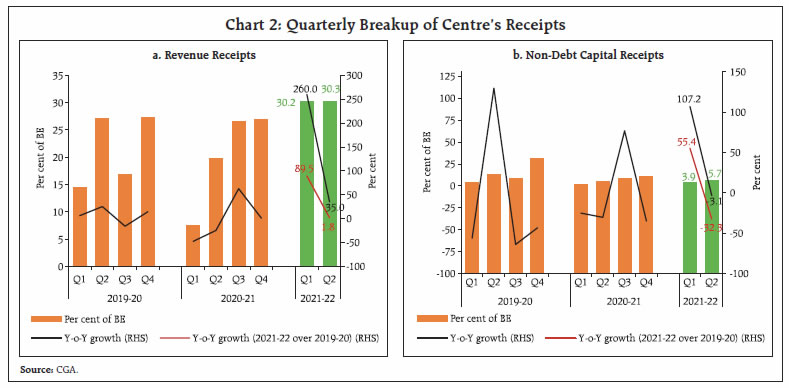

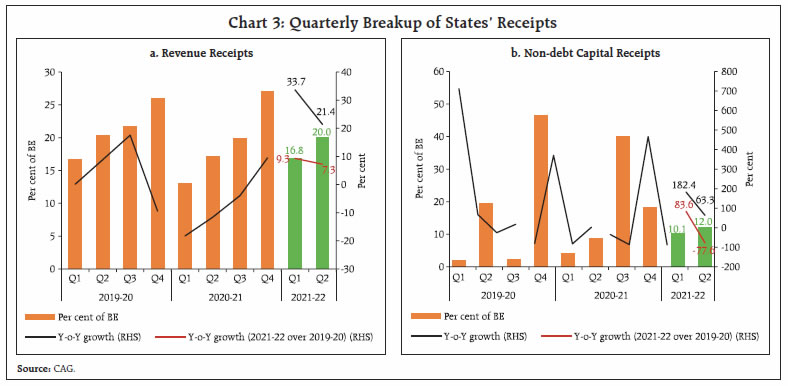

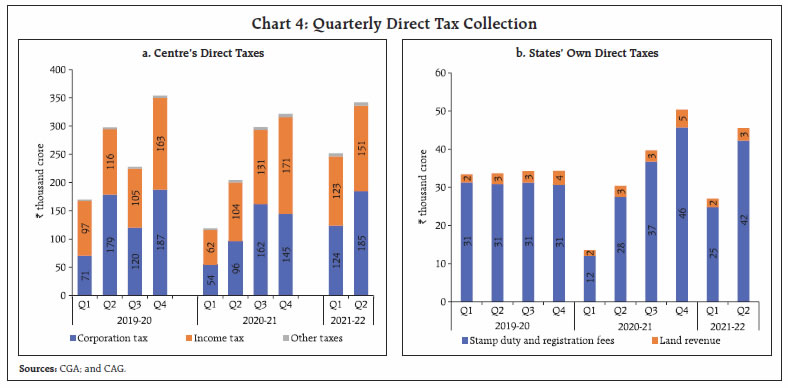

Government finances exhibited remarkable resilience to the second wave, with tax collections surpassing expectations, and government expenditure remaining broadly in line with the budget estimates despite higher pandemic related spending. There has also been a marked improvement in the quality of expenditure for both Centre and States, which bodes well for a durable growth revival. Going forward, the general government fiscal deficit, which remained subdued in H1:2021-22, allows space for a pick-up in expenditure in the second half of the current fiscal year to support and sustain the recovery in growth. I. Introduction The Union Budget for 2021-22 was presented at a juncture when the economy was witnessing a robust stimulus-led recovery from the severest recession encountered after the first wave of the pandemic, but amid lingering uncertainty about the prospect of a second wave. Accordingly, the Budget pursued a delicate balancing act, sustaining support to a broad-based and durable economic revival while aiming for feasible degree of fiscal consolidation in a challenging macroeconomic environment. The Budget envisaged a consolidation of gross fiscal deficit (GFD) from 9.5 per cent of GDP in 2020-21 (RE) to 6.8 per cent in 2021-22 (BE).1 States also budgeted for consolidation in their GFD from 4.7 per cent of GDP in 2020-21 (RE) to 3.7 per cent in 2021-22 (BE). The second wave, later during April-May 2021 turned out to be more severe in terms of loss of human lives, but the impact on economic activity was contained through localised restrictions and also better adaptation to live with the virus. Government finances showed remarkable resilience and buoyancy, and as a result, despite the additional expenditure burden imposed by the second wave, government spending has broadly remained in line with the budget estimates. The government’s thrust on capex resulted in a significant improvement in the quality of expenditure - a necessary condition for pro-growth fiscal consolidation in the medium-term. Centre’s tax collections surpassed expectations on the receipts side, with all major tax heads recording robust growth in the first half of 2021-22. States’ tax collections also exhibited strong growth, though not at the same pace as for the Centre, and have reached their pre-pandemic levels in H1:2021-22. The rest of the article is structured as follows: Section II analyses the receipt and expenditure outcomes for the Centre and States (at a quarterly frequency) for H1:2021-22. Section III deals with the outcomes in terms of key deficit indicators and their financing. Section IV presents estimates on general government finances for Q1 and Q2:2021-22 along with projections for the second half of 2021-22. Section V sets out the concluding observations and the near-term fiscal outlook. II. Fiscal Outcomes in Q1 and Q2: 2021-22 Total receipts of the Central government registered a marked improvement over its trend level and total expenditure remained contained in H1:2021-22, despite additional expenditure necessitated by the second wave as the government took precautionary measures to curtail avoidable expenditure. State finances also recovered to their pre-pandemic level in H1:2021-22. States collected 46.9 per cent of their budgeted receipts which is higher than the corresponding figures for the past three years2. On the expenditure side, the H1:2021-22 outgo was 37.8 per cent of the budgeted target, broadly in line with the average during the pre-pandemic years (Chart 1). a. Receipts Revenue receipts of the Central government registered a robust growth in Q1:2021-223, as tax revenues recorded high buoyancy despite the second wave and non-tax revenues received a boost from higher than budgeted dividend transfer from the Reserve Bank. With a 35.0 per cent growth in revenue receipts in Q2, it clocked a high of 60.4 per cent of BE in H1 as a whole. Non-debt capital receipts4 also improved in H1:2021-22 vis-à-vis H1:2020-21 but fell short of 2019-20 levels (Chart 2 a and b). States’ revenue receipts have also remained resilient to the second wave of the pandemic, with overall revenue receipts recording a y-o-y growth of 33.7 per cent in Q1:2021-22 over the previous year and 9.3 per cent over the corresponding quarter of 2019-20. Similar performance was sustained in Q2:2021-22 with the y-o-y growth in revenue being significantly high at 21.4 per cent. Overall, States’ revenue receipts in H1:2021-22 were 26.7 per cent higher than those in H1:2020-21 (8.2 per cent over H1:2019-20). Non-debt capital receipts of States also recorded high growth in both Q1 and Q2 of 2021-22 albeit with considerable volatility (Chart 3).  The Centre’s direct tax collections registered a y-o-y growth of 83.7 per cent in H1:2021-22, led by growth in income tax and corporation tax by 64.7 per cent and 105.1 per cent, respectively5, on the back of strong corporate performance. For States, stamp duties which account for more than 85 per cent of own direct tax revenues, more than doubled in Q1:2021-22; Q2 recorded a y-o-y growth of 53.4 per cent (Chart 4). The Centre’s indirect tax collections also increased during H1, led by a more than 100 per cent increase in customs duty collections on the back of improving trade activity and higher import demand. Union excise duty collections recorded an increase of 33.3 per cent over 2020-21 (79.0 per cent over 2019-20) during this period due to the higher duties levied last year (March and May 2020) to mobilise additional revenues as a pandemic induced emergency measure.

