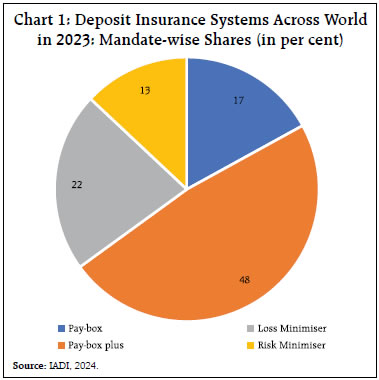

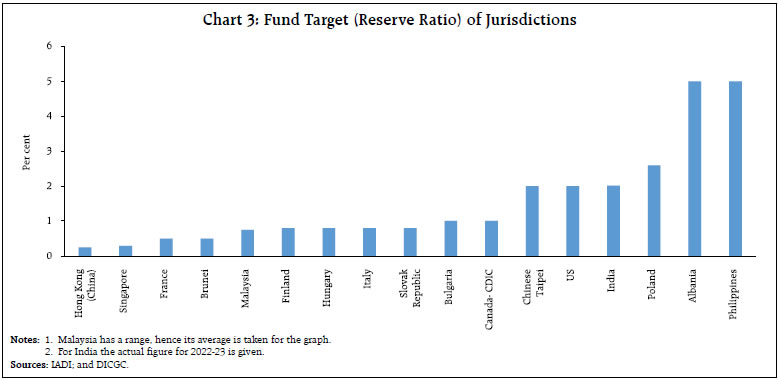

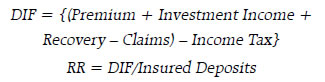

by Ashutosh Raravikar, Avijit Joarder and Anup Kumar^ Deposit insurance is crucial for financial stability and protection of depositors. India’s deposit insurance system has reached a milestone with completion of sixty years of its existence. This article provides an overview of global developments in the field, narrates the evolution of the Indian deposit insurance system, spells out its achievements and suggests an agenda in fulfilment of further goals during its onward journey. Introduction Deposit insurance system is vital for protection of depositors and financial stability through preserving their confidence in the financial system. The second oldest deposit insurance system in the world after the US and a pioneer in the field, the deposit insurance in India completed sixty years of its existence in 2022. This article reviews and analyses this voyage and also provides lessons for its next phase. Section II provides an overview of the existing deposit insurance system across the world. Section III outlines the evolution of deposit insurance in India, enumerates recent initiatives and makes suggestions to attain significant goalposts. In Section IV, an empirical exercise is carried out to make estimates of DICGC’s Reserve Ratio in near future in the context of adequacy of funds to meet future payment obligations. Section V sets out concluding observations. II. Overview of Global Systems The spread and coverage of deposit insurance has gradually expanded across the world especially since the global financial crisis. A well-designed deposit insurance system strengthens the incentives for depositors, borrowers, regulators and owners of banking system. As per the latest data available from International Association of Deposit Insurers (IADI), the deposit insurance explicitly exists in 148 jurisdictions across the world and under consideration in 25 others as of May 2024 as compared with only 12 in 1974. IADI, an international forum for all deposit insurers, gathers expertise and knowledge in the field and shares it among members. It is also involved in research and capacity building. It has issued the Core Principles for Effective Deposit Insurance Systems for quality assessment of systems and identify gaps in terms of fulfilment of their public policy objectives. II.1 Features at a Glance At present, the mandate of one-fourth of deposit insurers in the world is pay-box, while 48 per cent have pay-box plus mandate thereby having additional responsibilities like resolution (IADI, 2024).1 Over one-third entities are either loss minimisers or risk minimisers (Chart 1). Since 2011, the share of institutions with pay-box mandate has generally reduced, while there has been a rise in the number of pay-box plus insurers. Expansion in mandates reflects increasing responsibilities of deposit insurers in resolution process going beyond reimbursement, such as funding and decision making in resolution (IADI, 2023 and 2024). The regional variance in mandates continues. The toolkit for resolution has increased. The accurate and swift pay-out of deposits is important. As per IADI Core Principles, the reimbursement should take place within seven working days. There has been an improvement in reimbursement practices across the world. The speed of pay-out has been steadily rising. The proportion of deposit insurers who begin pay-out within seven days has increased from 30 per cent in 2013 to 60 per cent in 2023 (IADI, 2024). The financing for deposit insurance is based on ex ante principle, i.e., before occurrence of failure of banks, in majority (96 per cent) of the surveyed deposit insurers. Moreover, there has been a steady move towards risk based premium system, as about 50 per cent of the insurers across the world charge differential premiums as of 2023, up from 30 per cent in 2010.  The size of deposit insurance fund varies widely among regions. Africa has some of the largest funds while Europe has the lowest. The size of funds is set among regions as per adequacy levels which are different as per mandates and probabilities of default by member banks. As a world median, deposit insurers hold about 80 per cent of funds of their target fund levels. Globally, the coverage of depositors (both by depositor and by account basis) has been quite high during the last decade. Regarding the share of the value of fully covered deposits, the global coverage ratio declined during the decade from 50 per cent in 2014 to 47 per cent in 2023 (IADI, 2024). It was strong in high-income jurisdictions and low in upper middle -income and lower middle-income jurisdictions. II.2 Main Issues Pertaining to Deposit Insurance: A Global Perspective At present, the deposit insurers across the world face the following issues. First, the post COVID macroeconomic environment is marked by geopolitical risks, inflation, economic downturn, rise in debt levels and bank crises around the globe. The coverage limits may have to be revisited by deposit insurers in the light of these developments. Second, deposit insurers’ involvement and role in bank resolution is increasing. They need to acquire expertise in this expanding role. Third, there are rapid advancements in fintech and resultant digitisation in financial products and services. Though these have created opportunities for raising efficiency and financial inclusion, there are also challenges for banks in their operations due to various issues such as cybersecurity and lack of adequate public awareness. Banks may also face the risk of sudden withdrawal of large amounts of deposits through online mode from rapidly spreading rumours on social media about the banks. Such factors have changed their risk profiles. The Central Bank Digital Currencies (CBDCs) will create a new landscape. The deposit insurers will have to gauge the impact of these developments and factor them in their policies. Fourth, climate change can adversely affect deposit insurers through various channels such as risks of bank defaults and cost of resolution. Deposit insurers are now adopting a broader environment, social and governance (ESG) framework. The share of deposit insuring institutions having a formal ESG policy stood at 40 per cent in 2022 and it is expected to grow to 77 per cent in 2024 (IADI, 2023). Fifth, the