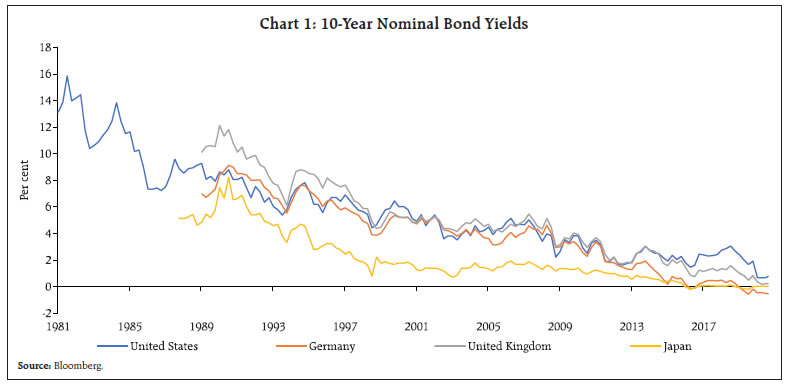

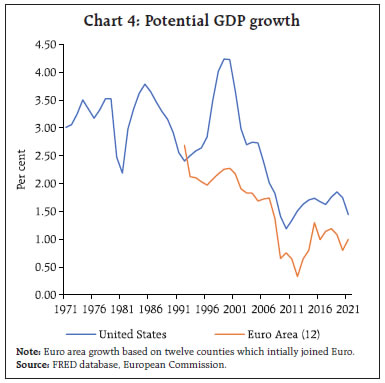

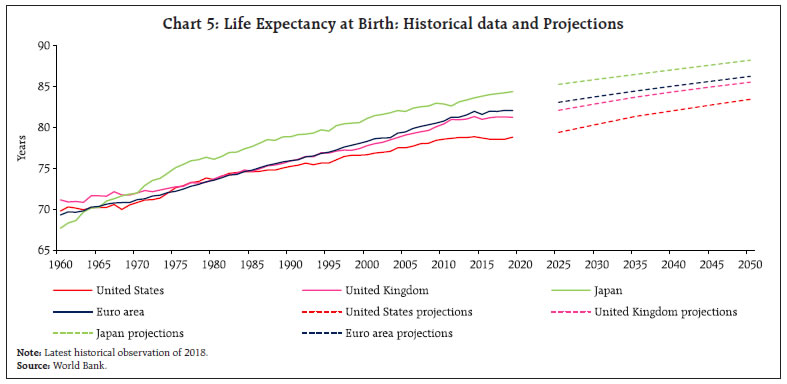

Interest rates which have been on a declining trajectory over the last four decades in advanced economies, touched their historic lows in 2020. The prominent drivers of the declining trend in nominal yields are the sustained downward shift in real interest rates and low levels of inflation, given well anchored inflation expectations. The structural low yield environment may persist in the post COVID environment due to uncertainty about the growth outlook. This low yield environment has made it an arduous task for the Reserve Managers to generate reasonable returns on their foreign assets. This article highlights the scope for looking beyond traditional ways to manage foreign exchange reserves in order to augment portfolio returns without undermining the predominant goals of safety and liquidity. Introduction The short term and long-term interest rates in advanced economies have been witnessing a trend decline since early 1980s, for example, 10-year bond yield in the USA fell from a high of 15.80 per cent in 1981 to below 1 per cent in 2020. The policy rates have also fallen dramatically in the USA from around 19 per cent in 1981 to close to zero currently. Many other advanced economies like the Euro zone, Japan and Switzerland have had negative policy rates for years now. This ultra-low interest rate environment is a reflection of structural changes in the advanced economies and global financial markets, in particular well anchored low inflation/expected inflation, and trend decline in equilibrium real interest rates over the last 3 to 4 decades. This low yielding environment warrants a relook at ways to enhance returns without compromising on the basic prudent investment principles of safety and liquidity. The rest of the article is organised as follows. Section II analyses the nominal and real interest rates trends and discusses the determinants of equilibrium real interest rates. Section III extends the discussion to trends in inflation/inflation expectations and drivers of the same. Section IV examines the strategic response of reserve managers to the low yield environment based on some recent surveys. Section V presents some policy options for the reserve managers and Section VI concludes. II. Trends and determinants of equilibrium real interest rates (a) Trends As mentioned earlier, the nominal long-term yields in the advanced economies have been declining in the last few decades (Chart 1). The real yields of the United States, Germany and Japan also show a declining trend since the early 1990s (Chart 2). The global trends in real interest rates, focusing on 13 advanced economies show that real ex post short-term and long-term interest rates