[Under Section 45ZL of the Reserve Bank of India Act, 1934] The forty second meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during April 3, 5 and 6, 2023. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: -

the resolution adopted at the meeting of the Monetary Policy Committee; -

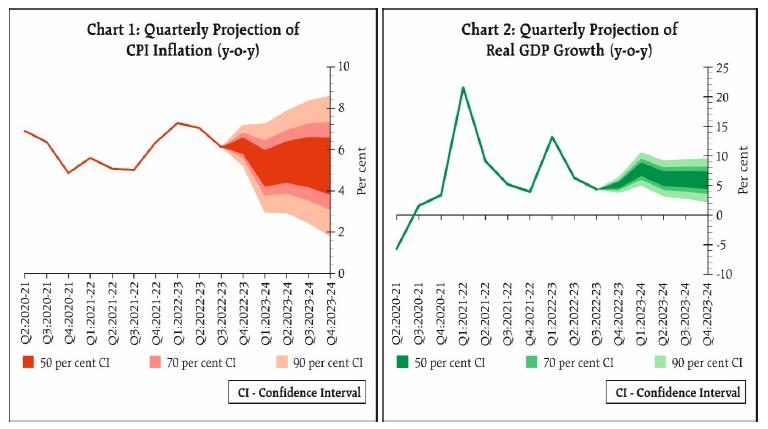

the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and -

the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (April 6, 2023) decided to: - Keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50 per cent.

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. - The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. Global economic activity remains resilient amidst the persistence of inflation at elevated levels, turmoil in the banking system in some advanced economies (AEs), tight financial conditions and lingering geopolitical hostilities. Recent financial stability concerns have triggered risk aversion, flights to safety and heightened financial market volatility. Sovereign bond yields fell steeply in March on safe haven demand, reversing the sharp increase in February over aggressive monetary stances and communication. Equity markets have declined since the last MPC meeting and the US dollar has pared its gains. Weakening external demand, spillovers from the banking crisis in some AEs, volatile capital flows and debt distress in certain vulnerable economies weigh on growth prospects. Domestic Economy 7. The second advance estimates (SAE) released by the National Statistical Office (NSO) on February 28, 2023 placed India’s real gross domestic product (GDP) growth at 7.0 per cent in 2022-23. Private consumption and public investment were the major drivers of growth. 8. Economic activity remained resilient in Q4. Rabi foodgrains production is expected to increase by 6.2 per cent in 2022-23. The index of industrial production (IIP) expanded by 5.2 per cent in January while the output of eight core industries rose even faster by 8.9 per cent in January and 6.0 per cent in February, indicative of the strength of industrial activity. In the services sector, domestic air passenger traffic, port freight traffic, e-way bills and toll collections posted healthy growth in Q4, while railway freight traffic registered a modest growth. Purchasing managers’ indices (PMIs) pointed towards sustained expansion in both manufacturing and services in March. 9. Amongst urban demand indicators, passenger vehicle sales recorded strong growth in February while consumer durables contracted in January. Among rural demand indicators, tractor and two-wheeler sales were robust in February. As regards investment activity, growth in steel consumption and cement output accelerated in February. Merchandise exports and non-oil non-gold imports contracted in February while the strong growth in services exports continued. 10. CPI headline inflation rose from 5.7 per cent in December 2022 to 6.4 per cent in February 2023 on the back of higher inflation in cereals, milk and fruits and slower deflation in vegetables prices. Fuel inflation remained elevated, though some softening was witnessed in February due to a fall in kerosene (PDS) prices and favourable base effects. Core inflation (i.e., CPI excluding food and fuel) remained elevated and was above 6 per cent in January-February. The moderation observed in inflation in clothing and footwear, and transportation and communication was largely offset by a pick-up in inflation in personal care and effects and housing. 11. The average daily absorption under the LAF moderated to ₹1.4 lakh crore during February-March from an average of ₹1.6 lakh crore in December-January. During 2022-23, money supply (M3) expanded by 9.0 per cent and non-food bank credit rose by 15.4 per cent. India’s foreign exchange reserves were placed at US$ 578.4 billion as on March 31, 2023. Outlook 12. The inflation trajectory for 2023-24 would be shaped by both domestic and global factors. The expectation of a record rabi foodgrains production bodes well for the food prices outlook. The impact of recent unseasonal rains and hailstorms, however, needs to be watched. Milk prices could remain firm due to high input costs and seasonal factors. Crude oil prices outlook is subject to high uncertainty. Global financial market volatility has surged, with potential upsides for imported inflation risks. Easing cost conditions are leading to some moderation in the pace of output price increases in manufacturing and services, as indicated by the Reserve Bank’s enterprise surveys. The lagged pass-through of input costs could, however, keep core inflation elevated. Taking into account these factors and assuming an annual average crude oil price (Indian basket) of US$ 85 per barrel and a normal monsoon, CPI inflation is projected at 5.2 per cent for 2023-24, with Q1 at 5.1 per cent, Q2 at 5.4 per cent, Q3 at 5.4 per cent and Q4 at 5.2 per cent, and risks evenly balanced (Chart 1). 