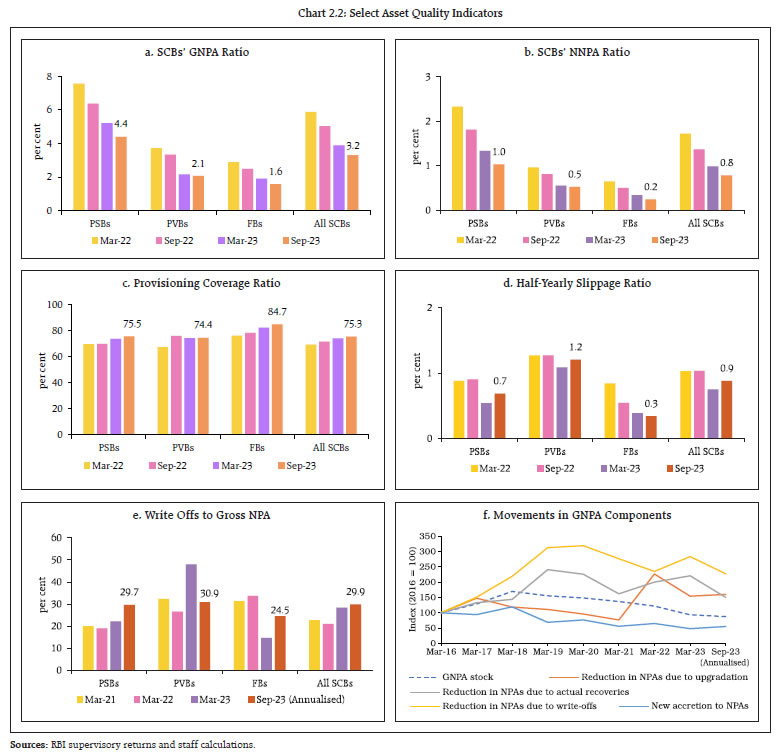

India’s financial sector has displayed stability and resilience, with ongoing improvement in asset quality, capital position and profitability during H1:2023-24. Macro stress tests for credit risk indicate that even under a severe stress scenario, all banks would be able to comply with minimum capital requirements. Stress in the NBFC sector has been assessed to be higher under a high-risk stress scenario relative to the March 2023 position. Contagion risks may warrant monitoring on account of increased inter-bank exposure. Introduction 2.1 The soundness and resilience of India’s banking sector has been underpinned by ongoing improvement in asset quality, enhanced provisioning for bad loans, sustained capital adequacy and rise in profitability. Credit growth remains robust, mainly driven by lending to services and personal loans. Deposit growth has also gained momentum due to transmission of previous rate increases resulting in repricing of deposits and higher accretion to term deposits. Lending by non-banking financial companies (NBFCs) accelerated, led by personal loans and loans to industry, and their asset quality has improved. Bilateral exposures among entities in the Indian financial system continued to expand. 2.2 This chapter presents stylised facts and analysis relating to recent developments in the domestic financial sector. Section II.1 analyses the performance of scheduled commercial banks (SCBs) in India through various parameters, viz., business mix; asset quality; concentration of large borrowers; capital adequacy; earnings; and profitability. Their resilience is evaluated through macro stress tests and sensitivity analyses. Sections II.2 and II.3 examine the financial parameters of urban cooperative banks (UCBs) and NBFCs, respectively, including their resilience under various stress scenarios. Sections II.4, II.5 and II.6 provide insights into the soundness and resilience of insurance sector, mutual funds, and clearing corporations, respectively. Section II.7 concludes with a detailed analysis of the network structure and connectivity of the Indian financial system, with contagion analysis under adverse scenarios. II.1 Scheduled Commercial Banks (SCBs)1 2 3 4 2.3 Mobilisation of deposits by SCBs gathered pace during 2023-24 so far (Chart 2.1 a). Accretions to term deposits rose further, reflective of pass-through of rate hikes alongside efforts to mobilise funds to match credit demand. On the other hand, growth in current account and savings account (CASA) has remained tepid (Chart 2.1 b). 2.4 Bank credit growth has sustained its momentum during 2023-24 so far, albeit with some moderation in public sector banks (PSBs) and foreign banks (FBs) (Chart 2.1 c). Lending to services and personal loans grew faster than to industrial and agriculture sectors (Chart 2.1 d and e). Personal loans recorded broad-based growth. In private sector banks (PVBs), education loans emerged as a new lending area, coming from a low base (Chart 2.1 f). II.1.1 Asset Quality 2.5 The asset quality of SCBs recorded sustained improvement and their GNPA ratio declined in September 2023 to an 11-year low level (Chart 2.2 a). Their NNPA ratio5 too has improved to a record low (Chart 2.2 b). Among bank groups, PSBs’ GNPA ratio improved the most (82 bps) in H1:2023-24. With the stock of GNPA coming down, requirement of provisions also reduced; however, active and deep provisioning by SCBs was reflected in their improved provisioning coverage ratio (PCR)6 in September 2023 (Chart 2.2 c). The half-yearly slippage ratio (viz., new NPA accretions as a share of standard advances), however, inched up for both PSBs and PVBs (Chart 2.2 d). The write-off to GNPA ratio7 increased in H1:2023-24 mostly due to reduction in GNPA stock across bank groups (Chart 2.2 e). Overall, the sustained reduction in the GNPA stock since March 2018 has been mainly on account of persistent fall in new NPA accretions; write-offs and recoveries; and higher upgradation in the post-pandemic period (Chart 2.2 f).  II.1.2 Sectoral Asset Quality 2.6 The improvement in SCBs’ asset quality has been broad-based (Chart 2.3 a). The GNPA ratio of the agriculture sector remains high at 7 per cent. At an overall level, asset quality in the personal loans segment has improved, although there has been a marginal impairment in credit card receivables (Chart 2.3 b). Within the industrial sector, asset quality improved across all major sub-sectors barring infrastructure (other than electricity) and petroleum (Chart 2.3 c).

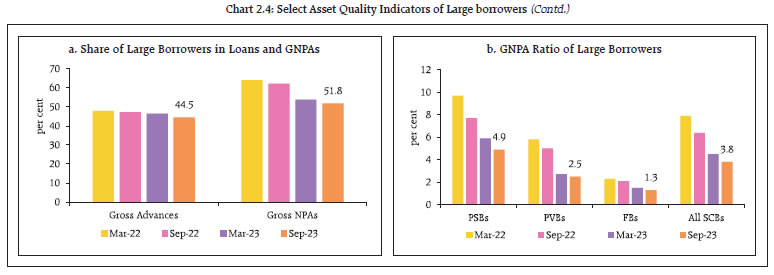

II.1.3 Credit Quality of Large Borrowers8 2.7 With retail loan growth outpacing borrowings by large borrowers, the share of the latter in gross advances of SCBs has declined further between March 2020 and September 2023. Asset quality in the large borrower portfolio saw significant improvement, which contributed to lowering of the share of large borrowers in GNPAs of SCBs (Chart 2.4 a and b). SMA-29 loans for large borrowers, which saw significant reduction during H2:2022-23, reverted to previous levels during June 2023 and September 2023 (Chart 2.4 c). The same was evident in the SMA-2 ratio also (Chart 2.4 d). In the large borrower accounts, the proportion of standard assets to total funded amount outstanding has been improving over the past three years (Chart 2.4 e), and the share of top 100 borrowers, which was rising for two years until March 2023, witnessed moderation during 2023-24. As at end September 2023, none of the top 100 borrower accounts remain in the NPA category (Chart 2.4 f). In terms of value, investment grade advances (rated BBB and above) constituted 90.3 per cent of total externally rated funded advances of large borrowers (Chart 2.4 g).

II.1.4 Capital Adequacy 2.8 As SCBs bolstered their capital base through capitalisation of reserves from higher profits and by raising fresh capital, their capital to risk-weighted assets ratio (CRAR) remained robust in September 2023, albeit lower than the March 2023 level (17.3 per cent) (Chart 2.5 a). The Tier I leverage ratio10 sustained its March 2023 level, with additional Tier I capital accretion matching incremental total exposure during H1:2023-24 (Chart 2.5 b). II.1.5 Earnings and Profitability 2.9 The net interest margin (NIM) of SCBs remained high in September 2023 (Chart 2.6 a). With growing net interest income (NII) and other operating income (OOI) and as the need for additional provisions fell, their profit after tax (PAT) rose by 43.0 per cent (y-o-y) in September 2023. PAT growth of PSBs remained higher than that of PVBs, mainly due to significant reduction in provisioning requirements. PAT of FBs nearly doubled on account of a steep fall in provisioning (Chart 2.6 b). 2.10 Profitability indicators remained strong: RoE and RoA ratios touched decadal highs in September 2023 (Chart 2.6 c and d) even as the transmission of past monetary policy rate increases led to a 100 bps rise in cost of funds from September 2022 to September 2023 (Chart 2.6 e). The yield on assets further improved due to rise in interest rates (Chart 2.6 f).