have hovered in the neighborhood of zero percent over 2011 to 2019, substantially below the levels that prevailed over the previous three decades (Kiley, 2019). (b) Determinants of equilibrium real interest rates The equilibrium real interest rate has been defined in the literature as (i) the level of interest rate at which savings equal investments and (ii) the level of the real interest rate at which output is at its long-run potential. The definitions are equivalent from common notions of macroeconomic balance (Kiley, 2019). Several approaches have been adopted in the literature to make an assessment of the factors affecting the equilibrium real interest rate but most of them rely on the underlying simple model of supply and demand for loanable funds, as shown in Chart 3. The factors affecting the supply and demand have shifted these curves in the last few decades leading to notable downward shift in the equilibrium real interest rate.   Savings and investments depend on a variety of factors among which the following are commonly viewed as the possible determinants of equilibrium real interest rates. Apart from these, the academic research has highlighted the demand for safe assets as another possible determinant (Caballero et al, 2017) i. Economic growth One fundamental driver of real interest rates is the potential growth rate of the economy. A high-growth economy would require a higher real interest rate to encourage the volume of saving required for the high investment levels needed to sustain its pace. A sustained fall in potential growth rate of the major advanced economies has been observed over decades which can be attributed to a decline in total factor productivity growth and a corresponding decline in labour productivity growth (Lane, 2019) (Chart 4). A slower trend productivity growth decreases the required increase in the capital stock and consequently, lower investment demand and interest rates. Also, slower growth in the labour force decreases required increase in the capital stock, thus depressing interest rates. ii. Demographics and Income inequality The demographics in advanced economies have been characterised by rising life expectancy over the last five to six decades, a trend which is expected to continue till at least 2050 (Chart 5). A higher life expectancy implies people will live longer and would spend more years in retirement, assuming constant working years. This is likely to increase aggregate savings as working age population would save more in anticipation of longer retirement. Also, an ageing population along with low fertility rates in advanced economies would mean lower proportion of working age population. This suggests that ratio of installed capital relative to work force would rise, thus adversely impacting the investment demand.

