[Under Section 45ZL of the Reserve Bank of India Act, 1934] The fifty second meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during December 4 to 6, 2024. 2. The meeting was attended by all the members – Dr. Nagesh Kumar, Director and Chief Executive, Institute for Studies in Industrial Development, New Delhi; Shri Saugata Bhattacharya, Economist, Mumbai; Professor Ram Singh, Director, Delhi School of Economics, Delhi; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: -

the resolution adopted at the meeting of the Monetary Policy Committee; -

the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and -

the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. After assessing the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (December 6, 2024) decided to: Consequently, the standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Growth and Inflation Outlook 6. The global economy remains stable with growth holding up amidst waning inflation, albeit at a slow pace. Geopolitical risks and policy uncertainty, especially with respect to trade policies, have imparted heightened volatility to global financial markets. 7. On the domestic front, real gross domestic product (GDP) registered a lower than expected growth of 5.4 per cent in Q2:2024-25 as private consumption and investment decelerated even while government spending recovered from a contraction in the previous quarter. On the supply side, the growth in gross value added (GVA) during Q2 was aided by resilient services and improving agriculture sector, but weakness in industrial activity – manufacturing, electricity and mining – tempered overall growth. Looking ahead, robust kharif foodgrain production and good rabi prospects, coupled with an expected pickup in industrial activity and sustained buoyancy in services augur well for private consumption. Investment activity is expected to pick up. Resilient world trade prospects should provide support to external demand and exports. Headwinds from geo-political uncertainties, volatility in international commodity prices, and geo-economic fragmentation continue to pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 6.6 per cent with Q3 at 6.8 per cent; and Q4 at 7.2 per cent. Real GDP growth for Q1:2025-26 is projected at 6.9 per cent; and Q2 at 7.3 per cent (Chart 1). The risks are evenly balanced. 8. Headline CPI inflation surged above the upper tolerance level to 6.2 per cent in October from 5.5 per cent in September and sub-4.0 per cent prints in July-August, propelled by a sharp pick-up in food inflation and an uptick in core (CPI excluding food and fuel) inflation. Going forward, food inflation is likely to soften in Q4 with seasonal easing of vegetables prices and kharif harvest arrivals; and good soil moisture conditions along with comfortable reservoir levels auguring well for rabi production. Adverse weather events and rise in international agricultural commodity prices, however, pose upside risks to food inflation. Even though energy prices have softened in the recent past, its sustenance needs to be monitored. Businesses expect pressures from input costs to remain elevated and growth in selling prices to accelerate from Q4.1 Taking all these factors into consideration, CPI inflation for 2024-25 is projected at 4.8 per cent with Q3 at 5.7 per cent; and Q4 at 4.5 per cent. CPI inflation for Q1:2025-26 is projected at 4.6 per cent; and Q2 at 4.0 per cent (Chart 2). The risks are evenly balanced.  Rationale for Monetary Policy Decisions 9. The MPC noted that the near-term inflation and growth outcomes in India have turned somewhat adverse since the October policy. Going forward, however, economic activity is set to improve along with rising business and consumer sentiments, as reflected in the Reserve Bank’s surveys. The recent spike in inflation highlights the continuing risks of multiple and overlapping shocks to the inflation outlook and expectations. Heightened geo-political uncertainties and financial market volatility add further upside risks to inflation. High inflation reduces the purchasing power of both rural and urban consumers and may adversely impact private consumption. The MPC emphasises that strong foundations for high growth can be secured only with durable price stability. The MPC remains committed to restoring the balance between inflation and growth in the overall interest of the economy. Accordingly, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. The MPC also decided to continue with the neutral stance of monetary policy as it provides flexibility to monitor the progress and outlook on disinflation and growth and to act appropriately. The MPC remains unambiguously focused on a durable alignment of inflation with the target, while supporting growth. 10. Shri Saugata Bhattacharya, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to keep the policy repo rate unchanged at 6.50 per cent. Dr. Nagesh Kumar and Professor Ram Singh voted to reduce the policy repo rate by 25 basis points. 11. Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Professor Ram Singh, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted for continuing with the neutral stance of monetary policy and to remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth. 12. The minutes of the MPC’s meeting will be published on December 20, 2024. 13. The next meeting of the MPC is scheduled during February 5 to 7, 2025. Voting on the Resolution to keep the policy repo rate unchanged at 6.50 per cent | Member | Vote | | Dr. Nagesh Kumar | No | | Shri Saugata Bhattacharya | Yes | | Prof. Ram Singh | No | | Dr. Rajiv Ranjan | Yes | | Dr. Michael Debabrata Patra | Yes | | Shri Shaktikanta Das | Yes | Statement by Dr. Nagesh Kumar 14. Since the October 2024 MPC Meeting, economic conditions have worsened dramatically on both economic growth and inflation fronts. At the last meeting, I had expressed my concerns about the growth slowdown and the need to support it through a cut in policy rates. The decline in the Q2 2024-25 growth numbers from 8.2% achieved in 2023-24 and from 6.7% on Q1 2024-25 to just 5.4% is much sharper than expected. The slowdown has led to the downgrading of the GDP growth forecasts for 2024-25 by most analysts from around 7% earlier to around 6.5% now. The RBI has downgraded it to 6.6% from 7.2% earlier. The extent of the slowdown is serious enough to warrant policy attention. 15. The slowdown largely reflects the weakness of the industrial sector. The growth rate of agriculture value added has actually improved from 2.0% in Q1 2024-25 to 3.5% in Q2. The services growth has moderated slightly from 7.7% in Q1 to 7.1% in Q2, while the growth rate of industrial value added has decelerated sharply from 7.4% in Q1 to only 2.1% in Q2. All the subsectors of the industry, namely mining, manufacturing and electricity, have decelerated. What is most worrying is the deceleration of growth of manufacturing value added from 7.0% to 2.2%. The corporate performance indicators corroborate the deceleration of manufacturing growth. The sales growth of manufacturing companies has moderated from 6.2% in Q1 to 3.3% in Q2. In particular, negative growth rates in iron & steel and cement are worrying. The listed private non-financial corporate performance results also suggest that manufacturing GVA growth decelerated from 11.7% (y-o-y) in Q1 to 5.0% in Q2. They also indicate the softening of corporate profit margins and corporate tax collections coming down for listed private manufacturing companies. The early results of Enterprise surveys suggest that seasonally adjusted capacity utilization declined from 75.8% in Q1 to 74.7% in Q2. There is also a trend towards deleveraging with the moderation of the total cost of projects sanctioned by banks and financial institutions. As a result of the slowdown of industrial activity, the employment sentiment deteriorated in Q2. 16. The factors driving growth slowdown are the slowdown of both consumption and investment. While government consumption has come out of elections-related squeeze of -0.2% in Q1 to a 4.4% growth in Q2, the growth of private consumption expenditure has moderated from 7.4% in Q1 to 6.0% in Q2. The fixed investment growth has declined from 7.5% in Q1 to 5.4% in Q2. The export demand has also declined from 8.7% in Q1 to just 2.8% in Q2. Although merchandise exports registered an impressive growth of 17.2% in October 2024, one has to see if the buoyancy sustains given the tendency of export figures to fluctuate wildly from month-to-month and were squeezing by -2.0% in July, -9.7% in August, and stayed rather flat at 0.4% in September 2024. 17. On the other hand, inflation, which was seemingly restrained in September, has hit 6.2% in October, a 14-month high. So, we find ourselves in a slow growth, high inflation scenario. However, inflation is largely on account of food prices, which have a rather high weight in the CPI. In particular, it is tomatoes, onions, and potatoes (TOP) which are largely responsible for the high inflation observed recently. As per the data from the Department of Consumer Affairs (DCA), price momentum for vegetables (TOP) went up from 0.7% in September 2024 to 14.0% in October but was easing to -4.4% in November 2024. DCA’s edible oil prices had also shown a high price momentum of 8.6% in October 2024 from 1.8% in September but eased down to 3.7% in November. Excluding food, the CPI headline comes down to just 3.1% in October 2024. Keeping in mind the easing of vegetables and edible oil in November, food inflation should be easing further in the coming months. Core inflation persistence has declined over time, suggesting an improving anchoring of inflationary expectations. 18. The policy responses to address the challenges of high inflation and growth slowdown should look into their determinants. Monetary policy, being a demand management tool, has limitations in addressing inflation largely driven by a supply-side shock driving up vegetable prices. The high vegetable prices represent an essentially seasonal supply-demand mismatch that has started to correct itself in November 2024. 19. On the other hand, the slowdown of the manufacturing sector can be addressed by bringing down the cost of capital, which may stimulate investments as well as consumer demand. Hence, a rate cut could help, among other measures. Expanding the manufacturing sector could also help in containing inflationary pressures by enhancing the supply capacity. 