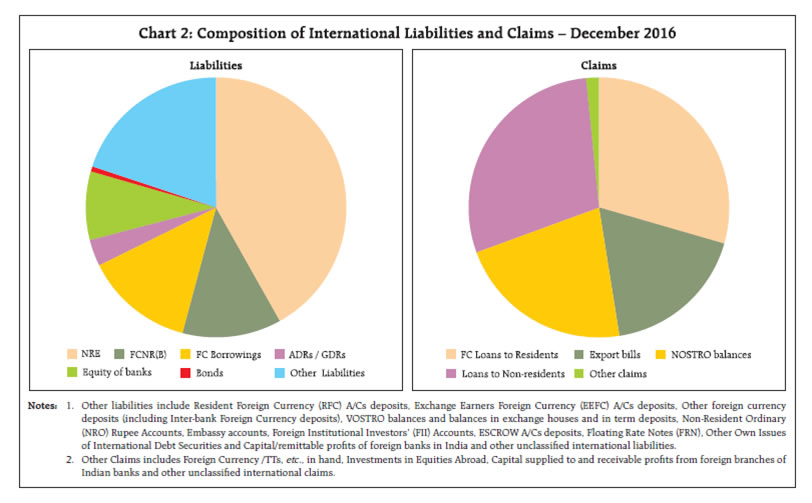

This article presents quarterly movements in (a) international liabilities / claims for the country / sector of customer by instrument and the currency / country of incorporation of reporting bank; and (b) consolidated international claims, according to country / sector of borrower and residual maturity, during the calendar year 20161. International claims derived from balance sheet items as well as off-balance sheet items are also presented. The Reserve Bank compiles international banking statistics (IBS) as a part of the global reporting system of the Bank for International Settlements (BIS) in which detailed information on international assets and liabilities of the banking system are collected for studying global financial inter-linkages. IBS is collected under Locational Banking Statistics (LBS) and Consolidated Banking Statistics (CBS). LBS cover international liabilities and claims by country of immediate borrower, currency, sector, type of instrument/components and nationality of reporting banks. CBS collects information on the consolidated global claims of internationally active banks (headquartered in BIS reporting countries), which include the claims of banks’ foreign affiliates but exclude intra-group positions. They detail the transfer of credit risk from the immediate counterparty to the country of ultimate risk (where the guarantor of a claim resides) including the exposures on derivatives, guarantees and credit commitments. These data are released through the BIS (web-link: www.bis.org/statistics/about_banking_stats.htm?m=6%7C31) and its highlights for 2016 are presented here. The detailed data were released on the Reserve Bank’s website on June 30, 2017. Aggregate International Liabilities and Claims International liabilities of banks in India far exceeded their international claims and claim/liability ratio was in the range of 47.0-54.1 per cent during 2016 (Chart 1). During Q1:2016, there was a surge in both liabilities and assets; while liabilities increased by ₹866 billion (US$12.8 billion) mainly due to rise in non-resident deposits, claims recorded an even higher increase of ₹1,636 billion (US$24.6 billion) on account of build-up of NOSTRO balances and trade credits. Subsequently, the international position re-adjusted and by December 2016, international liabilities of banks in India stood at ₹11,627 billion (US$171.2 billion) whereas their international claims were placed at ₹5,704 billion (US$84 billion).  Non-Resident External Rupee (NRE) deposits, Foreign Currency Non-resident Bank [FCNR(B)] deposits and foreign currency borrowings remained the major liabilities of banks in India whereas foreign currency loans to residents and non-residents, NOSTRO balances and export bills together accounted for over 98 per cent of their claims at the end of 2016 (Chart 2). Nearly 78 per cent of international liabilities and 71 per cent of international claims related to nonbanks (Chart 3). In terms of the currency composition, rupee-denominated non-resident deposits and equity/bonds of banks were mirrored in rupee liabilities constituting 63 per cent at end-2016, followed by the US Dollar (30 per cent) liabilities. Most of the claims were in US Dollar terms, followed by rupee-denominated claims (Chart 4). The Reserve Bank’s swap window that was introduced during September-November 2013 attracted large FCNR(B) inflows of 3-5 years maturity. An overwhelming portion of these deposits were of three-year maturity and redeemed during Q4:2016 (Chart 5). The redemption of FCNR(B) deposits, however, did not bring down the international liabilities of banks; the reduction of ₹1,212 billion in FCNR(B) deposits was excceded by increases in NRE deposits (₹574 billion), foreign currency borrowings (₹287 billion) and NRO deposits (₹60 billion). The redemption, however, brought big changes in the currency composition of FCNR(B) deposits whereby the share of the US dollar declined from 83 per cent to 70 per cent (Chart 6). International liabilities of banks were largely owed to entities in the USA, followed by the UAE and the UK whereas international claims of banks were on Indian entities (mainly due to foreign currency loans to residents), followed by the USA (Chart 7). An analysis of the composition of country of incorporation shows that Indian banks accounted for 79.8 per cent and 78.4 per cent of international liabilities and international claims, respectively. The share of short-term claims in the consolidated international claims of banks, as reflected in CBS, declined to 59.7 per cent at end-2016 from 74.3 per cent a year ago (Statement VII of the web-data release). Nevertheless, as the contribution of India’s IBS in total global cross-border aggregates remains very small (less than one per cent, as per BIS LBS data), India’s international banking exposures do not have a significant impact on the global cross-border liabilities/ claims of banks (Chart 8A & 8B). Global movements are mainly driven by major economies like the USA, the UK, France, Germany and Japan, which together comprise more than half of global cross-border exposures. External Debt versus IBS of India The liabilities side of IBS has a relation with the country’s external debt statistics – debt liabilities of banks under LBS (other than those to the residents) are constituents of external debt but their equity liabilities and their liabilities to residents, if any, are excluded (Annex). The ratio of total international liabilities of banks in India to the country’s external debt ranged between 35.1-38.3 per cent during 2016 (Chart 9).

Annex | Table: Items in International Liabilities in IBS as per BIS definition | | Category | Items in international liabilities of IBS | | I. Items included under External Debt Statistics | 1. Foreign Currency Non-Resident Bank [FCNR(B)] schemes | | | 2. Non-Resident External (NRE) Rupee A/Cs | | 3. Foreign Currency Borrowings (includes Inter-bank borrowings and external commercial borrowings of banks only) other than through ADRs, GDRs, Bonds, etc. | | 4. Bonds | | 5. Floating Rate Notes (FRNs) | | 6. Foreign Institutional Investors’ (FII) A/Cs | | 7. Other Own issues of International Debt Securities | | 8. Non-Resident Ordinary (NRO) Rupee Deposits | | II. Items not included under External Debt Statistics | 1. Embassy A/Cs | | | 2. ESCROW A/Cs | | III. Items not included under External Debt Statistics due to definitional aspects | 1. American Depository Receipts (ADRs) and Global Depository Receipts (GDRs) | Non-Debt Liabilities | | 2. Equities of banks held by NRIs | | 3. Capital of foreign banks/branches in India and certain other items in transition | | 4. Exchange Earners’ Foreign Currency (EEFC) A/Cs | FC Liabilities to Residents | | 5. Resident Foreign Currency (RFC) Deposits | | 6. Inter-Bank Foreign Currency Deposits and other Foreign Currency Deposits of Residents | | 7. Balances in VOSTRO A/Cs of non-resident banks and exchange houses (including term deposits) |

|