However, it has been argued in academic research that this effect is only transitional and partial as an ageing population along with constant working years would increase the dependency ratio leading to more dissaving, but these effects occur over very long periods and involve complex dynamics (Kiley, 2019). Further, the increase in the capital-labour ratio associated with a sustained phase of higher saving and a contraction in the workforce will weigh on the level of real interest rates for a considerable time (Lane, 2019). Apart from demographics, distribution of wealth also affects the real rates through its impact on aggregate savings. Increased inequality is likely to boost savings and lower interest rates, as the propensity to consume out of income for the rich is expected to be lower than that for other segments of the population (Dynan et al, 2004). iii. Demand for safe financial assets The global demand for safe assets has outpaced its supply in the last few decades. The major hallmark of this growing shortage has been a steady rise in the prices of safe assets and thus, decline in interest rates. Also, the term premia for many of these safe assets have declined and are even negative in many economies. The key drivers behind this increased net demand for safe assets are as follows. First, there has been a huge accumulation of safe assets by emerging economies in the form of foreign exchange reserves. Second, ageing has influenced portfolio preferences of investors towards lower-risk assets. Third, the regulatory requirements introduced in the aftermath of Global Financial Crisis has also fueled demand for safe assets by financial institutions. Fourth, central banks in advanced economies have acquired a substantial portion of safe assets as part of their unconventional easing of monetary policy. III. Causes of low inflation/ inflation expectations Over the last four decades, most parts of the world have witnessed a trend towards lower inflation rates (Chart 6). Inflation has remained at very low and stable levels for more than a decade now in advanced economies and is expected to remain so for the next few years, as evidenced by the inflation expectations. This stubbornly low inflation over the last decade is at odds with one of the longest periods of economic growth, highly expansionary monetary policies and multi-decade low level of unemployment. We try to highlight some of the reasons which seem to have played a major role in propagating the low inflation environment. a) Cross border trade The surge in cross border trade could be considered as the single biggest influence on low inflation across the globe. Trade has grown from 27 per cent of world GDP in 1970 to 59 per cent in 20181. Globalisation has brought down the price of manufactured goods as their production has shifted to economies with low labour costs. Global factors contribute to a significant part of inflation in countries which participate more in global supply chains. b) Commodity prices Commodity prices have had a softening impact on inflation for decades now. The boom and bust cycle in oil prices led to a surge in inflation to unprecedented levels in 1970s, while their declines in early 2010s contributed to deflation in Europe. The contribution of the oil price, however, to global inflation has been declining since 2011. The demand for other commodities like metals has also impacted inflation. As growth slowed in the emerging economies post Global Financial crisis, the demand for commodities and thus, commodity prices remained suppressed. c) Low wage growth Wage growth in the last few years has been weaker than in previous recoveries, given the declining trend in the unemployment rate. Various factors have led to this. Productivity gains in the recent years have been lower in the major advanced economies. Across the advanced economies, low wage growth has also been a drag on inflation on account of decline in bargaining power of trade unions and a rise in labour participation rates. In line with the increased importance of global factors, inflation rates and wage growth have been more closely synchronised among advanced economies in recent years. d) The role of inflation expectations Inflation expectations of the economic agents have an important influence on the inflationary pressures in the economy. If agents remain confident of central banks’ commitment to price stability, they would consider the volatility in inflation as transitory and cyclical pressures on inflation will be more muted. Over the last decade, the downward trend in inflation and increasing adoption of inflation targeting regimes has led to a decline in inflation expectations in many advanced economies. e) Velocity