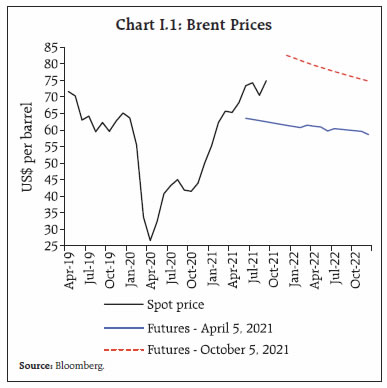

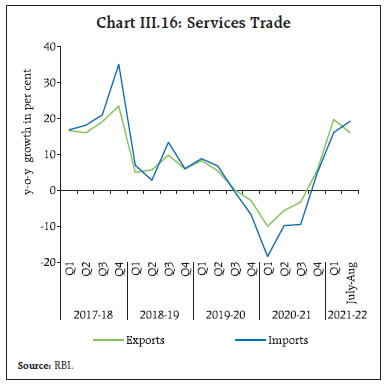

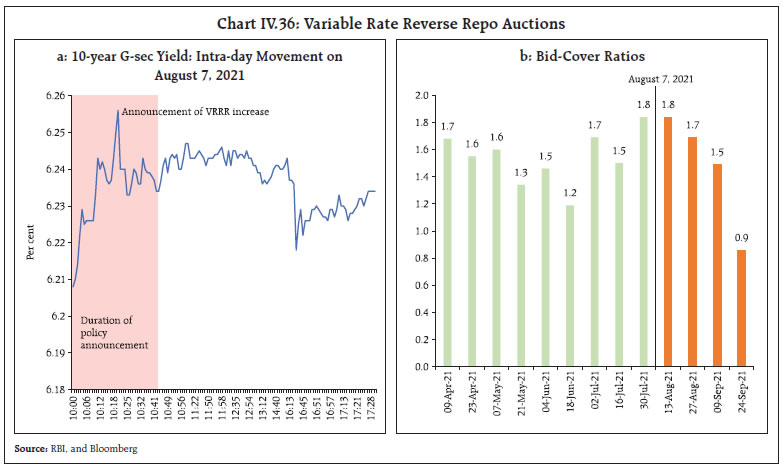

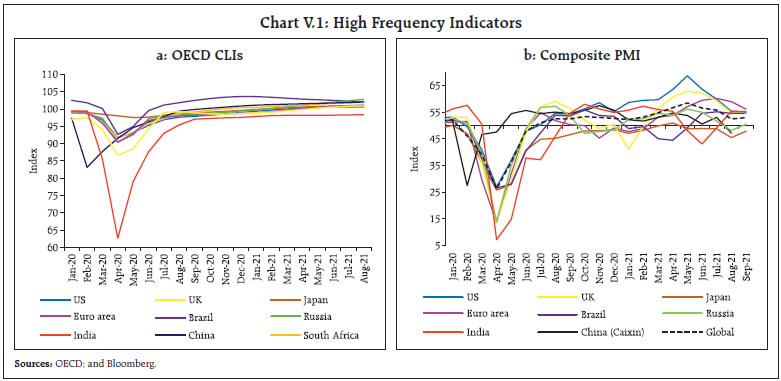

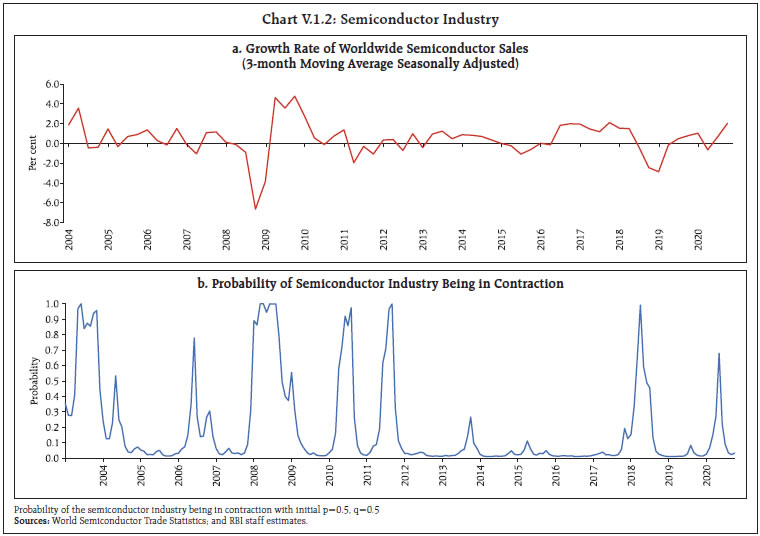

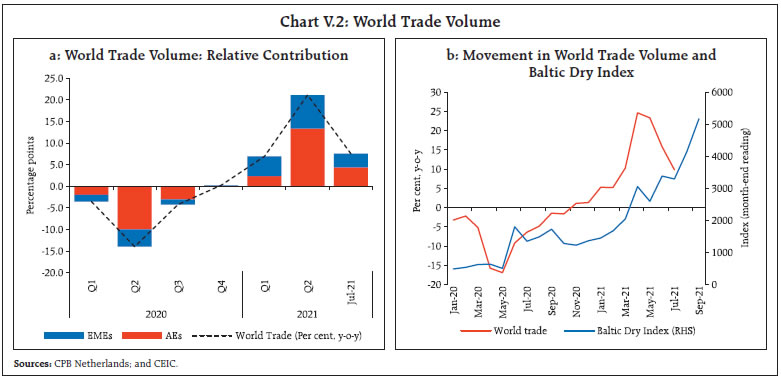

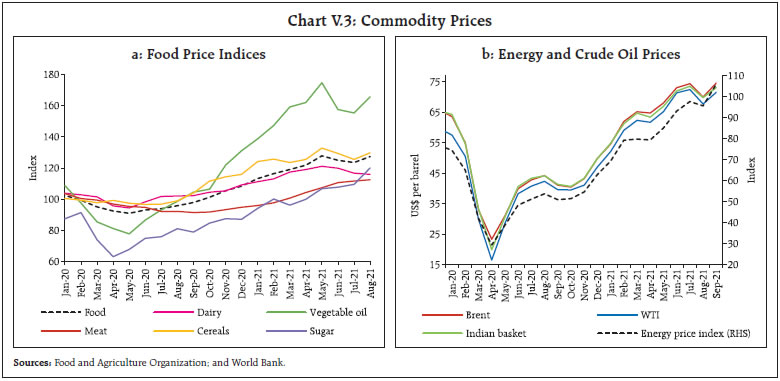

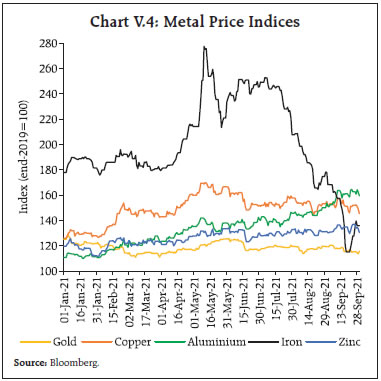

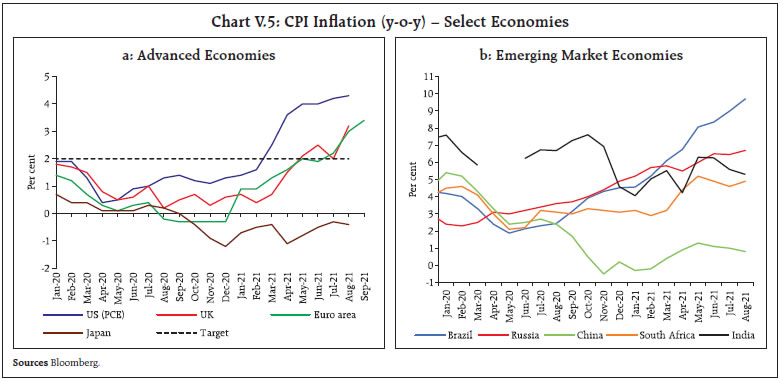

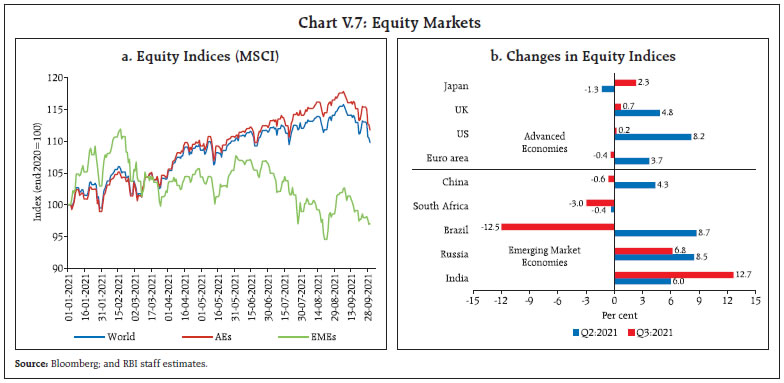

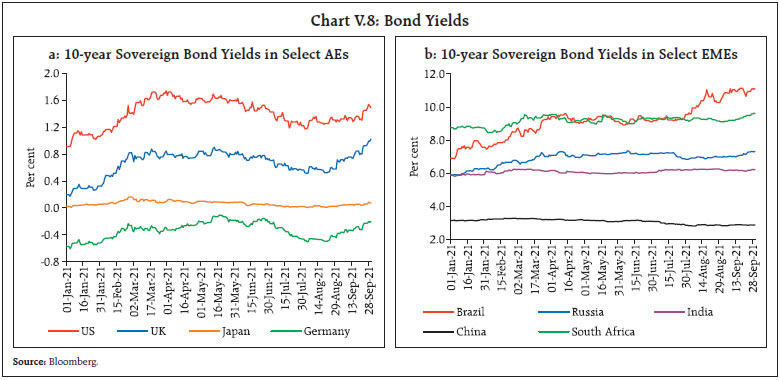

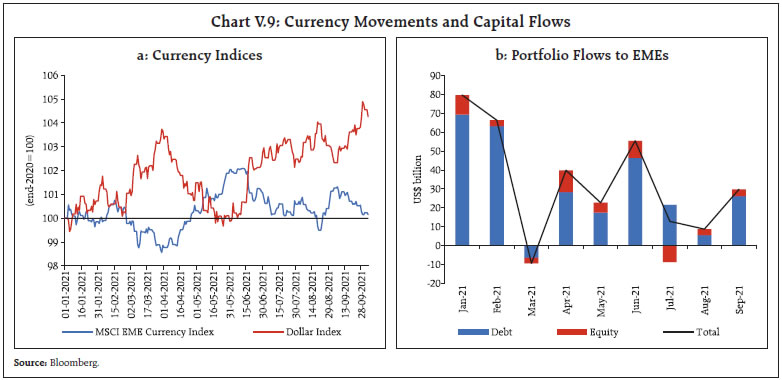

| I. Macroeconomic Outlook Domestic economic activity is normalising after the ferocious second wave retarded momentum. The outlook remains overcast by the future path of the pandemic; the accelerated pace of vaccination and release of pent-up demand provide an upside to the baseline growth path. Headline inflation has fallen back into the tolerance band and the trajectory is expected to be driven by supply-side factors. A faster resolution of supply chain disruptions, good foodgrains production and effective supply management could cause inflation to undershoot the baseline, contingent on the evolution of the pandemic and the efficacy of vaccines. In the months following the retention of the inflation target at 4 per cent with a +/- 2 per cent tolerance band around it for the period 2021-26 by the Government of India (GoI) on March 31, 2021, the monetary policy framework faced a testing challenge from a shock price spike in May 2021. In addition to pandemic-induced disruptions that shaped the trajectory of inflation during the first wave, spillovers from the hardening of commodity prices, especially of crude and edible oil, propelled headline inflation above the upper tolerance band. The episode was short-lived though and inflation has fallen back into the tolerance band. The monetary policy committee (MPC) decided to look through this shock, reading it as supply-driven and transitory. In its meetings in June and August, the MPC maintained status quo on the policy rate and committed to remain accommodative as long as it takes to revive and sustain growth and mitigate the impact of the pandemic on the economy. Developments in the real economy in the first half of 2021-22 have vindicated this stance – shorn of statistical base effects, aggregate demand trails below pre-pandemic levels and considerable slack still prevails in the economy, especially in contact-dependent sectors that faced the brunt of the pandemic. In the second quarter of 2021-22, however, a hesitant recovery is underway, nurtured by the appreciable decline in infections, the stepping up of the scale and speed of vaccinations, and the congenial financial conditions engendered by monetary policy. I.1 Key Developments since the April 2021 MPR Since the release of the April 2021 Monetary Policy Report (MPR), the global macroeconomic environment has been unsettled by diverging paths of economies across the world, between advanced and emerging economies and also among them, mainly differentiated by vaccine access. This is reflected most vividly in monetary policy actions and stances, with some of them staying the course of remaining accommodative and supporting growth and others pre-emptively tightening monetary policy on the assessment that inflation presents a bigger risk. Decoupling of growth paths and the disconnect in monetary policy responses pose downside risks to the global recovery, which already appears to be losing steam. Global economic conditions are also besieged by the resurgence of inflation across the world. Some central banks, mostly in advanced economies (AEs), have judged the rise in inflation as transitory, while some others, mostly in emerging market economies (EMEs) regard breaches of upper tolerance bands as unacceptable and growth threatening. Financial markets are trying to second-guess the commencement of normalisation. Episodic shifts in risk appetite have rendered equity markets frothy with stretched valuations, with intermittent flights into and out of the safety of bonds. Meanwhile, EMEs are awash with capital flows and rotations thereof on taper talk and carry trade and currencies have turned volatile as a result. Several countries that had unlocked their economies and encouraged mobility have faced renewed surges of infections from the Delta variant of the virus, which has turned the evolving global outlook highly uncertain and fragile. Global growth has been supported by strong external demand on the back of buoyant merchandise trade. The World Trade Organization’s (WTO) goods trade barometer hit a high in June 2021 reading. The 20-point year-on-year (y-o-y) rise in the index reflects both the strength of the recent trade expansion and the depth of the pandemic-induced shock in 2020. Worryingly, though, the rate of increase in the index has started to come off, presaging a peaking of the upward momentum in world trade. Container shortages, increased port turnover time and three major shipping alliances controlling much of the supplies have resulted in a jump in freight rates putting the sustainability of the global trade expansion at risk. Services trade continues to lag merchandise trade, with significant contraction in international travel services, although in Q2 some improvement is evident, including through revenge tourism, and increase in transport and other goods related services boosted by demand for goods and freight rates. In India, the recovery that was taking hold from the second half of 2020-21 was disrupted by the second wave of COVID-19 in the weeks following the release of the April 2021 MPR. Although the ferocity of the second wave was not anticipated, the loss of output was about 40 per cent less than during the first wave, as adaptation to pandemic protocols limited restrictions to localised and region-specific containment measures instead of the nation-wide lockdown that was enforced during the first wave. Nevertheless, inflationary pressures became accentuated, as set out earlier, with erosion in fiscal positions. Against this backdrop, the pace of domestic economic activity in Q1:2021-22 (April-June) turned out to be somewhat weaker than anticipated in the April MPR and remained below 2019-20 levels. High frequency indicators of activity suggest that the economy may be pulling out of the second wave’s impact, but uncertainty about the incidence of the third wave makes the outlook fraught with risks. Thus, the pandemic continues to have an overwhelming influence on global and domestic macroeconomic conditions. Virus mutations threaten the progress made through vaccinations and medical responses. Infections keep flaring up in various geographies, forcing authorities to re-impose restrictions/lockdowns restraining economic activity. At the same time, greater adaptability, rising vaccination coverage and continuation of policy support are working towards mitigating the effects of new waves of the pandemic. Equal and universal vaccination holds the key to a brighter outlook, both globally and domestically. Monetary Policy Committee: April-September 2021 During April-September 2021, the MPC met thrice. In the April meeting, the MPC noted that supply side pressures on inflation could persist while demand-side pull remains moderate. On the gross domestic product (GDP) growth outlook, the jump in COVID-19 infections in certain parts of the country and the associated localised lockdowns were seen as dampening the demand for contact-intensive services, restraining growth impulses and prolonging the return to normalcy. In such an environment, the MPC observed that continued policy support remained necessary and unanimously voted to keep the policy repo rate unchanged and to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remained within the target going forward. In the June 2021 meeting, the MPC observed that the rising trajectory of international commodity prices, especially of crude, together with logistics costs, posed upside risks to the inflation outlook with weak demand conditions tempering the pass-through to core inflation. On the growth outlook, the MPC noted that the second wave of COVID-19 had altered the near-term outlook, and policy support from all sides – fiscal, monetary and sectoral – was required to nurture recovery and expedite return to normalcy. Accordingly, the MPC decided unanimously to maintain status quo on the policy repo rate and continue with the accommodative stance. When the MPC met in August, headline inflation had breached the upper threshold for the second month in succession in June due to strong momentum in the May print running across all the major sub-groups. The MPC assessed that the inflationary pressures were largely driven by transitory supply shocks while stressing that it was conscious of its objective of anchoring inflation expectations. On growth, the MPC noted that the outlook for aggregate demand was improving, but it was still weak and there was a large amount of slack in the economy, with output below its pre-pandemic level. It judged that the nascent and hesitant recovery needed to be nurtured. Accordingly, the MPC decided unanimously to keep the policy repo rate unchanged and on a 5 to 1 majority to continue with the accommodative stance. The MPC’s voting pattern on the policy repo rate setting during H1:2021-22 reflected broader unanimity in members’ assessments and expectations, mirroring the voting outcomes in a number of other central banks (Table I.1). Macroeconomic Outlook Chapters II and III analyse the macroeconomic developments during H1:2021-22 (April-September). For the updated projections set out in this Chapter, the evolution of key macroeconomic and financial variables over the past six months warrants revisions in the baseline assumptions as set out below (Table I.2). | Table I.1: Monetary Policy Committees and Policy Rate Voting Patterns | | Country | Policy Meetings: April - September 2021 | | Total meetings | Meetings with full consensus | Meetings without full consensus | Variation in policy rate (basis points) | | Brazil | 4 | 4 | 0 | 350 | | Chile | 4 | 4 | 0 | 100 | | Colombia | 4 | 1 | 3 | 25 | | Czech Republic | 4 | 1 | 3 | 125 | | Hungary | 6 | 6 | 0 | 105 | | India | 3 | 3 | 0 | 0 | | Israel | 4 | 2 | 2 | 0 | | Japan | 4 | 0 | 4 | 0 | | South Africa | 3 | 3 | 0 | 0 | | Sweden | 3 | 3 | 0 | 0 | | Thailand | 4 | 3 | 1 | 0 | | UK | 4 | 4 | 0 | 0 | | US | 4 | 4 | 0 | 0 | | Sources: Central bank websites. | First, global crude oil prices have hardened substantially since the April MPR on the back of a rebound in demand and regulated production by the Organization of the Petroleum Exporting Countries (OPEC) plus. Crude prices initially eased from July 2021 highs on the back of the decision by OPEC plus to increase production by 0.4 million barrels per day on a monthly basis starting August and the moderation in demand due to renewed surge in COVID-19 infections. Crude prices, however, hardened again in August-September on supply disruptions due to hurricanes and fall in inventories. Taking into account these developments, crude prices (Indian basket) are assumed at US$ 75 per barrel in the baseline, 16 per cent above the April 2021 MPR baseline (Chart I.1). | Table I.2: Baseline Assumptions for Projections | | Indicator | MPR April 2021 | MPR October 2021 | | Crude Oil (Indian basket) | US$ 64.6 per barrel during 2021-22 | US$ 75 per barrel during H2:2021-22 | | Exchange rate | ₹72.6/US$ during 2021-22 | ₹74.3/US$ during H2:2021-22 | | Monsoon | Normal for 2021 | 1 per cent below long-period average | | Global growth | 5.5 per cent in 2021

