by Sangita Misra and Aastha^ Using semi-automated textual analysis, this study, parsing through the RBI’s flagship half-yearly publication, the Monetary Policy Report (MPR), since 2016 assesses the following – (a) What central bank communicates – its focus, (b) How it communicates – its tone and subjectivity and (c) How well it communicates – its readability. It draws the conclusion that MPR broadly fairs well in all these aspects, thus, upholding its remit under the RBI Act as an important communication tool. Introduction There has been greater recognition of the importance of communication as an influential instrument for monetary policy in the recent years. Constructive ambiguity of yesteryears has given way to communicating with prescience and clarity, the latter being a key to effective monetary policy, which can better anchor consumer expectations, guide markets and enhance monetary policy transmission (Das, 2022; Bouscasse et al., 2023; and RBNZ, 2020). In this endeavour towards clear communication, central banks very often face challenges varying across economies, reflecting different economic and institutional setups in their countries. While advanced economies (AEs) have used forward guidance as a powerful tool to directly make an impact on the public’s expectations since the global financial crisis (GFC), emerging market economies (EMEs) have faced different challenges concerning the need for communication to support the transition to new frameworks or explaining policy outcomes in the existence of several objectives that central bank had to deliver. Over the last twenty years, central banks have increasingly adopted a Flexible Inflation Targeting (FIT) regime. The FIT framework facilitates the desired balancing between the medium-term objective of the central bank of price stability and the needed flexibility to accommodate short-term objectives. However, the scale of short-term flexibility varies among central banks, related directly to the credibility gained by the central bank over the years, indicating effective communication and consistent policy actions (Gaspar, 2016). Central bank communication acts as a primary and significant tool to enhance policy dialogue with the general public, better anchor market expectations and in the process significantly upscale monetary policy credibility to achieve macroeconomic stability (Blinder, 1998; Bernanke and Reinhart, 2004; Sturm and De Haan, 2011; Berger et al., 2011; and Oshima and Matsubayashi, 2018). The Reserve Bank of India (RBI) reaches out to the general public through several tools – the bi-monthly Monetary Policy Committee (MPC) resolutions and minutes; Governor’s statement; press conferences/ media interactions, speeches, monthly RBI Bulletin and statutory RBI publications - Annual Report, as well as the full-fledged semi-annual publication, the Monetary Policy Report (MPR). Section 45ZM of RBI Act, 1934 read along with Regulation 6 of Reserve Bank of India Monetary Policy Committee and Monetary Policy Process Regulations, 2016, indicate that the Bank shall publish a document to be called the MPR once in every six months, containing the following: (a) Explanation of inflation dynamics in the last six months and the near term inflation outlook; (b) Projections of inflation and growth and the balance of risks; (c) An assessment of the state of the economy, covering the real economy, financial markets and stability, fiscal situation, and the external sector, which may entail a bearing on monetary policy decisions; (d) An updated review of the operating procedure of monetary policy; and (e) An assessment of projection performance. Applying textual analysis to this flagship monetary policy publication of the RBI, this paper attempts to check the effectiveness of using MPR as a communicating tool. Construing through 16 issues of the MPR since April 2016, we check for its focus, sentiment or tone, subjectivity, readability, and overall consistency with other macroeconomic variables. The article is structured as follows. Section II presents a quick overview of the literature. Section III deliberates on the methodology for the sentiment analysis while the results are explained in Section IV. Section V concludes. II. Review of Literature After the 2008 GFC, the key policy challenge for central banks was to effectively manage the market and expectations of agents. According to Naghdaliyev (2011), a central bank can avoid the knowledge burden that could lead to the “deterioration of the rational decision-making process by the public” by initiating a transparent and effective communication style. Such a communication style should involve both transitional and final objectives as given in Figure 1. With the increasing importance of communication as a tool in the monetary policy arsenal, literature in this area has surged over the past decade focussing on quantitative assessments of monetary policy documents to examine how best they serve this role. Such evidence is more commonly found among AEs, inflation targeting countries and mostly for analysing policy documents and press releases/statements (Cherry and Tong, 2023; Gonzalez and Tadle, 2021; and Shapiro and Wilson, 2019) and occasionally for inflation reports by central banks as well (Bulir et al., 2012). Small open economies like Nigeria and Ghana have also attempted similar studies on the tone and readability of the MPC’s communication. A brief overview of such studies is shown in Table 1. Cross correlation across nations established that during international crises, the tone of monetary policy press releases moves closer together (Gonzalez and Tadle, 2021). Textual analysis, whereby, big analytical reports are transformed into quantitative structured formats to get meaningful insights has been a preferred method for such analysis. Text sentiment analysis is a branch of Natural Language Processing and is now employed for many purposes, such as social media analysis, digital trading, customer experience management, economic, and financial research. The related economic literature is rapidly growing; the technique provides various ways to quantify a sentiment indicator for different types of economic texts (i.e., articles, speeches, notes, minutes etc). Text mining techniques have been applied to many central banking areas like communication in monetary policy (Cherry and Tong, 2023; Ferrara and Angino, 2022); banking reforms (Amadxarif et al., 2019), and financial stability reports (Correa et al., 2017) etc.