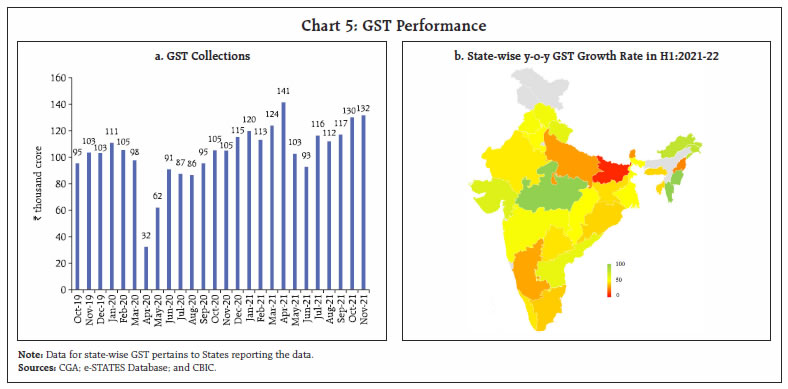

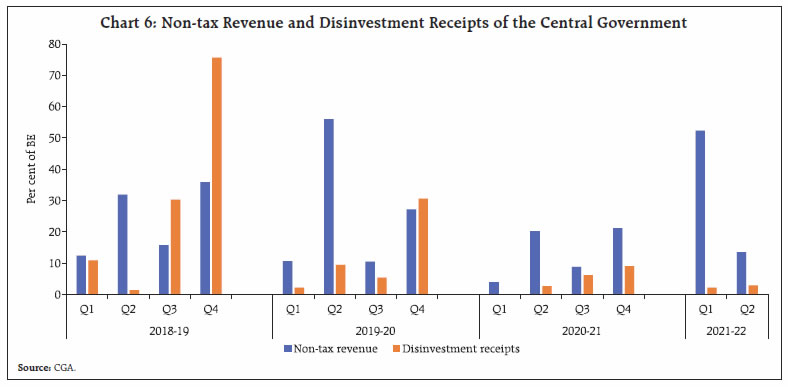

GST collections (Centre plus States) increased in H1 by 50.1 per cent and 12.5 per cent over 2020-21 and 2019-20 levels, respectively. GST revenues had taken a hit in May-June due to pandemic-related restrictions but recovered quickly thereafter, in line with the economic recovery and on account of steps taken by the tax administration to plug evasion and ease the compliance burden. In November 2021, GST collections registered a y-o-y growth of 25.3 per cent6 to reach ₹1.32 lakh crore, the second-highest since the introduction of GST. Around three-fifth of the budgeted GST compensation cess collections of ₹1 lakh crore were realised during April-October. The Union government has also transferred the entire amount of ₹1.59 lakh crore that was to be released to States in 2021-22 under the back-to-back loan facility in lieu of GST compensation cess. The front-loading has been done to enable States to plan their expenditure effectively. States’ GST collections recorded a y-o-y growth of 71.6 per cent in Q1 and 27.3 per cent in Q2, 2021-22, with many States like Gujarat, Uttarakhand, Andhra Pradesh, Himachal Pradesh, Maharashtra and Punjab registering a y-o-y growth of over 50 per cent in H1:2021-22 over H1:2020-21 (Chart 5). Given the comfortable revenue position both on the direct and indirect tax front, the Centre partially rolled back in November, the hike in excise duty on petrol and diesel that were introduced during the first wave of the pandemic. States also followed suit by reducing their VAT rates on fuel (Box 1). Centre’s non-tax revenues also increased during H1:2021-22 due to higher than budgeted surplus transfers from the Reserve Bank (Chart 6). On the disinvestment front, only 5.2 per cent of the budgeted disinvestment target of ₹1.75 lakh crore has been raised in H1. The progress on the proposed sale of Air India has, however, provided an impetus to the disinvestment programme of the government. The Centre also aims to raise resources through asset monetisation. An aggregate monetisation potential of ₹6.0 lakh crore, over a four-year period, from 2021-22 to 2024-25, is estimated under the National Monetisation Pipeline, with an indicative value of ₹0.88 lakh crore envisaged for the current financial year. However, the actual realization will depend on the timing, transaction structuring, and investor interest. For States, non-tax revenues increased by 40.2 per cent and 53.1 per cent in Q1 and Q2 of 2021-22, respectively (compared to Q1 and Q2 of 2019-20 at 15.9 per cent and 20.6 per cent, respectively).