13. A good rabi crop should strengthen rural demand, while the sustained buoyancy in contact-intensive services should support urban demand. The government’s thrust on capital expenditure, above trend capacity utilisation in manufacturing, double digit credit growth and the moderation in commodity prices are expected to bolster manufacturing and investment activity. According to the RBI’s surveys, businesses and consumers are optimistic about the future outlook. The external demand drag could accentuate, given slowing global trade and output. Protracted geopolitical tensions, tight global financial conditions and global financial market volatility pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent with Q1:2023-24 at 7.8 per cent; Q2 at 6.2 per cent; Q3 at 6.1 per cent; and Q4 at 5.9 per cent, with risks evenly balanced (Chart 2).  14. With CPI headline inflation ruling persistently above the tolerance band, the MPC decided to remain resolutely focused on aligning inflation with the target. It is essential to rein in the generalisation of price pressures and anchor inflation expectations. An environment of low and stable prices is necessary for the resilience in domestic economic activity to be sustained. While the policy rate has been increased by a cumulative 250 basis points since May 2022, which is still working through the system, there can be no room for letting down the guard on price stability. Taking these factors into account, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting, with readiness to act, should the situation so warrant. The MPC will continue to keep a strong vigil on the evolving inflation and growth outlook and will not hesitate to take further action as may be required in its future meetings. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. 15. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent. 16. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 17. The minutes of the MPC’s meeting will be published on April 20, 2023. 18. The next meeting of the MPC is scheduled during June 6-8, 2023. Voting on the Resolution to keep the policy repo rate at 6.50 per cent | Member | Vote | | Dr. Shashanka Bhide | Yes | | Dr. Ashima Goyal | Yes | | Prof. Jayanth R. Varma | Yes | | Dr. Rajiv Ranjan | Yes | | Dr. Michael Debabrata Patra | Yes | | Shri Shaktikanta Das | Yes | Statement by Dr. Shashanka Bhide 19. The Second Advance Estimates (SAE) of the National Income for FY 2022-23 released by the National Statistical Office have retained the overall YOY growth of GDP at constant prices at 7 per cent as provided in the First Advance Estimates (FAE) published on January 6, 2023. However, the Provisional Estimates have been replaced by the First Revised Estimates (FRE) for 2021-22 as the base and the estimated GDP for 2022-23 is now actually higher by 1.3 per cent in the SAE than in FAE. Private Final Consumption expenditure, Gross Fixed Investment expenditure and exports of goods and services growth rates in FY 2022-23 have exceeded the growth rate of overall GDP. Slower growth of Government Final Consumption expenditure and higher imports have offset the higher pace of growth of other demand components. 20. While the overall GDP growth reflects the resilience of the economy, a large part of this strength is contributed by the sharp increase in the first quarter of the year, a reflection of the rebound from the sharp COVID-19 impact of Q1 FY 2020-21. The YOY growth rate of GDP in Q1: 2022-23 is now placed at 13.2 per cent and the growth in the subsequent two quarters at 6.3 and 4.4 per cent. At the sectoral level, the growth drivers are the contact intensive Trade, Hotels, Transport, Communication and Services related to Broadcasting; Electricity, Water Supply and Other utilities; and Construction, which have registered higher YOY growth rates of Gross Value Added compared to the overall GVA growth rate of 6.6 per cent for FY 2022-23. Growth rate of the GVA of Manufacturing in FY 2022-23 is less than 1 per cent. The growth performance, therefore, points to both uneven growth across production sectors and subdued growth in the more recent quarters of FY 2022-23. 21. The weak global economic environment is marked by decelerating demand and uncertainty in the financial markets and energy markets. Some of the weakening demand conditions are due to the monetary policy tightening in the major advanced economies and the slower pace of growth in China. The financial market uncertainty is both due to the slowing global growth, monetary policy actions to bring down high inflation rates and the continued year-long Ukraine war impacting a range of markets including energy. These conditions are expected to prevail at least until the inflation rates moderate significantly. Both IMF and the World Bank have projected World Output YOY growth rates of less than 3 per cent in 2023 and marginally above 3 per cent in 2024. The drag on India’s exports - particularly goods exports - due to these adverse global demand conditions is, therefore, expected to prevail in FY 2023-24. 