[Under Section 45ZL of the Reserve Bank of India Act, 1934] The twelfth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the amended Reserve Bank of India Act, 1934, was held from July 30 to August 1, 2018 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, former Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the amended Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: - the resolution adopted at the meeting of the Monetary Policy Committee;

- the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and

- the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting.

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to: - increase the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6.5 per cent.

Consequently, the reverse repo rate under the LAF stands adjusted to 6.25 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.75 per cent. The decision of the MPC is consistent with the neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 6. Since the last meeting of the MPC in June 2018, global economic activity has continued to maintain steam; however, global growth has become uneven and risks to the outlook have increased with rising trade tensions. Among advanced economies (AEs), the US economy rebounded strongly in Q2, after modest growth in Q1, on the back of rising personal consumption expenditures and exports. In the Euro Area, weak growth in Q1 continued in Q2 due to subdued consumer demand, weighed down by political uncertainty and a strong currency. In Japan, recent data on retail sales, consumer confidence and business sentiment point to moderation in growth. 7. Economic activity in major emerging market economies (EMEs) has slowed somewhat on volatile and elevated oil prices, mounting trade tensions and tightening of financial conditions. The Chinese economy lost some pace in Q2, pulled down by efforts to contain debt. The Russian economy picked up in Q1; recent data on employment, industrial production and exports indicate that the economy has gained further momentum. South Africa’s economy contracted in Q1; though consumer sentiment has improved, high unemployment and weak exports pose challenges. In Brazil, economic activity suffered a setback in Q1 on nation-wide strikes; more recent data suggest that growth remained muted as industrial production contracted in May and the manufacturing purchasing managers’ index (PMI) declined. 8. Global trade lost some traction due to intensification of trade wars and uncertainty stemming from Brexit negotiations. Crude oil prices, which remained volatile and elevated in May-June on a delicate demand-supply balance, eased modestly in the second half of July on higher supply from Organisation of Petroleum Exporting Countries (OPEC) and non-OPEC producers. Base metal prices have fallen on the general risk-off sentiment triggered by fears of an intensification of trade wars. Gold prices have softened on a stronger dollar. Inflation remained firm in the US, reflecting higher oil prices and stronger aggregate demand. Inflation has edged up also in some other major advanced and emerging economies, driven, in part, by rising energy prices and pass-through effects from currency depreciations. 9. Financial markets have continued to be driven mainly by monetary policy stances in major AEs and geopolitical tensions. Equity markets in AEs have declined on trade tensions and uncertainty relating to Brexit negotiations. Investors’ appetite for EME assets has waned on increases in interest rates by the US Fed. The 10-year sovereign yield in the US has moderated somewhat from its peak on May 17 on safe-haven demand, spurred by escalating trade conflicts. Yields have softened in other key AEs as well. In most EMEs, however, movements in yields have varied reflecting domestic macroeconomic fundamentals and tightening global liquidity. Capital flows to EMEs declined in anticipation of monetary policy tightening in AEs. In currency markets, the US dollar appreciated, supported by strong economic data. The euro strengthened in June on receding political uncertainty and taper talk by the central bank. However, the currency has traded soft thereafter on mixed economic data and the rising US dollar. EME currencies, in general, have depreciated against the US dollar over the last month. 10. On the domestic front, south-west monsoon has been recovering after a brief spell of deficiency in the second half of June. The cumulative rainfall up to July 31, 2018 was 6 per cent below the long-period average. In terms of spatial distribution, 28 of the 36 sub-divisions received normal or excess rainfall, whereas 8 sub-divisions received deficient rainfall as against three sub-divisions last year. The total sown area of kharif crops as on July 27 was 7.5 per cent lower than that a year ago. The live storage in major reservoirs as on July 26 was at 41 per cent of the full reservoir level compared with 36 per cent a year ago, which portends well for the rabi sowing season. 