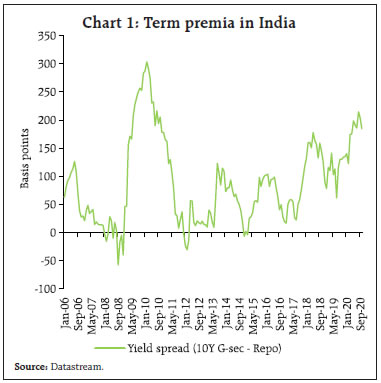

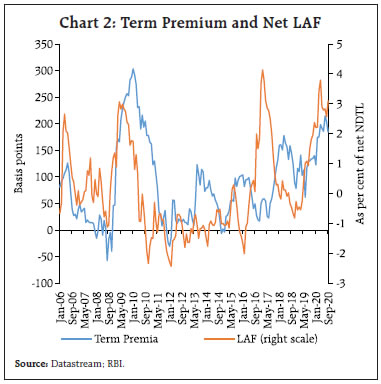

The underlying relationships that drive term premia are complex and constantly shifting. Empirical analysis over the period from January 2006 through September 2020 suggests that global uncertainity and liquidity are the main drivers of the term premium in India. In the wake of the outbreak of COVID-19, superimposed as it were on an economy ensnared in the inertial dynamics of an eight-quarter slowing phase of the underlying economic cycle, and the extraordinary monetary and fiscal policy response, there has been a surge of interest in the behavior of the term premium in the government securities (g-sec) market in India. Stirring this debate are somewhat polar views. At one end, it is argued that the weighted average cost of borrowings by the Central Government during the first half of 2020-21 at 5.82 per cent is the lowest in the last 16 years. The weighted average maturity of the outstanding stock of securities of the centre has also been the highest so far (Das, 2020). At the other end, it is held that India has one of the steepest yield curves in the world. Excessively high long term rates are inflicting damage to the economy by not allowing the easing of policy rates to be transmitted to longer term rates, thereby exacerbating the collapse of investments in the economy (Varma, 2020). Empirical investigations into the factors determining term premia in India have proliferated (Rathi and Pradhan, 2017; Akram and Das, 2019), including in the Reserve Bank of India (RBI) (Dua, Raje and Sahoo, 2003; Kapur, John and Mitra, 2018; Dilip, 2019), as much from the point of view of their central role in influencing the cost of borrowing by the government as in setting the price of issuances of corporate bonds and other financial instruments employed by the private sector to access finance from markets. These findings are, however, relevant in peacetime rather than in the backwash of black swan events like COVID-19. Do catastrophes influence term premia and their underlying determinants? Are term premia influenced by the effects of exceptional policy measures that tend to be taken in these overwhelming times or, do they remain impervious and continue to emit the signals that they typically do when all is well? This is the principal motivation of this article, which hopes to fill a residuary gap in the empirical literature on what causes term premia to behave as they do in highly uncertain times. The rest of the article is organised into three sections. The next section sifts through the stylised facts on recent movements in term premia over space and time, and in relation to factors that influence the g-sec market in India. Section III offers a methodological framework for examining the recent behaviour of term premia and their proximate determinants, and the results therefrom. Section IV concludes the article with some policy perspectives. II. Some Stylised Facts The yield on a long maturity bond is typically the sum of (i) the future short-term interest rate and (ii) the term premium. The first term is the expected return from rolling over a series of short-term bonds with a total maturity equal to that of the long-term bond. In addition, there is the extra return that the investors demand to compensate them for taking additional risks for holding the bond until the maturity or for a longer horizon, as embodied in the second term alluded to earlier (Cohen et al., 2018). The difference between yields on a long-term bond and a short-term bond or the term premium is also regarded as the slope of the yield curve1 - a positive term spread corresponds to an upward sloping yield curve and a negative spread describes an inverted yield curve. Monetary policy wields an important influence on the term premium. In the context of contractionary monetary policy, a rise in the policy rate leads to an increase in short-term interest rates, but longer-term interest rates respond incompletely and with a lag. Hence, the term premium, which is the spread between long-term and short-term interest rates, gets compressed. Conversely, easy monetary policy would lead a rise in the term spread (Estrella, 2005; Estrella and Mishkin, 1997). This phenomenon is observable in India today, as in the rest of the world. The term premium is, however, influenced by a number of other factors as well, such as changes in risk perceptions (De Backer et al., 2019) and expectations – if market participants anticipate an economic boom and higher rates of return on investment, the yield on long-term bonds should rise relative to short-term yields and widen the term premium. The converse would hold in the face of recessionary expectations and flights to safety (Modigliani and Sutch, 1966; Vayanos and Vila, 2009; D’Amico and King, 2013; Bonis et al., 2017). A fall in inflation and easing of inflation expectations can lead to a decline in term premium as agents believe that monetary policy will not need to act in a contractionary manner (Hördahl and Tristani, 2014; Camba-Mendez and Werner, 2017; De Backer et al., 2019). Rise in economic policy uncertainty increases risk and could lead to a rise in the term premium (Leippold and Matthys, 2015). Apart from these factors, the microstructure of the bond market also impacts yields and the term premium. Liquidity in any segment of the bond market impacts its price and thereby the yield (Amihud and Mendelson, 1991, Fleming, 2003, Goldreich et al., 2005; Rathi and Pradhan, 2017). The drying up of liquidity in the longer term segment, for instance, would indicate depressed demand, lower prices and correspondingly higher yields. If yields in other segments remain unaffected, a change in the term premium would occur. Changes in potential output, and the fiscal stance also affect long-term bond yields, leaving short-term yields largely unaffected (Poghosyan, 2014). In India, factors such as turnover in the g-sec market, inflation risk, foreign investment in domestic bonds and policy uncertainty have been found to influence the term pemium (Dilip, 2019). Among other potential drivers of long-term government bond yields, monetary policy action is found to be one of the most important determinants, while the government debt ratio does not have any discernible adverse effect (Akram and Das, 2019). While the impact of monetary policy is found to be strong across the term structure of interest rates, the forward premium, inflation and high powered money lose their statistical significance towards the longer end of the spectrum (Dua and Raje, 2014). Policies on liquidity provision to the banking system as reflected in the net liquidity adjustment facility (LAF) at the RBI can also impact yields at different maturities (Dua, Raje and Sahoo, 2003; Singh, 2011). The size of the government’s market borrowing programme, foreign portfolio investments in the domestic bond market and foreign bond yields are also found to move domestic government bond yields (Kapur, John and Mitra 2018). Financial commentators in mature g-sec markets typically focus on the difference between the 10 year and 2 year bond yields in view of the large amounts of liquidity at both points in the yield curve. In the academic literature, the preference is for the difference between the 10 year yield and a money market rate such as the three-month treasury bill rate because of the latter’s strong predictive power with regard to the monetary policy stance (Bauer and Mertens, 2018). We choose the difference between the 10 year yield and the overnight policy rate as our measure of the term spread, since these are the most liquid points on the yield curve in India and the monetary policy stance is completely captured in the policy rate. It is observed that the term spread peaked in February 2010 in the aftermath of the global financial crisis, with expectations of exit from monetary policy stimulus running high, the expanded volume of market borrowings by the Government of India (GoI) and rising inflation expectations (Chart 1). The term spread eased thereafter, however, and slipped into negative territory by January 2012 on account of sizable open market operations in the form of purchases of g-secs by the Reserve Bank that infused durable liquidity into the system and cooled yields substantially. Moreover, the ceiling for investment in g-secs by foreign portfolio