of money The central banks have increased the supply of money in the economies at an unprecedented pace since 2008, which should have led to increased inflation as per the Quantity Theory of Money. However, inflation has remained low during this period. Such a scenario can occur if the velocity of money falls, for example, in the United States, the velocity of money fell from 10.70 in Q4, 2007 to 1.20 in Q1, 2021.2 The fall in velocity can be explained by the private sector’s willingness to hoard money instead of spending it, bleak economic outlook and very low/negative rates inducing investors to move away from interest-bearing assets. A decline in velocity could also be one of the reasons for persistently low rates of inflation in advanced economies.3 IV. Impact of the low yield environment on reserve management The foregoing discussion on real interest rate and inflation illustrates the drivers of low nominal yields across the developed economies. This low yield environment has made it an arduous task for the asset managers in general and reserve managers in particular (who tend to hold a significant portion of their reserves till maturity) to generate reasonable returns. This situation has been further exacerbated by the COVID -19 pandemic, which has resulted in major loss of output across the world and led to adoption of unprecedented expansionary monetary and fiscal policies. The remaining part of this section looks at the changing preferences of the reserve managers towards various currencies for diversification purposes and the impact of the low yields on reserve management strategies. (a) International Monetary Fund’s currency composition of official foreign exchange reserves (COFER) statistics The IMF COFER statistics, March 2021 show that the USD continues to be the dominant currency in the composition of global foreign exchange reserves with approximately 59.5 per cent allocation (Table 1). Also, the EUR composition has shown little variation over the last three years with a share of approximately 20 per cent. Negative rates in the major European countries like Germany, France etc. have weighed on the Euro’s performance as a reserve currency. The share of RMB (Renminbi) as part of global reserves has gradually grown to 2.4 per cent but remains small as reserves managers are cautious about investing in Chinese assets and low level of liquidity makes trading in Chinese sovereign bonds challenging. | Table 1: Global foreign exchange reserves by currency over time (share in per cent) | | Year | USD | EUR | GBP | JPY | AUD | CAD | CHF | RMB | Others | Allocated Reserves | | 2010 | 62.3 | 26.3 | 4.1 | 3.3 | NA | NA | 0.1 | NA | 3.8 | 56.4 | | 2011 | 61.8 | 25.6 | 4.0 | 3.7 | NA | NA | 0.2 | NA | 4.8 | 54.9 | | 2012 | 61.6 | 24.4 | 4.0 | 4.0 | 1.5 | 1.4 | 0.2 | NA | 5.0 | 55.3 | | 2013 | 61.8 | 23.8 | 3.9 | 3.8 | 1.7 | 1.8 | 0.3 | NA | 3.0 | 54.1 | | 2014 | 64.0 | 22.3 | 3.8 | 3.6 | 1.7 | 1.8 | 0.2 | NA | 2.7 | 58.6 | | 2015 | 65.6 | 19.7 | 4.4 | 3.7 | 1.7 | 1.8 | 0.3 | NA | 2.8 | 63.8 | | 2016 | 65.2 | 19.4 | 4.5 | 4.0 | 1.7 | 1.9 | 0.2 | 1.1 | 2.9 | 74.7 | | 2017 | 63.7 | 19.9 | 4.4 | 4.6 | 1.8 | 2.0 | 0.2 | 1.1 | 2.3 | 84.2 | | 2018 | 62.2 | 20.4 | 4.5 | 4.9 | 1.7 | 1.9 | 0.2 | 1.7 | 2.5 | 92.2 | | 2019 | 61.4 | 20.4 | 4.5 | 5.6 | 1.7 | 1.9 | 0.1 | 1.9 | 2.5 | 93.8 | | 2020 | 60.7 | 20.5 | 4.5 | 5.8 | 1.7 | 1.9 | 0.2 | 2.1 | 2.5 | 93.6 | | 2021# | 59.5 | 20.6 | 4.7 | 5.9 | 1.8 | 2.1 | 0.2 | 2.4 | 2.7 | 93.4 | *AUD and CAD numbers were included in Others prior to 2012 and RMB in Others prior to 2016.

#Figures for 2021 are based on Q1, 2021 data.

Source: IMF COFER statistics, 31 Mar 2021. | (b) Recent surveys of Reserve Managers According to the Central Banking’s Trends in Reserve management 2021 survey4, reserve managers have found the reduction in yields since March 2020 as the most challenging aspect of their work. The traditional risks that gained priority during the COVID-19 pandemic include reduced market liquidity, pressure on reserve levels, credit deterioration, etc. The survey with 78 respondents, which was conducted in February- March 2021, indicates that the Reserve managers envisage that the effects of COVID-19 to continue to be felt in remote working, tactical and strategic asset allocation (TAA, SAA), risk appetite and frameworks. However, at the same time, the structural low yield environment and accommodative monetary policies introduced across the world in response to the coronavirus pandemic have also reinforced the multi-decade trend towards further asset diversification. Most of the participants in this survey accepted that the low yield environment, notably in major reserve currencies, has changed the reserve management