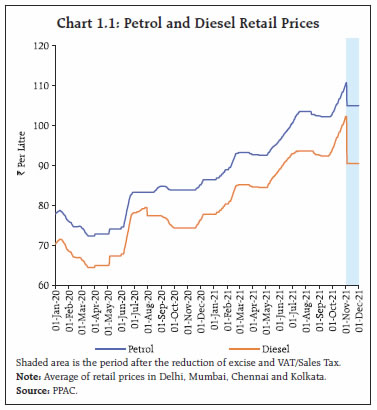

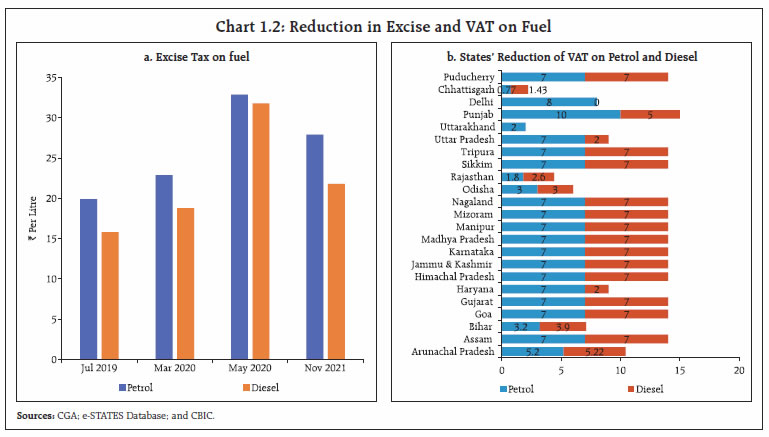

Box 1: Revenue Impact of Reduction in Fuel Taxes To provide relief to the consumers from the rapid rise in petrol and diesel prices resulting from significant hardening of international crude prices (Chart 1.1), the Centre decided to reduce excise duty on petrol and diesel by ₹5 and ₹10 per litre, respectively, with effect from November 4, 2021. Following the Centre, many States also reduced their value added tax (VAT) in the range of ₹0.8 to ₹10.0 per litre in petrol and ₹1.4 to ₹7.0 per litre in diesel. Reduction in the excise duty and value-added tax (VAT)/ Sales Tax on petrol and diesel entails direct short-term revenue losses but with scope for some increase in revenues later through the income effect due to expected stimulation of consumption and investment demand. In the medium-term, a reduction in fuel prices may help ease input cost pressures and thereby improve business and consumer sentiment. The potential fiscal impact of the recent cuts in excise duty on petrol and diesel by the Central government (Chart 1.2a) and subsequent reduction in VAT/Sales Tax by 23 States (Chart 1.2b) is analysed here.

The revenue loss to the Centre is estimated by multiplying all-India projected consumption of petrol and diesel during November-March with corresponding reductions in excise duties. State-wise consumption of petrol and diesel are estimated (November-March 2021-22)7 using State-wise sales data of petrol and diesel from Petroleum Planning and Analysis Cell (PPAC). The State-wise revenue losses are arrived at by multiplying these quantities with the State-specific reduction in price (due to VAT/Sales Tax reduction). The revenue loss to the Centre in 2021-22 is estimated at 0.2 per cent of GDP while the revenue loss to the States due to VAT/ Sales Tax cut is estimated at 0.1 per cent of GDP. |

