This article, based on the Union Budget 2015-16 presented to the Parliament on February 28, 2015 analyses the key features of the Budget and makes an assessment of the likely fiscal situation in 2015-16. The Budget has been formulated with the two-fold objective of promoting inclusive growth and strengthening the federal structure. In line with these objectives, higher allocations to infrastructure and a substantial increase in the resource transfer to States have warranted a deviation from the fiscal consolidation trajectory in 2015-16 and an extension of the period of convergence to the 3 per cent target for the gross fiscal deficit (as a proportion to GDP) by one year. Highlights -

Revised estimates show that the budgeted targets of revenue deficit and gross fiscal deficit for 2014-15 were met mainly through expenditure compression in the face of sluggish non-debt receipts. -

The Budget estimates for 2015-16 indicate a continuation of the process of fiscal consolidation albeit with revised roadmap, with all key deficit indicators relative to GDP set to decline. -

The Budget estimates the GFD-GDP ratio to decline to 3.9 per cent in 2015-16 (BE). In the medium-term, the GFD-GDP ratio is expected to decline to 3.0 per cent by 2017-18. The envisaged reduction in GFD in 2015-16 is to be achieved through combined impact of a compression in revenue expenditure and an increase in non-debt capital receipts. -

With the expected growth of 15.8 per cent in gross tax revenues over 2014-15 (RE), the gross tax revenue to GDP ratio is estimated to improve by 0.4 percentage points to 10.3 per cent in 2015-16 (BE). Net tax revenue accruing to the Centre, however, is budgeted significantly lower at 6.5 per cent of GDP in 2015-16 (7.2 per cent of GDP in 2014-15 RE) due to higher devolution to States following the Fourteenth Finance Commission award. -

Despite the shortfall in achieving the targets set in the past, including in 2014-15, aggregate disinvestment receipts are budgeted to grow by 121.7 per cent in 2015-16. -

Total subsidy expenditure is budgeted to decline by 8.6 per cent to 1.7 per cent of GDP in 2015-16 on account of 50 per cent reduction in provision for petroleum subsidy and modest increase in fertiliser and food subsidy. -