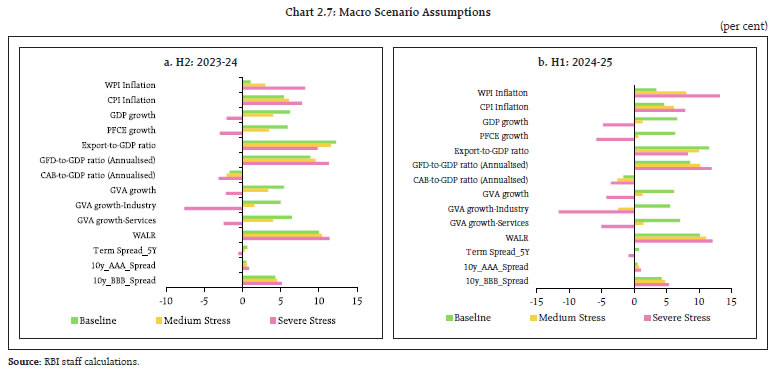

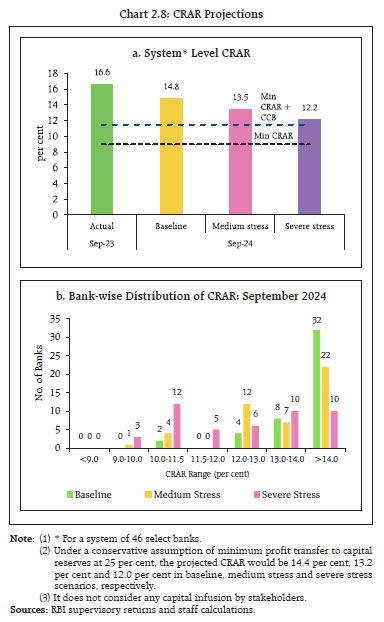

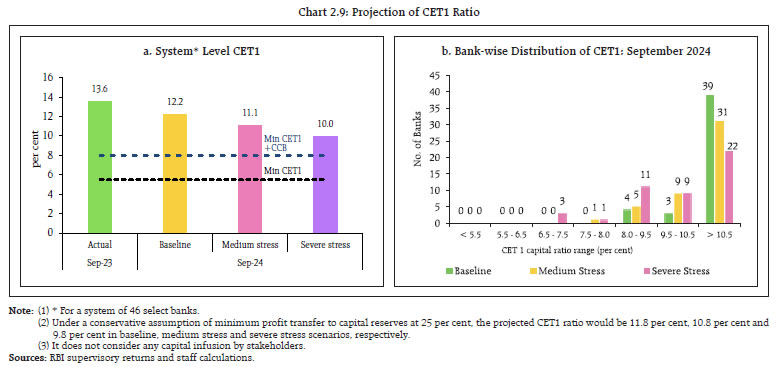

II.1.6 Resilience – Macro Stress Tests 2.11 Macro stress tests are performed to assess the resilience of SCBs’ balance sheets to unforeseen shocks emanating from the macroeconomic environment. These tests attempt to assess capital ratios over a one-year horizon under a baseline and two adverse11 (medium and severe) scenarios. The baseline scenario is derived from the forecasted values of macroeconomic variables. The medium and severe adverse scenarios are arrived at by applying 0.25 to one standard deviation (SD) shocks and 1.25 to two SD shocks, respectively, to the macroeconomic variables, increasing the shocks sequentially by 25 basis points in each quarter (Chart 2.7). In this exercise, capital ratio projections factor in the impact of recent regulatory measures prescribing higher risk weights for consumer credit and bank credit to NBFCs12. Additionally, to make the assessment more realistic, a transfer of 65 per cent of profit13 to capital funds is assumed. 2.12 The stress test results reveal that SCBs are well-capitalised and capable of absorbing macroeconomic shocks even in the absence of any further capital infusion by stakeholders. Under the baseline scenario, the aggregate CRAR of 46 major banks is projected to slip from 16.6 per cent in September 2023 to 14.8 per cent by September 2024. It may go down to 13.5 per cent in the medium stress scenario and to 12.2 per cent under the severe stress scenario by September 2024, which would also remain above the minimum capital requirements (Chart 2.8 a). No SCB would breach the minimum capital requirement of 9 per cent in the next one year (Chart 2.8 b).  2.13 The CET1 ratio of the select 46 SCBs may decline from 13.6 per cent in September 2023 to 12.2 per cent by September 2024 under the baseline scenario (Chart 2.9 a). In a severely stressed macroeconomic environment, the aggregate CET1 ratio would deplete by 360 basis points, but still remain above the minimum regulatory norms. All banks would be able to meet the minimum regulatory CET1 ratio of 5.5 per cent (Chart 2.9 b).

2.14 Under the baseline scenario, the GNPA ratio of all SCBs may improve to 3.1 per cent by September 2024 from the current level of 3.2 per cent (Chart 2.10). If the macroeconomic environment worsens to a medium or a severe stress scenario, the ratio may rise to 3.6 per cent and 4.4 per cent, respectively. At the bank group level, the GNPA ratios of PSBs may swell from 4.4 per cent in September 2023 to 5.1 per cent in September 2024, whereas it may go up from 2.1 per cent to 3.6 per cent for PVBs and from 1.6 per cent to 1.8 per cent for FBs under the severe stress scenario. II.1.7 Sensitivity Analysis14 2.15 This sub-section presents the results of top-down15 sensitivity analysis involving several single-factor shocks to assess the vulnerabilities of SCBs to simulated credit, interest rate, equity and liquidity risks under various stress scenarios16. a. Credit Risk 2.16 Credit risk sensitivity has been analysed under two scenarios wherein the system level GNPA ratio is assumed to rise from its prevailing level by (i) one SD17; and (ii) two SDs in a quarter. Under a severe shock of two SDs, it is assessed that (a) the aggregate GNPA ratio of 46 select SCBs would move up from 3.3 per cent to 8.2 per cent; (b) the system-level CRAR would deplete by 340 bps from 16.6 per cent to 13.2 per cent; and (c) the Tier 1 capital ratio would go down from 14.5 per cent to 11.0 per cent, well above the respective regulatory minimum levels. The system level capital impairment could be 22.2 per cent in this case (Chart 2.11 a). The reverse stress test shows that a shock of 5.3 SD would be required to bring down the system-level CRAR below the regulatory minimum of 9 per cent. 2.17 Bank-level stress tests indicate that under the severe (two SD) shock scenario, eight banks with a share of 18.4 per cent of SCBs’ total assets may fail to maintain the regulatory minimum level of CRAR (Chart 2.11 b). In such a scenario, the CRAR would fall below 7 per cent in case of three banks (Chart 2.11 c) and six banks would record a decline of over eight percentage points in the CRAR. In general, PVBs and FBs would face lower erosion in CRARs than PSBs under both scenarios (Chart 2.11 d). b. Credit Concentration Risk 2.18 Stress tests on banks’ credit concentration – considering top individual borrowers according to their standard exposures – show that in the extreme scenario of the top three individual borrowers of respective banks failing to repay18, no bank would face a situation of a drop in CRAR below the regulatory minimum of 9 per cent (Chart 2.12 a). In this extreme stress case, ten banks would experience a fall of more than two percentage points in their CRARs (Chart 2.12 b).

2.19 Under the extreme scenario of the top three group borrowers in the standard category failing to repay19, the CRAR of all banks would remain above 9 per cent (Chart 2.13 a). None of the banks would face a decline of more than five percentage points in their CRARs (Chart 2.13 b). 2.20 In the extreme scenario of the top three individual stressed borrowers of respective banks failing to repay20, the majority of the banks would remain resilient, with their CRARs depleting by a mere 25 bps or lower (Chart 2.14 a and b). c. Sectoral Credit Risk 2.21 Shocks applied on the basis of volatility of industry sub-sector-wise GNPA ratios indicate varying magnitudes of rise in GNPAs. By and large, sectoral credit risk remains muted - a two SD shock to basic metals and energy sub-sectors would reduce the system-level CRAR by merely 16 bps and 14 bps respectively, whereas the impact of shocks on the rest of the sub-sectors is negligible (Table 2.1).