22. Several factors are in play in determining the domestic output growth conditions in the short-term. The dynamics of high frequency indicators points to continuation of the present growth momentum. For example, the PMI for manufacturing and Services in March have continued to reflect an expansionary phase, although both are below their recent peaks. The GST collections and Railway freight traffic indicator show moderation in YOY growth in Q3: FY 2022-23 and the recent months of January-February 2023. Non-food credit growth, however, continued expansion at double digit rates. The sales growth data for the corporate sector, indicates price rise is an important driver of revenue growth in Q3: FY 2022-23. 23. The business outlook sentiments show a mixed picture. RBI’s survey of enterprises conducted during January-March 2023 points to a moderation of its Business Expectations index for the manufacturing sector firms in Q1: FY 2023-24, although the Business Assessment Index for the prevailing conditions moved up in Q4: FY 2022-23. Both the indices indicate an expansion of economic activities. Expectations of the overall business situation indicate rising optimism through Q1: FY 2023-24 to Q3: 2023-24 in the case of enterprises in the services and infrastructure sectors. Improvement in profit margins is expected by markedly smaller proportion of manufacturing enterprises in Q1: FY 2023-24 compared to Q4: FY 2022-23 than the enterprises in services and infrastructure. Increase in selling prices appears to be necessary to drive improvement in profit margin. The survey of Consumer Confidence for March 2023 points to expectations of improved conditions for employment over the expectations held in the previous round of the survey, with a marginal decline in sentiments on general economic conditions and household income. In all the three indicators of perceptions of the economy, one-year ahead situation is seen to be substantially superior to the present. 24. The estimates of GDP growth (YOY), for FY: 2023-24 provided by a number of agencies in the period from January 2023 onwards, have been around 6 per cent. The RBI’s Survey of Professional Forecasters conducted in March 2023 provides a median forecast of 6.0 per cent for 2023-24. Taking into account the growth trends and factors influencing growth along with an assumption of a normal monsoon for 2023 the GDP growth for FY 2023-24 is projected at 6.5 per cent with quarterly break up of Q1 at 7.8 per cent, Q2 at 6.2 per cent, Q3 at 6.1 per cent and Q4 at 5.9 per cent. The key concern on the growth front in the immediate future is the drag caused by the weak external demand conditions. The impact of any adverse weather conditions on Indian agriculture provides additional downside risk to the growth trajectory. 25. The headline Consumer price index rose by 6.5 and 6.4 per cent in January and February 2023, respectively, breaching the upper limit of the tolerance band of the policy target of 4% inflation, after two months of below 6 per cent inflation rate in November and December 2022. The key drivers of this high level of overall inflation rate in the recent two months were food items, particularly, cereals, milk and products, spices and ‘prepared meals, snacks and sweets’. However, the inflation rate of the category comprising of items excluding food and fuel, and light has also remained at or above 6 per cent in the first two months of the present calendar year. Among the components of the core inflation which exclude food and fuel items, price rise was well above 6 per cent in the case of Clothing & Footwear, Household Goods & Services, Health and Personal care & effects. Fuel & light has also been at close to double digit inflation rate in the first 11 months of FY 2022-23. A positive feature of the overall inflation trend is a decline in the month-to-month momentum, decelerating in February 2023. This development needs to be watched as the seasonal patterns may begin to reverse this pattern. 26. The combined impact of decelerating international commodity prices, significant monetary policy rate increases since May 2022 leading to higher bank deposit and lending rates is yet to translate into inflation rates below the upper tolerance band of the target in a sustained manner. There are significant downside risks to output growth momentum and gains from price led revenues for the firms may be limited. While policy rate increases were effected over a period of May 2022 to February 2023, the cumulative impact of these policy actions is yet to be realised. The recent Inflation Expectations Survey of Households by the RBI, points to expectations of reduction in inflation rate 3-months ahead and one-year ahead. The survey of firms by the Indian Institute of Management Ahmedabad points to reduction in the one-year ahead expected business inflation based on a cost-based Business Inflation Index in February 2023 compared to January 2023. The survey also finds a marginal increase in the one-year ahead expectations of CPI inflation in February 2023 as compared to the expectations in December 2022, with expectations of YOY inflation rates in both the rounds below 5 per cent1. 