[Under Section 45ZL of the Reserve Bank of India Act, 1934] The fifth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the amended Reserve Bank of India Act, 1934, was held on June 6 and 7, 2017 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the amended Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:– (a) the resolution adopted at the meeting of the Monetary Policy Committee; (b) the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and (c) the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The Committee reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to: - keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.25 per cent.

6. Consequently, the reverse repo rate under the LAF remains at 6.0 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.50 per cent. 7. The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 8. Since the April 2017 meeting of the MPC, global economic activity has expanded at a modest pace, supported by firming growth in major advanced economies (AEs) and in some emerging market economies (EMEs) as well. In the US, a tightening labour market is generating wage gains. Alongside, industrial production has steadily improved in recent months and retail sales remain robust, although home sales ebbed in April. Political risks remain high, however. In the Euro area, the recovery has been underpinned by consistently falling unemployment, rising retail sales and a brighter outlook for manufacturing reflected in purchasing managers’ and business surveys. In Japan, exports supported by a depreciated yen and industrial activity are driving an acceleration in growth. Wages and inflation, however, are depressed and holding back domestic demand. Among EMEs, the Chinese economy is stabilising, especially in manufacturing, but financial risks in the form of the credit-fuelled debt overhang could impinge on the outlook. Brazil appears to be emerging out of recession, although growth dynamics remain fragile due to worsening labour market conditions and political turmoil. In Russia, the strengthening global environment is supporting the recovery with improving macro fundamentals. South Africa is grappling with structural constraints which are depressing economic activity. 9. The pick-up in global merchandise trade volume since the start of the year has been sustained in Q2 of 2017, buoyed by strengthening global demand as reflected in rising international air freight and container throughput. Crude prices fell to a five-month low in early May on higher output from Canada and the US, and remain soft, undermining the OPEC’s recent efforts to tighten the market by trimming supply. Among non-fuel commodity prices, metal prices have been retreating on expectations of weak demand from China. Bullion prices remain range-bound, while food prices eased in April but rose in May. These developments suggest that the inflation outlook is still relatively benign for AEs and EMEs alike. 10. International financial markets have been lifted by improving global growth prospects, broadly accommodative monetary policy stances of systemic central banks and generally positive incoming data. Increasingly, financial markets have shown resilience to geo-political events and have swiftly priced them in. This has been reflected in the reinvigoration of the reach for returns. Country-specific factors have modulated investor sentiment. Equity markets in most AEs have gained in Q2, surpassing past peaks in the US; boosted by corporate profits in Japan; and supported by easing political tensions and upbeat data in the case of the Euro area. In EMEs, equities have turned in a mixed performance, with high valuations across Asia, but weaker in Latin America on softer commodity prices. Bond yields in major AEs have been largely range-bound. In EMEs, yields have hardened in the few countries facing inflation pressures and political uncertainties, but for commodity exporters, there has been some recent decline. In the currency markets, the US dollar has weakened in May after dovish guidance by the Fed and unexpected political events. Since mid-May, the yen has shed its depreciating bias and appears to have gained safe haven appeal. EME currencies, which had depreciated on the strength of the US dollar, have steadied more recently on renewal of capital flows and risk-on investor appetite. 11. On May 31, 2017 India’s Central Statistics Office (CSO) released quarterly estimates of national income accounts for Q4 of 2016-17, provisional estimates for 2016-17 and revisions for the preceding five years. The growth of real gross value added (GVA) for 2016-17 has been pegged at 6.6 per cent, 0.1 percentage point lower than the second advance estimates released in February 2017. Underlying the revision is a downward adjustment in services sector growth in Q4 for the constituents of construction, financial and professional services, and real estate. Estimates of agriculture and allied activities have been upgraded to incorporate the all-time high production of foodgrains and horticulture in the year. GVA in industry has also been placed higher in the provisional estimates relative to the earlier reading to reflect the impact of new indices of industrial production (IIP) and wholesale prices (WPI) rebased to 2011-12. The new data reveal that a slowdown in activity in both industry and services set in as early as Q1 of 2016-17 and became pronounced in Q4. Moreover, the deceleration of activity coursing through the year has had underlying drivers that have been in operation since Q2. Components of aggregate demand reflect a contraction in gross fixed investment in Q4, reversing the turnaround evident in the second half of the year in the advance estimates. This is also reflected in the contraction in the production of capital goods in the new IIP. However, private final consumption expenditure recorded robust year-on-year growth. 