| Table 1: Central Bank Communication Studies | | Country-wise | | Country | Study | Coverage | Key Results | | United States | Shapiro and Wilson (2019) | FOMC Transcripts, minutes, and speeches during 1986-2013. | • Computed metric for monetary policy sentiment.

• Negative sentiments were inversely related to US’s output. | | Canada | Binette and Tchebotarev (2019) | MPRs. | • Report is complex for an average citizen of the country to understand.

• Important macroeconomic events of country were associated with increased levels of verbal innovation in the reports. | | New Zealand | Cherry and Tong (2023) | Monetary Policy Statements during Q1:1997 -Q4:2021. | • The tone of MPS has been neutral and objective in nature.

• The Monetary Policy Snapshots proved to make communication easier. | | South Africa | Segawa (2021) | MPC statements during January 2000 - January 2021. | • Computed measure of readability using the FK Grade level index.

• Readability improved since 2016. | | Ghana | Omotosho (2020) | 12 monetary policy releases during 2018-2019. | • Monetary policy releases have become simpler to read. | | Nigeria | Tumala and Omotosho (2019) | MPC Communication during 2004-2019 | • MPC communication (word and sentence structures) became more complex, thus reducing its readability over time. | | Cross-country | | 18 Central Banks1 | Gonzalez and Tadle (2021) | Monetary Policy Press releases. | • In most cases, some level of college education required to understand the policy documents.

• The tone of press releases of central banks tends to move closer together during periods of international crises. | | Latin American Central Banks | Taborda (2015) | Minutes of Board meetings in the central banks.2 | • Readability of the central bank minutes has been broadly unchanged in case of Latin American countries. | | Chile, England, Thailand, Czech National Bank, ECB, Poland, and Sverige’s RiksBank | Bulir et al., (2012) | Inflation Reports during 1997-2012. | • Inflation reports have become vibrant over time in Chile, Sweden, and England.

