The sovereign yield curve has a special significance for monetary policy in influencing a wide array of interest rates in the economy. Explicitly integrating macroeconomic variables with latent factors of the yield curve in a dynamic factor model, the results reveal that the level of the yield curve has undergone a downward shift from the second quarter of 2019, reflecting the ultra-accommodative stance of monetary policy. Abundant liquidity is depressing short-term interest rates more than proportionately and steepening the slope of the yield curve, alongside a pick-up in issuances of ultra-long dated paper. Global policy uncertainty impacts the slope and curvature of the yield curve, signifying the rising exposure of bond markets in India to global spillovers. Out of sample forecasts indicate scope for moderation of longer-term yields from current levels. “Financial market stability and the orderly evolution of the yield curve are public goods and both market participants and the RBI have a shared responsibility in this regard.” Shaktikanta Das, October 20201 Towards the close of February and early March 2021, flash bond sell-offs ricocheted across major economies and spilled over to India, steepening sovereign yield curves everywhere. Although the turmoil was short-lived, it dispelled the uneasy calm that had prevailed until then. Bond markets and monetary policy authorities faced off, both disinclined to blink first. For markets, the combination of fiscal stimulus, monetary accommodation, vaccine rollout and the release of pent-up demand translated into upward revisions in growth forecasts and in their train, inflation – the nemesis of bonds – that would force the hand of monetary authorities to abandon ultra-accommodative stances and tighten sooner than later. On the other side, central banks across the world have stressed that they remain committed to accommodation. For them, the stakes are too high to let bond traders’ expectations get ahead of outcomes and undermine the still fragile and painfully extracted economic recovery. In India, the benchmark 10-year yield, which had averaged 5.93 per cent during April 2020 to January 2021 surged to 6.13 per cent on February 2 on the announcement of the market borrowing programme of the central government. Following the announcement of a slew of measures by the Reserve Bank of India (RBI) on February 5, the benchmark yield eased to 5.96 per cent by February 11. Thereafter, global spillovers referred to earlier sparked a stampede; by March 5, the benchmark yield in India had touched 6.23 per cent, but the RBI’s announcements of large-sized operation twists soothed frayed nerves and settled it at around 6.21 per cent on March 9. It has eased considerably since then and was trading range bound around 6 per cent at the time of this article going to print. The sovereign yield curve has a special significance for monetary policy. In fact, in extraordinary times characterised by unconventional monetary policy actions and stances, it is the centrepiece in policy setting. First, with policy rates at the zero bound, the usual channel of monetary policy transmission is dormant. Accordingly, policy makers have sought to leapfrog into the longer end of the interest rate structure in order to influence financial conditions more directly. Second, the sovereign yield curve is the benchmark off which other financial instruments are priced (Das, 2020a). By impacting the yield curve, central banks can influence a wider array of interest rates in the economy and thereby, overall cost conditions. Third, the yield curve offers valuable insights into the behaviour of risk premia, which provides clues as to how monetary policy should respond to these exogenous factors. Fourth, the yield curve embeds expectations about future growth and inflation once risk premia are separated out, and this is a useful guide for the conduct of forward-looking monetary policy. Fifth, for central banks that are also issuers of public debt by mandate, a good understanding of yield curve dynamics helps to place the debt in the market at minimum cost and rollover risk. Finally, policy makers can draw information from the term structure of yields to learn about the market’s expectations of monetary policy. The yield is a combination of the short-term interest rate typically set by the central bank, the expected future short-term interest rate typically embodied in the monetary policy stance, and the term premium. As the term premium is not directly observable, it has to be modelled under some assumptions. Early models were based on the expectations hypothesis of the term structure of interest rates, which posited the yield to be the average expected level of short-term interest rates over the maturity period of the bond (Fisher, 1896; Froot, 1989). There is, however, weak empirical support for the expectations hypothesis (Gürkaynak and Wright, 2012). Another approach is the market segmentation hypothesis which states that long and