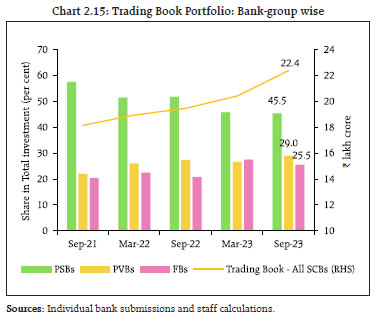

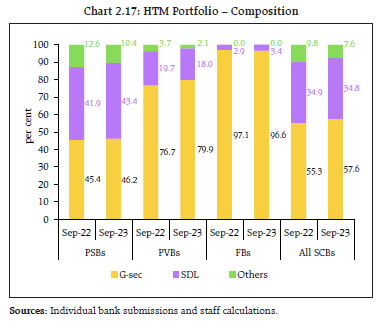

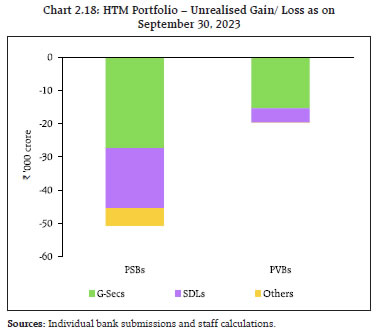

d. Interest Rate Risk 2.22 The market value of investments subject to fair value for the sample of SCBs under assessment in September 2023 was ₹22.4 lakh crore (Chart 2.15), of which, 94.5 per cent was categorised as ‘available for sale (AFS)’ and the remainder was classified as ‘held for trading (HFT)’. The share of the trading book portfolio in total investments of SCBs has been tapering for PSBs since June 2022, whereas it has risen for PVBs and FBs. 2.23 The AFS portfolio’s sensitivity (PV0121) increased for all categories of banks since June 2023. In terms of PV01 curve positioning, the tenor-wise distribution of PSBs’ portfolio indicates a higher allocation in the 5-10 year bucket. Around four-fifths of PSBs’ AFS portfolio remains in the 1-5 year and 5-10 year buckets. PVBs have built up positions in the more than 10-year bucket, with 1-5 year and over 10-year buckets predominating their portfolio. FBs continue to prefer the more than 10-year bucket and have reduced their holding in the other buckets. Although PV01 exposure of FBs in the highest maturity segment remains substantial, it may not be an active contributor to risk as some positioning involves bonds being held as cover for hedging purposes (Table 2.2). 2.24 The sensitivity (PV01) of PSBs and FBs in their HFT portfolios grew in H1:2023-24, whereas it decreased for PVBs. The interest rate exposure of FBs remained much higher than that of the other two bank groups. PVBs have predominantly built up their position in the greater than 10-year bucket in H1:2023-24, with around three-fourth of their portfolio in the 5-10 year and greater than 10-year buckets. The sensitivity of FBs’ portfolio has increased because of higher allocation to the 5-10 year and more than 10-year buckets (Table 2.3). The increased preference for longer dated securities can exacerbate the impact of interest rate shocks for such banks. | Table 2.1: Decline in System Level CRAR | | (basis points, in descending order for top 10 most sensitive sectors) | | | 1 SD | 2 SD | | Basic Metal and Metal Products (614 per cent) | 9 | 16 | | Infrastructure - Energy (347 per cent) | 7 | 14 | | Infrastructure - Transport (111 per cent) | 3 | 6 | | All Engineering (151 per cent) | 3 | 5 | | Textiles (87 per cent) | 2 | 4 | | Construction (68 per cent) | 1 | 3 | | Vehicles, Vehicle Parts and Transport Equipment (289 per cent) | 1 | 3 | | Food Processing (46 per cent) | 1 | 2 | | Infrastructure - Communication (216 per cent) | 1 | 2 | | Chemicals (128 per cent) | 1 | 2 | Note: (1) For a system of select 46 SCBs.

(2) Numbers in parenthesis represent the growth in GNPA of that sub-sector due to 1 SD shock to the sub-sector’s GNPA ratio.

Source: RBI supervisory returns and staff calculations. |

| Table 2.2: Tenor-wise PV01 Distribution of AFS Portfolio | | | Total

(₹ crore) | Share (in per cent) | | <1 year | 1-5 year | 5-10 year | >10 years | | PSBs | 227.2 (213.5) | 5.6 (7.4) | 33.3 (34.7) | 48.7 (45.2) | 12.4 (12.7) | | PVBs | 109.8 (99.8) | 12.4 (14.9) | 29.9 (32.1) | 15.5 (15.8) | 42.1 (37.3) | | FBs | 205.4 (182.4) | 3.0 (4.2) | 15.0 (17.2) | 11.8 (13.5) | 70.2 (65.1) | Note: Values in the parentheses indicate June 2023 figures.

Sources: Individual bank submissions and staff calculations. | 2.25 It is assessed that the impact of a parallel upward shift of 250 bps in the yield curve on the trading portfolio would reduce the system level CRAR and CET1 ratio by 101 bps and 102 bps, respectively (Table 2.4). At a disaggregated level, one bank would face a situation in which the CRAR will fall below the regulatory minimum. 2.26 As on December 11, 2023, yields hardened across the yield curve with the shorter end rising because of tight domestic liquidity conditions, and fuller transmission of the monetary policy tightening cycle. Since February 2023 when the pause in rate hikes began, the yield curve has reverted to an upward sloping position. 2.27 Robust demand from long-term investors (insurance companies and pension funds) assisted in compressing the yield of longer dated securities even as the maturity profile of outstanding Government debt elongated. Scenario analysis indicates that there is a shallower increase in borrowing costs when non-banks absorb all new government debt as compared to when it is absorbed entirely by banks22 (Chart 2.16). 2.28 The yield curve provides vital information about the future direction of the economy. Since June 2023, the curvature has fallen further, indicating that inflation expectations remain anchored (Table 2.5). In the Indian context, empirical analysis shows that curvature23 of the yield curve has more information content on future macroeconomic outcomes than the slope of the curve24. | Table 2.3: Tenor-wise PV01 Distribution of HFT portfolio | | | Total

(₹ crore) | Share (in per cent) | | <1 year | 1-5 year | 5-10 year | >10 years | | PSBs | 4.6 (3.3) | 2.9 (0.8) | 11.0 (14.8) | 45.7 (47.4) | 40.4 (37.0) | | PVBs | 8.5 (8.8) | 7.6 (4.3) | 19.7 (36.0) | 49.0 (46.6) | 23.6 (13.1) | | FBs | 44.1 (37.2) | 0.7 (1.2) | 11.8 (23.6) | 13.7 (6.2) | 73.8 (69.1) | Note: Values in the brackets indicate June 2023 figures.

Source: Individual bank submissions and staff calculations. |

| Table 2.4: Interest Rate Risk – Bank-groups - Shocks and Impacts | | (under shock of 250 basis points parallel upward shift of the INR yield curve) | | | Public Sector Banks | Private Sector Banks | Foreign Banks | All SCBs | | AFS | HFT | AFS | HFT | AFS | HFT | AFS | HFT | | Modified Duration (year) | 2.3 | 2.7 | 1.8 | 2.5 | 4.1 | 6.1 | 2.6 | 4.6 | | Share in total Investments (per cent) | 27.9 | 0.40 | 31.3 | 2.2 | 83.1 | 11.3 | 34.1 | 2.0 | | Reduction in CRAR (bps) | 80 | 47 | 507 | 101 | | Reduction in CET1 (bps) | 82 | 47 | 509 | 102 | | Source: Individual bank submissions and staff calculations. |

| Table 2.5: Curvature of Yield Curve | | | June 30, 2023 | September 29, 2023 | December 11, 2023 | | Curvature | 0.47 | 0.53 | 0.40 | | Sources: FBIL and RBI staff calculations. | 2.29 During Q1:2023-24, trading profits surged for all major bank groups on a sequential (q-o-q) basis, but they came down during Q2:2023-24. Losses recurred for FBs in Q2:2023-24 after recording profit in the previous quarter, which had followed losses in nine consecutive quarters. The share of trading profits in net operating income declined from June levels for PSBs and PVBs (Table 2.6). 2.30 PSBs preferred to increase their holdings in G-Secs and state development loans (SDLs) while paring their allocations to other securities that are eligible for holding in the HTM category (Chart 2.17). PVBs increased their holding of G-Secs in the HTM category, while reducing holdings of SDLs and other securities. 2.31 After a rapid upward movement during 2022-23, the yield curve as of end September 2023 remained largely in line with its March 2023 position. Accordingly, the notional loss in the HTM book of SCBs (PSBs and PVBs) declined marginally to ₹70,497 crore as at end September 2023 as compared to a notional loss of ₹71,817 crore as at end March 2023. 2.32 The distribution of unrealised losses across PSBs and PVBs indicates a contrasting picture across bank cohorts. Unrealised losses of PSBs are predominantly in G-Secs, although the proportion of Central and State government securities held by them in the HTM portfolio are by and large equal but for PVBs, the losses were distributed largely in line with their proportion of holdings (Chart 2.18). 2.33 If a parallel upward shock of 250 bps in the yield curve is applied, the mark-to-market impact on the HTM portfolio of banks excluding unrealised losses would reduce the system level CRAR by 347 bps. In respect of four banks, the CRAR would fall below 9 per cent (regulatory minimum). | Table 2.6: OOI - Profit/ (Loss) on Securities Trading – All Banks | | (in ₹ crore) | | | Q2: 2022-23 | Q3: 2022-23 | Q4: 2022-23 | Q1: 2023-24 | Q2: 2023-24 | | PSBs | 2594 (4.6) | 4128 (6.8) | 4084 (6.5) | 6394 (10.2) | 3914 (6.9) | | PVBs | 471 (0.9) | 796 (1.3) | 358 (0.7) | 2042 (3.3) | 903 (1.4) | | FBs | -241 (-2.6) | -778 (-8.4) | -599 (-2.6) | 215 (1.9) | -623 (-5.2) | Note: Figures in parentheses represent OOI-Profit/ (Loss) on Securities Trading as a percentage of Net Operating Income.