policies and practices in favour of i) investments in new geographies/ markets ii) investments in new asset classes iii) investment in more currencies and iv) changes in minimum credit rating accepted. The underlying theme throughout the last decade to deal with the low yield environment has been diversification, by means of adding exposure to new currencies, asset classes, etc. Another recent survey, UBS Annual Reserve Management Seminar Survey conducted during April – June 2021 indicates that lower/negative yields remain the top worry of reserve managers in 2021 and central banks are “still diversifying away from more conservative fixed income assets”5. The investment options mentioned by participants to diversify their portfolios included passive equity, corporates, emerging market local-currency debt and gold. This is also reflected in 13 per cent of reserve managers reporting that they recently moved, or considered moving, passively managed assets to active management strategies. V. Policy options for Reserve managers Most market participants expect the structural low yield environment to persist for a considerable time in future. In light of the likely persistence of various structural reasons for low yields, it is imperative that reserve managers look beyond the traditional approaches for the management of reserves to maintain and enhance returns. We highlight some alternate ways for reserves management in this section, with the caveat that not all proposals will suit every reserve manager due to the unique constraints faced by each one of them. Different reserve managers are in different positions with regard to their respective reserve management style and risk appetite. The risk appetite of a reserve manager to include various instruments in portfolio management depends on various factors like adequacy of reserves and sources of accretion to reserves, besides the overriding emphasis on liquidity and safety. a) Increasing duration of portfolio: The first and foremost way to tackle the low yielding environment to increase return would be to increase duration of the portfolio. The countries with adequate reserves have sufficient cushion to take on more duration risk. Increasing duration of the portfolio is the easiest and immediate step that can be taken to enhance return by some basis points. This should be combined with increasing investments in longer maturities. This would help the reserve managers utilize the opportunities at the steeper part of the curve given that the short end of the yield curve has been getting flatter. b) Investment in new products/asset classes: Investment in new asset classes entail investing in products beyond the traditional investment avenues. While some of them are already being used by reserve managers, they seem to be very few in number. Certain products may be novel in nature as surveys and anecdotal evidence do not suggest usage of these products by the reserve managers. i. FX Swaps: The demand of dollar funding through FX swaps by institutional investors such as corporates, pension funds, etc. outside the United States has grown over the last decade. These investors hedge their dollar assets generally through short term FX swaps. The 3 month FX swap basis points of various currencies against US dollar is illustrated in Chart 7. This has been calculated as the spread between three-month US dollar Libor and three-month FX swap implied US dollar rates. The chart implies that more the FX swap basis point goes below zero, higher is the return for an investor lending dollars in the swap market. Given that central banks are natural holders of large US dollar balances, as is clear from the COFER data, it puts them in a unique position to employ dollars in FX swap market for a short term to generate higher return in a riskless manner. A number of central banks like Australia and Germany have been using a portion of their reserves by exploiting this FX swap market. ii. Repo transactions: Reserve managers are holders of large amount of securities, most of which are held to maturity. The reserve managers can use these idle securities by lending them in the repo market generally as specials or also through General Collateral to generate cash, which they can either put in higher yielding instruments matching the tenor of the repo or invest in FX swaps as mentioned above. The Reserve managers can also use the reverse repo facility to employ their excess cash for a short tenor in the repo market and add to income on their portfolio. For reserve managers already using the repo market, the operational efficiency of the repo lending could be enhanced by using tri party repos /sponsored repos to scale up their repo operations. iii. Dual