|

Abstract

The significant increase in inflows into mutual funds and their subsequent deployment is altering the scope of disintermediation in India. We look at this evolving milieu and its implications for bank intermediation in general and credit portfolio of banks in particular. We find that there is, (i) a gradual shift in corporate borrowings from banks to mutual funds as reflected in the contraction in corporate spreads for near-investment grades; and (ii) a significant differential between the risk-free rate and the benchmark lending rate for banks, viz., Marginal Cost of funds based Lending Rate (MCLR), which has given rise to disintermediation of bank credit for quality corporates.

Introduction

Historically, the banking sector has played a preeminent role in facilitating flow of resources to the commercial sector in India (refer Chart 1). However, this is currently under challenge as credit disintermediation, bypassing banking channels, has attained a critical mass. In the year 2011, the share of bank loans in credit to the commercial sector was around 56% and that of non-bank sources of credit (commercial paper, corporate bonds and external commercial borrowings), 44%.2 By 2017, this has reversed—the banks’ share had plummeted to around 38% and that of non-bank sources rose to 62%. Our brief study looks at this evolving milieu and its implications for the credit portfolio of banks.

Disintermediation: Mutual Funds (MFs)

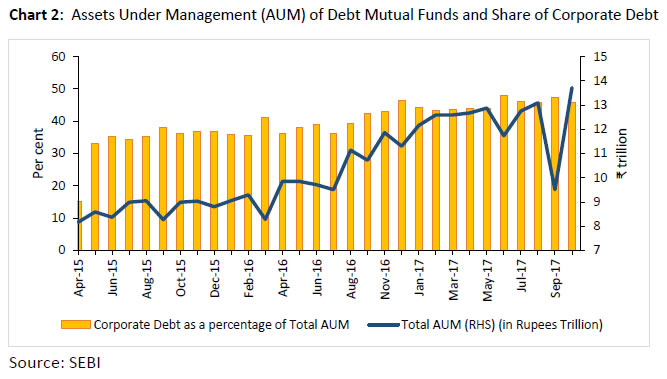

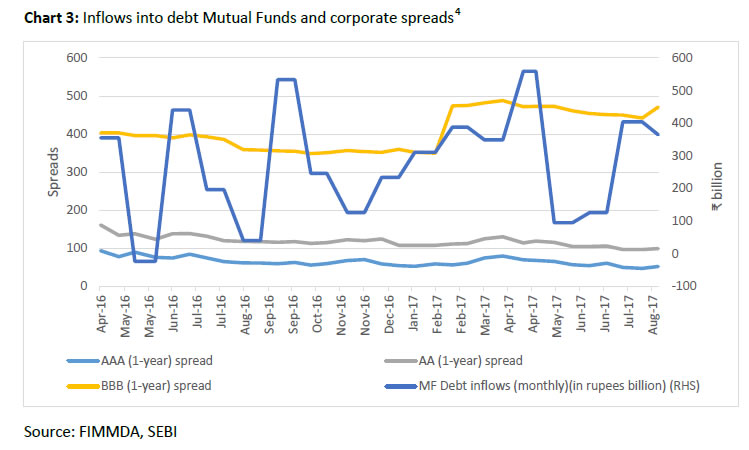

The dramatic growth in resources flowing to mutual funds (MFs) suggests that there is a discernible shift in the pattern of deployment of financial savings in India. The flow of liquidity into debt-oriented mutual funds has given rise to a swelling of Money Market Mutual Fund (MMMF) corpus, which is outlined in Chart 2. The implications of the large MFs corpus in the context of equity valuation is well documented. However, its implication for debt valuation does not invite much attention. A major consequence of the fluctuation in MFs flows is the significant variation that is possibly induced in corporate spreads - derived from Fixed Income Money Markets and Derivatives Association (FIMMDA)3 valuation - as MFs chase creditworthy assets (Chart 3). While the FIMMDA spreads are not necessarily based on executed transactions; being used to value the corporate bond portfolio, they do have a bearing on the secondary market as well as primary market trades.

A comparison of the movements of the cost of funds and loan-pricing benchmark (SBI 1-year MCLR5) over the last year is shown in Chart 4. The graph exhibits a correlation between the policy rate and the T-Bill yields, while at the same time, indicating the significant corridor between the risk-free and risky unsecured rates (MCLR).

Analysis

The significant spread of the corridor gives plenty of scope for potential movement of borrowers away from banks to mutual funds. We analyse the extent of disintermediation of highly rated corporates that can be accommodated within the corridor. The analysis is done by keeping the tenor of lending constant (1-year) and examining the threshold rating grades above which lending can be accommodated within the corridor; and keeping the rating grade constant and examining the tenor up to which the rating grade can be accommodated.6

To elaborate further, in the first instance, corporate bonds of different ratings, each having a different spread over the risk-free rate, were compared with the spread of SBI 1-year MCLR rate over the 1-year T Bill rate. This is done to assess up to what rating it is beneficial for the corporates to access alternative sources of funding while keeping the tenor constant at 1-year. In the second instance, corporate bonds with a particular rating but different tenor (say, AAA bonds of 3-year, 5-year, etc.) were examined. The objective is to assess up to what tenors it would be favourable for a corporate with a specific rating to raise resources from non-banking sources of credit.

Our analysis shows that over a 1-year investment horizon, rating grades up to ‘A’ can be accommodated within the corridor (Chart 5.I). On the other hand, for longer tenors, rating grades up to ‘AA’ can be accommodated over an intermediate investment horizon of 3 years and 5 years (refer Chart 5.II a & b).