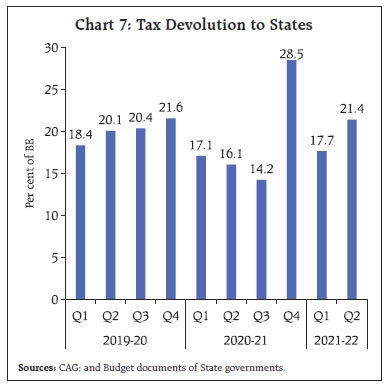

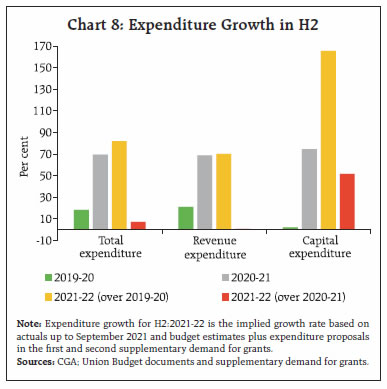

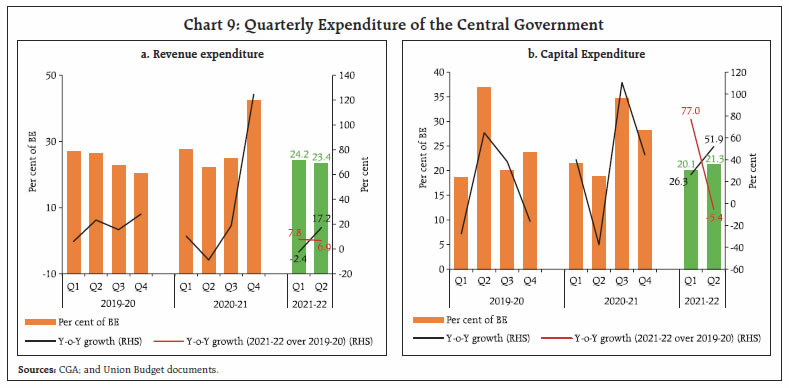

Tax devolution to States witnessed a y-o-y decline of around 12 per cent for Q1:2021-22. As a per cent of States’ budget estimates, however, the transfers were broadly in line with those in 2020-21 and 2019-20. For Q2:2021-22, the transfers were 13.3 per cent higher than the corresponding period of previous year and as a per cent of states’ budget estimates they were also higher than those in Q2 of previous two years (Chart 7). b. Expenditure The Centre announced a fiscal package of ₹6.3 lakh crore in June 2021 in response to the second wave, which included inter alia extension of free provisions of foodgrains under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) until November8, enhanced fertiliser subsidy necessitated by the impact of increase in international prices of fertilisers, measures to strengthen public health, and loan guarantee schemes for COVID affected sectors. While some of these measures led to an additional expenditure over and above the budgeted amount, a large part was in the form of liquidity support and did not entail any additional fiscal burden. Subsequently, the first supplementary demand for grants, introduced in July 2021, proposed additional expenditure measures resulting in net cash outgo of ₹23,675 crore. The government also took precautionary steps to limit spending through expenditure curbs on various Central ministries and departments in Q2: 2021-22 (these expenditure limits have been relaxed with effect from September 24, 2021). As a result, despite pandemic related expansionary measures, total expenditure remained contained at 46.7 per cent of BE during H1:2021-22, as against 48.6 per cent and 53.4 per cent during first half of 2020-21 and 2019-20, respectively.  Going forward, an expenditure pick up is expected in H2:2021-22, on the back of the second batch of supplementary demand for grants that has proposed net cash outgo of ₹2.99 lakh crore – ₹2.33 lakh crore on revenue expenditure and ₹0.66 lakh crore on capital expenditure. The first and second supplementary demand for grants together entail an increase of ₹3.23 lakh crore over budget estimates, which translates into a 7.3 per cent increase in total expenditure in H2:2021-22 over H2: 2020-21 and 82.0 per cent increase over H2: 2019-20 (Chart 8). Higher revenue expenditure in Q2, led to an overall increase of 6.3 per cent in H1. Revenue expenditure had contracted by 2.4 per cent in Q1:2021-22 over the previous year (though higher by 7.8 per cent over Q1:2019-20), partly on account of a high base in Q1:2020-21 when expenditure had to be frontloaded and also expanded to deal with the first wave of the pandemic. The expenditure focus was strategically tilted towards capital expenditure, with a y-o-y increase of 38.3 per cent in H1 over 2020-21 (growth of 22.3 per cent over 2019-20) (Chart 9 a and b).

The roll-out of the Pradhan Mantri Gati Shakti National Master Plan is also expected to provide a fillip to infrastructure development in the country. Based on geographic information system (GIS), the Gati Shakti platform would map all existing and proposed economic zones, along with their multi-modal infrastructure linkages (rail, road etc.). Approvals for individual projects of different line ministries are to be viewed from the perspective of conformity to the Gati Shakti National Master Plan, thus ensuring a holistic and coordinated approach to infrastructure development. To spur capital asset creation by States, the Centre introduced a scheme for providing interest-free loans for new or ongoing infrastructure projects. The major subsidies outgo of the Central government, comprising food, fuel and fertilisers, stood at 53.8 per cent of BE in H1:2021-22 compared to 68.6 per cent of BE in the corresponding period of last year. Food subsidy accounted for 72.5 per cent of total outgo on major subsidies (Chart 10). States’ revenue expenditure recorded a y-o-y growth of 10.9 per cent and 14.6 per cent in Q1 and Q2 of 2021-22, respectively (26.0 per cent and 4.8 per cent, respectively, over the corresponding quarters of 2019-20). As per cent of States’ budget estimates, revenue expenditure in H1:2021-22 is broadly in line with previous year’s pattern. On the capex front, States are being nudged by the centre through interest-free loans under the scheme ‘Special Assistance to States for Capital Expenditure’.8 Furthermore, on meeting the capex target set by the Centre for Q1:2021-22, eleven States have been permitted to undertake additional open market borrowings equivalent to 0.25 per cent of GSDP. Thus, States’ capex has seen a robust y-o-y growth of 98.5 per cent and 57.9 per cent for Q1 and Q2:2021-22 (Chart 11).

III. Fiscal Deficit and its Financing a. Fiscal Deficit Central Government After attaining a GFD of 9.2 per cent of GDP in 2020-21 (PA), the Union government has budgeted for a GFD of 6.8 per cent of GDP in 2021-22 with the medium-term target of below 4.5 per cent by 2025-26. However, due to improved revenue position and contained expenditure, the GFD of the Union government in H1:2021-22 stands at 35.0 per cent of BE, which is much lower than what was recorded in previous years (Chart 12). State Governments States have budgeted a GFD of 3.7 per cent of GDP for 2021-22, as against 4.7 per cent in 2020-21 (RE). In Q1:2021-22, their GFD stands at 3.2 per cent of quarterly GDP which, although lower than in Q1:2020-21, is significantly higher than the trend in pre-pandemic years. In H1:2021-22, GFD of States stands at 42.2 per cent of budget estimates (Chart 13).

The quality of expenditure for both Centre and States, as measured by revenue expenditure to capital outlay (RECO) ratio, has reverted to its usual level after deteriorating significantly in H1:2020-21, when undertaking new capex projects was severely constrained by the pandemic. The improvement in the quality of government expenditure augurs well for medium-term growth prospects of the economy (Chart 14). b. Financing of GFD In H1: 2021-22, the Union government completed 57.5 per cent of the budgeted net market borrowings for 2021-22, which financed over 90 per cent of its GFD during the first half of the year. The borrowing programme of the Union government during H1:2021-22 was carried out smoothly with the 10-year g-sec yield remaining in the range of 5.97 to 6.26 per cent. It is also noteworthy that the Union government compensated the States fully for the shortfall in GST collections from within its own borrowing programme without resorting to additional borrowings in this fiscal year so far. A State-level analysis points to a generalised decrease in the first half market borrowings (as per cent of BE). Amongst the larger States, Uttar Pradesh, Bihar and Rajasthan have seen an increase in H1 borrowings. The overall net market borrowings in H1:2021-22, accounting for 34.4 per cent of BE, were 20 per cent lower than those in H1:2020-21 (Chart 15). Financial accommodation availed by States under various facilities from RBI came down in H1:2021-22 compared to the corresponding period of last year9. Overall daily utilisation under all the three facilities witnessed a y-o-y reduction of 14.6 per cent in H1:2021-22. Compositionally, while the Ways and Means Advances (WMA) and Overdraft (OD) facilities have seen an increased daily utilisation in H1:2021-22, the daily utilisation of Special Drawing Facility (SDF) has seen a sharp decline of 57.8 per cent. Amongst the major States/UTs, Jammu and Kashmir, Telangana, Andhra Pradesh, Manipur and Mizoram have seen an increase in daily utilisation of WMA in H1:2021-22 compared to H1:2020-21 (Chart 16).