11. Industrial growth, measured by the index of industrial production (IIP), strengthened in April-May 2018 on a y-o-y basis. This was driven mainly by a significant turnaround in the production of capital goods and consumer durables. Growth in the infrastructure/construction sector accelerated sharply, reflecting the government’s thrust on national highways and rural housing, while the growth of consumer non-durables decelerated significantly. The output of eight core industries accelerated in June due to higher production in petroleum refinery products, steel, coal and cement. Capacity utilisation in the manufacturing sector remains robust. The assessment based on the Reserve Bank’s business expectations index (BEI) for Q1:2018-19 remained optimistic notwithstanding some softening in production, order books and exports. The July manufacturing PMI remained in expansion zone, although it eased from its level a month ago with slower growth in output, new orders and employment. 12. Several high-frequency indicators of services activity increased at a faster pace in May-June. Tractor and two-wheeler sales growth accelerated significantly, suggesting strong rural demand. Passenger vehicle sales growth, an indicator of urban demand, also strengthened. Commercial vehicle sales growth remained robust despite some deceleration. Domestic air passenger traffic – another indicator of urban demand – maintained double-digit growth. Construction activity indicators also improved with cement production sustaining double digit growth for the eighth consecutive month in June. Steel consumption also accelerated in May. The services PMI expanded to a twelve-month high in June, after a marginal contraction in May, supported by expansion in new business and employment. 13. Retail inflation, measured by the year-on-year change in the CPI, rose from 4.9 per cent in May to 5 per cent in June, driven by an uptick in inflation in fuel and in items other than food and fuel even as food inflation remained muted due to lower than usual seasonal uptick in prices of fruits and vegetables in summer months. Adjusting for the estimated impact of the 7th central pay commission’s house rent allowances (HRA), headline inflation increased from 4.5 per cent in May to 4.6 per cent in June. Low inflation continued in cereals, meat, milk, oil, spices and non-alcoholic beverages, and pulses and sugar prices remained in deflation. 14. Fuel and light group inflation rose sharply, pulled up by liquefied petroleum gas and kerosene. Inflation in firewood and chips ticked up, while electricity inflation remained low. The pass-through of global crude oil prices impacted inflation in domestic petroleum products as well as transport services. Inflation also picked up modestly in respect of education and health. 15. The June round of the Reserve Bank’s survey of households reported a further uptick of 20 basis points in inflation expectations for both three-month and one-year ahead horizons as compared with the last round. Manufacturing firms polled in the Reserve Bank’s industrial outlook survey (IOS) reported higher input costs and selling prices in Q1:2018-19. The manufacturing PMI showed that input prices eased slightly in July, although they remained high. Input costs for companies polled in Services PMI in June also stayed elevated. Farm and non-farm input costs rose significantly. Notwithstanding some pick-up in February and March 2018, rural wage growth remained moderate, while wage growth in the organised sector remained firm. 16. Systemic liquidity remained generally in surplus mode during June-July 2018. In June, the Reserve Bank absorbed surplus liquidity of around ₹140 billion on a daily net average basis under the LAF even as the system migrated from net surplus to a net deficit mode in the second half of the month due to advance tax outflows. Interest rates in the overnight call money market firmed up in June reflecting the increase in the repo rate on June 6, 2018. The weighted average call rate (WACR) traded, on an average, 12 basis points below the repo rate – the same as in May. Systemic liquidity moved back into surplus mode in early July with increased government spending but turned into deficit from July 10 onwards; on a daily net average basis, the Reserve Bank injected liquidity under the LAF of ₹107 billion in July. The WACR in July, on an average, traded 9 basis points below the policy rate. Based on an assessment of prevailing liquidity conditions and of durable liquidity needs going forward, the Reserve Bank conducted two open market operation (OMO) purchase auctions of ₹100 billion each on June 21 and July 19, 2018. 