Source: RBI Supervisory Returns. |

2.34 In September 2023, holdings of statutory liquidity ratio (SLR) securities by PSBs and PVBs in the HTM category amounted to 21.6 per cent and 19.2 per cent, respectively, of their net demand and time liabilities (NDTL), while it stood at 3.7 per cent for FBs. PVBs have decreased their holdings of SLR securities in the HTM portfolio. Nevertheless, most banks have increased their HTM holdings during H1:2023-24. Under the revised investment guidelines that will be effective from April 2024, the ceiling on the HTM portfolio of banks will be removed and reclassification of investments between different categories (HTM, AFS and FVTPL) will not be allowed without the prior approval of the Reserve Bank. The new guidelines could, therefore, impact the size of banks’ HTM portfolio going forward. 2.35 An assessment of the interest rate risk of banks25 using traditional gap analysis (TGA) and duration gap analysis (DGA) is undertaken for rate sensitive global assets, liabilities and off-balance sheet items of banks. TGA for time buckets up to one year places earnings at risk (EAR) at 11.7 per cent and 8.5 per cent of NII for PSBs and PVBs, respectively, for a 200 bps increase in the interest rate. The impact would be marginal for FBs and SFBs in case of a similar shock (Table 2.7). The impact of the interest rate rise on earnings is positive as the cumulative gap26 at bank group level was positive as of September 2023. 2.36 As per the DGA27 assessment, PVBs’ and FBs’ market value of equity (MVE) would reduce marginally from an upward movement in the interest rate, while that of PSBs would be positively impacted. SFBs’ MVE would be particularly weighed down by an interest rate rise (Table 2.8). | Table 2.7: Earnings at Risk (EAR) - Traditional Gap Analysis (TGA) | | Bank Group | Earnings at Risk (till one year) as percentage of NII | | 100 bps increase | 200 bps increase | | PSBs | 5.9 | 11.7 | | PVBs | 4.2 | 8.5 | | FBs | 1.1 | 2.1 | | SFBs | 1.0 | 2.0 | | Sources: RBI Supervisory Returns and Staff Calculations. |

| Table 2.8: Market Value of Equity (MVE)- Duration Gap Analysis (DGA) | | Bank Group | Market Value of Equity (MVE) as percentage of Equity | | 100 bps increase | 200 bps increase | | PSBs | 0.3 | 0.6 | | PVBs | -0.5 | -1.1 | | FBs | -1.2 | -2.4 | | SFBs | -5.4 | -10.8 | | Source: RBI Supervisory Returns and Staff Calculations. | e. Equity Price Risk 2.37 As banks have limited capital market exposures owing to regulatory prescriptions, any impact of a possible significant fall in equity prices on banks’ CRAR would be low for the overall system of 46 banks. Under the scenarios of 25 per cent, 35 per cent and 55 per cent drop in equity prices, the system level CRAR would reduce by 23 bps, 32 bps and 51 bps, respectively (Chart 2.19). f. Liquidity Risk 2.38 Liquidity risk analysis aims to capture the impact of any possible run on deposits and increased demand for unutilised portions of sanctioned/ committed/ guaranteed credit lines. In an extreme scenario of sudden and unexpected withdrawals of around 15 per cent of un-insured deposits along with the utilisation of 75 per cent of unutilised portion of committed credit lines, liquid assets28 at the system level would decrease from 21.1 per cent of total assets to 11.1 per cent (Chart 2.20). 2.39 The results of a reverse stress test performed to examine the extent of un-insured deposit run-offs required to exhaust the liquid assets of banks, while assuming utilisation of 75 per cent of unutilised portion of committed credit lines, reveal that for majority of the banks, an un-insured deposit run-off of over 30 per cent is required to knock off their liquid resources completely (Chart 2.21).

II.1.8 Bottom-up Stress Tests: Derivatives Portfolio 2.40 A series of bottom-up stress tests (sensitivity analyses) on derivative portfolios have been conducted by select banks29 with the reference date of end-September 2023. The derivative portfolios of the banks in the sample are subjected to four separate shocks on interest and foreign exchange rates. While the shocks on interest rates range from 100 to 250 basis points, in the case of foreign exchange rates, shocks of 20 per cent appreciation/ depreciation are assumed. The stress tests are carried out for individual shocks on a stand-alone basis. 2.41 Keeping parity with recent developments, most of the FBs maintained a significantly negative net mark-to-market (MTM) position as a proportion to CET1 capital in September 2023. The MTM impact is, by and large, muted for PSBs and PVBs. For the overall system, the extent of the negative MTM position is the highest in the last one year (Chart 2.22). 2.42 It has been observed that the realised income of foreign banks from derivatives portfolios forms a substantial portion of their net operating income despite many of them consistently reporting negative MTM positions in their derivatives portfolios (Chart 2.23). The income of PVBs remains under 10 per cent, while PSBs’ income is muted around the zero mark. FBs have more diversified counterparties while most of the positions taken by PVBs and PSBs are with other banks. 2.43 The stress test results show that the select set of banks would gain, on an average, from an interest rate rise, which is akin to the recent trend. As regards exposures to forex derivatives, they stand to benefit from INR depreciation. Potential gains from interest rate increases dipped in September 2023 as compared with March 2023, while it has been rising for INR depreciation (Chart 2.24). The pay-off profile in respect of both interest rate risk and foreign exchange risk remains asymmetric, with gains being significantly large relative to losses. This could be reflecting their views on the future interest rate and exchange rate movement.

II.2 Primary (Urban) Cooperative Banks30 2.44 Primary urban cooperative banks (UCBs)31 recorded a pick up in credit growth (Chart 2.25 a). Larger UCBs led the credit growth: the share of Tier 4 UCBs32 (with deposits of more than ₹10,000 crore) in total gross loans of UCBs increased from 23.9 per cent to 25.7 per cent during H1:2023-24, mainly at the cost of Tier 3 UCBs (having deposits in the range ₹1,000 crore to ₹10,000 crore), whose share declined from 34.2 per cent to 31.8 per cent during the period. 2.45 The capital position of UCBs improved further during H1:2023-24 with their CRAR increasing in September 2023 (Chart 2.25 b) across all tiers of UCBs to well above the minimum requirement33 (Chart 2.25 c). 2.46 Although the GNPA and NNPA ratios of UCBs increased in H1:2023-24, they have exhibited a downward movement in the post-pandemic period (Charts 2.25 d and e). Similarly, the provisioning coverage ratio (PCR) also showed improvement (Chart 2.25 f). A decline in asset quality in H1:2023-24 was observed in Tier 1, Tier 2 and Tier 3 UCBs, while the largest UCBs (Tier 4) showed improvement (Chart 2.25 g).