20. Most of the central banks around the world, barring a few, have embarked on an easing cycle in recent months, with some, like the US Fed, adopting a rather aggressive posture towards cutting the policy rates. India risks currency appreciation if we do not follow the process of normalisation when most others have moved forward. The rupee has already been appreciating in real terms, and a further appreciation would hurt the competitiveness of Indian products. 21. Therefore, I believe that a rate cut would help in reviving economic growth without worsening the inflationary situation, which may soften with seasonal correction in prices. Hence, I will again vote for a 25-basis point cut in the repo rate while keeping a neutral stance. In addition, we should also explore the use of non-rate measures for enhancing liquidity, such as a 50-basis point cut in CRR, to help enhance liquidity. Statement by Shri Saugata Bhattacharya 22. Among the multiple economic and financial developments informing a difficult voting decision, extracting interpretable signals from the set of factors underlying the unexpectedly sharp Q2 FY25 real GDP growth slowdown was, square and centre, the primary one. Was this slowdown transitory or a harbinger of some deeper underlying trend? Leading indicators broadly suggest the former, while highlighting some specific weaknesses. RBI nowcasts show a revival in Q3 growth outlook consistent with its FY25 GDP 6.6% forecast. Both data and surveys also point to expectations of an improving growth – inflation balance in the second half of FY25. Yet, we also note that some indicators keep alive niggling doubts. 23. Second, what is the extent of the growth sacrifice induced by inflation-focused tight monetary policy conditions? This is a complex question, necessitating a decomposition of transient, idiosyncratic, cyclical, policy-related and structural components underlying this slowdown. This is further complicated by the ongoing transmission of the previous easing cycle. A study provides some quantitative insights on the transmission effects of repo rate actions.2 This study estimates that the macroeconomic impact of the cumulative 250 basis points increase in the repo rate since May 2022 was comparatively much smaller on aggregate demand while having a more significant effect on reducing headline inflation and inflation expectations. In addition, the “Impulse Response Functions (250 bps Shock to Policy Rate)” show that the largest adverse impacts on aggregate demand had been in FY23 and FY24, before tapering off in H1 FY25. 24. Third, among the factors widely reported to have contributed to the growth slowdown, high interest costs are increasingly hypothesised as the proximate one. This is a serious issue and deserves a more granular dissection. A priori, we would have expected that smaller companies have been more adversely affected. Based on the 2Q FY25 results of listed non-Govt non-finance (NGNF) companies3, we calculate interest costs to EBIDTA ratios for smaller (with sales of less than Rs 100 crs), mid-size (Rs 100-1,000 crs) and large (greater than Rs. 1,000 crs) companies. For smaller companies, interest costs to EBIDTA are indeed high, but have fallen from a high of 46% in Q3 FY24 to 38% in Q2 FY25. The ratio for mid-sized companies has moderated from 25% to 18% and has remained stable for large companies at 11-12%. However, the share of smaller and mid-sized companies in total interest expenses is only about 9-11%; hence, they are unlikely to have contributed significantly to the growth slowdown. In no way, however, does this detract from the need to reduce interest costs for small enterprises. 25. Fourth, in my October ’24 statement, I had noted: “Retail credit, conjectured (albeit untested) to be a driver of consumption demand, while slowing, still remains robust.” Macro-prudential regulations have resulted in slowing growth in some of these segments, probably reducing the consumption stimulus. I remain unconvinced, though, given potential risks to financial stability, that lower policy rates are an antidote to this particular causal factor. Unquestionably, however, the flow of credit to micro and small enterprises needs to increase. This will require a coordinated policy response, one of which might be through augmenting system liquidity. 26. Fifth, the growth – inflation balance, from being “well-poised” as noted in RBI Governor’s October ’24 statement, has, in my view, turned adverse on both growth (as elaborated above) and inflation. The October CPI inflation printed at 6.2% (above the tolerance ceiling), following a 5.5% readout for September. Although largely the result of high prices of a few vegetables, other food components are also becoming more expensive. Preliminary data suggest that food price inflation for November, while moderating, is expected to remain elevated. 