IADI’s 2014 standard on Core Principles for Effective Deposit Insurance Systems is being reviewed and expected to get updated soon. Sixth, in the light of recent bank failures, the interaction between deposit insurers and bank resolution authorities needs further improvement. Seventh, in view of both opportunities and risks arising from digitalisation, the deposit insurers need to technologically equip themselves and pay attention to data governance and cybersecurity. Finally, the cross-border economic interactions, rising interconnectedness of financial flows and borderless digital transactions are increasingly the matters of concern for deposit insurers, as these affect their pay-out and resolution activities. Hence deposit insurers and other financial safety net participants need to work in synergy. III. Deposit Insurance: The Indian Experience III.1 Institutional Journey A need for protecting the depositors was felt after the failures and crises in the banking system. In 1938 the biggest bank in Travancore – Travancore National and Quilon Bank collapsed. Interim legislative measures were taken to address the situation. Subsequently in 1946 and 1948 there was a banking crisis in Bengal. A series of such crises emphasised the need for introduction of deposit insurance system. The Rural Banking Enquiry Committee backed the idea in 1950. The collapse of Laxmi Bank and Palai Central Bank in 1960 put the last straw and triggered the introduction of the system. Through the Deposit Insurance Act, 1961, the Deposit Insurance Corporation (DIC) was set up. It began operations since January 1, 1962. The objectives of deposit insurance were protection of small depositors through preserving their savings, avoiding panic withdrawals, increasing the trust in the banking system and contributing to financial stability. In the beginning, the functioning commercial banks were given deposit insurance cover. There were 287 insured registered banks to start with. By 1967 the number decreased to 100 due to the Reserve Bank’s (India’s central bank) policy of consolidation in the banking sector through mergers of weak banks for maintaining systemic stability. In 1968 the deposit insurance was extended to cooperative banks. Accordingly, DICGC was required to register “eligible cooperative banks” (DICGC, 2023).2 Credit Guarantee Scheme was commenced by the central government in 1960 for providing guarantee cover to banks and other institutions for their lending to small scale industries. This was intended to meet the credit needs of the weaker sections of society. The administration of the scheme was given to the Reserve Bank as a designated Credit Guarantee Organisation (CGO). A public limited company Credit Guarantee Corporation of India Ltd. (CGCI) was promoted by the Reserve Bank in January 1971. DIC and CGCI were merged and a new entity Deposit Insurance and Credit Guarantee Corporation (DICGC), wholly owned by the Reserve Bank of India, was formed in July 1978 through the amended Act termed as DICGC Act, 1961. This was done to integrate the functions of deposit insurance and credit guarantee. Thereafter, credit guarantee assumed the focus due to nationalisation of major banks. In 1981, the government cancelled its credit guarantee scheme and DICGC started providing credit guarantee cover also to small scale industries. In 1989, the guarantees were extended to the whole priority sector lending. After the introduction of financial sector reforms in the 1990s, the credit guarantees were reduced and again the deposit insurance turned as the core function of DICGC. The journey of deposit insurance system in India since inception till date is depicted in Tables 1-2 and Chart 2. | Table 1: Deposit Insurance Limit in India | | (₹; in Rupees) | | Effective From | Insurance Limit | | February 4, 2020 | 5,00,000 | | May 1, 1993 | 1,00,000 | | July 1, 1980 | 30,000 | | January 1, 1976 | 20,000 | | April 1, 1970 | 10,000 | | January 1, 1968 | 5,000 | | January 1, 1962 | 1,500 | | Source: DICGC. | III.2 Snapshot of the Present System DICGC is presently a pay-box plus system. It makes payment of claims to depositors of banks which are liquidated or placed under all-inclusive directions with restriction on deposit withdrawal. In addition, it also provides funding in matters of approved mergers of weak banks with strong ones. Its functions are governed by DICGC Act, 1961 and DICGC General Regulations, 1961. Its authorised capital is ₹50 crore which is completely subscribed by the Reserve Bank. The institutional coverage for deposits under deposit insurance includes all commercial banks, regional rural banks, payments banks, small finance banks, local area banks and cooperative banks licensed by the Reserve Bank. The insurance cover is mandatory for all banks. Insurance coverage includes all types of deposits except deposits received from foreign government, central and state governments, other banks and those received outside the country. Insurance cover of up to ₹5 lakh is per depositor per bank in same right and same capacity after setting off the loans availed against the deposits. | Table 2: Deposit Insurance Premium Rates Per Deposit of ₹ 100 | | (₹; in Rupees) | | Effective Date | Premium Rate | | April 1, 2020 | 0.12 | | April 1, 2005 | 0.10 | | April 1, 2004 | 0.08 | | July 1, 1993 | 0.05 | | October 1, 1971 | 0.04 | | January 1, 1962 | 0.05 | | Source: DICGC. | The premium is paid by banks, and the deposit account holders do not have to pay any premium. DICGC can cancel the registration of an insured bank if the bank defaults in payment of premium for three consecutive half-year periods.3 The Deposit Insurance Fund (DIF) is mainly financed by receipt of insurance premia, and it is used for settlement of claims. The General Fund is utilised for meeting the day-to-day expenses. Inter-fund transfer is allowed in case of shortfall. The claims are settled from the Deposit Insurance Fund in DICGC which is built up through excess of its income comprising of premium, interest and recovery over expenditure (mainly claim settlement). A summary of parameters of deposit insurance as at end March 2023 is given in Annex A. III.3 Recent Initiatives and Road Ahead DICGC has been working with a mission “To contribute to financial stability by securing public confidence in the banking system through provision of deposit insurance, particularly for