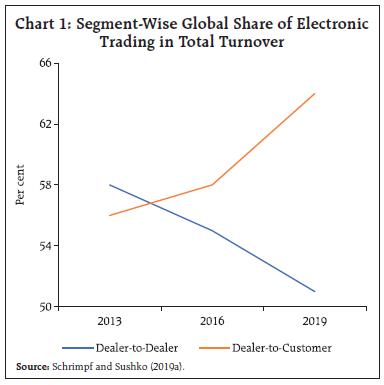

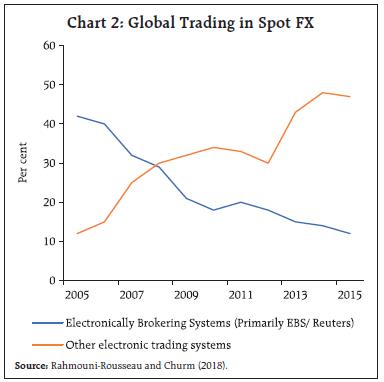

The electronification of global foreign exchange (FX) trading with the emergence of multi-bank platforms has transformed the execution of trade and price discovery. Recent changes in electronification, particularly the emergence of single-bank platforms, have further altered the market structure, resulting in market fragmentation and internalisation of trade. Some of these changes can be seen even in the onshore Indian Rupee (INR) market, albeit in a limited way. These structural shifts have implications for transparency, pricing and central bank oversight of FX markets. Introduction The global foreign exchange (FX) market is the largest financial market in the world, with an average daily turnover of $6.6 trillion1. The market is characterised by round-the-clock trading primarily over-the-counter (OTC) or outside the centralised exchanges; only about 3 per cent of the global FX trade is conducted through exchanges in the form of futures and options. A vast majority of the trading activity occurs between institutional traders, such as dealers (mostly banks), financial intermediaries, corporations and central banks. Traditionally, counterparties in the FX market traded with each other through phone calls (“voice”) or through FX brokers. The last couple of decades have, however, witnessed the emergence of electronic trading venues operated both by banks and non-banks. Increasingly, OTC FX trades are being executed on these venues leading to increasing electronification of FX trading. The first phase of electronification of global FX markets can be traced to the 1990s when multi-bank platforms (MBPs) with transparent central limit order books (CLOBs)2, such as Refinitiv (formerly Reuters) and Electronic Broking Services (EBS), emerged. This phase was characterized by an increase in trading over MBPs which, thereafter, went on to emerge as primary venues i.e., venues with substantial trading volume and where prices are discovered for major currency pairs. During the last decade, the nature of FX electronification too has undergone a change with the emergence of new forms of trading venues, such as single-bank platforms (SBPs), and market-makers, including principal trading firms (PTFs). These developments have altered the global FX market structure with growing market fragmentation viz., dispersion of FX trading across a wide range of trading venues, and internalisation viz., dealers increasingly offsetting client trades with each other instead of covering the risk in the interdealer market (Schrimpf and Sushko, 2019a, Moore et al., 2016). Electronification has reduced FX transaction costs (Woolridge, 2019). At the same time, it has made the understanding of market liquidity rather complex, by reducing the informative value of traditional indicators like the bid-ask spread. Furthermore, these developments have made it more challenging to monitor structural changes and undertake ex-post event analysis (Rahmouni-Rousseau and Churm, 2018). Some of these trends are also becoming evident in the onshore Indian Rupee (INR) market, concomitant with the growing integration of financial markets. However, the effects of these trends on the onshore INR market are limited as compared to the way in which they have affected the FX markets of other countries, partly owing to the idiosyncratic features of the onshore market. Considering (a) the importance of the Indian OTC FX market (with daily turnover of about $40 billion3) and (b) reliance of a diverse clientele from retail to institutional clients on this market for their hedging requirements, it becomes crucial to understand the developments shaping the structure of this market and their implications. These shifts may also be crucial for Reserve Bank’s market intelligence, market operations and market regulation. Against this backdrop, the present article analyses key trends related to FX electronification and their implications for onshore trading of the INR and suggests some policy actions. The article is structured as follows. A summary of the shifts observed in the global FX markets is provided in Section II. Section III focusses on the implications of these trends for the Indian markets, while Section IV concludes. II. Electronification, Market Fragmentation and Internalisation: The Global Scenario The electronification of the FX markets began in the 1990s with the advent of MBPs, primarily in the inter-dealer (or dealer-to-dealer) spot segment of FX market4. FX MBPs are trading venues, generally operated by non-bank institutions, which provide access to prices and liquidity from several banks and non-bank dealers. Many MBPs involve dealing through a transparent CLOB and provide pre- and post-trade transparency regarding prices, volume, and depth. Globally, these platforms have come to be classified as “lit” pools/markets (as against “dark pools” where such information is not disseminated). Venues operated by Refinitiv and EBS are examples of FX MBPs with transparent CLOBs. As the technology has developed, innovations in the FX market have led to the emergence of a variety of trading venues, featuring a diverse set of execution protocols, such as request for quotes (RFQ)/ request for stream (RFS), beyond the traditional CLOB5. This has expanded the scope of FX instruments traded electronically to include derivatives, such as FX forwards and swaps. As per data from the BIS Triennial Central Bank Survey 2019, about 70 per cent of the global spot trading is executed electronically, while 57 per cent and 52 per cent of FX forwards and swaps, respectively, are traded through electronic modes. Simultaneously, FX electronic dealing has also gained traction in the dealer-to-customer segment where growth in electronic dealing has outpaced electronification of the inter-dealer segment (Chart 1). As FX volumes are increasingly migrating to these venues from the MBPs, market fragmentation or the dispersion of global FX liquidity across a wide range of trading platforms, is becoming evident (Chart 2).