27. Globally, prices of edible oils have risen sharply. The FAO Food Price Index had surged to its highest level in 18 months in October ’24, up 5.5% yoy. This was led largely by vegetable oils, but also dairy products and sugar. High edible oils prices are also manifest in India. Prices of other agri-related inputs like non-edible oils (which are inputs into personal care products, confectionary, etc.) have also increased. These might eventually feed into consumer goods prices. IMD has forecast4 that “during the upcoming winter season (December 2024 to February 2025), above-normal minimum temperatures are likely over most parts of the country”; this, I am told, does not augur well for rabi crop yields. Core inflation has also started to creep up. Various surveys also suggest that prices of non-farm inputs have risen and are expected to remain elevated; so are services prices. 28. Sixth, the effects of heightened uncertainty, largely emanating from global sources, on domestic macro-economic and macro-financial metrics have increased. Spillovers have already impacted domestic financial conditions, which, going forward, might affect economic activity. It is worth emphasising that financial channels influence domestic monetary policy through the well-established trilemma of open economy macroeconomics. The present neutral stance provides the flexibility to respond quickly and appropriately to evolving economic conditions. 29. The prevailing economic conditions bring to mind a phrase a former RBI Governor had invoked in a different context: “Festina Lente”, Latin for “make haste slowly”. This is now apposite for guiding policy decisions. I had earlier noted the risk of making a “policy error” in my October ’24 statement; if anything, this risk has now increased. 30. Accordingly, based on my assessment of the appropriate response to the increasing complexity of the economic environment, I vote to keep the repo rate unchanged at 6.5 per cent, while continuing with the neutral monetary policy stance. Statement by Prof Ram Singh 31. In my view, the following questions warrant the attention of the MPC: Is there a strong case for a shift in the monetary policy (MP) in response to the recent developments on inflation and growth fronts, domestically and internationally? How are wages and prices likely to play out in the short term and impact inflation growth trade-offs? What is the nature of the relation between the short-term and the long-term inflation growth trade-offs for the Indian economy? What are the implications of the elevated uncertainty for the MP? 32. Though elevated, the inflation trajectory remains along the projected/expected lines. As we advance, food inflation is likely to soften in Q4:2024-25, and energy prices are also expected to be stable in the near future. Overall, CPI inflation for 2024-25, projected at 4.8 per cent, is within the tolerance band though above the 4.0 per cent target. The risks are evenly balanced. 33. Moreover, by now it is widely accepted that vegetable prices are essentially a supply-side phenomenon. Interest rates have little bearing on the volatility in fruits and vegetables prices. During the last ten years, changes in repo rates seem to have made little difference to vegetable price volatility. Specifically, the elevated interest rates during the last ten quarters had no significant effect on price volatility, especially of TOP (tomato, onion and potato) vegetables, the primary source of volatility in headline inflation. 34. Therefore, the question becomes: Does the food inflation transmit to the core inflation? 35. There is empirical evidence that the impact of food inflation on core inflation has significantly reduced in recent years suggesting that the wages and price-setting mechanisms warrant a serious reexamination. The effectiveness of the main channel of transmitting food inflation to core inflation, i.e., the food price-induced increases in wages, has reduced in recent years. The result is a duality - significant divergence between the food and core inflations. During the last nine quarters, while the food prices remained elevated, the CPI core has remained below the price inflation target of 4%. A significant part of this divergence is attributable to slacks (weak wage growth) and other frictions in the labour and food product markets. 36. Moreover, the CPI inflation figures used by the MPC are somewhat higher than what would follow if the share of food and beverages (45.86%) was in line with the total household consumption expenditure (MPCE) data. Even with current weights, core inflation is at 3.8%. From April to October 2024, the CPI excluding TOP, Gold, and Silver on an average stood at 3.80%, whereas the core inflation rate (%) excluding Gold and Silver was on an average at 2.84%. GDP Growth 37. The GDP growth rate has hit a seven-quarter low of 5.4% in Q2 amid a manufacturing slump and deceleration in private consumption and investment. The GVA, a critical indicator of economic activity, also came at 5.6 per cent in Q2. Accordingly, the RBI has lowered the GDP growth forecast to 6.6 per cent, down significantly from earlier projections of 7.2 per cent. 38. The MPC's mandate is to ensure price stability while supporting growth. The present situation of significantly slower growth without material changes in the prospects for inflation requires shifting the pivot of monetary policy to a counter-cyclical mode. 39. The empirical relation between the core inflation and GDP growth rate (actual and potential) is well established. A persistent decrease in the core inflation during the last 7-8 quarters, combined with the slowdown in growth rate, suggests that the difference between the actual and potential growth rate is increasing. These observations and the fact that the labour market is not tight mean that the economy can grow significantly faster without triggering inflation. 