17. Export growth picked up in May and June 2018 on a y-o-y basis, aided by engineering goods, petroleum products, drugs and pharmaceuticals, and chemicals. Import growth also accelerated largely due to an increase in crude oil prices. Among non-oil imports, gold imports declined due to lower volume, while imports of machinery, coal, electronic goods, chemicals, and iron and steel increased sharply. Double-digit import growth in May and June pushed up the trade deficit. On the financing side, net foreign direct investment (FDI) flows improved significantly in the first two months of 2018-19. With the tightening of liquidity conditions in AEs, growing geopolitical concerns and with the escalation of protectionist sentiment, net foreign portfolio investment (FPI) outflows from the domestic capital market have continued, albeit at an increasingly slower rate. India’s foreign exchange reserves were at US$ 404.2 billion on July 27, 2018. Outlook 18. In the second bi-monthly resolution of 2018-19, CPI inflation for 2018-19 was projected at 4.8-4.9 per cent in H1 and 4.7 per cent in H2, including the HRA impact for central government employees, with risks tilted to the upside. Excluding the impact of HRA revisions, CPI inflation was projected at 4.6 per cent in H1 and 4.7 per cent in H2. Actual inflation outcomes have been slightly below the projected trajectory as the seasonal summer surge in vegetable prices has remained somewhat muted in comparison with its past behaviour and fruits prices have declined. 19. The inflation outlook is likely to be shaped by several factors. First, the central government has decided to fix the minimum support prices (MSPs) of at least 150 per cent of the cost of production for all kharif crops for the sowing season of 2018-19. This increase in MSPs for kharif crops, which is much larger than the average increase seen in the past few years, will have a direct impact on food inflation and second round effects on headline inflation. A part of the increase in MSPs based on historical trends was already included in the June baseline projections. As such, only the incremental increase in MSPs over the average increase in the past will impact inflation projections. However, there is a considerable uncertainty and the exact impact would depend on the nature and scale of the government’s procurement operations. Second, the overall performance of the monsoon so far augurs well for food inflation in the medium-term. Third, crude oil prices have moderated slightly, but remain at elevated levels. Fourth, the central government has reduced Goods and Services Tax (GST) rates on several goods and services. This will have some direct moderating impact on inflation, provided there is a pass-through of reduced GST rates to retail consumers. Fifth, inflation in items excluding food and fuel has been broad-based and has risen significantly in recent months, reflecting greater pass-through of rising input costs and improving demand conditions. Finally, financial markets continue to be volatile. Based on an assessment of the above-mentioned factors, inflation is projected at 4.6 per cent in Q2, 4.8 per cent in H2 of 2018-19 and 5.0 per cent in Q1:2019-20, with risks evenly balanced (Chart 1). Excluding the HRA impact, CPI inflation is projected at 4.4 per cent in Q2, 4.7-4.8 per cent in H2 and 5.0 per cent in Q1:2019-20. 20. Turning to the growth outlook, various indicators suggest that economic activity has continued to be strong. The progress of the monsoon so far and a sharper than the usual increase in MSPs of kharif crops are expected to boost rural demand by raising farmers’ income. Robust corporate earnings, especially of fast moving consumer goods (FMCG) companies, also reflect buoyant rural demand. Investment activity remains firm even as there has been some tightening of financing conditions in the recent period. Increased FDI flows in recent months and continued buoyant domestic capital market conditions bode well for investment activity. The Reserve Bank’s IOS indicates that activity in the manufacturing sector is expected to remain robust in Q2, though there may be some moderation in pace. Rising trade tensions may, however, have an adverse impact on India’s exports. Based on an overall assessment, GDP growth projection for 2018-19 is retained, as in the June statement, at 7.4 per cent, ranging 7.5-7.6 per cent in H1 and 7.3-7.4 per cent in H2, with risks evenly balanced; GDP growth for Q1:2019-20 is projected at 7.5 per cent (Chart 2).

