| In the 23rd round of the Systemic Risk Survey, risks from global spillovers and financial market volatility rose further and remained in the ‘high’ risk category. General risks were perceived to have increased though they continued to be in the ‘medium’ risk category. Macroeconomic uncertainty was assessed to have moderated but continued to remain in the ‘medium’ risk category. Going forward, respondents’ perception of risk to financial stability included: (a) strengthening of US dollar and volatility in the exchange rate; (b) increase in crude oil prices; (c) global economic slowdown; (d) tightening of global monetary and liquidity conditions; (e) lower corporate growth on account of slowdown in consumption and weak external demand; (f) rise in current account deficit and capital outflows; (g) increased price pressures due to higher commodity prices; (h) decline in corporate margins due to an increase in cost of raw materials; (i) geo-political risks due to continued war in Ukraine. More than half of the respondents assessed that the prospects of the Indian banking sector over a one-year horizon have improved. | The 23rd round of the Reserve Bank’s Systemic Risk Survey (SRS) was conducted in November 2022 to solicit perceptions of experts, including market participants and academicians, on major risks faced by the Indian financial system. In addition to its regular format, this round of the survey also captured (i) respondents’ perception on risk to financial stability from external sector developments; and (ii) segments of the Indian financial system which are likely to be impacted by aggressive monetary policy tightening by advanced economies and (iii) respondents’ views on the likelihood of global recession in 2023. The feedback from 48 respondents is presented below. - Risk perception from global spillovers and financial market volatility grew further and remained in the ‘high’ risk category. General risks were perceived to have increased though they continued to be in the ‘medium’ risk category. Institutional risks were perceived to have remained unchanged. Macroeconomic uncertainty, though remaining in the ‘medium’ risk category, was gauged to have moderated (Figure 1).

-

Monetary tightening in advanced economies, geopolitical risks, global growth uncertainty and funding risk were perceived to be the major drivers of amplification in global risks (Figure 2). -

The rise in financial market risk emanated from tightening of financial conditions: foreign exchange pressure and liquidity tightening (Figure 2). -

Uptick in general risks primarily stemmed from cryptocurrencies, climate change and terrorism (Figure 2). -

Decline in risk perception on domestic growth and inflation, capital flows, fiscal deficit and sovereign credit rating resulted in moderation in overall macroeconomic risks, though risk perception remained elevated towards current account deficit (Figure 2).   -

Confidence in the stability of the global financial system marginally declined during the last six months. In contrast, confidence in the Indian financial system further improved with 93.6 per cent of the respondents remaining fairly/ highly confident of the stability of the Indian financial system (Chart 1 e and f). -

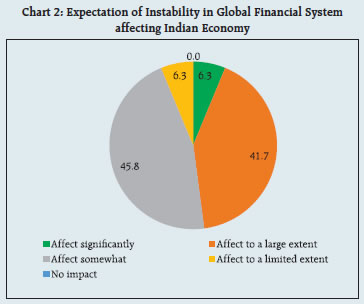

52.1 per cent of the respondents expected that the Indian economy will be impacted somewhat/to a limited extent from global spillovers (Chart 2). -

Despite global headwinds posing risks to domestic macro-financial conditions, the impact of external sector developments remained moderate as 53.2 per cent of the respondents perceived it of medium impact (Chart 3). -

More than three-fourths of the respondents perceived that the aggressive monetary policy tightening by advanced economies would adversely impact the exchange rate, capital flows, foreign exchange reserves and bond yields. Less than 40 per cent of respondents viewed that banks’ profitability and external debt would be adversely impacted (Chart 4).

-

57.8 per cent of the respondents assessed that the prospects of the Indian banking sector over a one-year horizon have improved and another 33.3 per cent of the respondents expected it to remain unchanged (Chart 5). -

Around 31 per cent of the respondents expected marginal improvement in banking sector asset quality over the next six months, and another 42.2 per cent expected it to remain unchanged attributable to factors such as economic recovery, pick up in credit growth, better underwriting standards of banks, improvement in credit profile of corporates, improved operating cashflows and credit guarantees to small enterprises (Chart 6 a). -

66.7 per cent of the respondents expected marginal to considerable improvement in credit demand over the next six months on the back of recovery in economic activity, upturn in the investment cycle, strengthening of business sentiments, increased demand for working capital loans, higher public investment in infrastructure sector and export promoting production linked incentive (PLI) scheme by Government (Chart 6 b).

-

Global economic outlook remains clouded as the number of downside risks remained high even though markets are pricing in moderate policy rate hikes in future. As per the survey responses, global economy is facing a threat of recession in 2023. More than 89 per cent of respondents expected medium to high and very high chances of global recession in 2023 (Chart 7). Risks to Financial Stability Going forward, respondents identified the following major risks to financial stability: -

Volatility in the exchange rate and strengthening of US dollar; -

Increase in crude oil prices; -

Global economic slowdown; -

Global monetary and liquidity tightening and interest rate risk; -

Lower corporate growth on account of slowdown in consumption and weak external demand; -

Rise in current account deficit and capital outflows; -

Increased price pressures due to higher commodity prices; -

Decline in corporate margins due to an increase in cost of raw materials; -

Geo-political risks due to continued war in Ukraine. |