the benefit of the small depositors” (DICGC, 2023). Its vision is “To be recognised as one of the most efficient and effective deposit insurance providers, responsive to the needs of its stakeholders” (DICGC, 2023). The journey so far has been fruitful. A number of initiatives have been taken recently by DICGC and the process needs to be continued for attainment of further goals and completion of agendas. The recent initiatives and suggestions for the way forward are given below. First, the deposit insurance cover per depositor was raised from ₹1 lakh to ₹5 lakh with effect from February 4, 2020. With this, as at end March 2023 about 98 per cent of total number of accounts in banking system are protected and about 46 per cent of the assessable deposits are insured.4 This provides higher protection to depositors in banks, increasing the level of trust and strengthening financial stability. As per the essential criteria of IADI’s 8th Core Principle titled ‘Coverage’ which states that “The level and scope of coverage are reviewed periodically (e.g. at least every five years) to ensure that it meets the public policy objectives of the deposit insurance system”5, there may be an arrangement for periodic review to check the deposit insurance cover. Moreover, there prevails a practice of a differentiated or targeted coverage system in different jurisdictions of world such as Ghana, Ecuador, Jamaica, Japan etc. (IADI, 2021).6 This involves different coverage levels for different products, institutions etc. Introduction of such system in India may be explored along with its implications for deposit insurance fund. This would be beneficial especially for vulnerable sections. Also, in the light of the evolving innovations such as digital products and e-money, the parameters and definitions of insurance coverage may be recalibrated (Patra, 2022). Second, the timeline has been fixed for pay-out of the claims to depositors of AID banks. Due to the amendment to DICGC Act, 1961 effective September 1, 2021, the DICGC is empowered to pay the insured deposits to depositors of banks which are under the Reserve Bank’s all-inclusive directions (AIDs) within 90 days from the date the directions are imposed.7 There is a big leap in settlement of claims by DICGC after the amendment of the DICGC Act. This was on account of payment to depositors of 22 banks under AID and increase in deposit insurance cover. The settlement of claims under the three streams (banks under AIDs, liquidated banks and financial assistance to Unity Small Finance Bank for making payments to depositors of PMC Bank) amounted to ₹8,517 crore in 2021-22 which was way above the total claim settlement of ₹5,763 crore during the period since inception of DICGC till 2020-21.8 It may be noted that as per Section 18A (2) of DICGC Act, 1961 (as amended up to August 2021), “A list showing the outstanding deposits of each depositor of the insured bank, as on the date on which the direction, prohibition, order or scheme referred to in sub-section (1) takes effect, shall be furnished by such insured bank within forty-five days of such date of effect”. DICGC Act does not have provision for extending the statutory timelines. There were some instances of non-submission of depositors claim list by some banks within the statutory timeline of 45 days, which constrained DICGC from making pay-outs to eligible depositors of such banks.9 The time period between receipt of claims from the liquidator and their settlement has been reduced by DICGC. Besides, DICGC has taken measures for facilitating the submission of depositors’ list by banks within a given timeframe to enable timely pay-out of claims to depositors. In future, the time taken from deregistration of a bank and settlement of claims could be further reduced as per global best practices. The direct payment to depositors instead of routing these through agency banks can expedite the process. Various ways to enhance the effectiveness of pay-out to depositors of AID banks may be explored. Third, DICGC has established a robust process of premium collection from member banks. As of now, there is compliance without any default. To ensure discipline in premium payment, the penal interest at Bank Rate plus 8 per cent is charged for default in payment of premium. Moreover, in tune with the revised insurance coverage, the rate of premium has been revised slightly upwards. In addition to raising the Corporation’s income, it would also enable higher participation of member banks in risk coverage by DICGC. In future, a framework of risk-based insurance premium could be considered to encourage appropriate risk management by banks and discourage excessive risk taking thereby avoiding the moral hazard issue. The framework needs to be simple and easy to implement. It may be mentioned that the IADI’s Core Principles encourage the deposit insurers to levy differential premia on members banks on basis of their risk profiles. A half of the IADI members have so far implemented the risk based premium system. Fourth, the operational indicators of DICGC reflect the commendable achievements of India’s deposit insurance system. The deposit insurance fund stands at a robust level enabled by steady increase in premium inflow and return on investments, despite the high amount of claim settlements and income tax payments. Going forward, arrangements for access to emergency liquidity funding may be explored, as the ex-ante funds may get depleted during sustained stress in financial sector. A formal framework for the purpose may comprise of public (such as central bank), private (such as market funding) and international organisations (IADI, 2024). Such arrangements existing in some countries may be studied. Fifth, the modern digital technology has been harnessed for claim settlement through Aadhar Enabled Payment System. Moreover, the communication with depositors was increased through messaging service. Going ahead, the upgradation of digital infrastructure for protection of data, use of cloud systems for its storage and modernisation of physical infrastructure along with digital mode of payments, robotic processes, chatbots, use of artificial intelligence and machine learning, and business intelligence would enhance the efficiency of operations and benefit the depositors. Moreover, the equipment of human resources in terms of knowledge, expertise, skills and