12. On May 9, the Ministry of Agriculture (MoA) released its third advance estimates of foodgrains production, which confirmed the record level of output achieved in 2016-17 and, in fact, revised it upwards to 273 million tonnes. The MoA also set out its second advance estimates of fruits and vegetables on May 30, which was also a historical record. Benefiting from the bumper harvest, rabi procurement during Q1 of 2017-18 so far has been significantly higher than a year ago, replenishing food stocks and taking them to 61.9 million tonnes in May 2017, three times the buffer norm. On June 6, the India Meteorological Department (IMD) re-affirmed its forecast of a normal and well-distributed south-west (June-September) monsoon, which augurs well for the agricultural outlook. 13. The new series on the IIP released by the CSO on May 12 improves the coverage of industrial activity, realigns weights and reclassifies sub-sectors to better capture the underlying structural dynamics of the sector, and smoothens the impact of lumpy items on the index. As a result, industrial production expanded by 5.0 per cent during 2016-17 based on the new series (as against 0.7 per cent in the old series). Turning to the current financial year, the output of eight core industries decelerated sharply in April on account of contraction in coal, crude oil and cement due to structural constraints and low demand. Furthermore, electricity generation decelerated due to depressed demand pricing out relatively expensive thermal output. By contrast, the production of steel and fertiliser picked up, the former driven up by exports and the latter by expectations of a normal monsoon. 14. The business expectations index generated by the Reserve Bank’s April round of the Industrial Outlook Survey reflects optimism in the manufacturing sector in Q2 of 2017-18, driven by expectations of rising rural demand, exports and profit margins. On the other hand, the manufacturing purchasing managers’ index (PMI) moderated sequentially in May as employment contracted and new orders, both domestic and exports, slowed down. The index, however, remained in the expansion zone and the future output index accelerated for the third month in succession. 15. High frequency real indicators of activity in the services sector point to a mixed performance in April. In the transportation sub-sector, freight carriage by air and rail gathered momentum, and passenger car sales accelerated on the back of sustained strength of urban demand. Sales of commercial vehicles and three-wheelers contracted, however, reflecting in part the effects of new emission norms and technology changes. Two-wheeler sales remained depressed, indicative of still subdued rural demand. In the communication sub-sector, there was a strong growth in the subscriber base of voice and data services. The sustained growth of foreign tourist arrivals and air passenger traffic, both domestic and international, supported activity in the hotels, restaurants and the hospitality sub-sector. Both steel consumption and cement production were, however, sluggish, pointing to continuing weakness in construction activity. The services PMI for May rose to its highest reading since November 2016, with an expansion in new business reflecting improving underlying demand conditions, alongside optimism on employment. 16. Retail inflation measured by year-on-year changes in the consumer price index (CPI) plunged to a historic low in April, pulled down by a large favourable base effect which overwhelmed a momentum that was feeble relative to the historical record for the month. Underlying this surprising softness was a sharp fall in food inflation brought about by a deflation in the prices of pulses and vegetables. In addition, moderation in the prices of cereals, eggs, oils and fats and spices contributed to the loss of momentum. In the case of pulses, the large-scale augmentation of supply on account of expansion in acreage, procurement, buffer stocking and imports caused a sharp decline in prices starting in August 2016. Propelled by significantly higher arrivals in mandis relative to the seasonal pattern, prices of vegetables also fell markedly from July and bottomed out in January 2017, with fire sales during the demonetisation period accentuating the fall. The seasonal uptick that typically occurs in the pre-monsoon months has been muted so far. In the fuel group by contrast, inflation surged across the board. Prices of liquefied petroleum gas (LPG) and kerosene rose in sympathy with international prices even as the subsidy was set on a path of calibrated reduction. Fuel used by rural households rose for the third month in succession, narrowing the wedge between fuel inflation facing rural and urban households. In response to these developments, inflation expectations three months ahead and a year ahead surveyed in the Reserve Bank’s inflation expectations survey of households have ticked down marginally. 