27. The forecast for FY 2023-24 points to a reduction in inflation rate below the upper tolerance band of 6 per cent with Q1 at 5.1 per cent, Q2 and Q3 at 5.4 per cent, Q4 at 5.2 per cent and an annual average rate of 5.2 per cent. The decline in projected inflation rates is also supported by the base effect of high inflation rate in FY 2022-23. 28. While these projections point to a path towards achieving the inflation target in the medium term, there are clearly upside risks associated with these projections. The weather uncertainty affecting key agricultural prices globally and in the domestic markets, higher fuel and energy prices due to the supply disruptions resulting from geo-political conflicts and policies may lead to spikes in inflation rate and reversal of these shocks also may not be quick. In this context, it is important to assess the extent of the impact of monetary policy actions on inflation rate, besides the other developments. 29. Taking into account the projected patterns of growth and inflation for FY 2023-24, the risks attached to these projections and a need to watch the cumulative impact of the monetary policy actions so far, I believe that a pause in the policy rates is appropriate in this meeting, without any commitments on the subsequent actions except that aligning the inflation rate with the target will remain a policy priority. 30. Accordingly I vote: (a) to keep the policy repo rate unchanged at 6.50 per cent, and (b) to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Statement by Dr. Ashima Goyal 31. The global slowdown is turning out to be less severe than expected but there are signs of a slowing in both growth and inflation suggesting central banks (CBs) tightening is adequate and lagged effects will bring about the required further fall in inflation. But as financial stress materialized in some advanced economies (AEs), as was to be expected with sharp tightening following sustained excess liquidity, the major CBs had to continue to tighten to demonstrate absence of financial dominance. Fortunately, India had financial deleveraging prior to the pandemic, much stronger and more broad-based regulation and supervision, as well as ongoing focus on corporate governance, so its financial sector has actually outperformed under pluri-shocks2. Continued regulatory vigilance is essential, but it is not necessary to demonstrate independence from financial dominance here. Instead, India’s better policies and buffers make it possible to demonstrate independence from AE CBs and their weaknesses. Inflation here is also different. It is relatively close to target—excess demand due to over-stimulus or second round effects due to a tight labour market are not driving it. 32. Although growth is resilient, there are signs of slowdown in some high frequency data. Softening non-oil non-gold imports point to weakness in domestic demand; slowing exports are affecting manufacturing; rising loan rates are reducing demand for low income housing. 33. A 2012 RBI working paper3 found monetary policy impacts output with a lag of 2-3 quarters and inflation with a lag of 3-4 quarters with the impact persisting for 8-10 quarters. The interest rate channel accounted for about half of the total impact of monetary shocks on output growth and about one-third of the total impact on inflation. Its effect on output was 2-3 times greater than that on inflation. Exchange rate changes had an insignificant impact on output growth, but a non-negligible impact on inflation. Many time series estimations before and since then had a similar pattern of results. A recent IGIDR M.Phil. on monetary transmission, using current data, also analysed GDP components and found monetary policy had the largest impact on investment through falling equity prices4. 34. By October 2022 the repo rate had risen to a material level (5.9%) with liquidity also tightening and spreads rising for many short-term market instruments. And we see some growth softening two quarters later. The lagged effects of the rate rise are just beginning, and may continue to play out over the next few months. Those on inflation will follow. 