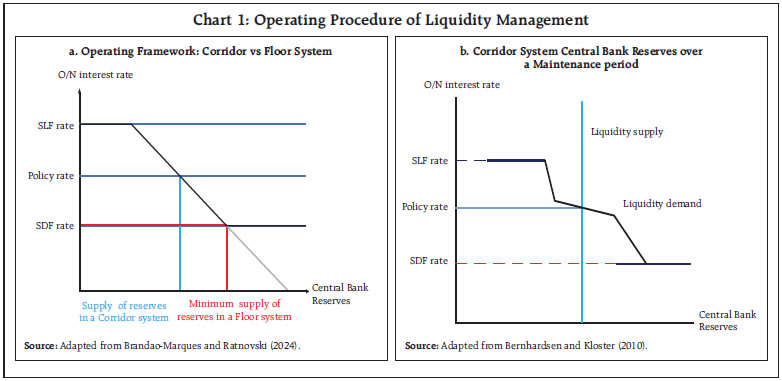

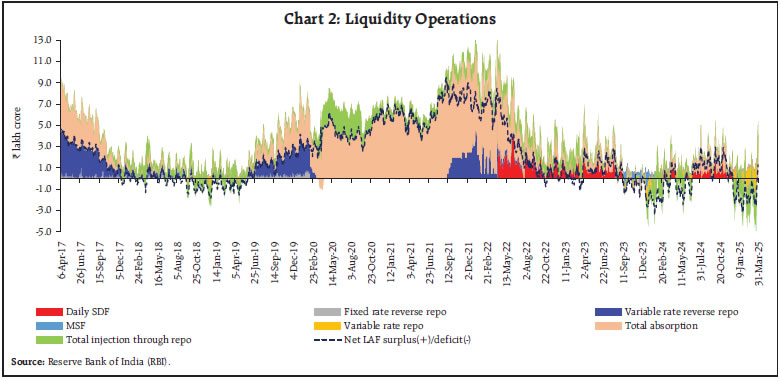

by Avnish Kumar, Priyanka Sachdeva and Indranil Bhattacharyya^ Marking three years since its introduction, the Standing Deposit Facility (SDF) has been an important feature of the Reserve Bank of India’s liquidity management framework, replacing the fixed rate reverse repo as the floor of the LAF corridor. This article presents an assessment of the SDF in India in the overall context of standing facilities made available by central banks. The institution of the SDF is generally in line with global best practices wherein deposit facilities are in the form of uncollateralised deposits. The empirical results bear testimony to the importance of liquidity conditions, liquidity uncertainty and market microstructure in determining the location of the WACR in the LAF corridor. Introduction Liquidity management operations and practices are at the core of the operationalisation of monetary policy – “the plumbing in its architecture” (Patra et al., 2016). In central banking parlance, the operating procedure of monetary policy refers to the daily implementation of monetary policy through appropriate liquidity management operations. The operating framework includes the operating target and the instruments that the central bank uses to manage liquidity conditions in the interbank market for bank reserves in pursuance of its objective of aligning the operating target to the policy rate. These instruments include (i) standing facilities – both lending and deposit facilities – which can be accessed by commercial banks at their own discretion; (ii) open market operations (OMOs) – both outright and reversible operations through repurchase agreements – that are conducted at the discretion of the central bank; and (iii) minimum reserve requirements along with its maintenance procedure prescribed by the central bank. In the Indian context, the weighted average call money rate (WACR), which is the rate of the uncollateralised segment of the money market and is reflective of liquidity mismatch in the banking system, is the operating target in the interest rate corridor framework institutionalised in May 2011 (RBI, 2011). Under this framework, banks could avail liquidity from the central bank at a penal rate above the policy rate on an overnight basis by pledging collateral through the marginal standing facility (MSF) while they could place funds with the central bank on an overnight basis at a rate below the policy rate against collateral under the fixed rate reverse repo (FRRR). Thus, the interest rates on both these facilities under the liquidity adjustment facility (LAF) defined the interest rate corridor with the MSF rate as the ceiling, the FRRR as the floor and the policy repo rate somewhere in between. This framework was operational till April 8, 2022, when the standing deposit facility (SDF) replaced the FRRR as the floor of the LAF corridor. Unlike the FRRR, however, the SDF is an uncollateralised facility which frees the central bank from collateral encumbrance and thereby enhances its flexibility in liquidity management. Once the policy repo rate is announced by the monetary policy committee (MPC), liquidity management operations are conducted to align the WACR to the policy repo rate. The main liquidity management operation is synchronized with the reserve maintenance cycle. In addition, fine tuning operations are conducted at the discretion of the Reserve Bank to offset temporary liquidity mismatches and stabilise the WACR close to the policy rate. With liquidity management assuming critical importance in monetary policy implementation, the operating procedure has undergone major refinements with the institution of the SDF. This article presents an assessment of the standing deposit facility in India in the overall context of standing facilities made available by central banks. The paper is structured in the following manner: Section II presents a snapshot of the global practices on standing facilities of central banks followed by a discussion of the Indian experience with the SDF in Section III. The empirical methodology, results and their implications are presented in Section IV, with some concluding observations in Section V. II. Central