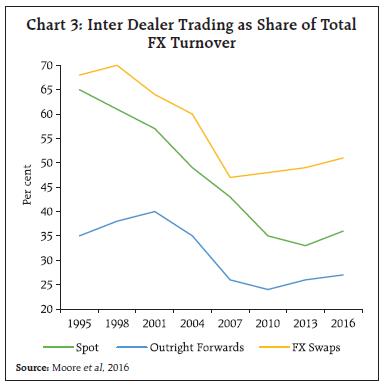

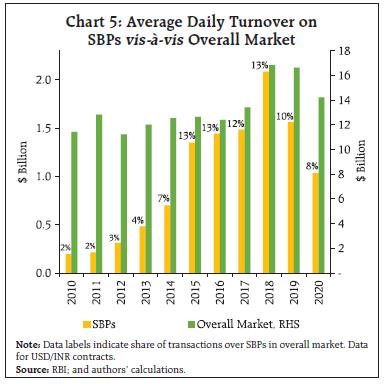

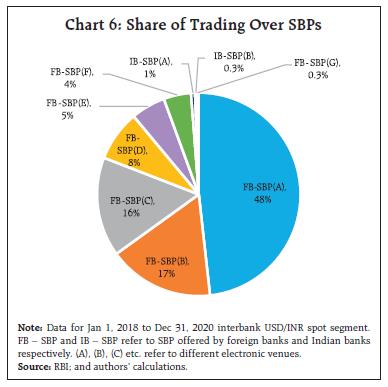

Among the new type of trading venues which have emerged in recent years, one of the most salient are SBPs. These are electronic trading systems operated by banks for their clients. They have come up as banks have sought to leverage technology to increase the ease with which their clients transact bilaterally with them. SBPs allow banks to employ automated pricing and risk management technology to provide customised pricing and execution for different client types (Rahmouni-Rousseau and Churm, 2018). SBPs are fundamentally different from MBPs. Unlike an MBP where the operator is typically a non-bank and cannot provide liquidity to the transacting parties, the offering bank is the sole liquidity provider on its SBP6. While an existing ‘relationship’ is an important determinant of transactions on SBPs, it is not relevant in an MBP having an anonymous CLOB dealing mode. Further, SBPs are often referred to as “dark pools” since price and trade information are not disseminated on such platforms, unlike in case of an MBP. By offering liquidity, the SBP operator is exposed to adverse inventory positions which may lead to losses while offloading positions. Despite this, the number of SBPs have grown on account of several advantages associated with operating them. SBP operating banks are able to avoid transaction fees of dealing over MBPs7, limit leakage of their flow-related information, have better control over choice of trading counterparties and receive opportunities for internalising flows. Moreover, SBPs provide their operators with visibility over a section of the interbank market thereby providing access to valuable market insights which could be leveraged for proprietary trading, quoting tighter prices to clients, fine-tuning the SBPs’ algorithms and providing other value-added services. As the SBP operator is also the sole liquidity provider, the emergence of such venues has influenced the way in which liquidity is provided to customers in the FX market. Dealers in OTC financial markets provide liquidity to customers and manage the risk positions arising out of this activity through either externalising the trade by hedging it out in the interbank market or internalising it by accumulating the risk in anticipation of future offsetting customer flow. Through internalisation, dealers hope to benefit from the bid-ask spread (Butz and Oomen, 2019) as against earning only the transaction charge (effectively the bid-to-bid spread)8.  