IV. General Government Finances The general government GFD for 2021-22 (BE) is budgeted to consolidate to 10.2 per cent of GDP from 13.3 per cent in 2020-21 (RE). In continuation of the effort to provide timely fiscal data on general government, quarterly fiscal position of the general government has been compiled till Q2:2021-22. In a departure from trend, general government GFD in Q4:2020-21 turned out to be higher than in Q2 and Q3: 2020-21, largely on account of on-budgeting of past Food Corporation of India (FCI) dues in March 2021. Due to improved revenue mobilisation by both the Centre and States, the general government GFD remained subdued in Q1 and Q2:2021-22. Going forward, while tax collections are expected to remain buoyant in Q3 and Q4, expected expenditure pick up could result in a general government deficit of 8.9 per cent and 12.9 per cent of GDP in Q3 and Q4 (projected), respectively. Accordingly, the GFD is expected to increase from 8.0 per cent of GDP in H1:2021-22 to 10.9 per cent in H2: 2021-22.  V. Conclusion After the pandemic-induced significant widening of general government fiscal deficit in 2020-21, both Centre and States demonstrated commitment to credible fiscal consolidation in their 2021-22 budgets even while sustaining the needed fiscal support to growth. During H1:2021-22, while nurturing a stimulus led recovery that raised GDP in Q2:2021-22 to pre-pandemic levels, the envisaged fiscal consolidation has been pursued. Robust growth in tax revenues, reflecting improved tax governance and administration, and the thrust on capex bode well for achieving both durable growth revival and fiscal consolidation in the medium-term. Within capital outlay, however, it is important for both the Centre and the States to channelise expenditure to sectors that can crowd-in private investments and optimise multiplier effects based on inter-temporal and intersectoral linkages that can boost output, employment and productivity. Going forward, notwithstanding renewed concerns associated with the new omicron variant of the virus, as economic revival gains further traction, the Centre and States should provide credible medium-term glide paths towards fiscal policy normalisation so that fiscal buffers can be replenished to deal with future economic shocks, if any.

Appendix Tables | Table 1: Budgetary Position of the Central Government during April-September 2021-22 | | Item | (₹ thousand crore) | (Per cent) | | Actuals | Budget Estimates | Percent of BE | Y-o-Y Growth Rate | | 2021-22 | 2020-21 | 2021-22 | 2020-21 | 2021-22 | 2020-21 | 2021-22 | 2020-21 | | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | | 1. Revenue Receipts | 1081.0 | 550.8 | 1788.4 | 2020.9 | 60.4 | 27.3 | 96.3 | -32.5 | | 1.1. Net Tax Revenue | 920.7 | 458.5 | 1545.4 | 1635.9 | 59.6 | 28.0 | 100.8 | -24.5 | | 1.2. Non-Tax Revenue | 160.4 | 92.3 | 243.0 | 385.0 | 66.0 | 24.0 | 73.8 | -55.9 | | 1.3. Interest Receipts | 10.3 | 5.7 | 11.5 | 11.0 | 89.3 | 52.1 | 79.4 | -11.3 | | 2. Capital Receipts | 18.1 | 14.6 | 188.0 | 225.0 | 9.6 | 6.5 | 23.8 | -28.9 | | 2.1. Recovery of Loans | 9.0 | 8.9 | 13.0 | 15.0 | 69.3 | 59.2 | 1.7 | 7.5 | | 2.2. Other Receipts | 9.1 | 5.8 | 175.0 | 210.0 | 5.2 | 2.8 | 57.7 | -53.2 | | 3. Total Receipts (1+2) | 1099.2 | 565.4 | 1976.4 | 2245.9 | 55.6 | 25.2 | 94.4 | -32.5 | | 4. Revenue Expenditure | 1396.7 | 1313.6 | 2929.0 | 2630.1 | 47.7 | 49.9 | 6.3 | 1.0 | | of which | | | | | | | | | | (i) Interest Payments | 363.8 | 305.7 | 809.7 | 708.2 | 44.9 | 43.2 | 19.0 | 12.9 | | 5. Capital Expenditure | 229.4 | 165.8 | 554.2 | 412.1 | 41.4 | 40.2 | 38.3 | -11.6 | | of which | | | | | | | | | | (i) Loans and Advances | 19.5 | 17.4 | 40.4 | 31.8 | 48.3 | 54.7 | 12.3 | 17.1 | | 6. Total Expenditure (4+5) | 1626.0 | 1479.4 | 3483.2 | 3042.2 | 46.7 | 48.6 | 9.9 | -0.6 | | 7. Revenue Deficit (4-1) | 315.6 | 762.8 | 1140.6 | 609.2 | 27.7 | 125.2 | -58.6 | 57.4 | | 8. Fiscal Deficit (6-3) | 526.9 | 914.0 | 1506.8 | 796.3 | 35.0 | 114.8 | -42.4 | 40.3 | | 9. Gross Primary Deficit {8-4 (i)} | 163.1 | 608.3 | 697.1 | 88.1 | 23.4 | 690.2 | -73.2 | 59.7 | | Source: Office of Controller General of Accounts, Ministry of Finance, Government of India. |

