[Under Section 45ZL of the Reserve Bank of India Act, 1934] The twenty eighth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held from April 5 to 7, 2021. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Mridul K. Saggar, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. Dr. Shashanka Bhide, Dr. Ashima Goyal and Prof. Jayanth R. Varma joined the meeting through video conference. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: (a) the resolution adopted at the meeting of the Monetary Policy Committee; (b) the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and (c) the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (April 7, 2021) decided to: - keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 4.0 per cent.

Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent. - The MPC also decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. Since the MPC’s meeting in February, lingering effects of the slowdown in the global economy in Q4 of 2020 have persisted, although recent arrivals of high frequency indicators suggest that a gradual but uneven recovery may be forming. The much anticipated boost to economic activity from the vaccination rollouts is being somewhat held back by new mutations of COVID-19, second and third waves of infections across countries and unequal access to vaccines more generally. World trade activity improved in Q4:2020 and January 2021. There are, however, concerns due to COVID-19-related fresh lockdowns and depressed demand in a few major economies, escalation in shipping charges and container shortages. Inflation remains benign in major advanced economies (AEs), although highly accommodative monetary policies and large fiscal stimuli have added to concerns around market-based indicators of inflation expectations, unsettling bond markets globally. In a few emerging market economies (EMEs), however, inflation is ruling above targets, primarily driven by firming global commodity prices. This has even prompted a few of them to raise policy rates. Equity and currency markets have been turbulent with the increase in long-term bond yields and the steepening of yield curves. More recently, however, calm has returned and major equity markets have scaled new peaks in March, while currencies are trading mixed against a generally firming US dollar. With the bond markets sell-offs, EME assets came under selling pressure and capital outflows imposed depreciating pressures on EME currencies in March. Domestic Economy 7. The second advance estimates for 2020-21 released by the National Statistical Office (NSO) on February 26, 2021 placed India’s real gross domestic product (GDP) contraction at 8.0 per cent during the year. High frequency indicators – vehicle sales; railway freight traffic; toll collections; goods and services tax (GST) revenues; e-way bills; and steel consumption – suggest that gains in manufacturing and services activity in Q3:2020-21 extended into Q4. Purchasing managers’ index (PMI) manufacturing at 55.4 in March 2021 remained in expansion zone, but lower than its level in February. The index of industrial production slipped into marginal contraction in January 2021, dragged down by manufacturing and mining. Core industries also contracted in February. The resilience of agriculture is evident from foodgrains and horticulture production for 2020-21, which are expected to be 2.0 per cent and 1.8 per cent higher respectively than the final estimates of 2019-20. 8. Headline inflation increased to 5.0 per cent in February after having eased to 4.1 per cent in January 2021. Within an overall food inflation print of 4.3 per cent in February, five out of twelve food sub-groups recorded double digit inflation. While fuel inflation pressures eased somewhat in February, core inflation registered a generalised hardening and increased by 50 basis points to touch 6 per cent. 9. System liquidity remained in large surplus in February and March 2021 with average daily net liquidity absorption of ₹5.9 lakh crore. Driven by currency demand, reserve money (RM) increased by 14.2 per cent (y-o-y) as on March 26, 2021. Money supply (M3) grew by 11.8 per cent as on March 26, 2021 with credit growth at 5.6 per cent. Corporate bond issuances at ₹6.8 lakh crore during 2020-21 (up to February 2021) were higher than ₹6.1 lakh crore during the same period last year. Issuances of commercial paper (CPs) turned around since December 2020 and were higher by 10.4 per cent during December 2020 to March 2021 than in the same period of the previous year. India’s foreign exchange reserves increased by US$ 99.2 billion during 2020-21 to US$ 577.0 billion at end-March 2021, providing an import cover of 18.4 months and 102 per cent of India’s external debt. Outlook 10. The evolving CPI inflation trajectory is likely to be subjected to both upside and downside pressures. The bumper foodgrains production in 2020-21 should sustain softening of cereal prices going forward. While the prices of pulses, particularly tur and urad, remain elevated, the incoming rabi harvest arrivals in the markets and the overall increase in domestic production in 2020-21 should augment supply which, along with imports, should enable some softening of these prices going forward. While edible oils inflation has been ruling at heightened levels with international prices remaining firm, reduction of import duties and