Currency deposits: A dual currency deposit (DCD, also known as Dual Currency Instrument or Dual Currency Product) is a derivative instrument which combines a money market deposit with a currency option to provide a higher yield than that available for a standard deposit. If an investor has a view on the initial investment currency, a dual currency strategy allows the investor to benefit from higher returns. The returns are higher than the returns on normal deposits in compensation for the higher risks that are associated with DCDs, as the product involves assuming foreign exchange risk, in addition to the risks normally associated with deposits. iv. Equity Index funds: Investment in equities is considered to be risky, especially for a central bank, which is responsible for safeguarding the reserves. However, investment of a small portion of the reserves in an index fund has the potential to augment the return of the portfolio. Investment in S&P 500 across various business cycles and financial booms and busts reveal that the CAGR return in 5 years, 10 years, 15 years, 20 years, 25 years and 30 years would have been 13.3 per cent, 11.1 per cent, 7.3 per cent, 5.4 per cent, 7.4 per cent and 8.5 per cent respectively. This implies that if held for a long to very long period of time, despite volatility in the interim, it can not only preserve the capital but also fetch a return much higher than most of the investments. The return on the S&P 500 equity index funds is comparable to that on Gold over a long period of time. A number of central banks are increasingly making investment in equities in some form or the other. Swiss National Bank, for example, has an investment of 20 per cent of its reserves in equities. v. Increase credit risk of the portfolio: The regional governments of the major advanced economies issue bonds which, in many countries, carry the implicit guarantee of the sovereign. They also yield better return than the sovereigns. Reserve managers could invest a small percentage of their reserves in such sub-national debt securities across the developed countries like Germany, Australia, Canada, etc and US agency bonds. Similarly, even the best rated supranational agencies yield better than sovereigns in most of the cases. If reserve managers can go further down the credit curve, then they can earn even higher yield. c) Active management of gold: Central banks own almost 35,000 tonnes of gold6 which is around 17 per cent of worldwide available above-ground stocks. While gold acts as a safe haven and provides diversification benefits to the portfolio, it does not offer any yield. Holding physical gold, in fact, comes at a cost. The active management of gold can, however, yield a decent return to the central banks beyond capital gains. We discuss some such avenues as under: i. Gold deposits: Central banks being owners of such huge amount of physical gold, can lend it out to the bullion banks at the gold deposit rate set by the bullion banks for a short period, typically 1 month, 3 months or 12 months. At the end of the period, the bullion banks return the gold along with interest in the form of gold or currency to the depositor. The gold lent by the central bank in this case is akin to any other term deposit done by central bank and is uncollateralised in nature. ii. Gold swaps: Gold swaps are similar to repo transactions i.e. they are collateralised. In gold swaps, central banks lend/sell gold to bullion banks for a specified period and receive USD in return for the same. Central banks can employ these dollars at the LIBOR while paying to the bullion bank the interest equivalent to Gold offered forward rates (GOFO). Essentially, a central bank earns Libor- GOFO which is termed as Gold lease rate. This rate varies and is contingent on various factors such as outlook for gold, demand for borrowing, real interest rates etc. The movement of gold lease rates over the years is depicted in Chart 8. iii. Gold ETFs: Gold ETF, or Exchange Traded Fund, is a commodity-based Mutual Fund that invests in assets like gold. These ETFs are backed by physical gold and allow investors to track the price of gold. They provide an easy way to access the properties and security of physical gold ownership but without the need to arrange for storage and insurance separately. ETFs have been playing a key role in the movement of gold price and have become a big part of the gold market. Total Assets Under Management (AUMs) of gold ETFs stood at 3,611 tonnes of gold worth about $211 bn as on August 31, 20217. SPDR Gold Shares, a Gold ETF which is a partnership between State Street Bank and the World Gold Council, has the ninth largest holding of gold in the world (Chart 9).