17. Excluding food and fuel, inflation dipped 60 basis points from a month ago to 4.4 per cent. The delayed and cumulative downward adjustment of domestic petrol and diesel prices in April to the softening of international crude prices in preceding months was among the factors at work. Inflation in respect of services embedded in transport and communication, education, recreation and health also moderated. The industrial outlook survey and the PMIs for manufacturing and services indicate that pricing power remains weak. 18. Even as surplus liquidity in the banking system post-demonetisation was drained by the ramping up of new currency in circulation by ₹ 1.5 trillion in April and May, massive spending by the Government re-injected liquidity into the system, raising the daily average overall surplus liquidity in the banking system to ₹ 4.2 trillion in April and ₹ 3.5 trillion in May. Unwinding of the excess reserves that banks used to dress up balance sheets for end-March also resulted in an accretion of ₹ 0.8 trillion to the surplus liquidity. Absorption operations undertaken by the Reserve Bank in the context of these developments and the consequent downward pressure on money market rates consisted of ₹ 1 trillion impounded through issuance of treasury bills (TBs) of tenors ranging from 312 days to 329 days under the market stabilisation scheme (MSS), auctions of cash management bills (CMBs) of ₹ 0.7 trillion triggered by the decline in cash balances of the Government, and variable rate reverse repo auctions of different tenors which took in the remaining surplus liquidity averaging ₹ 3.8 trillion in April and ₹ 3.4 trillion in May. With the narrowing of the LAF corridor from +/- 50 bps to +/- 25 bps in April 2017, these operations ensured that the weighted average call money rate (WACR) – the operating target of monetary policy– broadly traded within the corridor. The spread between the WACR and the policy repo rate narrowed from 29-32 basis points (bps) in March-April to 21 bps in May. 19. Merchandise exports posted double digit growth in March and April 2017 in an environment of slowly improving global trade, with 80 per cent of this expansion contributed by engineering goods, petroleum products, gems and jewellery, readymade garments and chemicals. Merchandise imports also increased sharply, propelled by domestic demand, with the jump of 47.2 per cent in US dollar terms not recorded since 2011. Imports of petroleum and products rose strongly on price effects as international crude prices firmed up in the wake of OPEC’s productions cut. Gold imports also surged in volume terms, initially driven by seasonal and festival demand but subsequently by stockpiling in anticipation of the roll out of the goods and services tax (GST). Non-oil non-gold imports contributed about half of the total import growth in March and April, reflecting higher recourse to electronic goods, pearls and precious stones, coal, machinery and machine tools from overseas markets. With import growth significantly outpacing export growth, the trade deficit increased sizably. The current account deficit (CAD) for the year 2016-17 is likely to remain within 1 per cent of GDP. Unlike in the immediately preceding quarter, capital flows in April-May 2017 were dominated by foreign portfolio investment (FPI), pushed out by risk-on investor sentiment as global growth prospects improved. Also, clarity emerged on taxation issues in the Union Budget and the expectations of faster structural reforms were fuelled by the decisive outcome of State elections. The level of foreign exchange reserves as on June 2, 2017 was US$ 381.2 billion. Outlook 20. The abrupt and significant retreat of inflation in April from the firming trajectory that was developing in February and March has raised several issues that have to be factored into the inflation projections. First, it needs to be assessed as to whether or not the unusually low momentum in the reading for April will endure. Second, the prices of pulses are clearly reeling under the impact of a supply glut caused by record output and imports. Policy interventions, including access to open trade, may be envisaged to arrest the slump in prices. Third, the accumulated downward adjustment in the prices of petrol and diesel effected in April has been largely reversed on June 1. Fourth, the easing of inflation excluding food and fuel may be transient in view of its underlying stickiness in a situation of rising rural wage growth and strong consumption demand. Thus, the April reading has imparted considerable uncertainty to the evolving inflation trajectory, especially for the near months. If the configurations evident in April are sustained, then absent policy interventions, headline inflation is projected in the range of 2.0-3.5 per cent in the first half of the year and 3.5-4.5 per cent in the second half (Chart 1). Risks are evenly balanced, although the spatial and temporal distribution of the monsoon and the government staying the course in effective food management will play a critical role in the evolution of risks. The risk of fiscal slippages, which, by and large, can entail inflationary spillovers, has risen with the announcements of large farm loan waivers. At the current juncture, global political and financial risks materialising into imported inflation and the disbursement of allowances under the 7th central pay commission’s award are upside risks. The date of implementation of the latter is still not announced and as such, it is not factored into the baseline projections. The implementation of the GST is not expected to have a material impact on overall inflation. 