4.2 per cent in 2022 | 6.0 per cent in 2021

4.9 per cent in 2022 | | Fiscal deficit (per cent of GDP) | To remain within BE 2021-22

Centre: 6.8

Combined: 10.8 | To remain within BE 2021-22

Centre: 6.8

Combined: 10.2 | | Domestic macroeconomic/ structural policies during the forecast period | No major change | No major change | Notes: 1. The Indian basket of crude oil represents a derived numeraire comprising sour grade (Oman and Dubai average) and sweet grade (Brent) crude oil.

2. The exchange rate path assumed here is for the purpose of generating the baseline projections and does not indicate any ‘view’ on the level of the exchange rate. The Reserve Bank is guided by the objective of containing excess volatility in the foreign exchange market and not by any specific level of and/or band around the exchange rate.

3. BE: Budget estimates.

4. Combined fiscal deficit refers to that of the Centre and States taken together.

Sources: RBI estimates; Budget documents; and IMF. | Second, the nominal exchange rate (the Indian rupee or INR vis-à-vis the US dollar) has exhibited two-way movements in a range of INR 72-75 per US dollar since April 2021. After depreciating in early-April on concerns about the economic fallout from the second wave, the INR remained under appreciating pressures until May 2021. It depreciated again in June on a strengthening US dollar and rising crude oil prices. The INR appreciated in August with the resumption of portfolio flows, but this was reversed in September. Taking these developments into consideration, the exchange rate is assumed at INR 74.3 per US dollar in the baseline as against INR 72.6 in the April MPR.  Third, the strength of global growth and external demand has been stronger than the April MPR baseline, albeit with some loss of momentum in recent months over renewed infections and persisting global supply-demand imbalances in key inputs such as chips and semiconductors (Chapter V). Growth prospects of AEs have improved significantly on better vaccine coverage and higher fiscal support relative to emerging market and developing economies (EMDEs) (Chart I.2). After a strong rebound in Q1:2021, the pace of expansion in global merchandise trade has slowed, weighed down by elevated shipping charges and logistics costs. The global manufacturing purchasing managers’ index (PMI) remained in expansion at 54.1 in September 2021, unchanged from August's six-month low as supply chain issues continued to hinder output growth. I.2 The Outlook for Inflation Consumer price index (CPI) inflation breached the upper tolerance threshold of 6 per cent in May and June 2021 driven by supply-side pressures in food, fuel and core inflation. In August 2021, inflation eased to 5.3 per cent, aided by a moderation in momentum and favourable base effect. Looking ahead, the three months and one year ahead median inflation expectations of urban households fell by 50 basis points (bps) and 60 bps, respectively, in the September 2021 round of the Reserve Bank’s survey, tracking actual inflation dynamics.1 The proportion of respondents expecting the general price level to increase by more than the current rate decreased for three months ahead horizon but increased for one year ahead horizon vis-à-vis the previous round (Chart I.3). Manufacturing firms polled in the July-September 2021 round of the Reserve Bank’s industrial outlook survey expect the cost of raw materials and selling prices to rise further in Q3:2021-22 (Chart I.4).2 Service sector companies participating in the services and infrastructure outlook survey also expect further rise in input cost pressure and selling prices in Q3:2021-22.3 According to the respondents in the manufacturing and services PMIs, input and output price pressures persisted in September 2021.

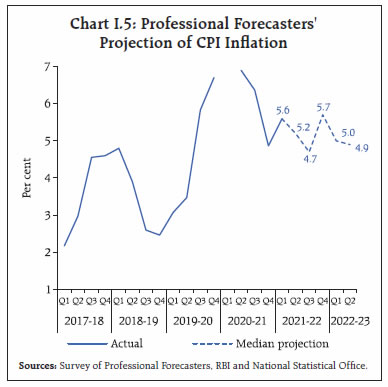

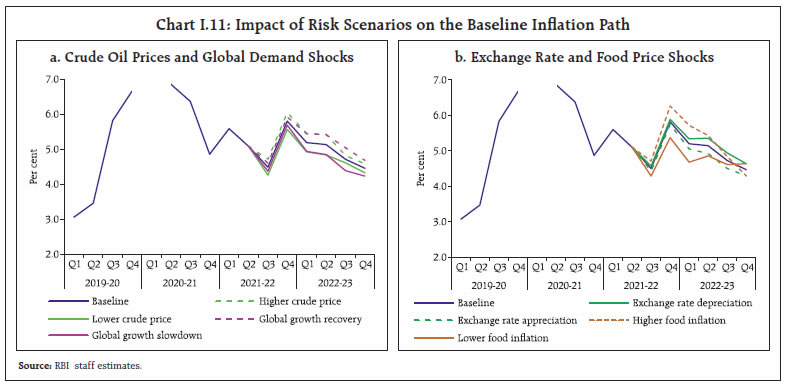

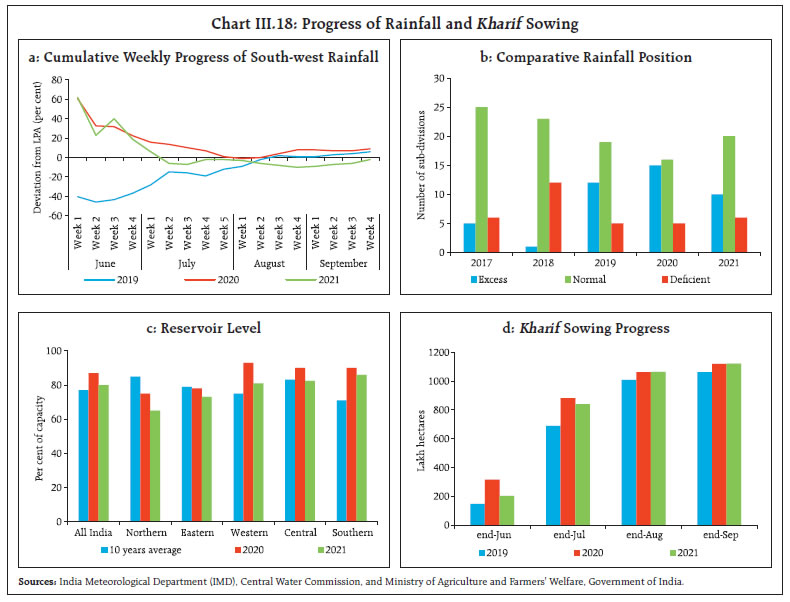

Professional forecasters surveyed by the Reserve Bank in September 2021 expect CPI inflation to ease from 5.3 per cent in August 2021 to 4.7 per cent in Q3:2021-22 and subsequently move up to 5.7 per cent in Q4:2021-22 before easing to 4.9 per cent in Q2:2022-23 (Chart I.5).4 Kharif sowing has progressed satisfactorily and foodgrains production is estimated to touch a new record which, along with ample buffer stocks of foodgrains, should help to contain cereal prices. Global food, oil and other commodity prices, however, remain firm. Taking into account the initial conditions, signals from forward-looking surveys and estimates from structural and other time-series models, CPI inflation is projected to move from 5.6 per cent during Q1:2021-22 to 5.1 per cent in Q2, 4.5 per cent in Q3, and 5.8 per cent in Q4, with risks broadly balanced (Chart I.6). The 50 per cent and the 70 per cent confidence intervals for headline inflation in Q4:2021-22 are 4.4-7.2 per cent and 3.6-8.0 per cent, respectively. For 2022-23, assuming a normalisation of supply chains on the back of improved vaccination, a normal monsoon and no major exogenous or policy shocks, structural model estimates indicate that inflation will move in a range of 4.5-5.2 per cent. The 50 per cent and the 70 per cent confidence intervals for Q4:2022-23 are 2.7-6.3 per cent and 1.7-7.2 per cent, respectively.  There are a number of upside and downside risks to the baseline inflation forecasts. The upside risks emanate from a longer-than-expected persistence of supply chain disruptions; a further hardening of global commodity prices, especially that of crude oil; a quicker pass-through of input cost pressures to output prices on the back of strong pent-up domestic demand from ebbing infections and vaccination-led consumer confidence; unseasonal rainfall impacting crop production; and global financial market volatility from a faster US monetary policy normalisation. The downside risks arise from an earlier than expected mending of supply chain disruptions; the persistence of weak demand and slack in the economy; and corrections in global commodity and crude prices in the event of a weakening of global demand over new mutants and poor vaccination coverage in low-income countries.

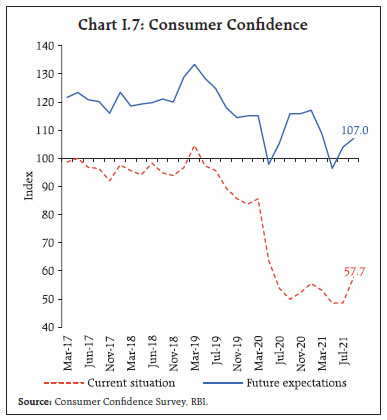

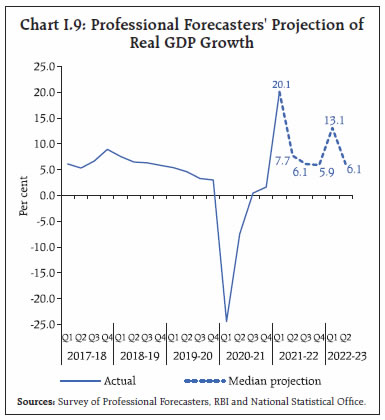

I.3 The Outlook for Growth With the ebbing of the second wave, a phased relaxation of the pandemic-related localised restrictions, and improving vaccine coverage, economic activity has been normalising gradually since June 2021. Looking ahead, prospects for the agricultural sector and rural demand look promising, supported by the late revival in kharif sowing. Urban demand is also likely to accelerate with the release of pent-up demand, aided by the significant expansion in the pace of vaccination since July and improving consumer confidence – as of October 6, 2021, nearly 27 per cent of India’s adult population has been fully vaccinated, while 71 per cent has received one dose. This augurs well for the sustenance of contact-intensive activities and consumption demand. The government’s focus on capital expenditure and continued reform push, large foreign direct investment flows, congenial monetary and financial conditions, and boom in the initial public offerings provide a conducive environment for investment activity. There are signs that the investment pipeline could increase in the rest of 2021-22 and in the coming year, given the interest in the production linked incentive (PLI) scheme and the continued focus on road infrastructure.  Turning to the key messages from forward-looking surveys, the consumer confidence (the current situation index) in the September 2021 round recovered marginally from the all-time low recorded in May-July 2021, while index for the year ahead remained in the optimistic zone, driven by recovery in sentiments on the general economic situation, the employment scenario and household spending (Chart I.7).5 Sentiments in the manufacturing sector for the quarter ahead strengthened further in the July- September 2021 round of the Reserve Bank’s industrial outlook survey, reflecting optimism on production, order books, capacity utilisation, and employment (Chart I.8). Services and infrastructure sectors expect further strengthening in overall business situation and turnover in Q3:2021-22. Surveys by other agencies released during May-July generally reported a decline in business expectations over the previous rounds but remained upbeat from a year ago (Table I.3). According to the purchasing managers’ survey for September 2021, the one year ahead business expectations of firms in the manufacturing and services sectors were optimistic albeit below historical levels. Professional forecasters polled in the September 2021 round of the Reserve Bank’s survey expect real GDP growth to move from 20.1 per cent in Q1:2021- 22 to 5.9 per cent in Q4; it is expected at 13.1 per cent in Q1:2022-23 due to base effects and 6.1 per cent in Q2 (Chart I.9). | Table I.3: Business Expectations Surveys | | Item | NCAER Business Confidence Index (July 2021) | FICCI Overall Business Confidence Index (May 2021) | Dun and Bradstreet Composite Business Optimism Index (July 2021) | CII Business Confidence Index (June 2021) | | Current level of the index | 61.8 | 51.5 | 74.2 | 50.4 | | Index as per previous survey | 85.2 | 74.2 | 61.5 | 68.7 | | % change (q-o-q) sequential | -27.5 | -30.6 | 20.7 | -26.6 | | % change (y-o-y) | 33.2 | 20.0 | 152.4 | 22.9 | Notes:

1. NCAER: National Council of Applied Economic Research.

2. FICCI: Federation of Indian Chambers of Commerce & Industry.

3. CII: Confederation of Indian Industry.

Sources: NCAER, FICCI, CII and Dun & Bradstreet Information Services India Pvt. Ltd. |

While the near-term prospects are bolstered by the lower base of last year, the outlook is contingent on the evolving COVID-19 trajectory. Taking into account the Q1 growth of 20.1 per cent, baseline assumptions, survey indicators, and model forecasts, real GDP growth is projected at 9.5 per cent in 2021- 22 –7.9 per cent in Q2, 6.8 per cent in Q3, and 6.1 per cent in Q4 – with risks evenly balanced around this baseline path (Chart I.10 and Table I.4). For 2022-23, the structural model estimates indicate real GDP growth at 7.8 per cent, with quarterly growth rates in the range of 5.0-17.2 per cent, assuming restoration of supply chains, a normal monsoon, no major exogenous or policy shocks, and full vaccination. There are upside and downside risks to the baseline growth path. Stronger-than-expected pent-up demand amidst a faster pace of vaccination and mild variants of the virus, and government’s focus on infrastructure investment and asset monetisation and reform measures provide an upside to the baseline growth path. On the contrary, new and more contagious variants of the virus, elevated levels of crude oil and commodity prices, more persistent pandemic-related domestic as well as global supply bottlenecks and global financial market volatility pose downside risks to the baseline growth path. | Table I.4: Projections - Reserve Bank and Professional Forecasters | | (Per cent) | | | 2021-22 | 2022-23 | | Reserve Bank’s Baseline Projections | | | | Inflation, Q4 (y-o-y) | 5.8 | 4.5 | | Real GDP growth | 9.5 | 7.8 | | Median Projections of Professional Forecasters | | | | Inflation, Q4 (y-o-y) | 5.7 | 4.9* | | Real GDP growth | 9.4 | 6.8 | | Gross domestic saving (per cent of GNDI) | 29.5 | 29.8 | | Gross capital formation (per cent of GDP) | 30.0 | 30.7 | | Credit growth of scheduled commercial banks | 7.5 | 8.1 | | Combined gross fiscal deficit (per cent of GDP) | 10.5 | 9.0 | | Central government gross fiscal deficit (per cent of GDP) | 6.8 | 5.6 | | Repo rate (end-period) | 4.0 | 4.25* | | Yield on 91-days treasury bills (end-period) | 3.8 | 4.3 | | Yield on 10-year central government securities (end-period) | 6.4 | 6.6 | | Overall balance of payments (US$ billion) | 50.6 | 35.0 | | Merchandise exports growth | 30.0 | 8.0 | | Merchandise imports growth | 36.1 | 9.1 | | Current account balance (per cent of GDP) | -0.7 | -1.1 | *: Q2:2022-23.

Note: GNDI: Gross National Disposable Income.

Sources: RBI staff estimates; and Survey of Professional Forecasters (September 2021). | I.4 Balance of Risks The baseline projections of inflation and growth presented in the previous sections are premised on the assumptions relating to key domestic and international macroeconomic and financial conditions set out in Table I.2. The inherent uncertainties around these assumptions, exacerbated by COVID-19 and its variants, have a significant bearing on the inflation and growth trajectories. Some plausible alternative scenarios to assess the balance of risks around the baseline projections are presented in this section. (i) Global Growth Uncertainties While the global growth outlook has been upgraded relative to the April MPR, it remains highly susceptible to COVID-19’s trajectory in view of the uneven spread of vaccination across countries and more contagious new variants of the virus, apart from volatility in global commodity prices and the elevated uncertainty over US monetary policy normalisation. First, continuing global supply chain disruptions are adversely impacting production in several manufacturing activities and could dampen global growth more than currently anticipated with additional headwinds from the steep increase in natural gas prices in recent weeks. Second, a slowing Chinese economy may drag down external demand. Third, if the inflationary pressures emanating from the demand-supply bottlenecks in the US and other AEs were to turn out to be persistent, it could trigger an earlier exit than currently being telegraphed from the accommodative policies in the major AEs, induce large financial market volatility and pose downside risks to global growth. Fourth, an escalation of geo-political tensions remains a potential source of downside risk to global growth. In such a scenario, if the global recovery slips by 100 bps below the baseline, domestic growth and inflation could be lower by around 40 bps and 30 bps, respectively. Conversely, a more widespread and equitable distribution of vaccines across the world, sustained success in containing the spread of new mutants, faster resolution of logistic bottlenecks, and the spike in inflation in major AEs reversing quickly could boost global economic activity. In such a scenario, assuming that global growth surprises by 100 bps on the upside, domestic growth and inflation could edge higher by around 40 bps and 30 bps, respectively (Charts I.11a and I.12a). (ii) International Crude Oil Prices International crude oil prices have firmed up amidst elevated volatility with the gradual resumption in economic activity, improvement in global demand and calibrated output normalisation by the OPEC plus. The supply-demand dynamics in the global oil market are subject to several uncertainties. On the supply side, shortfall in the OPEC plus production and rise in geo-political tensions could constrain supply and increase oil prices above the baseline. On the demand side, a better containment of COVID-19 infections could induce higher global growth, a faster closing of the global output gap and a sharper increase in international crude oil prices. Assuming crude oil prices to be 10 per cent above the baseline (Table I.2), domestic inflation could be higher by 30 bps and growth weaker by around 20 bps over the baseline. Conversely, crude oil prices could soften below the baseline if the global recovery is more subdued owing to a faster spread of virus mutations, delays in vaccination or improved supplies of shale gas. In this scenario, if the price of the crude falls by 10 per cent relative to the baseline, inflation could ease by around 30 bps with a boost of 20 bps to growth (Charts I.11a and I.12a). (iii) Exchange Rate The INR has exhibited two-way movements over the past six months, reflecting both global and domestic factors. The divergent paths of recovery across AEs and EMEs and the risk of currently elevated inflation in AEs acquiring a more structural character could necessitate an early exit from ultra-accommodative monetary policies by the AE central banks. The resultant heightened volatility in global financial markets could lead to a generalised risk aversion to EMEs assets, capital outflows and downward pressures on their currencies (Box I.1). A 5 per cent depreciation of INR from the baseline (Table I.2) in such a scenario could increase domestic inflation by up to 20 bps, while GDP growth could be higher by 15 bps through a boost to exports. On the other hand, given India’s relatively better growth outlook, boost to growth from the expanding scale of vaccination and reform measures by the government to attract foreign capital, INR could appreciate. In such a scenario, if the INR appreciates by 5 per cent relative to the baseline, inflation and growth could moderate by around 20 bps and 15 bps, respectively (Charts I.11b and I.12b).

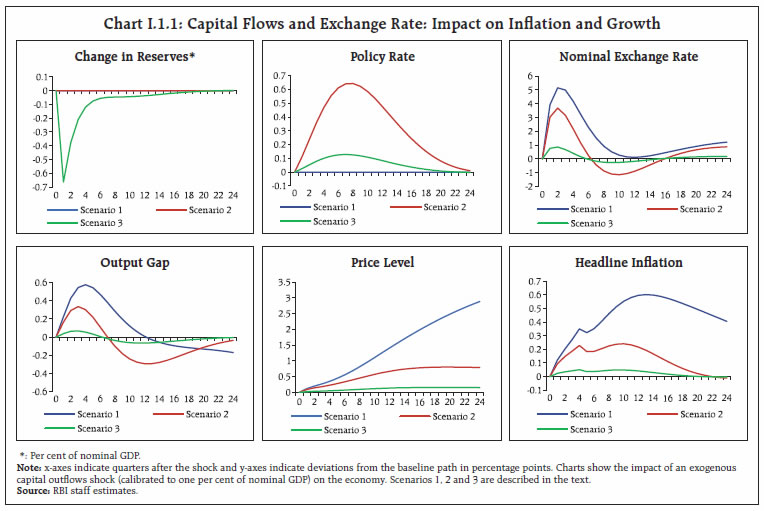

Box I.1: Capital Flow and Exchange Rate Shocks: Macroeconomic Implications Capital flows to EMEs ease external financing constraints and help to increase domestic investment and growth. On the other hand, such flows are often volatile and prone to sudden stops and reversals, causing disorderly movements in the exchange rate that can feed into domestic inflation and output. These effects are amplified by interactions with equity and bond markets and derivative positions. Furthermore, undesirable and unintended fluctuations in liquidity resulting from volatile capital flows can vitiate the monetary policy stance (Das, 2021). The macroeconomic implications of capital flows for the Indian economy can be analysed through the Quarterly Projection Model (QPM)6 (RBI, 2021) under alternative scenarios. In Scenario 1, the central bank allows the impact of capital flows to be borne out fully by the exchange rate with no monetary action. In Scenario 2, movements in the exchange rate pass through into inflation, causing a deviation of inflation from the target that prompts monetary policy action. Alternatively, the central bank may resort to a judicious combination of forex intervention and sterilisation, exchange rate adjustment and monetary policy action (Scenario 3) to contain the impact of the volatility in capital flows on the domestic economy.  In Scenario 1, there is a sustained deviation of inflation from the target (Chart I.1.1). Inflation deviations are relatively contained in scenario 2 but this comes at the cost of volatility in output because monetary policy is calibrated to bring inflation back to the target. Scenario 3, which involves forex intervention and sterilisation, helps to insulate the domestic economy from the capital flows shock, with only marginal impact on inflation and output. This policy combination reduces volatility in the forex market and helps the central bank to pursue a relatively more accommodative monetary policy in support of growth. The Reserve Bank of India undertakes two sided interventions in the spot, forward and futures markets to stabilise financial markets and liquidity conditions so that monetary policy retains its domestic orientation and the independence to pursue national objectives. References: Das, Shaktikanta (2021), “Governor’s Statement”, June 4, 2021, Reserve Bank of India. Reserve Bank of India (2021), Monetary Policy Report, April 2021. | (iv) Food Inflation Food inflation moderated in July-August from the recent peak in June 2021, driven largely by the deepening deflation of vegetable prices. Inflation in edible oil prices, however, remains substantially elevated at 33.0 per cent in August. The expectations of record kharif foodgrains production and large buffer stocks for cereals augur well for food prices. These developments along with continued effective supply management of key food items and easing of international food prices could soften headline inflation by around 50 bps. Conversely, a further hardening of international food prices, demand-supply imbalances in some food items and unseasonal rainfall could exert upward pressure on headline inflation by around 50 bps (Charts I.11b and I.12b). I.5 Conclusion Domestic economic activity is normalising after the ferocious second wave retarded momentum. The outlook remains overcast by the future path of the pandemic; however, the accelerated progress in the pace of vaccination, release of pent-up demand in the upcoming festival season, boost to investment activity from the government’s focus on infrastructure and asset monetisation, and accommodative monetary and liquidity conditions provide an upside to the baseline growth path. While the inflation trajectory is expected to be driven by supply-side factors and risks are to the upside, a faster resolution of global as well as domestic supply chain disruptions, softer international crude oil and food prices as pent-up demand normalises, and another round of good foodgrains production and effective supply management, could cause inflation to undershoot the baseline, contingent on the evolution of the pandemic and the efficacy of vaccines. __________________________________________________________________________________