short-term interest rates are not related to each other and should be viewed separately like items in different markets (Campbell, 1980). Yield curves are determined by supply and demand forces within each market/category of debt security, and the yields for one category of maturities cannot be used to predict the yields for a different category of maturities. The market for each segment derives from specific investor preferences in terms of durations, bond characteristics, and investment habits (Ang and Piazzesi, 2003). The segmented markets hypothesis can at best be used to explain any particular shape of the yield curve, although it fits positive sloping curves the best. It cannot be used, however, to interpret the whole yield curve in whatever shape it may be, and therefore offers no information content during analysis, i.e., by itself, it is not sufficient (Taylor and Masson, 1991; Gürkaynak and Wright, 2012). In the finance literature, factor models are popular and usually impose a no-arbitrage restriction – securities with the same risk characteristics have the same price. In these models, unobserved or latent factors explain the yield structure and they are typically classified as the level, the slope and the curvature. They are, however, bereft of any information on macroeconomic conditions under which yields are known to form. At the other end of the spectrum are models that rely on macroeconomic determinants of the yield curve (Diebold et al., 2006). This article joins a recent and rapidly growing strand in the literature in explicitly integrating macroeconomic determinants into a baseline latent factor model. Seminal work in this field preferred a model in which macroeconomic and financial variables are integrated in order to estimate the yield curve by considering two-way causality – components of yield curve to macroeconomic variables, and vice versa – so that potential bi-directional feedback from the yield curve to the economy and back are nested in the model (Diebold et al., 2006). In this article, we build on this work by incorporating additional macro variables to capture open economy dynamics as well as the RBI’s liquidity and market borrowing strategies. Bayesian methods are applied to estimate the model parameters as they are efficient in dealing with unobserved variables. The results indicate that our hybrid model predicts the observed yields well. They also reveal that the level of the yield curve has undergone a downward shift from the second quarter of 2019, reflecting the impact of ultra-accommodative monetary policy on longer-term yields; however, there has been a steepening of the yield curve due to abundant liquidity depressing short-term interest rates and a pick-up in issuances of ultra-long dated papers. Among other macroeconomic determinants, global policy uncertainty impacts the slope and curvature of the yield curve, signifying the rising exposure of bond markets in India to global spillovers. The rest of the article is organised into four sections. Section II presents some stylised facts on recent yield curve dynamics, and the factors that influence the government securities (g-sec) market in India. Section III discusses a methodological framework to find out the determinants of the yield curve, and the results therefrom are presented in Section IV. Section V concludes the article with some policy perspectives. II. Recent Bond Market Developments Across the world, central banks responded to the outbreak of the COVID-19 pandemic by engendering easy financial conditions through the provision of abundant liquidity via bond purchases and balance sheet policies. As a result, bond yields eased to all-time lows through 2020 and set the stage for record corporate issuances as well as strong rallies in equities. In India, where a similar sequence characterised the interface between markets and the monetary authority, the overriding objective was to prevent financial markets from freezing up and to ensure normal functioning of financial intermediaries; ease the stress faced by households and businesses so as to keep the life blood of finance flowing (Das, 2020b). Accordingly, the RBI carefully steered yields, emphasising an orderly evolution of the yield curve (Das, 2021a). This guidance was reinforced in both primary and secondary market operations by auction cut-offs, devolvements, cancellations and exercise of green shoe options (Chart 1). Borrowing costs in financial markets dropped to their lowest in a decade on the back of policy rate reductions and abundant liquidity. Interest rates on short-term treasury bills, commercial paper (CP) and certificates of deposit (CD) fully priced in the reduction in the policy rate and, in fact, traded below it (Chart 2a). The weighted average cost of borrowings in the gilt market dropped to its lowest level in 16 years (Das, 2020c). Spreads between corporate and g-sec rates were compressed across all maturities and rating categories of corporate bonds (Chart 2b).