21. With the CSO’s provisional estimates for 2016-17, the projection of real GVA growth for 2017-18 has accordingly been revised 10 bps downwards from the April 2017 projection to 7.3 per cent, with risks evenly balanced (Chart 2). The continuing remonetisation should enable a pick-up in discretionary consumer spending, especially in cash-intensive segments of the economy. Furthermore, the reductions in banks’ lending rates post-demonetisation should support both consumption and investment demand of households and stress-free corporates. Moreover, Government spending continues to be robust, cushioning the impact of a slowdown in other constituents. The implementation of proposals in the Union Budget should crowd in private investment as the business environment improves with structural reforms, including the GST, the Insolvency and Bankruptcy Code, and the abolition of the Foreign Investment Promotion Board. Strengthening external demand will likely play a more decisive role in supporting the domestic economy. In addition, the new IIP broadens the recognition of industrial activity. On the downside, global political risks remain elevated and could materialise. Second, rising input costs and wage pressures may prove a drag on the profitability of firms, pulling down overall GVA growth. Third, the twin balance sheet problem - over-leveraged corporate sector and stressed banking sector - may delay the revival in private investment demand.   22. The MPC noted that incoming data suggest that the transitory effects of demonetisation have lingered on in price formations relating to salient food items, entangled with excess supply conditions with respect to fruits and vegetables, pulses and cereals. At the same time, however, the CSO’s latest releases on national income accounts and industrial production attest to the effects of demonetisation on the broader economy being sector specific and transient, as well as to the noteworthy resilience of private consumption. At this stage, it is difficult to isolate these factors or to judge the strength of their persistence. As the year progresses, underlying inflation pressures, especially input costs, wages and imported inflation, will have to be closely and continuously monitored. 23. Noting that inflation has fallen below 4 per cent only since November 2016, the MPC remains focused on its commitment to keeping headline inflation close to 4 per cent on a durable basis keeping in mind the output gap. The current state of the economy underscores the need to revive private investment, restore banking sector health and remove infrastructural bottlenecks. Monetary policy can play a more effective role only when these factors are in place. Premature action at this stage risks disruptive policy reversals later and the loss of credibility. Accordingly, the MPC decided to keep the policy rate unchanged with a neutral stance and remain watchful of incoming data. 24. The Reserve Bank will continue to work in partnership with the government to address the stress in banks’ balance sheets. Better alignment of administered interest rates on small savings with market rates and stepped-up recapitalisation of banks to facilitate adequate flow of credit to productive sectors are important steps to follow through. 25. Five members were in favour of the monetary policy decision, while Dr. Ravindra H. Dholakia was not in favour. The minutes of the MPC’s meeting will be published by June 21, 2017. 26. The next meeting of the MPC is scheduled on August 1 and 2, 2017. Voting on the Resolution to keep the policy repo rate unchanged at 6.25 per cent | Member | Vote | | Dr. Chetan Ghate | Yes | | Dr.Pami Dua | Yes | | Dr.Ravindra H. Dholakia | No | | Dr. Michael Debabrata Patra | Yes | | Dr. Viral V. Acharya | Yes | | Dr.Urjit R. Patel | Yes | Statement by Dr. Chetan Ghate 27. The sharp decline in headline inflation in April was surprising. It should, however, be noted that while headline inflation in April 2017 was 3 per cent, net of vegetables and pulses it was 4.3 per cent. More importantly, it is highly unlikely that a single data point of 3 per cent for April 2017 is the harbinger of 4 per cent for the durable future. 28. I have consistently highlighted the risk that the persistence of CPI inflation excluding food and fuel poses to meeting the medium-term headline inflation target of 4 per cent within a band of +/- 2 per cent. To that extent, the significant decline in CPI inflation excluding food and fuel in April 2017 (from approximately 5 per cent to 4.4 per cent) is comforting and is indicative of a general moderation in demand-pull pressures in the economy. This outcome is possibly consistent with a further widening of the output gap induced in part by demonetisation. There has also been an inching down in the median 3-month and 1-year ahead inflation expectations which is also comforting. I, however, would like to see the reduction in CPI excluding food and fuel on a more durable basis. 29. The slowdown in growth in Q4 FY17 based on the latest CSO figures is suggestive of some adverse effects of demonetisation and that these effects may have widened the output gap. As I mentioned in my previous statement, however, these effects are likely to be transient, and therefore do not warrant a monetary policy response. For instance, private final consumption expenditure, the largest component of final expenditure, has remained robust, despite demonetisation. More clarity is required on the new CSO data on a number of fronts. For instance, the lower growth numbers for Q4 FY17 not being in line with several high frequency indictors for this period is puzzling. The new CSO data has too many moving parts at this juncture to provide a definitive picture on output and growth trends post-demonetisation. 