• ECB’s monthly bulletins and Thai inflation reports were less clear during the period. | | Sources: Shapiro and Wilson (2019); Binette and Tchebotarev (2019); Cherry and Tong (2023); Segawa (2021); Omotosho (2020); Tumala and Omotosho (2019); Gonzalez and Tadle, (2021); Taborda (2015); and Bulir et al., (2012). | While Machine Learning techniques are still at a nascent stage for applicability in economic text analysis (Shapiro et al., 2020), the lexicon method of textual study is extensively used in economics and finance literature. Its main benefit is that it is scalable for a particular document with consistency and transparency being less of a concern (Hansen and McMohan, 2016). The dictionary built by Loughran and McDonald (LM) [2011]3 is specific to the domain of economics and finance and has been used extensively for undertaking this exercise. As noted by LM, most dictionaries are not specifically built for economic texts, hence some words inside them could have an opposite connotation if considering an economic context. Therefore, they built their own dictionary precisely designed for the domain of finance and economics (LM dictionary). Given the advantages offered by this approach over alternative approaches in terms of simplicity, efficiency and easy comparability across nations, literature using this lexicon mushroomed since the second half of the 21st century, by when monetary policy communication itself had graduated from the veils of secrecy to the realms of transparency and accountability. Shapiro and Wilson (2019) applied it to minutes of the Federal Open Market Committee’s meetings; Armelius et al. (2020) used it for Central Bankers’ speeches; more recently, Cherry and Tong (2023) used it for analysing the Reserve Bank of New Zealand’s monetary policy statements, to cite a few. It is claimed that the predictive accuracy of the LM dictionary on economic texts is comparable to the Harvard General Inquirer Dictionary (Shapiro et al., 2020l); particularly, the sentiment scores assigned by the LM lexicon is comparable with those assigned by human ratings on the same articles. While many studies have created their own dictionaries with innovations to suit country circumstances, given the standardisation that the LM dictionary has established, very often their study results are compared with those of LM dictionary as a robustness check (Gonzalez and Tadle, 2021). Against this background, we have used text mining practices to examine the MPR from 2016 to 2023. This study is novel in its contribution to the literature in the Indian context as it applies the automated text mining attempt to document data from RBI source. We also measure the legibility of the published MPRs over time by computing readability scores. This work builds on some of the country-specific work as well as cross-country exercise undertaken recently for inflation targeting countries (Cherry and Tong, 2023; Gonzalez and Tadle, 2021). III. Methodology For each MPR document starting from April 2016, the text is first separated from the rest i.e., we removed charts, graphs, and other text deterrents to achieve 16 separate text corpuses. In line with customary methods for text mining analysis, we first start with pre-processing our corpus by removing numbers, punctuations, white spaces, and special characters from the documents. Starting with topic analysis to examine the focus of the publication, many text bags are created to account for select topics. To explore related but distinct topics, we first create a list of keywords each for three aspects – inflation and growth (which are the primary objectives mentioned in the Act) and uncertainty (specified by LM) as well which has been a key variable influencing policy decisions, especially in the last few years.4 In order to measure the tone of MPRs, we have used the approach indicated by Cherry and Tong (2023) using text mining measures. From the LM dictionary, we have computed positive and negative scores based on the count of words matched with each corpus of MPR. Subsequently, we obtain two parameters - Polarity Score5, and the Subjectivity Score6 for all the MPRs published since April 2016. Once we obtain positive and negative scores, the difference between the two gives us an estimate for net sentiments as used by Twedt and Rees (2012). The net sentiment score is then normalised by the total number of positive and negative words in each MPR to obtain the polarity assessment, which is a much more balanced and unbiased indicator of sentiment, providing a range for analysis (-1 to +1), rather than a number. Hence, we compute the following scores for their simplicity and transparency (Table 2). Recognising that readability of reports published by central banks is imperative for general public to understand monetary policy communication clarity of MPR is checked using two Readability metrics following the European Central Bank (Ferrara and Angino, 2022).7 The Flesch–Kincaid (FK) Grade Level specifies a score that can be interpreted as years of education necessary to comprehend a manuscript. The higher the score, the greater the difficulty of the language used. The FK formula is set out below (Kincaid et al., 1975). The Gunning-Fog (FOG) Index considers the number of complex words, rather than total syllables.8 Like FK, the final index is given in terms of number of years needed to understand the text, indicating the higher the index the lower the readability. The FOG Index is presented below (Gunning, 1952).