21. Even as inflation projections for Q2 have been revised marginally downwards vis-à-vis the June statement, projections for Q3 onwards remain broadly unchanged. Several risks persist. First, crude oil prices continue to be volatile and vulnerable to both upside and downside risks. In particular, while geopolitical tensions and supply disruptions remain an upside risk to oil prices, the fall in global demand due to further intensification of protectionist trade policies could pull down oil prices. Second, volatility in global financial markets continues to impart uncertainty to the inflation outlook. Third, households’ inflation expectations, as measured by the Reserve Bank’s survey, have risen significantly in the last two rounds, which could influence actual inflation outcomes in the months to come. Fourth, manufacturing firms polled in the Reserve Bank’s industrial outlook survey have reported hardening of input price pressures in Q2 of 2018-19. However, if the recent softening of global commodity prices persists, it could mitigate some of the upward pressure on input costs. Fifth, though the monsoon has been normal temporally so far, its regional distribution needs to be carefully monitored in the context of key CPI components such as paddy. Sixth, in case there is fiscal slippage at the centre and/or state levels, it could have adverse implications for market volatility, crowd out private investment and impact the outlook for inflation. Seventh, uncertainty around the full impact of MSP on inflation will only resolve in the next several months once the price support schemes are implemented. Finally, the staggered impact of HRA revision by state governments may push headline inflation up. While the statistical impact of HRA revisions will be looked through, there is need to watch out for any second-round impact on inflation. 22. Against the above backdrop, the MPC decided to increase the policy repo rate by 25 basis points. The MPC reiterates its commitment to achieving the medium-term target for headline inflation of 4 per cent on a durable basis. 23. The MPC notes that domestic economic activity has continued to sustain momentum and the output gap has virtually closed. However, uncertainty around domestic inflation needs to be carefully monitored in the coming months. In addition, recent global developments raise some concerns. Rising trade protectionism poses a grave risk to near-term and long-term global growth prospects by adversely impacting investment, disrupting global supply chains and hampering productivity. Geopolitical tensions and elevated oil prices continue to be the other sources of risk to global growth. 24. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of the decision; Dr. Ravindra H. Dholakia voted against the decision. The minutes of the MPC’s meeting will be published by August 16, 2018. 25. The next meeting of the MPC is scheduled from October 3 to 5, 2018. Voting on the Resolution to increase the policy repo rate by 25 bps to 6.5 per cent | Member | Vote | | Dr. Chetan Ghate | Yes | | Dr. Pami Dua | Yes | | Dr. Ravindra H. Dholakia | No | | Dr. Michael Debabrata Patra | Yes | | Dr. Viral V. Acharya | Yes | | Dr. Urjit R. Patel | Yes | Statement by Dr. Chetan Ghate 26. Since the last policy, demand conditions in the manufacturing sector have continued to improve. There is a significant improvement in the risk profile of the firms in most sub-sectors based on corporate results for H2:17-18. There is a noticeable improvement in consumer confidence, although the current situation index continues to be in the pessimistic zone. Organized sector wages – a proxy for pay inflation – continue to rise and need to be carefully watched. The increase in capacity utilization has coincided with better corporate performance. The Services PMI also expanded to a 12 month high in June. 27. On the expenditure side, private consumption (PFCE) continues to be the main driver of growth, and it will be further supported by a shift in the terms of trade towards agriculture, and the likelihood of a normal monsoon. Economic growth in the short run will also be buoyed by a political business cycle. The adverse implications of a political business cycle on fiscal consolidation should be carefully watched since fiscal consolidation is often a key feature of the adjustment required to contain trade imbalances. High frequency indicators on consumption suggest a mild tapering in the growth momentum since the last policy. Headline IIP also softened to 3.2% in May compared to 4.8% in April. Overall, I remain sanguine about current and medium term growth prospects. 28. One year projections of headline inflation (ex HRA) continue to durably persist above 4%, as in the last policy. CPI inflation ex food and fuel has continued to sustain above 6%, with strong momentum effects. On the positive side, this reflects a closing output gap. Favorable base effects will also prevail over a 12 month horizon for the ex food and fuel and ex HRA group, which will slow down CPI ex food and fuel and ex HRA inflation. Food inflation continues to be maverick. It ranged between 1.7% and 2.1% in Q1:18-19 and is the reason for the May-June 2018 undershoot of projections. Except food, all other groups contributed to an increase in headline inflation in the last few months. For instance, there is a tangible rise in price pressures in the miscellaneous sub-group (health, education, transport) in the last three months, possibly reflecting supply constraints in these sectors. Food inflation surprises continue to be one way, which is a puzzle. Crude prices have inched down, although the average price of crude remains elevated with risks persisting. 29. Both 3 month and 1 year ahead inflationary expectations have also hardened, which is worrisome. If inflationary expectations are well anchored, the 1 year ahead inflationary expectations should be less sensitive to “news” shocks (such as the recent elevated levels of the price of crude) compared to the 3 month level. The fact that median inflationary expectations (both 3 month and the 1 year ahead) in the last round increased roughly by the same amount (20 basis points) compared to the last policy suggests that much work lies ahead in making monetary policy more credible and anchoring inflationary expectations. 