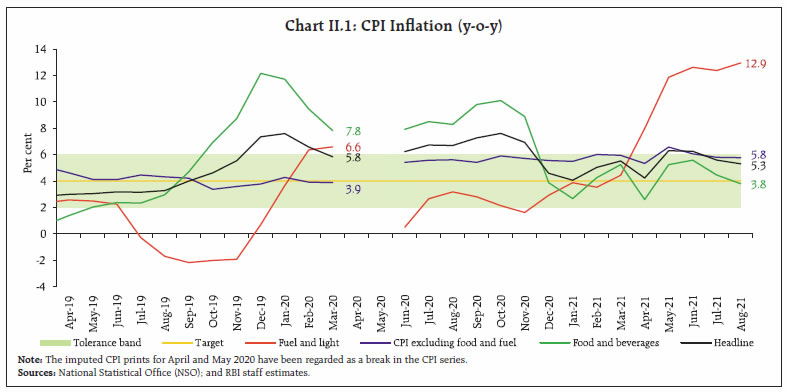

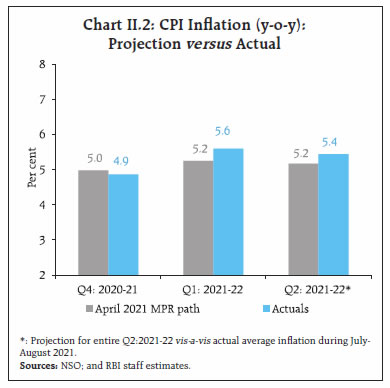

II. Prices and Costs Consumer price index (CPI) inflation remained highly volatile during March-August this year – after moderating close to the target rate in April, it rose abruptly to breach the upper tolerance threshold during May-June with a sharp pickup in food, fuel and core inflation and moderated in July-August on substantial softening in food inflation. Costs of farm and non-farm inputs remained elevated. Nominal rural wages for both agricultural and non-agricultural labourers were stagnant while staff costs in the organised sector rose. Since the publication of the April 2021 MPR, headline CPI inflation1 that had fallen close to the target rate of 4.0 per cent in April, sprang back amidst the second wave of intense infections to breach the upper tolerance threshold and touched 6.3 per cent during May-June 2021.2 This unanticipated spike came from a sharp pick-up in food and core (CPI excluding food and fuel3) inflation which peaked peaked at 6.6 per cent in May 2021 – the highest since May 2014, and fuel inflation which at 12.6 per cent in June 2021 was the then highest recorded in the CPI series. In the following months, however, inflation quickly moderated by one percentage point to 5.3 per cent by August on a substantial softening in food inflation even as fuel infation scaled another high and core inflation remained sticky and elevated. On the whole, CPI inflation has been highly volatile in the five months of the current financial year – moving within a wide range of 4.2 per cent to 6.3 per cent – averaging 5.5 per cent (Chart II.1). The Reserve Bank of India (RBI) Act enjoins the RBI to set out deviations of actual inflation outcomes from projections, if any, and explain the underlying reasons thereof. The April 2021 MPR had projected range-bound movement in CPI inflation – an average of 5.0 per cent in Q4:2020-21 to 5.2 per cent in Q1 and Q2 of 2021-22. Actual inflation for Q1:2021-22 at 5.6 per cent and Q2:2021-22 (July-August) at 5.4 per cent turned out to be higher than the projections by 35 bps and 27 bps, respectively (Chart II.2).  A number of factors impinging on food, fuel and core contributed to this overshoot. First, the rapid spread of COVID-19’s second wave at the start of 2021-22 resulted in restrictions on activity being imposed over a large swath of the country. These restrictions, in turn, resulted in transitory price pressures in Q1, especially in May, through supply-chain disruptions, elevated retail margins as well as from difficulties in accurate price measurements due to localised lockdowns and restrictions on non-essential commercial activities in several states.4 As restrictions eased and activity normalised, the effects of these factors dissipated from June. Second, the unanticipated surge in global energy prices kept petrol and diesel inflation firmly in double digits. The April 2021 MPR had assumed an Indian basket crude oil price of US$ 64.6 per barrel during 2021-22; however, crude oil prices edged up to a peak level of US$ 75 per barrel in early July before moderating to US$ 70 per barrel by end-August. Third, there was an extraordinary surge in international edible oil prices which fed into domestic inflation formation.5 Fourth, the persistence of industrial input and transport cost pressures and subsequent transmission to selling prices of manufactured goods was more than what was anticipated, in spite of demand conditions weakening due to the second wave.  II.1 Consumer Prices A dip in inflation to 4.2 per cent in April 2021 was overwhelmed in May 2021 by a sharp pick up in price momentum6 spanning across food, fuel and core groups, resulting in a surge in inflation by 2.1 percentage points to 6.3 per cent. In June, headline inflation plateaued, with positive price momentum completely neutralised by a favourable base effect which became even larger in July and more than offset the broad-based price momentum taking down headline inflation to 5.6 per cent in July. With overall price momentum registering a sharp deceleration in August, coming from a steady food price index, headline inflation moderated further to 5.3 per cent (Chart II.3). The distribution of CPI inflation during January- August 2021 varied distinctly from the pattern in the past few years. There has been a shift in the mean of the distribution from 3.4 per cent for 2017- 2019 (January-August) to 5.3 per cent in 2021 so far (Chart II.4). This was accompanied by an increase in volatility – with the standard deviation in 2021 more than two times that of 2017-2019 – and positive skewness, compared to a negative skew for the 2017-2019 period. These indicate high dispersion of inflation rates in the CPI basket, along with a larger number of items experiencing higher inflation rates than in the pre-pandemic period. The positive skew reflected outlier double-digit inflation in the CPI distribution, primarily on account of oils and fats.

During April-August 2021, 8 of the 23 sub-groups in CPI with a cumulative weight of 49.7 per cent contributed 82.7 per cent of CPI inflation, much higher than their contribution of 56.2 per cent in 2020-21 (Table II.1). | Table II.1: Contribution of CPI sub-groups to Headline CPI Inflation | | Sr. No. | Commodity | Weight | FY 2020-21 (June-March)* | FY 2021-22 (April-August) | | Average inflation (y-o-y, per cent) | Average contribution (per cent) | Average inflation (y-o-y, per cent) | Average contribution (per cent) | | 1 | Oils and fats | 3.56 | 16.8 | 9.1 | 31.4 | 18.3 | | 2 | Transport and communication | 8.59 | 10.6 | 13.4 | 11.1 | 15.6 | | 3 | Fuel and light | 6.84 | 2.8 | 3.3 | 11.6 | 13.4 | | 4 | Health | 5.89 | 5.4 | 5.7 | 7.9 | 8.6 | | 5 | Meat and fish | 3.61 | 16.0 | 10.8 | 9.6 | 8.0 | | 6 | Housing | 10.07 | 3.2 | 5.8 | 3.8 | 7.2 | | 7 | Prepared meals, snacks, sweets etc. | 5.55 | 4.5 | 4.7 | 5.6 | 6.0 | | 8 | Clothing | 5.58 | 3.4 | 3.4 | 5.7 | 5.7 | | | Total | 49.69 | 6.8 | 56.2 | 9.4 | 82.7 | | | CPI-Combined | 100.00 | 6.1 | 100.0 | 5.5 | 100.0 | * The imputed CPI prints for April and May 2020 have been regarded as a break in the CPI series.

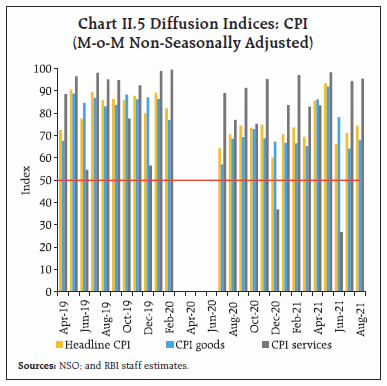

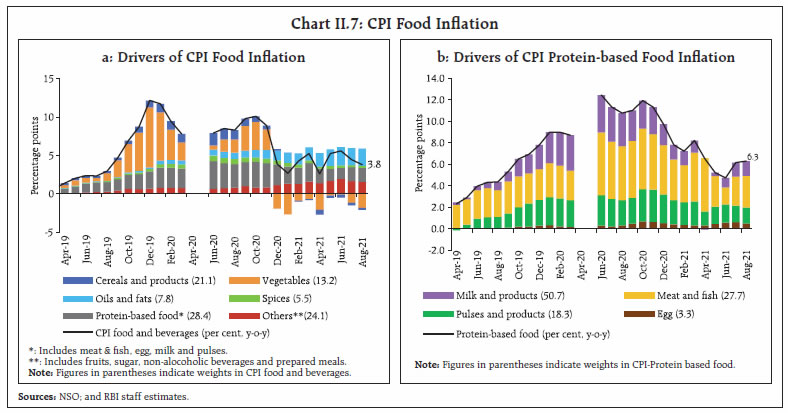

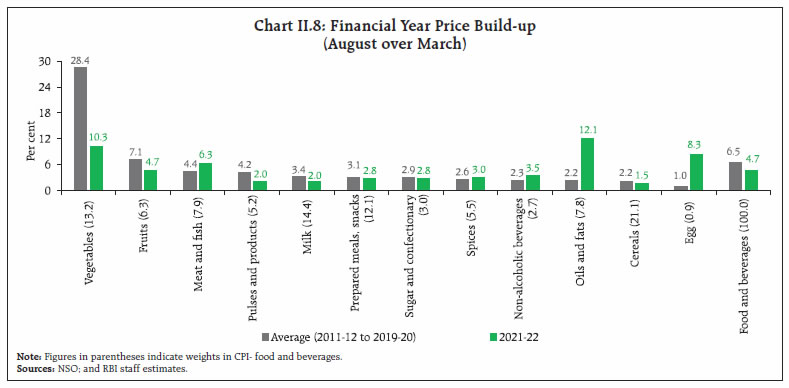

Sources: NSO; and RBI staff estimates. | The non-seasonally adjusted diffusion indices of price changes7 remained elevated (barring for services in June), indicative of price increases being broad-based across the CPI basket (Chart II.5).8 II.2 Drivers of Inflation The role of various factors impinging upon inflation dynamics can be captured through vector autoregression (VAR) estimates and historical decomposition.9 Inflationary pressures in Q1:2021-22 can be attributed to adverse supply shocks, firming up of asset prices and easy monetary conditions, even as muted demand conditions contributed to a softening of inflationary pressures. By Q2:2021-22 some softening in inflationary pressures came about from softening of wage pressures (Chart II.6a).  In terms of contribution of goods and services to headline inflation, the pick-up in inflation in June 2021 emanated from perishables – edible oils, fruits and vegetables – and semi-perishable goods (non-durable goods with a 30-day recall10) like LPG, kerosene, petrol, diesel, medicines and fast-moving consumer goods (FMCGs). In July-August, the contribution of perishables to headline inflation registered a sharp moderation, even as the contributions of semi-perishables, durables and services to headline inflation were largely steady (Chart II.6b). Some of the stickiness in semi-perishables and durables goods inflation reflected the transmission of high international prices. The surge in international prices of edible oil, silver and petroleum products resulted in an increase in the contribution of imported components to headline inflation – from 0.8 percentage points in February to a peak level of 1.9 percentage points in June before moderating to 1.4 percentage points in August 2021 (Chart II.6c). Food Group Food and beverages inflation treaded within a range of 2-6 per cent during March-August 2021 and on an average contributed around 37.2 per cent of headline inflation (CPI food has a weight of 45.9 per cent in the CPI basket). Elevated international prices of edible oils along with price pressures in protein rich items remained the major drivers (Chart II.7). The summer uptick in vegetables prices during May-July 2021 led to an increase in price pressures, while a decline in prices of cereals, protein-based food and fruits along with a sharp deceleration in vegetable price momentum in August 2021 provided relief dragging down food inflation to 3.8 per cent. Overall, the food price build-up in the financial year so far has been lower than historical patterns, even as price build-ups in oils and fats, eggs, meat and fish, non-alcoholic beverages and spices were higher than their long-term averages (Chart II.8). Excluding vegetables, during April-August 2021, food and headline inflation would have averaged 6.3 per cent and 6.5 per cent respectively, as against an overall average rate of 4.3 per cent for food and 5.5 per cent for headline. Prices of cereals (weight of 9.7 per cent in the CPI and 21.1 per cent in the food and beverages group) remained in deflation during March-August 2021, primarily reflecting favourable base effects and muted momentum. Within cereals, both rice and wheat witnessed subdued price pressures (barring May 2021) on the back of ample buffer stocks relative to norms (2.7 times and 1.8 times for rice and wheat, respectively, as on September 16, 2021) and distribution under Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY). In May 2021, restrictions on activity across many states affected supply chains leading to a pick up in prices. Moreover, production remained robust, with an increase of 2.9 per cent for rice and 1.5 per cent for wheat (as per the 4th Advance Estimates (AE) 2020-21) over 2019-20 Final Estimates (FE).

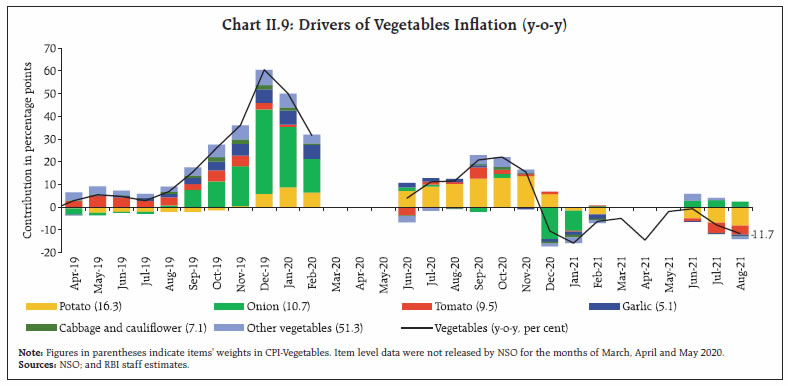

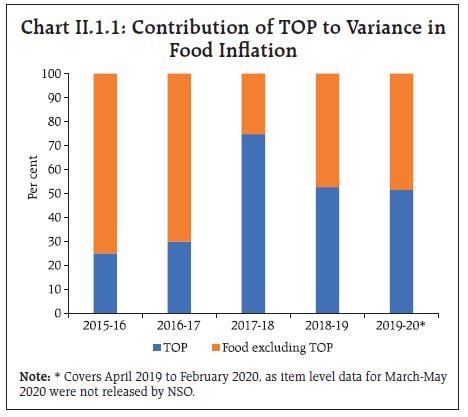

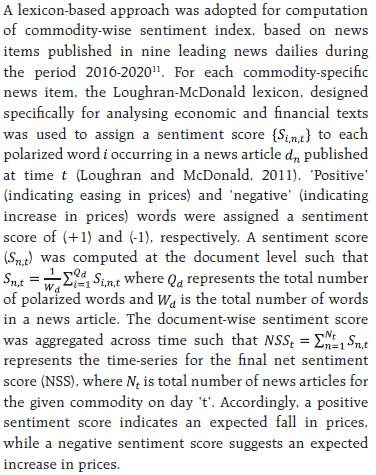

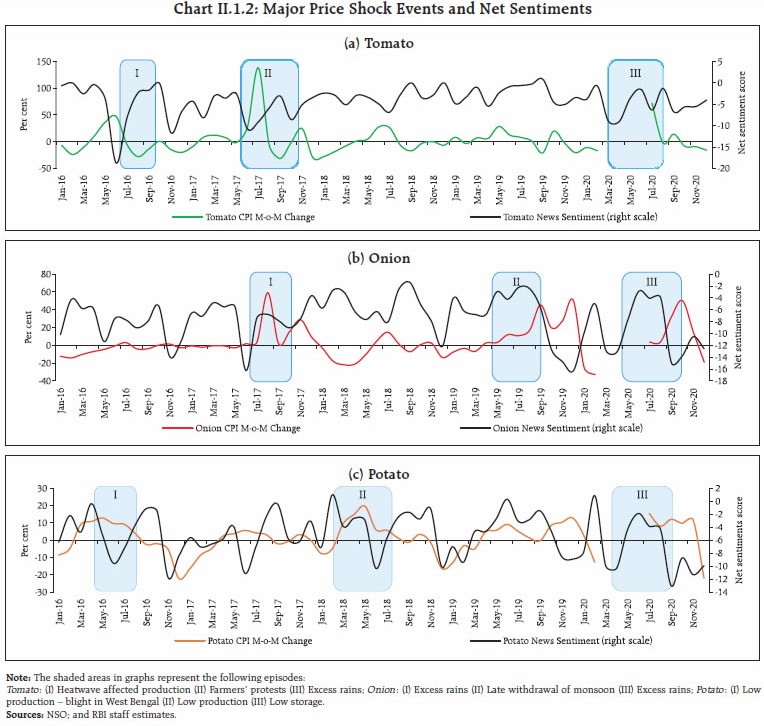

In the case of vegetables (weight of 6.0 per cent in the CPI and 13.2 per cent in the food and beverages group), prices remained in deflation during March-August 2021 (Chart II.9), reflecting, inter alia, favourable base effects. The three key vegetables – tomatoes, onions and potatoes – largely witnessed price increases during May-July 2021 less than the usual summer uptick. While prices of potatoes and onions eased in August 2021, tomato prices picked up due to lower supply in the markets as the lean period set in. Crop damage due to heavy rains and flood like situations in major tomato producing states such as Andhra Pradesh and Karnataka also impacted mandi arrivals. After moderating during March-May 2021, onion prices edged up subsequently, reflecting the seasonal uptick as well as damage to stored rabi onions in Maharashtra and Gujarat due to cyclone Tauktae. Potato prices were in deflation during June-August 2021, reflecting favourable base effects and easing of prices in August 2021 with higher production (10.6 per cent in 2020- 21) in response to elevated prices observed in the previous year, and higher cold storage stocks in major producing states. On the whole, as noted earlier, the price build-up in vegetables remained lower than their historical average in the financial year so far, reflecting the recovery of production (higher by 4.2 per cent in 2020-21 2nd AE compared to 2019-20 FE).  In a rapidly changing scenario where volatility in prices of key vegetables has substantial fallout on headline inflation, there is a need for real time monitoring of price situation, especially in case of perishables. Price sentiment derived from unstructured data contained in news articles can provide useful leading information on prices (Box II.1). Box II.1: News Sentiment-based Analysis of Food Inflation Outlook Strengthening market intelligence on high-impact food items is an integral element in inflation forecasting framework of the Reserve Bank. Newspaper articles provide information on local events that may lead to large swings in nation-wide retail food prices. Unstructured textual data in news items can be processed and quantified using text-mining techniques to analyse the nature of shocks and inflation dynamics. Three main vegetables viz., tomatoes, onions and potatoes (TOP), with a combined weight of 2.2 per cent in the CPI, have high contribution to variance in food price inflation (Chart II.1.1).