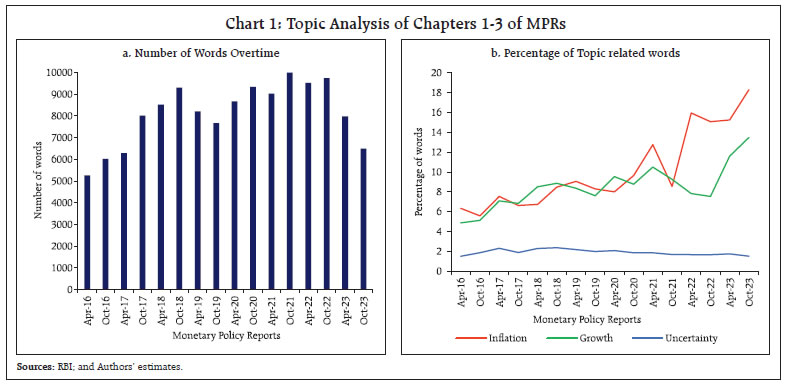

Our focus in this paper is on Chapters 1 to 3 of the MPR primarily for two reasons. First, these three chapters focus on inflation and growth dynamics, their projections and balance of risks. Second, it is these 3 chapters which provide a medium-term growth and inflation outlook, that is sought by the market and is important in influencing the sentiment. IV. Key Results Topic Analysis As per the topic analysis, total words of the MPR increased between 2016 and 2021 and have moderated since then (Chart 1a). October MPR has typically more words than April MPR (in 6 out of 8 occasions), probably reflecting more information by the middle of the year. The trend in words selected for the three topics (Annex I) – inflation, growth, and uncertainty - are indicated in Chart 1b. The share of inflation and growth topics has increased since inception, which is in line with its remit. The inflation related topics have been discussed more frequently vis-à-vis growth in the last few MPRs, mirroring the evolving inflation and growth dynamics (Annex II, Chart A1: a to d). Sentiment Analysis The overall sentiment associated with MPR is obtained by computing the polarity score, as stated in the methodology section using positive and negative sentiment words as selected by LM. A subset of positive and negative sentiment words picked up by LM as per standard practice and their respective share with respect to total sentiment words is enumerated in Table 3 and Chart 2, respectively. The choice of words duly takes care of the fact that inflation and growth variables may move in opposite directions to show the sentiment.  The polarity score, so obtained, is shown in Chart 3. It is observed to be time varying, yet broadly within the neutral range (-0.5 to +0.5). Thus, the text of MPR has largely been characterised by a neutral tone since its inception. There are some distinct trends that are pertinent to observe. First, a gradual decline in the sentiment had started even prior to pandemic, which reached the deepest during the COVID-19 pandemic when real GDP contracted sizeably and the sentiment index slipped into the negative range (below -0.5), although it was short-lived. Second, the recovery in sentiment post pandemic was quick and fast, with the rebound in economic activity. Third, there was again a decline in the sentiment during the Russia-Ukraine conflict with inflation exceeding the upper tolerance level around the target (4 +/- 2 per cent). The sentiment index was at the border line between neutral and negative tone. Fourth, the sentiment has since then gradually improved with strengthening macro fundamentals, enunciating back again a neutral tone, closer to zero level in October 2023 (Chart 3). Fifth, the time varying nature of MPR sentiment tone mirrors evolving macroeconomic developments and not the monetary policy stance per se (whether accommodative stance or withdrawal of accommodation). | Table 3: Sentiment Words | | Positive Words | improving, strong, progress, boost, optimistic, rebounded, leading, impressive, efficiency, profitability, abundant, upturn, opportunities, stability | | Negative Words | volatility, adverse, decline, disruptions, slowing, contraction, errors, losses, recession, disruption, shortfalls, burden, dropped, stagnant, lost, unfavourable | | Sources: RBI; and Authors’ estimates. |