30. At this juncture, it would be prudent to wait and watch to see (i) whether headline inflation durably evolves in line with the medium-term inflation target of 4 per cent within a band of +/- 2 per cent; and (ii) how other risks (fiscal risks in terms of state farm loan waivers, GST, HRA, the monsoon) impinge on the medium term target. 31. I vote for keeping the policy repo rate unchanged at 6.25 per cent at today’s meeting of the Monetary Policy Committee. Statement by Dr. Pami Dua 32. Inflation softened considerably with CPI inflation falling to 2.99 per cent in April, 2017 owing to a favourable base effect, moderation in prices of several food items, and deflation in prices of pulses and vegetables. Although prices of food remained subdued during the pre-seasonal months, core inflation stood at 4.4 per cent and continues to remain sticky. The monsoon is likely to be normal and may help to sustain the low food inflation trajectory. At the same time, upside risks include the prospect of rising rural wage growth, the resulting boost in consumption demand, fiscal slippages in the form of farm loan waivers and a possibility of disbursement of allowances under the 7th central pay commission’s award. 33. While growth in Gross Value Added at 2011-12 prices (provisional estimate) slowed down in the last quarter of 2016-17, several other factors, apart from remonetisation, indicate positive growth during 2017-18. Various reforms including GST, Insolvency and Bankruptcy Code, and the abolition of the Foreign Investment Promotion Board are expected to improve sentiments of domestic as well as international investors. 34. The expected pickup in economic activity is endorsed by the RBI’s 77th round of Industrial Outlook Survey which demonstrates much improved sentiment on account of anticipated growth in order books, decline in pending orders and improved outlook of the overall business situation. Moreover, the Consumer Confidence Survey conducted by the RBI suggests that the one-year outlook on general economic situation, employment scenario and household income has improved. 35. The downside risks to growth include an uncertain geo-political environment in several of India’s trade partners. Furthermore, while there is excess liquidity in the banking system and several banks have cut rates post demonetisation, stressed assets on bank balance sheets may preclude recovery of private investment. There is also a strong likelihood that the US Federal Reserve may increase interest rates later this month, given the earlier cyclical upturn in the US Future Inflation Gauge maintained by the Economic Cycle Research Institute (ECRI), New York, along with the strength in ECRI’s leading indexes of US economic growth. Meanwhile, growth in ECRI’s Indian Leading Exports Index recently hit a multiyear high, indicating a still-favourable export outlook. 36. In view of the mixed risks to inflation and growth, it may be best to adopt a wait and watch policy as new data flows in. Statement by Dr. Ravindra H. Dholakia 37. There are several noteworthy developments recently on prices and output fronts that warrant a decisive policy action by the MPC. In my opinion, this is the most opportune time for the MPC to effect a major cut of 50 basis points in the policy rate to bring it down from 6.25 per cent to 5.75 per cent. My reasons for this recommendation are the following: 38. After the MPC meeting of April 2017, the two monthly readings of the CPI-combined inflation turned out to be more consistent with my forecast stated in the Minutes of the previous meeting than of the RBI forecast. The core inflation figures also vindicated my view about a clear declining trend rather than stickiness as predicted in the RBI forecast. Now the RBI has also revised their forecast of CPI-headline inflation downward to 2 - 3.5 per cent during the first half; and 3.5 - 4.5 per cent during the second half of 2017-18. Though my forecasts now are lower than RBI’s by about 40 and 90 basis points respectively from the RBI’s upper bounds, the essential point is that the expected headline CPI inflation over the next 12 months is expected to ease by at least 50 basis points compared to the April meeting of the MPC. 39. The 3-months and 12-months advance inflationary expectations as per the RBI survey of households are unambiguously declining and are among the lowest levels observed in the history of such surveys. 40. On the other hand, capacity utilization has persistently remained below 75 per cent now for a long time indicating existence of a large output gap. Although precise measurement of the output gap is highly controversial particularly for a rapidly developing country like India, there cannot be disagreement on the Indian economy significantly under-performing compared to its potential now for quite some time. Moreover, recent policy reforms in the country would certainly lead to the increased potential output and growth in the economy implying persistent if not widening output gap in the near to medium term. If any unanticipated inflationary pressures arise in future, they are likely to be substantially subdued by the presence of the high output gap. 41. Given the change in the outlook and assessment of the inflation and output over time, any theoretical rule-based policy for flexible inflation targeting would not only justify but also necessitate at least 50 basis point cut in the policy rate. This is because, if we are consistent, we must consider changes in the values of the critical parameters during the period since the last meeting of the MPC. Even under the most conservative estimates of the multipliers indicating the assumed sacrifice ratio, a minimum of 50 basis point cut in the policy rate is suggested. If we consider more realistic estimates of the sacrifice ratio for India, the policy rate cut could be even higher. 