35. But the estimations above do not include the expectations channel of monetary policy transmission. To the extent policy rates rise with inflation and clear communication on the inflation target anchors inflation expectations, and there is evidence for this5, the interest rate channel does not have to carry the entire burden of adjustment. Inflation will fall faster and the growth sacrifice required to reach the inflation target is lower. This is more so if supply-side action is also reducing inflation. Such policy is part of the BCCR approach—balanced, countercyclical policy with good coordination across fiscal and monetary policy and continuing reform, which has helped make India a bright spot in a gloomy global macroeconomic scene. 36. Inflation is expected to come down over the year. There is the base effect but momentum is also slowing in some consumer goods. The RBI’s enterprise surveys shows firms expect inputs costs and selling prices to moderate. The exchange rate is stable or strengthening. The weightage issue that raised cereal prices sharply in the past 2 months is expected to have a reverse effect as market prices fall. 37. Since the inflation forecast for FY24 is 5.2% with Q4 at 5.2%, a repo rate at 6.5% implies the real policy rate is greater than one. It has already tightened enough to progressively bring inflation towards the target of 4%, with other complementary policies and barring major new shocks. A further rise in real interest rates is best avoided at present since high real rates can trigger a non-linear switch to a low growth path6. 38. There is no logic for overshooting policy rates and then cutting in a country such as India where the largest impact of the interest rate is on growth, the relation between expected rupee depreciation and interest rates is weak, many tools are available to reduce excess volatility of the exchange rate and have been successfully used, the current account deficit has reduced and its financing is no longer an issue. Moreover, the exchange rate is not directly included in the mandate of the MPC. 39. In view of these arguments, I vote for a pause. But because of erratic weather and continuing global uncertainties, and until it is clear that inflation is well on the path to reaching the target, it is necessary to emphasize that this may not be the end of the rate hikes. So I also vote for withdrawal of accommodation as the stance. But this stance is now with respect to the repo rate, so it is consistent with the injection of durable liquidity if shocks are so large that LAF instruments prove inadequate. Major CBs have allowed their balance sheets to expand as required for other reasons, while at the same time raising repo rates for monetary policy purposes. Statement by Prof. Jayanth R. Varma 40. Two inflationary risks have come to the fore since the February meeting. The first risk emanates from the announcement of an output cut by OPEC+ during the weekend just before the MPC meeting. Crude oil promptly reversed the entire price decline of the preceding weeks and settled slightly above the levels prevailing at the February meeting. The output cut by itself is not worrying as it could simply represent an attempt by OPEC+ to match supply to sluggish demand in a slowing global economy. It would become a matter of concern only if it signals a structural change in the geopolitical alignment of the major oil producing countries. So far, the crude oil market has been relaxed about this development with the futures curve continuing to slope downward. Nevertheless, the MPC needs to keep a careful watch on this evolving situation. If crude were to creep towards the triple digit mark, there might be a need for a monetary response. 41. The second risk relates to the monsoon. It is only around mid April that scientists are able to provide monsoon forecasts with some degree of confidence, and the forecast accuracy improves towards the end of May. In this meeting, therefore, the MPC has no choice but to operate under the default assumption of a normal monsoon. However, in recent weeks, there has been increasing concern about some unfavourable oceanographic patterns that could impact the monsoon this year. A deficient monsoon would likely create inflationary pressures that would need to be counteracted with monetary policy measures. We will however have to wait till May or even early June to have reasonable clarity on this matter. 42. On the growth front, early warning signs of a possible slowdown are visible to a greater extent than in February. In the current situation of high inflation, monetary policy does not have the luxury of responding to these growth headwinds. In fact, it is almost axiomatic that monetary action can cool inflation only by suppressing demand. However, policy makers must be vigilant against overshooting the terminal policy rate, and thereby slowing the economy to a greater extent than what is needed to glide inflation to the target. 