| Table 2: Quarterly Position of Central Government Finances | | Item | (₹ thousand crore) | (Per cent) | | Q1 | Q2 | Per cent of BE | Y-o-Y Growth Rate | | Q1 | Q2 | 2021-22 | | 2021-22 | 2020-21 | 2021-22 | 2020-21 | 2021-22 | 2020-21 | 2021-22 | 2020-21 | Q1 | Q2 | | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | | 1. Revenue Receipts | 540.0 | 150.0 | 541.1 | 400.8 | 30.2 | 7.4 | 30.3 | 19.8 | 260.0 | 35.0 | | 1.1. Net Tax Revenue | 412.7 | 134.8 | 508.0 | 323.7 | 26.7 | 8.2 | 32.9 | 19.8 | 206.1 | 56.9 | | 1.2. Non-Tax Revenue | 127.3 | 15.2 | 33.0 | 77.1 | 52.4 | 3.9 | 13.6 | 20.0 | 738.4 | -57.1 | | 1.3. Interest Receipts | 4.7 | 1.6 | 5.6 | 4.1 | 40.5 | 14.8 | 48.9 | 37.3 | 186.6 | 36.9 | | 2. Capital Receipts | 7.4 | 3.6 | 10.7 | 11.1 | 3.9 | 1.6 | 5.7 | 4.9 | 107.2 | -3.1 | | 2.1. Recovery of Loans | 3.4 | 3.6 | 5.6 | 5.3 | 26.2 | 23.9 | 43.1 | 35.3 | -4.7 | 6.0 | | 2.2. Other Receipts | 4.0 | 0.0 | 5.1 | 5.8 | 2.3 | 0.0 | 2.9 | 2.8 | | -11.5 | | 3. Total Receipts (1+2) | 547.4 | 153.6 | 551.8 | 411.8 | 27.7 | 6.8 | 27.9 | 18.3 | 256.4 | 34.0 | | 4. Revenue Expenditure | 710.1 | 727.7 | 686.5 | 585.9 | 24.2 | 27.7 | 23.4 | 22.3 | -2.4 | 17.2 | | of which | | | | | | | | | | | | (i) Interest Payments | 184.3 | 160.5 | 179.5 | 145.2 | 22.8 | 22.7 | 22.2 | 20.5 | 14.8 | 23.6 | | 5. Capital Expenditure | 111.5 | 88.3 | 117.9 | 77.6 | 20.1 | 21.4 | 21.3 | 18.8 | 26.3 | 51.9 | | of which | | | | | | | | | | | | (i) Loans and Advances | 6.6 | 13.9 | 12.9 | 3.4 | 16.4 | 43.9 | 31.9 | 10.8 | -52.5 | 276.6 | | 6. Total Expenditure (4+5) | 821.6 | 815.9 | 804.4 | 663.5 | 23.6 | 26.8 | 23.1 | 21.8 | 0.7 | 21.2 | | 7. Revenue Deficit (4-1) | 170.2 | 577.7 | 145.5 | 185.1 | 14.9 | 94.8 | 12.8 | 30.4 | -70.5 | -21.4 | | 8. Fiscal Deficit (6-3) | 274.2 | 662.4 | 252.6 | 251.6 | 18.2 | 83.2 | 16.8 | 31.6 | -58.6 | 0.4 | | 9. Gross Primary Deficit {8-4 (i)} | 90.0 | 501.9 | 73.1 | 106.5 | 12.9 | 569.4 | 10.5 | 120.8 | -82.1 | -31.3 | | Source: Office of Controller General of Accounts, Ministry of Finance, Government of India. |

| Table 3: Budgetary Position of the State Governments during April-September 2021 | | Item | (₹ thousand crore) | (Per cent) | | Actuals | Budget Estimates | Percent of BE | Y-o-Y Growth Rate | | 2021-22 | 2020-21 | 2021-22 | 2020-21 | 2021-22 | 2020-21 | 2021-22 | 2020-21 | | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | | 1. Revenue Receipts | 1,174.3 | 926.7 | 3,190.5 | 3,070.6 | 36.8 | 30.2 | 26.7 | -14.6 | | 1.1. Tax Revenue | 853.5 | 652.0 | 2,172.5 | 2,181.7 | 39.3 | 29.9 | 30.9 | -19.5 | | 1.2. Non-Tax Revenue | 83.3 | 56.7 | 254.4 | 250.5 | 32.7 | 22.6 | 46.9 | -19.4 | | 1.3. Grants-in-aid and Contributions | 237.6 | 218.0 | 763.6 | 638.4 | 31.1 | 34.2 | 9.0 | 6.0 | | 2. Capital Receipts | 4.7 | 2.3 | 21.0 | 18.1 | 22.2 | 12.7 | 102.2 | -81.5 | | 2.1. Recovery of Loans and Advances | 4.6 | 2.2 | 14.4 | 14.2 | 31.5 | 15.8 | 102.6 | -81.8 | | 2.2. Other Receipts | 0.1 | 0.1 | 6.6 | 3.9 | 1.5 | 1.4 | 87.1 | -11.3 | | 3. Total Receipts | 1,179.0 | 929.0 | 3,211.5 | 3,088.7 | 36.7 | 30.1 | 26.9 | -15.4 | | 4. Revenue Expenditure | 1,322.2 | 1,171.8 | 3,342.1 | 3,111.5 | 39.6 | 37.7 | 12.8 | 0.9 | | 4.1. Interest Payments | 154.7 | 145.3 | 417.8 | 370.5 | 37.0 | 39.2 | 6.4 | 11.5 | | 5. Capital Expenditure | 185.7 | 107.5 | 648.5 | 573.5 | 28.6 | 18.8 | 72.7 | -33.4 | | 5.1. Capital Outlay | 171.2 | 97.4 | 595.2 | 530.0 | 28.8 | 18.4 | 75.8 | -31.5 | | 6. Total Expenditure | 1,508.0 | 1,279.4 | 3,990.5 | 3,685.0 | 37.8 | 34.7 | 17.9 | -3.3 | | 7. Revenue Deficit (4-1) | 147.9 | 245.2 | 151.5 | 40.9 | 97.6 | 599.5 | -39.7 | 223.2 | | 8. Fiscal Deficit (6-3) | 329.0 | 350.4 | 779.0 | 596.4 | 42.2 | 58.8 | -6.1 | 55.9 | | 9. Gross Primary Deficit {8-4 (i)} | 174.33 | 205.07 | 361.23 | 225.88 | 48.3 | 90.8 | -15.0 | 117.2 | Note: Data pertains to 26 States.

