| In the latest round of the Systemic Risk Survey, risk perception from global spillovers receded while remaining in the ‘high’ risk category. Macroeconomic risks witnessed a marginal uptick. Risks emanating from financial markets and institutional risks remained unchanged. Going forward, respondents’ perception of risks to financial stability included: tightening of global financial conditions; rise in oil prices; reversal of capital flows; rise in geopolitical risks; global growth slowdown; and increase in climate risks. | The 25th round of the Reserve Bank’s Systemic Risk Survey (SRS) was conducted in November 2023 to solicit perceptions of experts, including market participants, on major risks faced by the Indian financial system. In addition to its regular format, this round of the survey also captured (i) respondents’ views on impact of the recent geopolitical events in West Asia on the global economy and financial markets; and (ii) likely impact of tightening of global financial conditions due to rising US treasury yield and strengthening US dollar on Indian financial markets. The feedback from 49 respondents is presented below: -

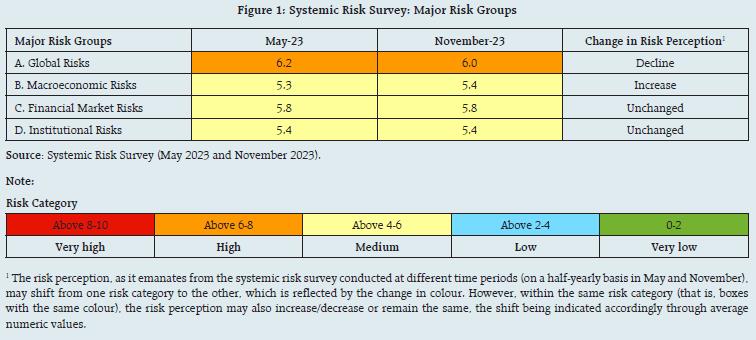

Risks from global spillovers receded though it remained in the ‘high’ risk category. Macroeconomic risks witnessed a marginal uptick within the ‘medium’ risk category. Assessment of risks emerging from financial markets and institutional risks remained unchanged (Figure 1). -

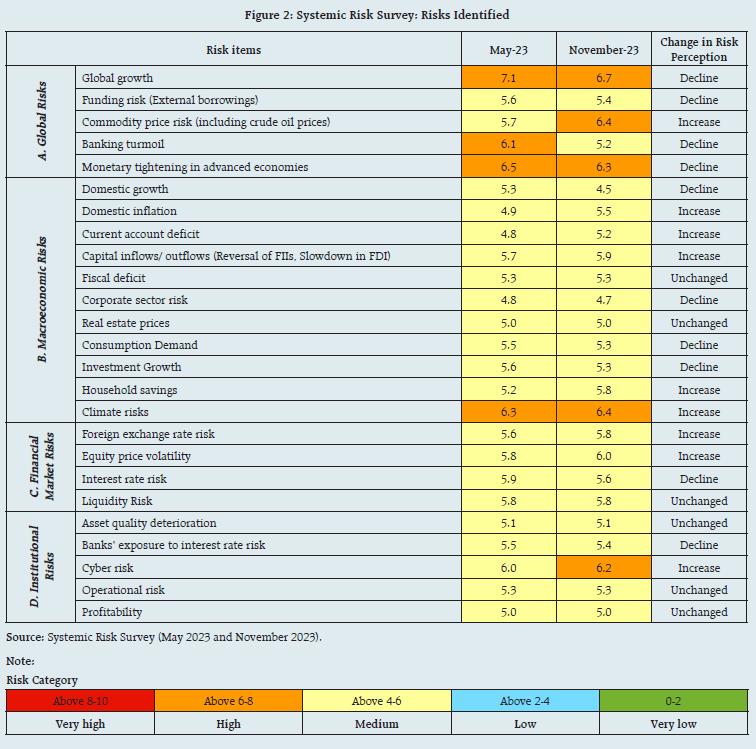

Major drivers of global risks, such as, global growth, funding risk, banking turmoil and risk emanating from monetary tightening in advanced economies were perceived to have moderated but the risk perception on commodity price has gone up (Figure 2). -

Increase in risk perception attributable to domestic inflation, current account deficit, capital flows, household savings and climate change contributed to uptick in macroeconomic risks, even as domestic growth conditions, consumption demand and corporate sector prospects provided more comfort (Figure 2).