appropriate incentives to enhance productivity domestically could work towards a better demand-supply balance over the medium-term. Pump prices of petroleum products have remained high. Reduction of excise duties and cesses and state level taxes could provide some relief to consumers on top of the recent easing of international crude prices. This could slow down the propagation of second-round effects. The impact of high international commodity prices and increased logistics costs are being felt across manufacturing and services. Finally, inflation expectations of urban households one year ahead showed a marginal increase than over the three months ahead horizon according to the Reserve Bank’s March 2021 survey. Taking into consideration all these factors, CPI inflation is now projected as 5.0 per cent in Q4:2020-21; 5.2 per cent in Q1:2021-22, 5.2 per cent in Q2, 4.4 per cent in Q3 and 5.1 per cent in Q4, with risks broadly balanced (Chart 1). 11. Turning to the growth outlook, rural demand remains buoyant and record agriculture production for 2020-21 bodes well for its resilience. Urban demand has been gaining strength on the back of normalisation of economic activity and should get a fillip with the ongoing vaccination drive. The fiscal stimulus from increased allocation for capital expenditure under the Union Budget 2021-22, expanded production-linked incentives (PLI) scheme and rising capacity utilisation (from 63.3 per cent in Q2 to 66.6 per cent in Q3:2020-21) should provide strong support to investment demand and exports. Firms engaged in manufacturing, services and infrastructure polled by the Reserve Bank in March 2021 were optimistic about a pick-up in demand and expansion in business activity into 2021-22. Consumer confidence, on the other hand, has dipped with the recent surge in COVID infections in some states imparting uncertainty to the outlook. Taking these factors into consideration, the projection of real GDP growth for 2021-22 is retained at 10.5 per cent consisting of 26.2 per cent in Q1, 8.3 per cent in Q2, 5.4 per cent in Q3 and 6.2 per cent in Q4 (Chart 2).

12. The MPC notes that the supply side pressures on inflation could persist. It also notes that demand-side pull remains moderate. While cost-push pressures have risen, they could be partially offset with the normalisation of global supply chains. On imported inflation from global commodity prices, urgent concerted and coordinated policy actions by Centre and States can mitigate domestic input costs such as taxes on petrol and diesel and high retail margins. The renewed jump in COVID-19 infections in certain parts of the country and the associated localised lockdowns could dampen the demand for contact-intensive services, restrain growth impulses and prolong the return to normalcy. In such an environment, continued policy support remains necessary. Taking these developments into consideration, the MPC decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 13. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted for keeping the policy repo rate unchanged. Furthermore, all members of the MPC voted to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 14. The minutes of the MPC’s meeting will be published on April 22, 2021. 15. The next meeting of the MPC is scheduled during June 2 to 4, 2021. Voting on the Resolution to keep the policy repo rate unchanged at 4.0 per cent | Member | Vote | | Dr. Shashanka Bhide | Yes | | Dr. Ashima Goyal | Yes | | Prof. Jayanth R. Varma | Yes | | Dr. Mridul K. Saggar | Yes | | Dr. Michael Debabrata Patra | Yes | | Shri Shaktikanta Das | Yes | Statement by Dr. Shashanka Bhide 16. The Second Advance Estimates by the National Statistical Office place the GDP at constant prices lower by 8 per cent in 2020-21 over the previous year, slightly steeper decline than decline of 7.7 per cent as per the First Advance Estimates. Source of deeper contraction in GDP has been the lower net taxes on products as the GVA decline was lower at 6.5 per cent in the second advance estimates compared to 7.2 per cent in the First Advance Estimates. These estimates are subject to further revisions but the order of decline in output contraction in FY 21 has been sharp and the present estimates of GVA or GDP are lower than in 2018-19. This pattern holds for private final consumption expenditure and gross fixed investment and, exports and imports of goods and services. The pace of recovery of output needed to offset the negative impact of the Covid 19 shock to the economy in terms of growth in income and employment will be substantial and sustained over many years. 17. The rise in GDP quarter over quarter, since the initial sharp decline in Q1:FY21 provides a basis for more robust future growth. After a massive decline in GVA in Q1:FY21, manufacturing sector registered positive year on year growth in Q3 and implicitly in Q4, based on projected GVA for Q3 and full year FY21 in the Second Advance Estimates. Year on year growth in Construction and Financial and Real Estate and Professional Services sectors turned positive in Q3:FY21 after two quarters of decline. 