by Brij Raj^ and Amit Kumar^ A timely transition away from coal-fired power plants is crucial for India’s transition towards a green economy. However, considering the current energy mix and the projected increase in power demand, it is expected that they will continue to play a critical role for the country in the coming decades. As climate policy becomes increasingly stringent, a significant proportion of coal-based assets are likely to lose their value, resulting in ‘stranded’ assets, which could affect banks and financial institutions (FIs) having direct and indirect exposures to the sector. The article examines the aspect of repurposing of coal-fired power plants and suggests a calibrated approach for a gradual and non-disruptive transition away from lending by banks and FIs to the coal and other fossil-based sectors while ensuring a just and equitable climate transition. Introduction The power sector in India is the largest source of its greenhouse gas (GHG) emissions, with the majority of these emissions emanating from coal-fired power plants (Manchanda, 2021). Although they remain an important source for the country’s energy mix, the Government and other stakeholders are actively working to decarbonise the power sector. Additionally, coal is the primary fuel used to produce steel and cement. India also has a considerable line-up of sanctioned coal-fired power projects, with 28.2 GW of coal-based power capacity currently under various phases of construction (Energy News Monitor, 2023). Availability of cheaper alternatives, particularly solar power, is impacting the price dynamics of the sector, even as the installed capacity in renewables is not yet sufficient to meet power demand. Going forward, this may put power sector companies under financial strain and limit their resource-raising capabilities from banks, FIs and capital markets. Although lending to and investing in green assets is a crucial part of climate change mitigation and transition to a net-zero emissions economy, the shift needs to be gradual and non-disruptive, particularly for a large and developing economy like India. This article examines the recent trends in the power sector in India, the challenges related to the financing of coal-based power projects and offers suggestions for a gradual and non-disruptive transition and phase down of Coal-Fired Power Plants while taking India’s developmental and sustainability needs into account. II. Power Sector in India II.1 Trends in Power Sector in India Over the past twenty years, electricity consumption in India has almost tripled, outpacing the overall energy demand growth. This surge is largely attributed to urbanisation and increasing household income (Ministry of Power, 2020). The increased deployment of electrical motors and a variety of machinery in the industrial sector has also been a contributing factor to the rise in electricity consumption. The power sector in India is witnessing a major overhaul in the wake of the challenges caused by the Covid-19 pandemic, the ongoing Russia-Ukraine conflict, deteriorating global financial conditions and concerns about climate change. The pandemic led to a temporary decline in power demand in 2020-21, but consumption quickly recovered to surpass 2019-2020 levels in 2021-22. The pandemic has underscored the urgent need for accelerated technological advancements in the power sector. Implementing smart technologies, such as an evolved grid system, smart metering, and distribution load management, has become essential for a successful transformation of the sector to adapt to the changing landscape. These advancements are crucial for ensuring energy efficiency, resilience, and sustainability in the face of evolving challenges and demands. II.2 Energy Mix Currently, 55 per cent of India’s energy needs are met by coal (Ministry of Coal, 2023). Coal remains the largest fuel in the country’s energy mix, although oil consumption has risen rapidly due to increased vehicle ownership and use of road transport. The country’s power generation capacity grew by 75 per cent between 2011-12 and 2022-23, with renewables1 accounting for 41 per cent of the total capacity in 2022-23, up from 32 per cent in 2011-12. Annual coal capacity additions have dropped dramatically from 19GW in 2015 to only 0.6GW in 2022, while simultaneously, annual renewable capacity additions have grown during the period (Ministry of Power, 2022). Since 2017, annual additions to renewable capacity have exceeded those from coal power [Chart 1]. II.3 Projections for the upcoming decade India’s announcements at the COP26 summit, which took place in Glasgow in November 2021, are expected to shape the future pathways of the country’s power sector in the coming decades: (PIB, 2022): -

Capacity: Reach 500GW non-fossil energy capacity by 20302 -

Generation: 50 per cent of its energy requirements should be met from renewable energy by 2030 -

Emissions: Reduction of total projected carbon emissions by one billion tonnes from November 2021 to 2030 -

Carbon Intensity: Reduction of carbon intensity of the economy by 45 per cent by 2030, over 2005 levels -

