggestions. Based on the feedback received, the recommendations of the Committee will be considered for implementation during the second half of 2015-16. 28. Cyber security has assumed critical importance across the globe. With the widespread use of new technologies, inter-connectedness and dependency, newer risks, threats and vulnerabilities have emerged. The Reserve Bank is setting up an information technology (IT) subsidiary to assist in monitoring the preparedness of banks and identifying systemic vulnerabilities along with aiding the Reserve Bank in its own cyber initiatives. 29. The Reserve Bank will update all its master regulations, and streamline the required procedure for compliance with the regulations by January 1, 2016. All master regulations will be fully updated and placed online. The Reserve Bank will also work to improve clarity in regulatory communications. III. Financial Markets 30. With the objective of having a more predictable regime for investment by the foreign portfolio investors (FPI), the medium term framework (MTF) for FPI limits in debt securities, worked out in consultation with the government, is set out below. (i) The limits for FPI investment in debt securities will henceforth be announced/ fixed in rupee terms. (ii) The limits for FPI investment in the central government securities will be increased in phases to 5 per cent of the outstanding stock by March 2018. In aggregate terms, this is expected to open up room for additional investment of ₹1,200 billion in the limit for central government securities by March 2018 over and above the existing limit of ₹1,535 billion for all government securities (G-sec). (iii) Additionally, there will be a separate limit for investment by FPIs in the State Development Loans (SDLs), to be increased in phases to reach 2 per cent of the outstanding stock by March 2018. This would amount to an additional limit of about ₹500 billion by March 2018. (iv) The increase in limits will be announced every half year in March and September and released every quarter. (v) The existing requirement of investments being made in G-sec (including SDLs) with a minimum residual maturity of three years will continue to apply. (vi) Limits for the residual period of the current financial year would be increased in two tranches from October 12, 2015 and January 1, 2016. Each tranche would entail an increase in limits as under: A circular with details of the MTF is being issued separately. 31. In the first bi-monthly monetary policy statement for 2015-16, announced on April 07, 2015, it was proposed to permit Indian corporates that are eligible to raise external commercial borrowings (ECB) to issue rupee bonds in overseas centres with an appropriate regulatory framework. Based on the comments received on the draft framework and in consultation with the Government, it has been decided to permit Indian corporates to issue rupee denominated bonds with a minimum maturity of five years at overseas locations within the ceiling of foreign investment permitted in corporate debt (US$ 51 billion at present). There shall be no restriction on the end use of funds except a small negative list. Detailed instructions are being issued separately. 32. The Reserve Bank has placed the draft framework on ECB on its website on September 23, 2015 for comments/ feedback. The revised framework suiting the current economic and business environment will replace the extant ECB policy. 33. Scheduled commercial banks and primary dealers (PDs) are currently permitted to execute the sale leg of short sale transactions in the over the counter (OTC) market in addition to the Negotiated Dealing System–Order Matching (NDS-OM) platform. Short sale in the OTC market is, however, not permitted between the primary member (PM) and its gilt account holder (GAH). The Clearing Corporation of India Ltd. (CClL) has introduced a facility in the reported segment of NDS-OM which captures details of transactions involving gilt accounts. Accordingly, it is proposed to permit short sale by a PM to its GAH and also to treat purchase by a PM from its GAH as a cover transaction. Guidelines in this regard will be issued by end-October 2015. 34. There has been significant improvement in market infrastructure in the inter-bank repo market in G-sec. This enables Reserve Bank to review restrictions placed on repo transactions, particularly relating to the participation of gilt account holders in the repo market, guided by the recommendations of the Working Group on Enhancing Liquidity in the Government Securities and Interest Rate Derivatives Markets (Chairman: Shri R. Gandhi). New guidelines in this regard will be issued by end- November 2015. 