18. An important source of growth of output during the pandemic phase of FY21, has been agriculture and allied activities sector, as the rural areas appear to have been relatively less affected by the pandemic, allowing production related operations uninterrupted. The GVA from agriculture increased by 3 per cent over the previous year, the only sector among the major sectors to register growth of over 1 per cent. 19. Although there is a positive growth in Q3:FY21, the gross fixed investment in expected to register a decline for the year as a whole over the previous year. The private final consumption expenditure is projected to be lower in Q3:FY21 compared to Q3:FY20. The exports and imports of goods and services for Q3:FY21 and FY21 as a whole are projected to be lower than in the previous year. These indicators reflect the subdued demand conditions in FY21. 20. The indicators such as improvement in capacity utilisation in manufacturing; turnover of business for the firms in the services, particularly in the IT services; and infrastructure sectors available from RBI’s enterprise surveys; bank credit and GST revenue do point to the pickup of economic activities in Q3 and ahead in the non-agricultural sectors. However, RBI’s March 2021 survey of consumer confidence, suggests that a large proportion of the respondents assess the prevailing economic conditions and income to have worsened compared to a year ago. The forward looking consumer expectations also reflect weakened sentiments compared to the previous quarter. 21. The revival of economic activities in Q3:FY21 points to the resilience in the economy but a broad based recovery covering all the production sectors and the micro, small and medium enterprises and employment to support consumption demand is needed to sustain this revival. 22. The improvement in growth performance in the final two quarters in FY21, therefore, is fragile and will require strong policy support for broadening and sustaining positive momentum. The external demand conditions also point to uncertainty although growth in some of the advanced economies is expected to improve. The measures put in place during FY21 to support growth such as the production linked incentives and the push for capital expenditure and infrastructure in the Central budget 2021-22 provide a positive push to economic activity. 23. The sustained growth will also depend on an effective control over the pandemic that would permit economic activities. As the rise of Covid infections and resulting local restrictions on the movement of people in March shows, controlling the spread of infections in essential for sustained economic recovery. Going forward, success of vaccinations, universal adoption of preventive measures to severely limit the chances of transmission of the virus and investment in health services to assure access to health care will define the course of economic recovery. As many have noted, the critical factor affecting sustained revival of the economy will be the victory in the battle over the Corona virus. 24. The headline inflation dropped below the upper tolerance limit of 6 per cent for monetary policy for three consecutive months from December 2020. The drop is mainly on account of easing of food inflation. There is hardening of consumer price inflation for fuel and light and particularly the core inflation. The international commodity prices for food, energy and metals show upward trend partly reflecting the global economic recovery. In the domestic market, the producer prices for manufactured products, reflected by WPI show significant rise in prices since December 2020. RBI’s March 2021 Inflation Expectations Survey of Households, points to expectations of higher inflation rate for three months ahead and one year ahead as compared to the expectations held in the previous survey. 25. The CPI inflation rate in the short run is projected at less than 5.3 per cent for the four quarters of FY22, although the risks to the projected trajectory from external sector, type of the south-west monsoon and the pattern of recovery of the domestic economy remain. 26. Expansion of supply of goods and services in public and private spheres will require new investments and access to funds. The monetary policy environment so far has provided support to sustaining economic activities and recovery of growth. Such policy environment is needed to strengthen and broaden the ongoing recovery process. 27. I vote in support of the resolution to keep the repo rate under the liquidity adjustment facility (LAF) unchanged at 4 per cent and also to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Statement by Dr. Ashima Goyal 28. Growth uncertainty has increased with the second wave in Covid-19 in some states. RBI surveys show consumer confidence to be lower in March 2021 compared to January, although corporate confidence was still intact. Exports have increased as some countries recover. Second waves in many countries have been sharp but short. The effect on growth could be marginal if complete lockdowns and bans on interstate movement are avoided. The nature of the virus and its ability to mutate imply too much unlocking can create a surge. Large gatherings are especially dangerous. 29. Tightening should be gradual, however, not reversing for long beyond the unlock 4 in September 2020 that forbade restrictions on interstate movements and led to a sustained revival of economic activity. Compared to past pandemics we have the advantage of fast creation of vaccines, but it will take some months for vaccination to reach a critical mass. In the interim, people have learnt to live and keep working with the virus, with technology creating some substitutes for high contact activities. The surge is a warning, however, to raise the level of care and precaution. The medical infrastructure can come under severe strain. 