43. The balance of risks has, in my view, shifted slightly towards inflation since the February meeting, but the best estimate currently is that the 315 basis points of effective tightening of the overnight interest rate (from a reverse repo rate of 3.35% to a repo rate of 6.50%) would be quite sufficient to bring inflation under control. Therefore, I vote in favour of keeping the policy rate unchanged in this meeting. 44. Turning to the stance, I must confess that I fail to comprehend its meaning. My colleagues in the MPC assure me that the language is crystal clear to market participants and others. It may well be that I am the only person who finds it hard to understand. But I am unable to reconcile the language of the stance with the simple fact that no further “withdrawal of accommodation” remains to be done since the repo rate has already been raised to the 6.50% level prevailing at the beginning of the previous easing cycle in February 2019. It is of course possible to undertake further tightening, but that would not constitute a “withdrawal of accommodation” by any stretch of the imagination. 45. One interpretation that has been offered is that the real interest rate measured using the most recent published inflation rate needs to rise further. This is doubtless true, but monetary policy should not be conducted by looking at the rear view mirror. The real interest rate must be measured against the projected inflation rate 3-4 quarters ahead, and, as things stand right now, there is very little ground to argue for a further rise in the correctly measured real interest rate. Moreover, even if a flawed definition of the real interest rate is accepted, the projected rise in this real rate would not require any action by the MPC; it would happen as a mechanical result of a falling inflation rate and an unchanged policy rate. And the projected fall in the inflation rate would be a consequence of what the MPC has already done, and not what it will do in coming months. 46. I cannot put my name to a stance that I do not even understand. At the same time, it is clear that the war against inflation has not yet been won, and it would be premature to declare an end to this tightening cycle. There is need for heightened vigilance in the face of the fresh risks that I highlighted earlier in my statement. For these reasons, I refrain from dissenting on this part of the resolution, and confine myself to expressing reservations on it. Statement by Dr. Rajiv Ranjan 47. Let me begin from where I ended my last minutes of February 2023: “Going ahead, assessment of the impact of the cumulative rate hikes will become important especially in view of higher policy transmission in a primarily bank-based economy”. Consistent with that assessment and in the wake of new information that has since become available, I vote for a pause in today’s meeting. 48. First, the crosscurrents of uncertainty continue to sweep across the globe. The challenges faced in recent times have raised important questions about the conduct of monetary policy under heightened uncertainty. The gradient of unpredictability in the economy runs deeper from quantifiable risks in the near term to unknowable Knightian uncertainty (Knight, 1921)7 over longer time horizons. Faced with these uncertainties, the ‘science’ of monetary policy – which is premised on a forward-looking and a rule-based approach (Clarida, Gali, and Gertler, 1999)8 – must be blended with the ‘art’ of monetary policy, which is data-centric and based on prudent judgement of policymakers. A virtuous guide to policymaking in such times is to tread cautiously (Orphanides, 2003).9 As the then President of the ECB, Mario Draghi, put it, “in a dark room you move with tiny steps.”10 I believe we are currently poised appropriately at this juncture to pause in the backdrop front-loaded rate actions even as monetary policy remains finely calibrated to the domestic and global situation. 49. Second, there are some clear positive signals visible on the domestic front. Inflationary expectations are gradually easing, domestic growth momentum remains robust, and India, so far, is insulated from the global banking crisis. 50. Third, it is important to keep in mind that there was considerable noise in the high inflation readings of January-February 2023 attributed to the statistical effect with respect to treatment of cereals.11 51. Fourth, though inflation at present remains above the comfort zone, there are reasons for optimism going forward. The heat wave of February and the unseasonal rains of March are expected to have only some localised impacts, raising the prospects of an overall good rabi harvest. High frequency food price indicators for the month of March are already indicating a decline in wheat prices. Furthermore, international food prices have registered a decline of around 19 per cent in February 2023 from its peak in March 2022, which could help lower costs for critical import dependent food items through appropriate trade policies. Global metals and industrial input prices have also seen significant correction from their March 2022 peak levels which could likely result in softening of core inflation pressures over the year, though in a protracted manner. The key factors that could adversely affect the inflation trajectory over 2023-24 are climate related, structural demand-supply imbalance in important food items such as milk and volatile crude oil prices. At present, there is considerable uncertainty on how these events will play out over the year; hence, a wait and watch approach may be a better strategy. 