Bank Standing Facilities - Global Practices In terms of permissible variability in the operating target, the monetary policy operating frameworks can be categorised as ceiling, corridor or floor system. Central banks across the world have generally adopted either a corridor or a floor system. Cross country experience suggests that all major central banks have standing facilities that are available to banks and other eligible counterparties at their own initiative under the conditions specified by the central bank to provide or absorb overnight liquidity (Bindseil, 2014). A liquid interbank market and a sound payments and settlement system ensures that market equilibrium simultaneously leads to equilibrium at the individual financial institution level, thus minimising recourse to standing facilities. In such a scenario, a central bank’s lending facility serves just as an overdraft facility to fund any end-of-day imbalances with regular access to it discouraged by charging a penal rate higher than the regular refinancing operation (policy rate). Similarly, the lower interest rate on deposit facility is meant to disincentivise passive funds deployment with the central bank; instead, participants should do transactions with each other which helps in developing a liquid inter-bank market. The penal rates ensure that standing facilities act as a safety valve for liquidity management (Mohan, 2006). The interest rates on standing facilities under the liquidity adjustment facility defines the corridor framework. An identical margin on both sides of the policy rate constitutes a symmetric corridor. A corridor system encourages banks to manage their liquidity buffers more tightly and facilitate greater activity in the interbank market. However, it requires relatively more frequent central bank operations to ensure that the money market rates stay close to the policy rate. A floor system has been the norm for large and advanced economies since the global financial crisis (GFC). Under this system, central banks supply reserves in abundance through liquidity operations, and provide a floor for the price of reserves (interest rate) through a deposit facility. The advantage of the floor system is that the central bank can increase the supply of liquidity to the banking system without pushing short-term money market rates below the key rate (Brandao-Marques and Ratnovski, 2024). Thus, the central bank has two independent tools – the interest rate and the amount of liquidity supplied (Chart 1.a). In a fractional reserve system, however, reserve requirements may check the need for fine-tuning liquidity, based on the statutory requirements for reserve maintenance. If banks are subjected to reserve averaging i.e., they can reduce maintenance to a minimum daily average level over the maintenance period, the demand curve for bank reserves becomes flatter for interest rates near the middle of the corridor (Chart 1.b). Among advanced economies, the European Central Bank (ECB), the Bank of Canada (BoC), Reserve Bank of New Zealand (RBNZ), and Reserve Bank of Australia (RBA) were the pioneers of the symmetric corridor system around the year 2000. While the ECB combined its standing deposit facility with a one-month reserve maintenance period, the other three central banks operated without reserve averaging (Whitesell, 2006). The Norges Bank implemented monetary policy through a relatively pure version of a floor system until October 2011; thereafter, it shifted to a quota-based system – a compromise between a floor system and a corridor system1. Central banks like the Bank of Canada (BoC) and the Reserve Bank of New Zealand (RBNZ) adopted the floor system in 2020. In the case of the US, the deposit facility takes the form of a remuneration of excess reserves, which is equivalent to a deposit facility with automatic transfer of excess reserves to it. The US Fed uses two rates to establish the floor of the overnight interest rate. One is the interest on reserve balances, which is the rate paid on reserve balances of banks or other eligible counterparties. The other is the rate on the overnight reverse repo facility that is offered to a broad range of financial institutions (Afonso et al., 2023).  