A growing electronic client base and rising sophistication of trading systems, including of the SBPs, have increased the ability of dealers to internalise. As these large internalisers effectively become deep liquidity pools, their need to manage inventory via “hot potato trading”9 has reduced, contributing to a decline in turnover in the interbank market (Moore et al., 2016) (Chart 3). These developments have raised an important debate around whether interbank MBPs continue to serve as primary venues for price discovery, amidst the rising FX fragmentation and internalisation-led decline in interbank liquidity. Finally, the BIS Triennial Central Bank Survey 2019 points to the increasing importance of the “non-bank electronic market-maker” community, which forms part of the broader group of principal trading firms (PTFs). PTFs in general rely on speed instead of balance sheet to trade large volumes. The Euromoney Survey 2019 indicates that the share of PTFs in spot e-trading rose sharply to 32 per cent, up from 10 per cent three years earlier (Chart 4). As PTFs have morphed into market-makers, alongside main FX dealing banks, they have become an integral part of FX intermediation and a key determinant of liquidity conditions, particularly in the spot market (Schrimpf and Sushko, 2019b). III. Electronification and the Indian FX market India has a vibrant onshore OTC FX market with an average daily turnover of about $40 billion. Spot, including value cash and value tom, is the largest segment accounting for about half of total OTC turnover with derivatives, mainly forwards and swaps, contributing the rest. A significant portion of the INR spot market is traded electronically on MBPs, while the bulk of the derivative transactions are executed through other modes (voice/brokers). MBPs operated by Refinitiv, Clearcorp, 360T and Bloomberg are the most popular in the interdealer segment. Most of these operators have separate venues for dealer-to-client segments as well. In recent years, SBPs are also becoming increasingly visible in the Indian FX market with trading volumes rising on such venues (Chart 5). SBPs operated by foreign banks account for almost the entire (99 per cent) volume of FX trades transacted over such platforms in the country. These banks have been able to leverage their global expertise to offer refined SBPs with sophisticated price engines to dominate this segment. A couple of Indian banks are also offering SBPs but the volume on these platforms remains insignificant (Chart 6).

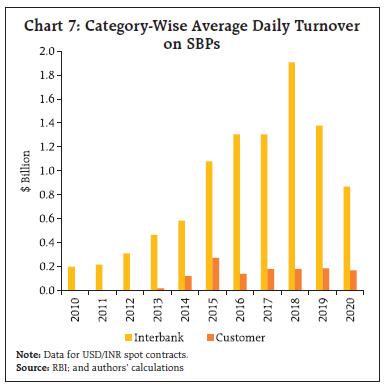

A primary reason for the growing volumes on SBPs in India has been the participation of domestic banks as clients on SBPs operated by foreign banks (Charts 7 and 8). One reason for this is possibly the competitive prices offered on these venues. Also, these venues offer the possibility of improved trade execution by enabling banks to split transactions across different SBPs or between SBPs and MBPs. Relative to trading on MBPs, such splitting of trades minimises the price impact of large trades and limits information leakage. However, client trades on these venues remain limited.