II.1 The Global Context As vaccination drives gathered speed and scale in some advanced economies towards the close of 2020, financial markets across the world caught the winds of reflation trade as hopes of a quicker global recovery revived. Equity and credit markets extended gains in spite of stretched valuations, and the return of risk-on sentiments spurred a search for yield as capital flows surged into emerging markets in January 2021 on the back of a weaker US dollar. Market-based inflation expectations hardened and bond markets began to believe that central banks would be forced to normalise, with inflation looking likely to exceed targets substantially as the recovery gained traction. Globally, high uncertainty clouded the outlook for monetary policy and chatter on taper tantrums and failed normalisations of the past rent the air. Subsequently, U.S. treasury yields started rising and surged to their highest level in a year on March 31, 2021. This development spilled over and led to a rise in term premia across the advanced and emerging market economies (Chart 3)2. Among EMEs, the term premium rose to as high as 500 basis points (bps) in South Africa, around 400 bps in Latin America and in the range of 65-300 bps in Asia (225 bps in India). In countries like Japan and Australia where yield control is the dominant objective of monetary policy, term premia have remained low and stable or have declined. II.2 Bond Market Dynamics in India In India, the announcement of the government’s borrowing programme in February was the trigger, but in hindsight, it is evident that the surge in the term premium in the beginning of 2021 was in tandem with the increasing global economic policy uncertainty (Chart 4), pointing to the rising sensitivity of the term premium to global spillovers (Patra et al., 2020). II.3 A Cross-sectional View Investigating the steepening of India’s yield curve cross-sectionally and over time (Chart 5a), it is observed that yields across the maturity spectrum have declined, but more at the short end than at the longer end (Chart 5b). Thus, monetary policy has been effective in pulling down and anchoring short-term interest rates which, in turn, facilitated the easing of rates right up to two years maturity even below the policy rate.

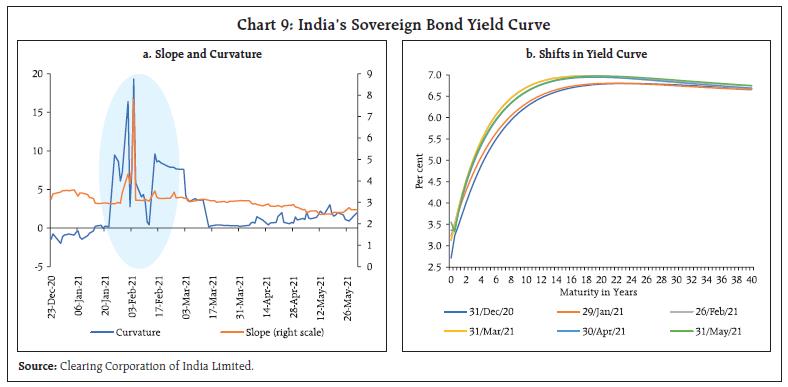

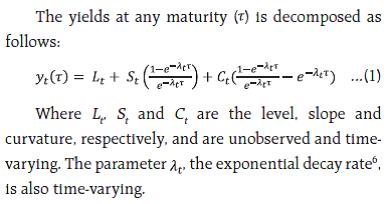

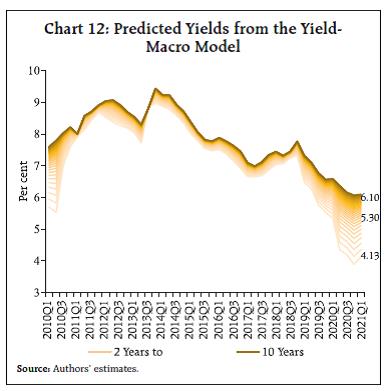

On the other hand, transmission to longer rates was lagged and less complete, leading to an increase in the term premium and a steepening of the yield curve. While the association between central bank liquidity and shorter-term yields shows a distinct inverse relationship, this co-movement is not so clear in the case of longer-term yields (Chart 6). II.4 The Role of Macroeconomic Factors Turning to macroeconomic influences, the yield curve reflects a reasonable degree of co-movement with both inflation and growth expectations. The ebbing of infections between September 2020 and March 2021 fuelled hopes of the resumption of strong and sustained growth, with several rounds of upward revisions to forecasts that were ab initio buoyed by base effects. Inflation expectations also appear to have set a floor to the evolution of yields (Chart 7). II.5 Policy Interventions and the Bond Market Confronted with interrupted transmission, the RBI engaged in large scale open market purchases of government bonds in the secondary market, effectively taking the overload of pandemic-related security issuances by the government on to its balance sheet (Chart 8). With the term premium persisting at levels unacceptable to the RBI – as reflected in frequent cancellations, devolvements, large secondary market operations and forward guidance – it is evident that forces other than monetary policy at work, echoed in a calling out of bond vigilantes (Patra et al., 2021). II.6 Investigating Latent Factors Daily data on the latent factors underlying the yield curve, i.e., level, slope and curvature, are published by the Clearing Corporation of India Limited (CCIL), based on the dominant arbitrage-free class of models (Nelson and Siegel, 1987; Svensson, 1994). These data show that the level of the yield curve, which was broadly stable throughout 2020, shifted upwards during the first week of February 2021, reflecting bond traders’ adverse perceptions about government market borrowings for the year ahead