In the recent period, however, the BoC, the Bank of England (BoE), the ECB, and the RBA have all announced plans to reduce reserves until borrowing from the central bank picks up and market rates are marginally above the interest rate paid by the central bank on deposits, essentially returning to a corridor system, although they do not refer to it as the “corridor” (Nelson, 2024). The new ‘soft’ floor framework with a narrower spread can be characterised as a hybrid system, combining the smallest possible central bank balance sheet with both structural and fine-tuning operations. Its main objective is to allow for effective control of short-term money market rates in transition from a situation of abundant excess liquidity to one of less ample liquidity (Höflmayr and Kläffling, 2024). To avoid high volatility in the short-term money market rate, the hybrid system complements the deposit facility with a standing lending facility or frequent fixed-rate full-allotment lending operations priced at or slightly above the deposit facility rate, capping the money market interest rate from above and thereby making the framework a zero-width or near-zero-width corridor. The RBA has endorsed a plan to move to ample reserves system in which banks’ demands for reserves are satisfied via open market repo operations at a price near the cash rate target, in what are known as full allotment auctions. Together with the floor provided by the exchange settlement (ES) rate, these operations should keep the cash rate close to target2. Historically, central banks used only liquidity providing facility – either a discount or an advance facility. Central banks, however, started to introduce liquidity absorbing facilities in late 1990s (Bindseil and Jablecki, 2011). Central banks generally lend to financial institutions through collateralised transactions, i.e., repurchase agreements to protect themselves from credit risk and ensure equal treatment of counterparties (Chailloux et al., 2008). While lending to counterparties, the central bank is clear about the extent of risk it is willing to be exposed to by specifying (i) the securities it is willing to accept as collateral; and (ii) the haircut/margin it would charge on these securities. This practice protects the quality of the central bank’s balance sheet besides fostering financial discipline. Deposit facilities, on the other hand, are generally in the form of unsecured deposits (Annex Table 1). Being the monopoly supplier of bank reserves; central banks never face a situation where it defaults – thus, banks do not have any counterparty risk while depositing funds with the central bank. A central bank, however, may choose to provide security as collateral through sale or reverse repurchase agreements for creating a market for securities (Rule, 2012). III. Standing Deposit Facility in India In the Indian context, the standing deposit facility (SDF) was first recommended in the report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: Dr. Urjit R. Patel, 2014) as part of the overhaul of the operating framework of monetary policy. The committee recommended that a (low) remunerated SDF may be introduced as the floor for absorption of surplus liquidity from the system but without the need for providing collateral in exchange, with the discretion to set the interest rate without reference to the policy target rate. The SDF was also proposed to be used for sterilisation operations as it will not require the provision of collateral for absorption – which may be a binding constraint on the reverse repo facility in the face of sustained surge in capital flows (RBI, 2014). The withdrawal of ₹500 and ₹1000 denomination currency notes from circulation in 2016 and the resultant liquidity glut also demonstrated collateral constraints associated with conventional instruments warranting introduction of unconventional measures like imposition of incremental cash reserve ratio (CRR) of 100 per cent on the increase in net demand and time liabilities (NDTL) and issuance of bonds under the market stabilisation scheme (MSS) to drain large surplus liquidity from the banking system. In the absence of such options, there is the risk of the inter-bank rates dropping to near zero levels amidst abundant liquidity, posing risks to