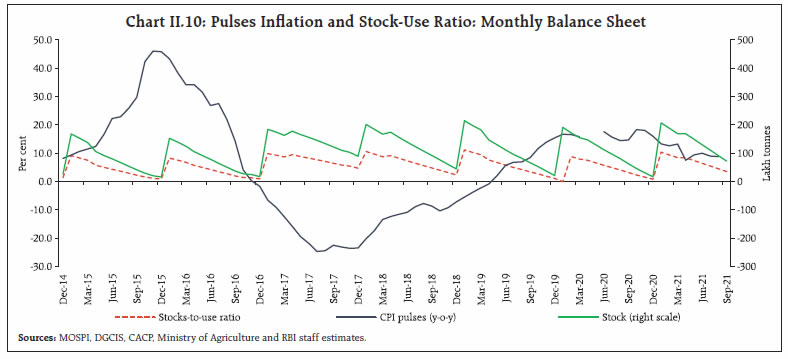

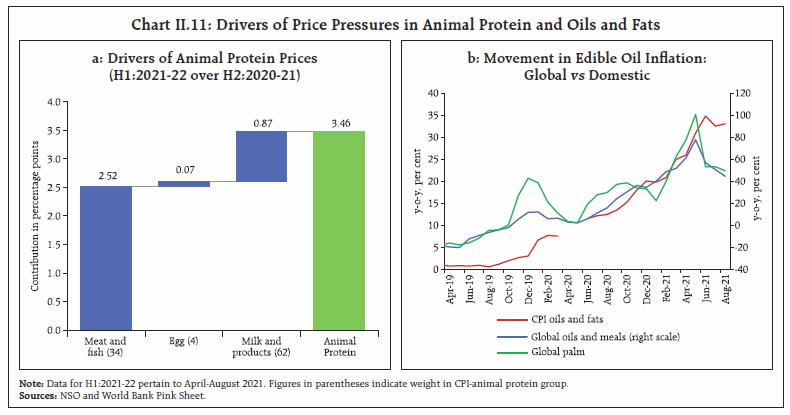

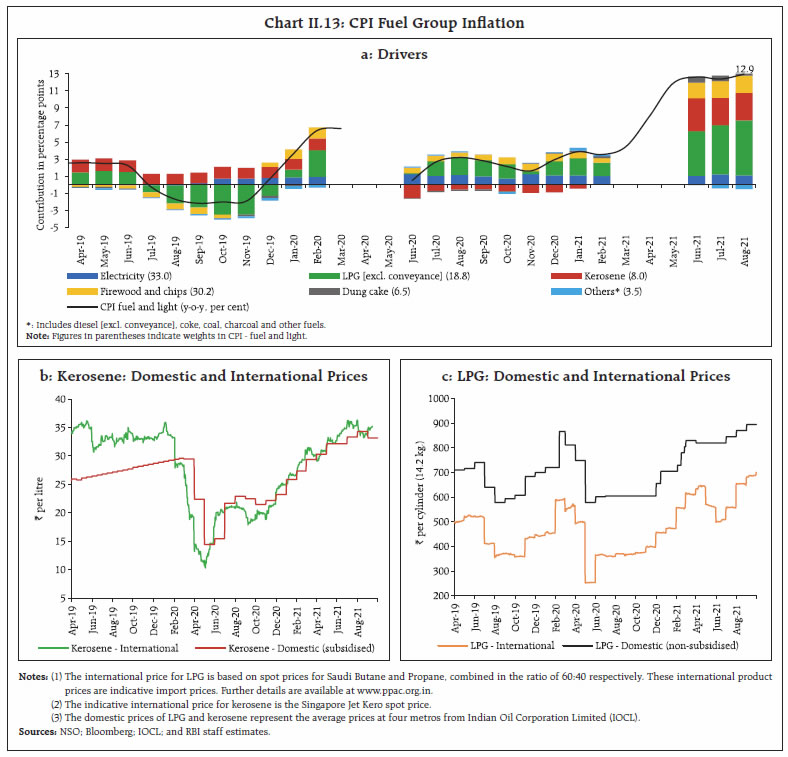

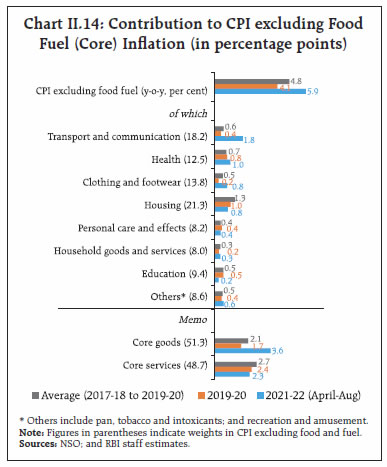

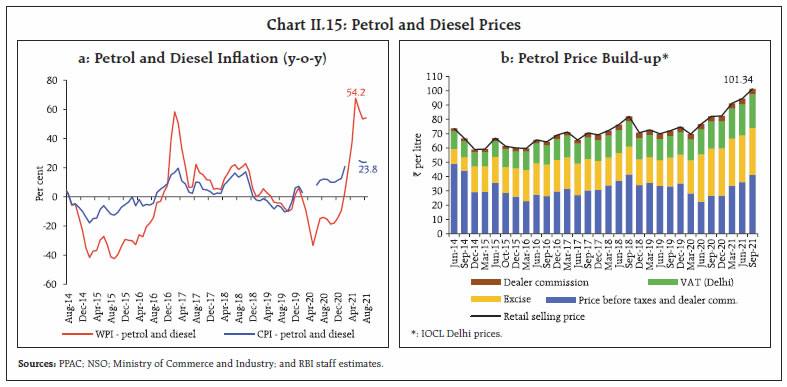

Monthly net sentiment score of TOP and changes in their prices as reflected in CPI show a negative relationship between them, as expected (Chart II.1.2). Large increases in TOP prices seen after major supply shocks coincide with large fall in sentiment related to each of the three commodities. Sentiments were found to ‘Granger cause’ change in prices, implying the predictive power of news-based sentiment in capturing future price movements of TOP. The results show that NSS can provide forward-looking information for price movements in TOP (up to 30 days as per the Granger causality test), which could be useful for nowcasting of food price inflation. References: Ardia, D., Bluteau, K., Borms, S., and Boudt, K. (2021). The R Package Sentometrics to Compute, Aggregate and Predict with Textual Sentiment. Journal of Statistical Software, 99(2). Loughran, T., and McDonald, B. (2011). When is a Liability not a Liability? Textual Analysis, Dictionaries, and 10- Ks. The Journal of Finance, 66(1), 35-65. | Despite pulses production of 257.2 lakh tonnes during 2020-21, an increase of 11.7 per cent over 2019-20 – augmenting domestic supply and overall stocks, factors like localised lockdowns in the second wave resulted in supply chain driven demand-supply gaps, accentuated by lower arrival of imports and precarious stock positions in the case of masur (Chart II.10). To address the tight demand supply situation, the government undertook several supply side initiatives such as imposing stock limits in July 2021 on some pulses under the Essential Commodities Act, 1955, easing import restrictions to enhance domestic availability of tur, urad and moong, a memorandum of understanding (MoUs) with Myanmar, Malawi and Mozambique for pulses imports, and reducing basic import duty and Agriculture Infrastructure and Development Cess (AIDC) on masur to 0 per cent12 and 10 per cent, respectively. Inflation in meat, fish and eggs witnessed upside pressures during March-July 2021 primarily reflecting feed cost pressures and transportation costs (Chart II.11a). Prices of key items such as eggs, chicken, mutton and fish surged as a consequence of several factors – increase in soybean meal prices (international soybean meal prices increased by 32.3 per cent in July 2021 compared to July 2020); restricted operations of the poultry industry during the second wave; festive demand in July 2021; damage of fishing boats owing to cyclones Tauktae and Yaas; higher fuel prices and the annual ban on fishing in the west coast during monsoons. However, prices eased in August 2021 reflecting seasonal fall in demand during the month of sravana. In the case of milk and products (weight of 6.6 per cent in the CPI and 14.4 per cent in the food and beverages group), a lean season of production coincided with upward revision in retail prices by ₹2 per litre by major milk co-operatives like Amul and Mother Dairy in July 2021 which was followed by many other state milk co-operatives such as Milkfed in Punjab, Gokul in Maharashtra and Parag in Uttar Pradesh, resulting in price pressures in July 2021. Milk cooperatives have cited various reasons for increase in input costs such as cost of transport, feed prices and operational costs of processing and packaging. However, post July 2021, no increase in retail milk prices by other milk cooperatives has been reported.  Inflation in oils and fats experienced price pressures in the post-lockdown period and shot up to an all-time high of 34.8 per cent in June 2021, mirroring elevated international edible oil prices (Chart II.11b). Prices fell in July 2021 in response to the supply side measures announced by the government, before showing some uptick in August to 33.0 per cent. Global palm oil prices escalated due to labour shortage in Malaysia and adverse weather conditions leading to lower than expected production and high export duties on crude palm oil. A number of measures were taken to alleviate price pressures, including reduction in import duty on crude and refined palm oil from 15.0 per cent to 10.0 per cent (effective rate reduced from 35.75 per cent to 30.25 per cent) and 45.0 per cent to 37.5 per cent (effective rate reduced from 49.5 per cent to 41.25 per cent), respectively; mechanism for speedy clearance of crude palm oil at shipping ports and placing the imports of Refined Bleached Deodorized (RBD) palm oil and RBD palmolein under free category from restricted category effective from June 30, 2021 and applicable till December 31, 2021. Further, effective September 11, 2021, import duty on crude and refined palm oil was reduced from 10 per cent to 2.5 per cent (effective rate reduced from 30.25 per cent to 24.75 per cent) and 37.5 per cent to 32.5 per cent (effective rate reduced from 41.25 per cent to 35.75 per cent), respectively. However, price pressures continued in the domestic market (barring in July 2021) as Malaysia increased its export reference price for July 2021, maintaining its export duty at the highest rate of 8.0 per cent. To control domestic edible oil prices, import duty on crude soybean and sunflower oil were reduced from 15.0 per cent to 7.5 per cent, effective August 20, 2021 and it was further reduced to 2.5 per cent from September 11, 2021. Similarly, import duty on refined soybean and sunflower oils was reduced from 45.0 per cent to 37.5 per cent and further to 32.5 per cent with the same effective dates. To attain self-sufficiency in production of edible oil, the Government announced a National Mission on Edible Oil - Oil Palm (NMEO-OP) with an investment of over ₹11,000 crore and assured farmers access to all facilities, from quality seeds to technology.  Price of sugar and confectionery (weight of 1.4 per cent in the CPI and 3.0 per cent in the food and beverages group) remained in deflation during March- August 2021, except for June 2021, due to higher domestic availability as a result of robust production (sugarcane production rose by 7.8 per cent in 2020-21 4th AE over 2019-20 FE) and export subsidy for sugar export under MAEQ (Maximum Admissible Export Quota) being reduced to ₹4000 per tonne from ₹6000 per tonne, effective May 20, 2021. Among other items in the CPI food group, prices firmed up in the case of non-alcoholic beverages and prepared meals, reflecting increase in input costs. Retail Margins Retail price margins, defined as the difference between retail and wholesale prices for four major sub-groups – cereals, pulses, vegetables and edible oil – have shown divergent movements.13 The margins in case of edible oils, pulses and cereals have risen unceasingly, since the first wave of the COVID-19 pandemic. Margins in case of vegetables are back to the usual seasonal pattern in absence of any major supply side disturbance (Chart II.12). CPI Fuel Group CPI fuel inflation surged from 4.4 per cent in March 2021 to 12.6 per cent in June 2021 before showing a transitory dip in July. In August 2021, fuel inflation touched an all-time high of 12.9 per cent (Chart II.13a). The year-on-year price changes in LPG and kerosene (PDS) during June-August 2021 were one of the highest recorded in the current CPI series. Market prices of crude and various oil-based fuels have firmed up through the waves of the pandemic pulling up kerosene and LPG fuel prices (Chart II.13c). The contribution of fuel items of rural consumption like firewood and chips was also substantial during June- August 2021 (Chart II.13b and II.13c). CPI excluding Food and Fuel CPI core inflation, i.e. CPI inflation excluding food and fuel, remained elevated and sticky in the financial year so far, reflecting persistent cost-push pressures even as demand conditions remained sluggish. Core inflation, from a peak level of 6.6 per cent in May, moderated to 6.1 per cent in June and to 5.8 per cent during July-August. Excluding petrol and diesel, it has also remained sticky in the range of 5.1-5.5 per cent throughout the pandemic period (Table II.2).

| Table II.2: Exclusion-based Measures of Inflation (y-o-y) | | Period | CPI excluding food and fuel (47.3) | CPI excluding food, fuel, petrol and diesel (45.0) | CPI excluding food, fuel, petrol, diesel, gold and silver (43.8) | | Jun-19 | 4.1 | 4.6 | 4.6 | | Sep-19 | 4.2 | 4.9 | 4.5 | | Dec-19 | 3.8 | 3.7 | 3.3 | | Mar-20 | 3.9 | | | | Jun-20 | 5.4 | 5.3 | 4.6 | | Sep-20 | 5.4 | 5.2 | 4.5 | | Dec-20 | 5.6 | 5.3 | 4.7 | | Jan-21 | 5.5 | 5.2 | 4.7 | | Feb-21 | 6.0 | 5.5 | 5.1 | | Mar-21 | 5.9 | | | | Apr-21 | 5.3 | | | | May-21 | 6.6 | | | | Jun-21 | 6.1 | 5.3 | 5.4 | | Jul-21 | 5.8 | 5.1 | 5.3 | | Aug-21 | 5.8 | 5.1 | 5.5 | Note: (1) Figures in parentheses indicate weights in CPI.

(2) Derived as residual from headline CPI.

