On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (August 10, 2023) decided to: - Keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50 per cent.

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. - The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. The global economy is slowing and growth trajectories are diverging across regions amidst moderating but above target inflation, tight financial conditions, simmering geopolitical conflicts, and geoeconomic fragmentation. Sovereign bond yields have hardened. The US dollar fell to a 15-month low in mid-July on expectations of an early end to the monetary tightening cycle, although it recouped some of the losses subsequently. Equity markets have gained on expectations of a soft landing for the global economy. For several emerging market economies, weak external demand, elevated debt levels and tight external funding conditions pose risks to their growth prospects. Domestic Economy 3. Domestic economic activity is maintaining resilience. The cumulative south-west monsoon rainfall was the same as the long period average up to August 9, 2023 although the temporal and spatial distribution has been uneven. The total area sown under kharif crops was 0.4 per cent higher than a year ago as on August 4, 2023. The index of industrial production (IIP) expanded by 5.2 per cent in May while core industries output rose by 8.2 per cent in June. Amongst high frequency indicators, e-way bills and toll collections expanded robustly in June-July, while rail freight and port traffic recovered in July after remaining muted in June. The composite purchasing managers’ index (PMI) rose to a 13-year high in July. 4. Urban demand remains robust, with domestic air passenger traffic and household credit exhibiting sustained double digit growth. The growth in passenger vehicle sales has, however, moderated. In the case of rural demand, tractor sales improved in June while two-wheeler sales moderated. Cement production and steel consumption recorded robust growth. Import and production of capital goods continued in expansion mode. Merchandise exports and non-oil non-gold imports remained in contraction territory in June. Services exports posted subdued growth amidst slowing external demand. 5. Headline CPI inflation picked up from 4.3 per cent in May to 4.8 per cent in June, driven largely by food group dynamics on the back of higher prices of vegetables, eggs, meat, fish, cereals, pulses and spices. Fuel inflation softened during May-June, primarily reflecting the fall in kerosene prices. Core inflation (i.e., CPI excluding food and fuel) was steady in June. 6. The daily absorption of liquidity under the LAF averaged ₹1.8 lakh crore during June-July as compared with ₹1.7 lakh crore in April-May. Money supply (M3) expanded by 10.6 per cent y-o-y as on July 28, 2023 as against 10.1 per cent on May 19, 2023. Bank credit grew by 14.7 per cent y-o-y as on July 28, 2023 as compared with 15.4 per cent on May 19, 2023. India’s foreign exchange reserves stood at US$ 601.5 billion as on August 4, 2023. Outlook 7. Going forward, the spike in vegetable prices, led by tomatoes, would exert sizeable upside pressures on the near-term headline inflation trajectory. This jump is, however, likely to correct with fresh market arrivals. There has been significant improvement in the progress of the monsoon and kharif sowing in July; however, the impact of the uneven rainfall distribution warrants careful monitoring. Crude oil prices have firmed up amidst production cuts. Manufacturing, services and infrastructure firms polled in the Reserve Bank’s enterprise surveys expect input costs to ease but output prices to harden. Taking into account these factors and assuming a normal monsoon, CPI inflation is projected at 5.4 per cent for 2023-24, with Q2 at 6.2 per cent, Q3 at 5.7 per cent and Q4 at 5.2 per cent, with risks evenly balanced. CPI inflation for Q1:2024-25 is projected at 5.2 per cent (Chart 1).  8. Looking ahead, the recovery in kharif sowing and rural incomes, the buoyancy in services and consumer optimism should support household consumption. Healthy balance sheets of banks and corporates, supply chain normalisation, business optimism and robust government capital expenditure are favourable for a renewal of the capex cycle which is showing signs of getting broad-based. Headwinds from weak global demand, volatility in global financial markets, geopolitical tensions and geoeconomic fragmentation, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent with Q1 at 8.0 per cent; Q2 at 6.5 per cent; Q3 at 6.0 per cent; and Q4 at 5.7 per cent, with risks broadly balanced. Real GDP growth for Q1:2024-25 is projected at 6.6 per cent (Chart 2).  9. The headline inflation is likely to witness a spike in the near months on account of supply disruptions due to adverse weather conditions. It is important to be vigilant about these shocks with a readiness to act appropriately so as to ensure that their effects on the general level of prices do not persist. There are risks from the impact of the skewed south-west monsoon so far, a possible El Niño event and upward pressures on global food prices due to geopolitical hostilities. Domestic economic activity is holding up well, supported by domestic demand in spite of the drag from weak external demand. With the cumulative rate hike of 250 basis points undertaken by the MPC working its way into the economy, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent, but with preparedness to undertake policy responses, should the situation so warrant. The MPC will maintain a close vigil on the evolving inflation scenario and remain resolute in its commitment to aligning inflation to the target and anchoring inflation expectations. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. 10. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent. 11. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 12. The minutes of the MPC’s meeting will be published on August 24, 2023. 13. The next meeting of the MPC is scheduled during October 4-6, 2023.

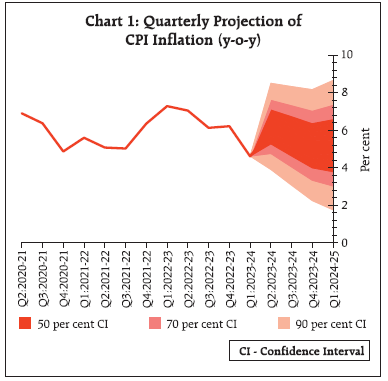

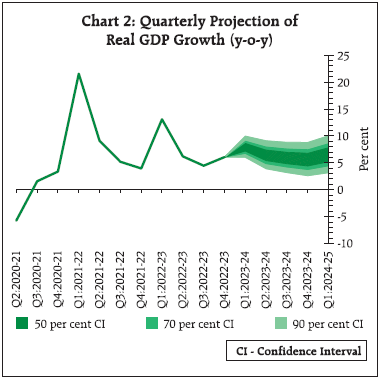

|