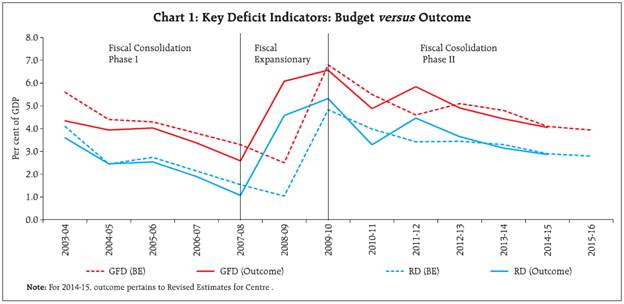

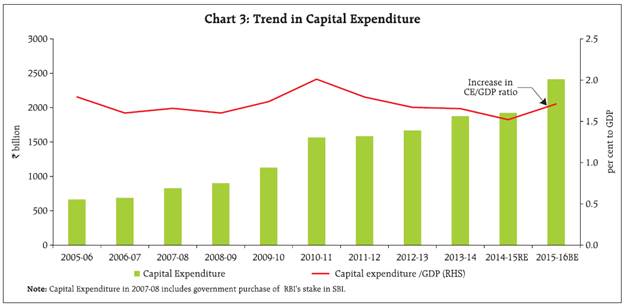

Capital expenditure is budgeted to increase sharply by 25.5 per cent in 2015-16 (BE) over 2014-15 (RE), reflecting high growth in non-defence capital outlay (38.6 per cent). The major policy initiatives proposed in the budget are highlighted in Box 1. Progress towards fiscal consolidation in 2014-15 and 2015-16 I. Fiscal Performance in 2014-15 Continuance of fiscal consolidation in 2014-15 (RE) as budgetary targets for the key deficit indicators are met Revised estimates show that the budgeted targets of revenue deficit (RD), gross fiscal deficit (GFD) and primary deficit (PD), as percentage of GDP, at 2.9 per cent, 4.1 per cent and 0.8 per cent, respectively, for 2014-15 were met, notwithstanding a shortfall in the non-debt receipts, including tax revenues and disinvestment proceeds (Chart 1). The fiscal consolidation in 2014-15 (RE) was achieved through expenditure compression in the face of sluggish non-debt receipts. Box 1: Union Budget 2015-16 - Policy Initiatives The Union Budget 2015-16 has announced a number of structural reforms measures and other policy measures to address the major constraints to the economy. 1. Major Structural Reforms The major structural reform measures, inter alia, include (i) agreement on Monetary Policy Framework setting out inflation targets for 2015-16 (6 per cent) and succeeding year (4+/- 2 per cent); (ii) amending the RBI Act in 2015- 16 to provide for a Monetary Policy Committee; (iii) amending the FRBM Act for rescheduling of deficit targets; (iv) introducing Goods and Services Tax by April 1, 2016; (v) setting up a Public Debt Management Agency (PDMA) to manage both external borrowings and domestic debt under one roof; (vi) amending the Government Securities Act and the RBI Act with a view to merging the Forwards Markets Commission with SEBI; (vii) amending Foreign Exchange Management Act (FEMA) to provide that control on capital flows as equity will be exercised by the Government, in consultation with the Reserve Bank; (viii) introducing the Indian Financial Code (IFC), currently being reviewed by the Justice Srikrishna Committee, in the Parliament for consideration; (ix) bringing in a Comprehensive Bankruptcy Code of global standards in 2015-16; (x) amending Prevention of Money Laundering (PML) Act, 2002 and FEMA to enable administration of new Act on black money; (xi) introducing Benami Transactions (Prohibition) Bill to curb domestic black money. 2. Initiatives relating to Banking Sector To provide access to institutional finance to micro and small business units, a Micro Units Development Refinance Agency (MUDRA) Bank would be created. Payments Bank venture would be set up by Postal Department. To improve the Governance of Public Sector Banks an autonomous Bank Board Bureau would be set up. The budget has proposed to introduce a Gold Monetisation Scheme, which will replace both the present Gold Deposit and Gold metal Loan Schemes. Developing Sovereign Gold Bond has been proposed as an alternative to purchasing metal gold.  The gross and net tax collections of the Central Government were lower than budgeted by 8.3 per cent and 7.0 per cent, respectively, mainly on account of sluggish indirect tax collections (Statement 1). Non-tax revenues exceeded the budgetary targets by 2.5 per cent due to higher receipts from dividends and profits and improved earnings from spectrum auction. The Government’s non-debt capital receipts were less than half of the budgetary targets reflecting large shortfalls in disinvestment proceeds. The shortfall in non-debt receipts, however, was more than offset by a sharp cutback in plan expenditure, particularly on the revenue account. Non-plan expenditure was marginally higher than the budget estimates, as the increase in expenditure on major subsidies was partly offset by saving on non-plan spending under an austerity drive. II. Budget Estimates for 2015-161 The Budget estimates for 2015-16 indicate a continuation of the process of fiscal consolidation, with all key deficit indicators relative to GDP set to decline (Table 1). As a ratio to GDP, RD and GFD are budgeted to decline to 2.8 per cent and 3.9 per cent, respectively, from 2.9 per cent and 4.1 per cent in 2014-15 (RE). The reduction in GFD reflects the combined impact of a compression in revenue expenditure and an increase in non-debt capital receipts. With the magnitude of reduction in the fiscal deficit being lower than required under the FRBM Act/ Rules, the goal post for achieving the GFD-GDP target of 3.0 per cent has been shifted to 2017-18, instead