Source: Comptroller and Auditor General of India. |

| Table 4: Quarterly Position of State Government Finances | | Item | (₹ thousand crore) | (Per cent) | | Actuals | Per cent of BE | Y-o-Y Growth Rate | | Q1 | Q2 | Q1 | Q2 | 2021-22 | | 2021-22 | 2020-21 | 2021-22 | 2020-21 | 2021-22 | 2020-21 | 2021-22 | 2020-21 | Q1 | Q2 | | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | | 1. Revenue Receipts | 535.5 | 400.6 | 638.8 | 526.1 | 16.8 | 13.0 | 20.0 | 17.1 | 33.7 | 21.4 | | 1.1. Tax Revenue | 378.4 | 262.4 | 475.1 | 389.6 | 17.4 | 12.0 | 21.9 | 17.9 | 44.2 | 21.9 | | 1.2. Non-Tax Revenue | 37.8 | 27.0 | 45.4 | 29.7 | 14.9 | 10.8 | 17.9 | 11.8 | 40.2 | 53.1 | | 1.3. Grants-in-aid and Contributions | 119.3 | 111.2 | 118.3 | 106.9 | 15.6 | 17.4 | 15.5 | 16.7 | 7.3 | 10.7 | | 2. Capital Receipts | 2.1 | 0.8 | 2.5 | 1.5 | 10.1 | 4.2 | 12.0 | 8.6 | 182.4 | 63.3 | | 2.1. Recovery of Loans and Advances | 2.1 | 0.7 | 2.4 | 1.5 | 14.6 | 5.2 | 16.9 | 10.6 | 186.9 | 61.6 | | 2.2. Other Receipts | 0.0 | 0.0 | 0.1 | 0.0 | 0.2 | 0.5 | 1.3 | 0.9 | -6.6 | 133.3 | | 3. Total Receipts | 537.7 | 401.3 | 641.3 | 527.6 | 16.7 | 13.0 | 20.0 | 17.1 | 34.0 | 21.5 | | 4. Revenue Expenditure | 625.2 | 563.6 | 697.0 | 608.2 | 18.7 | 18.1 | 20.9 | 19.5 | 10.9 | 14.6 | | 4.1. Interest Payments | 66.5 | 65.0 | 88.2 | 80.3 | 15.9 | 17.6 | 21.1 | 21.7 | 2.2 | 9.8 | | 5. Capital Expenditure | 78.0 | 39.3 | 107.7 | 68.3 | 12.0 | 6.9 | 16.6 | 11.9 | 98.5 | 57.9 | | 5.1. Capital Outlay | 68.9 | 36.6 | 102.3 | 60.8 | 11.6 | 6.9 | 17.2 | 11.5 | 88.3 | 68.3 | | 6. Total Expenditure | 703.2 | 602.9 | 804.8 | 676.5 | 17.6 | 16.4 | 20.2 | 18.4 | 16.6 | 19.0 | | 7. Revenue Deficit | 89.7 | 163.0 | 58.3 | 82.1 | 59.2 | 398.7 | 38.5 | 200.8 | -45.0 | -29.0 | | 8. Fiscal Deficit (6-3) | 165.5 | 201.6 | 163.5 | 148.8 | 21.2 | 33.8 | 21.0 | 25.0 | -17.9 | 9.8 | 9. Gross Primary Deficit (8 - 4.1) | 99.1 | 136.6 | 75.3 | 68.5 | 27.4 | 60.5 | 20.8 | 30.3 | -27.5 | 9.9 | Note: Data pertains to 26 States.

Source: Comptroller and Auditor General of India. |

| Table 5: Chronology of Major Policy Announcements by GoI to Mitigate the Impact of COVID-19 (March 2021 Onwards) | | Date of Announcement | Policy Initiative | | March 30, 2021 | • Centre releases ₹30,000 crore as GST Compensation as well as ₹28,000 crore as IGST ad-hoc settlement to the States/UTs. | | March 31, 2021 | • The last date for the intimation of Aadhaar number and linking thereof with permanent account number (PAN) was extended to June 30, 2021.

• The time-limits for passing of consequential order for direction issued by the dispute resolution panel (DRP) and processing of equalisation levy statements were extended to April 30, 2021.

• The validity of ECLGS 1.0 and 2.0 was extended up to June 30, 2021 or till guarantees for an amount of ₹3 lakh crore are issued.

• ECLGS 3.0 was introduced to cover business enterprises in hospitality, travel and tourism, leisure and sporting sectors that meet specified criteria. Last date of disbursement under the scheme has been extended to September 30, 2021.

• MoF released ₹45,000 crore as additional devolution to States in FY 2020-21 over and above the Revised Estimates for 2020-21. | | April 1, 2021 | • Centre released an amount of ₹11,830 crore to States under the scheme “Special Assistance to States for Capital Expenditure” to give timely boost to economic recovery. • Centre released ₹45,000 crore as additional devolution to States in FY 2020-21, an increase of 8.2 per cent over 2020-21 (RE). | | April 22, 2021 | A temporary exemption has been provided for capital expenditure of Union government from certain cash management guidelines which stipulate the timing of release of large payments so as to match them with the inflow of tax revenues during the month/quarter. | | April 23, 2021 | Distribution of free food grains under Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) during May and June 2021 was announced. | | April 24, 2021 | • The deadline for payment under the Direct Tax Vivaad se Vishwaas Act, 2020, without an additional amount, extended to June 30, 2021.

• Various deadlines for passing an order under the Income Tax Act, extended to June 30, 2021.

• Exemption of medical grade oxygen, oxygen therapy related equipment such as oxygen concentrators, cryogenic transport tanks, etc, and COVID-19 vaccines from basic customs duty till July 31, 2021. | | April 30, 2021 | • Exemption to import of oxygen concentrators for personal use, purchased from e-commerce portals through post or courier sans customs clearance till July 31, 2021.

• GST rate payable on imported oxygen concentrators reduced from 28 per cent to 12 per cent.

• Exemption to imports of Inflammatory Diagnostic (marker) kits; and remdesivir injection from basic customs duty till October 31, to supplement COVID-19 testing efforts.

• GoI announced to provide an additional amount of up to ₹15,000 crore to States as interest free 50 year loan for spending on capital projects. One-third of this overall limit will be provided to states which undertake monetisation and/or disinvestment of their assets, in the range of 33 to 100 per cent of the amount realised by them. | | May 1, 2021 | • As a special dispensation, Union government has released, in advance of the normal schedule, the first instalment for 2021-22 of the central share amounting to ₹8,874 crore for the State Disaster Response Fund (SDRF) to all the States. Up to 50 per cent of this amount can be utilised by the States for Covid-19 containment measures.

• Deadline for various compliances under the Income Tax Act extended to May 31, 2021. | | May 2, 2021 | Relief Measures for GST payers

• Concessional rates of interest in lieu of the normal rate of interest of 18 per cent per annum for delayed tax payments.

• Late fee waived for 15 days in respect of returns in Form GSTR-3B furnished beyond the due date for tax periods March 2021 and April 2021.