30. Even the above ten per cent growth most analysts still expect for 2021-22, however, will barely take us to the level we had reached in 2019. We have to also make up for lost time; alleviate widespread job loss and income stress. Expected growth is high because of the base effect and does not imply sustained growth at potential. Only when we reach the latter will true recovery have taken place. 31. While banks do not see turnaround in investment as yet there is a rise in alternative financing for manufacturing and a response to government incentives. A new investment cycle, however, will not be like the infrastructure boom of the 2000s, but will build up slowly. In the rest of the world credit leads investment, in India it follows and credit ratios are very low by world standards. With easier financing conditions and a healthier financial sector, there is a chance of a credit-led cycle this time. To the extent investment rises, potential growth will also rise with it. 32. While headline inflation is expected to remain well within the MPC’s tolerance band over this year, core inflation has been rising. Perishables supply chains resolved faster under the pressure of fresh supplies. Something similar will happen with manufactured goods, although it will take more time, since global factors are involved. Oil prices have already come off the boil and there are several factors that are working towards reducing them. Imported commodities have a large weight in WPI. Rising WPI is a temporary Covid-19 related digression, although the new surge may cause some delay in reversion to normal. Historically, wholesale inflation has ruled much lower than consumer price inflation. The base effect, however, will also raise WPI inflation over the next few months. 33. Despite all the emphasis on cost pressures, many firms have undertaken cost cutting measures. RBI’s analysis of the corporate sector in Q3 2020-21 shows a sharp rise in profit before tax. Rise in raw material and staff cost was not material, and margins were steady—there is space to absorb a temporary rise in costs and firms will do it as restoration of supply chains increases competition. 34. Urban retail margins rose somewhat in March 2021. But households do not expect this rise to last. The survey of household inflation expectations showed a rise in current and 3 month inflation expectations but 1 year ahead expectation remained almost the same. The monsoon is expected to be normal. 35. Transmission of low rates set by the MPC remained robust in the banking system. While real short rates are negative, real longer-term rates are positive. Transmission faltered in markets over the last 2 months. Taylor rules, estimated assuming negative output gap and headline inflation at 5 per cent above the 4 per cent target, suggest short rates should range from 3.2 to 3.65 per cent. But some short rates had risen above this. This is incompatible with low overnight rates, an accommodative stance and durable liquidity in clear surplus. 36. The spread of the 10-year G-Secs over short rates was 60 basis points over 2011-17 before rising sharply in 2018. The current spread of over 200 basis points, despite large OMO support, points to markets being caught in an irrational trap. They did not respond to positives such as government borrowing less than announced as well as better tax revenues. Bond markets are subject to disruption where they expect rates to rise and do not buy, so that rates rise, debt becomes unsustainable and fears are self-fulfilling. This is one reason why many central banks around the world have announced explicit support for a temporary Covid-19 related rise in borrowing requirements. Indian markets also need firm and clear guidance. Once market fears recede interventions required would reduce. 37. India’s cautious approach to capital account convertibility means that volatile fixed income flows are still capped at 6 per cent of outstanding stocks of G-Secs. Large foreign exchange (FX) reserves, acquired during surges in inflows, are sufficient to counter outflows due to rising US G-Sec rates, without having to raise domestic rates. Sale of FX stocks will release space on the RBI’s balance sheet to buy more Indian government securities consistent with its target for creation of durable liquidity. RBI has the space to smooth volatility. 38. In view of expected growth and inflation trends in the context of continued Covid-19 related stresses, I vote for keeping the policy repo rate unchanged and the stance accommodative. Greater uncertainties require more flexibility for the MPC. Therefore, I also support a move from time-based to data-based guidance with the understanding that in view of the unprecedented situation, supporting a full recovery is paramount. Statement by Prof. Jayanth R. Varma 39. The economic recovery after the pandemic shock of 2020 remains uneven and incomplete, and the renewed jump in COVID-19 infections in certain parts of the country has increased the downside risk to the growth momentum. On the other hand, inflation rates have been consistently well above the mid point of the target zone and is forecast to remain elevated for some time. This is a difficult situation, but I believe that the balance of risk and reward is in favour of monetary accommodation. Therefore, I support maintaining the policy rate at its current level, and I also support the accommodative stance. 