and consequent flush of excess supply of paper into the market. This was also reflected in a coincident steepening of the slope of the yield curve, which turned out to be episodic and could not be sustained in the ensuing period. The RBI’s assurance of the availability of the ample liquidity in the system through announcement of a few additional measures in the form of providing online access to retail investors to the g-sec market directly, on-tap targeted long-term repo operations (TLTRO) liquidity for non-bank financial companies (NBFCs), raising the limit of liquidity access under the marginal standing facility (MSF) for banks, open market operations, operation twists and the large-scale secondary market government securities acquisition programme (GSAP), and reassuring guidance assuaged market sentiment and smoothed liquidity along the curve, resulting in a flattening of the slope. The data also indicate a spike in the curvature in the same episode, as medium-term yields hardened transiently. Again, there was normalisation in the ensuing months. The spikes in all the three latent elements was thus short-lived, and the RBI’s measures helped in shifting the yield curve downward as observed in a decline in level, slope and curvature by 483 bps, 472 bps and 232 bps, respectively, during February 4 and 5 (Chart 9).   III. Model Structure Our estimation framework essentially follows the tradition of the dynamic latent factor approach augmented with macroeconomic variables representing real activity, inflation, and the monetary policy stance (Diebold et al., 2006). In addition, we include global factors, liquidity conditions and government market borrowing programme in the augmented model. We introduce a time-varying structure by allowing the latent variables - level3, slope4, and curvature5 - to follow an autoregressive process, which is preferred in the literature over the random walk process as the latter is a non-stationary progression.  The estimation of the structure of the yield curve and its dynamic interaction with macroeconomic and global variables is carried out by formulating a state-space representation which describes how observable variables relate to the latent variables and how they evolve over time. The measurement equation is formulated by relating the observed yields to the unobserved factors, i.e., level, slope and curvature, in a matrix representation: This is the yield-only model, which we use as a benchmark to evaluate the gains in accuracy when augmenting it with macroeconomic variables described earlier in a yield-macro model (Diebold et al,, 2006). Our model allows the dynamic two-way interaction of macro variables with the structure of the yield curve with feedback. Thus, our dynamic latent factor yield-macro model for estimating the yield curve in India is based on the following set of measurement and transition equations:  Real activity is represented by the output gap (OG), the inflation gap with inflation (INF) measured as seasonally adjusted quarter on quarter changes in the consumer price index (CPI) and monetary policy which is proxied by the weighted average call money rate (WACR) – its operating target. Liquidity conditions or LIQU, are captured by the outstanding absorption/injection under the RBI’s liquidity adjustment facility (LAF) as a proportion to banks’ net demand and time liabilities. The government market borrowing programme is proxied by the market borrowing to market turnover ratio (GMB) and global uncertainty is represented by the Global Economic Policy Uncertainty index (GEPU)7. LIQU, GMB and GEPU are treated as exogenous variables and are assumed to evolve independently of the yield curve factors and other macro developments – they are allowed to affect only the yield curve factors and not the other macro variables directly. The model is estimated by using Bayesian methods which score over other time series approaches in dealing with a large number of parameters over relatively short time periods. The unobservables (latent variables) are filtered out by using a multivariate Kalman filter8. IV. Results The model is estimated for the period spanning the first quarter of 2010 to the corresponding quarter of 2021 on quarterly data on Indian government security yields of maturities of 2 to 10 years. All data are sourced from the Database on Indian Economy (DBIE) of the RBI, except GEPU, which is