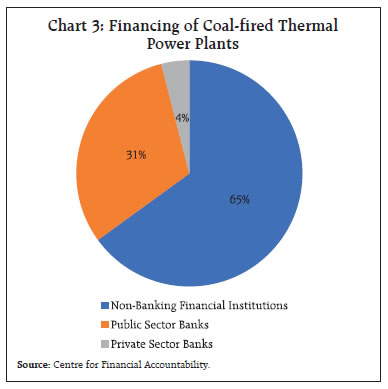

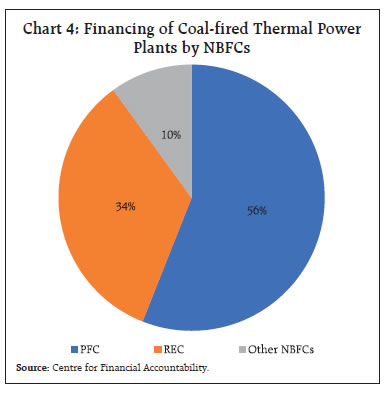

Net Zero: Achieving the target of net zero emissions by 2070 State Governments have also set sub-national targets in addition to targets by the Government of India. For instance, in 2019, Gujarat announced that it would no longer invest in new coal-fired power capacity (Ramanathan, 2019). In December 2022, Tamil Nadu took a decision to halt additions to its existing coal power capacity. Concurrently, the Delhi Government approved a new solar policy with the goal of fulfilling 25 per cent of the national capital’s annual electricity demand through solar power by 2025. In April 2023, the Central Electricity Authority (CEA) modelled the 2030 optimal generation capacity mix for the country and as per their assessment, India would need 293GW of solar energy and 100GW of wind power respectively by 2030. Around two-thirds of the installed capacity would come from zero-carbon sources, while 252GW of coal and 25GW of gas plants would continue to be in the mix [Chart 2]. II.4 Coal-Fired Power Plants and the Crucial Transitioning Coal-fired power plants have played a vital role in meeting India’s surging energy demands, making significant contributions to trade, industrialisation, and electrification. In January 2023, the CEA recommended that all power utilities refrain from decommissioning any thermal power generation units until 2030 and ensure their operational availability by undertaking necessary renovation and modernisation. Nevertheless, the extensive use of coal has led to adverse climate and environmental consequences, impacting air quality, land, water, and agriculture, particularly in regions reliant on coal. To transition away from a carbon-intensive economy, careful consideration of benefits, downsides, and distribution across different scales and timeframes is necessary. Despite the urgency to accelerate the shift from coal, several barriers stand in the way. Various socio-economic elements present obstacles, including the availability of electricity, the royalties from coal mining, and the payments made into the District Mineral Foundation (DMF) funds across different states. The technological issues involved in phasing out coal-fired power stations, limited grid integration for renewable energy, storage and smart grid challenges, and local manufacturing and sourcing constraints are also required to be addressed. Factors like black-market activities, subsidies, and Power Purchase Agreements (PPAs) with DISCOMs can also act as impediment to the transition (Climate Investment Funds, 2021). There are several drivers pushing for a faster transition. The decreasing cost of renewables and storage technologies makes them more cost-effective than fossils. India’s commitment to reducing emissions intensity requires addressing inefficiencies in coal-based power generation. Moreover, the reluctance of banks and FIs to fund new coal projects due to the risk of insolvency or closure is also driving the transition. Communities dependent on coal, whose livelihoods are tied to coal value chains, face challenges in engaging with cleaner energy efforts due to their economic and energy structures (ADB, 2023). Therefore, a well-managed transition will necessitate extensive consultations at international, national, and local levels to ensure a fair distribution of benefits over time. III. Financing Coal and other Fossil based Sectors - Emerging Issues III.1 Financial risk on account of stranded assets in Coal and other Fossil-based sectors Banks’ exposure to fossil fuel sector consists of both direct exposure - loans and investments in operations and firms associated with extracting, producing, and investing in fossil fuels - and indirect exposure - in firms that have exposure to fossil fuel investments. As climate policy becomes more stringent on the pathway to net zero emissions, a majority of fossil fuel reserves may never be extracted to prevent further exacerbation of global warming. This may render some of these natural resources and production infrastructure as ‘stranded assets’3 that would never be fully utilised. In order to maintain global temperature rise within 1.5 degrees Celsius, it is estimated that 60 per cent of the world’s oil and gas reserves and 90 per cent of the existing global coal reserves should be left unutilised (Welsby et al, 2021). The resultant devaluation of assets that become unusable could have financial repercussions for investors and this may also influence banks and FIs that have provided financing to these companies or have other forms of indirect exposure. Investors in emerging economies such as India face a significantly higher risk of