30. One more risk that has crystallized to the upside since the June review is the recent announcement of minimum support prices for Kharif crops for 2018. The weighted average increase in MSP, based on CPI weights, for 2018-2019 works out to 17%. Compared to this, the average increase in MSP for 2014-2015 to 2017-2018 was 3.6%. Higher MSPs of this magnitude have the potential of pushing headline inflation sustainably and significantly beyond the 4 percent target for headline inflation mandated in the RBI Act. While the final inflationary impact will depend on the exact procurement policy which is yet to be announced, given the magnitude of the MSP surprise, it is opportune to frontload a rate hike, somewhat akin to an “insurance policy”. In this regard, it will be crucial to watch how the twin terms trade of shocks – referenced to in my last few statements – play out on macroeconomic aggregates in the coming months. 31. For these reasons, I vote for an increase in the policy repo rate by 25 basis points at today’s meeting of the Monetary Policy Committee. Statement by Dr. Pami Dua 32. Headline inflation, as measured by the Consumer Price Index, rose to 5% in June 2018 from 4.9% in May due to a broad-based rise across its sub-indices. The pass-through of elevated global oil prices in the domestic economy directly affected prices of LPG, petroleum products and transport services. Inflation in education and health also increased modestly. Food inflation, however, declined marginally between May and June, partly due to a favourable base effect and also because of a decline in prices of fruits and soft inflation in vegetables. Inflation excluding food and fuel hovered above 6% and is a cause for concern. Moreover, high input costs and selling prices were reflected in the Reserve Bank’s Industrial Outlook Survey (IOS) for the first quarter of 2018-19. Companies covered in the Services PMI in June also highlighted high input costs as did those polled for the Manufacturing PMI in July. 33. Going forward, several upside risks to inflation remain. First, a larger than average increase in the minimum support prices (MSPs) for all kharif crops for the sowing season of 2018-19 is likely to have a direct impact on inflation in the food group as well as secondary effects through greater purchasing power in rural areas. However, the extent of impact will depend on the nature and scope of implementation of procurement by the government. The tapering impact of HRA revisions for central government employees and the staggered impact of HRA revisions by state governments may also push headline inflation up. Further, crude oil prices remain above $70 and future movements are expected to be volatile, depending on geopolitical events and their impact on global demand. Volatility in global financial markets also continues to impart uncertainty to the inflation outlook. Additionally, fiscal slippages by governments may have adverse implications for market volatility, and may crowd out private investment and impact the outlook for inflation. Moreover, the June round of RBI’s survey of households shows an increase in inflation expectations at the three-month and one-year horizons. Elevated input costs also pose a risk for further inflation in the coming months, although there is some potential for easing due to softening global commodity prices. Downside risks also include a normal southwest monsoon, which should help contain food inflation in the medium-term. Additionally, reduction in Goods and Services Tax (GST) rates may cool down inflation to the extent of a pass-through of reduced GST rates to retail consumers. 34. The use-based classification of the index of industrial production (IIP) shows that industrial growth has strengthened in recent months on account of growth in capital goods and consumer durables. Central government schemes concerning building of highways and rural housing have contributed towards acceleration of growth in the infrastructure and construction sectors. While the July manufacturing PMI remained in expansion mode, it eased relative to the previous month. The business expectations index (BEI) of RBI for Q1:2018-19 remained in optimistic zone. Further, the Reserve Bank’s Industrial Outlook Survey suggests that manufacturing sector activity is expected to remain robust in Q2. According to the June Round of the Consumer Confidence Survey conducted by the Reserve Bank of India, the Current Situation Index, an indicator of the current state of the economy, rose modestly after dropping in the previous two rounds. This rise was largely driven by an improvement in sentiment on the general economic situation and employment scenario as well as an increase in spending. 35. At the same time, the Future Expectations Index that depicts consumer outlook fell marginally in the June round. This was driven by a slight drop in sentiments on the one-year ahead general economic situation and the deterioration in the outlook on income. Downside risks to growth also include rising trade tensions that may hamper demand for India’s exports, aggravating the cyclical slowdown in exports signalled by the continued downswing in the growth rate of the Indian Leading Exports Index maintained by the Economic Cycle Research Institute (ECRI), New York. This is consistent with the global economic slowdown predicted earlier by ECRI's international leading indexes. 36. Thus, with hardening of actual inflation, rising inflation expectations along with prevailing upside risks to inflation, I vote for an increase in the repo rate by 25 basis points while retaining the neutral stance. Statement by Dr. Ravindra H. Dholakia 37. After the last meeting of the MPC in June 2018, the monthly headline inflation prints for May and June have turned out to be less than expected by the RBI and, as I had pointed out a possibility in my last statement, have resulted in lowering the forecast for Q4:2018-19. The current forecast of RBI does not show this decline and on the contrary shows an increase by about 20 bps only because it incorporates a remotely possible impact of MSP revisions on the headline inflation. Such an impact, on the other hand, is so uncertain even in its existence and definitely in magnitude that experts in the field advise to wait and watch till the revised MSP is implemented on ground by November 2018. There are so many well-known constraints on its implementation that prudence lies in not basing any policy rate decisions till clarity emerges on it. Once we take this crucial uncertain factor out, the rest of the developments do not warrant any change in the status quo even with a very conservative view. I, therefore, vote for the status quo both in the policy repo rate and the neutral stance. More specific reasons for my vote are: -