52. Fifth, though core CPI inflation (excluding food and fuel) continued to remain sticky and elevated, there are signs of a modest softening in February, which was also observed across various other exclusion as well as trimmed mean measures of underlying inflation. The month-over-month (MoM) seasonally adjusted annualised rate (SAAR) of core CPI has also slowed down from around 6 per cent in December 2022 to around 5 per cent in February 2023. Moreover, headline CPI diffusion indices for February, though indicating an expansion of prices, also showed that for the first time since July 2022, a significant majority the CPI basket registered price increases of less than 6 per cent (SAAR). Diffusion indices for a core CPI which also excludes petrol, diesel, gold and silver have also indicated price expansion at rates lower than 6 per cent (SAAR) since November 2022. Softer household inflation expectations revealed by RBI’s latest survey provides comfort that second order effects on inflation will also remain subdued. 53. Sixth, new incoming information suggests that the growth outlook for 2023-24 has improved with investment revival likely to become more entrenched along with a lesser drag from external demand. The government’s sustained focus on infrastructure spending will also crowd in private investment and support growth.12 54. Seventh, during the last one year of monetary policy normalisation, the operating target of monetary policy is up by around 320 basis points, the effects of which are yet to be fully transmitted to domestic macroeconomic aggregates. In the backdrop of increasing depth and liquidity in financial markets, the long and variables lags of monetary policy may have shortened in recent years, supported by complementary tools of better communication, forward guidance and balance sheet policies. The shift to external benchmark lending rate (EBLR) is an additional factor that has hastened the speed of transmission. Under these conditions, monetary policy tightening needs to be calibrated judiciously. 55. Eighth, real policy rates whether ex ante, or ex post, whether based on headline or core inflation, are now positive and expected to increase further given our projected inflation path.13 56. Notwithstanding this, let me state that this is a ‘wait and watch’ pause. It is neither a ‘premature’ pause nor a ‘permanent’ one. Not ‘premature’ because we have already increased policy rate by 250 bps in about a year with frontloaded rate action of about 190 bps during the first 5 months. Not ‘permanent’ as any durable decline in inflation towards the target of 4 per cent is still distant.14 Therefore, I vote to continue with our stance of withdrawal of accommodation. The inherent strength and resilience of the Indian economy with inflation expected to moderate going forward inspires confidence of our actions. Statement by Dr. Michael Debabrata Patra 57. The momentum of economic activity in India is broadening, and slack is being pulled in. The underlying price build-up indicates that demand pressures remain strong, especially for contact-intensive services. Hence, inflation remains elevated and generalised; and, as I stated at the time of the MPC’s February 2023 meeting, it is the biggest risk to the outlook for the Indian economy. 58. The lessons of experience and empirical evidence show incontrovertibly that inflation ruling above 6 per cent – as it has done through 2022-23 – is inimically harmful for growth. This is already showing up in the deceleration of private consumption spending and the moderation in sales growth in the corporate sector which, in turn, is hamstringing new investment. In my view, the baseline projection for real GDP growth at 6.5 per cent for 2023-24 will benefit from an upside from budgeted capital expenditure; this advantage should not, however, be frittered away by inflation. By current reckoning, the future path of inflation is vulnerable to several supply shocks. The MPC must accordingly remain on high alert and ready to act pre-emptively if risks intensify to both sides of its commitment: price stability and growth. 