obtained as discussed in footnote 7. IV.1 Benchmark Estimates In keeping with the finance literature, we estimate the structure of the yield curve by employing the moments of the yield curve distribution – mean; variance - to find the values of its latent factors. We rely on the commonly used empirical proxy for the level, which is the average of short (2 years maturity), medium (7 years) and long (10 years) term yields (Diebold et al,, 2006). The slope is closely linked to the spread and is obtained as the difference between the 10-year and 2-year yields. The curvature can be measured by the difference between twice the medium-term yield and the sum of the short- and long-term yields, i.e., 2Y(7) – {Y(2) + Y(10)}9. These estimates point to a steady softening of the level of the yield curve since 2018:Q4, which indicates that yield curve is shifting downwards coincident with the shift in the monetary policy stance towards accommodation10 (Chart 10). From Q1:2019-20, however, the slope of the yield curve started rising, reflecting successive reductions in the policy rate even with a neutral policy stance, which depressed short-term yields more than proportionately. From Q1:2020-21, the slope of the yield curve started to ease with the deployment of unconventional monetary policy instruments by the RBI that resembled balance sheet policies adopted by systemic central banks. Synchronously, with both short-term and long-term yields softening, the curvature has increased, reflecting the relative inflexibility of the intermediate segment of the yield curve, which is essentially populated by off-the run securities. IV.2 The Yield-Macro Model Moving away from pure ‘technicals’ to a more fundamental view of the yield curve that is informed by underlying macroeconomic conditions, we estimate the system of equations (4 and 5) in a Bayesian framework. It enables to incorporate the probability of an event based on previous knowledge of the conditions associated with it. We choose to work with relatively weak priors – we assume that the parameters vary in a wide range as we are less confident of the value of the parameters a priori. We assume that all the parameters follow normal distributions and standard deviations of the shocks follow inverse gamma distributions that are generally adopted in the literature. The long-run or steady state values of variables are obtained by solving a Newton-type algorithm11. The unobservables, including the level, slope, curvature and exponential decay parameter are extracted by using a multivariate Kalman filter, which produces estimates of unknown variables that tend to be more accurate relative to univariate filters, especially when multiple latent factors and macroeconomic determinants are being used simultaneously. The estimation is carried out in the IRIS toolbox of the Matlab software. | Table 1: Yield-Macro Model Performance | | Maturity (Years) | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Average | | Average Error (bps) | -1.86 | -5.54 | -3.09 | -0.36 | 1.60 | 2.00 | 1.44 | -8.42 | -9.15 | -2.60 | | SD of Error (bps) | 9.91 | 6.39 | 5.97 | 6.99 | 10.78 | 11.79 | 13.73 | 11.98 | 12.63 | 10.02 | | RMSE (bps) | 9.97 | 8.40 | 6.67 | 6.92 | 10.78 | 11.83 | 13.65 | 14.53 | 15.49 | 10.92 | | PRMSE (Per cent) | 1.39 | 1.15 | 0.90 | 0.92 | 1.41 | 1.54 | 1.77 | 1.90 | 2.02 | 1.44 | | Note: The means and standard deviations of the measurement error and RMSEs are expressed in basis points, for yields of various maturities measured in years. | The in-sample predictive power of the estimated model is high as revealed by low average standard deviation of errors (ranging between 6 bps and 14 bps across various maturities), low average root mean square error (RMSE) of 11 bps, average percentage RMSE (PRMSE) of only 1.44 per cent and average errors in each of the maturities (2 – 10 years) varying between (-) 9 bps and 2 bps. Thus, the model is able to predict observed yields well. (Table 1). The estimated level, slope and curvature from the yield-macro model validate the empirical proxies defined in the beginning of this section (Chart 11). The level of the yield curve has declined gradually from about 8 per cent in 2018 to about 6 per cent in 2020, reflecting the credibility bonus accruing to the RBI from maintaining the inflation target and anchoring inflation expectations, and explicit forward guidance on sustained