capacity development to keep pace with the dynamic global developments in the field would be a sine qua non. Sixth, DICGC initiated an internal assessment regarding compliance with Core Principles for Effective Deposit Insurance issued by IADI and Basel Committee on Banking Supervision (BCBS) and prepared an action plan for alignment of its processes with them.10 In this context, it would be relevant to mention that DICGC Chairman, in his keynote address of Annual Conference (2022) of DICGC stated that attaining complete alignment with the Core Principles released by IADI would be desirable. Seventh, initiatives were taken to increase the awareness among depositors about deposit insurance and DICGC’s activities. Going ahead, an awareness among the public about deposit insurance and DICGC’s activities through financial education campaigns would be precious in this mission. Basic awareness of the deposit insurance scheme is much essential. Assessment of depositor awareness may be done through surveys across various segments of population and geographical regions to identify gaps, which in turn, can be addressed through the focused measures including the existing popular social media channels. A suitable communication strategy can be framed in this regard. Finally, the treasury management operations focussed on strengthening risk management practices and prudent investments policy. This ensured maintaining adequate liquidity of portfolio while reducing interest rate risk and imparted robustness and efficiency to treasury operations. Going ahead, a proactive approach in reading market signals and effective investment strategy for portfolio would be beneficial (Patra, 2022). The cash inflows are certain, fixed and predictable. However, the outflows are uncertain and when they arise, they are bound by commitments of time and amounts. Liquidation of financial instruments involve liquidity and interest rate risk causing loss to treasury and eroding the fund position. These risks can be managed through buying floating rate instruments during expected rising interest rate scenario and fixed rate instruments when interest rates are expected to decline. The strategy of raising the portfolio duration in declining interest scenario and reducing it during rising interest rate expectations could be considered. IV. Empirical Analysis: Targeting the Reserve Ratio A deposit insurer needs to have sufficient magnitude of resources to meet the payment obligations as needed. For this purpose, globally the institutions try to attain their fund target or reserve ratio in tune with the 9th Core Principle of IADI which states that “The deposit insurer should have readily available funds and all funding mechanisms necessary to ensure prompt reimbursement of depositors’ claims, including assured liquidity funding arrangements”.11 Many of the deposit insurance agencies have set it by law or regulations or governing bodies. The target is set by them as a proportion of a base such as insured/covered/insurable/eligible/total deposits/deposits and borrowings/fixed amount. The fund target of some major jurisdictions set in terms of percentage of insured deposits (DICGC also calculates Reserve Ratio with same formula) ranges between 0.25 per cent to 5 per cent (Chart 3). DICGC’s present Reserve Ratio is closer to the average and median reserve ratios of the other countries (IADI and DICGC, 2023). As maintaining sufficiency of the funds is required for future payment obligations, an empirical exercise has been done in this section with estimates for DICGC’s Reserve Ratio for the near future. The targeting and periodic monitoring of Reserve Ratio avoids the need for large and sudden changes in the rates of premium. The estimates of reserve ratios may be carried out based on data pertaining to banks under AID, historic data on failure of banks, and scenario analysis with assumption of failure of a few mid-sized banks. The target ratio can be attained on the basis of expected income from premium, investments and recovery on one hand and estimated claims and taxes on the other hand. The estimates of claims can be made in the light of the revised insurance cover of up to ₹5 lakh, the existing health of insured banks and the worst-case stress scenario with application of stress test. In view of the recent bank failures around the globe, the macroeconomic factors may be included in the stress test.  The size of deposit insurance fund (DIF) and the resultant Reserve Ratio (RR) is based on a set of parameters in terms of inflow of funds – premium income, investment income and recovery; and outflow of funds – claims pay-out and income tax expenditure.  In this context, regression lines have been fitted to visualise the journey of the Reserve Ratio during the next few years. Using data from 1998-99 to 2022-23, Ordinary Least Squares (OLS) regression is estimated for the relationship between independent (year) variable and logarithm of dependent variables viz., premium income (log_pr_inc), investment income (log_inv_inc) and insured deposits (log_id) distinctly. Moreover, as premium rates and insurance coverage amount have changed recently, coefficients are also estimated on revised (adjusted) premium income (l_a_pr_inc) and adjusted insured deposit (log_a_id). The revised premium income and adjusted insured deposits are calculated based on ratio estimates. Thus, the estimates of the coefficient of regression equations were made both on actual basis (Annex C 1: with actual premium rates and insurance cover till 2022-23) and on adjusted basis (Annex C 2: through application of present premium rates and insurance cover to the data of previous years also) and in both cases the future value of all variables including deposit insurance fund and Reserve Ratio was calculated using fitted regression equations. Since claims settlement and recovery data do not show any specific pattern during the period of data analysis, the twenty-five years’ average information is taken for future estimation of DIF. The summary estimates of Reserve Ratios are given in Table 3. It shows that future rising Reserve Ratios are more quickly achievable by the estimates based on adjusted data. The regression results are given in Annex B on actual and adjusted basis. In both the scenarios, the Reserve Ratio is projected to show a steady rise. | Table 3: Reserve Ratio Estimates | Reserve Ratio