MPR being a bi-annual publication, only 16 MPRs have been released so far since 2016. Any examination of the relationship between polarity and macro-economic variables through robust regression analysis will have to wait for more observations. However, a preliminary graphical analysis of the MPR tone as implied from Polarity score vis-à-vis the relevant macroeconomic variables (Chart 4) shows that MPR’s tone seems to be positively correlated with growth and negatively correlated with deviation of inflation from its central target (4 per cent). Furthermore, the MPR tone moves contra to uncertainty and policy repo rate, i.e., higher uncertainty and higher policy rates are associated with lower sentiment score. These associations seem to have strengthened over the years, particularly after 2019-2020 indicating that MPR as a monetary policy publication has matured over the years, giving the right signal amidst uncertainty and stance.9

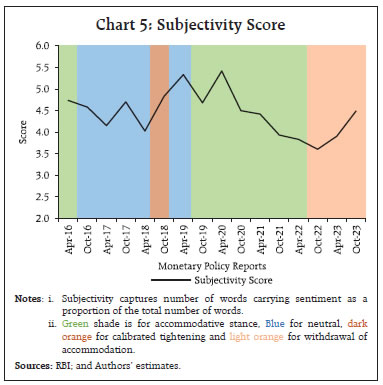

Subjectivity Analysis The MPR’s subjectivity score as shown in Chart 5 is hovering in the range of 3.5 to 5.5 and is in line with other countries (Cherry and Tong, 2023). The subjectivity was high during the initial years of inception of FIT, and it trended downwards during the accommodative phase but has seen slight upward movement during the ‘withdrawal of accommodation’ phase. Readability Analysis The results of two readability test – FK and FOG index - which gauge the years of formal training required to comprehend a writing are shown in Chart 6. The FK measure indicates that the MPR can be understood by readers who have completed about 18 years of formal education while the FOG index suggests even stricter readability parameters with target audience being no less than graduates. This is in line with literature whereby central bank monetary policy press releases/statements are generally observed to have FK and FOG scores in the range of 12-18 years and 17-23 years, respectively (Cherry and Tong, 2023; Gonzalez and Tadle, 2021). Both the readability indices are trending downwards i.e., the readability is seeing a marginal improvement over the years.10 In this context, complementary communication tools like Governor’s statement, press briefings, speeches, and monetary policy and MPR outreach programmes aimed at general public play an important role.