investors was raised by the Reserve Bank, and this had a salutary effect even as inflation expectations moderated somewhat and lifted market sentiment. Between this point and July 2017, the yield spread moved in a narrow range but firmed up from there to peak at 178 basis points in May 2018 on market concerns about the pace of tightening of monetary policy in the US, the unrelenting firming up of international crude prices and higher than expected inflation readings in India. From July 2019 right up to August 2020, the term premium moved up almost uni-directionally by 150 basis points to 215 basis points. During this period, the Reserve Bank reduced its policy rate by a cumulative 250 basis points and since the 10 year yield responds with a lag, this had the effect of widening the spread immediately. Fears of excess supply of paper due to deviations from budgetary targets on account of an expansionary fiscal stance, first in the context of the slowdown in economic activity and then to fight the pandemic, and elevated inflation prints due to supply disruptions brought on by COVID-19 led to the rise in the term premium. The term spread has begun easing from early October 2020 on various measures taken by the Reserve Bank to maintain comfortable liquidity conditions, and assuaging forward guidance that the Reserve Bank stands ready to undertake measures as necessary to assure market participants of access to liquidity and easy financing conditions in keeping with the monetary policy stance (Das, 2020).  Underlying this historical time profile of the term premium are degrees of separation or co-movement, as the case may be, with various underlying indicators identified from the literature. The closest association of the term premium is with liquidity conditions represented by the net position under the RBI’s liquidity adjustment facility (LAF) (Chart 2). With realised inflation, the term premium’s correlation is moderate (0.3); surprisingly, the correlation with inflation expectations of professional forecasters turns out to be perverse in sign and statistically insignificant, suggesting that the bond market is backward looking in its own inflation view, and adapts to inflation prints that are received with a lag of about a month (Chart 3a). The association between the term premium and economic activity proxied by the composite purchasing managers’ index (PMI) is weak (0.1) and statistically insignificant overall; the correlation, however, turns out to be negative and significant since 2012 (Chart 3b). With the supply of paper to the market, represented by the three-month moving average of market borrowings of the Central Government as a ratio of g-sec turnover, the correlation of the term premium is around 0.3, i.e., the same as with realised inflation (Chart 4).  At a global level, the term premium in India exhibits an insignificant correlation with economic policy uncertainty represented by the popular index of global economic policy uncertainty or GEPU (Baker, et al., 2016)2, if the period under consideration is taken from 2006 (Chart 5). From 2012, however, the correlation becomes significant and turns out to be the highest among all the variables taken so far (0.56). This indicates a growing sensitivity of India’s bond market term premium to global spillovers. Cross-country comparison of the recent behavior of yield curves across different advanced and emerging market economies suggest that with the steepening of the yield curve in the aftermath of the COVID-19 pandemic, the term premium has widened sizably across all countries, both emerging and advanced (Chart 6a and 6b). Even though the increase was notable in the case of India, it was found to be lower than several other emerging market economies.