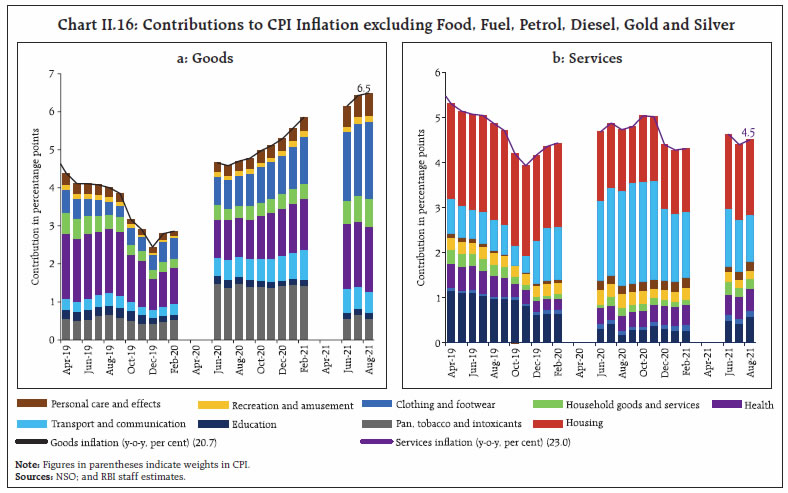

Sources: NSO; and RBI staff estimates. | In term of sub-groups, transport and communication, clothing and footwear and health accounted for more than 60 per cent of core inflation (weight of these sub-groups is around 45 per cent in the core CPI). On the other hand, the contributions of housing and education sub-groups to core inflation in the financial year so far have been lower than in the pre-pandemic period (Chart II.14). Overall, goods inflation is driving the core, with petrol and diesel (under the transportation and communication sub-group) registering double digit inflation consecutively since July 2020. Even as the one-off effects of indirect taxes instituted in the post-lockdown period waned from June 2021, the sustained increase in international crude oil prices – by around 104 per cent between end-May 2020 and end-August 2021 – has kept petrol and diesel inflation firm at 23.8 per cent in August. This was starkly evident in the WPI which excluded indirect tax effects; WPI petrol and diesel inflation was at 54.2 per cent in August (Chart II.15a). Petrol pump prices were at historic highs in early 2021 and breached ₹100 per litre by July 2021, with attendant implications for overall cost conditions in the economy (Chart II.15b).  After abstracting the effects of generally volatile items, i.e., food, fuel, petrol, diesel, gold and silver, core inflation rose from 5.1 per cent in February to 5.5 per cent in August, attesting to persistence (Table II.2). A decomposition of CPI excluding food, fuel, petrol, diesel, gold and silver into goods and services components points to contrasting movements. Inflation in the goods component (with a weight of 20.7 per cent in CPI) has been undergoing consecutive increases from August 2020, reaching 6.5 per cent in August 2021. This was driven primarily by clothing and footwear, health care – particularly medicines – household goods like utensils, washing soap/ powder, furniture, personal care items and toiletries (Chart II.16a). On the other hand, services inflation (with a weight of 23.0 per cent in CPI) which was at 4.3 per cent in February, firmed up moderately to 4.5 per cent in August 2021. The contribution of services, on an average, to core inflation was somewhat lower than what was seen in the pre-pandemic period (Chart II.14). A recovery in housing rentals along with rising education services inflation from the post-lockdown historic lows are the key drivers for the uptick in core services inflation between February and August 2021, apart from medical as well as household services (Chart II.16b).

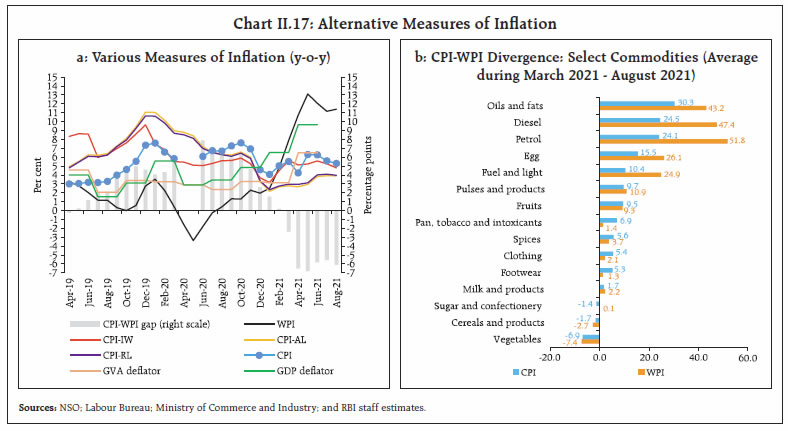

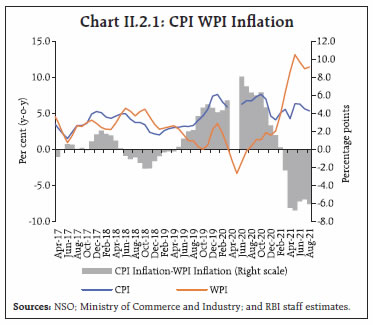

In order to filter noise from CPI inflation and get to the underlying inflation dynamics two common approaches are (i) excluding a fixed set of components from the CPI basket that display volatile price movements and are likely to be transitory; and (ii) excluding different components each month if they are located in the tails of the inflation distribution. The exclusion-based measures show heightened inflationary pressures over the last six months with no decisive signs of softening (Table II.2). Inflation measured by trimmed means, on the other hand, shows some edging down of the underlying inflation pressures in August from the June-July peak (Table II.3). Other Measures of Inflation Over the last 14 months, inflation in sectoral CPIs for agricultural labourers (CPI-AL) and rural labourers (CPI-RL) has remained below CPI headline inflation. Lower food inflation, paired with their higher weights in CPI-AL and CPI-RL contributed to the lower CPI-AL and CPI-RL inflation prints. Inflation in terms of the CPI for industrial workers (CPI-IW) fell below the headline during May-August 2021. WPI inflation registered sharp increases sequentially between February and May 2021 to touch an all-time high of 13.1 per cent (as per the WPI series, 2011-12=100) in May from a sharp and broad-based upsurge in price momentum in an environment of adverse base effects. WPI inflation moderated in June and July 2021, despite positive price pressures, owing to base effects turning favourable, although it remained in double digits. In August, WPI inflation reversed course and edged up to 11.4 per cent primarily on account of an increase in non-food manufactured products inflation, despite softening of food inflation. In line with WPI inflation, the deflators for gross value added (GVA) and gross domestic product (GDP) edged up sharply between Q3:2020-21 to Q1:2021-22. | Table II.3: Trimmed Mean Measures of Inflation (y-o-y) | | Period | 5% trimmed | 10% trimmed | 25% trimmed | Weighted Median | | Jun-19 | 3.0 | 3.1 | 3.0 | 2.8 | | Sep-19 | 3.3 | 3.2 | 3.1 | 2.8 | | Dec-19 | 4.4 | 4.0 | 3.7 | 4.0 | | Mar-20 | | | | | | Jun-20 | 5.8 | 5.4 | 5.1 | 4.9 | | Sep-20 | 6.2 | 5.6 | 4.7 | 5.1 | | Dec-20 | 5.6 | 5.1 | 4.3 | 4.0 | | Jan-21 | 5.0 | 4.8 | 4.0 | 3.6 | | Feb-21 | 5.1 | 4.9 | 4.1 | 3.7 | | Mar-21 | | | | | | Apr-21 | | | | | | May-21 | | | | | | Jun-21 | 5.7 | 5.2 | 5.0 | 5.2 | | Jul-21 | 5.8 | 5.3 | 5.0 | 4.6 | | Aug-21 | 5.5 | 5.1 | 4.9 | 4.3 | | Sources: NSO; and RBI staff estimates. | WPI inflation has averaged 11.7 per cent during April- August 2021, remaining markedly above CPI inflation (average of 5.5 per cent) (Chart II.17a). Inflation in petroleum products – especially petrol and diesel – eggs and edible oils diverged considerably between the CPI and the WPI (Chart II.17b). These developments have again brought to fore the possibility of transmission of WPI inflation to the CPI and their long-run relationship (Box II.2).

Box II.2: CPI-WPI Inflation Post-Lockdown: Long-run Cointegration and Short-run Error Correction Since the onset of the pandemic in 2020, consumer price and wholesale price inflation rates have been exhibiting considerable divergence, the wedge widening to 6.1 percentage points in August 2021 (Chart II.2.1). This brought to fore the concern – will elevated WPI inflation feed into CPI? Recent studies have shown that over time and through the course of the pandemic the sensitivity of CPI inflation to WPI inflation has come down (RBI, 2021). An analysis based on CPI and WPI for the period, April 2012-July 2021, shows that a long-run relationship exists between CPI and WPI14. The speed of adjustment is low. The CPI food index and the WPI food index are cointegrated as well as homogeneous, i.e., they move one-on-one in the long term. CPI core and WPI core are also found to be cointegrated but the long run coefficient is less than one. While WPI core largely comprises of basic and intermediate industrial inputs that do not find representation in CPI, CPI core comprises of household goods and services, including housing service, that are not part of WPI (Das and George, 2017). WPI and CPI fuel groups, on the other hand, are not cointegrated (Table II.2.1).

| Table II.2.1: Cointegration and VECM Estimates for CPI and WPI by Major Groups | | | Overall | Food@ | Fuel@ | Core@ | Johansen Cointegration Test Trace Statistic

H0: No Cointegrating Equation (p-value)#

Number of cointegrating vectors | 33.00***

(0.005)

1 | 26.74***

(0.005)

1 | 2.74

(0.97)

0 | 30.83**

(0.01)

1 | | Long-run equation | In(CPI)t = 2.90 + 0.38** In(WPI)t + 0.002*** t | In(CPI)t = 0.04 + 1.00*** In(WPI)t | Not Applicable | In(CPI)t = 3.52 + 0.24** In(WPI)t + 0.003*** t | Homogeneity

H0: Long run coefficient =1 (p-value) | (0.000)*** | (0.989) | Not Applicable | (0.000)*** | | Error correction term in short-run | -0.083*** | -0.089** | Not Applicable | -0.078*** | | Regression Diagnostics: | | | | | | Adjusted R2 | 0.211 | 0.317 | Not Applicable | 0.430 | | Breusch-Godfrey LM Test (p-value) | 0.213 | 0.238 | Not Applicable | 0.112 | | Conclusions | Cointegrated; not Homogeneous | Cointegrated; and Homogeneous | Not Cointegrated | Cointegrated; not homogeneous | @ See notes for definitions.

# Maximum eigenvalue statistic gives similar results as Trace statistic.

*** denotes significance at 1 per cent level, ** denotes significance at 5 per cent level and * denotes significance at 10 per cent level.

Notes: 1. The sample period for the analysis is April 2012-July 2021. The estimates on cointegration and vector error correction models (VECMs) are based on Johansen System Cointegration test. The homogeneity is tested using student’s t-test.

2. CPI food is defined as CPI food and beverages. WPI food comprises of WPI food articles, manufactured food products and non-alcoholic beverages.

3. CPI fuel comprises of CPI fuel and light, petrol and diesel. WPI fuel is defined as WPI fuel and power.

4. CPI core is defined as CPI excluding food, fuel, petrol, diesel and housing. WPI core is defined as WPI non-food manufactured products excluding non-alcoholic beverages.

5. COVID-19 related disruptions have been adjusted for by introducing time dummies in the VECMs – a dummy for April 2020 has been included in all four equations and additionally for May 2021 for the core equation. All dummies were found to be significant at 1 per cent level. WPI and CPI with appropriate lags have been included in estimating the short-term error correction equations. | References: RBI (2021), “State of the Economy”, RBI Bulletin, June 2021. Das, P., & George, A. T. (2017), “Comparison of Consumer and Wholesale Prices Indices in India: An Analysis of Properties and Sources of Divergence”, RBI Working Paper Series, WPS (DEPR): 05 / 2017. | II.3 Costs During H1:2021, costs, as measured by inflation in WPI industrial raw materials and farm inputs, increased (Chart II.18). The firming up of global crude oil prices during 2021 impacted the prices of inputs such as high-speed diesel (HSD), naphtha, aviation turbine fuel (ATF), and furnace oil. Prices of non-food articles also increased during March- August 2021. Prices of fibres and oilseeds edged up as international cotton and soybean prices increased. However, inflation in industrial raw materials eased marginally in July 2021 reflecting easing in prices of minerals, bitumen, paper and pulp, before picking up again in August 2021. The increase in farm input price inflation was largely driven by double digit inflation in fodder, due to damage to production from excess rains during September-October 2020, and HSD reflecting firming up of global crude oil prices. Fertiliser prices, on a year-on-year basis, edged up moderately during 2021, reflecting increase in international prices. Prices of electricity – a key input in both industrial and farm inputs – remained muted during H1:2021. Price increase of agricultural machinery and implements, on a year-on-year basis, also stayed subdued, although a gradual pass-through of higher manufacturing costs due to rising commodity prices is underway during March-August 2021. Nominal rural wages for both agricultural and non-agricultural labourers remained stagnant; growth rates of the nominal rural wages eased sharply, on a year-on-year basis, during May-July 2021, attributable to adverse base effects15 (Chart II.19). Growth in the value of production in the organised sector decelerated in contrast to the increase in staff costs for listed firms in the manufacturing sector during Q1:2021-22. In the services sector, staff cost increased sharper than the value of production. As a result, unit labour costs (measured as a ratio of staff cost to value of production) rose from 5.7 per cent in Q4:2020-21 to 6.2 per cent in Q1:2021-22 for firms in the manufacturing sector16 and from 29.1 per cent to 31.5 per cent for firms in the services sector17 (Chart II.20). Input cost pressures and salary outgoes are expected to rise in Q3:2021-22 for the manufacturing firms polled in the Reserve Bank’s industrial outlook survey. Manufacturers may pass on the cost burden and selling prices are expected to increase in Q3 (Chart II.21a).

The firms covered in the Reserve Bank’s services and infrastructure outlook survey also expect input cost pressures as also the cost of finance to harden further going forward. The firms expect these factors to push up the selling prices in Q3 along with increase in salary outgoes (Chart II.21b). An analysis of the composition of costs among listed non-government non-financial (NGNF) firms18 reveals that there has been a distinct upward shift in costs for all constituents since the pre-pandemic period (Chart II.22). Manufacturing firms included in the purchasing managers’ index (PMI) also reported increase in input prices, with the pace of increase picking up in September 2021. PMI services firms reported elevated input prices, mainly driven by fuel, raw materials and transportation. In tandem, selling prices also started to tick up, though the pace remained muted. One year ahead business inflation expectations polled by the Indian Institute of Management, Ahmedabad, rose to their highest reading in July before softening somewhat in August.19

II.4 Conclusion With inflation expected to moderate in near months, the outlook has improved, and its trajectory may be shifting downwards in contrast to initial expectations. Active supply-side interventions by the Government in food items, particularly in pulses and edible oils, should bring about a better balance between supply and demand. With cost pressures showing no sign of abating, core inflation remains sticky and elevated. Furthermore, shortage of key industrial components due to stretched global supply chains and logistics is also leading to cost escalation. As demand recovery gathers steam, there is a rising risk of higher input price pass-through to output prices. Measures to ameliorate supply-side cost pressures would be critical at this juncture, especially in terms of a calibrated reduction of the indirect taxes on petrol and diesel. This would help anchor inflation expectations, prevent build-up of a wage-price nexus and provide space for monetary policy to sustain support for the still incomplete growth recovery. __________________________________________________________________________________