financial stability. The amendment to Section 17 of the RBI Act in 20183 enabled the Reserve Bank to institutionalise the SDF. The SDF was introduced in April 2022 and replaced the FRRR as the floor of the LAF corridor. With the institution of the SDF, the FRRR, retained at 3.35 per cent, was delinked from the policy repo rate although it remains a part of the Reserve Bank’s toolkit and can be used at its discretion. The SDF rate, which is applicable on uncollateralised overnight deposits, was set at 25 basis points (bps) below the policy repo rate. This, along with the MSF rate at 25 bps above the repo rate, restored the width of the LAF corridor to its pre-pandemic level of 50 bps. Thus, standing facilities were instituted at both ends of the LAF corridor – one to absorb and the other to inject liquidity, rendering the operating framework symmetric. Furthermore, access to SDF and MSF are at the discretion of banks, unlike repurchase transactions, outright OMOs and CRR, which are conducted at the discretion of the Reserve Bank. In addition, the RBI retains the flexibility to absorb liquidity for longer tenors under the SDF with appropriate pricing, as and when the need arises. By removing the binding collateral constraint that could have inhibited the central bank’s liquidity management operations, the SDF has strengthened the operating framework of monetary policy. It also acts as a financial stability tool by providing a floor to overnight inter-bank market rates. The institution of the SDF is generally in line with global best practices wherein deposit facilities are in the form of unsecured deposits. In the aftermath of COVID-19, the Reserve Bank injected substantial liquidity into the banking system through both conventional and unconventional policy measures to mitigate the adverse impact of the pandemic on the real economy. The surplus was mopped up entirely through overnight FRRRs during March 2020 to January 2021. Subsequently, as normal liquidity operations resumed in January 2021, the bulk of surplus liquidity was absorbed through variable rate reverse repo (VRRR) fine tuning operations of various sizes and tenors. The liquidity glut and the required normalisation thereafter provided an opportune time for the introduction of the SDF in April 2022. Since then, surplus liquidity has been largely mopped up through the SDF with declining share of absorptions through VRRR operations. Surplus liquidity conditions abated in 2022-23 in sync with the change in monetary policy stance to withdrawal of accommodation. Taking cognisance of banks’ higher recourse to the MSF while simultaneously parking large surplus funds under the SDF, reversal of liquidity facilities under both the SDF and the MSF was allowed even during weekends and holidays, effective December 30, 2023, which provided banks greater flexibility in their operations. Of the average liquidity absorption of ₹1.7 lakh crore since April 2022 and up to March 2025, nearly 65 per cent was through the SDF while the remaining was mopped up through VRRR auctions as compared to only 16 per cent absorbed under the FRRR during April 7, 2017 to March 20, 2020 (Chart 2). The simultaneous occurrence of liquidity deficit conditions alongside substantial fund placements under the SDF suggests asymmetric distribution of liquidity within the banking system and the increased liquidity preference of banks (Chart 3). The increase in the share of SDF balances as a proportion of total absorption by the Reserve Bank reflects the increase in the precautionary demand for funds by banks. In the backdrop of the need for higher liquidity insurance in view of 24/7/365 payment systems, banks are facing uncertainty in their day-to-day transactions as high value transactions at late hours can result in shortfall in reserve maintenance. Moreover, the Just in Time release of funds from the treasury to the end beneficiary have considerably shrunk the float money that were available with banks earlier. Thus, banks increasingly prefer to hold larger balances on a daily basis in recent years, which coincide with the SDF phase. This has also resulted in banks showing less inclination in parking surplus funds with the central bank through VRRR operations of longer tenors under the LAF.