accommodation. On the other hand, both slope and curvature have moved up, mainly on account of the fall in short-term interest rates being larger than the decline in long-term rates on account of aggressive cuts in the policy rate by the RBI, initially leaning against the wind counter-cyclically and followed by the pandemic response. Correlations between the latent factors obtained from the yield-macro model and the empirical proxies are all statistically significant at 1 per cent level - 0.98 for the level; 0.57 for the slope; and 0.41 for the curvature – lending robustness to our estimates. The estimated model can also be used to simulate yields of different maturities (Chart 12). The increase in spreads and decadal low long-term rates in the recent past are identified by the model. A comparison between the yield curve estimated within the sample from the yield-macro model and that obtained from the yield-only model reveals a stark and noteworthy insight – in Q1:2021, the yield curve estimated from the yield-macro model is placed lower than that of the yield-only model by as much as 17 bps for the 10-year maturity (Chart 13). The out of sample forecasts of the yield curve for the second quarter of 2021 suggest a further moderation in yields in the medium to long maturity, with the benchmark 10-year yield is estimated at 5.87 per cent (Table 2). This underscores the importance of considering macroeconomic determinants in an unbiased assessment of the shape of the yield curve in India.   As Table 2 shows, estimates of the yield curve drawn from the yield-only model tend to fit the data well within-the-sample, but do not provide any insights into the underlying behavior of the latent factors. Furthermore, precision tend to decay out of sample as these estimates are bereft of macroeconomic underpinnings. In the face of the exceptional circumstances like the pandemic, idiosyncratic market behaviour tends to disproportionately influence out-of-sample estimation results from the yield-only model. Impulse responses of the latent factors to a unit shock to the macroeconomic variables depicts their interactions, enabling an empirical evaluation of the priors available in the literature (Chart 14). | Table 2: Model based Yield Forecasts | | (Per cent) | | Maturity (in Years) | Actual Q1:2021 | In Sample Forecasts for Q1:2021 | Out of Sample Forecasts for Q2:2021 | Q3:2021 | | Yield Only Model | Yield-Macro Model | Yield Only Model | Yield-Macro Model# | Yield-Macro Model | | 2 | 4.41 | 4.12 | 4.13 | 4.95 | 4.46 | 4.86 | | 3 | 4.91 | 4.93 | 4.87 | 5.47 | 4.99 | 5.26 | | 4 | 5.31 | 5.39 | 5.30 | 5.76 | 5.29 | 5.49 | | 5 | 5.73 | 5.68 | 5.56 | 5.95 | 5.48 | 5.64 | | 6 | 6.01 | 5.88 | 5.74 | 6.07 | 5.61 | 5.73 | | 7 | 6.21 | 6.02 | 5.87 | 6.16 | 5.70 | 5.80 | | 8 | 6.31 | 6.13 | 5.97 | 6.23 | 5.77 | 5.86 | | 9 | 6.22 | 6.21 | 6.04 | 6.28 | 5.82 | 5.90 | | 10 | 6.26 | 6.27 | 6.10 | 6.32 | 5.87 | 5.93 | | #: For Q2 and Q3: 2021, out-of-sample forecasts are generated by using the RBI’s forecasts for GDP growth and inflation and assuming the average levels of LAF, GMB and GEPU observed up to May to prevail. |

A decline in the policy rate has an immediate positive impact on the slope of the yield curve as the impact of the policy rate change is swiftly and completely transmitted to short-term maturities, causing the yield curve to become steeper (Chart 14a). This is in line with the cross-country experience (Vargas, 2005; Diebold et al., 2006; Fan and Johansson, 2010). When liquidity increases by one percentage point (ppt)12, the level of the yield curve declines by 5 bps, accompanied by a reduction in the slope by 16 bps. The increase in liquidity has a cooling effect across the yield spectrum, but with a relatively larger impact on the long-term rates: by reducing the risk premium, the injection of liquidity flattens the yield curve. The impact of liquidity on the curvature is unambiguous, producing a steepening of the yield curve in the medium to long-term segment as off-the-run securities turn increasingly illiquid (Chart 14b). A one percentage point change in inflation relative to the target changes the level of the yield curve by 13 bps as expectations of market participants about future interest rates adapt in response. The slope also adjusted by 28 bps, indicating that long-term rates respond relatively more aggressively to inflation developments (Chart 14c). If