59. Monetary policy must persevere with the withdrawal of accommodation. The stance of policy has to remain disinflationary and unwavering in its resolve to align inflation with the target of 4 per cent. It is prudent to anticipate future shocks to the inflation trajectory while evaluating the cumulative tightening of monetary policy so far. Bank credit growth is already reflecting the pass-through of past monetary policy actions, although it remains robust relative to the pace of underlying activity in the economy, and financial conditions more generally are supportive of growth. 60. While I vote for a pause in this meeting, an ongoing assessment of the macroeconomic outlook should inform a preparedness to re-calibrate monetary policy towards a more restrictive stance with consistent actions, should risks to the inflation trajectory materialise and impede its alignment with the target. The process of getting inflation back to target could turn out to be gradual and uneven, but the mission of monetary policy is to shepherd this process through potential bumps while containing second round effects and anchoring inflation expectations. Statement by Shri Shaktikanta Das 61. Since the last meeting of the MPC in February 2023, the global economic environment has changed dramatically. While issues of geopolitics and high inflation continue to impact the outlook, the emergence of banking sector turmoil on both sides of the Atlantic and the sudden announcement of oil production cut by the OPEC+ countries have rendered the global outlook even more uncertain. Global inflation is easing but at a tardy pace. Central banks face a runway which is becoming narrower and bumpy for soft-landing. 62. Against this background, inflation in India during January-February 2023 exceeded the upper tolerance limit of 6 per cent after a transitory respite during November-December 2022. Going forward, inflation projection for 2023-24 is indicating a moderation to an average of 5.2 per cent. Both domestic as well as global factors are expected to bring about this disinflation. There is better optimism on rabi harvest despite the recent unseasonal rains. This could significantly reduce price pressures on rabi food crops, particularly wheat. Further, prices of edible oils have moderated. The softening of global commodity prices from their peak levels a year ago is translating into lower input cost pressures for manufactured goods and services. These could result in some softening of core inflation going forward. The overall situation, nonetheless, remains dynamic and fast evolving. Clarity on monsoon would be available in the coming months. Milk prices may remain firm in the lean summer season on tight demand-supply balance and high fodder costs. The rising uncertainty in international crude oil prices also warrants close monitoring. 63. In parallel, domestic growth impulses remained buoyant in Q4:2022-23. Looking ahead, the thrust on infrastructure spending by the government would support investment activity. The drag from net external demand is moderating. Overall, broadening of economic activity and the strength of the external sector have allowed us room to remain steadfastly focused on inflation. 64. We have consecutively raised the policy repo rate by 250 basis points since May 2022 when we started the current rate hike cycle. Together with the introduction of the Standing Deposit Facility (SDF) at a rate 40 basis points above the fixed rate reverse repo rate, the effective rate hike has been 290 basis points. In tandem, our market operations have reined in surplus liquidity in an orderly manner. These actions have collectively transmitted into the weighted average call money rate (WACR), the operating target of monetary policy, along with other short-term rates. 65. The cumulative impact of our monetary policy actions over the last one year is still unfolding and needs to be monitored closely. Inflation for 2023-24 is projected to soften, but the disinflation towards the target is likely to be slow and protracted. The projected inflation in Q4:2023-24 at 5.2 per cent would still be well above the target. Therefore, at this juncture, we have to persevere with our focus on bringing about a durable moderation in inflation and at the same time give ourselves some time to monitor the impact of our past actions. I am, therefore, of the view that we do a tactical pause in this meeting of the MPC. Accordingly, I vote for a pause in rate action and for remaining focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. This is a tactical pause and not a pivot or a change in policy direction. We will continue to monitor all incoming information and undertake forward-looking assessment of the evolving economic outlook and stand ready to act, should the situation so warrant. Our fight against inflation is far from over and we have to continue with our efforts to bring down inflation closer to the target over the medium term. (Yogesh Dayal)

Chief General Manager Press Release: 2023-2024/88

|