40. The question that remains is about the time based forward guidance (first provided in October 2020) that is expiring now as we have already entered the new financial year. From my perspective, the principal motivation for the forward guidance was to reduce long term yields in the backdrop of an excessively steep yield curve. Unfortunately, forward guidance has failed to flatten the yield curve, and I see little merit in persisting with it any more. As the popular quote (often misattributed to Albert Einstein) says: insanity is doing the same thing over and over again and expecting different results. A flattening of the yield curve remains an important goal but, I think it must be pursued using other instruments which largely lie outside the remit of the MPC. 41. There is another reason why time based forward guidance is no longer appropriate. Experience of the last several months indicates that in the aftermath of the pandemic, forecasting has become more difficult. It is apparent that some economic and statistical relationships have tended to break down in the current exceptional environment. Consequently, model risk has now become an important issue as evidenced both in large realized forecast errors and in the dispersion of forecasts from different models. Model risk presents a far less tractable problem than the well defined statistical prediction error of any single model. In this situation, I think it is not prudent to repose excessive faith in forecasts. Instead, the MPC must have the agility and flexibility to respond rapidly and adequately to whatever surprises new data may bring in future. Time based guidance is inconsistent with this imperative. 42. Both these considerations weigh in favour of state contingent guidance that reaffirms the MPC’s commitment to continue to mitigate the impact of COVID-19 on the economy so as to sustain growth on a durable basis while ensuring that inflation remains within the target going forward. Statement by Dr. Mridul K. Saggar 43. The Central Government, in consultation with the Bank, retained the inflation target and the tolerance bands for the next five years. At the outset, I wish to acknowledge this, both from the viewpoint of the sage counsel exercised and the accountability it imposes on the MPC going forward. Over the first five-year period of practicing inflation targeting, the headline inflation averaged 4.3 per cent compared with the situation when the CPI inflation was averaging around double digits for six years before this framework was conceived.1 The retention of the target will go a long way in preserving the macro-economic stability and the credibility of the framework. However, the success of this framework has not been unfettered. The volatility of inflation has remained high as manifested in higher coefficient of variation. However, this is largely reflection of supply disruptions during the pandemic period at a time where the growth collapse warranted monetary policy to prop up demand. Better supply management and greater recognition that growth-inflation trade-offs dissipate in long-run can help lower inflation volatility ahead. 44. Let me now turn to business at hand. The five significant differences since we last met in early February are: (i) the sudden resurgence of the Covid-19 infections; (ii) emergence of incipient signs that the recovery is beginning to lose some steam; (iii) return of inflation after a short-lived decline to the target; (iv) asset prices facing resistance after a runaway rally from the pandemic lows a year ago; (v) some indications of the path of fiscal consolidation going forward that still needs further clarity. The current account has also slipped back into a small deficit, but I will not judge this as material to our decision in this policy. Let me briefly discuss all of these. 45. After a remarkable decline in Covid-19 incidence during mid-September 2020 to mid-February 2021, daily new confirmed cases have spiked back to about 100 thousand. More than half of these new cases have come from Maharashtra that accounts for about 9.0 per cent of the country’s population and 14.6 per cent of its output. The economic recovery can come under risk if this new wave of infections is not flattened soon. This is especially so as monetary and fiscal policies have already used most of their space to considerably limit loss of economic capital, though expansion of policy toolkits can still afford additional comfort. While the countrywide dispensation is still quite supportive of production activity, this can change if the virus spread, hitherto contained to few States, might transmit across country. Learning effects on calibrating stringency of restrictions may keep economic costs of the second wave much lower than the first but still retard full normalisation by a quarter or two. Ramping up vaccination, testing and treatment holds the key to protecting economic recovery and health policies have become the first line of defence. Monetary and fiscal policies can only play a second fiddle. 