In the 22nd round of Systemic Risk Survey, global spillovers and financial market volatility were assessed to have moved to the ‘high’ risk category. Macroeconomic uncertainty, though rising, remained a ‘medium’ risk. Going forward, respondents’ perception of risks to financial stability included: (a) aggressive monetary policy tightening by advanced economies; (b) volatility in capital flows and exchange rates; (c) de-anchoring of inflation expectations; (d) faltering of economic recovery; (e) disruptions in global supply chains; (f) de-globalisation; and (g) climate change risk. A majority of the respondents judged that the prospects of the Indian banking sector over a one-year horizon have improved or remained unchanged. | The 22nd round of the Reserve Bank’s systemic risk survey (SRS) was conducted in May 2022 to solicit perceptions of experts, including market participants, on major risks faced by the Indian financial system. In addition to its regular format, this round of the survey also captured (i) respondents’ views on new risks, which can potentially have a large impact on the Indian financial system, going forward; and (ii) likely impact of the ongoing war in Ukraine on the Indian economy. The feedback from 48 respondents is encapsulated below. -

Global spillovers and financial market volatility moved to the ‘high’ risk category. They also assessed that macroeconomic uncertainty, though rising, remained a ‘medium’ risk. On the other hand, institutional risks and general risks are gauged to have moderated during the preceding six months though they stayed in the ‘medium’ risk category (Figure 1). -

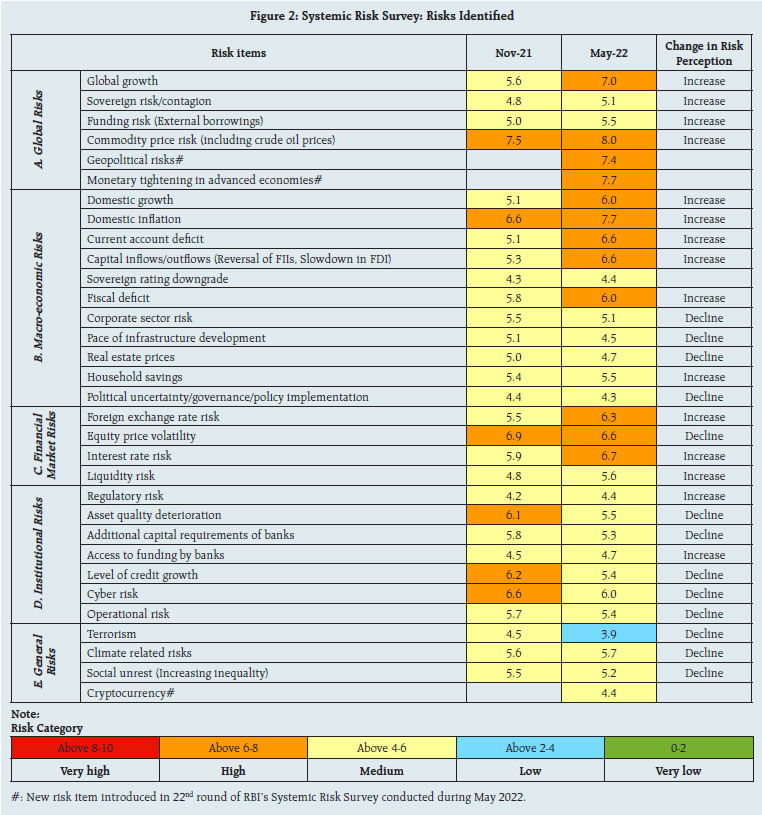

Global growth uncertainty, commodity price movements, geopolitical conditions and monetary tightening in AEs were perceived to be the major drivers of escalation in global risks (Figure 2). -

The rise in financial market risk was assessed to be emanating from tightening of financial conditions: foreign exchange pressure; interest rate and liquidity tightening; and elevated equity price volatility (Figure 2).