42. The monsoon forecasts released on 6th June, 2017 have created optimism for the second consecutive good year for agricultural production since the rainfall is expected to be higher at 98 per cent than 96 per cent of the long term average and would be geographically well distributed. Thus, the momentum pick up in agricultural inflation during the next 12 months is substantially less probable with obvious favorable impact on the headline CPI inflation. 43. International developments on oil price front are again not posing major threats. In my opinion, oil prices are likely to remain within the narrow range observed in recent times. Any breach on either side may not last for a longer time. I would not consider any major upside risk to the domestic headline inflation on this count. 44. Stable or appreciating exchange rate provides enough incentives for the FII and FDI particularly when there is a high degree of political stability; and when the observed Indian growth rate of output is among the highest in the world. US Fed rate hike is already factored in by the markets and no surprises are expected on its count. 45. The 7th CPC recommendations on HRA can at best be implemented by the Centre and only a few states during the year 2017-18. The impact assessment on the headline CPI inflation of about 150 basis points by the RBI is highly overstated because it assumes simultaneous and instantaneous implementation of the recommended HRA by the 7th CPC in the Centre and ALL states almost immediately. The impact of its implementation only by the Centre would be about 36 basis points over a six months period and about 106 basis points over a six months period if ALL states implement the recommendations together given the sampling design and methodology of estimating CPI-combined. In all probability, the impact on this count on the headline CPI inflation during 2017-18 would not be more than 50 basis points. On the other hand, it is most likely to be more than off-set by the implementation of GST in its present form. 46. There are concerns about the recent farm loan waivers announced by a couple of states. It is feared that it can lead to fiscal profligacy by other states too and result in significant increase in the fiscal deficits by the states jeopardizing the fiscal discipline and prudent levels of debt by states. In this context, we must note that states are bound by their own Fiscal Responsibility Legislations (FRLs) and that every state has it in place. So far, states have been behaving very responsibly and have collectively reduced their fiscal deficits and debt consistently. Now for quite some time, they have been borrowing directly from the market and their fiscal performance has a direct bearing on their interest costs. As a result, it is not justifiable to assume that loan waivers would directly and proportionately result in increasing their fiscal deficits. Actually, during 2017-18, they have budgeted to reduce their combined fiscal deficit by 70 basis points. The other possibilities for the states are that they may get more revenues from the implementation of GST (which are not budgeted by them) and/or that they may reallocate some of their expenditures to accommodate the loan waivers. So long as the aggregate fiscal deficit of the states does not increase, its inflationary impacts are not going to be felt. Moreover, not all states are likely to follow the suit and certainly not during the same year. Even if we consider that the loan waivers are granted immediately and they result in the increased fiscal deficit, their impact on the inflation would occur only with a considerable time-lag. Hence, these inflation risks, if at all, are in distant future and under normal circumstances are not very probable. It is altogether a different issue whether the loan waivers by some states is the least distorting and inflation impacting option among the alternatives available to address the problem. It need not be a concern for the MPC. 47. GST implementation is most likely to create demand for the working capital credit from the banking sector. Similarly, the corporate bond market needs to be given a boost. 48. All in all, the prevailing inflation and output conditions and prospects are such that there is enough space for a substantial rate cut of 50 basis points if not more. The risk factors appear to be highly mitigated and the probability of circumstances developing to reverse the decision is very low if not non-existent. Under such circumstances, becoming cautious and not acting amounts to ignoring all costs associated with not supporting growth in terms of unemployment and poverty reduction. Becoming too overcautious under such circumstances is against the principle of prudence. In fact, prudence lies in creating space when conditions are favorable and risks are not high than waiting and losing the opportunity. In case, the conditions were really to turn unfavorable in future, the costs to the society would be severe if during the right time expansionary policies are not followed. I, therefore, strongly plead to the MPC to effect a 50 basis points cut in the policy rate without losing any time. Statement by Dr. Michael Debabrata Patra 49. An inflation targeting framework is inherently forward-looking. The focus has to be on steering the trajectory of inflation towards its target over the medium-term and dealing with the risks around it, not on conducting monetary policy by looking at the rear-view mirror (the most recent inflation prints) or deviations of recent outcomes from projections (‘forecast errors’) that cannot be presumed to be durable. 