46. Going forward, the GDP growth in Q4: 2020-21 is likely to surpass its implied growth in the full year’s NSO’s Second Advance Estimates. The economy is then set for a growth rebound in 2021-22 with a baseline projection of 10.5 per cent; but this high growth will essentially be on account of an all-time low base. The realisation of the projected growth will translate to only a meagre average growth rate of 0.85 per cent in two years following 2019-20. This provides justification for the monetary policy’s continued support to growth. Both consumption and investment need to be stimulated. Capacity utilisation rate at 66.6 per cent in the latest RBI survey is well below the long-term average of 73.6 per cent and though there is evidence of some small ticket investments reflected in pick up in short cycle capital goods, an upturn in capex cycle will require larger public investments that can crowd in private investments. Consumption needs support from removing credit frictions and more redistributive policies. 47. Recovery is beginning to lose some steam. The IIP returned to the contraction zone in January and will remain so in February. The output of the eight core industries, in February, registered its most negative growth since September 2020 and the largest month-on-month contraction since April 2020. However, this fall has been exacerbated by the month’s peculiarity. But for the extra day in leap year 2020, the contraction would have been smaller with growth at (-)1.2 per cent instead of (-)4.6 per cent. Extrapolating February output for 31-days as in January, the month-on-month growth would have been (+)2.0 per cent instead of (-)7.8 per cent. The sequential improvement in high frequency indicators of real activity witnessed some loss of momentum in January with bulk of normalisation getting completed. In February, almost half of the indicators did not improve. This again may have lot to do with the peculiarity of the February month, but the second wave can entrench this trend. 48. Inflation rose back to 5.0 per cent in February after receding close to target at 4.1 per cent in January 2021. The momentum was somewhat above average, especially driven by core and fuel. Furthermore, the momentum in WPI was markedly above average. In each of the last four months, WPI prices have increased for larger number of commodities than ever in any of the months since October 2013. Therefore, momentum pressures for CPI may exacerbate in near term if producers hitherto absorbing a large part of cost push pressures decide to passthrough the price pressures to retail level. So far, this is not much seen in the CPI with lower-than-average CPI items witnessing price increases over last three months. Global commodity prices, both energy and non-energy, have surged since June 2020. The increases have been marked in case of crude oil, metals and food. The FAO food price index is higher by 27.5 per cent, while that for edible oils by 89.4 per cent. Imported commodities have a weight of about 22 per cent in CPI. Some price pressures may arise as a rise in global non-food commodity prices by 10 per cent is expected to increase CPI core goods inflation up to 50 bps. However, the passthrough to headline inflation is low. Therefore, despite the emerging risks and price pressures it should be possible to keep inflation within the band. 49. Asset prices are seemingly facing resistance after a runaway rally from the pandemic lows a year ago. Mundell has just left us, but his legacy will continue to haunt monetary policy as it manages the impossible trinity through surges and stops of capital flows. During February and March, EM equities have weakened slightly as global bonds faced a sell-off with US 10-year yield hardening 67 basis points. Benchmark yields in most emerging markets rose more sharply over the same period but in India the rise was contained to 26 bps. Indian rupee till now has remained stable and bucked the global trend of depreciating EM currencies. There is risk in too much focus on asset prices in the conduct of monetary policy. Credit channel that works in tandem with interest rate channel is far more important than the asset price channel for effective monetary transmission. Countries have certainly relied on negative nominal or real rates in an attempt to avert deep recessions. In part they have helped limit job losses and scarring. However, these benefits have to be weighed against the low interest rates fuelling K-shaped recoveries with increased inequalities and inflicting financial repression for savers. Also, there are added macroeconomic risks for countries where inflation is not as dampened as in Advanced Economies that are resorting to unconventional policies. 50. It is equally important to understand that while increasing fiscal space to the extent possible is desirable, any revision in fiscal targets should be consistent with medium-term debt sustainability and should not impinge on conduct of monetary policy, such as requiring direct monetisation that has been eschewed even by countries with low inflation. Lastly, the current account deficit in small size as expected is least of a worry, but going forward, with wide fiscal gaps, large twin deficits must be avoided over the medium term. 51. While we had moved towards calibrated exit from extra-ordinary supportive measures to mitigate the impact of Covid-19 as the curve was flattening, we have already made considerable adjustments in exit dates for these measures. The extant priority is now to continue supporting growth from the possible shock from the second wave. I, therefore, vote for retaining the policy rate at present level and continue with the accommodative stance as spelled out in resolution. I borrow what Marie Curie said, “Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less.” It is in this spirit that we act appropriately as per judgment based on scientific facts. Statement by Dr. Michael Debabrata Patra 52. I vote to keep the policy rate unchanged and to maintain an accommodative stance as articulated in the MPC’s resolution. 