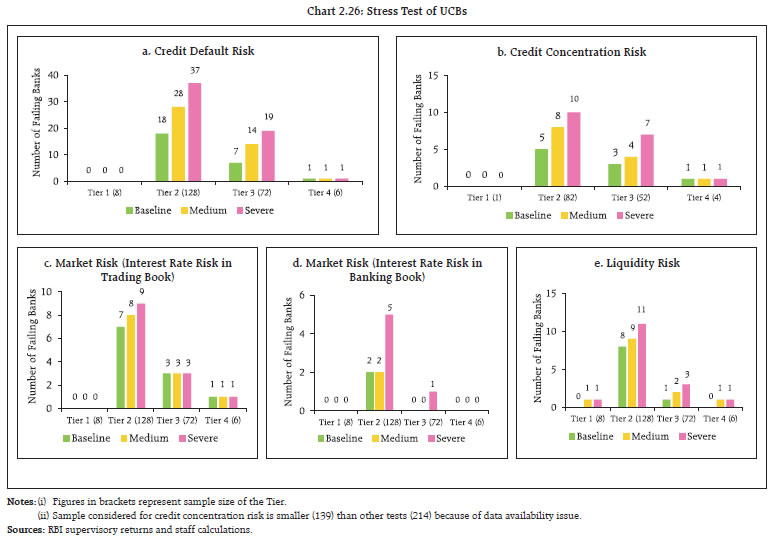

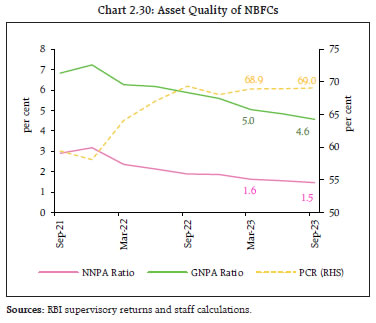

2.47 Profitability of UCBs improved in terms of RoA and RoE ratios in H1:2023-24 (Chart 2.25 h and i). scheduled UCBs (SUCBs) and Tier 4 UCBs witnessed an improvement across all their profit parameters though the net interest margin (NIM) of non-scheduled UCBs (NSUCBs) declined in September 2023 (Chart 2.25 j and k). From having the lowest RoA and RoE in March 2023, Tier 4 UCBs now have the highest RoA and RoE amongst all the Tiers. II.2.1 Stress Testing 2.48 Stress tests were conducted on a select set of major UCBs34 to assess credit risk (default risk and concentration risk), market risk (interest rate risk in trading book and banking book) and liquidity risk, based on their reported financial positions as of September 2023. 2.49 One bank in the Tier 4 UCB cohort would fail to meet the minimum regulatory CRAR requirement under both types of credit risk and interest rate risk in the trading book. In the case of liquidity risk, one Tier 4 UCB would have liquidity mismatch exceeding 20 per cent under medium and severe stress scenarios. The number of banks in Tier 2 and Tier 3 cohorts is large and the impact of credit default risk is higher than other types of risk for both these cohorts. UCBs in the small-sized cohort (i.e., Tier 1) would pass all stress tests, except one bank which fails in the liquidity stress test. In general, the impact of interest rate shock on the UCBs’ banking book would be low (Chart 2.26).  2.50 Under the severe stress scenario, the consolidated CRAR of 214 UCBs diminishes by 324 bps and 120 bps for credit default risk and interest rate risk in trading book, respectively. The consolidated CRAR of 139 UCBs diminishes by 334 bps for credit concentration risk under the severe stress scenario. The application of interest rate shock to the banking book indicates a decline in net interest income (NII) of 214 UCBs by 5.8 per cent under the severe stress scenario. System level liquidity mismatch remains positive (i.e., no liquidity gap) for liquidity risk even under the severe stress scenario. II.3 Non-Banking Financial Companies (NBFCs)35 2.51 Aggregate lending by NBFCs rose by 20.8 per cent (y-o-y) in September 2023 from 10.8 per cent a year ago, primarily led by personal loans and loans to industry (Chart 2.27). Growth in industrial advances was largely contributed by the Government NBFCs (18.3 per cent y-o-y), that account for 43 per cent of total credit by NBFCs. During the last four years, the compound annual growth rate (CAGR) for personal loans (nearly 33 per cent) has far exceeded that for overall credit growth (nearly 15 per cent) for the NBFC sector. Going forward, the recent increase in risk weights of select retail loan categories may have implications for NBFC credit growth at the overall, sectoral and sub-sectoral levels. 2.52 Credit growth by the NBFC sector in the post-pandemic period has accelerated for investment and credit companies (NBFC-ICCs), moving to double digits for infrastructure finance companies (NBFC-IFCs), and exceeding 30 per cent for micro-finance institutions (NBFC-MFI) (Chart 2.28). 2.53 The GNPA ratio of NBFCs continued on its downward trajectory with improvement across sectors. Among major sectors, the personal loans segment, which had grown rapidly in the last few years, continues to have the lowest GNPA ratio in September 2023 (3.6 per cent) (Chart 2.29). The GNPA ratio relating to Government and private NBFCs moderated further to 2.5 per cent and 6.1 per cent, respectively, but that of private NBFCs’ industrial advances remains high at 12.5 per cent, despite a recent fall and constitutes 21.6 per cent of overall GNPA of the NBFC sector. The aggregate NNPA ratio of NBFCs continued to improve with PCR remaining at a robust level (Chart 2.30).

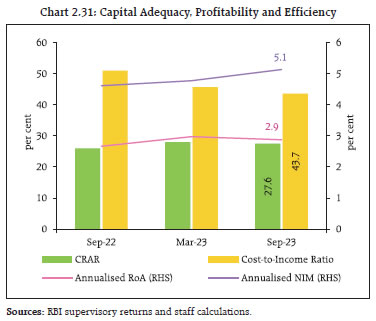

2.54 The capital position of NBFCs remained healthy, with CRAR at 27.6 per cent in September 2023, much above the regulatory minimum requirement of 15 per cent. The RoA ratio and net interest margin (NIM) stood strong and the cost-to-incomeratio36 has improved gradually (Chart 2.31).

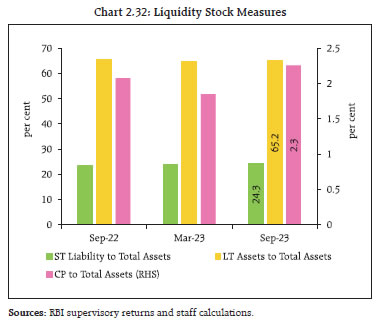

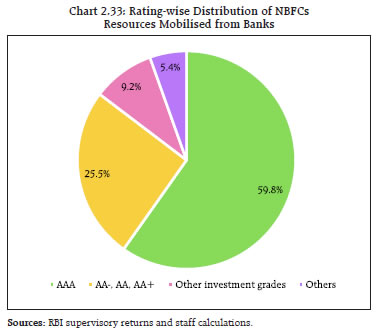

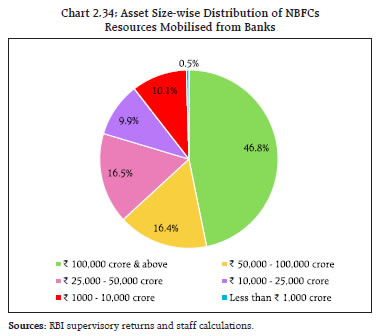

2.55 Various liquidity stock measures for NBFCs show a stable position (Chart 2.32). Based on past 5-year data, an analysis of the ALM profile of top 50 NBFCs (accounting for about 70 per cent of the assets of the NBFC sector) shows that 88 per cent of the bonds issued by these NBFCs had residual maturity of up to 5 years in September 2018 which reduced to 76 per cent in September 2023, indicating elongation in tenor of bonds. There has also been a shift away from short-term borrowing for these top 50 NBFCs as the share of short-term borrowings in total borrowings came down from 47.7 per cent in September 2018 to 37.3 per cent over this period. Together with their increasing preference for longer term sources of funds, there has also been a shift towards long-term uses of funds. On the asset side, about 80 per cent of loans and advances for these top 50 NBFCs had a maturity of less than three years in September 2018, which reduced to 67 per cent in September 2023. 2.56 Share capital, reserves and surplus of NBFCs decreased during H1:2023-24 to constitute 27.9 per cent of their total liabilities. Mobilisation of resources through debentures also declined. The reliance on funding from banks has gradually risen over the years (Table 2.9). Over three fourth of resources mobilised from banks were secured in nature and more than 85 per cent of such borrowings were by highly rated NBFCs (AA- and above) (Chart 2.33). Large NBFCs (viz., asset size above ₹25,000 crore) accounted for nearly 80 per cent of resources mobilised from banks by the sector (Chart 2.34).

| Table 2.9: NBFCs’ Sources of Funds | | (per cent) | | Item Description | Mar-21 | Mar-22 | Mar-23 | Sep-23 | | 1. Share Capital, Reserves and Surplus | 26.7 | 29.4 | 29.1 | 27.9 | | 2. Total Borrowings | 63.0 | 60.6 | 61.5 | 62.1 | | Of which: | | | | | | 2(i) Borrowing from banks | 19.8 | 20.6 | 21.9 | 22.2 | | 2(ii) CPs subscribed by banks | 0.4 | 0.4 | 0.3 | 0.4 | | 2(iii) Debentures subscribed by banks | 3.0 | 2.9 | 2.7 | 2.4 | | Total from banks [2(i)+2(ii)+2(iii)] | 23.2 | 23.8 | 25.0 | 25.0 | | 2(iv) CPs excluding 2(ii) | 1.6 | 1.4 | 1.5 | 1.9 | | 2(v) Debentures excluding 2(iii) | 22.8 | 20.4 | 19.5 | 19.6 | | 3. Others | 10.2 | 10.0 | 9.5 | 10.0 | | Total | 100.0 | 100.0 | 100.0 | 100.0 | | Source: RBI supervisory returns and staff calculations. |