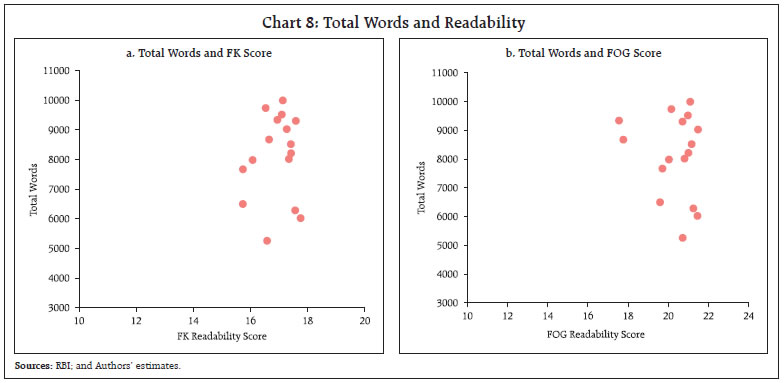

A comparison of polarity scores with readability scores, following Tumala and Omotosho (2019), indicates that whenever sentiment has moved from neutral to negative zone (viz, during COVID-19 pandemic and Russia-Ukraine conflict), readability score has improved to ensure better clarity in communication (Chart 7). Following Taborda (2015), who associates the length of minutes with the readability score, we examine whether readability can be improved by modifying the length of the text, in our case the length of MPR. Such an analysis shows no trend or statistical relationship between length and readability of MPRs (Chart 8). This suggests that the readability score is independent of length of MPR, in line with the results observed for Latin American central banks.11 V. Conclusion Parsing through 16 monetary policy reports (MPRs) since 2016 in India, this study attempts to decode intrinsic features regarding the focus, tone, objectivity and clarity of this flagship publication of RBI. The analysis suggests that the MPR broadly fairs well in all these features. First, the textual analysis shows that keywords mentioned in the MPR align broadly with the objectives in the Remit and move in line with incoming data and outlook. Second, the tone of MPR has been broadly neutral, neither too positive nor too negative, barring a few instances driven by large shocks like the COVID-19 pandemic and the Russia-Ukraine conflict. Third, the sentiment in the MPR seems to be moving in tandem with key macro variables. Fourth, the MPR has on the whole used objective language. Fifth, the publication, like other central bank publications, requires a high school education or higher to understand it, though the readability is showing modest signs of improvement in recent years. Overall, even as the MPR is an important communication tool, given the diverse nature of the economy, multiple communication channels are critical for effective communication. Accordingly, the Reserve Bank actively uses a variety of tools – the MPC resolutions and minutes, Governor’s exhaustive post-policy statements together with statement on developmental and regulatory measures, press conferences, speeches by top management, MPR and various other publications to anchor expectations (Das, 2022).  References Amadxarif, Z., Brookes, J., Garbarino, N., Patel, R., & Walczak, E. (2019), “The Language of Rules: Textual Complexity in Banking Reforms”, Bank of England Staff Working Paper, 834. Armelius, H., Bertsch, C., Hull, I., & Zhang, X. (2020), “Spread the Word: International Spillovers from Central Bank Communication”, Journal of International Money and Finance, 103, 102116. Baker, S. R., Bloom, N., & Davis, S. J. (2016), “Measuring Economic Policy Uncertainty”, The Quarterly Journal of Economics, 131(4), 1593–1636. Berger, H., Ehrmann, M., & Fratzscher, M. (2011), “Monetary Policy in the Media”, Journal of Money, Credit and Banking, 43(4), 689–709. Bernanke, B., & Reinhart, V. (2004), “Conducting Monetary Policy at Very Low Short-Term Interest Rates”, American Economic Review, 94(2): 85-90. Binette, A., & Tchebotarev, D. (2019), “Canada’s Monetary Policy Report: If text could speak, what would it say?” Bank of Canada Staff Analytical Note, 2019-5. Blinder, A. S. (1998), “Central Banking in Theory and Practice”, The Massachusetts Institute of Technology Press Cambridge. Bouscasse, J. F., Kapp, D., Kedan, D., McGregor, T., & Schumacher, J. (2023), “How Words Guide Markets: Measuring Monetary Policy Communication”, The ECB Blog, August 2023. Bulir, A., Jansen, D., & Cihak, M. (2012), “Clarity of Central Bank Communication about Inflation”, International Monetary Fund Working Paper, WP/12/1/9. Cherry, R., & Tong, E. (2023), “Words of RBNZ: Textual Analysis of Monetary Policy Statement”, Reserve Bank of New Zealand, Analytical Note, July 2023. Correa, R., Garud, K., Londono, J. M., & Mislang, N. (2017), “Sentiment in Central Banks’ Financial Stability Reports”, International Finance Discussion Papers, 1203. Das, S. (2022), “Monetary