53. Risks to the recovery have become accentuated since the MPC’s February meeting – new waves of infections and the inexorably slow pace of vaccinations; moderation in several high frequency sentiment indicators; global risks and spillovers. Monetary policy has to remain supportive of the economy until the recovery is more sure footed and its sustainability assured. Meanwhile, inflation middled the tolerance band in December and January and aligned with the target; although it has risen in February, it is expected to remain within the corridor over a 12-month horizon. Longer term inflation expectations remain broadly stable in spite of high volatility in food and fuel prices. Demand pull is still weak. The inflation print of February reflects pandemic effects in the form of input cost pressures – though still muted in translating into selling prices – retail margins and increased costs of doing business as supply chains are still mending. Accordingly, I would continue to look through the recent elevation in inflation and remain focused on reviving the economy on a path of strong and sustainable growth. An integral part of this approach would be to insulate domestic financial markets from global spillovers and volatility so that congenial financial conditions continue to support growth. Statement by Shri Shaktikanta Das 54. Economic activity and inflation developments over the past two months have been largely along the anticipated lines. The curve of active cases of COVID-19, which was on a downward trend till mid-February, has changed its course with a surge in several parts of the country. Experience of other countries suggest that this new surge can be more infectious due to several mutations of the virus. Rapidly rising cases of COVID-19 is the single biggest challenge to ongoing recovery in the Indian economy. Learnings of last one year should, however, help us in managing the crisis as it unfolds. 55. Global growth is gradually recovering, even though it remains uneven across countries, reflecting the substantial differences in the infections trajectory, the speed of vaccination drives, and the size of fiscal stimulus. International organisations are gradually scaling up their global growth outlook for 2021. The improving global outlook would support India’s exports and investment demand. At the same time, global financial markets have turned volatile over inflation fears in advanced economies and rising commodity prices, posing risks to the domestic outlook. 56. In the domestic economy, there are clear signs of revival of growth. The agricultural sector has been resilient throughout the pandemic period. Manufacturing and services activities continue to normalise as reflected in key high frequency indicators such as mobility data; issuance of e-way bills; GST revenue; wholesale dispatches of automobile; registrations of passenger vehicles and construction equipment vehicles; rail and water cargo; highway toll collections; and electricity generation. These indicators represent a wide range of sectors that are maintaining their pace, which we had noticed in the previous round of MPC deliberations as well. While there was a slight dip in industrial production during January, PMI manufacturing remained resilient. Manufacturing companies assessed further strengthening of production, order books and employment during Q4:2020-21 according to a survey conducted by the RBI. Forward looking surveys suggest further improvement in production and overall business situation during 2021-22. Capacity utilisation of the manufacturing sector recovered further. 57. A revival in real estate and residential construction activity also seems to be underway as reflected in stamp and registration duty collections in select states in February 2021, backed by lower cost of financing, stable prices and support from the Government. This, coupled with higher financial savings, show that the aggregate balance sheet of the household sector – the resource surplus sector of the economy – could provide support to demand recovery. Signs of incipient revival in domestic demand were discernible in the current account balance which swung into deficit in Q3:2020-21 after reporting surplus for three consecutive quarters. India’s exports and imports have attained their pre-pandemic levels in Q4:2020-21. Foreign direct investment flows have been running higher than the previous year. While strong domestic fundamentals and healthy level of foreign exchange reserves shall bode well for the external sector, the speed of domestic vaccination drive will be key in containing short-term risks to domestic economic recovery and mitigating spillovers from global shocks. 