incurring financial losses from stranded assets relative to investors in developed economies. This disparity arises from a range of issues, such as the relatively recent establishment of their energy sectors, the high capital costs of renewables, and limited diversification. The increased risk in India is attributed to the relatively young profile of its existing coal power plants, with an average age of just 13 years. In contrast, the coal power infrastructure in developed countries, such as the US, Europe, Russia, Japan, and South Korea, is considerably older with average ages ranging from 21 to 41 years4. The introduction of the Insolvency and Bankruptcy Code in 2016 and the subsequent reporting requirements5 by the Reserve Bank of India, has brought to light significant stress in the coal mining and energy sectors in India. A 2019 study conducted by The International Institute for Sustainable Development has revealed that Chhattisgarh, Odisha, and Jharkhand are confronting the most substantial impacts due to their high proportions of stressed assets - amounting to 58 per cent, 55 per cent, and 27 per cent of their respective state capacities (International Institute for Sustainable Development, 2019). This condition places the these assets at an elevated risk of becoming stranded6, signalling a significant vulnerability to economic losses resulting from asset devaluation as the country navigates the shift toward sustainable practices. On an encouraging note, a study by the Institute for Energy Economics and Financial Analysis (IEEFA) indicates that India has only eight remaining stranded coal-based power plants as of April 2023, and several of the initially identified stressed projects having been resolved or being on track for resolution. Globally, it is estimated that shutting down inefficient coal power plants alone could contribute significantly to reducing emissions in the power sector. In the context of India, the impact of closing inefficient coal power plants is expected to be even more pronounced (CIF, 2021). According to a study by the Oxford University, the cost of loans related to coal power plants is on the rise reflecting changes in real and perceived energy transition risks by lenders and investors. The loan spread7 for coal mines and coal-fired power plants rose 38 per cent and 54 per cent respectively between 2010 and 2020, as the global economies look for more sustainable investment (Zhou et al, 2021). Banks and FIs in India should, therefore, be able to properly assess and price this risk when lending to fossil fuel firms and gradually redirecting credit away from them is crucial to reaching India’s climate goals. III.2 Changes in policy of FIs on financing Coal and other Fossil Sectors The recent reduction in investment for thermal power plants in India reflects both the evolving status of coal and the increasing dominance of renewable energy sources within the country’s energy matrix. This trend also signifies a heightened sense of risk aversion among banks. According to a recent news report8, of the 87 mining sites auctioned off to private entities over the past three years under India’s ‘Unleashing Coal’ initiative - a part of the country’s plan to become energy self-sufficient - only four mines have commenced operations. The rest are yet to secure the necessary financial backing to become operational. Globally, this cautious approach by banks extends to reluctance in funding the $7 billion required for emissions control technology across 120 GW of coal power plants, which is necessary to meet stricter environmental standards (International Energy Agency, 2021). III.3 Financing to Coal-Fired Power Projects in India - Status Majority of debt financing to Coal and other Fossil based sectors is being provided by domestic commercial banks and non-banking financial institutions, like the Power Finance Corporation (PFC), Rural Electrification Corporation (REC), etc. As per a December 2022 report by the Centre for Financial Accountability, loans amounting to ₹7.62 lakh crore have been provided by 84 lenders, both domestic and international, to 140 thermal power plants (TPPs) in India (out of which 122 were commissioned and 18 were in the construction phase), with a capacity of 1,000 MW and above between 2005-2022. During this period, the 122 commissioned plants contribute to nearly 196 GW of the 204 GW total commissioned capacity. Out of the ₹7.12 lakh crore loans sanctioned domestically, 96 per cent is sourced from banks with the remaining being sourced from non-banking financial companies (NBFCs) [Chart 3]. Amongst NBFCs, PFC and REC account for 90 per cent of the loans given to the coal-fired thermal power plants [Chart 4]