Policy and Central Bank Communication”, Speech Delivered at National Defence College, Government of India. Ferrara, F., & Angino, S. (2022), “Does Clarity Make Central Banks more Engaging? Lessons from ECB Communications”, European Journal of Political Economy, Vol. 74. Gaspar, V., Obstfeld, M., Sahay, R., Laxton, D., Botman, D., Clinton, K., Duval, R., Ishi, K., Jakab, Z., Mayor, L.J., Ngouana, C. L., Griffoli, T. M., Mongardini, J., Mursula, S., Nier, E., Ustyugova, Y., Wang, H., & Wuensch, O. (2016), “Macroeconomic Management When Policy Space is Constrained: A Comprehensive, Consistent, and Coordinated Approach to Economic Policy”, International Monetary Fund, Staff Discussion Note, 16/09. Gonzalez, M., & Tadle, R. C. (2021), “Monetary Policy Press Release: An International Comparison”, Central Bank of Chile Working Paper, No. 912. Gunning, R. (1952), “The Technique of Clear Writing”, McGraw-Hill, New York. Hansen, S., & McMahon, M. (2016), “Shocking Language: Understanding the Macroeconomic Effects of Central Bank Communication”, Journal of International Economics, Vol. 99. Kincaid, J., Fishburne, P., Robert, P., Rogers, R., & Chissom, B. (1975), “Derivation of New readability formulas (Automated Readability Index, Fog Count and Flesch Reading Ease Formula) for Navy enlisted personnel”, Institute for Simulation and Training, 56. Loughran, T., & McDonald, B. (2011), “When Is a Liability Not a Liability? Textual Analysis, Dictionaries, and 10-Ks”, The Journal of Finance, LXVI (1), 35 – 65. Monetary Policy Handbook (2020), Reserve Bank of New Zealand. Naghdaliyev, N. S. (2011), “Central Banks’ Communication in the Post-Crisis Period”, The Harriman Institute, Columbia University. Omotosho, B. S. (2020), “Central Bank Communication in Ghana: Insights from a Text Mining Analysis”, Noble International Journal of Economics and Financial Research, 5(1), 1-13. Oshima, Y., & Matsubayashi, Y. (2018), “Monetary Policy Communication of the Bank of Japan: Computational Text Analysis”, Graduate School of Economics, Kobe University Discussion Paper, 1816. Segawa, A. (2021), “Communication by South African Reserve Bank: Has time yielded clarity?” Communicare Journal for Communication Studies in Africa, 40(2). Shapiro, A. H., Sudhof, M., & Wilson, D. (2020), “Measuring News Sentiment”, Federal Reserve Bank of San Francisco Working Paper, 2017-01. Shapiro, A. H., & Wilson, D. (2019), “Taking the Feds at its Word: Direct estimation of Central Bank Objectives using Text Analytics”, Federal Reserve Bank of San Francisco, Working Paper, 2019-02. Sturm, J. E., & De Haan, J. (2011), “Does Central Bank Communication Really Lead to Better Forecasts of Policy Decisions? New Evidence Based on a Taylor Rule Model for the ECB”, Review of World Economics, 147(1), 41–58. Taborda, R. (2015), “Procedural Transparency in Latin American Central Banks under Inflation Targeting Schemes: A Text Analysis of the Minutes of the Boards of Directors”, Ensayos sobre Política Económica, 33 (2015) 76–92. Tumala, M. M., & Omotosho, B. S. (2019), “A Text Mining Analysis of Central Bank Monetary Policy Communication in Nigeria”, CBN Journal of Applied Statistics, Vol. 10, No. 2. Twedt, B., & Rees, L. (2012), “Reading Between the Lines: An Empirical Examination of Qualitative Attributes of Financial Analysts’ Reports”, Journal of Accounting and Public Policy, 31(1), 1 – 21.

Annex I | Table A1: Select Words for Topic Analysis | | Inflation-related | price, cpi, headline, fuel, food, core, pulses, vegetables, costs, wpi, housing, oil, consumer, diesel, petrol, LPG, electricity, households, confidence, beverages, kerosene, deflator. | | Growth-related | output, gdp, gva, manufacturing, services, demand, production, industrial, fiscal, business, investment, imports, exports, merchandise, fiscal, trade, cement, steel, passenger. | | Uncertainty-related | risks, anticipated, assumption, reassessment, appears, contingent, volatile, deviation, unclear, possibility, vary, preliminary, random. | | Sources: RBI; and Authors’ estimates. |

Annex II

|