Central banks could use the Gold ETFs for trading purposes. They can execute their short/medium term view on gold and exploit the opportunities presented by the market as it may be operationally more convenient than trading in physical gold. The cash settlement nature of this product can help the reserve managers avoid the cost of storage, insurance etc. d) Investment in new markets: Reserve managers usually invest in highly rated sovereigns like G10 countries as they have deep bond markets and meet safety and liquidity criteria of the reserve managers. However, there are some countries which are relatively stable financially, are highly rated and offer better yields than some of the G7 countries. While these countries do not have very deep sovereign bond markets, a reserve manager could invest a small portion of their reserves in these markets and generate that extra yield. Another way to generate higher return is lowering the credit rating requirement and investing in emerging markets which provide higher yield. This, however, entails a higher exposure to currency risk as their currencies can be volatile. To mitigate that, the reserve managers could explore investing in US/Euro denominated debt of these countries. Various options through which a reserve manager could invest in these markets are as under: i) Direct investment: While this may seem to be the easiest way, it requires more expertise to invest in such markets directly since these markets are not as liquid as G7 countries. It may not be as easy to move in and out of these markets as timing plays an important role, especially in crisis situations, e.g., Global Financial Crisis (GFC) in 2008-09. ii) Passive funds: There are various emerging market funds which invest in sovereign bonds of emerging markets across the spectrum of ratings and liquidity. An allocation to these passive funds can help the reserve managers earn higher yield. iii) Exchange Traded Funds (ETFs): Many of these passive funds also trade on the prominent stock exchanges like NYSE. The benefit of the ETFs over the passive funds is that these can be bought/sold at the real time prices on the stock exchanges at any time during the market hours. iv) Separately Managed funds/Customised funds/ETFs: The passively managed funds generally include sovereigns of various ratings, including some below investment grade. In case a reserve manager has rating or other constraints which prohibit them from investment in such countries, it would not be possible to invest in these funds. In such cases, reserve managers can opt for customised funds, which would meet all their criteria like countries, allocation to each country, duration, etc. Such funds could also be traded as ETFs for more liquidity. v) Total Return Swaps: Under this mechanism, a reserve manager could enter into a swap agreement in which it would receive a payment based on the return of the underlying fund (includes both the income and capital gains) on a fixed interval while it makes payments based on a benchmark rate. This allows the reserve manager to get exposure to the emerging markets without much operational hassle. VI. Conclusion Declining real interest rates, low levels of inflation and well anchored inflation expectations explain the sustained easing of nominal yields in the advanced economies. The factors that affect real interest rates are potential growth rates, demographic factors, income inequality and demand for safer assets. The structural changes in these factors have led to the decline in equilibrium real rates and are expected to keep them low for the considerable future. The inflation outlook is also benign because of low realised inflation in the past decade and firm anchoring of inflation expectations by central banks. Asset managers and reserve managers across the world face a challenging task in maintaining and enhancing returns in a low yield environment. Some reserve managers are dealing with low yields through diversification, by means of adding new currencies and asset classes to their portfolio. We highlight that reserve managers can deal with the low yield environment by increasing the duration of their portfolios, investing in new asset classes, new markets and more active management of their gold stocks. The choice of strategy, however, would require to be tailored to suit the risk appetite, investment priorities, skill sets and operational capabilities of individual institutions. References Caballero, R.J., Farhi, E. and Gourinchas, P.O. (2017), ‘The safe assets shortage conundrum’. Journal of Economic Perspectives. Clarida, R. H. (2018), ‘The global factor in neutral policy rates: Some implications for exchange rates, monetary policy, and policy coordination’, BIS Working Paper, No 732, Bank for International Settlements. Dynan, K.E., Skinner, J. and Zeldes, S.P. (2004), ‘Do the rich save more?’ Journal of political Economy. Kiley, M. T. (2019), ‘The Global Equilibrium Real Interest Rate: Concepts, Estimates, and Challenges’, Finance and Economics Discussion Series, Federal Reserve Board, Washington, D.C. Lane, Philip R., (2019), ‘Determinants of the real interest rate’, Speech at the National Treasury Management Agency, Dublin Nick Carver (2021), ‘Trends in reserve management: 2021 survey results’, Centralbanking.com, 17 May 2021 Reserve Bank of Australia (2019), ‘Box B: Why Are Long-term Bond Yields So Low?’, Statement of Monetary Policy, May 2019 Stefan Avdjiev, Egemen Eren and Patrick McGuire (2020), ‘Dollar funding costs during the covid-19 crisis through the lens of the FX swap market’, BIS Bulletin No 1, 2020 Tigran Poghosyan (2012), ‘Long Run and short run determinants of Sovereign bond yields in advanced economies’, IMF Working paper. The Economist.(2019), ‘Low inflation is a global phenomenon with global causes’ World Gold Council (2020), Gold Deposit rates- a guidance paper.

|