58. All these indicators suggest that the real GDP is evolving on the lines of the February MPC resolution. Improving demand conditions, investment enhancing measures by the Government and improving external demand impart an upside to growth prospects. The recent jump in COVID-19 infections and its impact on economic activity, however, needs to be watched carefully. 59. Headline inflation registered significant softening in January 2021 to move close to the target rate from levels that were substantially above the upper tolerance threshold. A sharp correction in food inflation helped to bring about this rapid disinflation. In February, however, headline inflation increased to 5.0 per cent from 4.1 per cent in January, primarily due to volatility imparted by adverse base effects. On the other hand, core inflation remained elevated. Going ahead, sustenance of key factors like the bumper foodgrains production in 2020-21; mitigation of price pressures through timely supply-side measures on key food items such as pulses and edible oils; and coordinated reduction in taxes on petroleum products by centre and states can help assuage cost pressures on inflation. On the other hand, a combination of high international commodity prices and logistics costs may push up input price pressures across manufacturing and services. The projection of inflation rate at 5 per cent for the full year 2021-22, with 5.2 per cent for the first half and 4.8 per cent for the second half, takes into account both the upside and the downside pressures. 60. The April 2021 MPC meeting was the first after the Government notification of March 31, 2021 retaining the inflation target at 4 per cent with the lower and the upper tolerance levels of 2 per cent and 6 per cent, respectively, for the next five years (April 2021-March 2026). The successful implementation of the flexible inflation targeting (FIT) framework since 2016 has resulted in better anchoring of inflation expectations, especially those of financial market participants, around the 4 per cent target rate. It has also improved transparency of monetary policy process. The resultant increase in monetary policy credibility has helped the MPC to respond effectively to the growth-inflation trade-offs posed by an exceptional shock like the COVID-19. 61. In the recent period, the RBI’s policy strategy has been a combination of liquidity operations, support to targeted sectors, credible communication and explicit forward guidance. In sync with the MPC’s accommodative stance guidance, the RBI maintained ample surplus liquidity through conventional as well as unconventional measures which have helped to ease domestic financial conditions; reduce borrowing costs; improve transmission; and facilitate the successful completion of central and state government borrowing programmes in 2020-21. It has also led to significant amount of private borrowing through corporate bonds, commercial paper and debentures. As part of the liquidity management strategy for 2021-22, the Reserve Bank’s objective would be to ensure orderly evolution of the yield curve and to avoid volatility in G-sec market. This would help create pre-conditions in financial markets that support a durable economic recovery. The secondary market G-sec acquisition programme or G-SAP 1.0, where the RBI has committed upfront a specific amount of open market purchases of government securities is a step in this direction to ensure congenial financial conditions for the recovery to gain traction. Going forward, the RBI would continue to ensure ample surplus systemic liquidity and the system would remain in surplus even after meeting the requirements of all financial market segments and the productive sectors of the economy. 62. The MPC’s forward guidance over the past year has been helpful in anchoring market expectations; navigating the recovery from the crisis; and strengthening the pace of monetary transmission. The forward guidance provided by the MPC – to remain in accommodative stance as long as necessary to sustain growth on a durable basis – lays out the future course of monetary policy. Given the uncertainties and the fact that we are in the beginning of a new financial year, it is too early to give explicit time-based forward guidance. The forward guidance in terms of securing a sustainable growth on a durable basis itself testifies to our commitment to continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target, going forward. 63. The need of the hour is to effectively secure the economic recovery underway so that it becomes broad-based and durable. The renewed jump in COVID-19 infections in several parts of the country and the associated localised and regional lockdowns add uncertainty to the growth outlook. In such an environment, monetary policy should remain accommodative to support, nurture and consolidate the recovery. We need to continue to sustain the impulses of growth in the new financial year 2021-22. I vote to keep the policy rate unchanged and to continue with the accommodative stance as long as necessary to sustain growth on a durable basis, while ensuring that inflation remains within the target going forward. The RBI would take all steps, as needed, to ensure orderly conditions in the financial markets and to preserve financial stability. (Yogesh Dayal)

Chief General Manager Press Release: 2021-2022/91

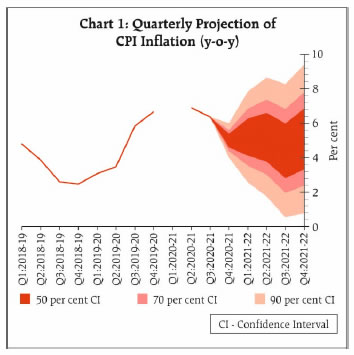

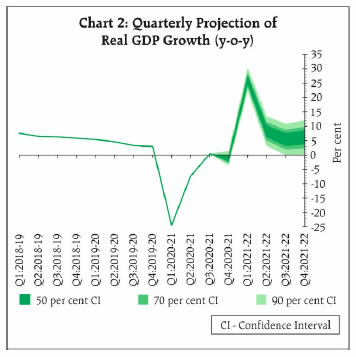

|