(in per cent) | Achievable by

(Based on Actual data) | Achievable by

(Based on Adjusted data) | | 2.50 | 2024-25 | 2026-27 | | 3.00 | 2026-27 | 2028-29 | | 3.50 | 2029-30 | 2030-31 | | 4.00 | 2031-32 | 2032-33 | | Note: Estimates made are subject to assumptions that in between there would be no change in the premium rate and coverage amount. | V. Conclusion Deposit insurance is crucial for financial stability and protection of depositors. Deposit insurance system has been adopted by many jurisdictions in the world. There has been a steady expansion in their mandates, reduction in the timespan of pay-outs, move towards risk-based premium and stability in the level of insurance coverage. The main issues facing them are the revision in coverage limits, involvement in bank resolution, challenges from fintech developments and climate change. The Indian deposit insurance system which completed its six decades of existence has evolved over the years and come a long way. Its achievements include enhanced coverage limit, speedy settlement of claims, revisions in premium, robust deposit insurance fund, prudent treasury management, significant compliance to IADI Core Principles and initiatives for depositor awareness. Looking ahead, the agenda may comprise of further alignment with Core Principles, targeting and increasing the Reserve Ratio, proactive treasury management, upgradation of digital infrastructure, alignment with developments in fintech, readiness to cope with black swan events and expansion in public awareness. Our empirical estimates show that the Reserve Ratio is expected to increase steadily in the near future. All these would go a long way in taking the deposit insurance system to further heights in tune with attaining its objectives. References Bert, V. R. and Ryan D. (2021). Five Emerging Issues in Deposit Insurance. IADI Policy Brief (No. 4). Retrieved from https://www.iadi.org/en/assets/File/Papers/Policy%20Briefs/IADI%20Policy%20Brief%204%20-%20Emerging%20Issues%20in%20Deposit%20Insurance.pdf Das, M. R. (2017). Modernising the Indian Deposit Insurance System: Imperatives and Reforms. Prajnan, XLV (3), 267-292. Demirguk K. A., Kane E. and Laeven L. (2015). Deposit Insurance Around the World: A Comprehensive Analysis and Database. Journal of Financial Stability, 20(10), 155-183. https://www.sciencedirect.com/science/article/abs/pii/S1572308915000893. Deposit Insurance and Credit Guarantee Corporation. (2015). Report of the Committee on Differential Premium System for Banks in India. Retrieved from https://www.dicgc.org.in/Pub_RR_CommitteeRecommendsDifferentialPremium.html Deposit Insurance and Credit Guarantee Corporation. (2022). 60th Annual Report of the Board of Directors Balance Sheet and Accounts for the year ended March 31, 2022. Retrieved from https://www.dicgc.org.in/pdf/AnnualReports/AR2021_22.pdf Deposit Insurance and Credit Guarantee Corporation. (2023). 61st Annual Report of the Board of Directors Balance Sheet and Accounts for the year ended March 31, 2023. Retrieved from https://www.dicgc.org.in/pdf/AnnualReports/AR2022_23.pdf Deposit Insurance and Credit Guarantee Corporation. (2023). About US/History. Retrieved from https://www.dicgc.org.in/AU_History.html Deposit Insurance and Credit Guarantee Corporation. (2023). Main Page. Retrieved from https://www.dicgc.org.in/index.html Financial Stability Board. (2012). Thematic Review on Deposit Insurance Systems: Peer Review Report. Retrieved from https://www.fsb.org/wp-content/uploads/r_120208.pdf?page_moved=1 Garcia G. G. H. (2000). Deposit Insurance: Actual and Good Practices. Occasional Paper (197). International Monetary Fund. https://www.imf.org/external/pubs/nft/op/197/ Gupta J. and Sardana V. (2021). Deposit Insurance and Banking Risk in India: Empirical Evidence on the Role of Moral Hazard. Mudra: Journal of Finance and Accounting, 8(2), 79-94. International Association of Deposit Insurers. (2014). IADI Core Principles for Effective Deposit Insurance Systems. Retrieved from https://www.iadi.org/en/assets/File/Core%20Principles/cprevised2014nov.pdf International Association of Deposit Insurers. (2018). Deposit Insurance Fund Target Ratio. Retrieved from https://www.iadi.org/en/assets/File/IADI_Research_Paper_Deposit_Insurance_Fund_Target_Ratio_July2018.pdf International Association of Deposit Insurers. (2020). Evaluation of Differential Premium Systems for Deposit Insurance. Retrieved from https://www.iadi.org/en/assets/File/Papers/Approved%20Research%20-%20Discussion%20Papers/DPS_Paper_final_16June2020_Final.pdf International Association of Deposit Insurers. (2021). Deposit Insurance Coverage Level and Scope. Retrieved from https://www.iadi.org/en/assets/File/Papers/Approved%20Research%20-%20Discussion%20Papers/IADI%20Research%20Paper%20on%20Deposit%20Insurance%20Coverage%20and%20Scope.pdf International Association of Deposit Insurers (2022). Central Bank Digital Currencies: A Review of Operating Models and Design Issues. IADI Fintech Brief (No. 13). Retrieved from https://www.iadi.org/en/assets/File/Papers/Fintech%20Briefs/FB%2013%20CBDC%20Operating%20models%20and%20design.pdf International Association of Deposit Insurers. (2023). Main page. Retrieved from https://www.iadi.org/en/ International Association of Deposit Insurers. (2023). Deposit Insurance In 2023: Global Trends and Key Issues. Retrieved from https://www.iadi.org/index.cfm/_api/render/file/?method=inline&fileID=C419010D-155D-040F-775C2E82D9F98EE5 International Association of Deposit Insurers. (2024). Deposit Insurance In 2024: Global Trends and Key Issues. Retrieved from https://www.iadi.org/index.cfm/_api/render/file/?method=inline&fileID=2CD649C5-155D-4F70-19680B94A10CF075 Patra, M. D. (2022). Deposit Insurance in India – Journey; Milestones; Challenges. Keynote Address in Annual Conference of Deposit Insurance and Credit Guarantee Corporation. Retrieved from https://www.dicgc.org.in/pdf/2023/Speeches/Deposit_insurance_in_India_Dr_MD_Patra.pdf Reserve Bank of India. (2020). Press Release: 2019-2020/1878. Retrieved from https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR18780D756E42C4CD4326AEBD8A3F6B9ACC7B.PDF Reserve Bank of India. (2023). Annual Report 2022-23. Retrieved from https://rbidocs.rbi.org.in/rdocs/AnnualReport/PDFs/0ANNUALREPORT20222322A548270D6140D998AA20E8207075E4.PDF Reserve Bank of India. (2022). Report on Trend and Progress of Banking in India 2021-22. Retrieved from https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/0RTP20212225730A6FC708454BB270AC1705CCF178.PDF Reserve Bank of India (1998). The Reserve Bank of India (Volume 2). Delhi: Oxford University Press. Reserve Bank of India (2005). The Reserve Bank of India (Volume 3). Mumbai: Reserve Bank of India. Reserve Bank of India (2013). The Reserve Bank of India (Volume 4). New Delhi: Academic Foundation. Reserve Bank of India (2022). The Reserve Bank of India (Volume 5). New Delhi: Cambridge University Press.