50. It is hard to believe that deflation of 15.9 per cent in the prices of pulses and 8.6 per cent in the prices of vegetables is the steady state that will define the medium-term food inflation path. Not when agricultural wages have risen by 8.5 per cent, farm input costs by 10 per cent, bank credit to agriculture by 13.5 per cent in the year just gone by and the output gap in agriculture is turning positive on rising rural incomes! As regards fuel, the wedge in fuel inflation between urban and rural households has closed at an elevated level. Inflation excluding food and fuel has turned down in three readings now, but it is still not generalized and projections still run ahead of headline inflation in the rest of 2017-18. 51. Turning to cyclical factors, households seem to be discounting the near-term and consequently, they expect inflation to rise faster a year ahead than in the next three months. Moreover, an output gap calculated on data for 2016-17 that profile a slowdown will, by definition, be negative and wider than otherwise. For an economy that is projected to grow at 7.3 per cent in 2017-18, however, it must be the case that the output gap would narrow and close. Meanwhile, the MPC has highlighted elements to look out for: the spatial and temporal distribution of the monsoon; fiscal slippages; global political and financial risks; and the disbursement of allowances under the 7th central pay commission’s award. 52. In the revised inflation trajectory for the first half of 2017-18, the near term inflation outlook is admittedly benign. Yet, in a situation in which transitory and structural factors are meshed and difficult to decouple, apparently divergent messages emanate from the few data points that are available at this stage. Without more clarity, it is possible to make policy errors that can be large and costly in the medium-term. Accordingly, I vote to wait and watch the incoming data while retaining the flexibility of a neutral stance. Statement by Dr. Viral V. Acharya 53. The softness of April inflation prints, in food, and excluding food and fuel, as well as of the CSO's revised estimates of growth for 2016-17, especially Q4, has posed difficult challenges for monetary policy. Our inflation forecasts relied on evidence of gradual reversal after fire sales in several food items, which were partly confirmed by February and March reversion, as well as on the seasonal uptick in food prices during summer. Realized food inflation, however, turned out to be much lower than our forecast. Inflation excluding food and fuel also moderated. The global and goods-and-services tax (GST) related risks, that we have been concerned about, haven't materialized. One needs to wait for some more time to ascertain whether our capital inflows and exchange rate remain relatively immune to the Federal Reserve’s unwinding of its asset purchase program; we might see a pick-up in imported inflation otherwise. Similarly, a few more months’ data will confirm if the GST rollout is likely to be entirely benign for inflation. It is the collapse of food inflation, however, that remains the primary driver of a steady decline in the headline number. It is clear now that supply factors, in addition to transitory effects, have been playing a significant role for at least three quarters with no sign yet of abating. 54. The growth slowdown has had two primary components: one, the continuing decline in private investment since the beginning of 2016-17; and second, the more recent fall in construction activity that is also evidenced in the poor performance of cement industry and real estate services. 55. Have we managed food inflation to a stable level so that the medium-term headline inflation path will remain firmly anchored below 4 per cent? While the continuing food disinflation due to supply-side measures in some high-weight food items would suggest so, farmer demands one is witnessing with each passing day gives me a pause. I remain concerned though that this may have sown the seeds of a "tail risk" in the form of fiscally expansive measures that could spark off generalized inflation in due course. 56. The growth slowdown in Q4 has finally led to the outcome that our estimates of “output gap", in spite of substantial uncertainty around such estimates, point to the opening up of a negative gap. In the traditional ways of thinking about monetary policy, this would push the interest rate policy towards being more willing to accommodate. I prefer to approach monetary policy through the finance angle where the focus is on effectiveness of the transmission policy: Will the interest rate changes have the desired amplifier effects on the economy through the bank and non-bank intermediation sector? On this front, we have a problem. A substantial part of the banking sector balance-sheet remains exposed to heavily indebted sectors, a stress that has built up over at least six to seven years. Accommodation in monetary policy during 2015-16 did not get transmitted to the corporate sector, and private investment remained weak then in spite of the monetary stance. The Treasury gains accruing to banks in this time, while not a direct concern for the monetary policy, only masked the true stress of their balance-sheets. 