the output gap reduces by one percentage point and turns negative under the impact of a shock, it reduces the level and curvature and increases the slope, mimicking the response of the yield curve to a reduction in the policy rate (Chart 14d). An increase in GEPU by 10 percentage points raises the slope by 12 bps - global policy uncertainty raises risk premia. The rise in the slope can be interpreted as either agents’ expectation of an accommodative policy response (as in the case of the COVID-19 pandemic) or hardening of long-term interest rates in response to excessive uncertainty. The curvature also increases in response to heightened uncertainty and is reflected in a steepening of the yield curve at the short- to medium maturity segment (Chart 14e). An increase in government market borrowing (0.1 ppt increase in turnover ratio) has a positive impact on the level, raising it by 7 bps, but it has a minimal impact on the slope and the curvature – because the expansion in the borrowing programme increases yields across the spectrum (Chart 14f). V. Conclusion In these extraordinary times, recent developments in gilt markets in India as well as in the rest of the world present a term premium conundrum. Market participants sneeze when large government borrowing programmes are announced and/or when their inflation expectations are aroused. Central banks struggle to prevent them from catching a cold by taking down policy rates to as low as they can, even to the zero bound and below. They also undertake open market operations that inject liquidity and take out bonds from market turnover. They relieve supply pressures in the market at the cost of bloating their own balance sheets, warranting additional provision for market risk. Central banks also provide calming communication that assure ‘low’ and ‘ample’ for longer as they look through inflation fears on their path of reviving economic growth. Without a doubt, it takes at least two views to make a market and derive efficient outcomes. In the recent period, however, when market processes of price discovery and efficient resource allocation have been overwhelmed by the pandemic, the search for cooperative solutions is often sacrificed at the altar of face offs. Market participants seek to outguess and front run central banks who, on their part, believe that markets are idiosyncratic and have to be intervened to produce competitive outcomes. To summarise the lessons gleaned, -

When the traditional channels of transmission of monetary policy are frozen because of risk aversion and absent demand, central banks have to turn to market-based channels of transmission to ensure congenial financial conditions for the recovery. In such situations, the gilt yield, off which other financial instruments are priced, becomes a variable that it is more important for monetary policy than debt management, and hence, macroeconomic conditions should be taken into account in any assessment of the level, slope and curvature of the yield curve. -

Monetary policy is a potent instrument for influencing the term structure of interest rates - policy rate changes tend to impact the slope of the yield curve, while liquidity impacts the level as well as the slope of the yield curve, rendering it a better instrument for managing the yield curve. -

Managing inflation expectations, including through effective communication, should be part of any strategy to manage the yield curve, since changes in inflation expectations impact the level, slope and curvature of the yield curve and can counteract the monetary policy stance. -

The empirical results obtained in this paper indicate that a yield-only model tends to overpredict the level of yields across the spectrum except 6-8 years maturities segment (Table 2; Annex). Comparing actual yields for Q2:2021 (up to June 10) with the forecasts, the yield-macro model point to the scope for yields to adjust upwards by 1-23 bps in the 2-3 years maturity segment and downwards by 39-56 bps in the 6-9 years segment. It finds the 5-year yield to be fairly valued and the 10-year yield converging to fair value in Q2:2021. In Q3 (July-September 2021), the estimates show that there is further scope for the 10-year yield to ease from current levels. These evolving yield curve dynamics suggest the scope for open market operations and the points on the yield curve to which they need to be targeted.