Annex A | Table A1: India’s Deposit Insurance at a Glance | | (As at end March 2023) | | Sr. No. | Feature | Value | | 1 | Total number of Accounts (number in crore) | 300.10 | | 2 | Fully Protected Accounts (number in crore) | 294.45 | | 3 | Percentage of 2 to 1 | 98.12 | | 4 | Assessable Deposits (in ₹ crore) | 1,81,14,550 | | 5 | Insured Deposits (in ₹ crore) | 83,89,470 | | 6 | Percentage of Insured Deposits to Assessable Deposits | 46.31 | | 7 | Deposit Insurance Fund (in ₹ crore) | 1,69,602 | | 8 | Total Registered Banks (Number) | 2,026 | | 9 | Claims Paid since Inception (in ₹ crore) - Commercial Banks | 296 | | 10 | Claims Paid since Inception (in ₹ crore) - Cooperative Banks | 10,504 | | 11 | Total claims paid since Inception (in ₹ crore) | 10,800 | Note: Amounts are rounded off.

Source: DICGC Annual Report 2022-23. |

Annex B I. Estimation of Reserve Ratio of DICGC (Actual) | Table B1: Regression – Logarithm of Premium Income over the Years | | log_pr_inc | Coef. | Std. Err. | t | P>|t| | [95% Confidence Interval] | | year | 0.0002035 | 7.54e-06 | 26.99 | 0.000 | 0.0001879 | 0.0002191 | | _cons | – 6.712601 | 0.3070283 | – 21.86 | 0.000 | – 7.347738 | – 6.077465 | | Number of observations | = | 25 | | | F(1, 23) | = | 728.69 | | Prob > F | = | 0.0000 | | R-squared | = | 0.9694 | | Adj R-squared | = | 0.9681 | | Root MSE | = | 0.0993 |

| Table B2: Regression – Logarithm of Investment Income over the Years | | log_inv_inc | Coef. | Std. Err. | t | P>|t| | [95% Confidence Interval] | | year | 0.0001793 | 3.25e-06 | 55.18 | 0.000 | 0.0001725 | 0.000186 | | _cons | – 5.969486 | 0.1322878 | – 45.12 | 0.000 | – 6.243144 | – 5.695827 | | Number of observations | = | 25 | | | F(1, 23) | = | 3044.44 | | Prob > F | = | 0.0000 | | R-squared | = | 0.9925 | | Adj R-squared | = | 0.9922 | | Root MSE | = | 0.04278 |

| Table B3: Regression – Logarithm of Insured Deposits over the Years | | log_id | Coef. | Std. Err. | t | P>|t| | [95% Confidence Interval] | | year | 0.0001361 | 5.68e-06 | 23.97 | 0.000 | 0.0001243 | 0.0001478 | | _cons | – 1.254561 | 0.2311733 | – 5.43 | 0.000 | – 1.73278 | – 0.7763431 | | Number of observations | = | 25 | | | F(1, 23) | = | 574.60 | | Prob > F | = | 0.0000 | | R-squared | = | 0.9615 | | Adj R-squared | = | 0.9598 | | Root MSE | = | 0.07477 |