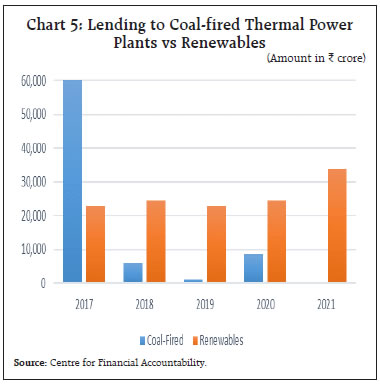

While lending to new coal power projects has decreased in the last five years, there has been a gradual increase in lending to new power projects based on renewables [Chart 5]. PFC and REC have emerged as the financiers of last resort for coal power projects in India in recent years, as financiers have increasingly avoided funding coal power projects. In 2021, no new coal power projects received any project finance, while one coal power project was granted a standby credit facility, namely 1.32 GW Buxar thermal power plant in Bihar. It received a total of ₹1,024 crore in loans from three institutions, viz., State Bank of India, Canara Bank and India Infrastructure Finance Company Ltd. In 2020, it was the only coal plant to receive project financing, wherein it secured loans from PFC and REC, with total project cost amounting to ₹8,448 crore (Centre for Financial Accountability, 2022). III.4 Investment with conditions The decision to not take new exposure to coal exploration activities is a key development for some banks in India. The action also marks a significant change in direction for some banks in India and is in line with many banks and FIs globally which are moving away from financing coal-related projects over carbon emission concerns such as Sumitomo Mitsui Financial Group of Japan, U.S based JP Morgan Chase, etc. The largest banks in Japan have committed to policies that exclude financing new coal-fired power projects. Japan International Cooperation Agency (JICA) have integrated no-coal commitments into their lending and bond issuance guidelines, in response to pressure from environmental activists and institutional investors concerned about climate change. If banks in India follow suit, then it would significantly affect the flow of credit to coal, oil and gas related businesses, etc., which are very critical for a developing economy like India. III.5 ESG adoption by global banks and impact on financing of coal and other Fossil Sectors The consideration of Environmental, Social, and Governance (ESG) factors is becoming a cornerstone in the banking sector, significantly impacting the decision-making processes of various stakeholders. A recent analysis of a cohort comprising 60 of the world’s largest banks that provide financial backing to major fossil fuel companies revealed a notable trend: banks with reduced financing activities in the fossil fuel sector—both in terms of lending and investment—were less likely to be categorised in the high-risk ESG group. Instead, they were more likely to be classified within the low-to-medium-risk ESG brackets (Bernardelli et al, 2022). This shift has profound implications for the banks and FIs involved, affecting not only their cost of capital but also the duration for which they can secure external financing and ultimately, their market valuation. Thus, as ESG adoption becomes more common, financing fossil fuels will get even more difficult. III.6 Financial Stability and Macroeconomic Concerns Stranded Assets in coal-fired power plants may represent a systemic threat to the financial stability, especially for developing economies. As per a recent report by the World Bank, the majority of such assets, particularly middle income economies (MICs), is under the control of governmental entities at both the national and local levels. Out of the $555 billion of public funds in these coal plants globally, an overwhelming majority (99 per cent) resides within MICs. Moreover, as of early 2020, there are proposals for more than 400 GW of new coal-fired power capacity worldwide. Commissioning these facilities could result in stranded assets valued at approximately half a trillion dollars if efforts to cap the global temperature rise at 1.5°C are successful. (Edwards, et al. 2022). Incurring costs from decommissioning coal power plants earlier than planned can hamper the financial health for the owners of these assets, implying that both investors and taxpayers will have to bear the financial burden of this loss (World Bank, 2023). Many FIs and investors may have already committed significant capital to these projects, and their inability to diversify their portfolios due to coal’s uncertain financial future can lead to concentration risk. In the case of coal, the concentrated exposure could lead to significant losses. In addition, transitioning away from the coal sector also entails macroeconomic costs like impact on employment and livelihoods of the communities dependent on the coal ecosystem. IV. Repurposing of Coal-Fired Power Plants According to a recent World Bank report, to remain on course with a 1.5°C climate scenario, it will be necessary to decommission more than 100 GW of the global coal-fired capacity each year over the next 20 years — effectively shutting down one coal unit daily until 