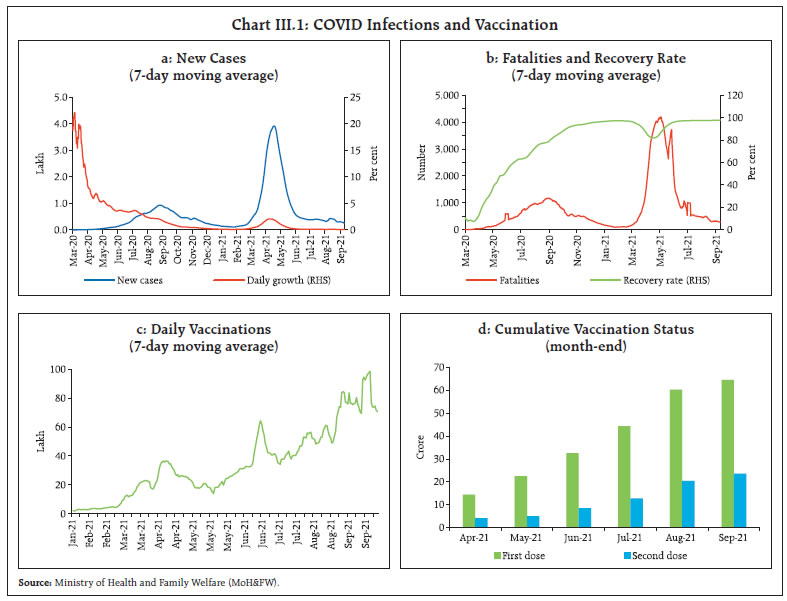

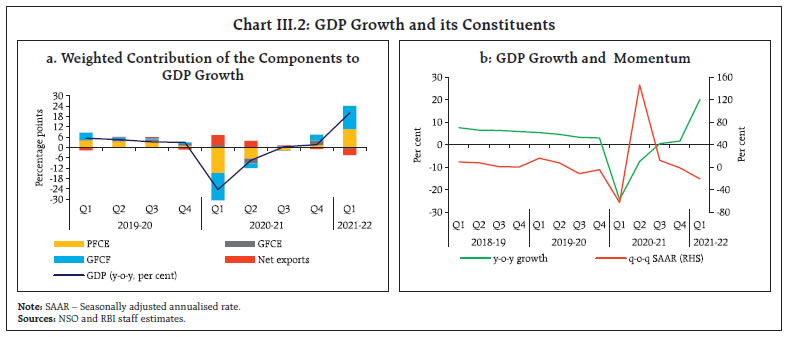

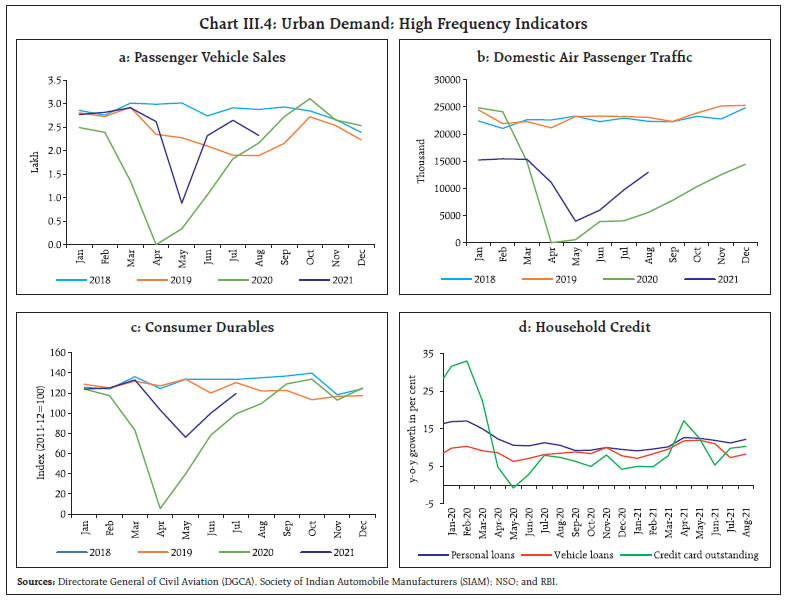

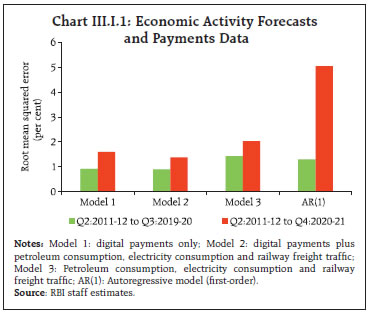

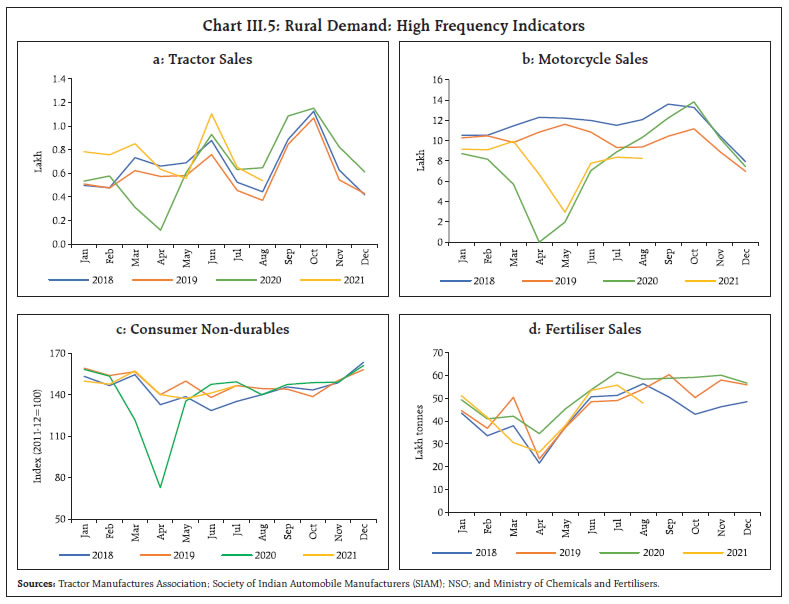

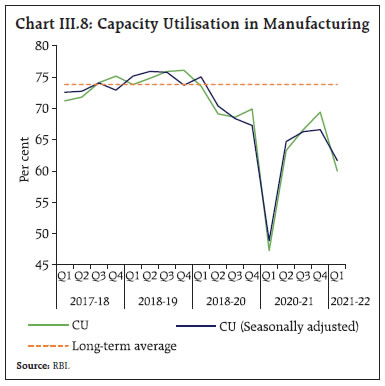

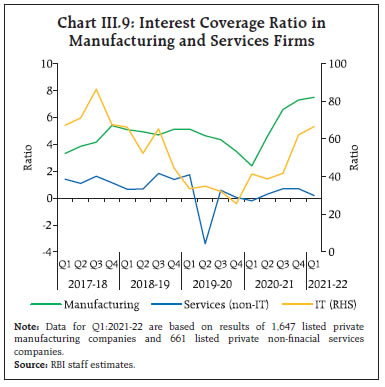

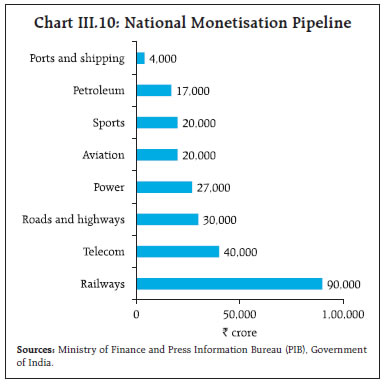

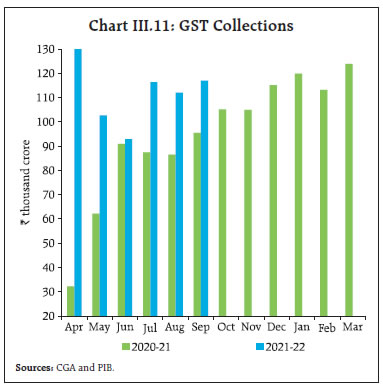

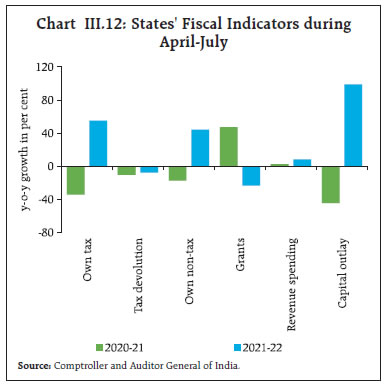

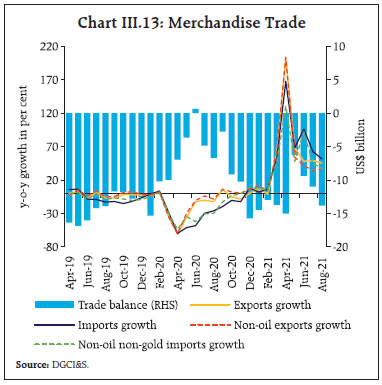

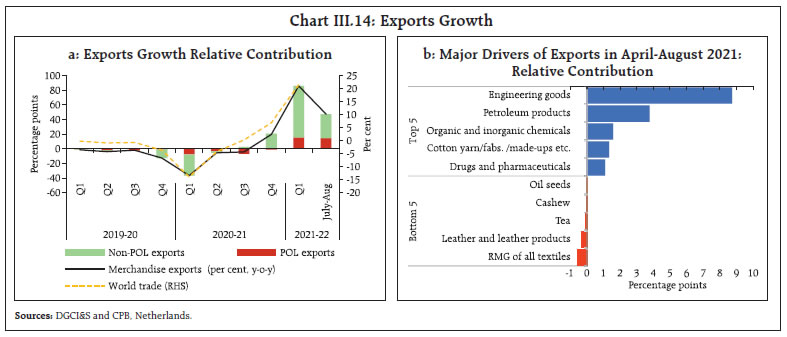

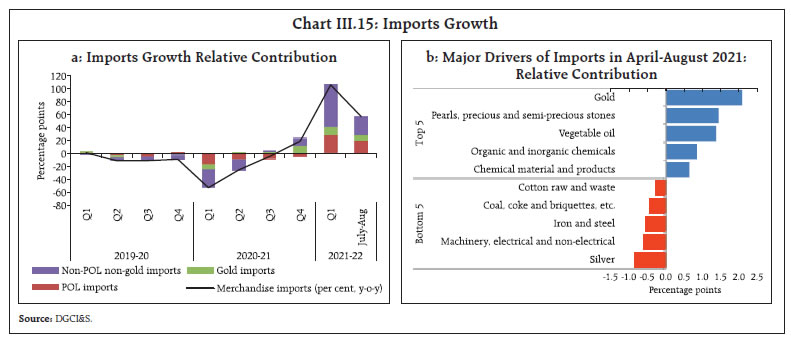

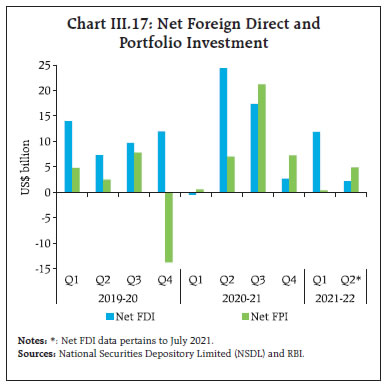

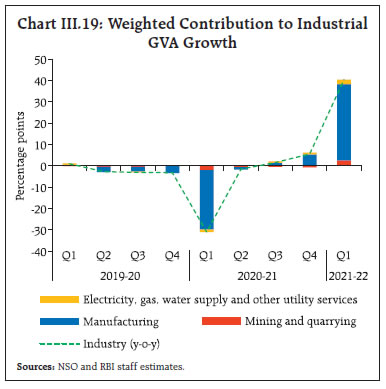

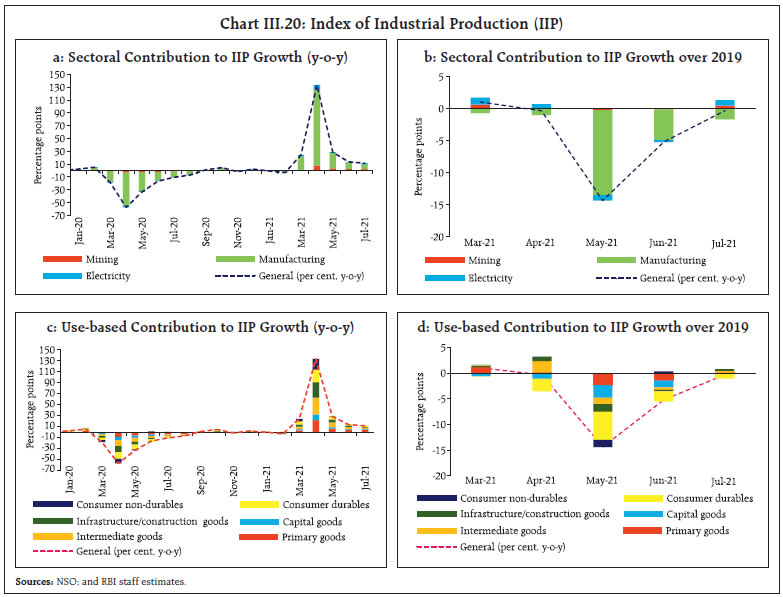

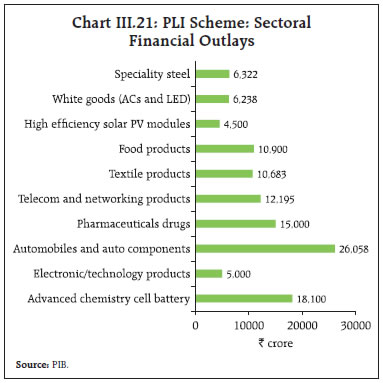

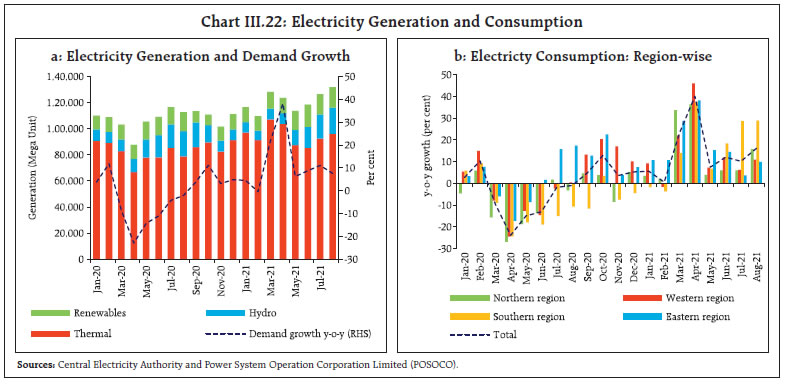

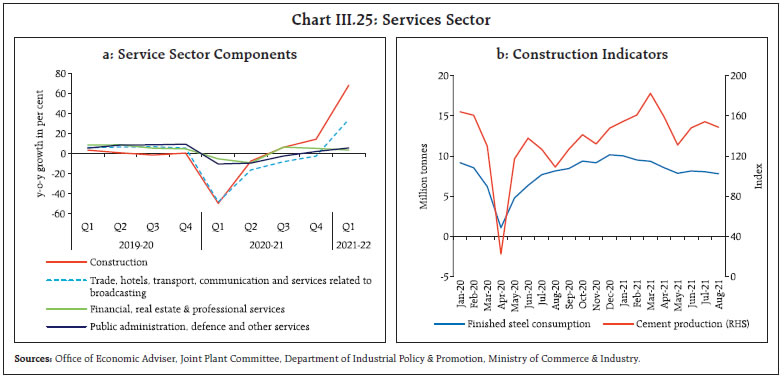

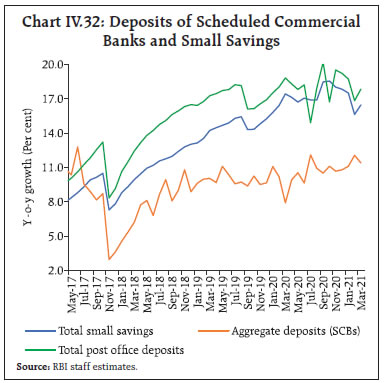

III. Demand and Output While the second wave dented the momentum of economic activity in Q1:2021-22, its impact on aggregate demand was muted relative to the first wave. Aggregate demand recovered in Q2:2021-22 and is expected to strengthen further in H2. The supply side is gradually normalising with the easing of supply chain and logistic disruptions. The recovery, however, remains dependent upon continued policy support, the COVID-19 trajectory and the progress of vaccination. Within days of the release of April 2021 MPR, the second wave of COVID-19 intensified and became virulent and lethal, overwhelming the health infrastructure and denting the momentum of economic activity in Q1:2021-22. The second wave receded as rapidly as it had surged (Chart III.1). Accordingly, the impact on aggregate demand was muted and short-lived relative to the first wave. More nuanced and calibrated containment measures and adaptation by businesses and households to working in a pandemic environment also moderated the headwinds from the second wave. Aggregate demand recovered further in Q2:2021-22, led by investment and private consumption.