II. Estimation of Reserve Ratio of DICGC (Adjusted) | Table B4: Regression – Logarithm of Adjusted Premium Income over the Years | | l_a_pr_inc | Coef. | Std. Err. | t | P>|t| | [95% Confidence Interval] | | year | 0.000198 | 8.38e-06 | 23.64 | 0.000 | 0.0001807 | 0.0002154 | | _cons | – 6.419318 | 0.3411014 | – 18.82 | 0.000 | – 7.12494 | – 5.713696 | | Number of observations | = | 25 | | | F(1, 23) | = | 558.89 | | Prob > F | = | 0.0000 | | R-squared | = | 0.9605 | | Adj R-squared | = | 0.9588 | | Root MSE | = | 0.11032 |

| Table B5: Regression – Logarithm of Adjusted Insured Deposits over the Years | | log_a_id | Coef. | Std. Err. | t | P>|t| | [95% Confidence Interval] | | year | 0.0001123 | 4.43e-06 | 25.35 | 0.000 | 0.0001031 | 0.0001214 | | _cons | – 0.0603885 | 0.1803558 | – 0.33 | 0.741 | – 0.433483 | 0.3127059 | | Number of observations | = | 25 | | | F(1, 23) | = | 642.46 | | Prob > F | = | 0.0000 | | R-squared | = | 0.9654 | | Adj R-squared | = | 0.9639 | | Root MSE | = | 0.05833 |

Annex C | Table C1: Reserve Ratio Estimates for DICGC (Actual) | | (Amounts in ₹ billion) | | Year (End March) | Premium Income | Income on Investment | Income before Tax Deduction | Deposit Insurance Fund | Insured Deposits | Reserve Ratio (DIF/Insured Deposits) (%) | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 1998-99 | 3.71 | 3.58 | 7.16 | 31.07 | 4,396.09 | 0.71 | | 1999-2000 | 4.72 | 4.18 | 8.75 | 33.10 | 4,985.58 | 0.66 | | 2000-01 | 5.15 | 5.34 | 10.12 | 37.06 | 5,724.34 | 0.65 | | 2001-02 | 6.35 | 6.19 | 8.39 | 42.50 | 6,740.51 | 0.63 | | 2002-03 | 7.07 | 6.56 | 11.76 | 55.14 | 8,288.85 | 0.67 | | 2003-04 | 7.71 | 7.01 | 12.91 | 59.08 | 8,709.40 | 0.68 | | 2004-05 | 13.55 | 7.28 | 16.43 | 78.17 | 9,913.65 | 0.79 | | 2005-06 | 19.74 | 8.79 | 22.87 | 91.03 | 10,529.88 | 0.86 | | 2006-07 | 23.21 | 10.79 | 28.55 | 109.78 | 13,725.97 | 0.80 | | 2007-08 | 28.44 | 11.45 | 38.28 | 133.62 | 18,050.81 | 0.74 | | 2008-09 | 34.53 | 12.89 | 45.13 | 161.56 | 19,089.51 | 0.85 | | 2009-10 | 41.55 | 15.13 | 50.13 | 201.52 | 16,823.97 | 1.20 | | 2010-11 | 48.44 | 18.01 | 62.66 | 247.04 | 17,358.00 | 1.42 | | 2011-12 | 56.40 | 23.53 | 77.05 | 300.93 | 19,043.00 | 1.58 | | 2012-13 | 57.18 | 27.68 | 82.86 | 361.20 | 21,583.65 | 1.67 | | 2013-14 | 73.13 | 33.90 | 106.00 | 406.17 | 23,791.52 | 1.71 | | 2014-15 | 82.29 | 40.32 | 119.39 | 504.53 | 26,067.94 | 1.94 | | 2015-16 | 92.00 | 47.83 | 139.35 | 602.54 | 28,264.00 | 2.13 | | 2016-17 | 101.22 | 56.19 | 156.85 | 701.55 | 30,509.00 | 2.30 | | 2017-18 | 111.28 | 64.18 | 175.03 | 814.32 | 32,753.00 | 2.49 | | 2018-19 | 120.43 | 72.45 | 192.51 | 937.51 | 33,700.00 | 2.78 | | 2019-20 | 132.34 | 85.32 | 216.95 | 1,103.84 | 68,715.00 | 1.61 | | 2020-21 | 175.17 | 96.50 | 266.43 | 1,299.04 | 76,212.58 | 1.70 | | 2021-22 | 194.91 | 104.96 | 218.93 | 1,468.43 | 81,104.31 | 1.81 | | 2022-23 | 213.81 | 119.08 | 325.76 | 1,696.03 | 83,894.70 | 2.02 | | 2023-24 | 333.15 | 147.06 | 474.48 | 2,051.08 | 83,546.68 | 2.46 | | 2024-25 | 395.29 | 170.98 | 560.54 | 2,470.54 | 93,671.12 | 2.64 | | 2025-26 | 469.02 | 198.79 | 662.08 | 2,965.97 | 1,05,022.46 | 2.82 | | 2026-27 | 556.50 | 231.12 | 781.90 | 3,551.07 | 1,17,749.40 | 3.02 | | 2027-28 | 660.62 | 268.82 | 923.71 | 4,242.28 | 1,32,060.00 | 3.21 | | 2028-29 | 783.84 | 312.54 | 1,090.65 | 5,058.42 | 1,48,063.43 | 3.42 | | 2029-30 | 930.05 | 363.37 | 1,287.69 | 6,022.00 | 1,66,006.20 | 3.63 | | 2030-31 | 1,103.52 | 422.47 | 1,520.27 | 7,159.61 | 1,86,123.32 | 3.85 | | 2031-32 | 1,309.97 | 491.38 | 1,795.63 | 8,503.29 | 2,08,743.71 | 4.07 | | Source: DICGC Annual Report, various issues (except for figures in shaded area which are the estimates). |