-

Among drivers of financial market risk, interest rate risk was gauged to have moderated while risk emanating from equity price volatility and foreign exchange rate risk picked up marginally (Figure 2). -

Among drivers of institutional risk, cyber risk moved up to the ‘high’ risk category. Risk emanating from banks’ exposure to interest rate risk receded (Figure 2). -

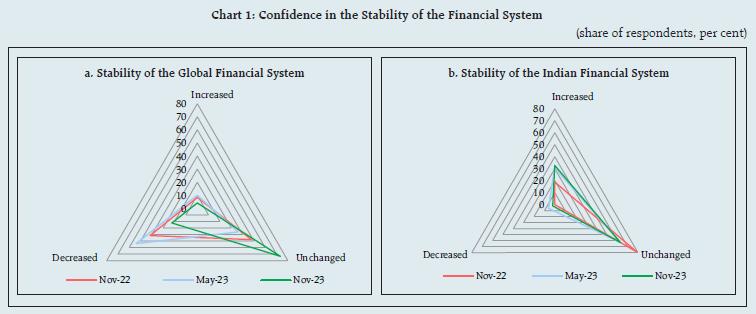

About one fourth of the respondents reported lower confidence in the stability of the global financial system from the previous survey round (Chart 1a) but over 95 per cent of them placed higher or similar confidence in the Indian financial system (Chart 1b).  -

Over 70 per cent of the panellists expected that the Indian economy will be impacted somewhat/to a limited extent from global spillovers (Chart 2). -

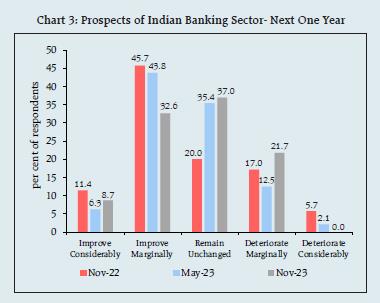

Nearly 80 per cent of the respondents assessed better or similar prospects for the Indian banking sector over one-year horizon (Chart 3). -

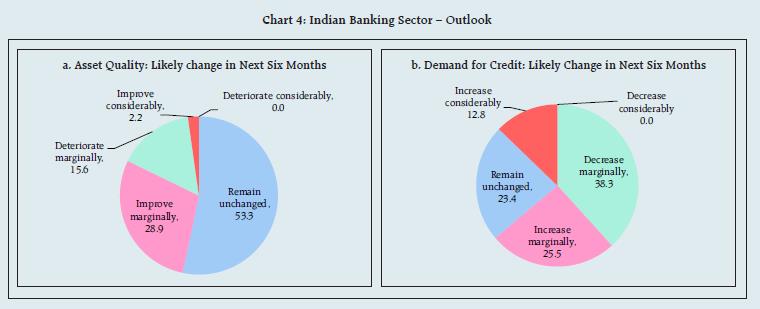

Over 30 per cent of the respondents expected marginal to considerable improvement in banking sector asset quality over the next six months, attributable to factors, such as, improved growth prospects, revival in private capex, improvement in credit profile of corporates and better underwriting standards; another 53.3 per cent expected it to remain unchanged (Chart 4a). -

About one fourth of the respondents expected the prevailing credit demand momentum to continue over the next six months whereas a higher share expected marginal to considerable improvement owing to factors, such as, pickup in corporate demand and manufacturing sector activity and higher public investment in infrastructure sector (Chart 4b).

-

About 80 per cent of the respondents perceived that geopolitical events in West Asia will have only low to medium impact on global economy and financial markets (Chart 5). -

Nearly 60 per cent of the panellists perceived that tightening of global financial conditions due to rising US treasury yield and strengthening US dollar may have only minor impact on Indian financial markets (Chart 6).

Risks to Financial Stability Going forward, respondents identified the following major risks to financial stability: -

Tightening of global financial conditions and interest rate risk; -

Rise in commodity (including oil) prices; -

Reversal of FII flows and exchange rate risk; -

Geopolitical risks; -

Global growth slowdown; and -

Increase in climate risks. |