The argument of a pre-emptive consecutive rate hike at this stage pre-supposes: (a) complete failure of the rate hike effected in the June 2018 policy on impacting the inflationary expectations in the economy, and (b) headline inflation forecasts ex-house rent revisions a year ahead increasing further without any uncertainty. Neither of these two pre-suppositions is correct. Although the RBI survey of the household inflationary expectations shows an increase in its median quantum by 20 bps, the proportion of respondents expecting higher inflation 12 months ahead declined noticeably. Moreover, the IIMA Business Inflation Expectation Survey conducted in June 2018 (after the repo rate hike by 25 bps) shows a sharp decline in the headline CPI inflation expectation 12 months ahead from 4.67 percent in the April 2018 round to 4.16 percent in the June 2018 round. This survey covered more than 1600 companies and shows low standard deviation. There are several reasons why the second pre-supposition is incorrect. -

The Central and State governments have shown reasonable commitment to the fiscal discipline in terms of bringing the fiscal deficit down. There is no reason to expect a substantial fiscal slippage this year despite the next year being an election year. -

GST rate reductions on several items may reduce the inflation marginally. -

Inflationary expectations of urban households have increased as per the RBI survey because two consecutive inflation readings (May and June 2018) increased. They are likely to fall when the next two consecutive readings (July and August 2018) would show a decline. Even RBI inflation forecasts point to this possibility on account of the strong base effects. If the actual fall in CPI inflation for July and August 2018 turns out to be larger than what RBI projected, their 12 month ahead inflation forecast may also show a reduction. Given the recent track record of RBI in terms of their near term forecasts, this possibility cannot be ruled out. -

Concerns about core inflation are misplaced on two counts: (a) the mandated target for our Committee is headline CPI inflation including food and fuel; and (b) my paper with a co-author in the Economic and Political Weekly (March 3, 2018) shows that inflation dynamics have changed during the last decade such that it is the core that adjusts to the headline and not vice-versa. -

The oil prices have not further increased. If at all, they show a marginal decline from $75 in early June 2018 to $72.5 towards the end of July 2018. All these factors together would bring down the baseline inflation forecast for Q4:2018-19. Only the most uncertain impact of MSP revisions on food prices after 2 or 3 quarters can push the inflation forecast marginally higher. In my opinion, we should not consider such a highly uncertain impact for a rate hike decision. -

On the other hand, there are disturbing signals and evidences pointing to likely slow down on the growth front. Capacity utilization seasonally adjusted has sharply fallen by 130 bps as per the RBI survey. It contradicts the RBI claim that output gap has closed. Actually, it is not getting closed, but is likely to widen creating downward pressure on wages and prices. -

Corporate performance points to less investment in fixed and financial assets in H2:2017-18 and is also likely to fall during 2018-19 as revealed by the pipeline projects up to 2017-18. Bonds and debentures issues by the private sector declined in Q1:2018-19. -

Global growth is not likely to sustain. Our exports may not grow at the envisaged rate due to tariff wars and increased protectionism. -