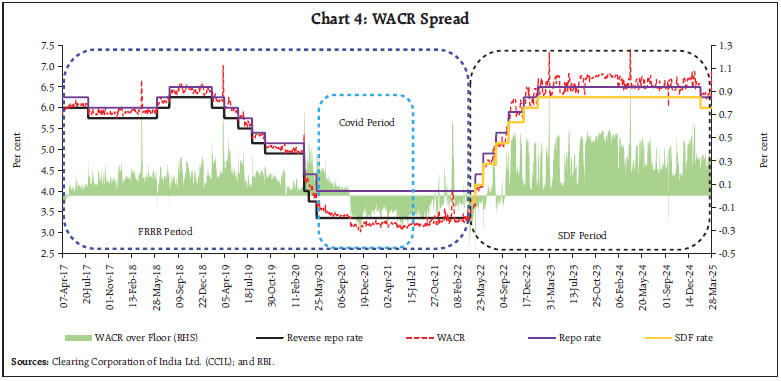

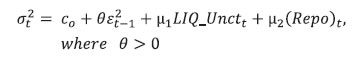

The standing facility is a primary tool used by central banks to control the level and volatility of the operating target. Since the formal adoption of flexible inflation targeting (FIT), the WACR largely traded above the floor of the corridor barring the COVID period. The liquidity glut due to COVID-19 related measures along with large capital inflows pushed the WACR below the FRRR (floor of the corridor) as reflected in the large negative spread of the WACR vis-à-vis the FRRR. This negative spread persisted after the implementation of the SDF during April to August 2022 with July 2022 being the exception. Subsequently, the WACR gradually moved above the SDF rate (Chart 4). Market microstructure and regulatory prescriptions, apart from system liquidity and corridor width, determine the level of the WACR and its variability. The skewed distribution of liquidity across banks may encourage arbitrage opportunities which may result in the hardening of WACR and widening of the spread. Furthermore, the regulatory developments regarding the Reserve Bank’s directive to all eligible call money participants (including cooperative banks) to obtain the Negotiated Dealing System-Call (NDS-Call) membership has resulted in migration of participants towards the NDS-Call platform – thus increasing traded deals. Call money market transactions were either traded on the NDS-Call or are reported on NDS-Call after being traded over the counter (OTC). The share of traded volume which had declined during 2020-22 has gradually increased since then with all transactions taking place in the traded segment since October 2023 (Chart 5). Earlier, the WACR was pulled down disproportionately because of the lower rate on reported deals as small cooperative banks – principal lenders in reported deals and who did not have the requisite information technology (IT) infrastructure to access the NDS-Call – usually extended loans bilaterally towards the close of market hours at lower rates.  Moreover, the restoration and harmonisation of market timing in the call money market removed the market anomaly which reduced reported deals and increased traded deals. The trading hours for various markets regulated by the Reserve Bank were amended with effect from April 7, 2020 in view of the operational dislocations and elevated levels of health risks posed by COVID-19. During the period of liquidity glut, banks could borrow funds from cooperative banks at ultra-low rates and park them at higher rates under the FRRR/SDF window. The Reserve Bank restored market hours in a phased manner commencing November 20204. IV. Empirical Analysis As alluded to earlier, several factors are at play in determining the level of WACR, and thus its spread over the floor of the LAF corridor. This section attempts to assess the determinants of WACR spread over the SDF, based on daily data during the period April 8, 2022 to March 28, 2025, benchmarking it to the FRRR period with similar attribute of corridor width (50 bps), i.e., April 6, 2017 to March 20, 2020.5 An empirical analysis is undertaken to investigate the determinants of the spread of the call rate over the floor of the LAF corridor under the two regimes, which is conditioned by factors influencing liquidity as well as elements of market microstructure. Based on existing literature (Kumar, et al., 2017; Prabu and Bhattacharyya, 2023), liquidity conditions (LIQ_Cond), liquidity distribution (LIQ_Dist) and liquidity uncertainty (LIQ_Unc), along with the proportion of traded to total deals in uncollateralised market (TRDtoTot) were included as independent variables. Liquidity condition is defined as the daily net LAF position6 as a proportion of net demand and time liabilities (NDTL) of the banking system. LAF operations are targeted to address transient/frictional liquidity mismatches in the system. During systemic liquidity deficit, banks with adequate collateral can avail liquidity from the Reserve Bank. On the contrary, easy liquidity condition results in lower recourse to liquidity from the Reserve Bank. Positive net LAF to NDTL implies surplus liquidity within the banking system and vice versa. An increase in this ratio would reduce the WACR and its spread over the SDF rate. Liquidity distribution is another important factor as a skewed distribution of liquidity is likely to result in higher dependence on the call money market from a systemic perspective. As such, an increase in demand for call money relative to the total overnight money market volume would exert upward pressure on the WACR and widen its spread over the SDF rate. In this exercise, liquidity distribution is proxied by