III. Methodology and Empirical Results Two methodological approaches are adopted to empirically investigate the determinants of the term premium in India, based on the stylised facts and the pointers available in the literature. First, an auto regressive distributed lag (ARDL) model is estimated, due to the presence of variables of different orders of integration, but without losing the intrinsic properties of these variables through over-differencing. Second, a restricted vector autoregression (VAR) model is used as a robustness check and to produce a historical decomposition of the term premium.  The variables that have been considered are: (i) the term premium defined as the difference between 10-year G-sec yield and the policy repo rate (Term_ prem); (ii) domestic economic activity represented by the composite PMI; (iii) deviation of CPI inflation (y-o-y) from its target (INFL_gap); (iv) ratio of market borrowings of the GoI to turnover in the g-sec market (GMB); (v) the net liquidity position under the LAF as a ratio of the banking system’s net demand and time liabilities (LAF); and the global policy uncertainty index (GEPU), all for the period January 2006 through September 2020. The variables used in the ARDL model are found to be stationary in levels except the inflation gap or INF_gap (inflation minus target), which is stationary in first difference. The bounds test confirms the presence of a cointegrating relationship between the term premium, economic activity, inflation gap and liquidity conditions (Table 1). The government’s market borrowing does not have statistically significant effects in the long run but in the short-run, it affects the term premium, along with changes in global uncertainty, the inflation gap and economic activity (Table 2). The stability of the parameter estimates is validated by cumulative sum of squares (CUSUM) with a reasonable level of confidence (Chart 7). Other diagnostic tests indicate absence of serial correlation and heteroscedasticity (Table 2). The error correction term (ecm) is also found to be statistically significant with the expected negative sign; however, the small size of the coefficient on the ecm term indicates that any disequilibrium created in the g-sec market takes long time to dissipate. | Table 1: ARDL Bounds Tests for Cointegration | | Function | F-Statistics | | | Term_prem=f( PMI, INFL_gap, LAF) | 6.64* | | | | Critical Bounds | 10% | 5% | 1% | | Lower Bounds | 2.72 | 3.23 | 4.36 | | Upper Bounds | 3.79 | 4.40 | 5.70 | | *: significant at 1% level. |

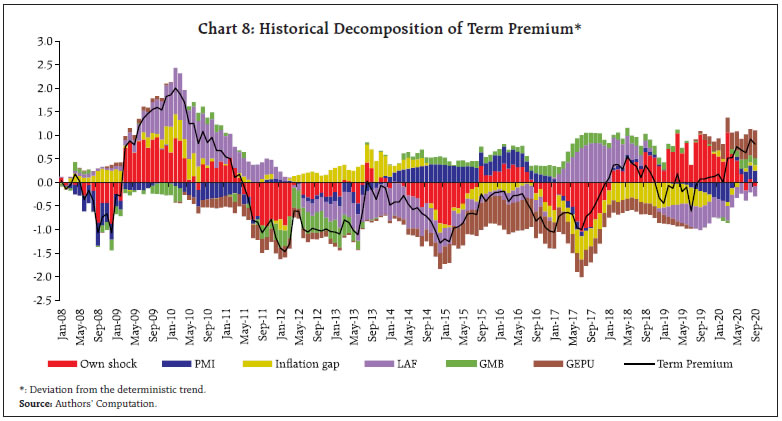

| Table 2: ARDL Results: Long-run and Short-run Estimates | | | Coefficient | P-value | | Long-run estimates | | PMI | -0.159* | 0.011 | | INFL_gap | 0.185* | 0.017 | | LAF | 0.352* | 0.025 | | Short-run estimates | | ΔTerm_prem(-1) | -0.131** | 0.089 | | ∑ΔPMI (0 to -3) | 0.028* | 0.014 | | ∑ΔINFL_gap (0 to -1) | 0.075* | 0.012 | | ∑ΔGMB (0 to -1) | 0.113** | 0.080 | | ΔGEPU (-3) | 0.001*** | 0.118 | | ecm(-1) | -0.083* | 0.000 | | Constant | 0.819* | 0.000 | | Diagnostics: | | Breusch-Godfrey LM test for autocorrelation p-value | 0.211 | | | LM test for autoregressive conditional heteroskedasticity (ARCH) p-value | 0.963 | | | Portmanteau test for white noise p-value | 0.616 | | | ***, **, *: Significant at 15%, 10% and 5% level, respectively. | A restricted VAR3, comprising all the variables used in the ARDL model, is estimated as a robustness check. The results are found to be broadly similar – the sign and magnitude of coefficients in ARDL model are comparable to the direction and size of impulse responses from the VAR. The historical decomposition (Chart 8) of term spread from its’ long term average estimated from the VAR shows that between July 2019 and March 2020, the most recent episode of hardening of the term premium, apart from hysteretic inertia in the g-sec market’s dynamics, global uncertainty was the main driving force, accounting for 90 per cent of the total variation in the term premium. This was followed by the government’s market borrowing (20 per cent). On the other hand, liquidity had a cooling effect, pulling down the term premium and partly offsetting the upside factors (-109 per cent). The slowing down of economic activity in the PMI and the narrowing of the inflation in that period also contributed to lowering the premium (-33 per cent and – 30 per cent, respectively). From April to September 2020, global uncertainty remained the dominant factor (66 per cent), followed by hysteresis (25 per cent), market borrowing (22 per cent) and pick-up in economic activity (19 per cent). Liquidity continued to exercise a calming effect (-32 per cent). Inflation had no contribution to the term premium’s variation in the period of COVID-19.  