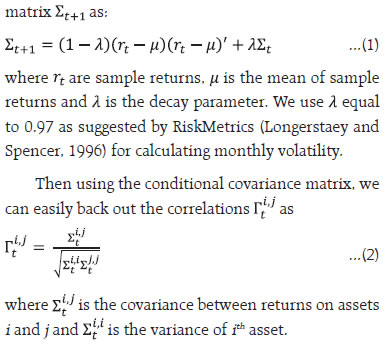

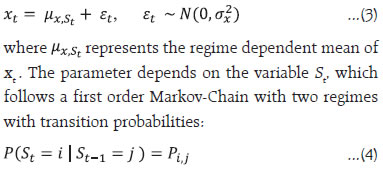

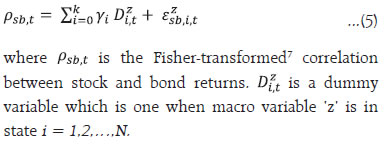

by Amit Pawar^, Mayank Gupta^, Palak Godara^ and Subrat Kumar Seet^ This study examines the time-varying stock-bond correlation under different inflation and output regimes in India from April 2004 to August 2023. Spells of negative stock-bond correlation are found to be ephemeral in India compared to episodes of positive correlation, suggesting low portfolio diversification benefits between bonds and equities. However, bonds can act as a useful vehicle for reducing equity portfolio volatility. Episodes of risk aversion in financial markets may lead to switching of correlation from a positive to negative sign amid flight to safety. Results indicate that when inflation is moderate, and the economy is growing, investors are more likely to buy both stocks and bonds resulting in a positive stock bond correlation. Introduction Stocks and bonds are two asset classes that are ubiquitous to most portfolios, from large institutional portfolios to small individual centric retail portfolios. While stocks have historically outperformed bonds, they have experienced higher volatility. Therefore, a rational risk-averse investor might be concerned about “expected risk adjusted returns” rather than only expected returns. This explains investor preference for portfolio diversification across asset classes especially between stocks and bonds. The co-movement between equity and bond market returns has sometimes been used as a market timing indicator to switch between equities and bonds by investors, analysts, and financial commentators1. During periods characterised by broad-based optimism, the purchases of equities outweigh bonds, and the prices of both the assets usually move in the same direction leading to a positive correlation (albeit low). The periods of negative correlation between the returns of the two assets can arise due to an increase in investor risk perception during periods of flight to safety when investors perceive heightened risk and rebalance their portfolios in favour of bonds which in turn creates a divergence between the returns of both the assets. Recent research has shown a time-varying and sign switching character of stock-bond correlation (Li et al., 2020; Brixton et al., 2023). One of the plausible reasons for this characteristic is the increased global financial integration in the last two decades. The asset markets, in many countries, co-move more strongly with the dominant asset markets (like the US stock and bond markets). This may have reduced the benefits of cross-country diversification and investors, thereby, need to reallocate their resources more frequently, inducing a random walk in the stock-bond return correlation (Baur, 2010). In a dynamic environment, it is desirable for investors to continuously assess the market information and adjust their portfolio. Thus, from a dynamic asset allocation perspective, correlation between stocks and bonds becomes important. Even though shifts in stock bond correlation driven by macro-factors is more important for individual portfolio allocators, the central bank too can, in principle, derive insights from the changing stock-bond correlation. For instance, Pericoli (2018) suggests “although central banks do not have specific price targets for bonds or stocks, they are increasingly using the information contained in the prices of these assets to gauge market participants’ growth and inflation expectations. Hence, stock/bond return correlation estimates may offer policymakers useful complementary information to determine whether markets are changing their views on inflation or economic activity prospects.” Empirical work on studying the stock bond correlation has focused on exploring the various economic factors driving the dynamic stock-bond correlation and has identified real interest rates, economic growth rate, inflation, and dividend growth as macroeconomic variables influencing the relationship (Pericoli, 2018). Uncertainty about expected inflation and growth, risk aversion, and market liquidity also emerged as potential factors influencing the trends in stock-bond correlation (Baele et al., 2010; Bekaert and Engstrom, 2010). A study by Hasseltoft and Burkhardt (2012) on the US market (1965-2011) suggests that the impact of inflation uncertainty on stock-bond correlation largely depends on the joint dynamics of growth and inflation. The study finds the shift in the cyclical relationship of inflation with respect to output from countercyclical to procyclical or vice versa as a plausible explanation for change in the sign of stock bond correlation. For India, a countercyclical relationship between inflation and output (Apergis, 