Real policy rate is already positive and very high compared to most other countries. For businesses, it is well above +2 percent (since their inflation expectation 12 months ahead is only 4.16 percent). It is already adversely impacting capital formation. All these factors will put further downward pressure on inflation. 38. This is certainly not the time and environment to hike the policy rate. Nor is it the time to tinker with the policy stance. Prudence lies in maintaining status quo on both. Statement by Dr. Michael Debabrata Patra 39. I vote for raising the policy repo rate by 25 basis points and for accordingly aligning the operating target with the policy action. 40. First, inflation has hardened through the first quarter of the year, extending its upturn into the third consecutive month in June. The forecast – the intermediate target that provides a proximate view of how the goal variables are forming – suggests that inflation is likely to encounter a soft patch in the second quarter, but it will resume an upward trajectory in the second half of the year. 41. Second, the recent softening of international crude prices has afforded some respite from inflation pressures. The outlook, though, is clouded with uncertainty as to how geopolitical tensions, OPEC production commitments, global demand and inventory adjustments will play out. It is prudent to prepare for international crude prices remaining elevated and volatile for some time. 42. Third, the recent experience is suffused with global spillovers impacting the bond and forex markets in India. Apart from implications for growth and external sustainability, financial turbulence feeding into volatile inflation outcomes is a real and present risk. 43. Fourth, the inflationary consequences of MSP revisions remain an upside risk. The pass-through of the announced MSPs to retail inflation is conditioned by two big unknowns: (a) the scale and ambit of procurement operations when they commence in Q3; and (b) the pace of drawdown of stocks in the case of paddy, the main crop for effective procurement in the Kharif season. A fair assumption can be that it will not be business as usual in view of the size of increases in MSPs this year that fulfils the commitment given in the Union Budget, and the timing of the announcement. 44. That said, the inflation trajectory is expected to slant upwards in the third and fourth quarters of 2018-19 and in the first quarter of the next financial year. Households and professional forecasters are anticipating it, corporates are reporting rising input costs which could swiftly translate into pricing power as the output gap closes and demand pressures build up. Consumers are pessimistic about the future course of the price situation. 45. The risk of failing to achieve the inflation target, and of being perceived as willing to accommodate deviations over the remaining period for which the MPC is tasked, has increased significantly. This could unhinge inflation expectations, dent the credibility of the MPC and allow inflation outcomes to test the upper tolerance band. This evolving configuration warrants an adequate monetary policy response, so that inflation realigns with the target and inflation expectations remain anchored. 46. The economy is poised for an acceleration of growth in 2018-19 relative to 2017-18, but the drivers of growth are amorphous at this juncture. International crude prices and global spillovers from trade wars, monetary policy normalisation and geopolitical tensions present significant risks to growth prospects. In this highly volatile and unsettled international environment, stability has to be secured on an enduring basis to enable the drivers of growth to gain traction and to preserve external viability. 47. My preference, therefore, is to reinforce the policy action that commenced in June with another policy rate increase now and to allow the accumulated policy impulse to work its way through the economy, while vigil is maintained on the expected rising path of inflation going forward. The softer inflation prints expected in Q2 could likely lull inflation expectations, but abundant precaution and decisiveness in quelling risks to the target is warranted if the hard-earned gains in terms of macroeconomic stability and credibility have to be preserved. Statement by Dr. Viral V. Acharya 48. Since the Monetary Policy Committee (MPC) met last in June 2018, inflation prints have been somewhat softer than the Reserve Bank’s projections. Notably, vegetables and fruits prices have surprised on the downside. However, the underlying inflation as reflected in “ex food fuel” segment, especially in petrol and diesel, transportation (including fares), education fees, health services and clothing persists, and does not augur well for headline inflation going forward. 49. The last three rounds of the Reserve Bank of India (RBI)’s Inflation Expectations Survey (IES) of households reflect hardening of the 3-month ahead and 12-month ahead inflation expectations by 110 basis points (bps) and 150 bps, respectively. The input cost pressures faced by the corporate sector are also reported to be robust. These outcomes are not surprising given that headline inflation – even after adjusting for the statistical effect of the Centre’s increase in house rent allowances (HRA) – has remained above 4%, the MPC’s mandated target headline inflation rate, for seven out of the past eight months, with a mean as well as median of slightly over 4.5%. 