40. From another perspective, the difference between the core inflation (<4%) and the policy rate (at 6.5 %) has been more than 2.5% for over a year now; this makes for a restrictive monetary regime. Further, the existing policy rates are more than two percentage points higher even when compared to the estimated average CPI inflation for the next four quarters - CPI inflation for 2024-25 Q3 at 5.7 per cent and Q4 at 4.5 per cent. For 2025-26, Q1 is projected at 4.6 per cent, and Q2 at 4.0 per cent. Therefore, the forward-looking policy rate is greater than the neutral R-star. 41. When the correlation between food prices and core inflation is weak at best and the share of items contributing to inflation has come down, keeping interest rates elevated to keep overall inflation closer to the target imposes growth costs that are disproportionate to the gains on the prices front. 42. Several indicators point to a slowing economy. Nominal sales growth of listed private manufacturing companies has fallen to 3.3% in Q2: 2024-25. Operating profit margins have moderated for manufacturing and non-IT services while the staff cost has seen only a modest increase even after factoring in the additional jobs. The flow of financial resources to the commercial sector has slowed noticeably, and the total costs of bank/FIs-funded projects have come down. The leverage ratio of companies surveyed by the RBI has reduced from almost 35% in H1: 2022-23 to 29.5% in H1: 2024-25. 43. A rate cut will reduce the costs of doing business and increase the opportunity cost of holding on to cash for firms and companies. Hopefully, this will boost companies' investment plans and improve the scope of employment-linked incentive schemes helping induce a virtual cycle of wage growth and demand. By tightening the labour market, it will also improve efficacy of the MP. 44. A growth-supportive monetary policy is also consistent with the international scenario. In most of big developed markets, the central banks have already cut benchmark interest rates. China's central bank has also cut interest rates. Furthermore, the currencies of several Asian countries, including our competitors, including China, are depreciating against the USD. Expectation of low crude prices is expected to provide further elbowroom for rate cuts by the RBI. 45. While deciding on short-term inflation-growth trade-offs, MP must factor in the long-term implications of the decisions made today. How we address the short-term inflation-growth trade-offs has implications for the long-term growth path. High growth rate, by providing meaningful employment to the millions on the job, boosts demand while reducing supply-side constraints. 46. There will always be uncertainty about the path of inflation and the appropriate policy rates. Due to increases in the capital intensity of production processes due to advances in ICT and AI, the employment elasticity of output is likely to fall in the future. As such, we have a limited window of 10-15 years to capitalise on the demographic dividend. So, the imperative is high growth rate while minimising the likelihood of extreme scenarios on the inflation front. 47. In a world with heightened uncertainty, if the MP were to use insights from research in the areas of Rules-versus-Standards and Regulation under Uncertainty, it would be more plausible to aim for price stability within a range rather than aiming to bring CPI inflation to a point target of 4%. The costs of trying to shoot at the point target in every state of the uncertainty ridden future can be unjustifiably high. 48. Considering all these factors, I vote to: Statement by Dr. Rajiv Ranjan 49. In my August 2024 statement, I had stated that we could see a window opening up for monetary policy to change its course, which materialised in October 2024 as the risk-reward for a change in stance to neutral was favorable then. Subsequently, in my October 2024 statement, I had mentioned that the neutral stance would allow flexibility to adapt and operate in accordance with the evolving situation. Since then, however, incoming data seems to have disturbed the balance between inflation and growth, thereby pushing ahead the space to normalise policy rate that was opening up. Let me elaborate on this based on the global and domestic perspective. 