2040. This target is set against the backdrop of the global coal fleet’s current capacity of 2,153 GW. Despite the typical 40-year operational lifespan of a coal plant, around 60 per cent of the existing fleet has not yet reached the halfway mark, with many units being under 20 years old (World Bank, 2023). The challenge in transitioning from coal to green energy not only involves scaling up zero-emission solutions but also expediting the phase-out of coal. While more countries commit to coal phase-out, not all of them fully align with the Net Zero Emissions by 2050 Scenario provided by the International Energy Agency. For instance, at COP26, over 40 economies from both developed and developing countries pledged to phase out coal. However, the phase-out ambition levels in many instances raise questions as some pledges mainly apply to plants near the end of their lifespan or already idle for a long time. The challenge lies in aligning the ambition of the 1.5°C objective with an actionable strategy to fast-track the decommissioning and retirement of plants that still have a long operational lifetime and remain economically competitive, possibly due to long-term contracts. Innovative climate finance tools, known as coal transition mechanisms (CTMs), are paving the way for a faster shift from coal to clean energy. These mechanisms streamline the move away from coal by offering structured financial solutions, such as securitisation, and robust support systems for those impacted by the energy transition. CTMs aim to balance the divestment from coal with sustainable investment, support for impacted communities, and risk management, ensuring an equitable transition towards a low-carbon economy. CTMs have gained traction in the key coal markets, including bond securitisation in the US, and programs spearheaded by Multilateral Development Bank, such as Energy Transition Mechanism (ETM) by the Asian Development Bank and Accelerating Coal Transition (ACT) Investment Program by the Climate Investment Fund. Extensive coal transition plans are also taking shape with Just Energy Transition Partnerships in countries like South Africa, Indonesia, and Vietnam. Despite this progress, CTMs remain in nascent stages of development, and establishing trust among banks, FIs, regulatory bodies and other stakeholders is imperative for their broader adoption and effectiveness. The repurposing of coal power plants, regardless of ownership, requires additional costs - for decarbonising, decommissioning, retirement, and ensuring a just transition - to the cost of scaling up clean energy to replace coal-fired generation. These expenses can be substantial and need careful management of the complex dynamics surrounding the coal sector in India as discussed in Section II.4. Refinancing of the existing high-cost debt can act as a strong imperative for the premature decommissioning of fossil fuel assets. There is potential to set up financial mechanisms that refinance the current debt on these energy-generating assets, hastening the period for the recovery of invested capital. For assets under private ownership, such refinancing schemes could lessen the need for hefty severance pay-outs from purchasers to the developers of these fossil fuel assets. Nevertheless, assets held by the public sector may gain from debt refinancing, which would lower their debt servicing obligations and enable an expedited cessation of operations (World Bank, 2023). Adopting sustainability-linked green bonds (SLGBs) could offer an effective financial mechanism to convert technically-feasible coal-fired power plants to renewable energy sources. This arrangement may be suitable for companies that are able to shut down coal plants ahead of schedule, are dedicated to reducing carbon emissions, and have robust financial health with the ability to tap into debt capital markets. A standard sustainability-linked bond depends on specific key performance indicators (KPIs) connected to the environmental, social, and governance goals determined by the issuer. If these KPIs are not met, the issuer may incur financial consequences, but meeting them can lead to lower interest rates on future coupon payments. As per a study by IEEFA, as on February 27, 2023, the global SLB market has grown to a substantial US$244 billion since its first issuance in 2019. However, concerns about greenwashing have arisen as the proceeds from plain vanilla SLBs may fund non-green projects. To address this, IEEFA has proposed an SLGB structure where both the KPIs and the proceeds are specifically tied to designated projects. Under this proposal, a coal power producer would issue an SLGB with three core KPIs: -

Decommissioning coal generation capacity by an ambitious date. -

Establishing renewable energy generation capacity prior to or in parallel with coal decommissioning. -