1996; Gupta, 2019)2 may point towards a prevalence of positive stock bond correlation. In case of India, using daily returns on BSE Sensex and CCIL broad bond index from April 2004 to August 2023, it is found that a portfolio having allocation to both stocks and bonds (such as 60 per cent stocks and 40 per cent bonds / 50 per cent stocks and 50 per cent bonds) exhibits better returns than bonds-only portfolios while exhibiting lower drawdowns3 compared to a stocks-only portfolio (Chart 1). During the Global Financial Crisis (GFC) and Covid-19 period, returns on BSE Sensex exhibited declines of around 60 per cent and 38 per cent respectively, which were steeper compared to a portfolio consisting of both stocks and bonds in a 60/40 and 50/50 split. Stock-bond correlation plays an important role in portfolio performance. A negative stock-bond correlation implies that stocks and bonds act as natural hedge to each other resulting in higher risk adjusted returns. A positive stock-bond correlation may not provide any hedging benefits and hence give lower risk adjusted returns. The valuation of the portfolio is likely to decrease because investors would require a higher forward expected return to offset the increased cross-asset risk they would be assuming. Simulations confirm that negative stock-bond correlation increases the Sharpe ratio, or the risk adjusted returns for a portfolio consisting of stocks and bonds while reducing the level of volatility. For instance, starting with a 60/40 portfolio and assuming a stock-bond correlation of (-) 0.3, the Sharpe ratio is 1.17 while the portfolio volatility is 7 per cent. However, if the stock-bond correlation was to rise to 0.3, the Sharpe ratio falls to 0.97 while portfolio volatility climbs to 8 per cent (Chart 2). The empirical evidence on the association of stock-bond correlation with the macroeconomic regimes is relatively scarce in emerging markets. Accordingly, this study endeavours to add evidence from the Indian market to the existing empirical literature on the role of macroeconomic regimes in influencing the dynamics of stock-bond correlations. Results indicate that moderate inflation and high growth regimes are associated with positive stock-bond correlation. The rest of the paper is structured as follows. Section II presents a literature survey of research studies in this area. Section III discusses the data and the models followed by Section IV which analyses the key findings. Finally, section V concludes the study. II. Survey of Literature Initial studies investigating the stock-bond return correlation asserted that the relationship is time invariant and positive over time. The work of Shiller and Beltratti (1992), Campbell and Ammer (1993) and Fleming et al., (1998) are among the seminal work that investigated the relationship between the two asset classes. The positive correlation was attributed to the presence of a common discount factor (Shiller and Beltratti, 1992; Campbell and Ammer, 1993). However, it has been argued that this model is oversimplified in terms of the constraining assumption of a common discount factor and ignores the differences in associated relative risk of the two asset classes (Chiang et al., 2015). Subsequent studies revealed the time-varying correlation between stock and bond returns and examined the critical factors that influence the relationship. The large variation and particularly the negative spells in the correlation have been attributed to factors such as the flight to safety episodes inducing investors to dump equities in favour of bonds (Baur and Lucey, 2009) and illiquidity (Baele et al., 2010). Macroeconomic stability, which is characterised by factors such as inflation, inflation expectations and economic growth can influence correlation between the returns of the two assets. According to Li (2002), who examines the impact of macroeconomic factors on the stock-bond correlation in G-7 countries, shows that uncertainty about inflation expectations predominantly determine the trend in stock-bond correlation. Dimic et al., (2016) highlight that over short horizons, monetary policy stance is the most important factor while over longer horizons inflation and stock market uncertainty are important. In a similar vein, Hasseltoft and Burkhardt (2012) link the sign switches in the correlation to the joint dynamics of inflation and output and find that inflation uncertainty had a uniform negative impact on stock prices throughout the period of study but the impact on nominal bond prices switched from negative to positive around 2000. This resulted in inflation uncertainty predicting positive stock-bond correlation in pre-2000 period and negative correlation post-2000. The authors argue that the negative or positive impact of