the ratio of uncollateralised interbank call money market volume as a proportion of the total volume of the overnight money market. Liquidity uncertainty, captured as the square of mean deviation of net LAF during the SDF period, firms up the WACR thus increasing its spread over the SDF rate. The share of traded to total deals is also expected to positively impact the spread as discussed earlier. The summary statistics of the selected variables for both the sample periods are presented in Annex Table 2. At the outset, scatter plots are presented for a preliminary evaluation of the relationship between the dependent and the explanatory variables. Scatter plots show that the spread of WACR is negatively correlated with the liquidity conditions during both the SDF as well as the FRRR period, while traded to total deals and liquidity uncertainty are positively correlated. The correlation between WACR spread and liquidity distribution is, however, ambiguous (Chart 6). The WACR, and thus its spread, exhibits high volatility persistence (Singh, 2020). An autoregressive conditional heteroscedasticity (ARCH) model also included in the variance equation. The model is specified below and the results are presented in Table 1 and Table 2. Mean Equation Variance Equation  From Table 1, it is noted that liquidity conditions have a negative and significant impact on the spread of WACR (over the SDF rate) during the sample period, i.e., surplus liquidity in the banking system softens the interbank call rate, thereby, compressing the spread. The positive coefficient of liquidity distribution and liquidity uncertainty are also on expected lines – a more skewed distribution and greater uncertainty firms up the WACR thereby increasing the spread. The positive relationship between WACR spread and liquidity distribution reflects the lack of depth in the call money market where few players often drive market dynamics (Kumar et al., 2017). An increase in share of traded deals is also associated with an increase in spread for reasons alluded to earlier. Since the interbank overnight market is characterised by volatility clustering, lagged spread indicating persistence is positively related to the spread. Results from the variance equation suggest that liquidity uncertainty increases volatility of the spread while policy announcement has positive and significant impact on spread. | Table 1: Factors impacting Spread during SDF Period | | Dependent Variable: Spread (WACR over SDF Rate) | | Mean Equation | Variance Equation | | Explanatory Variables | | Spread (-1) | 0.770*** | C | -0.009*** | | Liquidity Conditions | -0.027*** | RESID(-1)2 | 0.825*** | | Traded to Total Volume | 0.044*** | Repo | 0.002*** | | Liquidity Distribution | 0.011*** | Liquidity Uncertainty | 0.001*** | | Liquidity Uncertainty | 0.007*** | | | | Diagnostics | | ARCH LM (6) (p-value) | 0.99 | | | | Q (6) (p-value) | 0.67 | | | | Adjusted R2 | 0.75 | | | Note: ‘***’, ‘**’ and ‘*’ indicate the significance at 1, 5 and 10 per cent, respectively.

Source: Authors’ estimates. | As evident from Table 2, the signs of the coefficients for lagged spread, liquidity conditions and liquidity distribution in the mean equation of the FRRR period is similar to that under the SDF period. The impact of traded deals and liquidity uncertainty is not found to be significant under FRRR unlike in the SDF. During the FRRR period, banks had access to the fixed rate repo up to 0.25 per cent of their own net demand and time liabilities (NDTL) on a daily basis and up to 0.75 per cent of the banking system NDTL through four 14-day variable rate term repo auctions conducted during the reserve maintenance fortnight, which provided an amount of assured liquidity. Thus, the impact of liquidity uncertainty on the level of spread was not significant during this period. However, liquidity uncertainty is found to have a significant positive impact on variability of spread. Similar to SDF, policy announcement is also found to have a positive and statistically significant impact on spread during the FRRR period. | Table 2: Factors impacting Spread during FRRR Period | | Dependent Variable: Spread (WACR over Fixed Rate Reverse Repo) | | Mean Equation | Variance Equation | | Explanatory Variables | | Spread (-1) | 0.609*** | C | -0.002 | | Liquidity Conditions | -0.007*** | RESID(-1)2 | 0.342*** | | Traded to Total Volume | -0.008 | Repo | 0.001*** | | Liquidity Distribution | 0.007*** | Liquidity Uncertainty | 0.001*** | | Liquidity Uncertainty | -0.002 | | | | Diagnostics | | ARCH LM (6) (p-value) | 0.99 | | | | Q (6) (p-value) | 0.17 | | | | Adjusted R2 | 0.47 | | | Note: ‘***’, ‘**’ and ‘*’ indicate the significance at 1, 5 and 10 per cent, respectively.