IV. Conclusion Bond markets evince extreme views. What one stands for depends on where one sits. The underlying relationships that drive term premia are complex and constantly shifting. This is reflected in the burgeoning literature and in day-to-day market movements. Fundamentals and idiosyncratic factors intertwine and the test for the discerning policy maker is to extract signals from noise. This assumes relevance for modern-day monetary policy seeking quick and complete transmission to the longer end to revive the economy while skirting inflation scares. With interest rates at or the near zero lower bound in several advanced economies, whether real or nominal, monetary policy that seeks to compress the term premium and influence the long-term interest rates more directly takes a step into the unknown. Will the provision of extraordinary amounts of liquidity allay high uncertainty? Or will it kindle inflation with no material effects on real activity? Only time will tell. Reference Akram, T., & Das, A. (2019). The long-run determinants of Indian government bond yields. Asian Development Review, 36(1), 168-205. Amihud, Y. and Mendelson, H. (1991), “Liquidity, Maturity, and the Yields on U.S. Treasury Bonds”, The Journal of Finance, 46(4):pp. 1411–1425. Bauer, M.D. and Mertens, T.M. (2018), “Information in the Yield Curve about Future Recessions,” FRBSF Economic Letter, Federal Reserve Bank of San Francisco, No. 2018–20, August 27. Bonis B., J. Ihrig and M. Wei (2017), “The Effect of the Federal Reserve’s Securities Holdings on Longer-term Interest Rates”, Federal Reserve Board of Governors, FEDS Notes, April 20. Camba-Mendez G. and T. Werner (2017), “The Inflation Risk Premium in the Post-Lehman Period”, ECB, Working Paper 2033. Cohen B. H., P. Hördahl and D. Xia (2018), “Term Premia: Models and Some Stylised Facts”, BIS Quarterly Review, September. D’Amico S. and T. B. King (2013), “Flow and Stock Effects of Large-scale Treasury Purchases: Evidence on the Importance of Local Supply”, Journal of Financial Economics, 108(2), 425-448. Das, S. (2020), Governor’s Statement – October 9, 2020, Reserve Bank of India. De Backer, B., Deroose, M., & Van Nieuwenhuyze, C. (2019), “Is a Recession Imminent? The Signal of the Yield Curve”, Economic Review, (i), 69-93. Dilip, A. (2019), “Term Premium Spillover from the US to Indian Markets”, RBI Working Paper Series No. 05, Reserve Bank of India, December. Dua, P., N. Raje and S. Sahoo (2003), “Interest Rate Modelling and Forecasting in India”, Development Research Group Study 24, Reserve Bank of India. Fleming, M. J. (2003). Measuring treasury market liquidity. Economic policy review, 9(3). Goldreich, D., Hanke, B., and Nath, P. (2005). The price of future liquidity: Time-varying liquidity in the us treasury market. Review of Finance, 9(1):1–32. Hördahl P. and O. Tristani (2014), “Inflation Risk Premia in the Euro Area and the United States”, International Journal of Central Banking, 10(3), 1-47. Kapur, M., J. John and P. Mitra (2018). Monetary Policy and Yields on Government Securities, Mint Street Memo No. 16, Reserve Bank of India, December 18. Leippold, M. and F. H. Matthys (2015), “Economic Policy Uncertainty and the Yield Curve”, url: https://www.frbsf.org/economic-research/files/S02_P1_Felix-Matthys.pdf Modigliani F. and R. Sutch (1966), “Innovations in Interest Rate Policy”, The American Economic Review, 56 (1 / 2), 178-197. Poghosyan, T. (2014). Long-run and short-run determinants of sovereign bond yields in advanced economies. Economic Systems, 38(1), 100-114. Rathi, K., & Pradhan, H. K. (2017). Determinants of Yield Spread in the Government of India Bond Markets. Available at SSRN 3104333. Singh, B. (2011), “How Asymmetric is the Monetary Policy Transmission to Financial Markets in India?”, Reserve Bank of India Occasional Papers, 32(2), pp.1-37. Varma, J.R. (2020). Minutes of the Monetary Policy Committee Meeting October 7 to 9, 2020, Reserve Bank of India. Vayanos D. and J.-L. Vila (2009), A Preferred Habitat Model of the Term Structure of Interest Rates, NBER, Working Papers 15487.

|