inflation uncertainty on bond prices is determined by the correlation of inflation with real growth. The paper estimated a regime-switching model and concluded that negative correlation between the stock-bond returns in the early 2000s in the US can be attributed to the shift in the cyclical nature of the inflation from long-lived countercyclical to procyclical. Baele and Van Holle (2017) report that apart from cyclicality of inflation, monetary policy stance also helps in understanding the dynamics of stock-bond correlations. However, in this research work we restrict ourselves only to macroeconomics regimes for exploring the correlation dynamics between stock and bonds. III. Data and Methodology In this study, for stocks, returns are calculated using the daily BSE Sensex total return index. The CCIL Broad and CCIL Liquid indices serve as benchmark indices for the bond markets, allowing for the evaluation of bond market performance. For this study, we employ CCIL Broad total return index (TRI) which tracks the performance of top twenty traded bonds and provides the daily change due to both price movements as well as accrued coupons. While the Sensex total return data is available from 20034, the CCIL bond index is available from 2004. Accordingly, the study used the monthly data from April 2004 to August 2023. Both indices are sourced from Bloomberg. The study employs monthly data, the highest frequency at which key macroeconomic variables such as consumer price index (CPI) and the index of industrial production (IIP) are available. Due to base year revisions, splicing method is used to generate a consistent series for CPI and IIP. Macroeconomic data are extracted from the Reserve Bank of India’s (RBI) database on Indian economy (DBIE) and Ministry of Statistics and Program Implementation (MoSPI). III.1 Measuring Stock-Bond Correlations For modelling covariances, several GARCH-based methodologies exist like the constant conditional correlation model (Bollerslev, 1990), the BEKK model (Engle and Kroner, 1995) and the dynamic conditional correlation model (Engle, 2002). The GARCH methodology encounters two primary challenges as highlighted by McMillan and Speightl (2010). The first is the tractable estimation of parameters. For instance, a bivariate-GARCH (1,1) model with a full specification requires twenty-one parameters. The second issue is the existence of various GARCH specifications created to capture various data facets, such as asymmetric and long-memory effects. These two challenges together imply that no single GARCH specification is superior, and different GARCH specifications may yield varying results. Taking cognizance of this and the relatively small sample in our case, we employ the Risk Metrics (Longerstaey and Spencer, 1996) approach which is based on the Exponentially Weighted Moving Average (EWMA) of variance/covariance estimator5. Further, it can be shown that EWMA is just a special case of a GARCH (1,1) model (Dowd, 2007). The EWMA covariance model defines the conditional covariance  The EWMA correlation between BSE Sensex total return index and CCIL broad total return index has varied from a high of 0.42 in June 2008 to a low of (-) 0.22 during November 2008 with an overall average of around 0.06 (Chart 3). The spells of negative correlation were relatively short lived as compared to the episodes of positive correlation. This contrasts with evidence from developed economies – for instance, Baele and Van Holle (2017) for a sample of ten developed economies find extended spells of negative stock-bond correlation post- 2000. In India, the correlation turned sharply negative from a high positive value during the GFC due to the flight to safety where funds may have moved out of equity into low-risk bonds. Amid tightening of global and domestic monetary policy in 2022, the correlation has started to trend upwards following a period of low negative correlation since 2019 and during the pandemic. III.2 Regime Identification This study aims to relate stock-bond correlations with various macroeconomic regimes. This section outlines the methodology to estimate those regimes. First, we fit univariate regime switching models to inflation and output gap. The output gap is estimated from the observed IIP series using the Christiano- Fitzgerald (CF) filter (2003). The CF filter is a band pass filter, which retains the components of the time series with periodic fluctuations between specified time horizon while suppressing components at higher and lower frequencies. We use 18 and 96 months as the low and high frequency parameters while estimating the cyclical component from the monthly IIP series. We model a random series xt, with ‘x’ being either output gap or inflation, using a regime switching in mean model:

| Table 1: Univariate Regime Switching Model Estimates for Inflation and Output Gap | | | Inflation | Output Gap | | μ1 | 5.09***

(0.13) | 2.39***

(0.31) | | μ2 | 9.62***

(0.24) | -4.53***

(0.35) | | σ2x | 2.32***

(0.24) | 6.93***

(0.58) | | Ρ1 | 0.99***

(0.00) | 0.98***

(0.01) | | Ρ2 | 0.98***

(0.01) | 0.97***

(0.01) | Note: i) The table reports the estimates from a 2-state regime switching model for Inflation and Output gap as in (3). We allow for regime switches in the mean only. The estimated parameter and corresponding quasi-ML standard errors are in parentheses.

ii) Pi is the probability of the model in state i to stay in state i.

iii) Significance levels: *p<0.1; **p<0.05; ***p<0.01.

Source: Authors’ estimates. | where i and j are two different regimes. IV. Results6 The results from univariate regime switching model on inflation and output gap are presented in Table 1. For inflation, we identify two regimes with moderate (5.09 per cent) and high (9.62 per cent) inflation. On the other hand, for the output gap we identify expansion (2.39 per cent) and contractionary regimes ((-) 4.53 per cent). Inflation rate is found to be less volatile compared to output gap. Chart 4a & 4b plot the identified regimes with the corresponding macroeconomic variable. For inflation, the period between February 2008 till February 2014 is identified as a high inflation period. While for our estimated output gap, three periods each of expansion and contraction are identified. The sharp contraction and reversal during the Covid-19 pandemic features prominently in our estimated regimes. To test whether the stock-bond correlation is systematically different across various macroeconomic regimes, the following model is estimated.  Using univariate regimes, results indicate the presence of comparatively higher and positive stock-bond correlation during moderate inflation regimes and high growth/expansionary regimes. However, the fit of these univariate models is found to be low. To account for both inflation and growth dynamics simultaneously, column (c) presents the result of a model including all possible interactions8 of identified univariate regimes for inflation and output gap. Current inflation plays an important role in forming future expectations about inflation. Low and moderate level of current inflation keeps long term inflation expectations anchored leading to lower term premia which boosts valuation of bonds and hence higher returns on bonds. On the other hand, output expansion can improve the outlook on corporate earnings and hence may lead to a rally in stocks. Therefore, a combination of moderate inflation-output expansion is expected to exhibit positive stock-bond correlation. Moderate inflation and output expansion are found to be associated with higher and positive stock-bond correlation (Table 2). Additionally, the model with interaction terms is found to have higher adjusted R2 and lower predictive error. | Table 2: Stock-Bond Correlation and Macroeconomic Regimes | | | Inflation Regimes (a) | Output gap Regimes (b) | Inflation-Output gap Regimes interaction (c) | | Moderate Inflation | 8.04***

(3.08) | | | | High Inflation | 0.98

(2.40) | | | | Expansionary | | 7.16**

(3.17) | | | Contractionary | | 3.73

(3.08) | | | Moderate Inflation- Expansionary | | | 10.41***

(3.02) | | Moderate Inflation- Contractionary | | | 4.45

(4.15) | | High Inflation- Expansionary | | | 0.14

(3.26) | | High Inflation- Contractionary | | | 2.21

(2.60) | | Adjusted R2 (%) | 10.1 | 2.3 | 15.3 | | MAD | 7.38 | 8.52 | 7.37 | | Hit ratio (%) | 62.9 | 62.9 | 62.9 | Note: i) This table reports the estimated parameters of the regression of the (Fisher-transformed) stock-bond correlations (estimated using the EWMA model) as per (5).

ii) The parameter estimates capture the average stock-bond correlations across the different macroeconomic regimes. We use Newey-West standard errors (24 lags) to correct for the substantial serial correlation in the dependent variable.

iii) MAD is the Mean Absolute Difference computed between the fitted and empirically observed correlations (from the EWMA model). Hit ratio (%) represents the % of observations where the fitted and observed correlations share the same sign.

iv) The columns (a)-(c) show regression results using regime dummies for inflation, output gap and interaction dummies between inflation and output gap regimes, respectively.