50. Benign food inflation continues to act as a factor pulling forecasts down. It remains to be seen if the usual summer seasonal pickup in food inflation will simply be delayed by a month or two, or it is a feature of supply-driven soft food inflation prints. However, the major upside risk to food inflation that MPC had highlighted in its past resolutions, viz., the award of minimum support prices (MSPs), has materialised. There is now a concrete announcement detailing the targeted kharif crops and a much higher than the normal MSP increase. Though significant uncertainty remains regarding the exact rollout of the MSP program, inflation projections by the Reserve Bank include the impact of MSP under reasonable procurement assumptions. 51. Oil prices have moderated somewhat compared with two months back due to an increase in supply from some of the OPEC countries and Russia. Nevertheless, the price of the Indian crude basket remains at elevated levels and is just a throw away from levels that can cause domestic inflation to rise sharply. Hence, while the supply response has had some softening impact on the projections, oil price gyrations remain an important risk going forward. 52. Factoring in these considerations, I am more concerned about upside risks materialising compared to downside risks. This is especially so as most real-time indicators suggest that growth recovery is likely to be sustainable. As I have mentioned in the past few minutes, estimates suggest that the output gap has more or less closed. 53. In summary, since past several headline inflation prints have been above the target and projections suggest this will also be the case over the medium term, I vote to raise the policy rate by 25 basis points (bps) as a step towards fulfilling our inflation targeting mandate while paying attention to growth. The rate hike of June followed by another rate hike will help rein in demand pressures and manage inflation expectations. However, this transmission will occur with a lag. Since that is somewhat far and there is an important interim uncertainty in the form of tariff wars which can rock global growth, financial markets and inflation in abrupt and unexpected ways, I vote to retain the neutral stance of monetary policy. Statement by Dr. Urjit R. Patel 54. Inflation as measured by CPI ex HRA has risen for the third consecutive month in June 2018, driven by a broad-based increase in inflation in non-food goods and services. Continuing elevated crude oil prices have kept retail prices of petroleum products high; this has also resulted in higher inflation in transport services. Furthermore, inflation increased in education, health and clothing. In contrast, inflation in the food group remained benign due to a decline in prices of fruits and lower than the usual seasonal uptick in prices of vegetables. On the whole, actual inflation outcomes since the last MPC resolution of June 2018 have been slightly below the projected trajectory as food inflation has continued to surprise on the downside. 55. Going forward, excluding the HRA impact, CPI inflation is projected at 4.7-4.8 per cent in H2:2018-19; and 5 per cent in Q1:2019-20. These projections include the impact of an increase in minimum support prices (MSPs) for kharif crops announced by the central government over what was already assumed in projections in the June policy. The outlook for inflation, however, is faced with both upside and downside risks such as (i) considerable uncertainty around the full impact of MSP changes on inflation, which will be known only in the coming months when the procurement details are available and execution takes place; (ii) susceptibility of crude oil to both supply and demand shocks; (iii) continuing volatility in financial markets; (iv) a further rise in inflation expectations of households which has the potential to feed into wage & salary increases and induce cost-push pressures; (v) fiscal slippage at the centre and/or state levels; and (vi) second round effects on inflation on account of the staggered HRA revisions by various state governments, though the direct statistical impact of HRA revisions will be looked through. 56. Domestic growth impulses continue to be reasonably strong. The normal monsoon so far augurs well for the farm sector. Investment activity has remained broadly positive. The manufacturing sector has continued to be robust. Several high frequency indicators of services activity have expanded at a faster pace in recent months. However, rising trade protectionism may impact domestic investment and growth prospects by dampening India’s exports. Overall, economic activity appears to be buoyant with GDP growth for 2018-19 projected at 7.4 per cent, same as in the June policy; and 7.5 per cent for Q1:2019-20. 57. As inflation risks have continued to be elevated, I vote for an increase in the policy repo rate by 25 basis points; this action is a necessary step towards securing the mandated 4 per cent inflation target on a durable basis. However, in view of several uncertainties that are present, I maintain the neutral stance of monetary policy. Jose J. Kattoor

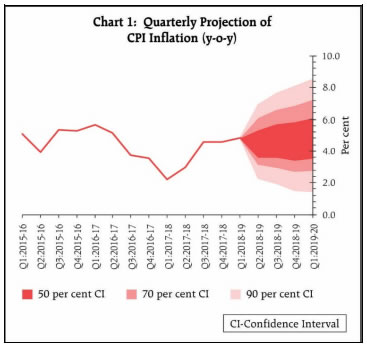

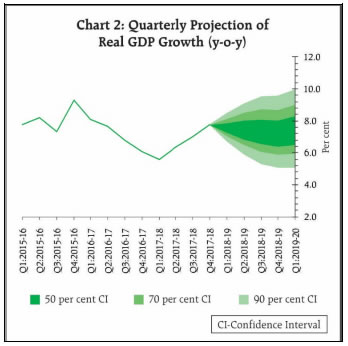

Chief General Manager Press Release : 2018-2019/409 |