of 2016-172. | Table 1: Fiscal Performance of the Central Government | | (Per cent of GDP) | | | 2004-08 | 2008-10 | 2010-14 | 2012-13 | 2013-14 | 2014-15 (RE) | 2015-16 (BE) | | Average | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | Non Debt Receipts | 10.4 | 9.5 | 9.5 | 9.2 | 9.3 | 9.2 | 8.7 | | Tax revenue (Net) | 7.8 | 7.5 | 7.3 | 7.4 | 7.2 | 7.2 | 6.5 | | Non-tax revenue | 2.1 | 1.8 | 1.8 | 1.4 | 1.8 | 1.7 | 1.6 | | Non debt Capital Receipts | 0.4 | 0.3 | 0.4 | 0.4 | 0.4 | 0.3 | 0.6 | | Total Expenditure | 13.8 | 15.8 | 14.5 | 14.1 | 13.7 | 13.3 | 12.6 | | Revenue Expenditure | 11.9 | 14.1 | 12.7 | 12.4 | 12.1 | 11.8 | 10.9 | | Capital Expenditure | 1.9 | 1.7 | 1.8 | 1.7 | 1.7 | 1.5 | 1.7 | | Plan Expenditure | 4.0 | 4.8 | 4.4 | 4.1 | 4.0 | 3.7 | 3.3 | | Non-Plan Expenditure | 10.2 | 11.0 | 10.1 | 10.0 | 9.7 | 9.6 | 9.3 | | Revenue Deficit | 2.0 | 4.9 | 3.6 | 3.6 | 3.1 | 2.9 | 2.8 | | Gross Fiscal Deficit | 3.4 | 6.2 | 5.0 | 4.9 | 4.4 | 4.1 | 3.9 | II.1 Non-debt Receipts Non-Debt receipts to decelerate Non-debt receipts-GDP ratio is budgeted to decline to 8.7 per cent in 2015-16 (9.2 per cent in 2014-15) on account of higher tax devolution to States. II.1a. Tax Revenue Indirect taxes budgeted to post sharp recovery in 2015-16 With the expected growth of 15.8 per cent in gross tax revenues over 2014-15 (RE), the gross tax revenue to GDP ratio is estimated to improve by 0.4 percentage points to 10.3 per cent in 2015-16 (BE). Net tax revenue of the Central Government, however, is budgeted significantly lower at 6.5 per cent of GDP in 2015-16 (7.2 per cent of GDP in 2014-15 RE) due to higher devolution to States following the Fourteenth Finance Commission award. Underpinning the high growth in gross tax revenue is an implicit tax buoyancy of 1.38 in 2015-16, notably higher than the realised buoyancy of less than 1 in the previous two years. A sharp increase of 19.5 per cent in indirect taxes as against 9.1 per cent in 2014-15(RE) assumes buoyancy of over 2 in respect of excise duty and service taxes, significantly higher than what was achieved in the past (Table 2). In the Budget, the Government has increased the service tax rate by 1.64 percentage points (inclusive of education cess3) and announced hikes in excise duty on select products. II.1b Non-Tax Revenue Non-tax revenues, which have experienced high growth in the last few years due to higher dividend payments from the public sector undertakings (PSUs), banks, the Reserve Bank and spectrum charges, is budgeted to grow at slower pace of 1.8 per cent in 2015-16 with higher potential under these items already realised. The Reserve Bank’s surplus transfer would account for over half the budgeted dividend receipts for the second successive year. | Table 2 : Tax Buoyancy | | | Average Tax Buoyancy (2008-09 to 2014-15) | Post Crisis Tax Buoyancy (2010-11 to 2014-15) | Budgeted Tax Buoyancy for 2015-16 | | 1 | 2 | 3 | 4 | | Gross Tax Revenue | 0.76 | 1.00 | 1.38 | | Corporation Tax | 0.81 | 0.78 | 0.91 | | Income Tax | 1.06 | 1.23 | 1.52 | | Customs Duty | 0.62 | 1.15 | 0.90 | | Union Excise Duty | 0.41 | 0.83 | 2.08 | | Service Tax | 1.35 | 1.65 | 2.15 | II.1c Non-debt Capital Receipts Disinvestment proceeds are budgeted at ₹410 billion in 2015-16 with additional resources to the tune of ₹285 billion estimated to flow from strategic disinvestments as against the actual receipts of ₹314 billion in 2014-15 (RE)4. Despite the shortfall in achieving the targets set in the past, including in 2014-15, aggregate disinvestment receipts are budgeted to grow by 121.7 per cent in 2015-16. II.2 Total Expenditure Total expenditure is budgeted to grow by a modest 5.7 per cent in 2015-16 (Chart 2) with revenue expenditure growing at 3.2 per cent in nominal terms but declining as a proportion of GDP to 10.9 per cent in 2015-16 from 11.8 per cent in 2014-15 (RE). Capital expenditure is budgeted to post sharp recovery in 2015-16. Capital expenditure budgeted to increase Capital expenditure is budgeted to increase sharply by 25.5 per cent in 2015-16 (BE) over 2014-15 (RE), reflecting high growth in non-defence capital outlay (38.6 per cent) (Chart 3). This is partly due to a base effect since the revised estimates for 2014-15 under this head were lower than the budget estimates by 18.5 per cent. If estimated over the budget estimates for 2014-15, non-defence capital outlay in 2015-16 (BE) would grow by only 13.0 per cent, mainly on account of strong growth in capital outlays for ‘railways’ and ‘road & bridges’. The Budget has allocated a sum of ₹79 billion in 2015-16 for recapitalisation of public sector banks (PSBs),