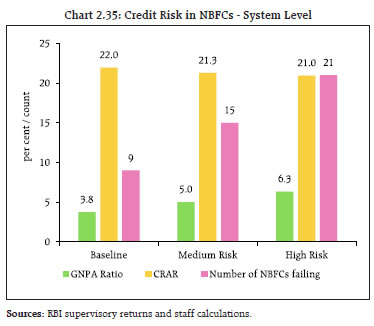

2.57 The scale based regulatory structure of NBFCs comprises of four layers based on their size, activity and perceived riskiness. As of September 2023, NBFCs in the base, middle and upper layers had shares of 6.0 per cent, 71.0 per cent and 23.0 per cent, respectively, in total assets of NBFCs, while the top layer is empty. NBFCs in the upper layer recorded a healthy growth in H1:2023-24 and their GNPA ratio gradually improved while capital position remained robust (Table 2.10). II.3.1 Stress Test37 - Credit Risk 2.58 System level stress tests for assessing the resilience of NBFC sector to shocks in credit risk were conducted for a sample of 14638 NBFCs. The tests were carried out under a baseline and two stress scenarios – medium and high risk – with increase in GNPA by 1 SD and 2 SDs, respectively. The capital adequacy ratio of the sample NBFCs stood at 24.4 per cent and the GNPA ratio at 3.1 per cent in September 2023. The one year ahead baseline scenario is built on the assumption of business continuing under usual conditions. 2.59 Under the baseline scenario, the one-year ahead GNPA ratio is estimated to be 3.8 per cent and CRAR at 22.0 per cent. Under a medium risk shock of 1 SD increase in GNPAs, the GNPA ratio increases to 5.0 per cent and the resultant income loss and additional provision requirements reduce the CRAR by around 70 bps relative to the baseline. Under the high-risk shock of 2 SDs, the capital adequacy ratio of the sector declines by 101 bps relative to the baseline, to 21.0 per cent. The number of NBFCs from the sample that would fail to meet the minimum regulatory capital requirement of 15 per cent increases from 9 under baseline scenario to 15 under medium and 21 under severe stress scenarios (Chart 2.35).

| Table 2.10: Select Indicators of NBFC – Upper Layer | | (per cent) | | Parameter | Mar-22 | Sep-22 | Mar-23 | Sep-23^ | | Growth Rate of Assets (y-o-y) | 11.8 | 14.1 | 14.7 | 13.1 | | Growth Rate of Credit (y-o-y) | 11.2 | 16.4 | 18.8 | 21.9 | | CRAR* | 22.9 | 22.3 | 22.2 | 21.9 | | GNPA Ratio | 4.5 | 4.2 | 3.7 | 3.4 | Note: * CRAR computation excludes the CIC which is in upper layer.

^ Sep-23 figures are computed based on the current set of NBFCs in upper layer.

Sources: NHB and RBI supervisory returns and staff calculations. | II.3.2 Stress Test - Liquidity Risk 2.60 The resilience of the NBFC sector to liquidity shocks has been assessed by capturing the impact of a combination of assumed increase in cash outflows and decrease in cash inflows39. The baseline scenario uses the projected outflows and inflows as of September 2023. One baseline and two stress scenarios are applied – a medium risk scenario involving 5 per cent contraction in inflows and 5 per cent rise in outflows; and a high risk scenario entailing a shock of 10 per cent decline in inflows and 10 per cent surge in outflows. The results indicate that the number of NBFCs which would face negative cumulative mismatch in liquidity over the next one year in the baseline, medium and high-risk scenarios stood at 6 (representing 1.3 per cent of asset size of the sample), 17 (10.4 per cent) and 34 (15.0 per cent), respectively (Table 2.11). II.4 Insurance Sector 2.61 The solvency ratio of an insurance company assesses the ability of the insurer to meet its obligations towards policyholders by reflecting the level of its assets over and above its liabilities. The minimum solvency ratio requirement set by the Insurance Regulatory and Development Authority of India (IRDAI) for insurance companies in India is 150 per cent. The higher the solvency ratio, the better will be the ability of the insurer to meet its liabilities. As insurance liabilities involve an assessment of future contingent events, a higher solvency ratio implies resilience of the insurer to withstand uncertainties of the future.

| Table 2.11: Liquidity Risk in NBFCs | | Cumulative Mismatch as a percentage of Outflows over Next One Year | No. of NBFCs having Liquidity Mismatch | | Baseline | Medium | High | | Over 50 per cent | 1 (0.1) | 2 (0.3) | 3 (0.8) | | Between 20 and 50 per cent | 3 (0.8) | 3 (1.3) | 3 (1.2) | | 20 per cent and below | 2 (0.4) | 12 (8.8) | 28 (13.0) | Note: Figures in parenthesis represent percentage share in asset size of the sample.

Source: RBI supervisory returns and staff calculations. | 2.62 The solvency ratio for life insurance companies has been above the prescribed threshold for both public sector and private sector at an aggregate level (Table 2.12). The solvency ratio for public sector non-life insurers’ group is sub-optimal with three of the four PSU insurers recording the ratio below the baseline prescription (Table 2.13). II.5 Stress Testing of Mutual Funds 2.63 As mandated by the Securities and Exchange Board of India (SEBI), stress testing40 of all open-ended debt schemes (except overnight schemes) is carried out by asset management companies (AMCs) every month to evaluate the impact of various risk parameters, viz., interest rate risk, credit risk, liquidity risk and redemption risk faced by such schemes on their net asset values (NAVs). 2.64 The analysis revealed stress (credit risk, interest rate risk, and liquidity risk) in the case of 17 mutual funds. In terms of schemes, however, only 24 out of a total of 299 schemes exhibited stress. The assets under management (AUM) of the open-ended debt schemes, which were found to have experienced stress, amounted to ₹1.7 lakh crore as against the total AUM of ₹12.4 lakh crore for all schemes for which the stress testing was conducted (Table 2.14). 2.65 Furthermore, as part of liquidity risk management for open-ended debt schemes, two types of liquidity ratios, viz., (i) redemption at risk (LR-RaR), which represents likely outflows at a given confidence interval, and (ii) conditional redemption at risk (LR-CRaR), which represents the behaviour of the tail at the given confidence interval, are used. All the AMCs have been mandated to maintain these liquidity ratios (LR-RaR and LR-CRaR) above the threshold limits, which are derived from scheme type, scheme asset composition and potential outflows (modelled from investor concentration in the scheme). Mutual funds are required to carry out backtesting of these liquidity ratios for all open-ended debt schemes (except overnight funds, gilt funds and gilt funds with 10-year constant duration) on a monthly basis. | Table 2.12: Solvency Ratio of Life Insurance Sector | | (per cent) | | | Public Sector | Private Sector | Industry | | Dec-22 | 185 | 235 | 197 | | Mar-23 | 187 | 227 | 197 | | Jun-23 | 189 | 222 | 197 | | Sep-23 | 190 | 220 | 197 | | Source: IRDAI. |

| Table 2.13: Solvency Ratio of Non-Life Insurance Sector | | (per cent) | | | PSU Insurers | Private Insurers | Stand Alone Health Insurers | Specialised Insurers | Total General Insurers | | Dec-22 | 62 | 225 | 212 | 612 | 169 | | Mar-23 | 44 | 225 | 203 | 642 | 163 | | Jun-23 | 38 | 227 | 203 | 677 | 162 | | Sep-23 | 39 | 228 | 195 | 688 | 164 | | Source: IRDAI. |

| Table 2.14: Stress Testing of Open-Ended Debt Schemes of Mutual Funds – Summary Findings | | (As of September 2023) | | Particulars | Stress | No Stress | Total | | No. of AMCs | 17 | 25 | 42 | | No. of Schemes | 24 | 275 | 299 | | AUM (₹ crore) | 1,70,080 | 10,73,556 | 12,43,636 | | Source: Association of Mutual Funds in India (AMFI). |