35. When Issued (WI) trading in G-sec was permitted in 2006 to facilitate the distribution process by stretching the actual distribution period for each issue and allowing the market more time to absorb large issues without disruption. In order to encourage trading in the WI market, it is proposed to: (i) permit the scheduled commercial banks to take short positions in the WI market for both new and reissued securities, subject to limits and other conditions in place from time to time; and (ii) permit regulated entities other than banks and primary dealers (PDs) to take long positions in the WI market. Detailed guidelines in this regard will be issued by end-November 2015. 36. Guidelines on repo in corporate debt were issued in January 2010. In order to further develop the repo market, a broad framework for introduction of electronic dealing platform/s for repo in corporate bonds will be designed in consultation with the Securities and Exchange Board of India (SEBI). 37. While the currency futures market has grown, participation in this segment has been restricted to a few categories of entities. In order to diversify the participation profile in the currency futures market, stand-alone PDs will be permitted to deal in currency futures contracts traded on the recognised exchanges, subject to adherence to certain risk control measures and without diluting their existing obligations in the G-sec market. Guidelines in this regard will be issued by end-November 2015. 38. At present, exchange traded currency derivatives include futures and options in four currency pairs viz., USD-INR, EUR-INR, GBP-INR and JPY-INR. With a view to enabling direct hedging of exposures in foreign currencies and to permit execution of cross-currency strategies by market participants, exchange traded currency futures and options will be introduced in three cross-currency pairs viz., EUR-USD, GBP-USD and USD-JPY. Necessary guidelines will be issued in consultation with SEBI by end-November 2015. 39. Establishing underlying exposure through verifiable documentary evidence has been a key regulatory requirement for accessing OTC forex markets. To provide more flexibility to market participants in managing their currency risk in the OTC market and for making hedging easier, it has been decided to increase the limit for resident entities for hedging their foreign exchange exposure in the OTC market from US$ 250,000 to US$ one million without the production of any underlying documents, subject to submission of a simple declaration. It is further proposed to comprehensively review the documentation related requirements in the OTC market. The possibility of participation by financially sophisticated investors up to certain limits in currency markets without underlying exposure will also be examined. Revised draft of the existing framework will be issued for public comments by end-December 2015. IV. Currency Management 40. With growing financial inclusion, there are concerted efforts to enhance the use of technology and move towards a “less-cash” society. In order to promote electronic payments and use of cards for transactions, the Reserve Bank will put in the public domain a concept paper for proliferation of card acceptance infrastructure in the country, especially in the tier III to tier VI centres, by end-November 2015. 41. The Reserve Bank has issued ₹100, ₹500 and ₹1000 denomination banknotes in the Mahatma Gandhi Series–2005 with a new numbering pattern with ascending order of the size of the numbers from left to right. This is being introduced in a phased manner for all denominations of banknotes. 42. With a view to making identification of banknotes easier for visually challenged persons, the process for introduction of additional identification marks in banknotes in the form of angular bleed lines has been initiated and is being introduced in the denominations of ₹100, ₹ 500 and ₹ 1000 as raised lines on both the left and right sides of the obverse of the banknote: 4 lines in ₹ 100, 5 lines in ₹ 500 and 6 lines in ₹1000. Furthermore, the size of the existing identification mark in these denominations is also being increased by 50 per cent to facilitate better identification. Sangeeta Das

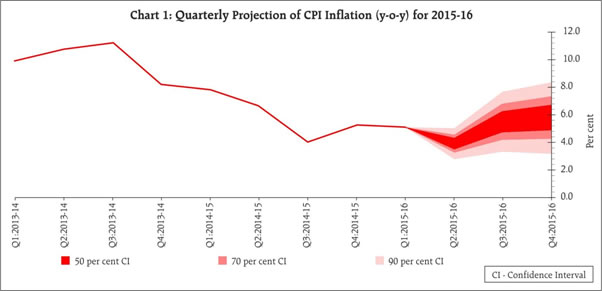

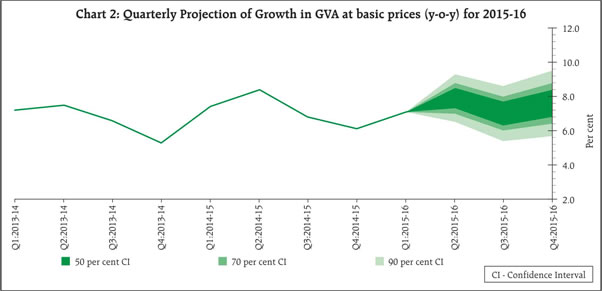

Director Press Release : 2015-2016/770 |