50. Globally, the easing cycle is quite guarded notwithstanding the fact that the tightening was unprecedented in many dimensions.5 The challenges to policy makers are aggravated predominantly because of the uncertainty that is prevailing on various fronts keeping the financial markets on razor’s edge. Even though many economies, who have had historical high policy rates or face severe sharp slowdown, have begun cutting policy rates, they remain cautious, maintaining a restrictive stance due to lingering uncertainty about inflation aligning sustainably with their targets. The last mile of disinflation is turning out to be trickier for many systemic and inflation targeting countries, slowing down the number and size of their rate cuts. With incoming data giving mixed signals, central banks are increasingly getting unintentionally checkmated by their own communication or rate action. Meanwhile, there are also countries like Australia, Norway and Malaysia, which had raised rates in a calibrated manner during their tightening cycle and are now holding back till their economic conditions become favorable to start the easing cycle. 51. On the domestic front, the inflation-growth balance turned adverse since the last policy in October. While inflation has surprised on the upside, growth has also surprised on the downside. As per our assessment, both are likely to reverse their course in the near future. At this juncture, confirmation of durable softening of inflation in the coming months is important. The critical factor would be the ongoing rabi season which will give us the clarity about the expected correction in food prices. Early indications point to a good start for crop sowing, adequate reservoir levels and good soil moisture conditions. We also need to be sure that the moderation in growth in Q2 was just one-off and the economy will recover on projected lines. Agriculture and government spending growth is expected to be much stronger and we expect around 7 per cent growth on average in the second half of 2024-25. 52. In this context, sequencing and timing of measures are very important for its effectiveness as witnessed during the pandemic time easing and post pandemic tightening. After the change in stance to neutral in the last meeting, addressing liquidity conditions to ensure adequate systemic liquidity seems more appropriate sequentially. Thus, a cash reserve ratio (CRR) cut of 50 bps by the Reserve Bank is appropriate at this juncture as it will provide durable liquidity to banks and keep the money market rate well aligned with the repo rate. It will also facilitate improvement in transmission, once the rate easing cycle sets in. This move is consistent with the neutral stance and will normalise the CRR to its pre-policy tightening and pre-pandemic level of 4 per cent of net demand and time liabilities (NDTL). The multiplier effect of the CRR cut would have an expansionary impact on deposit and credit over an extended period. A deft mix of policy tools, if timed and sequenced well, can best address the current challenging situation. 53. To conclude, amidst difficult policy trade-offs, our cautious and calibrated approach has kept us in good stead. Related literature shows that during periods of heightened uncertainty with mixed data signals, conservatism and cautious approach can be useful.6 The need of the hour is to be watchful of the forthcoming data to ascertain the projected improvement in the balance between inflation and growth outlook. If food price pressures wane on projected lines, this would open up the policy space to normalise rates. Our neutral stance provides the flexibility to respond to the evolving situation. Accordingly, I vote for a status quo on rates and stance in this meeting. Statement by Dr. Michael Debabrata Patra 54. The estimates of national accounts in India for the second quarter of 2024-25 reveal the corrosive power of repeated inflation shocks on economic activity. On the supply side, the drag from manufacturing performance shows the toll that persisting price pressures are taking on the urban consumer’s spending capacity. In turn, this is depressing sales growth among non-financial corporations and slowing down capex plans – as evident in the deceleration in gross capital formation – since corporates’ outlook for demand remains tainted by inflation. There may be wider ramifications on investment activity if slower growth in nominal GDP prompts expenditures on capital outlays to be pruned to ensure the achievement of fiscal targets. The prospects for the second half of the year are brighter than the outturn for the first half. It is now that efforts must be made to bring down inflation and revive consumption and investment spending. 