Implementing a comprehensive reskilling, rehiring, and compensation package to ensure a just transition from coal to renewable energy power plants. The issuer would be required to allocate the proceeds of the SLGB exclusively to these specified projects, ensuring transparency and preventing any misuse of funds. To promote cost-effective debt for utility companies and motivate early coal plant repurposing, a dual-tranche issuance approach could be employed. The senior tranche would target institutional investors, while the subordinate tranche would attract Multilateral Development Banks (MDBs) and Development Finance Institutions (DFIs). By providing capital at a concessional rate, subordinate bondholders would incentivise early coal plant repurposing. It should be noted that credit enhancements like guarantees from MDBs or Development DFIs can make SLGBs more affordable. These entities can also provide grants to defray costs associated with reskilling workers, managing the bond issuance, and the crucial tasks of ongoing monitoring and validation necessary to establish a credible SLGB. A strategy to repurpose the sites and equipment of closed plants for renewable energy, energy storage, or auxiliary services can give them a second life. Funding is generally needed for both the dismantling of old assets and the development of new renewable energy facilities. As per a report by the World Bank, to transition from coal to renewable energy obligations, a range of approaches can be employed. One such method includes refinancing a renewable energy asset under the existing coal power purchase agreement. This could involve bundling the financial obligations for solar power output with the costs associated with the acquisition and decommissioning of the coal facility (World Bank, 2023). The World Economic Forum (WEF) is leading a task force aimed at Mobilising Investment for Clean Energy in Emerging Economies, in collaboration with the IEA. The task force’s primary objectives include evaluating barriers, developing case studies, generating real-world ideas, and implementing solutions to address financing challenges in clean energy within Emerging Economies. The task force has come up with ‘bold proposals’ to support the acceleration of clean energy investment: -

Energy Transition Mechanism: This involves a blended finance mechanism that aligns with a national government’s transition plan and Nationally Determined Contributions (NDC) commitment. It allows countries to retire portions of their carbon-intensive power assets over a defined period. -

Net Zero Equity: This proposal introduces a new investment product that channels funds from investors seeking long-term contributions to society rather than immediate returns. Investors, such as foundations, citizens, and governments, can contribute to projects that might not receive funding otherwise, thus de-risking and enabling their implementation. -

Decommissioning Coal Mapping: This involves a purpose-built methodology that maps plants at the national fleet level9 and prioritises retirements. It helps frame and sequence decommissioning pathways while providing visibility into required investments. -

Cost of Capital Observatory: This effort aims to collect data on estimated and actual costs of capital for clean energy projects. A related study conducted by Imperial College and the IEA highlights that publicly traded renewable companies have outperformed fossil fuel companies, offering higher returns and lower volatility. The renewable portfolio is also less correlated with the broader market. -