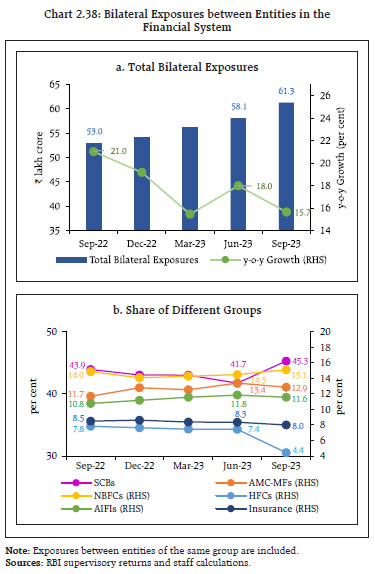

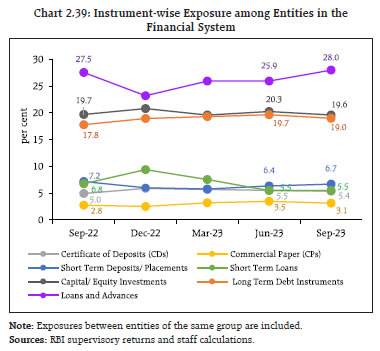

2.66 The LR-RaR and LR-CRaR computed by top 10 mutual funds (based on AUM) for 13 categories of open-ended debt schemes for October 2023 were well above the respective threshold limits for most of the mutual funds. A few instances of the ratios falling below the threshold limits were addressed by the respective AMCs in a timely manner (Chart 2.36 and Chart 2.37). II.6 Stress Testing Analysis at Clearing Corporations 2.67 Stress testing41 is carried out at clearing corporations (CC) to determine the minimum required corpus (MRC), which needs to be contributed by clearing members (CMs) to the core settlement guarantee fund (SGF). The MRC is determined for each segment (viz., cash market, equity derivatives, currency derivatives, commodity derivatives, debt and tri-party repo segment) every month based on stress testing. 2.68 Stress testing analysis undertaken during April-September 2023 indicates that though the monthly calculated amounts of MRC at clearing corporations varied, the actual MRC requirement for most of the segments remained the same during the period in line with SEBI stipulation. The MRC requirement of one of the CCs in the equity derivatives segment and that of another CC in the commodity derivatives segment increased during the period (Table 2.15). II.7 Interconnectedness 2.69 Interconnections among financial institutions involve funding gaps arising due to liquidity mismatch and maturity transformation, payments, and risk transfer processes. A financial system can be visualised as a network with financial institutions as nodes and bilateral exposures as links joining these nodes. These links could be in the form of loans to, investments in, or deposits with each other, which act as a source of funding, liquidity, investment and risk diversification. While these links enable gains in efficiency and diversification of risks, they can become conduits of risk transmission and risk amplification in a crisis. Understanding the nuances in propagation of risk through networks is useful for devising appropriate policy responses for safeguarding financial and macroeconomic stability. | Table 2.15: Minimum Required Corpus of Core SGF Based on Stress Testing Analysis at Clearing Corporations | | (Amount in ₹ crore) | | Segment | April 2023 | May 2023 | June 2023 | July 2023 | August 2023 | September 2023 | | Clearing Corporation 1 | | Average Stress Test Loss | | | | | | | | Cash Market | 49 | 57 | 42 | 46 | 127 | 67 | | Equity Derivatives Segment | 458 | 470 | 354 | 336 | 305 | 522 | | Currency Derivatives Segment | 124 | 116 | 118 | 153 | 164 | 158 | | Debt Segment | 4 | 4 | 4 | 4 | 4 | 4 | | Tri-Party Repo Segment | 17 | 17 | 17 | 17 | 17 | 17 | | Commodity Derivatives Segment | 0.1 | 0 | 0.1 | 6 | 5.1 | 0.7 | | Total | 652 | 664 | 535 | 562 | 622 | 769 | | Actual MRC requirement | | | | | | | | Cash Market | 348 | 348 | 348 | 348 | 348 | 348 | | Equity Derivatives Segment | 2,335 | 2,423 | 2,423 | 2,423 | 2,423 | 2,423 | | Currency Derivatives Segment | 242 | 242 | 242 | 242 | 242 | 242 | | Debt Segment | 4 | 4 | 4 | 4 | 4 | 4 | | Tri-Party Repo Segment | 17 | 17 | 17 | 17 | 17 | 17 | | Commodity Derivatives Segment | 10 | 10 | 10 | 10 | 10 | 10 | | Total | 2,956 | 3,044 | 3,044 | 3,044 | 3,044 | 3,044 | | Clearing Corporation 2 | | Average Stress Test Loss | | | | | | | | Cash Market | 7 | 9 | 11 | 15 | 12 | 15 | | Equity Derivatives Segment | 62 | 23 | 18 | 22 | 16 | 17 | | Currency Derivatives Segment | 53 | 39 | 49 | 55 | 42 | 42 | | Commodity Derivatives Segment | 0.1 | 0 | 0 | 0 | 0 | 0 | | Total | 122 | 71 | 78 | 92 | 70 | 74 | | Actual MRC requirement | | | | | | | | Cash Market | 194 | 194 | 194 | 194 | 194 | 194 | | Equity Derivatives Segment | 74 | 74 | 74 | 74 | 74 | 74 | | Currency Derivatives Segment | 235 | 235 | 235 | 235 | 235 | 235 | | Commodity Derivatives Segment | 14 | 14 | 14 | 14 | 14 | 14 | | Total | 517 | 517 | 517 | 517 | 517 | 517 | | Clearing Corporation 3 (Commodity Derivatives Segment) | | Average Stress Test Loss | 52 | 46 | 30 | 24 | 23 | 38 | | Actual MRC requirement | 124 | 124 | 124 | 124 | 124 | 124 | | Clearing Corporation 4 (Commodity Derivatives Segment) | | Average Stress Test Loss | 391 | 401 | 500 | 493 | 485 | 562 | | Actual MRC requirement | 417 | 417 | 500 | 500 | 500 | 562 | | Clearing Corporation 5 (Tri-Party Repo Segment) | | Average Stress Test Loss | - | - | - | - | - | 42 | | Actual MRC requirement | - | - | - | - | - | 42 | | Source: SEBI. | II.7.1 Financial System Network42 43 2.70 The total outstanding bilateral exposures44 among the entities in the Indian financial system expanded during H1:2023-24. A surge during September 2023 was primarily driven by growth in inter-bank exposure, higher borrowing of NBFCs in the form of long-term (LT) loans from SCBs and increasing exposure of AMC-MFs with SCBs and NBFCs. The growth (y-o-y) of bilateral exposures moderated to 15.7 per cent after large fluctuations witnessed since the onset of the pandemic (Chart 2.38 a). 2.71 There was a pronounced diversion of exposure in the financial network from housing financial companies (HFCs) to SCBs due to merger of a large HFC with a private bank during Q2:2023-24, which led to shrinkage of exposure of HFCs to the financial system while contributing to an increase in the exposure of SCBs (Chart 2.38 b). 2.72 The funding mix of the financial system shows that long-term funding, primarily loans and advances, equity and LT debt instruments play a major role in the financial system. A segment wise analysis indicates that in general (a) LT loans are mainly advanced by SCBs to NBFCs; (b) AMC-MFs are major investors in the equities issued by PVBs and NBFCs; (c) in the LT debt market, insurance companies hold a majority of instruments issued by PVBs, NBFCs and HFCs. In the short-term (ST) funding mix, apart from the inter-bank ST loans and deposits, CPs and CDs play a significant role. In the CP market, AIFIs, NBFCs and HFCs are the largest receivers of fund and AMC-MFs are the largest investor group, whereas PSBs, PVBs and AIFIs are the major fund receivers in the CD market, with AMC-MFs being the largest fund provider (Chart 2.39).

2.73 In terms of inter-sectoral exposures45, AMC-MFs, insurance companies and PSBs remained the largest fund providers in the system, whereas NBFCs and PVBs were the largest receivers of funds, followed by HFCs. Among bank groups, PSBs and UCBs had net receivable positions vis-à-vis the entire financial sector whereas PVBs, FBs and SFBs had net payable positions (Chart 2.40). 2.74 Movements in the net receivables/ payables position from September 2022 to September 2023 indicate that the declining share of PSBs in providing funds to borrowing institutions in the system (primarily NBFCs, PVBs and HFCs) is being taken up by AMC-MFs and insurance companies. Net payables of PVBs and NBFCs continued to rise while those of HFCs reduced due to the HFC-PVB merger mentioned earlier (Chart 2.41).

a. Inter-Bank Market 2.75 Inter-bank exposures increased to 3.4 per cent of the total assets of the banking system in September 2023 – the highest level since June 2020 – mainly on account of the merger. The increase was due to fund-based exposure46 while non-fund-based exposures47 remained almost unchanged (Chart 2.42). 2.76 PSBs continued to dominate the inter-bank market, (similar to their share in total bank assets), followed by PVBs (lower than their share of 38.5 per cent in total bank assets) and FBs (higher than their share in total bank assets of 6.5 per cent). The rise in borrowing and lending by PVBs (partly due to the merger) led to increase in the share of PVBs during Q2:2023-24 (Chart 2.43). 2.77 Unlike in the overall financial network in which LT fund-based exposure forms a major part, ST funding plays a critical role in the inter-bank market. As at end-September 2023, 71 per cent of the fund-based inter-bank market was short-term in nature in which ST deposits and ST loans constituted about 70 per cent, followed by CDs and call money market exposure. As deposit growth lagged credit growth, banks’ recourse to CDs raised their share in the inter-bank market. The share of long-term funding in the fund-based inter-bank market increased over the last one year. Although LT loans predominated in LT fund-based inter-bank exposures, their share reduced as banks have shored up funds through LT deposits and LT debt during the period (Chart 2.44).

b. Inter-Bank Market: Network Structure and Connectivity 2.78 The distribution of the number of links between entities in the inter-bank market network is highly skewed, with most banks having few links and few banks having many links. This resulted into a typical core-periphery network structure48 49. As of end-September 2023, four banks were in the inner-most core and six banks in the mid-core circle. The four banks in the inner-most core included one large PSB and three PVBs. The banks in the mid-core were PSBs and PVBs. Most of the old PVBs along with FBs, SUCBs and SFBs formed the periphery (Chart 2.45). 2.79 The degree of interconnectedness among SCBs, measured by the connectivity ratio50, increased partly due to the number of banks coming down during H1:2023-24 as one foreign bank went out of the sample due to closure, but the cluster coefficient51 declined marginally (Chart 2.46). c. Exposure of AMCs-MFs 2.80 Gross receivables of AMC-MFs stood at ₹14.84 lakh crore (around 33 per cent of their average AUM) whereas their gross payables were ₹0.76 lakh crore as at end-September 2023. SCBs (primarily PVBs) remained the major recipients of their funding, followed by NBFCs, AIFIs and HFCs (Chart 2.47 a). 2.81 The share of equity holdings in total assets of AMC-MFs, which had moderated in March 2023, rose in September 2023. Equity continued to maintain a dominant position, while the share of LT debt increased over the last year (Chart 2.47 b).