Incidentally, behaviour on the part of a few well-capitalised banks bear out our observation7.

We further examined if the shift from Base Rate to MCLR had any implication for pricing of tradable bonds. Table 1 looks at the relative pricing of various grades of corporate bonds with varying tenors as on April 2016, when the MCLR guidelines became effective8. The table along with Chart 5.I (April 2016 data point) shows that, under the base rate regime, the rating grade below which banks turn competitive moves up a notch from ‘A-‘ (under MCLR) to ‘A’ (under Base Rate). However, there has been an improvement in the threshold rating in the 1-year tenor from ‘A-‘ to ‘AA-’ under MCLR in the recent period as is evident from Table 2. This is despite a sharp increase in the mutual funds corpus following demonetization. This could possibly be due to the increase in spreads for lower rating grades on account of economic uncertainty. Nevertheless, given the sizeable increase in debt fund corpus (from ₹ 9.85 trillion in April 2016 to ₹ 13.09 trillion in August 2017), the possibility of high-rated corporates being financed by mutual funds is significantly higher.

| Table 1: Yields of graded corporate bonds across tenors (as on April 2016) |

| |

|

Yields |

|

| Tenor (years) |

Risk Free rate |

AAA |

AA+ |

AA |

AA- |

A+ |

A |

A- |

SBI Base Rate (annualised) |

| 1 |

7.11 |

7.89 |

8.04 |

8.45 |

8.83 |

9.24 |

9.61 |

10.01 |

9.63 |

| 2 |

7.29 |

8.01 |

8.22 |

8.65 |

9.01 |

9.41 |

9.79 |

10.19 |

9.63 |

| 3 |

7.38 |

8.10 |

8.36 |

8.81 |

9.15 |

9.55 |

9.93 |

10.33 |

9.63 |

| 4 |

7.50 |

8.17 |

8.47 |

8.92 |

9.27 |

9.66 |

10.05 |

10.44 |

9.63 |

| 5 |

7.57 |

8.23 |

8.56 |

9.01 |

9.35 |

9.74 |

10.14 |

10.54 |

9.63 |

| Source: FIMMDA, SBI |

| Table 2: Yields of graded corporate bonds across tenors (as on August 2017) |

| |

|

Yields |

|

| Tenor (years) |

Risk Free rate |

AAA |

AA+ |

AA |

AA- |

A+ |

A |

A- |

SBI MCLR

(annualized) |

| 1 |

6.29 |

6.81 |

7.05 |

7.28 |

7.50 |

8.25 |

9.50 |

10.00 |

8.24 |

| 2 |

6.38 |

6.97 |

7.20 |

7.44 |

7.69 |

8.44 |

9.69 |

10.19 |

8.24 |

| 3 |

6.48 |

7.13 |

7.35 |

7.61 |

7.87 |

8.62 |

9.87 |

10.37 |

8.24 |

| 4 |

6.52 |

7.22 |

7.43 |

7.40 |

8.00 |

8.75 |

10.00 |

10.50 |

8.24 |

| 5 |

6.56 |

7.30 |

7.52 |

7.75 |

8.13 |

8.88 |

10.13 |

10.63 |

8.24 |

| Source: FIMMDA, SBI |

Conclusion

The rise of bank disintermediation in corporate credit does enable our financial system to become robust and more efficient in allocating risks. The unintended consequence of this process could potentially force banks, concerned with the shift in higher-rated borrowers to mutual funds, to either lower their credit standards or to engage in pricing that does not truly reflect their cost of funds. If banks lower their credit standards, the impact of such “adverse selection”, may add to further disintermediation and an increase in the expected losses of credit portfolio of banks. On the other hand, pricing pressure may also force banks to ration the credit and lend only to the high-rated borrowers even at the cost of imperfect pricing (Stiglitz, 1981). Both could potentially result in a failure to properly allocate funds in the loan market. In the absence of a well-capitalized banking system, the ability of banks to compete with mutual funds and other market intermediaries through reduction in intermediation cost is limited. This may not only hamper credit growth but also further weaken the risk culture in banks. Therefore, undertaking necessary structural reforms to restore a healthy banking sector is of paramount importance (Patel, 2017), (Acharya, 2017). At the same time, structural reforms supporting the corporate bond market such as the Insolvency and Bankruptcy Code (IBC) are likely to give a further fillip to non-bank finance for Indian borrowers.

References

1. Stiglitz, J. E. and Weiss, “Credit Rationing in Markets with Imperfect Information”, American Economic Review Vol. 71, No. 3 (Jun., 1981), pp. 393-410 (Available at URL http://socsci2.ucsd.edu/~aronatas/project/academic/Stiglitz%20credit.pdf)

2. Patel, U. R. “Resolution of Stressed Assets: Towards the Endgame” - Inaugural speech of the program “National Conference on Insolvency and Bankruptcy: Changing Paradigm”, Mumbai, August 19, 2017. (Available at URL https://rbi.org.in/Scripts/BS_SpeechesView.aspx?Id=1044)

3. Acharya, V. V. “The Unfinished Agenda: Restoring Public Sector Bank Health in India” - speech delivered at the 8th R K Talwar Memorial Lecture organised by the Indian Institute of Banking and Finance at Hotel Trident, Mumbai (Available at URL https://rbi.org.in/Scripts/BS_SpeechesView.aspx?Id=1046)

|