Annex

References Ang, A., and Piazzesi, M. (2003). A No-arbitrage Vector Autoregression of Term Structure Dynamics with Macroeconomic and Latent Variables. Journal of Monetary Economics, 50(4), 745-787. Campbell, T. S. (1980). On the Extent of Segmentation in the Municipal Securities Market. Journal of Money, Credit and Banking, 12(1), 71-83. Das, S. (2019). Statement by Governor - Sixth Bi-monthly Monetary Policy Press Conference for 2018-19, February, Reserve Bank of India. Das, S. (2020a). Governor’s Statement, December 4, 2020, Reserve Bank of India. Das, S. (2020b). Governor’s Statement, August 6, 2020, Reserve Bank of India. Das, S. (2020c). Governor’s Statement, October 9, 2020, Reserve Bank of India. Das, S. (2021a). Governor’s Statement, February 5, 2021, Reserve Bank of India. Das, S. (2021b). Edited Transcript of Reserve Bank of India’s Monetary Policy Press Conference, June 04, Reserve Bank of India. Diebold, F. X., and Li, C. (2006). Forecasting the Term Structure of Government Bond Yields. Journal of Econometrics, 130(2), 337-364. Diebold, F. X., Rudebusch, G. D., and Aruoba, S. B. (2006). The Macroeconomy and the Yield Curve: A Dynamic Latent Factor Approach. Journal of Econometrics, 131(1-2), 309-338. Fan, L., and Johansson, A. C. (2010). China’s Official Rates and Bond Yields. Journal of Banking and Finance, 34(5), 996-1007. Fisher, I. (1896). Appreciation and Interest. Publications of the American Economic Association, 11, 21-29. Froot, K. A. (1989). New Hope for the Expectations Hypothesis of the Term Structure of Interest Rates. The Journal of Finance, 44(2), 283-305. Gürkaynak, R. S., and Wright, J. H. (2012). Macroeconomics and the Term Structure. Journal of Economic Literature, 50(2), 331-67. Nelson, C. R., and Siegel, A. F. (1987). Parsimonious Modeling of Yield Curves. Journal of Business, 60(4), 473-89. Patra, M.D., Behera, H. and John, J. (2020). Revisiting the Determinants of the Term Premium in India. RBI Bulletin, Reserve Bank of India, November. Patra, M.D., et al. (2021). State of the Economy. RBI Bulletin, Reserve Bank of India, May. Taylor, M.P. and Masson, P.R. (1991). Modelling the Yield Curve. IMF Working Paper, December. Svensson, L. E. (1994). Estimating and Interpreting Forward Interest Rates: Sweden 1992-1994. NBER Working Paper, No. w4871, National Bureau of Economic Research. Vargas, G. A. (2005). Macroeconomic Determinants of the Movement of the Yield Curve. MPRA Working Papers, March.

|