Accelerating Corporate Power Purchase Agreements (PPAs): The proposal seeks to promote direct procurement of renewable power by corporations targeting high levels of renewables consumption. These proposals hold the potential to catalyse clean energy investment in emerging economies, contributing significantly to the transition towards a more sustainable and greener energy landscape. The task force is actively exploring their viability and applicability to drive positive change and address the financing challenges in the clean energy sector. However, there is no 1.5°C aligned, science-based classification system currently available to define investments eligible as climate finance under coal transition schemes. The issue of a just transition is also rarely addressed. Mainstreaming climate finance for coal transition necessitates detailed evaluation criteria. The lack of specific, universal criteria and thresholds associated with each activity means that 1.5°C-aligned coal-transition activities will have to be defined independently for each transition process. This increases operational costs as banks and FIs may not have sufficient time and resources to evaluate projects with significant variance or utilise scale to prevent greenwashing claims. To increase the usability of coal transition debt vehicles, establishing credible standards is crucial. Robust criteria are needed to ensure that investments align with a 1.5°C-aligned transition pathway. These criteria should be granular, publicly available, science-based, future-proof, and just and inclusive. Incorporating these criteria will help ensure credibility and avoid greenwashing claims while facilitating the market uptake of coal transition initiatives (MAS, 2023). V. Way Forward V.1 Importance of calibrated approach by banks and FIs Despite growth in the renewable sector, coal is expected to remain a significant component of India’s energy mix. A transition towards a greener future is critical for the country’s sustainable economic growth, and banks and FIs must take a calibrated approach to strategically navigate the shift to renewable energy. They should progressively refine their Environmental, Social, and Governance (ESG) practices, and the move away from financing coal, oil, and gas must be systematic and non-disruptive to ensure these sectors continue to have access to necessary funding. As per an analysis by the Centre for Science and Environment, by implementing decarbonising strategies10 for the thermal power sector, GHG emissions can be reduced by up to 22 per cent in comparison to a business-as-usual scenario. Banks and FIs can contribute to decarbonising the sector by assisting the thermal power producers with their transitioning and mitigation goals as also helping them to meet the increasingly stringent environmental norms and emission standards. V.2 Roadmap for a gradual and non-disruptive transition from lending to coal and other fossil- based sectors Realising the goal of establishing 500 GW of non-fossil fuel capacity by 2030 necessitates a comprehensive overhaul of the power sector. This transformation will demand adaptable management of coal-powered facilities, the development of durable grid systems, advancements in battery storage, and the implementation of demand-side response strategies. To promote investment in renewable energy, it is also essential to address associated risks, which include delays in payments to energy producers, challenges in land procurement, and the need for regulatory and contractual certainty. Hence, a roadmap for a gradual and non-disruptive transition from lending to coal and oil and gas sector is very crucial. Some of the notable recent initiatives undertaken by the Government in this regard are as under: -

In a strategic move to bolster the supply-side dynamics of renewable energy and diminish reliance on coal for electricity generation, the Government, in March 2023, instituted a Renewable Generation Obligation (RGO) applicable to new coal-fired thermal power plants. Under this directive, any generating company that commences construction of a coal/lignite-based thermal power station from April 2023 will be required to either establish renewable energy projects amounting to 40 per cent of its coal power capacity by April 2025, or alternatively, secure and provide an equivalent amount of renewable energy. This policy underscores the commitment to a more sustainable and diversified energy mix, encouraging the integration of renewable energy into the national grid. Moreover, a captive coal or lignite-based thermal power station has been granted exemption from the mandate of the RGO, if it complies with the Renewable Purchase Obligations (RPOs) as stipulated by the Central Government. -

Flexibility in generation and scheduling of thermal / hydro power stations was provided for in November 2021 through bundling with renewable energy and storage power. -

While Indian companies have been generating and selling carbon credits, their buyers have been from outside the country. India is working to establish a fully domestic carbon market in which both buyers and sellers are Indian entities. The Energy Conservation (Amendment) Act of 2022 endows the Government of India to set up carbon markets within the country and outline a carbon trading scheme. The Act enables the Government to establish standards for energy consumption, which may include mandating that specified consumers obtain a minimum portion of their energy from non-fossil sources. The Act also aims to expand the reach of the Energy Conservation Building Code to encompass large residential structures, thereby incorporating them into the broader framework of energy conservation efforts. -