• Time limit for completion of various actions, by any authority or by any person, under the GST Act, which falls during the period from April 15, 2021 to May 30, 2021, has been extended up to May 31, 2021. | | May 3, 2021 | Exemption from IGST on the import of Covid-19 relief material (already exempted from customs duty), donated/received free of cost from outside India for free distribution up to June 30, 2021. | | May 9, 2021 | Centre released an amount of ₹8,923.8 crore to 25 States for providing grants to the Rural Local Bodies (RLBs). The amount released was the first instalment of the ‘Untied Grants’ for the year 2021-22, to be utilised by the RLBs, among other things, for various prevention and mitigation measures needed to combat the COVID-19 pandemic. | | May 19, 2021 | Additional fertilizer subsidy with an outlay of ₹14,775 crore was announced. | | May 20, 2021 | Timelines for certain compliances under the Income-tax Act,1961 were extended. | | May 28, 2021 | • The 43rd GST Council meeting recommended full exemption from IGST up to August 31, 2021 for a number of specified COVID-19 related goods such as medical oxygen, oxygen concentrators and other oxygen storage and transportation equipment, certain diagnostic markers test kits and COVID-19 vaccines, etc.

• The Council also recommended certain relaxations to GST taxpayers as COVID-19 related relief measure. | | May 30, 2021 | Emergency Credit Line Guarantee Scheme (ECLGS) was expanded with ECLGS 4.0 for onsite oxygen generation, wider coverage of ECLGS 3.0 and increase in tenor for ECLGS 1.0 | | June 12, 2021 | The 44th GST Council reduced the GST rates on specified items being used in COVID-19 relief and management till September 30, 2021. | | June 25, 2021 | Government granted further extension in timelines of specified compliances under Income Tax Act and announced tax exemption for expenditure on COVID-19 treatment and ex-gratia received on death due to COVID-19. | | June 28, 2021 | • Loan Guarantee Scheme worth ₹1.10 lakh crore was announced for COVID affected sectors like health and tourism.

• The ECLGS was expanded with the overall cap of admissible guarantee raised from ₹3 lakh crore to ₹4.5 lakh crore.

• Credit Guarantee Scheme for Micro Finance Institutions was announced.

• Free one month tourist visa to 5 lakh tourists or till 31st March, 2022 whichever is earlier.

• The date of registration under the Aatma Nirbhar Bharat Rozgar Yojana (ANBRY) was extended from June 30, 2021 to March 31, 2022.

• Provision of free food grains under PMGKAY was extended up to November 2021.

• A scheme for strengthening public health infrastructure and human resources with outlay of ₹23,220 crore was announced, with focus on short term emergency preparedness and special emphasis on children and paediatric care/paediatric beds.

• Release of Climate Resilient Special Traits Crop Varieties was announced.

• A revival package of ₹77.45 crore to be provided for North Eastern Regional Agricultural Marketing Corporation (NERAMAC).

• ₹33,000 crore boost for Project Exports was provided through National Export Insurance Account (NEIA).

• Equity infusion in Export Credit Guarantee Corporation (ECGC) over 5 years was announced to boost export insurance cover by ₹88,000 crore.

• ₹19,041 crore was provided for Broadband to each Village through Bharat Net PPP Model.

• Tenure of PLI Scheme for Large Scale Electronics Manufacturing was extended by 1 year.

• ₹3.03 lakh crore for Reform-Based Result-Linked Power Distribution Scheme was announced, of which the Central Government’s share will be ₹97,631 crore.

• New streamlined process to be formulated for appraisal and approval of PPP Projects and monetization of core infrastructure assets. | | July 14, 2021 | The Union Cabinet gave its approval for continuation of Rebate of State and Central taxes and Levies (RoSCTL) with the same rates as notified by Ministry of Textiles in March 2019, on exports of Apparel/Garments and Made-ups in exclusion from Remission of Duties and Taxes on Exported Products (RoDTEP) scheme. The scheme will continue till 31st March 2024. | | July 27, 2021 | Ministry of Health and Family Welfare on 13.07.2021 issued “Guidelines for Buffer Stock Management of COVID 19” to State Governments/UT administrations requesting them to initiate the necessary procurement process on priority, with a view to ensure continuous availability of drugs for any possible future surge in cases. | | August 29, 2021 | The closing date of late fee amnesty scheme and time limit for filing of application for revocation of cancellation of registration under GST Act were extended. | | September 14, 2021 | Eleven States achieved the target set by the Ministry of Finance for the capital expenditure in the 1st Quarter of 2021-22. As an incentive, these States were granted permission by the Department of Expenditure to borrow an additional amount of ₹15,721 crore. The additional open market borrowing permission granted is equivalent to 0.25 percent of their Gross State Domestic Product (GSDP). | | September 17, 2021 | • Government extended time limit for linking of PAN with Aadhaar, due date for completion of penalty proceedings under the Income-tax Act, and the time limit for issuance of notice and passing of order by the Adjudicating Authority under the Prohibition of Benami Property Transactions Act, 1988.

• 45th GST Council recommended extension of existing concessional GST rates on certain COVID-19 treatment drugs up to December 31, 2021 and reduction of GST rate to 5 per cent on some more COVID-19 treatment drugs up to December 31, 2021.

• Centre released an amount of ₹2,427 crore to 11 States for the Urban Local Bodies. The amount released is the first instalment of tied grants for the year 2021-22. | | September 25, 2021 | Centre approved capital projects worth ₹2,903.80 crore in 8 States under the scheme entitled ‘Special Assistance to States for Capital Expenditure for 2021-22’. An amount of ₹1,393.83 crore was released to these States. | | September 29, 2021 | The timeline of ECLGS was extended till 31.03.2022 or till guarantees for an amount of ₹4.5 lakh crore are issued under the scheme, whichever is earlier. Further, the last date of disbursement under the scheme was extended to 30.06.2022 and certain modifications were made in the scheme to enable support to businesses impacted by the second wave of COVID. | | October 1, 2021 | Centre issued an order on 25.09.2021, revising the items and norms of assistance under the State Disaster Response Fund (SDRF), making therein a provision for grant of ex-gratia payment to the next of kin of the deceased due to Covid-19. The State Governments will have an amount of ₹ 23,186.40 crore in their SDRF including State’s share, during the financial year 2021-22, in addition to the amount of opening balance available in their SDRF, to meet the expenses for granting ex-gratia to the next of kin of the deceased due to COVID-19 and for providing relief on other notified calamities. | | November 24, 2021 | PMGKAY, under which 5 kg of wheat or rice is provided to beneficiaries over and above their usual monthly quota was extended till March 2022. |

|