| Table C2: Reserve Ratio Estimates for DICGC (Adjusted) | | (Amounts in ₹ billion) | | Year | Premium Income | Income on Investment | Income before Tax Deduction | Deposit Insurance Fund | Insured Deposits | Reserve Ratio (DIF/Insured Deposits) (%) | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 1998-99 | 4.45 | 3.58 | 7.90 | 31.07 | 8172.87 | 0.38 | | 1999-2000 | 5.66 | 4.18 | 9.69 | 33.10 | 9268.80 | 0.36 | | 2000-01 | 6.18 | 5.34 | 11.15 | 37.06 | 10642.25 | 0.35 | | 2001-02 | 7.61 | 6.19 | 9.66 | 42.50 | 12531.43 | 0.34 | | 2002-03 | 8.48 | 6.56 | 13.17 | 55.14 | 15409.98 | 0.36 | | 2003-04 | 9.25 | 7.01 | 14.45 | 59.08 | 16191.84 | 0.36 | | 2004-05 | 16.26 | 7.28 | 19.14 | 78.17 | 18430.68 | 0.42 | | 2005-06 | 23.68 | 8.79 | 26.82 | 91.03 | 19576.33 | 0.47 | | 2006-07 | 27.85 | 10.79 | 33.19 | 109.78 | 25518.25 | 0.43 | | 2007-08 | 34.13 | 11.45 | 43.97 | 133.62 | 33558.65 | 0.40 | | 2008-09 | 41.44 | 12.89 | 52.04 | 161.56 | 35489.72 | 0.46 | | 2009-10 | 49.86 | 15.13 | 58.44 | 201.52 | 31277.81 | 0.64 | | 2010-11 | 58.13 | 18.01 | 72.35 | 247.04 | 32270.64 | 0.77 | | 2011-12 | 67.68 | 23.53 | 88.33 | 300.93 | 35403.26 | 0.85 | | 2012-13 | 68.62 | 27.68 | 94.30 | 361.20 | 40126.63 | 0.90 | | 2013-14 | 87.75 | 33.90 | 120.62 | 406.17 | 44231.33 | 0.92 | | 2014-15 | 98.74 | 40.32 | 135.85 | 504.53 | 48463.47 | 1.04 | | 2015-16 | 110.39 | 47.83 | 157.75 | 602.54 | 52546.22 | 1.15 | | 2016-17 | 121.47 | 56.19 | 177.09 | 701.55 | 56719.95 | 1.24 | | 2017-18 | 133.54 | 64.18 | 197.28 | 814.32 | 60891.82 | 1.34 | | 2018-19 | 144.52 | 72.45 | 216.60 | 937.51 | 62652.40 | 1.50 | | 2019-20 | 158.81 | 85.32 | 243.42 | 1103.84 | 68715.00 | 1.61 | | 2020-21 | 175.17 | 96.50 | 266.43 | 1299.04 | 76212.58 | 1.70 | | 2021-22 | 194.91 | 104.96 | 218.93 | 1468.43 | 81104.31 | 1.81 | | 2022-23 | 213.81 | 119.08 | 325.76 | 1696.03 | 83894.70 | 2.02 | | 2023-24 | 368.40 | 147.06 | 509.74 | 2077.46 | 108645.09 | 1.91 | | 2024-25 | 435.10 | 170.98 | 600.35 | 2526.71 | 119398.70 | 2.12 | | 2025-26 | 513.88 | 198.79 | 706.94 | 3055.71 | 131216.70 | 2.33 | | 2026-27 | 606.92 | 231.12 | 832.31 | 3678.53 | 144204.43 | 2.55 | | 2027-28 | 717.13 | 268.82 | 980.22 | 4412.03 | 158518.66 | 2.78 | | 2028-29 | 846.97 | 312.54 | 1153.78 | 5275.40 | 174208.72 | 3.03 | | 2029-30 | 1000.31 | 363.37 | 1357.96 | 6291.56 | 191451.78 | 3.29 | | 2030-31 | 1181.42 | 422.47 | 1598.17 | 7487.47 | 210401.53 | 3.56 | | 2031-32 | 1395.96 | 491.38 | 1881.62 | 8895.49 | 231286.72 | 3.85 | | 2032-33 | 1648.71 | 571.30 | 2214.28 | 10552.43 | 254179.31 | 4.15 | Notes: 1. Premium income amounts up to 2019-20 are on adjusted basis and 2020-21 onwards on actual basis.

2. Insured deposit amounts up to 2018-19 are on adjusted basis and 2019-20 onwards on actual basis.

Source: DICGC Annual Report, various issues (except for adjusted figures and for figures in shaded area which are estimates). |

|