To reduce emissions from Coal based power plans, the Government has promoted Clean Coal Technologies such as Coal Washing Coal gasification and Carbon Capture and Storage (CCS) technologies to help deploy India’s vast coal resources without causing air pollution. V.3 Importance of setting science-based targets The Science-Based Targets initiative (SBTi) promotes the adoption of scientifically grounded greenhouse gas (GHG) emissions reduction goals among companies to enhance their competitive edge amidst the shift to a low-carbon economy. Companies committing to such targets can have gains in innovation, diminished regulatory unpredictability, bolstered investor trust, and increased profitability. Within the framework of the SBTi, banks and FIs are mandated to set targets based on emission reductions through direct action within their operations or lending and investment portfolios. These targets ensure a clear pathway towards sustainability, aligning with national and global climate goals. Globally, banks and FIs are increasingly adopting science-based targets. It is vital that the entities regulated by the RBI also consider setting science-based targets for their operations if they have not already done so. V.4 Ensuring a just transition Physical manifestations of climate change, such as rising sea levels, prolonged droughts, extreme heat events, and more severe storms, are set to continue imposing the greatest strain on those populations most at risk. As momentum for climate action builds, it is imperative to facilitate a transition that is fair and inclusive. However, without careful management, efforts to combat climate change could unintentionally inflict harm on economies, livelihoods, and ecosystems. A transition that is just and equitable would ensure that measures taken to address climate change effectively balance mitigation and adaptation efforts while striving to be as inclusive and equitable as possible. For instance, an unmanaged phase down of the fossil fuel industry could eliminate 33 per cent of jobs (Sivaprasad et al). Therefore, facilitating a just transition presents a complex challenge, necessitating close collaboration among various stakeholders. VI. Conclusion India’s power sector is amid a significant transition towards a greener future, and banks and FIs are playing an important part in this endeavor. To ensure a smooth transition, a calibrated approach towards reducing lending to coal and other fossil-based sectors is required. The coal-fired thermal power sector has considerable potential for decarbonisation, and banks and FIs can contribute to this transition by adopting better ESG practices and providing financing to help producers meet environmental norms and emission standards. While challenges exist due to the country’s energy needs, stringent climate policies, and the risk of stranded assets, a well-planned and calibrated approach by banks and FIs can pave the way for a sustainable and equitable future. Setting science-based targets and ensuring a just transition are also essential for a sustainable future. With continued efforts and collaboration of stakeholders, the power sector can help India make significant strides towards becoming a low-carbon economy while meeting its developmental needs. References Asian Development Bank. (2023, April). Ensuring a Just Transition is Key to India’s Energy Transition Goals. Bernardelli, M., Korzeb, Z., & Niedziółka, P. (2022, January). Does Fossil Fuel Financing Affect Banks’ ESG Ratings?. Energies, 15(2), 1495. doi: 10.3390/en15071495 Centre for Financial Accountability. (2022, December). Coal vs Renewables Investment Report 2022. Centre for Financial Accountability. (2022, December). The Coal Tail: Tracking Investments in Coal-fired Thermal Power Plants in India. Climate Investment Funds. (2021, March). Supporting just transitions in India. Edwards, Morgan R., Ryna Cui, Matilyn Bindl, Nathan Hultman, Krinjal Mathur, Haewon McJeon, Gokul Iyer, Jiawei Song, and Alicia Zhao. (2022, January) Quantifying the Regional Stranded Asset Risks from New Coal Plants Under 1.5° C. Environmental Research Letters 17 (2): 02. Energy News Monitor. (2023, June). Volume XIX, Issue 49. International Energy Agency. (2021, March). India Energy Outlook 2021. International Institute for Sustainable Development. (2019). India’s Energy Transition: Stranded coal power assets, workers, and energy subsidies. Manchanda, H. (2021, October). Power Sector: Stumbling block in India’s net-zero journey. Observer Research Foundation. Ministry of Coal. (2023, October). Coal – Indian Energy Choice. Retrieved from https://coal.nic.in/en/major-statistics/coal-indian-energy-choice Ministry of Power. (2020, October). Growth of Electricity Sector in India from 1947-2020. Monetary Authority of Singapore. (2023, June). Criteria for early phase-out of coal-fired power plants. Press Information Bureau, Government of India. (2022, February). India’s Stand at COP-26. [Press release]. Retrieved from https://pib.gov.in/PressReleasePage.aspx?PRID=1795071 Ramanathan, S. (2019, September). Renewable capacity additions exceed new coal in India. Down To Earth. Sivaprasad, D., Hildebrandt, J., Chin, V., Lackovic, M., Schmidt, M., Lim, K. M., & Tan, D. (2022, November). How to Ensure a Just Transition. Saurabh Trivedi and Labanya Prakash Jena. (2023, March) Repurposing India’s coal power plants: Sustainability-linked green bonds as a financing solution. Institute for Energy Economics and Financial Analysis. Welsby, D., Price, J., Pye, S., & Ekins, P. (2021, September 08). Unextractable fossil fuels in a 1.5 °C world. Nature, volume 597, pages 230–234 (2021). World Bank. (2023, April). Scaling up to Phase Down: Financing Energy Transitions in the Power Sector. Zhou, X. Y., Wilson, C., & Caldecott, B. (2021, April). The energy transition and changing financing costs. Oxford Review of Economic Policy.

|