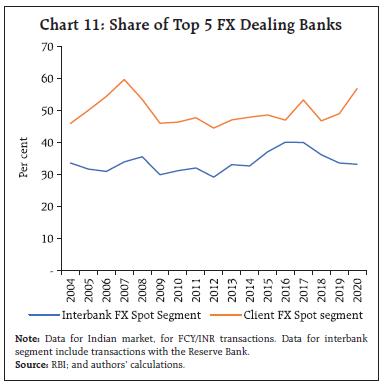

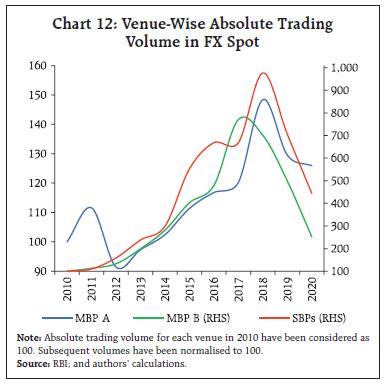

Market Fragmentation in India As is the case globally, the emergence of SBPs has fragmented interbank liquidity in the Indian FX market (Chart 9). SBPs’ share in spot FX trading has increased steadily from 3 per cent in 2011 to 13 per cent in 2019. The share of the dominant MBP, referred as “MBP A”, had declined from 53 per cent in 2010 to 44 per cent in 2019. Another MBP, “MBP B”, which had steadily increased its market share to 22 per cent in 2017 has witnessed a decline in trading activity, thereafter, and accounted for 11 per cent of transactions in 2019. Nonetheless, relative to global trends, where about 50 per cent of the spot trading is on non-primary venues, the degree of market fragmentation in India remains limited. One of the reasons may be that the emergence of SBPs is a comparatively recent phenomenon for the Indian FX market. In 2020, amidst COVID-19-related disruptions, the trading on the dominant MBP rose to 53 per cent from 44 per cent a year ago. This trend is consistent with global trends wherein FX trading activity tends to revert to the primary venues during periods of market stress as these platforms provide the highest concentration of liquidity and pre-trade anonymity, as observed by Rahmouni-Rousseau and Churm, 2018. While dealers can internalise large FX flows and quote narrow spreads to their clients in normal times, their need to hedge inventory risk in the inter-dealer market rises sharply when volatility is elevated, and client flow tends to be unidirectional. Indian FX Market: Externalised or Internalised? Risk management approaches of dealing banks is a crucial aspect in the context of market-making. Dealers in OTC markets, including FX, manage the risk positions through either externalising or internalising customer flows10. Risk management approaches across banks may also diverge based on degree of technology used, degree of discretion allowed, etc. Globally, with rising electronification there has been a trend towards increased internalisation of customer flows. This has contributed to a decline in turnover in the global interbank FX market.  Similarly, to understand the degree of internalisation/externalisation in the Indian FX market, the trends in interbank FX volumes may be considered as a partial indicator. Chart 10 plots the interbank FX transaction as a share of total FX transaction in the Indian market. Barring 2020, the long-term trends in India have clearly diverged from global trends, with the share of interbank transactions increasing over the years in India as against a decline in global FX markets. This seems to suggest that INR trading remains largely externalised viz., dealers hedge customer trades in the open market/with other banks. It has also been argued that rising internalisation may increase market concentration by contributing to a market structure in which concentration begets more concentration. This is because dealers with large flows from a diverse set of clients find it easier to internalise and can price more competitively, letting them attract ever greater customer flows (Schrimpf and Sushko, 2019b). Therefore, an alternate measure to check for FX internalisation could be through trends related to market concentration i.e., if FX activity passes through the desks of few top banks. Chart 11, which plots the share of top dealer banks in total FX trading, does not indicate that the market concentration has increased in the Indian markets substantiating that INR trading has broadly remained externalised.  The relatively externalised nature of Indian FX trading indicates that risk management of FX dealing banks remain less automated compared to global markets. Further, internalisation is material when a dealing bank receives adequate bi-directional flows which may meaningfully offset each other. Therefore, a primary reason for Indian FX trading remaining externalised could be due to certain idiosyncratic structural factors of the Indian market. The FX client base remains largely with the Indian banks, possible on account of a larger number of branches amidst low electronification in dealer-to-client segment, while the SBPs are being provided by the foreign banks. Notwithstanding these observations, Charts 10 and 11 still indicate a deviation from long-term trends in 2020 which could be on account of disruptions related to either COVID-19, or recent bank mergers or a shift in trend possibly alluding towards internalisation. Are Primary Venues Still Relevant? Even as the share of primary venues in total FX transactions has come down, volumes in absolute terms on such platforms remain significant, both onshore and in global FX markets (Chart 12). Rahmouni-Rousseau and Churm (2018) have also argued that primary venues continue to serve as an important point of price discovery on account of several reasons: (a) the tendency towards greater trade internalisation may have led to an increase in the informational content of the flow that is directed to the primary venues; (b) dealer positions in primary venues with transparent order books will almost instantaneously be reflected on other venues in which the dealer operates; and (c) primary venues provide a crucial backstop during periods of market stress with volumes on such venues increasing during periods of higher volatility (a trend also observed in INR trading in 2020 amidst COVID-19-related disruptions). With regard to growing internalisation in the global FX markets, onshore INR trading appears to be largely externalised, which further substantiate that interbank market remains crucial for price discovery and risk management.  