Source: Authors’ estimates. | V. Conclusion The introduction of the SDF represents a paradigm shift in monetary policy implementation in the Indian context. It allows the central bank greater flexibility in liquidity management without being hamstrung by collateral availability – a fact noted earlier during periods of exceptional liquidity glut. Moreover, the SDF provides the flexibility to absorb liquidity over longer tenors with appropriate pricing. Thus, sterilisation of excess liquidity can be conducted without triggering further inflows, which is likely through repeated OMO sales that keep interest rates elevated and maintains the interest rate differential. The empirical results bear testimony to the importance of liquidity conditions, liquidity uncertainty and liquidity distribution in determining the WACR and its spread, which is corroborated by recent developments in the overnight inter-bank money market. The results also provide evidence about the efficacy of the regulatory initiatives of the Reserve Bank in migrating cooperative banks to the NDS-Call platform that has ameliorated the distortions in the pricing of WACR witnessed earlier. In addition, introduction of daily VRR since mid-Jnauary 2025 has reduced liquidity uncertainty. Such refinements in market microstructure and the operating procedure of monetary policy on a continuous basis is indeed essential to facilitate signal extraction from market dynamics and the pricing of financial market instruments. References: Afonso, G., Cipriani, M., Spada, G. L. & Prastakos, P. (2023). “The Federal Reserve’s Two Key Rates: Similar but Not the Same?,” Liberty Street Economics 20230814, Federal Reserve Bank of New York. Bernhardsen, T., & Kloster, A. (2010). Liquidity management system: Floor or corridor. Norges Bank Staff Memo No 4 Bindseil, U. and Jablecki, J. (2011), “The Optimal Width of the Central Bank Standing Facilities Corridor and Banks’ day-to-day Liquidity Management Bindseil, U. (2014). Monetary Policy Operations and the Financial System, Oxford University Press. BIS (2022). MC Compendium, Monetary policy frameworks and central bank market operations. Brandao-Marques L., and L. Ratnovski (2024): The ECB’s Future Monetary Policy Operational Framework - Corridor or Floor? IMF Working PaperWP/24/56, March. Chailloux, A., Gray, S., & McCaughrin, R. (2008). Central Bank collateral frameworks: Principles and policies. International Monetary Fund Working Paper No. 222. Engle, R.F. and T. Bollerslev, (1986), “Modelling the Persistence of Conditional Variance”, Econometric Reviews, 5, 1-50. Höflmayr M., and D. Kläffling (2024): A new operational framework for the European Central Bank, European Parliamentary Research Service, May. Kumar, S., Prakash, A., & Kushawaha, K. M. (2017). What explains call money rate spread in India? RBI Working Paper Series: 07/2017. Mohan, R., (2006). Coping with Liquidity Management in India: A Practitioner’s View. RBI Bulletin, April. Nelson, B. (2024). From the Floor Back to the Corridor: Why the Choice of Monetary Policy Implementation Framework Matters? Bank Policy Institute Blog, September 30. https://bpi.com/from-the-floor-back-to-the-corridor-why-the-choice-of-monetary-policy-implementation-framework-matters/ Patra M.D., Kapur M., Kavediya R., & Lokare, S.M. (2016). Liquidity Management and Monetary Policy: From Corridor Play to Marksmanship in Ghate C.& Kletzer K. (eds) Monetary Policy in India, Springer, New Delhi, 257-296. Prabu, E. and Bhattacharyya, I. (2023). Regime-Dependent Determinants of the Uncollateralised Overnight Rate: The Interplay of Operating Procedure and Market Microstructure. RBI Working Paper Series, WPS(DEPR):07/2023. Reserve Bank of India (2014). Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework, January. Reserve Bank of India (2011). Report of the Working Group on Operating Procedure of Monetary Policy (Chairman: Deepak Mohanty), March. Rule, G. (2012). "Collateral management in central bank policy operations,” Handbooks, Centre for Central Banking Studies, Bank of England, number 31, April. Singh, B. (2020). Liquidity Shocks and Overnight Interest Rates in Emerging Markets: Evidence from GARCH Models for India. RBI Working Paper Series, WPS(DEPR):06/2020. Whitesell, W. (2006). Interest Rate Corridors and Reserves. Journal of Monetary Economics.53, 1177-1195.