| Table III.1: Real GDP Growth | | (y-o-y per cent) | | Item | 2019-20

(FRE) | 2020-21

(PE) | Weighted contribution* | 2019-20 | 2020-21 | 2021-22 | | 2019-20 | 2020-21 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | | PFCE | 5.5 | -9.1 | 3.1 | -5.2 | 7.6 | 6.5 | 6.4 | 2.0 | -26.2 | -11.2 | -2.8 | 2.7 | 19.3 | | | | | | | | | | | | | | | (-11.9) | | GFCE | 7.9 | 2.9 | 0.8 | 0.3 | 1.8 | 9.6 | 8.9 | 12.1 | 12.7 | -23.5 | -1.0 | 28.3 | -4.8 | | | | | | | | | | | | | | | (7.4) | | GFCF | 5.4 | -10.8 | 1.7 | -3.5 | 13.3 | 3.9 | 2.4 | 2.5 | -46.6 | -8.6 | 2.6 | 10.9 | 55.3 | | | | | | | | | | | | | | | (-17.1) | | Exports | -3.3 | -4.7 | -0.7 | -0.9 | 3.0 | -1.3 | -5.4 | -8.8 | -21.8 | -2.0 | -3.5 | 8.8 | 39.1 | | | | | | | | | | | | | | | (8.7) | | Imports | -0.8 | -13.6 | -0.2 | -3.1 | 9.4 | -1.7 | -7.5 | -2.7 | -40.9 | -17.9 | -5.0 | 12.3 | 60.2 | | | | | | | | | | | | | | | (-5.3) | | GDP at market prices | 4.0 | -7.3 | 4.0 | -7.3 | 5.4 | 4.6 | 3.3 | 3.0 | -24.4 | -7.4 | 0.5 | 1.6 | 20.1 | | | | | | | | | | | | | | | (-9.2) | Note: *: Component-wise contributions to growth do not add up to GDP growth because change in stocks, valuables and discrepancies are not included.

Figures in parentheses are growth rates over Q1:2019-20.

FRE: First revised estimates, PE: Provisional estimate

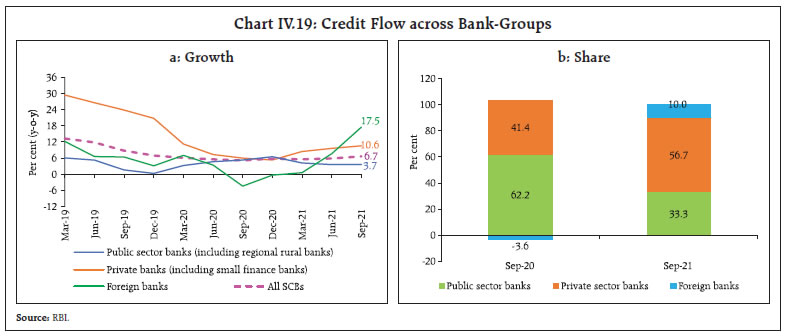

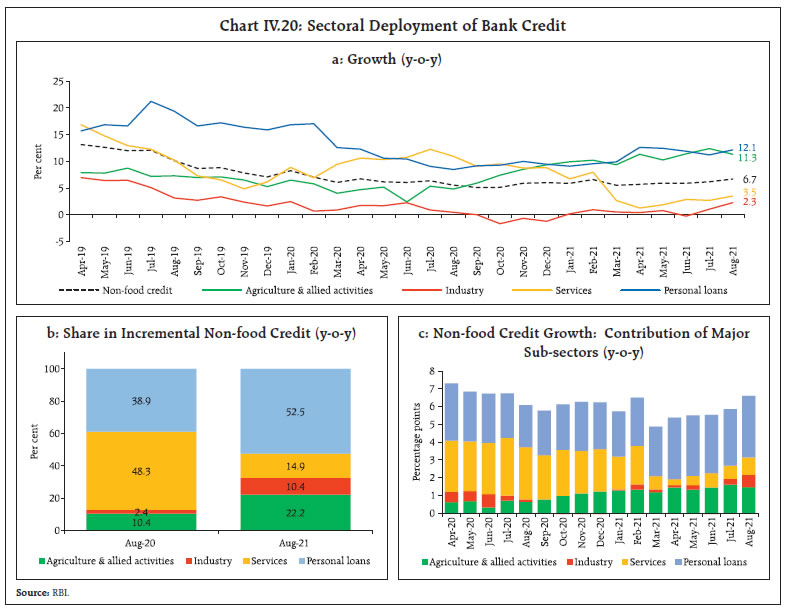

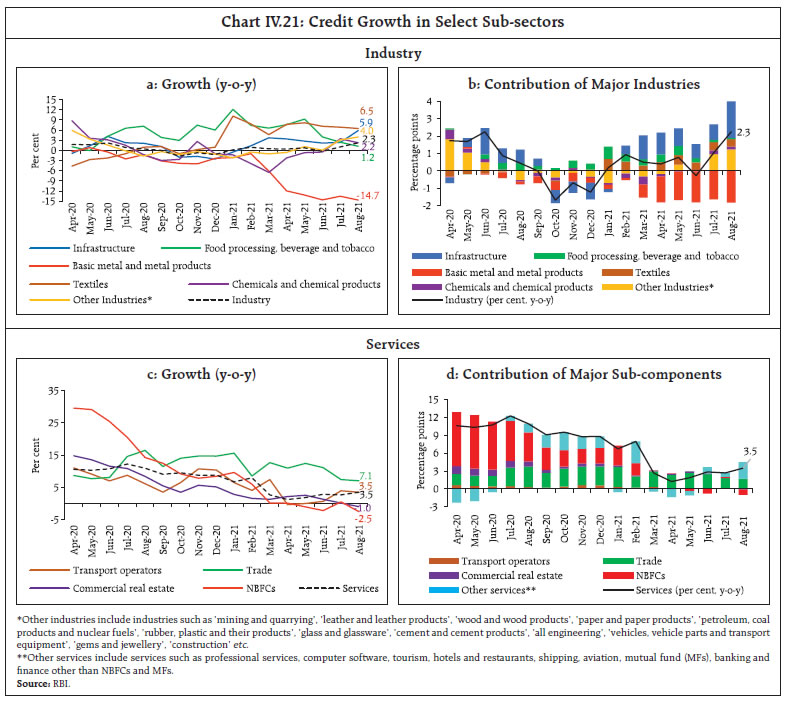

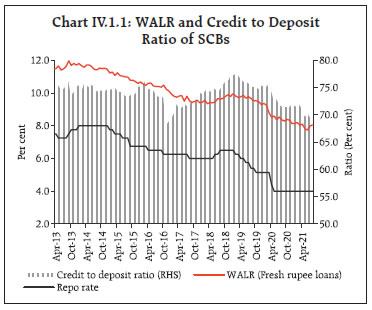

Source: National Statistical Office (NSO). | The recovery is benefitting from pent-up demand supported by the increasing vaccination coverage, the government’s push towards capital expenditure, robust external demand and normal monsoon. The ongoing demand revival is expected to get a further boost from the government’s asset monetisation programme and reforms encompassing the telecom and banking sectors. The supply side is also gradually normalising with the easing of supply chain and logistic disruptions. Agriculture and allied activities remain resilient, backed by above normal kharif sowing. A number of high-frequency indicators are yet to exceed the pre-COVID levels, however, and the recovery remains dependent upon continued policy support. III.1 Aggregate Demand Despite a loss of momentum in the wake of the severe second wave, real gross domestic product (GDP) rose by 20.1 per cent year-on-year (y-o-y) in Q1:2021-22 on a large favourable base effect (Table III.1 and Chart III.2a), supported by expansion in all its constituents except for government final consumption expenditure (GFCE) which contracted. The level of GDP in Q1:2021-22 was, however, still 9.2 per cent below the pre-pandemic (Q1:2019-20) level. Excluding GFCE, real GDP expanded by 25.0 per cent (y-o-y) during Q1. Momentum – the quarter-on-quarter (q-o-q) seasonally adjusted annualised rate (SAAR) of real GDP – fell during Q1:2021-22, however, reflecting the lockdowns/restrictions during the second wave, although the contraction was lower than a year ago with businesses and households adapting better to COVID-19 protocols as well as the sharp tapering in infections (Chart III.2b). Aggregate demand gained momentum in Q2, supported by recovery in private consumption and investment demand.  GDP Projections versus Actual Outcomes Actual real GDP growth of 20.1 per cent in Q1 undershot the April 2021 MPR projection of 26.2 per cent (Chart III.3), largely reflecting the impact of the steep jump in infections due to the second wave. The April MPR had alluded to the potential surge in infections and new mutants as downside risks to the baseline growth path. The decline in the government consumption expenditure also contributed to actual GDP growth trailing projections. III.1.1 Private Final Consumption Expenditure Private consumption, with a share of around 55 per cent in GDP during Q1:2021-22, continued as the mainstay of aggregate demand. Notwithstanding a y-o-y growth of 19.3 per cent, it was around 12 per cent lower than its pre-COVID level (Q1:2019-20). The accelerated pace of vaccination and the plateauing of new infections are facilitating faster resumption of contact-intensive services and giving a fillip to private consumption. Urban demand is turning the corner as corroborated by high frequency coincident and leading indicators for Q2. Passenger vehicle sales in July and August crossed pre-COVID levels (Chart III.4a), but production is facing headwinds from the persistence of global supply bottlenecks in the availability of semiconductor chips. Domestic air passenger traffic and the production of consumer durables regained traction during July and August, albeit they are still below pre-COVID levels (Chart III.4b and c). Household credit is gradually improving, driven by credit card transactions and personal loan, supporting consumer durables financing (Chart III.4d). Digital retail payments data, which provide useful signals of economic activity, corroborate the upturn (Box III.1). Rural consumption demand, which was largely immune to the pandemic during the first wave, was dented during the second wave with the fast spread of infections to rural areas. With the abatement of the second wave and improving vaccinations, rural consumption exhibited recovery in Q2, backed by buoyant rabi harvest, good kharif prospects, government transfers and the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) programme. The pick-up in motorcycle sales during June-August and the improvement in consumer non-durables underscore this revival (Chart III.5). Tractor sales have exhibited robust growth, remaining above their pre-pandemic levels, although sales dipped in August in the usual seasonal pattern. Fertiliser sales picked up from May, moving in tandem with 2019 levels, although trailing the exceptionally strong growth of last year.  Unemployment rose and labour force participation fell in Q1:2021-22 under the pressure of the second wave, but the impact was muted compared to the first wave. According to the Centre for Monitoring Indian Economy (CMIE), there was a deep hit to labour markets in mid-May at the peak of the second wave. Employment recovered swiftly in June-July and strengthened in September (Chart III.6a). In September, labour participation further rose with the phased opening up of the economy leading to rising demand for labour. Employment conditions improved in June and July 2021 in the organised sector, according to payrolls data (Chart III.6b). Increase in hirings is led by the IT sector, while non-IT sectors such as education, banking, financial, insurance, hospitality and automobile sector have also shown strong recovery recently, according to Naukri Jobspeak data. Box III.I: Tracking Macroeconomic Activity using Digital Payments Data A robust assessment of the current state of the economy and its expected trajectory is critical for the effectiveness of a forward-looking monetary policy. Data on GDP – the comprehensive measure of economic activity – are however, available, with a lag of two months after the end of the reference quarter. Given these data lags and the large and swift exogenous shocks that have been witnessed in the recent years (such as the 2008 global financial crisis and the ongoing COVID-19 pandemic), the interest in new macroeconomic forecasting tools to nowcast economic activity has become widespread. In this regard, payments data represent a unique source of tracing the underlying economic activity, given their crucial role in undertaking and settling transactions in a market economy. Cross-country empirical evidence suggests that the payments data enhance the accuracy of the nowcasts and short-term forecasts relative to other indicators (Aprigliano et. al., 2019; Bentsen et. al., 2021). India has state-of-the-art payments infrastructure and products and there is a wider adoption of digital payments (Das, 2021). The share of digital transactions in the total volume of non-cash retail payments stood at 98.5 per cent during 2020-21. The width and the depth of the banking system, the enhanced policy focus on promoting digital payments and the relatively quick availability of such data make them valuable for nowcasting GDP in the Indian context. A preliminary analysis shows that, amongst the various modes of digital retail payments, the volume of transactions through the following three channels – ATMs, credit cards and debit cards – has a high correlation with GDP (0.95 for the period Q1:2011-12 to Q4:2020-21). The dynamics are further explored through alternate autoregressive distributed lag (ARDL) model specifications with the following variables: real GDP, digital payments volumes (as defined above), and select real economy indicators having a strong association with output (namely, petroleum consumption, electricity consumption and railway freight traffic) as control variables1. To assess the role of the payments data relative to the competing variables, three model specifications are attempted. Model 1 includes data only on digital payments; Model 2 augments payments data with the control variables; Model 3 drops the payments data and includes only the three control variables. Given the large disruptions to the economic activity from the unprecedented COVID-19 pandemic and to evaluate the relative forecasting performance, the models are estimated initially for the pre-COVID period (Q2:2011-12 to Q3:2019-20) and subsequently for the sample including the COVID period (Q2:2011-12 to Q4:2020-21). The estimates indicate that the forecasts of the baseline model with payments data (Model 1) outperform the specification which does not include payments data (Model 3) and also upon the benchmark AR(1) model (Chart III.1.1). Payments data thus add value to the forecasting toolkit and mixed frequency modelling approaches can provide monthly updates of the evolving output dynamics. The fast pace of the innovations in the payments technology and the rapid shifts in the payments habits of economic agents need ongoing refinements in the modelling approaches.  References: Aprigliano, V., G. Ardizzi and L. Monteforte (2019), “Using Payment System Data to Forecast Economic Activity”, International Journal of Central Banking, 15(4), 55-80. Bentsen, K.N., D. Gorea (2021), “Nowcasting and Forecasting Economic Activity in Denmark using Payment System Data”, Denmark Nationalbank Working Paper. Das, Shaktikanta (2021). Financial Inclusion – Past, Present and Future, RBI Bulletin, August. |  III.1.2 Gross Fixed Capital Formation Gross fixed capital formation (GFCF) expanded by 55.3 per cent (y-o-y) in Q1 (contraction of 46.6 per cent a year ago). Sequentially, there was a dip of 23.6 per cent in Q1 despite robust government capex. The share of GFCF in aggregate demand inched up to 31.6 per cent in Q1 from 24.4 per cent a year ago but remained lower than its pre-pandemic level. Construction activity, a large portion of GFCF, was subdued due to pandemic effects, especially led by labour and materials shortages, although the impact was less than during the first wave. There are signs of revival in investment demand in Q2, as suggested by the movements in the proximate indictors – capital goods imports; production of capital goods; and cement production (Charts III.7).