55. Food price pressures are typically treated as transitory; however, if these shocks are not followed by reversals in the form of price declines, the pressures remain in the consumer price index and influence its evolution. Consequently, the readings for November and December are also expected to remain elevated, delaying the convergence of outcomes with the target. Households’ inflation perceptions and a year ahead expectations have ticked up, and consumer pessimism on the inflation situation has increased. Professional forecasters have revised their inflation projections upwards and lowered growth projections. Clearly, the fears of complacency due to sub-target outcomes for July and August are coming to roost. What is worrying is that core inflation has edged up by 70 basis points from its July low. There are early signs of second order effects or spill overs of high primary food prices – following the surge in prices of edible oils, inflation in respect of processed food prices is starting to see an uptick. The pick-up in price rises of household services like those of domestic helps/cooks also reflects higher cost of living pressures due to elevated food prices beginning to transmit to these specific wages. In this environment, the hardening of input costs across goods and services and their flow into selling prices needs to be watched carefully. If allowed to run unchecked, it can further undermine the prospects of the real economy, especially industry and exports. 56. It is a durable reduction in inflationary pressures that can rekindle the impulses of growth in a sustained manner. The expected winter easing of food prices may provide the turning point. With the prospects for private consumption expected to improve over the rest of the year, the key is to get investment going, since exports are hostage to a difficult external environment. Private investment will want to see a robust revival of domestic demand to draw in the slack that it is now experiencing. The monetary policy stance is open to support growth, but it must await the ebbing of inflation on a durable basis or else the uneven progress made so far in disinflation will get dissipated. Accordingly, I vote to maintain status quo on the policy rate and persevere with a neutral stance in this meeting. Statement by Shri Shaktikanta Das 57. The Indian economy remains resilient, notwithstanding the lower GDP data for Q2 of 2024-25. The direction of inflation is downwards, although the path is interrupted by periodic humps due to food inflation. As a result, the inflation growth balance has got somewhat unsettled now. 58. The latest high frequency indicators suggest that economic activity is recovering in Q3. Rabi sowing has exceeded previous year’s level and high reservoir levels augur well for the overall rabi output. With the expected pick up in government capital expenditure and end of monsoon related disruptions, industrial activity is expected to normalise and recover from the lows of the previous quarter. Services activity remains buoyant. On the demand side, consumption and investment is expected to pick up in the second half of the financial year on the back of factors like improving agricultural outlook, higher government expenditure, steady services sector growth, etc. Improving global trade volume will provide support to external demand. Overall, the real GDP growth is projected to be higher in the second half of the year at 7.1 per cent and for full year at 6.6 per cent. 59. A sharp accentuation in food inflation pressures led to headline inflation moving above the upper tolerance level of 6 per cent in October from sub-4 per cent levels in July-August. While primarily emanating from the spike in vegetable prices, the sharp pick-up in edible oil prices due to levy of import duties and continuing stickiness in cereals inflation also added to the surge in food inflation in October. Core inflation, though muted, also registered a sequential uptick during September-October 2024. Though, yet again, supply side shocks in food have interrupted the ongoing disinflation towards the target rate, moderation in food inflation can be expected in Q4:2024-25 due to correction in vegetables prices, robust kharif harvest arrivals, a likely good rabi crop and adequate cereal buffer stocks. Core inflation is likely to remain broadly contained as the disinflationary effect of past monetary policy actions continues to play out. On balance, headline inflation is expected to ease to 4.5 per cent in Q4:2023-24 and further to 4.0 per cent by Q2:2025-26. 60. In my overall assessment, the gains achieved so far in the broad direction of disinflation need to be preserved, while closely monitoring the evolving outlook of both inflation and growth. The flexibility inherent in the neutral stance of monetary policy gives us the space to monitor the incoming data and assess the outlook for confirmation of our expectations on the fronts of inflation and growth. 61. The policy priority at this critical juncture has to be on restoring the inflation-growth balance. The fundamental requirement now is to bring down inflation and align it with the target. Lower inflation will enhance disposable income with households and increase their purchasing power. Such an approach would support consumption and investment demand. Without addressing this core issue, it would not be possible to foster sustainable growth. As I have pointed out on several occasions, the biggest support for higher growth would come from price stability. Prudence and practicality demand that we now continue with the neutral stance of monetary policy and keep the repo rate unchanged at 6.50 per cent. Accordingly, I vote for the same. Any other approach would be counterproductive and a case of inappropriate timing. (Puneet Pancholy)

Chief General Manager Press Release: 2024-2025/1748

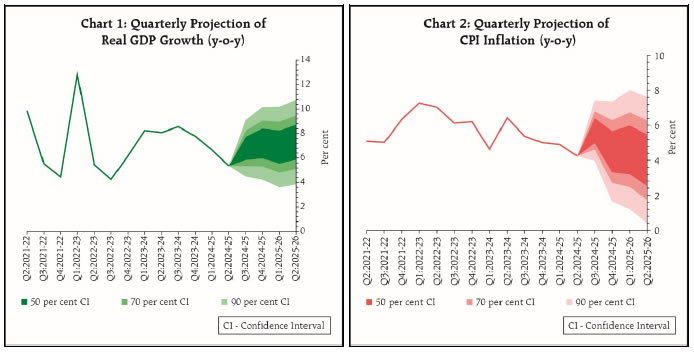

|