d. Exposure of Insurance Companies 2.82 With gross receivables at ₹8.81 lakh crore and gross payables at ₹0.58 lakh crore, insurance companies were the second largest net providers of funds to the financial system as at end-September 2023. SCBs (primarily PVBs) were the largest recipients of their funds, followed by NBFCs and HFCs. LT debt and equity accounted for 91 per cent of receivables of insurance companies with limited exposure to ST instruments (Charts 2.48 a and b). While the share of LT debt has been increasing gradually, the share of equity has been falling. e. Exposure to NBFCs 2.83 NBFCs were the largest net borrowers of funds from the financial system, with gross payables of ₹15.97 lakh crore and gross receivables of ₹1.87 lakh crore as at end-September 2023. A breakup of their gross payables reveals that the bulk of funds were sourced from SCBs, followed by AMC-MFs and insurance companies. The declining share of SCBs’ in total payables of NBFCs was arrested, whereas the shares of borrowings from AMC-MFs and insurance companies reduced during Q2:2023-24 (Chart 2.49 a).

2.84 The choice of instruments in the funding mix of NBFCs shows reliance on LT funds. The share of LT loans (borrowed from SCBs and AIFIs) increased while that of LT debt instruments (held by insurance companies and AMC-MFs) continued to moderate. AMC-MFs were the main investors in the equity capital of NBFCs, with an increased share in H1:2023-24 (Chart 2.49 b). f. Exposure to HFCs 2.85 HFCs remained net borrowers and had gross payables of ₹5.28 lakh crore against gross receivables of ₹0.15 lakh crore in September 2023. The large variation in exposure of HFCs in Q2:2023-24 reflected the impact of the merger with a PVB (Chart 2.50 a). Over 75 per cent of HFCs’ resource mobilisation was through LT loans and LT debt instruments (Chart 2.50 b). g. Exposure of AIFIs 2.86 With gross payables and receivables at ₹7.08 lakh crore and ₹7.05 lakh crore, respectively, AIFIs were net receiver of funds from the financial system in September 2023 at the margin. They raised funds mainly from SCBs (primarily PVBs), AMC-MFs and insurance companies (Chart 2.51 a). Given their nature of operations, LT Loans, LT debt and LT deposits remained their preferred instruments for resource mobilisation, though the combined share of these instruments came down to 51.3 per cent from 59.7 per cent a year ago. AIFIs’ recourse to CPs in raising funds has waned after a surge during Q4:2022-23 (Chart 2.51 b).

II.7.2 Contagion Analysis 2.87 Contagion analysis uses network technology to estimate the systemic importance of different financial institutions. The failure of a systemically important bank entails greater solvency and liquidity losses for the banking system which, in turn, depends on the initial capital and liquidity position of banks along with the number, nature (whether it is a lender or a borrower) and magnitude of the interconnections that the failing bank has with the rest of the banking system. a. Joint Solvency52- Liquidity53 Contagion Impact on SCBs due to Bank Failure 2.88 A contagion analysis of the banking network on the end-September 2023 position indicates that if the bank with the maximum capacity to cause contagion losses fails, it will cause a solvency loss of 3.63 per cent (as compared to 2.22 per cent in March 2023) of total Tier 1 capital of SCBs and liquidity loss of 0.33 per cent (as compared with 0.25 per cent in March 2023) of total high quality liquid assets (HQLAs) of the banking system. Contagion risk increased in September 2023 vis-à-vis March 2023 due to the expansion in inter-bank market following the merger of a large HFC with a bank (Table 2.16) but it would not lead to failure of any additional bank. b. Solvency Contagion Impact on SCBs due to NBFC/ HFC Failure 2.89 As noted earlier, NBFCs and HFCs are among the largest borrowers of funds from the financial system, with a substantial part of funding from banks. Therefore, failure of any NBFC or HFC will act as a solvency shock to their lenders which can spread through contagion. 2.90 By end-September 2023, hypothetical failure of the NBFC with the maximum capacity to cause solvency losses to the banking system would have knocked off 2.72 per cent (2.51 per cent in March 2023) of the latter’s total Tier 1 capital but it would not lead to failure of any bank. Similarly, failure of the HFC with the maximum capacity to cause solvency losses to the banking system would have knocked off 4.34 per cent (4.42 per cent in March 2023) of the latter’s total Tier 1 capital but without failure of any bank (Tables 2.17 and 2.18). | Table 2.16: Contagion Losses due to Bank Failure – September 2023 | | Name of Bank | Solvency Losses as per cent of Tier 1 Capital of the Banking System | Liquidity Losses as per cent of HQLA | Number of Bank Defaulting due to Solvency | Number of Bank Defaulting due to Liquidity | | Bank 1 | 3.63 | 0.33 | 0 | 0 | | Bank 2 | 2.19 | 0.18 | 0 | 0 | | Bank 3 | 2.04 | 0.09 | 0 | 0 | | Bank 4 | 1.47 | 0.34 | 0 | 0 | | Bank 5 | 1.42 | 0.04 | 0 | 0 | Note: Top five ‘Trigger banks’ have been selected on the basis of solvency losses caused to the banking system.

Source: RBI supervisory returns and staff calculations. |

| Table 2.17: Contagion Losses due to NBFC Failure – September 2023 | | Name | Solvency Losses as per cent of Tier 1 Capital of the Banking System | Number of Banks Defaulting due to Solvency | | NBFC 1 | 2.72 | 0 | | NBFC 2 | 2.48 | 0 | | NBFC 3 | 2.30 | 0 | | NBFC 4 | 1.60 | 0 | | NBFC 5 | 1.57 | 0 | Note: Only Private NBFCs are considered. Top five ‘Trigger NBFCs’ have been selected on the basis of solvency losses caused to the banking system.

Sources: RBI supervisory returns and staff calculations. | c. Solvency Contagion Impact54 after Macroeconomic Shocks to SCBs 2.91 The contagion from failure of a bank is likely to get magnified if shocks result in banking system distress. In such a situation, similar shocks may cause some SCBs to fail the solvency criterion, which then act as a trigger for further solvency losses. 2.92 In the previous iteration, a shock was applied to the entity that could cause the maximum contagion causing solvency losses. In another iteration in which the initial impact of such a shock on an individual bank’s capital is taken from the macro stress tests55, the initial capital loss due to macroeconomic shocks stood at 5.92 per cent, 14.13 per cent and 22.25 per cent of Tier I capital for baseline, medium and severe stress scenarios, respectively. No bank fails to maintain the Tier I capital adequacy ratio of 7 per cent in any of the stress scenario. As a result, there are no additional solvency losses to the banking system due to contagion (over and above the initial loss of capital due to the macro shocks) (Chart 2.52 a and b). | Table 2.18: Contagion Losses due to HFC Failure – September 2023 | | Name | Solvency Losses as per cent of Tier 1 Capital of the Banking System | Number of Banks Defaulting due to Solvency | | HFC 1 | 4.34 | 0 | | HFC 2 | 1.51 | 0 | | HFC 3 | 1.29 | 0 | | HFC 4 | 1.24 | 0 | | HFC 5 | 0.77 | 0 | Note: Top five ‘Trigger HFCs’ have been selected on the basis of solvency losses caused to the banking system.

Source: RBI supervisory returns and staff calculations. |

Summary and Outlook 2.93 Strong balance sheets, improved profits and stable financial conditions have enabled banking and NBFC sectors to engage in efficient financial intermediation in consonance with productive credit needs of the economy in H1:2023-24. The asset quality indicators of SCBs, UCBs and NBFCs continued to improve. Capital ratios remain robust for all three segments. 2.94 Macro stress tests show that SCBs are well-capitalised and capable of absorbing macroeconomic shocks under the severe stress scenario. An extreme scenario of a 250 bps upward movement in the yield curve may bring down the CRAR of a few banks below the regulatory minimum level. Although NBFCs have increased their reliance on banks for funding, the majority of such borrowing is secured in nature. Furthermore, most of the borrower NBFCs have high credit rating and are large in size. 2.95 The total outstanding bilateral exposures among the entities in the Indian financial system continued to expand, and the share of inter-bank exposures in the total assets of banking system reached a 3-year peak in September 2023. Though contagion risk and consequent additional solvency losses to the banking system have increased marginally, it would not lead to failure of any bank. 2.96 The Indian financial system is confronted with heightened global uncertainty and spillovers. Hence, close and continuous monitoring is warranted to detect any undue risk build up in the system. This has to be supported by prudent management of exposures and building of financial buffers.

|