Annex | Table 1: Standing Deposit Facilities: Cross Country | | Countries | Name | Form | Pricing method | Access limited by/to | | Australia | Exchange Settlement Account | RBA Deposit Rate | Cash target rate – 10 bps | Exchange settlement account eligibility | | Brazil | Standing facility | Reverse repo | Base Selic rate – 35 bps | Financial institutions that are primary dealers; eligible collateral | | Canada | Deposit facility | Deposit | Fixed at lower limit of the operating band; | Participants in the LVTS payment system | | Euro system | Deposit facility | Deposit | Fixed rate | No limit | | India | Standing deposit facility | Uncollateralised deposit | Policy Rate - 25bps | SCBs; select UCBs, RRBs, select SSCBs and Primary Dealers | | Indonesia | Deposit facility | Deposit | Policy Rate - 75bps | Banks registered as participants in monetary operations | | Korea | Liquidity adjustment deposits | Deposit | Base rate – 50bps | Reserve depository institutions | | Malaysia | Standing facility | Deposit | OPR - 25bps | Financial institutions that are interbank participants | | Mexico | Standing facility | Deposit | Not remunerated | Commercial and development banks | | New Zealand | Standing facility | Deposit | Fixed below Official cash rate | Commercial banks and Fis | | Norway | Standing facility | Excess Reserve | Remunerated | Commercial Banks, Settlement Banks and specialised financial institutions | | Philippines | Deposit Facility | Overnight Deposit | Fixed rate | Banks, NBQBs, and Trust entities | | Singapore | Standing facility | Deposit | Reference rate less 50bp, floored at 0 per cent | MEPS+ participating banks | | South Africa | Standing facility reverse repo | Automatic end of day square off facility | Repo less 100 bps | Clearing banks | | Sweden | Standing facility | Deposit | Repo rate minus 10 bps | Monetary policy counterparties and some participants in the Riksbank’s payment system RIX | | Thailand | End-of-day Deposit Facility | Deposit | Policy rate minus 50bp | Banks, finance companies, specialised financial institutions and other juristic persons permitted by BOT | | United Kingdom | Operational Standing Deposit Facility | Deposit | Bank Rate minus 25bp | Banks, building societies, CCPs and broker dealers, unlimited size | | United States | Standing facility | Interest on Reserve balances | As of March 2025, 440 bps | Depository institutions | | Sources: BIS; and Central Bank websites. |

| Table 2: Summary Statistics | | | SPREAD (WACR – Floor) | Liquidity Conditions | Liquidity Distribution | Traded to Total Deals | | | FRRR | SDF | FRRR | SDF | FRRR | SDF | FRRR | SDF | | Mean | 0.15 | 0.28 | 0.82 | 0.34 | 8.32 | 2.23 | 0.67 | 0.91 | | Median | 0.14 | 0.29 | 0.48 | 0.25 | 7.92 | 2.19 | 0.71 | 0.99 | | Maximum | 1.02 | 1.16 | 4.27 | 4.46 | 29.83 | 3.76 | 0.94 | 1.0 | | Minimum | -0.15 | -0.48 | -1.50 | -1.65 | 3.02 | 0.17 | 0.08 | 0.23 | | Std. Dev. | 0.09 | 0.20 | 1.28 | 0.99 | 2.76 | 0.40 | 0.13 | 0.15 | | Skewness | 2.11 | -0.33 | 0.51 | 1.24 | 1.40 | 0.22 | -0.73 | -1.91 | | Kurtosis | 19.7 | 3.53 | 2.27 | 5.70 | 8.77 | 4.37 | 3.27 | 5.7 | | Observations | 712 | 721 | 712 | 721 | 712 | 721 | 712 | 721 | Note: FRRR period covers April 6, 2017 to March 20, 2020; SDF period covers April 8, 2022 to March 28, 2025.

Source: Authors’ estimates. |

|