-

A bearish outlook on domestic economic growth, inflation, current account balance, capital flows and fiscal deficit has led to intensification of overall macroeconomic risks (Figure 2). -

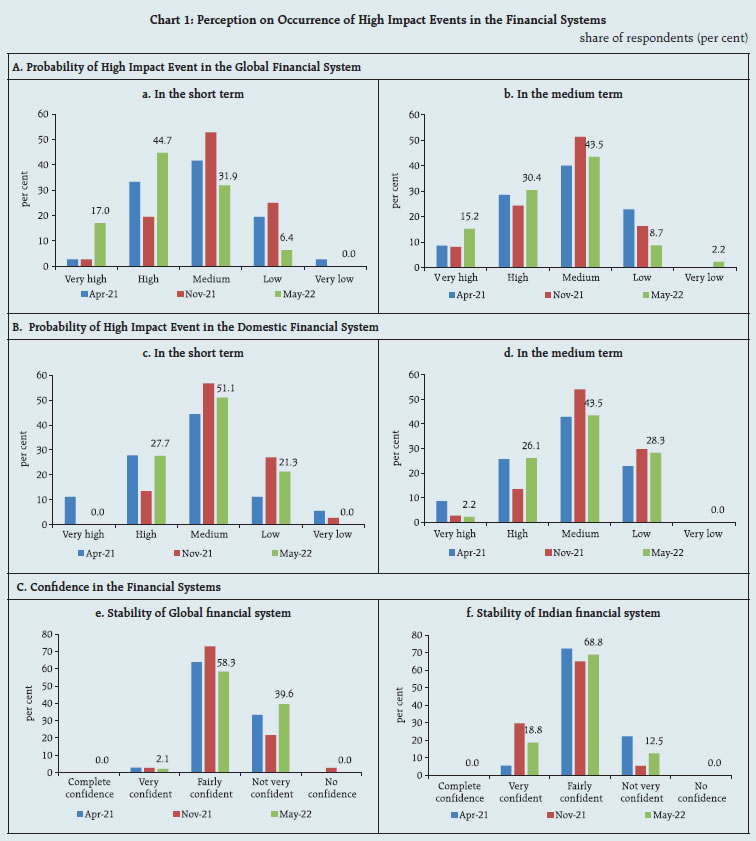

‘High’ to ‘very high’ probability of occurrence of a high impact event in the global financial system in the short run (Chart 1a). -

A high impact event in the domestic financial system was rated as ‘medium’ to ‘high’ for the same time horizon (Chart 1c). -

In the medium term, chances of a high impact event in the global financial system vis-a-vis the domestic financial system was rated as high (Chart 1b and 1d). -

Confidence in the stability of the financial system, both global and domestic, has diminished during the last six months, though 60 per cent and 88 per cent of respondents remained fairly/highly confident of the stability of global and Indian financial systems, respectively (chart 1e and 1f).

Three-fourths of the respondents perceived that the war in Ukraine to have a medium impact on the Indian economy as a whole (Charts 3a and 3b). The majority felt that the impact of the war is likely to be more on edible oils, crude oil and gas, automobile sector, base metals, agricultural commodities and fertilisers. Nearly 44 per cent of the panellists judged that the prospects of the Indian banking sector over a one-year horizon have improved and another 35 per cent expected it to remain unchanged (Chart 4). Most of the panellists expected marginal to considerable improvement in credit demand over the next three months on the back of recovery in GDP growth, higher consumer spending, pick up in manufacturing sector activity, public investment in infrastructure and higher demand for working capital (Chart 5a). Around 38 per cent of the respondents expected marginal deterioration in asset quality of the banking sector over the next three months, attributable to factors such as COVID-19 induced regulatory forbearance, improved asset quality recognition, higher input costs, supply chain bottlenecks impacting profit margins of firms and tightening of monetary and liquidity conditions (Chart 5b).

Risks to Financial Stability Going forward, respondents in the latest round of the SRS identified the following major risks to financial stability: -

Aggressive monetary policy tightening by AEs; -

Volatility in capital flows and exchange rates; -

De-anchoring of inflation expectations; -

Faltering of economic recovery; -

Disruptions in global supply chains; -

De-globalisation; and -

Climate change risk to the asset side exposure of financial sector. |