57. In such a scenario, the standard prescription for monetary policy does not necessarily work well. Tolerance for a slightly higher real rate of interest is justified to ensure weak banks do not find relatively low the hurdle rate for ever-greening (perennial extension) of bad loans. What is required for monetary policy to do its job better is to address the stress on bank (and highly-indebted borrower) balance-sheets. The Reserve Bank's efforts on this will start in the earnest in a few weeks. Once the transmission mechanism is restored to better health, monetary policy will more pervasively touch different parts of the economy. Targeted interventions to stimulate demand for sectors such as construction, where the supply is likely affected as an intended consequence of recent policies, would be more effective for now; this would not run the risks of ever-greening, given the relatively low delinquency rates in bank lending in these segments. 58. These considerations prevented me from considering a change in stance or recommending a rate cut based on available data, just before the Federal Reserve rate hike and before we had firmly put in place our efforts on resolution of banking sector stress. I will watch next few months of inflation and real economic activity indicators closely to confirm if lower-than-target headline inflation and negative output gap are persistent. 59. Finally, I wish to clarify one point. Some suggest that monetary policy should be eased with the explicit objective of recapitalizing the weak bank balance-sheets. Nothing could be worse for monetary policy, in my view. This would relax the pressure on good efforts that are underway deploying a slew of measures to improve the banking architecture (through private capital-raising, non-core asset sales, consolidation, divestment and regulatory prompt corrective action). In turn, this would trap the monetary policy from changing its direction if data so demand before the resolution of banks is complete. It is best for sake of policy credibility to not mix instruments with objectives they are not meant to target. Statement by Dr. Urjit R. Patel 60. Considering the high uncertainty clouding the near-term inflation outlook, there is a need to avoid premature policy action at this stage. I, therefore, vote for holding the policy repo rate at the current level of 6.25 per cent and maintaining the neutral stance of monetary policy. 61. The sharp disinflation in April 2017, coming on the back of firming of inflation in February and March, has imparted considerable uncertainty to the near-term inflation outlook. Food inflation fell sharply, driven by unusually low momentum in food prices combined with favourable base effects. Disinflation in services also resulted in moderation in CPI, excluding food and fuel inflation, which had remained sticky through most part of 2016-17. Incoming data is expected to provide greater clarity on the durability of recent food and non-food disinflation. There is also a need to be alert to elements that may have a significant influence on the inflation outcome over the medium-term. Firstly, inflation expectations of households remain elevated despite some recent moderation. Second, the implementation of 7th CPC HRA award is an upside risk. Third, some increase in MSPs is inevitable. Last, the rising fiscal risks due to growing demand for farm loan waivers also pose a risk to inflation. In this context, it may be instructive to note that the outstanding advances to agriculture & allied activities as ratio to GDP from agriculture & allied activities has increased from about 13 percent in 2000-01 to around 53 per cent at present; average annual nominal growth rate in Scheduled Commercial Banks' advances to agriculture & allied activities was 21.5 per cent during 2000-01 to 2016-17. 62. GVA growth weakened in Q4 of 2016-17 due mainly to slowdown in the services sector growth. On the demand side, while growth in private consumption expenditure was robust despite demonetisation, gross fixed investment contracted in Q4. Going forward, it is comforting that the India Meteorological Department has reiterated its forecast of a normal south-west monsoon. This bodes well for the agriculture sector and rural spending. The business expectation index of the latest round of the Reserve Bank’s Industrial Outlook Survey points to optimism. Overall, growth is expected to recover gradually in 2017-18. We have to be mindful of pitfalls in assessing the overall (national) output gap. For sub-sectors such as infrastructure (especially public transportation, railways etc.) that enter the aggregate (national) production process in “fixed” (Leontieff) coefficients, the “gap” may be positive, thereby impeding further growth acceleration, as well as undermining competitiveness. 63. The quiescent investment cycle remains a key macroeconomic concern. It is, therefore, imperative to ensure resolution of stressed assets of banks and timely recapitalisation of PSBs. While the transmission of past policy rate cuts continues – with some banks further reducing the deposit and lending rates – aligning administered interest rates on small savings to the committed formula can further strengthen the monetary transmission. Jose J. Kattoor

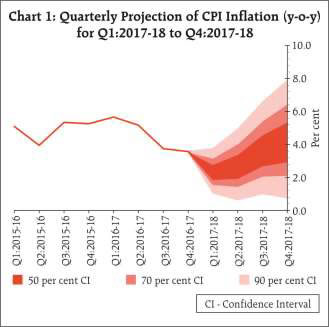

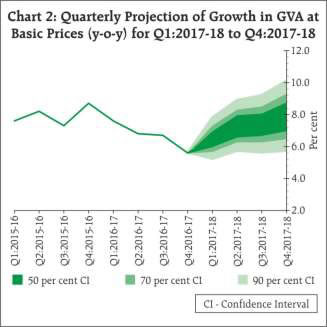

Chief General Manager Press Release: 2016-2017/3443 |