IV. Conclusions and Policy Suggestions The previous section discussed how electronification and associated developments in the onshore OTC FX market differ from the global FX market trends. The evolving trends for India regarding the emergence of SBPs point towards fragmentation and reduced transparency in markets, as is the case globally. The structural shifts in the FX markets have implications for both policymaking, especially with regard to transparency and pricing for clients, as well as central bank oversight on FX markets. In this regard, some policy suggestions are discussed below: Increasing transparency Transparency is a fundamental aspect of market regulation and design. Transparency has two aspects – pre-trade transparency, which refers to the availability of information about bid, offer and depth, and post-trade transparency, which refers to the public and timely transmission of information on past trades (price, volume, execution time, etc.). Greater transparency reduces the information asymmetry between banks and customers, which may enable customers to negotiate and achieve better terms-of-trade. Transparency is one of the key factors distinguishing centralised and fragmented markets (Yamaguchi, 2001). Electronic trading platforms (ETPs), by capturing aspects related to pre- and post-trade information, generally provide better transparency as compared to traditional OTC trading. Notwithstanding, the presence of multiple ETPs has ensured that this information is not easily accessible as ETPs, typically, disclose information about trades executed on the platform to their subscribers/ members only. Electronification of FX markets provides a unique opportunity to enhance transparency for further development of the market. Advancements in technology may be leveraged to pool market information from various venues and make it available to all the market participants. One of the possible methods could be collection of traded prices data directly from all venues (electronic as well as voice) on real time basis by the trade repository and publicly disclosing consolidated results. This will allow easy access to price information on a near real-time basis to all market participants. Best execution methods Fair, transparent and efficient pricing for clients in FX markets is a key goal for the RBI. Recent initiatives in this direction include introduction of FX-Retail platform and mandatory disclosure of mid-market mark for FX derivatives for retail clients. Globally, regulatory stipulations for best execution requirements nudged banks towards electronic execution of client transactions while also encouraging clients to demand competitive pricing. For example, Markets in Financial Instruments Directive (MiFID) II requires that “all sufficient steps are taken in pursuit of best execution and the Execution Policy must explain precisely what those steps are”. Going forward, best execution requirements could be considered for the Indian markets as well. Improving market monitoring SBPs and some other venues for OTC trading have often been referred to as “dark pools” as price and trade information are not disseminated on such platforms. There is limited literature available which shed light on the activities on these dark pools. The market monitoring of trading activity on SBPs should proportionately increase with the rising importance of these venues. One approach in this direction, considering that transaction level data on FX derivatives are already being reported to the CCIL Trade Repository (TR), could be to expand the TR reporting requirements to spot transactions (both client and interbank), along with a field to disclose the venue of execution. This would provide a holistic view of the microstructure of the FX market. Introduction of new intermediaries Exploiting new technology, a new set of non-bank electronic intermediaries, most notably PTFs, has gained a stronger footing in the global FX markets. The growth in PTFs has been driven by their ability to deploy technology to provide liquidity at reduced marginal cost. As they have morphed into market-makers, alongside main FX dealing banks, they have become an integral part of FX intermediation and a key determinant of liquidity conditions, particularly in the spot market. In addition to enhancing liquidity, non-bank market-makers also bring in different interests in the otherwise bank dealer-led market, increasing its efficiency and vibrancy. In view of the prominent role being played by non-bank electronic market-makers in the global FX markets, the benefits and risks of their introduction in the Indian FX market, also a bank dealer-led market, can be debated. To sum up, electronification has fundamentally altered the way prices are discovered and liquidity is provisioned to users in financial markets. Market monitoring must commensurately and continuously evolve to effectively keep track of the structural shifts on account of these trends. At the same time, the possibilities emerging out of electronification must be leveraged to increase market transparency, reduce information asymmetry, and improve pricing for the users. References BIS (2016). Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity. Butz, M and R Oomen (2019). Internalisation by electronic FX spot dealers. Quantitative Finance, 19 (1), 35–56. Rahmouni-Rousseau, I., & Churm, R. (2018). Monitoring of fast-paced electronic markets. BIS Markets Committee Report. Moore, M, A Schrimpf and V Sushko (2016). Downsized FX markets: causes and implications. BIS Quarterly Review, December, 35–51. Schrimpf, A and V Sushko (2019a). FX trade execution: highly complex and fragmented”. BIS Quarterly Review, December, 39–51. Schrimpf, A and V Sushko (2019b). Sizing up global foreign exchange markets. BIS Quarterly Review, December, 21–38. Woolridge, P. 2019. FX and OTC derivatives markets through the lens of the Triennial Survey. BIS Quarterly Review, December, 15-19. Yamaguchi, Y. 2001. The implications of electronic trading in financial markets. Committee on the Global Financial System, 1-37.

|