v) Significance levels: *p<0.1; **p<0.05; ***p<0.01

Source: Authors’ estimates. | V. Conclusion Modern portfolio theory and portfolio optimisation aims to maximise overall returns within an acceptable level of risk. Analysing asset correlations play an important role in achieving this objective. Negatively correlated assets act as a hedge against each other and protect the overall portfolio from extensive drawdowns during periods of high volatility. An analysis of stock-bond correlation can thus play an important role in asset allocation decisions as these are two of the most important asset classes. This study investigates how different macroeconomic regimes interact with stock-bond correlations in India. It is observed that spells of negative correlation are relatively ephemeral in India compared to episodes of positive correlation. Sentiments of risk aversion in financial markets can switch correlation from positive to negative. A moderate inflationary environment contiguous with expansion in output is associated with positive stock-bond correlation. References Apergis, N. (1996). The cyclical behavior of prices: evidence from seven developing countries. The Developing Economies, 34(2), 204-211. Baele, L., & Van Holle, F. (2017). Stock-bond correlations, macroeconomic regimes and monetary policy. Available at SSRN 3075816.. Baele, L., Bekaert, G., & Inghelbrecht, K. (2010). The determinants of stock and bond return comovements. The Review of Financial Studies, 23(6), 2374-2428. Baur, D. G. (2010). Stock-bond co-movements and cross-country linkages. International Journal of Banking, Accounting and Finance, 2(2), 111-129. Baur, D. G., & Lucey, B. M. (2009). Flights and contagion—An empirical analysis of stock–bond correlations. Journal of Financial stability, 5(4), 339- 352. Bekaert, G., & Engstrom, E. (2010). Inflation and the stock market: Understanding the “Fed Model”. Journal of Monetary Economics, 57(3), 278-294. Bollerslev, T. (1990). Modelling the coherence in short-run nominal exchange rates: a multivariate generalized ARCH model. The review of economics and statistics, 498-505. Brixton, A., Brooks, J., Hecht, P., Ilmanen, A., Maloney, T., & McQuinn, N. (2023). A Changing Stock–Bond Correlation: Drivers and Implications. The Journal of Portfolio Management, 49(4), 64-80. Campbell, J. Y., & Ammer, J. (1993). What moves the stock and bond markets? A variance decomposition for long-term asset returns. The journal of finance, 48(1), 3-37. Chiang, T. C., Li, J., & Yang, S. Y. (2015). Dynamic stock–bond return correlations and financial market uncertainty. Review of Quantitative Finance and Accounting, 45, 59-88. Christiano, L. J., & Fitzgerald, T. J. (2003). The band pass filter, International Economic Review, 44(2), 435- 465. Colacito, R., Engle, R. F., & Ghysels, E. (2011). A component model for dynamic correlations. Journal of Econometrics, 164(1), 45-59. Dimic, N., Kiviaho, J., Piljak, V., & Äijö, J. (2016). Impact of financial market uncertainty and macroeconomic factors on stock–bond correlation in emerging markets. Research in International Business and Finance, 36, 41-51. Dowd, K. (2007). Measuring market risk. John Wiley & Sons. Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3), 339-350. Engle, R. F., & Kroner, K. F. (1995). Multivariate simultaneous generalized ARCH. Econometric theory, 11(1), 122-150. Fisher, R.A. (1915). Frequency distribution of the values of the correlation coefficient in sample from an indefinitely large population, Biometrica 10, 507-521. Fleming, J., Kirby, C., & Ostdiek, B. (1998). Information and volatility linkages in the stock, bond, and money markets. Journal of financial economics, 49(1), 111- 137. Gupta, M. (2019). Are Prices Countercyclical? Evidence from India. Journal of Indian School of Political Economy, 31(1), 53-75. Hasseltoft, H., & Burkhardt, D. (2012). Understanding asset correlations. Swiss Finance Institute Research Paper, (12-38). Li, Erica X. N.; Zha, Tao; Zhang, Ji; Zhou, Hao (2020). Stock-bond return correlation, bond risk premium fundamentals, and fiscal-monetary policy regime (Working Paper, No. 2020-19). Federal Reserve Bank of Atlanta. Li, L. (2002). Macroeconomic factors and the correlation of stock and bond returns. Available at SSRN 363641. Longerstaey, J., & Spencer, M. (1996). Riskmetrics-technical document. Morgan Guaranty Trust Company of New York: New York, 51, 54. McMillan, D. G., & Speight, A. E. (2010). Return and volatility spillovers in three-euro exchange rates. Journal of Economics and Business, 62(2), 79-93. Pericoli, M. (2018). Macroeconomics determinants of the correlation between stocks and bonds. Bank of Italy Temi di Discussione (Working Paper) No, 1198. Seabold, S., & Perktold. J. (2010) “Statsmodels: Econometric and statistical modelling with python.” Proceedings of the 9th Python in Science Conference. Shiller, R. J., & Beltratti, A. E. (1992). Stock prices and bond yields: Can their comovements be explained in terms of present value models? Journal of monetary economics, 30(1), 25-46.

Annex 1 Chart A1 plots the inflation cycle with output gap in India from April 2004 to August 2023. The cyclical component of both the series are obtained using the Christiano-Fitzgerald filter. The contemporaneous correlation between inflation cycle and output gap is found to be (-) 0.49 for the entire sample period.

|