| Table 3: Major Subsidies of Central Government | | (Amount in ₹ billion) | | Items | 2013-14 | 2014-15 (BE) | 2014-15 (RE) | 2015-16 (BE) | | Amount | Per cent to GDP | Amount | Per cent to GDP | Amount | Per cent to GDP | Amount | Per cent to GDP | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | Major Subsidies | 2,447.2 | 2.2 | 2,514.0 | 2.0 | 2,539.1 | 2.0 | 2,273.9 | 1.6 | | i. Food | 920.0 | 0.8 | 1,150.0 | 0.9 | 1,226.8 | 1.0 | 1,244.2 | 0.9 | | ii. Fertiliser | 673.4 | 0.6 | 729.7 | 0.6 | 709.7 | 0.6 | 729.7 | 0.5 | | iii. Petroleum | 853.8 | 0.8 | 634.3 | 0.5 | 602.7 | 0.5 | 300.0 | 0.2 | Plan expenditure budgeted to decline Plan expenditure is budgeted to decline marginally in 2015-16 over 2014-15 (RE), with a decline of 10.0 per cent in plan revenue expenditure more than offsetting the substantial increase in the capital component. The reduction in plan revenue expenditure is attributable to a reduction of 28.1 per cent in plan grants to States and Union Territories (UTs), consequent to the modification in the centre-state funding pattern with larger devolution of tax revenue to states. Non-plan expenditure growth to moderate in 2015-16 The growth in non-plan expenditure is budgeted to moderate to 8.2 per cent in 2015-16. Subsidies are budgeted to decline by 8.6 per cent to 1.7 per cent of GDP in 2015-16 on account of (i) a reduction of 50 per cent in petroleum subsidy that accrues from the sharp fall in international crude prices and (ii) modest increases of 1.4 per cent and 2.8 per cent, respectively, in food and fertiliser subsidies (Table 3). Food subsidy is budgeted to show only a modest growth in 2015-16, despite the proposed expansion of coverage under the National Food Security Act (NFSA). Realising the budget target would depend on the impact of end-to-end computerisation of public distribution system, decentralisation of procurement and distribution of foodgrains and improving the operational efficiency of FCI. Under fertiliser subsidy, the budgeted provision for indigenous urea has been kept unchanged at 2014-15(RE) level. The achievement of this target would require a new urea pricing policy which periodically adjusts urea prices for cost escalations. III. Resource Transfers to States Resource transfers from Centre to States to increase in 2015-16 Pursuant to the acceptance of Fourteenth Finance Commission (FFC) recommendation to increase the share of tax devolution from 32 per cent to 42 per cent of the divisible pool, the States’ share in central taxes is budgeted to increase by 55 per cent in 2015-16 (BE) over 2014-15 (RE). While gross and net transfers as a ratio to GDP during 2014-15 (RE) have turned out to be lower than budgeted, they are budgeted to increase to 6.0 per cent, each, in 2015-16 (Table 4). | Table 4: Gross and Net Transfers from Centre to States | | (₹ billion) | | Items | 2013-14 | 2014-15 (BE) | 2014-15 (RE) | 2015-16 (BE) | | 1 | 2 | 3 | 4 | 5 | | 1. States' share in Central Taxes | 3,182 | 3,822 | 3,378 | 5,240 | | 2. Non-Plan Grants & Loans | 606 | 700 | 803 | 1,086 | | 3. Central Assistance for State & UT (with Legislature) Plans* | 1,053 | 3,297 | 2,703 | 1,958 | | 4. Assistance for Central and Centrally Sponsored Schemes | 441 | 59 | 46 | 239 | | 5. Total Grants & Loans (2+3+4) | 2,100 | 4,056 | 3,552 | 3,283 | | Grants | 1,989 | 3,935 | 3,432 | 3,157 | | Loans | 111 | 121 | 120 | 126 | | 6. Less-Recovery of Loans & Advances | 101 | 88 | 90 | 93 | | 7. Net Resources transferred to State and UT Governments (1+5-6) | 5,181 | 7,790 | 6,840 | 8,430 | | Gross Transfers / GDP (per cent) | 4.7 | 6.2 | 5.5 | 6.0 | | Net Transfers / GDP (per cent) | 4.6 | 6.2 | 5.4 | 6.0 | | * With effect from 2014-15, funds for centrally sponsored schemes are routed through the state budgets as part of central assistance to state plans. | Consequent to the higher devolution of Union Taxes to the States, the Centre has delinked eight centrally sponsored schemes (CSS) from Central Support, with the States being given the choice to continue them5. However, schemes which represent national priority (such as poverty alleviation programme), schemes mandated by legal obligations and schemes backed by cess collection will continue to get support of the Central Government. In case of other CSS, the centre-state funding pattern will undergo a change with states having to contribute a higher share. These changes in centre-state funding pattern of CSS schemes would result in a reduction in the central assistance to state plans to 1.4 per cent of GDP in 2015-16 (BE) from 2.1 per cent of GDP in 2014-15 (RE). IV. Market Borrowings and Liabilities During 2015-16 (BE), the GFD would continue to be largely financed by market borrowings. The Budget has estimated that out of the total borrowing requirements of ₹5,556 billion, net market borrowings (dated securities and 364-day treasury bills) would finance 83.6 per cent of GFD in 2015-16 as against 90.8 per cent in 2014-15 (RE) (Table 5). In terms of GDP, net market borrowings are budgeted to decline to 3.3 per cent in 2015-16 (3.7 per cent in 2014-15 RE). Interest payments to net tax revenue to decline in 2014-15 Reflecting the fiscal consolidation efforts, total liabilities-GDP ratio of the Central government is budgeted to marginally decline to 46.1 per cent in 2015-16 from 46.8 per cent in 2014-15 (RE). There would be an increase in interest payments to net tax revenue ratio to 49.6 per cent in 2015-16 (BE) from 45.3 per cent in 2014-15 (RE) (Chart 4). | Table 5 : Financing Pattern of Gross Fiscal Deficit | | (Amount in ₹ Billion) | | Items | 2013-14 | 2014-15 (RE) | 2015-16 (BE) | | 1 | 2 | 3 | 4 | | Gross Fiscal Deficit | 5,029 | 5,126 | 5,556 | | (100.0) | (100.0) | (100.0) | | Financed by | | | | | Net Market Borrowings* | 4,756 | 4,655 | 4,645 | | (94.6) | (90.8) | (83.6) | | Other treasury bills | 12 | 389 | 219 | | (0.2) | (7.6) | (3.9) | | Securities against small savings (net) | 124 | 333 | 224 | | (2.5) | (6.5) | (4.0) | | External Assistance | 73 | 97 | 112 | | (1.5) | (1.9) | (2.0) | | State Provident Fund | 98 | 100 | 100 | | (1.9) | (2.0) | (1.8) | | NSSF | 196 | -296 | 0 | | (3.9) | -(5.8) | (0.0) | | Reserve Fund | 35 | -127 | 57 | | (0.7) | -(2.5) | (1.0) | | Deposits and Advances | 255 | 204 | 132 | | (5.1) | (4.0) | (2.4) | | Draw Down of Cash Balances | -191.71 | -157 | 120 | | -(3.8) | -(3.1) | (2.2) | | Others | -329 | -71 | -53 | | -(6.5) | -(1.4) | -(1.0) | *Includes dated securities and 364-day treasury bills taking into account the net impact of buy-back operations.

Note: Figures in parentheses represent percentages to GFD. |

V. Overall Assessment To sum up, the Union Budget for 2015-16 attempts to balance the objective of accelerating growth through higher investment in infrastructure and structural measures while providing enlarged fiscal space to the states through higher devolution of shareable taxes. Successful implementation of proposed measures towards skill development could improve employment generation. In the face of rising NPAs and restructured advances of banks, the proposed bankruptcy code should help bring clarity, predictability, and fairness to the restructuring process. Revenue projections assumed for excise duties would be contingent on a robust manufacturing sector recovery. Steps have also been taken to restructure and rationalise excise duties and service tax rates to pave the way for GST introduction in April 1, 2016. The reliance on disinvestment receipts, however, continues to be high, despite poor marksmanship in attaining set targets in the past. Non-fulfilment of non-debt receipt targets can compromise the envisaged expansion of capital spending, given the deficit targets. Although expenditure on subsidies is budgeted to decline, concrete measures on containing food and fertiliser subsidies through better targeting is required to avoid build up of subsidy arrears. | Statement 1: Budget at a Glance | | (Amount in ₹ billion) | | Items | 2013-14 (Accounts) | 2014-15 (Budget Estimates) | 2014-15 (Revised Estimates) | 2015-16 (Budget Estimates) | Variation in per cent | | Col.4 over Col. 2 | Col. 5 over Col.4 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 1. | Revenue Receipts (i+ii) | 10,147.2 | 11,897.6 | 11,262.9 | 11,415.8 | 11.0 | 1.4 | | | i) Tax Revenue (Net to Centre) | 8,158.5 | 9,772.6 | 9,084.6 | 9,198.4 | 11.4 | 1.3 | | | ii) Non-tax Revenue | 1,988.7 | 2,125.1 | 2,178.3 | 2,217.3 | 9.5 | 1.8 | | | of which: | | | | | | | | | Interest Receipts | 218.7 | 197.5 | 221.7 | 236.0 | 1.4 | 6.5 | | 2. | Capital Receipts | 5,447.2 | 6,051.3 | 5,548.6 | 6,359.0 | 1.9 | 14.6 | | | of which: | | | | | | | | | i) Market Borrowings * | 4,756.3 | 4,813.0 | 4,655.0 | 4,645.3 | -2.1 | -0.2 | | | ii) Recoveries of Loans | 125.0 | 105.3 | 108.9 | 107.5 | -12.9 | -1.2 | | | iii) Miscellaneous Capital Receipts | 293.7 | 634.3 | 313.5 | 695.0 | 6.7 | 121.7 | | 3. | Total Receipts (1+2) | 15,594.5 | 17,948.9 | 16,811.6 | 17,774.8 | 7.8 | 5.7 | | 4. | Revenue Expenditure (i + ii) | 13,717.7 | 15,681.1 | 14,887.8 | 15,360.5 | 8.5 | 3.2 | | | i) Non-Plan | 10,190.4 | 11,146.1 | 11,219.0 | 12,060.3 | 10.1 | 7.5 | | | ii) Plan | 3,527.3 | 4,535.0 | 3,668.8 | 3,300.2 | 4.0 | -10.0 | | 5. | Capital Expenditure (i + ii) | 1,876.8 | 2,267.8 | 1,923.8 | 2,414.3 | 2.5 | 25.5 | | | i) Non-Plan | 870.8 | 1,052.8 | 913.3 | 1,061.7 | 4.9 | 16.3 | | | ii) Plan | 1,006.0 | 1,215.0 | 1,010.5 | 1,352.6 | 0.5 | 33.9 | | 6. | Total Non-Plan Expenditure (4i + 5i) | 11,061.2 | 12,198.9 | 12,132.2 | 13,122.0 | 9.7 | 8.2 | | | of which: | | | | | | | | | i) Interest Payments | 3,742.5 | 4,270.1 | 4,113.5 | 4,561.5 | 9.9 | 10.9 | | | ii) Defence | 2,035.0 | 2,290.6 | 2,223.7 | 2,467.3 | 9.3 | 11.0 | | | iii) Major Subsidies | 2,447.2 | 2,514.0 | 2,539.1 | 2,273.9 | 3.8 | -10.4 | | 7. | Total Plan Expenditure (4ii + 5ii) | 4,533.3 | 5,750.0 | 4,679.3 | 4,652.8 | 3.2 | -0.6 | | 8. | Total Expenditure (6+7=4+5) | 15,594.5 | 17,948.9 | 16,811.6 | 17,774.8 | 7.8 | 5.7 | | 9. | Revenue Deficit (4-1) | 3,570.5 | 3,783.5 | 3,624.9 | 3,944.7 | 1.5 | 8.8 | | | | 3.1 | 2.9 | 2.9 | 2.8 | -9.0 | | | 10. | Effective Revenue Deficit | 2,276.3 | 2,102.4 | 2,305.9 | 2,839.2 | 1.3 | 23.1 | | | | 2.0 | 1.6 | 1.8 | 2.0 | -9.2 | | | 11. | Gross Fiscal Deficit (8-(1+2ii+2iii)) | 5,028.6 | 5,311.8 | 5,126.3 | 5,556.5 | 1.9 | 8.4 | | | | 4.4 | 4.1 | 4.1 | 3.9 | -8.6 | | | 12. | Gross Primary Deficit (10-6i) | 1,286.0 | 1,041.7 | 1,012.7 | 995.0 | -21.3 | -1.7 | | | | 1.1 | 0.8 | 0.8 | 0.7 | | | *Includes Dated Securities and 364-day Treasury Bills, taking into account the net impact of buy-back operations.

Note: Capital Receipts are net of repayments.

Source: Budget documents of the Government of India, 2015-16. |

|